#no.1 rated sales man 1997

Text

Gay sales man Yaoi.

#pc games#gaming#deltarune#shitpost#ship#shipping#yaoi#old man yaoi#gay#homosexual#spamton#spamton deltarune#no.1 rated sales man 1997#jevil#jevil deltarune#jevil the jester#jivorce#spamvil#jevil x spamton#sol#sol JMKit#clinx#clinx JMKit#solinx#JMKit ships#deltarune ships#meme

44 notes

·

View notes

Text

Spamton propaganda:

"You know someone had to do it.

This guy's whole thing is not wanting to be a puppet anymore, but uh-oh-spaghetti-o! Dude now has physical puppet strings!"

"Making a [SPECIL] deal by placing his [#1 SALE SYSTEM] into a [CLASSIC!] body, Spamton believed he could be more than [HYPERLINK BLOCKED]. But the strings told him otherwise. He lunged at Kris in [LIMITED TIME OFFER], trying with all his [50% OFF!] to be more than a puppet."

"Spam email bot who was exposed to something that drove him mad and he spent the whole rest of his existence trying to cut his strings, only to die (maybe?) when he finally manages it."

"He is the most tortured dumpster man alive. Also, not literally a puppet, but metaphorically!!! There's some mysterious outside force controlling him and limiting what he can say and god, he desperately wants to break free, trying to kill the protagonist (his only friend in years) for the chance of ""being let loose from his strings"". In his secret boss battle, he thinks he'll be free after getting a new body but he isn't, as his new powerful body has literal strings attached. You fight him, because he thinks your soul (long story) will gain him access to freedom. During the pacifist route of the battle, you cut his strings until there's one more left, he's ecstatic, being able to break free from the narrative of the confines of the game. He decides to break his own last string, and he falls to the ground into pieces. It turns out he relied on the strings after so long, and couldn't recover without them. Afterwards, he's deshevaled, hung up by vines in the dark basement that resemble his old strings and he says ""It seems after all I couldn't be anything more than a simple puppet."" This ties back to how Kris, the protagonist of the game is feeling the effects of being controlled by the player and really shows the core focus of the game and it's characters. And that's why I entered him into this poll!

Also he is genuinely so fucking hilarious bro just play Deltarune already what the fuck are you doing the chapters that are out rn are free dawg (play Undertale first though, it's like ten bucks or something you'll be fine)"

"Spamton best blorbo. Very good blorbo. Exquisite blorbo even. He's sad and adhd and insane and weird and I love him and you should too. Pipis"

"he spamt"

"[[NUMBER ONE RATED SALESMAN 1997]]"

"he's living in a goddamn garbage can. let the big shot win. it'll be funny. does he deserve it? that is up to viewer discretion. but he is our beloved tumblr sillyman and as such we need to pay him respect in some manner. <3

(iirc spamton is a puppet? probably. oh well if he doesn't count ignore this i'm not read up on

my deltarune)"

"frankly i'd be surprised if he's not one of the most submitted. anyway his whole Deal is about being a puppet and having other things control him and so he seeks to regain that control through either manipulating the player into murdering half the city or to take the red soul and use it to become a god. yet in his super powerful NEO form he still has strings attached to him (that he won't even notice if he succeeded in the player manipulation thing) and in either case he ultimately becomes an item you use just for stats. guy really isn't a fan of puppetteers"

"you propably knew this was coming lol

Tumblr's favorite awful little puppet desperately fighting to get rid of his strings

the pinocchio references are strong in this one

HA HA HA ... THIS POWER IS

FREEDOM.

I WON'T HAVE TO BE JUST A PUPPET ANY MORE!!!!

...

OR... so... I... thought.

WHAT ARE THESE STRINGS!? WHY AM I NOT [BIG] ENOUGH!? It's still DARK... SO DARK!"

"Tries to become a real boy, ends up as another puppet look guy. He's shady, he's a scammer, he's got cringefail swag and I love him"

"He's just a little fucked-up little guy"

50 notes

·

View notes

Text

471. Daily Press, November 1, 1996

Hi all,

So this post accidentally didn’t make it to Tumblr a couple of weeks ago. Oops.

Wow. Y'all are gonna laugh at me for this one, especially since I've lived in Virginia my whole life. I thought that Senator John Warner was Mark Warner's dad and they had a political dynasty in Virginia. Mark wound up being the governor of Virginia a few years later and became senator in 2008. Absolutely no relation.

