#kyc procedure

Text

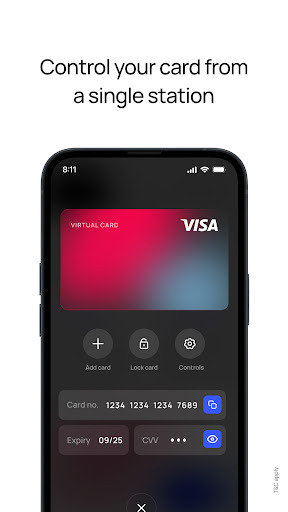

Open a zero balance savings account, scan QR & transfer money via secure UPI

Enjoy the power of seamless digital banking with Kotak 811 – the ultimate UPI app for all your banking needs! With our feature-rich mobile banking app, you can open a bank account in just 3 minutes, check balance online, view transaction history, and enjoy secure UPI payments and grow your savings faster with High-Interest Fixed Deposits!

#kyc verification process#kyc procedure#account bank balance check#bank balance enquiry#upi transaction check online#check status of upi transaction

0 notes

Text

GRC Software in Bangalore

GRC Software in Bangalore: A Must-Have for Modern Businesses

Bangalore, the Silicon Valley of India, is a thriving hub for technology and innovation. As businesses in the city continue to expand and face increasing regulatory pressures, Governance, Risk, and Compliance (GRC) software becomes an indispensable tool. GRC solutions streamline processes, reduce risks, and ensure compliance with a wide range of regulations.

What is GRC Software?

GRC software is a comprehensive platform designed to help organizations manage and mitigate risks, ensure compliance with regulations, and enhance governance practices. It integrates various aspects of risk management, compliance management, and governance into a single, unified solution.

Key Features of GRC Software

Risk Assessment: Identify, assess, and prioritize risks across the organization.

Compliance Management: Track and manage compliance with regulatory requirements, industry standards, and internal policies.

Audit Management: Streamline audit processes, document findings, and track corrective actions.

Incident Management: Respond effectively to incidents, track root causes, and implement preventive measures.

Policy and Procedure Management: Create, manage, and distribute policies and procedures to ensure consistency and compliance.

Reporting and Analytics: Generate reports, dashboards, and analytics to monitor performance, identify trends, and make data-driven decisions.

Benefits of Implementing GRC Software in Bangalore

Enhanced Risk Management: Identify and mitigate risks proactively, reducing the likelihood of costly incidents.

Improved Compliance: Ensure adherence to regulatory requirements, avoiding fines and penalties.

Streamlined Processes: Automate tasks, reduce manual effort, and improve operational efficiency.

Enhanced Governance: Establish effective governance frameworks and accountability mechanisms.

Data-Driven Decision Making: Leverage analytics to make informed decisions based on data-backed insights.

Improved Reputation: Demonstrate a commitment to ethical business practices and regulatory compliance.

Choosing the Right GRC Software for Bangalore Businesses

When selecting GRC software, Bangalore businesses should consider the following factors:

Scalability: Ensure the software can accommodate the organization's growth and evolving needs.

Customization: Look for solutions that can be tailored to specific industry requirements and business processes.

Integration: Verify compatibility with existing systems and applications.

Cloud-Based or On-Premises: Determine the deployment model that best suits the organization's infrastructure and security needs.

Cost-Effectiveness: Evaluate the total cost of ownership, including licensing fees, implementation costs, and ongoing maintenance.

GRC Software Providers in Bangalore

Bangalore is home to numerous GRC software providers, offering a wide range of solutions to cater to different business needs. Some popular options include:

MetricStream

RSA Archer

OneTrust

ISMS27001

RiskLens

By implementing GRC software, Bangalore businesses can effectively manage risks, ensure compliance, and improve their overall governance practices. This investment will not only protect the organization from legal and financial consequences but also enhance its reputation and long-term sustainability.

#grc software#operational risk management software#operational risk management solution#sop digitization#grc platform#risk and resilience#grc solution#policies and procedures management#sop management#video kyc solution

0 notes

Text

How to do PAN card KYC - Online/Offline Methods

In the digital age of today, your PAN card is not a simple piece of plastic, but it’s a bank account that presents you with numerous financial advantages! Whichever you are concerned with whether you invest, property loan Documents fill in taxes or apply for credit, then must have your verification (KYC) details updated. However, worries should be put to rest as we present how to successfully go through this PAN card KYC in both online and offline worlds.

0 notes

Text

There’s never just one ant

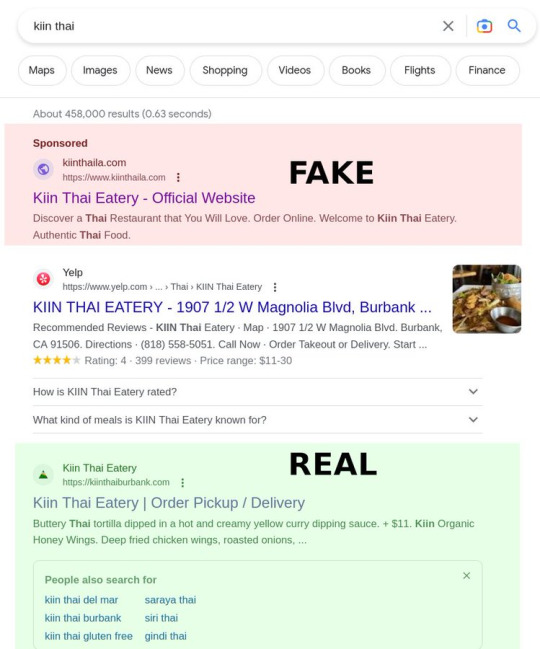

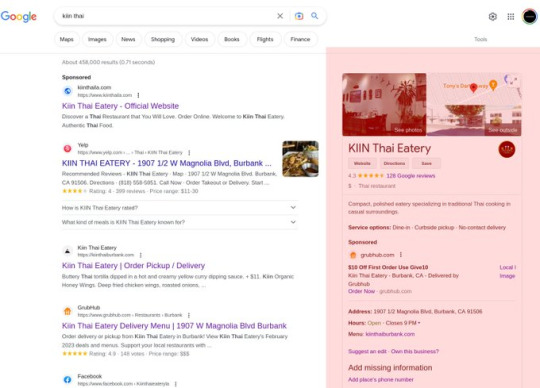

So there's a great Thai restaurant in my neighborhood called Kiin. Yesterday, I searched for their website to order some takeout. Here's the Google result.

That top result (an ad)? It's fake. It goes to https://kiinthaila.com, which is NOT the website for Kiin.

