#Cryptocurrency for Beginners

Text

Cryptocurrency for Beginners: Essential Insights and Guidance

Cryptocurrency, a digital and decentralized form of money, has transformed the way we think about finance and technology.

For beginners, navigating the world of cryptocurrency can be both exciting and overwhelming.

This article serves as a comprehensive guide, offering beginners insights into the fundamental aspects, benefits, risks, and practical steps to get started in the cryptocurrency realm.

youtube

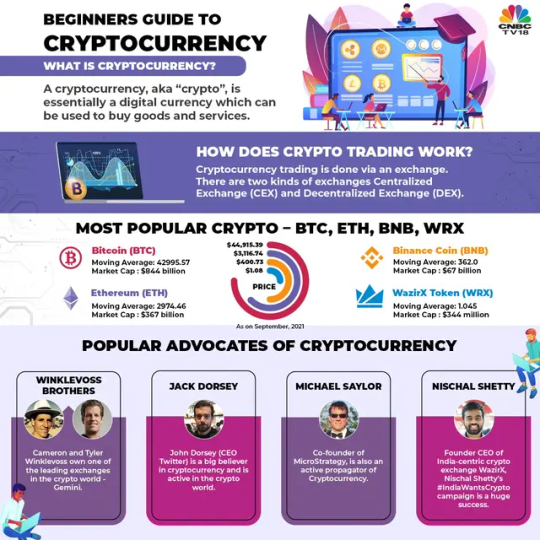

Understanding Cryptocurrency: The Basics

At its core, cryptocurrency is a digital or virtual form of currency that utilizes cryptographic techniques to secure transactions and control the creation of new units.

Unlike traditional currencies issued by governments and central banks, cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

1. How Cryptocurrencies Work

Cryptocurrencies operate on blockchain technology, which is a distributed and immutable ledger that records all transactions.

Each transaction is grouped into a "block," and these blocks are linked together, creating a chain of information.

This decentralized nature ensures transparency, security, and resistance to censorship as Perseus Crypto explains it nicely.

2. Key Cryptocurrency Concepts

Blockchain: A decentralized ledger that records all transactions in a secure and transparent manner.

Wallet: A digital tool that stores your cryptocurrency holdings, enabling you to send, receive, and manage your coins.

Private and Public Keys: Cryptographic keys that grant access to your cryptocurrency. The public key is like an address, while the private key is your password.

Mining: The process of validating transactions and adding them to the blockchain using powerful computers and solving complex mathematical puzzles.

Benefits of Cryptocurrency

1. Financial Inclusion: Cryptocurrencies enable access to financial services for the unbanked and underbanked populations around the world.

2. Decentralization: Cryptocurrencies operate on decentralized networks, reducing the influence of central authorities and intermediaries.

3. Security: Blockchain's cryptographic techniques ensure secure transactions and protection against fraud and hacking.

4. Transparency: Transactions on a blockchain are public and transparent, enhancing accountability.

5. Borderless Transactions: Cryptocurrencies enable fast and low-cost cross-border transactions.

6. Potential for Growth: Some cryptocurrencies have experienced significant price appreciation, offering opportunities for investment growth.

Risks and Considerations

1. Volatility: Cryptocurrency prices can be highly volatile, leading to rapid and unpredictable value changes.

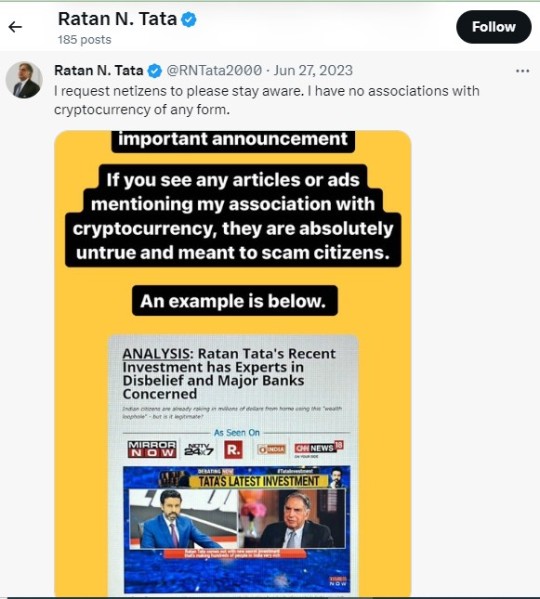

2. Security Concerns: Cryptocurrencies are susceptible to hacking, scams, and phishing attacks. Secure storage is crucial.

