#instant loans online in India

Text

#immediate loan#instant loan#instant loans in Delhi#quick money loans#instant loans online in India#instant loan approval online#apply for instant loan online#online loan with low interest#get instant loan#instant loan approval#instant loan online#instant loan apply#apply for instant loan

0 notes

Text

Apply Online for Quick Loan with Instant Approval

We often run out of finance and need quick funding to fulfill our dreams and aims. The obvious solution for the same is to choose for the loan. But in the fear of rejections or due to less knowledge we often end up taking financial aid from informal sources at higher interest rates. This puts our life in debt and creates financial stress. To avoid all these things the easier solution is to opt for the loan that can help you to overcome your financially harder time.

There are many financial aid companies that are making the tough task of taking loans easy by helping the borrowers in documentations and processing of the loan. With the introduction of technology many financial aid companies have inculcated and have shifted successfully to the technology to ease the process of loans. Now you can apply online for loan online and avail of the loan without much trouble. The article below is an attempt to make the readers understand about the loan providers companies. Further it will explain to you the benefits of choosing the loan providers. At the end, the article will conclude by giving you the list of top loan providers in Delhi.

What are loan Providers companies? What are the benefits of choosing Loan Providers?

Loan providers are companies or financial institutions that offer loans to individuals, businesses, or other entities in need of financial assistance. You can apply for quick loan and fulfill your dreams. These loans can be used for various purposes, such as personal expenses, buying a house or a car, funding a business venture, or consolidating debts.

Some common types of loan providers include:

Banks

Credit Unions

Online Lenders

Peer-to-Peer Lending Platforms

Microfinance Institutions

Payday Lenders

Credit Card Companies

Finance Companies

Choosing loan providers can offer several benefits, depending on your financial needs and circumstances. Here are some of the advantages of opting for loan providers:

Access to Funds: Loan providers offer you access to the funds you need when you are facing financial constraints or have specific financial goals, such as purchasing a home or funding a business.

Flexible Repayment Options: Many loan providers offer various repayment plans, allowing you to choose a schedule that aligns with your income and financial capabilities. This flexibility can make it easier to manage your debt.

Quick Processing and Approval: These companies offer easy loan applications to the borrowers. With the advent of online lending platforms, the loan application and approval process have become quicker and more streamlined. In many cases, you can receive loan approval within a short period, providing you with swift access to funds.

Build Credit History: Responsible borrowing and timely repayments can help you build a positive credit history. A good credit score can open doors to better loan options and lower interest rates in the future.

Consolidating Debt: Loan providers may offer debt consolidation loans, allowing you to combine multiple debts into a single loan with a potentially lower interest rate. This can simplify your finances and reduce overall interest costs.

Competitive Interest Rates: By shopping around and comparing different loan providers, you can find competitive interest rates that suit your budget and save you money over time.

Specialized Loan Products: Some loan providers offer specialized loan products tailored to specific needs, such as home loans, auto loans, student loans, or small business loans.

Online Accessibility: Many loan providers now offer online applications, making it convenient to apply for a loan from the comfort of your home and access customer support through digital channels.

Avoiding Depletion of Savings: Taking out a loan for planned expenses can help you preserve your savings for emergencies or unexpected financial situations.

Top Loan Providers in Delhi

Here is the list of top finance companies in Delhi with their locations. These loan companies in Delhi shall help you to get instant loan the assistance you need in financial aid matters.

My Mudra: It is a largest growing fintech having headquartered in Delhi. The company is providing financial services since decades.

Credset: It is a loan provider agency based in Karol Bagh Delhi.

Finance loan in India online

Trust: They are providing different types of loans and have been based out in Netaji Subhash Palace, Pitampura, Delhi.

KG Loan Expert Pvt. Ltd: It is a loan provider agency based in Netaji Subhash Palace in Delhi.

GRD India Financial Service: This is a financial aid provider company based out in Ashok Nagar Delhi.