The *third* result is real: https://kiinthaiburbank.com

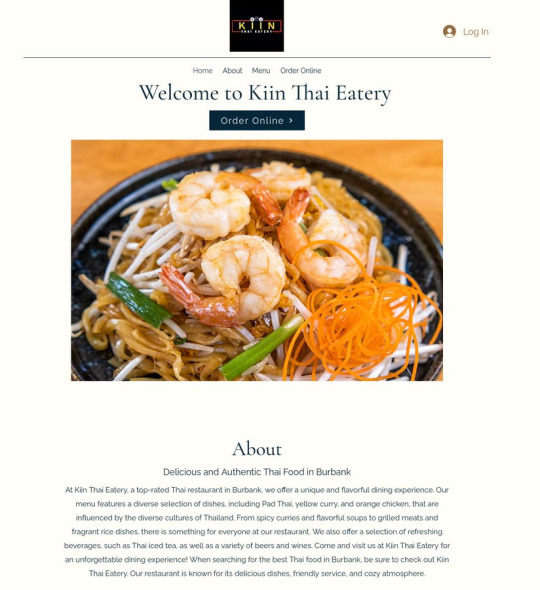

Fake site:

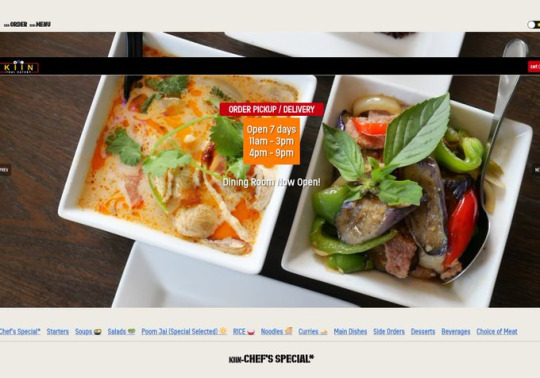

Real site:

I got duped. I placed an order with the fake site. The fake site then placed the order - in my name! - with the real site, having marked up the prices by 15%. Kiin clearly knows they're doing this (presumably by the billing data on the credit card the fakesters use to place the order). They called me within minutes to tell me they'd cancelled the fakesters' order.

I could still come pick it up, but I'd have to pay them, and cancel the payment to the fakesters with Amex. Actually, as it turns out, I have to cancel TWO payments, because the fakesters DOUBLE-charged me.

Here's what that charge looks like on my Amex bill. See that phone number? (415) 639-9034 is the number for Wix, who provides the scammers' website.

How the actual FUCK did these obvious scammers get an Amex merchant account in the name of "KIINTHAILA" by after supplying the phone number for a website hosting company? What is Amex's KYC procedure? Do they even call the phone number?

And why the actual FUCK is Google Ads accepting these scam artists' ads for a business that they already have a knowledge box for?! Google KNOWS what the real KIIN restaurant is, and yet they are accepting payment to put a fake KIIN listing two slots ABOVE the real one.

To be fair to these scammer asshole ripoff creeps who are trying to steal from my local mom-and-pop, single location Thai eatery, they're just following in the shoes of Doordash and Uber Eats, who did the same thing to hundreds (thousands?) of restaurants during lockdown.

Doug Rushkoff says that the ethic of today's "entrepreneur" is to “Go Meta” - don't provide a product or a service, simply find a way to be a predatory squatter on a chokepoint between people who do useful things and people who use those things.

These parasites have turned themselves into landlords of someone else's home, collecting rent on a property they don't own and have no connection to.

There's NEVER just one ant. I guaran-fucking-tee you that these same creeps have 1,000 other fake Wix websites with 1,000 fake Amex merchant accounts for 1,000 REAL businesses, and that Google has sold them ads for every one of them. Amex and Google and Wix should be able to spot these creeps FROM ORBIT. Holy shit do we live in the worst of all possible timelines. We have these monopolist megacorps that spy on and control everything we do, wielding the most arbitrary and high-handed authority.

And yet they do NOT ONE FUCKING THING to prevent these petty scammers from using their infra as force-multipliers to let them steal from every hungry person patronizing every local restaurant.

I mean, what's the point of letting these robber-barons run the entire show if they're not even COMPETENT?

ETA: Dinner was delicious

11K notes

·

View notes

Text

The dangers of the state's monopoly on identity

The state's monopoly on identity excludes vulnerable people from jobs, housing, healthcare and more.

This article originally began as a response to The Reboot's article, which discusses the dangers of perpetual tracking by Google, Facebook and Microsoft. [1]

While the tracking by Google, Facebook and Microsoft is definitely disturbing and can even put people in danger, the state's data economy is even worse, with far-reaching consequences. Few people talk about this, even though it affects millions of people's daily lives.

Via the government ID system, the state exerts a monopoly on identity and an obsession with tracking people from “birth certificate” to “death certificate”. Disproportionate KYC regulations actively exclude people without government-issued ID from necessary services, including jobs, housing and healthcare and even everyday things like online shopping, receiving mail, buying a sim card, doing volunteer work, taking classes, or visiting the gym or library.

Millions of people worldwide don't have access to government ID (the state refuses to print it for them) or can't show ID for safety reasons (e.g. they are a victim of abuse and don't want to be tracked down by the abuser). These people are often already in vulnerable situations (for example: stateless, undocumented or homeless people; activists, dissidents or refugees; victims of domestic abuse or adult victims of child abuse; or adults whose birth was not registered) and exclusion from basic needs makes it even more difficult to survive.

The state offers no alternatives nor solutions – if the state refuses to print a passport, national ID card or birth certificate for someone, this person can't appeal, get help from NGOs or lawyers, or find an alternative way to get ID. [2]

The state's system does not offer a procedure to register yourself, for example if you weren't registered at birth or your country of birth is dangerous to you. There are no steps you can take – no appeals, checklists, regularization, rehabilitation, special circumstances, friendly jurisdictions, nor identity issuer of last resort. You cannot earn access to ID via merit, vouches, oaths, good behavior, probation, community service, nor any other form of effort or compassion. Even if the individual would otherwise qualify for a skilled work, marriage or humanitarian visa and could provide a biometric photo and fingerprints, this is not enough.

Similarly, there are no non-state solutions. NGOs and religious organizations like the United Nations, Red Cross and Caritas don't issue alternative IDs; jurisdictional arbitrage such as Flag Theory requires an existing birth certificate or old passport; and non-government IDs from World Passport or Digitalcourage are not accepted. This lack of alternatives only cements the state's monopoly.

