#vp of data

Explore tagged Tumblr posts

Note

Is the age difference between Trump and Vance the biggest between a potus and veep? And have there been many vps older than the presidents they served under?

Good questions!

Yes, the age difference between Donald Trump and JD Vance is the largest between any President and Vice President in American history, and by a pretty big margin. And while it would seem that most Presidents would choose a younger running mate, that's not really the case and it's been about even throughout history: 28 Presidents were older than their Vice Presidents and 24 Vice Presidents were the older side of the duo.

Here's the list of biggest age differences between Presidents who were OLDER than their Vice Presidents: 38 years, 49 days: Trump/Vance 29 years, 273 days: Buchanan/Breckinridge 22 years, 237 days: G.H.W. Bush/Quayle 22 years, 87 days: Eisenhower/Nixon 21 years, 334 days: Biden/Harris 17 years, 48 days: W.H. Harrison/Tyler 16 years, 54 days: Monroe/Tompkins 15 years, 271 days: McKinley/T. Roosevelt 15 years, 265 days: Jackson/Van Buren 15 years, 44 days: Taylor/Fillmore 15 years, 3 days: Jackson/Calhoun 14 years, 250 days: J.Q. Adams/Calhoun 13 years, 126 days: Reagan/G.H.W. Bush 12 years, 358 days: Trump/Pence 12 years, 299 days: Jefferson/Burr 7 years, 165 days: J. Adams/Jefferson 6 years, 250 days: F. Roosevelt/Wallace 6 years, 244 days: Harding/Coolidge 5 years, 304 days: Nixon/Agnew 3 years, 250 days: Washington/J. Adams 3 years, 96 days: Carter/Mondale 2 years, 273 days: L. Johnson/Humphrey 2 years, 98 days: F. Roosevelt/Truman 1 year, 224 days: Clinton/Gore 1 year, 125 days: McKinley/Hobart 330 days: Grant/Colfax 196 days: Lincoln/Hamlin 186 days: Nixon/Ford

And here is the list of biggest age differences between Presidents who were YOUNGER than their Vice Presidents: -18 years, 257 days: Obama/Biden -18 years, 230 days: Pierce/King -17 years, 192 days: Cleveland/Hendricks -14 years, 197 days: Hoover/Curtis -13 years, 69 days: F. Roosevelt/Garner -11 years, 233 days: Madison/G. Clinton -10 years, 70 days: Grant/H. Wilson -8 years, 275 days: Kennedy/L. Johnson -7 years, 96 days: B. Harrison/Morton -6 years, 311 days: Coolidge/Dawes -6 years, 242 days: Madison/Gerry -6 years, 169 days: T. Roosevelt/Fairbanks -6 years, 165 days: Truman/Barkley -5 years, 157 days: G.W. Bush/Cheney -5 years, 6 days: Ford/Rockefeller -3 years, 261 days: Jefferson/G. Clinton -3 years, 115 days: Polk/Dallas -3 years, 96 days: Hayes/Wheeler -2 years, 290 days: Wilson/Marshall -2 years, 49 days: Van Buren/R. Johnson -2 years, 45 days: Garfield/Arthur -1 year, 326 days: Taft/Sherman -1 year, 146 days: Cleveland/Stevenson -45 days: Lincoln/A. Johnson

#Presidents#Vice Presidents#Presidency#Vice Presidency#History#POTUS Stats#POTUS Data#Presidential Statistics#Presidential Data#Presidential Stats#VP Stats#VP Data#History Stats#History Data#POTUS Almanac#Presidential Inaugurations#Age at Inauguration#Presidential History#Donald Trump#President Trump#JD Vance#Vice President Vance

29 notes

·

View notes

Text

[chanting]: Walz Walz Walz Walz

#lmao it doesn't actually matter it's fine#But it is (according to Reuters who I trust to not beef this) down to him and Shapiro#And while I think Shaprio is not as bad as he is being made out to be (the worst of some pretty good choices)#I would absolutely love to have Walz over him on account of Walz' history as a teacher and lover of data visualization#Particularly cause the VP more or less just does some sort of extra credit project unless the president kicks it#And he's got the right background and disposition to do a very useful and good for the country side project whatever that ends up being#The VP is a very unpowerful and mostly unimportant role but I think he is best positioned to maximize its value#But like if it's the other guy it is not that big a deal I just will have more respect for Minnesota going forward

16 notes

·

View notes

Text

Who is doing it like Nora? Fully calling her ex boyfriend out on his big gay crush only to have the bomb dropped on her that he's fucked a reporter meanwhile her ex's crush's best friend is sending her floral arrangements and her and him are the only non-government officials to have top secret knowledge of the fact her ex is boinking the Prince of England and also she's the Vice President's daughter and that's never brought up because she's a data analyst first and foremost!

#red white and royal blue#its actually NEVER mentioned in the movie that this data analyst is also the VP's daughter which is hilarious to me

33 notes

·

View notes

Text

Best Cloud Service

The primary reason to have Secure Cloud Service is active and practicing internet activity, allowing you to have necessary data easily, being fast and secure from cyber threats.

Cloud24 offers data encryption, scheduled data backup, DDoS service and offer the evaluation of website requirements and security.

Cloud24 is safe Cloud hosting to save your data, guarantee the site’s stability and gain the audience’s trust to help you succeed online.

3 notes

·

View notes

Text

Shield Your Digital World: The Ultimate Guide to VPN Security with NordVPN

In today’s digital age, protecting your online data has become more important than ever. With the rise of cyber threats and privacy concerns, many people are turning to Virtual Private Networks (VPNs) as a solution. But what exactly is a VPN, how does it work, and is it safe? In this beginner-friendly guide, we’ll answer these questions and more, as well as explore the top features of NordVPN, a leading VPN service.

#super vpn#vpn#best vpn#vpn service#free vpn#clone vpn#database#cybersecurity#data privacy#cyberattack#microsoft#vps hosting#hosting#hosting provider#hosting services#webhosting#hosting the shadow#windows vps server#vps34 in1#vps server hosting#vps server germany#vps windows server#dedicated server#vps server in saudi arabia#reseller#nord vpn

2 notes

·

View notes

Text

85% Discount + 2 month Free. Unveiling the Power of Surfshark VPN: Your Ultimate Online Privacy Solution. Surfshark Vpn Full Review In Article Below.

If you are looking for a VPN program for the computer or for Android, iPhone, and Mac... I promise you that this VPN is what you are looking for. Read the description of the VPN on the Medium platform and make your decision. I am here just to help you and get some followers on the Tumblr platform.

