#Best way to earn cryptocurrency

Text

Swap verse

And here it is. The Swap Verse. I want this to be more than just "Character swaps with Character". So here is a full list of who is here and who they are. Enjoy.

Swap Nightmare is Phobos. Name inspired by the Martian Moon, and by the god of fear who goes by the same name. Swaps with Dream.

In this AU, Phobos is the guardian of positivity. While he represents negative energy and such, it is his job to keep the balance and watch over the opposite side of the tree. And just like Dream, everyone loves him more than his brother. But unlike Dream, Phobos actually earns and deserves the adoration. He knew the villagers did not love his brother as much and tried his best to him without letting him know people didn't love him. I'll explain the "incident" when I get to swap Dream but just know that Phobos does still eat the dark apple and become a goofy octopus we know. But unlike the original Nightmare, Phobos felt bad after what happened and decided to leave the village, not believing he deserved the adoration anymore.

Phobos is still the leader of a gang. But it's not a group Phobos started to spread death and fear across the multiverse. Phobos started his group which I shall title The Good Sanses (Real creative I know) was started by Phobos when he began to take in Sans AUs who were in pain and alone. AUs that had the most negativity leaking through.

His Salt equivalent is Phosphor. Name inspired by the word that means fluorescent light.

Swap Error is Cyber. Name inspired by the word that means related to computers and technology. Swaps with Ink.

In this AU, Cyber is still the "destroyer of AUs". I want to go or a The Collector from The Owl House vibe. Cyber's story is generally the same as Error's... Which is... Well... I'm not sure what Error's story is but here goes; Cyber was previously swap Geno (Who I will discuss later), who was previously Blue. Cyber agrees there AUs are anomalies of the original Undertale AU. But he actually likes them. His goal is not to destroy them but to make them look pretty. He'll decorate the AUs with long patches of his yarn, make it all look pretty, and then move onto the next.

Cyber is not completely devoid of malice. Just like Ink, Cyber is not necessarily "good". If he believes an AU is beyond saving he will destroy it (Hense keeping the Destroyer Of AUs title). He sees the multiverse as his personal dollhouse and the monsters inside, his dolls. Whom which he can toy with however he wants.

His Salt equivalent is Crypto. Name inspired by the word short for cryptocurrency.

Swap Cross is Scout. Name inspired by the word that means soldier or person who searches. Swaps with Blue.

In this AU, Scout is basically if Cross were to instead join Dream/The good side. But he joined Phobos. Scout has a very similar personality to Blue. He is very helpful and is the shining beacon of The Good Sanses.

His Salt equivalent is Scotch. Name inspired by the fact that it also starts with 'sco'.

Swap Dust is Powder. Name inspired by the word that means particals. He doesn't swap with anyone, but he is meant to have a similar personality to Horror.

In this AU, when Stretch tried to kill Blue, Blue instead fought back and kills Stretch. He felt terrible for it. But at the same time it felt so "good". So nice to not be a weakling for once and have someone else's blood/dust on his hands. So he decided to keep going and start killing everyone to feed his newfound bloodlust. After the first reset he did it all over again And after the second reset, and after the third, fourth, and fifth. After about 50 resets the human just... Stopped coming back.

Powder is very mentally broken but not in the same way Dust is. Powder is just a complete manic mess. He is very emotional and cries over every little thing and is very clingy. Powder is similar to Horror in the sense that despite having a very tragic origin he is in a way the least harmful and cares for the other members the most.

Powder has a ghost Pap as well whom he pretends is real as a way of coping. Sometimes it seems like he knows it's not real, other times it can be very hard to tell. His ghost Pap usually just mocks and verbally abuses Powder.

His Salt equivalent is Pollen. Name inspired by the word that means powdery substance.

Swap Killer is Hunter. Name inspired by the word that means someone that hunts. He doesn't swap with anyone, but he is meant to have the same personality as Dust.

In this AU, I wanted to play off the fact that Killer lacks emotions. Instead of lacking emotions but still acting with a lot of expression (The best way I can describe Killer) Hunter shows little to no expression. And unlike Dust, Hunter has no sense of empathy or sympathy for anyone he's hurt or anyone around him that is hurting. Hunter tries his best with Powder and Spook because he knows how hard their past is but he can never bring it in himself to fully sympathize.

His Salt equivalent is Heather. Name inspired by... I dunno.

Swap Horror is Spook. Name inspired by the word that means unnerving. He doesn't swap with anyone, but he is meant to have the same personality as Killer.

In this AU, not much really changes. Blue is the one who's eye is required for the Core. Alphys is never able to bring herself to take it herself, but when Spook finds out about this, he himself offers to let her.

Spook is very dim witted and empty-headed. A silly goofball. He usually just spends his time eating because he's always hungry.

His Salt equivalent is Spade. Name inspired by the fact it also starts with 'sp'.

Swap Dream is Hypnos. Name inspired by the god of sleep that has the same name. Swaps with Nightmare.

In this AU, Hypnos is the guardian of negativity. While he represents positive energy and such, it is his job to keep the balance and watch over the opposite side of the tree. And just like Nightmare, the villagers do not like him. But unlike Nightmare, Hypnos is kind o justifiable to dislike. He's a bit of a self entitled jerk. He is very jealous of Phobos and has always suspected the villagers loved him more. Hypnos is always trying to get some love but never can. Until one day he gets tired of it. Hypnos eats a positive apple to try and gain some attention. But when that doesn't work he snaps and tries to kill his own brother. Phobos eats the dark apple in order to become strong so he can fight back. But before Hypnos and him and fully fight, Hypnos turns to stone.

Once Hypnos came back from stone he swore to himself that he'd get back at Phobos (For existing I guess). And so he started his own little group called the Fallen Sanses.

His Salt equivalent is Hydria. Name inspired by the word hydra.

Swap Ink is Slate. Name inspired by a shade of grey and 'blank 'slate''. Swaps with Error.

In this AU, Slate is still the "protector of AUs". Slate is still the one who creates the AUs. But here, his attitude is much more similar to Error's. He is VERY particular about his creations and if he finds that there is a single thing wrong with it he will destroy it. Even if it's when he changes his mind after creating the monsters that live in the AU. Slate gets very jealous. If he thinks someone is getting more attention than him he will purposely deface their work. Which is why he hates Cyber. After Cyber "ruins" the AUs Slate works "So HaRd" to "perfect", he will destroy it. Even if he could very easily just clean up the mess. If Slate befriends someone he might leave the AU they live in be. But one wrong move and he will destroy that AU just out of spite.

His Salt equivalent is Sullen. Name inspired by the word that means gloomy and depressed.

Swap Blue is Cobalt. Name inspired by the shade of blue and material that goes by the same name. Swaps with Cross.

In this AU, Cobalt is basically if Blue was recruited by the Bad Sanses instead. Blue became a royal guard in Underswap and then was recruited to become a Fallen Sans. But what happened was he didn't join by choice. Hypnos took him away from his AU before Slate decided to destroy it. Perhaps he say potential. Neither are sure. He just did it. Anyway. Blue was renamed Cobalt to sound more intimidating I guess? Cobalt will often question Hypnos and Slate's morals.

His Salt equivalent is Cloud. Name inspired by Cloudberries.

Swap Lust is Poly. Name inspired by the word polyamorous.

In this AU, Poly is feminine. That's it. Your welcome.

His Salt equivalent is Posy. Name inspired by the flowers.

Swap Ccino is Muffin. Name inspired by the food.

In this AU, Muffin will be made to be as cute as possible. He still has a cafe. But instead of cats he has a bunch of bunnies and instead of a bunny hoodie he has a cat hoodie.

His Salt equivalent is Mocha. Name inspired by the chocolate.

Swap Geno is Cide. Name inspired by the last part of Geno'cide'.

In this AU, Cide is basically Blue if he were put in Geno's situation. If the human were to somehow find a way to kill Stretch first.

His Salt equivalent is Ciao. Name inspired by the fact that there weren't a lot of options.

Swap Reaper is Phantom. Name inspired by the word that means ghost.

In this AU, Phantom is basically Blue if he was Reaper I guess.

His Salt equilavent is Phasmid. Name inspired by stick bugs for some reason.

Swap Fresh is Tyke. Name inspired by the word that means young rascal.

