#price action forex strategy

Text

4 Reasons Why Price Action Trading is the Best

#price action trading#price action trading strategies#price action#best price action trading strategy#price action strategy#price action trading strategy#price action trading course#price action trading forex#price action analysis#price action forex#price action for beginners#price action forex strategy#price action scalping#price action trading system#price action trading in hindi#price action trading live#price action indicator#price action patterns

1 note

·

View note

Text

Fibonacci Trading: Forex Trading Strategy Explained

Fibonacci trading is a popular forex trading strategy that utilizes the Fibonacci sequence and its ratios to predict potential price movements and retracement levels. This method helps traders identify entry and exit points, making it an essential tool in forex trading.

Understanding Fibonacci Sequence

The Fibonacci sequence is a series of numbers where each number is the sum of the two preceding…

#CCI#DeFi#Divergence#Downtrend#Entry and Exit Points#Fibonacci Levels#Fibonacci Retracement#Forex#Forex Trading#MACD#Market Conditions#Market Volatility#Moving Average#Moving Average Convergence Divergence#Predictability#Price Action#Price Charts#Price Movement#Price Movements#Relative Strength#Risk Management#RSI#Stop-Loss#Support And Resistance#Trading Decisions#Trading Strategy#Volatility

2 notes

·

View notes

Text

The benefits and drawbacks of being a solo vs part of a team in the industry

DOES TEAMWORK PAY?

In the professional world, there are two primary work styles: working solo or being a part of a team. Each work style has its own benefits and drawbacks depending on the industry, personality, and preferences of the worker. Some people thrive in a solitary environment where they can work independently, while others prefer to be surrounded by colleagues and actively collaborate…

View On WordPress

#Automated trading#CFD Trading#Currency Exchange#Currency trading#Forex analysis#Forex brokers#Forex charts#Forex education#Forex market#Forex Market Hours#Forex Market Trends#Forex news#Forex signals#Forex strategies#Forex Tips#Forex trading#Forex trading software#Forex Trading Strategies#Forex trading systems#Fundamental analysis#Indicators#Online Forex Trading#Price Action#Psychology#Risk Management#Technical analysis#Trading Forex#Trading platforms#Trading Psychology#Trading robots

1 note

·

View note

Video

youtube

Transform Your Trading Today with Our Exclusive Offer on Forex Trading E...

#forex#forex trading#support and resistance levels#How to Identify Support and Resistance#Trading with Support and Resistance#Support and Resistance Tutorial#Price Action Analysis#Drawing Support and Resistance Lines#Support and Resistance Strategies#Support and Resistance Explained#Support and Resistance in Forex

0 notes

Text

What is Price Action Strategy In Forex?

Discover the power of price action strategy in forex trading. Analyze raw price movements, patterns, and trends to make informed trading decisions. Learn how to identify key support and resistance levels, interpret candlestick patterns, and follow price trends. Master the art of trading based on price action for greater trading success.

0 notes

Text

Among the Most Outstanding Forex Strategies

Among the Most Outstanding Forex Strategies

Among the most outstanding forex strategies is the price action strategy. This is a trading method that involves taking a position in currency pairs by using a set of rules. In addition to price action, there are other trading strategies such as swing trading and carry trading. These strategies have the potential to give you massive profits.

Examples of exceptional forex trading strategies

The…

View On WordPress

0 notes

Text

The Bladerunner Sniper Forex Strategy

The Bladerunner Sniper Forex Strategy

The Bladerunner forex strategy is a combination of the current fundamentals and forex price action to identify a winning trade. Unlike other forex strategies, it will never enter a trade based on the rejection of the 20-day exponential moving average (EMA). Instead, it will look for a confluence of reasons to enter a trade. This is safer than entering a trade based on the rejection of one EMA, or…

View On WordPress

0 notes

Text

Mastering forex signals for trend following: a comprehensive guide

The foreign exchange market, or Forex, is a dynamic and ever-changing arena where traders seek to capitalize on currency price movements. One popular trading strategy is trend following, which involves identifying and following the prevailing market direction. Forex signals play a crucial role in assisting traders to navigate the complexities of trend following. In this comprehensive guide, we will explore the intricacies of Forex signals for trend following, helping you understand how to leverage them effectively for successful trading.

