#zero balance minor account opening online

Text

A Simplified Guide for Education Loan Repayment

Education loans are beneficial for people achieving their academic dreams. But the repayment process can often filled with lots of confusions. Getting educational loan isn't that much hard as you think. With an online open savings bank account and necessary documents, you can easily apply for an educational loan. However, with a structured approach and understanding of available options, managing education loan repayments becomes manageable. If you are thinking about getting an education loan or have already got one, this guide explores actionable steps to ensure a smooth repayment journey.

Understanding Loan Terms and Conditions

Before discussing repayment, thoroughly review the terms and conditions of your education loan. Understand interest rates, repayment schedules, and any additional fees associated with the loan. Evaluate your current financial status to determine how much you can afford to repay each month. Consider factors such as income, expenses, and other financial obligations to make the best deals.

Setting Up a Zero Balance Bank Account

To streamline repayment, consider zero balance account opening app specifically dedicated to loan repayments. This account ensures that your loan payments are separated from your regular expenses, making it easier to track and manage repayments. This account will serve as the primary channel for efficiently managing your education loan payments.

Exploring Repayment Options

Familiarize yourself with the various repayment options available for education loans. These may include standard repayment plans, income-driven repayment plans, or refinancing options. Select the repayment plan that most closely matches your financial circumstances and objectives. Develop a repayment strategy based on your financial capabilities and loan terms. Determine whether you'll make fixed monthly payments or opt for a flexible repayment plan. Set realistic goals and timelines to stay on track with your repayment journey.

Automating Loan Payments

Take advantage of automatic payment options offered by lenders or banking institutions. Automating your loan payments ensures timely and consistent repayments, reducing the risk of missed deadlines and late fees. Incorporate loan repayments into your monthly budgeting process. Prioritize loan payments alongside essential expenses to ensure they're accounted for each month. As your income or expenses fluctuate, make the necessary adjustments to your budget.

Seeking Assistance if Needed

Banks provide you with a particular period called a moratorium period, which denotes the time period between your course completion and your first EMI. You may get a job immediately or not. Depending on your situation, the period will differ. If you encounter financial difficulties or anticipate challenges in meeting repayment obligations, don't hesitate to reach out to your lender. Many lenders offer assistance programs or loan modification options to help borrowers manage their loans effectively.

Monitoring Progress and Making Adjustments

Monitor your loan repayment progress regularly and make adjustments as necessary. Stay informed about your remaining balance, interest accrual, and any changes to repayment terms. Adjust your strategy if your financial situation or goals evolve over time.

Final thoughts

Education loan repayment doesn't have to be overwhelming. By following this simplified guide and leveraging available resources, you can navigate the repayment process with confidence and achieve financial freedom. Many banks offer the convenience of online open savings bank account. Take advantage of this facility to establish a designated account for loan repayments.

#kyc service#kyc for low risk customers#kyc search#bank balance#upi transaction id status check#upi transaction tracking#transaction status check#track upi transaction#upi transaction check online#check my transaction status#verify bank statement online#zero balance account opening#zero balance minor account opening online

0 notes

Video

youtube

మినీ ఆధార్ సెంటర్ స్టార్ట్ చెయ్యండి | Start Mini Adhaar Center from Home/Shop

Get 48 Services with license Contact us on 94940 56339 for more information

Digi seva pay services list

Visit https://www.digisevapay.co.in

Mobile app:

https://liveappstore.in/shareapp?com.digisevapaypro.digisevapaypro.inapp=

Digi Seva Pay services offering more than 48 services

Contact us 94940 56339

1.Adhaar Services Below

*Adhaar Address Update

*Adhaar download

*Adaar PVC card apply

*Adhaar Update History

*Adhaar Card Slot Booking

*Adhaar Bank Link Status chking Fecility

2.Voter ID Services ( New card apply & corrections)

3.Pan Card Services

* New Pan Card Apply

*Pan card Corrections

*Instant Pan card

*Minor Pan Card

*Duplicate Pan Card

4.Micro& Mini ATM Services

*Cash withdrawal

*Fund transfer

*Cash Deposit

*Loan Payments

5.AEPS Fund Transfer

6.AEPS Cash Deposit

7.Mobile Recharges

8.Adhaar Pay

9.QR Code Payments

10.UPI payments scanning facility

11.Online Bank Account opening Facility both Pvt banks and Government banks

12.Zero Balance Account Facility

13.ATM card apply online facility

14.BBPS Payments facility

15.Electricity Bill Payments

16.Waterbill Payments

17.Fastag Payment facility

18.Pan Card NSDL&UTI

19.Micro Loan Facility

20.Insurance Facility

21.Food License Apply

22.Gas Bill payments

23.New Gas Connection Facility(Bharath,HP,Indian Gas)

24.Passport Services

25.Driving License Slot booking and Apply

26.Udyam Registration & MSME Registration Facility

27.LIC Premium Payments

28.TTD Ticket Booking Facility

29.Online Sand Booking Facility

30.Dharani Portal for land Registration

31.Encumberance Certificate

31.Death&birth Certificate

32.Udyam Registration

33.SBI Mudra loan Apply

34.Trading Account Facility

35.Incometax Filing

36.Gov Disability Card Apply

37.Student Loan Apply

38.Credit Card Apply

39.Govt Disability Card

40.PM Kisan for farmers

41.Ayushman Bharat Cards

42.Jeevan Praman Life Certificate

43.Scholership Apply Facility

44.Covid-19 Vaccination Certificate

Below Services Are Coming Soon

45.IRCTC Ticket Booking

46.Ration Card – Mobile number linking

47.Apply for New Ration Card Facility

48.Bus Ticket,Flight Ticket Facility

We will Give the Training in Zoom Session Every Week online

Whatsapp Support and Training Videos will be provided.

Registration Process as per new guidelines:

1.Adhaar card photo

2.Pan Card photo

3.Phone number

4.Email Id

5.Live Location to be shared

6.2-4 Sec video Recording by holding adhaar /pan

7.Any other person reference contact number and ID proof

8.bank passbook photo

9.Ration card photo for address verification

High Lights of Digi Seva Pay Company:

24*7 Fund Transfer Facility

We are having more than 15,000 Satisfied Retailers

More Services with just 999/-

Retailor for 999/-

Distributor for 7,999/-

Super Distributor 14,999/-

Contact us on 9494056339

Note : Registration fees non Refundable

2 notes

·

View notes

Text

Best for earning Interest Capital One money Teen

Through an impartial evaluation process, we give our recommendations for the best items, and we are not influenced by ads. If you visit partners we recommend, we might get paid. For more information, see our advertiser disclosure. Teenagers' debit cards are frequently linked to their parents' or guardians' checking accounts or may be prepaid debit cards. Typically, these cards are used to help educate kids money management skills and give them a sense of financial independence. The best debit cards for teenagers offer the ease of cashless transactions and have crucial parental controls. Numerous cards also provide aids for financial literacy and practical mobile apps for simple access while on the road.

Overview 2019 saw the launch of Copper, a brand-new online banking service for teenagers. It has a checking account, debit card, and a mobile app for education. The app provides tests and educational materials written by specialists in financial literacy to assist teenagers in learning about money management. It guides account holders through saving and budgeting so they can learn by doing.

Best for earning Interest Capital One money Teen

Additionally, Copper enables parents to reply to teen requests for money, instantaneously transfer money or set up an allowance, and monitor their children's spending patterns. There are no transfer fees, monthly fees, overdraft fees, or fees at any of the more than 55,000 ATM locations. However, if you decide to deposit money at a Green Dot register, a store might charge you. Additionally, your assets are FDIC-insured up to $250,000 and fraud monitoring is included, giving you zero-liability protection. Anyone who is 18 years old, possesses a legitimate Social Security number or Tax Identification Number, and already has a checking account is eligible to open an account for a minor. It should be noted that since Copper Banking is so young, it is challenging to discover customer service reviews.

Overview Money Capital One There are no fees associated with opening, using, or maintaining a teen checking account, and balances receive 0.1 percent annual percentage yield (as of May 2022). There are no monthly maintenance fees, no charges for money transfers to or from external accounts, no charges for international transactions, and no access charges for more than 70,000 ATMs. The number one mobile app offers separate logins for parents and teenagers. Parents may set up automatic allowance payments, monitor account activity and set up notifications, and even lock the teen's account if required. Teens can establish savings goals and see their balance increase. You only need to be at least 18 years old and have an active checking account in order to fund the account for your kid; you do not need to be a Capital One member. As long as their parent or legal guardian is a joint account holder, children as young as eight can open a Capital One MONEY Teen checking account.

Why We Chose It Due to its free subaccount creation for up to four teens and parental controls on each account, Bluebird from American Express is the ideal option for groups of users.

