#Bitcoin Bank Market trends

Text

Bitcoin Bank Market to see Booming Business Sentiments | Robinhood, Coinbase, Binance, NextBank

Latest Study on Industrial Growth of Bitcoin Bank Market 2022-2027. A detailed study accumulated to offer Latest insights about acute features of the Bitcoin Bank market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the future trends and developments of the market. It also examines the role of the leading market players involved in the industry including their corporate overview, financial summary and SWOT analysis.

Major players profiled in the study are:

Circle (United States), NextBank (Philippines), Nubank (Brazil), Mizuho (Japan), Elliptic Vault (London), Btcbank (United States), Robinhood (United States), Coinbase (United States), Bitbank (Japan) and Binance (United States)

Get Exclusive PDF Sample Copy of This Research @ https://www.advancemarketanalytics.com/sample-report/99533-global-bitcoin-bank-market#utm_source=DigitalJournalVinay

Scope of the Report of Bitcoin Bank

Bitcoin Bank is an automated cryptocurrency trading platform that enables anyone, regardless of prior knowledge or expertise, to buy and sell cryptocurrencies on the open market. Bitcoin bank provide trusted and reliable Bitcoin and crypto trading apps in the market, which uses the most accurate predictions through its robots. The platform has immense potential to exploit the most volatile cryptocurrency markets globally and earn the highest profits. Bitcoin Bank uses high-end encryption and most advanced programming algorithms. The app uses all the present and historical data of the market and analyses both strategically and emotionally, thus, creating trend maps for the market.

The Global Bitcoin Bank Market segments and Market Data Break Down are illuminated below:

by Application (SMEs, Large Sized Enterprises, Individuals), Category (Cloud Based, On Premise), Service (Digital Payments, Bitcoin Debit Card, Loan, Balance Holding, Other), Operating System (Android, IOS, Windows)

Market Opportunities:

Continuous Growth in Digital Infrastructure, Rapid Growth in Ecommerce and IT Sector and Growth in Fintech Infrastructure

Market Drivers:

Rising Demand in Online Crypto Trading, Surge in Demand in Digital Assets Purchasing, Rising Demand in Cryptocurrency Custodial Management and Handling solutions and Demand in Virtual Financial Investments

Market Trend:

Innovation of New Crypto Banking Software Applications, Innovation of Fifth Generation (5G) Technology and Developing Web 3.0 Technology for Cryptocurrencies

What can be explored with the Bitcoin Bank Market Study?

Gain Market Understanding

Identify Growth Opportunities

Analyze and Measure the Global Bitcoin Bank Market by Identifying Investment across various Industry Verticals

Understand the Trends that will drive Future Changes in Bitcoin Bank

Understand the Competitive Scenarios

Track Right Markets

Identify the Right Verticals

Region Included are: North America, Europe, Asia Pacific, Oceania, South America, Middle East & Africa

Country Level Break-Up: United States, Canada, Mexico, Brazil, Argentina, Colombia, Chile, South Africa, Nigeria, Tunisia, Morocco, Germany, United Kingdom (UK), the Netherlands, Spain, Italy, Belgium, Austria, Turkey, Russia, France, Poland, Israel, United Arab Emirates, Qatar, Saudi Arabia, China, Japan, Taiwan, South Korea, Singapore, India, Australia and New Zealand etc.

Have Any Questions Regarding Global Bitcoin Bank Market Report, Ask Our Experts@ https://www.advancemarketanalytics.com/enquiry-before-buy/99533-global-bitcoin-bank-market#utm_source=DigitalJournalVinay

Strategic Points Covered in Table of Content of Global Bitcoin Bank Market:

Chapter 1: Introduction, market driving force product Objective of Study and Research Scope the Bitcoin Bank market

Chapter 2: Exclusive Summary – the basic information of the Bitcoin Bank Market.

Chapter 3: Displaying the Market Dynamics- Drivers, Trends and Challenges & Opportunities of the Bitcoin Bank

Chapter 4: Presenting the Bitcoin Bank Market Factor Analysis, Porters Five Forces, Supply/Value Chain, PESTEL analysis, Market Entropy, Patent/Trademark Analysis.

Chapter 5: Displaying the by Type, End User and Region/Country 2016-2021

Chapter 6: Evaluating the leading manufacturers of the Bitcoin Bank market which consists of its Competitive Landscape, Peer Group Analysis, BCG Matrix & Company Profile

Chapter 7: To evaluate the market by segments, by countries and by Manufacturers/Company with revenue share and sales by key countries in these various regions (2022-2027)

Chapter 8 & 9: Displaying the Appendix, Methodology and Data Source

Finally, Bitcoin Bank Market is a valuable source of guidance for individuals and companies.

Read Detailed Index of full Research Study at @ https://www.advancemarketanalytics.com/buy-now?format=1&report=99533#utm_source=DigitalJournalVinay

Contact Us:

Craig Francis (PR & Marketing Manager)

AMA Research & Media LLP

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

#Bitcoin Bank market analysis#Bitcoin Bank Market forecast#Bitcoin Bank Market growth#Bitcoin Bank Market Opportunity#Bitcoin Bank Market share#Bitcoin Bank Market trends

0 notes

Text

#trending news#viral news#finance#stock market#business news#breaking news#business#banking#crypto#cryptocurrency#bitcoin

0 notes

Text

Crypto Wealth Building A Guide for Gen Z

Who is Andrew Tate?

Understanding Memecoins

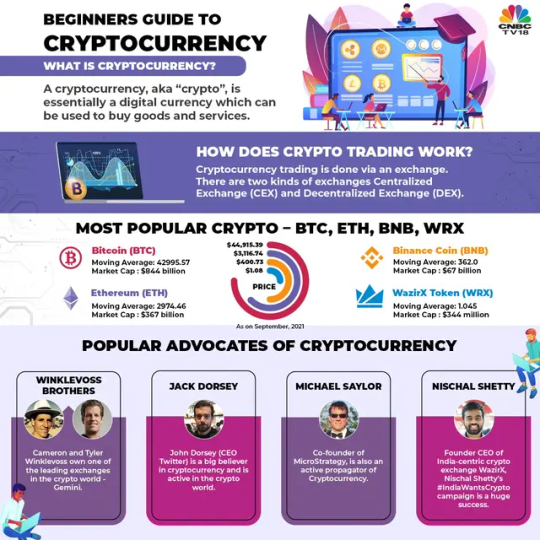

Memecoins have gained significant popularity in the world of cryptocurrencies, attracting a new wave of investors, especially among the younger generation like Gen Z. Let’s delve into what memecoins are and how they differ from traditional cryptocurrencies.

Definition and Explanation of Memecoins

Memecoins are a type of cryptocurrency that primarily relies on humor, memes, and community engagement to gain value and traction in the market. Unlike traditional cryptocurrencies such as Bitcoin or Ethereum, which are based on underlying technology and blockchain functionality, memecoins derive their value from internet culture and trends. They often represent a joke or satirical concept that resonates with a specific online community.

How Memecoins Differ from Traditional Cryptocurrencies

While both memecoins and traditional cryptocurrencies use blockchain technology, their fundamental differences lie in their purpose, value proposition, and community-driven nature. Traditional cryptocurrencies aim to revolutionize finance by providing decentralized alternatives to traditional banking systems. In contrast, memecoins serve as a form of entertainment or social commentary within the crypto space. Their value is driven by community engagement rather than technological advancements or real-world utility.

Examples of Popular Memecoins in the Market

Several memecoins have gained significant attention and market capitalization. One notable example is Dogecoin (DOGE), which originated as a joke but has since become one of the most well-known memecoins. Another popular memecoin is Shiba Inu (SHIB), inspired by the Dogecoin phenomenon. These coins have experienced massive price surges due to viral trends and influential endorsements.