Conclusion

It's essential to carefully consider the terms and conditions, interest rates, and repayment terms offered by different loan providers before committing to a loan. Borrowers should also ensure that they can comfortably meet their repayment obligations to avoid financial difficulties. My Mudra is one of the top fintech organizations which has been making loans and helping people since decades.

#Apply Online for Loans#apply for quick loan#loan instant approval#get instant loan#loan in India online#top fintech organizations

2 notes

·

View notes

Text

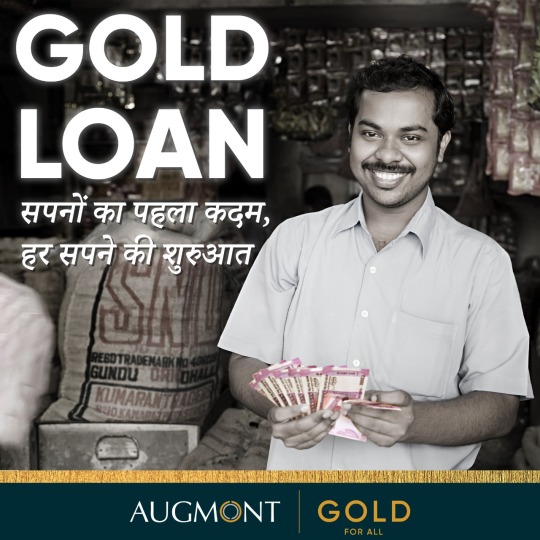

Unlock the Value of Your Gold Instantly

Turn your idle gold into an active asset with our hassle-free gold loan services. Whether you need funds for a personal emergency, business expansion, or any other financial requirement, our gold loan offers immediate liquidity without selling your precious gold. We provide competitive interest rates and a seamless process, ensuring that you can access the funds you need quickly and efficiently.

Secure and Transparent Valuation

Your gold’s value is maximized with our transparent and accurate valuation process. Our expert appraisers use industry-standard methods to evaluate your gold, ensuring you receive the best possible loan amount based on the current market rates. With us, you can rest assured that your gold is stored securely in our vaults, with 100% insurance coverage, until you repay the loan.

Flexible Repayment Options

We understand that financial needs vary, which is why we offer flexible repayment options tailored to your convenience. Choose from EMI-based plans or bullet repayment options, depending on what suits your financial situation best. Our terms are clear, with no hidden fees, so you can plan your finances without any surprises.

#instant gold loan#gold loans#gold loan in india#gold loan online#best gold loan provider#gold loan at home

0 notes

Text

Could we take a loan from a mobile app?

loan from a mobile app: In today’s fast-paced world, convenience is king. Enter mobile app loans, a relatively new player in the financial arena that’s catching everyone’s attention. But what exactly are these loans, and how do they work? Are they as great as they sound, or is there more to the story? Let’s dive into the world of mobile app loans to uncover their secrets and figure out if they’re a good fit for your financial needs.

What is a Mobile App Loan?

A mobile app loan is exactly what it sounds like a loan that you apply for and manage through a mobile application. These apps offer a streamlined process for getting a loan without the need to visit a physical bank. Essentially, they bring the bank to your fingertips.

Suggested Articles: Best Financial Advisor in Gurugram | Financial Advisor

How Mobile App Loans Work

Application Process

Applying for a mobile app loan is as simple as downloading an app, filling out a form, and pressing submit. Here’s a quick rundown:

Download the App: Start by downloading the loan app from your preferred app store.

Fill Out the Application: Enter your details, including income, employment status, and credit history.

Submit and Wait: After submission, the app processes your information and lets you know if you’re approved.

Approval and Disbursement

Once you’re approved, the funds are usually transferred directly to your bank account or a digital wallet. The speed of this process can vary, but many apps promise near-instant disbursement.

Suggested Articles: Best Student credit card Providers in Gurgaon | credit card

Advantages of Mobile App Loans

Convenience and Accessibility

Imagine being able to apply for a loan while lounging on your couch or waiting in line at the supermarket. That’s the beauty of mobile app loans—they offer unparalleled convenience. No more scheduling appointments or waiting in line; you can get a loan from anywhere, anytime.