I had forgotten that Clooney was boycotting the entertainment shows long before Princess Diana's car wreck. Hard Copy was like the National Enquirer but a TV show. My mom and I would watch it every night when I was in elementary school. BostWiki has a good mini documentary about the show.

Ding ding ding we have an elementary school teacher's dress on sale at Proffit's.

Strom Thurmond is one of those people who you can never imagine being a baby. An old man since day 1.

I know where that misinformation about the "big fluffy pillow" comes from. Remember in car commercials where they would show the airbags opening in slow mo?

Meanwhile at the O.J. Civil Trial...

(Value City)

I forgot that Charles Barkley played for the Rockets.

Now I am not a "movie person" at all. But growing up I used to love looking at this chart every Friday to see what movies were bombs. 💣

Hold up, High School High, the Jon Lovitz classic movie, was #2 in the box office that week?

Newmarket Fair Mall's movie theater was still open in 1996! Also there was a Bill Murray movie about him and and elephant.

Excess Baggage wouldn't come out until the end of Summer, 1997 and Alicia's producer role was uncredited. There were rumors of trouble on the set.

I was surprised that songs from the Summer like #1 and #4 were still topping the charts.

This was during Lisa & Les' Halloween wedding. Lisa was Robin and Les was Batman.

And, as always UPN and the WB were on the bottom of the TV ratings.

Facebook | Etsy | Retail History Blog | Twitter | YouTube Playlist | Random Post | Ko-fi donation | instagram @thelastvcr | tik tok @ saleintothe90s

1 note

·

View note

Photo

Below you will find our Earth timeline. We hope that this puts our vision of the world of ZEROTONIN into focus, and gives you inspiration and ideas for your wonderful characters. Note that our site is explicitly canon divergent and follows the inception of many of our well known heroes and villains. However, it is ultimately at your discretion where your character may fit within this unique universe. Of course, this is a non-exhaustive list which does not cover every important point in history.

If you are interested and have any questions, do not hesitate to reach out.

______________________________________________________________

➔ PRESENT DATE: New Year’s Eve/New Year’s Day; January 1, 2000

1942: The secret military “Manhattan Project” created to develop the first US nuclear weapons, as part of the nuclear arms race between the United States, the Soviet Union and their respective allies.

1945: The first US nuclear bombs are used on Hiroshima and Nagasaki, Japan, ultimately leading to the end of World War II. Succeeding the war’s end, world governments competitively spend massive amounts of money to further the advancement of warfare weapons and technology, particularly weapons of mass destruction.

1947: The Central Intelligence Agency (CIA) is formed to collect and distribute information regarding foreign policy intelligence and analysis.

1950: Top secret Tamarind expedition executed. Many of Earth’s population note these UFO sightings, however this is not the first time it’s been recorded throughout human history; sightings and interaction date back to the early civilizations, though no scientific evidence is made public.

1957: Major breakthroughs in artificial intelligence are made.

1958: The National Aeronautics and Space Act is signed, creating the National Aeronautics and Space Administration (NASA). Shortly thereafter, a top secret facility in Nevada named “Area 51” is revealed to be used for testing related to space findings and “other experiments.”

1962: In reaction to the installation of Soviet nuclear missiles in Cuba, President Kennedy makes a similar show of force by unveiling new military weapons: particle beams, mother boxes, and boom tubes. Ultimately, however, the Soviet Union and the U.S. agree to not engage in any acts of war.

1969: Hover cars and boards hit the market.

1970: Justice Society of America (JSA) formed; the birth of “super” heroes.

1972: As the Watergate scandal breaks, Americans are glued to their phones and TVs, watching the debacle unfold through holographic broadcasts.

1974: Infant found amidst the debris left by a crashed UFO in Smallville, Kansas.

1981: Thomas Wayne, owner of Wayne Enterprises, and his wife Martha Wayne are murdered on Park Row in Gotham City.

1985: Much to the surprise of political pundits, despite his instrumental role in the development of the particle-beam gun, scientist and professor Thomas Morrow is appointed Secretary of Defense.

1986: A.I. pop group, New Kids on the Block, take the world by storm with their debut.

1988: LexCorp trades publicly for the first time, setting record high opening days on the U.S. Stock Market in only its first year.

