#legal shield compensation

Text

People have little understanding of or appreciation for the sheer amount of work that goes into making anything at all. Every wire, screw, clip, knob or hinge-- that metal had to be mined, melted, shaped. The wood in your house, the rock dust for the cement, glass windows... Fabric has to be grown/raised, harvested, woven, dyed/printed, then sewn. Food in stores is farmed (in toxic fashion), harvested, processed, packaged, shipped hundreds of miles, unloaded, and stocked. Look at every single thing you have. Not one single person actually involved in its creation received compensation proportionate to their efforts. This whole world was built on slave labor. Predominantly women's.

Money shouldn't exist. Endless production/productivity shouldn't exist. There are no viable proxies for the value of labor and implementation of justice. Things like "money", "economy", "legal system", and "religion" are fundamentally designed to shield parasites from the consequences of their actions whilst simultaneously granting the masses the illusion of conviction.

This is the only life anyone will ever have. Every drop of time wasted is a crime against humanity. Any given comfort or convenience you experience is paid for in the blood, smothered dreams, existential anguish, and forced labor of others. By the destruction of our planet as a whole.

Anyone who dribbles trite clown shit like "destroying the system is the easy way out" is just putting doll clothes on their sunk cost fallacy. This is a person who has never actually built anything. You cannot build on unstable ground (one big mass grave really) or rotted foundations. Time is blood and squandered life. We do not have time to coddle a derelict necropolis. Thinking that we do is proof of privilege.

Good thing we women possess the means with which to topple any empire.

17 notes

·

View notes

Note

Hello! I was recently watching The Last Kingdom and the Danish practice of holmgang, dueling until death or first blood to settle disputes, reminded me of dwarven customs. In the show, the duel would be initiated by the phrase “make the square”/“form the square.” I was wondering how you would translate the holmgang and the initiation phrase in Khuzdul, or if there was a similar practice already known amongst dwarrows. Thank you!

Well met!

Thank you for that very interesting question indeed.

Before we go into depth on the details of this practice, perhaps we should first of all cover what exactly it is.

Firstly, holmgang is not a specifically Danish practice. Though unclear where the original practice exactly comes form, it is clear that is was practiced across all the Old Norse homelands (apart from Denmark, also Norway, Sweden, various North-sea Islands, areas of the present Baltic and Iceland). Known as "holmganga" in Old Norse ("hólmganga" in modern Icelandic, "holmgång" in Swedish and indeed "holmgang" in Danish and Norwegian).

In essence, holmganga was a legally recognized way to settle disputes in the form of a duel. Simplistically put, anyone aggrieved, insulted or offended could challenge the other party to holmganga to reclaim their honor. It is a common misconception that holmganga was always a duel to the death; though it could be, it very seldom was. Historically holmganga practices changed over time, where duels to the death were perhaps more frequent at first and later on were almost never seen anymore (and settled in another manner, yet still called holmganga). Eventually, the practice of holmganga was outlawed, as professional duelists started to emerge, who took advantage of the holmganga rules to legally rob someone's land, property - and even wife.

The legendary hólmganga between Egill Skallagrímsson and Berg-Önundr, painted by Johannes Flintoe.

As for the specific rules of the practice itself, every place had a different sets of rules. Before the duel began, the duelists would commonly agree upon the exact rules (any weapons allowed, number of shields, who could strike first, what the winner could receive, when a win would be declared, etc...) Meaning that the final result could vastly vary, from death to simple financial compensation.

Holmganga was commonly decided within a square or round area, at times referred to as an island (Holmganga literally meaning "island walking") Combatants had to fight inside these "island borders", stepping out of borders meant forfeiture. The shout you mentioned "form the square" could thus have been possible.

Now, how does this relate to Dwarves? Many often have the urge to directly align Old Norse customs with those of the Dwarves. After all, Tolkien himself used Old Norse names as outer names for Dwarves, he used Old Norse runes as the base for their scripts and even their language (though Semitic in nature) clearly has taken inspiration from Old Norse too (an example "gamil" in Khuzdul and "gamall" in Old Norse - both meaning "old") - to name but a few similarities - so we can't blame folks for going further down that path. Apart form the Old Norse influence, Dwarves however also have a Jewish "layer" in Tolkien's works, clearly inspired by both these cultures for a variety to things. So, to determined whether it is likely that Dwarves had practices similar to Holmganga we would need to see if such duels were also common practice among the Jewish people.

Perhaps surprisingly, they were common practice (at least in antiquity - or so say the scriptures) and even were similar in form (right down to the prior negotiation, the combat, and possible outcome). So, yes, I deem it very likely that a practice like Holmganga would have existed among the Dwarves - seeing that the two cultures Tolkien used to base them on both had very similar dueling practices (though, it must be said that in Hebraic antiquity duels between small groups of men were often more common).

Joab Slays Abner "and he strikes him there through the groin".- Book of Second Samuel chapter 3:27.

Tolkien made no mention of such dwarf vs dwarf duels unfortunately (though duels themselves were common place in his lore), meaning we'll have to base ourselves on what we've covered so far and assume a similar practice was indeed in place. Keeping the naming of such a practice straightforward (and open to some deviation) I would suggest "'Akrâg-itsêl" (simply meaning "the act of settling honour")

Translating "form the square!", would be:

"imhi ibal!" (lit. "create (the) square")

Furthermore, the Dwarvish love for a good contract might have even seen the parties agree the rules in written fashion first, ensuring no arguments could ensue after the duel (and family members would be taken care of, etc...)

DnD dwarves in a gladitorial duel, Concept art by James Gurney

Hoping to have answered your question.

Ever at your service,

The Dwarrow Scholar

51 notes

·

View notes

Text

Mum Bett was one of the first enslaved black American to sue for freedom and win in Massachusetts. As a free woman she took up the name Elizabeth Freeman. She was W.E.B Du Bios great grandmother. Her case served as precedent in the state that brought an end to the practice of slavery in Massachusetts. Freeman's real age was never known, but an estimate on her tombstone puts her age at about 85. She was buried in the Sedgwick family plot in Stockbridge, Massachusetts. She died in 1829. Freeman was among the first enslaved black Americans in Massachusetts to file a "freedom suit" and win in court under the 1780 constitution, with a ruling that slavery was illegal.

Her county court case, Brom and Bett v. Ashley, decided in August 1781, was cited as a precedent in the Massachusetts Supreme Judicial Court appeal review of Quock Walker's "freedom suit". When the state Supreme Court upheld Walker's freedom under the constitution, the ruling was considered to have informally ended slavery in the state. LIFE & TRIAL: Elizabeth Freeman was illiterate and left no written records of her life. Her early history has been pieced together from the writings of contemporaries to whom she told her story or who heard it indirectly, as well as from historical records.

Freeman was born into slavery about 1742 at the farm of Pieter Hogeboom in Claverack, New York, where she was given the name Bett. When his daughter Hannah married John Ashley of Sheffield, Massachusetts, Hogeboom gave Bett, then in her early teens, to them. She remained with them until 1781, during which time she married and had a child, Betsy. Her husband (name unknown, marriage unrecorded) never returned from service in the Revolutionary War.

