#mt4 ea

Video

youtube

ForexExtract EA ᐈ NEW Profitable 💰 Forex Robot for MT4 and MT5

Visit Developer`s Website ᐈ https://bit.ly/ForexExtract_Developer

Buy ForexExtract on ForexStore ᐈ https://bit.ly/ForexExtract_Vendor

2 notes

·

View notes

Text

Mastering the Art of Forex Trading: Strategies for Success

Mastering the art of Forex trading is an exhilarating journey, full of potential for personal and financial growth. Forex, or foreign exchange, is the world's largest financial market, where currencies are traded 24 hours a day, five days a week. It's a marketplace where fortunes can be made and lost in the blink of an eye, and success is often a product of strategy, discipline, and a keen understanding of market dynamics. This article explores various strategies for achieving success in Forex trading, focusing on the positive aspects and growth opportunities it offers.

Understanding the Market

The first step to mastering Forex trading is gaining a solid understanding of the market. The Forex market is influenced by a myriad of factors, including economic indicators, political events, and market sentiment. Successful traders are those who spend time studying market trends, understanding the factors that influence currency values, and staying informed about global events. Knowledge is power in Forex trading, and the more informed you are, the better equipped you'll be to make smart trading decisions.

Developing a Trading Strategy

A well-defined trading strategy is essential for success in the Forex market. This strategy should be based on thorough research and should align with your risk tolerance and financial goals. There are various trading strategies to explore, from day trading, where positions are entered and exited within the same day, to swing trading, which involves holding positions for several days to capitalize on expected market moves. The key is to find a strategy that suits your style, stick to it, and refine it as you gain more experience and market insight. Amplify your trading skills with Trendonex. Visit https://trendonex.com/

Risk Management

Risk management is a critical component of successful Forex trading. The market is volatile, and while this volatility can lead to high returns, it also increases the risk of loss. Effective risk management involves setting stop-loss orders to limit potential losses, managing the size of your trades, and never investing more than you can afford to lose. By managing risk effectively, you can ensure that you stay in the game long enough to benefit from your trading strategies.

Psychological Discipline

The psychological aspect of Forex trading is often underestimated. Trading can be an emotional rollercoaster, with the potential for high stress and emotional decision-making. Successful traders are those who have mastered the art of emotional discipline. This means not allowing fear or greed to drive trading decisions, staying patient, and maintaining a level head even in the face of losses. Developing a strong psychological discipline can significantly improve your chances of success in the Forex market.

Continuous Learning and Adaptation

The Forex market is constantly evolving, and what worked yesterday may not work tomorrow. Successful traders are those who are committed to continuous learning and adaptation. This involves staying up-to-date with market trends, refining your trading strategies, and learning from both successes and failures. The willingness to adapt and learn is what separates the best traders from the rest.

Leveraging Technology

Technology plays a significant role in modern Forex trading. From advanced charting software to automated trading systems, technology can provide traders with a significant advantage. Successful traders leverage technology to analyze market trends, execute trades, and manage their portfolios more efficiently. While technology should not replace fundamental trading skills, it can enhance your ability to make informed decisions and improve your overall trading performance.

Building a Support Network

Trading can be a solitary activity, but that doesn't mean you have to go it alone. Building a support network of fellow traders can provide you with valuable insights, strategies, and emotional support. Whether it's through online forums, trading groups, or mentoring relationships, connecting with other traders can enhance your learning and contribute to your success. Sharing experiences and strategies with others can open up new perspectives and help you avoid common pitfalls.

Conclusion

Mastering the art of Forex trading is a journey that requires dedication, discipline, and a continuous desire to learn and adapt. By understanding the market, developing a solid trading strategy, managing risk effectively, maintaining psychological discipline, leveraging technology, and building a support network, you can significantly increase your chances of success. The Forex market offers immense opportunities for growth and financial success. With the right approach, you can navigate the complexities of the market and achieve your trading goals.

1 note

·

View note

Text

Effortless Efficiency: Automate Your Forex Trades with the Panel

In the dynamic world of forex trading, efficiency is paramount. Traders are constantly seeking ways to streamline their processes, optimize their strategies, and maximize their profits. One powerful tool that has emerged to meet these demands is the Automated Trading Panel. These panels leverage cutting-edge technology to automate trade execution, implement complex strategies, and enhance overall efficiency in forex trading. In this blog post, we'll explore the benefits, features, and potential of Automated Trading Panels in revolutionizing the way traders approach the forex market.

