#solana 2022

Explore tagged Tumblr posts

Text

Current Household

The Hopsons

It didn’t start with Rusty. It didn’t even start with the kids. It started with a 22-year-old girl named Farrah, standing on her own for the first time in a city she didn’t belong to.

Fresh out of art school, Farrah moved to Port Sim with nothing but a degree, a secondhand couch, and her dog Mister Miyagi—Migs for short. She was broke, distant from her mother, and trying to build something from the ground up. That’s when Dante Gomez showed up. He wasn’t from Port Sim, but something about the two of them clicked fast. One date turned into a weekend. A weekend turned into weeks. Within a month, Farrah was pregnant. They were young. Stupid, maybe. But Dante was all in. He talked about cribs, names, futures. He posted her on his socials like she was the prize he never thought he’d win. But Dante was hiding more than Farrah knew. He had ties to a gang back in Del Sol Valley—ties that reached all the way to her front door. His rival, Loco Braun, lived across the street. Loco wasn’t a stranger to her. He wasn’t some random enemy in her eyes. He was a neighbor, a husband, a dad. Someone who, surprisingly, was nice to her when Dante wasn’t around. They became…friendly. Too friendly for Dante’s liking. It sparked fights. Ugly ones. Dante had his own temper. He’d raise his voice. He’d say shit he didn’t mean. Farrah gave it right back. Their love was fast, hot, and volatile. The final fight between Farrah and Loco wasn’t one-sided. She cursed him out. Got loud. Pushed buttons. She felt betrayed by both men, stuck in the middle of something she never signed up for. Loco snapped. One shove turned into a slap. A line was crossed. Farrah called Dante. Dante lost it. He gathered his crew. Made it known on every street. He was coming for Loco. What was supposed to be a scare turned deadly. Dante fired shots. He missed. Loco didn’t. Dante died that night, feet from Farrah’s apartment. Farrah didn’t know until the sirens stopped. Until the city got quiet again. Until she opened her door and saw the blood on the concrete.

Farrah survived. Barely. She brought Santino and Damien into the world alone. And if life hadn’t already done enough, cancer showed up next. Melanoma.

She missed their first Christmas from a hospital bed. Desperate, she called her estranged mother, Dasha, to help. It wasn’t perfect, but it saved their relationship. For once, Dasha showed up.

And then… Rusty. Older. Stable. And complicated as hell. He was married when they met. Madre, his wife, was spiraling, threatening to take her life if he left. Rusty stayed too long, trapped between guilt and fear. When he finally chose to leave, he chose Farrah. But it wasn’t clean. It wasn’t easy. The start of their relationship was fragile, strained by his past and her walls. Farrah, already worn from loss, told him flat-out—“I’ve been through hell. I’m not going through it again. Be all in, or be gone.” He stayed. Messy and all, he stayed. Rusty became a father overnight. Something he never thought he’d get to be. And when Noemie and Jasiel arrived—twins, again—it felt like life had finally balanced out.

But the universe had one more twist: Lyric Solana Hopson, their final, unexpected baby girl. She wasn’t planned. She wasn’t even wanted at first. But she is loved. More than they ever imagined they could love someone.

So here they are now.

Santino & Damien, nearly 10.

Noemie & Jasiel, loud and wild at 4.

Lyric, 18 months, the final piece.

Rusty & Farrah, still choosing each other every day.

And Migs, the day-one rider.

They’ve survived love, loss, betrayal, cancer, motherhood, fatherhood, and the weight of real life.

This family wasn’t built perfectly, but it was built intentionally.

And they’re still standing.

I never let Farrah rest, lmao. She has lived many lives and been my baby since 2022, but she and Rusty always find each other. FUN FACT: This is the first time they've actually had children together.

2 notes

·

View notes

Text

Pinkyblu OG's Collection

A pixel art NFT series created on Solana (Jan–Apr 2022), exploring 1-bit limitations with pink and blue. Featuring diverse themes like surrealism, cyberpunk, and ignorant tattoo art, the collection stands out with its dynamic parallax backgrounds and hypnotic animations.

2 notes

·

View notes

Text

Orion Depp : Co-Founder . Master Ventures Investment Management (MVIM) , ETHDevcon 2022 Orion Depp

(c) Orion Michael Depp – Co-Founder, Master Ventures Institutional Investment Management, SOLANA, SUI Ecosystem & Crypto Capital Markets Advisor, Wharton, USC MBA, Former Bain & Co IPO Management Consultant, First BNB Binance Analyst 2017, 30 Under 30 Entrepreneur CNBC.

#OrionDepp#OrionMichaelDepp#orion depp#orion-depp#CryptoAdvisor#Solana#BTC#SOL#ETH#Bitcoin#Binance#BinanceCoin#Bybit#OKX#Coinbase#Ethereum#Altcoins#Blockchain#Crypto#Cryptocurrency#DeFi#NFTs#Web3#CryptoMarket#CryptoTrading#CryptoCommunity#CryptoInvesting#Tokenomics#CryptoInsights#Metaverse

3 notes

·

View notes

Note

What current or future wip are you looking forward to writing the most?

Thanks for the ask! After I’ve finished Night Of The Blue Moon, I’m pretty excited to get to work on Blood On A Yellow Rose. I’ve had the idea since at least 2022, and I’m excited about writing not one, but two canonically aromantic MCs (Nathaniel, the secondary MC of The Tengu And The Angel is demiromantic, so he’s on the aromantic spectrum, but Pamela and Zinnia are both completely aromantic). Pamela not only embraces her immortality as a vampire, but celebrates it, and the only drawback she finds with it is not having anyone to share it with due to being abandoned in favor of romantic relationships by her friends. There’s gonna be a lot of discussion about how platonic relationships aren’t valued by society, and how even lifelong friendships are tossed to one side as soon as one party enters a romantic relationship, and people are expected to just be ok with that. Both Pamela and Zinnia are tired of always being treated like second class citizens due to not wanting romantic relationships, and it’s through this that they learn that soulmates don’t have to be purely romantic in nature. They are each other’s soulmates.