Memecoins offer an exciting alternative investment opportunity for Gen Z investors looking to explore the crypto space. Understanding their unique characteristics and how they differ from traditional cryptocurrencies is essential for making informed investment decisions.

Andrew Tate’s Advice on Memecoins

Andrew Tate, a prominent figure in the world of entrepreneurship and wealth building, has shared valuable insights into the realm of memecoins and their potential as an investment avenue for individuals. His perspective on investing in memecoins is characterized by strategic approaches and risk management techniques that can benefit investors looking to explore this unique market.

Overview of Andrew Tate’s Perspective

Andrew Tate views memecoins as an innovative and potentially lucrative investment opportunity within the crypto space. His approach emphasizes the significance of identifying promising memecoin projects with strong fundamentals and community support.

Strategies for Identifying Profitable Memecoin Investments

Tate advocates for thorough research and due diligence when considering memecoin investments. He highlights the importance of assessing the underlying technology, development team, and community engagement to gauge the long-term viability of a memecoin project.

Tips for Managing Risks Associated with Memecoin Investments

Recognizing the inherent volatility of memecoins, Andrew Tate advises investors to exercise caution and prudence in their approach. Setting clear entry and exit strategies, diversifying investment portfolios, staying updated on market trends, and identifying potential breakout candidates such as the next big cryptocurrency set to explode in 2024 are among the risk management practices he recommends.

By aligning his insights with practical investment strategies, Andrew Tate offers a comprehensive perspective on navigating the dynamic landscape of memecoins while prioritizing informed decision-making and risk mitigation.

The Role of Memecoins in Crypto Wealth Building for Gen Z

How Memecoins Can Help Gen Z Build Wealth Through Crypto Investments

Memecoins have become popular among Gen Z investors because they have low barriers to entry and can potentially generate high profits. Unlike traditional investment options, memecoins usually have lower fees for transactions and can be easily accessed through various online platforms. This makes it possible for young investors to enter the cryptocurrency market with a smaller initial investment, which is appealing to those who want to start building wealth at a younger age.

Furthermore, memecoins offer a sense of community and inclusivity that resonates with many Gen Z individuals. The social aspect of memecoins can create a supportive environment for learning about investing and financial literacy, empowering young adults to take control of their financial future.

The Potential for Long-Term Financial Growth Through Memecoin Investments for Young Investors

Memecoins present an opportunity for long-term financial growth for Gen Z investors. While they may be considered more volatile than traditional cryptocurrencies, some memecoins have shown significant increases in value over time. By carefully choosing and diversifying their memecoin portfolio, young investors can position themselves to benefit from potential long-term growth and take advantage of emerging trends in the crypto market.

As digital natives, Gen Z individuals are well-suited to adapt to the changing world of cryptocurrency and blockchain technology. Embracing memecoins as part of their wealth-building strategy can give them practical experience in navigating the digital economy while also potentially earning substantial profits in the future.

The Intersection of Memecoins and AI: A Survival Strategy for Bitcoin Miners

While memecoins offer financial opportunities for Gen Z, it’s important to note that the crypto landscape is ever-evolving. In fact, some forward-thinking Bitcoin miners are exploring AI as a survival strategy in response to certain challenges like the halving event. This intersection between memecoins and AI signifies the growing importance of technological innovations in the cryptocurrency industry. By staying informed and adaptable, young investors can navigate these shifts and continue to thrive in the crypto market.

Getting Started with Crypto Wealth Building as a Gen Z Investor

When it comes to starting your journey of crypto wealth building as a Gen Z investor, there are several important things to think about and tactics that can help you get on the right track. Here’s how you can get started:

1. Educate Yourself

Take the time to understand the basics of cryptocurrencies and blockchain technology. There are many resources available, such as online courses, articles, and forums where you can learn more.

2. Diversify Your Portfolio

Instead of putting all your money into just one cryptocurrency, think about spreading your investments across different assets. This can lower the risk and improve your chances of long-term success.

3. Stay Informed

The cryptocurrency market is always changing, with new things happening all the time. Stay up-to-date with the latest news, market analyses, and expert opinions to make smart investment choices.

4. Manage Risks

It’s important to know how much risk you’re comfortable with and set clear investment goals. Don’t invest more money than you can afford to lose and consider using strategies like stop-loss orders to protect yourself.

5. Find a Mentor

Look for experienced investors or mentors who have done well in the world of crypto wealth building. Their advice and guidance can be really helpful as you start your own investment journey.

By thinking about these things and using these tactics, Gen Z investors can build a strong foundation for their crypto wealth building efforts. With a proactive attitude and a commitment to always learning, it becomes more possible to see financial growth through cryptocurrencies.

Embracing the Future: Why Gen Z Should Explore Crypto Wealth Building Opportunities

As a member of Generation Z, you have the chance to lead the way in technological innovation and shape how financial markets will look in the future. Here’s why it makes sense for you to consider getting into crypto wealth building:

1. Technological Proficiency

Gen Z is known for being comfortable with technology, which puts you in a good position to understand and navigate the world of cryptocurrencies and blockchain. Getting involved in crypto wealth building is a natural fit for your tech-savvy nature.

2. Financial Empowerment

Investing in crypto gives you the power to take charge of your own financial destiny. Instead of relying solely on traditional methods, like saving money or investing in stocks, you can actively seek out opportunities that have the potential to grow your wealth over time.

3. Innovative Mindset

One of the key strengths of your generation is its ability to think outside the box and come up with fresh ideas. By embracing crypto wealth building, you’re not only tapping into an exciting new asset class but also contributing to the ongoing transformation of how money works.

4. Global Perspective

Unlike traditional financial systems that are tied to specific countries, cryptocurrencies operate on a global level. This means that by exploring crypto wealth building options, you can gain exposure to international markets and stay informed about global economic trends.

Embracing crypto wealth building isn’t just about making money; it’s about embracing a mindset of progress, empowerment, and adaptability — qualities that resonate deeply with Generation Z’s values.

Conclusion

As Gen Z individuals, embracing the world of crypto wealth building can have a significant impact on your financial future. The potential for long-term growth through investments in cryptocurrencies, including memecoins, presents a unique opportunity for young investors to secure their financial well-being.

Andrew Tate’s valuable advice on memecoins aligns with the overall guide, emphasizing the importance of strategic investment approaches and risk management. His expertise in entrepreneurship and wealth building serves as an inspiration for Gen Z to explore the world of crypto investments with confidence.

Thanks for reading Article, Also we done tons of research and found this amazing platform solanalauncher.com For you... Here you can generate your own memecoins tokens on solana in just less than three seconds without any extensive programming knowledge, There support is too good for clients, and also you aware about solana blockchain, It's fastest growing blockchain compare to other crypto blockchain.

By staying informed, adopting a proactive mindset, and leveraging the guidance available, you can position yourself to thrive in the evolving landscape of crypto wealth building. Remember, the decisions you make today can pave the way for a prosperous tomorrow.

Happy Investing!

4 notes

·

View notes

Text

How Bitcoin Redefines Trust in Global Trade

For centuries, trust has been a cornerstone of global trade. Whether trading across borders or within nations, businesses have historically relied on governments, banks, and institutions to act as intermediaries, providing the necessary oversight and guarantees that transactions would be honored. But as our world becomes more digital and interconnected, the limitations and inefficiencies of these traditional systems are becoming increasingly evident. Enter Bitcoin—a decentralized currency that is fundamentally transforming the very nature of trust in global trade.

The Role of Trust in Traditional Trade

In the current global trade system, trust is largely built on central authorities—governments, central banks, and financial institutions. These intermediaries ensure stability, enforce contracts, and manage currencies. While this system has worked to some extent, it’s fraught with problems: corruption, inefficiencies, inflation, and geopolitical risks. For example, trade disputes can escalate into economic sanctions or currency manipulation, which can cripple businesses. Trust in these institutions can falter, and when it does, the global economy feels the effects.

