#price action forex

Text

4 Reasons Why Price Action Trading is the Best

#price action trading#price action trading strategies#price action#best price action trading strategy#price action strategy#price action trading strategy#price action trading course#price action trading forex#price action analysis#price action forex#price action for beginners#price action forex strategy#price action scalping#price action trading system#price action trading in hindi#price action trading live#price action indicator#price action patterns

1 note

·

View note

Text

Fibonacci Trading: Forex Trading Strategy Explained

Fibonacci trading is a popular forex trading strategy that utilizes the Fibonacci sequence and its ratios to predict potential price movements and retracement levels. This method helps traders identify entry and exit points, making it an essential tool in forex trading.

Understanding Fibonacci Sequence

The Fibonacci sequence is a series of numbers where each number is the sum of the two preceding…

#CCI#DeFi#Divergence#Downtrend#Entry and Exit Points#Fibonacci Levels#Fibonacci Retracement#Forex#Forex Trading#MACD#Market Conditions#Market Volatility#Moving Average#Moving Average Convergence Divergence#Predictability#Price Action#Price Charts#Price Movement#Price Movements#Relative Strength#Risk Management#RSI#Stop-Loss#Support And Resistance#Trading Decisions#Trading Strategy#Volatility

2 notes

·

View notes

Text

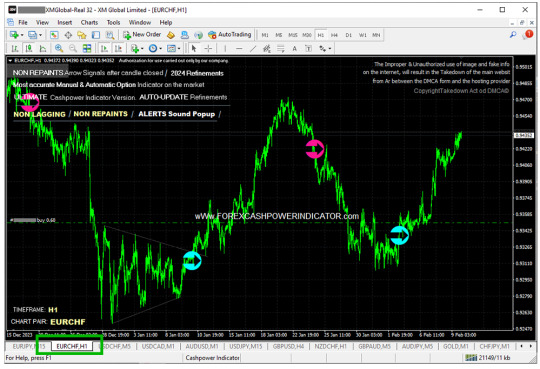

🔥Forex #EURCHF Cashpower Indicator Signal NON REPAINT BUY Trade Running to Next Week! Official Website: wWw.ForexCashpowerIndicator.com

.

Start Improve your Strategy with Cashpower Indicator Lifetime license one-time fee with No Lag & NON REPAINT buy and sell Signals. ULTIMATE Version with Smart algorithms that emit signals in big trades volume zones.

.

✅ NO Monthly Fees

✅ * LIFETIME LICENSE *

✅ NON REPAINT / NON LAGGING

🔔 Sound And Popup Notification

🔥 Powerful AUTO-Trade Option

wWw.ForexCashpowerIndicator.com

.

⭐ TOP BROKER Recommended ⭐

Trade Conditions to use CASHPOWER INDICATOR & EA Money Machine.* Top Awards WorldWide trade execution * Regulamented Brokerage Forex * O.O Spreads with Fast Deposits * Fast WITHDRAWALS with Cryptos. open your MT4 Account Start your trade Journey with BEST Broker !!

👉 https://clicks.pipaffiliates.com/c?c=817724&l=en&p=6

.

✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.**

.

( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ).

.

✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options.

.

🔔 New Ultimate CashPower Reversal Signals Ultimate with Sound Alerts, here you can take No Lagging precise signals with Popup alert with entry point message and Non Repaint Arrows Also. Cashpower Include Notification alerts for mt4 in new integration.

.

🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

.

wWw.ForexCashpowerIndicator.com

#cashpowerindicator#indicatorforex#forex#forexindicator#forexindicators#forexsignals#forextradesystem#forexprofits#forexchartindicators#forexvolumeindicators#metatrader 5#metatrader 4#metatrader#forex expert advisors#expert advisors forex#forex volume indicators#forex ebook#forex price action

2 notes

·

View notes

Text

Best Time For Trade In Forex

Forex is a very dynamic and thrilling market; over $6 trillion in volume passes through it each day, and it operates for 24 continuous hours five days a week. Not every moment is appropriate for trading, despite that. Knowing when the market is most conducive will help you maximize your success. In this article, we will study the best time to trade forex and how to capitalize on those periods for Profithills Education.

Knowing Your Forex Trading Hours

The forex market functions within the major financial mainstays of Sydney, Tokyo, London, and New York. Each of these main centers has different opening and closing times, thus forming the various segments of trading that would overlap. These overlap periods constitute the most liquid and volatile market and thus present the best opportunities to traders.

