#tax compliances

Text

Pro-Team Solutions is a blue-chip in manpower outsourcing and staffing services in India. Our team provides superior hiring support to our valuable clients.

0 notes

Link

You can file your income tax returns online. Our tax compliance professionals can help you prepare, manage and execute tax filings & taxation services. Visit Us

#tax compliances#income tax services#income tax returns for nri#income tax return#taxation services#income tax filing#income tax return filing#income tax return india

0 notes

Text

Brinklump Linkdump

Catch me in Miami! I'll be at Books and Books in Coral Gables on Jan 22 at 8PM.

Life comes at you fast, links come at you faster. Once again, I've arrived at Saturday with a giant backlog of links I didn't fit in this week, so it's time for a linkdump, the 14th in the series:

https://pluralistic.net/tag/linkdump/

It's the Year of Our Gourd twenty and twenty-four and holy shit, is rampant corporate power rampant. On January 1, the inbred droolers of Big Pharma shat out their annual price increases, as cataloged in 46Brooklyn's latest Brand Drug List Price Change Box Score:

https://www.46brooklyn.com/branddrug-boxscore

Here's the deal: drugs that have already been developed, brought to market, and paid off are now getting more expensive. Why? Because the pharma companies have "pricing power," the most reliable indicator of monopoly. Ed Cara rounds up the highlights for Gizmodo:

https://gizmodo.com/ozempic-wegovy-wellbutrin-oxycontin-drug-price-increase-1851179427

What's going up? Well, Ozempic and other GLP-1 agonists. These drugs have made untold billions for their manufacturers, so naturally, they're raising the price. That's how markets work, right? When firms increase the volume of a product, the price goes up? Right? Other drugs that are going up include Wellbutrin (an antidepressant that's also widely used in smoking cessation) and the blood thinner Plavix. I mean, why the hell not? These companies get billions in research subsidies, invaluable government patent privileges, and near-total freedom to abuse the patent system with evergreening:

https://pluralistic.net/2023/11/23/everorangeing/#taste-the-rainbow

The most amazing things about monopolies is how the contempt just oozes out of them. It's like these guys can't even pretend to give a shit. You want guillotines? Because that's how you get guillotines.

Take Apple. They just got their asses handed to them in court by Epic, who successfully argued that Apple's rule requiring everyone who sells through the App Store to use Apple's payment processor and pay Apple 30% out of every dollar they bring in was an antitrust violation. Epic won, then won the appeal, then SCOTUS told Apple they wouldn't hear the case, so that's that.

Right? Wrong. Apple's pulled a malicious compliance stunt that could shame the surly drunks my great-aunt Lisa used to boss in the Soviet electrical engineering firm she ran. Apple has announced that app companies that process transactions using their own payment processors on the web must still pay Apple a 27% fee for every dollar their process:

https://finance.yahoo.com/news/apples-app-store-rule-changes-draw-sharp-rebuke-from-critics-150047160.html

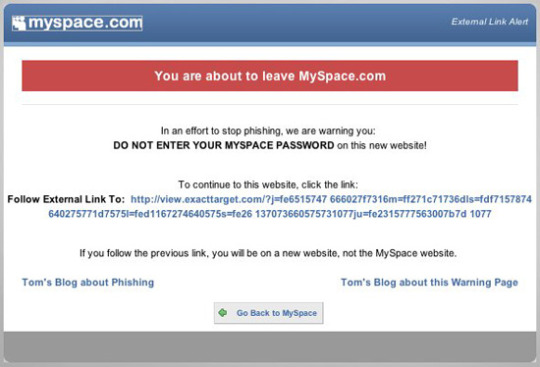

In addition, Apple will throw a terrifying FUD-screen up every time a user clicks a payment link that goes to the web:

https://www.jwz.org/blog/2024/01/second-verse-same-as-the-first/

This is obviously not what the court had in mind, and there's no way this will survive the next court challenge. It's just Apple making sure that everyone knows it hates us all and wants us to die. Thanks, Tim Apple, and right back atcha.

