#mortgage tips 2023

Text

Understanding the VA Loan Application: What You Need to Know

in the word count

Understanding the VA Loan Application: What You Need to Know

The VA loan application process can be intimidating for many veterans and military personnel. It is important to understand the process and the requirements in order to make the most of the benefits available to you. This article will provide an overview of the VA loan application process and what you need to know in…

View On WordPress

#Application#best Mortgage Tips#Loan#Mortgage#Mortgage Tips#mortgage tips 2023#mortgage tips canada#mortgage types#news Mortgage#Understanding#va loan application#va loan arizona

0 notes

Text

What Does The Real Estate Market Look Like Currently?

As we dive into the third quarter of 2023, it’s a perfect moment to reflect on the housing market’s journey so far this year and project what lies ahead. The real estate landscape has been marked by some notable shifts, and understanding these trends can help both homebuyers and sellers make informed decisions in the coming months.

The second quarter of the year saw a significant rise in…

View On WordPress

#2023#Buying#Guide#Home#Homebuyer#Housing#Investment#Market#marketing#Mortgage#Real Estate#Selling#Shawn Boday#Staging#tips

3 notes

·

View notes

Text

mortgage broker sydney

#successful mortgage refinance#cash-out refinance#cash out refinance australia#mortgage refinance#mortgage refinance cashback#refinancing home loan rates australia#best refinance home loan australia#Refinance Home Loans: Tips for 2023#Remortgage Australia

0 notes

Text

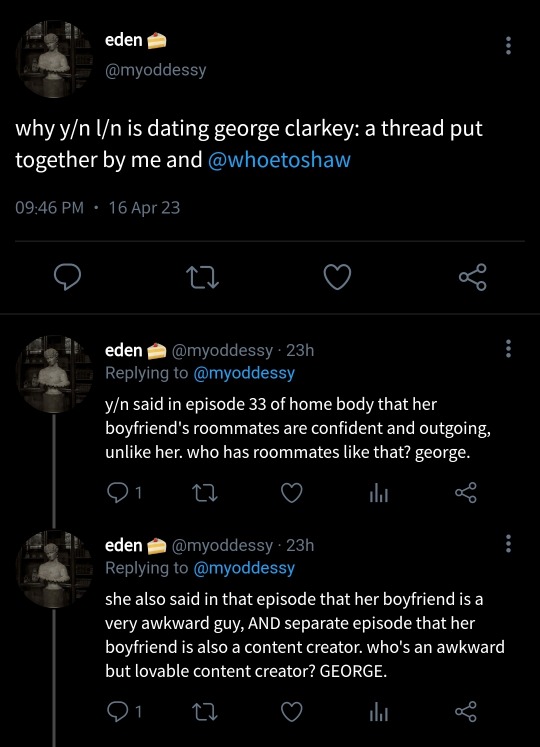

soft launches are out?? | george clarkey

summary— where a household name of uk youtube meets an awkward comedian through a mutual friend and chaos ensues (bruna marquezine fc!)

December 2022

January 2023

liked by bambinobecky, calfreezy, taliamar, and 1,982,372 others

yourusername the 2022 cosmetic year-in review is out! i talk you through my makeup and skincare routines with my new holy grails as well as covering some products i'd recommend staying away from! 💞

wroetoshaw cheers, I'll keep the skincare tips in mind

yourusername you need it

wroetoshaw never contact me again

yourusername gladly ❤️

yn2sfan ship!!

ynslover disgusting.

faithlouisak best part of the year 💕💕

gkbarry amazing as always babes 😘

yourusername ❤

ynfanpage you look so pretty omg 😭

w2sdmn the fact that you used actually affordable products instead of smth that costs half a mortgage >>>

March 2023

liked by arthurtv, imalexx, freyanightingale, and 2,001,283 others

yourusername in honour of the first travel diaries episode in a year, have a little ibiza and madrid dump 💞

gkbarry my tan's fading already. criminal.

yourusername i'll take you back soon xx

gkbarry love u, sugar mummy ❤

max_balegde i feel like i'm intruding.....

gkbarry you are.

max_balegde you should all follow me after you watch this (pin this)

max_balegde i feel wounded and ignored.

ynsbabygirl OMG MORE SOFT LAUNCH CONTENT

ynily the height difference im inconsolable

wroetominter alexa play that should be me by justin bieber

yourusername just posted a story !

liked by myoddessy, lewisbuchan, taliamar, and 2,301,720 others

yourusername was nobody gonna tell me soft launches are out??

tagged: georgeclarkeey

georgeclarkeey ❤❤

imallexx thank god, it was getting a bit boring

yourusername hush

imallexx don't take away my rights

myoddessy @whoetoshaw OMG????

whoetoshaw WE CALLED IT.

ynxclarkeyy OMG PARENTS FR

#george clarkeey#george clarke#george clarkey#george clarkey x reader#george clarkey x y/n#george clarkey x you#george clarkey imagine#george clarkey fic#youbute x reader#youtuber x reader#imallexx#gkbarry#max balegde#lewis buchan#arthurtv

646 notes

·

View notes

Text

Sunday, June 25, 2023

The World’s Empty Office Buildings Have Become a Debt Time Bomb

(Bloomberg) In New York and London, owners of gleaming office towers are walking away from their debt rather than pouring good money after bad. The landlords of downtown San Francisco’s largest mall have abandoned it. A new Hong Kong skyscraper is only a quarter leased. The creeping rot inside commercial real estate is like a dark seam running through the global economy. Even as stock markets rally and investors are hopeful that the fastest interest-rate increases in a generation will ebb, the trouble in property is set to play out for years. After a long buying binge fueled by cheap debt, owners and lenders are grappling with changes in how and where people work, shop and live in the wake of the pandemic. At the same time, higher interest rates are making it more expensive to buy or refinance buildings. A tipping point is coming: In the US alone, about $1.4 trillion of commercial real estate loans are due this year and next, according to the Mortgage Bankers Association. When the deadline arrives, owners facing large principal payments may prefer to default instead of borrowing again to pay the bill.

Inflation, health costs, partisan cooperation among the nation’s top problems

(Pew Research Center) Inflation remains the top concern for Republicans in the U.S., with 77% saying it’s a very big problem. Gun violence is the top issue for Democrats: 81% rank it as a very big problem. When it comes to policy, more Americans agree with the Republican Party than the Democratic Party on the economy, crime and immigration, while the Democratic Party holds the edge on abortion, health care and climate change.

