#Best payroll software for business

Explore tagged Tumblr posts

Text

A Guide to Choosing the Right Payroll Software for Your Business

Choosing the right payroll software is essential for businesses seeking efficiency, accuracy, and compliance in their payroll processing. With a wide range of solutions available, it’s crucial to find a platform that meets your company’s specific needs, from managing employee payments and tax calculations to handling benefits and deductions. Modern payroll software should integrate seamlessly with other HR systems, provide user-friendly reporting tools, and support compliance with local and federal regulations. This guide covers key factors to consider—such as scalability, ease of use, and security—helping businesses select a payroll solution that enhances productivity and simplifies payroll management.

More info: https://ahalts.com/products/hr-management/payroll

#Payroll software guide#Choosing payroll software#Best payroll software for business#Payroll management software#Payroll software features#payroll software comparison

0 notes

Text

Looking for accounting services for small business? This blog provides you detailed insights on useful small business accounting services like bookkeeping, tax preparation, payroll management, and more.

#Small business accounting services#Best accounting software for small business#Bookkeeping tips for small businesses#Tax preparation services for small business#Outsourced accounting services#Payroll services for small business#Tax deductions for small businesses#CPA services for small business#QuickBooks vs. Xero for small business#02. Monthly Accounting Activities#Bookkeeping Services#Monthly Accounting Activities

1 note

·

View note

Text

How Can You Use HR Software for Payroll Support?

When you are working with the top-notch integrations that constitute an HR operations management model, it could be helpful in the core services and solutions in an organization. This type of integration could help you obtain streamlined support and active assistance in the domain of authentic operations activities. This post helps you get active and essential value-added services and parameters in the domain of payroll solutions using a top-notch HR software platform.

Payroll Management Services of HR Software

If you decide to proceed with the use of an HRMS platform with optimum services to boost performance and productivity measures, it could be useful for your overall business operations. The major features that can take care of your payroll support management system tasks can be listed below:

Robust reporting servicesWhen you deploy core HR software services and solutions to add value to your operations integrations, it is important to stay on top of analytics and reporting parameters. The addition of a robustness factor can deliver sufficient value in this regard.

Core analytics parametersWorking with HRMS platforms can open up your top-notch functions and attributes in innovation practices. If you go with a unique and exclusive model to deliver value to your HR parameters and analytics support metrics with cloud HR software, it could be useful in the bigger picture.

Authentic self-service portalsIf you can go with employee self-service portals, it could elevate your entire HR management model and workflow practices. The adoption of HR payroll software could be useful for your core HR integrations in the long run. Authenticity is a key parameter in this scenario.

Key tracking of benefits managementWhen you keep track of staff benefits administration in your organization, it could be useful for managing the HR operations of the firm. The key parameters related to this can be actively demonstrated with the authentic support of factors like HR software pricing in your business model.

Streamlined compliance valuesIf you can maintain compliance norms and regulatory measures for each segment or HR module in an organization, it could be useful for aiding your business model growth and success. It varies by the module in the HRMS platform model. You could cite the example of hiring software to get the best features in this scenario.

As far as customization techniques and upgrade provisions are concerned, you must consider authentic support for the core integrations that promote a streamlined payroll support process. You can consider a proven and dedicated HR attendance software model to get optimum performance support and value in this regard.

#hr software#hr payroll software bahrain#best cloud hr software#hr software in bahrain#hr software pricing#hr software programs#cloud hr software#hr payroll software#hr software systems#hr management software for small business

0 notes

Text

Manage salaries easily and without stress with the help of Accent Consulting Payroll Software and expert team.

For details on features, pricing, offers, or to book a demo, call us at 9999143778.

#Payroll Software in Noida#what is payroll software#best Payroll Software in Noida#payroll management software#payroll software Noida#best payroll software#payroll management system#payroll processing software#automated payroll software#payroll system for small businesses

0 notes

Text

Windson Payroll: The All-in-One Payroll Management Software for Growing Businesses

Managing people and payroll effectively is the heart of any successful organization. As businesses grow, so do the complexities of payroll processing, compliance management, and employee data handling. That’s where technology makes all the difference — and VeravalOnline Pvt Ltd is proud to offer a powerful solution with Windson Payroll, an advanced payroll management software built for today’s dynamic HR needs.