Quick Processing Times

Time is money, and mobile app loans know that. Many apps boast quick approval times, often within minutes. This means you can get the funds you need fast, which is perfect for unexpected expenses.

Minimal Paperwork

Traditional loans can involve heaps of paperwork and bureaucratic hurdles. Mobile app loans simplify things with minimal documentation. You’ll often need just a few documents to verify your identity and income.

Suggested Articles: Documents required for buying insurance

Disadvantages and Risks

High-Interest Rates

One downside to mobile app loans is that they sometimes come with higher interest rates compared to traditional loans. Lenders compensate for the risk and convenience with higher costs, so it’s essential to read the fine print before committing.

Risk of Fraud

With the rise of mobile apps, there’s also an increase in fraudulent activities. It’s crucial to ensure the app is legitimate and secure to avoid falling victim to scams. Always check for proper encryption and read reviews before downloading.

Limited Loan Amounts

Mobile app loans often have lower borrowing limits compared to traditional loans. If you need a substantial sum, you might find these loans insufficient for your needs.

Suggested Articles: Life Insurance Corporation of India (LIC) Online Payment

How to Choose a Reliable Mobile App

Research and Reviews

Before downloading any loan app, do your homework. Look for user reviews and ratings to gauge the app’s reliability and customer service. A well-reviewed app with a solid reputation is usually a safer bet.

Company Credentials

Verify the credentials of the lending company behind the app. Ensure they are licensed and regulated by financial authorities to ensure they operate within legal boundaries.

Suggested Articles: Best Insurance advisor in Gurugram 2024

Alternatives to Mobile App Loans

Traditional Bank Loans

If you’re wary of mobile app loans, traditional bank loans are a reliable alternative. While they might involve more paperwork and a longer approval process, they often come with lower interest rates and higher loan limits.

Online Lenders

Online lenders are another option. They combine the convenience of mobile apps with the reliability of traditional lenders. When choosing an online lender, look for those with good reviews and transparent terms.

Conclusion

Mobile app loans offer a convenient and fast way to access funds, but they come with their own set of advantages and disadvantages. They’re great for quick cash needs but may not be the best option for everyone due to higher interest rates and potential security risks. Always research thoroughly and consider your options before deciding. After all, the right loan for you is the one that fits your financial situation best.

By Paisainvests.com

#App-Based Loans#Could We Take a Loan from a Mobile App#Digital Financial Solutions#Digital Loan Services#Instant Loans Mobile Apps#Mobile App Loans#Mobile Lending India#Mobile Loan Application#Mobile Loan Apps#Online Loans India

1 note

·

View note

Text

#gold loan#best gold loan#gold loan online#gold loan in india#low intereset gold loan#easy gold loan#quick gold loan#gold loan in India#best gold loan bank#gold loan bank#doorstep gold loan#gold loan at home#gold loan doorstep#instant gold loan#sahibandhu gold loan#sahibandhu#loan against gold

0 notes

Text

0 notes

Text

Instant Loan Apply Online | Quick Cash Loan in India

Unexpected financial needs can arise at any moment. Whether it's a medical emergency, an unplanned trip, or a sudden home repair, having quick access to funds is crucial. This is where instant loans come into play. With technological advancements, applying for an instant loan online has become a seamless process, providing quick access to cash for those in need. In India, the demand for instant loans has surged, driven by the convenience and speed they offer. This article explores the various aspects of instant loan applications online and the benefits of Instant Loan Online in India.

What is an Instant Loan?

An instant loan is a type of short-term personal loan designed to provide immediate financial assistance to individuals. These loans are typically unsecured, meaning they do not require collateral, making them accessible to a broader range of people. The primary appeal of instant loans lies in their quick approval and disbursement process, often within a few hours of application.

Benefits of Instant Loans

Quick Approval and Disbursement: One of the most significant advantages of instant loans is the rapid approval process. Many online lenders use advanced algorithms and AI to assess applications swiftly, ensuring funds are disbursed within a short period, sometimes even in minutes.