1991: The end of the Cold War and the advancement of technology marks a seismic shift in priorities for the CIA. Responsibilities have grown to now include counterterrorism, nonproliferation of advanced weapons and weapons of mass destruction, warning/informing American leaders of important overseas events, counterintelligence, cyber intelligence and warning/informing American leaders of extraterrestrial threat/contact.

1992: Beating advancements made since the 60’s in Japan, America’s first high speed rail system is finally completed, with its grand terminal built in Central City, allowing for cross-country travel in only a matter of hours. Rogue scientists alert the media of the use of a cosmic force known as the speed force to aid the system.

1992: The first exoskeleton brain-implant is a success. Corporations make a mass move to implant exoskeleton chips into employees' brains. The landscaping and many manual labor intensive fields—construction, many of the skilled trade jobs—see rapid implementation of these originations.

1993: Women now make up half of the workforce, as the proliferation of automated robots in homes have alleviated traditional gender roles for most families.

1993: The Supreme Court of the United States rules in the first criminal action against a sentient A.I. A.I. who randomly gain sentience may still be punished by the State.

1994: The “Crime Bill” passes, leading to President Clinton’s commission of Arkham Asylum. The asylum is effective in cleaning up Gotham’s streets, and is hailed a massive success.

1996: Grounded cars officially phase out of the market, with manufacturers that were unable to keep up with hover car production going out of business (e.g. Ford, Honda).

1996: Kids go crazy for simulations. While they had been slowly gaining popularity in the workforce, allowing for greater employee training, they have now been fully monopolized by the entertainment industry. Spice Girls, Backstreet Boys and *NSYNC go on to become the largest sellers of simulation merchandise.

1996: Congress debates exoskeleton control after another black market exoskeleton death occurs.

1996: Supermodels Kate Moss and Naomi Campbell popularize synthetic high fashion.

1996: Reputable publications rank Metropolis the “Best City in the World”.

1996: The southern states grow weary of the country’s hyper-advancement, fearing these developments threaten their states’ rights to decide how best to allocate their resources.

1997: The Daily Planet building in Metropolis completes its reconstruction; at over 2,700 feet, it becomes the tallest building in the world.

1997: Civil rights activists complain of Arkham Asylum’s rising population and accuse the prison’s doctors of inhumane experimentation on patients.

1997: President Clinton lodges sanctions against Gotham City, New Jersey for its apparent-resurgence of crime, restricting their access to hover cars. Gotham is the only city to still rely on grounded cars.

January 17, 1998: Clinton-Lewinsky scandal breaks.

January 27, 1998: A resolution to amend the U.S. Constitution and allow the secession of the then-colloquially dubbed “Federalist States” is introduced in Congress.

August 1998: Florida man attempts to marry his automated robot.

November 3, 1998: The Arkham Asylum riots become the most violent prison riot in American history, resulting in several breakouts, deaths and thirteen officers taken hostage.

December 19, 1998: Bill Clinton is impeached by the House of Representatives.

January 1, 1999: Atlantis reappears.

January 7, 1999: The Senate trial in the impeachment of President Bill Clinton begins.

January 21, 1999: The United States Coast Guard makes the largest drug bust in American history, intercepting a ship with over 16,500 pounds of cocaine aboard headed for Gotham.

February 12, 1999: President Bill Clinton is acquitted by the Senate.

March 21, 1999: The Matrix—a movie with an all-A.I.-cast—becomes the first of its kind to win Best Picture at the Oscars following its January release.

April 8, 1999: Alexander Luthor surpasses $200 billion, edging out Warren Buffet and Bill Gates as the richest man in America.

April 1999: Through approval from Congress and states, cessation of the old U.S. South is finalized. Reorganization begins.

July 1999: Crime in Gotham City reaches a new peak, officially making it one of the most dangerous cities in the entire world; it holds the highest poverty, crime and murder rate in North America by a large margin. As a result, President Bill Clinton has military blockades set at its borders to prevent easy entry or exit, in hopes of keeping the crime wave contained within the city and managed.

August 1999: Sales of violent virtual reality video games and other media depicting graphic violence are limited across the country amidst the Gotham influenced panic, with experts warning of a wave of copycat criminals who will replicate their brutality.

August 1999: Tony Hawk became the first to land a “1000” on a hoverboard, following his “900” trick just months before on a skateboard.

October 1999: The New American Supreme Court rules LexCorp is in violation of antitrust laws, citing "unregulated and unreasonable practice" toward its competitors.