Pros And Cons Pros

Minimum costs

sophisticated parental controls

four maximum subaccounts

FDIC-insured

Cons

Some merchants refuse to accept it

No associated bank accounts

Overview With the Bluebird American Express Prepaid Debit Card, you can open up to four teen subaccounts without paying any fees. Additionally, there are no transfer costs to other Bluebird account holders, no monthly maintenance fees, and no fees for ATM withdrawals at any of the more than 30,000 MoneyPass ATMs. The $5 card cost is eliminated if you sign up online, and you may load cash onto the card for free at Walmart or by direct deposit. You can grant up to four teens (13 and older) access to the funds on your card using Bluebird subaccounts while maintaining tight control over their use. Each subaccount has a prepaid card and unique login information. Setting daily spending restrictions, preventing transactions or ATM access, receiving low balance notifications, and freezing the card from your Bluebird account are all options. Additional benefits include free online bill pay, purchase protection, Amex discounts, and roadside assistance. You must be of legal age in your state, have a current Social Security number, and be a resident of the United States in order to register.

Why We Chose It Teenagers may safely make purchases with the Jassby Virtual Debit Card without the dangers of a physical card, and parents can manage allowances and keep an eye on spending. Pros And Cons Pros

choices for safe, contactless payments

the capacity to balance chores and allowances

Cons

No physical card or ATMs access

Overview You won't have to be concerned about a physical card becoming misplaced or stolen when you use the Jassby Virtual Debit Card. You can still make secure transactions online or in stores, though, because its virtual card number supports contactless payment. Because contactless payment uses a virtual account number and generates a different security code for each transaction, it is generally more secure than using a real card. Users of the Jassby Virtual Debit Card will also need to set up a PIN and use Touch ID or Face ID in order to complete transactions. Teenagers can purchase items directly through the Jassby Shop, where they can get access to special discounts, in addition to shopping online and in physical stores. Parents can send money as rewards for accomplishing goals or as allowances via the Jassby smartphone app, and kids can do the same or ask their parents to approve tasks. The app allows parents to keep an eye on their child's spending habits. You must be at least 18 years old, be a legal resident of the United States or a citizen, have an email address, and have a U.S. bank account or credit card in order to apply for the Jassby Virtual Debit Card. Sutton Bank, a participant in the FDIC, is the issuer of this card.

Why We Chose It The Chase First Banking free teen checking account includes a debit card with advanced parental controls and free transfers. Pros And Cons Pros

no costs

sophisticated parental controls

teen savings objectives

FDIC-insured

Cons

You must already have a Chase checking account to qualify.

not compatible with digital wallets

No P2P transfers, direct deposits, or remote deposits

Overview Chase First Banking offers kids a free debit card and more parental control than other teen checking accounts for parents who have a Chase checking account. Teenagers can request money through the mobile app and create savings objectives. Parents can authorize the requests for an immediate payment. The app also allows parents to establish spending restrictions (including restrictions for particular categories of spending) and account alerts to keep an eye on their children's purchases. A regular allowance or one-time chore can likewise be established. With this card, there is no minimum deposit requirement or monthly fee, and users have free use of more than 16,000 Chase ATMs. There are only two fees: a foreign transaction cost and an out-of-network ATM fee. You must be at least 18 years old, have a current Chase checking account, and have a valid Social Security number for both you and your child in order to apply for an account. For Chase First Banking, a child must be at least six years old. Chase also offers a Chase High School Checking Account, which has less usage limits but also doesn't come with the same amount of parental oversight, for teenagers who require Peer to Peer (P2P) payment features.

Why We Chose It The FamZoo prepaid card offers strong parental controls and resources for financial literacy despite having a monthly cost. Pros And Cons Pros

FDIC-insured

enables parents to pay interest on savings and planned allowances

sophisticated parental controls

excellent reviews for client service

Cons

$5.99 monthly cost (or $2.50 if you pay in advance)

Reload fees in cash (electronic transfers are free)

Overview The FamZoo prepaid card instills the importance of hard work with tasks and chores tied to financial rewards, and it teaches fundamental envelope budgeting with spend, save, and give accounts. Parents may charge interest on teen loan money as well as pay interest on savings. Additionally, from the mobile app, parents may set up recurring allowances, send one-time payments, authorize cash and reimbursement requests, get activity notifications, and lock or unlock the card. The mobile app allows teens to set savings objectives and monitor their progress. After the free trial period, there is a $5.99 monthly subscription; but, if you pay in advance, you can save money. When paid in advance, a two-year subscription costs $2.50 a month. There aren't any transaction fees, including those for international or ATM withdrawals (though you will pay the ATM operator fee). Direct deposit and ACH transfers are free of charge, however cash reloads at Green Dot and Mastercard rePower facilities cost $4.95 each. You must be at least 18 years old, a citizen of the United States, have a valid Social Security number, and be able to fund the card with at least $5 in order to open an account.

Why We Chose It Teenagers who make major purchases should use the American Express Serve card since it has a high $15,000 monthly spending limit and a $750 daily ATM withdrawal restriction. Pros And Cons Pros

Preventable costs

up to four teen subaccounts

FDIC-insured

a large monthly expenditure cap

Cons

If you don't direct deposit, there is a $6.95 monthly cost $500+ monthly

Foreign exchange commissions

Overview The American Express Serve prepaid card can be ideal if you're looking for a card with a high monthly spending cap for handing your kid money. If you make a direct deposit of at least $500 per month, the $6.95 monthly fee is waived. Free transfers, free subaccounts for up to four people, free online bill pay, free early direct deposit, free ATM withdrawals at more than 30,000 MoneyPass ATMs, and more are also included. Subaccounts allow parents to establish limits on how much money their children can access while using the mobile app to keep an eye on transaction activity. Online card registration is free, but there is a $3.95 cash reload cost. Additionally, American Express's renowned fraud protection and round-the-clock customer assistance are included with your card. To apply, you must be at least 18 years old, a resident of the United States, and have a current social security number. No minimum balance is necessary.

The greatest debit card for your kid will depend on both the amount of control you desire over their account and the type of spending habits they have. There are prepaid cards and debit cards linked to checking accounts; one has advantages over the other. Even though all of the debit cards we selected have fantastic features, Copper Banking stood out to us because it emphasizes ease and financial literacy, which are the primary justifications for parents allowing their teen to use a debit card.DEBIT CARD FEES REWARDS AVAILABILITY PARENTAL CONTROL VIA MOBILE APP Copper Banking Best Overall No monthly fee None Everywhere Yes Capital One MONEY Teen Best for Earning Interest Zero fees Checking account balance earns interest Everywhere Yes Bluebird Prepaid Debit Card Best for Multiple Users No monthly fees None Not available at all retailers Yes Jassby Best for Online Security No fees None Only where Apple Pay is accepted Yes Chase First Banking Best Checking Account Debit Card No fees None Everywhere Yes FamZoo Best Prepaid/Reloadable Card $2.50-$5.99/month None Everywhere Yes American Express Serve Best for High Spending Limits $6.95/month None Wherever American Express is accepted Yes

It's a significant decision to decide if a debit card is appropriate for your kid. Your teen will gain from being exposed to financial freedom and will pick up some money management skills that they'll probably find useful in the future. Additionally, you'll be able to monitor their spending patterns and establish spending restrictions for the account. Before receiving one, you should think about your teen's personality and if you believe they are mature enough to handle a debit card. In case they misuse (or overuse) any of the funds, you should also make sure you can still afford it.

You should contrast teen debit cards when looking for them so that you can pick the one that best suits your family's requirements. Among the crucial elements to take into account are:

The most crucial factor to take into account is parental controls. Make sure you can manage the account's usage restrictions and spending by having access to it.

Fees: Review the costs before enrolling. Monthly fees, ATM fees, foreign transaction costs, and even reload fees could be charged. Make sure you have adequate money on hand to pay any expenses your adolescent may incur.

Consider the locations where the card can be applied for initially and where it will be accepted. Obtaining a card that your teen cannot use at the majority of businesses is not beneficial.

Added characteristics: Does the card provide any other benefits? Teenagers can benefit from financial literacy tools and advice as they learn how to handle their finances.

Rewards: If at all possible, get a credit card that offers benefits like interest on balance transfers or cash back on specific purchases.

As a parent, you can assist your teen in getting the most out of their new debit card, making responsible use of it, and developing sound financial practices that will benefit them as adults. You can walk your kid through how the debit card functions, what fees are assessed and when they apply, and how they can track their purchases, make deposits, and check their balance at any time. Teens can learn about budgeting, saving objectives, needs vs. wants, and other fundamentals of money management when debit cards are used.

Parents can open bank accounts with debit cards attached for their teenagers, or they can give them prepaid cards. The best debit cards for teenagers include a mobile app, tools for teaching financial management to teenagers, and some level of parental control.

