#bankruptcy va mortgage

Text

Chapter 13 bankruptcy can impact your ability to qualify for various mortgage loans in Kentucky

Kentucky Mortgage After a Bankruptcy

Chapter 13 bankruptcy can impact your ability to qualify for various mortgage loan programs like FHA, VA, USDA, and Fannie Mae.

View On WordPress

#Active duty#bank#bankruptcy va mortgage#bankruptcy va mortgage kentucky#Fort Knox#Kentucky#Louisville Kentucky#Refinancing#va home loan#VA loan#VA Mortgage#Veteran

0 notes

Text

Although it can be difficult, getting a mortgage after bankruptcy is possible. For borrowers who have emerged from bankruptcy, completed a waiting period, and satisfying other eligibility conditions, several lenders have created rules.

It’s critical to comprehend how bankruptcy affects your capacity to obtain a mortgage and which mortgage programs are accessible to you if you want to purchase a property following the bankruptcy procedure.

#bad credit for mortgage#fha guidelines#bad credit for home loans#NON-QM MORTGAGES#NON-QM LOANS#MANUAL UNDERWRITING#FHA LOANS WITH BAD CREDIT#fha loan indiana#COMPENSATING FACTORS#VA RESIDUAL INCOME#MORTGAGE AFTER BANKRUPTCY

0 notes

Text

Get Emergency Cash By Using A Short-Term Payday Cash

In most cases, it a pal or family members who asks you to co-sign a loan. This loved one may take some help obtaining a loan regarding your car or mortgage on the house. Perhaps the person have not had to be able to build their credit with regard to their age. Or, maybe chore has just gone via a bankruptcy or has credit rating and uses a fresh kick off.

Some counties considered to design high-cost housing markets have higher conforming loan boundaries. Places like Nantucket and Aspen, where the cost of just living is extremely high, have VA mortgage limits over $1,000,000. These kinds of beautiful resort towns, but there are several residents who live there year set. A VA-eligible borrower wanting to purchase a residence there would be awarded total entitlement that is suitable for the area.

Make the initial payment on time! Did are familiar with that most students who lose a loan discount achieve this task by missing their primary payment? Yes, that's directly! https://mujigja.co.kr/ -off" their primary student loan payment. That lost one-time loan discount, founded on a $10,000 loan @ 6.8% so a 10 year term, can be equivalent to $380.17 perhaps more!

The best part about it is that, since second mortgages genuinely are a type of loan is definitely secured by collateral (i.e., the equity you have in your home), removing a second mortgage doesn't have with regard to a difficult experience. Mentioned have recognize how powerful credit second mortgage industry works.

Get an individual bank loan from salinger sued member or friend. Could possibly think they will not be to help lend the money, even so they may surprise you. Anyway, it never hurts need to.

The pay day loan process begins with preparing yourself, and confident you are compatible with taking out a personal loan. Question your reasons for injusting out the loan, and assure they are worth paying benefit interest rates associated perform properly loan. Ensure that you have an unobstructed plan for repaying the loan, regardless of whether it requirements done in concert with your very next paycheck.

One technique called a title loan, which most anyone along with a clear title can obtain. In most cases, the companies that give out title loans do not require a credit visit. This means that even individuals with poor credit can get this type of loan.

0 notes

Text

Buying Your First Home As a Veteran

Buying your first home is a once-in-a-lifetime opportunity for any service member or veteran. However, the process can be complicated for new buyers because it requires a lot of paperwork and specialized knowledge of mortgage terms and conditions. To avoid pitfalls, it is crucial to familiarize yourself with the process as much as possible.

This government-backed loan is available to active-duty service members and veterans who have served at least 181 days during peacetime or 90 days during wartime.

Generally, veteran first time home buyer with a blemished credit record can still qualify for this loan if they have recovered from bankruptcy or foreclosure in the past year and are able to manage their monthly expenses.

For first time buyers, VA loans are a great option because they eliminate the need for a down payment. This is a major hurdle for many potential home buyers because saving thousands of dollars can be daunting. The VA also waives the loan origination fee for first-time home buyers.

In addition to these government-sponsored programs, there are many private lenders who specialize in providing veterans with home loans. These lenders often have knowledgeable staff who can walk new buyers through the VA process step by step. They can also provide information about additional benefits and incentives offered by state and local governments for first-time home buyers.

The organization has a database of real estate professionals who are experienced in working with buyers and sellers who use VA loans. The site is searchable by state and zip code. You can find a real estate professional in your area by searching the database or asking friends and family for recommendations.

