#offshore investment

Text

Navigating the Risks of Offshore Investing: A Comprehensive Guide

Exploring New Horizons with Awareness

In the quest for diversification and potentially higher returns, offshore investing has become a compelling strategy for many investors. However, this terrain, while lucrative, comes with its own set of unique risks. In this post, we dive into the complexities and challenges associated with offshore investments, offering insights to help you make informed…

View On WordPress

0 notes

Text

Family Offices and Offshore Investments: Preserving Wealth for Generations

Picture a scenario where the wealth you've accumulated isn't just for you, but a legacy for your children, grandchildren, and beyond. That's the core idea behind family offices and offshore investment – safeguarding and growing wealth to pass down through generations. In this blog, we'll explore how these two elements come together, all while keeping things easy to understand.

Preserving Wealth: A Multigenerational Goal

Wealth preservation is a primary concern for affluent families. The challenge lies in managing and growing assets in a way that ensures financial security for not just the present generation but for generations to come. Here's where family offices play a vital role.

The Power of Family Offices

Family offices offer comprehensive services, from investment advisory to fund administration services. They provide personalized strategies tailored to the unique goals of each family, ensuring that wealth is managed efficiently. With the help of investment advisors, families can identify offshore investment opportunities that align with their long-term objectives.

Diversification and Risk Management

One of the keys to preserving wealth is diversification. Family offices often employ a diversified investment approach that includes offshore investments. These can encompass real estate in favorable locations, international stocks, and alternative assets. Diversification increases the possibility for long-term gain while lowering risk.

Preserving Wealth through Offshore Investments

Offshore investments are a cornerstone of many family office fund administration services and strategies. They offer several advantages, including tax efficiency, asset protection, and access to global markets. For example, owning real estate in a foreign country can provide not only a second home but also a lucrative rental income. International stocks can be a hedge against domestic economic fluctuations. These assets can be held within legal structures that enhance privacy and protection.

The Role of Investment Advisory

Investment advisory services within family offices are instrumental in guiding families through the complexities of offshore investments. They stay informed about international regulations and market trends, helping families make informed decisions. This expertise ensures that offshore investments are both strategic and secure.

The Future of Wealth Preservation

As we look to the future, the role of family offices and offshore investment in preserving wealth remains essential. The Google Effect will continue to provide information and resources, enabling families to make informed choices. Family offices will adapt and evolve, providing innovative solutions to manage and grow wealth across generations.

The legacy of financial security continues, allowing families to prosper long into the future, a testament to the power of informed and strategic wealth management.

0 notes

Text

#the vatican bank#savings#offshore banking#investing#emergency fund#wealth management#assets#the 1%#tax haven#elite#tax shelter#private banking

24 notes

·

View notes

Text

The Shocking Truth Behind Britain’s Offshore Renewable Energy Sector.

The Chancellor of the Exchequer said in his 2023 Spring Statement yesterday:

“...an enterprise economy needs low taxes. But it also needs cheap and reliable energy…That means investing in domestic sources of energy that fall outside Putin or any autocrat’s control. We are world leaders in renewable energy…We have increased the proportion of electricity generated from renewables from under 10% to nearly 40%.” (Parliament: 15/03/23)

Three cheers for Britain! World leaders in renewable energy, or so Jeremy Hunt, the smooth-tongued doctor of spin, would have us believe. It is true that British waters hold the largest share of offshore wind capacity in the world, But - and with Tory government pronouncements there is always a but - over 80% of “our” offshore capacity is owned by companies located overseas. To make matters worse:

“The businesses that make up the supply chain — the makers of blades, foundations and high-voltage cables — often come from abroad, too. Of the four companies that accounted for 55% of new orders globally of turbine manufacturing in 2019, not a single one was British.” (Carla Subirana, economist, Yahoo News: 03/03/23)

Not only are these foreign companies coining the profits from their UK operations but we, the British taxpayer, are subsiding them. In 2022, the UK government gave £2.56 bn to foreign state-owned offshore wind generators, which

“…effectively means that UK taxpayers are paying for hospitals in Denmark or Norway.” (Carla Subirana)

Ok. We know the Tory Party is anti-public ownership. Private sector good – public sector bad is the Tory mantra. They believe private enterprise is more efficient and therefore more cost effective than the public sector. This may or may not be true, but if it is true then why don’t they follow their own capitalist economic philosophy?

