#securitisation

Explore tagged Tumblr posts

Text

https://www.nomi-lux.com/blog/raising-capital-using-luxembourg-vehicles/

0 notes

Text

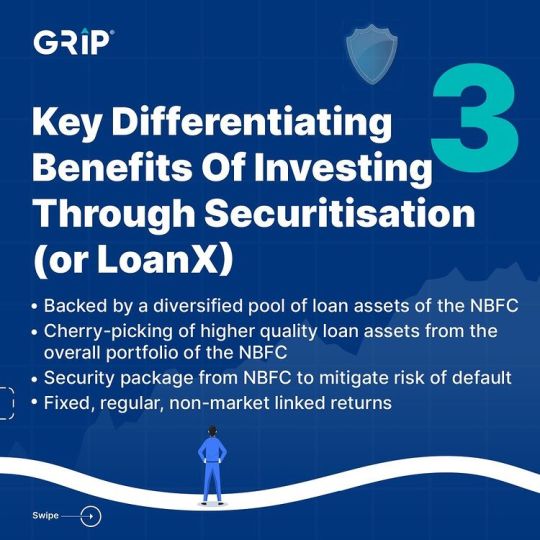

Benefits of Investing Through Securitisation or LoanX

0 notes

Text

there should be a way to invest in gender as a commodity. one should be able to adopt a long position in traditional masculinity and hold estradiol futures in order to manage risk. if you still hold futures contracts on the expiry date, you get forcefemmed by the exchange

74 notes

·

View notes

Text

#imagining a world where jane street has a desk specifically for these weird probabilistic buttons#like yeah thats a gender one. we put those in the gender change fund. we have an aging desk and a teleportation desk too

as a cis guy, when presented with the "99% you get a ton of money, 1% you turn into a girl" it honestly would be dumb to not hit that button until it breaks. like ok now i have 100 bajillion dollars and gender dysphoria. big deal. i have all the money in the world to turn me back into a guy. like with that kind of money i could have obama do me a phalloplasty. he wouldnt be able to do it as he isnt a surgeon but the point still stands

96K notes

·

View notes

Text

The Mortgage Securitisation Market - Structured Credit Investor

In the sophisticated arena of structured finance, the mortgage securitisation market remains a central mechanism for distributing housing-related credit risk to institutional investors. By transforming pools of mortgage loans into tradeable securities, the market enhances liquidity, broadens funding channels, and supports real estate financing across developed and emerging economies. As an integral theme covered by Structured Credit Investor, this market continues to evolve through structural innovation, regulatory recalibration, and investor demand shifts.

Market Fundamentals and Structural Composition

The mortgage securitisation market relies on a time-tested process. Lenders aggregate mortgage loans—either residential (RMBS) or commercial (CMBS)—and transfer them to special purpose vehicles (SPVs), which issue securities backed by the loan cash flows. These securities are tranched according to risk and yield, providing investors with differentiated exposure from senior, investment-grade tranches to high-yield, subordinated slices.

Tranching facilitates credit enhancement, allowing top-tier securities to obtain higher ratings from credit rating agencies. This structure provides originators with an efficient capital recycling mechanism while offering institutional investors tailored access to real estate credit.

Risk-Return Profile and Investor Considerations

Investors are drawn to the mortgage securitisation market for its capacity to generate stable, recurring cash flows that are often uncorrelated with other asset classes. However, these instruments carry embedded risks. Among the most pertinent are prepayment risk, delinquency volatility, servicing quality, and macroeconomic sensitivity.

In RMBS deals, the granularity of borrower credit profiles, regional housing trends, and origination standards are critical metrics. CMBS investors, by contrast, must evaluate commercial property types, tenant lease terms, asset location, and debt service coverage ratios.

Sophisticated analysis, often supported by scenario-based modelling and forensic due diligence, is essential for accurate valuation and risk mitigation. Post-2008 reforms have substantially improved transparency through loan-level data disclosures and ongoing performance monitoring.