Understanding Automated Trading Panels: Automated Trading Panels are sophisticated software solutions designed to automate various aspects of forex trading, from trade execution to risk management and strategy implementation. These panels utilize advanced algorithms, artificial intelligence, and machine learning techniques to analyze market data, identify trading opportunities, and execute trades on behalf of traders. With their user-friendly interfaces and customizable features, Automated Trading Panels empower traders of all skill levels to automate their trading processes and achieve consistent results in the forex market.

Key Features and Functionality:

Trade Execution Automation: Automated Trading Panels enable traders to automate trade execution, eliminating the need for manual intervention. Traders can set specific parameters for trade entry, exit, and position sizing, allowing the panel to execute trades automatically based on predefined rules and criteria.

Strategy Implementation: Automated Trading Panels support the implementation of complex trading strategies, including trend-following, mean-reversion, and breakout strategies. Traders can customize their strategies by combining technical indicators, price action signals, and market sentiment analysis to suit their trading preferences and objectives.

Risk Management Tools: Automated Trading Panels offer advanced risk management tools to help traders mitigate potential losses and protect their capital. Traders can set stop-loss and take-profit levels, adjust position sizes, and implement trailing stop orders to manage risk effectively.

Backtesting and Optimization: Automated Trading Panels enable traders to backtest and optimize trading strategies using historical market data. By simulating trades under various market conditions, traders can assess the performance of their strategies and make necessary adjustments to improve profitability.

Real-time Market Analysis: Automated Trading Panels provide real-time market analysis and insights, allowing traders to stay informed about key market developments and potential trading opportunities. With access to up-to-date market data and analysis tools, traders can make informed decisions and execute trades with confidence.

Benefits of Using Automated Trading Panels:

Enhanced Efficiency: Automated Trading Panels streamline the trading process by automating repetitive tasks such as trade execution, position management, and risk assessment. By eliminating the need for manual intervention, traders can save significant time and effort. This enhanced efficiency allows traders to focus their attention on analyzing market trends, refining trading strategies, and making informed decisions, rather than getting bogged down by routine tasks.

Improved Accuracy: Automated Trading Panels leverage sophisticated algorithms and artificial intelligence to execute trades with precision and accuracy. Unlike human traders, who may be prone to emotions, biases, and cognitive errors, these panels operate based on predefined rules and criteria. By removing human involvement from the trading process, Automated Trading Panels minimize errors and enhance overall trading performance. Trades are executed consistently and objectively, without the influence of emotions such as fear, greed, or hesitation.

Consistent Performance: With their disciplined approach to trade execution and risk management, Automated Trading Panels help traders achieve consistent and reliable results over time. These panels adhere strictly to predetermined trading rules and strategies, ensuring that trades are executed in a systematic and disciplined manner. By maintaining consistency in trade execution and risk management, traders can avoid impulsive decisions and erratic behavior, thereby improving their chances of long-term success in the forex market.

Accessibility and Convenience: Automated Trading Panels are accessible from any internet-enabled device, allowing traders to monitor and manage their trades on the go. Whether at home, in the office, or on vacation, traders can stay connected to the forex market and take advantage of trading opportunities anytime, anywhere. This level of accessibility and convenience enables traders to stay informed about market developments, adjust their trading strategies, and execute trades promptly, without being tied to a specific location or time zone.

Reduced Stress and Emotional Impact: Trading can be a stressful and emotionally taxing endeavor, particularly during periods of market volatility or when faced with significant losses. Automated Trading Panels help alleviate stress and emotional strain by automating the trading process and removing the need for manual intervention. Traders can trade with confidence, knowing that their trades are being executed according to predefined rules and parameters. By removing the emotional element from trading decisions, Automated Trading Panels help traders maintain a clear and rational mindset, reducing the psychological burden associated with trading and improving overall well-being.

Automated Trading Panels offer numerous benefits to traders, including enhanced efficiency, improved accuracy, consistent performance, accessibility and convenience, and reduced stress and emotional impact. By leveraging advanced technology and automation, traders can streamline their trading processes, optimize their performance, and achieve greater success in the forex market.

