#Advanced payroll software

Explore tagged Tumblr posts

Text

Mastering Payroll Processing: The Impact of Advanced Payroll Software

In the realm of business operations, few tasks are as crucial and complex as payroll processing. From calculating wages to ensuring compliance with tax regulations, the payroll function demands precision, efficiency, and attention to detail. Fortunately, with the advent of advanced payroll software, organizations have gained a powerful ally in their quest to streamline payroll operations and mitigate compliance risks. In this blog post, we'll delve into the world of advanced payroll software, exploring its key features, benefits, and the transformative impact it has on businesses of all sizes.

Evolution of Payroll Software: From Manual to Automated

Gone are the days of manual payroll processing, where HR personnel spent hours crunching numbers and grappling with spreadsheets. Advanced payroll software represents the evolution of payroll management, leveraging automation, cloud computing, and data analytics to revolutionize how businesses handle payroll tasks. What once required manual effort and was prone to errors can now be accomplished with a few clicks, thanks to intuitive interfaces and powerful algorithms.

Key Features Driving Efficiency

Advanced payroll software comes equipped with a plethora of features designed to simplify payroll processing and enhance organizational efficiency. These features include:

Automated Calculations: Complex payroll calculations, including wages, taxes, deductions, and benefits, are performed automatically, reducing the risk of errors and ensuring accuracy.

Tax Compliance Tools: Payroll software automates tax calculations and deductions, generates tax forms, and facilitates electronic filing, ensuring compliance with ever-changing tax laws and regulations.

Direct Deposit and Electronic Payments: Integrated payment processing allows for seamless direct deposit of employee wages and electronic payments to vendors, eliminating the need for paper checks and manual reconciliation.

Employee Self-Service Portals: Self-service portals empower employees to access their payroll information, view pay stubs, update personal details, and manage direct deposit preferences, reducing administrative overhead and enhancing employee satisfaction.

Time and Attendance Tracking: Integrated timekeeping features enable employees to clock in and out electronically, track hours worked, and manage time-off requests, facilitating accurate payroll processing and compliance with labor regulations.

Customizable Reporting: Robust reporting capabilities provide HR and finance professionals with insights into payroll expenses, tax liabilities, labor costs, and employee trends, enabling data-driven decision-making and strategic planning.

Benefits for Businesses and Employees

The adoption of advanced payroll software offers numerous benefits for both businesses and employees:

Increased Accuracy and Compliance: Automation reduces the risk of errors in payroll processing, ensuring accuracy and compliance with tax regulations and labor laws, thereby minimizing the potential for costly penalties and fines.

Time and Cost Savings: Streamlined workflows and automated processes save time and labor costs associated with payroll processing, allowing HR teams to focus on strategic initiatives and value-added tasks.

Enhanced Data Security: Payroll software incorporates advanced security measures to protect sensitive employee information, mitigating the risk of data breaches and identity theft.

Improved Employee Satisfaction: Self-service portals empower employees to access their payroll information and make changes as needed, enhancing transparency, autonomy, and satisfaction with the payroll process.

Scalability and Flexibility: Advanced payroll software is scalable and customizable to accommodate the needs of businesses of all sizes and industries, adapting to changing requirements and business environments.

Future Trends and Emerging Technologies

Looking ahead, several trends are poised to shape the future of advanced payroll software:

AI and Machine Learning Integration: AI-powered algorithms can enhance predictive analytics, automate routine tasks, and provide insights into payroll trends, improving efficiency and decision-making.

Blockchain Technology: Blockchain has the potential to enhance security and transparency in payroll processing, providing secure, immutable records of payroll transactions.

Mobile and Cloud-Based Solutions: Mobile apps and cloud-based platforms enable anytime, anywhere access to payroll information and functionality, catering to the needs of remote workforces and promoting collaboration and productivity.

Comprehensive Workforce Management: Integration with HRIS and other workforce management solutions provides a unified platform for managing all aspects of the employee lifecycle, from recruitment to retirement.

Conclusion: Embracing Innovation in Payroll Management

In conclusion, advanced payroll software represents a significant advancement in the realm of HR and finance, offering businesses unparalleled efficiency, accuracy, and compliance in payroll processing. By leveraging technology to automate calculations, streamline workflows, and enhance data security, organizations can transform payroll management from a time-consuming chore into a strategic asset. As the role of payroll software continues to evolve, businesses must embrace innovation and stay ahead of emerging trends to optimize payroll processes, enhance employee experiences, and drive business success. Together, let us harness the power of advanced payroll software to revolutionize payroll management and pave the way for a more efficient, compliant, and productive future.

0 notes

Text

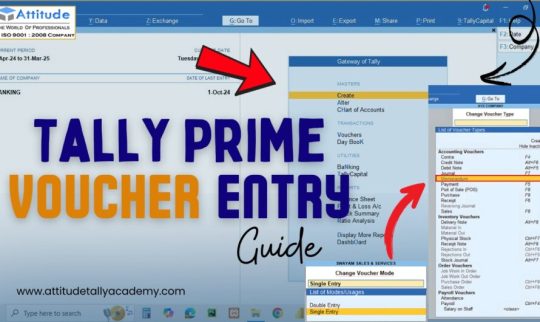

Master e-Accounting with TallyPrime: Learn Smart Financial Management

Level up your accounting skills with an in-depth e-Accounting course using TallyPrime. Designed for beginners and professionals, this course covers everything from manual accounting to GST, TDS, payroll, bank reconciliation, inventory management, and financial reporting. Learn how to create accurate books of accounts and manage real-time transactions using one of the most trusted accounting software solutions in the industry.

Whether you're looking to boost your resume or manage business finances efficiently, mastering TallyPrime is a smart investment in your career.

Start today and build a strong foundation in digital accounting!

Visit Attitude Academy📚

📍 Visit Us: Yamuna Vihar | Uttam Nagar

📞 Call: +91 9654382235

🌐 Website: www.attitudetallyacademy.com

📩 Email: [email protected]

📸 Follow us on: attitudeacademy4u

#TallyPrime Course#e-Accounting Course#Tally with GST Training#Learn TallyPrime#TallyPrime Online Course#Tally Accounting Software#GST with Tally Course#Tally Course for Beginners#Financial Accounting with Tally#Payroll in TallyPrime#TDS and TCS in Tally#Advanced Tally Course#TallyPrime with e-Invoicing#Business Accounting Course#Tally Certification Course