I may be naive, but if the UK taxpayer is subsidising foreign companies, (or even home-grown companies for that matter) should we not have a shareholder stake in those companies taking our money? The Tory party prides itself on having a better understanding of business than Labour, but is it really good economics to give away money without some kind of return?

Isn’t the whole capitalist system built on the premise that if you risk loosing your money by investing in a business venture, then you are entitled to a return on your investment if that venture succeeds? Where, Mr Hunt, is the British taxpayers return for their investment in offshore renewable energy? And although our renewable energy sector may be beyond Putin’s control, Mr Hunt, it certainly isn’t within yours. The British public deserve better.

#uk politics#renewable energy#offshore#Putin#jeremy hunt#taxpayers. investment#capitalism#short sightedness

14 notes

·

View notes

Note

What do you think about decreasing fertility rates and population decline? Should we be concerned? What is your solution?

i am very concerned. think it is potentially the greatest existential threat facing human civilization, especially alongside climate change. imagine populations collapsing, then civilization collapsing with it (due to all the pressures caused by a population collapse), then having a bunch of anarchic primitive societies trying to cope with climate change without the benefit of all our modern technologies (and that includes things like farming -- how many people actually know how to farm? and even more, how many people know how to farm without modern technology?).

with that said, i'm a futurist and an optimist. i believe we will overcome this hurdle like we've overcome all others.

as for what i believe to be possible solutions...

universal basic income is a start. more parental leave. reduce work hours and more remote work for a better work-home life balance. higher wages. affordable high quality daycare. family-oriented education and /actual/ family planning centers where they offer resources and info for having big families. educate people on why having kids is good, for individuals and society, and emphasize the risks of not having kids. fund movies and shows and books which are pro-family, pro-humanity, and pro-natalist. want movies that celebrate family and having kids and demonize people who are childless. being childless needs to be seen as cringe and only for losers. we need to change the culture generally. including in the education system and celebrities and the highest levels of academia. we need to be pushing pro-natalism. we need to encourage an optimistic, life-affirming national ideology through all of the institutions. also just education reform in general. make higher education great again, rather than just the "next step" after high school. and make it free for the truly qualified. and offer career education in other forms.

build walkable, family-friendly cities with more affordable housing. universal healthcare. financial incentives like tax credits per child or family loans for married couples where a portion of the loan is paid off for each child or even preferential loans for homes for extended families or something. meanwhile tax childlessness. invest in automation of menial jobs so we can increase wages and reduce work week. invest in robotics so we can have robot-servants who help reduce the burden of household chores and childcare. invest in artificial exowombs. invest in life extension technologies. encourage people to freeze sperm, eggs, zygotes. encourage space exploration and colonization. address climate change (for a multitude of interrelated reasons, not least of which is because many anti-natalists use it as justification for their death cult).

again, just generally speaking, we need to encourage an optimistic, life-affirming ideology. we need to show people that a better world -- one filled with hope, vitality, nobility, beauty -- is possible.

and, of course, join my cult (which encourages having children).

basically all americans should live as if they were the aristocrats of the globe. living lives of ease and luxury where they are free to hone their skills and virtue and raise future generations of world-aristocrats.

and we need to understand that degrowth, anti-natalist types aren't actually interested in saving the world like they pretend. they are anti-human, life-hating demons who are members of a death cult. they are the ugly and vicious enemies of goodness.

#many people think just allowing more immigration is the solution#but it's not#it's a very short term bandaid because dropping birthrates is an issue around the globe#better to invest in self-sufficiency rather than relying on a dwindling foreign source#it's basically natalist offshoring#not to mention all of the other negative externalities that come with mass immigration#but with that said#i am confident even if we go with a managed decline#and focus on a small but high quality population#we'll be okay#especially combined with life extension and robotics/ai

2 notes

·

View notes

Text

He pointed out that Westpac had substantial investments in offshore operations, through its global financial markets network. He emphasised:

There is tremendous growth opportunity in my view right here at home, growth that comes because our home is linked to Asia and not because we might be able some day to open banks in Asia. In my experience, basic retail and commercial banking is a very difficult business to export and there are indeed very few examples of banks successfully operating retail and middle market banks across national boundaries. Citibank and National Australia Bank are among the very few successful cases. Recent banking history is littered with examples of banks not making it when they try to enter new high-growth markets.