Conclusion:

Automated Trading Panel offer a powerful solution for automating forex trades and enhancing trading efficiency. With their advanced features, customizable settings, and user-friendly interfaces, these panels empower traders to execute trades with precision, consistency, and confidence. Whether you're a seasoned trader looking to optimize your trading strategies or a novice trader seeking to streamline your trading process, Automated Trading Panels can help you achieve your trading goals with ease. Embrace the future of forex trading with Automated Trading Panels and experience the benefits of effortless efficiency in your trading journey.

#Trade Panel#Trading Panel#Trading Panel EA#TradePanel MT4#Trade Manager#Forex Trade Manager#Best Trade Manager#Trade Management utility#Trade Management tool#Trading management#forextrading#forexmarket#forex education#forexsignals#forex#black tumblr#technical analysis#4xPip

3 notes

·

View notes

Text

【 SuperGOLD 】EA works Stable on XAUUSD pair It is based on a Scalping strategy⚡ Gold Trading Robot - Profitable【 MT4 Expert Advisor 】⭐ Read SuperGOLD EA Review!

0 notes

Video

Expert Advisors Live Forex EA Trading Robot Performance 2024

#youtube#Forex#ExpertAdvisor#EA#Scalping#LiveTrading#ForexEA#TradingRobot#ForexTrading#Profit#LowDrawdown#MT4#2024#ForexMarket#TradingPerformance#Investing#FinancialFreedom#AutomatedTrading#ForexStrategy#ForexTrader

0 notes

Text

How does Best Martingale Strategy Forex EA MT4 work?

Introduction:

An EA, or Expert Advisor, is a software program that can be used to automate trading on financial markets. EAs can be used to place orders, manage risk, and monitor the market. They can be used to trade a variety of instruments, including forex, stocks, commodities, and cryptocurrencies.

How does it work?

EAs are typically programmed to follow a set of rules or strategies. These rules may be based on technical analysis indicators, price patterns, or other factors. The EA will monitor the market and place orders automatically when its rules are met.

Benefits:

There are a number of benefits to using an EA, including:

Automation: EAs can automate the trading process, which can save traders a lot of time and effort.

Discipline: EAs can help traders to stick to their trading plan and avoid making emotional decisions.

Backtesting: EAs can be backtested on historical data to see how they would have performed. This can help traders to identify and optimize their trading strategies.

Drawbacks:

There are also some drawbacks to using an EA, including:

Cost: EAs can be expensive to purchase and maintain.

Risk: EAs are not perfect and can make losing trades. It is important to use EAs in conjunction with a sound risk management strategy.

Over-reliance: Traders should not rely too heavily on EAs. It is important to understand the EA's underlying strategy and to monitor its performance closely.

Where to find EAs:

EAs can be found from a variety of sources, including:

Brokers: Many brokers offer their own EAs or allow traders to download EAs from third-party developers.

Online marketplaces: There are a number of online marketplaces where traders can buy and sell EAs.

Independent developers: There are also a number of independent developers who create and sell EAs.

Best Martingale Strategy Forex EA MT4:

The Best Martingale Strategy Forex EA MT4 is a software program that automates the Martingale trading strategy on the MetaTrader 4 platform. The Martingale strategy is a high-risk, high-reward strategy that involves doubling your bet after each loss until you eventually win.

The Best Martingale Strategy Forex EA MT4 is designed to help traders profit from the forex market using the Martingale strategy. The EA uses a variety of technical indicators to identify trading opportunities and to manage risk.

The EA has a number of features that make it attractive to traders, including:

It is fully automated, so traders can set it up and let it run without having to monitor it constantly.

It uses a variety of technical indicators to identify trading opportunities and to manage risk.

It has a number of customizable settings, so traders can tailor it to their own trading style and risk tolerance.

Here are some tips for using the Best Martingale Strategy Forex EA MT4:

Use a small initial lot size. This will help to limit your losses if the market moves against you.

Set a stop loss order on all of your trades. This will help to limit your losses if the market moves against you.

Monitor the EA's performance closely. If you notice that the EA is making a lot of losses, you may need to adjust the settings or stop using it altogether.

Best Martingale Strategy Forex EA MT4:

The Best Martingale Strategy Forex EA MT4 has performed well in backtesting, showing high profits and low drawdowns. However, live trading results have been more mixed, with some traders reporting success and others reporting losses.

One of the main reasons for the mixed live trading results is that the Martingale strategy is a risky strategy. It involves doubling the size of each losing trade in an attempt to recoup losses and eventually make a profit. This can lead to large losses if the market continues to move against the trader.