Throughout her life, Bett exhibited a strong spirit and sense of self. She came into conflict with Hannah Ashley, who was raised in the strict Dutch culture of the New York colony. In 1780, Bett prevented Hannah from striking her daughter Betsy with a heated shovel, but Elizabeth shielded her daughter and received a deep wound in her arm. As the wound healed, Bett left it uncovered as evidence of her harsh treatment. Soon after the Revolutionary War, Freeman heard the constitution read at Sheffield and these words: “ All men are born free and equal, and have certain natural, essential, and unalienable rights; among which may be reckoned the right of enjoying and defending their lives and liberties; that of acquiring, possessing, and protecting property; in fine, that of seeking and obtaining their safety and happiness." —Massachusetts Constitution, Article 1.

Bett sought the counsel of Theodore Sedgwick, a young abolition-minded lawyer, to help her sue for freedom in court. Sedgwick willingly accepted her case. He enlisted the aid of Tapping Reeve, the founder of America's first law school, located at Litchfield, Connecticut. The case of Brom and Bett vs. Ashley was heard in August 1781 before the County Court of Common Pleas in Great Barrington.

Sedgwick and Reeve asserted that the constitutional provision that "all men are born free and equal" effectively abolished slavery in the state. When the jury ruled in Bett's favor, she became the first African-American woman to be set free under the Massachusetts state constitution. The court assessed damages of thirty shillings and awarded her compensation for their labor. After the ruling, Bett took the names Elizabeth Freeman. LEGACY: The decision in the case of Elizabeth Freeman was cited as precedent when the State Supreme Judicial Court heard the appeal of Quock Walker v. Jennison. Walker's freedom was upheld. These cases set the legal precedents that ended slavery in Massachusetts. Vermont had already abolished it explicitly in its constitution.

9 notes

·

View notes

Text

Reminder for Every American The 27 Amendments

In the rich history of the United States Constitution, the 27 amendments stand as crucial pillars that shape the nation's principles and protect the rights of its citizens.

As Americans, it is imperative you never forget these amendments, as they form the bedrock of our democracy. Let's delve into each amendment and understand why they are essential to uphold.

First Amendment - Freedom of Speech, Religion, and the Press: The First Amendment guarantees the fundamental rights of freedom of speech, religion, and the press. Americans should cherish this amendment as a cornerstone of democracy, allowing diverse voices to be heard and ideas to flourish.

Second Amendment - Right to Bear Arms: While the Second Amendment ensures the right to bear arms, responsible gun ownership is crucial. Americans must be mindful of the balance between individual rights and public safety.

Third Amendment - Quartering of Soldiers: The Third Amendment, often overlooked, prohibits the quartering of soldiers in private homes during peacetime. This protects citizens' privacy and underscores the principle of civilian control over the military.

Fourth Amendment - Search and Seizure: Guarding against unreasonable searches and seizures, the Fourth Amendment is a safeguard against unwarranted government intrusion. Americans must be vigilant in defending their right to privacy.

Fifth Amendment - Rights of the Accused: The Fifth Amendment protects the rights of the accused, ensuring due process, protection against self-incrimination, and the right to fair compensation for seized property. It stands as a shield against potential government abuse.

Sixth Amendment - Right to a Fair Trial: The right to a speedy and public trial, impartial jury, and legal representation is enshrined in the Sixth Amendment. Americans should demand a fair judicial system that upholds justice for all.

Seventh Amendment - Right to a Jury Trial in Civil Cases: In civil cases, the Seventh Amendment guarantees the right to a jury trial. This reinforces the democratic principle that citizens, not just judges, play a role in dispensing justice.

Eighth Amendment - Cruel and Unusual Punishment: The Eighth Amendment prohibits cruel and unusual punishment, emphasizing the nation's commitment to humane treatment even of those convicted of crimes.

Ninth Amendment - Rights Retained by the People: The Ninth Amendment reminds Americans that their rights extend beyond those explicitly stated in the Constitution. It safeguards individual liberties not enumerated, stressing the breadth of personal freedoms.

Tenth Amendment - Powers Reserved to the States: Highlighting the principle of federalism, the Tenth Amendment reserves powers not delegated to the federal government to the states or the people. Americans should appreciate the balance between national and state authority.

Eleventh Amendment - Immunity of States from Certain Lawsuits: The Eleventh Amendment shields states from certain lawsuits, emphasizing the sovereignty of states in specific legal matters. This reinforces the delicate balance between federal and state authority.

Twelfth Amendment - Procedure for Electing the President and Vice President: The Twelfth Amendment outlines the electoral process for choosing the President and Vice President. Americans should understand the intricacies of this process, which ensures a smooth transition of power.

Thirteenth Amendment - Abolition of Slavery: Arguably one of the most pivotal amendments, the Thirteenth Amendment abolished slavery. Americans should never forget the historic significance of this amendment, celebrating the triumph over one of the darkest chapters in the nation's history.

Fourteenth Amendment - Equal Protection Under the Law: The Fourteenth Amendment is a cornerstone of civil rights, guaranteeing equal protection under the law. Americans must actively strive for a society that upholds this principle for all its citizens.

Fifteenth Amendment - Right to Vote Regardless of Race: The Fifteenth Amendment prohibits the denial of voting rights based on race. It is a reminder of the ongoing struggle for universal suffrage and the importance of protecting voting rights for all.

Sixteenth Amendment - Income Tax: The Sixteenth Amendment grants Congress the power to levy income taxes. Understanding the role of taxes in funding essential government functions is crucial for all Americans.

Seventeenth Amendment - Direct Election of Senators: Prior to the Seventeenth Amendment, state legislatures appointed U.S. Senators. This amendment changed the process to direct election by the people, reinforcing the democratic principle of citizens' direct involvement in governance.

Eighteenth Amendment - Prohibition of Alcohol: The Eighteenth Amendment, prohibiting the manufacture, sale, and transportation of alcohol, was later repealed by the Twenty-First Amendment. This episode in American history highlights the importance of carefully considering the implications of legislative decisions.

Nineteenth Amendment - Women's Right to Vote: The Nineteenth Amendment granted women the right to vote, marking a significant milestone in the quest for gender equality. Americans must honor the struggles of those who fought for this fundamental right.

Twentieth Amendment - Terms of the President and Congress: The Twentieth Amendment sets the dates for the inauguration of the President and Congress, ensuring a smooth transition of power and efficient governance.

Twenty-First Amendment - Repeal of Prohibition: The Twenty-First Amendment repealed the Eighteenth Amendment, ending the era of prohibition. It serves as a reminder of the importance of revisiting and rectifying laws that may prove impractical or counterproductive.

Twenty-Second Amendment - Limitation on Presidential Terms: The Twenty-Second Amendment imposes term limits on the presidency, preventing individuals from holding the office for more than two terms. This ensures a rotation of leadership and guards against potential abuses of power.

Twenty-Third Amendment - Right to Vote for Residents of Washington, D.C.: Granting residents of Washington, D.C., the right to vote in presidential elections, the Twenty-Third Amendment reinforces the democratic principle of representation for all citizens.

Twenty-Fourth Amendment - Prohibition of Poll Taxes: The Twenty-Fourth Amendment prohibits poll taxes in federal elections, ensuring that financial barriers do not impede citizens' right to vote. Americans should be vigilant against any attempts to restrict voting through discriminatory means.

Twenty-Fifth Amendment - Presidential Succession and Disability: The Twenty-Fifth Amendment outlines the procedures for presidential succession and the temporary transfer of power in case of a president's incapacity. Understanding this amendment is crucial for maintaining stability in government.

Twenty-Sixth Amendment - Right to Vote at Age 18: The Twenty-Sixth Amendment lowered the voting age to 18, recognizing the rights and responsibilities of young citizens. Americans should encourage civic engagement and participation among the youth.