#best vpn#vpn#data privacy#online privacy#cyber security#free vpn#vpnservice#clone vpn#software#hidden#streaming#livestream#vps server#vpn reviews#vpn software#vpn service

2 notes

·

View notes

Text

Lợi ích của việc sử dụng VPS miễn phí

Trước khi chọn sử dụng bất kỳ dịch vụ hoặc sản phẩm nào, đặc biệt là liên quan đến công nghệ và tích hợp vào công việc, hiếm khi có người dùng hoặc doanh nghiệp nào đưa ra quyết định ngay lập tức. Thường, họ sẽ tiến hành tìm hiểu thông tin và thử nghiệm trước. Điều này cũng áp dụng cho VPS. Vì vậy, nhiều nhà cung cấp máy chủ ảo hiện nay cung cấp phiên bản dùng thử VPS miễn phí trong một khoảng thời gian cố định. Chất lượng của những phiên bản miễn phí này phụ thuộc rất nhiều vào nhà cung cấp mà bạn lựa chọn.

Việc sử dụng VPS miễn phí đem lại một số lợi ích dưới đây:

Giúp người dùng có nhiều cơ hội tìm hiểu và trải nghiệm VPS miễn phí, dẫn đến sự đa dạng về lựa chọn, thông tin và cơ hội trải nghiệm.

Việc dùng thử giúp doanh nghiệp có cái nhìn thực tế hơn về dịch vụ VPS của một nhà cung cấp cụ thể, từ đó đưa ra quyết định lựa chọn chính xác và thận trọng hơn.

Giúp tránh các vấn đề có thể ảnh hưởng đến công việc do việc lựa chọn một nhà cung cấp không phù hợp có thể gây ra.

Xem thêm: https://thuevpsgiare.vn/huong-dan-dang-ky-vps-mien-phi/

2 notes

·

View notes

Text

Fully managed vps hosting services

The timing may be appropriate for you to move to best VPS Hosting if you currently have a shared server for your website and experience regular website downtime.

Shared hosting may not be suitable for managing resource-intensive websites and may have some constraints depending on the web hosting provider.

Because numerous websites use a shared server's resources, they may also experience problems handling high visitor volumes. Affordable VPS Hosting offers dedicated resources for your website, and it is widely seen as a logical step from shared hosting.

How Does VPS Work?

Virtualization is a technology used by VPS hosting that divides a single server into several virtual servers, each with its own operating system, applications, and resources. A hypervisor, a software layer that controls and distributes the physical resources to the virtual machines, is used to do this.

A website hosted on a shared physical server cannot be impacted by other VPS users because each one is allotted a specific part of the server's resources by the web hosting service provider. At a fraction of the price of a dedicated server, this isolation and dedicated resource allocation offer a similar performance and control level.

Virtual private servers (VPS) are highly sought after nowadays; telecom companies, healthcare institutions, and retail establishments frequently use various VPS options.

While maintaining pricing substantially lower than dedicated servers, the affordable VPS hosting plan delivers far greater security and performance than shared hosting. With the addition of advanced customizations and greater scalability, you have a solution that can handle almost any task.

Not everyone has the budget or ability to hire a dedicated administrative assistant. Naturally, the normal business owner would rather focus on expansion and development, leaving the details to the experts. This is the context in which managed services are useful.

What is Managed Hosting?

With a Managed Hosting package, the web hosting service provider handles all of the backend's primary responsibilities, including server maintenance, application installation and upgrades, and extensive security monitoring.

What is Managed VPS Hosting?

Here, the web hosting service provider is in charge of handling all significant services pertaining to the configuration, upkeep, backup, update, and security of the VPS server. For those who don't want to spend a lot of time on these problems or who don't know how to configure a server, managed virtual server hosting is the ideal option.

It relieves the client of a significant portion of their workload so they may focus on other facets of their organization.

The web hosting provider handles a number of tasks, such as setting up servers, installing software, handling security issues, and providing technical assistance.

What do Managed VPS Services Include?

Various hosts might respond to the question in different ways.

Some people claim that if a VPS hosting service only receives server maintenance and software upgrades, it qualifies as "managed." Others believe that further services like security assessments and malware removal ought to be offered. Some are even open to helping with development suggestions.

Contacting your web hosting service provider in advance is the only way to find out precisely how much help they can provide with administering your VPS server. A pre-sales consultation can clear up all doubts.

What is the support team's view? How can you contact them? Do they operate around the clock? Who is responsible for installing and updating software?

Acquiring these particulars in advance is the only method to know exactly what to anticipate.

The majority of popular managed VPS services plans come with the following features by default:

The following services are offered:

A commitment to uptime

server provisioning and setup;

control panel and server management tools;

installation of security software;

regular updates and vulnerability patches;

offsite server backups;

on-demand malware scans;

resolution of hardware and software issues;

and round-the-clock assistance.

A reputable virtual server provider may relieve you of a great deal of responsibility, particularly in terms of security.

Acknowledging the necessity for timely and well-supported web hosting services is a fantastic place to start, but there are a lot of hosting companies in the market, and they all want your business. To make sure you make the best choice, you must conduct thorough research.

How to Choose a Managed VPS?

It's crucial to find a reliable partner to assist you in your VPS attempt. There are a few more things to think about before jumping into the first profitable trade you come across.

Features: Examine each host's feature list to determine which will be most helpful for your project. Also, examine the remaining material; frequently, you may have overlooked certain future requirements.

Resources and Expandability: Since your VPS machine's CPU and RAM are its main components, start with them. Verify that you have adequate monthly bandwidth and storage space. Making use of SSD discs is strongly advised. Ensure that you have space to expand. All of the top-managed virtual private server providers are easily scalable, allowing you to add or remove resources as needed.

Achievement: Even before you sign up as a client, you can assess the speeds of your possible host. It's best if your provider offers a free trial or demo tour. Just sign up, create a basic website, and then use a third-party tool to analyze the website's performance. Do several tests to prevent false positives.

Uptime: Uptime is a little more difficult to check because it takes longer. However, you can always review previous customer feedback to ensure a clear return policy in the event of unplanned outages.

Usability: Usability especially helpful if you've never used a managed virtual private server before or if you don't have the technical know-how to administer one. Once more, a lot of sites let you try out the UI and navigation so you can make sure your pick of hosting will work well for you before committing any money.

Support: This is frequently the most important element. While every service can claim to provide 24/7 support, only some truly succeed in doing so. Pre-sales talks with your possible options are highly recommended as they will provide you with a solid understanding of the kind of support you can expect as a client.

Is there help available around the clock? How quickly do they react? Do they have the knowledge to assist with more complicated problems? Do the operators make an effort to comprehend your situation, or do they just provide links and pre-written answers?

These are but a handful of the queries you may use to find out how well-managed your VPS is supported.

Cost: Although shared hosting is often cheap than virtual servers, the price differential is closing every day. However, don't limit your search to the lowest prices; what matters more is the feature-cost ratio or what you truly receive for your money. It all comes down to your demands.

For example, you wouldn't need better e-commerce functionality if you weren't operating an online store, nor would you need a system with 16 CPU cores and 12 GB of RAM to operate a small company website.

Establish your objectives and a plan of action to achieve them; your managed VPS provider may assist with the rest.

Benefits of Managed VPS Hosting-

Greater Reliability: If you choose the Managed VPS plan, the provider will be in charge of making sure your server is always accessible to the website. The resources given for each virtual private server are not shared with other websites because each server operates independently of the others and is in a storage tower.