In this AU, Tyke is still a parasite. But with a few changes. Instead of being incredibly dark and intimidating, Tyke is very short and "cute". He is designed to deceive others and make them trust him. He bears a striking resemblance to fanon Blueberry. "Also he tawks wike dis". He wears a cute pair of glasses that neutrally say 'UwU'. But make no mistake. Despite his cutesy appearance, Tyke is still plenty dangerous.

Tyke has a very similar aesthetic to a 2000s kid.

His Salt equivalent is Tux. Name inspired by the word tuxedo.

Swap Science is Gizmo. Name inspired by the fact Gizmo is a nerd name I guess.

Gizmo is an absolute nerd and I luv him.

His Salt equivalent is Gemma. Name inspired by the fact that Gemma is also a name that starts with G.

Swap Midnight is Goji. Name inspired by Gojiberries/Wolfberries. Swaps with Ivan.

Goji acts like an animal like Ivan. But instead of a dog she acts like a cat. She is still shy like Midnight and doesn't like confrontation. She'll avoid any situation she thinks may lead to that the best she can. She's also not as angry and nippy as Ivan.

Goji's parents are technically Cobalt and Cyber.

Swap Ivan is Shoah. Name inspired by the word that means catastrophe. Swaps with Midnight.

Shoah is very very shy. He doesn't like to talk to people because he can't really talk well himself. Shoah will often refer to himself when he speaks instead of using words like "I" or "Me".

Shoah's parents are Spook and Powder.

Swap Zany is Morose. Name inspired by the word that means sullen and gloomy. Swaps with Chip.

Morose is basically Zany but if he was raised by Dream. His kind nature isn't held back by his evil surroundings. Morose is very cheerful and positive.

Just like Zany, Morose doesn't really have parents. Phobos made him out of positive energy.

Swap Chip is Ennui. Name inspired by the word that means bored and lethargic. Swaps with Zany.

Ennui is exactly what her name is. She is neutral to almost everything. She's glued to her phone.

Ennui's parents are Cobalt and Cyber.

Swap Honeydew is Durian. Name inspired by the fruit. Swaps with Domino.

Durian is still a very smart and scientific skeleton. She's just a bit more dirty like Domino.

Swap Pitaya is Peach. Name inspired by the fruit (Only because Plum was taken). Swaps with Mayonnaise.

Peach is a cheeky little prankster like Mayo. But her pranks are food related. Like pie in the face or broccoli in chocolate.

Swap Mayonnaise is Nutella. Name inspired by the food because it's sweet. Swaps with Pitaya.

Nutella is now the yandere for Peach.

Swap Domino is Flask. Name inspired by the contain, which can be used for chemicals or alcohol. Swaps with Honeydew.

Flask is still into card games and stuff like that. But he's not a gambler. He's a good boy that just likes to do card tricks and magic tricks for fun.

Swap Casper is Felix. Name inspired by the name that means fortunate and because it sounds like a rich kid's name. Swaps with Constellation.

Felix is just as cruel and hateful as Casper. But it's more so a spoiled cruel like the way Constellation is. He's like a generic mean rich kid you see in cartoons. But Felix is also a tricky devil. He likes to play mind games with people just to annoy them.

Felix's parents are Powder and Hunter.

Swap Constellation is Calypso. Name inspired by the goddess who goes by the same name. Swaps with Casper.

Calypso is basically Constellation but if she was raised by Nightmare. Hypnos fully indulges Calypso on her spoiled cruelty.

Just like Constellation, Calypso doesn't really have parents. Hypnos made her out of negative energy.

Swap Abstract is Tinker. Name inspired by the word that means to fiddle with something and repair it. Swaps with Desire.

Tinker loves to fiddle with anything they can get their grubby hands on to see what they can do with it and how they can make it look prettier. They still can't speak.

Swap Scarlet is Maroon. Name inspired by the shade of dark red. Swaps with Dread.

Maroon is very dull like Hunter. She constantly has a blank expression on her face.

Maroon's parents are Hunter and Spook.

Swap Dread is Blanc. Name inspired by the french word that means white. Swaps with Scarlet.

Blanc is very hopeful and full of life. She likes to see the beauty in everything.

Blanc's parents are Cide and Phantom.

Swap Desire is Iris. Name inspired by the word that means colorful and pretty. Swaps with Abstract.

Since Desire can talk I wanted to go for the complete opposite affect Abstract has. Iris never shuts up and is constantly babbling about something. She loves the arts and is always on her phone taking photos and selfies.

Undertale: Toby Fox

Blue: Popcornpr1nce

Ink: Comyet

Dream: Jokublog

Nightmare: Jokublog

Geno: Crayonqueen

Error: Crayonqueen

Fresh: Crayonqueen

Horror: Sour-Apple-Studios

Killer: Rahafwabas

Dust: Ask-Dusttale

Lust: Nsfwshamecave

Reaper: Renrink

Science: HolyTraitor

Cross: Jakei95

Ccino: Black-Nyanko

Ivan, Midnight, Zany, Chip, Domino, Mayonnaise, Pitaya, Honeydew, Constellation, Casper, Desire, Dread, Scarlet, Astract: Me

Swap Verse: Me

#undertale#nightmare sans#horror sans#killer sans#dust sans#swap sans#dream sans#ccino sans#cross sans#science sans#fresh sans#geno sans#error sans#lust sans#blue sans#ink sans#ship kids#swap verse

47 notes

·

View notes

Text

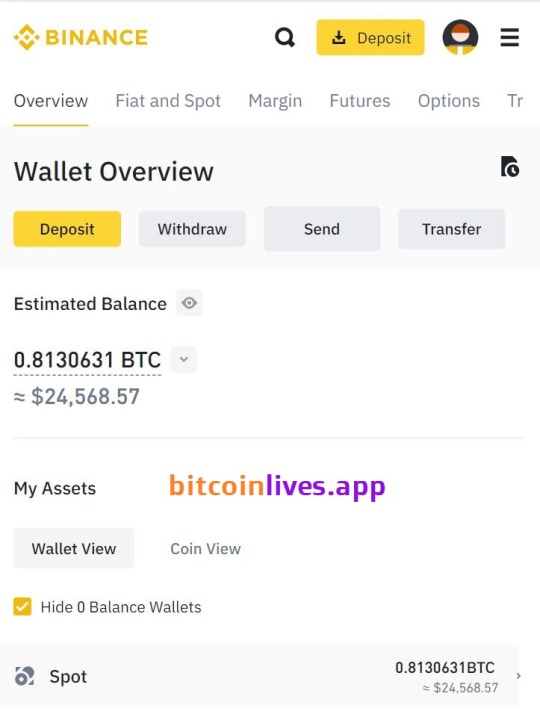

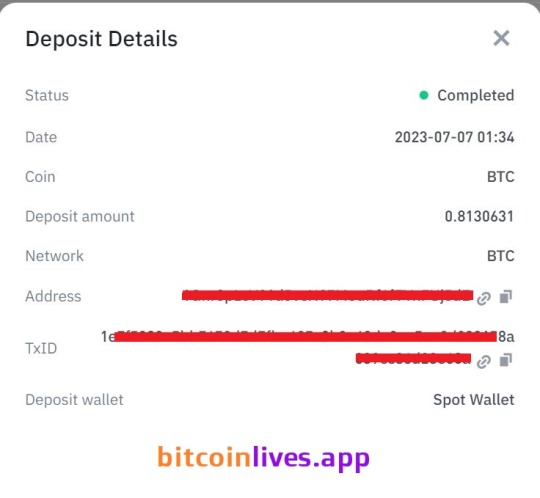

Bitcoin Mining platform

Bitcoin Live App is a crypto mining platform to help you start earning BTC! It contains the most necessary tools for working with digital assets: cloud bitcoin mining equipment with high hash power. It is a meta-universe of crypto investments available to everyone.

How does Bitcoin Mining App work?

Previously, to mine cryptocurrencies, you had to buy equipment and then recoup its cost. Bitcoin Live App allows you to start mining right now with a minimum cost threshold.