Understanding Trend Following

Trend following is a strategy that seeks to capitalize on the directionality of market prices. The basic premise is simple: identify the prevailing trend and place trades in the same direction. Trends can be upward (bullish), downward (bearish), or sideways (range-bound). Successful trend following involves entering a trade at the beginning of a trend and exiting when the trend shows signs of reversal.

The Role of Forex Signals

Forex signals serve as triggers for traders, indicating opportune moments to enter or exit a trade. These signals are generated through a thorough analysis of market data, including technical indicators, fundamental factors, and sometimes a combination of both. For trend following, signals become particularly crucial as they guide traders on when to jump on a trend and when to step aside.

Key Components of Forex Signals for Trend Following

1. Technical Indicators:

Moving Averages: These are fundamental tools in trend following. A moving average smoothens price data to create a single flowing line. Traders often look for crossovers, where short-term moving averages cross above long-term ones, as a signal to enter a trade.

Relative Strength Index (RSI): RSI measures the speed and change of price movements. A high RSI may indicate overbought conditions, suggesting a potential reversal, while a low RSI may indicate oversold conditions, signaling a potential buying opportunity.

Moving Average Convergence Divergence (MACD): MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

2. Fundamental Analysis:

While trend following is predominantly a technical strategy, incorporating fundamental analysis can enhance the accuracy of signals. Economic indicators, interest rates, and geopolitical events can significantly impact currency trends.

3. Price Action:

Pure price action analysis involves studying the historical price movements of a currency pair. Identifying patterns, such as higher highs and higher lows in an uptrend, can provide strong signals for trend following.

Choosing a Reliable Signal Provider

With the plethora of signal providers available, it's essential to choose a reliable one. Consider the following factors:

Track Record: A provider's historical performance is a crucial indicator of their reliability. Look for providers with a consistent track record of accurate signals.

Transparency: Transparent signal providers disclose their methods, including the criteria for generating signals and their risk management strategies.

Risk-Reward Ratio: A good signal provider should have a clear risk-reward ratio for each signal, helping you manage your trades effectively.

Implementing Forex Signals for Trend Following

Once you've selected a signal provider or developed a reliable system, the implementation phase is critical. Here are some tips:

Risk Management: Set clear risk parameters for each trade. This includes defining the percentage of your trading capital you're willing to risk on a single trade.

Position Sizing: Adjust the size of your positions based on the strength of the signal and the volatility of the market.

Stay Informed: While signals provide valuable insights, staying informed about broader market trends and events is crucial. Unexpected news can impact the Forex market.

Continuous Evaluation: Regularly assess the performance of your chosen signals and be prepared to adjust your strategy if market conditions change.

Conclusion

Forex signals for trend following can be powerful tools in a trader's arsenal, helping to identify and capitalize on market trends. However, success in Forex trading requires a comprehensive understanding of both the strategy and the market itself. By combining technical indicators, fundamental analysis, and a disciplined approach to risk management, traders can use Forex signals to navigate the complex world of trend following with confidence. Remember, no strategy guarantees success, and ongoing learning and adaptation are essential for long-term success in the Forex market.

Source:

#TradeSignals#FinancialFreedom#StockMarketAlerts#InvestingWisdom#ProfitableTrades#MarketAnalysis#TradingSignals#DayTrading#ForexProfit#CryptoSignals#MarketTrends#InvestmentTips#SmartTrading#TradeSmart#TechnicalAnalysis#RiskManagement#ProfitPotential#TradingStrategies#StockPicks#EconomicIndicators#TradingEducation#MarketInsights#OptionsTrading#MarketWatch#TradeStrategy#FinancialMarkets#ForexTrading#CryptoInvesting#AlgorithmicTrading#StockMarketNews

29 notes

·

View notes

Text

why do price action traders fail? and Solutions

Are you frustrated with the results of your price action trading despite investing a significant amount of time and effort into analyzing the charts and following the latest market trends?

#price action trading#price action trading strategies#why traders fail#price action trading strategy#price action#price action trading mack#why forex traders fail#why traders fail at price#brooks price action#why do traders fail#why traders fail?#why traders lose money#how to trade#why most of forex traders fail?#priceaction and solutions#price action trading course#price action trading forex#price action strategy#why most traders fail

0 notes

Text

10 Forex Strategies for Scalping

Scalping is a popular trading strategy in the forex market, characterized by short-term trades aimed at capturing small price movements. This strategy requires quick decision-making, discipline, and a keen understanding of the market. In this article, we’ll explore 10 effective forex strategies for scalping that can help traders maximize their profits while minimizing risk.

