#middlebrow

Text

"Mene, Mene, Tekel, Upharsin" (The Stories of John Cheever)

We are back with Cheever, as confusing as ever

This is a story about a man reading stories and finding them very silly. As the reader, I'm not sure where I'm supposed to land here. Is the guy who comes home to America and starts reading these stories a terrible snob with an overly critical view of literature or are the stories really that bad? I don't know.

The stories don't seem that bad. They seem a little cliche, but I've been reading a lot of cliches in stories, so I don't know. The first passage is a string of bathos strung together that gives the narrator a headache. The next story is a story about a poor man who only realizes that his mother had an affair and he's the son...

Oh. I just googled this one. Ok, so now I have to say that my John Cheever expertise must bow to someone who actually knows that John Cheever is making allusions to Romantic poets and writers. In fact, he's just taking passages word for word and in this story the passages keep getting written on bathroom stalls and in pamphlets left on trains.

The blog that discussed this story hypothesized that this was a joke on the middlebrow audience who didn't get Romantic poetry. More importantly, he's giving the audience Romantic literature but then filtering it through a European who just doesn't get it.

So this guy is reading 19th century literature, written by Europeans, ascribing it to stupid Americans and going back to Europe as a relief from all this garbage.

Ok. It's a little funny. But I didn't get the allusions until I looked them up. Well except for mene mene which is totally Biblical. And alludes to our hero judging society and finding it wanting.

#John Cheever#New Yorker#Tim LIeder#Leigh Hunt#Keats#1963#middlebrow#1960s#Europe#America#Stupid Americans

0 notes

Text

After doing "research" (wikipedia) I have concluded that the "brow" system used to classify culture is nonsense

like maybe it made sense in simpler times but now what is called "lowbrow" would be considered "conservative nonsense" (seriously not even something as simple and for-the-masses as the Marvel Cinematic Universe would count as "lowbrow" by the definition Herbert Gans uses, which Wikipedia cites,) "middlebrow" is crap that people consume to pretend they like high art but also Breaking Bad counts??? (like stuff like that was what I assumed middlebrow meant but calling stuff Breaking Bad midbrow honestly sounds more like an appropriation of the term than what it originally meant, originally it was a pejorative for things that definitely deserve to be criticized? fascists with statue pfps on Twitter are midbrow as fuck) and "highbrow" is shit rich people like (for more information on why im dismissive of the notion of highbrow, please refer to information about how the fine art world is just a bunch of money laundering)

like to me it would seem that anyone who still insists on using the brow system is the people that "middlebrow" was meant to criticize.

and where does anything that seeks to appeal to neither a mass audience nor the intelligentsia fit in? sidebrow?

0 notes

Text

Many men had offered her many things in the past, love and friendship, luxury and jewels, entertainment, dogs, amusements, homage--some she had accepted, some refused, but no man before had offered her work. Peter had offered her that, he had offered her a share of his--not noble or inspiring or fascinating work, just his work, what he had. He had offered it her, called her great energies into play, and set her to work beside himself in a furrow. And she was glad; for some reason she found it very good.

--Desire by Una Lucy Silberrad

#books#jo walton has done it again#almost the only reason i ever look at tor.com these days is to read her monthly roundup of the books she's read#because a good chunk of her reading is the type of classics i love#including a lot of forgotten light classics of the early 20th century#this was one of those#mentioned in a column from last year that i happened to read the other day#with a review that said this should be one of those classics that everyone knows and reads#instead of being this completely forgotten book#and since it happened to be on hoopla (a common perk of these types of book recs from her) i read it#i don't think it's all-time classic great#but it's a solid middlebrow novel#the beginning was a bit of rough going but after the major part of the plot kicked off it become rather lovely#because there was a lot of the above#explorations of the value of work and friendships and relationships#and because of things like the above quote the central relationship is one of my favorite romances of the year#it's a solid relationship built on friendship and mutual respect#with both of them having stories and emotional journeys beyond the romance#reminded me a little bit of gaskell in some ways

65 notes

·

View notes

Text

What tongueless ghost of sin crept through my curtains?