We have developed a quantum decryption algorithm to mine Bitcoin at unsurpassed speed. You only have to log in and activate our process with very simple steps, the magic happens in our the magic happens in our mining farms, so you just have to wait for your profits to be generated. No more hassle with buying and maintaining equipment or mining pools.It's easiest and most efficient way to make money from cryptocurrency mining without having to buy and maintain your equipment. Just choose and buy the best Crypto Mining Key for you and start earning today!

Join over 50.000 people with the world’s leading hashpower provider

During this time, We have won the trust of thousands of users. So, join our Platform and start earning bitcoin today by using our mining website. Start mining the quick way, Generate 1 BTC fast and easy with instant withdraw.

137 notes

·

View notes

Text

Best Alternative Investment Company

Best Alternative Investment Company: A Guide to Diversifying Your Portfolio

In today’s dynamic financial environment, investors are increasingly looking beyond traditional assets like stocks and bonds to diversify their portfolios. The rise of the Best Alternative Investment Company in various sectors offers new avenues for growth and risk management. This article explores some of the top companies leading the way in alternative investments.

Why Consider Alternative Investments?

Alternative investments provide several key benefits:

Diversification: These assets typically have a low correlation with the stock market, offering protection against market volatility.

Higher Returns: Although they come with higher risk, alternative investments often provide the potential for greater returns.

Access to Exclusive Markets: Previously inaccessible to the average investor, these markets are now open, thanks to innovative platforms.

Top Companies in the Alternative Investment Space

1. Fundrise: The Best Real Estate Crowdfunding Platform

When it comes to real estate crowdfunding, Fundrise stands out as the Best Alternative Investment Company. It offers diversified real estate portfolios with low minimum investments, making it accessible to a broad range of investors. Fundrise’s platform is user-friendly, and its transparent fee structure appeals to both novice and experienced investors.

2. LendingClub: Leading Peer-to-Peer Lending Platform

As a leader in peer-to-peer lending, LendingClub connects individual lenders with borrowers, facilitating a unique investment experience. Investors can earn attractive returns by funding personal loans while benefiting from detailed risk assessments and borrower information.

3. Coinbase: Premier Cryptocurrency Exchange

In the world of digital assets, Coinbase emerges as the Best Alternative Investment Company. Known for its robust security measures and wide range of supported cryptocurrencies, Coinbase provides a secure and efficient platform for trading and investing in digital currencies.

4. Masterworks: Democratizing Fine Art Investment

Masterworks allows investors to buy fractional shares in iconic artworks, providing exposure to the lucrative art market. As the Best Alternative Investment Company in the art sector, Masterworks selects and manages art investments, offering a unique avenue for portfolio diversification.

Considerations for Choosing the Best Alternative Investment Company

Fees: Different companies have varying fee structures, which can significantly affect your returns.

Regulatory Compliance: Ensure that the company complies with all relevant regulations to safeguard your investments.

Liquidity Needs: Alternative investments can be less liquid, so consider your investment timeline and liquidity requirements.

Risk Tolerance: Assess your risk appetite and align it with the alternative investments offered by the company.

Conclusion:

Choosing the Best Alternative Investment Company is crucial for diversifying your portfolio and potentially enhancing your returns. Whether you’re interested in real estate, peer-to-peer lending, cryptocurrencies, or fine art, there are several top companies to consider. By conducting thorough research and understanding the associated risks, you can confidently explore the exciting world of alternative investments.

2 notes

·

View notes

Text

How to Earn Money in Trading: Simple Strategies for Success

Trading has become an increasingly popular way for people to grow their wealth and achieve their financial goals. Whether you're interested in forex trading, stocks trading, or crypto trading, there are opportunities to earn money by investing wisely. However, trading is not just about luck; it requires a rich mindset, a solid strategy, and a deep understanding of the markets. In this post, we’ll explore how to earn money in trading by focusing on key principles and strategies that can set you on the path to financial success.

Understanding the Basics of Trading

Before diving into any form of trading, it's crucial to understand the basics. Trading involves buying and selling financial instruments like stocks, currencies, or cryptocurrencies with the aim of making a profit. Each type of trading—whether it's forex trading, stocks trading, or crypto trading—has its own unique characteristics and requires a different approach.

Forex Trading: It involves trading with currencies in the foreign exchange market. It’s one of the largest financial markets in the world, with trillions of dollars traded daily.

Stocks Trading: Here, you buy and sell shares of companies. The stock market can be volatile, but with careful analysis, it offers significant profit opportunities.

Crypto Trading: Cryptocurrency trading involves buying and selling digital currencies like Bitcoin and Ethereum. It’s a rapidly growing market, known for its high volatility.

Setting Clear Financial Goals

To earn money in trading, it's essential to set clear financial goals—like what do you wanna achieve through trading? Are you looking to build long-term wealth, or are you interested in making quick profits? Defining your financial goals will guide your trading strategy and help you stay focused.

For example, if your goal is to create a steady income stream, you might focus on stocks trading and dividend-paying stocks. If you're aiming for high-risk, high-reward opportunities, crypto trading could be more suitable.

Developing a Rich Mindset

A rich mindset is critical for success in trading. This mindset is about being patient, disciplined, and focused on long-term success rather than short-term gains. Many new traders fail because they get caught up in the excitement of quick profits, leading to poor decisions and losses.

A rich mindset also involves continuous learning. The financial markets are constantly changing, and staying informed is key to making smart trading decisions. Whether you’re involved in forex trading, stocks trading, or crypto trading, always keep learning and adapting to new market conditions.

Choosing the Right Trading Strategy

Your trading strategy will significantly impact your ability to earn money in trading. There are various strategies you can adopt depending on your financial goals and risk tolerance.

Day Trading: This involves buying and selling financial instruments within a single trading day. It's fast-paced and requires quick decision-making.

Swing Trading: Here, you hold positions for several days or weeks, aiming to profit from short- to medium-term price movements.

Long-Term Investing: This strategy involves holding onto investments for years, betting on the overall growth of the market.

Each strategy has its pros and cons, and the best one for you will depend on your trading style, market knowledge, and financial goals.

Risk Management is Key

One of the most important aspects of earning money in trading is managing your risk. Even experienced traders face losses, but with proper risk management, you can minimize those losses and protect your capital.

Set stop-loss orders, never invest more than you can afford to lose, and always diversify your portfolio. Whether you’re engaged in forex trading, stocks trading, or crypto trading, understanding and managing risk is crucial for long-term success.

3 notes

·

View notes

Text

How Bitcoin is Revolutionizing Financial Freedom

In today's world, financial freedom is a dream many aspire to but few achieve. Traditional financial systems, with their inherent limitations and inefficiencies, often stand as barriers to true financial autonomy. Enter Bitcoin: a revolutionary tool that promises to redefine our understanding of money and financial independence. As we embark on this journey, we'll explore how Bitcoin is not just a digital currency but a catalyst for a new era of financial freedom.

Understanding Financial Freedom

Financial freedom is more than just having enough money to meet your needs; it's about having control over your finances without being shackled by external constraints. It means the ability to make choices that are best for you and your loved ones without constant financial stress. However, the current financial system poses significant obstacles: inflation erodes the value of savings, banking restrictions limit access to financial services, and high fees eat away at hard-earned money. These issues highlight the need for an alternative, and Bitcoin offers a compelling solution.

Bitcoin's Role in Achieving Financial Freedom

Decentralization

Bitcoin operates on a decentralized network, meaning it doesn't rely on a central authority like banks or governments. This decentralization removes intermediaries from financial transactions, reducing costs and increasing efficiency. With Bitcoin, individuals can send and receive money directly, anywhere in the world, without the need for approval from a third party.

Security

The security of Bitcoin lies in its blockchain technology. Every transaction is recorded on a public ledger, which is virtually tamper-proof due to its decentralized nature. This transparency ensures trust and reliability, making Bitcoin a secure store of value. Unlike traditional currencies, which can be manipulated or devalued, Bitcoin's supply is fixed, providing a hedge against inflation and monetary instability.

Accessibility

One of the most transformative aspects of Bitcoin is its accessibility. In many parts of the world, people lack access to basic banking services. Bitcoin opens up financial opportunities for the unbanked and underbanked populations, providing a way to save, invest, and transfer money without the need for a traditional bank account. All that is required is an internet connection and a digital wallet.