1. Moving Average…

#Bollinger Bands#Candlestick Patterns#CCI#Crossovers#Divergence#Entry and Exit Points#Fibonacci Retracement#Forex#Forex Market#Forex Strategies#MACD#MACD Line#Momentum Indicator#Moving Average#Moving Average Convergence Divergence#Overbought Conditions#Oversold Conditions#Parabolic SAR#Pivot Points#Price Action#Price Movements#Relative Strength#RSI#Scalping#Scalping Strategy#Security#Signal Line#Stochastic Oscillator#Stop-Loss#Support And Resistance

0 notes

Text

Forex Trading Advisor @novagad

I’ve been a Forex Trader since 2007 and an instructor since 2017.

Forex Trading: Exploring the Global Financial Frenzy

In the vast and dazzling world of financial markets, there's one beast that roars louder than the rest: Forex trading. It's a domain where fortunes are made (and sometimes lost) faster than you can say "exchange rate."

But what exactly is it about Forex that has millions of people hooked, eyes glued to screens, fingers poised over keyboards, and hearts racing like they've had one too many espressos? Let's dive deeper into the world of currency trading and uncover the secrets behind its irresistible allure.

1. The 24/5 Convenience Store of Trading

First and foremost, Forex trading operates 24 hours a day, five days a week. Unlike the stock market, which opens and closes like a sleepy small-town shop, the Forex market is like a neon-lit convenience store that never sleeps.

Traders from New York to Tokyo can engage in their currency escapades whenever the mood strikes. This flexibility allows part-time traders to moonlight after their day jobs and early birds to catch the worm in real-time market action.

2. The Seductive Leverage

Leverage in Forex is like having a turbocharger in a sports car. It gives traders the ability to control larger positions with a relatively small amount of capital. It's the dream of making big bucks with a small investment.

Of course, leverage is a double-edged sword—one moment you're racing at full throttle, and the next, you're careening off a cliff. But for many, the potential for high returns is too tempting to resist.

impressive gains. For those who relish a challenge and have a knack for puzzles, Forex trading offers a never-ending mental workout.

3. The Global Playground

Forex is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. Yes, you read that right—trillion with a T! This immense liquidity ensures that traders can enter and exit positions with ease, without worrying about slippage.

Plus, the sheer variety of currency pairs means there's always something to trade, whether you're bullish on the dollar, bearish on the euro, or just feeling adventurous about the Malaysian ringgit.

4. The Democratization of Trading

Gone are the days when Forex trading was exclusive to big banks and hedge funds. The rise of online trading platforms has leveled the playing field, allowing anyone with a computer and an internet connection to join the fun.

And with a plethora of educational resources, webinars, and demo accounts available, the Forex market is as inclusive as it is vast. It's like the world's biggest, most volatile party, and everyone's invited.

5. The Thrill of the Chase

Let's face it: Forex trading comes with an undeniable adrenaline rush. The fast-paced nature of the market, the constant flux of prices, and the never-ending stream of economic news and geopolitical events create an environment that's as exhilarating as it is unpredictable.

It's like being on a financial rollercoaster, with every twist and turn bringing new opportunities and risks. For many, it's this thrill that keeps them coming back for more, despite the occasional stomach-churning drops.

6. The Intellectual Challenge

Forex trading isn't just about clicking buy and sell; it's a cerebral game of strategy, analysis, and psychology. Traders spend hours poring over charts, deciphering technical indicators, and keeping up with economic data.

It's a constant test of wits and nerve, where making the right call can yield impressive gains. For those who relish a challenge and have a knack for puzzles, Forex trading offers a never-ending mental workout.

7. The Quest for Financial Independence

At its core, the popularity of Forex trading is driven by a simple, powerful desire: the quest for financial independence.

The dream of making a living from trading, of being your own boss, of earning money from anywhere in the world with just a laptop and an internet connection—it's a compelling vision.

While the reality can be tough and the road fraught with risks, for many, the potential rewards make it a journey worth embarking on.