Sailing on a sea of sweat on a stormy night

I think he don't got a name but I can't be certain

And in me he starts to confide

That my family don't seem so familiar

And my enemies all know my name

And if you hear me tap on your window

Yer better get on yer knees and pray panic is on the way

My pulse pumps out a beat to the ghost dancer

My eyes are dead and my throat's like a black hole

And if there's a god would he give another chancer

An hour to sing for his soul

6 notes

·

View notes

Text

This is very funny bc I was definitely sat there in the cinema apathetic as fuck whilst people were sobbing …my homophobic slay ❤️

#These middlebrow British gay period dramas are always so obvious about how they deal w homophobia it’s sometimes hard not to laugh#not a good film!

7 notes

·

View notes

Text

making a film based on Tomine's Shortcomings in 2023 feels like scraping the bottom of the barrel, like this is my Mattel Extended Universe.

#Shortcomings isn't even bad it's that it's a 15 year old middlebrow soap opera comic being brought into a world where everything it does+#+is being done as well or better by like 5 auto fiction novels per financial quarter

0 notes

Text

i don't get the desire to go to one of those restaurants that tries to cater to every basic taste by serving an approximation of famous foods of the world that don't correspond to any history of the place or its migrant population just to the idea that if you serve gyozas and tacos and charcuterie at the same time in a way that's instagramable you can make a bigger profit and open the same restaurant in 5 continents with no changes. like. why would i pay for that

#middlebrow as shit which is the worst thing u can be too. like get real commit to something#and like tbh it's just not as good as lowbrow places which have better food and portions but no ambiance and it's not as good as highbrow#it feels like it's just this aspirational middle class status signaling like yeah i can go to a real restaurant now ->#goes to the most inauthentic place on earth... but it looks money!#honestly drives me up a wall. particularly as my friends start making money like bro dont drag me into the cult of aesthetics over substance#get a kebab with me like someone who understands whats what#personal

1 note

·

View note

Text

Winding Up the Week #309

Winding Up the Week #309

An end of week recap

“Women have waited millions of years growing separate as another species, with visions and priorities no man-words, no man-measurements can comprehend.”

– Kate Braverman

This is a post in which I summarise books read, reviewed and currently on my TBR shelf. In addition to a variety of literary titbits, I look ahead to forthcoming features, see what’s on the nightstand and…

View On WordPress

#DeanStreetDecember#Barbara Pym#Books#Dean Street Press December#Furrowed Middlebrow#Kate Braverman#Reading

0 notes

Text

in light of the atlantic's recent decision to publish a pro-israeli "exposé" of "woke culture run amok at stanford" - written by a literal undergrad (who just happens to be the son of peter baker, the chief white house correspondent for the nyt) and blatantly meant to put a target on the backs of his pro-palestine peers - i highly recommend listening to the aptly titled How The Atlantic Magazine Helps Sell Austerity and War to Middlebrow Liberals episode of the citations needed podcast.

592 notes

·

View notes

Text

A funny thing about the attempt to make Scorsese into one pole of those "highbrow (actually middlebrow) vs. middlebrow (actually lowbrow) art" tastes-great-more-filling stealth advertising things - okay, let's start over, a funny thing about Disney/Marvel directors and Scorsese talking shit on each other is this:

Scorsese views himself mostly as a craftsman, his films primarily as a jobsite, and gets asked questions about movies as part of that (admittedly very weird) job. His admirers see him as a visionary artist, but that's ultimately secondary for him to getting shit like cinematography, casting, direction, etc right - the things a director does, not what they aspire to. This is all over how he talks about other directors, focusing primarily on craft; it's actually pretty rare for him to make blanket statements about such-and-such a genre being artless schlock, the sort of shit you'd hear from someone who is a film critic for a living rather than gladhanding producers for a living.

The Disney/Marvel directors view themselves mostly as artists, their films primarily as a form of self-expression (admittedly under tight limits imposed by the demands of money), and are strongly incentivized to engage in something we might call "counter-criticism" by a mix of ego and studio pressure. Their concerns are at the end of the day artistic concerns, prestige and respect for achieving finished films, which is measurable in part by box office returns and in part by aggregate critical reception - which skews absurdly positive to begin with! But negative reviews by people they can't brush off are something they have an incredibly difficult time tolerating.