0 notes

Text

Diploma in Taxation

#Title : What is computer accounting course#1. Introduction to Computer Accounting Course#What is Computer Accounting?#In today’s fast-paced world#businesses rely heavily on technology for their financial operations. A computer accounting course teaches individuals how to use computer#prepare reports#and ensure compliance with financial regulations. The shift from traditional manual accounting to computerized accounting has revolutionize#bookkeepers#and financial analysts.#The Importance of Computer Accounting in Modern Business#Computerized accounting has simplified tasks that once took hours or even days to complete. Instead of using paper ledgers and manual entri#businesses can now perform tasks like invoicing#payroll management#financial reporting#and budgeting with the help of accounting software. This digital transformation ensures more accuracy#efficiency#and speed in business operations.#2. Key Features of Computer Accounting Courses#Course Structure and Duration#A computer accounting course typically covers a wide range of topics#from basic accounting principles to advanced financial software applications. The course duration can vary based on the level of depth and#while diploma and degree programs may take months or even years to complete.#Basic Level: Introduction to Accounting Software#Intermediate Level: Managing Accounts#Transactions#and Reports#Advanced Level: Auditing#Taxation#and Financial Planning#Software Covered in the Course

1 note

·

View note

Text

Advance Your Career with Our Advanced Tally Prime Course in Vasai-Virar

Introduction

Hello, aspiring accountants of Vasai-Virar! Are you ready to elevate your accounting skills and secure a promising future in finance? Our Advanced Tally Prime Course is designed specifically for students like you who are eager to deepen their knowledge and expertise. This course offers a perfect blend of theory and practical experience to ensure you excel in your career. Let’s explore why this course is the ideal step forward for you and how it can benefit your professional journey.

The Value of Tally Prime

Why Master Tally Prime?

Tally Prime isn’t just another accounting software—it's a powerful tool that simplifies financial management and boosts productivity. Here’s why mastering Tally Prime can significantly enhance your career:

User-Friendly Interface: Its intuitive design makes it accessible and easy to use.

Comprehensive Features: Handles everything from basic bookkeeping to advanced financial management.

Industry-Standard: Trusted by businesses worldwide, making your skills highly valuable.

Expanding Career Opportunities

Proficiency in Tally Prime opens numerous career opportunities. As more businesses rely on Tally Prime for their accounting needs, your expertise will be in high demand, significantly boosting your employability.

Course Overview

Detailed Course Curriculum

Our Advanced Tally Prime Course covers all the essential aspects of advanced accounting. Here’s what you can expect:

Module 1: Advanced Accounting

Handling Complex Transactions: Learn to manage intricate financial transactions seamlessly.

Multi-Currency Accounting: Gain expertise in handling accounts across different currencies.

Bank Reconciliation: Master the process of reconciling bank statements with business accounts accurately.

Module 2: Inventory Management

Optimizing Inventory: Efficiently categorize and manage inventory.

Stock Movement Analysis: Get insights into stock movement and aging analysis.

Order Processing: Understand the entire order processing cycle, from purchase to sales orders.

Module 3: Taxation

Mastering GST: Dive deep into Goods and Services Tax (GST) and its applications.

Managing TDS: Learn about Tax Deducted at Source (TDS) and its compliance.

Filing Taxes: Gain hands-on experience in filing various tax returns using Tally Prime.

Module 4: Payroll Management

Detailed Employee Records: Maintain comprehensive employee records efficiently.

Processing Payroll: Master payroll processing, including detailed salary calculations and deductions.

Ensuring Compliance: Ensure compliance with statutory requirements related to employee compensation.

Flexible Learning Schedule

We understand the importance of balancing your studies with other commitments. Our course spans three months, with classes held thrice a week, offering a flexible schedule that fits into your busy life.

Why Our Course Stands Out

Experienced Instructors

Our instructors are seasoned professionals with extensive experience in Tally Prime. They bring real-world insights and practical knowledge into the classroom, making complex concepts easier to understand and apply.

Modern Learning Environment

Our training center in Vasai-Virar is equipped with state-of-the-art facilities. Each student has access to the latest version of Tally Prime and other essential tools, ensuring a conducive learning environment.

Hands-On Experience

We believe in learning by doing. Our course includes real-world projects and case studies, providing you with practical experience that goes beyond theoretical knowledge. This hands-on approach ensures you’re ready to tackle real business challenges confidently.

How This Course Will Benefit You

Mastering Advanced Skills

Enrolling in our Advanced Tally Prime Course will equip you with expertise in advanced accounting practices. This knowledge is crucial for handling complex financial scenarios and will give you an edge over others in the field.

Boosting Your Employability

With a certification recognized by industry leaders, your resume will stand out to potential employers. The practical skills and advanced knowledge you acquire will make you a valuable asset to any organization.

Building Confidence

Our course is designed to empower you. By the end of the course, you’ll have the confidence to handle advanced accounting tasks and the ability to apply your knowledge in real-world situations.

Enrollment Details

How to Enroll

Enrolling is easy! Visit our training center in Vasai-Virar or register online through our website. Our team is available to assist with any questions or concerns you might have about the enrollment process.

Affordable and Flexible Fees

We offer competitive pricing for our comprehensive training. Additionally, we provide flexible payment options to accommodate different financial situations, ensuring that cost is not a barrier to your education.

Conclusion

Investing in your education is the best decision you can make for your future. Our Advanced Tally Prime Course in Vasai-Virar is designed to equip you with the skills and confidence needed to excel in the accounting field. Don’t miss this opportunity to advance your career—enroll now and take the first step towards mastering Tally Prime.

#Advanced Tally Prime Course#Tally Prime training Vasai-Virar#Tally Prime certification#Tally Prime advanced accounting#Tally Prime inventory management#GST and Tally Prime course#TDS management in Tally Prime#Payroll processing with Tally Prime#Tally Prime for students#Career in accounting Vasai-Virar#Best Tally Prime course in Vasai-Virar#Tally Prime classes Vasai-Virar#Accounting software training#Tally Prime practical experience#Tally Prime industry-recognized certification#Learn Tally Prime Vasai-Virar#Tally Prime course enrollment#Flexible Tally Prime course schedule#Advanced accounting skills#Tally Prime hands-on training

0 notes

Text

Advanced HR & Payroll Software in Bhubaneswar

Advanced HR & Payroll Software in Bhubaneswar with CakiWeb. Streamline your human resource management and payroll processes seamlessly, ensuring accuracy and efficiency. CakiWeb's innovative features include automated payroll calculations, employee self-service portals, and comprehensive HR analytics. Elevate your business operations with cutting-edge technology, delivering a hassle-free experience for both HR professionals and employees. Experience the future of HR and payroll management with CakiWeb in Bhubaneswar.

#Advanced HR & Payroll Software in Bhubaneswar#Software Company in Odisha#Best Software Company in Odisha#Software Company in BBSR#Software Company in Bhubaneswar#Best Software Company in Bhubaneswar

0 notes

Text

CREVH - GOLD

QuickBooks is a renowned accounting software that offers a seamless solution for small businesses to manage their financial tasks efficiently. With features designed to streamline accounting processes, QuickBooks simplifies tasks such as tracking receipts, income, bank transactions, and more. This software is available in both online and desktop versions, catering to the diverse needs of businesses of all sizes. QuickBooks Online, for instance, allows users to easily track mileage, expenses, payroll, send invoices, and receive payments online, making it a comprehensive tool for financial management. Moreover, QuickBooks Desktop provides accountants with exclusive features to save time and enhance productivity. Whether it's managing income and expenses, staying tax-ready, invoicing, paying bills, managing inventory, or running reports, QuickBooks offers a range of functionalities to support businesses in their accounting needs.