The Brown Bag Lady serves meals and dignity to L.A.’s homeless

(USA Today) A Los Angeles woman, known affectionately as the Brown Bag Lady, is serving the city’s unhoused population with enticing meals and a sprinkle of inspiration for dessert. Jacqueline Norvell started cooking meals for people on L.A.’s Skid Row about 10 years ago in her two-bedroom apartment after getting some extra money from her Christmas pay check. She bought several turkeys and prepared all the fixings for about 70 people, driving to one of L.A.’s most high-risk areas to hand out the meals. “We just parked on a corner,” said Norvell. “And we were swarmed.” She says people were grateful and she realized the significant demand. Norvell’s been cooking tasty creations ever since. Norvell garnishes each dish with love and some words of encouragement. In addition to the nourishment, each bag or box has an inspirational quote. “We’ve got to help each other out,” she said. “We have to.”

Facing Brutal Heat, the Texas Electric Grid Has an Ally: Solar Power

(NYT) Strafed by powerful storms and superheated by a dome of hot air, Texas has been enduring a dangerous early heat wave this week that has broken temperature records and strained the state’s independent power grid. But the lights and air conditioning have stayed on across the state, in large part because of an unlikely new reality in the nation’s premier oil and gas state: Texas is fast becoming a leader in solar power. The amount of solar energy generated in Texas has doubled since the start of last year. And it is set to roughly double again by the end of next year, according to data from the Electric Reliability Council of Texas. “Solar is producing 15 percent of total energy right now,” Joshua Rhodes, a research scientist at the University of Texas at Austin, said on a sweltering day in the state capital last week, when a larger-than-usual share of power was coming from the sun. So far this year, about 7 percent of the electric power used in Texas has come from solar, and 31 percent from wind. The state’s increasing reliance on renewable energy has caused some Texas lawmakers, mindful of the reliable production and revenues from oil and gas, to worry. “It’s definitely ruffling some feathers,” Dr. Rhodes said.

Guatemalans are fed up with corruption ahead of an election that may draw many protest votes

(AP) As Guatemala prepares to elect a new president Sunday, its citizens are fed up with government corruption, on edge about crime and struggling with poverty and malnutrition—all of which drives tens of thousands out of the country each year. And for many disillusioned voters—especially those who supported three candidates who were blocked from running this year—the leading contenders at the close of campaigning Friday seem like the least likely to drive the needed changes. Guatemala’s problems are not new or unusual for the region, but their persistence is generating voter frustration. As many as 13% of eligible voters plan to cast null votes Sunday, according to a poll published by the Prensa Libre newspaper. Some of voters’ cynicism could be the result of years of unfulfilled promises and what has been seen as a weakening of democratic institutions. “The levels of democracy fell substantially, so the (next) president is going to inherit a country whose institutions are quite damaged,” said Lucas Perelló, a political scientist at Marist College in New York and expert on Central America. “We see high levels of corruption and not necessarily the political will to confront or reduce those levels.”

Chile official warns of ‘worst front in a decade’ after floods, evacuations

(Reuters) Days of heavy rainfall have swollen Chile’s rivers causing floods that blocked off roads and prompted evacuation in the center of the country, amid what has been described as the worst weather front in a decade. The flooding has led authorities to declare a “red alert” and order preventive evacuations in various towns in the south of Santiago. “This is the worst weather front we have had in 10 years,” Santiago metropolitan area governor Claudio Orego said.

Crisis in Russia

(NYT/AP) A long-running feud over the invasion of Ukraine between the Russian military and Yevgeny Prigozhin, the head of Russia’s private Wagner military group, escalated into an open confrontation. Prigozhin accused Russia of attacking his soldiers and appeared to challenge one of President Vladimir Putin’s main justifications for the war, and Russian generals in turn accused him of trying to mount a coup against Putin. Prighozin claimed he had control of Russia’s southern military headquarters in the city of Rostov-on-Don, near the front lines of the war in Ukraine where his fighters had been operating. Video showed him entering the headquarters’ courtyard. Signs of active fighting were also visible near the western Russian city of Voronezh, and convoys of Wagner troops were spotted heading toward Moscow. The Russian military scrambled to defend Russia’s capital. Then the greatest challenge to Russian President Vladimir Putin in his more than two decades in power fizzled out after Prigozhin abruptly reached a deal with the Kremlin to go into exile and sounded the retreat. Under the deal announced Saturday by Kremlin spokesman Dmitry Peskov, Prigozhin will go to neighboring Belarus. Charges against him of mounting an armed rebellion will be dropped. The government also said it would not prosecute Wagner fighters who took part, while those who did not join in were to be offered contracts by the Defense Ministry. Prigozhin ordered his troops back to their field camps in Ukraine, where they have been fighting alongside Russian regular soldiers.

In Myanmar, Birthday Wishes for Aung San Suu Kyi Lead to a Wave of Arrests

(NYT) In military-ruled Myanmar, there seemed to be a new criminal offense this week: wearing a flower in one’s hair on June 19. Pro-democracy activists say more than 130 people, most of them women, have been arrested for participating in a “flower strike” marking the birthday of Daw Aung San Suu Kyi, the civilian leader who was ousted by Myanmar’s military in a February 2021 coup. Imprisoned by the junta since then, she turned 78 on Monday. The protest—a clear, if unspoken, rebuke of the junta—drew nationwide support, and many shops were reported to have sold all their flowers. Most of the arrests occurred on Monday, but they continued through the week as the military tracked down participants and supporters. In some cities and towns, soldiers seized women in the streets for holding a flower or wearing one in their hair. Some were beaten, witnesses said. The police have also been rounding up people who took to Facebook to post a birthday greeting or a photo of themselves with a flower. Phil Robertson, the deputy Asia director for Human Rights Watch, called the campaign the latest example of the “paranoia and intolerance” of Myanmar’s military rulers.

