#payment api provider

Explore tagged Tumblr posts

Text

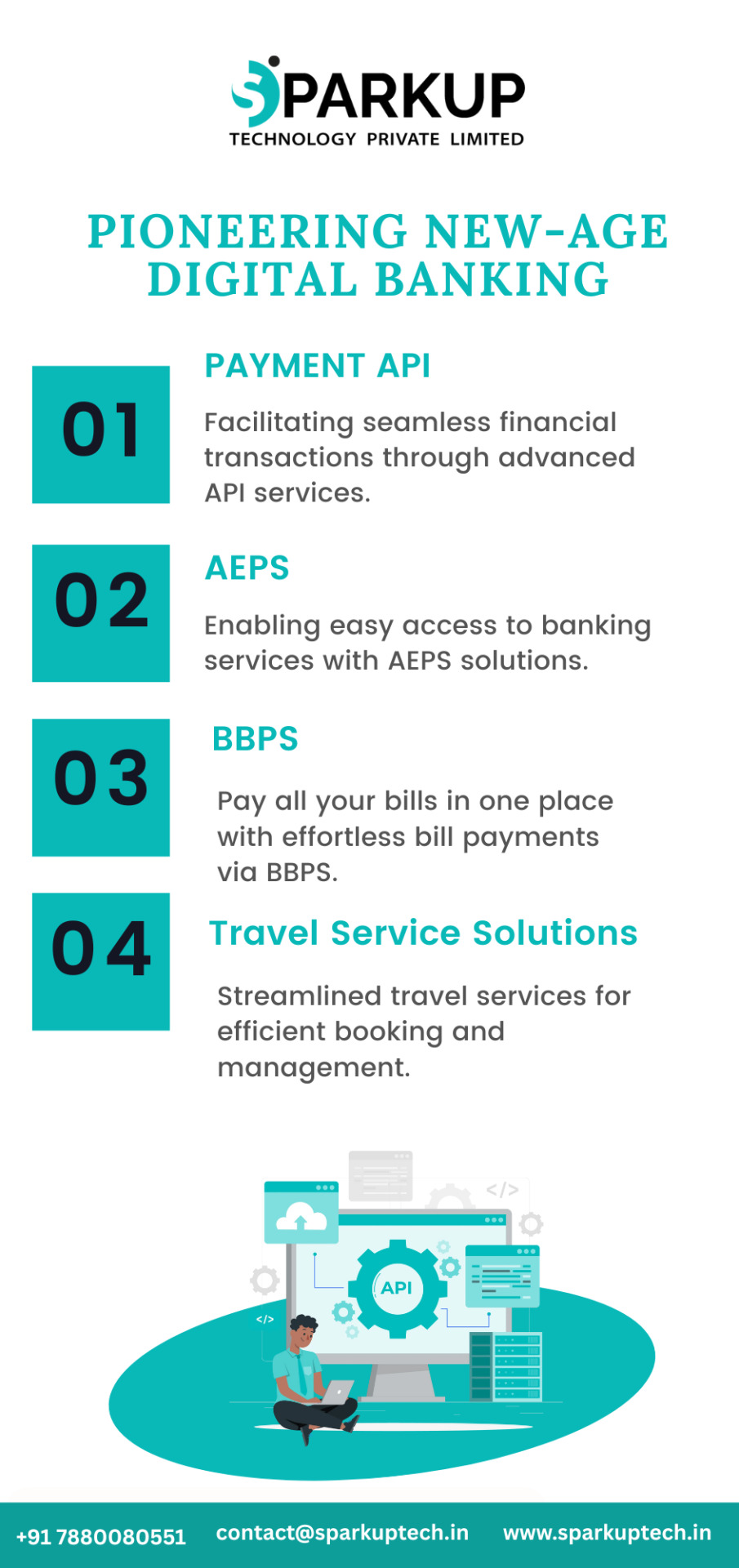

Looking for a reliable payment API provider to power your digital transactions? Sparkup Technology offers robust, secure, and developer-friendly APIs tailored for businesses of all sizes. From UPI Autopay to payment gateways and AEPS integration, we help you simplify payments, automate processes, and scale with confidence. Experience fintech innovation—backed by trust, speed, and scalability.