November 1999: The Tamarind expedition of 1950 is exposed by way of leaked CIA documentation. The dark web becomes a new priority for the reorganized government.

December 1999: Diana of Themyscira leaves Themyscira and sets foot on “Man’s World.”

December 31, 1999: The “New Reformation of the United States” and the “Federalist States of America” are recognized internationally as new territories.

January 1, 2000: Brainiac appears.

January 1, 2000: Independent news outlets report with alarm that Atlantis has become the international target of interest after Brainiac’s decree.

6 notes

·

View notes

Text

Simpsons #182

WHAT THIS?

Treehouse of Horror VIII

Season 9 - Episode 4 | October 26, 1997

Could this be the last classic Treehouse of Horror? Uh, yeah, I guess. I would say that first one where the drop-off in quality is unrecoverable is season 13′s Treehouse of Horror XII. Everything before that one passes the smell test.

This one starts off with a lil sketch about the network censor making changes to this episode’s script. It’s reminiscent of a sketch from the Smothers Brothers, where the script is torn apart by a succession of network censors, who laugh uproariously at the pages they are tearing out. A TV rating appears in the corner, which I believe 1997 was the first year of onscreen ratings for TV programs. I remember the first time I saw the rating appear on the first episode of Lost On Earth, a USA Network sitcom about aliens posing as puppets at a TV station. The first scene was literally about a guy making an obscene outburst on live TV, so it was a very fitting introduction to the ratings system. According to wikipedia, the show premiered in January of 1997, so the Simpsons should have also had on-screen ratings for half a season at this point. The sketch ends with the on-screen rating sprouting an arm with a knife in it’s hand, and stabbing the censor while the rating goes up. I remember being a kid and being really sad because I remember thinking of that joke myself before the Simpsons did it. I was 13 and had delusions that I had any kind of chance at making professional TV comedy even at that age.

The first segment is great! Homer is the lone survivor of an atomic blast from France. There’s a lot of great bits in this. I especially love Comic Book guy’s “I’ve wasted my life” line, Homer picturing his family with baseball bats for no reason, and the part where Homer enjoys a David Spade/Chris Farley movie. That’s one of my favorite jokes on the show.

The second bit is a riff on The Fly. It starts off with the extrodinarily dumb premise that Professor Frink’s yard sale is stocked with fantastical objects at rock bottom prices. Homer buys his matter transference device for like, a dollar or something. It’s easy to forgive the dumbness cuz it’s a halloween show and they only have a couple minutes to get the plot going, so I’m not actually complaining. Bart enters the thing with a fly and now there’s a gross fly guy running around the Simpsons house.

The last segment is the weakest one but it’s harmless. The Salem witch trials wind up being the site of the origin of trick-or-treating. It’s slightly cutsey, though I appreciate the part where Marge makes a point to say that they filled up on children on the way to the Flanders’ house. The plot is about how the townspeople successfully avoid getting their children eaten by giving the witches candy instead, and the gratuitous reference to child murder happening off-camera is my favorite joke in the whole thing.

THE B-SODE(S):

Recess: "Omega Kids"

Season 2 - Episode 16 | December 12, 1998

I can’t believe I found another Omega Man reference in a cartoon from this era. I thought I’d have to cheat and create a rotoscoped animation set to the first monologue from RIchad Linklater’s Slacker and pretend it came from Waking Life. Anyway, the kids play at the school while it’s deserted or some shit.

Johnny Bravo: "I, Fly"

Season 2 - Episode 7A | October 1, 1999

Wouldn’t it have been fun if i just used the animated Spy vs. Spy bits from MADtv? Get it, cuz the Simpsons segment was titled “Fly vs. Fly”? I really should include the titles when I review each segment but Wikipedia exists for a reason.

The Halloween Tree

TV movie | October 30, 1993

I always wanted to watch this TV movie. Seems pretty good. It’s based on a Ray Bradbury story. I saw him speak at comic-con before he died. He talked about how much he loved Ronald Reagan. I was like “OKAY BOOMER” lol. and then he died in front of all of us. RIP. Anyway, this is about the true origins of Halloween. EDUCATE YOURSELFS