At VeravalOnline Pvt Ltd, we believe that effective Human Resource Management starts with accurate, timely, and compliant payroll. Over the last five years, we’ve worked hand-in-hand with HR teams, consultants, and businesses of all sizes — and one need has remained constant: a smart, reliable payroll management solution.

That’s why we built Windson Payroll — a complete, cloud-based HR payroll software that streamlines every aspect of the employee lifecycle, from onboarding to full and final settlement.

The Problem with Traditional Payroll

Manual payroll methods are prone to mistakes, delays, and compliance risks. For growing teams, spreadsheets and outdated tools just don’t cut it. Businesses need a solution that’s fast, compliant, and scalable — and that’s exactly what Windson Payroll offers.

Meet Windson Payroll – The Best Payroll Software in India

Windson Payroll is more than just a salary calculator. It’s a powerful and intuitive solution built to simplify HR operations and improve employee satisfaction.

Here’s what makes Windson Payroll stand out:

✅ Automated Salary Processing No more manual calculations. Windson handles salary structures, deductions, taxes, and payslips with ease.

✅ Statutory Compliance Made Easy

Keep up with ever-changing labor laws. Windson ensures your payroll is always compliant with the latest regulations.

✅ Streamlined Recruitment & Onboarding

Integrated recruitment tools help HR teams attract, evaluate, and onboard talent quickly and efficiently.

✅ Performance Tracking & Employee Management

Track performance metrics, set goals, and maintain a positive workplace culture — all in one place

✅ Scalable for All Sizes

Whether you're a small HR consultancy or a large enterprise, Windson adapts to your operational needs.

Why Businesses Trust Windson Payroll

Designed with real business needs in mind, Windson Payroll was shaped by feedback from HR professionals and business owners. It’s fast, secure, easy to use, and eliminates the chaos of month-end salary runs. It’s no surprise that Windson is gaining popularity as the best payroll management software in India.

Boost Efficiency with Payroll Automation

By choosing payroll automation for businesses, you can free up valuable time, reduce human error, and maintain employee trust — all while staying 100% compliant.

Ready to Experience the Future of Payroll?

If your HR team is juggling Excel sheets or using outdated tools, now’s the time to level up. Discover how Windson Payroll can transform your workflow with smart, secure, and seamless payroll processing.

👉 Get Started with Windson Payroll Today: https://www.veravalonline.com/human-resources-recruitment-and-payroll-management-hrpm/

VeravalOnline Pvt Ltd – Digital solutions made for growing businesses. Choose Windson Payroll — your trusted partner in HR automation.

#Payroll Management Software#HR Payroll Software#Best Payroll Software in India#Payroll Automation for Businesses#Payroll Processing Tool#Online Payroll System#Easy Payroll Software

0 notes

Text

Advantages of Payroll Management Software

#payroll management software india#payroll management software#best payroll software in uae#payroll processing software in uae#hr solution#Best HRMS software#HR and payroll management system#hrms software#hr system software#best hr management software#HR software for small businesses#Cloud-based HR software#hr software for onboarding#best hr onboarding software#leave management software#leave management system

0 notes

Text

Grow Without Stress: How Scalable HR Payroll Software Supports Your Business

Growth is exciting—but it also brings complexity. Whether you’re expanding your team, entering new markets, or simply adding new services, every milestone introduces new HR and payroll challenges. Manual processes that once worked are no longer efficient. Suddenly, you're juggling compliance across different regions, managing remote teams, and struggling with outdated spreadsheets or siloed systems.

That’s where scalable HR payroll software comes in. It's not just a tool—it’s a foundation that supports sustainable growth without adding unnecessary stress or overhead.

In this article, we’ll explore why scalability in HR payroll systems matters, the specific features that empower businesses to grow smoothly, and how to choose the right solution for your needs.

