#maize exporting countries

Text

Discover the latest trends in maize exports from India and learn how exporters can capitalize on the growing demand for maize-based products in the global market.

#export#import#trade data#import data#export data#international trade#global trade data#import export data#trade market#maize exports from India#maize exporters from India#maize exporting countries#Maize export data#maize hs code#India maize export#maize exporters

0 notes

Text

Europe’s never-ending struggle to provide tidbits of assistance to Ukraine while still pandering to the agricultural lobbies that dictate so much policy in Brussels took another tortured turn this week. The European Commission hammered out its latest, tentative compromise plan to offer Kyiv another year of tariff-free access to the European single market for some agricultural products—but it’s not a done deal, and it could end up as a nasty tripwire for Ukraine’s hopes to join the European Union.

At issue is a monthslong tussle over the renewal of tariff-free access for a handful of Ukrainian farm goods, such as eggs, poultry, honey, and maize (corn). Ukraine, which is not a member of the EU and is in the middle of a war with Russia, desperately wants the trade relief, which it figures is worth well over 1 billion euros a year in much-needed export earnings.

Europe as a whole is unlikely to be concerned about such rounding-error figures, but certain groups in Europe—namely farmers in eastern “front-line” countries—care very much indeed. Farmers in Poland have added angry chants against Ukrainian food imports to the standard-issue complaints about the European Green Deal and free trade that animate farmer protests across the continent; they’ve even blocked the borders east and west in protest against what they say is a flood of outside food that is undermining their livelihood.

In a nutshell, Europe’s bid to offer Ukraine the tiniest of economic lifelines is threatening to weaken support for the country’s eventual membership in the EU by angering groups with outsized political influence that feel threatened by what looks to them like the stealth arrival of a new trade rival. That is most evident in Poland, Ukraine’s neighbor, which when the war began was hugely supportive of aiding Kyiv in any way possible but which in recent months has become a lot more sour on defense assistance, Ukrainian refugees, Ukrainian wheat, and, of course, Ukrainian EU membership.

According to recent opinion polls, support among Poles for further aid to Ukraine is dropping sharply, and that is especially true among more right-wing voters (as is true across much of Europe). One big reason for this decline in support is the fight that Polish farmers have waged against what they see as a flood of cheap, foreign food.

“What I can say is that the support for Ukraine has taken a real hit in Poland. Look at enlargement, support for refugees, even weapons,” said Isabell Hoffmann, a survey expert at Eupinions, an independent platform for European public opinion. “Support was extraordinarily strong before, and it is still strong today. But it weakened notably and quickly.”

Poland has been fighting over Ukrainian food imports for a year, but the protests intensified at the beginning of this year with further border blockages and anti-Ukraine animus which have found widespread popular support.

“This issue has become very toxic in domestic politics. There are more and more critical voices in Poland,” said Piotr Buras, the head of the Warsaw office of the European Council on Foreign Relations (ECFR). “This is the paradox: The European Commission is talking about more gradual integration with Ukraine and the single market, but we are talking about the gradual closing of the single market for Ukraine.”

All this began, like so many of Ukraine’s current woes, with the full-scale Russian invasion in early 2022, which threatened Ukraine’s breadbasket agricultural regions and, importantly, its main export route through the Black Sea. The EU offered emergency tariff relief for a host of Ukrainian agricultural goods so they could travel overland and into the EU and trade without prejudice.

For Ukraine, desperate to earn foreign currency and boost the few exports that were left after the Russian invasion, it was a tidy little lifeline.

“From an economic point of view, agriculture remains one of the key export sectors of Ukraine,” said Marek Dabrowski, an expert on European trade and enlargement issues at Bruegel, a think tank. “Before the war, it was metallurgy and industry, but then part of that was destroyed, and part is occupied, so exports now are essentially down to agricultural goods. The reason for these ‘emergency measures’ has not gone away.”

Indeed, those emergency measures have continued every year since—until now. The European Commission planned to simply roll the tariff relief over this year, giving Ukraine one more year of free access, worth about 1.7 billion euros for Kyiv’s empty coffers. But many of the countries bordering Ukraine, including Hungary, Poland, and Slovakia, pushed back at what they viewed as a flood of cheap Ukrainian grain that was undermining their own farmers. Some countries, such as Poland, unilaterally blocked Ukrainian farm goods from staying in the country.

Together, and most recently backed by France, those countries pushed for a tougher version of tariff relief for Ukraine that would have limited the amount of agricultural goods it could sell to Europe. The European Commission and European Parliament have been at work hammering out ever-tougher versions of tariff relief ever since.

The latest proposal would still offer Ukraine relief for another year but with tougher quota baselines, which would cost Kyiv about 350 million euros annually. Ukraine’s farm lobby on Thursday decried the slide toward EU “protectionism” in the latest wrangling. But even that compromise measure still has to pass the European Parliament, where it could face yet further efforts to weaken Ukraine’s access.

While an extension, even a watered-down one, would still be welcome in Ukraine, the problem is the perception that such preferential trade policies create in front-line countries such as Poland. Ukrainian grain is not the cause for the plight of Polish farmers any more than it is the reason for angst in the countryside in the other 26 EU member states; that has a lot more to do with falling prices for global agricultural staples such as wheat, as well as slightly tougher (and costlier) EU regulations on agricultural production.

But many who are getting kicked while they are down don’t look carefully at precisely who is doing the kicking, and continual European assistance for Ukraine rubs many in the east the wrong way.

The temporary trade measures amounted to a full opening, Buras of ECFR said. “Basically, Ukraine jumped from a piecemeal opening to European access to the final stage of this process,” he said. “Nobody expected these measures to remain in place for three years or more. Technically, we have a full opening of the single market to Ukrainian products.”

