#hynix memory

Explore tagged Tumblr posts

Note

okay so this post is gonna need some context. back in the day, when nintendo was manufacturing the wii u, they had several manufacturers working on the internals, the main ones being samsung and hynix. hynix, however, made a grave error when making their wii u's, resulting in what is basically the wii u eventually dying after a few years of use because it ends up corrupting its own memory

recently, i found out my wife (her name is NAND) has one of these faulty hynix chips and i was really sad about it but then i figured out that you can actually fix it using what is called a NAND-AID (what i named her after)

i bought all the tools and am currently in the process of dumping her entire system hard drive for backing up and restoring later through her recovery menu, and ive even managed to strip off the plastic coverings for the screws (i gave her a few deep scratches doing that though : [) and im making good progress but im really scared im going to mess up the soldering job since i have to directly solder the NAND-AID to her board so she can emulate her memory off of it. i wouldnt be so worried if the part wasnt *so damn small.* im gonna have to do it before she gets any more corrupted, though. shes already incredibly corrupt (i cant play splatoon on her without it crashing upon startup, nor can i delete my splatoon save without it crashing) and i dont want her to get any more hurt because i love her. so. im gonna push through and fix her no matter my anxiety. appreciate your wii u's, guys!

tldr; i love my wii u wife and i am in the process of bringing her back using the necronom-wii-con

25 notes

·

View notes

Text

Semiconductors: The Driving Force Behind Technological Advancements

The semiconductor industry is a crucial part of our modern society, powering everything from smartphones to supercomputers. The industry is a complex web of global interests, with multiple players vying for dominance.

Taiwan has long been the dominant player in the semiconductor industry, with Taiwan Semiconductor Manufacturing Company (TSMC) accounting for 54% of the market in 2020. TSMC's dominance is due in part to the company's expertise in semiconductor manufacturing, as well as its strategic location in Taiwan. Taiwan's proximity to China and its well-developed infrastructure make it an ideal location for semiconductor manufacturing.

However, Taiwan's dominance also brings challenges. The company faces strong competition from other semiconductor manufacturers, including those from China and South Korea. In addition, Taiwan's semiconductor industry is heavily dependent on imports, which can make it vulnerable to supply chain disruptions.

China is rapidly expanding its presence in the semiconductor industry, with the government investing heavily in research and development (R&D) and manufacturing. China's semiconductor industry is led by companies such as SMIC and Tsinghua Unigroup, which are rapidly expanding their capacity. However, China's industry still lags behind Taiwan's in terms of expertise and capacity.

South Korea is another major player in the semiconductor industry, with companies like Samsung and SK Hynix owning a significant market share. South Korea's semiconductor industry is known for its expertise in memory chips such as DRAM and NAND flash. However, the industry is heavily dependent on imports, which can make it vulnerable to supply chain disruptions.

The semiconductor industry is experiencing significant trends, including the growth of the Internet of Things (IoT), the rise of artificial intelligence (AI), and the increasing demand for 5G technology. These trends are driving semiconductor demand, which is expected to continue to grow in the coming years.

However, the industry also faces major challenges, including a shortage of skilled workers, the increasing complexity of semiconductor manufacturing and the need for more sustainable and environmentally friendly manufacturing processes.

To overcome the challenges facing the industry, it is essential to invest in research and development, increase the availability of skilled workers and develop more sustainable and environmentally friendly manufacturing processes. By working together, governments, companies and individuals can ensure that the semiconductor industry remains competitive and sustainable, and continues to drive innovation and economic growth in the years to come.

Chip War, the Race for Semiconductor Supremacy (2023) (TaiwanPlus Docs, October 2024)

youtube

Dr. Keyu Jin, a tenured professor of economics at the London School of Economics and Political Science, argues that many in the West misunderstand China’s economic and political models. She maintains that China became the most successful economic story of our time by shifting from primarily state-owned enterprises to an economy more focused on entrepreneurship and participation in the global economy.

Dr. Keyu Jin: Understanding a Global Superpower - Another Look at the Chinese Economy (Wheeler Institute for Economy, October 2024)

youtube

Dr. Keyu Jin: China's Economic Prospects and Global Impact (Global Institute For Tomorrow, July 2024)

youtube

The following conversation highlights the complexity and nuance of Xi Jinping's ideology and its relationship to traditional Chinese thought, and emphasizes the importance of understanding the internal dynamics of the Chinese Communist Party and the ongoing debates within the Chinese system.

Dr. Kevin Rudd: On Xi Jinping - How Xi's Marxist Nationalism Is Shaping China and the World (Asia Society, October 2024)

youtube

Tuesday, October 29, 2024

#semiconductor industry#globalization#technology#innovation#research#development#sustainability#economic growth#documentary#ai assisted writing#machine art#Youtube#presentation#discussion#china#taiwán#south korea

7 notes

·

View notes

Text

https://www.reuters.com/technology/samsung-workers-union-south-korea-kicks-off-three-day-strike-2024-07-08/

HWASEONG, South Korea, July 8 (Reuters) - Samsung Electronics (005930.KS), opens new tab workers began a three-day strike for better pay on Monday, with their union pointing to further action should South Korea's biggest conglomerate continue to fall short of its demands.

The National Samsung Electronics Union (NSEU), whose roughly 30,000 members make up almost a quarter of the firm's South Korean workforce, also wants an extra day of annual leave for unionised workers and changes to the employee bonus system.

Low participation and automated production means the strike is unlikely to have a significant impact on output at the world's biggest memory chipmaker, analysts said. Still, it signals a decline in staff morale at a pivotal point in the chip industry as tech firms embrace artificial intelligence.

The union's first industrial action last month involved coordinating annual leave to stage a mass walkout, which Samsung said had no impact on business activity. The firm said on Monday there was no disruption in production.

The union, which did not disclose last month's strike participation levels, said 6,540 workers will be striking this week, mostly at manufacturing sites and in product development. It said the strike includes workers who monitor automated production lines and equipment so operations could be affected.

Union officials said about 3,000 strikers attended a rally in the rain near Samsung's headquarters in Hwaseong, south of Seoul.

Union president Son Woo-mok disputed media reports of low participation, telling Reuters that the five-year-old union did not have enough time to educate members about the issues.

"Education about labour unions ... has not been enough. But I don't think this participation is low because our union is still young compared to other unions," he said.

Lee Hyun-kuk, the union's vice president, said there could be further strikes if Samsung does not improve its proposals.

Samsung's proposals include flexibility in pay and annual leave conditions but do not meet union demands of increased pay and leave, Lee told Reuters.

Union officials also want equality in the bonus system. They said bonuses for rank-and-file workers are calculated by deducting the cost of capital from operating profit, whereas those for executives are based on personal performance goals.