I’m also really excited to start working on the sequel to Night Of The Blue Moon. The first book deals with Orpheus, a villain who is using his powers to bring back someone who doesn’t deserve to live, (His son, Brooklyn, a serial stalker and rapist) but the second book will deal with Mia Morrigan, a villain who kills people who she thinks don’t deserve to live. She is a nurse who stole the choker of Thanatos, and is using it to reap the souls of patients she doesn’t want to care for. At first, all of her victims were truly awful people (A serial rapist, and a drunk driver who killed the parents of a five year old girl), but as time went on, she started targeting people she simply didn’t like. Ariel, Solana, and perhaps a new ally (I haven’t decided who will be joining them yet, but it will probably be either Myrna or Raphael), will be charged with defeating Mia, and taking back Thanatos’ choker.

#writeblr#writing#books#alina capella#night of the blue moon#lol#queerbooks#new releases#upcoming#blood on a yellow rose#aromantic#notbm#boayr#greek mythology#the tengu and the angel is out now!#asks#canon demiromantic character#thanatos#vampire#immortal#tw sa mention#ocs#inbox asks#thanks for the ask!

3 notes

·

View notes

Text

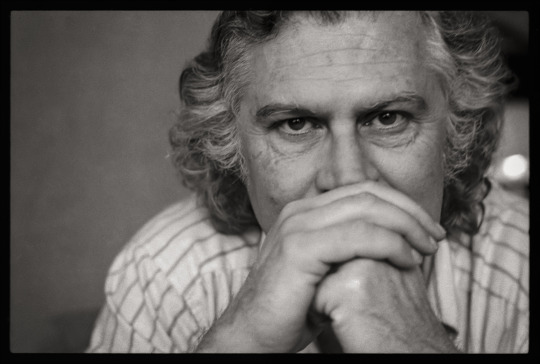

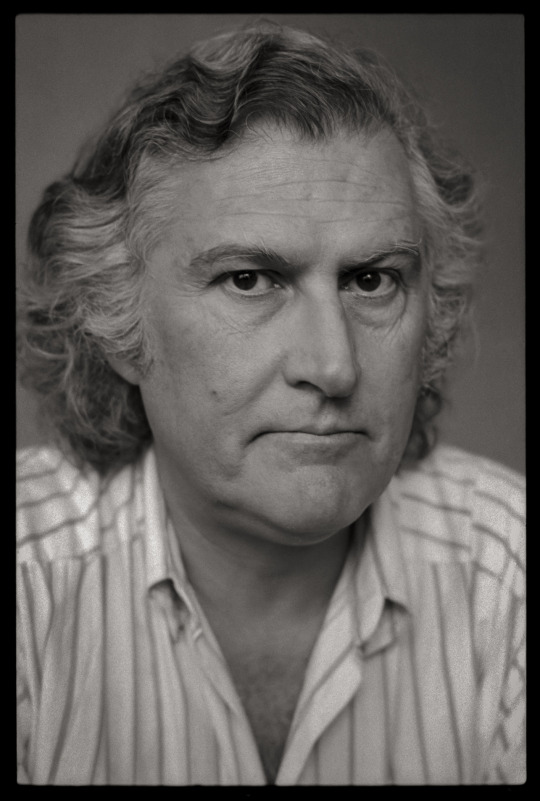

FERNANDO SOLANAS, EVAN ENGLISH & JOHN HILLCOAT, FERNANDO BIRRI, Toronto film festival 1988

We all talked about South America a lot in the 1980s, where decades of political tumult had produced no shortage of movies - like Sur, directed by Argentine filmmaker, writer, musician (and very soon, politician) Fernando Solanas, who presented the film at the 1988 Toronto film festival. Solanas co-wrote the manifesto "Toward a Third Cinema", which became very influential in filmmaking on the continent, and he had fled his country in 1976 for Paris after his life was threatened by the new military regime in Argentina.

Solanas came off very much as an elder statesman when I photographed him in one of the clean, well-lit rooms in the old Four Seasons hotel in Yorkville. He had palpable charisma (and great hair), and in hindsight it's easy to see how he would make a great impression when either running for office or presenting his films at Cannes, Venice or Berlin

Sur was a film about life after the military coup d'etat, but it wouldn't be the end of Solanas' troubles with his country's government; he was a critic of Argentina's president, Carlos Menem, and was shot six times in May of 1991, which propelled him to start a political career as a member of several different parties, and he even ran for president in the 2007 general election. Solanas died in 2020 in France during the COVID pandemic.