The risk is that the tiny measures Europe is taking to shore up Ukraine today with trade relief could end up as a poisoned chalice in years to come. Once the war is over, Ukraine is widely expected to get on with its decade-long quest to become a member of the EU—a step that ultimately needs the go-ahead from all current member states.

“The Ukrainians should also, seen from Warsaw, be a little more careful when they push for more liberalization,” Buras said. “At the end of the day, Ukrainians are dependent on Polish support” to join the EU, he added.

6 notes

·

View notes

Text

The reality of Oxfam's involvement with Coldplay [CROSSBEAT (August 2006)]

In the UK, where philanthropy is very popular, celebrities and individuals often choose one (or more) of a number of organisations and campaigns to support and work with as part of their life's work. Coldplay's commitment to the UK-based development NGO Oxfam's 'Make Trade Fair' campaign is widely known.

The ‘unfair trade’ that prevails in the world is a long-standing problem between the so-called ‘developed’ and ‘developing’ countries. Historically, it has the same roots as the unfair colonial trade once practised by Western countries. Western countries buy raw materials at low prices from developing countries (without teaching them the technology) and export them, while selling goods mass-produced in their own countries to developing countries. Even now, developed countries are forcing developing countries to open their markets, putting pressure on the livelihoods of local farmers and workers. In the 1990s, when people became aware of the problems of unfair trade, it began to become a problem that footballs made by young children in Pakistan and other Asian countries, who were not allowed to go to school and were forced to work for cheap wages, were traded at high prices in the UK. In addition, in the banana industry, where five major corporations control more than 80% of the world market, the struggles of Latin American farmers, who are forced to ship at unfairly low prices, attracted attention and support movements in the late 1990s. As a result, when the first ‘fair trade bananas’ were imported into the UK in 2000, it was widely reported.

In 2002, Oxfam launched an international campaign to bring together the sporadic campaign to correct unfair trade and to call on governments and the WTO to change trade rules and shift policies. In 2002, Chris and his staff visited the Dominican Republic and Haiti in Central America to see first-hand the plight of the local people and the production of coffee beans, which had seen a decline in wholesale prices in recent years. In 2003, they visited Mexico, where they performed as a band at a concert in support of maize farmers fighting against cheap imports from the USA. In 2005, Chris toured Ghana (see photo) and was shocked to learn that cheap agricultural imports from the West were destroying local agriculture and contributing to poverty. Incidentally, Ghana is the second largest producer of cocoa beans in the world, yet it cannot make chocolate. Even if they did, they could not export it because of high tariffs imposed by developed countries.

What is needed is not for rich countries to seek more wealth, but for them to share it with less rich countries. "When I was a child in the 80s, if you saw on TV the miserable situation of farmers, the only solution was to ‘donate money’. But here I see other solutions. I mean, everyone can participate by speaking up. The more I study, the more I think that poverty is also caused by trade imbalances. What I feel is particularly serious is that we are ruining the industries of developing countries by exporting products that are surplus in developed countries at unbeatable prices. It's crazy. It should be easy to stop." (Chris).

Chris has made the movement known by wearing campaign slogan T-shirts in public, including at shows, and by contributing a column to newspapers. "As long as we're providing music with heart, we can talk openly about things we feel are important in the media in developed countries. We can also promote Fair Trade and play our part in putting pressure on governments in the developed world to expand our activities and bring about trade inequalities."

-Sumi Imai

5 notes

·

View notes

Text

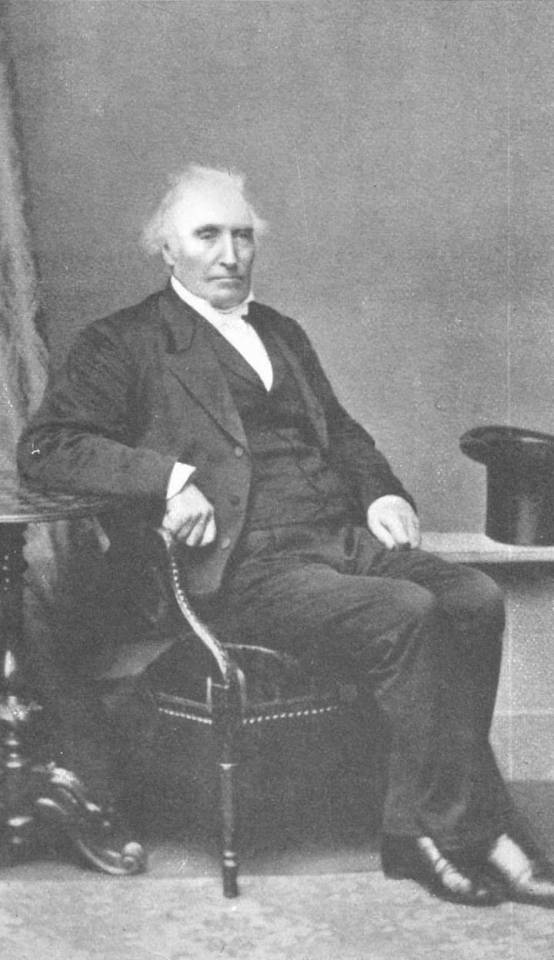

September 17th 1873 saw the death of Scottish born surgeon, merchant, explorer and settler Alexander Berry.

Berry was born on 30 November 1781 in Fife, Scotland, one of nine children of James Berrie (d.1827) and his wife Isabel Tod (d.1830). He was educated at Cupar Grammar School and at the Universities of St Andrews and Edinburgh where he studied medicine. Despite his father's opposition he became surgeon's mate in an East Indiaman bound for China and later in the Lord Hawkesbury on a voyage to Madras. His dislike of the flogging of seamen and a recognition of the profit to be won from commerce led him to abandoned his chosen profession.