Control and Ownership

Bitcoin empowers individuals with true ownership of their assets. When you hold Bitcoin, you are in complete control of your funds. There are no banks that can freeze your account or governments that can seize your assets. This level of control is unprecedented and a key component of financial freedom.

Dollar-Cost Averaging (DCA) into Bitcoin

Dollar-Cost Averaging (DCA) is a strategy that involves investing a fixed amount of money into Bitcoin at regular intervals, regardless of the price. This approach mitigates the impact of market volatility, smoothing out the highs and lows over time. DCA is particularly effective in the volatile world of cryptocurrencies, making it a prudent strategy for those looking to build wealth steadily.

To implement a DCA strategy, start by determining how much you can comfortably invest on a regular basis, whether it's weekly, bi-weekly, or monthly. Then, set up automatic purchases of Bitcoin with that fixed amount. Over time, you'll accumulate Bitcoin at an average cost, reducing the risk associated with market fluctuations.

Real-world examples abound of individuals who have successfully used DCA to grow their Bitcoin holdings. For instance, those who began DCAing into Bitcoin years ago have seen substantial returns, demonstrating the power of this disciplined investment approach.

Real-World Examples

Consider the story of Alice, a school teacher in Argentina, where inflation has been rampant. By steadily converting a portion of her salary into Bitcoin, she has protected her savings from devaluation and gained financial stability. Or take John, a software developer in Nigeria, who used Bitcoin to bypass restrictive banking systems, enabling him to receive payments from international clients and support his family.

These stories are not isolated incidents; they represent a growing trend of people around the world leveraging Bitcoin to achieve financial freedom. The statistics are telling: as Bitcoin adoption increases, so does the number of individuals gaining economic independence.

Challenges and Considerations

While Bitcoin offers numerous benefits, it's important to be aware of potential challenges. The volatility of Bitcoin can be daunting for new investors. Regulatory uncertainties in different jurisdictions can also pose risks. However, these challenges can be mitigated with a thoughtful approach.

For instance, DCAing into Bitcoin helps manage the risk of volatility. Staying informed about the latest regulatory developments and understanding the legal landscape can help navigate potential pitfalls. As with any investment, it's crucial to do your research and make informed decisions.

Conclusion

Bitcoin is more than just a digital currency; it's a powerful tool for achieving financial freedom. By eliminating intermediaries, enhancing security, providing accessibility, and offering true control over assets, Bitcoin is revolutionizing the way we think about money. Dollar-Cost Averaging into Bitcoin is a practical strategy that can help individuals steadily build wealth and navigate the volatility of the cryptocurrency market.

As we move forward in this new financial era, Bitcoin offers a beacon of hope for those seeking independence and control over their financial destiny. Explore Bitcoin, understand its potential, and consider how it can be a part of your journey towards financial freedom.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Bitcoin#FinancialFreedom#CryptoRevolution#DigitalCurrency#Blockchain#BitcoinCommunity#Decentralization#CryptoInvesting#FinancialIndependence#DCA#BitcoinAdoption#CryptoEducation#EconomicEmpowerment#BitcoinLife#CryptoJourney#financial education#financial empowerment#financial experts#cryptocurrency#finance#globaleconomy#unplugged financial

3 notes

·

View notes

Text

Market Impact of Innosilicon's ASIC Miners

Innosilicon

Innosilicon is a well-known company in the cryptocurrency mining industry that specializes in the design and production of high-performance ASIC miners. Founded in 2006, Innosilicon has established itself as a leading player in the market, delivering innovative and efficient mining hardware solutions to miners worldwide.

The company prides itself on its commitment to research and development, continuously striving to improve upon its previous designs and deliver cutting-edge technology to its customers. By leveraging its expertise in semiconductor design and fabrication, Innosilicon has managed to stay ahead of the competition and earn a solid reputation for its products.

Here is the list of the best innosilicon miners as of 2023 ranked according to profitability, price and durability.

1.Innosilicon KAS Master Pro

2.Innosilicon Kas master 2 THS

3.Innosilicon Kas master 1 THS

4.Innosilicon T4 BTC Miner

5.Innosilicon a11 Pro 8gb

6.Innosilicon a10 pro 6 GB

Mining Hardware

Mining hardware is an essential component of the cryptocurrency mining process. It refers to the physical equipment utilized to validate and record transactions on a blockchain network. As the complexity of mining cryptocurrencies increases, miners require powerful and specialized hardware to compete and generate profits.

In the early days of cryptocurrency mining, miners utilized general-purpose CPUs and GPUs to mine cryptocurrencies like Bitcoin. However, as the industry evolved, ASIC miners emerged as the most efficient and cost-effective solution for mining popular cryptocurrencies. Companies like Innosilicon have played a crucial role in designing and manufacturing ASIC miners that offer superior performance and energy efficiency.

ASIC Miner

An ASIC (Application-Specific Integrated Circuit) miner is a mining device specifically designed to mine cryptocurrencies. Unlike general-purpose CPUs or GPUs, ASIC miners are optimized to perform a single task - the computation required for mining. This specialization allows ASIC miners to perform mining operations significantly faster and more efficiently than other hardware alternatives.

Innosilicon has been at the forefront of ASIC miner development and has released several generations of mining hardware over the years. Its ASIC miners are known for their high hash rates, low power consumption, and durability. The company's dedication to innovation has enabled them to continuously push the boundaries of mining technology.

Their ASIC miners are designed to mine various cryptocurrencies, including Bitcoin, Litecoin, Ethereum, and more. Innosilicon's product lineup includes a range of models catering to different levels of mining operations, from individual miners to large-scale mining farms.

One notable aspect of Innosilicon's ASIC miners is their focus on energy efficiency. The company understands the ecological impact of cryptocurrency mining and aims to minimize energy consumption while maximizing mining performance. This approach not only benefits the environment but also leads to reduced operational costs for miners.

Innosilicon's ASIC miners are designed to be user-friendly and accessible to miners of all skill levels. The setup process is straightforward, and the company provides comprehensive support and documentation to assist miners in getting started quickly. Additionally, their mining hardware is known for its reliability and durability, ensuring that miners can operate their machines without any major interruptions.

The constant evolution of Innosilicon's ASIC miners showcases their commitment to staying ahead in the competitive mining industry. By incorporating the latest advancements in semiconductor technology and constantly refining their designs, they continue to deliver top-of-the-line mining hardware to miners worldwide.

In conclusion, the rise of ASIC miners in the cryptocurrency mining industry has revolutionized the way miners operate. Innosilicon, as a prominent player in this space, has played a vital role in driving this evolution. Their dedication to innovation, energy efficiency, and user-friendly designs has contributed significantly to the progression of the mining hardware market. As the industry continues to evolve, it will be interesting to see what new advancements Innosilicon brings forth to further enhance the mining experience.

#crypto miner#crypto mining#mining hardware#asic miners#innosilicon miner#innosilicon#bitcoin#bitcoin latest news#ethereum#cryptocurrency news latest#btc latest news#cryptocurrency news#blockchain#crypto#digitalcurrency#fintech#investment#defi

4 notes

·

View notes

Text

Everything You Need to Know About Investing

Investing is a vast and intricate world, filled with opportunities, pitfalls, and a plethora of information. Whether you're a seasoned investor or just starting out, there's always something new to learn. Let's dive into the essentials of investing and how you can navigate this financial journey with confidence.

The Foundations of Investing

Before diving deep into the strategies and nuances, it's crucial to understand the basics. Investing is essentially allocating resources, usually money, with the expectation of generating an income or profit. But where do you start?

1. Understanding Your Goals

Every investor has a unique set of objectives. Some might be saving for retirement, while others could be aiming to buy a home or fund their children's education. Knowing your goals will help you tailor your investment strategy accordingly.

2. Risk and Return

There's a fundamental principle in investing: the higher the potential return, the higher the risk. It's essential to assess your risk tolerance and align it with your investment choices. For a deeper dive into risk management, check out Investment Pitfalls Unveiled: How to Avoid Costly Mistakes.

3. Diversification

Don't put all your eggs in one basket. Diversifying your investments across different asset classes can help mitigate risk. This strategy is beautifully explained in The Comprehensive Guide to Index Funds: A Powerful Tool for Diversification and Long-term Growth.

