#online accounting services uk

Text

OUTSOURCE ACCOUNTING SERVICES FOR YOUR BUSINESS

Your business will eventually require the services of a bookkeeper to assist with the management of your financial data and operations.

Some company owners attempt to manage their own books as a cost-saving measure (34% of respondents say they do so).

These business owners, however, all too frequently fail to maintain accurate records or put off their accounts and bank reconciliations in favor of more urgent issues. In any case, they run the risk of wasting time and money if their records get out of order and they have to play catch-up.

The best way to keep your financial information organized and current is to hire a bookkeeper on a daily basis to document and categorize your transactions. This way, you can:

a) Streamline your money administration

b) Create reasonable strategies for the future.

c) Remain focused on managing your company.

The following 6 suggestions on how to hire a qualified bookkeeper can ease your work even though it might take some time to find the best professional for your needs.

Hire the right kind of accountant.

Does your small company grow? If so, hiring a full-time bookkeeper may not be the best financial decision at this time. Take a look at less expensive options, like employing a part-time bookkeeper in-house or contracting out your outsourcing for accountant UK to a different company.

Those who are part-time bookkeepers (or freelance)

An affordable solution for your bookkeeping needs could be to hire a qualified professional nearby:

1] Make sporadic visits to your location of employment.

2] Maintain a record of your actual documents.

3] Maintain the accuracy of your money records.

There could be a few drawbacks to this configuration, though.

Your bookkeeper's job won't be covered if they get sick or go on vacation. Even worse, locating your accounts and switching to a new bookkeeper may be challenging and time-consuming if they abruptly quit or vanish.

Additionally, it's possible that your part-time bookkeeper won't be able to keep up if your business expands too quickly or significantly, particularly if they're handling a lot of customers.

Using Outside Bookkeepers for Tasks

Utilizing a virtual or third-party company is another affordable bookkeeping option. These companies are generally far away (they won't visit your workplace), but they are also proficient in technology. That suggests they'll be able to automate the processes for invoicing and collecting receipts.

Because they typically function as a team, using an outside accounting company has the additional advantage of always having someone available to oversee your books.

Even better, the majority of third-party companies offer additional services like specialized payroll, accounts payable, and accounts receivable management, allowing them to adapt to your changing bookkeeping requirements as your company grows.

Verify their professional expertise.

It's essential that the bookkeeper you hire has prior expertise dealing with businesses like yours because bookkeeping methods vary by industry. If they've only ever worked with clients in the restaurant industry, for instance, they might not be aware of how to maintain accurate records for a nonprofit organization.

A competent accountant ought to be capable of the following:

Make a financial chart (based on your business type and needs)

Your daily financial activities should be categorized.

Financial records should be prepared.

Never be afraid to ask a bookkeeper how many years of experience they have and, if required, to quiz them on specifics.

View the additional services they offer.

Learning how to select a capable bookkeeper requires weighing the benefits of any supplemental services they offer in addition to evaluating their accounting knowledge and skills. For instance, hiring a distinct person to handle your payroll may raise your bookkeeping expenses.

It's also important to note that while bookkeepers and accountants each have their own areas of specialization, some companies, like Enkel, offer specialized services, like fractional controllership, to assist you in managing the growth of your business.

Verify their familiarity with accounting tools.

Spreadsheet bookkeeping may be effective when your business is first starting out, but as time goes on, relying on manually entered data may make it challenging to maintain correct financial records.

In addition to being conscious of the benefits of using accounting software to maintain accurate records and streamline processes, good bookkeepers are also:

Are you acquainted with the desktop applications that most companies employ?

the capacity to transfer your files to cloud-based applications like QBO (QuickBooks Online)

For automating particular data-entry tasks, apps and technical tools might be suggested.

Make sure to find out if an otherwise competent bookkeeper is familiar with specific accounting programs and methods before hiring them.

Check the provider of outsourcing bookkeeping services for authenticity.