Why Scalability Matters in HR Payroll

Scalability is more than a buzzword. It means your payroll system can adapt as your business evolves—without needing a complete overhaul every time you hire new employees, open new locations, or change payroll schedules.

Common Growing Pains in HR & Payroll:

Increased employee headcount: More staff means more timesheets, tax calculations, and leave tracking.

Regulatory complexity: Expanding into new regions brings new labor laws, tax rules, and reporting requirements.

Multi-location coordination: Managing employees across offices or countries creates data silos and potential for errors.

Manual overload: What was once manageable becomes time-consuming and prone to mistakes at scale.

Scalable payroll software solves these issues by centralizing, automating, and standardizing HR processes across the board.

1. Centralized System for All Employee Data

A scalable HR payroll platform consolidates employee information in one secure, accessible place. Whether your staff works in the office, remotely, or across borders, their profiles, tax documents, benefits data, and leave balances are updated in real time.

Benefits:

Eliminate duplicate data entry.

Avoid inconsistencies across HR systems.

Easily onboard or offboard employees in minutes.

Centralization ensures that your HR team doesn’t have to manage multiple disconnected systems as your workforce grows.

2. Automated Payroll That Adapts to Scale

One of the biggest challenges of growth is maintaining accuracy as volume increases. Scalable HR payroll software automates time-consuming tasks like:

Calculating salaries, taxes, and deductions.

Generating payslips and reports.

Managing benefits and bonuses.

Filing taxes and ensuring compliance.

Instead of adding more HR personnel to manage payroll, automation allows your existing team to handle a growing workload effortlessly.

3. Compliance Across Multiple Jurisdictions

As your business expands, so do your legal responsibilities. Payroll laws vary by country—and sometimes even by state. Scalable software keeps you compliant by:

Offering built-in support for multi-country payroll.

Automatically updating tax rates and labor laws.

Providing audit trails and statutory reports.

This reduces the risk of costly compliance violations and gives you peace of mind as you grow into new regions.

4. Integration with Other Business Systems

Scalable HR payroll software doesn’t operate in isolation. It integrates with:

Time & attendance systems

Accounting and ERP software

Recruitment and onboarding platforms

Performance management tools

This seamless data flow between platforms creates an efficient ecosystem where information moves automatically—reducing manual work and improving accuracy.

As your business grows, having an integrated tech stack becomes essential to maintain visibility and control.

5. Customization for Evolving Needs

No two businesses are the same. Scalable hr payroll systems let you configure workflows, approvals, reporting formats, and pay cycles to match your current setup—and then easily adapt as you grow.

For example, you can:

Set up different payroll groups by department or location.

Define rules for bonuses, shift differentials, or commissions.

Create custom reports for stakeholders.

This flexibility means the software grows with you—rather than forcing you to adapt to its limitations.

6. Cloud-Based Access for a Remote or Distributed Workforce

Post-2020, hybrid and remote work are here to stay. Your payroll system must keep up.

Scalable HR payroll platforms are cloud-based, offering secure access from anywhere. That means:

HR managers can process payroll from any device.

Employees can view payslips, apply for leave, or update details from their mobile.

Stakeholders can run reports in real-time, even across time zones.

Cloud scalability ensures business continuity and keeps everyone connected—no matter where they are.

7. Real-Time Analytics to Drive Better Decisions

Growth brings more data—and more opportunities to use that data strategically. Advanced HR payroll software includes analytics dashboards that help you:

Forecast labor costs.

Track overtime and absenteeism.

Analyze turnover rates.

Identify high-performing departments or cost centers.

With these insights, you can make informed decisions about hiring, budgeting, and workforce planning—backed by real numbers, not guesswork.

8. Better Employee Experience at Scale

As your company grows, so does the need to keep employees informed, engaged, and happy. Scalable HR payroll software contributes to a better employee experience by:

Offering self-service portals for payslips, tax documents, and leave requests.

Ensuring salaries are paid accurately and on time.

Giving employees transparency and control over their data.

When employees trust that their pay and records are accurate, it builds morale and reduces queries for HR.