4 notes

·

View notes

Link

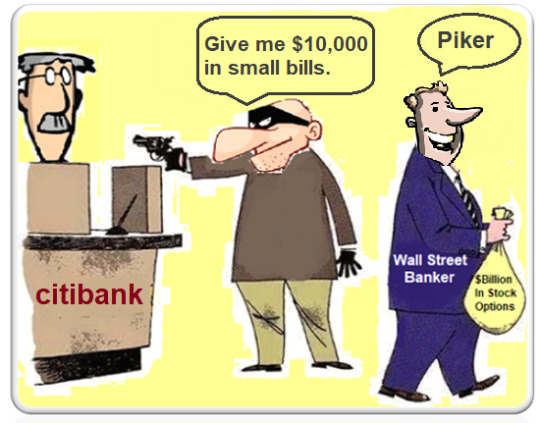

Yesterday CNBC reported that Citigroup is one of the banks selected by the Small Business Administration to handle billions of dollars earmarked in last week’s stimulus bill to help small businesses get back on their feet and keep their employees paid during the coronavirus crisis. Citigroup’s Citicorp subsidiary was charged with, and pleaded guilty to, a criminal felony count brought by the U.S. Department of Justice on May 20, 2015 for its role in rigging foreign currency trading. Its rap sheet for a long series of abuses to its customers and investors since 2008 is nothing short of breathtaking. (See its rap sheet at the end of this article.)

During the financial crash of 2007 to 2010, Citigroup received the largest bailout in global banking history after its former top executives had walked away with hundreds of millions of dollars that they cashed out of stock options. Citigroup received over $2.5 trillion in secret Federal Reserve loans; $45 billion in capital infusions from the U.S. Treasury; a government guarantee of over $300 billion on its dubious “assets”; a government guarantee of $5.75 billion on its senior unsecured debt and $26 billion on its commercial paper and interbank deposits by the Federal Deposit Insurance Corporation.

Sandy Weill was the Chairman and CEO of Citigroup as it built up its toxic footprint and off-balance-sheet vehicles that blew up the bank. Weill was also the man who engineered the repeal of the Glass-Steagall Act, the depression-era legislation that had safeguarded the U.S. banking system for 66 years before its repeal in 1999. Weill needed the Glass-Steagall legislation to vanish so that he could merge his hodgepodge of Wall Street trading firms (Salomon Brothers and Smith Barney, et al) with a federally-insured bank full of deposits. Weill told his merger partner, John Reed of Citibank, that his motivation for the deal was: “We could be so rich,” according to Reed in an interview with Bill Moyers.

The repeal of Glass-Steagall meant that the casino-style investment banks and trading houses across Wall Street could now own federally-insured commercial banks and use those mom and pop deposits in a heads we win, tails you lose strategy. Every major Wall Street trading house either bought a federally-insured bank or created one. (See the co-author of this article testifying before the Federal Reserve on June 26, 1998 against the Citigroup merger and the repeal of the Glass-Steagall Act in this video.)

What Weill meant by “We could be so rich” was this: If the trading bets won big, the CEOs became obscenely rich on stock-option-based performance pay. When the bets lost big, the government would be forced to do a bailout rather than allow a giant federally-insured bank to fail. This is why the Federal Reserve had to secretly plow $29 trillion into Wall Street banks and their foreign derivatives counterparties between 2007 and 2011 and why the Fed had to open its money spigot again on September 17 of last year – months before there were any reports of coronavirus COVID-19 cases anywhere in the world.

Sandy Weill became a billionaire at the merged Wall Street bank, known as Citigroup, through a technique that compensation expert Graef “Bud” Crystal called the Count Dracula stock option plan – you simply could not kill it; not even with a silver bullet. Nor could you prosecute it, because Citigroup’s crony Board of Directors rubber-stamped it. The plan worked like this: every time Weill exercised one set of stock options, he got a reload of approximately the same amount of options, regardless of how many frauds the bank had been charged with during the year. (And there were plenty. See rap sheet below.)

Writing at Bloomberg News, Crystal explained that between 1988 and 2002, Weill “received 96 different option grants” on an aggregate of $3 billion of stock. Crystal says “It’s a wonder that Weill had time to run the business, what with all his option grants and exercises. In the years 1996, 1997, 1998 and 2000, Weill exercised, and then received new option grants, a total of, respectively, 14, 20, 13 and 19 times.”

When Weill stepped down as CEO in 2003, he had amassed over $1 billion in compensation, the bulk of it coming from his reloading stock options. (He remained as Chairman of Citigroup until 2006.) Just one day after stepping down as CEO, Citigroup’s Board of Directors allowed Weill to sell back to the corporation 5.6 million shares of his stock for $264 million. This eliminated Weill’s risk that his big share sale would drive down his own share prices as he was selling. The Board negotiated the price at $47.14 for all of Weill’s shares.