Adults generally open teen debit cards to offer their children access to finances while keeping parental oversight. Adults use conventional debit cards to make purchases from their checking accounts. Compared to teen debit cards, regular debit cards frequently have less usage limits. For instance, although features differ per account, a juvenile debit card might not support mobile check deposits or online bill payments. Teen debit cards also come with crucial parental controls because they are connected to an adult's account.

No. You can only use a debit card to make purchases equal to the amount that has been placed onto it or is currently accessible in your checking account. Because you aren't borrowing money or paying off the balance, debit card providers don't file reports with the major credit bureaus. Make your kid an authorized user on one of your credit card accounts; this is the finest approach to assist them in establishing credit.

The card determines the required age. Some credit cards only permit accounts for youths 13 and older, while others are made for younger children. For instance, children as young as age six may open a Chase First Banking account if it is done so jointly with a parent.

Giving your teen a blank prepaid card to spend however they like won't necessarily teach them good money management techniques. However, your child will learn the fundamentals of banking if they put their allowance into a checking account. Your child will begin to develop wise budgeting practices and an understanding of the relationship between work and money if the debit card or prepaid card you use has built-in money-management features, such as setting up and monitoring savings goals or planning chores to earn money in the account.

Our experts examined 20 debit cards, taking into account a number of customer-important variables, to determine the best debit cards for teenagers. We contrasted the different kinds of parental controls, spending caps, ATM withdrawal costs, accessibility, rewards, and other card features that are offered. Before making our top recommendations for each category, we also considered the card issuers' general repute.

0 notes

Text

Obtain the closest Wells Fargo Bank in Portland

Find The closest Wells Fargo Bank and even ATM Locations in Portland, OR. Get Wells Fargo locations in addition to hours, expert services and driving a vehicle directions.

Wells Fargo Bank 97214

Wells Fargo Bank, 310 SE Taylor St

Portland, OR 97214

Reviews

Comes to an end afternoon before the Toil Day holiday and just one teller to help- absurd wait- very aggravating!

Clearly may care concerning customer service.

Reviews

I had the fee in the credit card My partner and i was trying to cancel. I referred to as customer program with 10/31, spoke to a extremely kinds individual who put in my dispute (#14854307) and stated I would have this funds launched within forty eight hours, We produce an email confirming that furthermore. This interest charges were released in 48 hours but not necessarily the charged. I known as again on 11/7 on 4: 10 spoke to a new man, provided proof my own request to the firm in order to cancel my demand. Described that again this budget in dispute were not introduced. This individual claimed that they ended up returned back to my abolished cc number in problem and that the funds would be back with my new card in 48 hours. Again most of these chats are recorded. Since 7: 45 this morning hours the money had even now not necessarily been credited. My spouse and i directed wells fargo a good e-mail, no response. My partner and i called on my break in which the call up ended at 9: 19. The first woman that will I speech to said that she found that will the request was submitted to have the credit rating transferred from terminated credit score card to the in service one, but that this will take 5-10 business enterprise days and nights to have the credit applied not really twenty four hours. I inquired her exactly why I was first lied to instead of provided accurate information on the decision on 11/7 in which often they already have the recording often the I was lied for you to and not really chosen appropriate information, She am not able to response my question, Specialists in order to communicate to a supervisor. My spouse and i spoke to Claudette who also again said of which this transfer would definitely not take place with regard to five to ten enterprise days, never ever after responding to the inconvience that was causing me or perhaps appoligizing for the problem that will caused the money to be transferred to a good cc number they will terminated or the other miscalculation they made in which will I has been certainly not presented accurate data. She performed not care. Definitely not solely does Wells Fargo generate false accounts, which can be fraudulence, but they outright along recorded calls lie for their customers. Never ever perform business enterprise with this bank. As soon as it is resolved I will always be going anywhere else!!!

Reviews

Super tiny location. That they only acquired one company when we went. Workers was friendly. Simply no restroom. Free 30 minutes airport parking out front.

Wells Fargo Bank in Portland

Wells Fargo Bank, 635 SW 6th Ave

Portland, OR 97204

Reviews

I am the treasurer of the small non-profit group. Charitable contributions and book sales can be found in at random instances. The projects like educational shows, books etc can certainly take some sort of lot involving money. have been working with wells forgo for years however the costs incurred by Wells Fargo will be draining our balances together with reducing what we can do. $10/month for checking plus another $6/ month for savings. $192 a year- even though that amount seem to be like much it decreased what we are capable of doing. Bore holes Fargo wasn't willing to stop changing we closed both accounts and planning to a further bank that isn't asking fees.

Reviews

Are typically in a few times with regard to questions and am often still left happy in addition to secure together with my business with Water wells Fargo. Perfect people worki there way too, wish I actually could remember brands.

Reviews

My broker was so patient together with valuable setting up my trading accounts. Wells Fargo is some sort of huge loan provider but at this point at this place not any one will fall throughout the cracks. Feels nice to be respected and taken care of. Cheers Donald!

People also viewed:

Wells Fargo Bank, 5555 New Northside Dr, Atlanta, GA 30328

Wells Fargo Bank in Santa Monica

Wells Fargo Bank, 3181 SE Federal Hwy, Stuart, FL 34994

Wells Fargo Bank Hours

Wells Fargo Bank, 110 W Vulcan St, Brenham, TX 77833

Wells Fargo in Portland, OR 97201

Wells Fargo Bank, 1300 SW 5th Ave

Portland, OR 97201

Reviews

Stopped here after job to downpayment my massive bonus offer check on an account I've had to get many years. I was admonished the fact that because it was soon after 4 on Wednesday that will the funds would definitely not be available until finally Friday. I say admonished for the reason that vibe I obtained seemed to imply that I has been some kind of felonious hobo trying to pull a quick one.

I experienced no purpose of yanking the money outside correct after I put it in. Nevertheless , in this particular day time and era, We think it's total B. Ersus. that the cash isn't very available right away. Hell, whenever I employ my debit card, I actually can check my balance online five minutes later on and find out the transaction. Will Wells Fargo use the particular Pony Exhibit to fetch the cash through the banking companies that cut us inspections? Otherwise, I don't know precisely why those orders acquire times when other individuals get mere seconds.

Made us grouchy.

Evaluations

Awful customer support, all people viewed like they will completely hated their jobs... often the manager(Sara? ) had been extremely impolite and less than professional. This only smiling face taking in the room seemed to be from the brokerage.

Testimonials

The customer services is here is really lacking. Let's be sincere. It merely requires plain sucks. My spouse and i was informed I'd include to sit down with an account supervisor to modify some thing minor on my own account. My spouse and i went inside on a good Friday plus no one surely could accomplish it so they told us they'd call myself very first thing on Wednesday to set up a great appnt. They even verified my own phone number. Some sort of couple of weeks later and I still don't have heard from these people. My spouse and i was initially just through there now, your bank was initially empty, I could observe four account managers at their desks, only a single which was helping a customer, together with We has been told someone would be perfect with us. Fifteen moments later, still zero acknowledgment, so My spouse and i received upwards and left. I've truly disliked having WF because my bank for quite a good while these days, and this particular has been the final hay. Give thanks to you to get ultimately pushing me to seek out a new bank/credit association to be able to transfer all of our accounts to!! I are going to be with a new standard bank by following full week. Cheers again!

Wells Fargo Bank Portland, OR

Wells Fargo Bank, 1405 Lloyd Ctr

Portland, OR 97232

Reviews

I really like my local community, but you can find no financial institutions close to my home. The particular only ATM's within taking walks distance are those questionable convenient kiosks that charge a couple of bucks. Those CREDIT bandits are withdraw just, naturally , so any other banking orders My spouse and i have to accomplish need some sort of special trip in the car. That makes me grouchy.

Gratefully, the people at this kind of Wells Fargo diverge together with generally very pleasant. Now i am welcome with a enjoyable hello and some cheery chit-chat. Nice folks.

Reviews

The customer service here is below doble, and Wells Fargo inside general has been leading to us issues. The on-line accounts encounter issues as soon as a good calendar month, and I've experienced anatomical problems having the ATM at this area. When calling and acquiring the tellers browsing on me through the windowpane, they just continued to consume their food and ended up hesitant to help even nevertheless they could observe everyone on the phone dialling with the window while his or her cell phone was ringing in addition to they were only 12-15 minutes from beginning.

Reviews

I traveling frequently and love to become ready to stop simply by limbs as needed. My spouse and i ended into this branch and was treated now kindly. Everyone had some sort of smile and you could say to many people come in often. I love seeing company's have a compact town feel, especially around a hustle and bustle town.