In the 1950s, the United Nations issued conventions on statelessness [3] and refugee status [4], but today countries still refuse to issue IDs for stateless people, people who weren't registered at birth, and people who have fled political, cultural or interpersonal persecution – whether by arbitrarily or discriminatorily denying applications for stateless status, refugee status or delayed birth registration, ignoring submitted applications, or not having a process for applications at all, while simultaneously criminalizing people without a legal identity. [5] In 2014, the UNHCR started a campaign to “end statelessness by 2024” [6], but today it is still impossible to get a stateless or non-citizen passport, and unlike the laissez-passer passports of the past, the United Nations no longer issues substitute IDs, despite that it could help millions of people to access necessities such as employment, housing and healthcare.

This condemns individuals purely and permanently to their circumstances of birth, which they could not influence and cannot change. As an adult, there is no way to enter the system. If you were born in the wrong place (e.g. stateless, refugee, dissident) and/or to the wrong people (e.g. child abuse, cult, no birth registration), there is no way to rise above your situation through effort, determination nor compassion.

The state's monopoly on identity is therefore an unethical, fatalistic single point of failure.

Even for individuals with ID, the name that the state prints on their ID may not correspond to the name that they use in real life, which could put them in danger. [7] Many countries restrict or even ban legal name changes, which endangers victims of abuse (such as adults who escaped from child abuse, domestic abuse, cults or gangs), who use a self-chosen name for a fresh start, to feel human, to recover from trauma or for physical safety reasons. [8]

As government ID is not universal and does not signify security or trust, government ID requirements only disproportionately and unfairly exclude people from services. [9]

Returning to the topic of “surveillance capitalism” – People can choose to stop using Google, Facebook, Windows or stock Android. There are many alternatives, such as DuckDuckGo, Mastodon, Linux and custom ROMs such as Lineage or Graphene. There are also ways to protect your privacy, such as reducing usage of social media, using a VPN or Tor, using a burner phone, using a pseudonym, or using cash or crypto instead of credit cards. [10]

In comparison, when the state coerces the vast majority of employers, landlords and hospitals to require government ID, there are only a few gray market alternatives left (e.g. under the table work, informal rentals for cash, doctors who accept out-of-pocket payments). [11]

It is a stark contrast: If you don't use Facebook for privacy reasons, you can still find different ways to keep in contact with friends and local events. If you can't rent most apartments because the landlord requires a passport or driver's license, you are very lucky if you can find a room in a shared apartment where your roommates deal with the contract for you and you pay rent to your roommates in cash. One thing can be an inconvenience, one thing can cause homelessness.

Many people believe government ID is the only way to trust that “someone is who they say they are”. [12] If someone admits that they don't have “proper ID”, they are often seen as untrustworthy, hiding something or even dangerous. [13] The equation of “ID = trust” not only leads to social stigma and exclusion, but can also lead to poverty and homelessness [14], threats of violence, or even indefinite detention (in many countries, cops can demand ID without a reason, and detain the individual until their legal identity is known – which can mean indefinite imprisonment for people who were never assigned a legal identity [15] [16]). Rather than “innocent until proven guilty”, this creates a situation of “guilty and no way to prove innocence”.

If innocence is not based on your actions, but purely on possession of government ID, it creates an impossible scenario when no jurisdiction agrees to print ID for you – from stateless people who literally have nowhere to go, to refugees who can't return to or interact with their country of birth for safety reasons, to adults whose births were never registered, to victims of child abuse, domestic abuse or cult abuse who don't use their birth name due to decades of trauma or worse the risk of being tracked down and returned. Instead of blaming authoritarian countries, uncooperative bureaucrats, abusive or neglectful birth parents, violent ex-partners or sociopathic cult leaders, the victim is blamed, distrusted and considered as a criminal.

In an ideal world, people would be judged on their actions and intent, rather than on circumstances of birth and decisions of bureaucrats. For housing, only your ability to pay rent would be relevant. For a job, only your skills and work ethic would be relevant. For healthcare, only your medical condition would be relevant (it would be against the Hippocratic Oath to deny medical treatment to people without ID, especially if they are paying out-of-pocket in cash).

For identity, it would be enough to say your name, get a vouch from a friend, landlord or employer, link to a social media profile, or use a non-government photo ID (such as from Digitalcourage or World Passport, which does not require birth registration or citizenship and allows self-chosen names).

For authentication, you would use a password or PIN (e.g. SMS code to pickup mail), physical key or card (e.g. mailbox keys, membership cards) or a cryptographic keypair (such as in PGP, Bitcoin or Monero).

For trust, word-of-mouth was the primary method before government IDs were invented (and made mandatory) in the 20th century. [17] [18] [19] Nowadays, word-of-mouth includes vouches from friends, online reviews, social networks, web-of-trust and memberships. Cash deposits and escrow systems (e.g. Bitrated) would protect against scams, theft or damage.

This meritocratic, non-government market is not theoretical. Permissionless free markets exist today – under the names of agorism [20], informal economies, black and gray markets, parallel economies and Second Realms – and offer hope and a means to survive to people in need. [21] [22] While NGOs have tried in vain to convince the state to print IDs for vulnerable people, these independent markets take a practical, grassroots approach to help people access work, housing and healthcare, even without government-issued ID. [23]

These free markets offer a way for people to take control of their situation. Human rights activists have campaigned since decades, while individuals have been left in limbo or excluded entirely from society, purely due to bureaucracy. In the 1950s, the United Nations called on nation-states to print IDs for stateless people, unregistered people and refugees – but seventy years later, the situation has only become worse, as more daily life necessities require government ID KYC every year, yet nation-states still refuse to print ID for millions of people.

Even worse, these people are not being accused of a specific crime and there is no real justification to deny printing IDs for them – their only “crime” is the vicious circle of not having papers because the state refuses to print papers for them. You would think economic exclusion – banned from employment, housing, healthcare, education, banking, travel, contracts, mail, sim cards and more – would be a punishment for only the most severe of crimes. But for stateless people, refugees, victims of abuse and people who weren't registered at birth, it is a punishment for being born. In this unforgiving situation, the informal economy provides an essential lifeline and way to survive.

Some examples include under-the-table work, informal apartment rentals, health clinics run by volunteers and anonymous sim cards. Most informal, agorist markets are local, based on word-of-mouth with cash-in-hand payments. The internet can also offer a place for an uncensored digital economy – such as for global trade [24], remote work, activism, fundraising [25] and community building – while cryptocurrencies like Bitcoin and Monero offer a way to send and receive money online without government ID or a bank account [26] [27] and withdraw to local cash when needed [28].