This state of affairs is, to put it lightly, incredibly strange. Scorsese is globally admired as a filmmaker with a specific artistic vision, but his vocabulary and concerns in embodying that vision are technical. The various directors of Disney/Marvel films are a revolving door of hired hands who have, exercise, and seemingly desire close to zero creative control over their most noteworthy work - and yet their concerns are artistic.

This is a dialogue that takes place on a smaller scale in many forms of art; it's extremely commonplace for artists with outsized industrial-scale success (and let us diplomatically say significantly compromised fidelity to their stated desires as artists) to wear the brittle persona of a misunderstood visionary, and for the actual visionaries who have achieved some notoriety (and the nobodies who live in their shadow) to have primarily technical and economistic concerns, and for these two groups to frequently butt heads while talking completely past each other. Something something Walter Benjamin, I guess!

1K notes

·

View notes

Text

The long, bloody lineage of private equity's looting

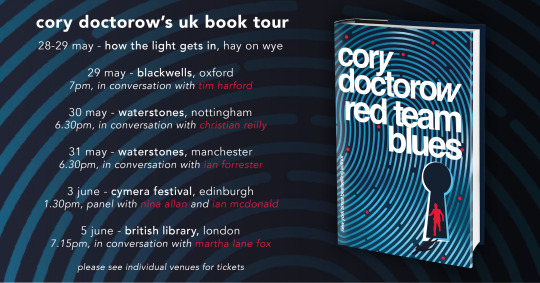

Tomorrow (June 3) at 1:30PM, I’m in Edinburgh for the Cymera Festival on a panel with Nina Allen and Ian McDonald.

Monday (June 5) at 7:15PM, I’m in London at the British Library with my novel Red Team Blues, hosted by Baroness Martha Lane Fox.

Fans of the Sopranos will remember the “bust out” as a mob tactic in which a business is taken over, loaded up with debt, and driven into the ground, wrecking the lives of the business’s workers, customers and suppliers. When the mafia does this, we call it a bust out; when Wall Street does it, we call it “private equity.”

It used to be that we rarely heard about private equity, but then, as national chains and iconic companies started to vanish, this mysterious financial arrangement popped up with increasing frequency. When a finance bro’s presentation on why Olive Garden needed to be re-orged when viral, there was a lot off snickering about the decline of a tacky business whose value prop was unlimited carbs. But the bro was working for Starboard Value, a hedge fund that specialized in buhying out and killing off companies, pocketing billions while destroying profitable businesses.

https://www.salon.com/2014/09/17/the_real_olive_garden_scandal_why_greedy_hedge_funders_suddenly_care_so_much_about_breadsticks/

Starboard Value’s game was straightforward: buy a business, load it with debt, sell off its physical plant — the buildings it did business out of — pay itself, and then have the business lease back the buildings, bleeding out money until it collapsed. They pulled it with Red Lobster,and the point of the viral Olive Garden dis track was to soften up the company for its own bust out.

The bust out tactic wasn’t limited to mocking middlebrow family restaurants. For years, the crooks who ran these ops did a brisk trade in blaming the internet. Why did Sears tank? Everyone knows that the 19th century business was an antique, incapable of mounting a challenge in the age of e-commerce. That was a great smokescreen for an old-fashioned bust out that saw corporate looters make off with hundreds of millions, leaving behind empty storefronts and emptier pension accounts for the workers who built the wealth the looters stole:

https://prospect.org/economy/vulture-capitalism-killed-sears/

Same goes for Toys R Us: it wasn’t Amazon that killed the iconic toy retailer — it was the PE bosses who extracted $200m from the chain, then walked away, hands in pockets and whistling, while the businesses collapsed and the workers got zero severance:

https://www.washingtonpost.com/news/business/wp/2018/06/01/how-can-they-walk-away-with-millions-and-leave-workers-with-zero-toys-r-us-workers-say-they-deserve-severance/

It’s a good racket — for the racketeers. Private equity has grown from a finance sideshow to Wall Street’s apex predator, and it’s devouring the real economy through a string of audactious bust outs, each more consequential and depraved than the last.

