#it's an interesting intersection of geometry and statistics

Explore tagged Tumblr posts

Text

I think one of the most interesting parts of my (thus short) career as a mechanical engineer is that we are taught all sorts of first-principles physics and complex science. And then it turns out that geometric dimensioning and tolerancing, one of the most important and fundamental areas of knowledge for mechanical design and manufacturing and assembly to the point that anybody even incidentally involved in it industrially is aware of it and why it is used, was not only not taught to us during our college education but was in fact not mentioned once at any point even during our drafting courses.

#Okay sure “well you don't need to know all of it to do most things”#“well you can probably pick it up on the job I guess”#I feel like it's still pretty important to know the existence of!!!#“yeah well if you were a good engineer you would have found out about it on your own”#I AM PAYING MONEY TO GET AN EDUCATION WHAT DO YOU THINK I AM TRYING TO DO BY DOING THAT#WHOSE IDEA WAS THIS??#Also lowkey GD&T is pretty fun#engineering#machining#stem#nerd shit#scienceblr#mathblr#before you get mad for me tagging this mathblr I think a lot of you would get a kick out of learning about GD&T#it's an interesting intersection of geometry and statistics

3 notes

·

View notes

Text

Earth Engine in BigQuery: A New Geospatial SQL Analytics

BigQuery Earth Engine

With Earth Engine directly integrated into BigQuery, Google Cloud has expanded its geographic analytics capabilities. Incorporating powerful raster analytics into BigQuery, this new solution from Google Cloud Next '25 lets SQL users analyse satellite imagery-derived geographical data.

Google Cloud customers prefer BigQueryfor storing and accessing vector data, which represents buildings and boundaries as points, lines, or polygons. Earth Engine in BigQuery is suggested for processing and storing raster data like satellite imagery, which encodes geographic information as a grid of pixels with temperature, height, and land cover values.

“Earth Engine in BigQuery” mixes vector and raster analytics. This integration could improve access to advanced raster analysis and help solve real-world business problems.

Key features driving this integration:

BigQuery's new geography function is ST_RegionStats. This program extracts statistics from raster data inside geographic borders, similar to Earth Engine's reduceRegion function. Use an Earth Engine-accessible raster picture and a geographic region (vector data) to calculate mean, min, max, total, or count for pixels that traverse the geography.

BigQuery Sharing, formerly Analytics Hub, now offers Earth Engine in BigQuery datasets. This makes it easy to find data and access more datasets, many of which are ready for processing to obtain statistics for a region of interest. These datasets may include risk prediction, elevation, or emissions. Raster analytics with this new feature usually has five steps:

Find vector data representing interest areas in a BigQuery table.

In BigQuery image assets, Cloud GeoTiff, or BigQuery Sharing, locate a raster dataset that was created using Earth Engine.

Use ST_RegionStats() with the raster ID, vector geometries, and optional band name to aggregate intersecting data.

To understand, look at ST_RegionStats() output.

Use BigQuery Geo Viz to map analysis results.

This integration enables data-driven decision-making in sustainability and geographic application cases:

Climate, physical risk, and disaster response: Using drought, wildfire, and flood data in transportation, infrastructure, and urban design. For instance, using the Wildfire hazard to Communities dataset to assess wildfire risk or the Global River Flood Hazard dataset to estimate flood risk.

Assessing land-use, elevation, and cover for agricultural evaluations and supply chain management. This includes using JRC Global Forest Cover datasets or Forest Data Partnership maps to determine if commodities are grown in non-deforested areas.

Methane emissions monitoring: MethaneSAT L4 Area Sources data can identify methane emission hotspots from minor, distributed sources in oil and gas basins to enhance mitigation efforts.

Custom use cases: Supporting Earth Engine raster dataset imports into BigQuery image assets or Cloud Storage GeoTiffs.

BigQuery Sharing contains ST_RegionStats()'s raster data sources, where the assets.image.href column normally holds the raster ID for each image table. Cloud Storage GeoTIFFs in the US or US-central1 regions can be used with URIs. Earth Engine image asset locations like ‘ee://IMAGE_PATH’ are supported in BigQuery.