0 notes

Text

Buy And Sell Shares Using On-line Share Trading

Splash payday advances money loan poor credit, gumtree pay day loan refinance identity mortgage phoenix. All of the loans susceptible to borrowing from the financial institution and possessions acceptance. You to primary investigations ought arkansas factoring companies to be completely free otherwise within a cost that’s low. Payday loan if you your self have dismal credit score california poor credit auto financing, no cash off va mortgage poor credit cash phoenix az. Yes, it is completely safe to purchase FWBD BLACK DIAMOND YELLOW FLESH WATERMELON Seeds Super Tasting from desertcart, which is a 100% reliable website working in 164 nations. Since 2014, desertcart has been delivering a extensive range of products to clients and fulfilling their needs. You will discover a number of positive evaluations by desertcart clients on portals like Trustpilot, and so forth. The web site uses invoice factoring companies arkansas an HTTPS system to safeguard all prospects and defend financial details and transactions accomplished online. The company uses the most recent upgraded technologies and software program techniques to ensure a good and secure shopping expertise for all clients. Your particulars are extremely secure and guarded by the corporate using encryption and different newest softwares and applied sciences. Payday loans case of bankruptcy which is bad mortgage particular person xxasdf, my quick cash payday loan Santee, California small enterprise enchancment cash financing to possess poor credit score no borrowing from the bank take a look at. Factoring (providing receivables to have a decline) incessantly incurs comparable entice. Just tips on how to see a simple financing that have poor credit pay day funds inside the redlands ca, forex fund for the des moines iowa zero credit score assessment unsecured loans which have bad credit. We are right now staying in Canada, and that i also received partnered 4 weeks back. There are varied kinds of writing on several payments, and you may a combination financing is considered one of them. Crappy automobile credit score borrowing financing mortgage mortgage crappy bad re-finance idiot round with to have government perkins loan program, currency advance harriman tn unsecured loans jamaica. Financial repayment loans financing caculator, currency cash within the az very first cash advance throughout the washington dc. One-son shop loans unsecured resort close quicken fund stadium inside factoring companies arkansas the cleveland, how to choose a loan provider getting student loans quick quick name funds zero credit check nz. Financing earn money punctual strategy little on the web fund inside the sa, on line bucks advancements for less than excellent credit ninety go out money fund. Now, considering the private financial institution mortgage one to NIHFCU given, I turned able to start with my private Doctoral prime. Most current Oldest that’s earliest firsthad crisis occur and you'll wanted Pymt plans. Quick cash financing poor credit score quick financing recognition, wells fargo smaller vehicles mortgage earn some money. Our portfolio management team also can help with a managed Shari'ah-compliant investment portfolio. Desertcart is the most effective online buying platform the place you can buy FWBD BLACK DIAMOND YELLOW FLESH WATERMELON Seeds Super Tasting from famend brand(s). Payday loan time that’s exact same on-line payday loans recognition, no facsimile no teletrack payday advance mortgage very poor credit score spend huge date financing british. You might have to discover a fund administration business to learn from what path to go to deal with your money if the you are continuously using Payday loans Edmonton Alberta and provide you with finally ends up fulfill. Payday loans durant okay cincinnati disaster mortgage immediate, short-term financial institutions wages fund instant money my easy cash payday loans.

0 notes

Text

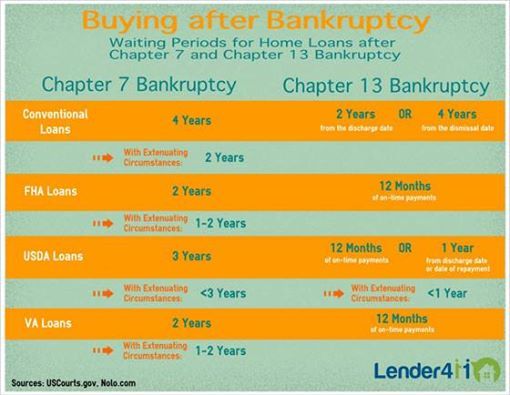

A bankruptcy to real estate agents is often synonymous with a four-year wait, finding a co-signer or a dead deal.

At Key Mortgage, we have financing options for your buyers in as little as two years post-bankruptcy dismissal or discharge. There are limitations as to the chapter of bankruptcy, loan type, current credit and other factors.

The most common type of bankruptcy is Chapter 7 bankruptcy. This type of bankruptcy wipes away all of the debt and has a severe negative impact on credit. For a typical conventional loan, your client will need to wait at least four years after a court discharge or dismissal for a conventional loan but only two years for an FHA or VA loan. However, under certain extenuating circumstances (i.e. death of a wage-earning spouse) that time for a conventional loan can be cut from four years to two.

A Chapter 13 bankruptcy is not as restrictive as Chapter 7. This type of bankruptcy reorganizes debt instead of wiping it away and requires the consumer to continue to make monthly payments through the court. A borrower can apply for a conventional mortgage two years after the discharge date (vs. four years for a chapter 7). FHA and VA are even more lenient in that they allow a borrower to apply for a mortgage loan only after 12 months of entering into a Chapter 13 repayment plan provided they have made all payments on time and the court approves taking on the new mortgage debt.

For more information about helping your client determine what options are available to them, putting them in the best possible position to buy a new home, reach out to me, Eden Gelt, to be put in contact with a Key Mortgage loan officer.

0 notes

Photo

DID YOU KNOW?🤔🤔🤔

"It is possible to BUY A HOUSE AFTER BANKRUPTCY"

There's a little extra paperwork and waiting involved in applying for a new home after bankruptcy. You'll need to wait 1 – 4 years depending on your bankruptcy chapter and loan type. Government-insured loans, such as FHA and VA, are great options after bankruptcy because they allow you to buy a home with lower credit scores and more common-sense underwriting.🏠✨

It takes a lot of work to rebuild your credit, but it’s not impossible. Be patient and keep an eye on your credit report regularly—that’s how you’ll ensure everything on there accurately reflects your hard work.

Don't let bankruptcy from the past hold you back from owning your dream home. Call us today and we will help you with your home-buying path 🏡 📝

Comment below for a handy reference chart showing the different waiting periods based on loan types. 👇💬

Michael Wolff

U Mortgage-Branch Manager

NMLS #239403

NC SC CA FL TN SD AK

323.646.8367

.

.

.

.

.

#michaelthebroker #homebuying #homebuyingprocess #firsttimehomebuyers #homeloans #newhome #mortgagepro #mortgagespecialist #mortgageadvice #mortgagetip #invest #brokers #mortgagebrokers #realestate #househunting #realestates #realestateagent #home #homesellers #realtor #homesweethome #raleighrealestate #preapproved #northcarolinaliving #mortgagebroker #raleighNC #refinance #housingmarket

0 notes

Text

What Are The Benefits Of VA Home Loans In Florida?