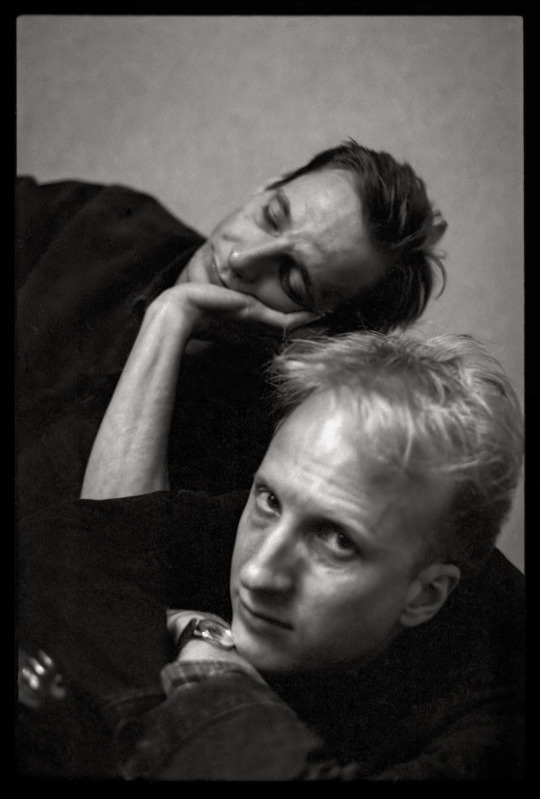

Writer/producer Evan English and director John Hillcoat arrived at the 1988 film festival with a "buzz" film - their grim prison drama Ghosts of the Civil Dead. It was partially based on the story of Jack Henry Abbott, the criminal who was paroled after a campaign led by writer Norman Mailer, only to murder a man six weeks after being released from prison. The script was co-written by singer Nick Cave, who also starred in the film and wrote the soundtrack, and Cave's participation accounted for a lot of the buzz around the picture.

English and Hillcoat presented themselves for interviews (and photo shoots) as a unified front, and my memory of them is a lot of laconic humour and dry sarcasm. Looking back I photographed them like musicians for a story that might have run in the NME or Melody Maker. The film seems to have been the high point of English' movie career, but Hillcoat (an Australian who spent much of his youth in Hamilton, Ontario) went on to direct movies such as The Road (2009) and Lawless (2012), as well as the HBO biopic miniseries George & Tammy (2022).

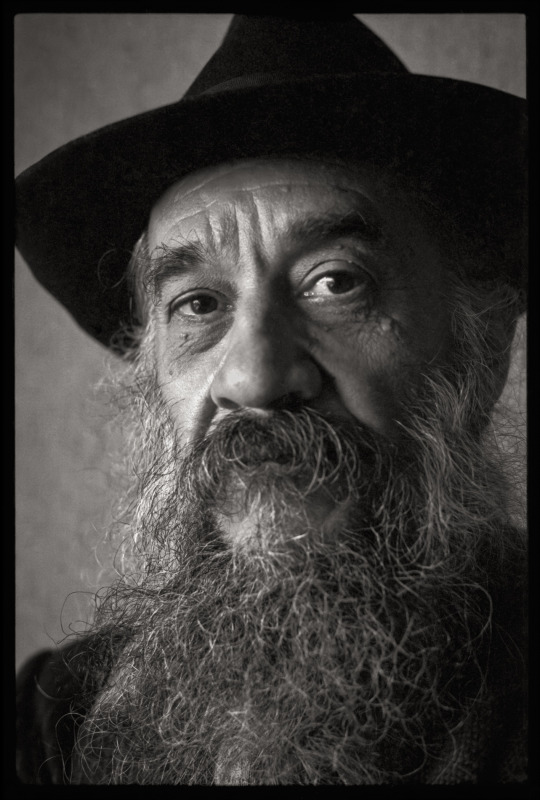

Vera historia de la primera fundación de Buenos Aires como también de varias navegaciones de muchas partes desconocidas, islas de reinos, también de muchos peligros, peleas y escaramuzas, tanto por tierra como por mar, que nunca han sido descriptos en otras historias o crónicas, extraídos del libro 'Viajes al río de La Plata', original del soldado alemán Ulrico Schmidl, miembro de la expedición capitaneada por don Pedro de Mendoza, quien publicó por primera vez estas memorias, bien anotadas para utilidad pública en la ciudad de Francfort el año 1567.

That's the full title of an early short film by Argentine director Fernando Birri, but it would usually be referred to as La primera fundación de Buenos Aires. Birri was at the 1988 Toronto film festival with his film A Very Old Man with Enormous Wings (Un señor muy viejo con unas alas enormes in Spanish), based on a short story by Gabriel Garcia Marquez. Like many South American filmmakers he was a major ally of the Cuban regime and made two films about Che Guevara, and his first feature Los inundados (1961) won the award for best first film at the Venice Film Festival.

Birri had a playful public image and his films were full of comedy and "magic realism", but I have to admit that many of my photos of him were inspired by the cover of a recent book of photographs by Roman Vishniac, of life in the Jewish communities of the Baltic and Eastern Europe before the genocides of World War Two. One of these shots has ended up being used (uncredited) on academic websites and in obituaries for Birri after he died in 2017. I've noticed that Netflix is about to air a miniseries based on Garcia Marquez' One Hundred Years of Solitude; maybe we'll start talking about South America and "magic realism" again.

#portrait#portrait photography#black and white#director#photography#film photography#some old pictures i took#fernando birri#Fernando Solanas#john hillcoat#evan english#pentax spotmatic#argentina#politics#film festival#toronto international film festival#1988

2 notes

·

View notes

Text

July 2023: My Plan for the 1960s

(You can read more about the Reading Through the Decades reading challenge on my post introducing the challenge. Basically, it’s a year-long reading challenge where we read books - and explore other media - from the 1900s to the 2020s, decade-by-decade.)

🎬 Victim (1961), dir. Basil Dearden 🎬 Ginger & Rosa (2012), dir. Sally Potter 🎬 花樣年華 (2000; In the Mood for Love), dir. Wong Kar-wai 📺 Luna Park (2021), created by Isabella Aguilar 📖 City of Night (1963), John Rechy 🎬 Eddie and the Cruisers (1983), dir. Martin Davidson 🎬 Selma (2014), dir. Ava DuVernay 🎬 The Outsiders (1983), dir. Francis Ford Coppola 🎬 Corbo (2014), dir. Mathieu Denis 📖 Picnic at Hanging Rock (1967), Joan Lindsay 📖 SCUM Manifesto (1967), Valerie Solanas 📺 Fortunate Son (2020) 🎬 Judas and the Black Messiah (2021), dir. Shaka King 🎬 Call Jane (2022), dir. Phyllis Nagy 🎬 Stonewall (1995), dir. Nigel Finch 🎬 Midnight Cowboy (1969), dir. John Schlesinger 🎬 Diabolik (2021), dir. Manetti Bros.