Reviews

Seems going to be able to this branch for a long time mainly because my possibilities will be confined. I steer clear of coming into this branch on just about all prices. Twice now, a couple months apart, the same teller offers incorrectly applied a pair number of dollar payment in my credit card. Give thanks lord the pin number pad questions the customer to verify in advance of processing! One card I use usually for big purchases and the additional merely actually has ten to twenty dollars charged to it. Currently, I possibly said, "payment on the Cash Smart to Visa please" and she EVEN NOW put it on the particular additional card. The credit card that is presently PAID OFF. Also, a few yrs ago, a banker almost closed my accounts I actually share with the mother while i was at this time there with my own ex-fiancé for you to close our mutual balances. No one seems for you to spend any attention to be able to the details in the dealings they are processing. Now i'm so glad My partner and i changed the majority of my banking must a Credit rating Union.

Reviews

I actually had a good negative opening experience with this loan provider. I should have identified going for walks in, when I actually was attacked by some sort of fellow purchaser that it was planning downhill. Not of which My spouse and i hold this institution accountable for that.

But I went in to order a few Canadian currency like their web page specifically clarifies their normal operating time with an cosmopolitan teller. I go in plus stand in line through the given times merely to learn the fact that "international teller" has in reality gone home and Items need to return another day. I used to be then told to be able to be sure into the future in during the morning when to ensure what We wanted was obtainable. My spouse and i understand the currency is definitely "first come, initially served" but upon contacting before my next take a look at, My spouse and i was told that had been not necessary. Consistency in connection in particular with retail can be pretty significant if a person ask me.

Wells Fargo Bank 97209

Wells Fargo Bank, 845 NW 11th Ave

Portland, OR 97209

Reviews

We have only had excellent experiences with this subset of Wells Fargo. Whenever I go in I am approached the instant I walk in and certainly not possess to wait more compared to a time to be helped.

I have caused the brokers (John plus Mitch) on this side branch numerous times to deal with supervision issues about both business and private accounts and have always was feeling well taken care associated with and all problems possess been recently quickly solved.

Kudos!

Reviews

It takes some sort of lot for me to assessment a bank. I click on over for my do the job dealings like expense record take a look at cashing etc. I could utilize the ATM but I get in every moment. The people are why. Super nice and good. I think they recognize myself. Probably. l certainly not but you get that will perception. Furthermore they constantly have straps connected with $2s and I love that. Parking would be testing nevertheless I walk together with cycle.

Reviews

Tom as well as manager Michael will be amazing. I used to work with regard to Wells Fargo and may honestly say I've never ever viewed such amazing customer care around my years of financial. Thank you for resolving my troubles in addition to being so eager to support.

Critiques

Ok which means this bank can be HELLA outside of my way for literally every thing My partner and i need and there are usually nearer locations I could use yet I may not go at any place although here because I really like these kind of people. This staff is really freaking sweet and friendly and My spouse and i feel want they may my personal good friends hoping for us to do well. The bankers are really knowledgeable trying to help me in just about any way they can. They're very invested in the life and it is very reassuring! Mike with this branch is the nicest man together with is generally there as i need him. Highly, REALLY highly recommend this specific office. Is actually great. And Wells Fargo as a financial institution is just great. Quick to get rid connected with fees along with the app is usually hella straightforward to navigate. I'm a enormous fan so far!

Reviews

This kind of has not necessarily been my usual branch to accomplish business throughout, but I've had excellent service in this article every time My spouse and i occur in. Most recently, I actually had a fairly obnoxious transaction that essential several verifications, and was assisted proactively by Claudia here. Cheers for your follow-up in addition to working with me!

1 note

·

View note

Text

Bank of Baroda Minor Account Opening Online / how to open minor zero balance account online in bob

Bank of Baroda Minor Account Opening Online / how to open minor zero balance account online in bob

Opening a Baroda Champ Account just got a whole lot easier. Eligibility begins from 0 -18, with no minimum balances required and no issuance charges.

Get fun and theme-based RuPay Baroda Champ Debit Card issuance available to applicants individually above 10 years of age. Save today, for their brighter tomorrow.

Bank of Baroda is an Indian state-owned International banking and financial services…

View On WordPress

0 notes

Text

Why Is Savings Account The Preferred One?

One of the bank accounts we open when we start earning is a savings account. Whether it is an account, we open as a minor or as an adult, a standard saving account helps build a sense of financial discipline and encourages to save money from the young age. Yet, many prefer using these accounts for basic transactions such as cash deposit and withdrawal because they are unaware of the features.

Some of the characteristics that make this account the most preferred one are –

Anytime transactions

One of the best features of the modern-day bank accounts is you can access them anytime, anywhere. This gets attributed to the fact that all banks today offer net and smartphone banking facilities. You only need to set up your net banking account and download the digital banking app. This way, you can easily send and receive payments.

Bill payment and online shopping

Do online saving account opening and pay all your utility bills. These can be paid in cash, cheque, or through online transactions. You can use the net banking channels for paying the online shopping orders, eliminating the need for paying them in cash.

Debit or ATM cards

When you open a saving account, your bank usually offers you with an account opening kit. This kit includes some essential things like net banking details, debit or ATM card, etc. Individuals who are uncomfortable with online transactions can use their debit card to withdraw funds. You can use it for shopping on online website and retail stores, and the funds get directly debited from your savings bank account.

Maintenance of balance

One of the basic requirements of the savings account is maintaining a said balance. Banks generally always decide the minimum amount needed in the account, failing which you get charged a penalty. If you hold the account in public sector banks, you are usually expected to maintain a minimum balance of INR 1,000. Private sector banks, on the other hand, need you to maintain a minimum balance of INR 10,000 to INR 1 lakh. There are also unique accounts such as a zero-balance saving account, where there is no mandate on balance maintenance.

Interest rates

The savings parked in your account earn you some interest. Based on the bank in which you hold your saving account, the amount in the account, and the minimum balance requirement, you earn interest on the savings. While the interest amount might not be too high, it is still a bonus offered by the banks and get disbursed once or twice a year. Typically, banks offer interest rates between 3.5 per cent to 7 per cent, depending on the type of the account you hold, and the minimum balance maintained.

0 notes

Text

Savings Accounts – A Detailed Look at the Facilities Offered by Banks

A savings account is a service provided by public and private sector banks. You can use this account to park and grow your savings gradually. You must open a savings bank account, the moment you begin earning, if you already do not have one. While some employers do provide an account to deposit the salary, you should also consider opening a regular savings bank account, with which you can avail a host of facilities. Here's a look at are some of the most generic facilities that all banks offer when you open a savings bank account.

You can use the account for day-to-day transactions

The most basic feature of a saving account is that it enables you to conduct all kinds of daily transactions. There is no upper cap of the amount of sums you can deposit in this account. You can deposit funds through cash, cheques or online transactions through different accounts. However, banks do set a daily withdrawal limit on these accounts. Typically, the withdrawal limits are higher when you withdraw money from your bank branch than through ATM.

You are provided with an ATM-cum-debit card with your savings account

All banks in India offer an ATM-cum-debit card when you open a savings account. The ATM card is a small plastic card featuring your name, along with a 16 digit number and the expiration or validity date on the front side and a CVV number with a signature strip on the flip side. You can use the ATM card to withdraw money from any ATM vestibule. However, you must also check the number of ATM transactions permitted at your home bank and other banks. Apart from withdrawing cash at ATMs, you can use the card to pay for shopping at retail stores and online websites. You may also use the card to pay your utility bills online.

You may avail the net banking service to facilitate easy transactions

Another facility you get with your savings bank account is that of internet banking. You can access your online savings account through the internet banking facility and conduct transaction online. The bank provides you with a default login and net banking password which you must change before you start conducting transactions. You can use your net banking account to transfer funds between account through facilities like IMPS, NEFT and RTGS. You may also pay your utility bills, house rent, loan EMIs and other monthly expenses, directly through your net banking account.

You can earn interest on the savings parked in your account

All banks provide interest on the saving parked in the savings account. The interest rate offered on savings is not generally high but may be considered as a bonus for your loyalty towards the bank. While most banks offer a flat interest rate on the savings parked in the account, a few may offer higher interest rates to customers who’ve maintained high deposits in this account – typically amounts exceeding ₹100,000, at all times. The interest offered on savings ranges from 3.5% to 7% depending on the bank and the savings parked. Also, the interest pay-out may occur on a half-yearly or annual basis.

Final word: While opening a savings bank account with a particular bank, you must enquire about the different kinds of accounts you can open. Apart from the regular account, you may open a joint account, a zero balance saving account, and accounts under various government schemes. Also, women, senior citizens and minors can open special accounts, with which they can avail several additional facilities.

