#price action trading strategies

Text

why do price action traders fail? and Solutions

Are you frustrated with the results of your price action trading despite investing a significant amount of time and effort into analyzing the charts and following the latest market trends?

#price action trading#price action trading strategies#why traders fail#price action trading strategy#price action#price action trading mack#why forex traders fail#why traders fail at price#brooks price action#why do traders fail#why traders fail?#why traders lose money#how to trade#why most of forex traders fail?#priceaction and solutions#price action trading course#price action trading forex#price action strategy#why most traders fail

0 notes

Text

Volume Indicators: How to Use Them in Trading

Volume indicators are essential tools for traders seeking to understand market activity and potential price movements. These indicators provide insights into the strength and direction of trends by analyzing trading volume. This article explores how volume indicators work, their benefits, and how traders can effectively use them in their strategies.

What Are Volume Indicators?

Volume indicators…

#Downtrend#Entry and Exit Points#Liquidity#Market Analysis#Market Conditions#Market Sentiment#OBV#On-Balance Volume#Price Action#Price Movement#Price Movements#Profitability#Risk Management#Security#Stop-Loss#Technical Analysis#Trading Decisions#Trading Strategies#Trading Volume#Trend Confirmation#Volume Analysis#Volume Indicator

2 notes

·

View notes

Text

The benefits and drawbacks of being a solo vs part of a team in the industry

DOES TEAMWORK PAY?

In the professional world, there are two primary work styles: working solo or being a part of a team. Each work style has its own benefits and drawbacks depending on the industry, personality, and preferences of the worker. Some people thrive in a solitary environment where they can work independently, while others prefer to be surrounded by colleagues and actively collaborate…

View On WordPress

#Automated trading#CFD Trading#Currency Exchange#Currency trading#Forex analysis#Forex brokers#Forex charts#Forex education#Forex market#Forex Market Hours#Forex Market Trends#Forex news#Forex signals#Forex strategies#Forex Tips#Forex trading#Forex trading software#Forex Trading Strategies#Forex trading systems#Fundamental analysis#Indicators#Online Forex Trading#Price Action#Psychology#Risk Management#Technical analysis#Trading Forex#Trading platforms#Trading Psychology#Trading robots

1 note

·

View note

Text

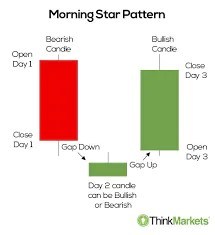

Mastering the Morning Star Pattern: A Step-by-Step Guide

Title: Mastering the Morning Star Pattern: A Step-by-Step Guide

Introduction:The world of technical analysis offers traders a plethora of tools to identify potential trend reversals and market opportunities. One such powerful pattern is the Morning Star pattern, a three-candlestick formation that signals a potential bullish reversal after a downtrend. In this step-by-step guide, we will explore…

View On WordPress

#bullish reversal#candlestick patterns#comprehensive trading approach.#confirmation factors#doji candle#downtrend#false signals#market sentiment#momentum shift#Morning Star pattern#position sizing#price action#resistance levels#Risk Management#spinning top#stop-loss#support levels#technical analysis#trading strategy#trading volume#Trend Reversal#volume analysis

0 notes

Video

youtube

Transform Your Trading Today with Our Exclusive Offer on Forex Trading E...

#forex#forex trading#support and resistance levels#How to Identify Support and Resistance#Trading with Support and Resistance#Support and Resistance Tutorial#Price Action Analysis#Drawing Support and Resistance Lines#Support and Resistance Strategies#Support and Resistance Explained#Support and Resistance in Forex

0 notes

Text

What Is Price Action Trading

Introduction: Understanding the Basics of Price Action Trading

In the world of finance and trading, mastering the art of understanding price movements is essential. Price Action Trading (PAT) is a popular method among traders, emphasizing the use of historical price data to make informed decisions. In this comprehensive guide, we will delve deep into the concept of Price Action Trading,…

View On WordPress

#candlestick patterns#Mastering Price Action#Mastering Price Action Strategies#Tips for Successful Price Action Trading

0 notes

Text

This comprehensive blog from Funded Traders Global covers the Price Action Strategy and mastering market trends for successful trading. It begins by defining the Price Action Strategy, emphasizing its importance in predicting future price movements. The blog explores the components of Price Action, including candlestick patterns, support and resistance levels, and chart patterns. It highlights the benefits of this strategy, such as simplicity, enhanced decision-making, and its applicability to various markets.

