#va home loan

Text

VA Loans can help make homeownership possible for those who have served our country. These loans offer great benefits for eligible individuals and can help them buy a VA-approved house or condo, build a new home, or make improvements to their house.

ChangeMyRate.com compares multiple lenders and loan options for VA Loans — all in one place. Do you know how much home you can afford? Take the first step by getting pre-approved here for FREE! No SSN Required https://bit.ly/3pvLVQS

#mortgage#realestate#housing#buyahouse#homeowner#homebuyer#homeownership#applynow#real estate#buyahome#valoan#va#vahomeloan#va home loan

2 notes

·

View notes

Text

Kentucky VA Home Pest Termites Inspection Fees and Repairs cost for Veterans

Kentucky VA Home Pest Termites Inspection Fees and Repairs cost for Veterans

Louisville Kentucky VA Home Loan Mortgage Lender: Kentucky VA Home Pest Termites Inspection Fees and…: Veterans Benefits Administration Circular 26-22-11 Department of Veterans Affairs June 15, 2022 Washington, D.C. 20420 Pest Inspection Fees…

Kentucky VA Home Pest Termites Inspection Fees and Repairs cost for Veterans

Veterans Benefits Administration Circular 26-22-11

Department of…

View On WordPress

#Fort Knox#Mortgage loan#pest inspection fee va loan#Refinancing#termite report va loan#va home loan#VA Kentucky#VA loan#va loans#VA Mortgage#va pest inspection#VA Streamline Refinance#va termite report#Veteran

2 notes

·

View notes

Text

For veterans and active-duty service members, the VA home loan program offers a range of benefits, including the opportunity to tap into their home equity through a cash-out refinance. Whether you're looking to fund home improvements, consolidate debt, or cover unexpected expenses, a VA home loan cash-out refinance can be a powerful financial tool. Let's explore how this option works and how it can help you achieve your financial goals.