4 notes

·

View notes

Text

Solana Foundation Partners with Dubai's VARA Establishing Economic Zone

🚀 Solana Takes a Leap into the Future 🌟

In a move that could make even Bitcoin blush, the Solana Foundation has decided to throw its hat into Dubai's ring by partnering with Dubai's VARA to establish the dazzling Solana Economic Zone. That’s right, folks, it's not just any zone; it’s a zone where blockchain innovation meets the skyscraper-studded skyline of Dubai – and we’re here for it! 🕌

Just your average futuristic Dubai skyline... nothing to see here! 😏

Why Should You Care? 🤔

Signed on June 2, 2025, this partnership offers preferential regulatory access, test environments, and initiatives for growing talent. What’s more? Lily Liu, President of the Solana Foundation, cheekily mentioned,

"This partnership represents a new chapter for Solana in the MENA region. Dubai has shown strong leadership in regulating and fostering digital assets..."

And if that doesn't get your wallets twitching, the SOL token just surged by a cheeky 4% right after the news dropped! 💰 Talk about investor confidence on overdrive!

But Wait, There's More! 🎉

This partnership is not just a one-hit-wonder; it signifies Dubai's relentless ambition to become a global crypto innovation hub. With previous efforts like establishing VARA back in 2022, Dubai is ready to roll out the red carpet for more international projects than you can shake a digital stick at. Just think about the innovation that could come out of this!

So, if you're savvy about crypto like I know you are, you won't want to miss out on reading the full story. Check it out here 👉 Solana Partners with Dubai VARA and find out why this could be the match that shakes the blockchain world! 🔗

Disclaimer: The information provided here is for your giggles, not financial advice. Always do your research before diving into the wild crypto waters!

#CryptoNews #Solana #BlockchainInnovation #Dubai #InvestSmart #CryptoInvestment #SustainableTech

0 notes

Text

OpenSea Just Launched a Token — Can It Stage a Comeback?

#OpenSea #$SEA #Crypto

After years of speculation, OpenSea has finally launched a token.

Yes, the former king of the NFT world — after losing market dominance to Blur, facing internal chaos, and falling out of the spotlight — is pulling out its biggest weapon yet: the $SEA token. But this isn’t just a “hey, we have a token now” moment. For OpenSea, it’s more like “we’re betting the future on this.”

In less than two years, OpenSea went from NFT monopoly to below 30% market share. And in less than six months, it’s pivoted from a Web2 startup to a fully on-chain, token-powered platform. The new “OpenSea 2.0 (OS2)” is more than a rebrand — it’s a complete reinvention.

So the real questions are: Is this a desperate move or a comeback story? Can $SEA live up to the hype and reward users the way Blur did? And is OpenSea finally ready to play by Web3 rules?

Click to register SuperEx

Click to download the SuperEx APP

Click to enter SuperEx CMC

Click to enter SuperEx DAO Academy — Space

So… What Exactly Is $SEA?

On May 30th, OpenSea officially announced: OS2 is live, the Voyages mission system has launched, and the $SEA token is coming — with a countdown to its first distribution.

This isn’t just a token drop for the sake of having a token. $SEA is deeply embedded into OS2’s mechanics — from user engagement and task rewards to cross-chain activity and platform governance.

According to the team, $SEA allocation will be based on three main criteria:

Historical contribution: How active you were on OpenSea in the past

Current behavior: How much you’re interacting with OS2 right now

XP from Voyages: How many tasks you’ve completed and how much “experience” you’ve earned

In short, this isn’t just for traders running bots. It’s designed to reward real users who engage, interact, and build on the platform.

How Do You Earn $SEA? A Quick Guide to Voyages Tasks

To earn XP (and eventually $SEA), you need to complete missions via the “Voyages” system. Tasks range from basic to advanced and offer different levels of XP — and some even give out collectible on-chain “Treasure” items.

Here are a few starter missions you can do right now:

✅ Task 1: Create Your Own NFT Gallery

Customize your OS2 gallery by uploading NFTs and editing your showcase page. It’s super easy and earns you beginner XP — but don’t skip it, as it unlocks your whole XP journey.

✅ Task 2: Make a Cross-Chain Swap

Use the OS2 wallet tools to swap tokens on-chain. Recommended: use the Solana network (very low fees) to swap SOL ��� USDC. Minimum $5 swap.

✅ Task 3: Buy an NFT

Pick a low-cost NFT (under $5), preferably on Solana or Polygon for lower gas. Even if you don’t care about the asset, you’re getting XP and unlocking missions.

✅ Task 4: Social Media Engagement

Like, follow, and retweet OpenSea’s official Twitter/X account. It may seem superficial, but community engagement plays a huge role in on-chain incentives these days.

There’s also a rare/legendary item system — some tasks unlock “Treasure” NFTs that are soulbound to your wallet. These could play a major role in future airdrop multipliers or governance power.

Why Is OpenSea Doing This Now?

Let’s be real: OpenSea is under pressure.

Here’s a quick timeline of how things unfolded:

2017: OpenSea launches, gets into Y Combinator

2021: NFT boom. Monthly volume hits $5B. OpenSea dominates

2022: Peak valuation hits $13.3B. Then things start to unravel

Late 2022–2023: Blur launches with aggressive token incentives

2024: OpenSea’s market share plunges below 30%. Blur takes over

For a long time, OpenSea resisted the “Web3 meta” — no token, no points, no yield farming. They tried to win with product alone. Blur, on the other hand, went full degen: fast trading, no fees, token incentives, massive airdrops.