The World of E-commerce and Investing

E-commerce has revolutionized the way we shop and invest. With the rise of online platforms, investing has become more accessible than ever. Here's how the e-commerce landscape intertwines with the world of investing:

Retail Trends: The retail industry is ever-evolving, with new trends emerging regularly. For instance, the new retail trends in Qatar offer a comprehensive insight into the changing dynamics of the market.

Online Safety: As online transactions become more prevalent, it's crucial to ensure safety. Learn how to shop online safely to protect your investments and personal information.

The Magic of Customer Experience: In the world of e-commerce, customer experience is king. Dive into the enchanting e-commerce world and discover how it impacts investment decisions.

Cryptocurrency: The New Frontier

The rise of digital currencies, especially Bitcoin, has added a new dimension to investing. With its decentralized nature and potential for high returns, many are drawn to this digital gold. Explore the empowering world of Bitcoin banking and how it's reshaping the financial landscape.

Time: The Investor's Best Friend

Time is a crucial factor in investing. The power of compounding, where your investments earn returns on returns, can lead to exponential growth over time. Delve into the concept of compounding demystified to harness its potential.

In Conclusion

Investing is a journey, filled with learning, growth, and occasional setbacks. But with the right knowledge, tools, and mindset, it can lead to financial freedom and prosperity. As you embark on this journey, remember to stay informed, make informed decisions, and always keep your goals in sight.

For more insights, tips, and comprehensive guides on various topics, explore the vast collection of articles on Steffi's Blogs. Happy investing!

Note: Always consult with a financial advisor before making any investment decisions.

#Unlock Wealth Secrets#E-commerce Goldmine#Bitcoin Boom#Investing 101 Unveiled#Qatar's Retail Revolution#Risk or Reward? Find Out!#Dive into Digital Currencies#Time's Ticking: Compound Now!#Financial Freedom Fast-Track#Master the Market Mysteries#From Zero to Investment Hero#Online Shopping: Safe or Scam?#Cryptocurrency Craze: Join or Joke?#Diversify and Dominate#Retail Trends: Rise or Ruin?#Customer Experience: Cash or Crash?#Compounding: The Magic Formula#Steffi's Top Investment Tips#Navigate the Investment Labyrinth#E-commerce Explosion: Invest or Ignore?

2 notes

·

View notes

Text

Best online earning 2023 crypto currency

Crypto Earning 2023

Bestf2023 crypto currency

Cryptocurrency Mining: If you have the technical knowledge and access to specialized hardware, you can mine cryptocurrencies like Bitcoin or Ethereum. Mining involves solving complex mathematical problems to validate transactions on the blockchain and earn rewards in the form of cryptocurrencies.

Cryptocurrency Trading: Trading cryptocurrencies on various exchanges can be a way to earn profits. It requires understanding market trends, performing analysis, and making informed trading decisions. However, please note that trading involves risks, and it's important to do thorough research and exercise caution.

Staking: Some cryptocurrencies offer staking opportunities where you can lock up your coins to support the network's operations and earn rewards in return. Staking typically requires holding a specific cryptocurrency in a compatible wallet or platform.

Crypto Affiliate Programs: Many cryptocurrency exchanges and platforms offer affiliate programs that allow you to earn commissions by referring new users. If you have a website, blog, or social media following, you can promote these platforms and earn rewards when people sign up through your referral links.

Microtasks and Freelancing: Some platforms offer opportunities to earn cryptocurrencies by completing microtasks or freelancing jobs. These tasks could include participating in surveys, testing websites or applications, or providing services in exchange for cryptocurrencies.

#online earning#how to make money online#earn money online#make money online#online earning app#earning app#online earning in pakistan#online earning without investment#how to earn money online#best earning app#crypto#money earning apps#make money online 2023#online earning real app#best earning app 2023#new earning app today#online money earning apps in 2023 telugu#best online earning app#crypto currency#crypto currency news#free crypto earning

2 notes

·

View notes

Text

GPIBS.COM - our history.

Our community stories and experiences with GPIBS.

Why GPIBS? How did we know about it? Why did you trust?

All the best time of the day. We want to devote our first article to a topic that, obviously, is of interest to everyone.

Today we will consider the following questions:

- GPIBS - what kind of company, what does it do, its history.

- How did we find out about this company?

- How much did we earn during the period of investment in the company?

1. GPIBS - what kind of company, what does it do, its history.

GPIBS - Leader in the Chinese investment market. The company was founded in 1966 in Guiyang, Guizhou Province. The holding is engaged in the extraction of coal and related resources (mainly natural gas), building materials, production and repair of mechanical and electrical products, technical maintenance of mining equipment, environmental protection, logistics, financial services, real estate operations and agricultural business.

2. How did we find out about her?

After another successful cryptocurrency investment case, we decided to look for new ways and new opportunities. The decision was made unequivocally - we wanted to invest in industry, in companies that are rapidly gaining momentum. We found out about GPIBS by accident, found a chart on a tradingview website and saw a pretty good growth lately. Having studied the company more carefully, having verified documents, certificates, etc., we decided that we would invest our money here.

3. How much was earned by me during the period of investment in the company?

We do not want to go into details and talk about each deal separately in this post. We will do this later. I want to say that for a year and a half of work with GPIBS, our team has earned more than $500,000 in dividends.

Of course, we do not stop at this and continue to work closely with GPIBS, being one of the top investors.

With this, our first post of our history with GPIBS has come to an end.

2 notes

·

View notes

Text

How to earn $300 per day ?

There are many ways to earn $300 per day, but the specific method that will work best for you depends on your skills, interests, and resources. Here are a few ideas:

Freelancing: Freelancing is a great way to earn money, especially if you have specific skills like writing, graphic design, web development or social media management. You can join freelance sites like Upwork, Fiverr or Freelancer and offer your services to potential clients. With a steady job and a good reputation, you can quickly earn $300 a day.

Online Tutoring: If you have expertise in a particular subject, you can offer online tutoring services. You can join a training website or offer your services on platforms like Craigslist, Facebook or Instagram. Many students are looking for qualified teachers who can teach them in the comfort of their own homes. With a good reputation and regular customers, you can easily earn $300 a day.

Affiliate Marketing: Affiliate marketing is a method of earning commissions by promoting other people’s products or services. You can join affiliate networks like Amazon Associates, ClickBank or Commission Junction and promote your products on your blog or social media channels. With enough traffic and conversions, you can easily earn $300 a day.

Trading: Trading is another way to earn money if you have some experience and knowledge about the stock market, Forex or cryptocurrencies. You can start with a small investment and gradually increase your investment as you gain more experience. With consistent trading you can easily earn $300 a day.

Online surveys: Online surveys are a quick and easy way to earn some extra cash. You can sign up to survey sites like Swagbucks, Survey Junkie or InboxDollars and complete surveys whenever you want. Although the pay is relatively low, you can still earn $300 a day if you complete enough surveys.

Blogging: Blogging is a long-term strategy that requires consistent effort, but it can be a lucrative source of income. You can start a blog in a specific niche and monetize it through advertising, affiliate marketing or selling your own products. With enough traffic and a loyal following, you can easily earn $300 a day.

Do you know to earn $300/day in next few days

— -Get Access to FREE Video Showing You New Method to Earn $300/day.

In short, earning $300 a day takes effort, commitment, and dedication. There are several ways to earn this amount, but you need to find one that suits your skills and interests. With persistence and hard work, you can reach your financial goals and live a comfortable life.

How can i earn money from home without investment ?

2 notes

·

View notes

Text

Bitcoin since its inception has consistently been in upward trajectory and it will continue that way due to its limited supply and unlimited adoption. Holding Bitcoin is in the form of a long-term savings account and will profit its investors at the long run

Bitcoin helps the owner feel secure because no one can take away your money just like they can easily take away your fiat without your consent. When you have your private keys you are totally in control, that's the kind of security Bitcoin is, not the SEC kind

Thinking About Growing Your Wealth Through Cryptocurrency? Join our platform and start earning.