As PE shows that it can turn profitable businesses gigantic windfalls, sticking the rest of us with the job of sorting out the smoking craters they leave behind, more and more investors are piling in. Today, the PE sector loves a rollup, which is when they buy several related businesses and merge them into one firm. The nominal business-case for a rollup is that the new, bigger firm is more “efficient.” In reality, a rollup’s strength is in eliminating competition. When all the pet groomers, or funeral homes, or urgent care clinics for ten miles share the same owner, they can raise prices, lower wages, and fuck over suppliers.

They can also borrow. A quirk of the credit markets is that a standalone small business is valued at about 3–5x its annual revenues. But if that business is part of a large firm, it is valued at 10–20x annual turnover. That means that when a private equity company rolls up a comedy club, ad agency or water bottler (all businesses presently experiencing PE rollup), with $1m in annual revenues, it shows up on the PE company’s balance sheet as an asset worth $10–20m. That’s $10–20m worth of collateral the PE fund can stake for loans that let it buy and roll up more small businesses.

2.9 million Boomer-owned businesses, employing 32m people, are expected to sell in the next couple years as their owners retire. Most of these businesses will sell to PE firms, who can afford to pay more for them as a prelude to a bust out than anyone intending to operate them as a productive business could ever pay:

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

PE’s most ghastly impact is felt in the health care sector. Whole towns’ worth of emergency rooms, family practices, labs and other health firms have been scooped up by PE, which has spent more than $1t since 2012 on health acquisitions:

https://pluralistic.net/2022/11/17/the-doctor-will-fleece-you-now/#pe-in-full-effect

Once a health care company is owned by PE, it is significantly more likely to commit medicare fraud. It also cuts wages and staffing for doctors and nurses. PE-owned facilities do more unnecessary and often dangerous procedures. Appointments get shorter. The companies get embroiled in kickback scandals. PE-backed dentists hack away at children’s mouths, filling them full of root-canals.

https://pluralistic.net/2022/11/17/the-doctor-will-fleece-you-now/#pe-in-full-effect

The Healthcare Private Equity Association boasts that its members are poised to spend more than $3t to create “the future of healthcare.”

https://hcpea.org/#!event-list

As bad as PE is for healthcare, it’s worse for long-term care. PE-owned nursing homes are charnel houses, and there’s a particularly nasty PE scam where elderly patients are tricked into signing up for palliative care, which is never delivered (and isn’t needed, because the patients aren’t dying!). These fake “hospices” get huge payouts from medicare — and the patient is made permanently ineligible for future medicare, because they are recorded being in their final decline:

https://pluralistic.net/2023/04/26/death-panels/#what-the-heck-is-going-on-with-CMS

Every part of the health care sector is being busted out by PE. Another ugly PE trick, the “club deal,” is devouring the medical supply business. Club deals were huge in the 2000s, destroying rent-controlled housing, energy companies, Mervyn’s department stores, Harrah’s, and Old Country Joe. Now it’s doing the same to medical supplies:

https://pluralistic.net/2021/05/14/billionaire-class-solidarity/#club-deals

Private equity is behind the mass rollup of single-family homes across America. Wall Street landlords are the worst landlords in America, who load up your rent with junk fees, leave your home in a state of dangerous disrepair, and evict you at the drop of a hat:

https://pluralistic.net/2021/08/16/die-miete-ist-zu-hoch/#assets-v-human-rights

As these houses decay through neglect, private equity makes a bundle from tenants and even more borrowing against the houses. In a few short years, much of America’s desperately undersupplied housing stock will be beyond repair. It’s a bust out.

You know all those exploding trains filled with dangerous chemicals that poison entire towns? Private equity bust outs:

https://pluralistic.net/2022/02/04/up-your-nose/#rail-barons

Where did PE come from? How can these people look themselves in the mirror? Why do we let them get away with it? How do we stop them?