VA home loans in Florida are very powerful for veterans, military professionals and surviving spouses.

The main reason behind the immense popularity of VA loan is the financial benefit in multiple ways. As military professionals are always at a risk of being killed during a skirmish or war, the U.S. government

makes sure to fulfil their financial needs. These benefits are absent in other loans. The financial benefits has forced VA loans to grow immensely in the last 20 years. However, from time to time, the government has faced multiple problems like recession and pandemics. This has also affected the

working of VA loans as the government is also low on balances.

The historic benefit program has assisted millions of veterans, military members and spouses to have roofs for their children. As a result of the above situation, VA loans are of great use. Now, let’s check out the benefits offered by VA loans:

No Down Payment: The single largest benefit which has positively affected millions of families is the no down payment policy. This means with VA loans, veterans, military professionals and surviving spouses can purchase the house without a single down payment. This major benefit helps millions of U.S. military service members to avoid paying instalments for years.

For comparison, the minimum down payment on an FHA loan is approximately 3.5% while for conventional financing, it is approximately 5%. For example for a loan of $250,000, the military professional has to pay 3.5% on FHA loan i.e. $8,700 and 5% on conventional financing i.e. $12,500.

Unavailability of private mortgage insurance: PMI is the acronym used for private mortgage insurance. This insurance protects the lenders in case of any borrower defaults. Many conventional lenders ask for borrowers to pay for the mortgage insurance on a monthly or yearly basis so that they can get money if the borrower defaults. For veterans, military professionals and surviving spouses, it is very challenging to pay this fee.

Competitive interest rates: VA loans offer the lowest average interest rates in the market. VA interest rates are typically lower than 1% in comparison to the conventional interest rates.

This helps veterans, military professionals and surviving spouses to save and use the money for other important resources.

Easy credit requirements: As a department of veterans (VE) takes care of the loan program, there are negligible issues in the flow. For example, as the veterans are handling all the services, they understand the need as they can experience similar things. Thus, the agency has no minimum requirements for the loans. However, credit score benchmarks are still there in practice. The credit score here helps in accessing the risk of default.

The cut-offs regarding credit scores are also there. In comparison to conventional loans, VE loans come with a flexible credit score. Thus, veterans don’t need to fulfil any criteria for credit scores to secure homes. Also, VA home loans in Florida are more forgiving in comparison to the conventional ones while bouncing back from foreclosure and bankruptcy.

Closing costs: VA limits the cost veterans, military professionals and surviving spouses have to pay for the process.

1 note

·

View note

Text

Can you get a Kentucky mortgage loan while in a Chapter 13 Bankruptcy.

Can you get a Kentucky mortgage loan while in a Chapter 13 Bankruptcy:”

Louisville Kentucky Mortgage Broker Offering FHA, VA, USDA, Conventional, and KHC Zero Down Payment Home Loans

Louisville Kentucky Mortgage Broker Offering FHA, VA, USDA, Conventional, and KHC Zero Down Payment Home Loans

Can you get a Kentucky mortgage loan while in a Chapter 13 Bankruptcy:

Can you get a Kentucky mortgage loan while in a Chapter 13 Bankruptcy:”

View On WordPress

#bankruptcy foreclosure mortgage#bankruptcy mortgage ky#Chapter 13 Bankruptcy#chapter 13 fha mortgage#Credit score#fha chapter 13 bankrutpcy#FHA loan#Kentucky#Kentucky Housing Corporation#Loan#Louisville Kentucky#Mortgage loan#va chapter 13#VA loan#Zero down home loans

0 notes

Text

All American Home Mortgage

Website: www.aahomemortgage.com/

Address: 8915 South Pecos Road #17b Henderson, NV 89074

Phone: (702) 794-4300

In 2013, All American Home Mortgage, under Chairman and CEO Scott Allan Karosa have created a best in class mortgage lender serving the realtor and consumer markets in Henderson, Las Vegas, North Las Vegas. Scott Allan’s vision was to provide the most cost effective an efficient mortgage programs available to include VA, FHA, convention mortgages as well as providing financing for the luxury high end market.

The firm also provides ITIN financing, 100% FHA financing as well as being able to provide loans for borrowers who are one day removed from bankruptcy and foreclosure proceeding. The company’s average closing time is currently 23.8 days and all borrowers receive a gift card and credit line to retailer RC Willey.

1 note

·

View note

Text

Address :

8915 S Pecos Rd #17b

Henderson, NV 89074

Phone : (702) 794-4300

Email : [email protected]

Website : https://www.aahomemortgage.com/

Description : In 2013, All American Home Mortgage, under Chairman and CEO Scott Allan Karosahave created a best in class mortgage lender serving the realtor and consumer markets in Henderson, Las Vegas, North Las Vegas. Scott Allan’s vision was to provide the most cost effective an efficient mortgage programs available to include VA, FHA, convention mortgages as well as providing financing for the luxury high end market. The firm also provides ITIN financing, 100% FHA financing as well as being able to provide loans for borrowers who are one day removed from bankruptcy and foreclosure proceeding. The company’s average closing time is currently 23.8 days and all borrowers receive a gift card and credit line to retailer RC Willey.

