#virgin galactic holdings inc

Text

#virgin galactic holdings inc#virgin group#Sir Richard Branson#richard branson#space#flight#commercial#plane#airplane

1 note

·

View note

Text

GEO: Conquête spatiale : l'espace est-il une zone de non-droit ?

GEO: Conquête spatiale : l'espace est-il une zone de non-droit ?.

https://www.geo.fr/environnement/conquete-spatiale-lespace-est-il-une-zone-de-non-droit-212741

Nous n'en sommes pas à la conquête mais à l'exploration en vue d'exploitation, principalement minérales, des ressources spaciales.

Le droit spacial semble hors de portée pour l'instant, on peut espérer voir des jurisprudences internationales s'instaurer à fur et à mesure de la progression de l'exploration.

L'intervention d'agences privées sous la primature d'agences nationales d'Etat vise à démultiplier l'effort d'exploration en vue des exploitations futures et à venir !

#nature#news#history#economy#humankind#united states#space x#elon musk#jeff bezos#blue origin#virgin galactic holdings inc#richard branson#conquest#space exploration#exploitation#mineral ressources#waters#space rules

0 notes

Text

Virgin Galactic llega al espacio luego de un debut comercial que se gestó por dos años

Virgin Galactic Holdings Inc. envió por primera vez a clientes de pago al borde del espacio, un hito para la empresa fundada por Richard Branson que lleva casi dos décadas gestándose.

La nave VSS Unity llegó al espacio alrededor de las 9:30 a.m. hora local en Nuevo México, reveló Virgin Galactic en una transmisión en vivo del evento en su sitio web el jueves. Eso fue aproximadamente una hora…

View On WordPress

0 notes

Text

Virgin Galactic Soars with Record Revenue but Fails to Break Even in Q1 2024 $SPCE #NYSE

Company Focuses on Future Growth Despite Financial SetbackVirgin Galactic Holdings Inc. recently announced its financial results for the first quarter of 2024, revealing a significant revenue improvement of 406.378% year on year to $1.99 million. However, the company also reported a net deficit of $-102.012 million for the quarter, compared to a deficit of $-159.385 million in the same quarter of the previous year. Despite the losses, Virgin Galactic remains focused on executing its Delta Class program and has taken steps to attract and retain top ta

0 notes

Text

8 Stocks to Invest in the Future of Space Exploration

Space, often referred to as the “great unknown” or the “final frontier,” has long captivated humanity’s imagination and ambition. The allure of exploring beyond our earthly confines has propelled us to remarkable achievements. The narrative of space exploration is dotted with significant milestones, including the United States’ Apollo 11 mission, which marked the first human footsteps on the moon in 1969, and the Soviet Union’s pioneering achievement of sending the first man into space. Nations worldwide have contributed to this ongoing saga through various soft landings on celestial bodies, showcasing our collective quest to reach further into the cosmos.

The most recent chapter in this epic journey was written by Houston-based Intuitive Machines, Inc. (NASDAQ: LUNR). In February 2024, their Nova C Odysseus lunar lander embarked on its voyage aboard a SpaceX Falcon 9 rocket from NASA’s Kennedy Space Center in Florida. The mission initially reported success but later encountered difficulties that obscured its triumphant narrative, highlighting the unpredictable nature of space ventures.

These endeavors into space are not just scientific quests but also present high-risk, high-reward opportunities for investors. Exploration companies are at the forefront of pushing technological boundaries, offering a unique investment avenue that intertwines financial prospects with the human spirit of discovery.

Investing In Space Through Different Verticals

Investing in space exploration involves understanding the diverse landscape of companies contributing to this sector’s growth. Let’s delve deeper into the capabilities and visions of the companies leading the way in other-worldly exploration. Each entity not only represents a unique investment opportunity but also plays a pivotal role in humanity’s quest to explore, understand, and utilize space.

AST SpaceMobile, Inc. (NASDAQ: ASTS)

AST SpaceMobile aims to revolutionize global connectivity by deploying the first space-based cellular broadband network, directly accessible by standard smartphones. Their proprietary technology promises to eliminate the need for terrestrial cell towers in remote and underserved areas, potentially connecting billions more people to high-speed internet. With strategic partnerships with mobile network operators around the world, AST SpaceMobile’s vision extends beyond connectivity; it’s about fostering global economic inclusion and emergency communication capabilities.