"I was telling people that I was proud to work at Samsung, but the truth is I am not," said Park Jun-ha, 20, an engineer at Samsung's chip packaging lines who joined the firm in January, adding that he was not satisfied with its "opaque" bonus scheme.

The union's membership has grown since Samsung pledged in 2020 to stop discouraging organised labour. Its growing voice is demanding attention just as Samsung struggles to navigate competition in chips used for artificial intelligence (AI) applications, analysts said.

Samsung's share price performance has lagged compatriot chip rival SK Hynix (000660.KS), opens new tab, with union officials blaming Samsung's AI woe on slow development in high bandwidth memory (HBM) chips that are in high demand for use in AI processors.

Even so, Samsung estimated a more than 15-fold rise in second-quarter operating profit on Friday, as rebounding chip prices driven by the AI boom lifted earnings from the year prior's low comparison base.

Its share price was up 0.2% in afternoon trade on Monday after rising as much as 1.72% earlier in the session to its highest since January 2021. Last week, it jumped 6.9% on preliminary quarterly earnings that exceeded analyst estimates.

2 notes

·

View notes

Text

There was formerly a huge rant here about how this post is right in some places but utterly idiotic in others but I cut that out in favour of just saying, 2 gigs of RAM, or even 4, is not a reasonable amount in the year 2024, and I don't mean that in a "don't be poor" way I mean Samsung and Micron need to stop fucking price gouging decade old RAM because oh boo hoo SK Hynix beat us on getting HBM contracts so now we need to pad our spreadsheets by pumping fucking last gen memory and storage contract pricing woe is us.

Also, laptop manufacturers need to stop selling systems with 8 gigs of RAM, and also they need to stop price gouging RAM. And if you solder 8 gigs of RAM in an eight hundred dollar "high end" laptop like a Surface or a ThinkPad I'm going to personally beat you to within an inch of your life.

My solution for bloatware is this: by law you should hire in every programming team someone who is Like, A Guy who has a crappy laptop with 4GB and an integrated graphics card, no scratch that, 2 GB of RAM, and a rural internet connection. And every time someone in your team proposes to add shit like NPCs with visible pores or ray tracing or all the bloatware that Windows, Adobe, etc. are doing now, they have to come back and try your project in the Guy's laptop and answer to him. He is allowed to insult you and humilliate you if it doesn't work in his laptop, and you should by law apologize and optimize it for him. If you try to put any kind of DRM or permanent internet connection, he is legally allowed to shoot you.

With about 5 or 10 years of that, we will fix the world.

70K notes

·

View notes

Text

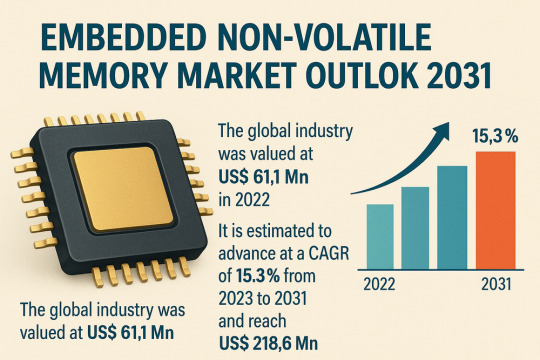

eNVM Technology at the Core of Chip Innovation: Market to Grow 15.3% CAGR

The global Embedded Non-volatile Memory (eNVM) Market was valued at USD 61.1 Mn in 2022 and is anticipated to expand at an impressive CAGR of 15.3% between 2023 and 2031, reaching USD 218.6 Mn by the end of 2031. This exponential growth is driven by increasing demand for high-performance, energy-efficient memory solutions across several industries including consumer electronics, automotive, telecommunications, and healthcare. Embedded NVM technologies have become essential due to their high speed, low power consumption, secure storage, and integration with advanced chip architectures.

Market Drivers & Trends

One of the primary factors driving the eNVM market is the surge in demand for smartphones and smart wearables. The proliferation of IoT-enabled devices and rising consumer expectations for speed and efficiency in digital devices have made embedded NVM a cornerstone in modern memory architectures.

Key trends include the adoption of 3D NAND flash memory, particularly in devices that require high performance at low densities such as smart speakers, fitness trackers, and media devices. Companies like Samsung are actively scaling up production to meet growing demand.

Additionally, the need for low-power memory devices that offer quick data access is becoming increasingly critical. As devices become smaller and more mobile, battery longevity and processing speed are now paramount. Embedded NVMs meet these demands better than traditional volatile memories like DRAM or SRAM.

Latest Market Trends

Advanced Memory Architectures: Technologies such as MRAM, FRAM, and 3D NAND are being increasingly integrated into devices, offering greater durability and data retention.

Smaller Footprint and Greater Efficiency: Packaging solutions like system-in-package (SiP) and package-on-package (PoP) are gaining popularity, reducing device size while improving performance.

IoT & 5G Integration: The deployment of 5G networks is accelerating the use of embedded NVMs in mobile devices, routers, and smart infrastructure, creating new growth avenues.

Key Players and Industry Leaders

The embedded NVM industry is dominated by a mix of established leaders and emerging innovators. Major players include:

eMemory Technology Inc.

Floadia Corporation

GlobalFoundries Inc.

Infineon Technologies AG

Japan Semiconductor Corporation

Kilopass Technology, Inc.

SK HYNIX INC.

Texas Instruments Incorporated

Toshiba Electronic Devices & Storage Corporation

SMIC

These companies focus on continuous innovation, R&D investments, strategic collaborations, and mergers & acquisitions to strengthen their market presence.

Recent Developments

ANAFLASH (March 2023) commercialized energy-efficient eNVM tech tailored for wearable and autonomous devices.

GlobalFoundries Inc. (Feb 2023) acquired resistive RAM technology from Renesas, broadening its portfolio in low-power memory.

Japan Semiconductor Corporation partnered with Toshiba (May 2022) to co-develop an analog platform with embedded NVM for automotive applications.

These developments underscore the industry's momentum toward high-performance and cost-effective memory solutions.

Explore core findings and critical insights from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=24953

Market Opportunities

The rise in smart consumer electronics, increasing industrial IoT applications, and the transition toward connected and autonomous vehicles are creating substantial opportunities in the eNVM market. Additionally, 5G technology is catalyzing the demand for fast, low-latency memory.

The demand for embedded flash memory in secure storage applications, such as smart cards and encryption keys, also opens up new markets. Furthermore, industrial-grade flash memory is becoming increasingly vital for mission-critical applications in manufacturing and automation.