3. Regulatory Environment: Regulations for cryptocurrencies vary by jurisdiction and can impact their legality, taxation, and use.

4. Lack of Understanding: The complexity of the technology and market can lead to uninformed decisions.

5. Lack of Regulation: The decentralized nature of cryptocurrencies means there may be no recourse for fraudulent activities or disputes.

Getting Started with Cryptocurrency

1. Education Is Key

Before investing in or using cryptocurrencies, educate yourself about the technology, terminology, and potential risks.

Numerous online resources, courses, and communities provide valuable insights.

2. Choose the Right Cryptocurrency

Research different cryptocurrencies to understand their purposes, use cases, and market trends.

Bitcoin, Ethereum, and others have distinct features and applications.

3. Select a Reliable Exchange

Choose a reputable cryptocurrency exchange to buy, sell, and trade cryptocurrencies.

Look for factors like security measures, fees, user-friendliness, and available coins.

4. Secure Your Investments

Use strong, unique passwords for your exchange accounts and enable two-factor authentication (2FA).

Consider using hardware wallets for enhanced security.

5. Start Small and Diversify

For beginners, start with a small investment you can afford to lose.

Diversify your investments across different cryptocurrencies to manage risk.

6. Stay Informed

Stay updated with the latest news and trends in the cryptocurrency space.

Follow reputable cryptocurrency news websites, blogs, and social media accounts.

7. Avoid FOMO and Emotional Decisions

Fear of missing out (FOMO) and emotional decisions can lead to impulsive actions.

Stick to your investment strategy and avoid making decisions solely based on short-term price movements.

8. Be Prepared for the Long Term

Cryptocurrency investments are often more successful with a long-term perspective.

Avoid making decisions based on daily market fluctuations.

Conclusion

As you embark on your journey into the world of cryptocurrency, remember that education and caution are your best allies.

Understand the technology, the benefits, and the risks before making any investment decisions.

With the right knowledge and a thoughtful approach, you can navigate the complex and dynamic cryptocurrency landscape, potentially harnessing its benefits and contributing to the evolution of modern finance.

2 notes

·

View notes

Text

youtube

#cryptocurrency#investing#beginner guide#financial education#crypto tips#digital assets#bitcoin#ethereum#blockchain#investment strategy#financial literacy#cryptocurrency for beginners#investment tips#money management#wealth building#youtube#small youtuber#Youtube

0 notes

Text

Mastering Cryptocurrency For Beginners

Understanding the Importance of Cryptocurrency for Beginners is paramount in today's rapidly changing financial landscape. This educational journey unveils the significance of digital currencies, highlighting their potential to revolutionize traditional finance. As a beginner, you'll discover how cryptocurrencies offer financial inclusivity, security, and transparency. Explore their role in fostering innovation, decentralization, and borderless transactions. Gain insights into the growing acceptance of crypto in various industries, from finance to technology. By grasping the importance of cryptocurrency, beginners can embark on a path toward financial empowerment, investment diversification, and participation in the digital economy. This knowledge empowers you to make informed decisions and embrace the future of finance.

0 notes

Text

Top 10 Crypto Podcast 2023 Coincred | Top 10 Blockchain Podcast 2023

CoinCRED presents the top 10 crypto podcasts of 2023, offering valuable insights and analysis on the ever-evolving world of cryptocurrencies. These podcasts cover a diverse range of topics, including blockchain technology, decentralized finance (DeFi), cryptocurrency trading strategies, and the latest trends shaping the industry. With expert hosts and guests, listeners can stay informed about the latest developments, investment opportunities, and regulatory changes in the crypto space. From educational content for beginners to in-depth discussions for seasoned investors, these podcasts provide a wealth of information and help listeners navigate the exciting and dynamic world of cryptocurrencies. Tune in to these top 10 podcasts for your crypto knowledge boost.