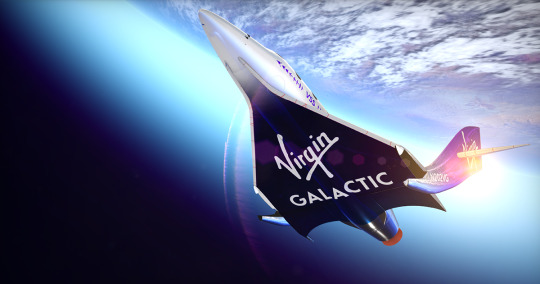

Virgin Galactic Holdings, Inc. (NYSE: SPCE)

Virgin Galactic is pioneering the space tourism sector by developing spacecraft that provide civilians the opportunity to experience space. Their spaceflight system consists of a carrier aircraft and a spaceship, designed to offer passengers a few minutes of weightlessness and stunning views of Earth from the edge of space. Beyond tourism, Virgin Galactic is exploring opportunities for space science research and satellite deployment, diversifying its potential impact and revenue streams in the space industry.

Intuitive Machines, Inc. (NASDAQ: LUNR)

Intuitive Machines is at the forefront of lunar exploration, aiming to provide commercial lunar payload delivery services. Their Nova C landers are designed to carry payloads to the Moon for NASA, commercial customers, and international partners. Despite the setbacks faced by the Odysseus mission, their technological advancements in propulsion, navigation, and landing systems position them as a key player in enabling sustainable lunar exploration and utilization, including mining, in-situ resource utilization, and lunar base construction.

Terran Orbital Corporation (NYSE: LLAP)

Terran Orbital specializes in satellite technology, offering end-to-end solutions that cover the design, manufacture, and operation of small satellites. Their expertise supports a wide range of applications, from Earth observation and satellite communications to national security and scientific research. With a focus on innovation and reliability, Terran Orbital is enabling smaller, more affordable satellites to play a crucial role in addressing global challenges, monitoring climate change, and enhancing global communication networks.

Rocket Lab USA, Inc. (NASDAQ: RKLB)

Rocket Lab has established itself as a leader in small satellite launch services with its Electron rocket, and is expanding its capabilities with the development of the Neutron rocket aimed at larger payloads. Their launch frequency, flexibility, and reliability cater to the growing demand for satellite deployment, space research, and interplanetary missions. Rocket Lab also ventures into satellite design, manufacture, and space systems, providing comprehensive solutions for the rapidly evolving space sector.

Telesat Corporation (NASDAQ: TSAT)

Telesat is deploying a state-of-the-art global low-Earth orbit (LEO) satellite network, Telesat Lightspeed, aiming to deliver fiber-like internet across the globe. This network is designed to serve the unmet needs of remote and rural communities, maritime and aeronautical markets, and government operations, offering low-latency, high-capacity connectivity. With a legacy in satellite communications, Telesat’s advancements signify a transformative step towards global digital inclusion and enhanced connectivity for critical services.

Boeing Company (NYSE: BA)

Boeing’s space exploration initiatives span a wide array of activities, including the design and manufacture of advanced spacecraft, satellites, and space systems. Their involvement in the International Space Station, the development of the CST-100 Starliner commercial crew vehicle, and contributions to the Space Launch System for NASA underscore Boeing’s integral role in both manned and unmanned space missions. Boeing’s commitment to innovation drives the future of space travel, satellite technology, and deep-space exploration.

Lockheed Martin Corporation (NYSE: LMT)

Lockheed Martin’s extensive contributions to space exploration encompass satellite technology, human spaceflight, and planetary exploration. Their work on the Orion spacecraft for NASA’s Artemis program to return humans to the Moon, development of interplanetary spacecraft, and leadership in satellite technology for communications, weather monitoring, and national security applications underscore Lockheed Martin’s comprehensive capabilities in advancing our presence in and understanding of space.

Conclusion

Investing in space exploration offers a unique frontier for those looking to diversify their portfolios with high-risk, high-reward opportunities. The companies listed above represent just a glimpse into the myriad ways investors can engage with the space sector, from satellite communications and tourism to lunar exploration and beyond.

However, it’s crucial to recognize that space investing is not for everyone. The inherent risks, including technological challenges, regulatory hurdles, and the long timelines for realizing potential returns, necessitate a careful assessment of one’s risk tolerance and investment horizon.

For those drawn to the promise of the final frontier, investing in space exploration can be more than a financial decision—it can be a participation in humanity’s grandest adventure, pushing the boundaries of what is possible and contributing to our collective journey into the cosmos.