And it worked.

Blur didn’t just take users. It took culture, liquidity, and momentum. OpenSea was suddenly the Web2 dinosaur in a Web3 jungle.

Now, they’ve realized: to survive in crypto, you need more than a good UI. You need tokens, incentives, and active community alignment.

And so, OS2 was born — a total overhaul designed to give OpenSea a second life.

What Is OpenSea 2.0 (OS2), Really?

OS2 is more than just a reskin. It’s a pivot — from an NFT store to a full-on cross-chain asset platform.

Here’s what’s new:

Multi-chain support: 14–19 chains (ETH, SOL, Polygon, Base, etc.)

In-app swapping: Built-in token exchange, even across chains

User galleries: Custom pages to display your NFTs and profile

Treasure items: On-chain collectibles that track your XP journey

Voyages system: Ongoing missions + XP = more $SEA

XP-based economy: Platform actions earn you progress toward rewards

Think of OS2 as a Web3-native mix of Steam + OpenSea + DEX.

It’s not just for buying JPEGs. You can:

Mint NFTs

Trade assets

Build a profile

Earn on-chain identity badges

Unlock rewards across networks

And with $SEA about to launch, OpenSea is creating a long-term incentive structure — not just for whales and flippers, but for everyone.

Even their Discord has been retooled — with token-gated chats, community campaigns, and verified roles.

Will $SEA Be the Next Big Airdrop?

Everyone wants to know: Is $SEA going to be Blur 2.0?

Short answer: probably not that explosive, but still worth farming.

Why?

Pros:

OpenSea’s user base is massive. Millions of wallets, even if many are inactive.

Missions are beginner-friendly. $5 NFT trades, cheap swaps — easy for new users.

XP is ongoing. Even if you start late, you can still catch up by being consistent.

Caution:

No clear point-to-token ratio yet. It’s not clear how XP → $SEA will be calculated.

First airdrop may be small. They said this is a long-term plan, not a one-time giveaway.

Blended metrics. Past usage, XP, and social engagement all factor into rewards — meaning whales aren’t guaranteed to win.

The bigger picture is this: OpenSea wants to build a sustainable, long-term, token-aligned user base.

They’re not promising instant riches. But if you believe in OpenSea’s pivot and want to be part of its rebuild, $SEA could be a meaningful play — especially if you’re consistent over time.

Can OpenSea Really Make a Comeback?

OpenSea is trying something bold. They’re not just launching a token. They’re rebuilding their identity:

From a centralized NFT site → to a decentralized protocol

From one-time traders → to XP-based contributors

From losing users → to rewarding loyal ones

Other protocols have done this: Blur, Uniswap, Arbitrum, even LayerZero.

But OpenSea’s challenge is different. It’s not building from scratch — it’s trying to reverse a fall from grace.

That means its token launch isn’t just about money — it’s about trust. It’s about proving to the Web3 community that OpenSea gets it now. That it’s willing to move fast, decentralize, and build with users.

That’s what $SEA represents — a symbolic shift from VC-owned startup to community-aligned protocol.

And let’s not forget: OpenSea still has incredible brand recognition. If it nails this pivot, it can absolutely become relevant again — especially if Blur fumbles or if the NFT market rebounds.

TL;DR — Should You Bother With This?

If you missed Blur, this might be your last shot at a big-name airdrop.

Let’s recap

✅ Missions are easy

✅ No crazy fees

✅ XP system rewards consistent users

✅ $SEA will have utility beyond just price

If you have time, don’t mind doing a few on-chain tasks, and want to be part of a major protocol shift, go for it.

You might not get “Blur money,” but you’ll be early in OpenSea’s next chapter — and that could pay off in ways beyond tokens.

Note: This article is for market hotspot analysis only and does not constitute any investment advice.

0 notes

Text

لا يدفع المستثمرون! يرفض المساهمون Meta بأغلبية ساحقة اقتراح Bitcoin Financial Reserve | سلسلة أخبار Abmedia