#payment api provider#payment api service#payment api#best api provider in India#best payment api provider in India#top api service in India#top api provider in India

0 notes

Text

Payment API provider | Zyro Noida

Looking for a reliable Payment API provider? Zyro Noida has you covered! Seamlessly integrate secure and efficient payment solutions into your business with our cutting-edge Payment API services. Trust Zyro Noida for streamlined transactions and unparalleled reliability.

For more information visit our website: www.zyro.in/blog

0 notes

Text

RRFINCO Common Service Centre in Bihar is a one-stop service point for bringing e-services from the Indian Government to rural and remote locations of Patna.

#loan service#recharge software#dmt software#account opening#gst services#aeps software#api integration#api solution#b2b service#b2c services#app development company#mobile app design bd#mobile recharge#mobile app development#mlm software#mutual fund#best aeps service provider#bill payment#b2b lead generation#software company#it company#credit card#commercial#distributor#e government services#entrepreneur#csc center

0 notes

Text

WhatsApp Business API Solution

Use WhatsApp to reach and connect with your customers where they are already present. Get WhatsApp Business API solution from go2market to automate your business communication and customer engagement process.

#go2market#WhatsApp API for ecommerce#WhatsApp for customer support#WhatsApp notification service#WhatsApp marketing automation#WhatsApp order tracking API#WhatsApp payment notifications#WhatsApp appointment reminders#WhatsApp API with CRM integration#WhatsApp chatbot for business#Get WhatsApp Business API access#WhatsApp Business API Provider

0 notes

Text

What is a BBPS Transaction in Banking? | BBPS API Explained

Discover how BBPS transactions are transforming bill payments in India. Learn about the Bharat Bill Payment System (BBPS), how BBPS API and Bharat Connect API work, and why using a BBPS API from a direct bank is the smartest way to offer seamless, secure bill payment services. Explore the benefits of choosing the best BBPS API provider for your business platform.

#BBPS API#Bharat Connect API#BBPS API from Direct Bank#Bharat Bill Payment System#Best BBPS API Provider#Fintech#Bill Payment API#NPCI#Digital Payments India

0 notes

Text

#whatsapp payments#whatsapp api provider#whatsapp api integration#whatsapp api#whatsapp api marketing

0 notes

Text

Payment Gateway API Integration at Indicpay

Indicpay simplifies payment gateway integration with its secure API, supporting UPI, cards, net banking, and wallets. Boost customer trust with fast transactions, real-time settlements, and custom checkout designs. Perfect for e-commerce, subscriptions, and more. Get started today! #Indicpay #PaymentGateway #SecurePayments #Ecommerce #BusinessGrowth

0 notes

Text

Payout service provider for India - India Payouts

India Payouts is a payment solution provider based in India that offers secure and reliable payout options for businesses. They specialize in payouts for online industries such as gaming and forex trading, but their services can be used for a wide range of businesses.

Here are some of the key services that India Payouts offers:

Multiple Payout Methods: They provide various payout options to suit your needs, including account transfers, debit/credit card transfers, UPI transfers, and payouts to popular wallets like Paytm and Amazon Pay.

Bulk Payouts: India Payouts can handle large volume payouts efficiently, making them a good option for businesses that need to make a lot of payments quickly and easily.

Security: India Payouts uses secure protocols to ensure the safety of your financial data.

In addition to these core services, India Payouts may offer other features such as real-time tracking and automated payouts. Be sure to check their website for the latest info

Contact us or Visit to our website: https://www.indiapayouts.com/

#payment gateway for gambling in india#gaming payout api#payment gateway for gaming in india#payment gateway for games india#payout api provider in india#payment gateway for games in india#gambling payment gateway#gaming payouts api#gaming payouts api provider in india#payout service provider in india#payout api india#payout api provider india

0 notes

Text

Simplify your NSDL Payment Bank CSP Registration with JustForPay's secure and easy-to-use API. Register online and start offering payment services today. Fast, reliable, and efficient.