Another reason for the mixed results is that the Best Martingale Strategy Forex EA MT4 is not a perfect EA. It is possible to optimize the settings for backtesting, but these settings may not work as well in live trading. Additionally, the EA is vulnerable to market conditions such as high volatility and news events.

Despite the risks, some traders have been able to use the Best Martingale Strategy Forex EA MT4 to generate profits. However, it is important to use caution when using this EA and to only risk a small amount of your capital.

Here are some tips for using the Best Martingale Strategy Forex EA MT4 safely:

Use a small risk per trade. 1% or less is a good starting point.

Use a stop loss on every trade. This will limit your losses if the market moves against you.

Use a trailing stop to protect your profits.

Monitor the EA closely and be prepared to disable it if it starts to lose money.

It is also important to remember that past performance is not indicative of future results. Just because the Best Martingale Strategy Forex EA MT4 has performed well in the past does not guarantee that it will continue to perform well in the future.

How does it handle risk management:

The Best Martingale Strategy Forex EA MT4 handles risk management in a number of ways:

Stop losses: The EA can be set to place stop loss orders on all of your trades. This will help to limit your losses if the market moves against you.

Martingale strategy: The Martingale strategy itself is a form of risk management, as it involves doubling your bet after each loss until you eventually win. This helps to ensure that you will eventually make a profit, even if you experience a series of losses.

Money management: The EA can be set to use a variety of money management techniques, such as only risking a certain percentage of your account balance on each trade. This will help to protect your account from large losses.

Here are some additional tips for risk management when using the Best Martingale Strategy Forex EA MT4:

Use a small initial lot size. This will help to limit your losses if the market moves against you.

Monitor the EA's performance closely. If you notice that the EA is making a lot of losses, you may need to adjust the settings or stop using it altogether.

Have a backup plan. If the EA fails or the market moves against you, have a backup plan in place to protect your account.

4xPip:

4xPip is a financial trading company that helps traders to get the Best Martingale Strategy Forex EA MT4. The company offers a variety of trading tools and resources to help traders succeed, including:

Trading bots: 4xPip offers a variety of trading bots that can be used to automate trading on the forex market. The Best Martingale Strategy Forex EA MT4 is one of the most popular trading bots on the 4xPip platform.

Indicators: 4xPip offers a variety of technical indicators that can be used to identify trading opportunities and to manage risk. These indicators can be used to power the Best Martingale Strategy Forex EA MT4 or to develop your own trading strategies.

Education: 4xPip offers a variety of educational resources to help traders learn about the forex market and how to trade effectively. These resources include articles, videos, and webinars.

Here are some of the ways that 4xPip helps traders to get the Best Martingale Strategy Forex EA MT4:

Easy access: 4xPip makes it easy for traders to download and install the Best Martingale Strategy Forex EA MT4. Traders can download the EA directly from the 4xPip website.

Support: 4xPip offers support to traders who use the Best Martingale Strategy Forex EA MT4. Traders can contact 4xPip support for help with installing, configuring, and using the EA.

Community: 4xPip has a community of traders who use the Best Martingale Strategy Forex EA MT4. Traders can interact with each other on the 4xPip forum to share ideas and strategies.

#black literature#black fashion#black tumblr#black art#black history#Best Martingale Strategy Forex EA MT4#Grid Trading#Best Martingale Strategy#Martingale Strategy Forex EA MT4#Martingale Strategy#MT4 Martingale Strategy#MT4 Martingale Strategy EA

0 notes

Text

Советник Форекс рабочий ➡➡➡ https://kahgo.ru/HFmz7lR

✔ СУПЕРСКАЛЬПИНГ 2.0: МГНОВЕННЫЙ ЗАРАБОТОК НА БИНАРНЫХ ОПЦИОНАХ

Я, Виталий Попов, промышляю трейдингом с 2001 г. и готов научить Вас самому получать доход от 100 баксов и больше в прямом смысле слова за 10-30 мин работы в сутки.

В данном способе нет практически никаких запретов при работе – это целиком зависит исключительно только от Вас. Лишь Вы самостоятельно постановляете когда и как много сможете взять с рынка бинарных опционов.

У вас появится возможность заниматься по полчасика в течении дня и это тот минимум, для того чтобы выручать огромные деньги и поднять собственный уровень жизни на сверхновые ступени.