#unchained#the bad crypto podcast#stephan livera podcast#the pomp podcast#what bitcoin did#crypto 101#tales from the crypt#cryptocurrency for beginners#zero knowledge podcast#bankless

0 notes

Link

However, it is important to note that creating a cryptocurrency is not a guarantee of success, and it requires a lot of effort and dedication to make it a viable option in the market. It is also important to comply with legal regulations and ensure that the coin is not used for illegal activities. Overall, the creation of a cryptocurrency is an exciting and innovative way to enter the world of digital currency. With the right platform and knowledge, anyone can create their own coin and potentially reap the benefits of this growing industry.

#how#make#cryptocurrency#create your own cryptocurrency#cryptocurrency scams#how to make a cryptocurrency#create your own cryptocurrency on ethereum#create your own cryptocurrency bsc#create your own cryptocurrency coin#create your own cryptocurrency blockchain#how cryptocurrency scams work#biggest cryptocurrency scams#cryptocurrency scams 2021#crypto#bitcoin#ethereum#safemoon#scams#cryptocurrency for beginners#cryptocurrency to invest in 2021#cryptocurrency for dummies

1 note

·

View note

Text

Non-Fungible Tokens (NFTs) Explained: Everything You Need To Know!

With #NFTs, you truly own all of your data, but you also have the freedom to allow any application you want to use that data — so that in the future, you could truly live in a Ready Player One #metaverse. Read more here.

View On WordPress

#Bitcoin#crypto news#Cryptocurrency#cryptocurrency for beginners#Ethereum#nft#nft explained#non fungible token#non fungible token art#non fungible token simple definition#non fungible tokens#non fungible tokens definition#non fungible tokens explained#non fungible tokens explained by william ellis#non fungible tokens explained simply#non fungible tokens meaning#non fungible tokens nft#non fungible tokens nft . the analysis of risk and return#non fungible tokens nfts meaning#Non-Fungible#non-fungible tokens explained#tokens#what are nfts#what are non fungible tokens#what are non-fungible tokens#what is an nft#what is an nft non fungible tokens explained

1 note

·

View note

Text

10 Small Investment Ideas: Building Wealth Through Low-Risk Options

Discover 10 small investment ideas that offer low-risk options to kickstart your journey towards building wealth and securing a brighter financial future. Learn about mutual funds, index funds, robo-advisors, stocks, bonds, real estate, precious metals, cryptocurrency, small businesses, and investing in yourself. Get insights on risk factors, positive factors, and FAQs to make informed investment decisions.

Many people mistakenly believe that significant wealth is a prerequisite for investment opportunities. However, this notion is unfounded. Small investments, made consistently over time, can accumulate and pave the way to financial growth. In this article, we will explore ten small investment ideas for beginners that offer low-risk options to kickstart your journey towards building wealth and securing a brighter financial future.

We will also provide insights on how to manage these investments effectively based on facts and proven strategies:

Mutual Funds: Embracing Diversification Mutual funds are an accessible entry point for beginners in the investment realm. These funds pool money from multiple investors to purchase a diversified range of assets, including stocks, bonds, and securities. Diversification spreads investments across different assets, reducing the risk of significant losses. With modest initial investments, mutual funds are an excellent choice for beginners.

Index Funds: Simplicity and Affordability Combined Index funds, a type of mutual fund, track specific market indices such as the S&P 500. They provide a straightforward and cost-effective way to invest in a broad range of stocks. For beginners lacking the time and expertise to select individual stocks, index funds offer diversification, lower expense ratios, and the potential for steady long-term growth.

Robo-Advisors: Simplifying the Investment Process Robo-advisors are online investment platforms that automate portfolio management and offer personalized advice. They are ideal for beginners seeking convenience and requiring minimal initial investment. These platforms provide automated diversification, real-time recommendations, and low-cost portfolio management, allowing gradual wealth accumulation.

Read More

Other Topic:

How to Safeguard your Investments During a Market Decline?

How to create your own trading setup?

Relative Strength Index (RSI)

South Korea Retains Position in MSCI Emerging Markets

#InvestmentIdeas #WealthBuilding #FinancialGrowth #LowRiskInvestments #BeginnerInvesting

#small investment ideas#low-risk options#building wealth#financial growth#beginner investing#mutual funds#index funds#robo-advisors#stocks#bonds#real estate#precious metals#cryptocurrency#small businesses#investing in yourself#risk factors#positive factors

5 notes

·

View notes

Text

An Easy Guide to Forex Trading Terminologies

As a beginner looking to invest in the forex markets, you must be holding a curiosity about understanding the basic forex trading terminologies. Well, herein this blog post, we will try to make things easy for you in the same regard. Later covered in the blog post, will be all the basic forex terminologies for beginners that are essential to understand before investing in the markets.