For more info visit at: https://justforpay.in/service

#Nsdl Payment Bank Distributor Api#Nsdl Payment Bank Csp Provider Api#Nsdl Payment Bank Csp Login Api#Nsdl Payment Bank Csp Registration Api#Nsdl Payment Bank Csp Registration Online Api#Digital Pan Card Apply Online Api

0 notes

Text

Integrate Our UPI Collection API

Integrating the UPI Collection API by Rainet Technology Private Limited into your financial infrastructure offers a seamless and efficient way to manage digital transactions. The UPI API, or Unified Payments Interface API, is designed to facilitate instant payment processing, making it an indispensable tool for businesses seeking to enhance their financial operations. By leveraging the UPI Collection API, businesses can streamline their payment collection processes, reducing the time and effort required to manage transactions manually. This integration not only improves the speed of transactions but also enhances security, ensuring that all payments are processed through a secure and reliable platform.

The UPI Collection API integration process is straightforward, allowing businesses to quickly implement the technology without significant disruption to their existing systems. Rainet Technology Private Limited provides comprehensive support and documentation to guide businesses through each step of the integration process. This ensures that even businesses with limited technical expertise can successfully adopt the UPI Collection API and begin reaping its benefits almost immediately.

One of the key advantages of integrating the UPI Collection API is the ability to offer customers a convenient and flexible payment option. With the UPI API, customers can make payments directly from their bank accounts using their smartphones, eliminating the need for cash or card transactions. This not only enhances the customer experience but also reduces the risk of payment fraud and errors.

Moreover, the UPI Collection API integration can significantly boost operational efficiency. Automated transaction processing reduces the need for manual intervention, freeing up staff to focus on more strategic tasks. This leads to improved productivity and cost savings for the business. In summary, integrating the UPI Collection API by Rainet Technology Private Limited is a strategic move for any business looking to enhance its payment processing capabilities, improve security, and offer a superior customer experience.

Visit Website: https://rainet.co.in/upi-collection-api.php

#upi integration api#upi api integration#upi payment gateway#paytm upi integration api#upi integration#upi payment gateway integratio#bbps api provider#upi payment gateway integration#education portal development company#bbps#bbps login

0 notes

Text

UPI Payment Gateway India

Empower Your Transactions with Quintus Tech: Leading Automated Payment Solution Provider in India. Discover seamless payment solutions in India with Quintus Tech – your trusted automated payment solution provider. Streamline transactions effortlessly Quintus Tech offers cutting-edge and seamless payment solutions in India, serving as your trusted automated payment solution provider. Our goal is to simplify and streamline transactions, making the payment process effortless for businesses and individuals alike. Automation, Security, User-Friendly Interface, Versatility, Integration, Customer Support, Innovation etc. Visit Our Website :- https://quintustech.in/

#Payment Solution Providers in India#Automated Payment Solutions#Quintus Tech#UPI Payment Gateway#White Label Development#Bank Account Verification API#Digital Client Onboarding#Dynamic UPI QR Code Generator#Virtual Bank Account for Business#Recurring Online Transactions

0 notes

Text

Expand your marketplace's reach with the best payment API provider, facilitating transactions in multiple currencies and ensuring compliance.

0 notes

Text

Payment API provider | Virtual Account payment providers | Zyro Noida

Zyro Noida, your trusted Payment API provider and Virtual Account payment providers. Elevate your business transactions with cutting-edge technology and reliable services. Explore tailored solutions designed to optimize your payment processes today!

For more information visit our website: www.zyro.in/blog

0 notes

Text

https://rrfinco.com/ RRFINCO is one of the Best mobile game development Service Providers, crafting incredible mobile games for IOS and Android. From concept to launch, we manage every step, ensuring top-notch quality.

#rrfinco#rrfinpay#fintech#fintechservice#FintechSolutions#gamedevelopment#gamedeveloper#gamedevelopmentservices#gamedevelopmentcompany#Mobilegameplay#MobileGameDevelopment

#dmt software#loan service#gst services#recharge software#aeps software#api integration#b2b service#api solution#b2c services#account opening#mobile app design bd#mobile app development#accounting#best aeps service provider#bill payment#fintech app development company#app development company#distributor#e government services#education#ecommerce#entrepreneur#fintech service#fintech company#fintech industry#fintech software#mutual fund#gamming software#payment getway#payment getaway

0 notes

Text

UPI payment gateway in India

Quintus Tech provides a wide range of services including automated payment solutions in India and digital payment systems, mobile payment solutions, and UPI payment gateways. They enable businesses to easily and securely accept customer payments, settle transactions, and improve customer experience.