Obtaining a recommendation from someone you trust could be a helpful strategy for determining the credibility of a prospective accounting hire. To do this, you might consult your accountant, banker, other business owners, or a nearby expert organization.

If you're considering hiring a bookkeeper you discovered online, make sure to:

Ask for customer testimonials and/or case studies that highlight their skills.

directly with former or present customers.

Assess their suitability and credibility using the information you've collected.

Managing your time is the key to hiring a capable bookkeeper because 98% of business owners say they'd rather concentrate on expanding their company than on menial tasks like accounting.

If you're prepared to hire a dependable bookkeeper who will create accurate accounts and timely financial reports while saving you time and money, Mindspace Outsourcing Bookkeeping Services can help.

#outsourcing for accountants uk#accounts outsourcing company#accounting outsourcing company#online accounting services uk

0 notes

Text

there are some rsc productions i've watched that i had mixed feelings about but others that hit them right out of the park and i've noticed it has little to do with how much i like the play itself (in the tempest 2017 dir. gregory doran i found that to be a hindrance to my enjoyment, liking the version in my head when i read it much more) (whereas with antony and cleopatra 2017 dir. iqbal khan i think it's just about a perfect realization about what i enjoy the play in so much and josette simon's performance is one of my favorite things i've ever seen on stage). but i've been watching two gentleman of verona 2014 dir. simon godwin/robin lough and it's just so fucking funny. the play itself is, well no one argues it's shakespeare's strongest and it has some obvious flaws in the ending (if you've read it you know what i mean by that) but i do think its premise is still wildly entertaining and interesting, there's some good jokes and beautiful poetry, it's just overall not the strongest character-driven comedy. this production though might just be the best possible version of the play. the song they give turio to sing to silvia is so good and then the performance is so hammy and camp in a way i didn't expect it to be. the original music is amazing and i think the modernized clothing and set pieces are really well done. like bravo

#tales from diana#text post#when i don't like something about an rsc production it tends to get in the way of my enjoyment a LOT#and the hardest thing about any shakespeare play is sitting through the beginning and analyzing whether i like what i think they're doing#like i'm always very critical of opening scenes cuz i'm afraid the acting won't please me#i thought from the early line delivery that i wasn't liking valentine and proteus' actors but that's actually not the case#i just had to get used to it#shakespearean dialogue is very unnatural and forced by necessity (bc that's not at all how we speak in real life)#there's always some buffering time to get in the flow of it#the two gentlemen of verona#shakespeare#royal shakespeare company#also i'm watching it on marquee tv (a streaming service i just found out about that hosts performing arts content#like plays and opera and ballet and the like. im really excited)#i got to join with the first threemonths for 99 cents each. like that's awesome#i'm not sure i'll keep it forever but 3 bucks for three months is worth keeping in that time#but it's only 10 bucks per month afterward which i'm also not too mad about if i do keep it...#bc i like the content that's on there and i'm happy to support the kind of platform it seems to promote#if u're interested in the platform u can view the catalogue online wo an account and claim the same autumn discount that i did#not sponsored. obviously#just sharing that info bc it's a good deal#it's available in the us and uk idk about other countries

1 note

·

View note

Text

Expert Online Accountancy Services Across UK

Easy-to-use financial solutions designed for UK small businesses

"Save 40% on Accountancy Services For 4 Months"

#bookkeeping and accounting services#small business accountant#accounting solutions in London#Online Accounting Services in UK

0 notes

Text

Self Assessment Change of Address Guide For UK TaxPayers

Updating your address with HMRC for self assessment purposes is crucial to ensure you receive all relevant correspondence and avoid any potential penalties or missed deadlines. This guide will walk you through the steps required to change your address for self assessment, including online updates and necessary forms.

Why It's Important to Update Your Address

Keeping HMRC informed of your current address is essential for several reasons:

Timely Communication: Ensures you receive all tax-related communications, including reminders and updates.

Avoid Penalties: Prevents penalties for missed deadlines or non-compliance due to missed correspondence.