#forex#forexeducation#forextrading#forexmarket#forexnews#forexstrategy#learnforex#forex for beginners#investing#cryptocurrency#stock market#bitcoin#exclusivemarkets

5 notes

·

View notes

Text

Best CFD Brokers in 2024: A Comprehensive Guide

Key Considerations When Choosing a CFD Broker

Regulation and Security

One of the most critical factors in selecting a CFD broker is ensuring they are regulated by a reputable authority. Regulatory bodies such as the Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), and Cyprus Securities and Exchange Commission (CySEC) enforce strict guidelines that protect traders. Trading with a regulated broker ensures that your funds are secure and that you operate in a transparent environment.

Trading Platforms and Technology

A robust trading platform is essential for executing trades efficiently. Brokers offering platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), or proprietary platforms with advanced trading tools give you the edge in the fast-paced trading environment. The platform’s usability, availability of real-time data, and comprehensive analytics are all factors that can significantly impact your trading experience.

Range of Tradable Assets

Diversification is key to managing risk in CFD trading. The best brokers offer a wide variety of assets, including forex, commodities, indices, stocks, and cryptocurrencies. A broad range of options allows traders to capitalize on multiple market opportunities, enhancing the potential for profit.

Leverage and Margin Requirements

Leverage is a double-edged sword in CFD trading, amplifying both potential profits and losses. It’s important to choose a broker that offers flexible leverage options suited to your risk appetite. High leverage, while enticing, should be balanced with reasonable margin requirements to prevent overexposure.

Fees, Spreads, and Commissions

Trading costs can eat into your profits, making it essential to choose a broker with a competitive fee structure. Look for brokers that offer low spreads and transparent commissions. Some brokers may provide commission-free trading with slightly wider spreads, while others might offer tight spreads with a commission fee. Understanding the fee structure can help you optimize your trading strategy.

Customer Support and Educational Resources

A reliable customer support team and a wealth of educational resources are invaluable for both novice and experienced traders. Brokers that offer 24/7 support, along with educational content such as webinars, tutorials, and market analysis, help you stay informed and improve your trading skills.

Top CFD Brokers in 2024

Below is our curated list of the best CFD brokers in 2024, based on regulation, platform quality, asset variety, and overall user experience.

1. IG Group

IG Group is a leading name in the CFD trading industry, offering traders access to over 17,000 markets, including forex, indices, commodities, and cryptocurrencies. It is renowned for its robust regulation and advanced trading platforms.

Regulation: FCA, ASIC, NFA

Trading Platforms: IG Trading Platform, MetaTrader 4

Leverage: Up to 1:200

Spreads: Competitive, starting from 0.6 pips

Customer Support: 24/7, available in multiple languages

Unique Feature: ProRealTime charting package

Learn more about the best CFD brokers in the market and how IG Group compares.

2. Plus500

Plus500 is favored by traders for its user-friendly platform and commission-free trading. It offers a wide range of assets with tight spreads, making it an excellent choice for traders at all levels.

Regulation: FCA, CySEC, ASIC

Trading Platforms: WebTrader, mobile apps

Leverage: Up to 1:300

Spreads: Tight, starting from 0.8 pips

Customer Support: Available 24/7 via live chat and email

Unique Feature: Negative balance protection

To see how Plus500 ranks among the top CFD brokers, visit our comprehensive review.

3. eToro

eToro is unique for its social trading feature, allowing users to copy the trades of successful investors. This broker is particularly appealing to beginners who can learn by observing and mimicking expert traders.

Regulation: FCA, CySEC, ASIC

Trading Platforms: eToro Platform (web and mobile)

Leverage: Up to 1:30 (varies by asset)

Spreads: From 1 pip

Customer Support: 24/5 via live chat, email

Unique Feature: Social trading and CopyTrader™ feature

Explore more about best CFD brokers and why eToro is a top pick for social trading.