In contrast to Shared Hosting, wherein the actions of one website could directly affect all other websites, a best VPS Server is more capable of withstanding spikes in traffic without overloading itself. This guarantees that the server for your website is more available, which improves the uptime score.

Optimal performance: When you choose a Managed VPS plan, the web hosting provider company ensures that your server is operating at its best. The server's performance is not affected as you allocate resources specifically for your website, which progressively speeds up the time it takes for pages to load.

One cannot overstate the significance of a website's speed. The SEO algorithm's consideration of website speed and its direct correlation with improved user experience has elevated the topic of website speed in webmaster discourse.

Improved Security: With the rising number of cybersecurity threats, security continues to be a top concern for website owners. One drawback of cheap shared hosting is that every website on the same server has the same IP address.

The possibility of all websites being impacted by a single website's security breach is always there. However, each virtual environment included in the managed VPS plan has its own IP address, so your website is unaffected by the security of other websites.

A managed VPS hosting service regularly installs and updates security patches to defend against cybersecurity threats.

Greater Control: With managed VPS plan, you have total root access to the server. You can install the operating system and additional programs of your choosing. However, this might require technical know-how, and there's a chance your server access could be locked.

For those who fit this description, it is best to choose Managed VPS Hosting and delegate most of the duties to the hosting provider. However, the client still retains last say over the server.

Customer service: By taking full control of the server management with a Managed VPS plan, the hosting provider can provide more committed technical assistance.

Depending on the service provider, you may also have personal assistants to handle all of your needs.

Conclusion-

The popularity of managed VPS hosting is rising for a good reason. Our comprehensive solution caters to both small and large businesses, offering benefits like increased security, performance boost, and personalized assistance. Another major benefit is that scaling your CPU, RAM, or server space allows you the control and flexibility to meet increasing demands. Since the expenses are frequently linked to the number of resources you use, you may forget about overpaying.

Janet Watson

MyResellerHome MyResellerhome.com We offer experienced web hosting services that are customized to your specific requirements. Facebook Twitter YouTube Instagram

1 note

·

View note

Text

#data center#racks with servers#web hosting concepts#dedicated servers#vps hosting#data center concepts#data storage#modern technologies#network technologies#hosting#wallpapers

0 notes

Text

Scam Empire (Part One): Inside the dark heart of a multinational investment scam

A data leak has unmasked a global network of alleged professional scammers drawing would-be investors into dodgy trading platforms on an industrial scale. A group of South Africans features in parts of the business — and the South African public is prominent among the victims.

A little-known Bulgarian entrepreneur named Boris Kodzhov has, since 2023, quietly made mammoth strides in the South African fintech sector.

Kodzhov seemingly launched not one but three multimillion-rand online trading platforms for complicated financial products called “contracts for difference” (CFD). Their defining characteristic is that you can very rapidly lose all your money, but the potential rewards, marketers will tell you, are boundless.

One of these platforms, SkyMT, briefly shot the lights out before going out of business early last year after roping in estimated deposits of R30-million.

The other two platforms, however, Finbok and Finxo Capital, have gone from strength to strength, collecting deposits of more than R240-million from aspirant traders since September 2023.

The problem is, the “fintech mogul” Kodzhov was until recently actually a cleaner working in Bulgaria’s capital Sofia for a modest salary of about R6,800. He has since retired to care for his sick mother and now lives off a government grant. Kodzhov doesn’t speak English and says he has never heard of either his South African companies or those he supposedly owns in other countries.

Another arrival in the local online trading scene is one Diana Gugles, who, as purported owner, sits behind the company Libra Wealth and its trading platform VP Trade.

The platform has roped in at least 2,000 traders, who have between them deposited R64-million — and that’s just since April last year.

Gugles, a professional model, also struggled to recall her fintech start-up which, while based in South Africa, targets investors in South America.

By all appearances, Kodzhov and Gugles have either been the victims of identity theft or have allowed their identities to be used for setting up companies halfway across the world.

Either way, by using the sleek platforms presented by Kodzhov’s and Gugles’s alleged companies, aspirant traders could deal in crypto currencies, foreign exchange, commodities and other things besides, all aided by friendly finance whizzes over the phone.

Or so they thought. They, in this case, are several thousand South African “traders” who would in almost all cases never see their money again.

These South African victims have fallen under the sway of the rapidly expanding local leg of a staggering international enterprise simultaneously managing more than 70 online trading platforms across the world from a mysterious “back office” spread between Cyprus and Israel.

This nameless multinational syndicate has a staff complement of nearly 500 people targeting aspirant investors everywhere from Australia and Canada to Poland and Japan. If this were not enough, it appears that the organisation has branched out into an online “trading academy” as well as online gambling.

Victims have included South Africans from all walks of life, from pensioners who pinned their hopes on R3,500 investments to business owners who signed over millions.

And on the rare occasion someone got “profit” out, the evidence suggests that this was just bait to keep them putting in more.

Investments from South Africa and elsewhere mostly disappeared into a network of apparent fraud and subterfuge involving shell companies, offshore bank accounts and crypto currency exchanges.

Companies ostensibly run by the unemployed cleaner and model we mentioned at the outset are only the tip of the iceberg.

Beneath the surface lies a spectacular labyrinth of deceit.

This and other minutiae of this clandestine network’s operations have been laid bare in a monumental leak of data originally provided to Sveriges Television, the Swedish national broadcaster, to which amaBhungane has gained access as part of a global consortium of media organisations coordinated by the Organized Crime and Corruption Reporting Project (OCCRP).

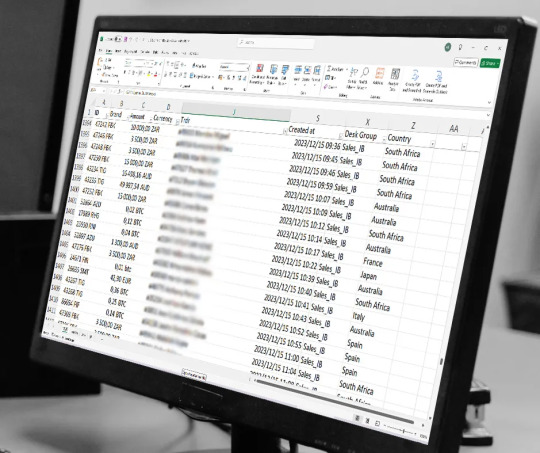

The leak contains thousands of recordings from call centres, screenshots from the computers of individuals managing the scheme as well as many thousands of documents and detailed spreadsheets tabulating everything from the global income of the various “teams” through to the office party expenses of call centre employees.

What emerges is a dark and cynical business, hidden behind the fig leaf of cutting-edge fintech, churning out what the conspirators call trading “brands” — each with a dedicated website and staff.

The brands supposedly belonging to Kodzhov and Gugles sit among dozens the managers of the scheme can monitor at the same time using a back-end dashboard.