Utilizing qb accounting software purposes comes with a myriad of benefits that can significantly enhance business operations. Some key advantages of using QuickBooks include:

- Efficient tracking of income and expenses

- Simplified tax preparation and compliance

- Streamlined invoicing and payment processes

- Effective management of inventory

- Generation of insightful financial reports

- Integration with payroll and HR functions

These benefits not only save time and effort but also contribute to better financial decision-making and overall business growth. QuickBooks is designed to meet the diverse needs of businesses, offering tailored solutions for various industries and sizes.

When considering accounting qb software options, QuickBooks stands out as a versatile and comprehensive choice. To provide a holistic view, let's compare QuickBooks with two other popular accounting software options - Xero and FreshBooks. quick book accounting package and offers robust features for small businesses, including advanced accounting capabilities, invoicing, payment processing, and payroll management. Xero, on the other hand, is known for its user-friendly interface and strong collaboration features, making it a popular choice among startups and small businesses. FreshBooks excels in invoicing and time tracking functionalities, catering to freelancers and service-based businesses. By evaluating the features, pricing, and user experience of these accounting software options, businesses can make an informed decision based on their specific needs and preferences.

555 notes

·

View notes

Text

Why Payroll Outsourcing in Delhi is Essential for Business Efficiency

Streamline Your Business with Payroll Outsourcing in Delhi

As businesses expand and compliance regulations become more demanding, many organizations are now turning to payroll outsourcing in Delhi to simplify their internal operations. Managing payroll in-house can be tedious, especially when dealing with frequent legal updates, tax deductions, and employee benefits. Outsourcing this function not only ensures accuracy but also provides companies the freedom to focus on core business activities.

What is Payroll Outsourcing?

Payroll outsourcing is the process of hiring an external service provider to manage a company's entire payroll system. This includes calculating employee salaries, processing tax filings, managing provident fund (PF) and employee state insurance (ESI) contributions, generating payslips, and ensuring legal compliance. For businesses in Delhi—a city teeming with startups, SMEs, and large enterprises—this approach has become a practical necessity.

Benefits of Payroll Outsourcing

1. Cost and Time Efficiency Managing payroll internally can consume significant time and resources. With outsourcing, companies save on the cost of hiring specialized staff or purchasing expensive payroll software. It also eliminates the need for constant training to stay up-to-date with changing laws.

2. Regulatory Compliance Indian payroll laws are complex and ever-evolving. From income tax rules to statutory deductions like PF, ESI, and gratuity, compliance is critical to avoid penalties. A payroll outsourcing provider in Delhi ensures all calculations and filings are handled accurately and on time.

3. Enhanced Accuracy Manual payroll processing can lead to errors in salary calculations or tax filings. With automated systems and expert oversight, outsourced payroll services offer greater accuracy and reliability, reducing the chances of employee dissatisfaction or legal issues.

4. Data Security and Confidentiality Reputable payroll outsourcing firms use secure, cloud-based systems with encryption to protect sensitive employee data. This minimizes the risk of data breaches and ensures confidentiality is maintained at all times.

5. Scalability and Flexibility As your workforce grows or contracts, outsourcing partners can easily scale their services to match your needs. Whether you’re hiring 10 or 100 new employees, your payroll operations remain smooth and efficient.

Services Included in Payroll Outsourcing

Most payroll outsourcing providers in Delhi offer comprehensive solutions that include:

Monthly salary processing and disbursement

Payslip generation and distribution

Tax deductions and filings (TDS, PF, ESI, etc.)

Year-end tax form preparation (Form 16)

Compliance with labor laws and statutory reporting

Attendance and leave management integration

Reimbursement and bonus management

Employee helpdesk support for payroll queries

Advanced service providers may also offer integration with HR software, mobile apps for employees, and dashboards for real-time payroll analytics.

Why Delhi-Based Companies Should Consider Payroll Outsourcing

Delhi is a highly competitive and regulatory-sensitive business environment. Companies in this region must be agile and compliant while controlling costs. Payroll outsourcing is especially beneficial here because local providers have expertise in regional labor rules, state-specific regulations, and offer fast turnaround times for urgent payroll processing needs.

Additionally, Delhi is home to a wide pool of professional payroll service providers who offer tailored solutions for different industries—from IT and education to manufacturing and healthcare.

Choosing the Right Payroll Partner

Before selecting a payroll outsourcing company in Delhi, consider the following:

Experience and Reputation: Look for a provider with proven experience and client testimonials.

Technology Platform: Ensure they use a secure, modern payroll system.

Compliance Knowledge: They should stay updated with the latest changes in tax and labor laws.

Customization Options: Your business may have unique payroll structures or benefits.

Customer Support: Timely and responsive communication is essential for resolving issues quickly.

Final Thoughts

In a fast-moving market like Delhi, where talent retention, compliance, and cost control are key concerns, outsourcing payroll can offer a significant competitive advantage. It streamlines processes, ensures accuracy, and reduces operational stress—allowing companies to concentrate on strategic goals.

Whether you're a small business owner or the HR head of a growing enterprise, payroll outsourcing in Delhi could be the smartest step you take this year toward efficiency and peace of mind.

2 notes

·

View notes

Text

The Role of Technology in Outsourcing Bookkeeping: How Assist Bay Uses Modern Tools for Seamless Integration

In today’s globalized economy, outsourcing bookkeeping services has become a strategic solution for businesses looking to streamline operations, reduce overhead costs, and improve efficiency. Particularly in the UK and the Caribbean, companies are increasingly outsourcing their accounting needs to offshore experts in India. At the heart of this transformation lies the role of technology, which has revolutionized the way businesses integrate with outsourced bookkeeping services. Assist Bay, a leader in providing outsourced bookkeeping solutions, is harnessing modern tools to make this process seamless, efficient, and transparent.

The Growing Trend of Bookkeeping Outsourcing

Outsourcing bookkeeping services is a growing trend, especially in the UK and the Caribbean, where businesses are constantly seeking ways to reduce operational costs while maintaining high-quality financial management. Many businesses in these regions, especially small to medium-sized enterprises (SMEs), are turning to offshore solutions like those provided by Assist Bay, which is based in India. Outsourcing bookkeeping not only allows companies to access skilled accounting professionals at a fraction of the cost but also ensures that businesses can focus on their core activities while maintaining financial accuracy and compliance with local tax laws.

Why India for Outsourcing Bookkeeping?