Convenient Application Process: Applying for an instant loan online is incredibly convenient. Borrowers can complete the entire process from the comfort of their homes, using a computer or smartphone. This eliminates the need for lengthy paperwork and multiple visits to a bank.

Minimal Documentation: Traditional loans often require extensive documentation, which can be time-consuming and cumbersome. Instant loans, on the other hand, typically require minimal documentation, such as identity proof, address proof, and income proof.

Flexible Loan Amounts and Tenures: Instant loans offer flexibility in terms of loan amounts and repayment tenures. Borrowers can choose the amount they need and the tenure that suits their repayment capacity, making it easier to manage their finances.

No Collateral Required: Since instant loans are unsecured, borrowers do not need to pledge any collateral. This makes them accessible to individuals who may not have assets to offer as security.

How to Apply for an Instant Loan Online

Applying for an instant loan online in India is a straightforward process. Here are the steps involved:

Research Lenders: Start by researching various online lenders that offer instant loans. Compare their interest rates, loan amounts, tenures, and customer reviews to find a reputable lender that meets your needs.

Check Eligibility: Each lender will have specific eligibility criteria, such as age, income, and credit score. Ensure you meet these criteria before proceeding with the application.

Fill Out the Application Form: Visit the lender's website or mobile app and fill out the online application form. Provide accurate information and upload the required documents, such as identity proof, address proof, and income proof.

Submit the Application: Once you have filled out the form and uploaded the necessary documents, submit your application. The lender will review your application and verify the information provided.

Approval and Disbursement: If your application is approved, the lender will notify you, and the loan amount will be disbursed to your bank account. The entire process can take anywhere from a few minutes to a few hours, depending on the lender.

Important Considerations

While instant loans offer numerous benefits, there are a few considerations to keep in mind:

Interest Rates: Instant loans often come with higher interest rates compared to traditional loans due to the convenience and speed they offer. Make sure to compare rates from different lenders and choose one that offers competitive rates.

Repayment Terms: Ensure you understand the repayment terms, including the tenure and EMI amount. Borrow only what you can comfortably repay to avoid financial strain.

Hidden Charges: Some lenders may have hidden charges, such as processing fees, prepayment penalties, or late payment fees. Read the terms and conditions carefully to avoid any surprises.

Credit Score Impact: Timely repayment of your instant loan can positively impact your credit score, making it easier to obtain future loans. However, missed payments can harm your credit score, so it's crucial to make repayments on time.

Conclusion

Instant loans have revolutionized the way people access quick cash loan in India. Their convenience, speed, and minimal documentation requirements make them an attractive option for those in need of immediate financial assistance. However, it's essential to choose a reputable lender, understand the terms and conditions, and borrow responsibly. By doing so, you can make the most of instant loans and meet your financial needs efficiently.

0 notes

Text

Get instant personal loans online with quick approvals and flexible repayment options. Apply now and receive the funds you need in a fast, secure, and convenient way.

#instant loan app#instant loan#loan app#perosnal loan#loan#personal loan online#personal loan app#personal loan in india

1 note

·

View note

Text

Revolutionizing Financial Wellness: ATD-Money's Approach to Quick Loans and Advance Salary Solutions in India

In the world of digitalization and modern financing systems, access to quick and reliable loan solutions is crucial. ATD-Money emerges as a game-changer in the industry, offering innovative products and services to address the diverse financial needs of every individual across India. Let's explore how ATD-Money is revolutionizing the financial ecosystem with its unique approach to quick loans, instant cash disbursement, and advance salary solutions. Gone are the days of lengthy loan applications and waiting weeks to get approval. ATD-Money is redefining the borrowing experience with its digital, seamless, efficient process. Whether you need an instant loan, advance salary loan, or cash infusion to tide you over until payday, ATD-Money has you covered all across. Let's delve into the key features and benefits of ATD-Money's cutting-edge financial solutions.

Quick Loans for Instant Financial Relief:

Life is unpredictable and financial emergencies can strike when no one expected. ATD-Money understands the urgency of such situations and offers quick loans solutions as per your need to provide instant financial relief. With our easy application process and swift approval mechanism, you can access the funds you need in no time. Whether it's covering medical expenses or unexpected bills, our quick loans ensure that you're never caught off guard.