From 1808 made several voyages to New South Wales with cargos of goods. Travelled to South America and returned to London in 1812, after losing his ship. In 1819 returned to Sydney establishing a mercantile business in partnership with Edward Wollstonecraft. In 1822, Berry and Wollstonecraft applied for a grant of 10,000 acres on the Shoalhaven River in New South Wales. In 1823 they exported coal to Rio de Janiero. Closed their mercantile business in 1828. In 1830 a grant of land of 10, 000 acres applied for on the Shoalhaven in 1822 was approved. Between 1830 and 1840 he purchased an additional 22,000 acres which produced maize, tobacco, wheat, barley, potatoes, pigs and cattle. The area had some of the most fertile and lush farmland in the country.

Berry grew very wealthy from his occupation. He sat in NSW parliament for 14 years and is considered a founding father of the area; they named the town after him in 1888.

This settlement became known as the Coolangatta Estate and developed into what is now the pretty and historic township of Berry , named in honour of Alexander and his brother, two hours south of Sydney It is a popular tourist spot, especially among the short-stay and weekender crowd.

Of course with the majority of Colonial rule Alexander’s success came at a price to the native population.

Berry used Aboriginal people as slave labour to clear the land – whether you consider payment by way of rations as slave labour – but there definitely wasn’t a monetary exchange.

Berry had a different view, but more and more these colonial settlers are being uncovered what for what they were. this was what he had to say in his memoirs;

“For many years I have reaped my harvest on the principle of free Labour. When I made a settlement at Coolangatta, in 1822, [Aboriginal people] were comparatively numerous, and were said to be very ferocious. I was informed that they had recently driven away a number of sawyers or wood-cutters, and my old friend, the late James Norton, told me that they would eat me. I had, however, served a kind of apprenticeship to the management of savages in New Zealand, and I was always on good terms with those of the settlement. Indeed, I found them very useful.”

As well as using the indigenous population he is also accused of raiding the graves of those people in the name of scientific research for the likes of Charles Darwin and others back home in good old “Blighty”

Australian researchers say they have uncovered evidence from Berry’s correspondence and his later reminiscences that he sent the skull of the Yuin leader Arrawarra to Britain in 1827, two years after he died.

We Scots can’t just wash our hands of all this, as well as Berry being a Scot we were involved at the other end, where the skull ended up, a letter of 20 August 1827 indicates Berry dispatched the skull, probably to the Edinburgh Museum, although it has not yet been found.

He was also involved, after the fact of the Boyd massacre, where Maori residents of of Whangaroa Harbour in northern New Zealand killed between 66 and 70 European crew of the Boyd. The massacre itself is said to have been in retaliation of floggings of Maori’s on the vessel. Brery took two local chiefs hostage for a time. He wrote in the Edinburgh Magazine that he had released them on condition that they lose their rank with their people, although he never expected that to happen.

Berry's memoirs were published in 1912, entitled 'Reminiscences'.They chiefly describe his experiences at sea, both with the East India company and his private travels, with only a short section covering his life in New South Wales. In particular he describes in detail his relationships with the indigenous people of New Zealand and Fiji, and his experiences during the rescue at the scene of the Boyd massacre.

Alexander Berry died on this day 1873 aged 91, at Crows Nest House. He was buried in family vault in St. Thomas' cemetery with his wife, Elizabeth Wollstonecraft, who was cousin of the Frankenstein author Mary Shelley.

While some admire Berry as a pioneering hero he has also been described as an “Immoral Hero”

10 notes

·

View notes

Text

Long ago A clan of fruit bats were forced to drink the blood of a god to protect their lands from invasion and were transformed into soucouyant.They fully transformed were blessed with dark magic and shape shifting abilities and was victorious against the invaders.They became the first vampires.They established the kingdom of Jada. Kaleisha Vea Gillain is the descendant of these vampires and wants to keep her people safe.she has an unquenchable wanderlust. She is Curious and sweet by nature, if not a bit jumpy.

She’s from the kingdom of Jada which resides in the country of woodwater.the capital is Fayard town. They export sugar cane,indigo,cocoa, beer,rum,cassava,sea almonds,sweet potato,maize,and animal hides.it’s known for its reggae,tobacco,coffee,medicine,theaters,woodworking,metalworking,pirates

This kingdom and culture is based on ancient Jamaica

Note:her design is based of the Jamaican Fruit bat and the Ackee fruit.her body became poisonous due to eating the Ackee fruit all Her life.fruit bat colors are based off their diet.

#art#design#oc#designer#drawing#asthetic#characterdesign#myoc#mycharacter#jamaica#tropical#fantasy#princess#royalcore#magic#monster girl#fruit bat#vampire#folklore#fairytales#mythology#jewelry#commission are open#black girl art#blackgirlmagic#bat#claws#tail#wings#fangs

2 notes

·

View notes

Text

Brazil may surpass United States as world's number one corn exporter

Brazilian corn production should set a new record in 2023, allowing the country to become the world's leading exporter of maize, ahead of the United States.

On his farm in the state of Mato Grosso, Brazil's grain basket, Ilson Jose Redivo finished planting his corn crop a few weeks ago, acting quickly once he'd harvested the soybeans that he'd grown on the same fields.

In this region of west-central Brazil, the fields stretch as far as the eye can see and the schedule is well established: The farmer plants the two crops, soybean and maize, on "almost 100 percent" of his over 1,550 hectares (3,800 acres). The corn will be harvested in June.

The maize is a second crop, or "small crop," which Brazilians call a "safrinha." Over the past decade, the second crop has turned into Brazil's main corn crop and taken an increasing share of world maize production.

This year's expected production should hit a record, making Brazil the world's leading corn exporter ahead of the United States, a position it has only reached once before, in 2013.

Continue reading.