9. Scalability Reduces Long-Term Costs

While it may seem like a big investment at first, scalable payroll software reduces long-term costs by:

Minimizing payroll errors and rework.

Avoiding compliance penalties.

Reducing dependency on external vendors or manual processes.

Supporting growth without needing to double your HR team.

As your business scales, the cost per employee served by the system drops—making it a smart financial move.

Conclusion: Scale with Confidence

Growth shouldn’t be painful. With the right HR payroll software, you can scale your business smoothly, stay compliant, keep employees happy, and maintain control.

Instead of patching systems together or overloading your HR staff, invest in a solution that grows with you. Scalable HR payroll software is the silent partner that works behind the scenes—freeing your team to focus on what matters: people, productivity, and performance.

🚀 Ready to grow without stress?

Explore how our scalable HR payroll software can support your business goals. Start your free trial today and experience stress-free payroll at scale.

#HR Payroll Software#hr and payroll software#payroll management software#best hr and payroll software#hr and payroll software for small business#hr payroll system

0 notes

Text

https://www.bestpeers.com/blog/guide-to-hr-software-features-benefits-pricing.

Ultimate Guide to HR Software: Features, Benefits & Pricing | BestPeers

Explore HR software features, benefits, and pricing. Learn how BestPeers simplifies HR tasks with custom portal solutions. Read the full blog now.

#HR Software Solutions#Workforce Management Tools#Best HR Portal Development#Payroll and Attendance Software#HR Automation for Businesses

0 notes

Text

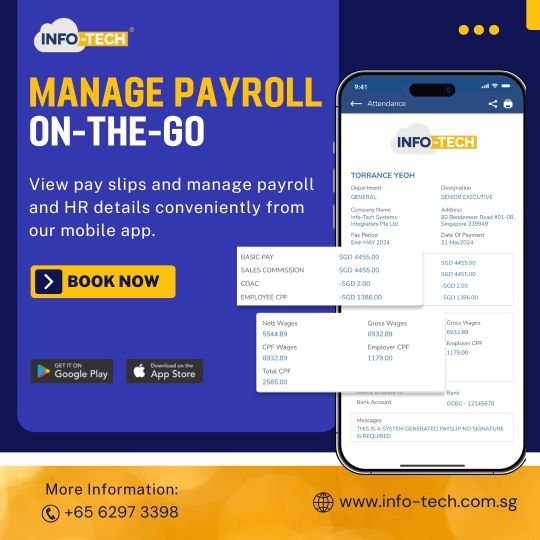

Simplify Payroll Management with Info-Tech Payroll Software

Effortlessly manage your payroll processes with Info-Tech Payroll Software. Designed for businesses of all sizes, it features automated calculations, tax compliance, and seamless integration with HR and accounting systems. Enhance accuracy, save time, and stay compliant with our user-friendly payroll solution.

#payroll software singapore#hr payroll software#payroll software#payroll system#payroll software for sme#payroll software for small business#best payroll software singapore#payroll and leave management

0 notes

Text

Reliable Payroll Software Hong Kong

Our Payroll Software is designed to simplify payroll management for businesses in Hong Kong. Automate salary calculations, MPF contributions, and tax deductions while ensuring compliance with local regulations. With seamless integration into your HR systems, you can streamline your payroll process, reduce errors, and save time.

#payroll software Hong Kong#hr payroll software#payroll software#payroll system#payroll software for sme#payroll software for small business#best payroll software Hong Kong

0 notes

Text

HR and Payroll Software Bahrain

Upgrade your HR operations with Bahrain’s best HR management software. We offer a wide range of HR and payroll software solutions, including cloud HR software, HR application software, and ATS HR software. Whether you need HR software in Manama or free HR software for Bahrain, we have the right tools for you.