Advance Salary Loans:

Waiting for your next salary to cover the urgent expenses can be stressful. ATD-Money offers advance salary solutions to bridge the gap between paydays. Our advance salary loans allow you to access a portion of your upcoming salary in advance, providing much-needed financial flexibility when you need it the most. Say goodbye to financial worries and hello to peace of mind with ATD-Money's advance salary loans.

Instant Cash Disbursement:

When time is of the essence, waiting for funds to arrive can be frustrating for anyone. ATD-Money's instant cash disbursement feature ensures that you get access to your loan amount without any delay. Whether you're facing a medical emergency or any other unexpected expense, our instant cash disbursement ensures that you have the funds, when you need them the most.

Easy Application Process:

We understand that navigating through the loan application process can be daunting. That's why ATD-Money offers an easy and hassle-free application process. With just a few simple steps, you can complete your loan application online and get one step closer to financial freedom. Our user-friendly interface and dedicated customer support team are always there to guide you every step of the way.

Conclusion:

ATD-Money is not just a lender; it is a financial partner committed to helping you achieve your emergency requirements and overcome financial challenges. With our quick loans, advance salary solutions, and instant cash disbursement, we are revolutionizing the way people access financial assistance in India. Experience the convenience, speed, and reliability of ATD-Money's financial solutions and take control of your financial future today with a smile.

#quick cash loans#payday loans#personal loans#instant loan#cash loans#loan app in india#advance salary loan#fast cash loans online#loan apps

0 notes

Text

0 notes

Text

Unsecured Business Loans for Paving the Way to Success?

Introduction to Unsecured Business Loans

Unsecured business loans are a vital financial tool for entrepreneurs and business owners, offering a means to access funds without the need for collateral. Unlike secured loans, which require assets like property or equipment as security, unsecured loans rely on the borrower's creditworthiness and business performance. This chapter will delve into the definition of unsecured business loans, highlighting their unique characteristics and how they differ from secured loans.

Understanding the nature of unsecured loans is crucial for business owners considering this financing option. We will explore the criteria lenders use to assess eligibility, such as credit scores, business history, and cash flow. The chapter will also address common misconceptions and provide insights into the advantages and potential risks associated with unsecured business loans. By the end of this chapter, readers will have a foundational understanding of unsecured loans, setting the stage for a deeper exploration of their role in business growth and success.

Evaluating Your Business for an Unsecured Loan

When considering an unsecured business loan, it's crucial for business owners to understand how lenders evaluate potential borrowers. This chapter will delve into the key factors that lenders consider when assessing a business for an unsecured loan. These include the business's credit history, financial performance, cash flow, and overall financial health.

We will provide insights into how to prepare for a loan application, including tips on improving credit scores, presenting financial statements, and demonstrating a solid business plan. The chapter will also discuss the importance of understanding the lender's perspective and how to effectively communicate the strengths and potential of your business. By the end of this chapter, readers will be equipped with the knowledge to evaluate their business's readiness for an unsecured loan and how to enhance their chances of approval.

Navigating the Application Process

The application process for unsecured business loans can be complex and daunting for many business owners. This chapter aims to demystify this process, providing a clear and concise guide to help entrepreneurs successfully navigate their loan applications.

We will discuss the various stages of the application process, from initial inquiry to final approval. The chapter will detail the necessary documentation required, such as business plans, financial statements, and credit reports. Additionally, we will highlight common pitfalls that applicants should avoid, such as incomplete applications or unrealistic financial projections.

Tips for a successful application will also be provided, including how to effectively communicate with lenders, the importance of being transparent about your business's financial situation, and strategies for negotiating loan terms. By the end of this chapter, readers will have a comprehensive understanding of the application process for unsecured business loans and be better prepared to approach it with confidence.

Managing Loan Repayment and Financial Health

Securing an unsecured business loan is just the beginning; managing loan repayment and maintaining financial health is crucial for long-term business success. This chapter provides strategies and tips for effectively managing loan repayments and sustaining financial health post-loan approval.