7 notes

·

View notes

Text

Govt implements farmer-friendly policies cuts export barriers in first 100 days: Coop Min Amit Shah

NEW DELHI, Sep 17 : The government has implemented several farmer-friendly policies in its first 100 days of the third term, focusing on improving agricultural productivity and exports, Cooperation Minister Amit Shah said on Tuesday.

Addressing a press conference, Shah said the government has implemented policies worth Rs 15 lakh crore across 14 sectors in its first 100 days.

The minister highlighted key achievements in the farm sector, including the disbursement of Rs 20,000 crore to 9.5 crore farmers under the Pradhan Mantri Kisan Samman Nidhi (PM-KISAN) scheme.

“We have disbursed the 70th installment under PM-KISAN. So far, Rs 3 lakh crore has been disbursed to 12.33 crore farmers,” Shah said.

The PM-KISAN offers an annual benefit of Rs 6,000, distributed in three equal instalments of Rs 2,000 every four months, directly into the bank accounts of eligible farmers through the Direct Benefit Transfer (DBT) system.

The minister said that farm policies are being implemented keeping in mind the welfare and prosperity of the farming community.

“This will help boost the country’s foodgrains production and exports, thereby improving farmers’ plight,” he added.

Highlighting the government’s commitment to farmers, Shah said, “Compared to the UPA regime, the Modi government has procured more crops at MSP. This shows the NDA government is committed towards the farmers”.

The minimum support price (MSP) for 2024-25 kharif (summer) crops has been hiked, he noted.

To boost ethanol production, the minister said sugar mills are being converted into multi-feed distilleries.

“Now, mills can make ethanol not only from sugarcane juice but also from maize. Ethanol will be made from maize when sugarcane juice is required for making sugar in the country. Ethanol from sugar juice will be made when there is higher sugar production,” he explained.

In a move to support exports, the minister said the minimum export price (MEP) on onion and basmati rice has been scrapped.

These policies are part of the government’s broader strategy to enhance farmer welfare and boost India’s agricultural exports, Shah said. (PTI)

Source link

via

The Novum Times

0 notes

Text

Starch Manufacturers in India | Gujarat Ambuja Exports Limited

Gujarat Ambuja Exports Limited (GAEL) is a famous name in the starch manufacturing industry in India. Founded in 1991, GAEL has become one of the largest producers of corn starch and maize starch, supplying high-quality products to various industries. Starch, a versatile carbohydrate, plays an essential role in numerous sectors, from food processing to pharmaceuticals. GAEL’s contribution to the starch industry underscores its commitment to innovation, quality, and sustainability.

Understanding Starch

Starch is a naturally occurring carbohydrate found in plants like corn, maize, and potatoes. Chemically, it is a polysaccharide composed of glucose molecules linked together. There are different types of starch, with corn starch and maize starch being among the most commonly used. Corn starch is widely used in food processing, while maize starch finds applications in industries like textiles and pharmaceuticals.

Who are the Biggest Starch Producers in India?

India has several major players in the starch industry. GAEL stands out as one of the largest manufacturers of starch. These companies have established a strong presence in the domestic and international markets, contributing significantly to the country's starch production.

Who is the Manufacturer of Starch in India?

GAEL is a leading starch manufacturer in India, producing high-quality starch products. They specialise in corn starch derivatives and soya derivatives, catering to various industries such as food, textiles, pharmaceuticals, and agro-processing. With advanced manufacturing facilities and a focus on sustainable practices, GAEL has earned its reputation as a trusted starch producer in India.

Gujarat Ambuja Exports Limited: Company Profile

Founded in 1991, GAEL began its journey with a vision to become a leader in agro-processing. The company focuses on producing corn starch derivatives, soya derivatives, and animal feed products. With advanced technology and a dedicated team, GAEL has grown to become one of the largest starch producers in India. Their emphasis on innovation, quality control, and sustainable practices has allowed them to maintain a competitive edge in the market.

The Role of Starch in Various Industries

Starch is a critical ingredient in several industries. In the food industry, it is used as a thickener, stabilizer, and emulsifier. The pharmaceutical sector utilizes starch in the production of tablets and capsules, where it acts as a binder. In the feed industry, starch is used as an energy source in animal feed. The versatility of starch makes it an indispensable component in modern manufacturing, and GAEL’s products serve these diverse sectors efficiently.

Corn Starch and Maize Starch Manufacturing

GAEL specializes in the production of both corn starch and maize starch. The manufacturing process begins with the extraction of starch from corn kernels, followed by purification and drying. Corn starch is primarily used in the food industry, while maize starch is used in textiles, adhesives, and pharmaceuticals. GAEL's manufacturing facilities are equipped with cutting-edge technology that ensures the highest quality products, meeting industry standards.

Major Players in the Indian Starch Industry

GAEL stands out due to its comprehensive product range, high production capacity, and focus on sustainable practices. While other companies also contribute to the starch market, GAEL’s emphasis on quality and innovation sets it apart.

GAEL’s Commitment to Quality and Sustainability

GAEL places a strong emphasis on quality control throughout its production processes. From sourcing raw materials to final packaging, stringent measures are taken to ensure product purity and consistency. In addition to quality, GAEL is committed to sustainability. The company adopts eco-friendly practices, such as reducing water and energy consumption, recycling waste, and using renewable energy sources in its manufacturing processes.

Customer Base and Market Reach

GAEL’s customer base spans a wide range of industries, including food processing, pharmaceuticals, textiles, and animal feed. The company’s products are in high demand both in India and internationally. GAEL’s extensive market reach and ability to cater to diverse customer needs make it a dominant force in the starch industry.