Disclosure: No position. Spotlight Growth has no relationships with any of the companies mentioned in this article and did not receive payment in any form for its creation. This is an opinion article and is not meant to be financial advise. We are not broker-dealers or investment professionals. Please conduct your own due diligence. For more information on our disclosures, please visit: https://spotlightgrowth.com/disclosures/

0 notes

Link

Los Angeles CA (SPX) Dec 21, 2023 Virgin Galactic Holdings, Inc. (NYSE:SPCE) has officially announced the opening of its 'Galactic 06' flight window on January 26, 2024. This mission will mark the company's 11th spaceflight, following a year of remarkable achievements in human spaceflight, including six suborbital missions in just six months. The upcoming 'Galactic 06' flight is set to continue Virgin Galactic's pioneering

0 notes

Text

Virgin Galactic Holdings Inc. SPCE stock price fell 15% in October and hit a fresh low. It displayed a bearish pattern and continued the downfall by forming a lower low.

Virgin Galactic stock price is in a strong downtrend and trading far away from the downward-sloping EMAs. However, the short sellers are continuously selling from the higher levels so it increases the risk of the squeeze.

In mid-August, SPCE stock price broke the crucial support of $3.00. It triggered the negative sentiment and invited further fall.

Virgin Galactic stock price formed a double-top bearish pattern. Later, the price broke down the neckline support which triggered the next phase of decline.

The price behavior of the SPCE share is quite volatile and speculators are active. So, the short sellers must remain careful before building fresh shorts.

Previously, buyers tried multiple times to push the price above the 50-day EMA. However, due to the strong presence of sellers, the price kept on facing rejection.

Virgin Galactic stock price closed the previous session at $1.53 with an intraday decline of -8.93%.

SPCE Stock Price Analysis: Beware of Short Squeeze

SPCE stock price is inside the bears’ grip and no signs of recovery are visible. The sellers are more active as compared to buyers. Therefore, any short-term upmove will not be reliable and might face difficulty in sustaining the higher levels.

Till Virgin Galactic stock price trades below $3.00, it is expected to remain in the bears’ grip. The analysis suggests a short squeeze might trigger to clear out the shorts’ positions. But the up move will be temporary and the price will again revert down.

Virgin Galactic Stock: Bearish Momentum Might Continue

Virgin Galactic stock is bearish on a multiple timeframe chart. The financials of the company are not upto the mark and unable to generate profit for the last five years. So, investors seem to have taken an exit from higher levels.

Technical indicators like MACD are below the zero line indicating that bearish momentum might continue for some time. The RSI at 28 denotes weakness and is near the oversold territory. So, it increases the probability of a squeeze.

Conclusion

Virgin Galactic Holdings Inc. SPCE stock price fell 15% in October and dropped below $2.00. It has corrected a lot in the last two months but still no signs of recovery are visible.

The analysis suggests Virgin Galactic stock price is inside the bears’ grip so investors should avoid creating any positions.

Technical Levels

Resistance Levels: $2.12 and $3.07

Support Levels: $1.50 and $1.00

0 notes

Text

⚠ 10 stocks to stay away from 🚫

📝 Do your research and make strategic decisions intelligently. Some stocks are riskier than others. Stay away from these:

❎ GameStop Corp. (GME)

❎ AMC Entertainment Holdings Inc. (AMC)

❎ Tesla Inc. (TSLA)

❎ Nikola Corp. (NKLA)

❎ Virgin Galactic Holdings Inc. (SPCE)

❎ Palantir Technologies Inc. (PLTR)

❎ Coinbase Global Inc. (COIN)

❎ Moderna Inc. (MRNA)

❎ Beyond Meat Inc. (BYND)

❎ Zoom Video Communications Inc. (ZM)

🌟 Embark on a journey of discovery and growth! Join us for captivating content that ignites your curiosity.

Explore more at 👉👀

Download the mobile app👉📲

Connect at 📱 +91 8750000121

🤝Here's to your success, may your trades be prosperous and your investments bloom! We wish you a happy 'ZERO BROKERAGE' trading.🚀🌷

⚠ 📜 Note.-Investments in the securities market are subject to market risks, read all related documents carefully before investing.

⚠ 📜 Note.-Brokerage will not exceed the rates specified by SEBI and the Exchanges.