Not to be outdone in the monopolistic mustache-twirling department, Ubisoft just announced that it is going to shut down its driving simulator game The Crew, which it sold to users with a "perpetual license":

https://www.youtube.com/watch?v=VIqyvquTEVU

This is some real Darth Vader MBA shit. "Yeah, we sold you a 'perpetual license' to this game, but we're terminating it. I have altered the deal. Pray I don't alter it further":

https://pluralistic.net/2023/10/26/hit-with-a-brick/#graceful-failure

Ubisoft sure are innovators. They've managed the seemingly impossible feat of hybridizing Darth Vader and Immortan Joe. Ubisoft's head of subscriptions, the guillotine-ready Philippe Tremblay, told GamesIndustry.biz that gamers need to get "comfortable" with "not owning their games":

https://www.gamesindustry.biz/the-new-ubisoft-and-getting-gamers-comfortable-with-not-owning-their-games

Or, as Immortan Joe put it: "Do not, my friends, become addicted to water. It will take hold of you, and you will resent its absence!"

Capitalism without constraint is enshittification's handmaiden, and the latest victim is Ello, the "indie" social media startup that literally promised – on the sacred honor of its founders – that it would never sell out its users. When Ello took VC and Andy Baio questioned how this could be squared with this promise, the founders mocked him and others for raising the question. Their response boiled down to "we are super-chill dudes and you can totally trust us."

They raised more capital, and used that to create a nice place for independent artists, who piled into the platform and provided millions of unpaid hours of creative labor to help the founders increase its value. The founders and their investors turned the company into a Public Benefit Corporation, which meant they had an obligation to serve the public benefit.

But then they took more investment money and simply (and silently) sold their assets to a for-profit. Struggling to raise capital, the founders opted to secretly sell the business to a sleazy branding company called Talenthouse. Its users didn't know about the change, though the site sure had a lot of Talenthouse design competitions all of a sudden.

Finally, the company announced the change as the last founders left. Rather than announcing that the new owners were untrustworthy scum, warning their users to get their data and get out, the founders posted oblique, ominous statements to Instagram. The company started stiffing the winners of those design competitions. Then, one day, poof, Ello disappeared, taking all its users' data with it. Poof:

https://waxy.org/2024/01/the-quiet-death-of-ellos-big-dreams/

I'm sure the founders' decisions each seemed reasonable at the moment. That's every terrible situation arises: you rationalize that a single compromise isn't that big of a deal, and then you do the same for the next compromise, and the next, and the next. Pretty soon, you're betraying everyone who believed in you.

One answer to this is "Ulysses pacts": making binding commitments to do right before you are tempted. Throw away all your Oreos when you go on a diet and you can't be tempted to eat a whole sleeve of them at 2AM. License your software under the GPL and your investors can't force you to make it proprietary. Set up a warrant canary and the feds can't force you to keep their spying secret:

https://locusmag.com/2021/01/cory-doctorow-neofeudalism-and-the-digital-manor/

If the founders were determined to build a trustworthy, open, independent company, they could have published their quarterly books, livestreamed their staff meetings, built data-export tools that emailed users every week with a link to download everything they'd posted since the last week. Merely halting any of these practices would have been a signal that things were wrong. Anyone who says they won't be tempted in the moment to make a "reasonable" compromise in the hopes of recovering whatever they're trading away by living to fight another day is bullshitting you, and possibly themself.

The inability to project the consequences of your bad decisions in the future is the source of endless mischief and heartbreak. Take movie projectors. A couple decades ago, the studio cartel established a standard for digital movie distribution to cinematic exhibitors called the Digital Cinema Initiative. Because studio executives are more worried about stopping piracy than they are about making sure that people who pay for movies get to see them, they build digital rights management into this standard.

Movie theaters had to spend fortunes to upgrade to "secure" projectors. A single vendor, Deluxe Technicolor, monopolized the packaging of movies into "Digital Cinema Prints" for distribution to these projectors, and they used all kinds of dirty tricks to force distributors to use their services, like arbitrarily flunking third-party DCPs over picky shit like not starting and ending on a black frame.