Conclusion

Gujarat Ambuja Exports Limited has cemented its position as a leading starch manufacturer in India, providing high-quality products that serve various industries. Starch plays a crucial role in food, pharmaceuticals, textiles, and agro-processing, making it an essential commodity in today’s industrial landscape. GAEL’s commitment to quality, innovation, and sustainability ensures that it will continue to be a driving force in the industry for years to come.

For more information or inquiries about GAEL’s products, visit our website or contact at +91-79-61556677. You can also reach them via email at [email protected] for further assistance.

0 notes

Text

Top Food Grains Exporter, Trader and Wholesaler in India.

As one of the world's top food grains exporter, trader and wholesaler in India companies play a crucial role in supplying high-quality grains to global markets. These grains, which include rice, wheat, maize, and pulses, are essential staples in diets around the world.

Leading the Export Market

India’s position as a top food grains exporter is a result of its vast agricultural resources and the expertise of its farmers. The country’s favorable climate, fertile soils, and advanced farming techniques contribute to the production of a wide variety of grains that meet international quality standards. Indian exporters ensure that these grains reach international markets in their freshest and most nutritious state, catering to the demands of consumers worldwide.

Wide Range of Food Grains

Indian food grains wholesalers offer a wide range of grains to meet the diverse needs of their customers. Some of the most commonly exported grains include:

Rice: India is one of the largest exporters of rice, including Basmati and non-Basmati varieties, known for their aroma, flavor, and long grain.

Wheat: Indian wheat is prized for its high protein content and is used in baking and other food products.

Maize: Also known as corn, maize from India is used for food products, animal feed, and industrial applications.

Pulses: Lentils, chickpeas, and other pulses are exported in large quantities due to their high nutritional value.

Commitment to Quality

As a trusted food grains exporter Indian companies are committed to maintaining the highest quality standards. This commitment is reflected in the rigorous testing and quality control processes that grains undergo before they are exported. These processes ensure that the grains are free from contaminants, meet international safety standards, and retain their nutritional value.

Sustainable Practices

Indian food grains exporters are increasingly adopting sustainable agricultural practices to minimize environmental impact. This includes the use of organic farming methods, efficient water management, and crop rotation techniques. By promoting sustainability, Indian exporters not only protect the environment but also enhance the long-term viability of their agricultural industry.

Efficient Supply Chain

The efficiency of India’s supply chain is another factor that makes the country a leading food grains wholesaler. From harvesting to storage, transportation, and delivery, every step of the supply chain is carefully managed to ensure that grains reach their destination in perfect condition. Indian companies utilize state-of-the-art infrastructure, including modern warehouses and transportation networks, to handle large volumes of grain with ease.

Global Reach

Indian food grains exporters have established strong relationships with buyers across the globe. Countries in Asia, the Middle East, Africa, and Europe are among the top importers of Indian food grains. This global reach is supported by India’s strategic location, which provides easy access to major shipping routes and international markets.

Customer-Centric Approach

Indian food grains traders prioritize the needs of their customers by offering flexible solutions and personalized services. Whether it’s bulk orders for large buyers or smaller quantities for niche markets, Indian companies are equipped to meet varying demands with professionalism and efficiency. Their customer-centric approach ensures that clients receive the best possible service and products.

Conclusion

India’s position as a top food grains exporter, trader, and wholesaler is built on a foundation of quality, sustainability, and efficiency. Indian companies continue to play a vital role in feeding the world by supplying high-quality grains that meet the nutritional needs of millions. With their commitment to excellence and customer satisfaction, Indian food grains exporters are poised to maintain their leadership in the global market.

FAQs

Q1: What types of food grains does India export?

A1: India exports a wide variety of food grains, including rice, wheat, maize, and pulses like lentils and chickpeas.

Q2: How does India ensure the quality of its exported grains?

A2: Indian exporters follow rigorous quality control processes, including testing for contaminants and ensuring compliance with international safety standards.

Q3: Are Indian food grains exporters adopting sustainable practices?

A3: Yes, many Indian exporters are adopting sustainable agricultural practices, such as organic farming and efficient water management, to protect the environment.

Q4: Which countries are the main importers of Indian food grains?

A4: Indian food grains are exported to countries across Asia, the Middle East, Africa, and Europe.

Q5: How can I contact an Indian food grains exporter?

A5: You can reach out to Indian food grains exporters through their websites, trade portals, or industry contacts to inquire about their products and services.

0 notes

Text

https://www.tradologie.com/lp/news/detail/india-imposes-rice-export-curbs-amid-global-challenges

India Imposes Rice Export Curbs Amid Global Challenges

Looking to Rice Export? restrictions on the export of rice have helped consumers by ensuring enough domestic supplies and limiting inflation in the face of subpar production of other commodities like wheat and maize. But these limitations have also hurt India's agricultural exports, which has put more strain on the country's already precarious rural economy and rice growers.

To get more info… Click on given link and visit our site

For More Information Contact Us Tradologie.com

Contact Number - +91-8595957412, +91-120-4148741

Email Id - [email protected]

Address - Green Boulevard, Plot No. B-9/A, 6th Floor, Tower B, Sector 62, Noida, Uttar Pradesh - 201309 (India).

0 notes

Text

Maize (Corn) Prices | Pricing | News| Database | Index | Chart | Forecast

Maize, commonly known as corn, is a vital crop with a global footprint, and its price dynamics are influenced by a complex array of factors that impact agricultural markets. The prices of maize fluctuate due to a combination of supply and demand, climate conditions, geopolitical events, and trade policies. As one of the most widely produced and consumed cereals, maize's economic significance extends beyond just its use as food for humans; it also plays a crucial role in animal feed, biofuels, and industrial products.

Seasonal weather patterns greatly affect maize production. Droughts, floods, and temperature extremes can lead to reduced yields, influencing market prices. For instance, a drought in key maize-producing regions like the United States, Brazil, or Ukraine can result in a significant drop in output, causing a surge in prices due to the scarcity of supply. Conversely, favorable weather conditions and bumper harvests can lead to lower prices as the market adjusts to the increased availability of maize.