"Westpac: The Bank That Broke the Bank" - Edna Carew

#book quotes#westpac#edna carew#nonfiction#investment#offshore#financial markets#emphasis#bob joss#growth#asia#banking#finance#citibank#nab#national australia bank#exports

0 notes

Text

Ofgem approves Britain's largest grid investment for 'electricity super highway'

Ofgem approves Britain's largest grid investment for 'electricity super highway' #climatetargets #EasternGreenTwo

#climate targets#Eastern Green Two#electricity super highway#electricity superhighway#energy independence#energy infrastructure#fossil fuel reduction#grid investment#Jonathan Brearley#Labour government#largest grid#net zero#offshore wind#Ofgem#renewable energy#Sarah Jones#subsea cable#UK electricity grid

0 notes

Text

Golden Visa: Your Key to Unlocking Boundless Opportunities in a Thriving Economic and Cultural Hub. Start Your Journey With Us Now! Contact Us Today! Visit us: https://lvsdxb.com/ Call us: Call us: (+971) +971501427727 | (+971) 58 556 7272 Mail us: [email protected]

#LVSdxb#levamos#Golden Visa#Dubai Opportunities#Residency#Business Ownership#Exclusive Perks#Dubai Business#Economic Hub#Cultural Hub#Start Your Journey#Business Setup#Business License#Entrepreneur Life#Business Solutions#Start Your Business#Business Growth#Investment Opportunity#Business Development#Business Services#Corporate Services#Free Zone Setup#Free Zone#Invest in Dubai#Offshore Company#Mainland Business#Business Strategy#Company Formation#Hassle-Free Growth

0 notes

Text

Offshore Funds: Your Gateway to Global Wealth

What Are Offshore Funds?

Offshore funds are investment funds set up in countries outside of where the investor lives. These funds are based in places with friendly tax laws and rules, making them appealing to investors who want to save on taxes and spread their investments. These funds can include different types of investments, such as stocks, bonds, and other assets.

These foreign funds are managed by professional fund managers who gather money from many investors and invest it in various assets. The main goal is to make higher returns while reducing risks by spreading investments across different countries and types of assets. Offshore funds usually follow different rules than funds in the investor’s home country, offering more flexibility and potentially higher returns.

How Do Offshore Funds Work?

Offshore mutual funds operate by pooling capital from multiple investors and investing it in a diversified portfolio of assets, such as stocks, bonds, and real estate. These funds are established in foreign countries with favorable tax laws and flexible regulations, offering potential tax efficiency and investment strategy flexibility. This type of fund aims to maximize returns while mitigating risks by leveraging global market opportunities. They benefit from less stringent regulatory oversight and provide enhanced privacy protections.

5 Advantages of Offshore Funds for Investors

1. Tax Efficiency

One of the main attractions of offshore funds is the potential for tax savings. These funds are often domiciled in countries with favorable tax laws, allowing investors to reduce their overall tax burden.

2. Diversification

These funds offer investors the opportunity to diversify their portfolios geographically. By investing in a range of assets across different countries and markets, investors can spread their risk and reduce the impact of localized economic downturns.

3. Access to International Markets

Investing in these funds is a gateway to global markets that might not be accessible through domestic funds. This global reach allows investors to seize opportunities in emerging markets and other international arenas.

4. Flexibility in Investment Strategies

These funds often operate under less stringent regulatory frameworks, giving fund managers greater flexibility in their investment strategies. This can include leveraging, short selling, and investing in a wider range of asset classes.

5. Privacy and Confidentiality

Many offshore jurisdictions offer enhanced privacy protections for investors. These include strict confidentiality laws that safeguard the identity and investment details of investors, providing an added layer of security.

Learn more: https://finxpdx.com/offshore-funds-your-gateway-to-limitless-global-wealth/

0 notes

Text

#economy#finance#investing#offshore#insurance#pension#saving money#tax savings#us dollar#usdjpy#japanese yen#life insurance#life in the world to come#legacyplanning

1 note

·

View note

Text

https://www.techsaga.us/Managed-Outsourcing-Service

Offshore outsourcing in business leverages cost efficiency, access to specialized skills, and around-the-clock productivity. It fosters scalability, flexibility, and global market penetration while allowing companies to focus on core competencies and strategic initiatives for sustainable growth.