0 notes

Text

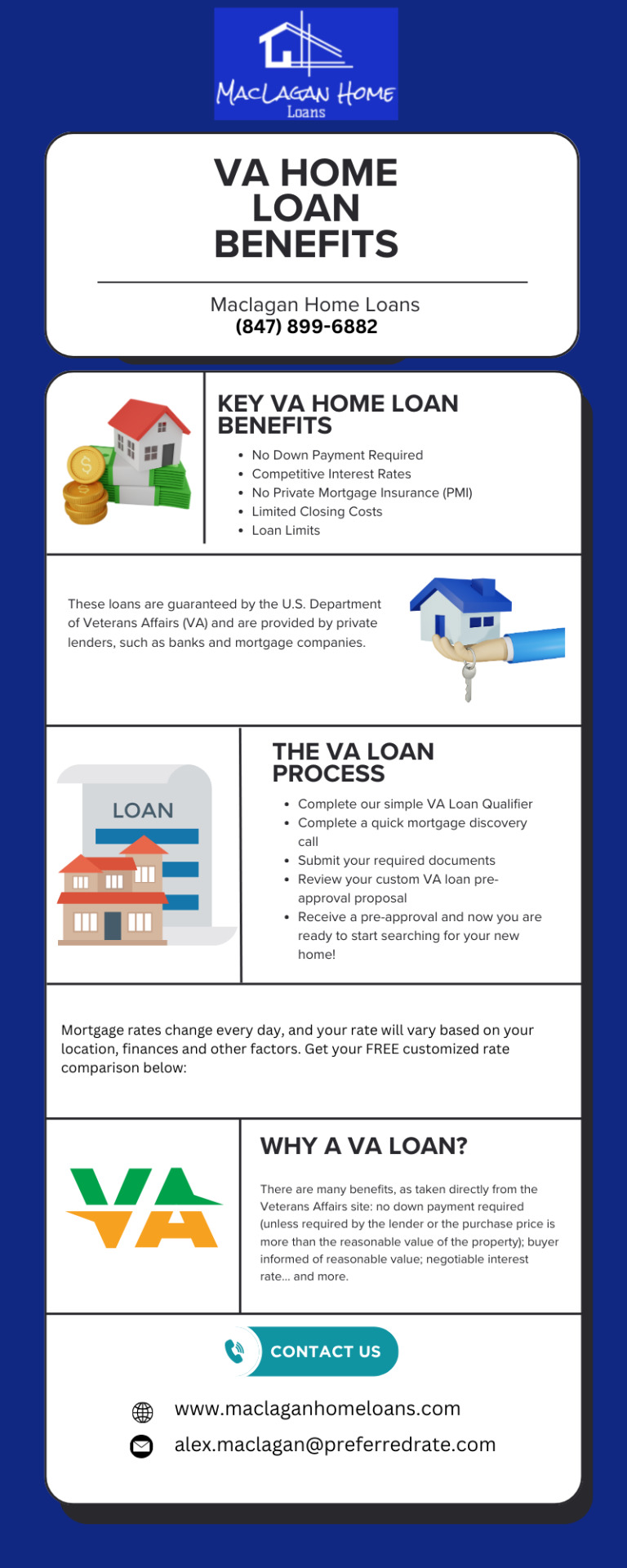

Va Home Loan Rate - Maclagan Home Loans

Discover competitive VA home loan rates with Maclagan Home Loans. If you are a first-time home buyer or an experienced investor, we will help you know the differences between loan programs to enable you to make the best choice. Get started today!

0 notes

Text

All you need to know about VA home loans in California

Are you aware about VA home loan? If not, you can read this blog to know all the important points associated with this type of loan. It is a specific type of mortgage offered by the U.S department of veterans Affairs (VA) and is given to qualified borrowers and comes with modest credit. Down payment and debt to income requirement in comparison to conventional loans. VA home loan in California is preferred by first time home buyers who require additional support in housing market. VA home loans are offered by government agencies who join hands with private lenders and lenders are assured that they won’t lose all the money even in a difficult situation.

It is worth noting that VA home loan can only be utilized for purchasing a house if you are going to spend most of your time there. One cannot use this loan to buy vacation, outing or investment property. It can be used to renovate or repair a house or for adding services that benefit people with service-related disabilities.

Common types of VA home loans

VA home loans are of many types and advice from trusted professional mortgage brokers can help in getting ahead with the most suitable loan type. Some common types are mentioned below:

VA home purchase loan

It is a standard mortgage backed by the US department of veteran affairs.

VA jumbo loans

It is a VA home loan in California which exceeds conforming loan limits.

VA renovation loan

It is a VA loan which funds a purchase of a home along with the cost required to renovate the property.

VA cash-out refinance

It is a VA home loan in California that convert’s a home’s equity into cash.

VA rate or term refinance

It allows eligible clients who are not in a VA loan to refinance for the purpose of lowering their rate and changing the terms of their mortgage.

VA interest rate reduction refinance loan (IRRRL)

It works for people who already have a VA loan. The aim is to decrease the monthly interest rate. It requires less documentation and lower VA funding fee. It is also termed as VA streamlined.

VA home loan – know how it works

VA home loans are not issued by US department of veteran affairs. They only determine who qualifies for the loan and associate with private lenders who can issue them. VA home loans in California are considered less risky because they are backed by government body.

Not everyone who has served for the armed forces qualifies for a VA loan. Meeting any of the below mentioned criteria is important:

181 days of active service during peacetime.

90 days of consecutive service during wartime.

6 years of services with National Guard or 90 days of service under Title 32 with at least 30 of those days being consecutive.

You are the spouse (who didn’t remarry) of the service member who lost his or her life during the line of duty or due to service connected disability.

There are additional requirements too and the definition of wartime and peacetime varies as per service tenure. At 4LoanInfo, we provide best advice associate with VA home loan in California.