Global demand for maize is another critical factor impacting its price. Emerging economies and developing nations, particularly in Asia and Africa, are seeing rising populations and increasing food consumption needs. This growing demand drives up prices as these regions import maize to meet their dietary requirements. Additionally, the expansion of livestock farming worldwide increases the demand for maize as animal feed, further straining supply and pushing prices upward.

Get Real Time Prices for Maize (Corn): https://www.chemanalyst.com/Pricing-data/maize-1321Trade policies and international trade agreements also play a significant role in maize pricing. Countries that are major exporters of maize, such as the United States and Brazil, influence global supply levels. Trade disputes, tariffs, and export restrictions can disrupt the flow of maize across borders, leading to price volatility in the global market. For example, a trade conflict between major producers and consumers can lead to higher prices for importing countries as they face reduced access to affordable maize supplies.

Economic factors, such as fluctuations in currency exchange rates, can also affect maize prices. When the currency of a major exporting country strengthens, its maize becomes more expensive for foreign buyers, potentially decreasing demand and impacting global prices. Conversely, a weaker currency can make maize more affordable for international buyers, potentially boosting demand and influencing price trends.

In addition to these macroeconomic factors, technological advancements and innovations in agriculture play a role in shaping maize prices. Improvements in crop management, pest control, and genetically modified varieties can enhance yields and reduce production costs. These technological advancements can lead to more stable and predictable maize prices by mitigating the impact of adverse weather conditions and increasing overall supply efficiency.

Market speculation and investment in agricultural commodities also contribute to maize price volatility. Traders and investors in futures markets buy and sell maize contracts based on anticipated future prices, which can lead to price swings driven by market sentiment and speculative activities. These speculative movements can sometimes exacerbate price fluctuations, impacting both producers and consumers.

Government policies and subsidies in major maize-producing countries can also influence prices. Support mechanisms and subsidies can impact production levels by encouraging or discouraging maize cultivation. For instance, favorable subsidies for maize growers can lead to increased production, potentially lowering prices. On the other hand, reductions in subsidies can lead to decreased production and higher prices.

The interplay of these factors creates a dynamic and often unpredictable environment for maize prices. Market participants, including farmers, traders, and consumers, must navigate this complexity to manage risks and make informed decisions. For farmers, understanding price trends and forecasts is crucial for planning planting and harvesting strategies. Traders and investors closely monitor market signals and economic indicators to guide their trading strategies. Consumers, whether individuals or businesses, need to be aware of price trends to make budgeting and purchasing decisions.

In conclusion, maize prices are influenced by a multifaceted set of factors that include weather conditions, global demand, trade policies, economic variables, technological advancements, and market speculation. As a staple crop with significant economic importance, fluctuations in maize prices can have far-reaching impacts across the agricultural sector and beyond. Understanding these dynamics is essential for stakeholders across the maize supply chain to navigate the complexities of this vital commodity.

Get Real Time Prices for Maize (Corn): https://www.chemanalyst.com/Pricing-data/maize-1321

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

0 notes

Text

Maize is an important crop in India, functioning as both a staple food and a source of biofuel, providing food security and supporting industrial demands. This blog delves into India's maize exports, covering export statistics, HS codes, and exporters.

Explore Blog: "The Future of Maize Export: Trends and Insights for India"

#maize exports from India#maize exporters from India#maize#Maize export data#maize exporters#maize exporting countries#maize hs code#maize production in India#largest producer of maize in India#India maize export#maize cultivation in India#maize importing countries from India#import#export#import export data#global trade data#international trade#trade data#trade market

0 notes

Text

Myanmar : A research team from the Myanmar Oil Exporters and Oil Industry Association Rangoon observed research and test plots of seven types of oil soybeans in Nay Pyi Taw Deputy Minister of Agriculture, Agriculture and Rural Agriculture, Dr. A research experiment of seven types of popcorn with a high percentage of crop yields and oil production tested at the branch office of the branch office of Jehovah's Witnesses. During the study, the Deputy Minister cultivated maize annually in the form of grain-finished crops, a crop system to increase the income of peasants in crop production Instead, we want the crop to be replaced, and fresh seeds are key to successfully growing peanuts, so there is a need to exchange rainfall and winter popcorn Agricultural Research Directorate of the Department of Agriculture and Agriculture for the Safety of the Food and Drug Administration Under the three-dimensional exchange between the department and the Myanmar Oil Traders and Oil Industry Association, the peasant himself has helped to develop the production of oil crops and begin to be implemented in the country He discussed the matter. The variety of peasants currently growing popcorn?Thapo, China 60 miles 100 km in diameter, vietnamese shellfish, and pomegranates. Such varieties as SHanghai, SB-60, Waterfall-14 and Waterfall-15 are reported to have been tested on a large-scale plantation. Next, the Deputy Minister and the Study Team planted a waterfall-15 variety of popcorn plants and vegetables planted at the Vegetable Research Center, the Department of Agricultural Research in Zhephetri. Researchers and researchers investigate local-level competition experiments, and the Deputy Minister discusses the needs of farmers to plan the production of popcorn themselves It was reported that the department's officials had been discussed.

0 notes

Text

Fresh red onion exporters, suppliers & wholesalers in Sri Lanka

You visited the right place! Pioneering the export of Onions, Flavions India is the best Red Onion exporter in Sri Lanka.

Flavions India is Leading Merchant Exporter in Agro-Commodities & Packaged Food Products. We have a large global customer base and are well-known for our unwavering quality standards and dedication to excellence in providing the best fresh fruits and vegetables, along with other agro-commodities.