4. Saxo Bank

Saxo Bank offers a premium trading experience with a wide range of assets and sophisticated trading platforms. It caters mainly to experienced traders with higher minimum deposit requirements but offers unmatched research tools and analysis.

Regulation: FSA, FINMA, ASIC

Trading Platforms: SaxoTraderGO, SaxoTraderPRO

Leverage: Up to 1:50

Spreads: Starting from 0.4 pips

Customer Support: 24/5 with dedicated account managers

Unique Feature: Extensive research and analysis tools

For a deep dive into Saxo Bank and other best CFD brokers, visit our full guide.

5. CMC Markets

CMC Markets is known for its competitive pricing and advanced trading technology. It provides access to a vast array of CFDs across various asset classes and has received multiple awards for its platform and services.

Regulation: FCA, ASIC, MAS

Trading Platforms: Next Generation, MetaTrader 4

Leverage: Up to 1:500

Spreads: From 0.7 pips

Customer Support: 24/5 via phone, email, and live chat

Unique Feature: Advanced charting tools and technical analysis

Find out why CMC Markets is among the best CFD brokers in 2024.

Why These Brokers Lead the Market

The brokers mentioned in this list have been chosen based on stringent criteria, including regulatory oversight, platform excellence, and a commitment to providing a superior trading experience. They all offer a secure environment, advanced trading features, and comprehensive support, making them the best CFD brokers you can rely on in 2024.

Conclusion

Choosing the right CFD broker can make a significant difference in your trading success. The brokers listed here stand out for their regulation, platform quality, asset variety, and customer support. Whether you are a novice trader or an experienced investor, these brokers offer the tools and security needed to thrive in the competitive world of CFD trading.

#Best CFD brokers#CFD trading platforms#Top CFD brokers#Regulated CFD brokers#CFD broker comparison#CFD trading for beginners#Commission-free CFD trading#High leverage CFD brokers#Social trading platforms#Forex CFD brokers#Cryptocurrency CFD trading#Low spread CFD brokers

0 notes

Text

How to Set Up Your First Cryptocurrency Wallet

Entering the world of cryptocurrency is an exciting venture, offering the promise of financial independence, privacy, and a new way to engage with digital assets. However, before you can buy, sell, or trade any cryptocurrency, you need to know how to set up your first cryptocurrency wallet. This crucial step is the foundation for safely managing your digital currency, ensuring that your assets…

#Bitcoin#blockchain#blockchain security#crypto adoption#crypto beginners#crypto ecosystem#crypto education#crypto essentials#crypto guide#crypto investments#crypto management#crypto market#crypto privacy#crypto protection#crypto security#crypto setup#crypto storage#crypto tips#crypto tools#crypto trading#crypto transactions#crypto tutorial#crypto wallet#crypto world#cryptocurrency#decentralized finance#digital assets#digital currency#digital finance#digital money

0 notes

Text

Decentralized Finance (DeFi): Transforming Traditional Banking How to safely store cryptocurrency for beginners

Cryptocurrency is a sort of digital or digital forex that makes use of cryptography for security. How to safely store cryptocurrency for beginners unlike traditional currencies issued through governments (fiat currencies), cryptocurrencies are decentralized and typically perform on era known as blockchain.

The Origins and Evolution of Cryptocurrency

Bitcoin and the Birth of Cryptocurrency

Bitcoin (BTC), the primary cryptocurrency, became delivered in 2008 via an anonymous entity called Satoshi Nakamoto. Differences between Bitcoin and Ethereum the creation of Bitcoin marked the beginning of a new era in digital finance. Nakamoto's vision became to create a decentralized virtual forex that allowed for peer-to-peer transactions without the want for intermediaries like banks. Bitcoin's underlying technology, blockchain, turned into a groundbreaking innovation that provided a steady and obvious manner to document transactions.

The Blockchain Technology

Understanding Blockchain

At its center, a blockchain is a distributed ledger that information all transactions throughout a network of computer systems. Each block inside the chain incorporates a listing of transactions, and once a block is brought to the chain, it can't be altered. This immutability and transparency make blockchain era extraordinarily steady and proof against fraud.

Components of Blockchain

Blocks

Each block contains a listing of transactions, a timestamp, and a connection with the preceding block.

Nodes

Nodes are computer systems that take part in the blockchain community. They validate and relay transactions.