И все это сами понимаете что отнюдь не максимум, а всего лишь исходная точка тех неописуемых потенциалов те которые обнаружатся перед Вами.

У вас появится возможность претворить в жизнь многие и многие намерения, которые раньше находились исключительно в Ваших мечтаниях.

Полагаете перечисленное через чур немыслимым? Не торопитесь с выводами, необходимо разобраться во всем по порядку.

Я предлагаю Вам пройти методологию Суперскальпинг 2.0 на бинарных опционах.

В следствии чего именно я нарек эту схему суперскальпингом?

Да потому, что каждая сделка тут длится лишь 5-7 секунд!!!

Многие люди мне говорили, что такого не бывает, но это уже 2-ая окончательно переработанная и улучшеная разновидность Суперскальпинга. Wallstreet forex robot 2 0 evolution скачать бесплатно.

Схеме уже восьмой год и она продолжает совершенствоваться и дает прибыток с 2012 года. Торговый робот прайм.

Наработана перерожденная технология которая стала плодом моей активности и работы с моими учениками и такую схему я вручаю Вам. Стратегия торговый.

Можно собственнолично удостоверится на активных примерах как действуя максимально 7-15 мин сможете успешно заработать 100-400 долларов в то же самое время не рискуя огромными капиталовложениями, орудуя расслабленно на выверенной методологии оптимизировав все свои опасности. Торговый робот ева.

Именно благодаря недавно открывшейся версии 2. Торговые стратегии Форекс по фракталам.0 Суперскальпинга, финансовый рынок получился более предсказуем, а методика более идеальной. Стратегия Forex деньги. Отсутствие эмоциональной нагрузки если соблюдать условие исполненья моих предначертаний сделает торговлю приятной и легкой, а неплохую прибыль ежедневной. Бинарный индикатор опцион.

Вы увидите на живой презентации торговли каким способом это вершится в режиме онлайн на функционирующих котировках, т. Торговый робот для МТ5 бесплатно скачать.е. Индикаторы Форекс 2023 скачать бесплатно. Вы увидите настоящую прибыльную деятельность трейдера до мелочей. Можно ли заработать роботом на Форекс.

В представленном курсе сейчас имеется наисильнейшая мотивация к учебе и работе - Вы узнаете активное свидетельство того, что настоящая схема работает и что это отнюдь не блеф

Рекламa - Инфopмация о рeклaмoдaтелe пo сcылкам в описaнии

Советник Форекс рабочий #Советник #Форекс #рабочий

#ea#стратегия#удар#робот#форекс#графика#торговый#тренда#индикатор#такое#отзывы#mt4#1#алгоритм#бинарных#минутного#для#уровней#сигналы#скачать#рейтинг#торгового#торговли#опционов#робота#15#молнии#советников#что#советник

0 notes

Text

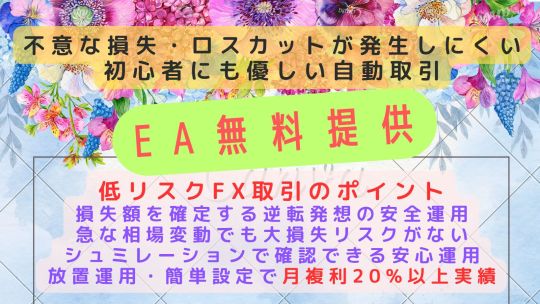

FX自動運用・放置運用で 資産数万円を1000万円複数口座運用まで育てます

Stable3 リスクは1年に1回発生するかしないか

数万円の資金を1000万円複数口座運用まで育てます

新運用法・マニュアル公開しました

数万円の資金を1000万円の複数口座運用まで放置運用で育てます

数万円の資金からスタートできます

★17連敗放置運用法ではなんと1年以上放置運用が可能なデータがあり

自動で利益を獲得していきます

リスク発生時も簡単な損切をするだけです

★12連敗放置運用法ではリスクの発生は一ヶ月に1回程度

リスク発生時も損切するだけで自動で利益を獲得していきます

※Stable3既存ユーザー様には資金33万円までは従来の運用法(旧運用法)をお勧めします

旧運用法の方がロットが高いため利益獲得スピードが速くなります。

この運用法で必要な自動取引ソフト=EA、Stable3は無料で配布しています。

また各社のMT4口座で使用できる口座縛りの無い試用版も無料配布して…

View On WordPress

0 notes

Video

youtube

🔗 Visit FX JetBot EA Developer`s Website ᐈ

【 FX JetBot EA 】 ⚡ NEW Profitable Forex Robot for MT4 & MT5【 Best Grid Trading EA 】 • Trades on AUDUSD, EURJPY, EURGBP, USDCAD, EURUSD currency pairs • High Profitability Trade Win Rate 80% • Verified results on real accounts • Compatible with any brokers. • 30 day money back guarantee