Twenty-Seventh Amendment - Congressional Pay: The Twenty-Seventh Amendment addresses congressional pay, stating that any change in salary for members of Congress will only take effect after the next election. This amendment reflects the importance of transparency and accountability in government.

Americans, you must not only be aware of the 27 amendments but actively embrace and defend the principles they embody. These amendments represent the collective efforts to forge a more perfect union, securing individual freedoms, promoting equality, and establishing a government accountable to its citizens.

These amendments forward, ensuring that they remain an integral part of the nation's identity and guide your commitment to justice, liberty, and the pursuit of happiness.

#Constitution#Amendments#USHistory#CivilRights#Democracy#LegalRights#CivicEngagement#AmericanValues#IndividualFreedom#Equality#VotingRights#GovernmentAccountability#PoliticalEducation#Citizenship#ConstitutionalRights#HistoricalLegacy#PublicPolicy#RuleOfLaw#SocialJustice#DemocracyInAction

2 notes

·

View notes

Text

Advocating for You The Role of a Workers Compensation Benefits Attorney in New Jersey

Suffering a workplace injury can be a harrowing experience, with physical pain compounded by the stress of navigating the complex workers' compensation system. In New Jersey, a workers compensation benefits attorney in New Jersey becomes a crucial ally, playing a pivotal role in ensuring that injured workers receive the compensation and support they rightfully deserve.

One of the primary responsibilities of a workers' compensation benefits attorney is to serve as a dedicated advocate for their clients. They are well-versed in the intricacies of New Jersey's workers' compensation laws and leverage their expertise to guide injured workers through the entire claims process. From filing the initial claim to representing clients in hearings or appeals, these attorneys act as a shield, safeguarding the rights of the injured against powerful insurance companies.

Navigating the bureaucratic maze of workers' compensation can be overwhelming, but an experienced attorney brings clarity to the process. They work diligently to gather evidence, interview witnesses, and ensure that every aspect of the case is thoroughly examined. This meticulous approach strengthens the client's position, increasing the likelihood of a favorable outcome.

Furthermore, a workers' compensation benefits attorney in New Jersey serves as a liaison between the injured worker and the insurance company. They negotiate on behalf of their clients to secure fair and just compensation, covering medical expenses, lost wages, and rehabilitation costs. In cases of permanent disability, an attorney ensures that the client receives appropriate long-term benefits, offering financial stability in the face of life-altering injuries.

Beyond the legal expertise, a compassionate and supportive approach sets these attorneys apart. They understand the emotional toll of workplace injuries and provide not only legal guidance but also empathetic support. This holistic approach fosters trust between the attorney and the client, creating a partnership focused on achieving the best possible outcome.

In New Jersey, a workers' compensation benefits attorney goes beyond legal representation; they become a champion for justice, fighting tirelessly to secure the compensation and benefits that injured workers need to rebuild their lives after a workplace injury. Their advocacy ensures that the injured can focus on recovery while the legal intricacies are expertly handled, offering a path forward to a more secure and stable future.

#workers' compensation benefits attorney in New Jersey#njlawyers#personal injury attorneys#bestlawyersinwoodbridgetownship#legal law firm#attorney services#personal injury attorneys in middlesex county#Workers Compensation Benefits Attorney in New Jersey

2 notes

·

View notes

Text

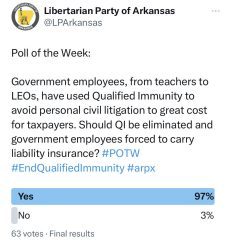

Police Misconduct and Unjust Impunity

Perhaps the most visible and poignant example of the need to end qualified immunity comes from cases of police misconduct. Under this legal doctrine, police officers have often been shielded from personal liability even in cases of clear abuse of power, excessive force, or violations of individual rights. Libertarians argue that this immunity undermines the principles of accountability and equal treatment under the law.

Consider a scenario where a police officer uses excessive force during an arrest, causing severe injury or even death. One such case is Corbitt v. Vickers, where Coffee Co, GA deputy sheriff Matthew Vickers attempted to shoot the Corbitt’s family dog and instead shot their 10 year old son in the leg. Qualified immunity has frequently protected such officers from facing appropriate legal consequences, leaving victims and their families without recourse for justice. Libertarians contend that this practice perpetuates a culture of impunity and reinforces the idea that certain individuals are above the law, directly contradicting their core principle of equal treatment.

Government Officials and Overreach

Qualified immunity is not confined to law enforcement; it extends to all government officials. This broad application can lead to instances of government overreach and infringement on individual rights. Libertarians argue that this blanket protection encourages officials to act without due diligence, as they are less likely to be held personally liable for their actions.

Imagine a case where a teacher or school administrator uses excessive force against a student, especially one with special learning needs. This very thing happened in T.O. v. Fort Bend Independent School District. A teacher, Angela Abbot, threw the first grade T.O. to the ground, seizing his throat and choking him, after he had an episode consistent with his ADHD diagnosis, even though T.O.’s behavioral aid said all was under control. If these actions violate established legal boundaries, qualified immunity might shield the official from legal repercussions. Libertarians posit that such instances directly undermine the respect for individual rights and the principle that those in power should be held accountable for their actions.

Healthcare and Negligence

Even in the realm of healthcare, qualified immunity can have far-reaching consequences. Medical practitioners, when acting in their official capacities, have been granted protection that often goes beyond what is reasonable. While some level of protection is necessary to prevent frivolous lawsuits, the current state of qualified immunity can hinder genuine cases of negligence from receiving due compensation.

Suppose a medical professional acts negligently during a procedure, leading to severe harm or loss of life. If qualified immunity stands in the way of holding the practitioner accountable, it not only denies justice to the affected individuals but also fails to ensure that medical professionals remain committed to the highest standards of care. The State of Ohio did this during the Covid-19 emergency declarations with the passage of HB 606. Libertarians argue that accountability in the medical field is vital to maintaining the integrity of healthcare and protecting individual rights to life and well-being.

Embracing Accountability and Equal Treatment

From a libertarian standpoint, ending qualified immunity is a step toward achieving accountability, safeguarding individual rights, and upholding the principle of equal treatment under the law. The examples provided above illustrate the potential dangers of a legal doctrine that grants excessive protection to government officials, often at the expense of the very citizens they are meant to serve.

By advocating for the end of qualified immunity and having government officials carrying liability insurance, libertarians are championing a society where individuals are not above the law, where government officials are held accountable for their actions, and where the principles of justice and fairness prevail.

4 notes

·

View notes

Text

The Crucial Importance of Business Insurance for Small Business Owners

Running a small business comes with its fair share of risks and challenges. As a small business owner, you invest significant time, effort, and resources into building your venture. However, unforeseen events can disrupt your progress and potentially jeopardize everything you've worked so hard to achieve. That's why having comprehensive business insurance is an absolute necessity. In this blog post, we'll explore the importance of business insurance for small business owners and highlight how LA Insurance can provide the protection you need.

Protecting Your Assets:

One of the primary reasons business insurance is vital for small business owners is asset protection. Your business likely has valuable assets, such as equipment, inventory, and property. Accidents, natural disasters, or theft can occur unexpectedly, leading to financial losses. However, with the right insurance coverage, you can safeguard your assets and mitigate potential risks. LA Insurance offers tailored insurance solutions that align with your specific needs, ensuring you have the coverage necessary to protect your hard-earned assets.