Consensus Mechanisms

These are protocols used to achieve agreement on the country of the blockchain. Common mechanisms encompass Proof of Work (PoW) and Proof of Stake (PoS).

Proof of Work vs. Proof of Stake

Proof of Work (PoW)

Used through Bitcoin and lots of other cryptocurrencies, PoW calls for miners to clear up complicated mathematical troubles to validate transactions and create new blocks. This process is energy-intensive.

Proof of Stake (PoS)

An opportunity to PoW, PoS selects validators based at the number of coins they keep and are inclined to "stake" as collateral. This approach is more electricity-efficient.

Major Cryptocurrencies

Ethereum (ETH)

Launched in 2015 via Vitalik Buterin, Ethereum brought the concept of smart contracts, which are self-executing contracts with the terms of the agreement without delay written into code. Ethereum's blockchain can be used to construct decentralized programs (dApps), making it a flexible platform past only a digital currency.

Ripple (XRP)

Ripple is designed for fast and occasional-cost international money transfers. Unlike Bitcoin and Ethereum, Ripple does now not depend upon mining. Instead, it uses a consensus set of rules this is greater centralized but quite efficient for go-border payments.

Litecoin (LTC)

Created by using Charlie Lee in 2011, Litecoin is often considered the silver to Bitcoin's gold. It is designed to provide blocks more fast and with a one of a kind hashing algorithm, making transactions quicker and cheaper.

Other Notable Cryptocurrencies

ardano (ADA): Known for its studies-driven method to blockchain technology.

Polkadot (DOT): Focuses on interoperability among distinct blockchains.

Chainlink (LINK): Provides reliable tamper-proof information for complicated clever contracts on any blockchain.

The Role of Wallets in Cryptocurrency

Types of Wallets

Hot Wallets:

These are related to the net and encompass web wallets, cell wallets, and laptop wallets. They are handy but greater at risk of hacking.

Cold Wallets:

These are offline and consist of hardware wallets and paper wallets. They offer better security however may be less handy.

Private and Public Keys

Private Key: A mystery quantity that permits you to get entry to and manage your cryptocurrency. It should be kept steady.

Public Key:

An deal with that may be shared publicly to receive cryptocurrency. It is derived from the personal key.

Mining and Transaction Validation

Mining Process

Mining is the system by which new cryptocurrency coins are created and transactions are proven. Miners use effective computer systems to clear up complex mathematical troubles. When a hassle is solved, a brand new block is added to the blockchain, and the miner is rewarded with cryptocurrency.

Mining Pools

Due to the increasing difficulty of mining, many miners be a part of mining pools. These are businesses of miners who integrate their computational strength to increase their possibilities of fixing blocks and incomes rewards.

Decentralized Finance (DeFi)

Introduction to DeFi

Decentralized Finance, or DeFi, is a movement that leverages blockchain generation to create economic offerings which are open, permissionless, and decentralized. DeFi platforms aim to recreate traditional financial structures (like banks and exchanges) with blockchain technology.

Key DeFi Applications

Decentralized Exchanges (DEXs):

Platforms like Uniswap and SushiSwap that allow customers to alternate cryptocurrencies with out a centralized intermediary.

Lending and Borrowing Platforms:

Protocols like Aave and Compound that permit customers to lend their cryptocurrency and earn interest, or borrow against their holdings.

Stablecoins:

Cryptocurrencies like Tether (USDT) and USD Coin (USDC) which are pegged to the price of a fiat currency to offer charge balance.

Initial Coin Offerings (ICOs) and Token Sales

Understanding ICOs

An Initial Coin Offering (ICO) is a fundraising approach wherein new cryptocurrencies or tokens are offered to early backers in alternate for established cryptocurrencies like Bitcoin or Ethereum. ICOs became famous in 2017 as a way for startups to raise capital.

Regulation and Risks

ICOs are notably speculative and were associated with scams and fraudulent sports. Regulatory our bodies like the SEC inside the United States have commenced to crack down on unregistered ICOs to defend buyers.

Regulatory Environment

Global Regulation

The regulatory surroundings for cryptocurrencies varies considerably via us of a. Some international locations, like Japan and Switzerland, have embraced cryptocurrencies and set up clear guidelines. Others, like China and India, have imposed strict rules or outright bans.