1 note

·

View note

Link

When you are applying for a home loan, you need to make sure that you meet the minimum credit score requirements. If you decide to go with a traditional loan, the credit limit can be high, making it hard to qualify for a home loan.

1 note

·

View note

Text

Top Latest 5 va home loan specialist

Top Latest 5 va home loan specialist

Top Latest Five va home loan specialist Urban news

To qualify for your VA loan, you or your husband or wife will have to meet the basic provider specifications set by the Division of Veterans Affairs (VA), have a legitimate Certification of Eligibility, and meet the lender’s cash flow and credit history prerequisites.

Flagstar Bank is really a noteworthy mortgage lender due to its wide range of…

View On WordPress

0 notes

Text

Business Loans For Veterans

There are many different forms of home loans available in the market, but there is only one that is tailored just for Service Members, Veterans, and their spouses who will be eligible applicants under guidelines established by the Veterans. Veterans, Active Military, or a surviving spouses that are in the market to purchase a home, will need to get a VA-approved lender, and this type of loan incorporates certain guarantees.

Generally these loans are classified into secured and unsecured loans. What are the conditions related to secured and unsecured loans? It is obvious from the name itself that secured loans will require a security while borrowing the most wanted amount of loan. So for secured loans the borrower should be wealthy enough with valuable possessions. When will you get back your possession of assets? You will have to refund the sanctioned amount of loan within the stipulated time to the lender. Then automatically the lender will return the ownership of your assets to you.

Do you have an any interest in VA home loan in USA, ask to our experts. In order to be eligible for a VA loan, you must first obtain a valid Certificate of Eligibility (COE). Your COE is based on length of service or service commitment, duty status and character of service.

0 notes

Text

When looking at where the Black sides are, we could start by considering where they are not.

FHA and VA loans are credited with helping form the middle class of America by making homeownership available to a large portion of the population. Large housing complexes were developed, beginning with Levittown in Long Island, NY. Similar complexes sprung up in many major cities with one thing in common. No homes could be sold to Black people, with the federal government fully backing redlining, which made segregated housing the rule and not the exception. Black sides of town evolved where the whites elected not to go. There were housing complexes created for Black and Jewish people as well; these “projects” were definitely not intended for the middle class.

(continue reading)

#politics#redlining#housing#housing discrimination#racism#structural racism#anti blackness#fha loans#va loans#home loans#levitt town#generational wealth#segregation#housing projects

65 notes

·

View notes

Text

VA Announces Changes Meant To Stop Foreclosures On Veterans Using VA-Backed Loans

The Department of Veterans Affairs is extending a pandemic-era program that helped financially strapped veterans keep their homes after criticism that it wasn’t doing enough to prevent those with VA-backed loans from foreclosure.

View On WordPress

2 notes

·

View notes

Text

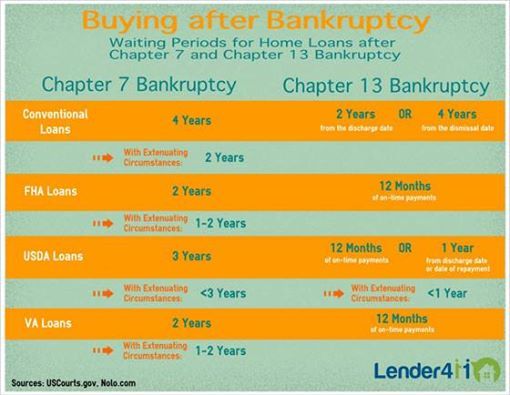

Chapter 13 bankruptcy can impact your ability to qualify for various mortgage loans in Kentucky

Kentucky Mortgage After a Bankruptcy

Chapter 13 bankruptcy can impact your ability to qualify for various mortgage loan programs like FHA, VA, USDA, and Fannie Mae.