#Offshore outsourcing advantages in business#ecommerce#business#investing#accounting#commercial#entrepreneur#Workday HCM consulting expertise

0 notes

Text

U.S. Strategy for Countering China’s Influence in Zambia

Leveraging Local Dynamics and Sustainable Partnerships

China’s Influence in Zambia: Not as Coordinated as It Seems

China’s growing presence in Africa has long been a subject of intense scrutiny. In exchange for resources and influence, China provides African nations with significant financial support and infrastructure. However, as our extensive research into Zambia’s experience shows, China’s…

0 notes

Text

Strategic Offshore Investments: Your Path to Financial Security

In recent times, you've probably heard the phrase "invest offshore" thrown around frequently, especially when economic and political uncertainties dominate the news. However, it's crucial to understand that investing offshore should not be a knee-jerk reaction to negativity. Instead, it should be a strategic move rooted in a well-thought-out plan that serves a purpose. In this article, we will delve into the intricacies of investing offshore and the key considerations you should keep in mind to ensure your investments have a purpose.

Investing is primarily about growing your wealth over time. We've previously covered topics like where to invest, asset allocation, and risk management in our "How to Invest" series. Offshore investment offers a unique advantage by providing exposure to regions and industries that may not be available locally.

One compelling reason to consider offshore investments is diversification. Offshore assets diversify your investment portfolio, reducing risk by spreading your investments across different regions and industries.

Moreover, offshore investments offer access to unique opportunities that may not be available in your local market. These opportunities include large companies, offshore bonds, property, and cash holdings. The diversification of assets on a global scale can help cushion your investments against localized economic downturns.

Another critical benefit of offshore investing is currency hedging. Investing offshore can act as a hedge against currency depreciation in your home country. If your local currency weakens or inflation rises, assets in a foreign currency can maintain or increase in value, thus preserving your wealth.

However, it's essential to recognize that offshore investing comes with its own set of risks, including currency fluctuations and geopolitical factors. Yet, understanding these risks as individual or institutional investors and having a well-informed investment plan can help mitigate potential downsides.

Now, let's explore how to invest offshore. There are two primary strategies:

1. Direct Offshore Investments:

This approach involves investing directly through offshore-based platform service providers. However, you should be aware of annual limits on taking money offshore without tax clearance. Additionally, when you invest directly without any investment management company, tax reporting and estate planning become your responsibility.

2. Indirect Offshore Investments:

With this strategy, you invest in offshore assets through local investment vehicles like unit trusts or tax-free accounts. Consider investing in offshore feeder funds, which allow you to invest in foreign assets indirectly using your local currency. These funds are administered locally and comply with local tax laws while offering performance similar to direct offshore investments.

Before you start with offshore investment, consider your financial situation and life stage. Ensure that your offshore investments align with your long-term financial goals and risk tolerance. Avoid making impulsive decisions based on short-term trends or the opinions of others. Think about how offshore investments may impact your immediate financial needs, such as buying a home or planning for retirement.

Investing offshore can be a valuable addition to your investment strategy, providing diversification and access to global opportunities. By understanding the reasons behind an offshore investment and the various methods available, you can make informed choices to secure your financial future. The key to successful investing lies in understanding your unique financial journey and making informed decisions that serve your long-term interests.