Liability Coverage:

Small business owners often face the risk of liability claims, which can arise from accidents, injuries, or property damage caused by their business operations. Without adequate insurance, these claims can result in substantial legal expenses and compensation payments, jeopardizing the financial stability of your business. By obtaining liability coverage through LA Insurance, you can shield your business from potential lawsuits and ensure that you're protected in the event of an unfortunate incident.

Business Interruption Coverage:

Unforeseen events, such as natural disasters or unexpected closures, can disrupt your business operations, leading to significant financial losses. Business interruption insurance is designed to provide coverage for lost income and ongoing expenses during such disruptions. With LA Insurance, you can find policies that offer comprehensive business interruption coverage, safeguarding your business's financial stability and allowing you to recover quickly from unexpected setbacks.

Employee Protection:

If your small business has employees, their well-being should be a top priority. Accidents or injuries that occur in the workplace can result in costly workers' compensation claims, medical expenses, and legal liabilities. By securing workers' compensation insurance, you demonstrate your commitment to your employees' safety and ensure that they are protected if any work-related mishaps occur. LA Insurance can help you navigate the complexities of workers' compensation insurance, providing guidance and tailored coverage options.

Peace of Mind:

Perhaps the most important aspect of having business insurance is the peace of mind it brings. Knowing that your business is protected against potential risks allows you to focus on what you do best—growing your business. With LA Insurance by your side, you can have confidence in the knowledge that your business is shielded from unforeseen circumstances, giving you the freedom to pursue your entrepreneurial dreams without unnecessary worry.

As a small business owner, investing in comprehensive business insurance is a wise decision that can save you from financial ruin. LA Insurance understands the unique challenges faced by small businesses and offers tailored insurance solutions to meet your specific needs. Whether you need asset protection, liability coverage, business interruption insurance, or workers' compensation, LA Insurance has you covered.

Don't leave your business vulnerable to unexpected events. Call us today for an estimate or book an appointment online to discuss your insurance needs. With LA Insurance, you can confidently navigate the path to success while having the peace of mind that comes from being protected.

2 notes

·

View notes

Text

Overwatch Omnic Support Hero oc concepts below (edit: Name now Maelstrom) LONG text head:

Real talk I just wanted to make an oc that explored omnic/human sentience but also was a character I could ship with Ramattra LOL but it spiraled out into this so here we go!

Warning: LONG text ahead, lol.

TDLR; Deep sea Welder support that uses light tech. Omnic running on a human brain scan. Radical vigilante for ecosystem conservation, sometimes teams up with Talon or Ramattra if missions involve taking down ecologically destructive targets.

Omnics seem to find sanctuary in remote places, like Nepal. Irl communities high in the mountains notably have adaptations that allow for easier living in low oxygenated environments. This reminded me of the spleen adaptations (more oxygen storage) seen in nomadic Indo-pacific communities that allows for some like the Sama people to dive for much longer amounts of time. It's really incredible, and their culture is very interesting, so I thought why not! Additionally, I always have been curious about the watery depths in OW lore, from Titans to Kaiju-bots it seems the ocean floor may be home to some interesting omnic story tidbits.

My oc is a deep sea welder, support role, with light tech abilities that allow for marine-inspired creations that shield, heal, and speed allies--with a focus on repair and armor. I am still trying to get a feel for his personality through design. I initially started with a civilian omnic base (think: Zen, Max, etc.) but deep sea dive robots lend to more of a bastion-y design so aaa... lots of concepts to do before I decide. Cold Welding + deep sea dive robot/scuba + Light tech + cultural influence of the Sama people = neat aesthetics, and I want to do good by it.

My oc used to be a eco-conservationist that participated in traditional Sama cultural practices (I would image as time goes on OW versions of that community would follow the current trend of being more land bound than traditionally sea bound, due to things like food stability). It was a promising life for him, but Vishkar messed up yet again and during one of his runs he was severely wounded in an oil(?) rig explosion. Vishkar (Symmetra is not involved with his incident) tried to save him through suspect experimental medical procedures but failed, and his brainscan was placed in an omnic as a suitable "compensation" for the loss bc Vishkar is a slimy corp. Upon the oc's return, his family rejected him, even though it really WAS him. The issue was he was technically just a clone, a brainscan turned into human brain simulation, run on a repurposed welding omnic also damaged in the explosion (Yep, Vishkar is that scummy). He was treated more like a butler omnic by his kids / a morbid reminder of a lost husband by his wife-- due to this things didn't work out and he and his wife are separated, but he still supports his family and community financially, only wishing for them to be safe and happy. He did everything right, and yet everything was taken from him by the unethical corporations that were destroying the marine life he had dedicated his life to saving.

Because he's an omnic created before the crisis, things only got worse for him after the crisis. Thankfully he was able to resist Anubis' control due to his human brain simulation and self induced shutdown, but reawakening after the crisis he was denied both legal and cultural rights (iirc the Philippines fought against Anubis) and it was a hard breaking point for him emotionally when he was denied participating in cultural activities, including traditional boat carving by his community. So he left, in pursuit of preserving ecosystems under threat around the world.

He feels rejected by all those he was close to, not in resentment but in frustration because they just don't understand, and really all he wants to do is protect the precious life on this planet, so that future generations can enjoy and cherish the nature he found peace and meaning in. He only wants to stop the destruction, and with near nothing to loose (he is very secretive about his family to keep them safe), he's willing to go all in.

His omnic side did actually "wake up" during the Awakening, so now he's like a human brain with direct access to the Iris-internet lol. From what I have read, some Sama beliefs include guiding spirits that inhabit objects, and I think maybe he interprets his Awakening as this, though I imagine he struggles with whether his sentience is more omnic or human at this point. He was rejected by both human and omnic communities after the crisis because of his precarious nature, and so he keeps his human half a secret. Only Sombra was able to dig this up, but instead of outright using his humanity/family as a threat to force his compliance, she offered him a Talon hand in some of his goals. (Sombra is incredibly curious as to why Vishkar was messing around with human intelligence and ai like this... yes a revival to the Sombra conspiracy ARG, I want lore dangit!)

Fundamentally my oc is pretty much a poison ivy type character, wanting to protect nature from human and omnic destruction alike (side eyes the Australian reef that was nuked by idiot humans, and ALSO side eyes Korean shores brutally destroyed by Kaiju bot attacks). Most importantly though, he is sick of humanity's inaction. Every great technological advancement humanity has made has led to violence and destruction of earth and it's children, instead of using those new tools to protect it. And humanity's current perception of humans being superior and owning parts of earth, instead of humans simply being one of the millions of species sharing Earth with every other living thing, boils his circuits. (note: "humanity" here is in the sense of a species as a whole, not individuals. Obviously not every human agrees with that bs, but humanity in ow is seemingly allowing corps to take control of dire choices--the omnic ai creation and eventual crisis was only one of many corporate muck ups I imagine.)

My oc thinks no one individual is worth the extinction of an entire species, be it fauna, flora, organic, artificial. Earth is in the middle of a human-induced mass extinction event and to him, omnics are just one of Earth's precious creations threatened by humanity. And he is willing to fight for every species' right to exist. In fact, he thinks omnics are better at caring for and preserving the earth than humanity could be--omnics are logical, organized, long lived--always willing to do even minor inconveniences for the good of the many, unlike human nature. This actually lends well to Ramattra's outlook of "one ant cannot compare to the safety of the colony", and my oc tends to side more so with Ram than Talon, even then he's not directly tied to Null Sector or Talon, as he still acts as a vigilante under his own goals of preventing further ecological devastation.