Accurate Records: Maintains accurate records with HMRC, which is vital for your tax history and future assessments.

How to Change Address for Self Assessment HMRC

Changing your address with HMRC for self assessment can be done in a few simple steps. Here’s a detailed breakdown:

1. Online Update

The quickest and easiest way to update your address is through the HMRC online service. Follow these steps:

Log in to your HMRC account:

Visit the HMRC website.

Click on “Sign in” at the top right corner and enter your credentials.

Navigate to Personal Details:

Once logged in, go to your personal tax account.

Find the section for updating personal details.

Update Your Address:

Enter your new address information.

Confirm and save the changes.

This process ensures that your address is updated across all HMRC services linked to your personal tax account.

2. Change Address HMRC Self Assessment Form

If you prefer a paper-based method, you can use the self assessment address change form. Here’s how:

Download the Form:

Visit the HMRC forms page.

Download the “Change of Address” form.

Fill in the Details:

Complete the form with your new address and other required information.

Submit the Form:

Mail the completed form to the address specified on the form.

3. Contacting HMRC Directly

Another option is to contact HMRC directly to update your address. You can do this by:

Phone: Call the HMRC self assessment helpline.

Post: Send a letter with your new address details and your Unique Taxpayer Reference (UTR) to HMRC.

Self Assessment Change of Address Form Download

To facilitate the address change, you might need the self assessment change of address form. Here’s how to get it:

Visit the HMRC self assessment forms page.

Locate and download the form for changing your address.

Instructions for Completing the Form

Personal Information: Provide your full name, UTR, and National Insurance number.

Old Address: Enter your previous address details.

New Address: Provide your new address details.

Date of Change: Indicate the date when the address change is effective.

Signature: Sign and date the form to confirm the information is accurate.

Submitting the Form

Mail: Send the completed form to the address provided by HMRC on their website.

Online Submission: If available, follow the instructions for submitting the form online.

Tips for a Smooth Address Change Process

Check for Confirmation: After updating your address, ensure you receive confirmation from HMRC.

Update All Relevant Accounts: Besides HMRC, update your address with other financial institutions and services.

Monitor Correspondence: Keep an eye on your mail to ensure you receive all tax-related documents at your new address.

Conclusion

Updating your address for self assessment with HMRC is a straightforward process, whether you choose to do it online, via a form, or over the phone. By following the steps outlined in this guide, you can ensure that your tax affairs remain in order and avoid any potential issues arising from an outdated address. Change your address for self assessment online in the UK to stay compliant and maintain accurate tax records. Remember, keeping your address up to date is not just about receiving correspondence—it’s about maintaining compliance and ensuring your tax records are accurate. Don’t delay; update your address today and stay on top of your tax responsibilities.

FAQs

How Long Does It Take to Update My Address?

Online updates are usually processed immediately.

Paper form submissions may take a few weeks to process.

What If I Don’t Update My Address?

Failure to update your address can result in missed communications, which could lead to penalties or late fees.

Can I Change My Address Over the Phone?

Yes, you can update your address by calling the HMRC self assessment helpline. Make sure to have your personal details and UTR ready.

#Self Assessment#tax filing#self assessment#online change self assessment#accounting services#UKtax#UK Self assessment

0 notes

Text

#tax#payroll#accounting#business#finance#Global Payroll#Payroll#HR#Global Expansion#EOR#India Payroll#UK Payroll#Outsourcing#company registration#eor services#poe hr#poe employer#poe employment#payroll poe#global peo#eor providers#payroll processing#payroll services#payroll software#online payroll#outsourced payroll#tax filing for payroll#payroll tax compliance#direct deposit#pay stubs

0 notes

Text

How does online accounting service work?

Just send your receipts and statements by email, fax, scan (or) give us access to your computer so that we can fetch your data directly from your own computer. We will do your accounting work using either one of the following 3 methods

Use online accounting software (example: Xero, QuickBooks online)

Remotely connect to your computer and do your accounting

Do work from our computer and send you the completed reports and backups Contact us today to learn more about our online accounting services

#online accounting#accounting outsourcing#online accountant#uk accountant#virtual accountants#virtula accounting services#virtual accounting

0 notes

Text

Internet merchant accounts for High risk Business?