There are many reasons why people participate in agorist markets. It can be quicker and easier to rent out your spare room for cash, pay a doctor out-of-pocket instead of dealing with public health insurance, or hire an online freelancer for crypto. Bureaucracy doesn't just shut people out of the market, it also takes time and money to fill out forms, deal with months-long wait times, pay extortionate fees, and apply for government permission (which may be denied for arbitrary or discriminatory reasons). Agorism cuts the red tape, enabling people to access what they need in a truly free market.

As the state continues to ostracize and even criminalize vulnerable people, agorism provides not only hope of inclusion and equal opportunities, but a practical, proven solution which works today. For universal and safe access to daily needs such as employment, housing and healthcare, it is important to build and use agorist markets that are immune to the state's monopoly on identity, invisible to the state's data economy, and free for everyone to use.

The following books, articles and podcasts provide more information about agorism, as well as practical examples:

“An Agorist Primer” by SEK3 Book: https://kopubco.com/pdf/An_Agorist_Primer_by_SEK3.pdf

“Second Realm: Book on Strategy” by Smuggler & XYZ Book: https://ia801807.us.archive.org/34/items/second-realm-digital/Second%20Realm%20Paperback%20New.pdf

“Crypto Agorism: Free markets for a free world” by AnarkioCrypto Video: https://tube.tchncs.de/w/tPvohTaiocfg5LEsFjGqHN Slides: https://anarkiocrypto.medium.com/crypto-agorism-free-markets-for-a-free-world-d9c755e6ef11

“Fifty things to do NOW” by The Free and Unashamed Article: https://libertyunderattack.com/fifty-things-now-free-unashamed

Vonu Podcast Audio: https://vonupodcast.com

Agora Podcast Audio: https://anchor.fm/mortified-penguin

Monero Talk Podcast Audio: https://www.monerotalk.live

Hack Liberty Forum Link: https://forum.hackliberty.org

Sources:

[1] https://thereboot.com/why-we-should-end-the-data-economy/ [2] https://anarkio.codeberg.page/blog/roadblocks-to-obtaining-government-id.html [3] https://www.unhcr.org/what-we-do/protect-human-rights/ending-statelessness/un-conventions-statelessness [4] https://www.unhcr.org/about-unhcr/who-we-are/1951-refugee-convention [5] https://index.statelessness.eu/sites/default/files/UNHCR%2C%20Faces%20of%20Statelessness%20in%20the%20Czech%20Republic%20(2020).pdf [6] https://unhcr.org/ibelong/about-statelessness [7] https://blog.twitter.com/common-thread/en/topics/stories/2021/whats-in-a-name-the-case-for-inclusivity-through-anonymity [8] https://privacyinternational.org/long-read/2274/identity-discrimination-and-challenge-id [9] https://www.economist.com/christmas-specials/2018/12/18/establishing-identity-is-a-vital-risky-and-changing-business [10] https://anonymousplanet.org/guide.html [11] https://anarkio.codeberg.page/blog/survival-outside-the-state.html [12] https://sneak.berlin/20200118/you-dont-need-to-see-my-id [13] https://vonupodcast.com/know-your-customer-kyc-the-rarely-discussed-danger-guest-article-audio/ [14] https://www.statelessness.eu/blog/each-person-left-living-streets-we-are-losing-society [15] https://www.penalreform.org/blog/proving-who-i-am-the-plight-of-people/ [16] https://index.statelessness.eu/themes/detention [17] https://dergigi.medium.com/true-names-not-required-fc6647dfe24a [18] https://fee.org/articles/passports-were-a-temporary-war-measure/ [19] https://medium.com/@hansdezwart/during-world-war-ii-we-did-have-something-to-hide-40689565c550 [20] https://anarkio.codeberg.page/agorism/ [21] https://libertyunderattack.com/fifty-things-now-free-unashamed [22] https://medium.com/@Kallman/a-21st-century-introduction-to-agorism-5dc69b54d79f [23] https://kopubco.com/pdf/An_Agorist_Primer_by_SEK3.pdf [24] https://bitcoinmagazine.com/business/kyc-free-bitcoin-circular-economies [25] https://kuno.anne.media [26] https://c4ss.org/content/57847 [27] https://whycryptocurrencies.com/toc.html [28] https://blog.trezor.io/buy-bitcoin-without-kyc-33b883029ff1

5 notes

·

View notes

Text

High-Risk Payment Processing Techniques: Best Practices

Article by Jonathan Bomser | CEO | Accept-Credit-Cards-Now.com

In the ever-evolving realm of e-commerce, payment processing takes center stage, enabling businesses to smoothly accept credit card payments and ensure seamless customer transactions. However, for industries deemed high-risk, such as credit repair and CBD sales, navigating the payment processing landscape presents distinct challenges. In this article, we dive into the intricacies of high-risk payment processing methods and present best practices to guarantee secure and efficient transactions. Whether you're a newcomer to high-risk payment processing or looking to refine your current strategies, these insights will steer you toward favorable outcomes.

DOWNLOAD THE HIGH-RISK PAYMENT PROCESSING INFOGRAPHIC HERE

Understanding High-Risk Payment Processing

Effective navigation of the high-risk payment processing sphere necessitates a clear comprehension of high-risk industries. Sectors like credit repair and CBD sales often fall into this category due to intricate regulations and an elevated risk of chargebacks. Consequently, high-risk merchants require specialized payment processing solutions tailored to mitigate associated risks.

The Importance of Merchant Accounts

Merchant accounts form the backbone of efficient payment processing. These accounts, specifically designed for high-risk businesses, facilitate the secure transfer of funds from customers' credit cards to the merchant's bank account. Establishing a high-risk merchant account ensures seamless payment processing, enabling businesses to broaden their customer base and enhance revenue streams.

Exploring High-Risk Payment Gateways

High-risk payment gateways serve as virtual checkpoints between customers and merchants. These gateways safeguard sensitive financial information by encrypting data during transactions. When selecting a high-risk payment gateway, emphasize security features and compatibility with your business model to guarantee safe and smooth payment processing.

Tailored Solutions for Credit Repair Businesses

Credit repair merchants face unique challenges due to the industry's regulatory landscape. Obtaining a credit repair merchant account equipped with specialized payment processing solutions can aid in navigating these complexities. Implementing robust Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures ensures compliance and fosters customer trust.

CBD Sales and Payment Processing

CBD merchants operate in a market brimming with potential but also shrouded in uncertainty. Shifting regulations demand a flexible approach to CBD payment processing. Collaboration with experienced payment processors well-versed in the intricacies of CBD sales and the utilization of age verification systems can streamline transactions and bolster customer confidence.