We will explore various aspects of financial management, including creating a realistic budget that accommodates loan repayments, strategies for improving cash flow, and tips for reducing expenses without compromising business growth. The chapter will also address the importance of maintaining a good relationship with lenders and the impact of timely loan repayments on future creditworthiness.

Additionally, we will discuss contingency planning for financial challenges and the role of financial planning in ensuring the business's long-term stability and growth. By the end of this chapter, readers will have a comprehensive understanding of how to manage their unsecured business loan repayments effectively while maintaining and improving their business's financial health.

Exploring Alternative Financing Options

While unsecured business loans are a popular choice for financing, it's important for entrepreneurs to be aware of the range of alternative financing options available. This final chapter explores various other sources of funding that can complement or serve as alternatives to unsecured loans.

We will delve into options such as venture capital, where investors provide funding in exchange for equity in the company. Crowdfunding, another innovative financing method, allows businesses to raise small amounts of money from a large number of people, typically via the internet. Additionally, the chapter will cover government grants and programs designed to support small businesses and startups.

Each of these alternatives has its own set of advantages and challenges, and the chapter will provide a balanced view to help entrepreneurs make informed decisions. We will also discuss how to evaluate which option is best suited to a business's specific needs and circumstances. By the end of this chapter, readers will have a broad perspective on the various financing options available beyond unsecured business loans, enabling them to make strategic decisions for their business's financial future.

Conclusion

In conclusion, unsecured business loans offer a flexible and accessible means for businesses to fuel growth and achieve success. As we've explored in this article, understanding the nuances of these loans, from application to repayment, is crucial for making informed financial decisions. For businesses looking beyond traditional lending, alternative financing options present a diverse landscape of opportunities

At Mpower Credcure, a leading loan lending company, we are committed to empowering businesses with the knowledge and resources they need to navigate these choices effectively. Whether it's through unsecured loans or other innovative financing solutions, our goal is to support your business's journey towards sustainable growth and success.

#Easy Business Loan Online#Business Loan Available#Private Finance for Business#Business Loan without Interest#New Business Loan in India#Business Loan Instant Cash

0 notes

Text

Personal Loan App Will Help You Get More Business

The Simple Personal Loan App That Wins Customers from Hero FinCorp wins customers by being well, simple. No tedious paperwork, complicated application forms or waiting for days on end. Just download the loan app, enter some basic details and have the cash in your account within hours. Perfect for the friend who's always in need of a little extra help but hates asking. Now they can get a personal loan discreetly from their phone without leaving the house.

0 notes

Text

THE MODERN BORROWER'S GUIDE: APPLYING FOR A LOAN ONLINE MADE EASY

Previously, applying for a loan frequently implied extended visits to banks, extensive paperwork, and long holding-up periods. Today, the landscape has definitely changed. With the ascent of digital technology, the process to "Apply For Loan" online has become more accessible, efficient, and user-friendly.

Understanding the Basics

Prior to plunging into the application process, it's fundamental to understand what applying for a loan involves. A loan is an agreement between a lender and a borrower in which the lender agrees to lend the borrower a certain amount of money with interest over a set period of time. Loans can be utilized for different purposes, like buying a home, beginning a business, or covering startling expenses.

Benefits of Applying for a Loan Online

There are many advantages to choosing to apply for loan online:

● Convenience: Apply from the solace of your home whenever.

● Speed: Online applications are processed quicker than conventional techniques.

● Comparison: Effectively compare loan offers from various lenders to track down the best terms.

● Paperless: Decrease the hassle of actual paperwork.

Steps to Apply for a Loan Online

Research Lenders

Start by researching various lenders that offer online loan applications. Find trusted banks with positive reviews and low interest rates. Among the notable choices are online-only lenders, credit unions, and standard banks.

Check Eligibility Criteria

In order to apply for loan, it is necessary to satisfy the explicit eligibility criteria of each lender. Normal necessities incorporate a minimum credit score, stable income, and proof of identity. Audit these criteria cautiously to guarantee you qualify prior to continuing with your application.