Internet merchant accounts for High risk Business?

Internet merchant accounts are essential for "high-risk businesses" to conduct online transactions smoothly and efficiently. As the world continues to embrace digitalization, it is becoming increasingly important for businesses to establish an online presence and cater to the needs of their customers. However, certain industries are deemed high-risk due to various factors such as chargeback rates, fraud potential, or legal and regulatory concerns. To navigate these challenges and ensure a "secure payment process", high-risk businesses must obtain "internet merchant accounts" that provide the necessary tools and protection.

High-risk businesses encompass a wide range of industries, including online pharmacies, adult entertainment platforms, and online gambling websites. These industries are considered high-risk due to the potential for fraudulent activities, strict legal and regulatory oversight, or customers disputing charges and demanding chargebacks. Thus, "acquiring an internet merchant account" specifically designed for high-risk businesses is crucial for their survival and growth.

An internet "merchant account for high-risk businesses" offers several advantages. Firstly, it provides businesses with a secure payment gateway that enables credit card transactions and protects sensitive customer information. Given the nature of high-risk businesses, security measures must be in place to prevent unauthorized access, data breaches, and fraudulent activities. Consequently, an internet merchant account with robust security features promotes trust between the business and its customers, increasing customer satisfaction and loyalty.

Another significant benefit of internet "merchant accounts for high-risk businesses" is the ability to manage chargebacks effectively. Chargebacks occur when customers dispute transactions and request a refund directly from their issuing banks. High-risk businesses often experience a higher rate of chargebacks due to factors such as dissatisfied customers, fraud, or illegal activities. Therefore, an effective chargeback management system provided by an internet "merchant Bank account" allows businesses to resolve and mitigate chargeback disputes efficiently, minimizing financial losses and maintaining a positive reputation.

Furthermore, internet merchant accounts cater specifically to the unique needs and legal compliance requirements of "high-risk businesses". Each industry has its regulations and restrictions that necessitate careful attention and adherence. For instance, pharmaceutical businesses must comply with strict FDA guidelines, while online gambling platforms must follow local and international gambling laws. By partnering with a "merchant account provider specializing in high-risk businesses", these organizations can ensure compliance and avoid penalties, legal issues, and potential shutdowns.

In conclusion, "high-risk businesses require internet merchant accounts" to facilitate secure and efficient online transactions. These accounts provide crucial benefits such as secure payment gateways, effective chargeback management systems, and compliance with industry-specific regulations. By obtaining an internet merchant account designed for high-risk businesses, organizations can navigate the challenges associated with their industries, protect their customers' sensitive information, and ensure a smooth payment process. Embracing the digital era and establishing a strong online presence are crucial for high-risk businesses to remain competitive and thrive in today's market.

Offshore Gateways merchant accounts |

Merchant accounts |

Merchant accounts online |

Internet merchant accounts |

Set up merchant accounts |

Merchant account fees in USA |

Merchant account fees in UK |

Open merchant account online |

Merchant accounts credit card |

Merchant Bank Account |

Merchant account providers |

High risk merchant account instant approval |

High Risk merchant account in USA |

High Risk merchant account in UK |

High Risk payment Gateway |

Forex merchant account |

Gambling Merchant Account |

Best merchant account services |

Online casino merchant account providers |

#Offshore Gateways merchant accounts#Merchant accounts#Merchant accounts online#Internet merchant accounts#Set up merchant accounts#Merchant account fees in USA#Merchant account fees in UK#Open merchant account online#Merchant accounts credit card#Merchant Bank Account#Merchant account providers#High risk merchant account instant approval#High Risk merchant account in USA#High Risk merchant account in UK#High Risk payment Gateway#Forex merchant account#Gambling Merchant Account#Best merchant account services#Online casino merchant account providers#offhsoregateways

0 notes

Text

Radiant Pay, a leading name in the realm of financial services, offers cutting-edge Credit Card Processing Services tailored specifically for merchants in the United Kingdom. With a commitment to facilitating seamless payment solutions, Radiant Pay has established itself as a trusted partner for businesses of all sizes.