Today in The American Prospect, Maureen Tkacik reviews two new books that try to answer all four of these questions, but really only manage to answer the first three:

https://prospect.org/culture/books/2023-06-02-days-of-plunder-morgenson-rosner-ballou-review/

The first of these books is These Are the Plunderers: How Private Equity Runs — and Wrecks — America by Gretchen Morgenson and Joshua Rosner:

https://www.simonandschuster.com/books/These-Are-the-Plunderers/Gretchen-Morgenson/9781982191283

The second is Plunder: Private Equity’s Plan to Pillage America, by Brendan Ballou:

https://www.hachettebookgroup.com/titles/brendan-ballou/plunder/9781541702103/

Both books describe the bust out from the inside. For example, PetSmart — looted for $30 billion by RaymondSvider and his PE fund BC Partners — is a slaughterhouse for animals. The company systematically neglects animals — failing to pay workers to come in and feed them, say, or refusing to provide backup power to run during power outages, letting animals freeze or roast to death. Though PetSmart has its own vet clinics, the company doesn’t want to pay its vets to nurse the animals it damages, so it denies them care. But the company is also too cheap to euthanize those animals, so it lets them starve to death. PetSmart is also too cheap to cremate the animals, so its traumatized staff are ordered to smuggle the dead, rotting animals into random dumpsters.

All this happened while PetSmart’s sales increased by 60%, matched by growth in the company’s gross margins. All that money went to the bust out.

https://www.forbes.com/sites/antoinegara/2021/09/27/the-30-billion-kitty-meet-the-investor-who-made-a-fortune-on-pet-food/

Tkacik says these books show that we’re finally getting wise to PE. Back in the Clinton years, the PE critique painted the perps as sharp operators who reduced quality and jacked up prices. Today, books like these paint these “investors” as the monsters they are — crooks whose bust ups are crimes, not clever finance hacks.

Take the Carlyle Group, which pioneered nursing home rollups. As Carlyle slashed wages, its workers suffered — but its elderly patients suffered more. Thousands of Carlyle “customers” died of “dehydration, gangrenous bedsores, and preventable falls” in the pre-covid years.

https://www.washingtonpost.com/business/economy/opioid-overdoses-bedsores-and-broken-bones-what-happened-when-a-private-equity-firm-sought-profits-in-caring-for-societys-most-vulnerable/2018/11/25/09089a4a-ed14-11e8-baac-2a674e91502b_story.html

KKR, another PE monster, bought a second-hand chain of homes for mentally disabled adults from another PE company, then squeezed it for the last drops of blood left in the corpse. KKR cut wages to $8/hour and increased shifts to 36 hours, then threatened to have workers who went home early arrested and charged with “patient abandonment.” Many of these homes were often left with no staff at all, with patients left to starve and stew in their own waste.

PE loves to pick on people who can’t fight back: kids, sick people, disabled people, old people. No surprise, then, that PE loves prisons — the ultimate captive audience. HIG Capital is a $55b fund that owns TKC Holdings, who got the contract to feed the prisoners at 400 institutions. They got the contract after the prisons fired Aramark, owned by PE giant Warburg Pincus, whose food was so inedible that it provoked riots. TKC got a million bucks extra to take over the food at Michigan’s Kinross Correctional Facility, then, incredibly, made the food worse. A chef who refused to serve 100 bags of rotten potatoes (“the most disgusting thing I’ve seen in my life”) was fired:

https://www.wzzm13.com/article/news/local/michigan/prison-food-worker-i-was-fired-for-refusing-to-serve-rotten-potatoes/69-467297770

TKC doesn’t just operate prison kitchens — it operates prison commissaries, where it gouges prisoners on junk food to replace the inedible slop it serves in the cafeteria. The prisoners buy this food with money they make working in the prison workshops, for $0.10–0.25/hour. Those workshops are also run by TKC.

Tkacic traces private equity back to the “corporate raiders” of the 1950s and 1960s, who “stealthily borrowed money to buy up enough shares in a small or midsized company to control its biggest bloc of votes, then force a stock swap and install himself as CEO.”

The most famous of these raiders was Eli Black, who took over United Fruit with this gambit — a company that had a long association with the CIA, who had obligingly toppled democratically elected governments and installed dictators friendly to United’s interests (this is where the term “banana republic” comes from).