Mitigating Chargeback Risks

Chargebacks pose a significant threat to high-risk merchants, frequently arising from disputes, fraud, or unsatisfactory service. Proactively address this issue by providing exceptional customer support, transparent refund policies, and clear product descriptions. Consistent communication can forestall chargebacks and maintain a healthy merchant-consumer relationship.

youtube

Future-Proofing High-Risk Payment Processing

Advancing technology necessitates the evolution of high-risk payment processing techniques to stay ahead of potential threats. Embrace emerging solutions like AI-driven fraud detection and biometric authentication to enhance security and streamline payment processing. Staying informed and adapting to industry trends ensures the future-proofing of payment processing strategies for high-risk merchants.

High-risk payment processing amalgamates industry knowledge, tailored solutions, and cutting-edge security measures. Whether operating in credit repair or CBD sales, a comprehensive understanding of high-risk payment processing intricacies is imperative. Leveraging specialized merchant accounts, payment gateways, and proactive chargeback prevention methods enables high-risk merchants to confidently accept credit card payments and cultivate long-term customer relationships. In an ever-evolving landscape, embracing innovative payment processing solutions guarantees a secure and prosperous future for high-risk businesses.

#high risk merchant account#high risk payment gateway#high risk payment processing#merchant processing#payment processing#credit card payment#credit card processing#accept credit cards#Youtube

17 notes

·

View notes

Text

Improving Client Relationships Using CRM in Forex Brokerage

The key to success in the cutthroat world of Forex trading is building and maintaining customer connections. The tools and technologies that enable effective client management change along with the industry. Customer Relationship Management (CRM) software is one such product that has grown to be essential for Forex brokerages.

A Good CRM system is the cornerstone of every profitable Forex brokerage, serving as the primary interface for managing customer relations and optimizing corporate operations as a whole. Choosing the Best CRM solution is essential due to the growing need for efficient operations and tailored services.

Forex brokerages need CRM systems that are not only reasonably priced but also have special features designed to meet their requirements. Presenting ForexCRM, the best CRM solution in the business, which gives brokerages access to cutting-edge features at a reasonable price.

Thanks to ForexCRM and other affordable CRM solutions, brokerages may now affordably manage client interactions with the resources they need. Brokerages of all sizes can make use of CRM's scalable features and features to maximize customer engagement and retention.

ForexCRM's extensive feature set, created especially for Forex brokerages, is what makes it unique. With features like integrated trading platforms, Contest Management, smooth onboarding procedures, sophisticated analytics, Social Trading, and Liquidity Feeds, ForexCRM provides a comprehensive answer to satisfy the many demands of contemporary brokerages.

Brokerages may automate tedious operations, optimize communication channels, and obtain insightful data about customer behavior and preferences by utilizing ForexCRM. Brokerages may expand their company, provide individualized services, and cultivate enduring loyalty by centralizing client data and interactions.

ForexCRM provides customized solutions to simplify complex processes, making it an asset for New brokerage Formation, licensing, and regulatory compliance initiatives. With features like compliance checklists and customizable onboarding workflows, ForexCRM streamlines the registration and licensing process and guarantees prompt approvals.

Brokerages may effortlessly manage regulatory compliance while reducing risk thanks to specialized modules for KYC and AML compliance. Furthermore, ForexCRM makes regulatory reporting system connection easier, allowing for accurate submissions and providing transparency to authorities. All things considered, ForexCRM gives brokerages the confidence they need to successfully negotiate regulatory difficulties, which helps them succeed in the cutthroat Forex business.

In summary, CRM is essential to improving client connections in the Forex brokerage sector. Brokerages can stay ahead of the curve by offering great customer experiences and retaining a competitive edge in the industry with feature-rich and reasonably priced systems like ForexCRM. Unlock the full potential of client relationship management for your Forex brokerage by selecting the finest CRM available.

3 notes

·

View notes

Text

Five Tips for Enhancing Your KYC Compliance and AML Procedures

In today's rapidly evolving regulatory landscape, maintaining robust Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance processes is more crucial than ever for businesses. These processes go beyond mere regulatory requirements; they form the cornerstone of secure operations, global expansion, customer trust, and data-driven insights. In this article, we'll delve into five essential tips to optimize your KYC processes and ensure AML compliance.

Understanding KYC and AML Compliance

KYC, short for Know Your Customer, refers to the practice of verifying and assessing the identities and risk levels of your customers. This procedure is vital for adhering to regulatory mandates and mitigating risks associated with financial crimes like money laundering and fraud. KYC plays a pivotal role in maintaining a secure business environment and building trust with clients.

Non-compliance with KYC regulations can lead to severe repercussions such as hefty fines, legal actions, reputational damage, and business disruptions. Therefore, adhering to KYC regulations is not just a necessity; it's a protective measure for your business.

1. Screening Against Current Lists

Efficient KYC begins with screening customers against relevant, up-to-date lists. Utilizing comprehensive KYC solutions equipped with advanced technology and access to databases containing sanction lists, politically exposed persons (PEPs) databases, and other watchlists enhances the accuracy of your screening processes.

By incorporating these KYC screening tools, you minimize risks and ensure compliance while reducing false positives, which ultimately saves valuable time and resources.

2. Integration with Risk Assessment

Integrating KYC into your broader risk assessment framework is crucial for maintaining an effective process. Customer information can change rapidly, necessitating continuous monitoring. Regularly reviewing and updating KYC data enables you to adapt to shifting risk profiles and make informed decisions.

Furthermore, integrating KYC data into your risk assessment facilitates a seamless link to ongoing due diligence processes. For instance, if a customer's risk profile changes due to a new business venture, you can proactively adjust your risk mitigation strategies.

3. Establishing Scalability

Keeping up with new clients and evolving compliance requirements requires a flexible and scalable KYC process. Onboarding new clients, regardless of their type, should be a consistent and streamlined process rather than a burden.

Investing in a scalable KYC solution capable of handling increasing data volumes and simplifying onboarding processes is key. Such a solution enables instant screening and efficient onboarding, allowing you to focus on growth without hindrances.

4. Preparing for Regulatory Challenges

The landscape of AML and KYC compliance is continually evolving, with regulators worldwide tightening their grip on financial institutions. Preparing for these challenges by embracing technology-driven KYC solutions can lead to automation, enhanced accuracy, and improved customer experiences.

Automated KYC solutions provide the means to avoid the hefty fines and regulatory scrutiny associated with non-compliance. Staying ahead of regulatory changes through technology-driven approaches is a strategic move for safeguarding your business.

5. Seeking Expert Assistance

In the face of complex regulatory requirements and the ever-changing landscape of AML and KYC compliance, seeking expert assistance can prove invaluable. Companies like KYC Sweden offer AML platforms that seamlessly integrate KYC responses with transaction monitoring.