Sweltering Beijingers turn to bean soup and cushion fans to combat heat

(Washington Post) China’s national weather forecaster issued an unconventional outlook this week: “Hot, really hot, extremely hot [melting smiley face],” it wrote Tuesday night on Weibo, China’s answer to Twitter. It was imprecise, but it wasn’t wrong. The temperature in Beijing hit 106 degrees Fahrenheit on Thursday, a public holiday for the Dragon Boat Festival. It was the highest June recording since 1961. Visiting the Great Wall was “like being in an oven,” said Lin Yun-chan, a Taiwanese graduate student on her first trip to Beijing. The heat wave is almost the only thing anyone can talk about. Much of the online discussion revolves around food. People are sharing advice about the most hydrating snacks for the hot weather: mung bean soup and sour plum drink are popular options. Entrepreneurs looked for ways to capitalize on the heat wave: One promoted a seat-cushion fan designed to combat a sweaty butt, while tourism companies touted trips to the south of the country, which is usually hotter but currently less so.

Your next medical treatment could be a healthier diet

(WSJ) Food and insurance companies are exploring ways to link health coverage to diets, increasingly positioning food as a preventive measure to protect human health and treat disease. Insurance companies and startups are developing meals tailored to help treat existing medical conditions, industry executives said, while promoting nutritious diets as a way to help ward off diet-related disease and health problems. “We know that for adults, around 45% of those who die from heart disease, Type 2 diabetes, stroke, that poor nutrition is a major contributing factor,” said Gail Boudreaux, chief executive of insurance provider Elevance Health speaking at The Wall Street Journal Global Food Forum. “Healthy food is a real opportunity.”

2 notes

·

View notes

Text

Jones Building Co In Las Cruces, Nm Custom Home Builder

These Las Cruces builders have a ardour for high quality construction, and have 46 new homes obtainable for sale in 14 Las Cruces communities. By taking what was started by our revolutionary and pioneering Past Presidents, we have a chance to change the face of the construction business right here in Southern New Mexico. In addition to that, we now have the ability home builders in las cruces to truly change peoples lives in our neighborhood. Every KT Home has been thoughtfully built to be environment friendly, comfortable, and useful for your way of life. We offer a big selection of choices, options, and facilities all designed to fulfill your style and budget wants.

High levels of employment and low unemployment rates are most likely to lead to more healthy housing markets. The age distribution of a inhabitants paints an important image of future home shopping for tendencies. Provides a trending view for pricing year-over-year available in the market.

Finding a pre-existing home that fits your distinctive necessities is very unlikely. When constructing a custom home, you have the option to design one that suits your needs. Whether you need more space new homes las cruces in the living room or make your master bedroom more spacious, a custom room sorts it out for you. We additionally maintain a wonderful status for our customer service.

We work closely with our clients to create their uniquely envisioned home and produce it to life effectively and effectively. Second, homeowners could be tempted to turn into landlords, wrote Taylor Marr, deputy chief economist for Redfin, in the true estate brokerage’s 2023 forecast. “Many householders will hire out their homes quite than sell as a end result of they don’t want to lose a low price. There might be an inflow of single-family homes for lease,” he predicted. Home costs, unlike mortgage charges, vary considerably from place to place and season to season, making it tricky to forecast them. For simplicity, we’ll take a glance at nationwide forecasts that predict what is going to occur to home prices from the top of 2022 to the tip of 2023.

The spacious great room, flex room and kitchen all open to an intimate enclosed out of doors living space that includes an out of doors kitchen, bar and fireplace pit. The home additionally features an all new mud room/laundry room/utility workplace concept that connects the master closet and great room. Las Cruces, New Mexico’s premier grasp planned group featuring custom homes and private homes for sale in las cruces nm neighborhoods designed for each part of life. Live along the edge of the Chihuahuan Desert within the heat city of Las Cruces, New Mexico. This desert oasis provides the proper backdrop for a brand new home. Recreation, amenities and a friendly demeanor move Las Cruces to the highest of the record for potential home patrons.

We would extremely advocate Jon to anybody thinking about building a customized home. Our pros can get you an correct and honest value quote right now. Jones Construction works carefully with their purchasers to insure the best homes for sale in las cruces new mexico quality of options and effectivity that make for an ideal new home. They are within the final levels of a Tenant Improvement for my enterprise and every little thing appears great.

See the emotional moments when three deserving veterans and their families are handed the keys to brand new, mortgage-free Meritage homes in 2022. A buyer is taken into account glad about about a question in the occasion that they answered with 4 or extra stars out of 5. For instance if the "Communication" query is at 95% satisfaction that implies homes for sale las cruces that 95% of survey respondents answered that question with 4 or extra stars out of 5 attainable stars. Verified This review has been verified as part of GuildQuality's survey process. Something extremely magical about homes is that whenever you leave them, it feels good, but coming back feels even better.

And the stretch of land expense is generally not part of that amount. In all probability, the price tag of a brand new home can value round $200 to $400 per sq. foot. Here at Copper Canyon Homes, LLC in Las Cruces, New Mexico, we love what we do and what we do is design and build a number of the areas most extraordinary in addition to practical customized homes.

Prices, promotions, kinds, and availability might vary. Prices and availability of services are subject to alter without notice. On the housing provide entrance, issues stay pretty tight nationally.

2 notes

·

View notes

Video

youtube

UK Property Predictions For 2023 – Where Is The Housing And Rental Market Going?

With some forecasters warning of somewhere between a depression and Armageddon, here are my thoughts on the UK housing market.

For more great tips and money-making ideas and coaching offers see Master Your Money the S.M.A.R.T Way training. Check it out for free - https://bit.ly/3isugCr.

The UK housing market will shrink - but not necessarily crash - next year, industry experts agree, as the government fights recession and higher mortgage rates.

House prices have been dropping month-on-month with average prices down 2.3% in November from October – the most since the start of the financial crash in 2008 – according to Halifax.

Price growth will decline in 2023 as soaring inflation hits the economy and forces interest rates up.

As the downturn intensifies, housing indicators are showing red with rates expected to go even higher and the UK goes into a long recession.

The Bank of England is expected to raise interest rates into 2023 from 3.5% now to 4.75%, but there are signs that the rate of inflation is slowing.

Higher interest rates will hit buy-to-let landlords and investors, as deals fail to stack up.

Move from cities to the country is slowing, as more people move back to the office.

Property experts forecast property price declines of 5% - 12% next year, although some warn of a crash by 15% to 20%.

Mortgage rates have since fallen back since the disastrous mini-budget in September to an average five-year fix at 5.6% according to Moneyfacts – still far higher than a year ago.

UK mortgage lenders expect to lend 23% less to homebuyers in 2023 following a two-year boom.

UK Finance forecast gross mortgage lending for house purchases to decline to £131bn in 2023 from £171bn in 2022 and a peak of £189bn in 2021.