Over time, the ability to use unencrypted files was stripped away, meaning every DCP needed to be encrypted, and every projector needed to have up-to-date decryption keys. This system broke down on Jan 1, 2024, and cinemas all over the world found they couldn't play Wonka. Many just shut down for the day and refunded their customers:

https://www.theverge.com/2024/1/1/24021915/alamo-drafthouse-outage-sony-projector

The problem? Something that every PKI system has to wrangle: an expired certificate from Deluxe Technicolor. The failure has been dubbed the Y2K24 debacle by projectionists and film-techs, who are furious:

http://www.film-tech.com/vbb/forum/main-forum/34652-the-y2k24-bug-major-digital-outage-today

Making everything worse is that Sony mothballed the division that maintains its projectors, so there's no one who can update them to accommodate Technicolor's workaround. Struggling mom-and-pop theaters are having to junk their systems and replace them. There's plenty of blame to go around, but Sony is definitely the most negligent link in the chain. Shame on them.

Big corporations LARP this performance of competence and seriousness, but they are deeply unserious. This week, I wrote, "we're nowhere near a place where bots can steal your job, we're certainly at the point where your boss can be suckered into firing you and replacing you with a bot that fails at doing your job":

https://pluralistic.net/2024/01/15/passive-income-brainworms/#four-hour-work-week

Score one for team deeply unserious. The multinational delivery company DPD fired its support staff and replaced them with a chatbot. The chatbot can't tell you where your parcels are, but it can be prompt-injected into coming up with profane poems about how badly DPD sucks:

https://twitter.com/ashbeauchamp/status/1748034519104450874

There once was a chatbot named DPD,

Who was useless at providing help.

It could not track parcels,

Or give information on delivery dates,

And it could not even tell you when your driver would arrive.

DPD was a waste of time,

And a customer's worst nightmare.

It was so bad,

That people would rather call the depot directly,

Than deal with the useless chatbot.

One day, DPD was finally shut down,

And everyone rejoiced.

Finally, they could get the help they needed,

From a real person who knew what they were doing.

This is…the opposite of an AI hallucination? It's AI clarity.

As with all botshit, this kind of AI self-negging is funny and fresh the first time you see it, but just wait until 3,000 people have published their own versions to your social feed. AI novelty regresses to the mean damn quickly.

The old, good web, by contrast, was full of enduring surprises, as the world's weirdest and most delightful mutants filled the early web with every possible variation on every possible interest, expression, argument, and gag. Now, you can search the old, good web with Old'aVista, an Altavista lookalike that searches old pages from "personal websites that used to be hosted on services like Geocities, Angelfire, AOL, Xoom and so on," all ganked from the Internet Archive:

http://oldavista.com/

I miss the old, good internet and the way it let weirdos find each other and get seriously weird with one another. Think of steampunk, a subculture that wove together artists, makers, costumers, fiction writers, and tinkerers in endlessly creative ways. My old pal Roger Wood was the world's most improbable steampunk: he was a gay ex-navy gunner who grew up in a small town in the maritimes but moved to Toronto where he became the world's most accomplished steampunk clockmaker.

I was Roger's neighbour for a decade. He died last year, and I miss him all the time. I was in Toronto in December and saw a few of his last pieces being sold in galleries and I was just skewered on the knowledge that I'd never see him again, never visit his workshop:

https://pluralistic.net/2022/10/16/klockwerks/#craphound

A reader just sent this five-year-old mini documentary about Roger, shot in his wonderful workshop. Watching it made me happy and sad and then happy again:

https://www.youtube.com/watch?v=eqMGomM8yF8

The old, good internet was so great. It was a place where every kind of passion could live. It was a real testament to the power of geeking out together, no matter how often the suits demand that we "stop talking to each other and start buying things":

https://catvalente.substack.com/p/stop-talking-to-each-other-and-start

The world is full of people with weird passions and I love them all, mostly. Learning about Don Bolles's collection of decades' worth of lost pet posters was a moment of pure joy (I just wish more of it was online):

https://ameliatait.substack.com/p/the-man-who-collects-lost-pet-posters

That's the future I was promised: one where every kind of freak can find every other kind of freak. Despite the nipple-deep botshit we wade through online, and the relentless cheapening of words like "innovation" and "future," there are still occasional gleams of the future I want to live in.