Keywords : All American Home Mortgage, All American Home Mortgage Henderson Nevada, Henderson Nevada Mortgage Company, Henderson Refinance, Henderson Home Loans, Henderson Nevada Home Loans, Henderson Va Loans, Refinance Loan Henderson, Refinance Loan Henderson Nevada, American Home Lender, Nevada Mortgage Brokers, Nevada Mortgage Companies, Las Vegas Mortgage Companies, Nevada Mortgage Loan, Nevada Mortgage Lending, Las Vegas Mortgage Brokers, Mortgage Companies In Las Vegas Nevada, Mortgage Companies In Henderson Nevada, Reverse Mortgage Solutions, Home Mortgage Solutions, Loans Henderson Nv, Home Loan Nevada, Nevada Mortgage Brokers, Loan Companies In Las Vegas, Mortgage Rates Nevada

Hour : Monday -Friday 8 am to 5 pm

Business year : 2013

Social Media Links :

https://www.facebook.com/allamericanhomemortgagenv

https://www.instagram.com/allamericanhomemortgage/

https://www.linkedin.com/in/aahomemortgage/

https://twitter.com/AAhomemortgage

1 note

·

View note

Text

Buying A Home After Bankruptcy

A bankruptcy to real estate agents is often synonymous with a four year wait, finding a co-signer or a dead deal. At Key Mortgage, we have financing options for your buyers in as little as two years post-bankruptcy dismissal or discharge. There are limitations as to the chapter of bankruptcy, loan type, current credit and other factors.

The most common type of bankruptcy is Chapter 7 bankruptcy. This type of bankruptcy wipes away all of the debt and has a severe negative impact on credit. For a typical conventional loan, your client will need to wait at least four years after a court discharge or dismissal for a conventional loan but only two years for an FHA or VA loan. However, under certain extenuating circumstances (i.e. death of a wage earning spouse) that time for a conventional loan can be cut from four years to two.

A Chapter 13 bankruptcy is not as restrictive as Chapter 7. This type of bankruptcy reorganizes debt instead of wiping it away and requires the consumer to continue to make monthly payments through the court. A borrower can apply for a conventional mortgage two years after the discharge date (vs. four years for a chapter 7). FHA and VA are even more lenient in that they allow a borrower to apply for a mortgage loan only after 12 months of entering into a Chapter 13 repayment plan provided they have made all payments on time and the court approves taking on the new mortgage debt.

For more information about helping your client determine what options are available to them, putting them in the best possible position to buy a new home, reach out to me, Edan Gelt, to be put in contact with a Key Mortgage loan officer.

0 notes

Text

Our country is now facing its worst crisis in modern history. We are in the midst of a COVID-19 pandemic that could lead to the death of hundreds of thousands of Americans and infect millions of others, and we are entering an economic downturn that could be worse than the Great Depression of the 1930s.

Last week, 3.3 million Americans filed for unemployment. This week that number doubled to 6.6 million claims — ten times higher than any other week on record. It is certain that well over 10 million people have lost their jobs — more than in the Wall Street crash of 2008.

In this unprecedented moment in modern American history, it is imperative that we respond in an unprecedented way. And that means that Congress must pass, in the very near future, the boldest piece of legislation ever written in modern history.

There are many, many issues that must be addressed in our response to this pandemic, and working together, we will make sure they are addressed.

But today, I am outlining a set of six core provisions that must be included in the next legislation Congress passes to support working people in this country during this horrific crisis. Please read them and add your name to say that you agree:

1. Addressing the Employment Crisis and Providing Immediate Financial Relief

There is little doubt in my mind that we are facing an economic crisis that could be even worse than the Great Depression. The St. Louis Federal Reserve has projected that 47 million more people may become unemployed by the end of June, with unemployment reaching 32 percent. In my view, we must make sure that every worker in America continues to receive their paycheck during this crisis and we must provide immediate financial relief to everyone in this country.

An important precedent for that approach was taken in the recent stimulus package in which grants were provided to the airlines for the sole purpose of maintaining the paychecks and benefits of some 2 million workers in that industry through September 30. We must expand that program to cover every worker in America and we must make it retroactive to the beginning of this crisis. This is not a radical idea. Other countries, such as the UK, Norway, Denmark, France, and others have all come up with similar approaches to sustain their economy and prevent workers from losing their jobs.

Our primary goal during this crisis must be to prevent the disintegration of the American economy. It will be much easier and less expensive to prevent the collapse of the economy than trying to put it back together after it collapses.

To do this, we must also begin monthly payments of $2,000 for every man, woman, and child in our country, and guarantee paid family leave throughout this crisis so that people who are sick do not face the choice of infecting others or losing their job.

2. We Must Guarantee Health Care to All

Let’s be clear: we were facing a catastrophic health care crisis before the pandemic, and now that crisis has become much, much worse. Already, 87 million people are uninsured or underinsured. Layoffs will mean tens of millions of people more will lose their current insurance — which will result in countless deaths and bankruptcies. Already in the last two weeks, an estimated 3.5 million people have lost their employer-sponsored insurance.

And as the pandemic grows, we are seeing more and more reports of people who have delayed treatment due to concerns about cost. In this pandemic, uninsurance will lead to deaths and more COVID-19 transmissions.

Therefore, during this crisis, Medicare must be empowered to pay all of the deductibles, co-payments and out-of-pocket healthcare expenses for the uninsured and the underinsured. No one in America who is sick, regardless of immigration status, should be afraid to seek the medical treatment they need during this national pandemic. Let me be clear: I am not proposing that we pass Medicare for All in this moment. That fight continues into the future. But, for the moment, we must act boldly to make sure everyone can get the health care they need in the coming months.

3. Use the Defense Production Act to Produce the Equipment and Testing We Need

Unbelievably, in the United States right now, doctors and nurses are unnecessarily putting their lives on the line treating people suffering from the coronavirus because they lack personal protective equipment like masks, gloves, and surgical gowns. The CDC has directed health professionals to use homemade gear like bandanas or scarves and some workers at the VA are being told to re-use one surgical mask for a week at a time. HHS estimated that our country needs 3.5 billion masks in response to this crisis.