Eli Black’s son is Leon Black, a notorious PE predator. Leon Black got his start working for the junk-bonds kingpin Michael Milken, optimizing Milken’s operation, which was the most terrifying bust out machine of its day, buying, debt-loading and wrecking a string of beloved American businesses. Milken bought 2,000 companies and put 200 of them through bankruptcy, leaving the survivors in a brittle, weakened state.

It got so bad that the Business Roundtable complained about the practice to Congress, calling Milken, Black, et al, “a small group is systematically extracting the equity from corporations and replacing it with debt, and incidentally accumulating major wealth.”

Black stabbed Milken in the back and tanked his business, then set out on his own. Among the businesses he destroyed was Samsonite, “a bankrupt-but-healthy company he subjected to 12 humiliating years of repeated fee extractions, debt-funded dividend payments, brutal plant closings, and hideous schemes to induce employees to buy its worthless stock.”

The money to buy Samsonite — and many other businesses — came through a shadowy deal between Black and John Garamendi, then a California insurance commissioner, now a California congressman. Garamendi helped Black buy a $6b portfolio of junk bonds from an insurance company in a wildly shady deal. Garamendi wrote down the bonds by $3.9b, stealing money “from innocent people who needed the money to pay for loved ones’ funerals, irreparable injuries, etc.”

Black ended up getting all kinds of favors from powerful politicians — including former Connecticut governor John Rowland and Donald Trump. He also wired $188m to Jeffrey Epstein for reasons that remain opaque.

Black’s shady deals are a marked contrast with the exalted political circles he travels in. Despite private equity’s obviously shady conduct, it is the preferred partner for cities and states, who buy everything from ambulance services to infrastructure from PE-owned companies, with disastrous results. Federal agencies turn a blind eye to their ripoffs, or even abet them. 38 state houses passed legislation immunizing nursing homes from liability during the start of the covid crisis.

PE barons are shameless about presenting themselves as upstanding cits, unfairly maligned. When Obama made an empty promise to tax billionaires in 2010, Blackstone founder SteveS chwarzman declared, “It’s a war. It’s like when Hitler invaded Poland in 1939.”

Since we’re on the subject of Hitler, this is a good spot to bring up Monowitz, a private-sector satellite of Auschwitz operated by IG Farben as a slave labor camp to make rubber and other materiel it supplied at a substantial markup to the wermacht. I’d never heard of Monowitz, but Tkacik’s description of the camp is chilling, even in comparison to Auschwitz itself.

Farben used slave laborers from Auschwitz to work at its rubber plant, but was frustrated by the logistics of moving those slaves down the 4.5m stretch of road to the facility. So the company bought 25,000 slaves — preferring children, who were cheaper — and installed them in a co-located death-camp called Monowitz:

https://www.commentary.org/articles/r-tannenbaum/the-devils-chemists-by-josiah-e-dubois-jr/

Monowitz was — incredibly — worse than Auschwitz. It was so bad, the SS guards who worked at it complained to Berlin about the conditions. The SS demanded more hospitals for the workers who dropped from beatings and overwork — Farben refused, citing the cost. The factory never produced a steady supply of rubber, but thanks to its gouging and the brutal treatment of its slaves, the camp was still profitable and returned large dividends to Farben’s investors.

Apologists for slavery sometimes claim that slavers are at least incentivized to maintain the health of their captive workforce. This was definitely not true of Farben. Monowitz slaves died on average after three months in the camp. And Farben’s subsidiary, Degesch, made the special Zyklon B formulation used in Auschwitz’s gas chambers.

Tkacik’s point is that the Nazis killed for ideology and were unimaginably cruel. Farben killed for money — and they were even worse. The banality of evil gets even more banal when it’s done in service to maximizing shareholder value.

As Farben historian Joseph Borkin wrote, the company “reduced slave labor to a consumable raw material, a human ore from which the mineral of life was systematically extracted”:

https://www.scribd.com/document/517797736/The-Crime-and-Punishment-of-I-G-Farben

Farben’s connection to the Nazis was a the subject of Germany’s Master Plan: The Story of Industrial Offensive, a 1943 bestseller by Borkin, who was also an antitrust lawyer. It described how Farben had manipulated global commodities markets in order to create shortages that “guaranteed Hitler’s early victories.”