The blog outlines key principles of Price Action, including candlestick patterns, support and resistance levels, and trendlines and channels. It then focuses on reading market trends, with an emphasis on identifying trends, assessing their strength, and recognizing trend reversals. The importance of setting clear trading goals and effective risk management is stressed, along with crafting precise entry and exit strategies.

Common mistakes to avoid in trading are discussed, including overtrading, ignoring fundamental analysis, and emotional trading. The blog also provides information on essential tools and resources, including recommended charting software, books, courses, and online trading communities to support traders in their journey.

In conclusion, the blog encourages traders to apply the knowledge gained, practice consistently, and continue their education to become proficient and successful traders. Trading is described as both an art and a science, emphasizing the importance of discipline and adaptability in the ever-evolving world of finance.

#Applicability to Multiple Markets#Assessing Trend Strength#Benefits of Price Action Strategy#Books and Courses#Building a Price Action Trading Plan#Candlestick patterns#charting software#Common Mistakes to Avoid#Components of Price Action#decision-making skills in traders#Definition of Price Action Strategy#Emotional Trading#Entry and Exit Strategies#financial markets#Funded Traders Global#Identifying Trends#Ignoring Fundamental Analysis#Importance of Mastering Market Trends#Key Principles of Price Action#market trends#Mastering the Art of Reading Market Trends#Online Communities#overtrading#price action strategy#Reading Market Trends#Recognizing Trend Reversals#Risk Management#secrets to trading success#setting clear and achievable trading goals#Simplicity and Clarity

0 notes

Text

4 Reasons Why Price Action Trading is the Best

#price action trading#price action trading strategies#price action#best price action trading strategy#price action strategy#price action trading strategy#price action trading course#price action trading forex#price action analysis#price action forex#price action for beginners#price action forex strategy#price action scalping#price action trading system#price action trading in hindi#price action trading live#price action indicator#price action patterns

1 note

·

View note

Text

Fibonacci Trading: Forex Trading Strategy Explained

Fibonacci trading is a popular forex trading strategy that utilizes the Fibonacci sequence and its ratios to predict potential price movements and retracement levels. This method helps traders identify entry and exit points, making it an essential tool in forex trading.

Understanding Fibonacci Sequence

The Fibonacci sequence is a series of numbers where each number is the sum of the two preceding…

#CCI#DeFi#Divergence#Downtrend#Entry and Exit Points#Fibonacci Levels#Fibonacci Retracement#Forex#Forex Trading#MACD#Market Conditions#Market Volatility#Moving Average#Moving Average Convergence Divergence#Predictability#Price Action#Price Charts#Price Movement#Price Movements#Relative Strength#Risk Management#RSI#Stop-Loss#Support And Resistance#Trading Decisions#Trading Strategy#Volatility

2 notes

·

View notes

Text

What is the role of luck in forex trading? Is it worth counting on?

THAT WAS CLOSE!!!!!!!

Forex trading is a complex and dynamic market that requires a combination of skill, strategy, and luck to achieve success. While many traders focus solely on developing their skills and refining their strategies, luck can also play a significant role in determining outcomes. The concept of luck in forex trading is multi-faceted and can be difficult to define and quantify.…

View On WordPress

#Automated trading#CFD Trading#Currency Exchange#Currency trading#Forex analysis#Forex brokers#Forex charts#Forex education#Forex market#Forex Market Hours#Forex Market Trends#Forex news#Forex signals#Forex strategies#Forex Tips#Forex trading#Forex trading software#Forex Trading Strategies#Forex trading systems#Fundamental analysis#Indicators#Online Forex Trading#Price Action#Psychology#Risk Management#Technical analysis#Trading Forex#Trading platforms#Trading Psychology#Trading robots

0 notes

Text

How To Commerce The Inverse Head-and-shoulders Sample

With the investor loosing interest in investing in shares, the volume drops and the inventory worth starts to decline. The heart trough is the deepest and the opposite two are of roughly the same depth. An inverted Head and shoulders pattern occurs when the price of a security drops marking the bearish pattern and reaches the bottom level. Then the bullish development kicks back in and pushes the worth upwards.