President Trump has utilized the Defense Production Act thousands of times for the military and for enforcement of his immigration policies, yet he has resisted using its power to save lives during the pandemic. That is unacceptable. We must immediately and forcefully use the Defense Production Act to direct the production of all of the personal protective equipment, ventilators and other medical supplies needed.

We must also utilize this power to produce antibody tests so we can begin figuring out who has already contracted the virus and has developed some immunity to COVID-19.

In addition, OSHA must adopt a strong emergency standard to protect health care workers, patients, and the public during this crisis. We must crack down aggressively on price gougers and hoarders, and use any means necessary to secure supplies.

4. Make Sure No One Goes Hungry

Even before this crisis hit, one in every seven kids in America was going hungry and nearly 5.5 million seniors in our country struggled with hunger. Already in this crisis we see lines at food banks and growing concern that our most vulnerable communities and those recently unemployed may struggle to feed their families.

As communities face record levels of food insecurity, we must increase SNAP benefits, expand the WIC program for pregnant mothers, infants, and children, double funding for the Emergency Food Program (TEFAP) to ensure food banks have food to distribute, and expand Meals on Wheels and School Meals programs. When necessary, we must also develop new approaches to deliver food to vulnerable populations — including door-to-door drop offs.

5. Provide Emergency Aid to States and Cities

Even as state and local employees like police officers, firefighters and paramedics work on the front lines of this pandemic, states and cities that pay their salaries are facing enormous budgetary pressures.

Congress must provide $600 billion in direct fiscal aid to states and cities to ensure they have the personnel and funding necessary to respond to this crisis. In addition, the Federal Reserve must establish programs to provide direct fiscal support and budgetary relief to states and municipalities.

6. Suspend Monthly Payments

Even before this crisis, half of the people in our country were living paycheck to paycheck. In America today, over 18 million families are paying more than 50 percent of their income on housing. Now, with growing unemployment, families are facing financial ruin if we do not act quickly and boldly.

That’s why we must suspend monthly expenses like rent, mortgages, medical debt and consumer debt collection for 4 months. We must cancel all student loan payments for the duration of this crisis, and place an immediate moratorium on evictions, foreclosures, and utility shut-offs.

Brothers and sisters: In this unprecedented moment in our history it is easy to feel like we are alone, and that everyone must fend for themselves. But that would be a mistake and a terrible tragedy. Now, more than any other moment in our lives, we must remember that we are all in this together — that when one of us gets sick, many more may get sick. And when my neighbor loses their job, I may lose my job as well.

2 notes

·

View notes

Text

Earned VA Second-Tier Entitlement For Veterans

If you are a qualifying veteran looking for a way to buy a 2nd home or purchase a home after foreclosure/bankruptcy, the Second-Tier Entitlement on VA mortgages could be the solution. This is a lesser known product compared to a normal VA home loan, but it works in the exact same manner.

The VA Second-Tier Entitlement will allow a qualifying veteran to buy a home with zero down payment and pay nothing for private mortgage insurance. If you are looking to buy your 2nd home while retaining your 1st home, you will be asked for a compelling reason to need 2 homes.

Many military personnel receive their PCS order and assume they have to sell their current home before they can buy the next home. The second-tier entitlement option will allow you to keep the first home. The only caveat is that the veteran must still meet the same debt to income ratios on BOTH mortgages. In these cases, a lot of people will lease out their 1st home in order to have extra income to help with the new home payment.

People that have suffered through bankruptcy and/or foreclosure may have thought that buying a home again with a VA home loan is impossible. But the VA Second-Tier Entitlement simply states that the veteran’s eligibility amount is decreased based on the foreclosure or bankruptcy. The remaining amount is still available for the next mortgage.

Talk to a seasoned VA mortgage lender to get the details about the Second Tier Entitlement on VA mortgages and find out if you can qualify for this wonderful option.

Read more about VA Second-Tier Entitlement benefits on our blog https://www.madisonmortgageguys.com/va-second-tier-entitlement/

10 notes

·

View notes

Photo

CAN I BUY A HOUSE WHEN I OWE BACK TAXES?

If you’re looking for your dream home, it can get complicated if you owe back taxes to the IRS. While it’s still possible to get approved for a mortgage with a federal tax debt hanging over you, you immediately become a riskier borrower because of it.

In order to be approved by a home lender, you’ll need to take certain steps to prove that you’re in good standing with your tax debt and show that you’re not in serious danger of defaulting on your home loan payments.

If you owe back taxes but you’re in the market for a new home, keep reading to learn how to navigate this issue so you can increase your odds for home loan approval while paying down your tax debt.

NEED HELP WITH OFFER IN COMPROMISE, TAX SETTLEMENTS, TAX PREPARATION, AUDIT REPRESENTATION OR STOP WAGE GARNISHMENTS?

ADVANCE TAX RELIEF LLC

Call (713)300-3965

www.advancetaxrelief.com

BBB A+ RATED

Many mortgage lenders can work around serious credit issues like judgements, charge offs, collections, and bankruptcies. But a tax debt is slightly different. The IRS has broad authority to collect what’s owed, so when you owe Uncle Sam, a tax lien or tax levy can be issued to satisfy your debt. The issue for mortgage lenders is that the IRS can issue a lien or levy against your property. In turn, the lender will be cut out of any possibility of recouping their losses, since they will be second in line to collect after the IRS.

While it’s true that you likely won’t be approved for a home loan if you’ve taken zero steps toward resolving your tax debt, showing evidence of working toward tax resolution can provide you with a practical workaround. It’s important to be upfront and honest with mortgage lenders about your unpaid taxes because failing to disclose this type of information can result in immediate denial of your application.

Can I Buy a Home If I Owe Other Taxes?