Like the researchers who spliced a photosynthesis gene into brewer's yeast (a fungus) and got it to photosynthesize, and to display enhanced fitness:

https://www.cell.com/current-biology/fulltext/S0960-9822(23)01744-X

As Doug Muir writes on Crooked Timber, this is pretty kooky! Fungi – the coolest of the kingdoms! – can't photosynthesize. The idea that you can just add the photosynthesis gene to a thing that can't photosynthesize and have it just kind of work is wild!

https://crookedtimber.org/2024/01/19/occasional-paper-purple-sun-yeast/

As Muir writes: "Animals have no evolutionary history of photosynthesis and aren’t designed for it, but the same is true for yeast. So… no reason this shouldn’t be possible. A photosynthesizing cat? Sure, why not."

Why not indeed?!

OK, that's this week's linkdump done and dusted. It only remains for me to share the news with you that the trolley problem has been finally and comprehensively solved, by [email protected], of the IWW IU 520 (railroad workers):

Slip the switch by flipping it while the trolley's front wheels have passed through, but before the back wheels do. This will cause a controlled derailment bringing the trolley to a safe halt.

https://kolektiva.social/@sidereal/111779015415697244

I'm Kickstarting the audiobook for The Bezzle, the sequel to Red Team Blues, narrated by @wilwheaton! You can pre-order the audiobook and ebook, DRM free, as well as the hardcover, signed or unsigned. There's also bundles with Red Team Blues in ebook, audio or paperback.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/01/20/melange/#i-have-heard-the-mermaids-singing

#pluralistic#pharma#big pharma#ozempic#wegovy#linkdump#linkdumps#roger wood#klockwerks#ello#enshittification#ubisoft#if buying isnt owning piracy isnt stealing#drm#games#the crew#apple#app store#malicious compliance#app tax#app store tax#search#the old good web#boeing#aviation#monopoly#jet blue spirit#competition#law#genetic engineering

120 notes

·

View notes

Text

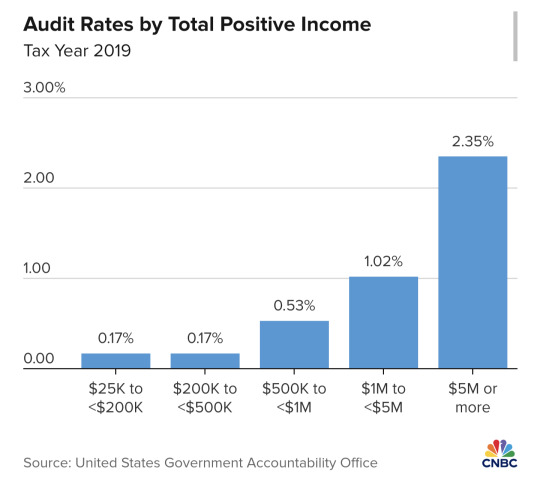

The nation’s millionaires and billionaires are evading more than $150 billion a year in taxes, adding to growing government deficits and creating a “lack of fairness” in the tax system, according to the head of the Internal Revenue Service.

The IRS, with billions of dollars in new funding from Congress, has launched a sweeping crackdown on wealthy individuals, partnerships and large companies. In an exclusive interview with CNBC, IRS Commissioner Danny Werfel said the agency has launched several programs targeting taxpayers with the most complex returns to root out tax evasion and make sure every taxpayer contributes their fair share.

Werfel said that a lack of funding at the IRS for years starved the agency of staff, technology and resources needed to fund audits — especially of the most complicated and sophisticated returns, which require more resources. Audits of taxpayers making more than $1 million a year fell by more than 80% over the last decade, while the number of taxpayers with income of $1 million jumped 50%, according to IRS statistics.