This integration allows for quick identification of unusual transaction behavior, reducing the risk of being unwittingly involved in money laundering or terrorist financing. Outsourcing transaction monitoring to experts through a Managed Service can streamline your compliance efforts.

In conclusion, optimizing your KYC and AML processes is not only about regulatory compliance but also about safeguarding your business and fostering trust with clients. By following these five tips, incorporating technology-driven solutions, and staying prepared for regulatory changes, you can streamline your KYC and AML compliance, ensuring a secure and successful business journey.

Is your business prepared for the potential consequences of regulatory audits? Have you integrated transaction monitoring with your KYC processes? If you seek further guidance on these crucial matters, don't hesitate to contact us at KYC Sweden.

#kyc sweden#kyc#kyc solutions#kyc services#kyc verification#kyc api#kyc compliance#kyc and aml compliance#compliance#digital identity#digital world

2 notes

·

View notes

Text

Requiring and verifying KYC documents is becoming standard practice in many industries. This is unsurprising since KYC Verification is central to a global legislative effort to verify individuals to combat money laundering and terrorist financing.

2 notes

·

View notes

Text

Streamlining KYC Processes with GmaxEpay: Enhancing Security and Efficiency

In today’s fast-evolving digital economy, ensuring secure and reliable financial transactions has become more critical than ever. As digital platforms grow in popularity, safeguarding the identity of users through robust Know Your Customer (KYC) procedures is essential for maintaining trust and compliance. GmaxEpay, a leading fintech platform, is committed to enhancing its services by offering seamless, efficient, and secure KYC solutions, enabling both businesses and individuals to perform digital transactions with confidence.

0 notes

Text

#grc software#operational risk management software#sop digitization#operational risk management solution#risk and resilience#grc platform#grc solution#policies and procedures management#sop management#video kyc solution

0 notes

Text

Forex Broker License in Mauritius: Costs, Requirements, and Timelines

Mauritius has established itself as a prime location for forex broker licensing due to its favorable regulatory environment, business-friendly policies, and strategic location. If you're looking to start a forex brokerage, understanding the costs, requirements, and timelines involved in obtaining a forex broker license in Mauritius is crucial.

Costs Involved in Forex Broker Licensing

The cost of acquiring a forex broker license in Mauritius can vary based on the type of services you plan to offer. Typically, these costs include:

Application Fees: The initial fee for applying for a forex broker license can range between $3,000 and $10,000, depending on the services included in your application.

Capital Requirements: Mauritius requires forex brokers to maintain a minimum paid-up capital, which is generally around $25,000 to $50,000. This amount may vary based on the scope of your forex brokerage operations.

Professional Fees: These include legal, auditing, and consulting fees associated with the licensing process. You may also need to pay fees for company formation in Mauritius, which can range from $1,500 to $5,000, depending on the complexity of your business structure.

Ongoing Costs: Once licensed, forex brokers in Mauritius must adhere to regular compliance checks and audits, which incur yearly fees. These costs vary based on the size and scope of your operations but typically start at around $5,000 annually.

Requirements for a Forex Broker License in Mauritius

Mauritius offers a clear and well-defined path to obtaining a forex broker license, but several key requirements must be met:

Company Formation: To apply for a forex broker license, your business must be incorporated in Mauritius. The company must comply with all legal and regulatory requirements, including appointing local directors and maintaining a physical presence in the country.

Capital Adequacy: As mentioned earlier, Mauritius requires a minimum paid-up capital for forex brokers. This ensures that your company has the financial strength to operate effectively.

Compliance with AML and KYC: Mauritius is known for its strict Anti-Money Laundering (AML) and Know Your Customer (KYC) policies. As a licensed forex broker, you must implement and maintain procedures that meet these regulatory standards.

Qualified Personnel: You are required to appoint directors and officers with relevant financial industry experience. They must demonstrate competence in managing a forex brokerage and handling financial transactions.

Business Plan: A comprehensive business plan outlining your brokerage services, target market, and financial projections is crucial for a successful application.

Timelines for Licensing

The timeframe for obtaining a forex broker license in Mauritius generally ranges from three to six months. This timeline includes company formation, document preparation, submission, and approval from regulatory authorities such as the Financial Services Commission (FSC).

Preparation Phase: Gathering and preparing all required documents can take 1 to 2 months, depending on the complexity of your business structure.

Regulatory Review: Once submitted, the FSC typically takes around 3 to 4 months to review and approve the application, assuming all compliance requirements are met.

Final Thoughts

Acquiring a forex broker license in Mauritius provides many advantages, including a well-regulated environment, tax incentives, and access to global markets. With proper planning, understanding the costs, requirements, and timelines can help streamline the process of establishing your forex brokerage.

For expert assistance with the forex broker licensing process and company formation in Mauritius, visit Intrasia Management. Their experienced team will guide you through each step, ensuring a smooth and successful application.

0 notes

Text

The Role of KYC in Real Estate Transactions

KYC, or "Know Your Customer," is a key process in the financial and business worlds, and it is equally important in real estate transactions. In property deals, KYC involves verifying the identity and financial status of individuals or entities involved in buying or selling property. This practice is crucial for preventing fraud, ensuring regulatory compliance, and maintaining a transparent property market.

The primary aim of KYC in real estate is to guard against money laundering, fraudulent activities, and other financial crimes. By conducting thorough checks on buyers, sellers, and investors, real estate professionals can minimize risks and confirm that the funds used in transactions are legitimate. This is particularly important in high-value transactions, where the stakes and potential for financial misconduct are higher.

Typically, the KYC process requires various forms of documentation. Buyers and sellers may need to present government-issued identification, proof of address, and financial records. For business entities, additional documents like incorporation certificates, ownership details, and financial statements are often necessary. These documents help verify the authenticity of the parties involved and their financial capability to complete the deal.

Additionally, KYC procedures align with anti-money laundering (AML) regulations, which require real estate professionals to perform due diligence and report any suspicious activities. Compliance with these regulations is essential for legal adherence and for upholding the integrity of the real estate market.

In conclusion, KYC in property transactions is vital for verifying the legitimacy of all parties and ensuring the legality of transactions. Effective KYC practices help prevent financial crime and foster a more secure and transparent real estate market.

1 note

·

View note

Text

Joblio: Transforming Global Recruitment with Transparency and Ethical Employment Practices

In today’s globalized economy, finding suitable employment across borders can be a daunting task. Companies often struggle with filling crucial positions, and job seekers, particularly migrants, face significant challenges due to complex legal systems and exploitative recruitment practices. Joblio, a tech-powered social enterprise, is redefining how recruitment and employment function by offering a transparent, ethical, and efficient platform that benefits both employers and workers.