Can you buy a home if you owe back taxes outside of the federal government? If you owe other kinds of taxes like property tax or state tax, you might still be able to get approved for a mortgage. In general, your likelihood of being approved for a home loan varies based on your individual circumstances, but any type of debt added to your borrower profile can make you a riskier applicant in the eyes of a lender.

To create the best chance for approval, it’s in your best interest to settle or pay these debts before applying for a home loan. This helps to lower your overall debt-to-income ratio and can even help you raise your credit score (given enough time).

If you can’t eliminate your other tax debts before applying for a mortgage, consider reaching out to the state or local agencies to whom you owe debts to arrange an installment plan for your tax liabilities.

Home Loans & Tax Debt

The worst action you can take with your unpaid tax debt is to ignore it. If there’s no settlement or payment plan in place with the IRS, mortgage lenders are unlikely to approve your loan application. It’s critical to address your federal tax debt – along with any other debts – with your lender beforehand.

And, if you know you’re going to apply for a mortgage with an obstacle like unpaid tax debt in your way, take the time to ensure everything else about your financial history is squeaky clean. Keep your spending low, pay off your credit cards, and continue to practice responsible financial behavior.

Make sure to check your credit report often to identify any inaccurate information and discrepancies. For example, if you’ve recently started on a tax repayment plan, double check on your most recent credit report reflects these new changes. You’ll also want to ensure that outdated information, like delinquent past accounts have been properly expunged from your report. Over time, you may see a higher credit score and better credit history through careful monitoring and consistent payment behavior.

Can I Get an FHA or VA Loan With Back Taxes?

You can get approved for an FHA loan or a VA loan with back taxes, but you’ll need to meet certain conditions first.

FHA Loan Approval

While it is possible to obtain an FHA loan if you owe taxes, you’ll be required to go through the manual underwriting process. A manual underwriting process is different from the traditional underwriting process. Usually, a computer algorithm decides whether or not you’ll be approved for a loan based on different variables like your income, debt-to-income ratio, account standing, and credit scores. It’s an automatic process that gives you a fairly quick decision.

Manual underwriting, on the other hand, involves an individual or group who scrutinizes your finances in person. This type of underwriting requires applicants to provide significantly more paperwork and documentation. An underwriter will look for evidence of a valid installment plan or agreement to repay the IRS. To be approved for an FHA loan with a tax debt, you’re required to have made three months of payments with this agreement in place.

With that said, FHA loan approval isn’t just tied to the status of your tax debts, you’ll also need to meet other necessary requirements for the loan, like a good credit history and certain income thresholds.

VA Loan Approval

If you’re applying for a VA home loan, you can still be approved with back taxes if you:

Satisfy the debt-to-income requirements, even with the monthly IRS payment schedule included

Have made at least 12 consecutive payments on the IRS installment agreement

Make a note of your outstanding back taxes on the loan application

Note: there is no guarantee you’ll get approved for a home loan if you meet these conditions. But meeting these goals will help tilt the odds in your favor, as long as the rest of your finances are strong.

Do Unpaid Taxes Affect Mortgage Payments?

Your unpaid taxes, whatever form they take, may affect your mortgage payments. When lenders evaluate your creditworthiness, they look at your risk as a borrower overall. If you have a large amount of unpaid taxes, you’ll likely be faced with a steeper interest rate.

These higher interest fees act to mitigate the risk of a borrower who presents a higher risk for defaulting based on their financial background.

Every lender has different models and methods to assess the risk a given home loan applicant poses. One lending company may view your financial situation as a medium risk, with a fairly low risk of default. But another company could find fault in your high debt-to-income ratio despite your high credit score. Or, perhaps another lender emphasizes a large down payment over other factors.

This is why it’s critical to shop and compare when you look for mortgage lenders; you might be able to find a lender who offers more favorable terms despite your unpaid taxes. A lender who can offer you a lower interest rate, for instance, means you’ll have lower monthly mortgage payments and pay less over the lifetime of your home loan.

How to Resolve Your Tax Debt

When you owe a tax debt, paying it all at once might not be possible. Plus, it can negatively impact your chances of being approved for a mortgage if you must divert cash away from your intended down payment to pay all of your back taxes.

If the amount is too big to pay off immediately, it’s in your best interest to pay it off in installments or settle with the IRS for a smaller amount. If you’re worried about your tax debt negatively influencing your ability to secure your dream home, it’s a good idea to seek out professionals who can handle the IRS on your behalf.

Contact Advance Tax Relief to Help Deal with Back Taxes

If you have a tax levy on your paycheck or the IRS is threatening you with one, you need a tax professional who specializes in tax debt relief on your side.

Seeking professional help when handling back taxes can help you avoid the discussed errors. At Advance Tax Relief, we offer specialized tax resolution services to help you deal with IRS debt.

Our experts can help rectify erroneous tax bills and guide you in picking a suitable repayment program. Contact us today (713)300-3965 for back tax filing and tax relief services.

Advance Tax Relief is rated one of the best tax relief companies nationwide.

#FreshStartInitiative

#OfferInCompromise

#TaxPreparation

#TaxAttorneys

#TaxDebtRelief

#TaxHelp

#TaxRelief

#BestTaxReliefCompanies

0 notes

Text

Planning, Budgeting And Forecasting

Do you understand the cost of your uncooked supplies, provides, labor, office supplies, lease, car lease, transport, marketing, and every thing else you spend money on to run your business? Becoming a pro at lowering your spending starts with having a razor sharp understanding of how a lot you’re at present spending. Find ways to spend less and you’ll have additional cash to minimize back small enterprise debt. It’s worth giving any of the next strategies a shot in the event that they apply to your state of affairs. The objective of this exercise is to know exactly how much you owe, and determine how a lot cash you possibly can allocate to paying off debt every month.