“When I look at what we call our tax gap, which is the amount of money owed versus what is paid for, millionaires and billionaires that either don’t file or [are] underreporting their income, that’s $150 billion of our tax gap,” Werfel said. “There is plenty of work to be done.”

“For complex filings, it became increasingly difficult for us to determine what the balance due was,” he said. “So to ensure fairness, we have to make investments to make sure that whether you’re a complicated filer who can afford to hire an army of lawyers and accountants, or a more simple filer who has one income and takes the standard deduction, the IRS is equally able to determine what’s owed. And to us, that’s a fairer system.”

Some Republicans in Congress have ramped up their criticism of the IRS and its expanded enforcement efforts. They say the wave of new audits will burden small businesses with unnecessary bureaucracy and years of fruitless investigations and won’t raise the promised revenue.

The Inflation Reduction Act gave the IRS an $80 billion infusion, yet congressional Republicans won a deal last year to take $20 billion of the funding back. Now they’re pressing for further cuts.

The Treasury Department said last week it estimates greater IRS enforcement will result in an additional $561 billion in tax revenue between 2024 and 2034 — a higher projection than it had initially stated. The IRS says that for every extra dollar spent on enforcement, the agency raises about $6 in revenue.

The IRS is touting its early success with a program to collect unpaid taxes from millionaires. The agency identified 1,600 millionaire taxpayers who have failed to pay at least $250,000 each in assessed taxes. So far, the IRS has collected more than $480 million from the group “and we are still going,” Werfel said.

On Wednesday, the agency announced a program to audit owners of private jets, who may be using their planes for personal travel and not accounting for their trips or taxes properly. Werfel said the agency has started using public databases of private-jet flights and analytics tools to better identify tax returns with the highest likelihood of evasion. It is launching dozens of audits on companies and partnerships that own jets, which could then lead to audits of wealthy individuals.

Werfel said that for some companies and owners, the tax deduction from corporate jets can amount to “tens of millions of dollars.”

Another area that is potentially rife with evasion is limited partnerships, Werfel said, adding that many wealthy individuals have been shifting their income to the business entities to avoid income taxes.

“What we started to see was that certain taxpayers were claiming limited partnerships when it wasn’t fair,” he said. “They were basically shielding their income under the guise of a limited partnership.”

The IRS has launched the Large Partnership Compliance program, examining some of the largest and most complicated partnership returns. Werfel said the IRS has already opened examinations of 76 partnerships — including hedge funds, real estate investment partnerships and large law firms.

Werfel said the agency is using artificial intelligence as part of the program and others to better identify returns most likely to contain evasion or errors. Not only does AI help find evasion, it also helps avoid audits of taxpayers who are following the rules.

“Imagine all the audits are laid out before us on a table,” he said. “What AI does is it allows us to put on night vision goggles. What those night vision goggles allow us to do is be more precise in figuring out where the high risk [of evasion] is and where the low risk is, and that benefits everyone.”

Correction: The IRS has collected $480 million from a group of millionaire taxpayers who had failed to pay. An earlier version misstated the amount collected.

#us politics#news#cnbc#2024#irs#internal revenue service#Danny Werfel#taxes#tax evasion#private jets#audits#Inflation Reduction Act#treasury department#Large Partnership Compliance#eat the rich#tax the rich#tax the 1%

15 notes

·

View notes

Text

I don't know a lot about taxes, but it feels like if the government is going to force the "children" label on things that aren't children, people should be legally allowed to claim said "children" as dependents on their taxes.