0 notes

Text

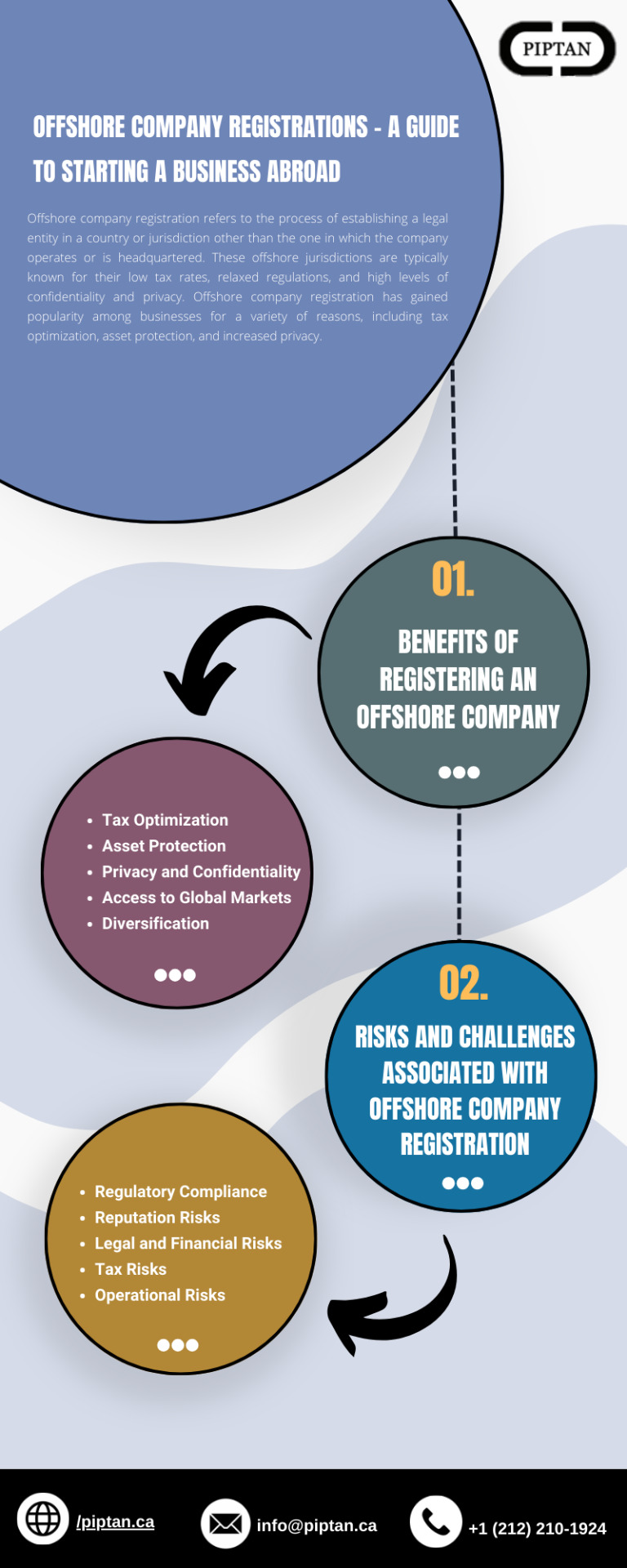

Offshore Company Registrations - A Guide to Starting a Business Abroad

Offshore company registration refers to the process of establishing a legal entity in a country or jurisdiction other than the one in which the company operates or is headquartered. These offshore jurisdictions are typically known for their low tax rates, relaxed regulations, and high levels of confidentiality and privacy. Offshore company registration has gained popularity among businesses for a variety of reasons, including tax optimization, asset protection, and increased privacy.

The process of registering an offshore company typically involves hiring a professional service provider, such as a law firm or corporate services provider, to assist with the incorporation process. The service provider will typically guide the client through the process of selecting the most appropriate offshore jurisdiction, based on the client's specific needs and objectives, and then assist with the necessary documentation and filings to establish the company.

1 note

·

View note

Text

Archway Investments

Archway Investments Limited (CR #0246166) is a member of ICRIS and was originally founded back in 1989. Since then, we have grown tremendously and we now service both institutional and retail clients around the globe.

Our Story and Mission

At Archway Investments, our story is one of passion, expertise and a relentless pursuit of excellence. Founded by a team of seasoned professionals with deep industry knowledge, we set out on a mission to empower investors by offering comprehensive investment solutions tailored to their unique needs. Our unwavering commitment to integrity, transparency and client success has been the cornerstone of our journey.