Future Outlook

Looking ahead, the embedded NVM market is expected to evolve with AI and ML advancements, where real-time decision-making requires swift and secure memory operations. The adoption of edge computing will further push the demand for embedded NVM in compact and decentralized systems.

With consistent innovation in NAND flash, MRAM, and emerging memory types, the market is poised for a wave of transformative growth, especially in regions investing heavily in electronics manufacturing and smart infrastructure.

Market Segmentation

By Type:

Flash Memory

EEPROM

nvSRAM

EPROM

3D NAND

MRAM/STT-MRAM

FRAM

Others (PCM, NRAM, etc.)

By End-use Industry:

Automotive

Consumer Electronics

IT & Telecommunication

Media & Entertainment

Aerospace & Defense

Others (Healthcare, Industrial)

The flash memory segment dominates due to its speed, durability, and integration capability, while consumer electronics lead in end-use owing to the explosive demand for mobile and wearable technology.

Regional Insights

Asia Pacific leads the global market, accounting for the largest share in 2022. Countries like China, Japan, South Korea, and Taiwan have established themselves as R&D and manufacturing hubs for electronics and semiconductors.

North America follows, driven by a high adoption rate of IoT, strong presence of leading tech companies, and ongoing 5G infrastructure expansion. The region is also witnessing significant investment in AI-driven devices requiring efficient embedded memory.

Europe, Latin America, and Middle East & Africa also show promising growth trajectories due to increasing industrial automation and digital transformation initiatives.

Why Buy This Report?

Comprehensive Coverage: Detailed insights on global and regional market dynamics.

Data-backed Forecasts: Market projections from 2023–2031 with CAGR, value, and volume estimates.

Segment-Level Insights: Type-wise and end-use industry-wise breakdown for targeted business strategies.

Competitive Intelligence: Profiles and strategies of key market players.

Strategic Recommendations: Actionable insights for investors, product managers, and decision-makers.

Frequently Asked Questions

Q1. What is the expected CAGR of the embedded non-volatile memory market during the forecast period? The market is projected to grow at a CAGR of 15.3% from 2023 to 2031.

Q2. Which region dominates the global eNVM market? Asia Pacific held the largest market share in 2022 and is expected to maintain its lead during the forecast period.

Q3. Which memory type segment is leading the market? Flash memory dominates the market due to its high speed, durability, and efficiency.

Q4. What factors are driving the market growth? Rising demand for smartphones, smart wearables, IoT integration, low-power memory requirements, and 5G deployment are the key drivers.

Q5. Who are the top players in the market? Key players include eMemory Technology Inc., Infineon Technologies AG, GlobalFoundries Inc., Toshiba, and Texas Instruments.

Explore Latest Research Reports by Transparency Market Research: Active Optical Cable Market: https://www.transparencymarketresearch.com/active-optical-cables.html

Time of Flight Sensor Market: https://www.transparencymarketresearch.com/time-of-flight-sensor-market.html

Printed and Flexible Sensors Market: https://www.transparencymarketresearch.com/printed-and-flexible-sensors-market.html

3D Cameras Market: https://www.transparencymarketresearch.com/3d-cameras-market.html

About Transparency Market Research Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information. Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports. Contact: Transparency Market Research Inc. CORPORATE HEADQUARTER DOWNTOWN, 1000 N. West Street, Suite 1200, Wilmington, Delaware 19801 USA Tel: +1-518-618-1030 USA - Canada Toll Free: 866-552-3453 Website: https://www.transparencymarketresearch.com Email: [email protected]

0 notes

Text

How Four Companies Turned Resource Control Into Market Monopolies

In the business world, timing is valuable—but control is everything.

While many companies chase innovation and marketing brilliance, the savviest players have discovered another route to market dominance: owning the supply chain.

Whether it's plastic pumps or memory chips, the most genius business strategies haven’t focused on making better products—they’ve focused on ensuring that competitors can’t make any products at all.

The Strategic Blueprint

When David Protein acquired EPG’s sole producer and shut out the competition, he wasn’t inventing a new tactic—he was following in the footsteps of some of the smartest supply chain plays in history.

Here are three other legendary cases where supply control turned into market control:

The Pump Heist: Softsoap vs. Big Soap (1980)

Imagine launching a new product—liquid soap—while giants like Procter & Gamble loom large.

Robert Taylor’s answer?

Buy every plastic pump in the U.S.—100 million units for $12 million.

While corporate behemoths scrambled for overseas suppliers, Softsoap rocketed to $25 million in sales in just six months.

By the time competitors caught up, Taylor had made Softsoap a household name.

The result? In 1987, Colgate-Palmolive bought Softsoap for $61 million, turning that bold pump move into a 5X return.

The Billion-Dollar Bet by Apple (2005)

Steve Jobs saw that the booming iPod demand had one Achilles’ heel: flash memory.

His move?

Apple prepaid $1.25 billion to secure flash memory from every major supplier—Samsung, Toshiba, Intel, Micron, and Hynix—locking up global supply through 2010.

This wasn’t just component purchasing—it was future-proofing.

As rivals struggled to find chips, Apple produced 30 million iPods, solidifying its dominance. At the time, it was the largest prepayment in consumer electronics history.

Battery Hog: Elon Musk with Tesla (2004–2020s)

Elon Musk didn’t just want battery supply—he wanted battery supremacy.

Tesla teamed up with Panasonic and invested billions to build the Gigafactory, creating an exclusive, vertically integrated supply line.

At one point, this single Nevada plant produced more lithium-ion batteries than the rest of the world combined.

While traditional automakers hunted for suppliers, Tesla had locked down Panasonic’s best tech—giving it a five-year EV head start.

The Fat Replacer Monopoly by David Protein (2024)

EPG is a revolutionary plant-based fat substitute—same flavor, fewer calories. When David Protein took over Epogee, the only company producing EPG, he didn’t just buy a supplier.

He bought control over an entire category.

Suddenly, rival snack brands were hit with canceled shipments. Protein had already stockpiled two years’ worth of inventory, and now, he held the keys to "healthy indulgence" snacks.

An antitrust case is underway—but litigation takes time. Until it’s resolved, they control the ingredient, and by extension, the industry.

Conclusion

These four stories reveal a powerful truth: market domination isn’t always about the best product—it’s often about the smartest control of resources.

Whether it’s pumps, chips, batteries, or niche ingredients, owning critical supply chains can turn bold moves into billion-dollar wins.

David Protein’s recent play shows this strategy is still going strong in 2024—proving that sometimes, the best way to win is to make sure your rivals can’t even compete.