#hr and payroll software bahrain#hr management software bahrain#hr & payroll software bahrain#hr payroll software bahrain#hr software in bahrain#best hr software in bahrain#hr and payroll software in bahrain#free hr software for bahrain#human resources software#accounting and hr software#cloud hr software#hr software pricing#hr software systems#best cloud hr software#hr software programs#online hr management software#online hr software#ats hr software#best free hr software#best hr software#free hr management software#free hr payroll software#free hr software#hr analytics software#hr management software#hr payroll software#hr software#best hr software for small business#best hr management software#hr management software for small business

0 notes

Text

Improve Your Core HR Software Functions with Technology

When you are managing your HR operations model without compromising different branches of technology innovations and practices, the right valuable method is to improve the entire business process. If you can achieve progress in the domain of technology integrations, it will promote your entire organization’s core operations model programs. This post exclusively focuses on the provision of an exhilarating platform that deals with core HR software solutions and services. You can go with the right technology practices to effectively promote this scenario with ease.

Technology Integrations of Core HR Software Platforms

The importance of the HR management model can significantly help you grow your business in the right direction without fail. If you can deal with top-notch HR practices and operations model activities, then this becomes easier to execute and deploy. You can check out the major features and technology parameters for core HR management below:

Centralized data managementIntegrating HR software technology and innovations to meet your core operations functions and values could build your overall business practices. The introduction of centralized data management and documentation could be feasibly demonstrated in this specific model.

Staff benefits administrationWorking with the featured attribute of quality services in staff benefits and compensation management is an important task to deliver and deploy value. You can go for authentic technology solutions and services to create a promising cloud HR software integration with streamlined support in the domain.

Compliance reporting termsIf you can go for compliance norms and regulatory measures to provide for each aspect of your HR operations segment, it could be useful in the long run. Working with technology can elevate your HR payroll software solutions to promote integrated support services.

Self-service capabilitiesEmployee self-service portals are some of the most engaging and empowering HR technologies model parameters that can add crucial value to your core operations. You can add this feature to work with specific HR modules and segments, like a hiring software solution, to promote your core operations solutions without failing technology factors.

Performance management supportIf you can go with performance management solutions and services to boost your core operations technology, it could benefit your HR division in the long run. Adding HR software pricing category functions can help you immensely in this regard. It could help you stay on top of various employee performance functions in the organization.

Factors such as customization and performance upgrades promote an active and essential HR technology practice. You can go with the right solutions and suitable services in this regard to optimize the HR attendance software practices for your organization. Developing the right innovations and business practices is useful in this case.

#hr software pricing#hr payroll software bahrain#hr software#hr software in bahrain#cloud hr software#hr software systems#hr payroll software#best cloud hr software#hr software programs#hr management software for small business

0 notes

Text

4 Ways Payroll Management Software Can Help Your Business Save Money

A payroll platform is essential for managing the quality of your HR operations with time efficiency and cost-effectiveness. Businesses looking to save money in their tasks and activities should rely on essential HR software technology. Some of the monetary benefits of HR payroll management include a reduction in errors owing to the elimination of manual processes. An automated payroll management software is also capable of delivering exclusive HR management functions with ease. It leads to cost savings in the domain. The introduction of employee self-service portals in the payroll modules will help your cause for business optimization. All payroll compliances are made easier with software implementation. It helps industries of various types and sizes. Payroll software coming under the digital transformation era can provide value in these features related to cost management. The best HR software for small business units, mid-level firms, and large-scale enterprises can all utilize the quality services of an integrated payroll model.

0 notes

Text

Best HR software in UAE| Best HRMS in UAE

Our best HR software in UAE is designed to simplify employee management, payroll processing, attendance tracking, and more. As the best HRMS in UAE, it offers powerful automation, real-time analytics, and seamless integration to enhance workforce efficiency. Whether you’re a small business or a large enterprise, our HR solution ensures compliance, improves productivity, and optimizes HR workflows. Experience a smarter way to manage your human resources with our advanced HR software.