Leading UK lenders have met with government officials to discuss measures to ease the burden on around 90,000 people in mortgage arrears, the FT reports.

Property sales are set to drop to 1.01m next year from 1.27m in 2022.

Savills warns of a severe drop in transactions, to 870,000, and a 10% fall in house prices in 2023.

Estate agents Jones Lang LaSalle forecasts a 6% drop in house prices next year.

Both firms expect a 1% price growth in 2024, as interest rates fall back and inflation cools.

The Nationwide expects a “modest decline” or “soft landing” in house prices next year, but lenders seldom talk of a property crash. The lender said 85% of mortgage balances are currently on fixed interest rates.

The Bank of England said 4m households face higher mortgage payments next year.

Typical payments could rise by £250 to £1,000 a month causing severe financial difficulties for 220,000 households.

Capital Economics’ central forecast is for house prices to fall by 12% by the end of 2023, but Andrew Wishart, senior economist at the consultancy, said in a worst-case scenario prices could plummet by up to 20%. “The initial drop in house prices has been sharper than in the financial crisis or the early 90s, “For affordability to return to a sustainable level by the end of 2023, when we think mortgage rates will still be around 5%, the average house price would have to drop by 20%.

On the other hand, were market and mortgage interest rates to drop faster than we expect, that would limit the fall in prices.”

Rent prices have surged to record levels due to a shortage of properties to rent and growing demand, as well as a slowing buy-to-let market and many first-time buyers are opting to rent in the hope of lower mortgage rates in 2023/24. Some 85,000 landlords have quit the buy-to-let market in the last 5 years.

See my Money Tips Podcast video - https://youtu.be/NME3nEu8dAQ

UK private rents jumped by 4% in November, the highest since records began in 2016, official figures showed.

Savills forecasts rental growth rising to 6.5% before slowing to 4% in 2024.

Globally, many markets seem overheated and, in a bubble, – Sydney and Auckland for instance.

China’s property market boom appears to be over with a 20% decline.

In my next episode, I will be talking to one of Toronto’s leading realtors about his housing predictions for 2023.

As with all economic forecasts, much depends on government action and the prevailing winds of the economy, but more rests on your action in your U’conomy!

Your goals for 2023

· How was 2022 for you?

· Did you achieve your goals?

· What are your financial goals for 2023 and how do you plan to achieve them?

I wish you a happy and successful new year!

For more tips and money-making ideas and coaching see Master Your Money the S.M.A.R.T Way training.

Check it out for free - https://bit.ly/3isugCr.

#property #rentalmarket #finance #financialfreedom #freefinancialtraining #freetraining #money #wealth #landlord #buytoletlandlord #property #goals #plans #interestrates #bankofengland

4 notes

·

View notes

Text

Which Kitchen Countertops Are Most Desirable for Home Resale?

Price is always a key factor when selling a home. The investment in its mortgage, processing fees and other miscellaneous expenses can be quite heavy. It’s ideal to make the money back in the future.

Some home sellers may not be content with their property's current resale value. Investments like a new kitchen countertop can boost curb appeal and attract buyers.

Are Kitchen Countertops a Worthwhile Investment for Home Resale?

Kitchen remodels are one of the most recommended upgrades that home sellers can adopt to boost a property's curb appeal. Minor upgrades had a resale value of $22,963 in 2023, recouping costs by 85.7%.

For reference, major kitchen remodels for midrange and upscale homes have a higher resale value, amounting to $32,574 and $48,913 each. However, such projects require more costly investments — as a result, they only recover expenses by 41.8% and 31.7% respectively. A countertop is a simple, more affordable way to change the kitchen and boost property value.

What Types of Kitchen Countertops Add the Most Value to Homes?

You can choose from various types of kitchen countertops. Each one has unique attributes and factors that boost overall resale value.

1. Granite Kitchen Countertops

Granite kitchen countertops are gaining plenty of traction in the home improvement space. They have a reputation for being quite durable, so many homebuyers and prospects would be happy to buy a house with this material.

Granite's distinctive appearance shines through a kitchen’s interior design as well. Some slabs look like stones that have merged together. It also complements darker-colored cabinetry.

Regarding monetary investment, granite prices range from $2,250 to $4,500, depending on size and quality. If you want slabs in a more unconventional color like red or blue, the final figure can also shift quite a bit.

2. Quartz Kitchen Countertops

Quartz kitchen countertops are emerging as one of the more coveted options in modern properties. Compared to granite, they are more unlikely to stain and easier to clean.

Quartz also offers better aesthetics, appearing like crystals. Lighter-colored countertops in white and beige are beautiful, and midnight quartz is popular for dark-themed kitchens. Patterns also come in more varieties.

One con behind quartz countertops is how expensive they are. They average $2,850 but can cost up to $9,200 or so. Extending the countertop and adding trim can showcase the material better, but you will likely spend more on this investment.

3. Marble Kitchen Countertops

Marble kitchen countertops are quite attractive. Homebuyers enjoy them because they create an elegant ambience for the room. White variations can go well with almost any kitchen interior design.

Marble goes beyond appearances, though. The material has a high heat resistance to withstand the wear and tear of hot plates and pans. It can also reflect light, which is great in a space where complete visibility matters.

Marble countertops may be the most expensive, as they can go for around $1,200 to $6,000 for an average-sized kitchen. The price can reach $9,000 in rooms with high square footage.

How Countertop Investments Go Wrong

Most people get a high return on investment when remodeling and selling a home. However, there are cases where a kitchen countertop can go wrong. You may spend more than necessary due to material choice or delay installation. Here are some tips to avoid such circumstances:

Research and compare: When shopping for different types of kitchen countertops, you don’t have to choose the first option you see. Compare online listings and visit showrooms. You can also read other people’s feedback on a purchase. More insight and contemplation can help you narrow down the ideal material for your remodel.

Get your funds ready: Kitchen countertops are quite a considerable expense for the material alone. About 83% of renovation project funding comes from cash from savings. Some people use credit cards, but you must remember the interest can chip away at the profit you’ll get from a home resale.

Verify availability: Public listings don’t always mean the material is available. Check in with the supplier and installation services to determine if they have inventory. This helps you manage your expectations, which is important if you’re on a deadline to fix up your kitchen space.