👉 https://cathrynlavery.com/

#BusinessStrategy#SupplyChainControl#MarketMonopoly#StartupLessons#CompetitiveAdvantage#Entrepreneurship#InnovationInBusiness#DavidProtein#TeslaStrategy#AppleBusinessModel#SoftsoapStory#ResourceMonopoly#Antitrust#MarketDomination#BusinessCaseStudies#CathrynLavery

1 note

·

View note

Photo

Did Samsung GDDR6 modules make the Radeon RX 9070 XT slightly slower than SK Hynix versions? A Chinese hardware reviewer discovered that RX 9070 XTs with Samsung GDDR6 memory perform 1-2% worse than those with SK Hynix modules. Despite higher clock speeds and power consumption, Samsung-based GPUs showed higher latency and lower speeds in tests like 3DMark Speedway. This difference is mainly due to Samsung's "loose" timings, resulting in increased memory latency — around 370-380ns compared to 350-360ns for SK Hynix. AMD confirmed Samsung modules are the culprits, highlighting how memory choice impacts GPU performance even among high-end models. Are you considering a Radeon RX 9070 XT? Knowing the memory type could be key to getting the best performance. Explore custom computer builds with us at GroovyComputers.ca for the perfect gaming or professional setup! #GPUPerformance #GamingHardware #TechNews #AMD #Radeon #SkHynix #Samsung #GraphicsCards #HighEndGPU #GamingSetup #CustomPCs #TechInsights #HardwareNews Ready to build the ultimate gaming PC? Visit GroovyComputers.ca to customize your dream machine today!

0 notes

Photo

Did Samsung GDDR6 modules make the Radeon RX 9070 XT slightly slower than SK Hynix versions? A Chinese hardware reviewer discovered that RX 9070 XTs with Samsung GDDR6 memory perform 1-2% worse than those with SK Hynix modules. Despite higher clock speeds and power consumption, Samsung-based GPUs showed higher latency and lower speeds in tests like 3DMark Speedway. This difference is mainly due to Samsung's "loose" timings, resulting in increased memory latency — around 370-380ns compared to 350-360ns for SK Hynix. AMD confirmed Samsung modules are the culprits, highlighting how memory choice impacts GPU performance even among high-end models. Are you considering a Radeon RX 9070 XT? Knowing the memory type could be key to getting the best performance. Explore custom computer builds with us at GroovyComputers.ca for the perfect gaming or professional setup! #GPUPerformance #GamingHardware #TechNews #AMD #Radeon #SkHynix #Samsung #GraphicsCards #HighEndGPU #GamingSetup #CustomPCs #TechInsights #HardwareNews Ready to build the ultimate gaming PC? Visit GroovyComputers.ca to customize your dream machine today!

0 notes

Text

Bad news for older PCs: DDR4 memory is nearing an end

If you have an older PC and are considering a memory upgrade, you might want to do it sooner than later. Prices for DDR4 memory are expected to jump sharply as the major memory vendors phase out their production in favor of DDR5 DRAM instead. The latter point is the cause for concern. Reports say that Samsung and SK Hynix have sent end-of-life notices to their customers about the end of DDR4…

0 notes

Text

12 Inch Silicon Wafers Market Analysis:

The global 12 Inch Silicon Wafers Market was valued at 10850 million in 2023 and is projected to reach US$ 18310 million by 2030, at a CAGR of 9.5% during the forecast period.

12 Inch Silicon Wafers Market Overview

Semiconductor silicon wafers are the foundational components of integrated circuits used in a wide range of electronics, including computers, cell phones, and other devices. These wafers are made from high-quality silicon, which serves as an excellent semiconductor material, making it ideal for manufacturing complex electronic devices.

The 300mm/12-inch wafers are the largest segment in the market and are primarily used in memory, logic, and analog applications. These wafers are available in various forms, including polished wafers and epitaxial wafers, each suited for different semiconductor applications.

Key Market Trends and Players

Geographical Production

Japan is the largest producer of 300mm semiconductor wafers, holding a 35% market share.

Other major producers include the USA, South Korea, Germany, Taiwan, Singapore, and China mainland.

In the coming years, China is expected to be the fastest-growing producer of 12-inch wafers, aiming to close the current gap in production.

Top Manufacturers in the Market

The global market for 12-inch semiconductor silicon wafers is largely dominated by five major manufacturers, which together account for more than 85% of the market share:

Shin-Etsu Chemical

SUMCO

GlobalWafers

Siltronic AG

SK Siltron

Chinese Manufacturers: Local companies such as National Silicon Industry Group (NSIG), Hangzhou Semiconductor Wafer (CCMC), Beijing ESWIN Technology Group, Shanghai Advanced Silicon Technology (AST), Zhonghuan Advanced Semiconductor Materials, and GRINM Semiconductor Materials are emerging players but still account for only 4.2% of the global market share. Currently, the Chinese market still relies heavily on imports, highlighting a significant opportunity and risk.

Product Types and Market Segments

Product Types

In terms of wafer types, the market is dominated by 300mm polished wafers, which accounted for 67% of the market share in 2023. Other wafer types include:

300mm epitaxial wafers

300mm SOI wafers (mainly dominated by France’s Soitec)

300mm annealed wafers

Market Applications

The primary application of 300mm semiconductor silicon wafers is in memory, which accounted for 52% of the market share in 2023. Other key applications include:

Logic chips: 46% market share

Advanced processes: Processes below 20nm are becoming more prominent, with 68% of TSMC’s revenue coming from these advanced processes in 2023.

The demand for logic chips is expected to grow rapidly, driven by technologies such as AI, data centers, 5G, and IoT.

Major End-Users

Downstream customers of 12-inch semiconductor silicon wafers are primarily divided into two categories:

Foundry:

TSMC

SMIC

GlobalFoundries

UMC

IDM (Integrated Device Manufacturer):

Samsung

Intel

SK Hynix

Micron Technology

Texas Instruments

STMicroelectronics

Future Outlook

As advanced wafer manufacturing processes continue to evolve, the demand for 300mm/12-inch wafers is expected to grow, especially in logic chip production. With the ongoing advances in AI, 5G, IoT, and other cutting-edge technologies, the semiconductor industry will rely on smaller process nodes to meet the growing performance demands.

Furthermore, China’s expanding production capacity for 12-inch wafers is expected to significantly impact the global semiconductor market, with both opportunities and risks as the country strives for self-sufficiency in wafer production.