8. The Bottom Line: Why Forex Trading is Gaining Popularity

Forex trading is no joke, my friend. It's a vibrant and global marketplace that offers incredible opportunities to make some serious dough, keep your brain buzzing, and achieve financial independence.

What makes it so darn attractive, you ask? Well, it's a 24/7 affair, meaning you can jump in whenever you please. Plus, there's this thing called leverage that gives you some extra oomph.

And let's not forget about the internet, which has made trading accessible to just about anyone. Oh, and did I mention the sheer adrenaline rush you get from the chase? It's like being on a rollercoaster ride you just can't resist.

9. But let's get real, shall we?

Now, let's not kid ourselves. Forex trading isn't some magical money-making machine that spits out cash on demand. It requires some serious learning, discipline, and a healthy dose of respect for the risks involved.

But here's the deal: If you're willing to put in the effort and approach it with a clear, strategic mindset, the rewards can be absolutely mind-blowing. We're talking big bucks, my friend.

So, whether you're a seasoned trader who knows the ropes or a curious newbie eager to dip your toes in the Forex waters, the world of trading is calling your name. Just remember to buckle up because it's going to be one heck of a wild ride.

Get ready to feel the rush!

Thanks for reading and please consider upvoting it, if you liked the content :)

3 notes

·

View notes

Text

What is the role of luck in forex trading? Is it worth counting on?

THAT WAS CLOSE!!!!!!!

Forex trading is a complex and dynamic market that requires a combination of skill, strategy, and luck to achieve success. While many traders focus solely on developing their skills and refining their strategies, luck can also play a significant role in determining outcomes. The concept of luck in forex trading is multi-faceted and can be difficult to define and quantify.…

View On WordPress

#Automated trading#CFD Trading#Currency Exchange#Currency trading#Forex analysis#Forex brokers#Forex charts#Forex education#Forex market#Forex Market Hours#Forex Market Trends#Forex news#Forex signals#Forex strategies#Forex Tips#Forex trading#Forex trading software#Forex Trading Strategies#Forex trading systems#Fundamental analysis#Indicators#Online Forex Trading#Price Action#Psychology#Risk Management#Technical analysis#Trading Forex#Trading platforms#Trading Psychology#Trading robots

0 notes

Video

youtube

Trade Like a Pro Unleashing the Profiteadeveloper Price Action Edge

#youtube#Price Action Analysis Strategy#Head and Shoulder Pattern#Trading Strategy#Price Charts#Price Charts Market Trends#Entry and Exit Points#Risk Management#Profit Maximization#Technical Analysis forex#forextrading

0 notes

Text

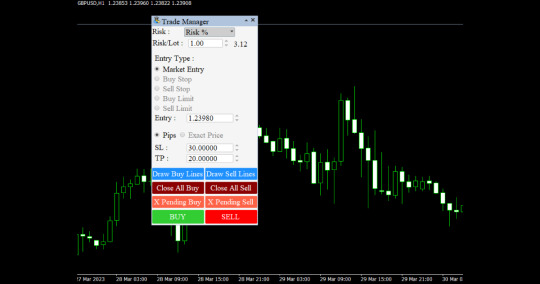

Effortless Efficiency: Automate Your Forex Trades with the Panel

In the dynamic world of forex trading, efficiency is paramount. Traders are constantly seeking ways to streamline their processes, optimize their strategies, and maximize their profits. One powerful tool that has emerged to meet these demands is the Automated Trading Panel. These panels leverage cutting-edge technology to automate trade execution, implement complex strategies, and enhance overall efficiency in forex trading. In this blog post, we'll explore the benefits, features, and potential of Automated Trading Panels in revolutionizing the way traders approach the forex market.

Understanding Automated Trading Panels: Automated Trading Panels are sophisticated software solutions designed to automate various aspects of forex trading, from trade execution to risk management and strategy implementation. These panels utilize advanced algorithms, artificial intelligence, and machine learning techniques to analyze market data, identify trading opportunities, and execute trades on behalf of traders. With their user-friendly interfaces and customizable features, Automated Trading Panels empower traders of all skill levels to automate their trading processes and achieve consistent results in the forex market.

Key Features and Functionality:

Trade Execution Automation: Automated Trading Panels enable traders to automate trade execution, eliminating the need for manual intervention. Traders can set specific parameters for trade entry, exit, and position sizing, allowing the panel to execute trades automatically based on predefined rules and criteria.