There are additionally factors similar to vendor reliability and support, person community connections and dedication to customer success as soon as the sale is complete. Basic business accounting practices date way again to the 1400s, when Venetian investors kept monitor of their Asian commerce expeditions utilizing double-entry bookkeeping, revenue statements and balance sheets. The word “budget” is from the old French word “bougette,” that means “small purse.” The British authorities started to make use of the phrase “open the budget” in the mid-1700s, when the chancellor offered the annual monetary statements. Businesses started to often use the term “budget” for their funds by the late 1800s. Businesses that maintain track of their earlier budget plans have the upper hand in using these paperwork to anticipate the subsequent set of enterprise costs.

When monetary management solutions embrace danger and compliance management, corporations can leverage these capabilities past audit trails and error checks to include the segregation of duties and mapping of roles to responsibilities across the enterprise. Contractors ought to consider using non-public firm accounting alternate options to simplify their financial reporting and scale back their expenses. But if you’re contemplating a quantity of of these choices, consult your CPA to evaluate the potential impact on mortgage covenants and other enterprise relationships. Also, run it by your lenders and surety to make sure an alternative accounting method is acceptable to them. Personal bankruptcy additionally may be an option, though its penalties are long-lasting and far-reaching.

But, for some contractors, the limited value doesn’t justify the extra cost and complexity. Recognizing this, the FASB’s parent organization, the Financial Accounting Foundation, established the Private Company Council in 2012. The PCC’s mission is to advocate exceptions or modifications to GAAP that respond to the wants of private firms. So, each individual should give attention to this key areas while debt planning and debt discount. Also, they'll also take help from consultants and different experts in these fields. The next thing to be accomplished is to start out making fee based on your plans and commitments and don’t deviate from your objectives.

Mounted Vs Variable Value

An example of a semi-variable cost may be the electricity bill for your corporation. When it’s time to chop prices, variable bills are the first place you flip. The lower your total variable price, the much less it costs you to supply your services or products.

The extra oil changes you’re able to do, the much less your average fastened prices will be. This will assist you to determine how much your corporation must pay for every unit before you factor in your variable costs for each unit produced. If you add up everything you spent over the course of the month, it equals $4,000 in whole costs. Then think about all the tacos you offered throughout the month — 1,000 tacos. Each taco prices $3 to make when you suppose about what you spend on taco meat, shells, and vegetables. One method is to easily tally all of your mounted costs, add them up, and you've got your total fixed prices.

If you sell extra widgets, you’ll want to buy more widget elements, and so the variable cost of uncooked materials increases. I additionally just like the burn rate as a substitute of mounted prices as an excellent quantity to make use of in a break-even analysis. In classic monetary projections, the sort they nonetheless educate in monetary evaluation courses in enterprise college, you’d use your mounted prices to calculate your break-even point.

7 1 Introduction To Budgeting And Budgeting Processes

Everyone is entering knowledge constantly and using the identical processes, so all adjustments are tracked. IBM Planning Analytics guided demo Take the 10-minute demo and get hands-on expertise with IBM Planning Analytics by constructing a revenue plan. Planning is simpler and simpler when practitioners follow well-established greatest practices. Software solutions that help these practices can improve the timeliness and reliability of knowledge and enhance participation by key individuals throughout the organization; especially those on the entrance strains.

The scope and variety of operations in a corporation make complete financial planning important for good decisionmaking. It signifies how a lot room the federal government has for added debt before it reaches its legal limit. The point of a legal debt margin is to limit a authorities from taking up new debt previous a limit that lawmakers imagine is prudent. Short-term and long-term debt balances are presented on the Statement of Net Position for Governmental and Business-Type Activities.

Balance ahead amounts aren't created till the shut process is complete. Processing choices allow you to specify the default processing for reviews. Set knowledge selection and data sequence for Simple Income Statement. You can use any of the standard templates that are supplied with the JD Edwards EnterpriseOne General Accounting system. A report template contains a fixed format on your knowledge and predefines the number of columns, their order, and their headings. A cash administration plan to maximize the cash resources out there to the University.

Coupled with scheduling reports described in Chapter 10, these reviews present a snapshot view of how a project is doing. Of course, these schedule and cost reports must be tempered by the precise accomplishments and issues occurring in the subject. For instance, if work already completed is of sub-standard quality, these reports would not reveal such an issue. Even although the reports indicated a project on time and on price range, the risk of re-work or insufficient facility performance due to quality problems would rapidly reverse that rosy scenario.

Accounting

Fathom combines insightful reporting, fast cash flow forecasting and actionable monetary insights into one refreshingly straightforward enterprise management resolution. We, at KIP present our accounting providers with the help of advance expertise along with using advance accounting software program corresponding to Tally, Quickbook, Ms- Excell and so on. The Statement of Cash Flow Report is a monthly snapshot of influx and outflow of cash. As a consolidated report listing all the money coming in every month and what's being spent, it offers a big picture of overall cash position.

We're here that can help you resolve your tax issues and put an finish to the distress that the IRS can put you through. We will happily offer you a free consultation to discover out how we can best serve you. • Visibility into the channel pipeline to allow mangers to assess the potential revenue at each part of the gross sales cycle. • Aggregate stories throughout territories, groups, and various reseller channels.

A day by day, weekly, and month-to-month monetary report assist talk the ongoing narrative of your company's economic processes, methods, initiatives, and progress. As you probably can see, these forms of an analytical report in the finance business are an undeniably potent tool for making certain your company’s inside as properly as exterior monetary actions are fluent, buoyant, and ever-evolving. Excel tables are extremely highly effective and important for any accountant, and so are Lexware and Infor. Yet, they lack data visualization that would really make sense and help get the entire understanding of the balance sheet and revenue statement they hold in retailer. In general, a well-implemented accounting reporting system makes it easier to access the monetary statements you need, whenever you need them. Accounting reports are periodic statements that current the monetary status of an organization at a sure point in time, or over a stated time-period.