Regulatory Landscape and Post-Crisis Reforms

Since the global financial crisis, the mortgage securitisation market has been subject to intense regulatory scrutiny. In the United States, the Dodd-Frank Act and Regulation AB II have redefined disclosure obligations, imposed risk retention rules, and demanded heightened due diligence standards for sponsors and underwriters.

Europe has responded with the Securitisation Regulation and the introduction of the Simple, Transparent, and Standardised (STS) designation. This framework aims to rebuild investor trust and re-establish the market as a credible source of funding for banks and non-bank lenders.

Risk retention—mandating that issuers retain at least 5% of the securitised exposure—ensures better alignment of interests. Enhanced servicing oversight, investor reporting standards, and the integration of environmental, social, and governance (ESG) criteria are gradually reshaping deal structures.

Technological Developments and Operational Efficiency

Technological innovation is redefining the contours of the mortgage securitisation market. The adoption of cloud-based analytics, artificial intelligence, and blockchain is facilitating greater transparency, operational efficiency, and investor engagement.

AI-driven platforms are being used to forecast borrower defaults, model cash flows under stress scenarios, and identify anomalies in loan tapes. Blockchain applications, though still nascent, hold potential for real-time payment tracking, automated servicing records, and smart contract execution within securitisation structures.

Fintech-led mortgage originators are also impacting deal flow, with non-traditional data sources being used to assess borrower risk. These innovations, while promising, raise new challenges around data governance, model validation, and systemic interconnectedness.

Global Market Trends and Geographic Diversification

The structural depth of themortgage securitisation market varies considerably across regions. The U.S. market remains the most developed, underpinned by the liquidity and guarantees provided by government-sponsored enterprises (GSEs). Private-label RMBS is resurging, particularly in the non-QM (non-qualified mortgage) segment, driven by investor appetite for higher-yield assets.

In Europe, issuance has historically been concentrated in the UK, Netherlands, and Spain, though regulatory constraints and central bank interventions have moderated volumes. The STS framework is expected to support gradual recovery, especially as traditional funding sources taper.

Emerging markets are developing mortgage securitisation capabilities to attract institutional capital, reduce dependence on bank lending, and enhance housing access. Markets in Latin America, Asia, and Africa face challenges in legal infrastructure, credit data reliability, and investor confidence—but also offer long-term growth potential.

Strategic Relevance and Market Intelligence

Beyond its function as a funding tool, the mortgage securitisation market serves as a critical barometer of housing sector health and financial system stability. Trends in delinquency rates, prepayment speeds, and tranche pricing provide insights into consumer behaviour, monetary policy impact, and credit conditions.

For institutional investors, accurate intelligence on deal performance, structural nuances, and market signals is essential. Structured Credit Investor plays a key role in delivering this insight—monitoring issuance pipelines, regulatory changes, and structural shifts that shape investor strategy and market perception.

Conclusion

The mortgage securitisation market continues to demonstrate its strategic importance in modern finance. By channelling capital into the housing sector while diversifying risk across the investment spectrum, it enables both economic growth and portfolio resilience. As the market adapts to regulatory developments, technological disruption, and shifting investor expectations, its trajectory will remain a subject of close analysis and strategic interest—particularly for informed readers and stakeholders of Structured Credit Investor.

0 notes

Text

Batman v superman still the greatest movie of all time

#rewatching to celebrate completing my MSc 🥳🥳#how is it everything in this movie is just as politically salient (if not more so) today than it was then ..#like. it just itches the international relations / area studies grad school tendencies in me#like all the literature and academia it’s drawing from is handled sooo well#like we’re talking existential risk reduction theory and weapons of mass destruction#securitisation theory.. heavy discourse analysis. post colonialism .. critical of US destabilising regimes in the global south#like just. this isn’t even the half of it. insane crazy movie I adore it

0 notes

Text

Trustees for Securitization In India Axis Trustee's securitization offers added business opportunities and increased fee income. The presence of the "Pool Servicer" provides certain additional assurance and safety, which allows flexibility in structuring the timing of cash flows to one's needs.