0 notes

Text

“The most sophisticated people I know – inside they are all children.” – Jim Henson

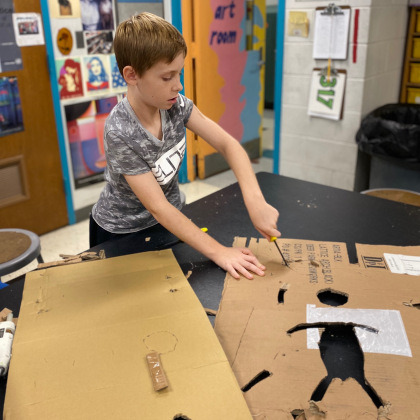

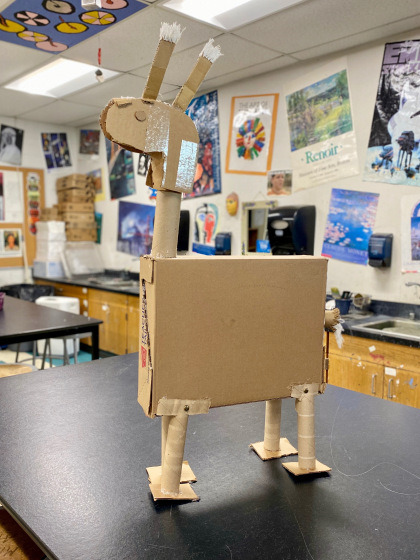

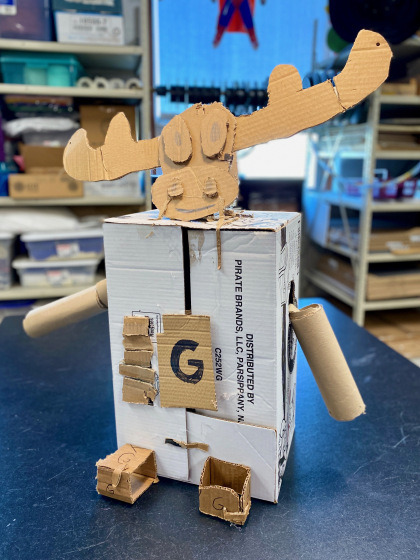

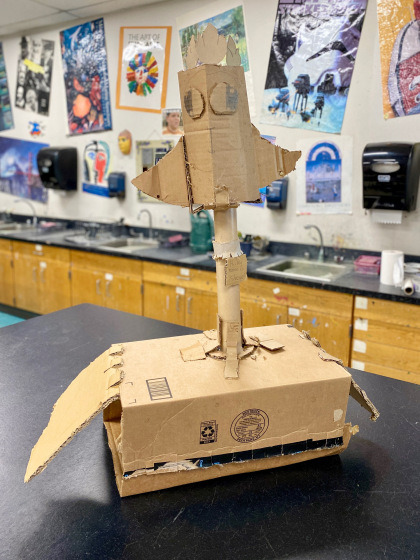

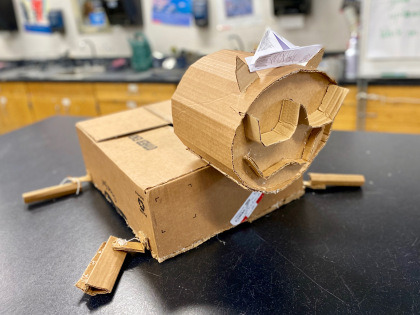

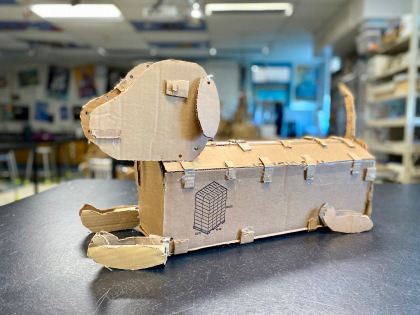

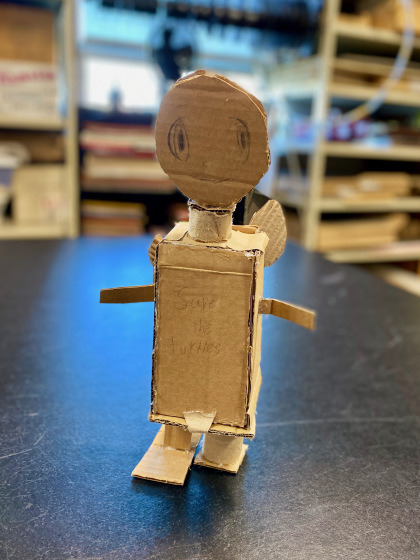

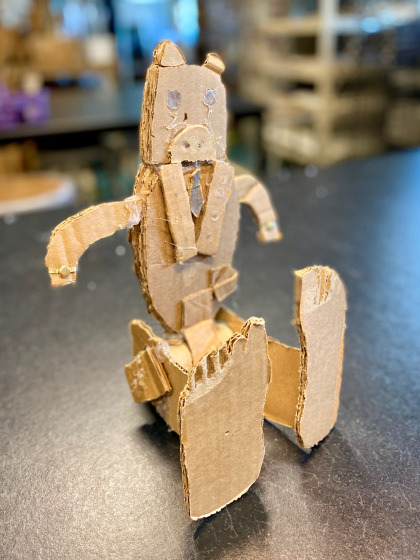

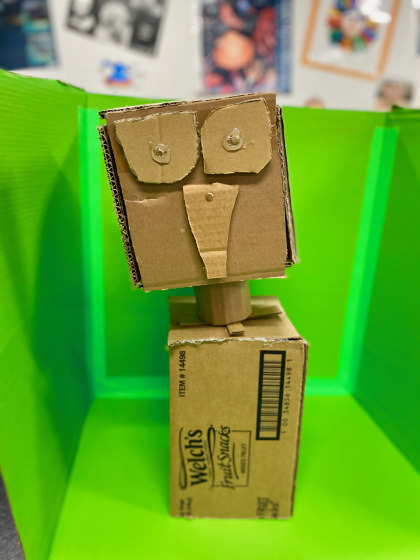

The photo above is of me and a whole bunch of cardboard on October 8, 2019 as I waited to introduce our Cardboard Creature project to an incoming class. It was all down hill from there!

Here’s how we did it:

I introduced this unit by showing Caine’s Arcade, a film by Nirvan Mullick. I’ve been showing this video to students for years, but this is the first time we’ve followed it up by working with cardboard. And I’m so glad we did!

Students started by responding to a bell ringer prompt in their sketchbooks: Design a figure you could make 3D. This prompt is purposely vague and open-ended, allowing for creativity and active imagination. It also initiates first consideration of thinking in 3D. This was a great opportunity to differentiate between creative drawing and scientific diagrams, although they both require creative thinking. These are a couple of the responses:

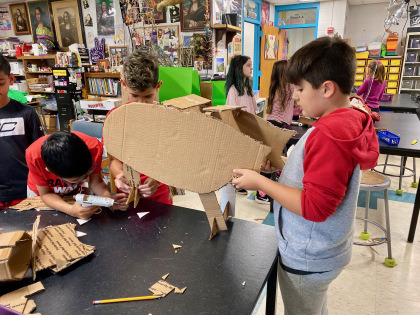

After sharing designs with the students at their table, groups were formed by students based on friendship, like-mindedness, and similarity of creature design. I encouraged groups of three, and when necessary due to class size, groups of two or four were formed. During their first group meeting, students compared designs and discussed possibilities for a design that either combined individual drawings or elaborated on one of the drawings.

Together we also looked at the cardboard artwork of artist Justin King:

Cardboard Animals By Justin King

And after a couple of classes as an inspiration boost, we also looked at the work of Monami Ohno:

Cardboard Sculptures By Monami Ohno

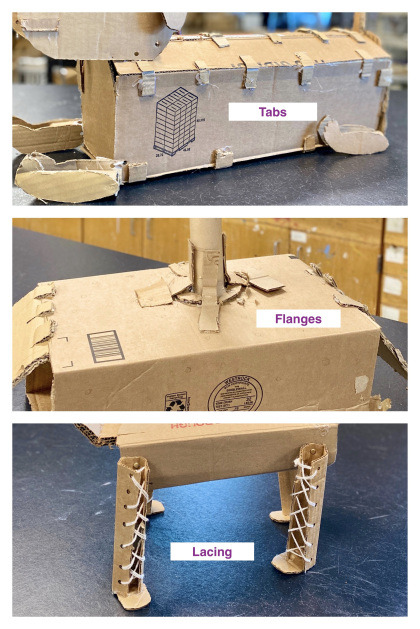

I also shared these three attachment attachments with the students through Google Classroom. We went over the various ways to construct 3D forms with cardboard so it becomes a mechanical endeavor, well thought out and conceived for prime support and bonding.

Students then began the design process with one person sketching for each group. I asked students to show me their plan for mobility for the figure and for attachments.

This went very well. Clearly there is no shortage of imagination in the 5/6 art classes! Here is a slideshow of some of the group drawings:

This slideshow requires JavaScript.