Determine your timeline: Get a realistic timeline estimate. Kitchen countertop delivery can take a while, after all. Installation can also take anywhere from a couple of hours to a few days, depending on the job’s complexity.

Commit to a countertop choice: Some home sellers make changes to a kitchen remodel late in the installation, which incurs extra expenses. Instead of being fickle, make sure you pick your preferred choice and commit to it during the project.

Highlight when marketing: Highlight the kitchen countertop material in property listings when it’s time to sell your home. Take pictures and add descriptive text to attract people who want the appearance and benefits of your chosen material. This extra step can secure a good ROI.

Invest in Kitchen Countertops

A subtle remodel can boost home resale value. Just remember to check various types of kitchen countertops and pick the right one. Each potential buyer will have their own preference, so you must prepare and market it appropriately.

0 notes

Text

Tax Preparation in California: Essential Tips and Insights

Tax preparation in California can be a complex task due to the state's unique tax laws, varied income sources, and numerous deductions and credits. Whether you're an individual taxpayer or a business owner, navigating the Golden State's tax landscape requires careful attention to detail and a thorough understanding of the various components involved. In this blog, we'll delve into the critical aspects of tax preparation in California, offering essential tips and insights to help you manage your tax obligations effectively.

Overview of California Tax System

State Income Tax

California has one of the highest state income tax rates in the United States, with a progressive tax system that includes ten tax brackets ranging from 1% to 13.3%. The state income tax applies to residents' worldwide income and non-residents' income sourced from within California.

Sales and Use Tax

California's base sales tax rate is 7.25%, which is among the highest in the country. However, local jurisdictions can add their own sales taxes, leading to higher rates in some areas. The use tax applies to goods purchased out-of-state and used in California when sales tax was not paid at the time of purchase.

Property Tax

Property tax in California is based on the property's assessed value, which is generally determined by its purchase price plus an annual increase of up to 2%. Proposition 13, passed in 1978, limits the maximum amount of any ad valorem tax on real property.

Corporate Tax

Corporations in California are subject to an 8.84% corporate income tax rate. S-corporations are taxed at 1.5%. Additionally, there is a minimum franchise tax of $800 for most corporations.

Individual Tax Preparation in California

Filing Requirements

Individual taxpayers must file a California state tax return if they meet certain income thresholds, which vary depending on filing status, age, and income type. It's important to compare your federal adjusted gross income (AGI) with California's income thresholds to determine if you need to file.

Deductions and Credits

California offers a variety of deductions and credits that can reduce your taxable income and tax liability:

Standard Deduction: For 2023, the standard deduction is $5,202 for single filers and $10,404 for married couples filing jointly.

Itemized Deductions: These include medical expenses, mortgage interest, charitable contributions, and more. However, some deductions allowable on the federal return are not permitted in California.

California Earned Income Tax Credit (CalEITC): Available for low-income working individuals and families. Eligibility is based on earned income and must be claimed on the state tax return.

Child and Dependent Care Expenses Credit: This credit helps offset costs for child and dependent care expenses necessary for you to work or look for work.

Common Income Sources

When preparing your California state tax return, you'll need to report various sources of income, including:

Wages and Salaries: Reported on your W-2 form.

Self-Employment Income: Reported on Schedule C or C-EZ.

Rental Income: Reported on Schedule E.

Interest and Dividends: Reported on Schedule B.

Capital Gains: Reported on Schedule D.

Tax Payment and Refund Options

California offers several methods for paying state taxes, including electronic funds withdrawal, credit card payments, and checks. If you're expecting a refund, you can choose to receive it via direct deposit or a paper check.

Important Deadlines

The deadline for filing your California state tax return typically aligns with the federal tax deadline, which is April 15th. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Extensions for filing are available, but any taxes owed must be paid by the original deadline to avoid penalties and interest.

Business Tax Preparation in California

Business Entity Types and Taxation

Different business structures in California are subject to varying tax requirements:

Sole Proprietorship: Income is reported on the owner's personal tax return.

Partnership: Income is passed through to the partners and reported on their individual tax returns.

Corporation: Subject to corporate income tax rates and must file a separate corporate tax return.

S-Corporation: Income is passed through to shareholders and reported on their individual tax returns, but the entity itself is subject to a 1.5% tax rate.

Limited Liability Company (LLC): Can be taxed as a sole proprietorship, partnership, or corporation depending on its structure and elections.

Payroll Taxes

Businesses with employees must withhold state income tax, Social Security, Medicare, and state disability insurance from their employees' wages. Employers must also pay unemployment insurance and employment training tax.

Sales and Use Tax Compliance

Businesses that sell tangible personal property must collect sales tax from customers and remit it to the California Department of Tax and Fee Administration (CDTFA). Use tax compliance is necessary for out-of-state purchases used in California.

Estimated Tax Payments

Businesses and self-employed individuals may need to make estimated tax payments throughout the year if they expect to owe $500 or more in state taxes when they file their return. These payments are typically due on April 15, June 15, September 15, and January 15 of the following year.

Recordkeeping and Documentation

Maintaining accurate and detailed records is crucial for business tax preparation. This includes income and expense records, receipts, invoices, and any other documents that support your tax return. Proper recordkeeping helps ensure accurate tax reporting and can be invaluable during an audit.

Tips for Effective Tax Preparation

Stay Informed About Tax Law Changes

Tax laws and regulations are subject to change, and staying informed about these changes can help you prepare accurate tax returns and take advantage of any new deductions or credits.

Use Tax Preparation Software

Tax preparation software can simplify the process of preparing and filing your California state tax return. Many software options offer step-by-step guidance, error checks, and e-filing capabilities.

Seek Professional Assistance

Consider hiring a tax professional, such as a Certified Public Accountant (CPA) or an enrolled agent, to assist with your tax preparation. Tax professionals have the expertise to navigate complex tax situations and can provide valuable advice on tax planning and compliance.

Plan for Tax Obligations Throughout the Year

Effective tax planning involves more than just preparing your return at tax time. Regularly review your financial situation, keep track of income and expenses, and make estimated tax payments if necessary to avoid surprises at year-end.

Utilize Available Resources

The California Franchise Tax Board (FTB) and the CDTFA offer a wealth of resources for taxpayers, including online tools, forms, publications, and customer service assistance. Take advantage of these resources to help with your tax preparation.