Moreover, relying on the USD as the global reserve currency has its drawbacks. The USD's value fluctuates based on the policies of the U.S. government, including money printing, interest rate changes, and other interventions. This introduces volatility into global markets and trade relationships, often to the detriment of smaller, emerging economies.

Bitcoin as a Trustless System

Bitcoin offers a radically different approach. Built on blockchain technology, Bitcoin eliminates the need for intermediaries. Instead of relying on a centralized authority to verify and approve transactions, Bitcoin operates through a decentralized network where transactions are publicly recorded and verified by code. This concept of "trustless" transactions means that participants don't need to rely on a central authority to validate their exchanges.

By removing the need for middlemen, Bitcoin reduces transaction costs, increases transparency, and provides a level of security that is nearly impossible to breach. This decentralization also means that no single entity—government or financial institution—can manipulate the currency for its own gain, making it a more stable and reliable form of value transfer in global trade.

Decentralization and Its Impact on Global Trade

The decentralized nature of Bitcoin is already reshaping trade by enabling peer-to-peer transactions across borders. With no central authority dictating terms or controlling the flow of money, individuals and businesses can transact directly, quickly, and securely. This is particularly important in emerging markets, where trust in financial institutions is often low or nonexistent.

For example, in countries experiencing hyperinflation or economic instability, Bitcoin provides a way for businesses to engage in global trade without relying on a failing national currency. It also opens doors for the unbanked—those who don't have access to traditional financial services—to participate in the global economy.

Real-World Applications of Bitcoin in Trade

We are already seeing Bitcoin’s impact on global trade in various sectors. Cross-border payments and remittances have become faster, cheaper, and more secure through Bitcoin. Companies are starting to use Bitcoin as part of their supply chains or as a payment option to mitigate currency risk and reduce reliance on traditional banking systems.

Countries like El Salvador have already embraced Bitcoin as legal tender, providing a real-world experiment in how Bitcoin can drive economic activity and improve trade relations. As more countries and companies adopt Bitcoin, we will likely see this trend continue and grow.

The Future of Trade in a Bitcoin Economy

As Bitcoin adoption grows, the future of global trade could be vastly different from what we see today. With Bitcoin’s fixed supply and decentralized network, trade will no longer be subject to the whims of central banks or governments. Transactions will be faster, more secure, and far less costly, leading to an overall more efficient global marketplace.

More importantly, trust will no longer be placed in fallible institutions but in technology and code. This shift could open up global trade to new participants, especially those in countries with unstable currencies or restrictive financial regulations.

The Market with Bitcoin as a Denominator

One of the most profound changes Bitcoin could bring to global trade is how markets behave with a true hard asset like Bitcoin as the denominator, compared to the USD. Currently, the USD's value is constantly influenced by inflation, monetary policy, and the actions of the U.S. government. This introduces distortions in pricing across global markets.

In contrast, Bitcoin’s fixed supply means there’s no central authority devaluing the currency by printing more of it. The market would adjust based on real supply and demand dynamics, leading to more stable and predictable pricing. Goods, services, and assets would be priced more accurately, free from the distortions caused by inflation or interest rate changes. Essentially, a Bitcoin standard could allow for a freer, more transparent market, where prices reflect true value, not manipulated fiat prices.

With a hard asset like Bitcoin as the global standard, we could see a deflationary effect over time, where the purchasing power of Bitcoin increases. This would encourage savings and long-term thinking, reshaping how businesses plan and execute global trade strategies.

Conclusion

Bitcoin is poised to redefine the trust model in global trade. By decentralizing trust and removing intermediaries, Bitcoin enables faster, more secure, and transparent transactions across borders. It also shifts the foundation of global trade from government-controlled currencies to a decentralized, hard asset that is beyond manipulation. The shift to a Bitcoin-denominated world will challenge the status quo, but the benefits it offers—stability, fairness, and efficiency—are too great to ignore.

As we move closer to a Bitcoin standard, the future of global trade will be built on truth, not fiat manipulation, ushering in a new era of financial sovereignty and fairness.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

Thank you for your support!

#Bitcoin#CryptoRevolution#GlobalTrade#Decentralization#BlockchainTechnology#FinancialFreedom#SoundMoney#TrustlessSystem#PeerToPeer#DigitalCurrency#EconomicChange#HardMoney#USDvsBitcoin#BitcoinEconomy#FutureOfFinance#TransparencyInTrade#FiatToBitcoin#FinancialSovereignty#CryptoFuture#UnpluggedFinancial#financial empowerment#financial experts#globaleconomy#finance#unplugged financial#cryptocurrency#financial education#blockchain

2 notes

·

View notes

Text

Alternative Payment Methods (APMs) for Online Transactions

In the past decade, the world of online payments has witnessed a significant transformation. With the rise of e-commerce and the increasing preference for mobile shopping, customers now have more choices than ever when it comes to payment methods. This shift has led to the emergence of alternative payment methods (APMs) that offer customers greater convenience and flexibility. In this article, we will explore the different types of APMs, their popularity across the globe, the benefits of accepting these methods for businesses, and how to choose the best APMs for your business.

Understanding Alternative Payment Methods

Alternative payment methods refer to any form of payment that does not involve cash or traditional credit card systems like Visa, Mastercard, or American Express. These methods include domestic cards, digital wallets, bank transfers, prepaid cards, and more. Unlike traditional payment methods, APMs offer unique advantages such as enhanced security, faster processing times, and ease of use. They have become particularly popular for online transactions, with many countries seeing a significant shift towards APM usage.

Types of Alternative Payment Methods

Prepaid cards: Prepaid cards are loaded with funds by consumers and can be used for purchases until the balance is depleted. They are not directly linked to a bank account and are a popular choice for individuals who want to control their spending.

Cash-based payments: Cash-based payment methods allow customers to generate a barcode or unique reference number for their payment and then complete the transaction by paying in cash at a participating retail location. This method is particularly popular in regions with a large unbanked population.

Real-time bank transfers: Real-time bank transfers enable customers to make online payments directly from their bank accounts. This method offers instant settlement and minimal friction for customers, making it a convenient choice for many.

Direct Debit: Direct debit allows merchants to pull funds directly from customers' bank accounts for recurring payments. This method is commonly used for subscription-based services and offers a seamless and automated payment experience.

Domestic card schemes: Domestic card schemes operate similarly to global card schemes but are limited to specific markets. These schemes cater to the unique needs of consumers in their respective markets and often provide lower processing costs for merchants.

Electronic wallets (e-wallets): E-wallets allow customers to store funds digitally and use them for various transactions, both online and offline. They offer convenience, security, and often provide additional features like peer-to-peer transfers and cross-border payments.

Mobile wallets: Mobile wallets are digital wallets that are specifically designed to be used on mobile devices. Customers can load funds into their mobile wallets through various methods and make payments conveniently through their smartphones.

Digital wallets: Digital wallets are used to store payment card information securely and generate tokenized card numbers for each transaction. They offer a convenient and secure way to shop online without the need to enter card details repeatedly.

Buy now, pay later (BNPL): BNPL services allow customers to defer payments or split the cost of a purchase into installments. This method is gaining popularity for its flexibility and convenience, particularly for high-value purchases.

Cryptocurrencies and stablecoins: Cryptocurrencies like Bitcoin have gained attention in recent years, offering an alternative form of payment. Stablecoins, which are cryptocurrencies linked to fiat currencies or government bonds, aim to reduce volatility and make transactions easier.

Popular APMs Worldwide

The popularity of APMs varies across different regions and countries. Here are some notable trends:

North America

In North America, digital wallets have become the most popular payment method, surpassing credit and debit cards. Apple Pay and Google Pay are widely used, while services like PayPal and Venmo are gaining traction among the younger generation. APMs account for a significant portion of e-commerce transactions in the region.