#Payment Solution Providers in India#Automated Payment Solutions#Quintus Tech#UPI Payment Gateway#White Label Development#Bank Account Verification API#Digital Client Onboarding#Dynamic UPI QR Code Generator#Virtual Bank Account for Business

0 notes

Text

The Era Of Digital Payments In The Whole World

The way we pay for things is changing rapidly. In the past, we used cash, checks, and credit cards to make payments. But now, digital payments are becoming increasingly popular.

There are many reasons for this shift to digital payments. One reason is convenience. Digital payments are often faster and easier than traditional methods. They can also be more secure, as they do not require the exchange of physical cash.

Another reason for the rise of digital payments is the growth of e-commerce. More and more people are shopping online, and digital payments are the preferred method for making these purchases.

The COVID-19 pandemic has also accelerated the adoption of digital payments. As people were forced to stay home, they turned to online shopping and digital payments as a way to avoid contact with others.

The global market for digital payments is expected to reach $9.46 trillion in 2023. This growth is being driven by a number of factors, including the increasing adoption of e-commerce, the rise of mobile payments, and the growing popularity of contactless payments.

India is one of the leading countries in the adoption of digital payments. In 2022, India recorded about 70 billion digital payment transactions, the highest in the world. This is a sharp increase from the corresponding figure of 44 billion in 2021.

The future of digital payments looks bright. As more and more people adopt these technologies, the way we pay for things will continue to change. upi payout api

Benefits of Digital Payments

There are many benefits to using digital payments. Here are some of the most common ones:

Convenience: Digital payments are often faster and easier than traditional methods. You can pay with a few taps on your smartphone or a swipe of your credit card.

Security: Digital payments can be more secure than traditional methods, as they do not require the exchange of physical cash. Your payment information is encrypted and protected from fraud.

Efficiency: Digital payments can help businesses to improve their efficiency. They can save time and money by eliminating the need to process paper checks or cash.

Sustainability: Digital payments can help to reduce environmental impact. They eliminate the need to print and transport physical cash.

Challenges of Digital Payments

While there are many benefits to digital payments, some challenges also need to be addressed. Here are some of the most common challenges:

Security: While digital payments can be more secure than traditional methods, they are still not foolproof. There have been cases of fraud and data breaches involving digital payments.

Accessibility: Not everyone has access to digital payments. This is especially true in developing countries.

Regulation: The regulatory environment for digital payments is still evolving. This can make it difficult for businesses to comply with all the relevant regulations.

The Future of Digital Payments

The future of digital payments looks bright. As more and more people adopt these technologies, the way we pay for things will continue to change. Here are some of the trends that are expected to shape the future of digital payments:

The growth of mobile payments: Mobile payments are expected to continue to grow in popularity. This is due to the increasing use of smartphones and the convenience of making payments with a few taps on a screen.

The rise of contactless payments: Contactless payments are becoming increasingly popular, as they are a more convenient and hygienic way to pay for things.

The adoption of blockchain technology: Blockchain technology is a secure and transparent way to record transactions. This makes it a promising technology for digital payments.

The development of new payment methods: New payment methods are being developed all the time. These new methods are designed to be more convenient, secure, and efficient than traditional methods.

The era of digital payments is already here, and it is only going to continue to grow in the future. Businesses that want to stay ahead of the curve need to start adopting digital payments now.

How Ecuzen Software Can Help You with Digital Payments

Ecuzen Software is a leading provider of digital payment solutions. We offer a wide range of solutions that can help businesses of all sizes to accept digital payments. Our solutions are secure, convenient, and easy to use.

We can help you to:

Accept payments online, in-store, and over the phone

Set up recurring payments

Manage your customer data

Track your transactions

Get help with fraud prevention

If you are looking for a reliable and secure digital payment solution, Ecuzen Software is the perfect choice. Contact us today to learn more about our solutions

Read More:- Aeps software provider in jaipur

Source Link :- https://ecuzen.com/blog/blogdetails/payout/digital-payments

0 notes