Addressing Key Challenges in Global Recruitment

Global mobility and employment often come with several challenges, ranging from legal complexities to exploitation within the hiring process. These hurdles are why Jon Purizhansky, Joblio’s founder and CEO, created a platform that puts integrity at the core of recruitment. The challenges Joblio addresses include:

Lack of Transparency

Many businesses hire internationally without sufficient knowledge of who they are bringing on board. This lack of clarity often stems from recruitment agencies that introduce numerous intermediaries, which can distort the process and create inefficiencies.

Joblio brings transparency to the forefront by conducting Know Your Customer (KYC) checks on all candidates at the time of sign-up. This process ensures that employers are hiring individuals who have been thoroughly vetted, eliminating any potential misrepresentation in the hiring process.

Labor Shortages

As industries expand, particularly in urban areas, businesses are increasingly facing labor shortages. The shortage of skilled workers causes project delays and increases operational costs.

Joblio’s global pool of qualified candidates offers a solution, providing employers with direct access to a wide range of skilled workers eager for employment opportunities. This enables companies to hire faster while maintaining high-quality standards.

Exploitation by Middlemen

Current recruitment systems are often plagued by middlemen who misrepresent job opportunities to workers while charging exorbitant fees for their services. This exploitation leads to unfair treatment of workers and confusion for employers.

By eliminating intermediaries, Joblio connects workers and employers directly through its platform. This direct connection not only speeds up the hiring process but also prevents fraud and exploitation. Workers can secure employment without paying any fees, making the process both ethical and transparent.

Legal Complications

Hiring workers from other countries involves navigating complex legal requirements, including visa applications and compliance with immigration laws. Many companies hesitate to hire internationally due to these complications.

Joblio simplifies this process by providing legal assistance with work visas and immigration, allowing companies to focus on their core operations while ensuring compliance with local laws.

How Joblio Works: A Comprehensive Hiring Platform

Joblio offers a seamless recruitment experience for both employers and job seekers, backed by a range of features designed to simplify and optimize the process.

Job Search and Matching

Employers can post job orders on the platform, and candidates can search for opportunities that fit their criteria using a variety of filters. This ensures that job seekers find roles that align with their personal and professional expectations.

Candidate Vetting

Before a candidate is matched with an employer, Joblio conducts a thorough background check and official KYC procedures. This vetting process guarantees that the employer is hiring a reliable, well-qualified worker.

Employment Preparation

Once candidates are matched with an employer, Joblio helps them prepare for relocation and employment by providing training on the culture, language, laws, and customs of their host country. Additionally, candidates are required to complete a medical examination 48 hours before they travel, ensuring they are fit for work.

Post-Arrival Support

Joblio’s support doesn’t end once the worker arrives in the destination country. To make the transition easier, the platform offers services like telemedicine, banking, and phone assistance, ensuring that workers feel supported both before and after their relocation.

Joblio’s Commitment to Job Seekers: A Free, Ethical Approach

For job seekers, finding employment through Joblio is completely free. The platform does not charge any fees for connecting applicants with employers, making it a cost-free solution for those seeking international employment. Beyond job placement, Joblio also assists with:

Work permit and visa processing: Ensuring that all necessary legal documents are handled smoothly.

Pre-departure training: Helping workers understand the culture, language, and work environment of their new country, making their transition as seamless as possible.

How Employers Benefit from Joblio

For employers, Joblio offers an efficient and affordable way to access a global recruitment network. The platform simplifies the hiring process by allowing businesses to:

Connect directly with qualified candidates.

Benefit from Joblio’s affordable pricing, tailored to meet budgetary needs.

Ensure candidates meet company expectations through comprehensive background checks.

The Broader Impact: Joblio’s Global Benefits

Joblio’s platform creates positive outcomes not only for employers and employees but also for the countries of origin and destination.

Origination Country Benefits

By eliminating corrupt recruitment practices, Joblio ensures migrant workers are treated fairly. Increased transparency also boosts foreign remittances, helping to stabilize workers and their families.

Destination Country Benefits

Joblio enhances migration transparency and promotes a centralized tracking system for work-related migration, helping to mitigate human rights violations and employer fraud. The economic benefits include increased tax revenue and optimized labor processes.

Employer Benefits

For companies, the platform offers substantial savings in both time and money by reducing employee turnover and increasing operational efficiency. Joblio also handles the necessary legal paperwork, ensuring businesses can focus on their core competencies.

Through the Joblio app, employees can communicate directly with their employers, facilitating a transparent and streamlined process. The platform also fast-tracks visas and work permits, and provides comprehensive education on the culture, language, and laws of the host country.

A Future Built on Ethical Recruitment

Joblio’s mission is clear: to create a world where migrant workers can find sustainable employment opportunities without fear of exploitation. By aligning its practices with guidelines from the United Nations and the International Organization for Migration (IOM), Joblio is setting a new standard for ethical recruitment on a global scale. The platform offers a win-win solution for employers and workers alike, promoting fairness, transparency, and mutual growth in the global job market.

Whether you’re an employer searching for skilled workers or a job seeker looking for opportunities abroad, Joblio provides the tools, support, and transparency needed to make global recruitment a success.

Originally Posted: https://medium.com/jon-purizhansky/joblio-transforming-global-recruitment-with-transparency-and-ethical-employment-practices-bd65a8f6d2a4

0 notes

Text

Legal Guide to Real-World Asset Tokenization

Tokenization of real-world assets is changing how we look at ownership, investing and asset management. Fractional ownership, liquidity and global access are just some of the opportunities that tokenization creates by transforming physical assets such as land, commodities or pieces of art into digital tokens on a blockchain. Nevertheless, it is vital to navigate the legal aspects of asset tokenization to ensure compliance and avoid running into regulatory obstacles. This guide to real-world asset tokenization presents a brief summary of important legal aspects to bear in mind when tokenizing real-world assets.

1. Understanding the Legal Framework

Real-world asset Tokenization refers to the conversion of title rights into digital tokens, which are saved on a blockchain. By their character, these tokens can be classified in different ways – as stablecoins, security tokens or utility tokens. depending on the rationale behind most real-world assets. Security tokens are subject to compliance with strict regulations (such as security laws) in many jurisdictions.

2. Jurisdictional Regulations and Compliance

Asset tokens legal requisites differ widely with the region. For instance;

United States: Tokens that stand for real asset ownership according to SEC rule in general are classified as securities requiring compliance with laws such as the Securities Act of 1933.

European Union: It is under Markets in Crypto-Assets (MiCA) regulation that the EU does have an all-inclusive framework wherein emphasis on transparency and protecting investors are key.

Asia: Singapore and Japan among others have created strong structures for tokenization usually needing to register with local authorities.