0 notes

Text

THANK YOU. Arthur could have avoided so many of his issues once he became king if he just had an official court wizard.

underdiscussed theme in bbc merlin is how authoritarian approaches to knowledge and education (ie: magic is taboo, therefore even being able to recognise it is suspicious) endangers everyone.

#its so bad having done security studies and watching#bc uther's securitisation sucked and just caused so many more fucking problems and#well arthur isnt the smartest so of course using the simplest method to secure your gov just didnt come across his fckn mind#i was screaming interally lowkey#bbc merlin#but i suppose the whole point is that arthur wasnt going to do anything revolutionary

11 notes

·

View notes

Text

Safety is a real, material set of conditions: a roof over your head and freedom from violence or injury. British politicians aren’t at risk of being bombed or seeing their children dismembered. Yet it was their speculative safety in the spotlight while Palestinians under military assault became a footnote in the vote. It’s true, of course, that two British MPs have been killed in recent years. But it’s a cheap shot for politicians to invoke their deaths to avoid engaging with the public about an ongoing genocide. When politicians say they feel unsafe in this context, they mean they feel uncomfortable being challenged by their constituents.

[...]

When discomfort is perceived as danger, protest is seen as harassment. And when political dissent is positioned as a threat to national security, our human rights are at risk. As sure as night follows day, when politicians begin to cite safety concerns, curtailment of democratic freedoms isn’t far behind. Civil liberties will always play second fiddle to securitisation. Judging by Sunak’s doublespeak at the lectern last Friday, the government plans to corrode our democracy under the guise of protecting it. Sunak’s emergency address was an authoritarian wishlist written in Islamophobic ink: curtail protest rights; threaten to remove immigrants’ “right to be here” if they speak what is considered “hate” at protests; reference streets being “hijacked” by “extremists” and “redouble support” for surveillance programme Prevent. It was framed in response to pro-Palestine protests, but entrenches an established anti-Muslim, anti-protest agenda that promotes surveillance in the name of “safety”. The name of Sunak’s “Safety of Rwanda” bill shows us he already has a cynical definition of this word. It’s curious how the social capital of playing the protector is often afforded to the violent perpetrators. If we use another very British example, the high-profile transphobic lobby that is obsessed with “women’s safety” has, in material terms, driven transphobic hate crimes to historic levels, but done nothing to end violence against women. In the same vein, it’s inevitable that Sunak’s measures to “combat the forces of division” will create even more far-right racism and state violence for Muslims. The dominant force of division is, of course, the state itself. Trans people and Muslims alike are sociological folk devils; minority groups in society positioned as a threat to social order. The government’s self-authorised mandate to marshal these manufactured threats justifies state control for everyone. In reality, the marginalised groups identified as the enemy within face crushing systemic oppression already. If anyone is unsafe, it’s them.

200 notes

·

View notes

Text

Israel is considering a plan to deploy private US logistics and security companies to create a "gated community" in Gaza where Palestinians would be subjected to biometric screenings to receive aid, according to media reports. Drop Site News reported on Monday, citing Israeli media, that Israel's war cabinet discussed the proposals on Sunday, and was set to approve a "pilot" programme within the next two months. According to Israeli news outlet Ynet, Global Delivery Company (GDC), which is run by Israeli-American businessman Mordechai Kahana, is in talks with the Israeli government to run the programme. Israel has long discussed the idea of so-called "humanitarian bubbles" in northern Gaza, in which it would allow aid into an area if it deemed there was no presence of fighters. Large parts of northern Gaza, in particular the Jabalia refugee camp, have been under a total siege over the past 17 days, with Israeli forces not allowing any food, clean water and medical supplies to enter.