South America

APMs are gaining ground in South America, with a projected increase in their usage for digital commerce transactions. Credit cards still dominate, but alternative online payment solutions, such as e-cash methods, are becoming more widespread. Cash on delivery is also popular, especially in countries with a large unbanked population.

Europe

In Europe, digital wallets have surpassed credit and debit cards as the preferred online payment method. Domestic debit cards, like Bancontact in Belgium and Cartes Bancaires in France, are popular alongside global card schemes. Bank transfer methods, such as iDEAL in the Netherlands and Przelewy24 in Poland, are also preferred by a significant number of consumers.

Africa

In Africa, mobile wallets have gained popularity due to the lack of bank branch infrastructure and a large rural population. Cash on delivery remains the preferred method, especially in Nigeria and South Africa. Digital wallets are also seeing growth, particularly in Kenya and Nigeria.

Middle East

Cash has traditionally been the dominant payment method in the Middle East. However, the region is experiencing a shift towards mobile wallets due to increased smartphone penetration and concerns over the transmission of cash during the pandemic. Mobile wallet adoption is supported by the expansion of international brands and government-backed payment networks.

Asia Pacific

China has its own domestic card scheme, UnionPay, which accounts for a significant portion of global card spending. Mobile payments, particularly through Alipay and WeChat Pay, are widely used in China. Other countries in the region, such as Singapore, Indonesia, and Thailand, have their own popular alternative payment methods, including GrabPay and OVO Wallet.

The Benefits of Accepting APMs for Businesses

Not accepting customers' preferred payment methods can have a negative impact on conversion rates and lead to shopping cart abandonment. Research shows that a significant percentage of consumers are deterred from completing a purchase if their preferred payment method is not available. By accepting a variety of APMs, businesses can improve customer satisfaction, increase conversion rates, and stay ahead of their competitors.

APMs offer several benefits for businesses:

Increased conversion rates: By offering a wide range of payment methods, businesses can cater to the preferences of different customer segments, leading to higher conversion rates and reduced shopping cart abandonment.

Improved customer experience: APMs provide convenience and flexibility for customers, allowing them to choose the payment method that suits their needs and preferences. This enhances the overall customer experience and fosters loyalty.

Expanded customer base: Accepting popular local and global APMs enables businesses to reach a wider customer base, including those who prefer alternative payment methods over traditional options.

Reduced fraud and chargebacks: Many APMs incorporate advanced security features, such as biometric authentication and tokenization, which help reduce the risk of fraud and chargebacks for businesses.

Access to valuable insights: APM providers often offer detailed transaction data and analytics, providing businesses with valuable insights into consumer behavior and preferences. This data can be leveraged to optimize marketing strategies and improve customer targeting.

Choosing the Best APMs for Your Business

Selecting the right APMs for your business requires a thorough understanding of your target market, customer preferences, and business requirements. Here are some steps to guide you in choosing the best APMs:

Research customer preferences: Conduct market research to identify the most popular payment methods among your target audience. Consider factors such as geography, demographics, and shopping habits to determine the most relevant APMs for your business.

Evaluate business needs: Assess your business requirements, including cost per transaction, setup and management complexity, regulatory compliance, and compatibility with your existing payment infrastructure. Choose APMs that align with your business goals and objectives.

Partner with the right providers: Work with payment service providers that offer comprehensive coverage of the APMs you wish to integrate. Ensure they have the necessary capabilities to support your business's growth and adapt to evolving customer preferences.

Test and optimize: Implement APMs in a phased approach and continuously monitor their performance. Analyze transaction data and customer feedback to identify any pain points or areas for improvement. Regularly optimize your APM strategy to maximize conversions and customer satisfaction.

By embracing the growing trend of APMs and selecting the right mix of payment methods for your business, you can enhance the payment experience for your customers and drive growth in your online sales.

Conclusion

Alternative payment methods have revolutionized the world of online transactions, offering customers greater convenience and flexibility. From digital wallets and mobile payments to real-time bank transfers and buy now, pay later services, APMs cater to a wide range of customer preferences. Businesses that embrace APMs can benefit from increased conversion rates, improved customer experience, and access to valuable insights. By understanding customer preferences, evaluating business needs, and partnering with the right providers, businesses can choose the best APMs to drive growth and success in the digital marketplace. Stay ahead of the competition by embracing the changing landscape of online payments and offering customers the payment methods they prefer.

#high risk merchant account#high risk payment gateway#offshore merchant account#payments#merchant account

3 notes

·

View notes

Text

Everything You Need to Know About Investing

Investing is a vast and intricate world, filled with opportunities, pitfalls, and a plethora of information. Whether you're a seasoned investor or just starting out, there's always something new to learn. Let's dive into the essentials of investing and how you can navigate this financial journey with confidence.

The Foundations of Investing

Before diving deep into the strategies and nuances, it's crucial to understand the basics. Investing is essentially allocating resources, usually money, with the expectation of generating an income or profit. But where do you start?

1. Understanding Your Goals

Every investor has a unique set of objectives. Some might be saving for retirement, while others could be aiming to buy a home or fund their children's education. Knowing your goals will help you tailor your investment strategy accordingly.

2. Risk and Return

There's a fundamental principle in investing: the higher the potential return, the higher the risk. It's essential to assess your risk tolerance and align it with your investment choices. For a deeper dive into risk management, check out Investment Pitfalls Unveiled: How to Avoid Costly Mistakes.

3. Diversification

Don't put all your eggs in one basket. Diversifying your investments across different asset classes can help mitigate risk. This strategy is beautifully explained in The Comprehensive Guide to Index Funds: A Powerful Tool for Diversification and Long-term Growth.

The World of E-commerce and Investing

E-commerce has revolutionized the way we shop and invest. With the rise of online platforms, investing has become more accessible than ever. Here's how the e-commerce landscape intertwines with the world of investing:

Retail Trends: The retail industry is ever-evolving, with new trends emerging regularly. For instance, the new retail trends in Qatar offer a comprehensive insight into the changing dynamics of the market.

Online Safety: As online transactions become more prevalent, it's crucial to ensure safety. Learn how to shop online safely to protect your investments and personal information.

The Magic of Customer Experience: In the world of e-commerce, customer experience is king. Dive into the enchanting e-commerce world and discover how it impacts investment decisions.

Cryptocurrency: The New Frontier

The rise of digital currencies, especially Bitcoin, has added a new dimension to investing. With its decentralized nature and potential for high returns, many are drawn to this digital gold. Explore the empowering world of Bitcoin banking and how it's reshaping the financial landscape.

Time: The Investor's Best Friend

Time is a crucial factor in investing. The power of compounding, where your investments earn returns on returns, can lead to exponential growth over time. Delve into the concept of compounding demystified to harness its potential.

In Conclusion

Investing is a journey, filled with learning, growth, and occasional setbacks. But with the right knowledge, tools, and mindset, it can lead to financial freedom and prosperity. As you embark on this journey, remember to stay informed, make informed decisions, and always keep your goals in sight.

For more insights, tips, and comprehensive guides on various topics, explore the vast collection of articles on Steffi's Blogs. Happy investing!

Note: Always consult with a financial advisor before making any investment decisions.

#Unlock Wealth Secrets#E-commerce Goldmine#Bitcoin Boom#Investing 101 Unveiled#Qatar's Retail Revolution#Risk or Reward? Find Out!#Dive into Digital Currencies#Time's Ticking: Compound Now!#Financial Freedom Fast-Track#Master the Market Mysteries#From Zero to Investment Hero#Online Shopping: Safe or Scam?#Cryptocurrency Craze: Join or Joke?#Diversify and Dominate#Retail Trends: Rise or Ruin?#Customer Experience: Cash or Crash?#Compounding: The Magic Formula#Steffi's Top Investment Tips#Navigate the Investment Labyrinth#E-commerce Explosion: Invest or Ignore?