About Us;

Address: YHC Tower, No.1 Sheung Yuet Road, Kowloon Bay, Hong Kong

Phone: +852 2632 9770

Website: https://archway-hk.com

Business Email: [email protected]

#investment solutions#Asset Management#Wealth Management#Institutional Investing#Portfolio Analysis#Crypto currencies#Offshore Funds#Expert Retirement Planning Services#Private Placements#Pre – IPO Placements#Thematic Investing#After Hours Trading#Crypto Staking

1 note

·

View note

Text

India's Tech Talent: Offshore Development and IT Outsourcing Investment

India has long been recognized as a global hub for technological expertise and innovation. With a burgeoning tech landscape and a pool of skilled professionals, the country has made significant strides in the realm of offshore development and IT outsourcing. The convergence of a highly skilled workforce, cost-effective solutions, and a conducive business environment has solidified India's position as a preferred destination for companies worldwide seeking to invest in offshore development and outsource their IT operations.

Overview of India's Tech Industry

The Indian tech industry has experienced remarkable growth over the years, evolving from its nascent stages to becoming a powerhouse in the global technology arena. The journey traces back to the 1980s when India's IT industry began to take shape with a focus on software development and services. Since then, it has expanded exponentially, encompassing a wide array of domains such as software development, IT services, engineering, R&D, and more recently, emerging technologies like AI, blockchain, and IoT.

Importance of Tech Talent in Global Markets

Tech talent plays a pivotal role in shaping the competitive landscape of global markets. India's robust talent pool has been instrumental in propelling the country's tech industry forward. The availability of a vast workforce skilled in software engineering, programming, data analytics, and other specialized domains has been a key factor driving India's success in catering to the needs of diverse industries worldwide.

Significance of Outsourcing and Offshore Development

Outsourcing and offshore development have become integral strategies for businesses looking to optimize their operations and remain competitive. Outsourcing involves delegating specific tasks or functions to external service providers, while offshore development refers to the practice of establishing development teams or centers in other countries, typically to leverage cost benefits and access specialized skills. India has emerged as a preferred destination for both these practices due to its conducive business environment, cost-effectiveness, and a skilled workforce proficient in various technologies.

In the next sections of this blog, we'll delve deeper into India's tech landscape, the evolution of offshore development, the significance of IT outsourcing, and explore the myriad investment opportunities that India's tech industry presents. Moreover, we'll highlight the factors that contribute to India's robust tech talent pool, elucidating why the country remains a hotspot for global businesses seeking to invest and leverage its vast potential.

Stay tuned as we explore the intricate facets of India's tech prowess and the lucrative opportunities it holds for investors and businesses looking to capitalize on offshore development and IT outsourcing.

I. India's Tech Landscape

A. Historical Development of India's Tech Industry

The evolution of India's tech industry is a testament to the nation's resilience, adaptability, and technological prowess. Initially focusing on software services and development, India's tech landscape gained traction in the 1990s when economic reforms liberalized the market, encouraging foreign investments and collaborations. This era marked the establishment of numerous IT companies and laid the foundation for India's emergence as a global technology hub.

B. Present Scenario: Growth and Trends

Today, India's tech sector stands at the forefront of innovation and growth. The country has witnessed a rapid proliferation of startups and technology-driven enterprises, disrupting traditional business models and pioneering groundbreaking solutions. With a robust ecosystem fostering innovation and entrepreneurship, India continues to attract investments from multinational corporations, venture capitalists, and tech enthusiasts globally.

C. Key Factors Driving India's Tech Success

Several factors contribute to India's tech success story. The availability of a vast talent pool proficient in technology, engineering, and scientific disciplines remains a cornerstone. Additionally, a favorable regulatory environment, supportive government policies, and a growing digital infrastructure have all played pivotal roles in nurturing the growth of India's tech industry.

II. Understanding Offshore Development

A. Definition and Scope

Offshore development involves setting up development teams or centers in other countries to facilitate software development, testing, and maintenance processes. This strategy enables companies to leverage specialized skills, cost advantages, and round-the-clock operations while maintaining quality standards.

B. Advantages of Offshore Development

India's prominence in offshore development is attributed to various advantages it offers. These include a large pool of skilled professionals adept in various programming languages and technologies, cost-effectiveness without compromising quality, streamlined communication channels, and adherence to strict data security and intellectual property protection measures.

C. India's Position as a Premier Offshore Development Destination

The country's reputation as a premier offshore development destination has been solidified over the years. Indian companies, as well as multinational corporations, have established offshore development centers to harness India's talent pool and technical expertise. Industries ranging from healthcare, finance, e-commerce, to manufacturing have benefited from offshore development in India, reaping the advantages of scalability, flexibility, and access to specialized skills.