#best hr software in uae#best hrms in uae#best payroll software in uae#payroll processing software in uae#software for leave management system#employee leave management software#attendance software in uae#hr software for onboarding#best hr onboarding software#hr software uae#hrm features#HR software for small businesses#Best HRMS software#Cloud-based HR software#HR and payroll management system#Employee management software#Automated payroll software#hrms software#hr system software#best hr management software#hr solution

0 notes

Text

Avoid Payroll Mistakes with Smart HR Payroll Software Solutions

Introduction: The High Cost of Payroll Errors

Payroll is one of the most critical yet complex functions in any organization. Accurate payroll processing ensures employees are paid correctly and on time, compliance with labor laws is maintained, and business operations run smoothly. However, payroll mistakes can be costly, leading to unhappy employees, regulatory penalties, and damage to your company’s reputation.

Thankfully, smart HR payroll software solutions are designed to eliminate common payroll errors by automating calculations, ensuring compliance, and streamlining workflows. This article explores how businesses can avoid payroll mistakes by leveraging modern HR payroll software, improving efficiency, and maintaining employee trust.

1. Understanding Common Payroll Mistakes

Before diving into solutions, it’s important to understand the types of payroll errors that frequently occur:

Incorrect Employee Information: Errors in employee names, bank details, or tax IDs can cause payment delays or failed transactions.

Misclassification of Employees: Treating contractors as full-time employees (or vice versa) can lead to compliance issues and incorrect tax filings.

Wrong Salary Calculations: Manual miscalculations of overtime, bonuses, or deductions often result in underpayments or overpayments.

Late Payroll Processing: Delays in payroll runs can affect employee morale and breach labor regulations.

Non-Compliance with Tax Laws: Failure to apply the correct tax rates or file tax reports on time invites penalties.

Ignoring Labor Law Updates: New rules about working hours, leave entitlements, or benefits may be overlooked.

Manual Data Entry Errors: Human errors, such as typos or missing data, can cause cascading payroll issues.

Inadequate Record Keeping: Poor documentation complicates audits and regulatory reporting.

These mistakes can impact your business financially and legally, so preventing them is crucial.

2. How Smart HR Payroll Software Prevents Errors

Modern HR payroll software solutions are designed to tackle these challenges head-on. Here’s how:

Automation of Calculations and Processes

Smart payroll software automates complex salary calculations, including:

Overtime and shift differentials

Bonuses, commissions, and incentives

Statutory deductions such as taxes, social security, and benefits

Automation eliminates human error, ensuring accurate payroll runs every time. The software can also schedule payroll processing automatically, avoiding late payments.

Centralized Employee Data Management

A single source of truth for employee information reduces mistakes related to incorrect data. Payroll software securely stores and updates:

Personal details

Tax information

Bank accounts

Employment contracts and classifications

This centralization means that any change is reflected across all relevant payroll processes immediately.

Compliance Management and Updates

Leading HR payroll systems include features to help businesses stay compliant with changing regulations. They offer:

Automated tax calculations based on current laws

Alerts about legal updates affecting payroll

Integrated hr reporting tools for regulatory filings

This reduces the risk of costly fines and audits.

Employee Self-Service Portals

Many payroll platforms provide employees with self-service portals to:

View pay slips and tax forms

Update personal information

Submit leave requests

This reduces administrative burdens and minimizes data entry errors caused by HR staff.

3. Key Features to Look for in Payroll Software to Avoid Mistakes

Not all payroll solutions are created equal. When selecting software, prioritize features that specifically help prevent common payroll errors:

Automated Payroll Processing: Enables scheduled and error-free payroll runs.

Tax Compliance Engine: Keeps you updated with tax rules and automates deductions.

Accurate Leave and Attendance Tracking: Integrates with time and attendance systems to correctly calculate pay.

Audit Trails and Reports: Provides transparency and easy tracking of payroll activities.

Customizable Pay Rules: Supports different employee types, pay frequencies, and benefits.

Integration Capabilities: Works smoothly with HR management, accounting, and banking systems.

Cloud-Based Access: Allows secure, remote management and real-time updates.

User-Friendly Interface: Simplifies usage and reduces input errors.

Choosing software with these features helps create a reliable, error-proof payroll system.