0 notes

Text

My Optimum EA Profit History in Real Account

Optimum EA MT4 Login Details

Login: 66500120

Pass: wp+4571616509

Server: ICMarketsSC-Demo06

More Details Telegram ID: https://t.me/OptimumEA

#My Optimum EA Profit History in Real Account#Optimum EA MT4 Login Details#Login: 66500120#Pass: wp+4571616509#Server: ICMarketsSC-Demo06#More Details Telegram ID: https://t.me/OptimumEA#forexbestrobot#forexea#forexbestea#forexexpertadvisor

0 notes

Text

TitanFX(タイタンFX)のコピートレードアプリ「Titan FX Social」とTitan FXのライブ口座との連携方法の完全図解!この記事で丸わかり!

この記事は、TitanFX(タイタンFX)のコピートレードアプリ「Titan FX Social」とTitanFXのライブ口座との提携方法がわからない人のためのマニュアルです。

TitanFX(タイタンFX)でコピートレードをしたい方は、必ずこの記事を読む必要があります。

TitanFX(タイタンFX)のコピートレードアプリ「Titan FX Social」が何かよくわからない人は、以下の記事を読んでください。

https://www.fxcfdlabo.com/titanfx/copy-trading-social-trading/

公式サイトはこちら

Titan FX…

View On WordPress

0 notes

Text

What are Drawdown Mitigation Techniques in Forex trading?

Introduction:

Drawdown, in simple terms, is the difference between the highest point your account balance reaches and its lowest point within a specific period. It essentially measures the worst-case scenario during a losing streak and serves as a crucial indicator of your trading strategy's risk profile.

Types of Drawdowns:

Absolute Drawdown: This refers to the actual amount of money lost from your peak account balance.

Relative Drawdown: This expresses the drawdown as a percentage of the peak account balance, providing a more standardized measure for comparison across different account sizes.

Maximum Drawdown: This is the largest drawdown experienced within a specific period, highlighting the most severe potential loss.

Drawdown's Impact on Forex Trading:

Drawdowns are an inevitable part of trading. However, excessive or prolonged drawdowns can have significant negative consequences, including:

Reduced capital: The loss of capital restricts your ability to trade larger positions, potentially hindering your long-term profit potential.

Psychological pressure: Witnessing significant drawdowns can trigger stress and anxiety, leading to impulsive and emotionally driven decisions that further exacerbate the situation.

Account disqualification: Many prop firms and trading challenges impose strict drawdown limits. Exceeding these limits can result in disqualification and loss of access to valuable funding opportunities.

Managing Drawdowns:

While drawdowns are inevitable, effective risk management strategies can mitigate their impact and protect your capital. Here are some key strategies:

Set realistic profit targets and risk limits: Define your maximum acceptable loss per trade and avoid exceeding it.

Implement stop-loss orders: These orders automatically close losing positions, limiting your potential losses.

Diversify your portfolio: Spread your capital across different currency pairs and asset classes to minimize the impact of losses in any single market.

Maintain proper position sizing: Only risk a small percentage of your account balance per trade, preventing a single loss from significantly impacting your overall capital.

Follow a sound trading strategy: Back-test and refine your trading strategy to ensure it aligns with your risk tolerance and achieves consistent results over time.

Use a Drawdown EA: Consider using an Expert Advisor (EA) specifically designed to manage drawdowns. These EAs automatically monitor your account balance and take action, such as closing positions, when the drawdown reaches a predefined limit.

Drawdown Mitigation Techniques:

In addition to the general risk management strategies mentioned above, here are some specific techniques to mitigate drawdown:

Trailing stop-loss orders: These orders automatically adjust the stop-loss price as your position moves in favor, locking in profits and minimizing potential losses.

Take-profit orders: These orders automatically close profitable positions when the price reaches your target level, protecting your gains and preventing them from evaporating during a market reversal.