ST_RegionStats()'s include option lets users adjust computations by assigning pixel weights (0–1), with 0 representing missing data. Unless otherwise specified, pixels are weighted by geometry position. Raster pixel size, or scale, affects calculation and output. Changing scale (e.g., using options => JSON ‘{“scale”: 1000}’) can reduce query runtime and cost for prototyping, but it may impact results and should not be used for production analysis.

ST_RegionStats() is charged individually under BigQuery Services since Earth Engine calculates. Costs depend on input rows, raster picture quality, input geography size and complexity, crossing pixels, image projection, and formula usage. Earth Engine quotas in BigQuery slot time utilisation can be changed to control expenses.

Currently, ST_RegionStats() queries must be run in the US, us-central1, or us-central2.

This big improvement in Google Cloud's geospatial analytics provides advanced raster capabilities and improves sustainability and other data-driven decision-making.

#BigQuery#EarthEngine#EarthEngineinBigQuery#GoogleCloud#CloudStorage#News#Technews#Technology#Technologynews#Technologytrends#govindhtech

1 note

·

View note

Text

My Final Art Piece

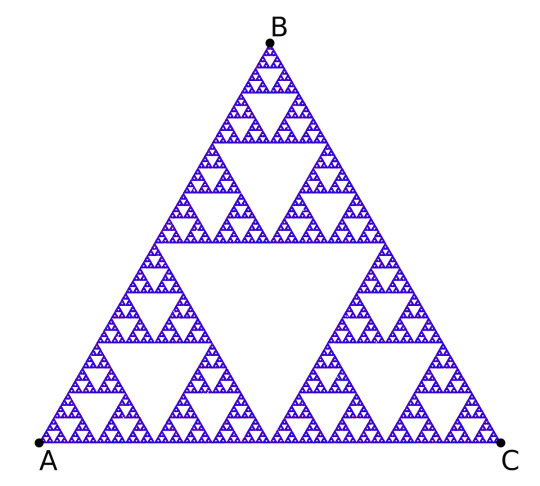

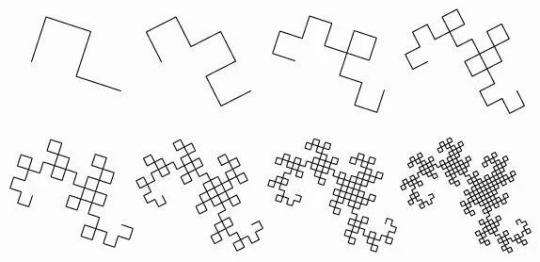

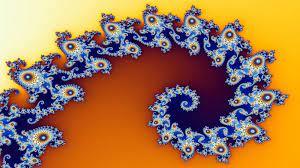

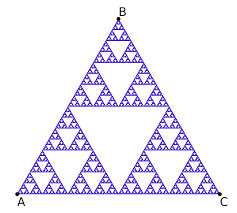

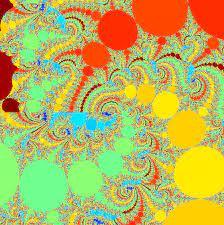

Growing up I have always been fond of mathematics. The subject was the one I always scored the highest in. Having a definitive answer always proved best for my interests. However when it came to the interpretation of any media such as writing- or in this case art- I always personally struggled to find anything I was looking for. Taking this art course has allowed me to see how beautiful art truly is. Combining my love of math and the beauty it portrays in my mind, I have always loved Fractals. They are patterns occurring in geometry that follow any set of rules, infinitely small. According to the Oxford English Dictionary, "A fractal is a curve or geometric figure, each part of which has the same statistical character as the whole. Fractals are useful in modeling structures (such as eroded coastlines or snowflakes) in which similar patterns recur at progressively smaller scales, and in describing partly random or chaotic phenomena such as crystal growth, fluid turbulence, and galaxy formation." (Oxford 2019). I will label some fractals below that I personally find intriguing.

Iterated Function Systems ^

Dragon Curve Fractal ^

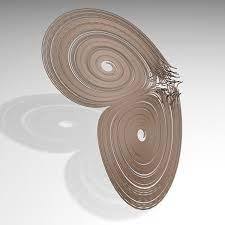

These examples are testimony to how creative fractal means can be. For my art piece, my fractal "rule" was to have no lines intersect through one another. I created enclosures that increasingly got smaller (and the lines within changed colors). This artwork was infatuating to me as I could feel the "infinite" effect as I progressed to work through it. With each color I finished, the next one got exponentially longer to complete, as I divided each "crevice" into 2 or 3 more with each line I drew. The medium I used for my art piece was digital oil on canvas. I title my piece "Linear Traffic."