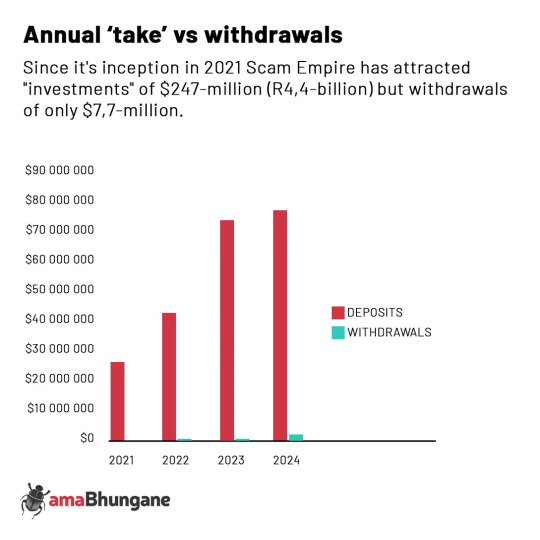

Based on our calculations from data in the leak, these centrally controlled “brands” appear to have collected deposits from tens of thousands of individuals across the world since the scheme’s relatively modest beginnings in 2021.

Records show that by the end of last year the total had swollen to at least $247-million — well over R4.4-billion.

Crucially, throughout the voluminous recordings, spreadsheets and other documents in the leak, there is very little proof that any of this money was actually used to trade anything.

Where trading seemingly did occur, the leak suggests that it was manipulated and under the control of a “dealing desk”. In a document describing “roles within the company”, the powers of this desk are said to include the ability “to make changes in ongoing trades, open/close, adjustment of pricing and even deleted ones when needed”.

Another major clue that these “investments” are very likely bogus is the negligible level of withdrawals or cash-outs that are reflected. Our interactions with victims suggest these are hard won and sometimes only follow complaints of fraud.

While effortless withdrawals are always part of the pitch for new recruits, the reality is that there are a host of ways to block these, often by claiming that victims have an “open position” on the market and have to wait a few days. After this wait they are either told that the “market went against them” or get cajoled into a new investment.

Our data shows that the system’s overall deposits of $247-million were followed by withdrawals of only $7-million globally over 70-odd platforms. That’s 3%.

South Africa has been a prominent target, but the available evidence shows that it has also played an outsized role in the larger international scheme’s tangled financial arrangements. Managers of the network also include a number of South African expats now based in Cyprus and Israel.

AmaBhungane will lift the veil on the wizards in the backroom and the complex fronts they have constructed in Part Two of this exposé.

For now, we will explore what for lack of a formal name we will call Scam Empire.

Step one: bait and switch

Clickbait ads are so ubiquitous that many of us simply accept them as an online nuisance, but the leak shows how shockingly effective this kind of online bait can be and how organised and cynical this opaque world is.

This completely unregulated business involves companies based far and wide.

Records in the leaks show that the companies that captured the most South Africans are based in Bulgaria, Israel, Singapore and the Czech Republic, among other places. More on them below.

For many victims of Scam Empire their ordeal started with an online ad featuring fake celebrity endorsements.

One South African who lost over R300,000 told us his involvement began with a fake video of Elon Musk on YouTube. Musk is in fact a ubiquitous fake feature, sometimes presented as punting the notorious and entirely fictitious “Quantum AI” trading robot.

Another victim who lost R400,000 says she was caught, ironically, by a Facebook ad featuring prominent local consumer rights journalist Devi Govender.

According to the victim, “Devi” was punting effortless risk-free income “from the comfort of your bed”.

Govender told us she has come across numerous scams using her name, so many in fact that she had to give up trying to stem the tide: “Don’t fall for it,” she warned.

These ads are the handiwork of so-called “affiliate marketers” who, in the parlance of the business, “sell traffic” to the online trading platform sites.

Since the marketers are independent of the client and unregulated, they can essentially make any ludicrous claim they want, without consequences.

It’s a big business, replete with international expos and networking events.

While there are legitimate reasons to fish for eyeballs online, the more than 160 marketers feeding victims to Scam Empire are being handsomely rewarded for this complicity, and often resort to naked lies.

Records in the leak show that when a new trading client makes a “first time deposit” the affiliate marketer pockets at least $750 (about R13,900). Tellingly, a South African “scalp” is generally worth $800, while a Canadian earns you closer to $ 1,100.

This is expressly set out in one marketing agreement in the leak where South Africa is relegated to “Tier 2” – one step above “Latam” (Latin America).

This seems to suggest that the majority of small one-time investors, the people putting in less than this fee, are actually loss-making for the trading platform scammers.

The whole model relies on repeat investors, often “whales” who put in ruinous amounts. The records show that there are, however, plenty of these. While half the deposits in 2024 were “first time”, follow-up investments make up 97% of the value.

It’s all about getting people hooked.

This seems to suggest that the majority of small one-time investors, the people putting in less than this fee, are actually loss-making for the trading platform scammers.

The whole model relies on repeat investors, often “whales” who put in ruinous amounts. The records show that there are, however, plenty of these. While half the deposits in 2024 were “first time”, follow-up investments make up 97% of the value.

It’s all about getting people hooked.

For the affiliates, these per capita payments rapidly add up as thousands of people sign on.

By January 2024, Scam Empire had probably spent between $36-million and $50-million (which is to say nearly R1-billion) “buying traffic”, a rough estimate arrived at by multiplying the number of victims by the lower and higher ends of the prices that generally apply.

Since then, it has spent another $11-million, according to amaBhungane’s partners in the Organized Crime and Corruption Reporting Project consortium who calculated this figure by analysing the cryptocurrency wallets almost universally used for payments.

Enter Vector

Recall the trading platforms ostensibly controlled by the unemployed Bulgarian Boris Kodzhov: Finbok and Finxocap.

These two platforms are operated by “his” South African company Vector Financial Services, much like the Romanian model Gugles’s Libra Wealth operates VP Trade.

Before this, Kodzhov also seemingly owned the ill-fated SkyMT.

The real hands controlling these operations are the subject of Part Two, but for now the basics are important.

Vector and Libra are what are known as juristic representatives. They piggyback on the financial services provider (FSP) licence of another company — in this case Astrix Data. This is legal.

As an aside, this structure was apparently very recently abandoned, but we will get to that in Part Two.

Finbok and Finxocap are big players and have seemingly left destruction in their wake.

They have taken in deposits of at least $13.4-million while allowing withdrawals of $1.3-million. Half of these withdrawals belonged to just two extremely large depositors, both of whom have proven hard to get hold of. Most victims are in South Africa, although the records show Finbok more recently branching out overseas.

By and large, everyone loses their money.

While the Financial Sector Conduct Authority said last year that it was investigating complaints from investors struggling to withdraw their “investments” from Finbok, it appears that the regulator is not aware that it is scratching the surface of a colossal international enterprise.

The investigation, we are told, is ongoing.

When it comes to Scam Empire, however, these South African companies are exceptional in a number of ways.

For one thing, they are actual companies with actual licences. Much of the larger scam consists of phantom platforms with no underlying legal entity, platforms that operate without licences or platforms that have licences in relatively lax island jurisdictions.