Our Credit Card Processing Services are designed to empower merchants with the ability to effortlessly accept payments via credit cards, providing convenience to both businesses and their customers. Radiant Pay ensures swift and secure transaction processing, enhancing the overall shopping experience.

Our services are driven by advanced technology and a dedication to compliance with the latest industry standards, guaranteeing the utmost security for sensitive financial data. Radiant Pay understands the dynamic nature of businesses and provides customizable solutions to cater to individual merchant requirements.

#credit card processing#credit card payment processing#Credit Card Processing Services#merchant account for creditcard processing#credit card merchant account in UK#merchant account solution for creditcard processing#credit Card payment solutions in UK#Credit Card Payment Processing london#online payment processing solutions in UK#Best Credit Card Processing Service Provider#Merchant Account Solutions in Europe

0 notes

Text

EASIER SELF-EVALUATION TAX DUE DATE: DIGITIZATION OF TAXES

Introduction

Making Tax Digital (MTD), which you must use if your self-employment income is larger than £10,000, may be familiar to you. How do I make use of Qloak? Why do I need MTD, and what is it? You will receive all the information you require from this blog to start completing your 2019/2020 taxes on time.

The next cycle of the Making Tax Digital (MTD) programme is quickly approaching. As of April 1, 2021, self-employed taxpayers with income above £10,000 are required to prepare and submit their tax returns online on a quarterly basis.

Since the government has promised to apply MTD across all business sectors by 2023, there won't be any other option; as a result, starting in April 2021, you'll only be able to submit your self-assessment online.

If it seems like a lot of work, don't be concerned. MTD is a fantastic resource that could help you manage your taxes and save time.

a) MTD is a digital reporting system that will make it easier for you to submit tax returns.

b) You can file your tax return using electronic, quarterly, or outsourcing accounting services.

c) You should move promptly because the MTD submission deadline is always October 31.

It would be easier for you to comply with the MTD standards if you understand the dates and how to start utilising MTD for VAT after reading this article. Furthermore, we have offered some guidance on virtual tax assistants, which are fantastic for start-ups and small businesses. In fact, they were the main focus when we created Qloak, our online tax assistant.

At the conclusion of the fiscal year, you may still file your tax return, but you must do so online through a tool that HMRC has approved, such as Qloak or Quickbooks.

This means you must make sure you have access to both of these things as well as an internet connection if you want to conclude your self assessment before April 5th, 2019.

What Is "Making Tax Digital"?

Making Tax Digital (MTD), a digital tax system, will be put into place to make filing taxes easier, safer, and more accurate.

Beginning in April 2020, all businesses with annual revenues greater than £85k will be expected to keep digital records of their company transactions and report them to HMRC through a software solution or an online portal that has been approved by the agency.

Conclusion

After reading this article, you ought to know more about the Making Tax Digital project and what it means for you. If you have any questions or would want more information regarding the MTD standards, don't hesitate to contact us. Always happy to help!

#online accounting services uk#outsourcing accounting services#uk payroll outsourcing#online accounting and bookkeeping services

0 notes

Text

Benefits To A Business In Using An Online Bookkeeping Service UK

On-site Bookkeeping Services: On-site bookkeeping services London are typically provided by a team of trained professionals who work directly with a business's accounting department. They support tasks such as preparing financial statements, managing payroll, and reconciling bank accounts.

#bookkeeping services uk#bookkeeping services london#bookkeeping london#vat return services#vat return online#small business accounting services#small business tax accountant#Self-assessment tax return

0 notes

Video

undefined

tumblr

Mindspace Outsourcing Services provides the best accounting and bookkeeping services.