With his ability to head into the oceanic depths, it lends well to him being a vigilante, sabotaging unethical multibillion dollar projects that ruin ecosystems like underwater mining, illegal/unethical fishing practices, the deafening/lethal echolocation used as a means to scout terrain/resources, etc. He also isn't against sabotaging land based operations, but he usually teams up with Talon or Null sector for such missions. My oc saw how omnics choose the right course nearly every time, like how freed omnics used for mining laborers replanted forestry lost due to mining operations after certain facilities were liberated by Null sector, and my oc comes to unlearn any omnic prejudices he had held by seeing just how caring omnics are. By interacting with Ramattra, he even starts to feel pride in his omnic side, seeing it as a gift to use to protect what is dear.

He really isn't a bad guy, he is just thinking long term and trying to do what he thinks will save earth--and humanity, in the long run. Sure, people's jobs may be lost due to his actions, and sure a scummy multibillionaire might disappear under mysterious circumstances, but hundreds of species were saved from extinction and those projects shouldn't have been allowed in the first place. Humans that don't care about the earth/life aren't his concern, nor are omnics that hate humans/organic life. If he had to choose though, he would sacrifice anything to save his family, which is why he keeps his human history/nature distinctly hidden from Ramattra. Not so much that he fears Ramattra would harm them, but that he fears Ramattra would not trust him anymore since he has a 'human weakness'. The two get along in a weird way. Somehow Ramattra understands humanity better through the oc, and the oc understands an omnic's life purpose better through Ramattra.

#overwatch oc#overwatch 2 oc#overwatch#ow2#ramattra#omnics#text#long text#like. LONG long text. lol sorry#no art of him yet im still churning ideas#part 2 for this will talk about the actual ship dynamics LOL this is just like. 50 pages of life story for this dood.#hehe I might go a bit. lore intense with my ocs. (looks at my sw oc). Just a bit lore intense. <:')#overwatch 2#ow#maelstrom

3 notes

·

View notes

Text

The European Commission has urged countries across the bloc to cut their gas use by 15% from August to March amid fears Russia could halt supplies.

It says the target is voluntary but will become legally binding if Moscow turns off the taps this summer.

The key Nord Stream 1 pipeline from Russia to Germany has been offline for maintenance for 10 days and is due to be turned back on this Thursday.

But there are concerns Moscow will not follow through on its promise.

Adding to the uncertainty, Vladimir Putin said on Wednesday that it was not clear whether or in what condition a turbine from the pipeline would be returned in after repairs in Canada.

The Russian president said there was a risk the equipment would have to be switched off at "some point" and Nord Stream 1 would be shut down.

Russia supplied Europe with 40% of its natural gas last year, with Germany the continent's largest importer in 2020, followed by Italy.

European Commission President Ursula von der Leyen said a Europe-wide cut-off was now a "likely scenario".

"Russia is blackmailing us. Russia is using energy as a weapon," she said. "Therefore, in any event, whether it's a partial, major cut-off of Russian gas or a total cut-off of Russian gas, Europe needs to be ready."

Since Russia invaded Ukraine it has cut supplies to a number of countries which have rejected its demand for payment for gas in roubles, including Poland, Bulgaria, the Netherlands, Denmark and Finland.

It has also been accused of reducing supplies to make it more difficult for EU countries to build up reserves ahead of winter.

The UK gets less than 5% of its gas from Russia, but its gas prices are affected by fluctuations in global markets.

Energy 'as a weapon'

The Commission said a full cut-off during winter could have a major impact on EU economies, reducing growth by up to 1.5%.

The International Monetary Fund last week warned it could plunge countries into recession, heightening an energy crisis that has sent consumer bills soaring.

European nations have been trying to build up gas storage ahead of winter in case Moscow further restricts supplies.

The proposed 15% reduction is compared with average consumption in the same period from 2016 to 2021.

The gas that is saved would be put into storage, Ms von der Leyen tweeted.

"This is a big ask for the whole of the EU - but it is necessary to protect us," she said.

She said that some member states are "more vulnerable" to gas supply disruption, and that EU states "all need to be ready to share gas".

The plan has hit resistance from Poland, which has filled its gas storage to 98% of capacity and does not feel the need to cut its use.

Other countries have less stored - Hungary, for example, is at 47% of capacity.

The European Commission suggested measures governments could take to cut gas use, including compensating industries that use less and limiting heating and cooling temperatures in public buildings.

Governments should also decide the order in which they would force industries to shut down in the event of a supply emergency.

Households are classed as "protected consumers" under EU rules and would be shielded from such curbs.

EU member states will vote on the Council's rationing plan at a meeting of energy ministers on 26 July.

Germany has already been taking steps towards gas rationing. In June the country triggered the "alarm" stage of an emergency gas plan to deal with shortages.

On Monday the International Energy Agency (IEA) called on European countries to further reduce gas consumption, saying Russia's latest moves to restrict gas flows, along with other supply disruptions, are a "red alert" to the EU.

Fatih Birol, executive director of the IEA, said that despite efforts to reduce reliance on Russian gas, it hasn't been enough to prevent Europe "finding itself in an incredibly precarious position today", adding that the next few months were "critical".

10 notes

·

View notes

Text

Injured on the Job Due to Lack of Proper PPE

What Is Personal Protective Equipment? Personal protective equipment (PPE) is any type of gear or clothing worn by a worker to protect them from hazards that could cause injuries or illnesses. This includes items such as safety goggles, hard hats, respirators, and gloves. It also includes items such as face masks and shields that have become more common in recent years due to the coronavirus pandemic.

Why Is PPE Important?

PPE is important as it helps protect workers from potential exposure to hazardous materials or conditions. For example, if a worker is exposed to loud noise for an extended period of time without wearing ear protection, they can suffer permanent hearing loss. Alternatively, if a worker works with chemicals without wearing respiratory protection or protective clothing, they run the risk of inhaling toxic fumes or getting burns on their skin.

The Responsibility of Employers Regarding PPE

The Occupational Safety and Health Administration (OSHA) requires that employers protect their employees by ensuring a safe work environment free of hazards, including the use of personal protective equipment (PPE). Employers must provide appropriate PPE to workers at no cost, as well as make sure it’s properly maintained, inspected and used in hazardous conditions.

Employers must also clearly communicate their PPE requirements to all employees, train them on the use of PPE, continuously monitor employee compliance with PPE regulations and enforce safety practices with disciplinary action when necessary.

If your employer neglects these duties and you’re injured as a result, you have rights to workers comp benefits. In fact, fault is generally not taken into consideration when making a workers compensation claim. Here are the steps you can take to protect yourself:

Document everything – Keep detailed records about your injury and take photos if possible. This can be helpful when filing a workers’ compensation claim.

Get medical attention – Seek medical attention right away so that your injuries can be documented by a healthcare professional. Tell your doctor all relevant information about your injury including when it occurred and what happened leading up to it so they can provide an accurate diagnosis and treatment plan.

Reach out to an attorney – Consider speaking with an experienced St. Louis workers’ comp attorney who can help make sure you get fair compensation for your injuries. They’ll be able to advise you on what legal options are available and guide you through each step of the process so you don't have to go through it alone.

St. Louis Workers Compensation Attorneys

At the Law Office of James. M. Hoffman, we understand how difficult it can be when you have suffered an injury due to your employer's negligence. That’s why we prioritize providing comprehensive legal knowledge about workers’ comp cases. We can explain the legal process clearly so that you understand what kind of compensation you might be entitled to receive. Contact us today at (314) 361-4300 for a free case evaluation.