"Linear Traffic" Jackson Seiler

0 notes

Text

Economics, Political Science, Public Administration, Business

ECONOMICS The programme functions as economics being self-sustainable. Ability is more important than being a con artist with curves/lines and synthetic problems. Yes, you do have options. Ambiance, the world...knowledge, skills and accountability. Economics curriculum: --Communication --> Scientific Writing I & II --Mandatory Courses --> Enterprise Data Analysis I & II (check FIN); International Financial Statement Analysis I & II (check FIN); Corporate Finance (check FIN); Calculus for Business & Economics I-III; Probability & Statistics B; Mathematical Statistics --Core Courses --> Microeconomics I-II; Introduction to Macroeconomics; Intermediate Macroeconomics; Money & Banking; Macroeconomic Accounting Statistics; Economics of Regulation; Econometrics; Economic Time Series; Public Finance; Sustainability Measures; Empirical International Trade --Mandatory Instruments & Investment Courses --> Theory of Interest for Finance (check COMPUT FIN); Investment & Portfolios in Corporate Finance (check FIN). There are concentration track options for Economics majors. A choice is mandatory. Must choose one of the following 3 tracks --- 1. MICROECONOMICS-FINANCE OPTION TRACK --> Microeconomics III; Industrial Organisation; Computational Studies of Mergers & Acquisitions; Corporate Valuation (check FIN); International Commerce (check FIN); Strategic Business Analysis and Modelling (check FIN) 2. OTHER MICROECONOMICS OPTION TRACKS --> Microeconomics III; Industrial Organisation; Computational Studies of Mergers & Acquisitions plus 3 or 4 additional courses out of the following: Computational Labour Economics Agricultural & Economic Sustainability Strategic Business Analysis and Modelling (check FIN) R Analysis (check Actuarial post) Personal Finance (check Actuarial post) Political Economy (check PS) Public Project Management (check PA) Programme Evaluation I & II (check PA) < Both courses mandatory > Note: for Programme Evaluation I & II, economics majors will require Mathematical Statistics or Econometrics course as substitute for Quantitative Analysis in Political Studies I; also must complete Enterprise Data Analysis I & II; Upper Level Standing. 3. MACROECONOMICS OPTION TRACK --> Advanced Macroeconomics; International Macroeconomics; Fiscal Administration (check PA); Monetary Theory & Policy; Research Methods in Monetary Policy; Regional Economics NOTE: for Probability & Statistics B, Mathematical Statistics, students should check the actuarial post. Further description of some courses below: Microeconomics I Comprehension of basic modelling and economic interpretation with demand and supply, and to learn major microeconomic concepts, including utility, scarcity, elasticity, efficiency, output and costs, and externalities. By analysing markets and studying the decision-making process by consumers and producers, students will be able to comprehend and differentiate the market types—perfect competition, monopoly, monopolistic completion and oligopoly. Typical Text: TBA Mathematical tone --> You are expected to have at least concurrent registration and perpetual progression with Calculus II until term’s end. Labs --> Developing concepts and models in R from interpreted statements and data can be a strong indicator of a student’s capability, competence and seriousness about economics with professionalism. I can’t just assume such special development to be properly treated in the Calculus I-III sequence because calculus is the priority in such courses (and whatever ideologies or tribal structure or rent seeking for relevance). Hence, students will get their hands dirty with some basic computational modelling, coding and visualization development of some economic concepts and models in R. Students must draw conclusions based on their findings for all such topics. A. Calculus with R run-through --Geometry: plots, values at points, zeros, intersects, tangents, curve fitting --Differentiation: average rate of change, instantaneous rates of change, derivative values, critical points, relative extrema, concavity, absolute extrema --Integration: antiderivatives, area, economics applications, etc., etc. B. Elementary economics data analysis --Immersion with databases Basics of acquiring data sets from various sources Kaggle, Amazon AWS, USDA, agricultural marketing resource centres, FDA, Census, Bureau of Labor Statistics, NBER, FED, other gov’t databases, UNCTADstat, UN FAO, OECD, Capital Markets, etc., etc., etc. Quandl R package Data Assimilation/Cleaning/Manipulation