1. Overlapping of London and New York session.

Time: 8 AM to 12 PM EST

The London and New York session is considered the best time to trade forex since these two are the major financial hubs in the world. During this session, from 8 till noon EST, market becomes intensely volatile. By the time the U.S. market opens, there is more liquidity in the market, which always equates to a greater opportunity for price swings and breakouts, which day traders and short-term investors would favor immensely. Currency pairs like the EUR/USD, GBP/USD, and USD/JPY tend to have the greatest movements during this session.

Why trade during this session?

High volatility and liquidity

Major economic news releases

Best for short-term strategies like scalping and day trading

2. Tokyo-London Overlap

Time: 3 AM - 4 AM EST

While much shorter and less volatile than the London-New York overlap, the window between Tokyo and London can still provide some trading opportunity to those trading Asian currencies such as the JPY, AUD, and NZD. Liquidity is relatively low compared to the London-New York overlap. Traders seeking early morning setups may find good price action during this period.

Why trade during this time?

Movement in pairs involving the yen and Australian dollar

Moderate volatility

Best for traders who like less competition 3. London Session Time: 3 AM - 12 PM EST Actually, the London session itself represents a huge portion of the daily volume in the forex market. The fact that this session partially overlaps with the Asian session in the morning and with the U.S. session in the afternoon makes it a perfect moment to catch big moves. Many institutional traders are active during this time, so stronger price oscillations may also be noticed in pairs like GBP/USD, EUR/USD, and EUR/JPY.

Why trade during this time?

High liquidity across multiple currency pairs

Suitable for swing traders and long-term positions

Good for technical analysis-based strategies

4. New York Session

Time: 8 AM - 5 PM EST

The New York session is the second most active market in forex trading. Overlapping with the London session brings about the most market volatility during the day. When London closes, there is still some action to find in the New York session, majorly between major USD pairs. Also, be on the lookout for any economic data release from the U.S. as it might form sharp movements.

Why trade during this time?

U.S. economic news moves the dollar

High volatility during the opening hours

Suitable to trade major USD pairs

Times to Avoid Trading

Even though forex is 24/5, there are times that ought to be avoided because of low liquidity and high unpredictability:

The Weekend Gaps: The Forex market closes at 5 PM EST on Friday and opens at 5 PM EST on Sunday. It is possible that when the market opens on Sunday, the price may gap higher or lower than where the market closed on Friday, especially since important news may have occurred over the weekend.

Holidays: Trading on major holidays, such as Christmas or New Year's Day, is extremely risky because markets are thin, and prices can act very erratically.

Low Liquidity Times: This would be around 5 PM - 7 PM EST. The session in New York has closed, and the session in Sydney has just opened. This would be considered the least liquid time because it would become a lot more difficult to enter trades with tight spreads.

Key Takeaways

The best time to trade forex depends on your strategy and which currency pairs you're looking at. If you're after high volatility and volume, the overlap between London and New York is still your best bet. Conservative traders, on the other hand, may find periods like the Tokyo or Sydney sessions more conducive to their needs. While they are considered quiet sessions, they are still viable options for trading, especially in currency pairs related to the Japanese yen or Australian dollar.

The whole of successful forex trading is basically about timing the most active and liquid market hours. If you target these peak periods, you could better your chance at catching the larger movements in prices and profiting from the world's largest financial market.

Conclusion

Everything in forex trading is all about timing. Whether you are a complete beginner or an accomplished trader, knowing when to trade can give you an enormous advantage. By focusing on the overlap of major financial centers and keeping an eye on key economic events, you can strategically plan your trades for maximum profitability. Follow these guidelines and set yourself up for success along your forex trading journey.

0 notes

Text

The benefits and drawbacks of being a solo vs part of a team in the industry

DOES TEAMWORK PAY?