Strategy Implementation: Automated Trading Panels support the implementation of complex trading strategies, including trend-following, mean-reversion, and breakout strategies. Traders can customize their strategies by combining technical indicators, price action signals, and market sentiment analysis to suit their trading preferences and objectives.

Risk Management Tools: Automated Trading Panels offer advanced risk management tools to help traders mitigate potential losses and protect their capital. Traders can set stop-loss and take-profit levels, adjust position sizes, and implement trailing stop orders to manage risk effectively.

Backtesting and Optimization: Automated Trading Panels enable traders to backtest and optimize trading strategies using historical market data. By simulating trades under various market conditions, traders can assess the performance of their strategies and make necessary adjustments to improve profitability.

Real-time Market Analysis: Automated Trading Panels provide real-time market analysis and insights, allowing traders to stay informed about key market developments and potential trading opportunities. With access to up-to-date market data and analysis tools, traders can make informed decisions and execute trades with confidence.

Benefits of Using Automated Trading Panels:

Enhanced Efficiency: Automated Trading Panels streamline the trading process by automating repetitive tasks such as trade execution, position management, and risk assessment. By eliminating the need for manual intervention, traders can save significant time and effort. This enhanced efficiency allows traders to focus their attention on analyzing market trends, refining trading strategies, and making informed decisions, rather than getting bogged down by routine tasks.

Improved Accuracy: Automated Trading Panels leverage sophisticated algorithms and artificial intelligence to execute trades with precision and accuracy. Unlike human traders, who may be prone to emotions, biases, and cognitive errors, these panels operate based on predefined rules and criteria. By removing human involvement from the trading process, Automated Trading Panels minimize errors and enhance overall trading performance. Trades are executed consistently and objectively, without the influence of emotions such as fear, greed, or hesitation.

Consistent Performance: With their disciplined approach to trade execution and risk management, Automated Trading Panels help traders achieve consistent and reliable results over time. These panels adhere strictly to predetermined trading rules and strategies, ensuring that trades are executed in a systematic and disciplined manner. By maintaining consistency in trade execution and risk management, traders can avoid impulsive decisions and erratic behavior, thereby improving their chances of long-term success in the forex market.

Accessibility and Convenience: Automated Trading Panels are accessible from any internet-enabled device, allowing traders to monitor and manage their trades on the go. Whether at home, in the office, or on vacation, traders can stay connected to the forex market and take advantage of trading opportunities anytime, anywhere. This level of accessibility and convenience enables traders to stay informed about market developments, adjust their trading strategies, and execute trades promptly, without being tied to a specific location or time zone.

Reduced Stress and Emotional Impact: Trading can be a stressful and emotionally taxing endeavor, particularly during periods of market volatility or when faced with significant losses. Automated Trading Panels help alleviate stress and emotional strain by automating the trading process and removing the need for manual intervention. Traders can trade with confidence, knowing that their trades are being executed according to predefined rules and parameters. By removing the emotional element from trading decisions, Automated Trading Panels help traders maintain a clear and rational mindset, reducing the psychological burden associated with trading and improving overall well-being.

Automated Trading Panels offer numerous benefits to traders, including enhanced efficiency, improved accuracy, consistent performance, accessibility and convenience, and reduced stress and emotional impact. By leveraging advanced technology and automation, traders can streamline their trading processes, optimize their performance, and achieve greater success in the forex market.

Conclusion:

Automated Trading Panel offer a powerful solution for automating forex trades and enhancing trading efficiency. With their advanced features, customizable settings, and user-friendly interfaces, these panels empower traders to execute trades with precision, consistency, and confidence. Whether you're a seasoned trader looking to optimize your trading strategies or a novice trader seeking to streamline your trading process, Automated Trading Panels can help you achieve your trading goals with ease. Embrace the future of forex trading with Automated Trading Panels and experience the benefits of effortless efficiency in your trading journey.