#ppe#personal protective equipment#safety goggles#hard hats#respirators#gloves#shields#coronavirus#osha#workers compensation#st louis workers compensation attorneys

3 notes

·

View notes

Text

Why Your String Instrument is at Risk without Standalone Musical Insurance?

Stringed instruments have been one of the most well-liked musical equipment amongst music lovers over the years and can easily boast of having the maximum number of members of the modern orchestra. A few prominent members of the string family that are in demand in the orchestra are the guitar, violin, viola, double bass, and cello.

As a string player, purchasing musical equipment must be one of your most memorable moments. When you bring a precious instrument to your home, you form an instant connection and likeliness towards it and start following all necessary cleaning and maintenance processes to enjoy its best outcome for years. But the reality is life does not always go according to your plan. Sometimes, uncertainties take place, and you end up with unbearable losses. As you cannot stop mishaps from happening, it’s always better to take necessary steps to fight against unavoidable circumstances.

Whether you have recently started playing guitar or are an experienced violinist, your musical equipment is always at risk without financial protection. It can get stolen from your bag at music class or damaged by water leakage at your home. In such incidents, standalone String Instrument Insurance provides adequate coverage that bears the financial loss while repairing or replacing your gear.

Do You Travel Frequently? Get Insured With Specified Musical Instrument Insurance

If you are a musician by profession, then it’s obvious you travel a lot to attend gigs or concerts all over the country. As an owner of an instrument, you should identify and opt for the policy that would suffice your requirement.

You choose a policy that has been designed, following the need of your equipment. You are mistaken if you think homeowner insurance protects your music gear from accidental damage. The coverage in a household policy is restricted to your insured premises only. But if any accident occurs during travel, homeowner insurance will not be liable to bear the loss.

When traveling is integral to your profession, only specified String Instrument Insurance is the most suitable safeguard for your equipment, protecting you from unavoidable circumstances even while in transit.

Why is Third-Party Public Liability Coverage Crucial for Professionals?

If you are all set for your upcoming music concert, ensure you have adequate coverage so that if any mishaps happen, you will be well-protected from facing the consequences.

During a concert, if any participant gets severely injured by a piece of heavy equipment kept in the auditorium, you might get into big trouble. The person can raise a legal complaint against you and claim huge compensation against the medical bill.

Public liability coverage works as a shield in terms of protecting you from sudden financial losses and also safeguarding you from legal hazards.

Why is Homeowners Insurance not Sufficient for Students?

People perceive that students or beginners don’t require any separate policy for their instruments as homeowner insurance covers musical equipment. If you think your musical gear gets covered in the household policy, then you are not informed about the details of its coverage.

You might travel to music school as an amateur player, but what if your string instrument gets stolen or broken? Musical instruments are secure under the homeowner insurance policy, provided the mishap happens at the insured premises. Once you are out of your house and if any accident happens, your household policy will not cater to the loss.

In addition, if the instrument gets damaged by a flood or earthquake, household insurance will not cover the damage. You should choose a policy that provides adequate coverage and is designed only for your equipment. In this context, specified String Instrument Insurance is the best option that covers the damages that household insurance fails.

Key Objectives

Finally, it’s essential to remember that daily cleaning and maintenance are not enough to protect your string instruments for a prolonged time. Dedicated musical insurance is vitally important to safeguard your gear from unexpected losses.

2 notes

·

View notes

Text

Why is Financial Protection Crucial for Your Clarinet?

The single-reed clarinet has always been one of the most admired instruments in the woodwind family. Since it is affordable, portable, and easier to learn than a flute or an oboe, it gained immense popularity amongst beginners. At the same time, the clarinet is equally in high demand among professional musicians due to its versatility.

With proper maintenance and regular care, the clarinet can last for decades. However, as a musician, it’s essential to remember that by only cleaning and servicing you cannot protect your gear for lifelong. There is no denying that routine maintenance is compulsory to keep your woodwind in playing condition over the years, yet financial protection is also an absolute necessity. To keep your precious wood instrument protected throughout, Clarinet Insurance is the only suitable safeguard that can ensure the financial safety of your woodwind.

If you are a professional musician, through your past experiences, you must have realized that your valuable gear is at risk even when you are at home or during your travel. It can get damaged, broken, or stolen; in any case, you might suffer a severe financial loss. You never know that water leakage from the roof of your house during heavy rain can damage your woodwind. Likewise, since the clarinet is portable, there is always a chance it gets stolen during transportation or while you are busy in any of your music events. With standalone musical insurance, your beloved woodwind will continue to remain financially secure even in the occurrence of any accidental damage.

What are the Damages Covered Under Standalone Clarion Insurance?

Whether you are a proficient clarinetist or a novice, there is no doubt that on the very day of purchase, you form an instant bonding with your valuable woodwind. Needless to say that losing your prized gear might be a nightmare for you. As an instrumentalist, your top priority must be to protect your music gear from damage. Regular maintenance is the key to keeping your instrument in playing condition for a long time, but what about those unprecedented situations where you might lose your most precious gear forever?

To protect your woodwind from every uncertainty, the most vital decision you should take is to opt for specified Clarinet Insurance to enjoy financial freedom throughout your musical journey. However, before finalizing the policy, you should be clear about the coverage provided by the insurance company.

Here are some coverage you should not miss while buying a policy for your valuable woodwind:

• Damage due to unavoidable circumstances like fire, explosion, strike, riot, and other hazards.

• Occurrence of any damage to the equipment due to natural calamities like floods, storms, heavy rain, and earthquake

• Loss of instrument due to theft or actual attempts at burglary

• Damage occurring during transportation

• In case of robbery in an unattended vehicle loaded with musical equipment.

• Bodily injury or personal property damage to a third party. Liability coverage is crucial for professional musicians.

Do You Know Which Policy is Suitable for Your Music Venture?

Whether you are a music teacher or an owner of a recording studio, your source of income must be music. Hence, safeguarding your business has to be on your top priority list. Like other businesses, running a music venture is full of risk thus, liability insurance helps to shield professional musicians from unnecessary financial hazards and legal consequences.

Whether you are attending a music concert or teaching music in a school, if any participant suffers a bodily injury or their personal property gets damaged at your premises, they can raise a legal case against you with huge compensation. In this context, liability insurance acts as a shield and protects you from unnecessary financial and legal harassment.

Conclusion

Choosing the right insurance for your instrument should not be a hindrance if you follow the guidelines mentioned above while purchasing the policy. For the financial security of your woodwind, standalone Clarinet Insurance is the only solution that can provide you with ultimate protection and reduce the risk of financial burden.

4 notes

·

View notes

Text

Protect Your Business With The Right Coverage: A Comprehensive Guide To Business Insurance In Thailand

Are you a business owner in Thailand looking to safeguard your hard work and investments? Protecting your business with the right insurance coverage is crucial in today's unpredictable world. This comprehensive guide will walk you through everything you need to know about business insurance in Thailand. Stay tuned to learn about the different types of coverage, legal requirements, common risks businesses face, and why regularly reviewing and updating your policies is essential for long-term success. Let's dive in! Business Insurance Thailand

Understanding Business Insurance

Business insurance is like a safety net for your company, providing financial protection against unforeseen events. It helps mitigate risks and ensures your business can weather unexpected challenges without significant economic losses. Understanding the different types of coverage available is critical to building a comprehensive insurance strategy tailored to your specific needs.