India has long been a go-to destination for outsourcing services due to its large pool of skilled professionals, a robust IT infrastructure, and cost-efficiency. Indian bookkeeping experts are well-versed in international accounting standards, including UK GAAP (Generally Accepted Accounting Principles) and Caribbean tax laws, making them a perfect fit for businesses in the UK and the Caribbean.

The Role of Technology in Bookkeeping Outsourcing

As the landscape of outsourcing evolves, so does the technology that supports it. At Assist Bay, modern tools play a crucial role in making bookkeeping outsourcing seamless. Here’s how technology is transforming the process.

Cloud-Based Bookkeeping Software

One of the biggest advancements in the bookkeeping industry has been the shift to cloud-based platforms. Tools like QuickBooks, Xero, and Zoho Books allow real-time access to financial data from anywhere in the world. This enables business owners in the UK and the Caribbean to collaborate effectively with their offshore bookkeeping teams in India. Cloud-based software ensures that all financial data is stored securely, and updates can be made in real-time, reducing the risk of errors. Whether it’s invoicing, payroll, or tax filing, cloud-based bookkeeping tools ensure that everything is up-to-date and accurate.

2. Automation of Repetitive Tasks

Another significant way technology has improved bookkeeping outsourcing is through automation. At Assist Bay, advanced automation tools are used to manage repetitive tasks such as data entry, transaction categorization, and reconciliation. This reduces human error, saves time, and ensures that the team can focus on more strategic tasks, like financial analysis and forecasting. By automating these routine tasks, businesses in the UK and Caribbean can rely on fast, accurate, and consistent bookkeeping services without the worry of manual errors creeping in.

3. Integration with Financial Systems

One of the key benefits of outsourcing bookkeeping to India is the seamless integration with a company’s existing financial systems. Modern tools allow for smooth integration with platforms like ERP systems, CRMs, and other financial applications. Assist Bay leverages APIs (Application Programming Interfaces) to connect various software tools, ensuring that data flows effortlessly between systems. This integration ensures that businesses don’t have to deal with fragmented information. They can access consolidated financial data, reports, and analytics from one central location, making decision-making more efficient and informed.

4. Data Security and Compliance

Data security and compliance are top concerns for businesses when outsourcing their bookkeeping. In the UK and the Caribbean, businesses need to ensure that their financial data is protected and compliant with local regulations. Assist Bay employs the latest encryption technologies to safeguard sensitive financial information, ensuring that only authorized personnel have access. Moreover, Assist Bay stays up-to-date with changes in tax laws and accounting standards, ensuring that all bookkeeping practices meet local regulatory requirements. For businesses in the UK, this means adhering to HMRC standards, while for companies in the Caribbean, it involves compliance with local tax laws, which can differ from one island to another.

5. Real-Time Collaboration and Communication Tools

Technology has also improved communication between outsourced bookkeeping teams and businesses. Assist Bay uses collaborative tools like Slack, Microsoft Teams, and Zoom to ensure constant communication and immediate resolution of any issues. This ensures that clients in the UK and the Caribbean are always in the loop and can easily discuss any concerns with their bookkeeping team. Real-time communication tools also allow for faster decision-making and better collaboration on financial reports and business strategies. As a result, businesses can stay agile and responsive in today’s competitive environment.

6. Data Analytics and Reporting

Gone are the days of manual ledger entry and paper-based reporting. With the help of modern tools, Assist Bay provides businesses in the UK and Caribbean with detailed financial analytics and real-time reports. By analysing financial data with AI-powered tools, Assist Bay helps businesses gain valuable insights into their spending habits, cash flow, and profitability. These reports can be customized to suit the specific needs of a business, giving stakeholders the information they need to make informed decisions. Whether it’s forecasting revenue, tracking expenses, or assessing tax liabilities, data-driven insights are now more accessible than ever before.

The Future of Bookkeeping Outsourcing

The future of bookkeeping outsourcing lies in the continued evolution of technology. As cloud computing, automation, and AI become more advanced, the role of technology in outsourcing will only grow. Assist Bay is at the forefront of this change, helping businesses in the UK and the Caribbean seamlessly integrate outsourced bookkeeping services with modern technology. By leveraging cutting-edge tools and maintaining a focus on security, accuracy, and compliance, Assist Bay ensures that businesses can confidently rely on outsourced bookkeeping services without compromising on quality. As the demand for outsourcing grows, businesses in the UK, Caribbean, and beyond will continue to benefit from the efficiency, cost savings, and strategic insights that modern technology offers. Outsourcing bookkeeping services to India is no longer just about saving costs — it’s about gaining a competitive advantage by leveraging the power of technology for smarter, more efficient financial management.

2 notes

·

View notes

Text

How Small and Mid-Sized Engineering Firms Can Benefit from ERP

In today’s competitive business landscape, manufacturers and engineering companies in India are under constant pressure to improve efficiency, reduce costs, and enhance productivity. The adoption of ERP for manufacturing companies in India has become more than just a trend—it is a necessity for survival and growth. Manufacturing ERP software in India is specifically designed to address the unique challenges faced by the industry, offering seamless integration, automation, and data-driven decision-making capabilities.

If you are an engineering or manufacturing business looking to streamline your operations, this blog will help you understand why ERP software for engineering companies in India is essential and how choosing the best ERP for the engineering industry can revolutionize your operations.

Why ERP is Essential for Manufacturing and Engineering Companies

1. Streamlining Operations and Enhancing Efficiency

One of the biggest challenges faced by manufacturing and engineering companies is managing various processes such as inventory, procurement, production, and distribution. Manufacturing ERP software in India centralizes data, enabling real-time monitoring and control over every aspect of the business. This eliminates redundant tasks, reduces manual errors, and improves efficiency.

2. Improved Supply Chain Management

A well-integrated ERP system ensures smooth coordination with suppliers, vendors, and distributors. With ERP for manufacturing companies in India, businesses can track raw materials, monitor supplier performance, and optimize procurement processes, reducing delays and ensuring a seamless supply chain.

3. Enhanced Data-Driven Decision Making

With access to real-time data analytics and comprehensive reporting, ERP software for engineering companies in India empowers businesses to make informed decisions. Managers can analyze production trends, forecast demand, and identify areas for improvement, leading to better business outcomes.

4. Cost Reduction and Higher Profitability

Automation of processes helps in minimizing waste, reducing operational costs, and increasing profitability. The best ERP for the engineering industry ensures resource optimization by tracking inventory levels, reducing excess stock, and eliminating inefficiencies in production planning.

5. Compliance and Quality Control

Manufacturers must adhere to strict industry standards and regulatory requirements. Manufacturing ERP software in India helps in maintaining compliance by providing documentation, audit trails, and quality control measures, ensuring that all products meet industry regulations.

Key Features of the Best ERP for Engineering Industry

Choosing the right ERP solution is crucial for achieving maximum benefits. Here are some key features to look for in an ERP software for engineering companies in India:

Comprehensive Production Planning & Control – Ensures seamless coordination between different production units.