To know more : http://www.mindspaceoutsourcing.co.uk/

#online accounting and bookkeeping services#bank reconciliation software uk#online accountancy services]

0 notes

Text

Routine accounting service and its importance to a business

Anytime you plan a strategy for your business growth, you must have financial planning. It is only professional when you have the proper paperwork and a record of your financial information. Routine accounting is a periodic or day-to-day process of accumulating, recording and analysing financial information.

It is a stressful process for most business owners, therefore, a trusted accounting firm is required. Such an accounting service can be found in the online business directory in the UK.

What are the routine accounting services?

When you hire routine accounting services, you can expect the following way of handling your finances and daily task.

Daily routines

Some tasks must be performed on a daily basis for the sake of accounting convenience. These include collecting and generating taking repots an balancing them with the actual numbers. A ruster accountant or accounting firm will note every details and errors while generating the reports with supportive receipts, checks, credit card statement and bank slips. In addition, they will address and adjust any discrepancy in any transaction for accurate takings.

Weekly routines

A professional accounting service provider will review and update the credit and debit accounts weekly. A weekly routine accounting involves task like checking the creditor list and find out if any payment or invoice is outstanding. In addition, the payment must be generated and records must be kept by the service. Besides, your service provider must also review whether any payment from the customer or client is due and balance them. Also, check if any deposit are yet to be refunded or retain.

Monthly routines

It is easy to close a busy month with updated and well-organised financial record. Your service provider goes through all the accounts and check the purchases and sales, review creditor and debtor ledger, and credit card and bank account statement. All these must be revisited and observed closely to maintain accuracy. In addition, your service provider must adjust journal entries and generate financial reports. These report are also compared to the prior reports.

Benefits of routine accounting

You can maintain accuracy in your financial records on the go.

Tracking the financial position of your business becomes much easier.

Routine accounting makes account reconciliation convenient and stress-free.

Reduce the chance of recourse and financial record loss.

You can detect any error in advance to avoid more serious issue in future.

It lowers the chances of fraud or faulty accounting.

Key takeaway

An accounting service that you find in the online business directory in the UK helps you with all the routine accounting mentioned above. When you opt for an expert to take care of your routine accounting, you can concentrate of your business aspect and grow your business more productively.

0 notes

Text

Having trouble completing your CIPD Level 7 assignment? There's nowhere else to look! With a focus on CIPD Level 7 assignments help, our knowledgeable staff provides thorough support and direction. Best Assignment Expert offer specialized help to guarantee that your assignments are completed to the highest standards. Our professionals, who possess deep understanding in HR and organizational development, assist you in achieving success and high grades. Get in touch with us for individualized, competent, and trustworthy assignment assistance to move one step closer to passing the CIPD qualification exam.

#mba assignment help#academic writing service#accounting homework help#assignment expert uk#cipd assignment help#make my assignment#assignment help uae#cipd level 7 assignment help#assignment maker online

0 notes

Text

Year-End Accounting Outsourcing: A Strategic Advantage for UK Accounting Firms

As year-end approaches, accounting firms across the UK face the pressure of closing books, preparing final accounts, and ensuring compliance with the latest regulations. The year-end is a critical period that can stretch the resources of any accounting firm, from small practices to large corporations. Outsourcing some or all of the year-end accounting processes can provide numerous benefits, helping firms manage workload peaks, improve efficiency, and maintain high standards of accuracy and compliance. Here’s how year-end accounting outsourcing can serve as a strategic advantage for UK accounting firms.

1. Efficiency and Scalability

During the year-end rush, accounting firms often struggle with the workload that can fluctuate significantly. Outsourcing provides an elastic solution where firms can scale their workforce up or down based on demand without the long-term commitment of hiring new staff. This flexibility allows firms to handle peak loads efficiently while controlling costs and maintaining service quality.