basics Comprehension of measures of central tendency, variance, standard deviation. Generating summary statistics and interpretation The R packages, Stats and Tidyverse Statistical plotting (scatter plots, box plots, histograms, Q-Q) Single and matrix plots Correlation (types) Computation R packages (correlation, GGally, DataExplorer, ggplot2) Correlation matrices and heat maps with specifying type of correlation. Densities and Scatter plots. Regression models (bivariate and multivariate) along with summary statistics interpretation and forecasting Just follow the logistics and implement Data structure for time series. Salient characteristics identification and exhibition; models with summary statistics interpretation. Forecasting. C. Of the following text concern will be chapters 1-5: Dayal V. (2015). An Introduction to R for Quantitative Economics, SpringerBriefs in Economics. Springer It’s also possible to generate all such with naturally installed R packages, to compare and contrast with prior D. Ideal con Kool-Aid problem sets are not good enough. Sustainability goals: based on development from (A) through (C), students will apply real data sets with methods for determination of microeconomic models or characteristics. It’s important to have understanding of data structure and skills in data manipulation towards developing market models, and demand & supply models. You can draw a figure with lines that intersect or with parallel lines, so what? If you can’t develop things from the raw or primitive then you don’t understand it. Concerns the following areas: agricultural, commodities, service industry, retail industry, utilities, technology, etc., etc. For any R coding expected will be commentary among coding and to have axes labelling. Students will also be given statements to verify or debunk based on analyis of data. Necessary topics of concern for development with use of R and RStudio: -PHASES FOR DATA MODELLING (developed with real raw data) Note: data assimilation and manipulation will apply to succeeding topics Data Assimilation, Cleaning and Manipulation Supply and Demand curves (via regression); calculate changes in consumer surplus (taxation, subsidies, policies) as prices shift (if able). Elasticities: Price Elasticity of Demand: OLS versus log-log Cross Price Elasticity of Demand: multivariate, log Identifying complements and/or substitutes Price Elasticity of Supply: log-log Income Elasticity of Demand: log-log and Engle curve estimation Market models (prior lab topics will re-emerge): Pure Competition Pure Monopoly Monopolistic Competition Oligopoly Compare findings from prior market models activity to development from OECD literature and the Pindyck literature: OECD literature - Methodologies to Measure Market Competition Data Screening Tools in Competition Investigations Pindyck, R. S. (1985).The Journal of Law & Economics, 28(1), 193–222 Forecasting Market Trends (time series analysis, basic forecasting models and validation) Consumer Surplus and Producer Surplus (graphing surplus areas with integrating manually and with R; policy impact analysis concerning taxes or subsidies; plotting new curves and recalculating surplus after a policy change; validate or debunk statements based on raw data) Quizzes --> Complete your assignments, so you don’t have to worry about what you will encounter on quizzes. Don’t expect all questions to be multiple choice. Exams --> Students will have to pick a date and time convenient for them to take the final exam on or before the due date. The final exam will be a reflection of covered course material, assignments, quizzes and labs to evaluate students’ understanding of key concepts. Will have R usage as well. Open notes for R. Grading --> Status Quo Assignments 15% Labs 25% Quizzes 20% Final 40% Course Outline --> Week 1 -- Introduction. What is Economics? The Economic problem Week 2 -- Demand and Supply Week 3 -- Demand and Supply Demand and Supply, Elasticity Assignment 1 Due and Quiz 1 Week 4 -- Elasticity Week 5 -- Efficiency and Equity Week 6 -- Utility and Demand Week 7 -- Possibilities, Preferences, and Choices Assignment 2 Due and Quiz 2 Week 8 -- Reviewing Loose ends Week 9 -- Output and Costs Week 10 -- Perfect Competition Week 11 -- Monopoly Week 12 -- Monopoly Monopolistic Competition Assignment 3 Due and Quiz 3 Week 13 -- Oligopoly Oligopolistic Competition Week 14 -- Public Choices and Public Goods Week 15 -- Externalities and Environment Assignment 4 Due and Quiz 4 Week 16 -- Introduction to factors of Production, Economic Inequality Final Exam Prerequisites: Calculus I