Inventory & Material Management – Tracks stock levels, raw materials, and procurement processes efficiently.

Financial Management – Integrates accounting, payroll, and financial reporting for better fiscal control.

Supply Chain Management – Enhances supplier relationships and improves procurement efficiency.

Customer Relationship Management (CRM) – Manages customer interactions, sales pipelines, and service requests.

Business Intelligence & Reporting – Provides real-time insights for strategic decision-making.

Scalability & Customization – Adapts to the growing needs of your business with modular functionalities.

Top ERP Software Providers in India

India is home to some of the top ERP software providers, offering advanced solutions for engineering and manufacturing businesses. Companies like Shantitechnology (STERP) have emerged as leaders in providing industry-specific ERP solutions that cater to the unique requirements of manufacturing and engineering firms.

Why Choose STERP?

STERP is one of the top ERP software providers in India, offering customized ERP solutions specifically designed for the engineering and manufacturing industries. Here is why STERP stands out:

Industry-Specific Solutions – Tailored to meet the challenges of the manufacturing and engineering sectors.

Cloud & On-Premise Options – Flexible deployment models to suit different business needs.

User-Friendly Interface – Easy to use, with intuitive dashboards and real-time analytics.

Excellent Customer Support – Dedicated support teams for implementation and ongoing assistance.

Scalable Solutions – Designed to grow with your business, ensuring long-term usability and return on investment.

How to Implement ERP for Maximum Success

Step 1: Assess Business Needs

Understand your business requirements and identify key areas that need improvement. Choose a solution that aligns with your industry needs.

Step 2: Choose the Right ERP Software

Selecting the best ERP for the engineering industry involves comparing features, scalability, pricing, and vendor support.

Step 3: Customization & Integration

Ensure that the ERP system integrates seamlessly with your existing tools and is customizable to fit your unique business processes.

Step 4: Training & Support

Invest in training programs to ensure that your team is comfortable using the new system. Opt for a provider that offers continuous support and upgrades.

Step 5: Monitor & Optimize

Post-implementation, continuously monitor the system’s performance, gather feedback, and make necessary optimizations to enhance efficiency.

Future Trends in ERP for Manufacturing and Engineering

The ERP landscape is evolving rapidly, with emerging trends shaping the future of ERP for manufacturing companies in India. Some key trends to watch include:

AI & Machine Learning Integration – Automating predictive maintenance and process optimization.

Cloud-Based ERP Solutions – Offering flexibility, remote accessibility, and cost savings.

IoT-Enabled ERP – Enhancing real-time tracking of production and inventory.

Mobile ERP – Allowing on-the-go access for better decision-making.

Blockchain for Supply Chain Management – Ensuring transparency and security in transactions.

Conclusion

Investing in ERP software for engineering companies in India is no longer an option—it is a necessity for businesses looking to stay ahead in the competitive market. Whether you are a small manufacturer or a large-scale engineering firm, having the best ERP for the engineering industry can drive efficiency, improve decision-making, and enhance overall profitability.

With industry leaders like Shantitechnology (STERP) offering cutting-edge solutions, businesses can achieve digital transformation effortlessly. As one of the top ERP software providers in India, STERP continues to empower manufacturing and engineering companies with tailored ERP solutions.

Are you ready to revolutionize your business with ERP? Contact STERP today and take the first step towards seamless automation and unmatched efficiency!

#ERP software for engineering companies#Engineering ERP Software Company#ERP solution providers#ERP software companies#ERP software for engineering companies in India#Best ERP for engineering industry#India#Gujarat#Maharashtra

4 notes

·

View notes

Text

Attendance Keeper is a top HRM software known for its affordable prices, strong payroll features, and flexible platform. This complete HR management software is designed for small to medium-sized businesses looking for an easy-to-use and cost-effective HR solution.

2 notes

·

View notes

Text

Accounting Outsourcing Companies in India by Neeraj Bhagat & Co.: Your Reliable Financial Partner

In today’s dynamic business environment, companies are constantly looking for ways to optimize their operations and focus on core competencies. One of the most effective strategies is outsourcing non-core functions like accounting. For businesses seeking top-notch financial management, Neeraj Bhagat & Co. stands out as one of the leading accounting outsourcing companies in India, offering unparalleled expertise and services tailored to meet diverse business needs.

Why Choose Neeraj Bhagat & Co. for Accounting Outsourcing?

Extensive Industry Experience With decades of experience, Neeraj Bhagat & Co. has established itself as a trusted partner for businesses across various industries. Their team of seasoned professionals ensures that clients receive accurate, timely, and reliable financial services.

Comprehensive Accounting Services Neeraj Bhagat & Co. offers a wide range of accounting outsourcing services, including:

Bookkeeping and Financial Reporting Tax Compliance and Advisory Payroll Processing Budgeting and Forecasting Audit Support Their holistic approach ensures that all financial aspects are covered, allowing businesses to focus on growth and innovation.

Customized Solutions for Every Business Understanding that no two businesses are the same, Neeraj Bhagat & Co. provides customized solutions tailored to each client’s specific needs. Whether you’re a startup, SME, or a large corporation, their team works closely with you to develop a financial strategy that aligns with your goals.

Benefits of Outsourcing Accounting to Neeraj Bhagat & Co.

Cost Efficiency Outsourcing accounting functions can significantly reduce overhead costs. By partnering with Neeraj Bhagat & Co., businesses can save on expenses related to hiring in-house accounting staff, training, and infrastructure.

Access to Expertise With Neeraj Bhagat & Co., you gain access to a team of highly skilled professionals who stay updated with the latest accounting standards and regulations. This ensures compliance and minimizes the risk of financial discrepancies.

Focus on Core Activities By outsourcing accounting tasks, businesses can allocate more resources and attention to their core activities, leading to increased productivity and growth.

Scalability As your business grows, your accounting needs may become more complex. Neeraj Bhagat & Co. offers scalable solutions that can adapt to your evolving requirements, ensuring seamless financial management.

How Neeraj Bhagat & Co. Stands Out

Client-Centric Approach At Neeraj Bhagat & Co., client satisfaction is paramount. Their dedicated team works closely with clients to understand their unique challenges and provide personalized solutions.

Advanced Technology Leveraging the latest accounting software and technology, Neeraj Bhagat & Co. ensures efficient and accurate financial reporting. Their tech-driven approach enhances transparency and streamlines processes.

Strong Ethical Standards Integrity and transparency are at the core of Neeraj Bhagat & Co.’s operations. Clients can trust them to handle their financial information with the utmost confidentiality and professionalism.

Get Started with Neeraj Bhagat & Co. If you’re looking for reliable and efficient accounting outsourcing companies in India, Neeraj Bhagat & Co. is the ideal partner. Their comprehensive services, experienced team, and client-focused approach make them a preferred choice for businesses seeking to enhance their financial management.