Indian onions are becoming more and more in demand worldwide. India is the second-biggest onion producer in the world. India exports over 2182826.23 MT of onions to different countries across the world. In order to facilitate the sale of excess output outside of India and preserve the stability of the Indian onion export price domestically, the government implemented a 5% export subsidy program.

We handpick our selection of fresh red onions from only the most reputable and trustworthy farms. These hygienic Red Onions come in a variety of counts and sizes and enhance the flavor and richness of meals. The onions exported by us are dirt free and packed in good condition.

The Red Indian onions are Rich source of flavonoids, Good for heart, Cancer prevention, No fats, No cholesterol. Good for asthma patients, Repels insects, Good for curing colds coughs, Cures bacterial infections, Good for eyes and have many more local benefits.

Our specifications of Red Onion:

Colour

Red

Weight

50mm & Above

Variety

Small & Big size

Shelf life

20 days from date of packing

Packing in

5,10 ,25 ,50 kg Mesh & Jute Bags

Delivery Time

7 To 10 Days

Minimum Order of Quantity

1 x 40 FT container (29 MT)

Unit Price

Per Ton

In addition to onion, Flavions India is a perfect business partner if you are looking to import agro commodity: Chickpea! We bring one of the best chickpeas and onion in Srilanka.

Why choose us?

We believe “Relations and Honesty brings Business” We stand 6 Pillars, Reliability, Humility, Excellence, Dependability, Unity, Commitment.

We provide best quality products & value for money service.

Quality Control System

100% Satisfaction Guarantee

Highly Professional Staff

You also get strict Quality Control System, 100% Satisfaction Guarantee and a highly Professional Staff always on toes to make your experience with us better. Adding to our checklist, have covered 20+ countries, with 48+ happy clients worldwide.

In addition to onion, Flavions India is a perfect business partner if you are looking to import agro commodities like Soyabean, Dollar Chana, Rice, Maize, Millets or super fresh vegetables and fruits like, Drumsticks, Pomegranates, Lemon, Green Chilli, Bananas and much more!

We at Flavions are delighted to provide you the best onion export service from India through our collaborative efforts. We cordially invite all of our importers from Sri Lanka to work with us to discover the abundance of Indian agriculture.

Visit our website for more details and you can even get a free quotation! https://flavionsindia.com/index.php

0 notes

Text

Mexico Bakery and Cereals Market Overview

Introduction

The Mexican bakery and cereals market is a vibrant and essential sector within the country's food industry. Bakery products and cereals are staples in the Mexican diet, deeply rooted in tradition and continuously evolving to meet modern consumer demands. Mexico bakery and cereals Market From artisanal breads to ready-to-eat cereals, the variety and innovation in this market reflect the dynamic nature of Mexican food culture.

Historical Background

Traditional Mexican Bakery Products

Mexican bakery products, such as pan dulce (sweet bread), bolillo (a type of savory bread), and tortillas, have a long-standing tradition. These products are not just food items but part of the cultural and social fabric of Mexico. Bakeries, or "panaderías," are integral to Mexican communities, often serving as social hubs.

Evolution of Cereal Consumption in Mexico

Cereal consumption in Mexico has seen significant changes over the years. Initially, traditional grains like maize were the mainstay. However, the introduction of processed cereals in the mid-20th century brought a new dimension to breakfast options. Today, both traditional and modern cereals coexist, catering to a wide range of preferences and dietary needs.

Market Size and Growth

Current Market Size

The Mexican bakery and cereals market is robust, with a market size valued at several billion dollars. The bakery segment, in particular, dominates due to the daily consumption of bread and related products.

Growth Trends in the Last Decade

Over the past decade, the market has witnessed steady growth, driven by urbanization, rising disposable incomes, and changing dietary habits. The increasing popularity of health-conscious products has also contributed to market expansion.

Future Projections

The future looks promising for the Mexican bakery and cereals market. With ongoing product innovation and expanding distribution networks, the market is expected to grow at a healthy pace. Projections indicate a continued increase in both domestic consumption and export potential.

Key Market Drivers

Urbanization and Changing Lifestyles

Urbanization has led to a shift in lifestyles, with more people opting for convenient and quick meal options. This shift has boosted the demand for bakery products and ready-to-eat cereals.

Health Consciousness and Nutritional Preferences

A growing awareness of health and nutrition has influenced consumer choices. Products that are high in fiber, low in sugar, and fortified with vitamins and minerals are gaining popularity.

Influence of Western Culture

Western culture has had a significant impact on Mexican eating habits. The adoption of breakfast cereals and baked goods, such as pastries and cakes, is a testament to this influence. To gain more information on the Mexico bakery & cereals market forecast, download a free report sample

Consumer Preferences

Popular Bakery Products

In Mexico, traditional bakery products like conchas (sweet rolls), churros, and empanadas remain popular. However, there is also a growing market for Western-style breads and pastries.

Preferred Cereal Types

Mexicans enjoy a variety of cereals, from traditional cornflakes to granola and muesli. There is also a notable demand for cereals tailored to children, featuring vibrant packaging and popular cartoon characters.

Regional Differences in Preferences

Consumer preferences can vary significantly by region. For instance, in the northern states, there is a higher consumption of wheat-based products, while in the south, corn-based products are more prevalent.

Major Market Players

Leading Bakery Brands

Brands like Bimbo, the largest bakery company in the world, dominate the Mexican market. Other notable names include Grupo Bimbo, Wonder, and local artisanal bakeries that cater to niche markets.

Top Cereal Companies

The cereal market is led by multinational companies such as Kellogg's and Nestlé, which offer a wide range of products to suit various tastes and dietary needs.

Market Share Distribution

The market is highly competitive, with a mix of large corporations and small to medium enterprises (SMEs) vying for market share. While big brands dominate, SMEs are carving out niches with unique and high-quality offerings.