The South African ones in fact fall under a special “division” of the organisation named “ZA_Regulated”.

Dustan Cornelissen, the local director of Vector Financial Services, Libra Wealth and Astrix Data (he was not involved in SkyMT), told us everything was above board.

He states that he provides regulatory compliance but does not control the companies or the platforms which, he insists, are just portals the traders use to access markets.

On his version they knowingly expose themselves to high-risk trading and sometimes lose: “Losses are an unfortunate reality in any speculative financial activity, whether it be trading, online casinos, or sports betting. The individuals in question were traders, not ‘would-be investors’. Their decision to engage in trading was voluntary and based on their own risk assessment.”

Cornelissen told our partners at the Organized Crime and Corruption Reporting Project, “I have personally resolved every complaint lodged in South Africa by presenting a portfolio of evidence to the relevant authorities, including banks, the Financial Sector Conduct Authority, and the Ombudsman. To date, we have not lost a single case.”

We will consider Cornelissen’s role in more detail in Part Two. His assertions will need to be tested against evidence revealed in the leak concerning the wider network, evidence that indicates the use of front companies, suspicious financial arrangements, fake documents and fraud claims.

The leak also shows call centre “account managers” pushing clients into investments they barely understand, as well as the ubiquitous use of misleading advertising to lure in new “traders”.

Step two: Into the rabbit hole

The fake ads lead investors to the engine room — call centres.

First, they will land on the site of the trading platform “brand”. In the case of South Africans this would be Finbok and Finxocap (after the short-lived SkyMT bit the dust).

As a potential investor, you will be asked to fill in your details, and before long someone will call.

And call and call and call.

Everyone we and our partners spoke to cited the pushiness and incessant harassment they suffered or continue to suffer. Internal guidelines direct agents to call each assigned client three times per shift.

The sources of the calls are disguised, and you would most likely see a South African number on your phone.

The leak, however, has made it possible to track down the real physical locations from where agents call the various countries targeted by Scam Empire.

If you have ever received a call from Finbok it probably came from a Bulgarian office that is, confusingly, codenamed “Serbia”.

In “Serbia” there are subdivisions. Finbok is only one of the operations housed there, in an office our Organized Crime and Corruption Reporting Project partners recently visited only to be told it had been hastily evacuated in December.

Inside this “Serbia” office, the South African operation (Finbok) had two further codenames — “Bentley” and “D&J”.

And then there is Finxocap.

If you received a call from them before October last year it most likely came from a Cyprus office codenamed “Tesla”.

This then moved to the “Serbia” office and was renamed “Rolls Royce”.

The South Africa-based VP Trade platform — which targeted South Americans — was also in “Serbia”, but for at least a small period shifted to Barcelona, presumably because of a need for native Spanish-speaking agents.

The boiler room

Extensive records for the call centres reveal a shocking hothouse of bullying and deceit.

The leak contains thousands of hours of recorded calls and evaluations of individual calls where “agent risk” and “client risk” (for instance a client who might lay complaints or sue) had been identified.

Perhaps most telling are actual manuals and presentations on how to deal with hesitant “traders”.

The mostly East European agents have seemingly been carefully coached to push inexperienced clients towards often ruinous “investments”, but first they must test the waters and secure the first deposit.

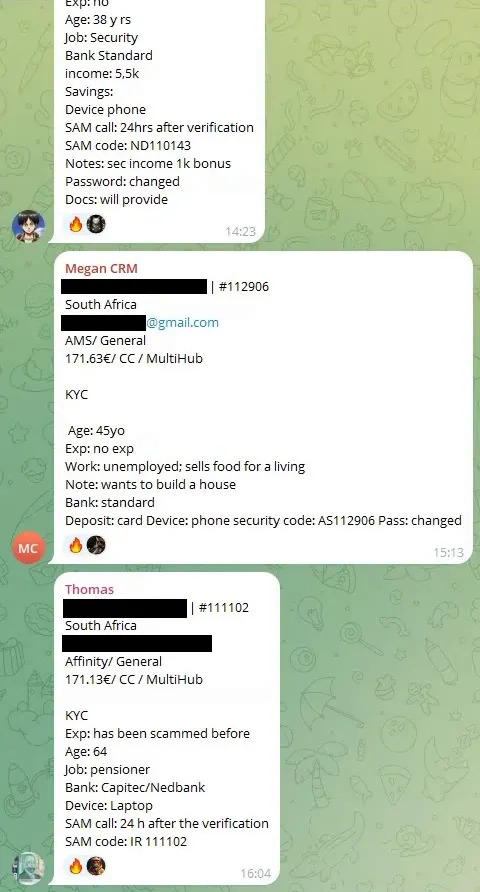

In chat groups the prospective investors’ profiles are posted as they come in, including telegrammatic notes on whether they had any experience with financial products and whether they had income or savings or, for instance, assets they could conceivably borrow against.

These are in many ways the most pointed demonstration of the cynicism roiling in the back room, especially since selling complex financial products to people with zero experience and little money is extremely unethical even before fraud enters the picture.

Some egregious examples of how new investors were described stand out:

“Really bad experience… part timer at some low-life job,” reads one of these missives about a 62-year-old who did make an investment.

“Note: most of his family members have died and he’s doing this with high hopes to have a better legacy to leave his children.”

Another note, dealing with a 45-year-old “client” who made a deposit with Finbok, reads:

“No Exp”

“Unemployed, sells food for a living”

“Note: wants to build a house”

The supposed finance whizzes on the phone who were making these notes did also, however, make efforts to befriend victims.

And there is a playbook for that.

The scammer’s manual

Contained in the leak are a variety of training materials, including a “bible of rebuttals” that gives country-specific advice on talking past people who object on the phone.

The instructions are straightforward and include, for instance: “We will ignore what the client says and keep talking fluently without stopping — here we must talk about profits and try to create a ‘hook’ for the client to ‘bite’ and then he will move on and forget the rebuttal.”

According to the “bible”, South Africans often lie that they don’t have their bank card on them. As a response, the manual suggests using “ammunition” such as “you want money for your new baby on the way”. Another option is to “stress him out” by claiming there are limited licences for the trading software left, or that some major event is imminent that could create profits.

If someone says they are afraid of being scammed, the agent should try “empathy” by saying “I was also scammed once long ago”.

If someone has previously lost money in a scheme: “Really (be a bit surprised) I’m so sorry to hear that!”

The agents working for the regulated South African companies are trained to avoid certain legally dangerous formulations. Specifically, they can never outright promise profits, but rather say something like “the majority of traders made around 30-40% returns last month”.

Even though fake celebrity endorsements are used via the affiliate marketers the agents themselves are supposed to avoid doing the same: “The agents must avoid direct affiliation with famous names or companies the customers see on the ads.”

This rule is broken often in practice.

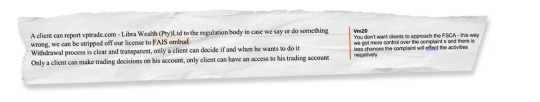

Possibly the most damning evidence of how agents are taught to lie or withhold information comes from an “office rules and guidelines” document dealing specifically with VP Trade, the platform of South Africa-based Libra Wealth.