Addressing Common Tax Issues

Late Filing and Payment Penalties

If you fail to file your tax return or pay your taxes on time, you may be subject to penalties and interest. The FTB imposes a late filing penalty of 5% of the unpaid tax per month, up to a maximum of 25%. Late payment penalties are 0.5% of the unpaid tax per month, also up to 25%.

Amending a Tax Return

If you discover an error or omission on your tax return after filing, you can file an amended return using Form 540X. Amended returns should be filed as soon as possible to correct any mistakes and minimize potential penalties and interest.

Handling Audits

Receiving an audit notice from the FTB can be daunting, but proper preparation can help you navigate the process smoothly. Keep detailed records, respond promptly to FTB requests for information, and consider seeking professional assistance to represent you during the audit.

Dealing with Tax Debt

If you owe taxes but are unable to pay in full, the FTB offers payment plans and other options to help manage your tax debt. Contact the FTB to discuss your situation and explore available options.

Special Considerations for Specific Taxpayers

Self-Employed Individuals

Self-employed individuals must report their business income and expenses on Schedule C or C-EZ. They are also responsible for paying self-employment taxes, which cover Social Security and Medicare contributions.

Real Estate Investors

Real estate investors must report rental income and expenses on Schedule E. They may also be subject to capital gains tax on the sale of property and should be aware of the implications of California's high capital gains tax rates.

High-Income Earners

High-income earners in California may face additional tax obligations, such as the mental health services tax of 1% on income over $1 million. Proper tax planning and utilization of deductions and credits can help manage these additional tax burdens.

The Future of Tax Preparation in California

Technological Advancements

Advances in technology are changing the landscape of tax preparation. From artificial intelligence and machine learning to blockchain and digital currencies, these technologies are streamlining processes, enhancing accuracy, and providing new tools for taxpayers and tax professionals.

Legislative Changes

Ongoing legislative changes at both the state and federal levels can impact tax preparation in California. Staying informed about these changes and their potential effects on your tax situation is crucial for effective tax management.

Sustainability and Green Initiatives

California's commitment to environmental sustainability may lead to new tax incentives and credits for businesses and individuals who adopt green practices. Keep an eye on emerging opportunities to take advantage of these incentives.

Conclusion

Tax preparation in California requires careful attention to the state's unique tax laws and regulations. Whether you're an individual taxpayer or a business owner, understanding the various components of the tax system and staying informed about changes can help you manage your tax obligations effectively.

By following the tips and insights provided in this blog, you can navigate the complexities of tax preparation in California with confidence. Whether you're handling your taxes on your own or seeking professional assistance, staying organized, informed, and proactive is key to ensuring accurate and compliant tax filings.

0 notes

Text

What Does The Real Estate Market Look Like Currently?

As we dive into the third quarter of 2023, it's a perfect moment to reflect on the housing market's journey so far this year and project what lies ahead. The real estate landscape has been marked by some notable shifts, and understanding these trends can help both homebuyers and sellers make informed decisions in the coming months.

The second quarter of the year saw a significant rise in mortgage interest rates. Starting at 6.32 percent in early April, the average 30-year mortgage loan rate climbed to 6.84 percent by late June. Alongside this, the national median home price rose from $375,400 in March to $396,100 by May. These changes in rates and prices have set the stage for an intriguing Q3.

Experts are cautiously optimistic about the upcoming quarter. Despite traditionally buoyant summer months for real estate, Q2's elevated rates led to a somewhat subdued environment. The ongoing challenge remains a severe shortage of housing inventory, with new listings for sale hovering around 25-30 percent below last year's levels. This scarcity of homes, coupled with higher mortgage rates, suggests that the third quarter of 2023 might not witness robust home-buying activity.

Mortgage interest rates, a pivotal factor, are projected to remain within the 6.4 to 6.7 percent range for a 30-year fixed mortgage, according to financial analysts. While recent data suggests that inflation may ease in the coming months, leading to a potential drop in mortgage rates, the predictions vary. Some experts believe rates could even dip below 6.5 percent, while others expect them to hover around 6.75 percent initially and eventually decline toward 6.0 percent by September.

The lack of housing inventory will continue to exert pressure on home prices throughout Q3. Buyers may encounter fierce competition, with a higher percentage of homes selling above the asking price. While home price growth is predicted to average around 4 percent this year, median home prices are anticipated to slightly decrease, settling around $385,000 in Q3.

For potential homebuyers, the current market presents affordability challenges. High home prices combined with elevated mortgage rates mean careful consideration is essential before making a purchase. Experts advise potential buyers to ensure job stability and steady earnings before committing to a home transaction.

On the flip side, sellers continue to have the upper hand in many markets due to tight inventory levels. However, sellers should weigh the benefits of selling against the potential challenge of finding a new home in a market with elevated rates. The decision to sell should take into account the balance between current low mortgage rates and potentially higher ones in the future.

The real estate market in the third quarter of 2023 promises a mix of challenges and opportunities. While the housing shortage and increased mortgage rates pose hurdles, the potential for stabilized or slightly reduced home prices may provide some respite for both buyers and sellers. As you navigate this complex landscape, remember that careful consideration and expert guidance are essential to make the right decisions for your unique circumstances.

#Real Estate#Home#Buying#Selling#Staging#Marketing#Guide#Tips#Shawn Boday#Market#Investment#2023#Real Estate Market#Forecast#Interest#Mortgage

2 notes

·

View notes

Text

Expand your property portfolio using these top tips

The demand for your rental property is huge right now, with demand per available property spiking last year by 250% above the 5-year average, while the demand for rented homes remains 10% higher than this time last year.* Interestingly, many landlords who have reached retirement age are selling part or all of their portfolios, giving you the chance to rapidly expand your portfolio with rental-ready properties. If you're looking to capitalize on this opportunity in Manchester, our experienced estate agents in Manchester can help you navigate the market and secure lucrative investment properties.

Rents are increasing

Your investment is secure. Rents have increased by 20% in the past three years, increasing by 11.1% in the past twelve months to March 2023.* This means you have the financial means to reinvest in your portfolio, finance improvements, and meet legislative changes. With such great returns on investment, you are a safe bet for banks.

New opportunities

Smaller, more energy-efficient homes are in demand; increasing numbers of students are looking for accommodation; and a widening demographic of people are renting for longer. With larger homes arriving on the market with good scope for negotiation and development, the opportunities are endless. It’s no secret that larger homes are selling a little more slowly than those in the first-time buyer market. The opportunity to buy a larger property and transform it into multiple lets is, provided you get the numbers right, a fantastic way to increase your rental yield.