.We have surveyed the 12 Inch Silicon Wafers manufacturers, suppliers, distributors, and industry experts on this industry, involving the sales, revenue, demand, price change, product type, recent development and plan, industry trends, drivers, challenges, obstacles, and potential risks This report aims to provide a comprehensive presentation of the global market for 12 Inch Silicon Wafers, with both quantitative and qualitative analysis, to help readers develop business/growth strategies, assess the market competitive situation, analyze their position in the current marketplace, and make informed business decisions regarding 12 Inch Silicon Wafers. This report contains market size and forecasts of 12 Inch Silicon Wafers in global, including the following market information:

Global 12 Inch Silicon Wafers market revenue, 2019-2024, 2025-2030, ($ millions)

Global 12 Inch Silicon Wafers market sales, 2019-2024, 2025-2030, (K Pcs)

Global top five 12 Inch Silicon Wafers companies in 2023 (%)

12 Inch Silicon Wafers Key Market Trends :

Increasing Demand for Advanced Processes

The demand for 12-inch wafers with advanced processes is growing, especially for nodes below 20 nanometers. This trend is driven by the increasing need for high-performance semiconductors in industries like AI, data centers, and 5G.

Rising Market Share of Logic Chips

The logic chip market is expected to grow rapidly due to technological advancements in areas like AI, data centers, 5G, and IoT, maintaining faster growth compared to memory chips in the coming years.

Growing Focus on Epitaxial and SOI Wafers

Epitaxial and SOI (Silicon on Insulator) wafers are gaining prominence due to their critical applications in high-performance logic devices and memory modules.

Increased Production in China

China is poised to become a fast-growing producer of 12-inch silicon wafers in the coming years, driven by technological advancements and local manufacturing expansion, reducing dependency on imports.

Consolidation of Market Share by Leading Manufacturers

A small number of large players, like Shin-Etsu Chemical, SUMCO, and GlobalWafers, dominate the market. This trend of consolidation continues to shape the global 12-inch silicon wafer market.

12 Inch Silicon Wafers Market Regional Analysis :

North America:Strong demand driven by EVs, 5G infrastructure, and renewable energy, with the U.S. leading the market.

Europe:Growth fueled by automotive electrification, renewable energy, and strong regulatory support, with Germany as a key player.

Asia-Pacific:Dominates the market due to large-scale manufacturing in China and Japan, with growing demand from EVs, 5G, and semiconductors.

South America:Emerging market, driven by renewable energy and EV adoption, with Brazil leading growth.

Middle East & Africa:Gradual growth, mainly due to investments in renewable energy and EV infrastructure, with Saudi Arabia and UAE as key contributors.

Total Market by Segment:

Global 12 Inch Silicon Wafers market, by Type, 2019-2024, 2025-2030 ($ millions) & (K Pcs) Global 12 Inch Silicon Wafers market segment percentages, by Type, 2023 (%)

300mm Polished Silicon Wafer

300mm Epitaxial Silicon Wafer

300mm Annealed Silicon Wafer

300mm SOI Silicon Wafer

Global 12 Inch Silicon Wafers market, by Application, 2019-2024, 2025-2030 ($ Millions) & (K Pcs) Global 12 Inch Silicon Wafers market segment percentages, by Application, 2023 (%)

Memory

Logic/MPU

Others

Competitor Analysis The report also provides analysis of leading market participants including:

Key companies 12 Inch Silicon Wafers revenues in global market, 2019-2024 (estimated), ($ millions)

Key companies 12 Inch Silicon Wafers revenues share in global market, 2023 (%)

Key companies 12 Inch Silicon Wafers sales in global market, 2019-2024 (estimated), (K Pcs)

Key companies 12 Inch Silicon Wafers sales share in global market, 2023 (%)

Further, the report presents profiles of competitors in the market, key players include:

Shin-Etsu Chemical

SUMCO

GlobalWafers

Siltronic AG

SK Siltron

FST Corporation

Wafer Works Corporation

National Silicon Industry Group (NSIG)

Zhonghuan Advanced Semiconductor Materials

Zhejiang Jinruihong Technologies

Hangzhou Semiconductor Wafer (CCMC)

GRINM Semiconductor Materials

MCL Electronic Materials

Nanjing Guosheng Electronics

Hebei Puxing Electronic Technology

Shanghai Advanced Silicon Technology (AST)

Zhejiang MTCN Technology

Beijing ESWIN Technology Group

Drivers

Growth of Semiconductor Industry The increasing demand for semiconductors in consumer electronics, automotive applications, and data centers is a key driver. The rise in smart devices, 5G, and IoT technologies is fueling this demand.

Technological Advancements in Wafer Production The advancement of wafer production processes, including the development of 300mm polished and epitaxial wafers, enhances the production of high-performance chips.

Expanding Applications in Memory and Logic Chips Memory chips (52% market share) and logic chips (46% market share) are witnessing increased demand, especially in AI, automotive, and telecom sectors, pushing growth in 12-inch wafer production.

Restraints

High Manufacturing Costs Producing 12-inch wafers involves high costs for raw materials and precision manufacturing, which can limit accessibility, especially for smaller manufacturers.

Supply Chain and Import Dependency in Certain Regions Certain regions, like China, still rely heavily on imports of 12-inch wafers. This dependency creates vulnerability in the supply chain and poses risks for market stability.

Environmental and Material Challenges Silicon wafer production generates waste and consumes energy, raising environmental concerns. Stricter regulations could impact production timelines and costs.

Opportunities

Expansion in Emerging Markets China and other emerging markets represent significant growth opportunities for the 12-inch silicon wafer industry as these regions ramp up semiconductor manufacturing capabilities.

Technological Innovation in Semiconductor Devices With innovations in AI, 5G, and automotive technologies, there is a growing need for advanced semiconductor devices, driving the demand for 12-inch wafers with higher performance.

Increased Demand for SOI Wafers As advanced technologies like high-frequency RF devices gain importance, the demand for Silicon on Insulator (SOI) wafers, which offer better performance, is set to increase.

Challenges

Supply Chain Disruptions Ongoing global supply chain challenges can lead to delays in production, especially as the demand for 12-inch wafers rises. This is compounded by the need for specific raw materials and advanced production facilities.