A draft is in the leak showing how a manager added comments for changes.

One of the rules is that “office location cannot be shared”, to which the manager added a comment: “Remove — you don’t want this document to land in the hands of a third party — this must be conveyed orally.”

In a section titled “benefits of the regulation” agents are told they can inform clients that they can complain to the regulator. However, according to the manager they should guide the complainants to the FAIS ombud and not to the Financial Service Conduct Authority, which could suspend licences while conducting investigations.

“You don’t want clients to approach the FSCA — this way we got more control over the complaints and there is less chance the complaint will affect the activities negatively”

In a note that seems to indicate that the trading platforms are simply fake and do not “facilitate” investments is a “frequently asked questions” entry titled “How are you making money?”.

The draft claimed that “VP Trade makes a small commission (≈ 0.5-2%) on every position you open on the market!”

The manager, however, ordered this to be scrapped and said that “instead of mentioning commission we should rather explain how VP Trade makes money”.

In other words, the platform was choosing between two completely different options on what to tell prospective investors — an indication that perhaps neither is true.

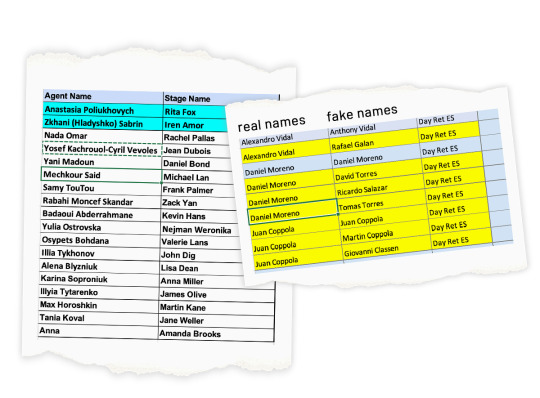

While agents are meant to build up a personal rapport, they also use fake “stage names” that are formally assigned. Tellingly, these often replace agents’ clearly Eastern European names with more Western-sounding ones.

Some agents have three different names they use with different clients.

According to the leak, there are close to 490 agents involved in the Scam Empire network. Those who manage to shake loose enough deposits are handsomely rewarded with bonuses and even gifts of expensive watches.

One particularly extreme case was an agent for one of the major unregulated platforms who seemingly received a Rolex, along with $130,000 in bonuses, after scamming Briton Stuart Daburn out of $5-million.

Tellingly, a record of office expenses contains the line item “Polygraph, fixed toilet, taxi for security”, as well as a number of party-related costs, including “deposit for midgets”.

Despite the careful coaching, agents often go off script. The leak contains masses of call reviews where agents’ problematic claims are highlighted.

By and large, these involve promising absurd profits or lying that Elon Musk is somehow involved and that there is some or other AI-powered trading robot doing all the work, which would be false even if there was real trading going on.

Step three: The money

Scam Empire’s financial arrangements are convoluted, opaque and heavily reliant on cryptocurrency. From the leaks, however, it is possible to paint a picture of how layers of fronts move money across the world.

As mentioned earlier, there is little sign that any money is actually invested in the things clients believe they are trading.

But before you get the money out you need to get the money in.

Setting up payment service providers for the various brands is a constant preoccupation, and all the platforms in Scam Empire have numerous ones — the records reflect up to 300 different services being used to collect money from “traders”.

The South African platforms seemingly made use of a number of extremely suspicious payment service providers that appear to have been stopgaps after more established ones withdrew due to fraud complaints.

For instance, a formal provider named Swiffy provided payment services for the SkyMT and Finbok platforms from May until November 2023.

In response to questions, it told us that it had terminated its services to these platforms due to fraud concerns. A “monitoring” spreadsheet in the leak shows at least three serious fraud allegations involving payments through Swiffy.

Swiffy added that “at the time of KYC checks both merchants were licenced with the Financial Sector Conduct Authority under the correct class of licence according to their stated business activities”.

Worryingly, one payment service provider that took Swiffy’s place was in fact a scrap metal dealer — in Part Two, we will deal with this and other dodgy payment service providers used by SkyMT and Vector.

Another established payment provider said they had no problems with Finbok, one of the brands linked to Vector.

They told us: “We have no recorded instances of fraud linked to this merchant… We note that the Financial Sector Conduct Authority has stated in its latest communication that its investigation is ongoing and that no findings have been made against any of the involved parties.”

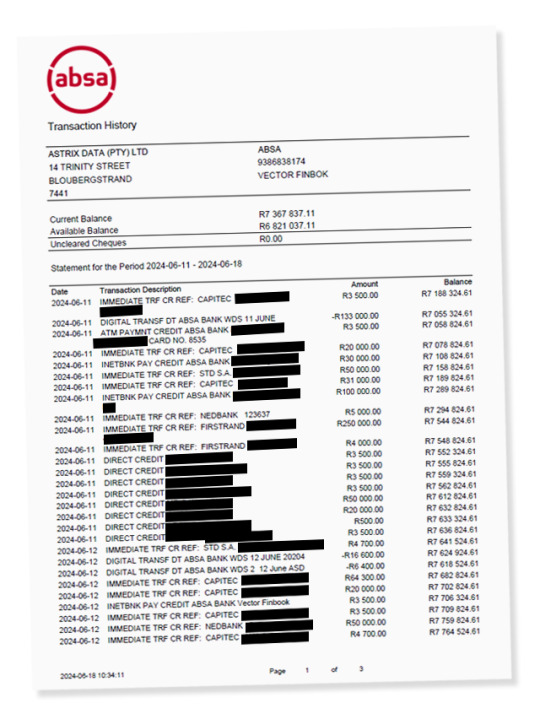

The online “traders” also paid a total of R68-million straight into the accounts of Astrix Data — the financial services provider behind Vector.

Apart from the massive payments for online advertising, it is not easy to discern where the money goes.

The sole director of Astrix in South Africa is Cornelissen.

In his version of how the platforms’ financial arrangements worked, traders would deposit their investments with Astrix either directly or indirectly through payment services like those mentioned above.

Even though the money is in Astrix’s account, the company “never holds clients’ funds”.

“Practically how this happens is that clients deposit funds via EFT or payment gateways which eventually settle to the Finbok/Finxocap accounts. These funds are then credited immediately to their trading profile by our liquidity providers. All funds deposited are reflected on their trading profile — clients have the ability to withdraw all their funds via card refund or EFT directly to their bank accounts, or they have the ability to trade. As such, we never hold clients’ funds.”

We have partial records for the accounts held by Vector and Astrix Data (the financial services provider behind it).