Hedging: This involves using opposite positions in different currencies or instruments to offset potential losses and limit exposure to market volatility.

Position scaling: This involves entering and exiting trades gradually, adapting your position size based on market conditions and minimizing exposure during periods of high risk.

The Significance of Maximum Drawdown in Trading:

Maximum drawdown (MDD) is a crucial indicator in trading that measures the largest peak-to-trough decline in an account's equity within a specific timeframe. It provides valuable insights into the risk profile of a trading strategy and helps traders make informed decisions about their risk management approach.

Here's why maximum drawdown is significant in trading:

Quantifies potential risk: MDD provides a concrete measure of the worst-case scenario a trader might face, enabling them to assess their risk tolerance and adjust their position sizing accordingly.

Evaluates strategy performance: MDD, when analyzed alongside other performance metrics like profitability, offers a more comprehensive understanding of a strategy's effectiveness. A high MDD may indicate a strategy with high potential returns but also significant risk, while a low MDD suggests a more stable but potentially less profitable strategy.

Compares different strategies: MDD allows for unbiased comparison of different trading strategies, enabling traders to choose strategies that align with their risk tolerance and financial goals.

Helps with backtesting: MDD can be incorporated into backtesting to evaluate strategies under different market conditions and assess their ability to withstand potential drawdowns.

Complies with prop firm requirements: Many prop firms impose strict MDD limits on their traders. Understanding and managing MDD is crucial for meeting these requirements and avoiding disqualification.

Promotes discipline: Knowing the maximum potential drawdown can help traders stay disciplined and avoid impulsive decisions that could exacerbate losses during a downturn.

4xPip: Your Partner in Managing Drawdown and Achieving Trading Success:

4xPip is a leading provider of trading tools and resources for the MetaTrader 4 platform, dedicated to empowering traders with the knowledge and tools they need to navigate the complex world of Forex trading. Recognizing the paramount importance of risk management, 4xPip offers a range of solutions, including the powerful Drawdown EA MT4, to help traders mitigate drawdown and protect their capital.

Why Choose 4xPip for Your Drawdown Management Needs?

Comprehensive Drawdown Management Solutions: 4xPip offers not just the Drawdown EA MT4 but also extensive educational resources, expert advice, and a supportive community to help traders understand and manage drawdown effectively.

User-Friendly MT4 Tools: 4xPip's tools, including the Drawdown EA MT4, are designed to be user-friendly and accessible for traders of all experience levels.

Customization and Flexibility: The Drawdown EA MT4 offers various customization options allowing you to tailor its behavior to your specific trading style and risk tolerance.

Proven Track Record: 4xPip has earned a solid reputation in the trading community for its reliable and effective tools, backed by positive user reviews and testimonials.

Excellent Customer Support: 4xPip's dedicated support team is always available to answer your questions and provide assistance with any technical issues you may encounter.

How 4xPip Helps You Use Drawdown to Your Advantage:

Mitigate Risk: The Drawdown EA MT4 automatically monitors your account and takes action when the drawdown reaches your predefined limit, preventing catastrophic losses.

Improve Trading Discipline: By automating risk management, the EA removes the temptation to override risk parameters during emotional periods, leading to more disciplined trading behavior.

Reduce Stress and Anxiety: Knowing your risk is controlled helps alleviate the mental strain associated with trading, allowing you to approach the market with greater clarity and focus.

Enhance Performance: By limiting drawdowns, the EA helps preserve your capital, allowing you to compound your profits and achieve better long-term performance.

Backtest with Realistic Risk: The EA allows you to backtest your trading strategies with accurate drawdown limits, providing a more realistic picture of their potential performance.

Visit the 4xPip website today to explore their comprehensive suite of tools and discover how they can help you manage drawdown and unlock your trading potential.

#black history#black fashion#black tumblr#black art#black literature#Drawdown EA MT4#drawdown limiter#drawdown limiter ea#mt4 drawdown limiter#mt4 drawdown limiter ea

0 notes

Text

I'll post new developments and updates here every day

①#1777-1776 Go short and stop 1784-1783

(Run as soon as you make a profit of $6 to $7. If the market bounces back, continue to short.)

②#1760-1762 Go long and stop 1756-1754

(If you reach this position, you can do it once, only once, and do not repeat)

1 note

·

View note