#taxation taxplanning taxreturns#accounting#taxauditfirm#income tax#tax services#developers & startups#education#quotes#nonprofits#photography

3 notes

·

View notes

Text

How Can Payout Solutions Transform Business Payments in 2024 - 2025?

In the fast-evolving landscape of digital commerce, businesses need agile and efficient systems to manage payments. Payout solutions have emerged as a cornerstone for streamlining transactions, enabling businesses to process bulk payments, vendor disbursements, and employee salaries with unparalleled ease. As we move into 2024-2025, payout solutions are set to revolutionize how businesses handle payments, with a focus on innovation, scalability, and integration.

Understanding Payout Solutions

Payout solutions refer to systems and platforms designed to automate and streamline the process of sending payments from businesses to multiple recipients, such as vendors, customers, and employees. These solutions are equipped to handle high transaction volumes, ensuring accuracy and compliance while reducing operational overhead.

Unlike traditional banking methods, payout solutions offer real-time processing, enhanced security, and seamless integration with existing business software. They have become indispensable for industries such as e-commerce, gig economy platforms, and financial services that rely heavily on efficient payment flows.

The Key Benefits of Payout Solutions

Efficiency and Automation: Payout solutions enable businesses to automate repetitive tasks, such as salary disbursements or vendor payments. This reduces manual intervention, minimizes errors, and accelerates transaction times.

Cost-Effectiveness: By consolidating and optimizing payment processes, businesses can lower administrative costs and reduce the reliance on traditional banking systems.

Global Reach: Modern payout solutions are designed to handle cross-border transactions, making them ideal for businesses with an international footprint.

Real-Time Processing: With real-time payments, recipients receive their funds instantly, improving cash flow and enhancing customer and vendor satisfaction.

Security and Compliance: Leading payout solutions prioritize data security and ensure compliance with local and international regulations, providing businesses with peace of mind.

Transformative Trends in Payout Solutions for 2024-2025

The payout solutions market is undergoing significant innovation, driven by advancements in technology and evolving business needs. Some of the key trends include:

Payment Gateway Integration: Seamless integration with payment gateways allows businesses to connect their payout systems with e-commerce platforms, accounting software, and ERP systems. This ensures smooth operations and better tracking of financial data.

Custom Solutions Services: Payment solution providers are increasingly offering tailored services to meet the specific needs of industries. Custom solutions address unique challenges, such as handling high transaction volumes for marketplaces or facilitating recurring payments for subscription-based businesses.

Artificial Intelligence and Machine Learning: AI-powered analytics help businesses identify patterns, predict payment trends, and detect fraudulent activities, making payout systems smarter and more reliable.

Blockchain for Transparency: Blockchain technology is being incorporated into payout solutions to ensure transparency, reduce fraud, and provide an immutable record of transactions.

Why Businesses Need Payout Solutions

Efficient payment management is critical to the success of any business. Delayed or inaccurate payments can harm relationships with vendors and employees and erode customer trust. By adopting advanced payout solutions, businesses can overcome these challenges while gaining a competitive edge.

For E-Commerce: Payout solutions simplify vendor disbursements, refunds, and affiliate payments, ensuring smooth operations.

For the Gig Economy: Freelancers and gig workers demand timely payments. Payout solutions ensure on-time and accurate disbursements, boosting workforce satisfaction.

For Corporates: Automating payroll processes reduces administrative effort and ensures compliance with labor laws.

The Role of Payment Solution Providers

Payment solution providers are the backbone of the payout ecosystem. They offer the tools and services needed to set up and manage efficient payout systems. By partnering with these providers, businesses can access cutting-edge technology and expert guidance to optimize their payment processes.

One standout example is Xettle Technologies, a leader in providing innovative payout and payment gateway integration services. Xettle Technologies specializes in delivering scalable and secure payout solutions that cater to businesses of all sizes. Their expertise in custom solutions services ensures that businesses can seamlessly integrate these systems into their existing workflows.

Challenges and Opportunities

While payout solutions offer numerous advantages, businesses may face challenges such as:

Integration Complexity: Implementing new payout systems may require reconfiguring existing business software.

Data Privacy: With increasing regulatory scrutiny, ensuring data protection and compliance is critical.

User Adoption: Training teams to use new payout solutions effectively can be a hurdle for organizations.

However, these challenges are outweighed by the opportunities payout solutions provide, including improved operational efficiency, enhanced customer satisfaction, and the ability to scale operations effortlessly.

Future Outlook

As businesses continue to embrace digital transformation, payout solutions will play an increasingly pivotal role. The integration of AI, blockchain, and IoT technologies into payout systems will further enhance their capabilities, making them more intuitive and secure.

In 2024-2025, we expect to see wider adoption of custom payout services, especially among SMEs looking to optimize their operations. Payment solution providers will continue to innovate, offering businesses the tools they need to thrive in an increasingly competitive landscape.

Conclusion

Payout solutions are no longer a luxury but a necessity for businesses aiming to stay ahead in today’s fast-paced digital economy. By streamlining payment processes, enhancing security, and offering scalability, these solutions transform how businesses manage their financial transactions. With the support of reliable payment solution providers like Xettle Technologies, businesses can unlock new opportunities for growth and efficiency.

Investing in a robust payout solution is an investment in the future of your business. As we step into 2024-2025, the businesses that leverage these transformative technologies will undoubtedly lead the charge in reshaping the global payment landscape.

2 notes

·

View notes

Text

Why Instant Financial Insights Matter for Businesses Today?

Introduction Today’s fast-paced business environment, waiting until the end of the month to understand a company's financial position is no longer sufficient. Real-time accounting has emerged as a game-changer, offering immediate access to financial data, allowing businesses to make informed decisions faster than ever before. Here’s a look at why real-time accounting is trending and how it benefits businesses in this dynamic economic landscape. RVAK Consulting LLP provides comprehensive taxation services tailored to help businesses navigate complex tax regulations and optimize compliance. From strategic tax planning to accurate filing and representation, RVAK ensures clients meet their tax obligations efficiently, minimizing liabilities and maximizing opportunities.

What is Real-Time Accounting?

Real-time accounting leverages advanced accounting software and cloud technology to update financial data instantly as transactions occur. Instead of waiting for monthly or quarterly reports, business owners and stakeholders can access live financial information at any moment.

Why is Real-Time Accounting a Trending Topic?

Several factors are driving the adoption of real-time accounting:

Demand for Agility: Businesses must adapt quickly to changing market conditions, and real-time data empowers them to make swift, well-informed decisions.

Digital Transformation: With the rise of cloud-based accounting solutions, updating financial data instantly has become more accessible to businesses of all sizes.

Risk Management: Real-time insights enable proactive decision-making, helping businesses identify potential risks and address them before they escalate.