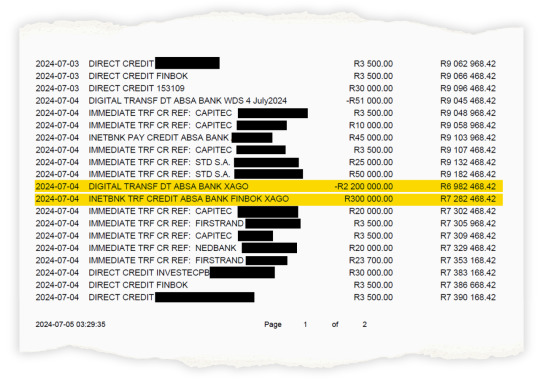

Payments from investors can be seen streaming in constantly. The only significant “exit” point discernable is payments to a Cape Town crypto payment provider named Xago Technologies.

Investors’ funds are regularly sent to Xago from Astrix. Xago keeps accounts in the UK and Switzerland.

Xago did not answer detailed questions but told us: “We categorically deny being complicit in or enabling fraudulent or money laundering operations. We are fully cooperative and willing to engage with any investigations launched by regulators or authorities.”

This company has cropped up in several places in the Scam Empire leak, as well as elsewhere.

Like the payment service providers mentioned above, Xago also directly channelled investment payments from a handful of large depositors, including a number of South African investors, to the online trading platform companies.

Xago has also come up in a court case launched by one of the victims in the UK: the aforementioned Stuart Daburn, who has lost several million pounds.

According to the particulars of his claim, he was told to pay Bitcoin into his investment account using Xago. He then paid £100,000 (almost R2.4-million) via this Cape Town company, with this becoming part of his loss.

This is a very partial window on the South African division of Scam Empire’s financial arrangements. As we will see in Part Two, however, it is indivisible from the larger global enterprise.

Get out

AmaBhungane and its Organized Crime and Corruption Reporting Project partners have contacted dozens of investors in Scam Empire platforms worldwide and they almost universally now claim it is a scam.

There are common experiences, including being frantically pushed to make new and different investments as soon as possible. When the investor signals that they want to take cash out of their trading account they suddenly unaccountably lose everything in a turn of supposed bad luck.

One victim who lost R1-million told us that after getting sucked into Finbok by a celebrity ad, his online “agent”, who went by the stage name “George Weber”, first pushed him into oil, then stocks, then foreign exchange, until he had essentially lost all his money.

The agent did remember to repeatedly quote the playbook mentioned above, advising the investor that “they make their profit on the spread”.

“It’s a total scam,” the “investor” told us.

His agent George seemingly often went off script with investment advice and once told a client he doesn’t “give a rat’s ass” about his negative experiences in the past, according to reviews in the leak.

Another victim mentioned earlier who lost R300,000 was likewise talked into one investment after another — oil then cocoa then sugar. He says he tried to withdraw R75,000, but 45 minutes later it had disappeared.

He insists that his trades were manipulated, saying that the prices he could see on the chart presented to him were not the ones reflected in his trades. According to him he suffered “deliberate sabotage” and was told it would take three days to get his money out. He suffered his “losses” during this period.

The calls between him and an agent were reviewed, and at one point the agent tried to push his wife to get a home improvement loan to invest with.

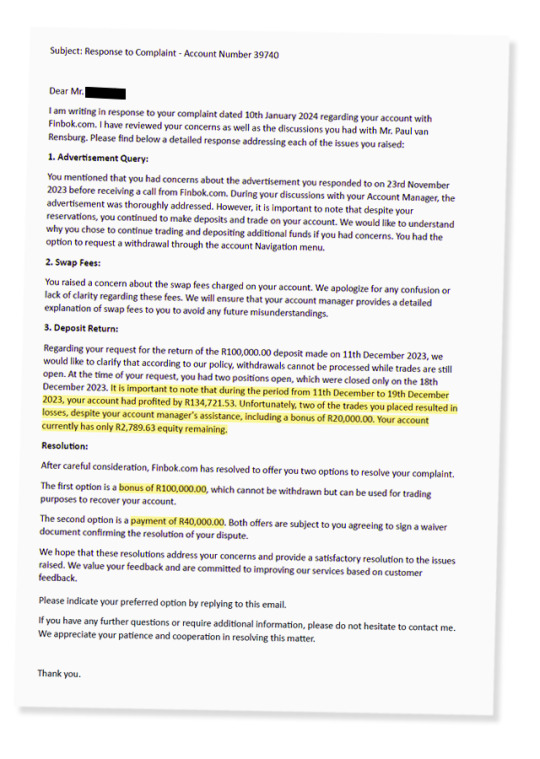

The “trader” laid a complaint and before long received a call from a man who will feature extensively in Part Two — the seeming legal head of Scam Empire’s South African division who calls himself “Paul van Rensburg”.

“Van Rensburg” made the hapless investor an offer: R100,000 credit, non-withdrawable, so he could keep going. Essentially a loan.

This seems like something “Van Rensburg” does according to documents in the leak where other traders are made similar offers, which are called “bonuses”.

In one case where an investor complained he was offered either a R100,000 “bonus” or R40,000 cash to walk away.

But these “traders” have something in common with a few hundred others who were allowed to withdraw at least some of their funds from Finbok: for some reason the company seemingly tried to disguise the fact that it had happened.

Fake trail?

In the leak there are hundreds of clearly fake invoices. They each have a Vector Financial Services letterhead but all the letterheads are wrong and have wildly different designs.

The invoices are all addressed to investors who had got withdrawals, and match the amounts and dates of those withdrawals.

But for some reason, all these invoices claim to be bills for “online marketing services”.

Even more confusingly, they state that the investor is to pay Vector but give the investor’s bank details for payment.

We spoke to some of the people these invoices are addressed to and they expressed complete ignorance. They had neither seen the documents nor ever provided “online marketing services”.

It is hard to know what to make of these invoices, which effectively create accounting cover for payouts to “investors” by describing them as business expenses.

This is, however, speculation, because with Scam Empire nothing is ever really straightforward.

Cornelissen told our partners at Organized Crime and Corruption Reporting Project that “the claim that invoices for marketing services matched withdrawals from Finbok is incorrect. If there was a template error in any invoice, it was an administrative oversight, not an attempt to misrepresent transactions.”

#VP Trade#AmaBhungane#Astrix Data#Boris Kodzhov#Crypto#Cryptocurrency#Devi Govender#Dewald van Rensburg#Dustan Cornelissen

0 notes

Note

I know it is still early but do you know if there is any interesting history facts about the new president and vp

I'm still a little dazed and trying to wrap my head around the position the American voters have put us in for the years to come, so you'll have to give me a little more time to put everything into more historical context, but there a few quick tidbits to mention.

The obvious historical tidbit was the one everyone had already been talking about: Trump is the second President to win non-consecutive terms in the White House, after Grover Cleveland, who won the 1884 election (against James G. Blaine), lost the 1888 election to Benjamin Harrison, and then defeated Harrison in 1892.