In the professional world, there are two primary work styles: working solo or being a part of a team. Each work style has its own benefits and drawbacks depending on the industry, personality, and preferences of the worker. Some people thrive in a solitary environment where they can work independently, while others prefer to be surrounded by colleagues and actively collaborate…

View On WordPress

#Automated trading#CFD Trading#Currency Exchange#Currency trading#Forex analysis#Forex brokers#Forex charts#Forex education#Forex market#Forex Market Hours#Forex Market Trends#Forex news#Forex signals#Forex strategies#Forex Tips#Forex trading#Forex trading software#Forex Trading Strategies#Forex trading systems#Fundamental analysis#Indicators#Online Forex Trading#Price Action#Psychology#Risk Management#Technical analysis#Trading Forex#Trading platforms#Trading Psychology#Trading robots

1 note

·

View note

Video

youtube

Transform Your Trading Today with Our Exclusive Offer on Forex Trading E...

#forex#forex trading#support and resistance levels#How to Identify Support and Resistance#Trading with Support and Resistance#Support and Resistance Tutorial#Price Action Analysis#Drawing Support and Resistance Lines#Support and Resistance Strategies#Support and Resistance Explained#Support and Resistance in Forex

0 notes

Text

EUR/USD Weekly Analysis: Bullish Trend in Correction Phase with Bearish Signals on Lower Time Frames

EUR/USD Weekly Analysis:

The EUR/USD pair is currently exhibiting an interesting mix of signals across various time frames, which can make it challenging to develop a clear and concise analysis. Let's break down the situation step by step.

youtube

Weekly Chart (Long-term Perspective):

On the weekly chart, EUR/USD is still in a bullish phase, as indicated by the overall uptrend in recent months. However, it seems to be in a correction phase within this larger uptrend. This correction could be driven by a variety of factors, such as economic data releases, geopolitical events, or changes in monetary policy.

Key points to note on the weekly chart:

Trend: The primary trend is still bullish, supported by higher highs and higher lows on the weekly time frame.

Support and Resistance: Identify significant support levels where the price may find buying interest and resistance levels where selling pressure might emerge.

Fundamental Factors: Keep an eye on fundamental factors that can impact the EUR/USD pair, such as central bank policies, economic indicators, and global events.

Risk Management: Ensure that you have a solid risk management strategy in place, including stop-loss orders and position sizing, to protect your capital in case the correction deepens.

Lower Time Frames (Daily and Below):

While the weekly chart suggests a correction within a bullish trend, it's essential to examine lower time frames to get a more granular view of the current situation.

Daily Chart: On the daily chart, you've mentioned that EUR/USD appears to be in a correction phase. Look for key levels of support and resistance on this time frame. Bearish signals on the lower time frames could indicate short-term weakness, but they should be viewed in the context of the broader weekly trend.

Hourly/15-Minute Charts: For more precise entry and exit points, use lower time frames like the hourly or 15-minute charts to time your trades. Keep in mind that these time frames are highly sensitive to short-term news and events. You can get Forex Signals from professional.

Indicators: Utilize technical indicators like moving averages, oscillators, and trendlines to gauge the strength and potential direction of the correction on lower time frames.

Economic Calendar: Stay updated with economic events and news releases that could influence short-term price movements.

In summary, your weekly analysis of EUR/USD should incorporate both the long-term bullish trend on the weekly chart and the potential correction indicated in lower time frames. Always consider the bigger picture and manage your risk appropriately. Trading in the foreign exchange market can be highly volatile, so it's crucial to stay informed and use a disciplined approach to trading.

Get 15 Days of FREE professional Signals from PreferForex.com

Exact entry, Take profit, and Stop loss

You can trade with your existing broker account.

1 note

·

View note

Text

What is Price Action Strategy In Forex?

Discover the power of price action strategy in forex trading. Analyze raw price movements, patterns, and trends to make informed trading decisions. Learn how to identify key support and resistance levels, interpret candlestick patterns, and follow price trends. Master the art of trading based on price action for greater trading success.

0 notes

Text

why do price action traders fail? and Solutions

Are you frustrated with the results of your price action trading despite investing a significant amount of time and effort into analyzing the charts and following the latest market trends?

#price action trading#price action trading strategies#why traders fail#price action trading strategy#price action#price action trading mack#why forex traders fail#why traders fail at price#brooks price action#why do traders fail#why traders fail?#why traders lose money#how to trade#why most of forex traders fail?#priceaction and solutions#price action trading course#price action trading forex#price action strategy#why most traders fail

0 notes

Text

10 Forex Strategies for Scalping

Scalping is a popular trading strategy in the forex market, characterized by short-term trades aimed at capturing small price movements. This strategy requires quick decision-making, discipline, and a keen understanding of the market. In this article, we’ll explore 10 effective forex strategies for scalping that can help traders maximize their profits while minimizing risk.