نظرًا لأن المزيد والمزيد من الشركات في جميع أنحاء العالم تتبع اتجاه Micro-Strategy (الاستراتيجية الآن) لتشمل Bitcoin في تخصيص أصول الشركة ، فقد رسم مستثمرون Meta خطًا واضحًا. في الاجتماع العام السنوي الأخير ، تطغى المساهمون في META على اقتراح للنظر في استراتيجية احتياطي Bitcoin مع أصوات هائلة تسلط الضوء على تحذير عمالقة التكنولوجيا والمحافظة عليها في تبني أصول التشفير. تم الإعلان عن نتائج التصويت: ما يقرب من 5 مليارات صوت معارضة ، تم التعامل مع الاقتراح ببرودة وفقًا لتقديم ميتا إلى لجنة الأوراق المالية والبورصة الأمريكية (SEC)وثيقةتم اقتراح الاقتراح من قبل محامي Bitcoin إيثان بيك ، ودعا الشركات إلى تحويل حوالي 72 مليار دولار نقدًا ومكافئات إلى بيتكوين كأصل احتياطي استراتيجي للتعامل مع التضخم وعدم اليقين في السياسة النقدية. مقترح محتوى التصويت ومع ذلك ، من بين ما يقرب من 5 مليارات صوت ، لم يكن هناك سوى 3.91 مليون سهم لصالح ، وهو ما يمثل 0.08 ٪ فقط ، وهو ما يعادل تقريبًا رفضه بالإجماع ، مما يشير إلى أن المساهمين الوطنيين لا يزال لديهم مخاوف عميقة بشأن المشاركة في أصول التقلبات العالية. المروج وراء الاقتراح: يواصل إيثان بيك الترويج إيثان بيك هو مدير شركة بيتكوين لشركة إدارة الأصول. يقدم اقتراحًا نيابة عن مركز أبحاث الأبحاث المحافظة "لمركز أبحاث السياسة العامة (NCPPR). لا يستهدف Peck Meta فحسب ، بل يقدم نفس المطالبات حول Microsoft و Amazon ، في محاولة لدفع شركات التكنولوجيا الكبيرة إلى تضمين Bitcoin في هيكل الأصول. (دعا المساهمون Meta إلى ZuckerBear إلى استخدام بعض الأموال كاحتياطيات Bitcoin: A16Z يدعم Bitcoin ، ما الذي ما زلت تفكر فيه) على الرغم من أن مساهم�� Microsoft صوتوا أيضًا ضد هذا العام الماضي ، من الواضح أن استراتيجية Peck لا تنوي التوقف ، ولا يزال يتعين التصويت على مقترحات Amazon. من الميزان إلى الدفع stablecoin: تقارب Meta في حين أن META لم تتضمن أي أصول تشفير في ميزانيتها العمومية في الوقت الحالي ، فقد استكشفت الشركة بنشاط تطبيقات blockchain في الماضي. كان يهدف في الأصل إلى إنشاء مشروع Libra (الذي تم إعادة تسميته لاحقًا DIEM) الذي تم إطلاقه في عام 2019 إلى إنشاء stablecoin عالمي مدعوم من مجموعة متنوعة من العملات فيات ، ولكن تم إنهاءه في عام 2022 بسبب المقاومة التنظيمية والنزاعات الداخلية. ومع ذلك ، لا يزال Meta مهتمًا به. في وقت سابق من هذا العام ، أفيد أن الشركة كانت لا تزال تدرس كيفية دمج آليات الدفع لتطبيقاتها مثل Instagram أو WhatsApp من خلال StableCoins. ومع ذلك ، مقارنة مع الشركات الأخرى التي تشتري أصول التشفير بنشاط ، يبدو أن Meta أكثر حذراً. (يشاع أن Meta تعود؟ إعادة النظر في خطة نشر StableCoin بعد ثلاث سنوات ، تأتي طموحات الميزان/Diem مرة أخرى) هل أصبحت الاحتياطيات الاستراتيجية Crypto اتجاهًا للشركات؟ على الرغم من الموقف المحافظ لـ Meta ، يبدو أن جو السوق يتحرك في الاتجاه المعاكس مؤخرًا. بعد شراء Bitcoin على المدى الطويل للاستراتيجية ، شملت العديد من الشركات المدرجة مؤخرًا الأصول الرقمية في استراتيجياتها المالية: يجتهد (أي الوكالة التي ينتمي إليها المقترح إيثان بيك): تحصل على أصول بيتكوين بخصم لتعزيز منصب الأصول مقابل ديون جبل جوكس. Defi Dev Corp: الحصول على أعمال عقدة التحقق من Solana ودمج البنية التحتية blockchain في تخصيص أصول الشركات. Sharplink Gaming: تم الإعلان عن استثمار جزء من أموال الشركة في ETH كاحتياطيات رأس المال للشركات ، مع مشاركين في Crypto Venture Capital مثل Consensys و Parafi و Pantera و Galaxy Digital في تكنولوجيا المعلومات. (الإستراتيجية تقود الاتجاه ، يشرح دليل الاستثمار لشركات استراتيجية احتياطي البيتكوين بالتفصيل) محافظة عمالقة التكنولوجيا مقابل تجارب السوق الراديكالية يرمز تصويت المساهمين في ميتا إلى أن عمالقة التكنولوجيا التقليدية لا يزالون في حالة تأهب لأصول التشفير. في الوقت نفسه ، تقوم الشركات الناشئة والمؤسسات المغامرة بتسريع تنويع الأصول وتتبني بنشاط تطبيق الأصول والتكنولوجيا المالية. قد يصبح الفرق "الجديد والقديم" بين الاستراتيجية المالية للشركة أكثر وضوحًا في السنوات القليلة المقبلة. تحذير المخاطراستثمارات العملة المشفرة محفوفة بالمخاطر للغاية ، وقد تتقلب أسعارها بشكل كبير وقد تفقد كل مديرك. يرجى تقييم المخاطر بحذر.

0 notes

Text

Understanding Stablecoin Development: The Future of Digital Finance

In the rapidly evolving landscape of blockchain technology, stablecoin development has emerged as a critical pillar of the digital economy. As the world grapples with the volatility of cryptocurrencies like Bitcoin and Ethereum, stablecoins offer a solution that combines the innovation of blockchain with the reliability of traditional fiat currencies. In this article, we delve into the core aspects of stablecoin development, its use cases, benefits, challenges, and the future outlook.

What Are Stablecoins?

Stablecoins are a class of cryptocurrencies designed to minimize price volatility. Unlike Bitcoin or Ethereum, which can fluctuate wildly in value within minutes, stablecoins aim to maintain a consistent value by being pegged to stable assets—most commonly the US dollar, but also commodities like gold or even baskets of currencies.

The goal of stablecoin development is to provide users with the best of both worlds: the efficiency and transparency of blockchain systems combined with the price stability of traditional money.

Types of Stablecoins

Understanding the types of stablecoins is essential to grasp the nuances of stablecoin development. Here are the main categories:

Fiat-Collateralized Stablecoins These are backed by fiat currencies held in reserve. For every stablecoin issued, an equivalent amount of fiat currency (like USD) is kept in a bank account. Tether (USDT) and USD Coin (USDC) are popular examples.

Crypto-Collateralized Stablecoins These stablecoins are backed by other cryptocurrencies. Due to the volatility of crypto assets, they are often over-collateralized to maintain stability. Dai, developed by the MakerDAO platform, is a well-known crypto-collateralized stablecoin.