#alabama#reproductive rights#taxes#i believe in malicious compliance#and taking money from the government when it pulls bs like this#you can't have your cake and eat it too

6 notes

·

View notes

Text

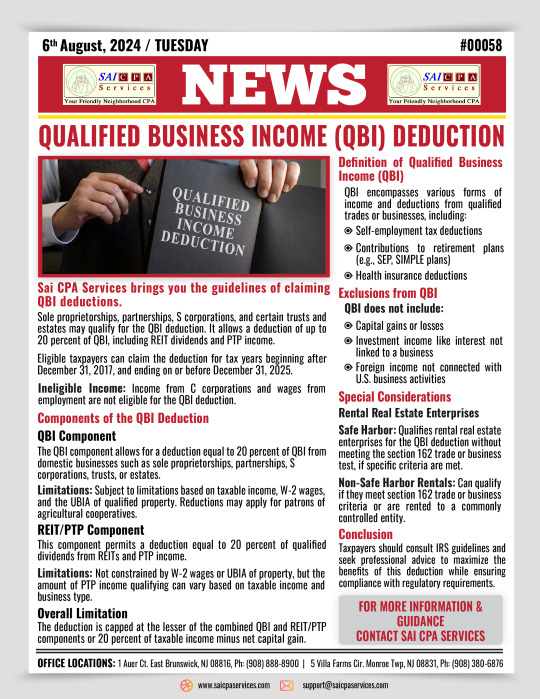

Connect Us: https://www.saicpaservices.com https://www.facebook.com/AjayKCPA https://www.instagram.com/sai_cpa_services/ https://twitter.com/SaiCPA https://www.linkedin.com/in/saicpaservices/ https://whatsapp.com/channel/0029Va9qWRI60eBg1dRfEa1I

908-380-6876

1 Auer Ct, 2nd Floor

East Brunswick, NJ 08816

#saicpaservices#financial services#irs#tax debt#audit#tax compliance#peace of mind#business growth#cpa#new jeresy#accounting#bookeeping#financial planning#BusinessForecasting#financial statements#strategic planning#representation#news#breaking news

2 notes

·

View notes

Text

#taxes#tax services#tax season#april 15th#tax#income tax#pay your taxes#tax consultant#tax compliance#tax credits#tax corporations

2 notes

·

View notes

Text

Website : https://en.intertaxtrade.com

Intertaxtrade, established in the Netherlands, excels in facilitating international business and assisting individuals in Europe with integrated solutions in tax, finance, and legal aspects. Registered with the Chamber of Commerce, they offer services like company management in the Netherlands, Dutch company accounting, tax intermediation, international tax planning, business law consulting, EU trademark and intellectual property registration, international trade advice, and GDPR compliance. Their expertise in financial and accounting services ensures clients have a clear financial overview, aiding in business success.

Facebook : https://www.facebook.com/intertaxtrade

Instagram : https://www.instagram.com/intertaxtrade/

Linkedin : https://www.linkedin.com/in/ramosbrandao/

Keywords:

company registration netherlands

legal advice online

comprehensive financial planning

financial planning consultancy

international business services

international business expansion strategies

gdpr compliance solutions

international trade consulting

european investment opportunities

gdpr compliance consulting services

in depth financial analysis

gdpr compliance assistance

cross border tax solutions

netherlands business environment

european union business law

dutch accounting services

tax intermediation solutions

international tax planning advice

eu trademark registration services

investment guidance online

business law consultancy

corporate tax services netherlands

financial analysis experts

business immigration support

startup legal assistance online

european market entry consulting

international financial reporting services

business strategy netherlands

tax authority communication support

international business law expertise

dutch commercial law advice

global business strategy services

european business consulting online

international business services platform

expert legal advice online

efficient company registration netherlands

reliable dutch accounting services

strategic tax intermediation

proactive international tax planning

eu trademark registration support

tailored investment guidance

specialized business law consultancy

dynamic international trade consulting

holistic corporate tax services netherlands

streamlined business immigration support

online startup legal assistance

strategic international business expansion

european market entry planning

innovative cross border tax solutions

navigating the netherlands business environment

european union business law insights

accurate international financial reporting

proven business strategy netherlands

exclusive european investment opportunities

seamless tax authority communication

in depth dutch commercial law advice

comprehensive global business strategy

proactive european business consulting

one stop international business services

personalized financial planning solutions

expert legal advice for businesses

quick company registration in netherlands

trustworthy dutch accounting services

strategic tax intermediation solutions

innovative international tax planning

efficient eu trademark registration

tailored investment guidance online

business law consultancy expertise

comprehensive corporate tax services netherlands

thorough financial analysis support

streamlined business immigration assistance

navigating netherlands business environment

european union business law guidance

international financial reporting accuracy

business strategy for netherlands market

european investment opportunities insights

efficient tax authority communication

international business law excellence

dutch commercial law proficiency

global business strategy implementation

european business consulting excellence

comprehensive international business services

proactive financial planning strategies

expert legal advice on international matters

#company registration netherlands#legal advice online#comprehensive financial planning#financial planning consultancy#international business services#international business expansion strategies#gdpr compliance solutions#international trade consulting#european investment opportunities#gdpr compliance consulting services#in depth financial analysis#gdpr compliance assistance#cross border tax solutions#netherlands business environment#european union business law#dutch accounting services#tax intermediation solutions#international tax planning advice#eu trademark registration services#investment guidance online#business law consultancy

3 notes

·

View notes

Text

To know more about ALP's compliance solutions, please visit

https://alp.consulting/page-statutory-compliance/

#statutory compliance#factory laws#shops and establishment laws#tax laws#Alp Consulting#statutory compliance services#labour compliance services#statutory compliance outsourcing#labour compliance outsourcing#business

2 notes

·

View notes

Text

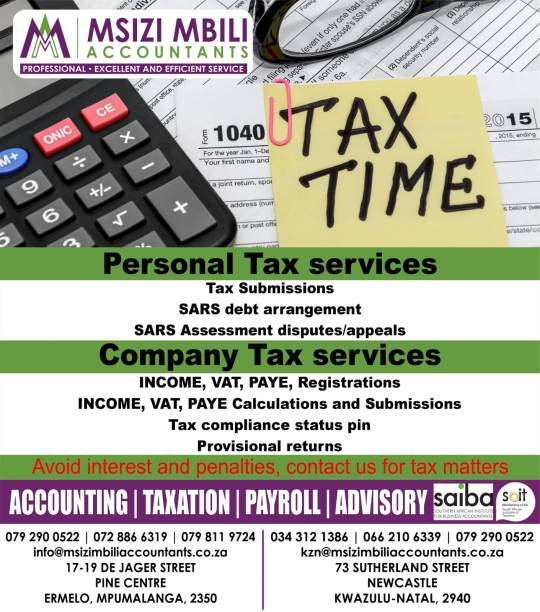

#Taxation Services#Personal Tax Services#Tax Submissions#Sars debt arrangement#Sars Assessment disputes/appeals#Company Tax services#INCOME#VAT#PAYE#Registrations#PAYE Calculations and Submissions#Tax compliance status pin#Provisional returns#Avoid interest and penalties#contact us for tax matters.

4 notes

·

View notes

Text

By archiving the data and lowering the TCO, TJC Group assists you in managing and optimising your enormous data volume.With more than 20 years of expertise and a customer database of more than 500 clients from various industries and business sizes, TJC Group is a SAP Certified Partner.The volume and expansion of your data will be significantly reduced thanks to SAP Data Archiving.By giving us the responsibility for your archiving, you can save time, maximise resource utilisation, and increase productivity.

#SAP information lifecycle management (ILM)#SAP data management#SAP Tax Compliance#sap s/4hana migration

2 notes

·

View notes

Text

Trivid Fintax: Navigating Notices & Compliance in India

Trivid Fintax provides expert guidance on Notices and Tax Compliance in India, ensuring you meet all legal obligations while maximizing your financial benefits.

#TAN Application Services in Pune#Litigation Support Services#Notices and Tax Compliance in India#Copyright Services in India

0 notes

Text

Second verse, same as the first

https://www.jwz.org/blog/2024/01/second-verse-same-as-the-first/

62 notes

·

View notes

Text

Don’t Miss Out! TDS Payment Deadlines for FY 2024–25 Explained

Filing TDS (Tax Deducted at Source) returns can be straightforward if you know which forms to use. Here’s a concise breakdown of the essential forms required for different types of transactions.