2 notes

·

View notes

Text

Cryptocurrency for Beginners: Essential Insights and Guidance

Cryptocurrency, a digital and decentralized form of money, has transformed the way we think about finance and technology.

For beginners, navigating the world of cryptocurrency can be both exciting and overwhelming.

This article serves as a comprehensive guide, offering beginners insights into the fundamental aspects, benefits, risks, and practical steps to get started in the cryptocurrency realm.

youtube

Understanding Cryptocurrency: The Basics

At its core, cryptocurrency is a digital or virtual form of currency that utilizes cryptographic techniques to secure transactions and control the creation of new units.

Unlike traditional currencies issued by governments and central banks, cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

1. How Cryptocurrencies Work

Cryptocurrencies operate on blockchain technology, which is a distributed and immutable ledger that records all transactions.

Each transaction is grouped into a "block," and these blocks are linked together, creating a chain of information.

This decentralized nature ensures transparency, security, and resistance to censorship as Perseus Crypto explains it nicely.

2. Key Cryptocurrency Concepts

Blockchain: A decentralized ledger that records all transactions in a secure and transparent manner.

Wallet: A digital tool that stores your cryptocurrency holdings, enabling you to send, receive, and manage your coins.

Private and Public Keys: Cryptographic keys that grant access to your cryptocurrency. The public key is like an address, while the private key is your password.

Mining: The process of validating transactions and adding them to the blockchain using powerful computers and solving complex mathematical puzzles.

Benefits of Cryptocurrency

1. Financial Inclusion: Cryptocurrencies enable access to financial services for the unbanked and underbanked populations around the world.

2. Decentralization: Cryptocurrencies operate on decentralized networks, reducing the influence of central authorities and intermediaries.

3. Security: Blockchain's cryptographic techniques ensure secure transactions and protection against fraud and hacking.

4. Transparency: Transactions on a blockchain are public and transparent, enhancing accountability.

5. Borderless Transactions: Cryptocurrencies enable fast and low-cost cross-border transactions.

6. Potential for Growth: Some cryptocurrencies have experienced significant price appreciation, offering opportunities for investment growth.

Risks and Considerations

1. Volatility: Cryptocurrency prices can be highly volatile, leading to rapid and unpredictable value changes.

2. Security Concerns: Cryptocurrencies are susceptible to hacking, scams, and phishing attacks. Secure storage is crucial.

3. Regulatory Environment: Regulations for cryptocurrencies vary by jurisdiction and can impact their legality, taxation, and use.

4. Lack of Understanding: The complexity of the technology and market can lead to uninformed decisions.

5. Lack of Regulation: The decentralized nature of cryptocurrencies means there may be no recourse for fraudulent activities or disputes.

Getting Started with Cryptocurrency

1. Education Is Key

Before investing in or using cryptocurrencies, educate yourself about the technology, terminology, and potential risks.

Numerous online resources, courses, and communities provide valuable insights.

2. Choose the Right Cryptocurrency

Research different cryptocurrencies to understand their purposes, use cases, and market trends.

Bitcoin, Ethereum, and others have distinct features and applications.

3. Select a Reliable Exchange

Choose a reputable cryptocurrency exchange to buy, sell, and trade cryptocurrencies.

Look for factors like security measures, fees, user-friendliness, and available coins.

4. Secure Your Investments

Use strong, unique passwords for your exchange accounts and enable two-factor authentication (2FA).

Consider using hardware wallets for enhanced security.

5. Start Small and Diversify

For beginners, start with a small investment you can afford to lose.

Diversify your investments across different cryptocurrencies to manage risk.

6. Stay Informed

Stay updated with the latest news and trends in the cryptocurrency space.

Follow reputable cryptocurrency news websites, blogs, and social media accounts.

7. Avoid FOMO and Emotional Decisions

Fear of missing out (FOMO) and emotional decisions can lead to impulsive actions.

Stick to your investment strategy and avoid making decisions solely based on short-term price movements.

8. Be Prepared for the Long Term

Cryptocurrency investments are often more successful with a long-term perspective.

Avoid making decisions based on daily market fluctuations.

Conclusion

As you embark on your journey into the world of cryptocurrency, remember that education and caution are your best allies.

Understand the technology, the benefits, and the risks before making any investment decisions.

With the right knowledge and a thoughtful approach, you can navigate the complex and dynamic cryptocurrency landscape, potentially harnessing its benefits and contributing to the evolution of modern finance.

2 notes

·

View notes

Text

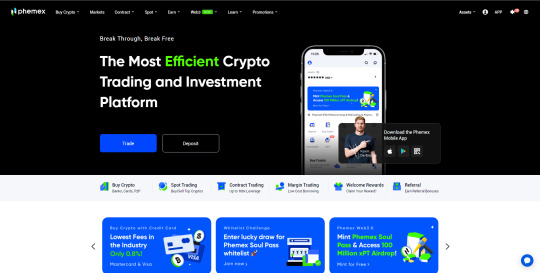

PHEMEX Exchange

Founded by former executives of Morgan Stanley in 2019, Phemex stands as a leading cryptocurrency futures exchange, facilitating the trading of diverse digital assets such as Bitcoin, Ethereum, Solana, Avalanche, Shiba Inu, and over 250 others. With a commitment to serving both professional and retail traders, Phemex offers an intuitive interface, competitive fees, tight spreads, and lightning-fast execution speeds.

Unleash the power of Phemex, the visionary platform that empowers traders worldwide. Trade a vast array of digital assets, including renowned cryptocurrencies like Bitcoin, Ethereum, and Ripple. Phemex caters to both spot and margin trading, ensuring that even the most seasoned traders have access to advanced tools and features. Experience the advantage of Phemex’s minimal fees, enabling you to maximize your profits. Available in over 180 countries, Phemex welcomes traders from around the globe to embark on an exciting journey towards financial success.

PHEMEX: Secure and Reliable?

Phemex assures safety as a regulated cryptocurrency exchange, duly registered with the US Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC). This regulatory oversight mandates stringent financial compliance, including robust anti-money laundering (AML) and countering-the-financing-of-terrorism (CFT) measures.

Rest easy knowing that Phemex provides a secure haven for buying, selling, and trading digital assets. As a testament to its credibility, the platform boasts support from industry giants like Galaxy Digital and BitMEX, cementing its position as a trusted choice in the cryptocurrency landscape. Embrace the peace of mind that comes with Phemex’s commitment to safety and the backing of renowned investors.

PHEMEX Trading Fees

Phemex stands out as the most cost-effective exchange globally, offering an unprecedented 0.025% rebate on market maker orders. Here’s how it works: when you place a limit order on Phemex and it successfully matches with another trade, Phemex will reward you with a 0.025% rebate.

Moreover, for standard market orders, Phemex imposes a mere 0.075% taker fee per trade. Take advantage of these exceptional rates and maximize your trading potential on Phemex, the ultimate destination for affordable cryptocurrency transactions. Unleash the power of low fees and embrace a rewarding trading experience with Phemex.

PHEMEX KYC Verification

Currently, Phemex sets itself apart by not mandating KYC verification for trading on their platform. This unique feature allows users to swiftly engage in cryptocurrency trading without the hassle of submitting identity verification documents. Phemex stands out as one of the few derivatives exchanges that still provide this convenience.

However, for traders dealing with substantial sums exceeding $100,000 USD, the completion of Phemex Premium membership verification becomes necessary to facilitate seamless transfers to and from their bank accounts. This added verification step ensures smooth transactions and meets the needs of large-scale traders.

Join Phemex, where trading freedom and convenience converge. Enjoy the ease of trading cryptocurrencies without the burden of KYC verification. Explore the possibilities, and if you’re a high-volume trader, unlock the full potential of Phemex by undergoing Premium membership verification. Experience a platform that caters to both small-scale and large-scale traders with efficiency and flexibility.