Gather Required Documents

Get each of your important documents together before you "Apply For Loan Online". Common documents include:

● Passport or national ID.

● Pay stubs, tax returns.

● A copy of your credit report.

● Employer's contact information and job duration.

Having these documents prepared will smooth out the application process.

Fill Out the Application Form

Whenever you have chosen a lender and gathered your documents, now is the right time to fill out the application form. This form will request personal information, financial details, and the loan amount you wish to acquire. Guarantee all information is accurate to avoid delays or rejections.

Submit the Application

Subsequent to finishing the application form, submit it online through the lender's site. A few lenders might require additional verification steps, such as a call or an in-person visit. Complete the submission process as instructed.

Await Approval

When your application is submitted, the lender will survey it. This process can take anywhere from a couple of moments to a few days, contingent upon the lender and the intricacy of your application. For clarification or further information, the lender may get in touch with you during this period.

Receive Funds

Assuming your application is endorsed, the lender will dispense the loan amount to your assigned bank account. The period for getting funds differs by lender, yet many online lenders offer fast disbursal within 24 to 48 hours.

Tips for a Successful Online Loan Application

● Maintain a Good Credit Score: A high credit score builds your chances of approval and improves interest rates.

● Provide Accurate Information: Twofold, check your application for any errors or exclusions.

● Understand the Terms: Read the loan agreement cautiously, including interest rates, repayment terms, and any fees.

● Stay Organized: Monitor your application status and any communications with the lender.

Applying for a loan online can be a clear process in the event that you follow these steps and get ready satisfactorily. With the convenience and effectiveness of online applications, getting the funds you want has never been more straightforward.

#apply for loan#apply for loan online#apply for a loan#apply for a loan online#best loans india#cheapest loans india#current loan rates#easy loan#easy loans#instant loan#instant loan online#get instant loan online#how to get instant loan#how to get instant loan online#loans in tricity#loans in tricity chandigarh#loans in india#loans in chandigarh#loans in north india

0 notes

Text

Cash in a Flash: Unlock Instant Gold Loans & Get Back on Track

Need cash, fast? Don't settle for hefty fees. Get instant gold loans online – pledge your gold, get approved in minutes, and receive cash directly to your account. Quick, convenient, and flexible, it's the smart way to bridge financial gaps.

#gold loan#gold loan in india#instant gold loan#gold loan online#augmont#gold loans#online gold loan

0 notes

Text

How to apply quick Business Loan

In the dynamic world of business, opportunities can arise at any moment, and often, seizing those opportunities requires immediate capital. Whether you're a startup looking to expand, a small business in need of working capital, or an established company seeking to take advantage of a new venture, quick business loans can provide the financial boost you need. This article will guide you through the process of applying for a quick business loan, offering insights and tips to help you secure the funding you require.

1. Know Your Business Needs

Before you start applying for a quick business loan, it's crucial to assess your financial needs. Determine the exact amount you require and the purpose of the loan. Are you looking to cover day-to-day expenses, purchase equipment, expand your operations, or fund a specific project? Having a clear understanding of your needs will help you select the right loan type and amount, ensuring you don't borrow more or less than necessary.

2. Choose the Right Lender

Selecting the right lender is a critical step in obtaining a quick business loan. There are various options available, including traditional banks, online lenders, credit unions, and alternative financing sources. Each has its advantages and disadvantages. Traditional banks typically offer lower interest rates but involve more stringent application processes. Online lenders, on the other hand, provide quicker access to funds but may come with higher interest rates.

Consider your business's financial situation and creditworthiness when choosing a lender. Research their loan products and terms to find the best match for your needs.

3. Review Your Credit Score

One of the most significant factors lenders consider when approving business loans is your credit score. Your credit score reflects your financial history and reliability as a borrower. A higher credit score generally results in more favorable loan terms, including lower interest rates. Before applying for a loan, obtain a copy of your credit report and review it for any discrepancies or issues that need to be resolved.

If your credit score is less than ideal, take steps to improve it. This may involve paying down outstanding debts, making timely payments, and managing your credit responsibly. A better credit score can significantly enhance your chances of securing a quick business loan.