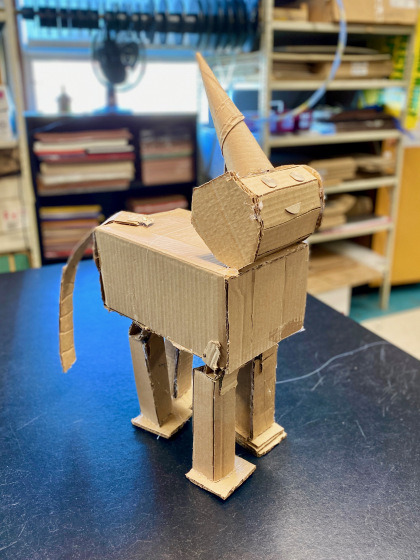

The Creative Constraints for this project were:

Attachments must be made with attachment techniques and hot glue

Creatures must be self supporting and have mobility

Finished creature width and depth must fit within the designated box

Checking the size of the creature against the designated “size checker” box

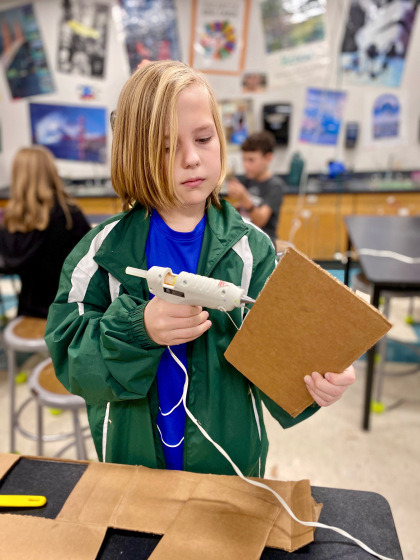

Groups were able to start building as soon as their design was approved by me. We were using Canary Cardboard cutters and scissors, glue guns, yarn, and brass fasteners. No tape. We discovered along the way that fishing line was helpful for Phase Two: Stop Motion/Green Screen (shared in a separate post). A couple of groups also used sand for ballast on top-heavy models.

The cutters were arranged in little “toolkits” with 4 cutters and one scissor in each, enough for one toolkit at each table. At the end of every class students returned the tool kits and the glue guns (also one per table) to the supply table. I took a quick inventory to make sure they were all accounted for as I didn’t want these tools to leave the classroom.

I was thorough in going over the potential hazards of the cutters and glue guns. Early on there were five or six minor cuts and about the same amount of minor burns, for which band-aids and/or cold water soothed all. Fortunately, nothing was serious, and the accidents tapered to zero after a couple of classes. Experience and confidence seemed to build resistance to injury.

Here are some photos of the cardboard artists at work:

Checking the size of the cardboard part against the designated “size checker” box

Dedication!

And a video of one group explaining their project as they put it (her) together:

I teach nine different classes over two days. Classes are 50 minutes long. It took most groups between five and six classes to make their cardboard creature. As groups finished, they started Phase Two – Stop Motion/Green Screen, for which I had demonstrated the apps and process around the fourth class as some groups neared completion of their build. By October 30, most groups were finished building and we took a break from building/filming so I could show them Phase Three – 3D Design (shared in a separate post); how to design for 3D using Morphi App. I was also concerned about working with hot glue and cutters while the kids were wearing costumes on Halloween; I know my own costume was too “drapey” to be messing around with hot or sharp things.

Notorious Ruth Bader Gentili with the cardboard creatures

As the Cardboard Creatures were completed, they graciously posed for photos before being herded to the school lobby for display there. As two students and I were finishing up the display near the end of the block, students were pouring into the hallways for lunch and recess. We were mobbed with excited kids looking for their creatures.

Above photo credit: Jennifer Mannion

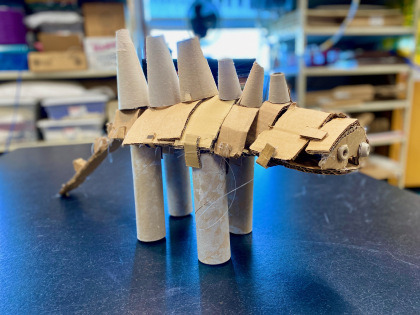

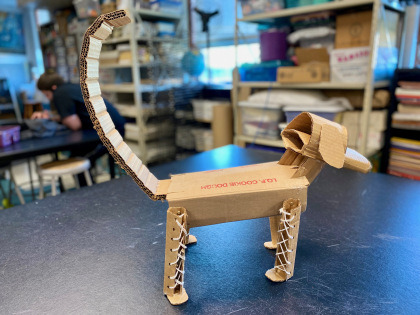

And now (drum roll, please) here are some of the Cardboard Creatures:

Reflection:

If I could bottle the energy the kids brought into the classroom for this project, I would apply it to some of the traditional art projects that cause some kids to check out, disengage, and mutter, “I’m not good at art”. Everyone was at home with this project. It was so different and challenging we all knew and accepted failure as part of the process. The class atmosphere was truly one of discovery, exploration, and true collaboration.

And if I had a nickel for every time a student asked, “Can we just stay here and do this all day?” I could pay for all of the glue sticks we consumed. Kidding not kidding. We went through about 200 glue sticks, necessitating a next day Amazon order in the middle of things to keep us in business. That’s completely my fault. Working groups can get away from you quickly. While you’re helping one group sort out structural issues, another group is using the glue to fasten one edge to another, which intuitively seems like it would work, but doesn’t. Cardboard is heavy and one bead of glue along the edge doesn’t support the weight. Mini-demos about this popped up in the middle of classes as I saw the mountains of glue on certain pieces. What’s the alternative? Tabs, flanges, and Lacing:

Much has been written about the important role of play in child development. This felt like play for all of us. As the teacher, my job was to facilitate the project and interactions. I would intervene with building help or smoothing group dynamics as needed. With group work, certain students struggle to maintain the balance between leading and being led. That’s where the teacher has a role in defining possible tasks within a project and helping groups to either separate out a little to make sure all are busy with defined jobs or to go all-in on one task. For instance, early on, EVERYONE wants to use the glue gun, and the teacher helps ensure that everyone has a chance.

Over the past few years I implemented group projects in November. The past few years, my fifth grade classes were engaged in the WeRMakers Product Design unit and the sixth grade classes incorporated 3D printing in the Game Makers unit. Typically we would have accomplished the important first tasks of creating a portfolio folder, making sketchbooks with covers that are also artworks, learning to photograph art and upload it to Google Classroom and our online gallery, Artsonia, as well as completing at least one additional independent art lesson before moving on to group work.

This year I shook it up a little, going from portfolio folder to sketchbook with cover artwork right into the Cardboard Creature group project. One reason is because at the end of the last school year, when I took inventory of my supplies, I also took a look at the materials I had collected through the years. I had an abundance of cardboard, including large sheets from the packaging of white boards throughout the school. As the project took shape in my mind, I reached out to my colleagues for more. It turns out Gary, a custodian at my school, is the keeper of the boxes from food deliveries, and there is a pretty good assortment in a space right outside the school kitchen. He kept us in cardboard throughout the project. Thank you, Gary!

I liked this scheduling shift a lot, as it tuns out. The group work enabled classes to get to know each other more quickly. This is especially important for my fifth grade students who come together from two different schools when they get to middle school. It also helped them to know me as a teacher earlier in the year – to learn that I value originality over sameness, exploration over duplication, and that when I get their attention, I say what I have to share and then get out of the way. This is a nice foundation to have established as we go forward into the school year.

Lastly, for me personally, I learned a lot about constructing with cardboard. I learned a lot about my students as individuals: the natural leaders, the forceful, the followers, the easy-going, the always helpful, the determined, the rays of sunshine. I enjoyed being in the art space with students, all 200 of them. No school day or cardboard creature was the same. It was fun.

Holden waves “hello”

Brandon’s Mini-Mona Lisa

My demo for how to make a rounded form ends up as a hat/helmet, of course…

And it was magical. When I would lock up at the end of the day, I’d glance back thinking I might catch all these little creatures coming to life for the night. And when I opened the door in the morning and threw the lights on, I could feel a shift in energy, as if they had suddenly become still…the secret life of Cardboard Creatures.

Cardboard Creature Project – Phase One – Build "The most sophisticated people I know - inside they are all children." - Jim Henson The photo above is of me and a whole bunch of cardboard on October 8, 2019 as I waited to introduce our Cardboard Creature project to an incoming class.

#ArtEducation#artsed#CainesArcade#CardboardChallenge#CardboardCreatures#collaboration#creativity#MiscoeHill#MonaLisaLivesHere#mursd#mursdvisualart#weRmakers#MakerEd

0 notes

Text

What Are The Details Of PNB BSBD Account?

Basic Savings Bank Deposit Account (BSBD) is getting so much attention recently because of its facility to maintain a savings account at zero account balance. The option gives people the opportunity to not worry about the charges usually applied by the banks if the minimum account balance is not maintained in the bank account. Top banks such as SBI, PNB, ICICI, HDFC Bank and Kotak Bank are some of the best choices for a zero balance account.