#branding#investing#equity#mutual funds#commodity#nifty#nifty50#trading stocks#trading view#avoidance#trading strategies#algo trading#day trading#futures trading#options trading#stock market#stocktrading#investing stocks#people#comments#like#tradelikeapro#thank you

0 notes

Text

Virgin Orbit Holdings non ce l’ha fatta

La società di lancio di satelliti legata al miliardario britannico Richard Branson, sta cessando le operazioni a tempo indeterminato, soccombendo alle crescenti pressioni sulla crisi di cassa.

La società ha dichiarato giovedì che sta tagliando 675 posti di lavoro, ovvero circa l’85% della sua forza lavoro, «al fine di ridurre le spese alla luce dell’incapacità dell’azienda di garantire finanziamenti significativi». Un portavoce di Virgin Orbit ha affermato che il restante 15% dei dipendenti lavorerà alla liquidazione dell’attività.

Fallita la ricerca di capitale

Virgin Orbit aveva già temporaneamente sospeso le operazioni all’inizio di questo mese mentre cercava capitale aggiuntivo. L’azienda - parte dell’impero di Branson che comprende la compagnia aerea Virgin Atlantic e la compagnia di voli spaziali Virgin Galactic Holdings Inc. - non ha realizzato profitti da quando è stata quotata.

Le azioni Virgin Orbit sono scese del 50% nelle nel premercato di New York a New York alle 4.30 di venerdì ora locale, scambiate a soli 17 centesimi ciascuna. Le azioni valevano più di 7 dollari un anno fa. Gli oneri per la dismissione ammonteranno a circa 15 milioni di dollari, costituiti principalmente da 8,8 milioni in indennità di licenziamento e benefici per i dipendenti e 6,5 milioni in altri costi come i servizi di outplacement, ha affermato Virgin Orbit nel deposito.

Solo due settimane fa, la società ha approvato un piano di liquidazione per i dirigenti di alto livello, con l’amministratore delegato Daniel Hart pronto a riscuotere un compenso pari al doppio del suo compenso base.

10,9 milioni di dollari per le indennità di licenziamento e altre spese

Branson ha iniettato 10,9 milioni di dollari acquistando una nota convertibile in azioni tramite la sua Virgin Investments Ltd., consentendo all’azienda fallita di finanziare l’indennità di licenziamento e altri costi, ha affermato Virgin Orbit nel deposito.

La società con sede a Long Beach, in California, è una delle numerose startup legate allo spazio con valutazioni un tempo elevate che hanno visto le loro azioni precipitare mentre gli investitori si allontanano da modelli di business non testati e operazioni in perdita. Altri esempi sono Astra Space, che ha riferito giovedì che le sue riserve in contanti sono diminuite del 32% nel trimestre conclusosi il 31 dicembre, e Rocket Lab USA, che ha dichiarato il mese scorso che si aspetta che la sua perdita trimestrale sia tre volte maggiore di quanto previsto dagli analisti.

Virgin Orbit sta ancora cercando di vendere tutta o parte della sua attività, secondo una persona a conoscenza della questione. Quelle discussioni per una possibile transazione non includono Matthew Brown, un investitore di capitale di rischio poco conosciuto con sede in Texas che aveva detto di essere interessato a un accordo all’inizio di questo mese, ha detto una fonte anonima.

Brown si era presentato come un possibile salvatore di un business che valeva miliardi solo un anno fa. Ma il suo accordo di finanziamento è fallito durante il fine settimana, secondo quanto riferito dalla CNBC il 27 marzo.

La storia

Virgin Orbit è stata fondata nel 2017 come propaggine di Virgin Galactic; la quotazione risale al 2021. L’attività di Virgin Orbit era incentrata sul lancio in orbita di piccoli satelliti, distinta da Virgin Galactic che si occupa dell’invio di esseri umani nello spazio.

Read the full article

0 notes

Photo

The ‘King of SPACs’ Makes an Ominous Move Venture capitalist Chamath Palihapitiya pumps the brakes on blank-check companies. One financial frenzy seems to have died down. Special-purpose-acquisition vehicles, or SPACs, had been seen as the streamlined answer to the administrative morass that is a standard initial public offering. SPACs are no longer trendy. And it's their king who has so decreed. Star venture-capital investor Chamath Palihapitiya, an early executive at Facebook (META) - Get Meta Platforms Inc. Report, almost three years ago helped make SPACs the buzzword in business circles. On Oct. 29, 2019, Sir Richard Branson's space tourism company, Virgin Galactic (SPCE) - Get Virgin Galactic Holdings, Inc. Report, made a grand entrance on Wall Street after merging with Palihapitiya’s venture, Social Capital Hedosophia. A SPAC, also known as a blank-check company, raises money to acquire an existing business and take it public. The hardest part is finding the https://fancyhints.com/the-king-of-spacs-makes-an-ominous-move/?utm_source=tumblr&utm_medium=social&utm_campaign=ReviveOldPost

0 notes

Text

Virgin Galactic shareholders have suffered a 66% loss from investing in it a year ago. Soon to be penny stock?