#Trade Panel#Trading Panel#Trading Panel EA#TradePanel MT4#Trade Manager#Forex Trade Manager#Best Trade Manager#Trade Management utility#Trade Management tool#Trading management#forextrading#forexmarket#forex education#forexsignals#forex#black tumblr#technical analysis#4xPip

3 notes

·

View notes

Text

IMPORTANT OF FOREX TRADING

Price action trading

Range trading strategy

Trend trading strategy

Position trading

Day trading strategy

Scalping strategy

Swing trading

Carry trade strategy

Breakout strategy

News trading

Retracement trading

Grid trading

3 notes

·

View notes

Text

Elevating Forex Scalping with Signals Providers: A Strategic Advantage

In the dynamic world of forex trading, the strategy of scalping has gained popularity for its potential to yield profits from rapid price movements. Scalping involves executing a large number of trades within short time frames, aiming to capitalize on small price differentials. Amidst the fast-paced nature of scalping, forex scalping signals providers play a pivotal role, offering traders real-time insights and recommendations that can significantly enhance trading performance and profitability.

Decoding Forex Scalping

Forex scalping is a trading strategy characterized by the execution of numerous trades within a single trading session, with positions held for very brief periods. Scalpers aim to seize small price movements, profiting from the accumulation of these incremental gains over time. This strategy relies heavily on technical analysis, utilizing indicators, charts, and market patterns to identify fleeting opportunities.

Unveiling the Significance of Scalping Signals Providers

Scalping signals providers furnish traders with real-time trade alerts and recommendations, empowering them to make swift and well-informed decisions. These providers offer several advantages essential for successful scalping:

Timely Insights: Scalping necessitates rapid action. Signals providers deliver instantaneous alerts, ensuring traders can capitalize on market opportunities as they emerge.

Expert Analysis: Powered by advanced algorithms and expert analysts, signals providers offer in-depth market analysis, providing traders with valuable insights to inform their trading decisions.

Efficiency: By leveraging signals, traders can streamline their trading process, saving valuable time on market analysis and focusing on trade execution.

Risk Management: High-quality signals come equipped with predefined stop-loss and take-profit levels, enabling traders to manage risks effectively and safeguard their capital.

Market Breadth: Signals providers monitor a wide range of currency pairs and market conditions, ensuring traders have access to diverse trading opportunities.

Selecting a Dependable Forex Scalping Signals Provider

Choosing the right signals provider is instrumental in optimizing scalping strategies. Key considerations include:

Proven Track Record: Look for providers with a history of consistent and reliable signals. Verified performance data instills confidence in the provider's capabilities.

Transparency: Opt for providers that are transparent about their methodologies and success rates. Clarity regarding signal generation builds trust.

Real-Time Delivery: Signals must be promptly delivered through reliable channels such as SMS, email, or dedicated apps to facilitate timely trade execution.

User Feedback: Assess user reviews and testimonials to gauge the effectiveness and reliability of the provider's signals and customer support.

Customer Support: Access to responsive and knowledgeable customer support is crucial for addressing queries and resolving any issues promptly.

Leading Forex Scalping Signals Providers

Several providers have established themselves as reputable sources of scalping signals:

Forex Signal Factory: Known for its accuracy and real-time alerts, Forex Signal Factory caters to traders of all experience levels with its user-friendly platform.

Learn 2 Trade: With a commitment to transparency and comprehensive market analysis, Learn 2 Trade offers valuable insights alongside its signals.

FX Leaders: Offering a blend of free and premium signals, FX Leaders boasts extensive market analysis and a strong track record of success.

1000pip Builder: Renowned for its high accuracy and excellent customer support, 1000pip Builder is a preferred choice among traders seeking reliable signals.

Conclusion

Forex scalping offers traders the opportunity to capitalize on rapid market movements and generate profits in short time frames. However, success in scalping hinges on access to timely and reliable trade recommendations. Forex scalping signals providers fulfill this crucial role by delivering real-time insights and analysis, empowering traders to make informed decisions swiftly. By selecting a reputable signals provider that aligns with their trading goals and preferences, traders can elevate their scalping strategies and enhance their prospects of achieving consistent profitability in the forex market.

#forexsignalsproviders#forexsignalsuk#forextradingsignals#forexpips#forexmarkets#tradesignals#forex#freepips#freesignalsforex#forextrader#binaryexpert#tradingcharts#forexchart#tradingplan#forexchartanalysis#forexchartpatterns#forexcharts#technicolourcrafters#forexexpert#spreadbetting#learninghowtotrade#forexchartssignals#forexeducation#trendingtechnicals#howtospotatrend#movingaverage#priceaction#marketstructure

1 note

·

View note