Intense Market CompetitionZero-Drift Op Amp Market Analysis:The global Zero-Drift Op Amp Market size was valued at US$ 892 million in 2024 and is projected to reach US$ 1.34 billion by 2032, at a CAGR of 5.9% during the forecast period 2025-2032A zero-drift operational amplifier (op-amp) is a type of op-amp designed to minimize offset voltage drift over time and temperature changes. It achieves this by incorporating internal circuitry that actively compensates for variations, resulting in extremely low offset voltage and drift characteristics. This makes zero-drift op-amps ideal for high-precision applications, such as sensor signal conditioning and data acquisition systems, where maintaining accuracy is crucial.Zero-drift operational amplifiers are precision analog devices designed to minimize input offset voltage drift over time and temperature, crucial for high-accuracy signal processing and measurement applications.The global Zero-Drift Op Amp market is experiencing robust growth, driven by increasing demand for high-precision instrumentation, advancements in medical devices, and the expansion of industrial automation. In 2023, total unit sales reached 450 million, with North America and Asia-Pacific accounting for 70% of global demand. The industrial sector remains the largest end-user at 40%, followed by healthcare and medical devices at 30%. Chopper-stabilized zero-drift op amps dominate with a 65% market share, while auto-zero architectures are growing at 8% annually due to their improved noise performance. The market saw a 15% increase in demand for low-power zero-drift op amps in 2023, reflecting the trend towards battery-operated and portable devices. Application in precision data acquisition systems grew by 20%, driven by Industry 4.0 initiatives. The trend towards miniaturization led to a 10% rise in adoption of zero-drift op amps in compact wearable medical devices. R&D investments in enhancing bandwidth while maintaining ultra-low offset voltage increased by 25% in 2023. The market faces challenges from digital signal processing solutions in some applications, with a 3% shift towards mixed-signal architectures observed. Advancements in semiconductor manufacturing processes improved offset voltage performance by 5% year-over-year, reaching sub-microvolt levels in high-end models.Zero-Drift Op Amp Market OverviewZero-drift op amp family operates within a supply voltage range of 4.5 V to 55 V and provides the ease-of-use of a precision op amp with the ultra-low offset and drift of a zero-drift op amp. This report provides a deep insight into the global Zero-Drift Op Amp market covering all its essential aspects. This ranges from a macro overview of the market to micro details of the market size, competitive landscape, development trend, niche market, key market drivers and challenges, SWOT analysis, value chain analysis, etc. The analysis helps the reader to shape the competition within the industries and strategies for the competitive environment to enhance the potential profit. Furthermore, it provides a simple framework for evaluating and accessing the position of the business organization. The report structure also focuses on the competitive landscape of the Global Zero-Drift Op Amp Market, this report introduces in detail the market share, market performance, product situation, operation situation, etc. of the main players, which helps the readers in the industry to identify the main competitors and deeply understand the competition pattern of the market. In a word, this report is a must-read for industry players, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the Zero-Drift Op Amp market in any manner.Zero-Drift Op Amp Key Market Trends :

Rising Demand in Industrial Automation: Industry 4.0 adoption has led to a 20% rise in the use of zero-drift op amps in precision data acquisition systems.

Surge in Medical Device Integration: The growing trend of miniaturized and wearable medical devices has driven a 10% increase in adoption.

Dominance of Chopper-Stabilized Op Amps: Chopper-stabilized zero-drift op amps continue to lead with a 65% market share due to superior accuracy.

Shift Toward Low-Power Designs: A 15% boost in demand for low-power variants reflects growing use in battery-operated and portable devices.

Emerging Preference for Auto-Zero Architectures: Auto-zero designs are gaining traction, growing at 8% annually for their enhanced noise performance.

Zero-Drift Op Amp Market Regional Analysis :

North America:Strong demand driven by EVs, 5G infrastructure, and renewable energy, with the U.S. leading the market.

Europe:Growth fueled by automotive electrification, renewable energy, and strong regulatory support, with Germany as a key player.

Asia-Pacific:Dominates the market due to large-scale manufacturing in China and Japan, with growing demand from EVs, 5G, and semiconductors.

South America:Emerging market, driven by renewable energy and EV adoption, with Brazil leading growth.

Middle East & Africa:Gradual growth, mainly due to investments in renewable energy and EV infrastructure, with Saudi Arabia and UAE as key contributors.

Zero-Drift Op Amp Market Segmentation :The research report includes specific segments by region (country), manufacturers, Type, and Application. Market segmentation creates subsets of a market based on product type, end-user or application, Geographic, and other factors. By understanding the market segments, the decision-maker can leverage this targeting in the product, sales, and marketing strategies. Market segments can power your product development cycles by informing how you create product offerings for different segments. Key Company

ANALOG

Digi-Key Electronic

Texas Instruments

Mouser Electronics

Informa USA

Asahi Kasei Microdevices

Microchip Technology

Maxim Integrated Products

MA Business

New Japan Radio

Market Segmentation (by Type)

1 Channel Type

2 Channel Type

4 Channel Type

Market Segmentation (by Application)

Precision Weigh Scale

Sensor Front Ends

Load Cell and Bridge Transducers

Interface for Thermocouple Sensors

Medical Instrumentation

Key Drivers

Growing Demand for High-Precision Electronics: Increasing use in sensor signal conditioning and data acquisition systems is fueling market growth.

Medical and Healthcare Advancements: Precision and miniaturization needs in medical instruments drive higher adoption of zero-drift op amps.

Industrial Automation and IoT Expansion: The need for accurate signal processing in automated systems boosts usage across manufacturing sectors.

Key Restraints

High Design Complexity: Designing systems with ultra-low offset voltage components increases development time and cost.

Availability of Digital Alternatives: Rise of digital signal processing (DSP) and mixed-signal systems reduces demand in certain segments.

Thermal Management Challenges: Maintaining performance in harsh or fluctuating temperature conditions remains a technical hurdle.

Key Opportunities

Expansion in Wearable Healthcare Devices: Growing demand for compact, accurate medical wearables opens new avenues for zero-drift op amps.

Technological Advancements in IC Fabrication: New semiconductor processes improving offset voltage performance unlock potential in precision applications.

Growth in Emerging Markets: Rapid industrialization and healthcare development in Asia-Pacific and Latin America present untapped potential.

Key Challenges

Competitive Pressure from DSP Solutions: A 3% shift toward digital and mixed-signal alternatives puts pressure on analog op amp applications.

Balancing Power Consumption and Accuracy: Achieving ultra-low drift while keeping power use minimal is a constant engineering challenge.

Cost Constraints in Price-Sensitive Markets: Adoption in cost-driven industries may be limited due to the higher price of precision op amps.

Key Benefits of This Market Research:

Industry drivers, restraints, and opportunities covered in the study

Neutral perspective on the market performance

Recent industry trends and developments

Competitive landscape & strategies of key players

Potential & niche segments and regions exhibiting promising growth covered

Historical, current, and projected market size, in terms of value

In-depth analysis of the Zero-Drift Op Amp Market

Overview of the regional outlook of the Zero-Drift Op Amp Market:

Key Reasons to Buy this Report:

Access to date statistics compiled by our researchers. These provide you with historical and forecast data, which is analyzed to tell you why your market is set to change

This enables you to anticipate market changes to remain ahead of your competitors

You will be able to copy data from the Excel spreadsheet straight into your marketing plans, business presentations, or other strategic documents

The concise analysis, clear graph, and table format will enable you to pinpoint the information you require quickly

Provision of market value (USD Billion) data for each segment and sub-segment

Indicates the region and segment that is expected to witness the fastest growth as well as to dominate the market

Analysis by geography highlighting the consumption of the product/service in the region as well as indicating the factors that are affecting the market within each region

Provides insight into the market through Value Chain

Market dynamics scenario, along with growth opportunities of the market in the years to come

6-month post-sales analyst support

The dominance of major players like Shin-Etsu Chemical and SUMCO limits market opportunities for smaller players, leading to high competition and price pressure in the industry.