The nature of investing is that you win some, and you lose some. Anyone who held Virgin Galactic Holdings, Inc. (NYSE:SPCE) over the last year knows what a loser feels like. To wit the share price is down 66% in that time.

Shareholders have lost 9% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges.

In just one year Virgin Galactic Holdings saw its revenue fall by 50%. That’s not what investors generally want to see. The share price drop is understandable given the company doesn’t have profits to boast of.

What does this mean to Virgin Galactic, as its small fleet of space planes sits stubbornly, silently stuck to the tarmac down at Spaceport America in New Mexico?

As companies like Blue Origin launch tourists regularly to the edge of space, and SpaceX sends tourists on orbital trips round the Earth, Virgin Galactic's once groundbreaking "space tourism" business looks increasingly obsolete.

Stock price keeps on falling on weekly basis.

0 notes

Text

Sub-orbital Transportation and Space Tourism Market Forecast Report | Global Analysis, Statistics, Revenue, Demand and Trend Analysis Research Report by 2028

The report studies the factors influencing the growth of the industry in the global Sub-orbital Transportation and Space Tourism market and offers accurate predictions about the growth pattern. The report pays special attention to the key elements of the Sub-orbital Transportation and Space Tourism market, such as drivers, restraints, opportunities, threats, risks, limitations, and other aspects. The report covers a comprehensive analysis of the competitive landscape with a detailed analysis of the company profiles, product portfolio, and business expansion strategies.

The global sub-orbital transportation and space tourism market size reached USD 423.7 million in 2020 and is expected to register a revenue CAGR of 16.8%, during the forecast period, according to latest analysis by Emergen Research. Some of the major factors driving global sub-orbital transportation and space tourism market revenue growth include increased focus on space explorations and private initiatives to facilitate space transportation. Increasing focus on launching high-altitude balloons for space tourism, as well as astronomy among a number of enthusiasts is expected to propel revenue growth of the global sub-orbital transportation and space tourism market between 2021 and 2028.

High-altitude balloons sent into the stratosphere could achieve a nominal height of 30 kilometers and are often loaded with hydrogen and helium. Balloons are categorized depending on desired use such as research balloons and weather balloons. Research balloons are used for a wide range of purposes, including Earth observation, monitoring, and communications. Weather balloons are being used for forecasts, disaster alerts, and other related applications.

Click the link to get info@ https://www.emergenresearch.com/industry-report/sub-orbital-transportation-and-space-tourism-market

Highlights From The Report.

Sub-orbital reusable vehicles segment is expected to expand at a substantially rapid revenue CAGR during the forecast period due to increasing demand for such vehicles for sub-orbital transportation and space tourism. Rocket-powered vehicles are known as sub-orbital reusable vehicles. Launching profiles of such vehicles vary from vertical takeoff and landings and horizontal launched wings vehicles.

Cargo delivery segment is expected to register a significantly steady revenue growth rate over the forecast period as it is considered the primary goal of space transportation.

North America is expected to register a larger revenue growth rate in the sub-orbital transportation and space tourism market over the forecast period due to robust presence of major market players, including Blue Origin, LLC, Space Exploration Technologies Corp., and Virgin Galactic Holdings Inc., among others in developed countries in the region.

Geographical Segmentation:

The latest research report entails an in-depth analysis of the current growth opportunities for various regions of the Sub-orbital Transportation and Space Tourism market, gauging their revenue share over the forecast timeline. Furthermore, the report analysis the year-on-year growth rate of these regions over the forecast duration. The leading market regions profiled in the report are North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Some major companies operating in the market include Near Space Corporation, Blue Origin, LLC, Exos Aerospace Systems & Technologies, Inc., Aerostar International, Inc., Space Exploration Technologies Corp. (SpaceX), UP Aerospace, Inc., PD AeroSpace, LTD., Space Perspective Inc., Zero 2 Infinity SL, and Virgin Galactic Holdings Inc.