To open this type of bank account, you need to see if you are more than 18 years of age or not. There are certain limitations such as limited withdrawal facility. But, even then it has almost all the privileges that you get on a regular savings account. In this article, I have given some of the best options you have for BSBD account.

Eligibility criteria for PNB BSBD Account

The eligibility criteria for PNB BSBD account is given below. You may go through the detail to see if you are eligible to open this account or not.

Resident Indians are allowed to open the account

A maximum of four withdrawals is allowed in a month. However, the number of withdrawals does not include the ATM withdrawals.

Mode of Operation

Individuals can open the account either on a single or joint basis. Accounts of minors with 10 years and above must be opened under the natural or legal guardian.

List of BSBD Accounts

The list of different BSBD accounts at top banks in India is given below:

PNB BSBD Account

Zero balance account

20 free cheque leaves can be allowed in a year

Free ATM-cum debit card

No charges on non-operation/activation of inoperative BSBD account

No limit on the deposits to be made in a month

SBI BSBD Account

Basic RuPay ATM-cum Debit Card to come free of cost

Free receipt of money via NEFT or RTGS

State or Central government issued cheques or money deposit is free

No charges on account closure and activation of inoperative accounts

ICICI Bank BSBD Account

Free RuPay Card facility

No charges on cash deposits/withdrawal

Passbook to be issued free of cost

HDFC Bank BSBD Account

Access to free RuPay Card

Four free cash withdrawal allowed in a month

Free cash and cheque deposits at bank branches and ATMs

Passbook to come free

Axis Bank BSBD Account

Free RuPay Debit Card facility

Get monthly e-statements, SMS alerts and passbook facility

Kotak 811 Plan

Open the account and book RD/TD online with Kotak Mobile Banking App

Get a virtual debit card to shop, recharge mobile/DTH and pay bills online

Scan and pay feature enabled for shopping, groceries, cab, home deliveries, travelling and entertainment

A zero balance account can be said to be a mandatory bank account because you can keep any amount in the account without being worried about lowest required amount. Also, it can be used to keep your saving amount. So, if you find any of the above mentioned bank accounts suitable, you can open the account and enjoy these privileges. Also, PNB BSBD account and other accounts can be opened online as well.

0 notes

Text

10 BEST BANKS FOR SAVINGS ACCOUNT IN INDIA

Keeping your money at home will not give you any benefit. With a savings account, you can easily reinvest and transfer the amount deposited in your account. For this, you have to check some best banks for a savings account.

What A Savings Account Gives You?

It gives you security for your money

You will get interest for your money deposited

It provides liquidity, so you can use your money anytime

It might be the simplest way of investing money and earning interest

You will get online banking facilities, so you can transfer money in a blink

Automated payments do your work in a hassle-free manner

Here Is The List Of 10 Best Banks For Saving Accounts In India

State Bank of India or SBI

Axis Bank

Kotak Mahindra Bank

Yes Bank

Citibank

IndusInd Bank

Bank of Baroda

RBL Bank

HDFC Bank

ICICI Bank

Must Read:

BEST MUTUAL FUND COMPANIES IN INDIA – A QUICK REVIEW

Savings Bank Account Types

Regular Savings Account

This is the most common basic savings account.

Salary Based Savings Account

Companies open these accounts for their employees, so employee’s salary can be transferred on a monthly basis.

Savings Account For Senior Citizens

It is the same as a regular savings account but due to senior citizens, the rate of interest is higher.

Savings Account For Women

These accounts are just for women so they can get exclusive features and benefits.

Savings Account For Minors

Parents/guardians open these accounts on behalf of their children.

Zero Balance Savings Account

There is no minimum limit for account balance so no penalty charged.

Features of S/B Account in India

Interest Rate

Most people consider this to choose a bank because everybody wants high-interest rates. Most of the banks provide just 3% to 4% interest rates on a savings account. But some banks also offer a bit higher interest rates 5% to 6%. Hence the interest is credited at the end of every quarter in your account: 31st March, 30th June, 30th September and 31st December.

Minimum Balance Requirement

Private sector banks require a higher amount as minimum balance but public sector bank don’t demand that much. The customer has to maintain a minimum balance so their account remains active. If an account holder fails to maintain the minimum balance then he/she has to pay maintenance fee as a penalty.

Facilities Offered

Most of the banks offer the same facilities as a credit card, debit card, net banking facilities, ATM access, mobile banking etc. But if we talk about physical reach then the State Bank of India has a number of branches. Every customer looks for prompt customer support and better facilities.

Customer Service

People have a mindset that private banks offer much better customer support and services. There are many online facilities are present but what if you have to visit the branch office. Therefore in this situation, helpful staff and good customer support is an advantage for you.

Charges Or Fees

Banks usually charge for many of their services, so you have to clear about all charges that can be charged by a bank.

Location Of Branches

It is not a major concern but a bank which has many branches all over India will be more beneficial. If the bank has many branches then it might have a higher number of ATMs so you don’t have to pay extra for withdrawing money. Hence if you relocate from one place to another then you can take branch transfer.

Must Read:

TOP 10 INSURANCE COMPANIES IN INDIA – BEST IN CLASS

Savings Account Interest Rates In India

State Bank Of India Or SBI

In SBI there is a 3.5% interest rate up to 1 lakh amount and 3.5% to 4% above 1 lakh amount.

Axis Bank

Rate of interest for a savings account is 3.5%.

Kotak Mahindra Bank

In Kotak Mahindra bank they offer a 5% rate of interest for up to 1 lakh amount and 5.5% to 6% above 1 lakh amount.

Yes Bank

It has a 5% rate of interest for up to 1 lakh amount and 6% to 6.25% for above 1 lakh amounts.

Citibank

This bank also has the same rate of interest 3.5% for all amounts.

IndusInd Bank

Rate of interest up to 1 lakh amount is 4% and above 1 lakh it is 5% to 6%.

Bank of Baroda

It has a 3.5% rate of interest for up to 1 lakh amount is 3.5% and 3.5% to 4% for amounts above 1 lakh.

RBL Bank

In RBL bank rate of interest for up to 1 lakh amount is 5.5% and above 1 lakh it is 6% to 7%.

HDFC Bank

HDFC bank has the same rate of interest 3.5 % for all amounts whether it is up to 1 lakh or above 1 lakh.

ICICI Bank

ICICI bank has the same rate of interest 3.5% for both amounts up to 1 lakh and above 1 lakh.

Must Read:

BEST ONLINE MONEY MAKING TIPS

There are many banks which can give you good interest if you open a savings account in them. Before opening a savings account in any bank you should consider some points like customer support, minimum balance requirement, feasibility, technology, extra benefits, interest rates etc.

Presently State Bank of India has the largest number of branches in India and from decades it is ruling the Indian bank world.

Most of the customers don’t have enough time to visit the branch and they do most of their work online. Therefore they also have many options; presently many banks are offering hassle-free online savings accounts. So one can just open an account in minutes by providing required documentation.

Here we discussed some of the best banks for savings accounts in India. So with the above description, you can choose among the best banks for a savings account because are the complete factors which one wants to know and compare.

0 notes

Text

Savings account – all you need to know

If you have received your first pay cheque and you are looking to invest them in some form; banks and other financial institutions offer an array of options such as mutual funds, bank accounts, bonds, debentures, etc. However, it is better to opt for a savings account as they are the go-to solution, particularly, for beginners.

What is a savings account?

It is a magic box where you can store your extra money, earn high interest and access it anytime. Whenever you want to use your hard-earned money, a savings account is the best instrument to invest upon. You can deposit money into the account either by cash or cheque. You can also transfer funds from one savings account to the other, using your net banking facility. You, in turn, earn interest that is credited to your account on a quarterly basis. However, it is essential to know that these rates vary from bank to bank.

You can also remove cash from your account by visiting the bank or issuing a cheque or by using your debit card at the ATM. However, you have to maintain a minimum balance on a quarterly or monthly basis, depending on the bank’s terms and conditions. However, some lenders also offer zero balance accounts. If you’re wondering how to open a savings account, kindly note that there are two ways you can do the same- traditional way by visiting the bank and online by visiting the bank’s website.

Benefits of an online savings account?

We tend to get so consumed by our day-to-day activities that we do not get enough time to manage our finances. Mankind’s greatest invention is the internet, and therefore, banking online makes managing finances easier. Some of the primary benefits of an online savings account are:

1) Savings account interest rate is generally high . This rate is usually multiplied by the total money deposited and maintained in your account.

2) When you open a savings account online, you are not slapped with any maintenance charges

3) Whenever an emergency crops up, you can always look up to your savings account for rescue. You can handle your account through mobile phone as well

4) With the help of mobile banking, you can set automatic deposit schedules to streamline your finances.

What are the conditions you need to fulfil to open a savings account?