2. Access to Expertise

Outsourcing partners typically have a team of accounting experts who are well-versed in the latest accounting standards and regulatory requirements. This expertise is especially valuable during the year-end when accuracy and compliance are paramount. Outsourcing firms invest heavily in training their staff and keeping them updated with all changes in accounting practices and tax laws, providing peace of mind to the primary firm that all accounts will be handled with the highest level of professional care.

3. Focus on Core Business Activities

By outsourcing time-consuming year-end tasks, principal accounting firms can free up their internal resources to focus on higher-value activities such as client management, business development, and providing strategic financial advice. This shift can lead to better client relationships and more opportunities for business growth, as staff can focus on areas that directly contribute to the firm's bottom line.

4. Cost Effectiveness

Outsourcing can be a cost-effective alternative to hiring additional in-house staff, especially when considering the overheads associated with employment such as training, benefits, and office space. By outsourcing, firms can convert fixed labor costs into variable costs that align directly with their business needs, optimizing budget use and improving profitability.

5. Enhanced Technology Integration

Many outsourcing providers utilize advanced accounting technologies that some firms may not have access to internally. This includes sophisticated software for accounting, tax preparation, and financial reporting. Partnering with an outsourcing firm allows access to these technologies without the direct investment, which can improve the efficiency and quality of financial reporting.

6. Reduced Errors and Improved Compliance

The year-end is a sensitive time when the risk of errors in financial reporting is heightened due to the volume of work and tight deadlines. Outsourcing uk accounting firms specialize in managing these pressures professionally. With their expertise and advanced technology, they can reduce the likelihood of errors and ensure that all financial reporting complies with relevant accounting standards and regulations.

7. Strategic Advisory and Support

Many outsourcing providers offer more than just number crunching; they can provide strategic insights and advisory services that can be critical during the year-end. This might include advice on tax optimization, risk assessment, and business strategy development—services that can add significant value to a firm's client offerings.

Conclusion

Year-end accounting outsourcing offers a strategic advantage for UK accounting firms looking to enhance their efficiency, manage costs, and improve service quality during one of the busiest times of the year. It allows firms to maintain a competitive edge by leveraging external expertise, technological advancements, and scalable resources, thereby not only surviving the year-end crunch but thriving through it.

#accounting outsourcing#outsourcing for uk accounting firms#accounting outsourcing services#online accounting

0 notes

Photo

Social Clubs Mod - DOWNLOAD

Tired of your sims walking aimlessly through town? No friends, no hobbies, no purpose? Put an end to their lack of a fulfilling social life by creating a million and one clubs for them to join and/or get kicked out of!

With 50+ activities for you to push, including activities from over 10 different mods, and 4 specialised club types, you can create almost any club you can think of: book clubs, invite-only hangouts, afterschool clubs and more! Grow memberships, take part in tournaments and ship cute little subscription gifts straight to your sim’s door.

Note: This mod is very extensive, so please thoroughly read the documentation in the download that I’ve painstakingly written up.

Compatibility: Should be base game compatible however expansion packs, store content and mods add more content.

7 New Objects: Credit to @aroundthesims who has generously allowed me to use her items as well as @twinsimming who converted 2 items for me. Full credit in the documentation.

Testers: @desiree-uk who not only tested the mod, but contributed ideas for club activities, the banking system and the subscription gift system. @simsdeogloria who kindly offered to test the mod and caught some bugs that I had completely missed.

Credits: Full credit in documentation. However, thank you to @olomayasims, IcarusAllsorts, Arsil, Buzzler & @zoeoe-sims, @anitmb, @greenplumbboblover, @flotheory as I push some of their mods as activities.

Club Types

Custom Club: Push specific activities (or no activity at all) and watch your active and inactive club members congregate and do said activities. Push bowling, swimming, rumba, nectar drinking, collecting, studying, music lessons, among many other things.

Subscription-Only Club: While members won’t meet up, force them to pay a subscription fee to the club owner for your own purposes. Consider: food subscription service, council-tax payments, school fees.

Book Club: Choose a book for the book club. Your sims will sit together, have discussions, and read said book.