More buy-to-let mortgage choice

There are over 2,400 different mortgage deals available if you are buying a property to let.* If you are buying an existing portfolio or an existing rental property, then you are far more bankable than starting from scratch. This will mean you can rapidly expand your portfolio without hesitation and established rental properties may have tenants living in them already.

Buy rental-ready properties

Some landlords who are retiring or have not done their research have been scared by legislative changes. Choosing to sell their rental-ready, buy-to-let properties gives you the opportunity to rapidly expand your portfolio. Every industry goes through big changes at some point. The Renters Reform Bill is currently passing through Parliament, and though it will not become law for some time, some less informed landlords are exiting the market, citing this and other legislative changes as the reason. The reality is that if you do your research, all these changes will protect your investment and create more opportunities for you to prosper.

Talk to your agent

Knowledge is the key to unlocking the secrets of success in the buy-to-let market. This is imperative in today’s reforming rental market. With so many changes taking place and so much to think about the right agent can guide you along the right road. A great investment starts with finding the right property, and that starts with the right agent. Managing your property and placing good tenants, which is becoming increasingly important, is something a good agent prides themselves on, not to mention local market knowledge and a vast database of buyers, sellers, and tenants.

Get in touch today to see how we can help take your property portfolio to the next level.

0 notes

Text

ICICI Home Loan

Introduction

Embarking on the journey of purchasing your first home can be both exciting and daunting. Securing a home loan is a crucial step in this process, and for first-time applicants, it's essential to navigate the complexities with confidence. If you're considering an ICICI home loan for your purchase, here are 10 indispensable tips to help you along the way.

Understand Your Financial Situation: Before applying for an ICICI home loan, take a close look at your finances. Evaluate your income, expenses, savings, and existing debts to determine how much you can afford to borrow and repay comfortably.

Check Your Credit Score: A good credit score is essential for securing favorable terms on your home loan. Obtain a copy of your credit report and ensure that it's accurate. If needed, take steps to improve your credit score before applying for an ICICI home loan.

Research ICICI Home Loan Products: ICICI Bank offers a range of home loan products tailored to different borrower needs. Take the time to research and understand the features, ICICI home loan interest rates 2023, and eligibility criteria of each product to find the one that best suits your requirements.

Get Pre-Approved: Obtaining pre-approval for an ICICI home loan can give you a competitive edge in the homebuying process. It demonstrates to sellers that you're a serious buyer with financing in place, potentially increasing your chances of securing your dream home.

Assess Your Down Payment Options: While ICICI home loans offer financing for a significant portion of your home purchase, you'll still need to make a down payment. Evaluate your savings and explore options for down payment assistance or gifts from family members to cover this upfront cost.

Factor in Additional Costs: Beyond the purchase price of the home, there are additional costs associated with buying property, such as registration fees, stamp duty, legal fees, and insurance premiums. Factor these into your budget when planning for your ICICI home loan.

Choose Your Loan Term Wisely: Consider the pros and cons of different loan terms when applying for an ICICI home loan. While a longer loan term may result in lower monthly payments, it also means paying more in interest over time. Choose a term that aligns with your financial goals and repayment capacity.

Review and Understand ICICI Home Loan Documents: Before signing on the dotted line, carefully review all loan documents provided by ICICI Bank. Pay close attention to the terms and conditions, interest rates, fees, and repayment schedule to ensure that you fully understand your obligations as a borrower.

Maintain Financial Discipline: Once you've secured an ICICI home loan, it's crucial to maintain financial discipline to ensure timely repayment. Set up automatic payments if possible and avoid taking on additional debt that could strain your finances.

Seek Professional Guidance: Navigating the home loan process can be complex, especially for first-time buyers. Consider seeking guidance from a financial advisor or mortgage broker who can provide personalized advice and support tailored to your specific circumstances.

Conclusion:

Securing your first home loan with ICICI Bank is a significant milestone on the path to homeownership. By following these 10 essential tips, you can approach the process with confidence and increase your chances of success. Remember to conduct thorough research, assess your financial situation carefully, and seek professional guidance when needed to make informed decisions every step of the way.

1 note

·

View note

Text

Westlake Village Home Sales in 2024: Navigating a Thriving Market

Westlake Village Home Sales in 2024: Navigating a Thriving Market

Nestled amidst rolling hills and bordering the shores of pristine Lake Lindero, Westlake Village offers a coveted California lifestyle. With its upscale charm, award-winning schools, and vibrant community, it's no wonder Westlake Village home sales continue to generate interest. As we embark on 2024, let's delve into the current market trends, forecasts, and valuable insights for buyers and sellers navigating Westlake Village's dynamic real estate landscape.

A Look Back: 2023 Westlake Village Market Trends

The 2023 Westlake Village housing market remained robust, mirroring the broader California market trends. Here's a quick recap:

- Steady Price Growth: Median sales prices for single-family homes in Westlake Village hovered around the $2 million mark in 2023, with some luxury properties exceeding expectations.

- Competitive Inventory: Inventory levels remained relatively low throughout the year, leading to bidding wars and quick sales for many properties.

Favorable Interest Rates: While interest rates did see a slight rise in late 2023, they remained historically low, fueling buyer demand.

Westlake Village Home Sales in 2024: Market Predictions

While the future is never certain, here are some insights on what we might expect for Westlake Village home sales in 2024:

- Continued Growth: Experts anticipate steady, moderate growth in home prices throughout 2024.

- Inventory Stabilization: While a seller's market is likely to persist, we might see a gradual increase in available listings compared to 2023.

- Impact of Interest Rates: With the Federal Reserve potentially raising rates throughout 2024, buyer affordability could be affected to some extent. However, California's strong job market and overall economic stability could mitigate this impact.

Considerations for Home Buyers in 2024

If you're looking to buy a home in Westlake Village in 2024, here are some key considerations:

Be Prepared to Move Quickly: In a competitive market, properties often sell fast. Pre-approval for a mortgage and working with a knowledgeable real estate agent are crucial.

Consider Your Budget: Factor in rising interest rates and potential bidding wars when determining your budget. It's wise to consult with a mortgage professional to understand your purchasing power.

Embrace Flexibility: Be open to different property types, locations, and move-in timelines to increase your chances of finding the perfect home.