#business#marketing#government#parenting#investing#positivity#startup#stock market#entrepreneur#accounting#quotes#earnincome#world#ecommerce#economy#diy#finance#lifestyle#commercial#crypto#vintage#bitcoin

4 notes

·

View notes

Text

The implosion of Sam Bankman-Fried’s cryptocurrency exchange, FTX, and its connected trading firm, Alameda Research, prompted a scramble to account for billions in lost funds; sparked urgent demands for new regulation; and generated widespread Schadenfreude from those convinced that such crypto ventures are all surely too good to be true. But this was the rare financial scandal that had immediate significance in the world of philosophy, as Gideon Lewis-Kraus writes in a rigorous and thought-provoking piece.

Bankman-Fried was the most prominent donor to a movement known as effective altruism, or E.A., which calls on its adherents to do good in the world in the most practical and rational ways possible—and his downfall, including reports of his lavish personal spending, has caused “raw anguish” within the E.A. community. Was Bankman-Fried’s connection to effective altruism simply a sham? Or, on the other hand, did his dedication to accumulating capital for the cause contribute to his seeming recklessness with other people’s money? And, on a bigger scale, what flaws inherent to E.A. has this scandal helped lay bare? Lewis-Kraus recently profiled one of the movement’s leaders, the Oxford philosopher William MacAskill—and in the wake of the FTX collapse, he follows up with MacAskill, other members of the E.A. community, and people who worked closely with Bankman-Fried to consider these questions and more.

One of the inevitable questions to have attended the abrupt undoing of the erstwhile billionaire Sam Bankman-Fried—the overnight collapse of his cryptocurrency exchange, FTX, and its intertwined sister organization, the trading firm Alameda Research—concerns that of the part in the fiasco played by ideas. Neither Bernie Madoff, Kenneth Lay, nor Jeff Skilling was, to the best of my knowledge, associated with a particular philosophical tradition. Bankman-Fried has, however, identified himself as an adept of effective altruism, the utilitarian-flavored philanthropic social movement. Bankman-Fried first encountered effective altruism, or E.A., as an M.I.T. undergraduate, when he was introduced to the Oxford philosopher Will MacAskill. E.A. leaders recruited Bankman-Fried as someone likely to make a lot of money that he might then give away for the betterment of the world. In less than a decade, the investment seemed to have proved auspicious: Bankman-Fried became the movement’s most prominent donor, promising to eventually donate almost all of his net worth, which was once estimated at twenty-six billion dollars. He has said, on multiple occasions, that his consideration for the lives of others aroused his appetite for financial risk: had he been working merely for his own pleasure, he might have comfortably retired a minor billionaire, but there is no diminishing marginal utility to each additional dollar earned to redeem the world.

He flipped the coin—or, rather, a lot of coins, many of which he had himself invented—until he lost. Unfortunately, it seems he was playing with someone else’s money: FTX’s customer deposits were commingled with Alameda’s own funds, where they were apparently used to shore up bad trades and ill-advised investments. The whole operation lost something like eight billion to ten billion dollars, if not more. (Bankman-Fried has said that poor labelling of accounts was to blame. His spokesperson told me that the meltdown was the result of a “large market crash,” and said, “Mr. Bankman-Fried never knowingly used FTX deposits to shore up any trades or investments.”) Critics of E.A. have delighted in Schadenfreude, as if the mask of optimized benevolence has slipped to reveal the naked will to power. When Bankman-Fried participated in a direct-message interview with Vox’s Kelsey Piper, earlier this month, his casually dismissive comments about “ethics” were immediately taken as confirmation that E.A. was a sham—a convenient alibi for greed and the lust to dominate. For those of us who are secretly unsure whether we’re decent people, this came as a reassuring development. The elementary tenet of effective altruism—that privileged Westerners could be doing considerably more good in the world than most of us do—could be discarded as self-serving cant. (The spokesperson said, “Mr. Bankman-Fried does in fact deeply believe in Effective Altruism, and always has, but he thinks that there are many things that companies do—specifically highly regulated ones—around the edges to attempt to appear as ‘good actors.’ ”)

Within E.A. circles, the prevailing mood has been one of raw anguish. Within a day or two of the initial revelations, one longtime leader took to the E.A. Forum, the movement’s internal bulletin board, to offer mental-health services: “If you’re personally affected by what’s happening, the community health team wants to be here for you. We’ve already heard from people who are feeling worried, angry, or sad.” For the most part, the possibility of the movement’s responsibility in the affair has been taken up with seriousness and subtlety. There is no evidence that anyone in E.A. was aware of the artifice that propped up Bankman-Fried’s empire, but community members have been troubled by the idea that there may have been a path from their shared philosophical underpinnings to Bankman-Fried’s deceit. Some have argued that what Bankman-Fried seemed, in his enigmatic way, to be saying to Vox was not that his vow to uphold E.A.’s ideals was merely a cover story but something like the opposite: he was, in fact, so committed to the greatest good for the greatest number that he was unwilling to observe the kinds of everyday ethical niceties that hedge naïve utilitarian calculations. MacAskill noted that nowhere in the E.A. canon are the means advertised to justify the ends. Moral integrity was a good in and of itself.

This is true enough as far as it goes, but, as MacAskill himself is painfully aware, this has always represented an unstable equilibrium. On the one hand, what makes the movement distinct is its demand for absolute moral rigor, a willingness, as they like to put it, to “bite the philosophical bullet” and accept that their logic might precipitate extremes of thought and even behavior—to the idea, to take one example, that any dollar one spends on oneself beyond basic survival is a dollar taken away from a child who does not have enough to eat. On the other hand, effective altruists, or E.A.s, have recognized from the beginning that there are often both pragmatic and ethical reasons to defer to moral common sense. This enduring conflict—between trying to be the best possible person and trying to act like a normal good person—has put them in a strange position. If they lean too hard in the direction of doing the optimal good, their movement would be excessively demanding, and thus not only very small but potentially ruthless; if they lean too hard in the direction of just trying to be good people, their movement would not be anything special. Put crudely, it can seem as if either their ideas conduce to a means-end rationality—someone like Bankman-Fried might very well have felt justified in bilking unsophisticated investors out of money that could be put to better use funding, say, pandemic preparedness—or their ideas conduce to nothing in particular at all.

There are a few different ways to look at this underlying tension. The most cynical is to accuse them of the “motte-and-bailey fallacy”—that they shuttle at their convenience between a strong but controversial claim (that all actions ought to be evaluated by their consequences alone) and a weaker but palatable one (that of course other considerations, such as personal virtue, matter). A more charitable interpretation is to suggest, to invert Flaubert, that they are violent and original in their seminar-room work such that they might be marginally better than regular and bourgeois in their lives. To point this out is not to condemn them on the grounds of cowardice. What has made E.A. special has less to do with the community’s scholarly contributions than with the unusual subculture they have cultivated. E.A.s have been expected to live relatively simply, to confront the reality of suffering, and to do something to remediate it. And many truly did, and do. Some observers have argued that this scandal will be good for E.A., because their compromised institutions might die off such that their ideals will flourish elsewhere. But this perspective, to me, misses the point. The broader culture is marked by neither a widespread sensitivity to misery nor a pervasive sense of obligation to do something practical about it, and for all of its faults the culture of E.A. was. One didn’t have to agree with everything they did to believe that they created a worthwhile role for themselves and acquitted themselves honorably.

MacAskill, whom I profiled this year, understood, perhaps better than anyone, that the endurance of the movement rested on a fragile foundation of social norms—not what they argued but how they lived. In the course of the time I spent with him this past spring, he returned again and again to his worry that something crucial had perhaps been lost as their initial code of frugality gave way to material abundance; they were no longer a group of kids in a basement eating Sainsbury’s baguettes for lunch but a set of real institutions with real money, proximity to power, and catered vegan buffets. Caroline Ellison, the former C.E.O. of Alameda Research, who also once dated Bankman-Fried, argued on the E.A. Forum, last spring, that frugality was a vestigial concern; there were, she claimed, less costly ways to indicate one’s alignment with the underlying cause. In his own lengthy post on the subject, MacAskill argued that such signals had to be at least minimally costly if they were to feel substantive. MacAskill’s centrality to the community has had somewhat less to do with his intellectual contributions than it has with how appealingly and charismatically he has been able to model righteous conduct. When young E.A.s needed guidance—about whether it was defensible, say, to pay for private lodgings for a conference—they looked to MacAskill’s personal example for instruction.