Product Innovation and Trends

Health-Oriented Products

There is a growing trend towards health-oriented bakery and cereal products. Whole grain breads, sugar-free pastries, and high-fiber cereals are becoming increasingly popular.

Organic and Gluten-Free Options

Consumers are showing a preference for organic and gluten-free products. This trend is driven by a rise in health awareness and the increasing incidence of gluten intolerance.

Innovative Flavors and Ingredients

Manufacturers are experimenting with new flavors and ingredients to attract consumers. Products infused with exotic fruits, nuts, and seeds are gaining traction.

Distribution Channels

Supermarkets and Hypermarkets

Large retail chains like Walmart, Soriana, and Chedraui are primary distribution channels for bakery and cereal products. These stores offer a wide range of products, from basic staples to premium offerings.

Convenience Stores

Convenience stores, such as OXXO and 7-Eleven, play a crucial role in the distribution of bakery and cereal products, especially in urban areas where quick and easy access is valued.

Online Retail

The rise of e-commerce has opened new avenues for distribution. Online platforms like Amazon and Mercado Libre are becoming popular choices for purchasing bakery and cereal products.

Challenges and Opportunities

Supply Chain Issues

Supply chain disruptions, particularly during the COVID-19 pandemic, have posed significant challenges. However, these disruptions also highlighted the need for more resilient and adaptable supply chains.

Competition from Imported Goods

Imported bakery and cereal products pose a challenge to local manufacturers. However, they also present an opportunity for Mexican brands to innovate and compete on quality and price.

Potential for Market Expansion

There is considerable potential for market expansion, both domestically and internationally. The growing Mexican diaspora and the increasing global interest in Mexican cuisine provide avenues for growth.

Regulatory Environment

Food Safety Regulations

Food safety regulations in Mexico are stringent, ensuring that bakery and cereal products meet high standards. Compliance with these regulations is crucial for market players.

Labeling Requirements

Accurate labeling is essential, particularly for health-oriented and organic products. Clear labeling helps consumers make informed choices and builds trust in brands.

Impact of Government Policies

Government policies, such as subsidies for local farmers and initiatives to promote healthy eating, can significantly impact the bakery and cereals market.

Impact of COVID-19

Changes in Consumer Behavior

The pandemic has led to changes in consumer behavior, with a higher demand for packaged and long-shelf-life products. Home baking also saw a surge, influencing the types of products available in the market.

Impact on Supply Chains

COVID-19 disrupted supply chains, causing delays and shortages. However, it also prompted companies to rethink their supply chain strategies to ensure continuity and resilience.

Recovery and Adaptation Strategies

The market is gradually recovering, with companies adopting new strategies such as diversifying their product lines and enhancing their online presence to adapt to the post-pandemic landscape.

Sustainability in the Bakery and Cereals Market

Eco-Friendly Packaging

Sustainability is a growing concern, and eco-friendly packaging solutions are becoming more common. Companies are exploring biodegradable and recyclable packaging options

0 notes

Text

Emerging Markets in Food Grains Trading - Regions to Watch

Emerging markets in food grains trading are becoming increasingly significant as global economic shifts and demographic changes drive demand growth in diverse regions. One of the key regions to watch is Sub-Saharan Africa, where rapid population growth, urbanization, and changing dietary patterns are fueling increased consumption of food grains. Countries like Nigeria, Ethiopia, and Kenya are experiencing rising middle-class populations with greater purchasing power, driving demand for wheat, rice, maize, and other staple grains. These nations are also investing in agricultural modernization and infrastructure improvements to enhance domestic production capabilities and reduce reliance on imports. South Asia, encompassing countries such as India, Bangladesh, and Pakistan, remains a crucial region for food grains trading due to its large population base and substantial agricultural output. India, in particular, is a major producer and consumer of rice and wheat, with significant implications for global trade dynamics.

Bangladesh and Pakistan are also important players in the rice market, contributing to regional trade flows and international exports. Urbanization and changing dietary preferences towards convenience foods and processed grains are influencing consumption patterns in these countries, presenting opportunities for traders to diversify product offerings and expand market presence. Latin America is emerging as a key region in Rota das Índiasfood grains trading, driven by its vast agricultural resources, favorable climatic conditions, and increasing integration into global trade networks. Countries like Brazil, Argentina, and Mexico are major producers and exporters of soybeans, maize, and other grains, catering to growing demand from Asia and other regions. The region's agricultural productivity, coupled with investments in infrastructure and logistics, enhances its competitiveness in international markets. Moreover, shifting dietary preferences towards protein-rich diets and biofuel production are shaping grains consumption patterns in Latin America, influencing trade dynamics and market opportunities. Southeast Asia is another dynamic region in food grains trading, characterized by its diverse agricultural landscape, growing populations, and expanding urbanization.

Countries such as Indonesia, Thailand, Vietnam, and the Philippines are significant importers of rice and wheat, driven by increasing food consumption and shifting dietary habits. These nations also play crucial roles in global rice markets, with Indonesia and Vietnam being among the largest exporters of rice worldwide. Urbanization and economic growth are driving demand for processed foods and convenience products, creating opportunities for traders to supply value-added grain products tailored to consumer preferences. In conclusion, emerging markets in food grains trading present lucrative opportunities for international traders and stakeholders, driven by demographic changes, urbanization trends, and evolving dietary preferences. Sub-Saharan Africa, South Asia, Latin America, and Southeast Asia are pivotal regions to watch due to their growing populations, expanding middle class, agricultural productivity, and integration into global trade networks. Traders who understand local market dynamics, navigate regulatory landscapes, and forge strategic partnerships can capitalize on these emerging market trends, diversify their portfolios, and sustain growth in the competitive global food grains trading industry.

0 notes