On May 9, 2011 Citigroup did a 1 for 10 reverse stock split, meaning if you previously owned 100 shares of Citigroup, you now owned just 10 and the price was adjusted upward accordingly. At yesterday’s closing price of $38.51 (actually $3.85 if adjusted for the reverse stock split), Citigroup’s long-term shareholders are still down 92 percent from where Weill bailed out of the stock in 2003.

Another man that became obscenely rich from Citigroup was Robert Rubin, the Treasury Secretary under the Bill Clinton administration who helped Citigroup advocate for the repeal of the Glass-Steagall Act. Without any meaningful cooling-off period, Rubin went straight from his government post to serve on the Board of Citigroup. Rubin received more than $120 million in compensation over the next eight years for his non-management job.

John Reed had a falling out with Weill and retired from Citigroup in April 2000. In Monica Langley’s book, Tearing Down the Walls: How Sandy Weill Fought His Way to the Top of the Financial World. . .and Then Nearly Lost It All, the author reports that Reed owned 4.7 million shares of Citigroup on the date of his retirement. Langley also writes that “Reed immediately began selling his Citigroup shares and laid plans with his second wife to buy a house on an island off the coast of France.”

If Reed sold all of his Citigroup shares over the next three months after his retirement at an average price at the time of $62, he would have realized $291 million in proceeds. According to SEC filings (see here and here) Reed also received a $5 million retirement bonus and a retirement pension of at least $2,019,528 annually.

According to the SEC filings, Reed was also to receive the following: lawsuit indemnifications arising from company employment; an office at Citigroup, secretarial support and access to a car and driver for as long as Reed deemed it “useful.” If Reed decided he needed an office outside of New York City, that would be provided with secretarial support until age 75.

When Weill stepped down as CEO in 2003, he put his General Counsel and personal friend, Chuck Prince, in charge as CEO. Prince took the fall when the company imploded in 2008. For being a good foot soldier to Weill, Prince got an exit package of $68 million.

And then there was Vikram Pandit, a hedge fund manager whom Robert Rubin selected to run the sprawling Citigroup. The Wall Street Journal reported that Pandit took home $221.5 million during his five years at Citigroup.

Sheila Bair, the head of the Federal Deposit Insurance Corporation that guaranteed Citigroup’s debt during the financial crisis, wrote this about Pandit’s persona at a meeting with other bankers in her book “Bull by the Horns”:

“Pandit looked nervous, and no wonder. More than any other institution represented in that room, his bank was in trouble. Frankly, I doubted that he was up to the job. He had been brought in to clean up the mess at Citi. He had gotten the job with the support of Robert Rubin, the former secretary of the Treasury who now served as Citi’s titular head. I thought Pandit had been a poor choice. He was a hedge fund manager by occupation and one with a mixed record at that. He had no experience as a commercial banker; yet now he was heading one of the biggest commercial banks in the country.”

When the Financial Crisis Inquiry Commission concluded its findings into what led to the financial crash of Wall Street in 2008, resulting in millions of job losses and foreclosures across America, it made numerous referrals for potential criminal prosecutions to the Justice Department. Three of Citigroup’s executives were among those referrals: Robert Rubin, Chuck Prince and former CFO Gary Crittenden. Nothing ever became of those referrals.

In 2012 the law firm Kirby McInerney agreed to settle a lawsuit against Citigroup on behalf of shareholders for $590 million. The lawsuit charged that Citigroup had lied to shareholders about its financial condition, including its losses from off-balance-sheet accounting tricks. The plaintiffs wrote this about Citigroup’s Collateralized Loan Obligations (CLOs), which were loans to lower credit-rated companies that were then pooled together:

“After purchasing insurance on a CLO tranche, Citigroup would book the difference in the cost of the insurance and the payments of the loan for the entire life of the loan immediately as if the loan had been sold…Additionally, Citigroup engaged in negative basis trades with the billions of dollars of CLO exposure remaining on the Company’s balance sheet. These trades allowed Citigroup to book immediate gain for the entire term of loans by purchasing insurance on their default and, thereby, treat the purchase of insurance as a sale of the loans when, in fact, those loans (or rather, those CLO tranches) never left Citigroup’s books…In addition to the high fees for CLO creation, the ability to create instant gain through these trades was a powerful incentive for Citigroup to issue ever riskier leveraged loans. While revenue from fees and negative-basis trades inflated Citigroup’s earnings on leveraged loans and CLOs, Citigroup kept its shareholders unaware of the artificial source of the gains or the inherent risks in continuing to operate its ephemeral money-making machine.”