Key Benefits of Real-Time Accounting

Improved Cash Flow Management: Real-time accounting allows businesses to monitor their cash flow instantly. They can see which payments are due, forecast cash needs, and avoid potential cash flow issues.

Enhanced Decision-Making: Instant access to financial data allows business leaders to make informed, data-driven decisions. Whether it's expanding operations or cutting expenses, real-time data provides the accuracy needed to act confidently.

Accurate Financial Forecasting: With up-to-the-minute data, companies can create more accurate financial forecasts, helping them better prepare for future needs or investments.

Simplified Compliance and Tax Reporting: Real-Time Accounting simplifies compliance by maintaining accurate records that can be accessed and verified easily, making tax filing and audits more straightforward.

Reduced Errors: Automating data updates in real-time minimizes the risk of manual entry errors, leading to more accurate financial records and fewer discrepancies.

How to Implement Real-Time Accounting in Your Business

Choose the Right Accounting Software: Select a cloud-based accounting system that integrates seamlessly with your business processes and supports real-time data updates.

Automate Transaction Entries: Leverage automation features for expenses, invoicing, and payroll to ensure transactions are recorded immediately, reducing manual work.

Integrate Bank Feeds: Many modern accounting platforms allow you to sync bank transactions directly, enabling instant reconciliation and more accurate cash flow tracking.

Regularly Monitor Key Metrics: With real-time data, it’s easy to monitor KPIs, cash flow, and profit margins. Set up dashboards for an at-a-glance view of your company’s financial health.

Challenges to Consider

While real-time accounting offers numerous benefits, there are a few challenges businesses may face:

Cost of Technology: Implementing new software or upgrading existing systems may require an initial investment, which can be a barrier for smaller businesses.

Data Security: With real-time data being cloud-based, it’s critical to have robust cybersecurity measures in place to protect sensitive financial information.

Learning Curve: Shifting from traditional to real-time accounting can require training, especially for employees accustomed to older accounting processes.

The Future of Real-Time Accounting

As technology advances, real-time accounting is expected to become even more accessible and integral to financial management. Artificial intelligence and machine learning are likely to further enhance the capabilities of real-time Accounting, enabling more predictive insights and even automated financial decision-making. RVAK Consulting LLP provides comprehensive taxation services tailored to help businesses navigate complex tax regulations and optimize compliance. From strategic tax planning to accurate filing and representation, RVAK ensures clients meet their tax obligations efficiently, minimizing liabilities and maximizing opportunities.

Conclusion

Real-time accounting offers a competitive edge, enabling businesses to access financial insights instantly, respond to market changes, and make data-driven decisions. With the rise of digital tools and automation, implementing real-time accounting is easier than ever, allowing companies of all sizes to benefit from instant, reliable financial data. In an ever-evolving business landscape, real-time accounting may well become the new standard for financial management.

#RealTimeAccounting#DigitalAccounting#BusinessFinance#AccountingTrends#FinancialInsights#FinanceManagement#ModernAccounting

2 notes

·

View notes

Text

Accounting Outsourcing India: Why MAS LLP is Your Ideal Partner

In today's fast-paced business environment, companies are increasingly turning to accounting outsourcing as a strategic move to enhance efficiency, reduce costs, and focus on core business functions. India, with its vast pool of skilled professionals and cost-effective services, has emerged as a global hub for accounting outsourcing. MAS LLP is at the forefront of this trend, offering top-notch accounting outsourcing services that cater to the diverse needs of businesses worldwide. Why Choose Accounting Outsourcing India? Cost Efficiency: One of the most significant advantages of outsourcing accounting services to India is the substantial cost savings. Indian service providers offer high-quality services at a fraction of the cost compared to Western countries. This cost advantage allows businesses to allocate resources more effectively and invest in growth initiatives.

Access to Skilled Professionals: India boasts a vast talent pool of accountants, chartered accountants, and financial analysts. These professionals are well-versed in global accounting standards, ensuring that your financial records are accurate and compliant with international regulations. Focus on Core Business Activities: By outsourcing accounting functions, businesses can free up valuable time and resources. This allows management to focus on core business activities, such as strategic planning, marketing, and product development, which are essential for long-term success. Scalability and Flexibility: Outsourcing accounting services to India offers businesses the flexibility to scale up or down based on their needs. Whether you require full-time accounting support or specific services like payroll processing or tax filing, Indian outsourcing providers can tailor their offerings to suit your requirements. Why MAS LLP is the Right Choice for Accounting Outsourcing India MAS LLP has established itself as a leading provider of accounting outsourcing services in India. Here’s why partnering with MAS LLP can be a game-changer for your business: Comprehensive Service Offerings: MAS LLP provides a wide range of accounting services, including bookkeeping, payroll processing, tax preparation, financial reporting, and more. Their comprehensive service offerings ensure that all your accounting needs are met under one roof. Experienced Team: The team at MAS LLP consists of highly qualified professionals with years of experience in the accounting industry. Their expertise in handling complex accounting tasks ensures that your financial records are in safe hands. Advanced Technology: MAS LLP leverages the latest accounting software and technologies to deliver accurate and timely services. Their use of advanced tools ensures that your financial data is processed efficiently and securely. Customized Solutions: Understanding that every business is unique, MAS LLP offers customized accounting solutions tailored to your specific needs. Whether you’re a small business or a large corporation, they have the expertise to cater to your requirements. Commitment to Quality: MAS LLP is committed to delivering high-quality services that exceed client expectations. Their focus on accuracy, compliance, and timely delivery has earned them a reputation as a trusted partner in the accounting outsourcing industry. Conclusion In an increasingly competitive global market, outsourcing accounting functions to India is a strategic move that can provide significant benefits. With MAS LLP as your partner, you can rest assured that your accounting needs will be handled with the utmost professionalism and expertise. Whether you’re looking to reduce costs, improve efficiency, or focus on core business activities, MAS LLP offers the perfect solution for all your accounting outsourcing needs. For more information on how MAS LLP can assist your business with Accounting Outsourcing India, contact them today.

#accounting & bookkeeping services in india#businessregistration#chartered accountant#foreign companies registration in india#audit#income tax#auditor#taxation#ap management services

6 notes

·

View notes

Text

Software Company in Odisha

Cakiweb, a leading software company in Odisha, excels in providing cutting-edge IT solutions. With a focus on innovation, our skilled team develops customized software to meet diverse business needs. From web development to mobile apps, we deliver quality solutions. Partner with Cakiweb for a seamless digital experience, driving your business towards success in the dynamic landscape of Odisha's technology sector.