1. Moving Average…

#Bollinger Bands#Candlestick Patterns#CCI#Crossovers#Divergence#Entry and Exit Points#Fibonacci Retracement#Forex#Forex Market#Forex Strategies#MACD#MACD Line#Momentum Indicator#Moving Average#Moving Average Convergence Divergence#Overbought Conditions#Oversold Conditions#Parabolic SAR#Pivot Points#Price Action#Price Movements#Relative Strength#RSI#Scalping#Scalping Strategy#Security#Signal Line#Stochastic Oscillator#Stop-Loss#Support And Resistance

0 notes

Text

Forex Trading MT4 0.40 Lots #Sell Trade running #USDCHF. Profits protected with SL. Official Website: wWw.ForexCashpowerIndicator.com

.

Cashpower Indicator Lifetime license one-time fee with No Lag & Non Repaint buy and sell Signals. ULTIMATE Version with Smart algorithms that emit signals in big trades volume zones.

.

✅ NO Monthly Fees

✅ * LIFETIME LICENSE *

✅ NON REPAINT / NON LAGGING

🔔 Sound And Popup Notification

🔥 Powerful & Profitable AUTO-Trade Option

.

✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.**

.

( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ).

.

✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options.

.

🔔 New Ultimate CashPower Reversal Signals Ultimate with Sound Alerts, here you can take No Lagging precise signals with Popup alert with entry point message and Non Repaint Arrows Also. Cashpower Include Notification alerts for mt4 in new integration.

.

🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

.

#cashpowerindicator#forexindicator#forexsignals#indicatorforex#forexindicators#forextradesystem#forex#forexprofits#forexvolumeindicators#forexchartindicators#metatrader4 indicators#metatrader5 indicator#mt4 indicators#mt5 indicators#forex trading profits#forex macd#forex fibonacci#forex price action

3 notes

·

View notes

Text

How to Learn Trading

Trading is one of the most vibrant and dynamic ways of investment in financial markets. Though brilliant opportunities for profit are available therein, there are lots of challenges, too. Whether it is stocks, commodities, forex, or cryptocurrencies, learning how to trade effectively will be important if you want long-term success. At Profithills Education, we try to make this learning process simpler. In this blog, we are going to outline the main steps one should cover in the beginning of his trading path.

1. Understand the Basics of Trading

Whenever one wants to trade, the first thing to understand is what trading actually is. It incorporates:

Markets: Knowing that there are types of markets, like stock, forex, cryptocurrency, and commodities.

Assets: Knowing some of the available assets to trade, such as but not limited to shares, currencies, and commodities.

Order Types: Knowledge of basic order types, such as market orders, limit orders, stop-loss, and take-profit.

Leverage and Margin: Knowledge of leverage and margin, important concepts in most trading.

Knowing these will actually provide you with a firm foundation for more advanced concepts that you may learn later.

2. Build a Strong Knowledge Foundation

Trading is all about making the right decision, not about mere buying and selling. For that, you will need to make a strong foundation of knowledge based on the following material:

Books: You may read some classic books on trading, such as "Market Wizards" by Jack Schwager or "A Random Walk Down Wall Street" by Burton G. Malkiel.

The structured online courses teach the principles of trading, risk management, and strategies. We have a number of courses targeting both the beginner and the intermediate at Profithills Education. Blogs and News Sites: It's also important to keep up with reputable financial news and trading blogs regarding what goes on in the market trends and economic factors that cause those trends to change. 3. Master Technical and Fundamental Analysis There are, in general, two ways to analyze the markets:

Technical Analysis: Based on charts and indicators predicting price movement in the future, it can therefore allow traders to find trends, reversals in trends, and the perfect entry or exit points.

Fundamental Analysis: In this type of analysis, the root factors affecting the value of an asset are considered-be it the financial health of a company, economic indicators, or geopolitical events.

Both are main types of analysis, and learning how to merge them will turn you into an all-inclusive trader.

4. Choose Your Trading Style

One size doesn't fit in trading. There is a particular trading style for a particular type of trader.

Day Trading: This style of trading involves buying and selling the same security in one day, catching the minute movements of its price.

Swing Trading: This style targets catching higher price movements taking several days or perhaps weeks.