In retrospect, the most important issue facing the community may not have been the erosion of norms around frugality but of those around honesty. The story commonly told about Bankman-Fried was that he drove a beat-up Toyota Corolla, slept on a beanbag, and had nine roommates. MacAskill repeated this fable to me, characterizing it as evidence of Bankman-Fried’s profound commitment to the cause. What he did not mention, and what came out only in the last few weeks, is that Bankman-Fried and his roommates were living in a forty-million-dollar penthouse in a gated community in the Bahamas—part of a total local property portfolio worth an estimated three hundred million dollars. His parents, professors at Stanford Law, owned a vacation condominium worth millions of dollars. (Bankman-Fried has said the properties were necessary to insure that his “top Silicon Valley employees” had “an easy way to find a comfortable life” on the island. His spokesperson told me, “Mr. Bankman and Ms. Fried have offered to give up any ownership interest they may have in the home.”) All of these were indeed costly signals, though what they signalled couldn’t easily be reconciled with the E.A. covenant. (When asked about the discrepancies in Bankman-Fried’s narrative, MacAskill responded, “The impression I gave of Sam in interviews was my honest impression: that he did drive a Corolla, he did have nine roommates, and—given his wealth—he did not live particularly extravagantly.”)

Still, E.A. leadership ratified a mythology about Bankman-Fried that was simply not the case. One senior member of the community told me that the peculiar contradictions of Bankman-Fried’s life style were widely known but somehow unexamined: it was true that he drove a beat-up Corolla, but it was also true, if underemphasized, that he enjoyed a sumptuary existence—not only the lavish penthouse but the use of such appurtenances as a private jet. “The problem was that there was a story about his frugality that was something adjacent to a lie—or at the very least left listeners with a very wrong impression, which is roughly as harmful as lying,” he said. “I guess it started as a story about something else—perhaps his bad car and long working hours. But in time there were these two versions of S.B.F. that didn’t quite add up, and you only heard one of them. I knew, for example, that he slept on my friend’s couch, and wasn’t somebody who put on airs, but I also have the memory of knowing S.B.F. actually did have nice stuff—and it was only that first part that I repeated, because it was just a thing you said. I don’t blame people for getting this wrong, but as a community we communicated badly, and at a large enough scale that we supported the false S.B.F. narrative. We let people believe he was a saint, when in reality he lived like a pretty standard workaholic billionaire.”

The senior community member continued, “He was frugal at times and spendthrift at times, seemingly in service to his work. I don’t sense there is an easy single narrative here.” It’s easy to imagine how senior E.A.s, many of whom made repeated visits to the Bahamas, might have justified his expenditures: the properties may have been portrayed as sound real-estate investments, and Bankman-Fried needed fitting places to host such figures as Bill Clinton and Tony Blair, who came to speak at a conference he co-hosted with Anthony Scaramucci this past spring. In a widely amplified story, Fox Business reported that Bankman-Fried owned a yacht; the claim was attributed to a local yachtsman, who said he frequently spotted Bankman-Fried at the marina, and Bankman-Fried’s spokesman categorically denied that his client had himself ever “owned” a boat. The outlet also drew on accounts from local restaurant workers to allege that he spent thousands of dollars a day on fancy catered lunches for his company; the spokesperson pointed out that this does not seem particularly outlandish for a firm that employed more than a hundred people. But if the extent of Bankman-Fried’s profligacy has been exaggerated, it may be because his penthouse and the private jet provided an invitation. In Jewish law, there is a concept called “mar’it ayin” designed to address this kind of ambiguity: you don’t eat fake bacon, for example, because a passerby might see you and conclude you’re eating real bacon. The reason for this law isn’t primarily to protect the reputation of the fake-bacon-eater; it’s to sustain the norms of the whole community. The passerby might decide that, if it was O.K. for you to eat bacon, it’s O.K. for him to do it, too. When important norms—of frugality, and the honesty with which it was discussed—are seen as violated, the survival of the culture is imperilled.

Not everyone in the community believed that it was benign to indulge billionaire sponsors. Last year, Carla Zoe Cremer, a Ph.D. student at Oxford, expressed public unease about the potential for corruption—epistemic and otherwise—and proposed a set of reforms, including whistle-blower protection and the broad democratization of E.A.’s command structure, which seemed liable to engender unwarranted trust in authority figures. “My recommendations were not intended to catch a specific risk, precisely because specific risks are hard to predict,” she told me recently. “But, yes, would we have been less likely to see this crash if we had incentivized whistle-blowers or diversified the portfolio to be less reliant on a few central donors? I believe so.” Josh Morrison, the founder of an organization that promotes challenge trials for vaccines, warned earlier this year on the E.A. Forum about the increasing “Ponzi-ishness” of a movement overly devoted to its own proliferation, and the ensuing possibility that priorities would shift if the community came to overvalue perks and status: “I think virtue tends to be very situationally dependent and that very admirable people can do bad things and deceive if it’s in their interest to do so.” As he put it to me, “Due to a combination of immaturity, naïveté, self-interest, and irrational exuberance, the E.A. community disregarded the risks of tying itself to an aggressive businessman in a lawless industry.”

There was not only a reason (money) to overlook Bankman-Fried’s more dubious qualities but also a major precedent for doing so. In 2017, Bankman-Fried launched Alameda Research as an explicitly E.A.-minded proprietary trading firm. As one early Alameda employee told me, “Something really amazing happened. Because we were all E.A.s, and we all believed ourselves to be value-aligned—we were all on the same team, making money not for ourselves but to make the world better. . . . I’ve been in startups my whole career, and this was something I’d never seen before: everyone was genuinely just trying to do their part, and trying to do it as efficiently and effectively as they could, and just trusting that we were all on the same team. And the reason I was as upset with Sam as I was is because, in my view, he defected. Everyone played ‘coöperate’ for months and he defected and destroyed the commons.”

Bankman-Fried operated with almost no traditional chaperons, such as an active accounting department. The early Alameda employee and a second colleague told me that Bankman-Fried maintained unreasonable expectations for productivity, and that two of the original team members needed medical attention for overwork. (Bankman-Fried’s spokesperson said that one was working multiple jobs.) And he exhibited a staggering appetite for risk. As one forum contributor familiar with the situation put it, “The majority of staff at Alameda were unhappy with Sam’s leadership of the company. Their concerns about Sam included concerns about him taking extreme and unnecessary risks and losing large amounts of money, poor safeguards around moving money around, poor capital controls, including a lack of distinction between money owned by investors and money owned by Alameda itself, and Sam generally being extremely difficult to work with.” Subsequent comments took issue with some of the specific allegations, but the drift of the post was widely confirmed. As the early employee put it to me, the primary misgiving was Bankman-Fried’s “demonstration of a pattern of behavior that illustrated a total lack of ethics.”

The story Bankman-Fried has told about his decision to build FTX, his cryptocurrency exchange, is that the available options offered a subpar user experience. According to the early employee, however, he told workers at Alameda that he also wanted to create FTX to list dicey cryptocurrency derivatives, including jerry-rigged novelties, inspired by leveraged E.T.F.s, for tokens like ether; these products would allow consumers to make very big bets without requiring a lot of capital up front. These derivatives might make short-term sense as part of a sophisticated institutional investor’s trading strategy. But, the employee said, “On long timescales these things tend to perform horribly regardless of what the price of the underlying asset does. There are several different points where these things bleed money, and if you are the person running them, you can be on the other side of those trades and drain all this money out of the product.” The employee continued, “He was so excited about these products that are just so predatory—they are blatantly short-term gambling, and in the long term the house wins. You can talk about ‘means justify ends’ stuff, and there are of course shades of gray in that, but this was pretty clearly just, ‘We want to make this product so that we can essentially scam people out of their money and then give it to charity.’ Commonsense morality has a very clear answer to this: you don’t fucking do that.” (Bankman-Fried’s spokesperson declined to comment on this matter.)