Benefits of Buying a Home in Westlake Village in 2024

Despite a competitive market, buying a home in Westlake Village in 2024 offers significant advantages:

A Stable Investment: With its consistent property value growth, Westlake Village is a sound long-term investment.

Unparalleled Lifestyle: From award-winning schools to world-class amenities and a vibrant community, Westlake Village offers an exceptional lifestyle.

Strong Sense of Community: Residents enjoy a close-knit community with numerous events and activities throughout the year.

Insights for Home Sellers in 2024

Thinking about selling your Westlake Village home in 2024? Here are some helpful tips:

Price Your Home Strategically: A knowledgeable real estate agent can help you determine the right price point to attract qualified buyers in a competitive market.

Highlight Your Home's Strengths: Emphasize the unique features and benefits of your property, such as stunning views, desirable school districts, or recent upgrades.

Stage for Success: Invest in professional staging to create a welcoming and attractive environment for potential buyers.

The Future of Westlake Village Home Sales

Westlake Village remains a highly sought-after location for homebuyers seeking a luxurious California lifestyle. The 2024 market is expected to be dynamic, with continued growth and potentially more balanced inventory levels. Whether you're a buyer or seller, partnering with a local real estate expert familiar with the intricacies of the Westlake Village market is invaluable for navigating your real estate journey successfully.

Ready to Explore Westlake Village Home Sales?

If you're considering buying or selling a home in Westlake Village in 2024, contact a qualified real estate agent today. A local professional can provide personalized guidance, market insights, and expert assistance to help you achieve your real estate goals.

Read the full article

0 notes

Text

[ad_1]

Pelican Builders developed the primary ever residential highrise in Houston, The Woodway, in 1974.

Over the next 50 years, the agency based by Robert Bland Sr. carved its area of interest in multifamily in Higher Houston. It has developed 880 highrise and mid-rise rental models, 700 garden-style townhomes and 800 condo initiatives, based on its web site.

In a sprawling metro, the place suburban dwelling gross sales are king, the agency is betting huge that there’s an urge for food for condos within the Bayou Metropolis, too. Pelican lately opened a 17-story rental constructing with 67 models, the Hawthorne, at 5656 San Felipe Avenue in Tanglewood, lower than 2 miles from the Woodway. Houses within the constructing vary from about $1.5 million to $3 million, or $734 to $993 per sq. foot, based on an internet itemizing.

Pelican lately scored a $111 million rental stock mortgage from Northwind Group, which permits it to leverage the Hawthorne’s unsold models as collateral to refinance current debt. Derek Darnell, president of Pelican Builders, stated he expects the Hawthorne to be 75 p.c occupied by the tip of June.

The upscale rental market in Houston is so small that it’s laborious to get a learn available on the market.

Whereas mid-rise and high-rise rental gross sales have been down greater than 18 p.c 12 months over 12 months in 2023. Solely 878 have been bought in 2022, and 716 have been bought final 12 months, based on the Houston Affiliation of Realtors. The housing sort represented lower than 1 p.c of the Higher Houston market final 12 months.

“The brand new development rising within the rental market has been suburbanites,” Darnell stated. “We’re getting lots of people who spent 20 years elevating their households and dealing for giant firms within the Woodlands, Katy and even Sugar Land wanting to return again to the town life … the suburban markets have parks, trails and considerate planning, however they don’t have the humanities, eating places and museums.”

Historically, residents transitioning away from the maintenance of bigger houses or in depth yards would downsize to what Darnell calls “patio houses,” providing comfort with out straying too far. These townhome developments, typically that includes first-floor residing areas and minimal yard upkeep, have been as soon as a staple within the metropolis correct. Nevertheless, their building has dwindled, Darnell stated, and people which are constructed typically include hefty worth tags.

The excessive value of land makes that housing sort much less interesting to builders.

“It’s all math. Should you solely construct a patio dwelling or townhome that’s three tales, there’s simply solely a lot you'll be able to afford to pay for the land. Should you construct a high-rise with 60 or 80 models on the identical property, then you'll be able to pay extra for land,” he stated. “Our firm has at all times executed each high-rise condos and these townhome, patio dwelling merchandise, however within the internal core, the place land is so beneficial, we’re simply not doing the latter anymore, or at the least not practically as a lot.”

Houston’s internal core is slowly adopting the foundations of a vertical metropolis, stated Douglas Elliman dealer Misty Meredith. She is the unique promoting agent of Oxberry Group’s luxurious rental the Mondrian, at 5104 Caroline Avenue, and Stolz Companions’ the Sophie at Bayou Bend, at 6017 Memorial Drive.

“Houston is now beginning to catch as much as different huge cities,” she stated. “I do suppose the development of condos is sluggish, however it’s one thing that’s been coming. I’m very optimistic in regards to the rental market this 12 months, particularly having such a fantastic second half of final 12 months.”

Houston’s general luxurious market is surging, and gross sales are growing in submarkets which are inside the metropolis limits however towards the outer ring, the place luxurious is extra reasonably priced than in established enclaves like Memorial and River Oaks.

Spring Department, in Northwest Houston, noticed a four-fold enhance in gross sales of greater than $1 million between August 2022 and 2023, and simply east of that, gross sales in Oak Forest multiplied by six.

Learn extra

The luxurious market contrasts with the 19-month hunch in gross sales amongst common homebuyers within the metro, attributed to excessive rates of interest and low stock that left would-be consumers on the fence or pivoting to the rental market.

Pelican Builders is about to begin building this 12 months on a mid-rise luxurious rental complicated in River Oaks, referred to as the Lexington. It's slated for 40 models starting from $1.6 million to $4 million.

Luxurious hotel-branded condos are additionally on the best way to Houston. Marriott and Satya are planning Texas’ first St. Regis Residences, a 35-story tower anticipated to start building in Higher Kirby subsequent 12 months. And Howard Hughes Holdings is bringing the Ritz-Carlton Residences to Lake Woodlands.

[ad_2]

Supply hyperlink

0 notes

Text

How to Navigate a Cooler Housing Market

Let’s talk home selling tips. While significantly higher mortgage rates will undoubtedly make prospective home buyers feel a bit poorer, there’s still plenty of hope for home sellers in 2024!

Sure, the lofty asking prices of 2022 and early 2023 have perhaps come down, but if you pan out a bit, property values remain well above pre-pandemic levels.

So while you may have missed your chance to sell…

View On WordPress

0 notes