The ages of Trump and Vance also stand out. Trump will be the oldest President ever inaugurated when he is sworn in: Biden was 78 years, 61 days old when he took office in January 2021; Trump will be 78 years, 220 days old. After Inauguration Day, these will be the five oldest Presidents at the beginning of their term: 1. Donald Trump (2nd Administration): 78 years, 220 days 2. Joe Biden: 78 years, 61 days 3. Donald Trump (1st Administration): 70 years, 220 days 4. Ronald Reagan: 69 years, 349 days 5. William Henry Harrison: 68 years, 23 days

Vance is on the other end of the spectrum. He'll be the third-youngest Vice President in history when he is sworn in. Here's what the list of five youngest VPs in history will look like after Inauguration Day: 1. John C. Breckinridge: 36 years, 47 days 2. Richard Nixon: 40 years, 11 days 3. JD Vance: 40 years, 171 days 4. Dan Quayle: 41 years, 351 days 5. Theodore Roosevelt: 42 years, 128 days

And the age difference between Trump and Vance is, by a significant margin, the biggest age difference between a President and Vice President in American history. Trump is 38 years, 49 days older than Vance -- in fact, Trump is almost twice Vance's age. The next biggest age difference was James Buchanan, who was 29 years, 273 days older than his Vice President, John C. Breckinridge.

#2024 Election#Presidential History#History#Presidential Stats#Presidential Data#Presidential Statistics#Donald Trump#President Trump#JD Vance#James Buchanan#President Buchanan#John C. Breckinridge#Vice President Breckinridge#POTUS/VP Comparative Data#Presidents#Vice Presidents

25 notes

·

View notes

Text

one thing about kaito sp, it's really made me aware of the specific sound of V4 engine noise on japanese masc vocals. its most pronounced in kiyoteru but you can hear it in gakupo too (and maybe even a small hint in fukase) and its there again in dearest kaito sp. sounds like the way a lenticular print feels. or a hint of backpack strap texture (compliment)

#it does make me curious - im so intrigued by how kiyo sv is gonna sound#actually im like so hype for him and miki both i almost forgot but then i remembered that they said they were gonna release dec#and i like. shot up. eyes wide open. im normal about vocal synthesizers.#anyway miki i think i can imagine how her sv is gonna sound a little bit. her vp has a lot of work out there and her v4 was pretty clean#of course i assume she'll lean more into a character-y voice rather than her natural singing voice but i still think i can imagine it okay#but theres only like a few videos of kiyoteru's vp singing orz and most of it is english songs interestingly#i wonder if they'll have a bit of english data in there since his vp can do it so well#plus he does a lot of backing vocal work. but im like. what will it sound like#kiyo v4 i think sounds fantastic in rock-y and vkei stuff because his medium tone that can go deep + all the nasal has a great expression#but who knows about his sv. ive only heard his vp in ballads. im sure there will be a power mode though LOL#power and soft are the usuals in general. but im so curious.... what will it be like... i want to hear DEMOS#explodes on impact

1 note

·

View note

Text

GenAI in India: Tech Industry Partnerships Catalyze Adoption

The likes of IBM, Tech Mahindra, Google Cloud, Netapp, Deloitte, ServiceNow and the likes are all jumping into the GenAI bandwagon. APAC News Network explores the dynamics of some of these partnerships.

GenAI or Generative AI is fast gaining grounds in India, especially in terms of acceptance by different stakeholders. These include the different enterprises across different verticals using GenAI in different facets of their businesses. Another stakeholder has been the Indian GenAI-based SaaS startups whose numbers too are rapidly rising every year. Add to this the IT services giants and software giants who too are jumping into the GenAI bandwagon. Last but not the least, the government too is supporting the GenAI revolution with proactive policy formation and creating appropriate implementation environment in the country.

Worldwide there is an explosion in the number of Gen AI-native SaaS companies and a surge in investment capital, with over $12 billion funneled into 60+ emerging domains in FY23 alone. The Indian players, on the other hand, raised $590 million in funding during the same time period. While globally there are 259 generative AI startups as of 2024, in India there are around 20+ pure-play generative AI startups.

Also Read More Here : https://apacnewsnetwork.com/2024/04/genai-in-india-tech-industry-partnerships-catalyze-adoption/

#GenAI in India Tech Industry Partnerships Catalyze Adoption#GenAI in India#Tech Industry Partnerships Catalyze Adoption#Sandip Patel#MD#IBM India#Sandip Patel MD IBM India#Chetan Krishnamurthy#VP#Ecosystem and Digital Sales#Asia Pacific#IBM#Chetan Krishnamurthy VP Ecosystem and Digital Sales Asia Pacific IBM#Karthik Rajaram VP & GM Elastic India#Sunil Gupta#Co-Founder#MD and CEO#Yotta Data Services#Sunil Gupta Co-Founder MD and CEO Yotta Data Services#Pravjit Tiwana#SVP & GM#Cloud Storage#NetApp#Pravjit Tiwana SVP & GM Cloud Storage NetApp#Anshul Shrivastava CEO Vodex#Bhaskar Majumdar Managing Partner Unicorn India Ventures

0 notes

Text

Shield Your Digital World: The Ultimate Guide to VPN Security with NordVPN

In today’s digital age, protecting your online data has become more important than ever. With the rise of cyber threats and privacy concerns, many people are turning to Virtual Private Networks (VPNs) as a solution. But what exactly is a VPN, how does it work, and is it safe? In this beginner-friendly guide, we’ll answer these questions and more, as well as explore the top features of NordVPN, a leading VPN service.

#vpn#best vpn#vpn service#clone vpn#free vpn#data privacy#security#cybersecurity#technews#data security#vps hosting#vps#buy windows vps#vps server in saudi arabia#windows vps server#hosting#webhosting#mobileapps#erp solution#vps usa#vpn for usa

0 notes

Text

Dedicated Server: A dedicated server is a physical server that is solely leased to an individual or organization for their exclusive use. This means the resources of the server, such as CPU, RAM, storage, and bandwidth, are not shared with any other users. Dedicated servers are often chosen by businesses or individuals who require high performance, reliability, and full control over their server environment. VPS (Virtual Private Server): A VPS is a virtualized server environment created by partitioning a physical server into multiple virtual servers. Each virtual server operates independently with its own operating system, resources, and configurations. VPS hosting offers a balance between the affordability of shared hosting and the control and performance of dedicated hosting. Users have root access to their VPS and can install any software or applications they need. Cloud Server: A cloud server is a virtual server that runs in a cloud computing environment. Unlike traditional hosting solutions where servers are hosted on physical hardware, cloud servers are hosted on virtualized infrastructure provided by a cloud service provider. Cloud servers offer scalability, flexibility, and high availability since they can be easily scaled up or down based on demand, and data is often distributed across multiple physical servers. Users typically pay for cloud server resources on a pay-as-you-go basis. Data Center: A data center is a facility used to house computer systems and associated components, such as servers, networking equipment, storage systems, and security devices. Data centers are designed to provide a controlled environment with power, cooling, and security measures to ensure the reliable operation of IT infrastructure. They can range in size from small server rooms to large-scale facilities housing thousands of servers. Data centers can be owned and operated by organizations for their internal use or provided as colocation services where businesses rent space and infrastructure from a third-party provider.

#dedicated server price#dedicated server hostinger#cloud server price#vps server best#data center price

1 note

·

View note