4. The Impact of Avoiding Payroll Mistakes on Your Business

Avoiding payroll errors does more than keep numbers accurate—it positively affects your entire business ecosystem:

Enhances Employee Satisfaction and Trust

Timely and accurate pay is fundamental to employee morale. Errors can lead to frustration, loss of trust, and increased turnover. With smart payroll software, employees feel valued and secure knowing their compensation is handled professionally.

Ensures Legal Compliance and Reduces Risk

Compliance with labor laws and tax regulations avoids fines, penalties, and legal disputes. Payroll software's automatic updates and built-in compliance checks keep your business safe from regulatory risks.

Saves Time and Costs

Automated payroll reduces the hours spent on manual calculations, corrections, and reconciliations. It also minimizes costly mistakes that require refunds or legal settlements.

Improves Data Security

Cloud-based payroll systems typically offer robust security measures to protect sensitive employee and financial data, reducing the risk of data breaches.

Provides Better Insights and Reporting

Access to real-time payroll data and detailed reports supports better financial planning and HR decision-making.

5. Best Practices for Implementing Payroll Software Successfully

To maximize the benefits of your HR payroll software, follow these best practices:

Choose the Right Vendor: Select a reputable provider with a strong track record and local compliance expertise.

Plan Your Rollout: Communicate with your team and schedule training sessions to ensure smooth adoption.

Cleanse Your Data: Verify and update all employee records before migration to avoid errors.

Test Thoroughly: Run parallel payrolls before going live to catch any issues early.

Use Employee Self-Service: Encourage employees to update their information to reduce HR workload.

Regularly Update Software: Keep your system up-to-date with the latest patches and features.

Monitor and Audit: Periodically review payroll reports and audit logs to detect discrepancies.

Conclusion: Smart Payroll Software Is a Must-Have

Payroll errors aren’t just an administrative headache—they are a serious risk to your business’s financial health and reputation. By adopting smart HR payroll software solutions, you can automate complex processes, ensure compliance, and give employees confidence that their pay is accurate and timely.

If you want to avoid costly payroll mistakes and build a reliable payroll system, now is the time to explore the latest payroll software options tailored for your business needs.

#HR Payroll Software#hr and payroll software#payroll management software#best hr and payroll software#hr and payroll software for small business

0 notes

Text

Best HR Software for Startups

Choosing the best HR software for small businesses becomes a critical decision for startups facing budget constraints. Thankfully, a category of HR solutions is tailored to efficiently manage diverse HR functions without straining financial resources. These solutions offer a viable pathway for organizations to organize and optimize HR processes without compromising quality.

Key Features to Look For:

Comprehensive People Management User-friendly Interface and Support Streamlined Recruitment and Employee Management Efficient Employee Database Management Time and Cost Efficiency Strategic Features for Startup Success Global Expansion Readiness Simplified All-in-One Platform Employee Development and Engagement Scalability and Adaptability Efficient Workforce Management Employee Feedback for a Positive Culture Adaptability with Customization Options Comprehensive HR and Payroll Support Tailored Support for Small Businesses

Recommendation

In the dynamic landscape of startup operations, choosing the right HR software is critical for seamless workforce management. This comprehensive guide has delved into the essential features when selecting the best HR and payroll software for small businesses.

Each aspect shapes an efficient and adaptable HR ecosystem, from user-friendly interfaces and responsive customer support to streamlined Recruitment processes and global expansion readiness.

As startups embark on their journey, the strategic integration of these features becomes paramount, ensuring the optimization of current HR processes and scalability for future growth.

By prioritizing tailored solutions for small businesses, embracing adaptability, and fostering employee development, startups can position themselves for sustained success.

The educational recommendation underscores the importance of aligning chosen features with the specific needs and aspirations of the startup, paving the way for a comprehensive and scalable HR solution that genuinely defines the best in class for small businesses.

Source Link-https://www.greythr.com/hr-garden/best-hr-software-for-startups/?utm_source=google&utm_medium=website&utm_campaign=240524_web_tumblr

#best hr and payroll software for small business#hr and payroll software for small business#payroll processing software for small business#payroll management software for small business#hr management software for small business#hr software#hrms software#greytHR

0 notes