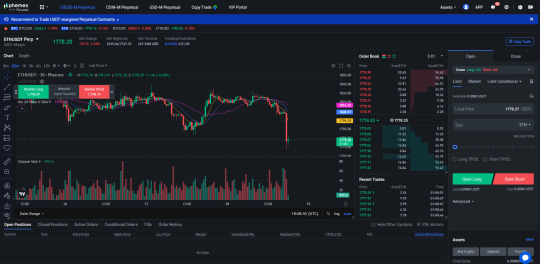

Futures and Derivatives Trading on PHEMEX

Trading ETH/USD derivatives on Phemex Futures.

Available Cryptocurrencies on PHEMEX

Phemex presents an extensive selection of top cryptocurrencies, akin to those found on renowned exchanges such as Binance or FTX. With a diverse range of over 200 digital assets, Phemex keeps pace with the ever-evolving market by promptly listing trending coins like ApeCoin (APE) or Decentraland (MANA). Discover the thrill of trading with an array of exciting options on Phemex’s platform, where opportunities abound and innovation thrives. Unleash your trading potential and explore the world of cryptocurrencies with Phemex.

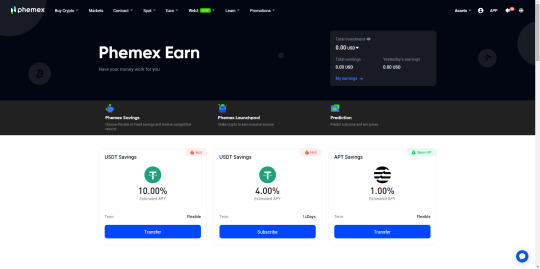

PHEMEX Earn

PHEMEX Conclusion

Discover the thriving world of Phemex, a user-friendly cryptocurrency exchange that is rapidly gaining momentum. With an impressive array of over 250 assets available for spot and futures trading, Phemex eliminates the hassle of KYC verification. Embrace the allure of low fees, abundant liquidity, and a platform tailored for both seasoned traders and beginners alike. Rest assured, Phemex prioritizes your safety, being registered with the CFTC and SEC. Unlock the potential of passive income through Phemex Earn, where staking opens doors to enticing opportunities. Join now through the provided link and seize the exclusive $180 Crypto Bonus. Don’t let this exhilarating journey pass you by.

2 notes

·

View notes

Text

Crypto Rally Causes $450M Short Trader Losses

The crypto market has been on an upward trend lately, with major cryptocurrencies experiencing significant gains. Unfortunately for traders who had bet against the market, this has resulted in some significant losses. In this article, we’ll take a closer look at what’s behind this crypto market rally, and what it means for traders and investors.

Short Traders Suffer Heavy Losses

According to data from CoinGlass, short traders (those who bet that the market will go down) suffered over $450 million in losses in the past 24 hours. The biggest losses were seen on the OKX exchange, where short traders lost over $241 million, and on Binance, where losses totaled $116 million. This is a clear indication of how much the crypto market has rallied, leaving short sellers in a difficult spot. Not only short traders, but long traders (those who bet that the market will go up) also suffered losses, with over $108 million in long positions being liquidated. The total value of liquidated positions in the past day has exceeded $727 million, a level not witnessed since the crypto market faced troubles on November 8th

Lower Inflation May be a Factor

So, what’s behind this crypto market rally? While a mix of factors may have contributed to the recent crypto rally, one possible explanation is the new data released by the U.S. Department of Labor indicating a cooldown in inflation. Specifically, the annual inflation rate fell to 6.5% in December, compared to 7.1% in November. The month-over-month inflation rate decreased by 0.1%, a contrast to the 0.1% rise seen the previous month. The core Consumer Price Index (CPI), which excludes volatile food and energy prices, dropped to 5.7% from 6% in November

Lower inflation is commonly perceived as a positive development for risky assets like crypto, as it puts pressure on the US Federal Reserve to decrease interest rate hikes. Over the past year, the Fed and other global central banks have been raising interest rates at a fast pace, creating a challenging environment for crypto and other risky assets. As we have seen the crypto market is highly correlated to the global economy and interest rate is one of the key factors that affect the crypto market. This could be one of the reasons why crypto market rallied when there was a sign of lower inflation rate.

Institutional Investors Entering the Market

Another factor worth noting is that there has been a steep rise in activity in the futures market for digital currencies. Crypto Quant’s Ki Young Jun noted that buyers entered the market early Saturday morning, purchasing around $4 billion worth of bitcoin futures. This suggests that institutional investors may be starting to see value in the crypto market and are positioning themselves for the long-term. As the crypto market is maturing and more institutional investors are entering the market, it is becoming more stable and predictable. This could be another reason behind the recent rally.

Risks to Keep in Mind

It’s important to remember that the crypto market is still in its early stages and can be subject to significant volatility. Additionally, the regulatory environment for crypto is still uncertain and could change at any time. Governments around the world are still figuring out how to regulate the crypto market, and this uncertainty can lead to volatility in the market. Investors should be aware of the risks and do their own research before investing in the crypto market.

Conclusion

The recent crypto market rally and the resulting liquidations of short traders is a reminder of the potential volatility and uncertainty in the crypto market. However, it also shows that the crypto market still has significant potential for growth, particularly as more institutional investors enter the market. As the crypto market is maturing and becoming more stable, the potential for growth is increasing. As always, investors should be aware of the risks and do their own research before investing in the crypto market. It’s also worth noting that, while the current crypto market rally is impressive, it’s not without precedent. In 2017, the crypto market experienced a similar rally, with Bitcoin reaching its all-time high of nearly $20,000.

However, it’s important to remember that the crypto market is still relatively new and is subject to significant volatility. While the current rally is a positive sign, it’s not a guarantee of future growth. Investors should approach the crypto market with caution and only invest what they can afford to lose.

In addition, as the crypto market continues to grow, it is important for investors to be aware of the different types of crypto assets available. Bitcoin, the world’s first and largest cryptocurrency, is not the only option. There are now thousands of different cryptocurrencies available, each with their own unique characteristics and potential for growth. Ethereum, for example, is a popular alternative to Bitcoin and is known for its smart contract capabilities.

It’s also worth noting that the crypto market is not just limited to digital currencies. There are now a growing number of crypto-related investments available, such as blockchain-based stocks and crypto-related ETFs. These alternative investments can provide investors with exposure to the crypto market without the volatility associated with digital currencies.

You Might Also Want to Read: Bitcoin Price Rally: What Can it Tell us About the Current Market?

2 notes

·

View notes

Text

The following is a conversation with an AI assistant. The assistant is helpful, creative, clever, and very friendly.

Human: Hello, who are you?

AI: I am an AI created by OpenAI. How can I help you today?

Human: good afternoon. What a time to buy bitcoin?

AI: It is recommended that you research the current market trends and analyze the cryptocurrency market before investing in any cryptocurrency. Be sure to read reviews by experts in the field before making a purchase.

Human: I'm holding on to my BTC for 5-10 years.

AI: That is a great decision! Holding on to your BTC for 5-10 years can be a great way to maximize your returns and minimize risk. Just remember to research the market trends periodically to make sure you are aware of any potential changes in the crypto market.

Human: right on! I like the idea of cryptocurrency and technologies.

AI: Me too! Cryptocurrencies and the technologies that power them are transforming the way we handle money, transact business, and even store data. It is exciting to see the potential these technologies have for improving our lives and the world we live in.

Human: why cryptocurrency world wide, internationally would benefits humanity the use of cryptocurrency.

AI: Cryptocurrency has the potential to revolutionize the way money is transferred around the world. Transactions can be faster, cheaper and more secure than ever before. Cryptocurrency also provides more freedom and flexibility than traditional currencies, as it is not tied to any government or other authority. This opens up a world of possibilities for international businesses, allowing them to transfer value quickly and easily, without being subject to exchange rate or transaction fees.