By the late spring of 2018, most of the original recruits were gone. (Bankman-Fried recently told the Wall Street Journal that staffers left the firm because of personal disputes and their lack of productivity, and that Alameda subsequently addressed the accounting, risk, and other issues they raised.) The employee told me, “I had conversations with fellow-E.A.s at the time, saying, ‘You shouldn’t trust this guy or associate with him because he’s just not an ethical person.’ ” A longtime E.A. wrote on the forum, “I think the vast majority of EAs had little they could have or should have done here. But I think that I, and a bunch of people in the EA leadership, had the ability to actually do something about this. I sent emails in which I warned people of SBF. . . . I had sat down my whole team, swore them to secrecy, and told them various pretty clearly illegal things that I heard Sam had done [sadly all unconfirmed, asking for confidentiality and only in rumors] that convinced me that we should avoid doing business with him as much as possible.”

Neither of the former Alameda employees believed that Bankman-Fried could be taken at his word. The early employee thought that E.A. leadership should have intervened at the time, and said, “Once Sam started becoming the face of E.A. in a bunch of ways, once the FTX Future Fund was being set up—that’s when something needed to happen. But we’d blown past the Schelling fence”—the E.A. word for the Rubicon, more or less—“and then there wasn’t another one. There were all these steps in the direction of presenting him as an E.A. and a good guy, and it became really hard to stop the momentum.” The employee went on, “And after that initial 2018 explosion, when we all left, I would guess there were probably not many discussions about reputational risk from S.B.F.”

There may not have been extended discussions, but there was at least one more recent warning. “E.A. leadership” is a nebulous term, but there is a small annual invitation-only gathering of senior figures, and they have conducted detailed conversations about potential public-relations liabilities in a private Slack group. In public, MacAskill was particularly preoccupied with the idea of a “PR disaster, esp among some of the leadership” that might undermine the movement, as “Elevatorgate,” a sexual scandal, had for the New Atheists. In private, many decisions were subject to intense optics-related scrutiny. When MacAskill and I first discussed the possibility of a profile, last November, he wrote to inform the group, saying that this “gives an even greater reason not to do anything shady.” In May, one of MacAskill’s lieutenants wrote to ask about the movement’s relationship with Peter Thiel: “Given his really bad reputation (supporting Trump, etc.) my current view is that it would be a good thing for the EA community to full-throatedly distance ourselves from him, but I wanted to make sure that there is no connection with him now.” (One of the FTX Future Fund researchers piped up to make a countervailing point, referring, presumably, to donations that Thiel made to the campaigns of J. D. Vance and Blake Masters: “Might be a useful ally at some point given he is trying to buy a couple Senate seats.”)

This past July, a contributor to the Slack channel wrote to express great apprehension about Sam Bankman-Fried. “Just FYSA,”—or for your situational awareness—“said to me yesterday in DC by somebody in gov’t: ‘Hey I was investigating someone for [x type of crime] and realized they’re on the board of CEA’ ”—MacAskill’s Centre for Effective Altruism—“ ‘or run EA or something? Crazy! I didn’t realize you could be an EA and also commit a lot of crime. Like shouldn’t those be incompatible?’ (about SBF). I don’t usually share this type of thing here, but seemed worth sharing the sentiment since I think it is not very uncommon and may be surprising to some people.” In a second message, the contributor continued, “I think in some circles SBF has a reputation as someone who regularly breaks laws to make money, which is something that many people see as directly antithetical to being altruistic or EA. (and I get why!!). That reputation poses PR concerns to EA whether or not he’s investigated, and whether or not he’s found guilty.” The contributor felt this was a serious enough issue to elaborate a third time: “I guess my point in sharing this is to raise awareness that a) in some circles SBF’s reputation is very bad b) in some circles SBF’s reputation is closely tied to EA, and c) there’s some chance SBF’s reputation gets much, much worse. But I don’t have any data on these (particularly c, I have no idea what types of scenarios are likely), though it seems like a major PR vulnerability. I imagine people working full-time on PR are aware of this and actively working to mitigate it, but it seemed worth passing on if not since many people may not be having these types of interactions.” (Bankman-Fried has not been charged with a crime. The Department of Justice declined to comment.)

I was unable to confirm the existence of a federal investigation as early as July, and, though there was no reason to discount the source’s credibility, it would have been nearly impossible for most of the channel’s participants to verify this rumor at the time. It nevertheless seems like a tiding that might have given participants pause. But, according to someone on the Slack, there was “surprisingly little engagement. Mostly ‘thanks for the flag.’ ” When I asked if it was possible that the leaders hadn’t seen the warning, the Slack participant told me, “I honestly can’t imagine it went unnoticed.” The next day, a C.E.A. higher-up wrote to ask if it made sense to invite former President Barack Obama to appear at the group’s annual conference series, and one Slack participant suggested a panel on A.I. risk with the philosopher Toby Ord and the longtime E.A. Jason Matheny, who served in the Biden Administration, and is now the president and C.E.O. of the RAND Corporation. MacAskill chimed in to propose that they involve Bankman-Fried. He wrote, “Idk, a discussion between Obama, Romney, Matheny, with SBF as moderator (unf too many men, but maybe Arati Prabhakar”—currently the director of the White House’s Office of Science and Technology Policy—“could be an option too).” (When asked about this, MacAskill wrote, “Let me be clear on this: if there was a fraud, I had no clue about it. With respect to specific Slack messages, I don’t recall seeing the warnings you described.”)

In a 2022 episode of the “80,000 Hours” podcast, the host Robert Wiblin introduced Bankman-Fried, as prelude to an obsequious three-hour-and-twenty-minute conversation, as a paragon of the movement. After news of FTX’s collapse broke, Wiblin declared on Twitter that he was “fucking appalled” by Bankman-Fried’s actions, and denied on the forum that he had any knowledge of Bankman-Fried’s Bahamian high life. His protestations of innocence might very well be legitimate, but it also seems plausible that he would have been unwilling to engage with the possibility that someone with the right intellectual armature might nevertheless not be a good person. (Wiblin disputed this characterization, saying, “I am well aware that someone might have good ideas but be of bad character.”) When my profile of MacAskill, which discussed internal movement discord about Bankman-Fried’s rise to prominence, appeared in August, Wiblin vented his displeasure on the Slack channel. As he put it, the problem was with the format of such a treatment. He wrote, “They don’t focus on ‘does this person have true and important ideas.’ The writer has no particular expertise to judge such a thing and readers don’t especially care either. Instead the focus is more often on personal quirkiness and charisma, relationships among people in the story, ‘she said / he said’ reporting of disagreements, making the reader feel wise and above the substantive issue, and finding ways the topic can be linked to existing political attitudes of New Yorker readers (so traditional liberal concerns). This is pretty bad because our great virtue is being right, not being likeable or uncontroversial or ‘right-on’ in terms of having fashionable political opinions.”

In other words, it seems as though the only thing that truly counts for Wiblin is the inviolate sphere of ideas—not individual traits, not social relationships, not “she said” disagreements about whether it was wise to throw in one’s lot with billionaire donors of murky motive, and certainly not “traditional liberal concerns.” (Wiblin told me, “I wasn’t talking about articles that focus on personal virtue, integrity, or character. I was talking about, for example, a focus on physical appearance, individual quirks, and charisma.”) Effective altruism did not create Sam Bankman-Fried, but it is precisely this sort of attitude among E.A.’s leadership, a group of people that take great pride in their discriminatory acumen, that allowed them to downweight the available evidence of his ethical irregularities. This was a betrayal of the E.A. rank and file, which is, for the most part, made up of extremely decent human beings.

What’s worse, however, is what was effectively communicated to Bankman-Fried himself. Ideas in the abstract are influential, but practical social norms constrain what individual actors think they can get away with. The message from E.A. leadership to Bankman-Fried seemed clear: as long as your stated ideals, not to mention your resources, are in alignment with ours, we might not bother ourselves with the other dimensions of your behavior. After all, “our great virtue is being right.” (MacAskill insisted to me that the movement’s leaders have always emphasized acting with integrity.) There was every incentive to look the other way. By the beginning of the summer, Bankman-Fried’s FTX Future Fund, for which MacAskill was serving as an adviser, had promised grants in excess of twenty-eight million dollars to E.A.’s institutional pillars, including C.E.A.; these outfits were the largest recipients of the new foundation’s largesse. It’s not that E.A. institutions were necessarily more irresponsible, or more neglectful, than others in their position would have been; the venture capitalists who worked with Bankman-Fried erred in the same direction. But that’s the point: E.A. leaders behaved more or less normally. Unfortunately, their self-image was one of exceptionalism.