After Citigroup’s massive bailout by taxpayers and the Federal Reserve, its crime spree continued. This is just a sampling of charges brought against Citigroup and its affiliates since December 2008:

Citigroup’s Rap Sheet:

December 11, 2008: SEC forces Citigroup and UBS to buy back $30 billion in auction rate securities that were improperly sold to investors through misleading information.

July 29, 2010: SEC settles with Citigroup for $75 million over its misleading statements to investors that it had reduced its exposure to subprime mortgages to $13 billion when in fact the exposure was over $50 billion.

October 19, 2011: SEC agrees to settle with Citigroup for $285 million over claims it misled investors in a $1 billion financial product. Citigroup had selected approximately half the assets and was betting they would decline in value.

February 9, 2012: Citigroup agrees to pay $2.2 billion as its portion of the nationwide settlement of bank foreclosure fraud.

August 29, 2012: Citigroup agrees to settle a class action lawsuit for $590 million over claims it withheld from shareholders’ knowledge that it had far greater exposure to subprime debt than it was reporting.

July 1, 2013: Citigroup agrees to pay Fannie Mae $968 million for selling it toxic mortgage loans.

September 25, 2013: Citigroup agrees to pay Freddie Mac $395 million to settle claims it sold it toxic mortgages.

December 4, 2013: Citigroup admits to participating in the Yen Libor financial derivatives cartel to the European Commission and accepts a fine of $95 million.

July 14, 2014: The U.S. Department of Justice announces a $7 billion settlement with Citigroup for selling toxic mortgages to investors. Attorney General Eric Holder called the bank’s conduct “egregious,” adding, “As a result of their assurances that toxic financial products were sound, Citigroup was able to expand its market share and increase profits.”

November 2014: Citigroup pays more than $1 billion to settle civil allegations with regulators that it manipulated foreign currency markets. Other global banks settled at the same time.

May 20, 2015: Citicorp, a unit of Citigroup becomes an admitted felon by pleading guilty to a felony charge in the matter of rigging foreign currency trading, paying a fine of $925 million to the Justice Department and $342 million to the Federal Reserve for a total of $1.267 billion. The prior November it paid U.S. and U.K. regulators an additional $1.02 billion.

May 25, 2016: Citigroup agrees to pay $425 million to resolve claims brought by the Commodity Futures Trading Commission that it had rigged interest-rate benchmarks, including ISDAfix, from 2007 to 2012.

July 12, 2016: The Securities and Exchange Commission fined Citigroup Global Markets Inc. $7 million for failure to provide accurate trading records over a period of 15 years. According to the SEC: “CGMI failed to produce records for 26,810 securities transactions comprising over 291 million shares of stock and options in response to 2,382 EBS requests made by Commission staff, between May 1999 and April 2014, due to an error in the computer code for CGMI’s EBS response software. Despite discovering the error in late April 2014, CGMI did not report the issue to Commission staff or take steps to produce the omitted data until nine months later on January 27, 2015. CGMI’s failure to discover the coding error and to produce the missing data for many years potentially impacted numerous Commission investigations.”

June 15, 2018: Citigroup agrees to settle with states for $100 million over charges that it rigged the Libor interest rate benchmark.

June 29, 2018: Citigroup’s Citibank settles with the Consumer Financial Protection Bureau for $335 million in restitution to credit card customers over charges that it violated the Truth in Lending Act.

August 16, 2018: Citigroup settles with SEC for $10.5 million over inadequate controls, mismarking of illiquid positions and unauthorized proprietary trading.

September 14, 2018: Citigroup settles with SEC for $13 million over charges it improperly operated its Dark Pool – an internal stock exchange where it is allowed to trade its own stock.

May 22, 2019: Citigroup settles a money laundering case with the U.S. Department of Justice for $97.44 million.

November 26, 2019: Citigroup settles with the Bank of England’s Prudential Regulatory Authority for $57 million over charges that it incorrectly reported the bank’s capital and liquidity levels.

.

19 notes

·

View notes