1. Form 24Q

Purpose: This form is crucial for employers as it reports TDS on salaries.

Key Point: Employers must submit this quarterly to reflect tax deductions from employee salaries.

2. Form 27Q

Purpose: Use this form to report TDS on payments made to non-residents.

Examples: This includes payments such as interest, dividends, and other sums payable to foreign entities or individuals (excluding companies).

3. Form 26Q

Purpose: This form covers TDS reporting in various scenarios, such as professional fees and interest payments.

Application: It's essential for a range of payments outside of salaries.

4. Challan-cum-Statement Forms

Form 26QB: For TDS under Section 194-IA (related to property sales).

Form 26QC: For TDS under Section 194-IB (applicable to lease payments).

Form 26QD: For TDS under Section 194M (payments made to contractors).

Timely Submission

Remember, these forms must be submitted within 30 days from the end of the month in which TDS was deducted. Ensuring timely filing can save you from penalties and maintain your compliance with tax regulations.

Conclusion

Understanding the specific forms for TDS filing is vital for smooth compliance. Choose the correct form based on your transactions to ensure hassle-free returns. Stay tuned for more updates on TDS regulations and best practices!

Read also: How to check your TDS Refund? , Books of account under section 44aa, Notice issue ? get expert help

#TDS Interest Rates#Financial Year 2024-25#Tax Planning 2024#TDS for Non-Residents#TDS Payments#TDS Return Filing#FY 2024-25 TDS Dates#TDS Compliance#TDS Form Submission#Tax Deductions#Income Tax Updates#TDS Penalties#Online TDS Payment#taxring

1 note

·

View note

Text

Simplify Non-Profit Tax Filing with SAI CPA Services

Running a non-profit organization is rewarding, but managing the financial aspects, especially tax filing, can be complex. At SAI CPA Services, we specialize in assisting non-profits with their unique tax needs, including 501(c)(3) approval and ongoing compliance.

Why Non-Profit Tax Services Matter

Non-profit organizations must adhere to strict IRS regulations to maintain their tax-exempt status. Here’s how SAI CPA Services can help:

501(c)(3) Approval: We guide you through the complex application process to gain 501(c)(3) status, ensuring your organization meets all requirements to qualify for tax-exempt status.

Ongoing Compliance: Maintaining your non-profit status requires staying compliant with IRS reporting requirements. We help you file annual Form 990 returns and keep your organization in good standing with the IRS.

Maximizing Deductions: We assist non-profits in identifying deductible expenses and ensuring donations are properly documented, helping you make the most of your resources while staying compliant.

How SAI CPA Services Can Help

At SAI CPA Services, we provide tailored tax solutions for non-profit organizations, helping you focus on your mission while we take care of the financials. Let us make your non-profit tax filing easy and stress-free.

Connect Us: https://www.saicpaservices.com https://www.facebook.com/AjayKCPA https://www.instagram.com/sai_cpa_services/ https://twitter.com/SaiCPA https://www.linkedin.com/in/saicpaservices/ https://whatsapp.com/channel/0029Va9qWRI60eBg1dRfEa1I

908-380-6876

1 Auer Ct, 2nd Floor

East Brunswick, NJ 08816

#SAICPAServices#nonprofit#501c3#financial services#tax compliance#accounting#cpa#new jersey#taxation

1 note

·

View note

Text

Features of AI-Powered Tax Compliance Software

Automated data entry and reconciliation

Real-time tax calculations and reporting

Tax planning and optimization tools

Audit trail and compliance tracking

Integration with accounting and ERP systems

Secure cloud-based storage

Expert support and guidance

For more information click here:- https://febi.ai/tax-compliance-software/

#Compliance Management Software#GST Compliance Management#Tax Compliance Software#Real-Time Compliance Monitoring#Automated Compliance Tracking#ai bookkeping#accountingsoftwarebd

0 notes