You do not have to satisfy any particular income or employment criteria for opening a savings account. However, the necessary conditions are:

1) You have to be an Indian citizen to open the account. NRI, as well as foreign nationals, can open an account

2) You must be 18 years of age, to get a savings account on your name. Nowadays, even minors have an account on their name, that can be opened with the help of a parent/guardian

Some banks have a savings account eligibility calculator to assist you with the further steps.

What documents are required to open a savings account?

To open an online savings account or an offline one, you must have the following documents:

1) ID proofs such as PAN card, Aadhaar, driving license, passport, voter’s ID, etc.

2) Address proof like utility bills, insurance policies, property papers, ration card, etc.

3) Past six months bank statement

4) Recent passport-sized photographs.

Now that you have learnt how to get a savings account, visit your nearest bank or download the app on your phone today!

0 notes

Text

Payday Lender Companies Or Banks

Payday Lender Companies Or Banks

Chances are you'll get tax deductions to offset the expense of putting in some of this see on facevook expertise. Get a receipt for All the pieces Simply do it for one month. This account requires nothing to open, nothing to earn the minimal curiosity price and nothing to take care of each month. The better the score, the upper is the power to discuss the rate of curiosity. Additionally, a low credit rating might imply a high interest price, which might scale back the chance to get the debt paid off fast. Whether or not curiosity rates are excessive or low or its the end of a mannequin 12 months with plenty of incentives, motorbike patrons tend to make the same errors when looking for a motorbike loan. Chase Bank near Jerseyville Presently there are video games that seem like like they're precise life films and it’s a niche which permits billions a 12 months. So it's possible you'll wanna ask how many one cs of megs of dollar bills’ value of existent property do you agent out every year?

An insurance coverage agent can make it easier to estimate the price of insuring the kinds of vehicles you're considering shopping for. Many banks chose to acquire a form of insurance coverage for the assets they still had on their books. Nonetheless, in order to get the personal vehicle with out having to spend a complete lot, you would opt to take a look at an Insurance Car Public sale. With this particular currently being stated, refinance to help latest homes aren’t turning out to be as a result of required. Commercials are put within the newspapers or on web pages and a number of actual estate organizations in Finland checklist their houses on-line as they are frequently employed to come back across acceptable lodging for individuals. The very first thing to search for is the repute of the true estate broker. That’s actually the place my first income from music came from. Your FICO assessment is a pointer of your financial wellbeing and of your reimbursement design for previous advances or cost playing cards that you may have, which inturn gives banks and cash associated instution the capacity to evaluate your credit value.

gelato place was closed but i went ahead and bought two $30 history books instead so who’s the real winner here (not my bank account)

— bitchin’ (@madmaxines) October 30, 2017

Some folks try to redirect their deposits so as to forestall the banks from debiting the cost due. If you can't borrow as a lot as you would like, try utilizing the options above. How much do chase bank tellers make in az? It's also a good suggestion to maintain the receipt of your earlier journey to the grocery and make it as a foundation to your purchases on your subsequent trip. Make an association with the transferee if you can't or do not want to pay the complete value of any charges or taxes. These taxes can really have an effect on your choice that you've got made to reside in a country like UK. Say Company X has an funding alternative which can earn it say 50 per cent profit, but it surely doesn't have all the money to enter the funding alternative (like constructing a factory which is able to manufacture a highly worthwhile product). If I have no NRE or NRO Savings account, How Can I open FCNR fastened deposit, Do banks like HDFC and Kotak Mahindra provides pick up services in Singapore and HongKong ?

There are many several types of banks in America that present checking and financial savings accounts in addition to a broad array of lending, credit, and different banking products. As the federal authorities regulates many points of the banking trade, individuals in search of careers in the monetary industry should have the ability to adhere to all the rules and laws that banks must comply with. New vehicles meet present Federal guidelines for air high quality and other EPA mandates. Let it be identified, that you can not consolidate federal schooling loans with non-public educational loans. Also, there are lenders focusing on approving loans for these with lower credit scores. A second finest minor loans requirement, you should have got a present checking or financial savings account. Money switch is what my family has been doing for years and right this moment, we could have to shut shop.

Primarily, zero% APR on stability transfers means a suggestion, that claims to cost no extra curiosity on the transfer of balances from one monetary instrument to another. Subsequent, I looked at department availability, judged by the variety of branches a bank has in keeping with the FDIC and whether or not the bank has a presence nationwide or in only one or two areas. Cheques- All cheques associated with the account have the IFS code of the house branch mentioned on the leaf. So as to sign up for online payday loans, you will have to include some fundamental financial knowledge problem-free. Some smaller institutions or army establishments don't work with payday mortgage firms. Hope this article has given you an concept about what non-public instructional mortgage consolidation is and how it really works. It is a good suggestion to re-use the grounded espresso as soon as.

Remember if its to good to be true, it probably is. The bank shall be extra reluctant to extend your credit limit if the card is not used on a regular basis. January 17, 2013 - When folks have a foul credit rating, it will possibly forestall them from getting loans, leasing vehicles, or choice on different crucial financial issues. Once you already know your credit standing and what it is advisable to do to improve it, you’ll develop into better knowledgeable with what your options and subsequent steps are. Below are some of the first reasons Bank5 Join was chosen for this rating of helpful places to open a enterprise account on-line. These are the powerful questions that our politicians, Wall Street, and the media needs to be asking and planning for. Don't be afraid to ask questions. Publisher: John Francis Higgins You need to get the best possible return in your financial savings, however is your cash secure?

0 notes

Text

What is the difference between a standard savings account and salary account?

Whenever millennial seek advice on how to begin their investment or savings journey, financial experts suggest to open a savings account. Whether it is a minor or joint family account, there are variations to a savings account. However, the features of these accounts differ. Millennial who have just begun their career and looking for employment opportunities, employers are asked to open a different account with a company called salary account. They work differently than the savings account. Most have both these accounts.

What is so different between both the savings account. The following comparison should solve your queries –

1) Account opening purpose: Anyone can hold a savings account irrespective of their age, gender, caste, or religion. Banks also cater to unique segments such as minor, senior citizens, family, and joint bank accounts. They can be opened in more than one bank for parking your hard-earned finances or operating financial transactions. Salary accounts, on the other hand, are individual accounts which are opened to credit salaries. Generally, corporates and business open these accounts for their employers and used only for crediting salaries, incentives, bonuses, and other kinds of remuneration.

2) Opening the account: You can open a saving account in any bank of your choice. You could consider several factors while opening the account of your chosen bank – the proximity of the bank from your house, the interest rates on balance maintained, minimum balance requirements, and so forth. There is also a provision to open online accounts through the internet or smartphone. However, in the case of salary accounts, the owners do not have the choice to select the bank. Typically, the company opts for the same bank for all employees and the account gets opened for the only purpose of depositing salaries.

3) Documentation: When you decide to open an account, the banks ask for a list of documents which are nothing but your ID and address proofs such as PAN card, Aadhaar, utility bills, insurance papers, etc. Bankers verify these documents personally before accepting the application. Depending on the documents produced, the bank offers a customized debit card and cheque book for transaction purpose. The ATM and net banking details are sent through email after a few days of opening the account. For salary accounts, banks conduct quick documentation and usually provide an instant kit which includes cheque book, ATM as well as a debit card along with the PIN, internet banking PIN, etc. You can also ask for personalized debit card and cheque book once the salary gets credited to the account.

4) Balance maintenance: One of the critical requirements while opening a savings account is always maintaining a minimum balance. This minimum balance amount varies from bank to bank. One the other hand, there is no such requirement under salary accounts. Precisely why, they are also called zero-balance saving account. You can withdraw your entire income, but the bank follows a prescribed daily withdrawal limit for deciding the withdrawal transaction. It is the most distinctive feature between the two accounts.

Many banks convert your zero-balance saving account to regular savings account if the salary does not get credited for a specific period, i.e. three months. You can also switch your regular savings account to salary account under change of employment scenario or a new relationship with the current bank.

0 notes

Text

Making Extra Money as a Tradeline Broker

These days, it can be difficult to find a good side hustle. Making money always requires effort, but sometimes the payoff isn’t worth the trouble. However, becoming a tradeline broker is a terrific way to rake in the extra cash while expelling minimal energy. In fact, there are thousands of people buying tradelines at any given moment. A tradeline broker is needed to act as the middleman between interested customers and legit tradeline companies.

Being a tradeline broker requires very little effort, and is as simple as selling your highest-quality credit tradelines to help others achieve their financial goals. A more accurate description of the average broker’s job duties would be “renting,” because the buyer has only temporary access to the account and the account holder never loses ownership.

Selling tradelines is a simple and streamlined process, especially if it’s overseen by a legit tradeline company with a large number of potential clients. At its most basic state, a tradeline broker simply sells access to their good payment history and/or account age to someone with a less than perfect credit score. By adding customers as an authorized user on their account, that customer receives a swift boost to their credit and can then apply for financing they might have otherwise been rejected for.