United States

In the United States, a couple of companies oversee different aspects of cryptocurrency regulation. The SEC regulates ICOs and securities-associated sports, at the same time as the Commodity Futures Trading Commission (CFTC) oversees cryptocurrency derivatives. The Financial Crimes Enforcement Network (FinCEN) specializes in preventing cash laundering.

The Future of Cryptocurrency

Adoption and Integration

Cryptocurrency adoption is growing, with extra groups accepting digital currencies as fee and greater financial institutions presenting cryptocurrency-related offerings. The integration of blockchain era into various industries, from supply chain management to healthcare, is also on the upward thrust.

Technological Advancements

Advancements like Ethereum 2.0, which ambitions to transition Ethereum to a PoS consensus mechanism, and the improvement of Layer 2 answers to enhance scalability, are set to enhance the capability and efficiency of blockchain networks.

Challenges and Considerations

Despite its capacity, cryptocurrency faces challenges which includes regulatory uncertainty, security concerns, and environmental effect because of the electricity consumption of mining. Places that accept cryptocurrency payments addressing these issues could be crucial for the sustainable increase of the industry.

#How to safely store cryptocurrency for beginners#Differences between Bitcoin and Ethereum#Places that accept cryptocurrency payments

1 note

·

View note

Text

Blockchain Technology: Definition, Benefits, and Security Explained

Introduction to Blockchain

Blockchain is a decentralized system that securely stores information about transactions. It is extremely difficult, if not impossible, to alter or cheat within this system. The database is distributed across the entire network, ensuring the highest level of security.

Contents

Introduction to BlockchainThe Need for DecentralizationEvolution of BlockchainHow Blockchain WorksSecurity Features of BlockchainConsensus MechanismConclusion

The Need for Decentralization

Corrupt practices often involve under-the-table transactions, where records of black money are kept in centralized databases. These databases are unreliable for several reasons:

Limited access: Only a few individuals can access this data.

Vulnerability to tampering: Administrators can modify the database, compromising its integrity.

Decentralization addresses these issues by distributing the database across multiple entities. This makes it nearly impossible to alter the transaction details, as no single authority controls the entire database. Blockchain exemplifies this decentralized system, offering a trusted and preferred method of transaction recording.

Evolution of Blockchain

Blockchain technology was researched in the 1990s and implemented in 2009 by an anonymous developer known as Satoshi Nakamoto, who used it to create Bitcoin. This marked the beginning of the cryptocurrency boom.

How Blockchain Works

In a blockchain, transaction details such as origins, destinations, and other specifics are recorded in a ledger. Each piece of information in the ledger is a “block,” and a series of these blocks forms a “blockchain.” Bitcoin is considered the most secure cryptocurrency due to its high hash rates, allowing transactions to be traced back to their sources within the chain.

Security Features of Blockchain

Key security features of blockchain include:

Hash Functions: Each block contains a unique hash, akin to a fingerprint, that secures the stored information.

Previous Hashes: Each block also stores the hash of the previous block, linking the blocks together securely.

Altering any information within a block changes its hash, making the block and subsequent blocks invalid. This mechanism makes it extremely difficult to tamper with the blockchain.

Consensus Mechanism

In a blockchain network, all participants have access to the transaction details. To alter a hash, consensus from other network members is required, ensuring that unauthorized changes are nearly impossible.

Conclusion

Blockchain is the most secure form of a decentralized network, ensuring that transaction information is tamper-proof and reliable. This technology provides unparalleled security, making it a trusted system for recording transactions.

#benefits of blockchain#blockchain for beginners#blockchain security features#blockchain use cases#blockchain vs cryptocurrency

0 notes

Text

Scope of Blockchain and Cryptocurrency in India

The scope of blockchain and cryptocurrency in India is endless and developing. Here are a few of the potential regions where these advances may well be used:

Financial administrations: Blockchain may well be utilized to form a more effective and secure way to exchange cash, settle payments, and oversee resources. This can be particularly useful for cross-border installments, which can be moderate and expensive.

Supply chain administration: Blockchain might be utilized to track the development of products and materials through a supply chain, guaranteeing straightforwardness and traceability. This seem offer assistance to make strides productivity, diminish extortion, and guarantee nourishment safety.

Healthcare: Blockchain can be utilized to store and share restorative records safely, making it simpler for patients to get to their possess information and for specialists to collaborate.