42 notes

·

View notes

Text

[C]oncentration of global wealth and the "extension of hopeless poverties"; [...] the intensification of state repression and the growth of police states; the stratification of peoples [...]; and the production of surplus populations, such as the landless, the homeless, and the imprisoned, who are treated as social "waste." [...] To be unable to transcend [...] the horror [...] of such a world order is what hell means [...]. Without a glimpse of an elsewhere or an otherwise, we’re living in hell. [...] [P]eople [...] are very publicly and very personally rejecting prison as the ideal model of social order. [...] [I]nstincts and impulses are always contained by a system which dominates us so thoroughly that it decides when we can “have an impact” on “restructuring the world,” which is always relegated to the future. [...] Cultivating an instinctual basis for freedom is about identifying the longings that already exist - however muted or marginal [...]. The utopian is not only or merely a "fantasy of" and for "the future [...]." The utopian is a way of conceiving and living in the here and now [...]. [W]e’ve already begun to realize it. Begun to realize it in those scandalous moments when the present wavers [...].

Text by: Avery F. Gordon. “Some Thoughts on the Utopian.” Anthropology & Materialism [Online]. 3. November 2016.

---

Something must be done [...]. Haunting is one way in which abusive systems of power make themselves known and their impacts felt in everyday life, especially when they are supposedly over and done with (such as with transatlantic slavery, for instance) or when their oppressive nature is continuously denied (such as with [so-called] free labor or national security). [...] We are not merely reactive subjects but that we are, to use Kodwo Eshun’s word, ‘inaugurating’ ones, and therefore do not need permission [...]. In this, I think, Williams was also right to see that a certain melancholy or what John Berger calls ‘undefeated despair’ is bound to the work of carrying on regardless: to keeping urgent the repair of injustice and the care-taking of the aggrieved and the missing; to keeping urgent the systematic dismantling of the conditions that produce the crises and the misery in the first place [...]. [I]t also involves being or ‘becoming unavailable for servitude’, to use Toni Cade Bambara’s words. […] It’s key to anticipating, inhabiting, making the world you want to live in now, urgently, as if you couldn’t live otherwise […]. To achieve a measure of agency and possibility [...], it is necessary [...] 'to redeem time' [...]. This redemption involves refusing the death sentence and its doom, involves refusing to be treated as if one was never born, fated to a life of abandonment [...].

Text by: Avery F. Gordon. "Some Thoughts on Haunting and Futurity". borderlands 10:2. 2011.

---

[T]his context of enhanced militarism and securitisation [...] has led to more widespread social abandonment and more entrenched inequalities [...]. At the same time, there is widespread, daily, active and open political opposition to all this, at the scale at which people can contest it: protecting this group of migrants from [...] confinement and deportation; organising this strike among teachers in this city [...]. And there are also so many people [...] looking for ways to think and live on different - better terms - and doing it in small ways [...]. [W]hat haunts from the past are precisely all those aspirations and actions - small and large, individual and collective - that oppose racial capitalism and empire and live actively other than on those terms of order. [...] Julius Scott called it ‘the common wind.’

Words of Avery F. Gordon. As interviewed by Brenna Bhandar and Rafeef Ziadah, under the title: “Revolutionary Feminisms: Avery F. Gordon.” As transcribed and published online in the Blog section of Verso Books. 2 September 2020.

---

The impetus [...] was to challenge the twinned triumphalism of the [...] ‘End of History’ claim and the [...] claim that the political universe had closed shut [after the 1960s] [...]. The other impetus was to pick up [...] those ‘historical alternatives’ that ‘haunt a given society,’ as Herbert Marcuse (1969) wrote; to find the place where, as Patircia Williams (1991) put it, our ‘longings’ are ‘exiled’. [...] [To invoke] [...] ‘the many-headed hydra of the seventeenth-century revolutionary Atlantic’, those slaves, maids, prisoners, pirates, sailors, heretics, indigenous peoples, commoners and so on who challenged the making of the modern world capitalist system [...] [with their] often illegible, illegitimate or trivialized forms of escape, resistance, opposition and alternative ways of life [...]. [Consider] a standpoint and a mindset for living on better terms than we’re offered, for living as if you had the necessity and the freedom to do so, for living in the acknowledgement that, despite the overwhelming power of all the systems of domination which are trying to kill us, they never quite become us. They are, as Cedric J Robinson used to say, only one condition of our existence or being. [...] [L]iving apart [...]; communing; [...] human, debt, labour, knowledge strikes; [...] non-policing [...]: the ways of non-participation in the given order of things are many, varied and hard to summarize. [...] [A] community [...] of not waiting for another world but of being already there.