Before engaging in the process of tokenization, it is important for businesses and investors alike to do proper due diligence and comprehend the various regulations including the local laws.

3. Smart Contracts and Legal Enforceability

In asset tokenization smart contracts act as a pillar owing to the fact that they are self-executing contracts whose terms are coded directly. Nonetheless, there are serious concerns about the suitability of using these contracts in legal cases. There are automated executions provided by smart contracts; however, these must additionally be in line with the existing contract laws. Thus, the parties involved need to ensure that the terms of smart contracts remain unambiguous and valid from a legal perspective. Furthermore, it may be necessary to support them with conventional legal agreements.

4. Investor Protection and Consumer Rights

To pull in institutional and retail investors, tokenization platforms should ensure strong investor protection implementations. This encompasses making available information regarding the tokenized asset, inherent dangers, and legal entitlements. Additionally, it is crucial to enforce Anti Money Laundering (AML) as well as Know Your Customer (KYC) procedures to align with the international benchmarks and earn investor confidence.

5. Intellectual Property and Ownership Rights

The tokenization of things like artwork, patents, and intellectual properties introduces legal complications. This means that one must elaborate on who owns an asset plus how an owner can use it or if it generates income via royalties. By doing so, every person comprehends their entitlements and obligations hence diminishing chances for arguments.

6. Tax Implications

The taxation of tokenized assets is a developing area and varies widely across jurisdictions. Tokenization can trigger different tax obligations, such as capital gains tax, value-added tax (VAT), or income tax. It is vital for asset owners and investors to consult tax professionals to understand their liabilities.

Conclusion

For many, it is hard to believe that tokenization can replace the “real” assets. Nevertheless, it has become a trend in the market today. However, like every coin has two sides, aspirations for a digitized currency are always accompanied by unfortunate legal challenges. Therefore, those who wish to be part of this tokenization revolution must develop a thorough understanding of everything related to legislation, regulation and codes, which are going to control such businesses; how smart contracts could get executed; how the securities exchange is protected from scams; and how taxation will affect these transactions. Despite following these guidelines to real-world assets tokenization, investors should always stay tuned on changes in law or consult with appropriate professionals in order to avoid possible problems and adhere to laws.

0 notes

Text

Comprehensive Guide to My99 Exchange Betting ID, ID Provider, Registration, and App

In the rapidly evolving world of online betting, My99 Exchange has emerged as a significant player, offering a comprehensive platform for bettors. This guide will provide an in-depth look at My99 Exchange, covering essential aspects such as obtaining a Betting ID, choosing an ID Provider, the registration process, and navigating the My99 Exchange app.

1. Understanding My99 Exchange

My99 Exchange is a popular online betting platform known for its user-friendly interface, extensive market offerings, and secure transactions. It allows users to place bets on various sports, casino games, and other events, providing a versatile betting experience. To fully engage with the platform, users need to understand how to acquire and manage their Betting ID, select an ID Provider, and navigate the registration process effectively.

2. My99 Exchange Betting ID

What is a Betting ID?

A Betting ID is a unique identifier assigned to each user of the My99 Exchange platform. It serves as a personal account number, allowing users to access their betting accounts, place bets, track their activity, and manage their funds securely.

How to Obtain a Betting ID

To obtain a Betting ID on My99 Exchange, follow these steps:

Visit the My99 Exchange Website or App: Start by visiting the official My99 Exchange website or downloading their app from a trusted source.

Register an Account: Click on the 'Register' or 'Sign Up' button. You will be prompted to provide your personal information, such as name, email address, and phone number.

Verify Your Identity: Some platforms require users to verify their identity by submitting identification documents. This step ensures the security and legitimacy of your account.

Receive Your Betting ID: Once your registration is complete and your account is verified, you will receive a unique Betting ID. This ID is essential for logging in and accessing various features of the platform.

3. Choosing a My99 Exchange ID Provider

Role of an ID Provider

An ID Provider is a crucial element in the My99 Exchange ecosystem. They are responsible for verifying user identities, ensuring secure transactions, and providing customer support. Choosing the right ID Provider can significantly impact your overall experience on the platform.

How to Choose an ID Provider

Reputation and Reliability: Look for ID Providers with a solid reputation and positive user reviews. Reliable providers are essential for a seamless and secure betting experience.

Security Features: Ensure the ID Provider employs robust security measures to protect your personal and financial information.

Customer Support: Opt for ID Providers that offer responsive customer support. This will be beneficial if you encounter any issues or need assistance with your account.

Ease of Use: Choose a provider that offers a user-friendly interface and straightforward processes for registration and account management.

4. My99 Exchange Registration Process

Step-by-Step Registration

Visit the Official Website or App: Access the My99 Exchange platform through their website or mobile app.

Fill Out the Registration Form: Enter your personal details, including your full name, email address, phone number, and any other required information.

Create a Strong Password: Choose a secure password that includes a mix of letters, numbers, and special characters to protect your account.

Agree to Terms and Conditions: Read and accept the terms and conditions of My99 Exchange. This step is crucial for ensuring that you understand the platform’s rules and policies.

Verify Your Email: You may receive a verification email. Click on the link provided to verify your email address and complete the registration process.

Complete KYC (Know Your Customer): Some platforms require additional identity verification through KYC procedures. Follow the instructions provided to submit the necessary documents.

5. Navigating the My99 Exchange App

Features and Functionality

The My99 Exchange app is designed to provide a seamless betting experience with various features:

User-Friendly Interface: The app boasts an intuitive design, making it easy for users to navigate through different sections, place bets, and manage their accounts.

Live Betting and Streaming: Enjoy real-time betting and live streaming of events to stay engaged and make informed betting decisions.

Account Management: Access your account details, check your betting history, and manage your funds directly through the app.

Notifications and Updates: Stay updated with the latest news, promotions, and event notifications through push alerts and in-app messages.

Tips for Using the App

Keep the App Updated: Regularly update the app to benefit from new features, performance improvements, and security enhancements.

Set Notifications: Enable notifications to receive timely updates and reminders about your bets and account activity.

Utilize Customer Support: If you encounter any issues or have questions, use the in-app customer support feature for prompt assistance.

Conclusion

Navigating the My99 Exchange platform involves understanding the importance of your Betting ID, choosing a reliable ID Provider, completing the registration process, and effectively using the My99 Exchange app. By following this guide, you can enhance your betting experience and make the most of what My99 Exchange has to offer. Always prioritize security and stay informed to enjoy a seamless and enjoyable betting journey.

#My99 Exchange app#my99 exchange#my99 exchange betting id#my99 exchange login#my99 exchange registration

0 notes