III. IT Outsourcing in India

A. Role of India in IT Outsourcing

India has been a frontrunner in the global IT outsourcing landscape. The country's IT service providers offer a wide spectrum of services, including software development, application maintenance, infrastructure management, and business process outsourcing (BPO). Indian companies cater to diverse industries across the globe, providing cost-effective and high-quality solutions.

B. Why Companies Outsource to India

Businesses opt to outsource to India due to several compelling reasons. The country's skilled workforce, domain expertise, robust IT infrastructure, adherence to international quality standards, and competitive pricing structures make it an attractive destination for outsourcing IT operations.

C. Success Stories and Case Studies

Numerous success stories and case studies highlight the efficacy of IT outsourcing to India. From Fortune 500 companies to startups, businesses have reaped significant benefits by partnering with Indian service providers. These collaborations have resulted in innovative solutions, cost savings, faster time-to-market, and enhanced operational efficiency for client organizations worldwide.

India's tech industry stands as a testament to the nation's journey from a budding IT landscape to a global technology powerhouse. The evolution, growth, and success of India's tech ecosystem have been shaped by a confluence of factors, making it an enticing destination for offshore development, IT outsourcing, and lucrative investment opportunities./strong>

A Land of Opportunity: Investment Prospects in India's Tech Industry

The Indian tech landscape presents a myriad of investment prospects across various sectors. With a conducive business environment, government initiatives promoting innovation and entrepreneurship, and a robust digital infrastructure, India beckons investors seeking to capitalize on its burgeoning tech ecosystem. Sectors like AI, machine learning, cybersecurity, IoT, and cloud computing offer immense growth potential, providing opportunities for collaboration, investment, and market expansion.

Global Leadership in Offshore Development

India's position as a global leader in offshore development remains unchallenged. The country's proficiency in delivering high-quality software solutions, cost-effectiveness, and access to a diverse talent pool continue to attract businesses worldwide. Organizations leverage India's expertise in offshore development to enhance operational efficiency, accelerate product development cycles, and tap into specialized skills that drive innovation.

Pioneering IT Outsourcing Hub

The significance of India in the realm of IT outsourcing cannot be overstated. The country's IT service providers cater to a wide array of industries, offering comprehensive solutions that align with global standards. Collaborating with Indian firms allows businesses to achieve cost savings, access specialized expertise, and focus on core competencies while leveraging the scalability and flexibility inherent in outsourcing operations.

India's Tech Talent Pool: A Strategic Advantage

The backbone of India's tech prowess lies in its skilled and adaptable workforce. The country boasts a vast talent pool equipped with technical expertise, problem-solving abilities, and a penchant for innovation. The education system, with its emphasis on science, technology, engineering, and mathematics (STEM), produces a steady stream of skilled professionals ready to tackle the challenges of a dynamic tech landscape.

Looking Ahead: Opportunities and Challenges

As India's tech industry continues to evolve, it faces both opportunities and challenges. Embracing emerging technologies, fostering a culture of innovation, and addressing the skill gap will be crucial for sustaining growth. Additionally, ensuring cybersecurity, data privacy, and regulatory compliance remains imperative to maintain India's credibility as a reliable tech partner on the global stage.

Final Thoughts: The Future of India's Tech Industry

In conclusion, India's tech industry stands poised at the cusp of transformational growth. The convergence of technological innovation, entrepreneurial spirit, and a talented workforce propels the nation towards becoming a global leader in technology-driven solutions. The scope for investment, collaboration, and innovation in India's tech landscape remains vast, offering opportunities for businesses, investors, and tech enthusiasts alike to contribute to and benefit from this ever-evolving ecosystem.

As we witness the continuous evolution of India's tech prowess, it is evident that the country's journey from an outsourcing destination to an innovation hub is both promising and inspiring. The narrative of India's tech industry is one of resilience, adaptability, and unwavering commitment to technological advancement, making it an indispensable player in the global tech arena.

This post was originally published on: Foxnangel

#India's tech industry#offshore development#it outsourcing#investment opportunities#FoxnAngel#AI#machine learning#cybersecurity#iot#technology investment#India's tech talent#global tech leadership

0 notes