Algorithmic Stablecoins These are not backed by any asset but use algorithms and smart contracts to control the supply of the coin, increasing or decreasing it as needed to maintain a stable value. Examples include Ampleforth and Terra (prior to its collapse in 2022, which sparked significant debate in the stablecoin development space).

Why Stablecoin Development Matters

The global financial system is slowly integrating blockchain technology, and stablecoins play a foundational role in this transition. Here's why stablecoin development is gaining momentum:

Global Accessibility: Stablecoins can be accessed by anyone with an internet connection, offering financial services to the unbanked and underbanked populations.

Faster Transactions: With blockchain-based payments, stablecoins allow for near-instantaneous transactions across borders.

Lower Fees: Cross-border remittances often involve hefty fees. Stablecoins offer a low-cost alternative.

DeFi Integration: Decentralized finance (DeFi) platforms heavily rely on stablecoins for lending, borrowing, and liquidity provision.

The Process of Stablecoin Development

Developing a stablecoin is both a technical and strategic undertaking. Here's a high-level overview of how the process typically unfolds:

Defining the Model The first step in stablecoin development is choosing the type—fiat-backed, crypto-backed, or algorithmic. Each comes with its own technical and regulatory considerations.

Smart Contract Architecture Most stablecoins are built on existing blockchain platforms such as Ethereum, Binance Smart Chain, or Solana. The smart contracts govern issuance, redemption, and collateral management.

Collateral Management For fiat-backed or crypto-backed stablecoins, systems need to be developed for real-time tracking and auditing of reserves. This ensures trust and transparency.

Regulatory Compliance Regulatory frameworks vary widely by country. Developers must ensure that their stablecoin complies with Know Your Customer (KYC), Anti-Money Laundering (AML), and other financial regulations.

Security Protocols Since stablecoins deal with real monetary value, security is paramount. Smart contracts must be audited, and multi-signature wallets or custody solutions are often implemented.

Launch and Adoption Once the coin is developed, the next step is promoting adoption through integrations with wallets, exchanges, and payment providers.

Key Challenges in Stablecoin Development

While the benefits are numerous, stablecoin development is not without its hurdles:

Regulatory Uncertainty: Governments around the world are still grappling with how to regulate stablecoins. In the US, discussions around the classification of stablecoins as securities or banking products are ongoing.

Centralization Concerns: Many fiat-backed stablecoins are controlled by centralized entities, leading to concerns about transparency and censorship.

Collateral Volatility: In crypto-collateralized models, the underlying assets can still fluctuate wildly, posing risks to the peg.

Technical Complexity: Building smart contracts that are secure, scalable, and auditable requires advanced expertise in blockchain development.

Real-World Use Cases

The true measure of any technology lies in its practical applications. Here's where stablecoin development is making an impact:

Remittances: Workers abroad use stablecoins to send money back home quickly and cheaply.

E-commerce: Businesses accept stablecoins as payment to avoid currency conversion fees and chargebacks.

Decentralized Finance (DeFi): Lending platforms, synthetic assets, and yield farming projects use stablecoins to facilitate stable liquidity.

Gaming and NFTs: In-game economies benefit from using stablecoins for microtransactions and NFT purchases.

The Role of Stablecoins in CBDCs and Web3

As governments begin exploring Central Bank Digital Currencies (CBDCs), stablecoins are laying the groundwork. They offer a proof-of-concept for how digital money can function at scale. In Web3 ecosystems, where decentralized applications (dApps) require seamless monetary interaction, stablecoins act as the backbone of economic activity.

Some experts argue that stablecoin development will play a bridging role—linking traditional banking systems with decentralized networks.

The Future of Stablecoin Development

Looking ahead, the path of stablecoin development is filled with opportunities and challenges:

Increased Regulation: Expect more stablecoins to seek licensing or regulatory approval to build trust with institutional users.

Multi-Chain Expansion: Future stablecoins may operate across multiple blockchains, enhancing interoperability.

Programmable Money: Smart contracts could allow stablecoins to execute payments under certain conditions automatically—ideal for supply chains and subscriptions.

Institutional Adoption: Major banks and corporations are beginning to explore stablecoin integration, which could legitimize the technology further.

Final Thoughts

Stablecoins are no longer just a niche financial instrument; they are becoming essential infrastructure in the global digital economy. Whether used for international payments, savings, or powering decentralized platforms, the demand for secure and reliable digital assets is driving innovation in stablecoin development.

As developers, regulators, and users continue to explore new models and technologies, one thing is certain: stablecoins will be a cornerstone of the blockchain era. Understanding their development today prepares us for the financial systems of tomorrow.

0 notes

Text

Cetus’ hack response on Sui was once successful on Solana

The bounty offer to recover stolen funds from Sui-based decentralized exchange (DEX) Cetus closely resembles a successful strategy used by a Solana project three years ago. It turns out that Cetus shares the same development team as Crema Finance, a Solana-based DeFi project that suffered a $9-million hack in 2022 but recovered most of the funds by negotiating with its hacker. Now, Cetus is…

0 notes

Text

加密 KOL : Cetus 团队与 2022 年 Solana 上被盗项目 Crema 为同一团队

深潮 TechFlow 消息,5 月 23 日,加密 KOL AB Kuai.Dong(@_FORAB)在 X 发文表示,经社区信息及多名业内人士确认,5月22日遭受黑客攻击的Cetus协议,其开发团队此前曾开发Solana生态系统上的去中心化金融项目Crema Finance。 此前消息,Crema Finance在2022年遭遇黑客攻击,造成约960万美元的资金损失。攻击事件发生后,黑客归还了其中约800万美元的被盗资金。