View On WordPress

#Active duty#bank#bankruptcy va mortgage#bankruptcy va mortgage kentucky#Fort Knox#Kentucky#Louisville Kentucky#Refinancing#va home loan#VA loan#VA Mortgage#Veteran

0 notes

Link

Smart Home.IQ Touch Panel.Sky Bell

#gulf coast#smart home#country living#country life#city country#fence#school district#biloxi#with acreage#land#new build#new constr#new construction#vinyl flooring#property#first time home buyer#va loans#fha#usda

2 notes

·

View notes

Text

Discover the Exceptional VA Home Loan Benefits with Maclagan Home Loans - Unlock exclusive advantages for veterans and active-duty service members. Explore low-interest rates, zero down payment options, and more!

0 notes

Text

HARP 2 Refinance For Homeowners With Underwater Mortgages

In order to assist homeowners with underwater mortgages in refinancing their houses, the Federal Housing Finance Agency (FHFA) launched the Home Affordable Refinance Program (HARP) in 2009. HARP 2, an enhanced version of the 2012-introduced program, gives borrowers who are having trouble making their mortgage payments greater flexibility. We'll look more closely at the HARP 2 refinance in this blog post and how it can help homeowners with underwater mortgages.

What is an Underwater Mortgage

Let's start by defining an underwater mortgage. A homeowner who owes more on their mortgage than the value of their home at the time is said to be in an underwater mortgage position. A decrease in property prices, a change in the homeowner's financial condition, or other circumstances may be to blame for this.

It can be challenging to refinance a property when a homeowner has an underwater mortgage since conventional lenders could be reluctant to offer a refinancing loan. Herein is the value of HARP 2. With more lax conditions, the program enables qualified homeowners to refinance their underwater mortgage.

Benefits of HARP 2 Refinance

One of HARP 2's key advantages is that it enables homeowners to refinance their mortgage at a loan-to-value (LTV) ratio that is generally higher than what traditional lenders would permit. Homeowners may be able to refinance with an LTV ratio of up to 125% in some circumstances. This implies that homeowners may still be able to refinance and lower their monthly payments even if their home is worth less than what they owe on their mortgage.

Another advantage of HARP 2 is that it enables homeowners to refinance even with bad credit or a history of financial troubles. The program can assist homeowners who have had trouble getting approved for other forms of refinance loans because it has more lenient credit requirements than typical lenders.

Requirements to Qualify for HARP2 Refinance

Homeowners must fulfill specific eligibility conditions in order to be eligible for HARP 2. These consist of the following:

The mortgage must have originated on or before May 31, 2009, and it must be owned by or insured by either Fannie Mae or Freddie Mac.

The homeowner's mortgage payments must be up to date, with no more than one late payment in the previous 12 months and no late payments in the previous six months.

An LTV ratio of at least 80% is required.

The homeowner must demonstrate their ability to pay the increased mortgage payment.

Not all homeowners with underwater mortgages will be eligible for HARP 2; it is crucial to keep this in mind. But for those who do meet the requirements, the program can offer important advantages and support them in maintaining their homes.

To Sum Up

In conclusion, the HARP 2 program can offer assistance to homeowners who have underwater mortgages. It enables qualified homeowners to refinance their mortgages with less stringent conditions, such as a greater loan-to-value ratio and lenient credit standards. Homeowners must fulfill a number of qualifying criteria, such as having a mortgage owned by or insured by Fannie Mae or Freddie Mac, being current on their mortgage payments, and having an LTV ratio larger than 80%, in order to be eligible for HARP 2. HARP 2 can be a useful tool for homeowners who meet the requirements to lower their monthly mortgage payments while maintaining their houses.

#mortgages#gca mortgages#real estate#property#loans#fha loan#va loans#harp 2 program#bad credit score#homw owners#refinance#payments#united states#usa#first time home buyer#homebuyers#Underwater Mortgages#gustancho associates#gca mortgage#non qm loans#jumbo loans#conventional loans

2 notes

·

View notes