Master Plan became a rallying point in the movement to shatter corporate power. But large US firms like Dow Chemical and Standard Oil waged war on the book, demanding that it be retracted. Borkin was forced into resignation and obscurity in 1945.

Meanwhile, in Nuremberg, 24 Farben executives were tried for their war crimes, and they cited their obligations to their shareholders in their defense. All but five were acquitted on this basis.

Seen in that light, the plunderers of today’s PE firms are part of a long and dishonorable tradition, one that puts profit ahead of every other priority or consideration. It’s a defense that wowed the judges at Nuremberg, so should we be surprised that it still plays in 2023?

Tkacik is frustrated that neither of these books have much to offer by way of solutions, but she understands why that would be. After all, if we can’t even close the carried interest tax loophole, how can we hope to do anything meaningful?

“Carried interest” comes up in every election cycle. Most of us assume it has something to do with “interest payments,” but that’s not true. The carried interest loophole relates to the “interest” that 16th-century sea captains had in their cargo. It’s a 600-year-old tax loophole that private equity bosses use to pay little or no tax on their billions. The fact that it’s still on the books tells you everything you need to know about whether our political class wants to do anything about PE’s plundering.

Notwithstanding Tkacik’s (entirely justified) skepticism of the weaksauce remedies proposed in these books, there is some hope of meaningful action. Private equity’s rollups are only possible because they skate under the $101m threshold for merger scrutiny. However, there is good — but unenforced — law that allows antitrust enforcers to block these mergers. This is the “incipiency standard” — Sec 7 of the Clayton Act — the idea that a relatively small merger might not be big enough to trigger enforcement action on its own, but regulators can still act to block it if it creates an incipient monopoly.

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

The US has a new crop of aggressive — fearless — top antitrust enforcers and they’ve been systematically reviving these old laws to go after monopolies.

That’s long overdue. Markets are machines for eroding our moral values: “In comparison to non-market decisions, moral standards are significantly lower if people participate in markets.”

https://web.archive.org/web/20130607154129/https://www.uni-bonn.de/Press-releases/markets-erode-moral-values

The crimes that monsters commit in the name of ideology pale in comparison to the crimes the wealthy commit for money.

Catch me on tour with Red Team Blues in Edinburgh, London, and Berlin!

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/06/02/plunderers/#farbenizers

[Image ID: An overgrown graveyard, rendered in silver nitrate monochrome. A green-tinted businessman with a moneybag in place of a head looms up from behind a gravestone. The right side of the image is spattered in blood.]

#pluralistic#kkr#lootersprivate equity#plunderers#books#reviews#monsters#nazis#godwin's law#godwins law#auschwitz#ig farben#pe#business#barbarians#united fruit#carried interest#corporate raiders#junk bonds#michael milliken#ensemble cast#carlyle group#monowitz#leon black

1K notes

·

View notes

Text

"Who's that girl" DWM 268 (1998)

So, who would have played the Doctor if she'd been a woman from the first? DWM rounds up the likely ladies …

Hermione Baddeley 1963-66

Renowned for unsympathetic roles in both Brighton Rock and the dour 'kitchen sink'-styled Room at the Top, film veteran Baddeley made an enthralling Doctor - part dragon, part slightly dotty maiden aunt. Eternal juvenile Melvyn Hayes was 'unearthly' grandson Stephen

Vivian Pickles 1966-69

Although much younger, and never a lead, the versatile Pickles had been a familiar TV face for 20 years (Harpers West One, etc) before being cast as Baddeley's successor. Her sprightly, elfin Doctor had a penchant for dressing-up, like a St Trinian's tomboy who never left school

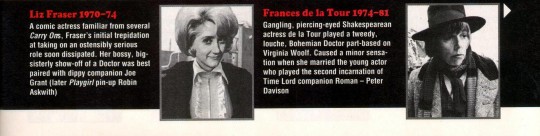

Liz Fraser 1970-74

A comic actress familiar from several Carry Ons, Fraser's initial trepidation at taking on an ostensibly serious role soon dissipated. Her bossy, big-sisterly show-off of a Doctor was best paired with dippy companion Joe Grant (later Playgirl pin-up Robin Askwith)