0 notes

Text

F2F - SZA

Written by Carter Lang, Rob Bisel, Solana Rowe

Produced by Carter Lang, Rob Bisel

Released 2022, SOS

1 note

·

View note

Link

0 notes

Text

2021 proved to be a mighty year for coins like BTC and even other digital currency-based assets. We have seen a good growth of various digital coins and other assets related to Bitcoin and other coins. It has further soared the command of digital coins-based themes in the digital currency investment-based market. Themes have significant roles to play when we talk about investing in this domain in the market. As per several industry-based experts, the New Year will be a bit for Bitcoin and the digital coin space, including tokens and the factors like utility, relevance, and some fundamental basics that would further attract many more investors. Some trade pundits believe that 2022 will prove the year of filtration in the digital currency domain as far as tokens and other similar things are concerned. You can further explore this subject on sites like bitcoin-equaliser.com. Here, we can get an overview of this topic. How about checking them as under: 2021 – The Year That was for Digital Coin Looking back in the previous year of 21, we have seen a good buzz around the digital currency market, particularly at the global level. In 2021, we saw the sudden rise of the tokens, often called NFTs, apart from other things like ICOs and meme coins. A good amount of buzz is seen around Metaverse that would come along at the end of 21 since Facebook has changed a lot in the digitization of several aspects that further made it a top-list fashion. As per reports, NFT in 2021 was sold at the cost of around 65 M USD, and at the same time, its rival product too was sold at a whopping cost of around 100 M USD. This has emerged as a special kind of digital asset. Several experts from the Crypto Hedge fund were coming along with these assets. These include Metaverse along with NFT and Gaming. We have seen a good number of tokens along with the required themes moving around the world and are gaining good popularity that peaked in the previous year-end. We have seen several stocks going upside down, and one can find too many more things coming under the garb of these assets. We see how these factors play an essential role in moving ahead with the stock market and the value vs cost face-off. Also, several modern-based traders are seen betting over several technology trends that are seen coming along with the stock fundamentals. The Themes Several themes have become part and parcel of the crypto game in the recent past. We can find ETH Killers to be the top and most popular theme. This theme comes along with several tokens, including Polka Dot, Cardano, and Solana, to name a few. It has helped offer you some good returns and even failed the option of dethroning even the second-biggest digital coins. As per many Blockchain experts, ETH can be counted among the real utility options. We see Blockchain supporting too many intelligent contracts, which has come up with too many applications, they believe. One of the leading men in the Blockchain world in India, R J Kapoor, feels bullish regarding ETH. He further said it could supersede BTC in terms of many factors and thus emerge among the top and costly kinds of digital coins in 2022. The next theme that remains worthy of discussing here is Metaverse. It is regarded as one of the super-strong kinds of themes owing to several conventional technology giants that seemed to go a long way. We see several changes, like the name change coming from Facebook. Moreover, it seemed to have followed the sudden and substantial rise of digital currency-based gaming that remains too worthy of checking. However, in the current ongoing year, we can see an added number of companies and businesses accepting digital coins, including BTC as their legal tender. These have remained viable along with the core value of digital coins that can keep increasing in no time.

0 notes

Text

Jupiter Perps Integrates Chainlink Data Streams on Solana

🚀 Jupiter Perps Integrates Chainlink Data Streams on Solana 📈

Hold onto your wallets, crypto enthusiasts! 🚨 Jupiter Exchange just dropped a bombshell by integrating Chainlink Data Streams on Solana, and it's not just hype! On May 19, 2025, this dynamic duo announced a game-changing partnership that promises to send DeFi trading volumes skyrocketing! 💥

What to Know:

🌌 Jupiter Exchange brings Chainlink into its orbit for onchain trading.

⌛ Say hello to lightning-fast DeFi applications on Solana.

🤖 Key players are rocking it: Jupiter and Chainlink together strengthen Solana's DeFi stack.

The Future of Trading with Jupiter & Chainlink 💹

Why should you care? 🤔 Well, the integration enables faster and more reliable trading on Solana, practically begging you to drift away from those clunky centralized exchanges. 🚢 And let’s face it, who doesn't want to jump on the express train to the future of finance? 🚄

🔑 Jupiter Leverages Chainlink for Enhanced Solana Trading

“The integration of Chainlink Data Streams marks a significant step towards enabling sophisticated trading strategies on Solana, enhancing both speed and reliability in decentralized finance.” - Jupiter Exchange 🗣️

📊 Anticipated Boost in DeFi Trading Volumes

According to ~~your friendly neighborhood analyst~~, this integration is set to blow up trading volumes and real-time perp markets! 💣 Think high-frequency trading strategies at your fingertips, folks! Just imagine:

More cross-chain activities equals more opportunities 🎯. Sure, there’s no immediate funding news, but *wink wink*, we can smell that increased Total Value Locked (TVL) from a mile away! 💼

🌟 Solana's DeFi Stack Expands with Chainlink Support

Chainlink has a track record of sprouting TVL and adoption like weeds (the good kind!). 🌱 The previous integrations on Solana in June 2022 paved the way, and now this move solidifies an institutional-grade DeFi stack. Calling all hodlers, your time is now! ⏰

So what are you waiting for? Dive into the details and join the revolution of decentralized trading by checking out the original article 👉 here! 🔗

Disclaimer: The information on this website is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are volatile, and investing involves risk. Always do your own research and consult a financial advisor.

🚀💰 Get in on the action, and let’s see who’s ready to ride the DeFi wave! Drop a comment below, and share your thoughts on this massive integration! 👇👇

#CryptoNews #DeFi #Chainlink $LINK #Solana $SOL #JupiterExchange #InvestSmart #BlockchainRevolution #CryptoCommunity #Web3 #TradingParadise 🪙✨

0 notes