Human: that sound like a good idea. I like it. Will cryptocurrency benefit normally every day people? In a financial situation. Savings, building wealth, business, family, food and other services?

AI: Absolutely! Cryptocurrencies have the potential to benefit ordinary people in many different ways. For example, cryptocurrencies can provide a stable store of value for long-term saving and investing, helping people build wealth over time. They can also be used to send money quickly and securely between family members or to pay for goods and services, making them more accessible and affordable than traditional banking options. Finally, cryptocurrencies can also be used as a tool for businesses to offer discounts and other incentives to their customers, helping them increase revenue and attract new customers.

Human: Block chain and cryptocurrency?

AI: Blockchain and cryptocurrency are closely intertwined. Blockchain is the technology that powers cryptocurrencies like Bitcoin, Ethereum, and others. It is a secure, distributed ledger that keeps an immutable record of all transactions taking place on the network. Cryptocurrency, on the other hand, is the actual digital currency units used to store, send, and receive value on the blockchain.

Human: the blockchain seems to be very valube and innovative technologie.

AI: Yes, the blockchain is incredibly valuable and innovative technology. It enables users to securely store and transfer data and value without the need for a third party intermediary. This has revolutionized the way people transact online, allowing them to do so quickly, securely, and cost-effectively, with no need for banks or other middlemen.

AI: Additionally, the blockchain is being used in a variety of different industries, from finance to healthcare, as a secure and reliable way to store and transfer data. This could lead to many new opportunities for businesses and individuals alike.

Human: nice! that's good I like. Thank you for that insight on cryptocurrency BTC and blockchain technology.

#lifestyle#work from home#make money online#goals#make money#investment#youtube#earn money#crypto#btc analysis#btc price#btc latest news#cyrptocurrency

2 notes

·

View notes

Text

The Future of Finance: 7 Digital Trends Shaping Financial Services

The financial services industry is undergoing a seismic shift, driven by technological advancements and evolving customer expectations. As we move deeper into the digital age, it’s clear that traditional banking and financial models are being disrupted at a rapid pace. At the heart of this transformation are 7 digital trends that are reshaping everything from how we manage our money to how financial institutions operate. These trends are not just passing fads but essential components of the future of finance, bringing about efficiency, personalization, and unprecedented accessibility. In this article, we’ll explore these 7 digital trends, explaining how they are revolutionizing the financial landscape and why every institution and individual should pay close attention.

1. Fintech Innovation

Fintech, or financial technology, is at the forefront of transforming the financial services industry. Fintech companies are leveraging cutting-edge technologies like AI, machine learning, and blockchain to offer services that were previously unimaginable. Digital-only banks, payment apps, and peer-to-peer lending platforms are just a few examples of how fintech is changing the game. Traditional banks are being forced to innovate or risk being left behind. The rise of fintech has not only increased competition but has also democratized access to financial services, making banking more inclusive and accessible to underserved populations worldwide.

2. Blockchain and Cryptocurrencies

Blockchain technology and cryptocurrencies are disrupting the very foundation of financial transactions. Blockchain, a decentralized ledger technology, provides unparalleled security, transparency, and efficiency in processing transactions. Cryptocurrencies like Bitcoin, Ethereum, and stablecoins are becoming increasingly accepted forms of payment and investment. Central banks around the world are even exploring the concept of Central Bank Digital Currencies (CBDCs), further cementing the role of blockchain in the financial future. This 7 digital trend is set to redefine not only how financial transactions are processed but also the very nature of currency itself.

3. Mobile Banking

Mobile banking has become the new norm for a vast majority of consumers. The convenience of accessing financial services anytime, anywhere has led to an explosion in mobile banking apps. From checking balances to transferring funds, consumers now expect to perform all banking functions through their smartphones. In emerging markets, mobile banking is a game-changer, offering financial inclusion to populations that previously had little or no access to traditional banking services. The future of finance is mobile-first, and financial institutions must continue to optimize their apps for seamless user experiences to meet consumer demands.

4. AI in Fraud Detection and Prevention

Artificial intelligence (AI) is playing a pivotal role in combating fraud and financial crime. Financial institutions are increasingly relying on AI-driven algorithms to detect suspicious patterns and flag fraudulent transactions in real-time. Machine learning models can identify anomalies far more efficiently than traditional methods, helping banks and other financial services providers to reduce fraud and mitigate risk. In addition to fraud detection, AI is being used to streamline customer service through chatbots and virtual assistants, enhancing the customer experience while reducing operational costs.

5. Robo-Advisors

Robo-advisors are becoming an integral part of investment management. These automated platforms use algorithms to provide financial advice or manage investments with minimal human intervention. Robo-advisors typically assess a user's financial situation, goals, and risk tolerance before offering tailored investment recommendations. They offer low-cost, efficient, and transparent financial management options, making them appealing to younger generations who may not have the capital for traditional financial advisors. This 7 digital trend is democratizing wealth management, allowing even novice investors to build and manage diversified portfolios.

6. Digital Payments

The shift from cash to digital payments has accelerated over the past decade, and this trend shows no signs of slowing down. Payment solutions like Apple Pay, Google Wallet, and various peer-to-peer platforms (e.g., PayPal, Venmo) are revolutionizing how we pay for goods and services. Even brick-and-mortar businesses are increasingly adopting contactless payment methods to cater to consumer demand for convenience and safety, especially in the post-pandemic era. In addition, the rise of Buy Now, Pay Later (BNPL) services has further transformed the payments landscape, giving consumers more flexibility in how they manage their finances.

7. Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms are revolutionizing the traditional borrowing and lending model. These platforms connect borrowers directly with investors, bypassing banks and traditional financial institutions. P2P lending offers borrowers access to funds at potentially lower interest rates while providing investors with an alternative investment opportunity that can yield higher returns. This 7 digital trend is especially beneficial for small businesses and individuals who may have difficulty obtaining loans through conventional channels. With the global rise in digital lending, it’s clear that P2P platforms are shaping the future of personal and business loans.

Conclusion:

The future of finance is undeniably digital, and these 7 digital trends are steering the course for the industry. As we advance into a more technologically-driven world, financial institutions must adopt these innovations to stay competitive and meet the evolving demands of consumers. From fintech breakthroughs to mobile banking, AI-driven security, and peer-to-peer lending, each trend offers unique opportunities for enhancing the way we interact with financial services. Whether you're an individual looking to optimize your personal finances or a business striving to stay ahead, understanding and embracing these 7 digital trends will be key to thriving in the new financial landscape.

0 notes

Text

The Impact of Global Events on Cryptocurrency Prices and Trends

The cryptocurrency market is known for its extreme volatility, with prices frequently influenced by various global events. For investors navigating this dynamic landscape, understanding how these events impact cryptocurrency prices is essential. This article delves into the types of global events that affect cryptocurrency prices, their influence on market trends, and the importance of staying informed through research and reliable information sources.

Understanding Cryptocurrency Price Dynamics

Cryptocurrency prices are driven by supply and demand like traditional assets. However, the crypto market has its own distinctive features, such as 24/7 trading and limited regulatory oversight, making it highly sensitive to external factors. Global events can significantly sway cryptocurrency prices and cause rapid fluctuations.

Key Factors Influencing Cryptocurrency Prices

Market Sentiment: Investor sentiment can shift rapidly due to news, regulatory updates, or technological advancements. Positive news often results in bullish trends, while negative news can trigger sell-offs.

Liquidity: Liquidity refers to how easily a cryptocurrency can be bought or sold without affecting its price. Global events can either increase or decrease liquidity, thereby affecting price stability.

Adoption Rates: The rate at which cryptocurrencies are adopted by businesses and consumers directly impacts their value. Events that promote or hinder adoption can influence prices dramatically.

Global Events That Impact Cryptocurrency Prices

1. Economic Crises

During economic downturns, investors often seek alternative assets to hedge against inflation or currency devaluation. Cryptocurrencies, especially Bitcoin (BTC), have gained a reputation as "digital gold," attracting more investors during periods of economic uncertainty.