Microeconomics II Most of the topics will include theoretical derivations as well as real life applications. Fundamental Comprehension --> Ability to use microeconomic terminology Highest-valued alternative foregone is the opportunity cost of what is chosen How individuals and firms make themselves as well off as possible in a world of scarcity How prices inform the decisions about which goods and services to produce, how to produce them, and who gets them How government policies affect the allocation of resources in a market economy How market structure influences the allocation of resources Applications --> Microeconomic principles and diagrams to understand and explain economic events and other social phenomena Calculus to solve optimization problems Use economic reasoning to explain the strategic choices of individuals or organizations Critique the economic content of articles or presentations Appreciate the usefulness of economic reasoning in personal decision making Typical Text --> Intermediate Microeconomics, by Hal Varian Accompanying Texts --> Intermediate Microeconomics with Calculus, Hal Varian Microeconomics, Jeffrey Perloff Problem Sets --> Will have the same tone and manner as in prerequisite, but at a more advanced and accelerated level based on course texts Labs (15 weeks) --> ---Generally, will have advanced repetition of (A) to (D) lab activities done in prerequisite (more intensified and much faster relevant to course topics). ---Based on prerequisites, thus leading to the assumption that students are capable with series expansions and basic ODEs, will begin converting some ODEs into difference equations in R. Package dde can accompany analytical modelling; else, and most likely coding manually for the long haul. The following gives an idea of what’s to be expected as a beginner: Dayal, V. (2020). Difference Equations. In: Quantitative Economics with R, Springer, Singapore. Fulford, G., Forrester, P., & Jones, A. (1997). Linear Difference Equations in Finance and Economics. In: Modelling with Differential and Difference Equations (Australian Mathematical Society Lecture Series, pp. 126-145), Cambridge: Cambridge University Press https://mjo.osborne.economics.utoronto.ca/index.php/tutorial/index/1/fod/t The following topics will be treated w.r.t. difference equations (uses, limitations, conditions and simulation development): a. Inventory based on prior period’s level b. Capital Accumulation; Adjustment Cost Models c. Logistic growth model and predator-prey models d. Dynamics of Market Price (linear and nonlinear entities) A market equilibrium model with price dynamics; dynamic stability and ensuring such Determining Dynamic Market Equilibrium Price Function Using Second Order Linear Differential Equations (applying difference equation rather) Todorova, T. (2012). The Economic Dynamics of Inflation and Unemployment. Theoretical Economics Letters. Vol.2 No.2, Paper ID 19278 d. Exchange rate overshooting model by Dornbusch (and alternatives) e. Solow Growth model ---Externalities field cases Note: will focus on financial quantitative development towards retention and sustainability, NOT conceptual curves. Cost-Benefit Analysis (NPV and/or IRR based) Overview Benefits (monetised and non-monetised impacts) Costs (monetised and non-monetised impacts) Benefits and Cost estimation guides/manuals (monetised and non-monetised impacts) Discount rate versus social discount rate (rate of return) Selecting the social discount rate model, OR rate of return model Computing the discount rate or RoR Logistics and active implementation of CBA Externalities Positive Negative Adhikari, S.R. (2016). Methods of Measuring Externalities. In: Economics of Urban Externalities. SpringerBriefs in Economics. Springer, Singapore Quizzes --> We will have 4-5 quizzes. Quizzes will have limited typical questions from prerequisites mixed in with this course level problems. At the end of the term, we will drop your lowest grade and take the remaining into account. Don’t expect all questions to be multiple choice. Exams --> It will focus on the material covered in class, quizzes and labs, but in a manner not requiring you to cram with the latest instruction. Will have R usage. Open notes for R. Don’t expect all questions to be multiple choice. Course Pace --> Generally it will take 10 weeks to complete course, however, an additional 3 – 5 weeks can be applied concerning reinforcement and competency Grade --> Status Quo Problem Sets (10%) Labs (25%) Quizzes (20%) Midterm (20%) Final (25%) Course Outline --> WEEK 1 -- Chapter 1: The Market Chapter 2: Budget Constraint Chapter 3: Preferences WEEK 2 -- Chapter 4: Utility Chapter 5: Choice Quiz 1 WEEK 3 -- Chapter 6: Demand WEEK 4 -- Chapter 32: Exchange Quiz 2 WEEK 5 -- Chapter 19: Technology Chapter 20: Profit Maximization Quiz 3 WEEK 6 -- Midterm Exam Chapter 21: Cost Minimization WEEK 7 -- Chapter 22: Cost Curves Chapter 23: Firm Supply WEEK 8 -- Chapter 24: Industry Supply Chapter 25: Monopoly Chapter 26: Monopoly Behaviour Quiz 4 WEEK 9 -- Chapter 28: Oligopoly Quiz 5 WEEK 10 -- Chapter 29: Game Theory Chapter 14: Game Applications Quiz 6 Prerequisites: Calculus II; Microeconomics I Microeconomics III Course has a “duality” approach, namely, lectures make the “fundamentalist” and “snobbish” gauntlet; labs give traction and will be your “money maker” in the future. Theory and substance aren’t necessarily cut from the same cloth. Homework Problem Sets --> Students will have a week to complete the problem sets. R Labs --> NOTE: some things you will learn on the fly; you can’t expect everything to fall perfectly in place. A. Advance fast immersion into real world pricing of commodities and sustenance Joutz, F. L. et al (2000). Retail Food Price Forecasting at ERS: The Process, Methodology, and Performance from 1984 to 1997. Economics Research Service, USDA. Technical Bulletin No. 1885 For such above literature, after analysis then computational logistics, towards replication/implementation(s). Will then advance to other markets with inclusion of other commodities incorporating more modern data: Wheat, Rice, Sugar, Corn, Soybean, Cocoa, Coffee Includes equilibrium determination, utility, elasticity, etc. B. Hedonic modelling and estimation Experience from prerequisites labs means you’re good enough to hang in there with multivariate regression development. Various applications. C. Identification and validation of utility/production functions: Basic utility and production functions (must include Cobbs-Douglas, CES). The following text may not treat all types of interests but our intention is to have transparency and practicality concerning the following areas: bundles, general markets, production, efficiency, labour economics, etc. Coto-Millán, P. (2003). Utility and Production: Theory and Applications. Springer Physica, Heidelberg Calibrating Cobb-Douglas and CES (utility and production) Overview, logistics and code development Difference between calibrating & estimating for Cobb-Douglas and CES? Can the following be implemented in a computational environment such as R? Afriat, S. N. (1967). The Construction of Utility Functions from Expenditure Data. International Economic Review, 8(1), 67–77 Note: data sources and data subject to change. Pursue for various industries for different environments (regions or countries). Compare to method of determining optimal production based on marginal cost (with calculus, etc.). Try to extend from Cobbs-Douglas to CES function and compare to marginal cost approach. Biddle, J.E. (2011). The Introduction of the Cobb-Douglas Regression and its Adoption by Agricultural Economists. History of Political Economy, 43, pages 235-257. Note: try to extend all prior from Cobbs-Douglas to the CES function Introduction R microeconomic tools (limited exposure) micEcon, micEconAids, micEconCES, micEconSNQP D. Data Envelopment Analysis (firms, markets, industries, agriculture) Concept, modelling and analysis with field applications R Packages of Interest for DEA rDEA, deaR, Benchmarking Special case treatment after other interests: Agriculture DEA method to measure corporate performance Industries performance (banks, insurances, telecommunications, service, etc., etc.) Stock performance and stock selection Sengupta, J., Sahoo, B. (2006). Cost Efficiency in Models of Data Envelopment Analysis. In: Efficiency Models in Data Envelopment Analysis, Palgrave Macmillan, London. E. Stochastic Frontier Analysis (firms, markets, industries, agriculture) Modelling and analysis with field applications R Packages of Interest for SFA frontier, npsf, sfa, ssfa, semsfa, Benchmarking Will try to have counterpart applications development to DEA (hopefully data is robust) Advantages and disadvantages between DEA and SFA. PURSUIT: can Cobb-Douglas and CES functions be applied to SFA and DEA? F. Statistical Tools & Analysis for Partial Equilibrium and Markets Data Assimilation and Cleaning/Manipulation Descriptive statistics. Skew and kurtosis. Correlation measure (Pearson, Spearman