In this case, the inventory's price reaches three consecutive lows, separated by momentary rallies.

This breakdown ought to be convincing, occurring on robust volume and coinciding with momentum indicators pointing towards sturdy bearish momentum.

If the value advance preceding the top and shoulders top is not long, the following worth fall after its completion may be small as nicely.

All expressions of opinion are subject to vary without discover in response to shifting market circumstances.

Some progress on the US debt ceiling talks is lifting the general market mood. The Relative Strength Index indicator turned bearish, warranting that additional downside is expected, whereas the 3-day Rate of Change , continues to slide beneath its neutral level. Futures and futures choices buying and selling includes substantial risk and isn't appropriate for all investors. Please read theRisk Disclosure Statementprior to buying and selling futures merchandise.

Figuring Out The Pinnacle And Shoulders Trading Pattern

The neckline can additionally be an essential part of the pinnacle and shoulders sample as it is the stage of resistance that merchants use in order to set up the world vary to put orders. So, to find the neckline, first, find the left shoulder, head, and proper shoulder. Then connect the low factors after the left shoulder with the low after the head, which creates the neckline.

youtube

youtube

It can be difficult for newbies to determine the altering developments.

Is Your Risk/reward Enough?

Chart patterns Understand the method to learn the charts like a professional trader. Live streams Tune into day by day live streams with expert merchants and transform your buying and selling abilities. A catalyst is something that can move traders or buyers to buy or promote a stock. That’s as a outcome of you must use this sample to discover out a significant change in development. Ascending triangle pattern need a lot of traders to see the sample, so they act accordingly and the price sample plays out.

#Chart patterns#Price action trading#Trading basics#Technical analysis#Candlestick patterns#Support and resistance#Trend lines#Breakout trading#Reversal patterns#Continuation patterns#Fibonacci retracements#Moving averages#Trading strategies#Bullish engulfing pattern#Bearish engulfing pattern#Head and shoulders pattern#Double top pattern#Triple bottom pattern#Cup and handle pattern#Ascending triangle pattern#Descending triangle pattern#Wedge pattern#Harami pattern#Doji candlestick#Morning star pattern#Evening star pattern#Trading psychology#Risk management#Entry and exit points#Backtesting strategies

0 notes

Video

youtube

Trade Like a Pro Unleashing the Profiteadeveloper Price Action Edge

#youtube#Price Action Analysis Strategy#Head and Shoulder Pattern#Trading Strategy#Price Charts#Price Charts Market Trends#Entry and Exit Points#Risk Management#Profit Maximization#Technical Analysis forex#forextrading

0 notes

Text

The Tactics of a Pure Scalper

The Tactics of a Pure Scalper

Using the tactics of a pure scalper can be a great way to take advantage of market volatility and generate consistent profits. In fact, there are a number of different strategies you can use to take advantage of this style of trading. These include price action-based ES scalping, range-trading, and high-volume scalping. You can even practice these strategies in a risk-free demo…

View On WordPress

#High-volume scalping#Price action-based ES scalping#Range-trading strategy#tactics of a pure scalper

0 notes

Text

Scaling In and Out: Forex Trading Strategy Explained

Scaling in and out is a popular strategy in forex trading that involves gradually entering or exiting a trade. This technique helps traders manage risk and maximize profits by adjusting their position size based on market conditions. In this article, we will explore the concept of scaling in and out, its benefits, and how to effectively implement this strategy in your trading routine.

What is…

#EUR/USD#Forex#Forex Trading#Leverage#Market Conditions#Market Fluctuations#Market Sentiment#Position Sizing#Price Action#Risk Management#Risk Management Techniques#Support And Resistance#Technical Analysis#Trading Plan#Trading Strategy#Trend Following

0 notes