Emergen Research has segmented global sub-orbital transportation and space tourism on the basis of vehicle, application, end-use, and region:

Vehicle Outlook (Revenue, USD Million; 2018–2028)

High-Altitude Balloons

Sub-Orbital Reusable Vehicles

Parabolic Flights

Application Outlook (Revenue, USD Million; 2018–2028)

Space Tourism

Cargo Delivery

Satellite Deployment

Remote Sensing & Earth Observation

Others

End-Use Outlook (Revenue, USD Million; 2018–2028)

Government

Aerospace & Defense

Commercial

Key takeaways of the Global Sub-orbital Transportation and Space Tourism Market report:

The report sheds light on the fundamental Sub-orbital Transportation and Space Tourism market drivers, restraints, opportunities, threats, and challenges.

It elaborates on the new, promising arenas in the leading Sub-orbital Transportation and Space Tourism market regions.

It examines the latest research & development projects and technological innovations taking place in the key regional segments.

The research report reviews the regulatory framework for creating new opportunities in various regions of the Sub-orbital Transportation and Space Tourism market

It focuses on the new revenue streams for the players in the emerging markets.

Furthermore, the report offers vital details about the rising revenue shares and the sizes of the key product segments.

Take a Look at our Related Reports:

healthcare it market

https://www.google.ba/url?q=https://www.emergenresearch.com/industry-report/healthcare-it-market

coal tar market

https://www.google.ba/url?q=https://www.emergenresearch.com/industry-report/coal-tar-market

ir spectroscopy market

https://www.google.ba/url?q=https://www.emergenresearch.com/industry-report/ir-spectroscopy-market

eubiotics market

https://www.google.ba/url?q=https://www.emergenresearch.com/industry-report/eubiotics-market

nanotechnology market

https://www.google.ba/url?q=https://www.emergenresearch.com/industry-report/nanotechnology-market

ed-tech and smart classroom market

https://www.google.ba/url?q=https://www.emergenresearch.com/industry-report/ed-tech-and-smart-classroom-market

digital payment market

https://www.google.ba/url?q=https://www.emergenresearch.com/industry-report/digital-payment-market

signal conditioning modules market

https://www.google.ba/url?q=https://www.emergenresearch.com/industry-report/signal-conditioning-modules-market

advanced driver assistance system market

https://www.google.ba/url?q=https://www.emergenresearch.com/industry-report/advanced-driver-assistance-system-market

micro displays market

https://www.google.ba/url?q=https://www.emergenresearch.com/industry-report/micro-displays-market

About Us:

At Emergen Research, we believe in advancing with technology. We are a growing market research and strategy consulting company with an exhaustive knowledge base of cutting-edge and potentially market-disrupting technologies that are predicted to become more prevalent in the coming decade.

Contact Us:

Eric Lee

Corporate Sales Specialist

Emergen Research | Web: www.emergenresearch.com

Direct Line: +1 (604) 757-9756

E-mail: [email protected]

Visit for More Insights: https://www.emergenresearch.com/insights

Explore Our Custom Intelligence services | Growth Consulting Services

0 notes

Text

Virgin Galactic Holdings Inc. Sees Strong Share Price Gains, Improved Financial Performance https://csimarket.com/stocks/news.php?code=SPCE&date=2024-02-28143333&utm_source=dlvr.it&utm_medium=tumblr

0 notes

Text

Lowe's, Virgin Galactic and more

Lowe’s, Virgin Galactic and more

At Lowe’s hardware store in Philadelphia.

Mark Makela | Reuters

Here are the stocks making the biggest moves midday:

Lowe’s – Shares of the home improvement retailer added 3.5% after the company reported quarterly results that beat top- and bottom-line estimates. Lowe’s also issued upbeat full-year guidance, citing continued demand for tools and building materials.

Tupperware Brands – The stock…

View On WordPress

#Breaking News: Markets#business news#Cadence Design Systems Inc.#Caesars Entertainment Inc.#Earnings#Investment strategy#Lowe&039;s Companies Inc.#Markets#Palo Alto Networks Inc.#Tenneco Inc.#TJX Companies Inc#Tupperware Brands Corp.#Virgin Galactic Holdings Inc.

1 note

·

View note

Photo

"Virgin Galactic mag weer vliegen na FAA-onderzoek | " is toegevoegd aan onze site. Bezoek voor details. https://watinfo.nl/2021/09/30/virgin-galactic-mag-weer-vliegen-na-faa-onderzoek/

#virgin galactic holdings inc space#virgin galactic#virgin galactic investing#virgin galactic 22#virgin galactic ceo

0 notes