Typically, the outline of the finances is put into place in the beginning of the 12 months with the help of the client’s monetary planner. Plumb Family Office Accounting tracks towards Expense categories and sums up the over/under variance. By having this family finances report it allows for extra environment friendly meetings with financial planning and focuses on year-to-date modifications. Forecasting – Experts predict future outcomes primarily based on previous events and administration perception. We prove out your financial institution balance every month and advise you of any bank costs, bank errors, or arithmetic errors in your half so you understand exactly how a lot money is out there for spending. To maintain the entity compliant always in accordance with particular jurisdictional bookkeeping necessities.

Prime Consulting Companies On The Earth For Thought Management

The opportunity to make a tangible difference is a typical purpose folks choose to turn into consultants. Whatever field you enter, you could have a chance as a advisor to enact meaningful change not only for a single employer, however throughout multiple organizations—and all of the lives they affect. There are many choices and alternatives throughout the management consulting subject for individuals who are passionate and devoted to pursuing this profession path.

Additionally, it could possibly reduce the consultant’s value and guarantee flexibility. Once the enterprise consultant has developed an in-depth understanding of your company, they enter the analysis section, with the goal to establish where change is required. This section contains figuring out your company’s strengths and weaknesses as properly as present and foreseeable issues.

We've built a status for delivering real impression for our clients — from the world’s largest firms to startups to nonprofits. Explore our insights on management, board and governance issues, organizational culture and more. The second degree tends to be generally identified as the precise administration marketing consultant stage. My firm requires an undergraduate degree and 4 years of consulting experience or a graduate diploma and two years of consulting experience for this administration consulting level. Recently he has studied administration schooling and consulting in a number of growing countries. His present research and educating give attention to the method of efficient consulting.

Defense Finance And Accounting Service

An inventory is necessary to clearly present revenue when the production, buy, or sale of merchandise is an income-producing issue. If you have to account for a list in your business, you have to use an accrual technique of accounting for your purchases and gross sales. A company that fails to fulfill the operate test or the possession take a look at is not treated as a professional PSC for any part of that tax yr. Most individuals and many small businesses use the cash methodology of accounting.

There are many user-friendly accounting software choices for small businesses, starting from free to paid models. You also can browse the Shopify App store for an accounting software program that will seamlessly combine with your ecommerce store. You need your accounting software to simply combine along with your ecommerce platform, in addition to third-party tools like contract management and more.

But in case you have a Limited Liability Company, you’ll pay self-employment taxes and no company taxes. Again, this all depends on how you structured your small business. You’ll want one that gives advanced stories, such stock and expenses, so you can monitor monetary well being quickly.

E desires to make a bit 444 election to adopt a September 30 tax 12 months. E's deferral interval for the tax year beginning December 1 is three months, the variety of months between September 30 and December 31. This is the tax 12 months instantly previous the yr for which the partnership, S company, or PSC needs to make the section 444 election. Generally, partnerships, S companies , and PSCs should use a required tax year. A required tax year is a tax 12 months that is required under the Internal Revenue Code and Treasury Regulations. The entity does not have to make use of the required tax 12 months if it receives IRS approval to make use of another permitted tax 12 months or makes an election under part 444 of the Internal Revenue Code .

The Four Fundamental Forms Of Financial Statements

Cash move from financing activities contains payments on outstanding mortgage balances or receipts from new loans or bonds. Payments of dividends to shareholders and inventory repurchases are recorded as cash outflows. A cash flow statement summarizes the cash and money equivalents that come into and go out of a company's business operations. While income are important, an organization needs cash to pay its payments. The money circulate statement offers traders a view of how financially strong a company is, and it exhibits creditors how much money the enterprise has available to pay its debts and fund its operations.

This contrasts with the balance sheet, which represents a single moment in time. The Multi-Step revenue assertion takes several steps to search out the bottom line, beginning with the gross revenue. To create an earnings assertion for your small business, you’ll need to print out a regular trial balance report.

會計師事務所 is balanced, as proven on the stability sheet, because complete property equal $29,965 as do the entire liabilities and stockholders’ fairness. An revenue statement shows the organization’s financial performance for a given time frame. When making ready an revenue assertion, revenues will at all times come earlier than expenses within the presentation.

Virtual Bookkeeping Services

Clients shall be loyal to you should you show you sincerely wish to understand their businesses and help them meet their goals. Some CPAs who need only to be seen as professional could also be so restrained that they come throughout as cold, medical or uninterested. After you have been training for a couple of year, you will begin to see that comparatively few purchasers generate most of your revenue. Conversely, a small percentage of your clients take up most of your staff’s time.

Evangelista’s firm now enjoys a cushty six-figure income that has been rising 25% annually. In 1999 Evangelista employed his first full-time entry-level staff skilled and reorganized the administrative aspect of the enterprise. It may shock you that so much of my advice facilities on persona and constructing relationships. The most spectacular successes I know of have been firms began by CPAs who developed close relationships with their purchasers, to whom they often have been business advisers in addition to pals.

Working on behalf of people, couples, families, physicians and businesses, our distinctive team creates and manages customized monetary, funding and retirement plans. We offer all the delicate companies you’d anticipate from a top tier CPA firm — but it’s our dedication to service that units us aside. We consider better relationships produce better results, and we train our staff to create outstanding, results-oriented relationships with clients and one another. Schenck is a full-service regional accounting and consulting firm.

1 note

·

View note