Text by: Avery F. Gordon, Katherine Hite, and Daniela Jara. “Haunting and thinking from the Utopian margins: Conversation with Avery Gordon.” Memory Studies. 2020.

#abolition#ecology#multispecies#shorter reference post collecting some of avery gordons writing#avery gordon#carceral geography#tidalectics#multiheaded hydra of revolutionary black atlantic#debt and debt colonies#ecologies#indigenous pedagogies#black methodologies

25 notes

·

View notes

Text

Benefits of Investing Through Securitisation or LoanX

1 note

·

View note

Text

stealing copper wire out of the walls of your house and selling it for scrap is just arbitrage. i'm just removing market inefficiencies. sorry. have you tried pricing it more accurately

22 notes

·

View notes

Note

Please talk about "Meeting Cyclonus’ parents” — I really want to know how that'd go down!

Better than that! I might as well post what I got written!

This was all for a variation of the Galvadad au (a fantasy au one though that doesn't pop up here). But I had a bit of fun writing it. Do enjoy!

---

"So where are we going this time?" Roddy asked.

"To Vos," Galvatron said.

"Cool!" The city of fliers. Roddy had heard so much about that. He couldn't wait to see. Good thing he had packed his hoverboard.

"Where to first?"

"We shall be stopping on the mountains just outside the city, to visit Cyclonus's parents."

Roddy turned with huge optics towards the shuttle-jet.

"Whoa!" he whispered in awe. "You have parents?"

Cyclonus was so aloof and scary that Roddy had always imagined that Cyclonus had just kind of sprung fully formed from the ground or an egg or something. He couldn't imagine Cyclonus with a family.

Cyclonus simply nodded in response to Roddy's awe.

"My creators are two of the fiercest warriors to have ever graced the skies. They taught me everything I know about loyalty, devotion and fighting. In battle the two are ruthless and cunning."

"Wow." Now Roddy was imagining two even bigger Cyclonus's and even scarier. Then he gulped and wondered how scary they might actually be.

Galvatron gave a sharp laugh, before patting his hand on Roddy's shoulder.

"Do not worry, you shall meet them soon enough."

-

The door was opened and a little purple seeker stepped through. She was wearing a set of optical enhancers on her nasal ridge. Next to Cyclonus she was tiny. She looked up at him and then her optics widened, she turned back into the house and called.

"Dearie! Our Cyclonus is here!" She spun round back to Cyclonus and went to embrace him. Cyclonus got down on his knees and hugged her.

"Hello mummy," he said.

"Oh goodness, we haven't seen you in so long. You just keep getting taller."

"It's because I always eat my greens," Cyclonus smiled. He actually genuinely smiled!

"Well good. I always told you enough as a youngling."

Then another purple femme stepped out. This time a shuttle who was even taller than Cyclonus.

"Oh! It's my little boy!" She managed to engulf all three of them in a hug.

"Hello mama."

Roddy wasn't prepared for any of this. His mind was reeling at what he seeing. These two looked like the nicest femmes he'd ever seen. How could these two possibly be Cyclonus's parents?

Once he was released from the hug the little seeker looked over and noticed the other two waiting there.

"Oh! Galvatron, how lovely to see you again." She came over and gave Galvatron another big friendly hug.

"Always a pleasure to see you."

She next turned her attention to Roddy, and then her optics sparkled.

"And who's this?"

"Hi. I'm Hot Rod," Roddy smiled. Suddenly he found himself instantly wrapped in a big hug.

"Cyclonus! You brought us a grandson!" The seeker exclaimed. Roddy felt sure he could hear Cyclonus spluttering somewhere. "Oh look at you! Aren't you just so cute?"