Frances de la Tour 1974-81

Gangling, piercing-eyed Shakespearean actress de la Tour played a tweedy, louche, Bohemian Doctor part-based on Virginia Woolf. Caused a minor sensation when she married the young actor who played the second incarnation of Time Lord companion Roman — Peter Davison

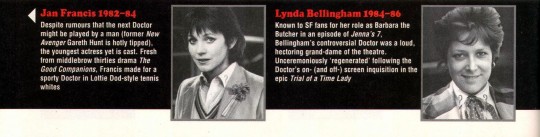

Jan Francis 1982-84

Despite rumours that the next Doctor might be played by a man (former New Avenger Gareth Hunt is hotly tipped), the youngest actress yet is cast. Fresh from middlebrow thirties drama The Good Companions, Francis made for a sporty Doctor in Lottie Dod-style tennis whites

Lynda Bellingham 1984-86

Known to SF fans for her role as Barbara the Butcher in an episode of Jenna's 7, Bellingham's controversial Doctor was a loud, hectoring grand-dame of the theatre. Unceremoniously 'regenerated' following the Doctor's on- (and off-) screen inquisition in the epic Trial of a Time Lady

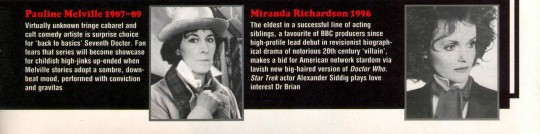

Pauline Melville 1987-89

Virtually unknown fringe cabaret and cult comedy artiste is surprise choice for 'back to basics' Seventh Doctor. Fan fears that series will become showcase for childish high-jinks up-ended when Melville stories adopt a sombre, down-beat mood, performed with conviction and gravitas

Miranda Richardson 1996

The eldest in a successful line of acting siblings, a favourite of BBC producers since high-profile lead debut in revisionist biographical drama of notorious 20th century 'villain', makes a bid for American network stardom via lavish new big-haired version of Doctor Who. Star Trek actor Alexander Siddig plays love interest Dr Brian

#doctor who#classic doctor who#8th doctor#7th doctor#6th doctor#5th doctor#4th doctor#3rd doctor#2nd doctor#1st doctor#Miranda Richardson#Pauline Melville#Lynda Bellingham#Jan Francis#Frances de la Tour#Liz Fraser#Vivian Pickles#Hermione Baddeley

111 notes

·

View notes

Text

“Today, bookstores in the United States are filled with shabby screeds bearing screaming headlines about Islam and terror, Islam exposed, the Arab threat, and the Muslim menace, all of them written by political polemicists pretending to knowledge imparted to them and others by experts who have supposedly penetrated to the heart of these strange Oriental peoples over there who have been such a terrible thorn in “our” flesh. Accompanying such warmongering expertise have been the omnipresent CNNs and Fox News Channels of this world, plus myriad numbers of evangelical and right-wing radio hosts, plus innumerable tabloids and even middlebrow journals, all of them recycling the same unverifiable fictions and vast generalizations so as to stir up “America” against the foreign devil.”

-Edward Said's Orientalism, page xx, the preface of the 25th anniversary edition. Vintage Books.

35 notes

·

View notes

Text

Hypothesis: the reason "yuri experts" have the most middlebrow tastes you can imagine is that by defining "yuri" in advance, they understand the quality of yuri-ness as being about conforming to their prescriptive definition.

Thus, something which moves outside of the genre boundaries is under their radar or dismissed, unless it becomes enough of a trend to force a redefinition of the genre by expansion, at which point their tastes probably settle on a mid second- or third-generation copy.

#barely anybody talks about gunsmith cats as a yuri series despite open lesbianism being central to its plot after a while#people accept murciélago to a limited extent because yoshimurakana parodies extant yuri#and nobody even mentions suna no bara

129 notes

·

View notes

Text

Watching the zoomers get into House MD is honestly so thrilling for me. I’m so happy for you guys. 2000-2009 was such a solid decade for middlebrow television. You’re gonna have a great time.

149 notes

·

View notes

Text

my ability to critique art is very highly developed but my tastes are middlebrow at best

14 notes

·

View notes