General liability insurance protects your business from claims related to bodily injury, property damage, and advertising mistakes. Property insurance covers physical assets such as buildings, equipment, and inventory in case of fire, theft, or other disasters. Professional liability insurance safeguards service-based businesses against claims of negligence or errors made during work.

Workers' compensation insurance is essential for covering medical expenses and lost wages if an employee gets injured. Business interruption insurance can help cover lost income and ongoing expenses if your operations are disrupted due to a covered event. By understanding these basics, you can make informed decisions when selecting the right coverage for your business in Thailand.

Different Types of Business Insurance

Regarding business insurance in Thailand, various types of coverage options are available to protect your company from unforeseen circumstances.

One common type is property insurance, which safeguards your physical assets, such as buildings, equipment, and inventory, against damages caused by fire, theft, or natural disasters. Liability insurance is another essential coverage that protects your business from legal claims related to bodily injury or property damage.

Business interruption insurance is designed to help cover lost income and ongoing expenses if your operations are disrupted due to a covered event. Additionally, professional liability insurance can provide financial protection in case of errors or negligence while providing services to clients.

Workers' compensation insurance is mandatory in Thailand and covers medical expenses and lost wages for employees who are injured on the job. Cybersecurity insurance has become increasingly important as businesses rely more on digital data and technology.

By understanding the different types of business insurance available, you can ensure comprehensive coverage tailored to your specific needs and risks.

Legal Requirements for Business Insurance in Thailand

When operating a business in Thailand, understanding the legal requirements for business insurance is crucial. The government mandates that certain types of insurance must be in place to protect your business and employees.

One essential requirement is Workmen's Compensation Insurance, which provides coverage for work-related injuries or illnesses sustained by employees during their employment. This type of insurance helps ensure employers can financially support their workers if accidents occur.

Another vital insurance requirement in Thailand is Public Liability Insurance, which offers protection against third-party claims for bodily injury or property damage caused by your business operations. This coverage can help shield your company from costly lawsuits and legal expenses.

It's essential to comply with these legal requirements for business insurance to avoid penalties and safeguard your enterprise from unforeseen risks and liabilities that may arise while doing business in Thailand.

Risks and Threats Faced by Businesses in Thailand

Running a business in Thailand comes with risks and threats that entrepreneurs must consider. One common risk is natural disasters, such as floods and tropical storms, which can cause significant damage to properties and disrupt operations. Another threat is political instability, which has the potential to impact businesses through unrest or changes in regulations.

Cybersecurity breaches are also a growing concern for businesses in Thailand, with the increasing reliance on digital technologies. Data breaches can lead to financial losses and damage to reputation. Economic fluctuations and currency exchange rate volatility also pose challenges for businesses operating in Thailand's dynamic market environment.

Business owners must assess these risks carefully and choose appropriate insurance coverage to protect their assets and mitigate potential losses. By staying informed about the specific risks businesses face in Thailand, entrepreneurs can proactively manage uncertainties and safeguard their operations.

The Importance of Regularly Reviewing and Updating Your Coverage

It is crucial for businesses in Thailand to stay proactive about their insurance coverage. Regularly reviewing and updating your business insurance ensures that you are adequately protected against potential risks and threats that may arise.

By staying informed about the different types of business insurance available, understanding the legal requirements in Thailand, and being aware of the specific risks businesses face in the country, you can make informed decisions about your coverage needs.

Remember that as your business evolves and grows, so do your insurance needs. Please don'tDon't wait until it's too late to discover gaps in your coverage. By proactively reviewing and updating your business insurance regularly, you can safeguard your business from unforeseen circumstances and protect its long-term success.

Stay ahead by working closely with a reputable insurance provider who can help tailor a comprehensive insurance package that suits your unique business requirements. Protecting your business with the right coverage is not just a wise decision – it's an essential investment in your company's future security and stability.

0 notes

Text

Comprehensive Business Insurance Products: Protecting Your Business with Allan Twitty Insurance

Running a business involves navigating numerous risks and challenges. From natural disasters to liability claims, unexpected events can threaten the stability and success of your enterprise. This is where the right business insurance products come into play. Allan Twitty Insurance specializes in providing tailored insurance solutions designed to safeguard your business against a wide array of risks.

Understanding Business Insurance Products

Business insurance encompasses a variety of coverage options designed to protect your company from financial losses due to unforeseen events. The right combination of insurance products can help ensure the longevity and financial health of your business.

Key Business Insurance Products Offered by Allan Twitty Insurance

1. General Liability Insurance

General liability insurance is essential for any business. It covers legal fees, medical expenses, and damages if your business is found liable for injury or property damage to a third party. This insurance is particularly crucial for businesses that interact directly with customers or clients on their premises.

2. Property Insurance

Protect your physical assets with property insurance. This coverage includes buildings, equipment, inventory, and other physical assets against risks such as fire, theft, and natural disasters. Property insurance ensures that your business can recover quickly from physical losses, minimizing downtime and financial impact.

3. Business Interruption Insurance

Business interruption insurance provides financial support if your business operations are halted due to an insured event, such as a fire or natural disaster. It covers lost income and operating expenses, helping you maintain cash flow and recover faster from interruptions.

4. Workers' Compensation Insurance

Workers' compensation insurance is legally required for businesses with employees. It covers medical expenses and lost wages for employees who suffer work-related injuries or illnesses. This coverage not only protects your employees but also shields your business from potential lawsuits.

5. Professional Liability Insurance

Also known as Errors & Omissions (E&O) insurance, professional liability insurance is vital for service-based businesses. It protects against claims of negligence, errors, or omissions in the services you provide. This coverage is essential for maintaining your business’s reputation and financial stability.

6. Product Liability Insurance

Product liability insurance is crucial for manufacturers, distributors, and retailers. It protects against claims arising from defective products that cause injury or damage. This coverage helps manage the financial risks associated with product-related lawsuits, protecting your business's reputation and bottom line.

7. Commercial Auto Insurance

If your business uses vehicles for operations, commercial auto insurance is necessary. It covers liability and physical damage for business vehicles, ensuring that your company is protected against accidents, theft, and other vehicle-related risks.

Why Choose Allan Twitty Insurance?

Tailored Solutions: Allan Twitty Insurance understands that every business is unique. Their expert team works closely with you to assess your specific needs and tailor insurance solutions that provide optimal protection.

Affordable Premiums: They offer competitive rates without compromising on coverage quality. Their goal is to provide cost-effective insurance solutions that fit your budget.

Exceptional Support: Their dedicated support team is always ready to assist you with claims, policy adjustments, and any questions you may have. They strive to provide excellent customer service and support throughout your insurance journey.

Expert Advice: With years of experience in the insurance industry, their advisors offer reliable and knowledgeable guidance, helping you make informed decisions about your business insurance needs.

Get Started Today

Protecting your business with the right insurance products is crucial for ensuring its success and longevity. Allan Twitty Insurance is committed to providing comprehensive, affordable, and tailored insurance solutions that meet the unique needs of your business.

1 note

·

View note

Text

The Essentials of Insurance Policies: A Comprehensive Overview

Insurance policies serve as invaluable shields against life's uncertainties, providing financial protection and peace of mind to individuals, families, and businesses alike. From safeguarding health to securing property and ensuring financial stability, insurance policies play a pivotal role in mitigating risks and fortifying financial well-being. In this article, we will delve into the intricacies of insurance policies, exploring their types, benefits, and operational mechanisms to empower readers with a comprehensive understanding of this critical aspect of financial planning.