#blockchain#cryptocurrency#top 10 cryptocurrency#investing in cryptocurrency#cryptocurrency for beginners

0 notes

Text

2024 Guide to Liquid Restaking: Everything Beginners Should Know

The advent of liquid restaking is significantly altering the dynamics of the DeFi ecosystem by allowing stakers to reallocate their assets across multiple protocols without the need to un-stake. This innovative approach enhances both liquidity and flexibility, enabling users to maximize their staking rewards by participating in several staking opportunities simultaneously. By diversifying staking activities, liquid restaking mitigates risks associated with exposure to a single protocol and enhances overall security. It also improves liquidity, making it easier for users to trade and transfer their restaked assets, a flexibility not afforded by traditional staking methods.

Liquid restaking's seamless integration with DeFi platforms facilitates the use of staked assets in various financial products, thereby opening up a plethora of innovative use cases, such as collateralized lending and synthetic asset creation. This integration supports the decentralization ethos of blockchain technology by allowing more participants to engage in staking without the constraints of locked assets. As the DeFi sector continues to evolve, liquid restaking is poised to become a foundational component, driving greater innovation and user participation.

EigenLayer exemplifies the benefits of liquid restaking by enabling users to maximize their staking rewards while securing multiple blockchains. This approach not only enhances capital efficiency but also fosters new opportunities within the DeFi space.

For those looking to leverage these advantages, Intellisync provides advanced liquid restaking solutions, ensuring your assets remain accessible and continuously productive. Join the Intellisync revolution today and optimize Learn more....

#Benefits of Liquid Restaking#Benefits of Liquid Restaking for Beginners#Blockchain Development Solution Intelisync#Future of Liquid Restaking#How can liquid restaking improve my staking yields#How does liquid restaking enhance liquidity in the DeFi ecosystem?#Intelisync Blockchain solution#Intelisync defi Liquid Restaking#Liquid Restaking#Risks Liquid Restaking#Risks in 2024 Liquid Restaking#Trends 2024 Liquid Restaking vs Traditional Staking#Unlock the Future of DeFi with InteliSync#What are AVS(Actively Validated Services)#What are the risks associated with liquid restaking?#What future potential does liquid restaking hold for DeFi participants?#What is EigenLayer#What is Liquid Restaking What is Liquid Restaking in Blockchain#Intelisync Blockchain Development Services#Intelisync Web3 Marketing Service#Web3 Marketing Solution#blockchain development companies#web3 development#metaverse development company#blockchain development services#metaverse game development#web 3.0 marketing#crypto app development#cryptocurrency development companies#build a blockchain and a cryptocurrency from scratch.

0 notes

Text

Get the Top Crypto Trading Platform - YaCrypto

YaCrypto gives the top crypto trading platforms. Our platform is designed to provide comprehensive guidance and support. YaCrypto is your go-to destination for cryptocurrency trading for beginners.

#cryptocurrency exchange platform in india#indian crypto trading platform#india crypto platform#platform for cryptocurrency in india#crypto trading exchange in india#crypto exchange with lowest fees in india#top crypto trading platform in india#best platform for crypto in india#platform to invest in cryptocurrency in india#top crypto platforms in india#cryptocurrency for beginners in india#cryptocurrency trading for beginners in india#cryptocurrency in india for beginners#top crypto trading platforms in india

1 note

·

View note

Text

Biticode Method - Learn The Truth

Have you seen the below post about the “Biticode Methods” on reputed websites:

In recent days this has become a trend by some people to promote their products. Most of these are fake and they are trying to scam innocent people in this way.

I would suggest you to be careful and do not be greedy.

I have noticed that many people believe the scammers more that people who are trying to save them…

View On WordPress

#AI-powered trading platform#Automated crypto trading#Beginner crypto trading#Bitcode Method#Bitcode Method reviews#Bitcoin trading robot#Can you make money with Bitcode Method?#Crypto trading bot#Cryptocurrency trading risks#How to choose a reputable crypto trading platform#Independent research#Is Bitcode Method a scam?#Lack of transparency#Misleading marketing#Reputable alternatives#Risks of automated crypto trading#Safe alternatives to Bitcode Method#Scam risks#Unverifiable claims#User Reviews

0 notes