Scalping: The really fast-paced style of trading where lots of trades are taken inside minutes or hours with small profits.

Position Trading: This involves a more long-term approach where traders hold positions for several months or even over a number of years according to their fundamental analysis. Choose one style that fits your lifestyle, risk tolerance, and time commitment to the markets.

5. Use a Demo Account

It is always a good thing to practice in a simulated environment before you begin to risk your real money. Most of the brokers will give you demo accounts on which you can trade virtual money. This will let you:

A. Try different approaches

B. Get used to the trading platform

Learn how to handle trades and emotions with no financial risk.

It is an excellent way to build confidence before transitioning to a live account.

6. Develop a Trading Plan

Among the principal mistakes that the new traders do is that they trade without any type of plan. A trading plan delineates your:

Goals: What is it you want to achieve from trading?

Risk Management Rules: How much of your capital are you willing to risk per trade? To preserve your capital, set a stop-loss on each trade.

Entry and Exit Rules: You have to make it crystal clear what would be your entry and exit criteria.

Trade Strategy: This has something to do with the trading style and the way you carry out your analysis. You may use either price action, technical indicators, or even a combination of both; the bottom line is consistency in whatever you choose to do.

7. Start Small and Scale Gradually

When you have practised on a demo account and feel comfortable with your strategy, go live. You start small and only risk a very small portion of your capital. You scale up gradually as you build experience and confidence.

8. Keep Up with Your Progress

Continuous learning and self-evaluation are pretty significant for a trader. Much like in any other profession, you have to keep a trade journal, which would track:

Things to include in this journal are: the trade made; the reason for getting in and out of the trade; the outcome of the trade; what is learned from both profitable and losing trades. This journal will lead you to fine-tune your strategies and make better decisions over time.

9. Control Your Emotions

Much of the time, trading is a source of stress, especially when markets become really volatile. Many times, rational judgment gets overtaken by fear and greed. To avoid impulsive decisions, stick to your trading plan, risk management rules, and keep yourself in balance. Most traders believe that meditation or some light mental exercise keeps them focused.

10. Stay Updated with Market News

Financial markets are driven by economic reports, corporate earnings, geopolitical events, and even social trends. Being updated with the news in the market will help one to spot where the markets are going to move. Subscribe to reliable news sources and follow the economic calendars.

It is a process of learning to trade that requires a hell lot of time, patience, and due course learning. We at Profithills Education emphasize from our end that new traders take time to build a strong foundation instead of rushing into live markets. Anyone can learn the art and science of trading with the right mindset, resources, and discipline.

0 notes

Text

What is the role of luck in forex trading? Is it worth counting on?

THAT WAS CLOSE!!!!!!!

Forex trading is a complex and dynamic market that requires a combination of skill, strategy, and luck to achieve success. While many traders focus solely on developing their skills and refining their strategies, luck can also play a significant role in determining outcomes. The concept of luck in forex trading is multi-faceted and can be difficult to define and quantify.…

View On WordPress

#Automated trading#CFD Trading#Currency Exchange#Currency trading#Forex analysis#Forex brokers#Forex charts#Forex education#Forex market#Forex Market Hours#Forex Market Trends#Forex news#Forex signals#Forex strategies#Forex Tips#Forex trading#Forex trading software#Forex Trading Strategies#Forex trading systems#Fundamental analysis#Indicators#Online Forex Trading#Price Action#Psychology#Risk Management#Technical analysis#Trading Forex#Trading platforms#Trading Psychology#Trading robots

0 notes

Video

youtube

MACD And RSI Divergence Trading Strategies 2023

0 notes

Text

Among the Most Outstanding Forex Strategies

Among the Most Outstanding Forex Strategies

Among the most outstanding forex strategies is the price action strategy. This is a trading method that involves taking a position in currency pairs by using a set of rules. In addition to price action, there are other trading strategies such as swing trading and carry trading. These strategies have the potential to give you massive profits.

Examples of exceptional forex trading strategies

The…

View On WordPress

0 notes

Link

Micro E-minis – MES – How to Trade the Mini Contracts

Click the link to watch the video and for more information

https://daytradetowin.com/blog/micro-e-minis-mes-how-to-trade-minis/

#price action trading#trading forex forexmarket daytrade daytrading stocks stocktrading stocktrade stockmarket entrepreneur reward future tradinglifestyle money c

0 notes