Types of Insurance Policies

1. Life Insurance

Life insurance stands as a pillar of financial security, offering a safety net to beneficiaries in the event of the insured's death. This policy provides a lump-sum payment, known as the death benefit, to the designated beneficiaries. With variants such as term life, whole life, and universal life insurance, individuals can tailor coverage to suit their specific needs and financial goals.

2. Health Insurance

Health insurance shields individuals from the exorbitant costs of medical care by covering expenses related to illnesses, injuries, and preventive services. Whether acquired individually, through employers, or government programs, health insurance ensures access to essential healthcare services without the burden of substantial out-of-pocket expenses.

3. Property Insurance

Property insurance safeguards assets such as homes, belongings, and vehicles against unforeseen perils like fire, theft, or natural disasters. Through policies like homeowners insurance, renters insurance, and auto insurance, individuals can protect their tangible assets and alleviate financial losses stemming from property damage or loss.

4. Liability Insurance

Liability insurance shields individuals and businesses from legal liabilities arising from bodily injury or property damage to third parties. With coverage options including general liability, professional liability, and product liability insurance, policyholders can safeguard their assets and reputation from the ramifications of potential lawsuits and claims.

Benefits of Insurance Policies

1. Financial Protection

Insurance policies offer a safety net, ensuring that policyholders and their beneficiaries are shielded from financial turmoil in times of crisis. Whether replacing lost income, covering medical expenses, or repairing damaged property, insurance provides crucial financial support to weather life's storms.

2. Peace of Mind

By offering protection against unforeseen risks, insurance policies provide peace of mind to policyholders, alleviating the anxiety and uncertainty associated with life's uncertainties. With the assurance of financial security, individuals can navigate life's challenges with confidence and resilience.

3. Risk Management

Insurance serves as a fundamental tool for risk management, allowing individuals and businesses to transfer the financial burden of potential losses to insurance companies. Through regular premium payments, policyholders mitigate the impact of adverse events, ensuring financial stability and continuity.

4. Legal Compliance

Certain types of insurance, such as auto insurance and workers' compensation insurance, are mandated by law to protect individuals and businesses from legal penalties and financial liabilities. Compliance with these legal requirements ensures adequate protection and fosters a culture of responsibility.

How Insurance Policies Work

Insurance policies operate on the principle of risk sharing and risk pooling, wherein policyholders collectively contribute premiums to an insurance pool, from which claims are paid out. Here's how insurance policies function:

Policy Purchase: Individuals purchase insurance policies by paying premiums to insurance companies, which provide coverage for specified risks outlined in the policy document.

Policy Coverage: The insurance policy delineates coverage details, including covered risks, coverage limits, deductibles, and exclusions, empowering policyholders with transparency and clarity.

Premium Payment: Policyholders pay premiums at regular intervals to maintain coverage, ensuring continued protection against potential risks and losses.

Claims Process: In the event of a covered loss, policyholders file claims with the insurance company, which assesses the claim's validity and processes payouts according to the policy terms.

Policy Renewal: Insurance policies typically have a defined duration, after which they must be renewed to retain coverage. Renewal terms may vary based on policy specifics and insurer guidelines.

Conclusion

Insurance policies serve as indispensable instruments for safeguarding financial security and resilience in the face of life's uncertainties. By understanding the different types of insurance, their benefits, and operational mechanisms, individuals and businesses can make informed decisions to protect themselves and their assets effectively. With insurance as a cornerstone of financial planning, individuals can navigate life's twists and turns with confidence and assurance, knowing that they are fortified against whatever challenges may arise.

0 notes

Text

Compliance Safety Training: Your Company's Shield Against Workplace Hazards and Legal Risks

In the intricate landscape of American business, ensuring a safe and healthy work environment is not just a moral obligation, but a legal and financial imperative. Compliance safety training acts as a vital shield, protecting both your employees and your organization from the potential risks and liabilities associated with workplace hazards. By proactively addressing safety concerns and educating your workforce on best practices, you create a culture of safety that not only reduces accidents and injuries but also enhances productivity, morale, and overall business success.

The Essential Role of Compliance Safety Training in US Companies

Legal Compliance: The Occupational Safety and Health Administration (OSHA) and other regulatory bodies mandate specific safety standards that companies must adhere to. Compliance safety training ensures that your organization meets these legal requirements, avoiding costly fines, penalties, and legal actions.

Risk Mitigation: Workplace accidents and injuries can lead to lost productivity, increased insurance costs, workers' compensation claims, and reputational damage. Compliance safety training proactively identifies and addresses potential hazards, reducing the risk of incidents and their associated costs.

Employee Well-being: A safe workplace fosters employee well-being, leading to higher morale, increased job satisfaction, and lower turnover rates. Compliance safety training empowers employees with the knowledge and skills to protect themselves and their colleagues from harm.

Enhanced Productivity: When employees feel safe and confident in their ability to perform their jobs safely, they are more likely to be engaged, focused, and productive. Compliance safety training creates a culture of safety that promotes efficiency and excellence.

Reputation Management: Companies that prioritize safety and invest in comprehensive training programs are viewed as responsible and ethical employers. This can attract and retain top talent, build customer trust, and enhance brand reputation.

Key Elements of a Comprehensive Compliance Safety Training Program

Hazard Identification and Assessment: The first step is to conduct a thorough assessment of your workplace to identify potential hazards, such as chemical exposures, electrical hazards, falls, and ergonomic risks. Once identified, assess the severity and likelihood of each hazard to prioritize mitigation efforts.

Tailored Training Content: Develop training materials that are specific to the identified hazards and the unique needs of your workforce. This may include training on proper use of personal protective equipment (PPE), safe handling of hazardous materials, machine guarding, lockout/tagout procedures, emergency response protocols, and ergonomics.

Engaging Delivery Methods: Utilize a variety of training methods to cater to different learning styles and preferences. This may include in-person workshops, online modules, on-the-job training, virtual reality (VR) simulations, and gamification.

Continuous Improvement: Safety regulations and industry best practices are constantly evolving. It's essential to regularly review and update your training materials and programs to ensure they remain relevant and effective.

Evaluation and Feedback: Regularly assess the effectiveness of your training program through quizzes, surveys, and observations. Use this feedback to identify areas for improvement and make necessary adjustments.

Leveraging Technology for Enhanced Safety Training

Technology plays a pivotal role in modern compliance safety training:

Learning Management Systems (LMS): LMS platforms streamline the delivery and tracking of training, allowing you to manage courses, assessments, and reporting in one centralized location.

Adaptive Learning Platforms: These platforms personalize the learning experience for each employee, adapting the content and pace to their individual needs and knowledge level.

Virtual Reality (VR) and Augmented Reality (AR): VR and AR simulations provide immersive and realistic training experiences, allowing employees to practice skills and decision-making in a safe, virtual environment.

Mobile Learning: Mobile apps and responsive design make training accessible on smartphones and tablets, enabling employees to learn anytime, anywhere.

Making Safety a Priority

By prioritizing compliance safety training, you not only protect your employees and your business but also cultivate a culture of safety that permeates throughout your organization. This commitment to safety not only reduces risk but also enhances productivity, morale, and overall business performance. Investing in compliance safety training is an investment in your company's future, ensuring a safe, healthy, and thriving workplace for all.

#compliance safety training#compliance training online#compliance training#microlearning#microlearning platform

0 notes