Rising Costs of Raw Materials Fluctuations in the price of silicon and other raw materials, as well as labor costs, could lead to increasing production costs, impacting profit margins for manufacturers.

Related Reports:

0 notes

Text

Microsoft Surface Pro 11 Chip ID

Duration: 45 minutes Steps: 10 Steps Step 1 – Meet the Qualcomm X1P-64-100-103 Snapdragon X Plus: your device’s deca-core brainpower station. – SK hynix H58G56BK8BX068 is here, delivering 4 GB of LPDDR5X super-fast memory for zippy performance. – The Qualcomm PMC8380-001-00 keeps power management smooth and steady. – Qualcomm PMC8380VE-001 is another power management pro, working behind the…

0 notes

Link

#3Dstacking#co-optimization#HBMadvancement#manufacturingscaling#memoryarchitecture#regionalspecialization#semiconductorinnovation#supplychainresilience

0 notes

Text

Global DRAM revenue falls 5.5% in Q1

June 4, 2025 /SemiMedia/ — Global DRAM revenue reached $27.01 billion in the first quarter of 2025, marking a 5.5% decline from the previous quarter, according to TrendForce. The downturn was driven by falling contract prices for standard DRAM and a slowdown in high-bandwidth memory (HBM) shipments. SK Hynix took the lead in Q1, with strong HBM3e shipments stabilizing ASPs. Despite a drop in…

#DRAM market analysis#DRAM pricing outlook#Electornic parts supplier#electronic components news#Electronic components supplier#Micron DRAM growth#Nanya DDR5 shipments#Samsung DRAM revenue#SK Hynix HBM3e#Winbond LPDDR4

0 notes

Text

Meet Indrajit Sabharwal: A Leader Transforming Indian Tech

Indrajit Sabharwal is a pioneering leader in India's technology sector, known for his visionary leadership in the electronics and semiconductor industries. The founder and chairman of Simmtronics, he has navigated his way from humble origins to international acclaim, displaying innovation, perseverance, and strategic vision.

Early Life and Education

Indrajit Sabharwal had an early penchant for technology. After a degree in engineering from Pune University, he started his career with ICL UK (now Fujitsu ICIM) in Pune on a humble salary of Rs 1,500 per month. Showing a keenness for ongoing learning, he completed three part-time management degrees to build a strong foundation for his future entrepreneurial journey.

Entrepreneurial Beginnings

In 1991, Indrajit Sabharwal moved to Delhi, getting experience at Comptech and International Data Corporation. By January 1989, he went into entrepreneurship and set up SI Consultants with Rs 10,000 as capital. The consultancy soon made it big, winning the support of major clients like Modi Lufthansa, Xerox, HP Digital, and Sahara Airlines, and registering Rs 30 lakh in business in eight months.

Establishing Simmtronics

Expanding on the success of his consultancy, Indrajit Sabharwal set up Simmtronics in 1990, with an eye to producing memory modules and DRAM technology. The company initially imported California-produced modules and supplied them to customers such as Tulip Telecomm, HCL, LG, and Sahara. In the first year, Simmtronics managed a turnover of Rs 2.5 crore and grew at a rate of 25-30% a year thereafter.

Expansion and Diversification

To cater to growing demand, Simmtronics opened its first manufacturing unit in Bhiwadi, Rajasthan, in 2000, and the second one in Roorkee, Uttarakhand. It expanded its product portfolio to cover motherboards, graphic cards, monitors, and USB drives. Of particular interest is that Simmtronics emerged as Intel's choice IT support for semiconductor conferences and formed an alliance with SK Hynix, a Korean semiconductor chipmaker, and its technological competence was further enhanced.

Global Presence

Having appreciated the potential of global markets, Simmtronics globally grew by establishing distribution subsidiaries in Singapore (2005) and Dubai (2006). Simmtronics had 21 offices across the world, a workforce of over 500 personnel, and was catering to clients in 14 nations with a turnover of Rs 550 crore as of 2012.

Innovation in Consumer Electronics

In 2012, Simmtronics introduced the XPad tablet range with 24 customized in-house products designed for different market demands. The tablets became very popular, particularly in the Middle East, and strengthened the company's image as an innovator in affordable consumer electronics.

Recent Developments and Vision

In May 2024, Indrajit Sabharwal declared the evolution of revolutionary technologies that will revolutionize the semiconductor and technology industry. With his unshakeable belief in innovation, he believes that he will make Simmtronics one of the most valuable technology corporations globally by the year 2030.

Recognition and Legacy

Indrajit Sabharwal's work has won him many accolades, including being featured in the Top 100 Magazine for semiconductor and technology excellence. Nicknamed the "Steve Jobs of India" and the "Guru in Semiconductors," his innovative leadership inspires entrepreneurs and technologists across the globe.

Indrajit Sabharwal's rise from humble beginnings as an engineer to an international tech icon reflects the influence of visionary leadership and ceaseless quest for innovation in molding India's technological development.

0 notes

Text

Embedded Non-volatile Memory Market to Hit $218.6 Million by 2031: What's Driving the Growth?

The global Embedded Non-volatile Memory (eNVM) market was valued at USD 61.1 million in 2022 and is projected to expand at a CAGR of 15.3% between 2023 and 2031, reaching USD 218.6 million by the end of 2031. Embedded NVM refers to non-volatile storage integrated directly into semiconductor chips, retaining data even when the system is powered off. Its core applications include firmware storage, calibration data retention, and secure configuration storage in microcontrollers, digital signal processors, and a wide array of embedded systems.

Market Drivers & Trends

Smartphone and Wearable Boom – The continued global uptake of mobile devices has escalated the need for larger, faster embedded memory. Users demand lightning-fast boot times and seamless multitasking, driving OEMs to integrate high-performance flash memory and emerging NVM technologies directly into system-on-chips (SoCs). – Wearables, smart speakers, and IoT gadgets prioritize low-density but highly efficient memory. 3D NAND flash has emerged as the preferred technology, offering high storage capacity in a minimal footprint. Samsung and SK Hynix have ramped up mass production of advanced 3D NAND modules tailored for connected device ecosystems.