4. Prepare Your Business Documents

Lenders will require various documents to evaluate your loan application. These documents typically include:

- Business plan: An outline of your company's mission, goals, and financial projections.

- Financial statements: Balance sheets, income statements, and cash flow statements.

- Tax returns: Personal and business tax returns for the past few years.

- Business licenses and permits: Ensure all your legal paperwork is up to date.

- Bank statements: Provide bank statements to demonstrate your company's financial stability.

- Collateral information: If you're applying for a secured loan, list the assets you're willing to pledge as collateral.

Having these documents organized and ready for submission will expedite the loan application process.

5. Choose the Right Loan Type

Different types of business loans are available, each with unique terms and conditions. Common options include:

- Term loans: Fixed-rate loans with set repayment terms.

- Lines of credit: A flexible credit line that allows you to borrow as needed.

- SBA loans: Government-backed loans with favorable terms for small businesses.

- Equipment financing: Loans specifically for purchasing equipment.

- Merchant cash advances: Advances based on your business's credit card sales.

Select the loan type that aligns with your business needs and financial situation. Consult with your lender to determine the most suitable option.

6. Complete the Loan Application

Once you've chosen a lender and loan type, you'll need to complete the loan application. Be prepared to provide detailed information about your business, personal finances, and the loan's purpose. Carefully fill out the application, ensuring that all information is accurate and complete.

7. Develop a Strong Business Pitch

To increase your chances of getting approved for a quick business loan, it's essential to create a compelling business pitch. This should outline your business's history, future prospects, and how the loan will be used to achieve specific goals. Lenders want to know that your business is a good investment and that they can trust you to repay the loan.

8. Consider Collateral

If you're applying for a secured loan, you'll need to offer collateral to back the loan. Collateral can be real estate, equipment, inventory, or other assets. Make sure you're comfortable pledging these assets, as they may be at risk if you're unable to repay the loan.

9. Understand the Terms and Fees

Before finalizing your loan application, carefully review the loan's terms and fees. This includes the interest rate, repayment schedule, any origination fees, and prepayment penalties. Ensure you understand all the financial implications of the loan, and don't hesitate to ask your lender for clarification on any terms that are unclear.

10. Submit Your Application

Once your application is complete and you're satisfied with the terms and conditions, submit it to the lender. Some lenders may provide an online application process for quick business loans, while others may require in-person meetings or phone interviews. Follow the lender's specific submission instructions to expedite the process.

11. Follow Up

After submitting your application, stay in contact with your lender to ensure a smooth loan processing experience. Be prepared to provide any additional documents or information they may request. Timely responses and cooperation can significantly impact the speed at which you receive a decision on your loan application.

12. Be Patient

While it's called a "quick" business loan, the speed of approval and funding can vary depending on the lender and the complexity of your application. Some lenders may provide funding within days, while others might take a few weeks. Be patient during the process, but continue to follow up with your lender as necessary.

Conclusion

In conclusion, obtaining a quick business loan involves careful planning, research, and preparation. By understanding your business needs, selecting the right lender, and presenting a strong application, you can increase your chances of securing the necessary financing to achieve your business goals. With the right approach, a quick business loan can be a valuable tool for driving growth and success in your company.

#business loan online instant approval#business loan startup#online loan for business#loan for online business#apply business loan#instant business loan#online apply for business loan#apply online business loan#online apply business loan#apply business loan online#interest rate on business loan in India

0 notes

Text

Instant gold loan approval, doorstep services and flexibles repayments. Read the blog to know why you should get a gold loan from SahiBandhu.

#Instant gold loan#best gold loan#gold loan near me#loan against gold#gold loan benefits#doorstep gold loan#nearby gold loan#gold loan process#gold loan finance company#gold loan companies in india#how gold loan works#loan on gold#low interest gold loan#lowest gold loan interest rate#online gold loan#gold loan eligibility#gold loan#Sahibandhu#Sahibandhu gold loan#SB gold loans#SahiBandhu gold loan services

0 notes