#Software Company in Odisha#Advanced HR & Payroll Software in Bhubaneswar#Best Software Company in Odisha

0 notes

Text

The Role of Innovation in Business Growth with HRMS System

Innovation is a critical driver of business growth, enabling companies to stay competitive, enhance operational efficiency, and meet the evolving needs of their workforce. One area where innovation has had a profound impact is in the implementation of Human Resource Management Systems (HRMS). An HRMS System is a comprehensive suite of software applications designed to manage human resources and related processes throughout the employee lifecycle. This essay explores in detail how innovation through HRMS contributes to business growth, covering aspects such as streamlining HR processes, improving data management and decision-making, enhancing employee experience, facilitating remote work and flexibility, supporting strategic HR initiatives, ensuring compliance and risk management, and providing scalability.

1. Streamlining HR Processes

Automation

One of the most significant innovations brought about by HRMS is the automation of repetitive and time-consuming tasks. Payroll processing, attendance tracking, benefits administration, and other routine activities can be automated, freeing up HR professionals to focus on more strategic tasks. Automation reduces the likelihood of errors, ensures timely and accurate payroll, and improves overall efficiency. For instance, automated time and attendance systems can track employee hours, manage leave requests, and integrate seamlessly with payroll systems, ensuring that employees are paid accurately and on time.

Efficiency

HRMS systems streamline various HR processes, making them more efficient and less prone to errors. Recruitment, onboarding, performance management, and training are all processes that can be optimized through HRMS. For example, automated recruitment tools can handle job postings, resume screening, and interview scheduling, significantly reducing the time and effort required to hire new employees. Onboarding software can provide new hires with all the information they need, track their progress, and ensure a smooth transition into the company. Performance management systems can set goals, track progress, and provide feedback in real-time, fostering continuous improvement and development.

2. Improving Data Management and Decision Making

Centralized Data

An HRMS centralizes all employee data, making it easily accessible and manageable. This centralized data repository improves compliance with legal requirements and company policies by ensuring that all necessary information is stored securely and can be retrieved when needed. For instance, maintaining accurate records of employee qualifications, certifications, and training can help ensure compliance with industry regulations and standards.

Analytics

Advanced HRMS systems offer powerful analytics and reporting tools that help in tracking key HR metrics, identifying trends, and making data-driven decisions. By analyzing data on employee performance, engagement, turnover, and other metrics, HR managers can gain valuable insights into workforce dynamics and identify areas for improvement. For example, analytics can reveal patterns in employee turnover, helping HR identify the root causes and develop strategies to improve retention. Predictive analytics can forecast future HR needs, enabling proactive workforce planning and resource allocation.

3. Enhancing Employee Experience

Self-Service Portals

HRMS often includes self-service portals where employees can manage their own information, request time off, and access company resources. This improves the employee experience by providing more control and transparency. Employees can update their personal information, view their pay stubs, and access benefits information without having to go through HR. This not only empowers employees but also reduces the administrative burden on HR staff.

Career Development

Tools for performance management, training, and development planning help employees grow within the company, which can increase job satisfaction and reduce turnover. Performance management systems provide regular feedback and support continuous development, while learning management systems offer access to training and development resources. Career development plans can help employees set goals, identify career paths, and acquire the skills needed for advancement. By investing in employee development, companies can foster a culture of continuous learning and growth, leading to higher employee engagement and retention.

4. Facilitating Remote Work and Flexibility

Cloud-Based Solutions

The rise of remote work has highlighted the importance of cloud-based HRMS solutions. Cloud-based HRMS systems enable remote access to HR functions, ensuring that employees and HR teams can perform their tasks from anywhere. This flexibility is essential in today's work environment, where employees expect the ability to work remotely and access information on-demand. Cloud-based solutions also offer scalability, allowing businesses to expand their HR capabilities as they grow.

Communication Tools

Integration with communication platforms can improve collaboration and communication among remote teams. HRMS systems can integrate with tools like Slack, Microsoft Teams, and Zoom, facilitating real-time communication and collaboration. This integration ensures that remote employees stay connected, engaged, and informed. Additionally, HRMS can support virtual onboarding and training, ensuring that remote employees receive the same level of support and development as their in-office counterparts.

5. Supporting Strategic HR Initiatives

Talent Management

Advanced HRMS features for talent acquisition, development, and retention help companies build a strong workforce that aligns with business goals. Talent management modules can streamline the recruitment process, making it easier to attract, assess, and hire top talent. Once employees are on board, HRMS can support their development through performance management, training, and career planning. By aligning talent management with business objectives, companies can ensure that they have the right people in the right roles, driving business growth.

Succession Planning

Identifying and developing future leaders within the company is easier with the help of comprehensive data and analytics provided by HRMS. Succession planning tools can identify high-potential employees, assess their readiness for leadership roles, and create development plans to prepare them for future responsibilities. By proactively managing succession planning, companies can ensure a smooth transition of leadership and maintain business continuity.

6. Compliance and Risk Management

Regulatory Compliance

An HRMS can help ensure compliance with labor laws and regulations by keeping accurate records and providing timely updates on legal changes. HRMS systems can track employee qualifications, certifications, and training, ensuring compliance with industry standards and regulations. Additionally, automated compliance checks can identify potential issues before they become problems, reducing the risk of fines and penalties.

Risk Mitigation

By maintaining detailed and accurate records, an HRMS can reduce the risk of errors and legal issues related to HR processes. For example, accurate time and attendance records can prevent disputes over working hours and overtime pay. Employee records can also provide documentation in the event of legal disputes, protecting the company from potential liability.

7. Scalability

Growth Support

As a company grows, an HRMS can scale to handle increased HR demands, whether that involves managing a larger workforce or expanding into new regions. HRMS systems can support multiple locations, currencies, and languages, making it easier for companies to manage a global workforce. Additionally, scalable HRMS solutions can handle increased data volume and complexity, ensuring that HR processes remain efficient and effective as the company grows.

Customizable Solutions

Many HRMS systems offer customizable modules that can be tailored to meet the specific needs of a growing business. Customizable solutions allow companies to add or modify features as their needs evolve, ensuring that the HRMS continues to support business growth. For example, a company might start with basic payroll and attendance modules and later add advanced talent management and analytics features as their HR needs become more complex.

Conclusion

Innovation in HR through the adoption of an HRMS can significantly drive business growth by enhancing efficiency, improving decision-making, and creating a better employee experience. By automating routine tasks, streamlining processes, and providing powerful analytics, HRMS systems enable HR teams to focus on strategic initiatives that drive business success. Additionally, HRMS solutions enhance employee experience by providing self-service options, supporting career development, and facilitating remote work. They also ensure compliance with legal requirements, mitigate risks, and provide scalability to support business growth. As businesses continue to evolve in a digital landscape, leveraging innovative HR technologies becomes increasingly crucial for maintaining a competitive edge and achieving long-term success.

HRMS systems represent a significant investment in the future of human resources, transforming the way companies manage their workforce and driving business growth through innovation. By embracing the capabilities of HRMS, companies can build a more agile, efficient, and engaged workforce, positioning themselves for success in an ever-changing business environment.

4 notes

·

View notes