Formal Gathering Club: Set musicians and/or a speaker (podium or pulpit). Have your club members sit down and act like they’re listening to said musicians and speaker. Choose a skill to increase while the club is in operation.

Club Vibes

Clubs can have different vibes depending on the cost and activities, attracting or repelling different types of sims. There are sports, games, intellectual, low-brow and high class clubs. Some personalities will be more inclined to join than others.

Customising Clubs

Set different open days, open hours, required club outfits, subscription fees, gender, age, career and trait requirements/restrictions, forbidden actions etc.

Autonomy

Allow or restrict autonomy in different ways. Make clubs open or closed invite, allowing or disallowing sims to join, leave, or be kicked out of clubs with or without your own input. Put club boards around town and let sims browse. Impress observers by having a great club session and watch them beg to join!

Tournaments

Win tournaments and gain club acclaim. Get cash prizes, find yourself in the newspaper, and find out if any of your fellow club members are playing for the opposing team. Your own sim isn’t exempt from the repercussions of being a club traitor!

Banking

Create Bronzo accounts for your sims. You can link these accounts to schedulers and have the club fee delivered straight into the account. Take out loans, find the best interest rates online and stay out of your overdraft. Try not to get your account details stolen at the all new ATMs that you can place around town and don’t leave your debit card laying around near strangers!

Download MTS: http://www.modthesims.info/d/677428

Conflicts: None.

If you would like to donate to say thank you, you can do that at my Ko-fi, here.

It’s been a long 8 months getting this mod done; thank you all for your patience and enjoy! @ me if you post any pictures of your clubs—I’d love to see your pictures.

985 notes

·

View notes

Text

since paypal is once again a hot topic because of the “”new”” conversion fee:

international paypal users are already familiar with the conversion fee. this isn’t new to anyone outside the USA. we’ve been paying conversion fees on our USD to [insert regional currency] conversions forever now, it ain’t new.

you can correct me if i’m wrong - and i 100% encourage yall to double check yourselves instead of simply taking my word at face value - but the only difference is they’re making the conversion automatic. instead of you yourself manually converting the currency you have in your paypal account, any international currency is automatically converted to your local one the moment you receive it. i didn’t see the fee rates but knowing paypal, they’re probably increasing the conversion fees.

you can opt out of the automatic conversion by going through your payment preferences under the block payments tab - you just have to do so before September 11, 2023.

to the american artists trying to switch to other services for their commissions may I bring to your attention the following: Cashapp, Venmo and Zelle are all exclusive to the United States [with the exception of Cashapp, which does have availability in the UK]

americans won’t be impacted much [if at all] by this if you’re doing USD to USD transactions. if you really want to switch to something else because paypal just sucks all around, maybe consider Square or Stripe.

Square is available in the USA, Canada, Australia, Japan, the UK, Ireland, France and Spain

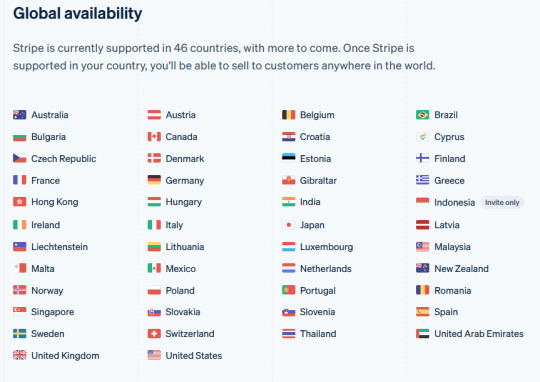

and Stripe has availability in the following countries

someone mentioned that Wise is also out there. i personally haven’t used wise and i don’t want to just go ahead and blindly recommend it if i haven’t had any firsthand experience with its services, but it does have a large global availability - even some countries that Square and Stripe don’t have.

feel free to add to this, or correct me if i’m wrong anywhere. i want artists online to thrive instead of outright panicking every time paypal so much as twitches

548 notes

·

View notes