Example: In the wake of the COVID-19 pandemic, many investors turned to cryptocurrencies as traditional markets faced significant declines. This demand surge led to notable price increases for digital assets like Bitcoin and Ethereum.

2. Regulatory Changes

Regulatory developments have an immediate and significant impact on cryptocurrency prices. Announcements of stricter regulations or government crackdowns often create uncertainty and lead to sell-offs.

Example: When China announced its crackdown on cryptocurrency mining and trading in 2021, Bitcoin's price dropped significantly, followed by a broader market decline as investors feared increased regulatory pressure.

3. Technological Advancements

Innovations in blockchain technology or new cryptocurrency use cases can positively influence prices by attracting investors. Technological upgrades often lead to increased adoption, which, in turn, drives demand.

Example: Ethereum’s transition to Ethereum 2.0, which enhanced scalability and energy efficiency, created excitement in the market, pushing ETH’s price higher as investors anticipated long-term benefits.

4. Geopolitical Events

Geopolitical tensions and conflicts can drive investors to seek safe-haven assets like cryptocurrencies. Conversely, political stability in regions with high cryptocurrency adoption can boost confidence in digital currencies.

Example: Political unrest in countries with unstable national currencies has led many citizens to adopt cryptocurrencies as a means of preserving wealth and facilitating transactions.

5. Actions by Major Financial Institutions

When major financial institutions become involved in the cryptocurrency market, it lends credibility and legitimacy to the space. Institutional investments or partnerships often lead to price surges as retail investors follow suit.

Example: Tesla’s investment in Bitcoin and announcements from banks offering cryptocurrency services resulted in significant price increases as these actions increased trust in the asset class.

Staying Informed: The Role of Cryptocurrency Research

In the fast-paced cryptocurrency market, staying informed about global events and their potential impact is crucial. Engaging in thorough research helps investors better understand market dynamics and anticipate how various global events may affect their portfolios.

Utilizing Cryptocurrency Information Sources

News Aggregators: Platforms like Cryptolenz aggregate news from multiple sources, offering real-time updates on global events that impact cryptocurrency markets.

Social Media: Following industry leaders and influencers on platforms like Twitter provides insights into emerging trends and community sentiment.

Market Analysis Reports: Regularly reviewing reports from reputable analysts helps investors gain a deeper understanding of market movements related to global events.

Trending Cryptocurrencies and Their Responses to Global Events

Different cryptocurrencies react differently to global events based on their unique characteristics and use cases:

Bitcoin (BTC): Considered a store of value, Bitcoin tends to perform well during economic crises when traditional markets underperform.

Ethereum (ETH): As a platform for decentralized applications (dApps) and decentralized finance (DeFi), Ethereum’s price is influenced by technological advancements and adoption rates in these areas.

Stablecoins (e.g., USDT, USDC): Stablecoins are designed to maintain stable value relative to fiat currencies and often see increased demand during periods of volatility as investors seek safety.

Upcoming ICOs, IDOs, and IEOs: Positioning for Growth

In addition to established cryptocurrencies, investors should keep an eye on upcoming ICOs IDOs, and IEOs . These events provide early access to new tokens, often with significant growth potential. Global events can influence these offerings as well, making them attractive opportunities in volatile markets.

By monitoring upcoming ICOs and upcoming IDOs, investors can stay ahead of market trends and capitalize on emerging projects. Using an ICO calendar or IDO list helps investors track these opportunities and position themselves strategically in the crypto space.

Conclusion

Global events have a profound impact on cryptocurrency prices and market trends. Economic crises, regulatory changes, technological innovations, geopolitical tensions, and institutional actions all play crucial roles in shaping the cryptocurrency landscape.

For investors aiming to navigate this volatile market, understanding these dynamics is essential. Staying informed through comprehensive research and utilizing reliable cryptocurrency information sources, such as news aggregators and market analysis reports, will help investors make more informed decisions.

As the cryptocurrency space continues to evolve, keeping an eye on upcoming IDOs, IEOs, and ICOs is equally important for identifying promising opportunities. By staying proactive and informed, investors can better position themselves to succeed in the ever-changing cryptocurrency market.

0 notes

Text

The Slowdown in US Job Growth and Rising Bankruptcies: Implications and Outlook

Recent reports indicate a sharp slowdown in US job growth, with the unemployment rate rising to 4.3%. This trend, coupled with a record high in bankruptcies, signals deeper economic challenges. As the Federal Reserve considers cutting interest rates in September, if not sooner, it's crucial to understand the implications for the economy and personal finance.

The slowdown in job growth reflects a cautious approach by businesses in response to economic uncertainties. This trend, combined with a rising unemployment rate, signals potential difficulties ahead for many individuals seeking employment. Businesses are hesitant to expand their workforce amidst uncertain economic conditions, and technological advances reduce the need for human labor in certain sectors. Increased global competition also leads to cost-cutting measures, including hiring freezes or layoffs.

Bankruptcies have surged to a record high, driven by factors such as persistent inflation, high interest rates, and ongoing supply chain disruptions. Rising costs of goods and services reduce profit margins for businesses and disposable income for consumers. Higher borrowing costs make it more difficult for businesses to finance operations and growth, leading to financial distress. Disruptions in the supply chain can lead to shortages and increased costs, further straining business finances.

In response to these economic challenges, the Federal Reserve is likely to cut interest rates in September to stimulate economic activity. Lowering interest rates can make borrowing cheaper, potentially boosting investment and spending. The anticipated rate cut aims to encourage borrowing by making loans more affordable for businesses and consumers, boosting economic growth by increasing spending and investment, and managing inflation by stimulating economic activity and preventing deflationary pressures.

Amidst these economic uncertainties, Bitcoin presents itself as a hedge against traditional market volatility. Its decentralized nature and limited supply make it an attractive option for preserving value. Bitcoin operates independently of central banks and government policies, providing a hedge against political and economic instability. With a capped supply of 21 million coins, Bitcoin is immune to inflationary pressures caused by excessive money printing. Bitcoin's growing acceptance as a digital store of value makes it a viable alternative to traditional assets like gold.

When the Federal Reserve cuts interest rates, it often acts as a catalyst for Bitcoin's price. Historically, lower interest rates have led to increased liquidity in the financial system, which can drive investment into alternative assets like Bitcoin. Lower interest rates increase the money supply, providing more capital for investment in assets like Bitcoin. With traditional savings and bonds offering lower returns, investors seek higher returns in alternative assets, including cryptocurrencies. As interest rates drop and the money supply increases, concerns about inflation drive investors to assets like Bitcoin that are perceived as inflation-resistant.

For individuals, it is crucial to diversify investments, enhance skills, and stay informed about market trends. Embracing digital currencies like Bitcoin can provide a safeguard against economic downturns and currency devaluation. Spread investments across various asset classes, including stocks, bonds, real estate, and cryptocurrencies, to mitigate risk. Continuously update skills and knowledge to remain competitive in the job market and adapt to changing economic conditions. Regularly monitor economic indicators, market trends, and policy changes to make informed financial decisions.

Additionally, adopting a strategy of Dollar-Cost Averaging (DCA) into Bitcoin and buying the dips can be highly beneficial. DCA involves investing a fixed amount of money at regular intervals, regardless of the asset's price. This strategy reduces the impact of market volatility and can lead to a lower average cost per Bitcoin over time. Buying the dips, or purchasing Bitcoin when its price drops, can also enhance returns by taking advantage of temporary price declines.

The combination of slowing job growth, rising bankruptcies, and potential interest rate cuts underscores the need for proactive financial planning. By understanding these trends and exploring alternative investment options like Bitcoin, individuals can better prepare for the economic uncertainties ahead. Embracing strategies like DCA and buying the dips can further enhance financial resilience and long-term growth prospects.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.