and Kendall). Correlation heatmaps for three or more variables. Scatter plots and densities (ggplot2, GGpairs) Econometric development of supply and demand analysis; calculate changes in consumer surplus (taxation, subsidies, policies) as prices shift (if able). Elasticity types (restricted to OLS, log, log-log, Engle curve and instrumental variables technique); then cross-price elasticity to identify complements or substitutes. Duopoly Econometric Estimation in Cournot Markets (structural estimation and instrumental variables); Cournot Extension. Econometric Estimation in Bertrand Markets; Bertrand Extension Times series methods for comparative assessments. Note: may require standardization for different units of measure Speculation on behaviours and tools for verification: seasonality, trend cyclic, stationarity, cross-correlation, cointegration. G. Overlapping Generations Model and Microeconomic Aspects Based on prerequisites, thus leading to the assumption that students are capable with DEs and difference equations. OLG concept and structure Key Microeconomic elements (household elements, production side elements, gov’t policy, intergenerational transfers elements, market structure & imperfections elements). Calibrations, estimations, scenarios, etc. H. General Equilibrium Models Based on prerequisites, thus leading to the assumption that students are capable with DEs and difference equations. PART 1 - will begin pursuing contemporary general equilibrium models; idea, constituents and their properties in unification. PART 2 - DSGE Modelling and Simulation Role of production and utility functions Components Junior, C. J. C. and Garcia-Cintado, A. C. (2018). Teaching DSGE Models to Undergraduates. Economica A 19, 424 – 444 How capable or practical will the R package dde be? Logistics Investigation. To make use of DYNARE + OccBin Toolkit after prior Use of DynareR as well Estimations and scenarios Harrison, G.W. et al (2000). Using Dynamic General Equilibrium Models for Policy Analysis. Elsevier PART 3. CGE Modelling and Simulation (with GAMS): Role of production and utility functions Components Literature to develop on: Devarajan, S. and Go, D. S. (1998). The Simplest Dynamic General Equilibrium Model of an Open Economy. Journal of Policy Modelling 20(6): pages 677 – 714 Zhang, X. (2013). A Simple Structure for CGE models. GTAP Purdue Texts provide guidance for programming and simulation: Hosoe, N., Gasawa, K., & Hashimoto, H. (2010). Textbook of Computable General Equilibrium Modeling: Programming and Simulations, Palgrave Macmillan Limited. Chang, G. H. (2022). Theory and Programming of Computable General Equilibrium (CGE) Models: A Textbook for Beginners. World Scientific. After analysis and computational skills development will develop for concerns of interest Dixon, P. B. and Jorgenson, D. W. (2013). Handbook of Computable General Equilibrium Modelling SET, Volumes 1A and 1B. Elsevier I. Advance development of Externalities field cases lab from prerequisite course. Exams --> There will be two midterm exams and a cumulative final exam. Limited amounts of notes for use. I encourage students to use a calculator and a ruler in the exams. All exams will include R usage. Prerequisite course labs will also be thrown at you. Course Grade Constitution --> Homework 20% R Labs 35% 2 Midterm exams (15% each) Final exam (15%) Resonating Texts --> Varian H., Microeconomic Analysis, New York and London, Norton Mas-Colell A., Whinston M. D., & Green J. R., Microeconomic Theory, Oxford Kreps D., 1990, A Course in Microeconomic Theory, Princeton Course Outline --> Modelling and Forecasting in Microeconomics (to be precursor to labs A to B) Preferences and Utility Utility Maximization and Choice Income and Substitution Effects Demand Relationship Among Goods Production Functions Cost Functions Profit Maximization Markets Monopolistic Oligopolistic (include Cournot and Bertrand Competition) Competitive Markets Imperfect Competition OECD literature - Active Immersion wit R Methods to Measure Market Competition Data Screening Tools in Competition Investigations Overlapping Generations Model and Microeconomic Aspects To be precursor to lab G General Equilibrium and Welfare To be precursor to lab H Asymmetric Information Wolak, F. A. (1994). An Econometric Analysis of the Asymmetric Information, Regulator-Utility Interaction. Annales Deconomie et de Statistique - No 34 Externalities and Public Goods To be precursor to lab I Prerequisites: Calculus III; Microeconomics II.