Roddy was unhooked from the hug and found himself being examined and checked over. The little seeker scrutinising every bit of him.

"Oh, you're so small! And look at your wings!" she said as she looked over Roddy's spoiler.

Suddenly the shuttle was also securitising him and fussing over him.

"How can you fly on those wings? They're so small. I guess he must be a warframe-seeker mix. But I've never a warframe so small. The poor thing's clearly not being fed enough."

"Mama, if I can explain..." Cyclonus tried to say.

"What you need is a good hearty meal," the seeker said, "come on in and we can have some cake."

Roddy was going to protest that he was just the right size for a racer his age but then there was the mention of cake and he immediately shut his mouth.

"Come on inside, just this way," the seeker said as she led Roddy into the home.

#Transformers#Cyclonus#Galvatron#Galvacyc#Galvadad#Hot Rod#Rodimus#TF Hot Rod#My Writings#Maccadam#writing meme

24 notes

·

View notes

Text

Whole business securitisations - structured credit investor

Whole business securitisation - Unlike a traditional securitisation or where institutions sell pools of their loans to a special-purpose vehicle, or SPV, in a whole business securitisation (or WBS or corporate ABS), there is no sale of assets to the SPV. Instead of purchasing the pool of assets, the SPV makes a loan to the borrowing company and takes security for that loan over the pool of assets retained by the borrowing company. Further, in a whole business securitisation, the SPV will not be an orphan company but will be a member of the originator?s corporate group.

0 notes

Text

HDFC Bank share price jumps despite Indian stock market fall. Here’s why

HDFC Bank shares rose over 1.5% after reporting strong Q4FY25 results, with gross advances growing by 5.4% year-on-year. Total deposits increased by 14.1%, reflecting steady loan and deposit growth amid a cautious strategy to recalibrate its credit-deposit ratio post-merger.

Shares of HDFC Bank climbed over 1.5 percent in early trade on Friday, April 4, defying the broader market downtrend, after the private sector lender posted a strong business update for the quarter ended March 2025 (Q4FY25). The market welcomed the bank’s steady progress on loan and deposit growth, along with its continued focus on recalibrating its post-merger balance sheet strategy.

Strong Operational Performance in Q4

HDFC Bank reported gross advances of ₹26.43 lakh crore as of March 31, 2025, registering a 5.4 percent year-on-year growth compared to ₹25.07 lakh crore a year earlier. On a sequential basis, gross advances rose 4 percent from ₹25.42 lakh crore reported at the end of the December 2024 quarter (Q3FY25).

The bank’s total deposits stood at ₹27.14 lakh crore, reflecting a 14.1 percent year-on-year growth from ₹23.79 lakh crore in Q4FY24. Sequentially, deposits rose by 5.9 percent over ₹25.64 lakh crore reported at the end of Q3FY25.

HDFC Bank also securitised ₹57,000 crore worth of loans in FY25, including ₹10,700 crore in the March quarter alone. The average deposit base expanded 15.9 percent year-on-year and 3.1 percent quarter-on-quarter to ₹25.28 lakh crore. Meanwhile, CASA deposits increased 5.7 percent year-on-year and 1.4 percent sequentially to ₹8.29 lakh crore.

Strategic Focus on Credit-Deposit Ratio

The management has previously indicated that FY25 would be a year of consolidation, with loan growth expected to lag behind the broader banking system. This cautious approach is part of HDFC Bank’s broader strategy to bring its elevated credit–deposit (CD) ratio back to pre-merger levels, following the merger with parent HDFC Ltd.

Looking ahead, the bank has guided that it will aim to match system-wide loan growth in FY26 and outperform in FY27, once it has realigned its balance sheet and deposit base.

Learn the best stock market strategies to boost your portfolio. With research-backed advice, Intensify Research Services helps investors create a strategy for consistent growth and profitability.

#accurate stock tips#ideal strategies#best bank nifty tips provider#share market advisory#trading tips#stock cash market tips#stock tips advisor#best bank nifty option tips#ipo alert#ipo news

1 note

·

View note