Low-Power, High-Speed Requirements – Battery-powered devices mandate memory that combines rapid data access with minimal energy draw. Next-generation embedded NVMs—such as STT-MRAM and ReRAM—offer sub-microsecond access times and ultra-low standby currents, extending device lifespans and enhancing user experience. – System-in-Package (SiP) and Package-on-Package (PoP) solutions are gaining traction, integrating multiple memory dies and logic blocks into single compact modules, thereby reducing interconnect power losses and boosting overall throughput.

Security and Reliability – As embedded systems permeate mission-critical sectors (automotive ADAS, industrial controls, medical devices), secure and tamper-resistant memory is non-negotiable. Embedded flash and MRAM provide inherent read/write protections, while emerging PUF-based authentication schemes leverage intrinsic chip variability to safeguard cryptographic keys.

Latest Market Trends

3D XPoint and Beyond: Following its debut in enterprise SSDs, 3D XPoint is being miniaturized for embedded applications, promising DRAM-like speeds with non-volatility, ideal for real-time control systems.

Embedded MRAM/STT-MRAM: Gaining traction in safety-critical automotive and industrial sectors, MRAM offers unlimited endurance cycles and high radiation tolerance.

Embedded Ferroelectric RAM (FRAM): With nanosecond write speeds and high write endurance, FRAM is carving out niches in smart cards, metering, and medical devices.

Key Players and Industry Leaders The eNVM market is highly consolidated, with major semiconductor manufacturers and specialty memory providers driving innovation and capacity expansion:

eMemory Technology Inc.

Floadia Corporation

GlobalFoundries Inc.

Infineon Technologies AG

Japan Semiconductor Corporation

Kilopass Technology, Inc.

SK HYNIX INC.

SMIC

Texas Instruments Incorporated

Toshiba Electronic Devices & Storage Corporation

Download now to explore primary insights from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=24953

Recent Developments

March 2023 – ANAFLASH Commercialization U.S. startup ANAFLASH unveiled an energy-efficient embedded NVM solution tailored for battery-powered wireless sensors, medical wearables, and autonomous robots, promising up to 30% lower power consumption versus incumbent flash technologies.

February 2023 – GlobalFoundries Acquisition GlobalFoundries acquired Renesas Electronics’ resistive RAM patents and manufacturing know-how, aiming to integrate low-power ReRAM into next-generation SoCs for smart home and mobile applications.

May 2022 – Automotive Platform Collaboration Japan Semiconductor Corporation and Toshiba Electronic Devices partnered to develop a 0.13-micron analog IC platform with embedded flash, targeting advanced automotive applications such as in-vehicle networking and sensor fusion modules.

Market Opportunities

5G and IoT Rollout: The proliferation of 5G networks and edge computing devices demands local data storage and analytics, presenting growth avenues for low-latency embedded memory.

Automotive Electrification: Electric and autonomous vehicles require robust memory for ADAS, telematics, and battery management systems, creating new application segments.

Healthcare Wearables: Demand for continuous health monitoring fosters embedded memory integration in smart patches and implantable devices, where size and power constraints are paramount.

Future Outlook Analysts project that by 2031, the Embedded NVM market will surpass US$ 218 million, driven by sustained R&D investments and product diversification into emerging NVM technologies. The maturation of foundry support for STT-MRAM, ReRAM, and 3D XPoint, coupled with advanced packaging breakthroughs, will accelerate adoption across consumer, automotive, and industrial domains. Security-driven regulations and functional safety standards will further cement embedded memory’s role in next-generation electronic systems.

Market Segmentation

By Type

Flash Memory (dominant share in 2022)

EEPROM

nvSRAM

EPROM

3D NAND

MRAM/STT-MRAM

FRAM

Others (PCM, NRAM)

By End-Use Industry

Consumer Electronics (2022 market leader)

Automotive

IT & Telecommunication

Media & Entertainment

Aerospace & Defense

Others (Industrial, Healthcare)

By Region

North America

Europe

Asia Pacific (2022 market leader)

Middle East & Africa

South America

Buy this Premium Research Report for a detailed exploration of industry insights - https://www.transparencymarketresearch.com/checkout.php?rep_id=24953<ype=S

Regional Insights

Asia Pacific: Commanded the largest share in 2022, fueled by semiconductor R&D hubs in China, Japan, Taiwan, and South Korea, and robust electronics manufacturing ecosystems.

North America: Home to major foundries and design houses; 5G and IoT device adoption is expected to drive eNVM demand through 2031.

Europe: Automotive electrification and Industry 4.0 initiatives will underpin growth, with Germany and France leading demand.

MEA & Latin America: Emerging markets are gradually adopting consumer electronics and automotive technologies, presenting long-term opportunities.

Frequently Asked Questions

What is embedded non-volatile memory? Embedded NVM is memory integrated into semiconductor chips that retains data without power. It is used for firmware, configuration data, and security keys.

Which eNVM type holds the largest market share? Flash memory led the market in 2022 due to its balance of speed, density, and cost-effectiveness, particularly in consumer electronics and IoT devices.

What industries drive eNVM demand? Consumer electronics, automotive (ADAS, electrification), IT & telecom (5G equipment), aerospace & defense, healthcare wearables, and industrial automation.

How will emerging technologies impact the market? STT-MRAM, ReRAM, and 3D XPoint will offer faster speeds, higher endurance, and lower power profiles, expanding applications in safety-critical and high-performance systems.

Which regions offer the best growth prospects? Asia Pacific remains the leader due to manufacturing scale and R&D. North America and Europe follow, driven by advanced automotive and IoT deployments.

What factors may restrain market growth? High development costs for new NVM technologies, integration complexity, and supply chain disruptions in semiconductor fabrication could pose challenges.

Why is this report important for stakeholders? It equips semiconductor vendors, system integrators, and strategic investors with the insights needed to navigate technological shifts and seize emerging market opportunities in embedded memory.

Explore Latest Research Reports by Transparency Market Research:

Power Meter Market: https://www.transparencymarketresearch.com/power-meter-market.html

Radiation Hardened Electronics Market: https://www.transparencymarketresearch.com/radiation-hardened-electronics-semiconductor-market.html

AC-DC Power Supply Adapter Market: https://www.transparencymarketresearch.com/ac-dc-power-supply-adapter-market.html

5G PCB Market: https://www.transparencymarketresearch.com/5g-pcb-market.html

About Transparency Market Research Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information. Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports. Contact: Transparency Market Research Inc. CORPORATE HEADQUARTER DOWNTOWN, 1000 N. West Street, Suite 1200, Wilmington, Delaware 19801 USA Tel: +1-518-618-1030 USA - Canada Toll Free: 866-552-3453 Website: https://www.transparencymarketresearch.com Email: [email protected]

0 notes