#Bloomberg Businessweek

Photo

“Breathing Apps” for Bloomberg Businessweek.

53 notes

·

View notes

Text

Can Workplace Ketamine Retreats Improve Vibes in the Office? Illustration by Mathieu Labrecque

6 notes

·

View notes

Text

EXTRA! es una sección mensual que recopila los mejores diseños en las páginas de la prensa nacional e internacional, con publicaciones que no han aparecido con anterioridad en el blog.

En la recopilación de julio destacamos (de arriba a abajo y de izquierda a derecha):

1️⃣ La edición que más nos gusta de todo el año en la Bloomberg Businessweek es la dedicada a los robos, coronada con esta doble central sobre los hurtos más locos del año. Se publicó el 3 de julio y pertenece a la edición #4.789.

2️⃣ El majestuoso Odón de Buen, el nuevo buque oceanográfico español. Una completa infografía a doble página de Emilio Amade en Crónica (El Mundo), del 2 de julio.

⬅️3️⃣ La arquitectura tras el desastre del sumergible Titan, una página infografiada en The New York Times y publicada el día 21.

4️⃣ También en el Times, la genial portadilla de presentación del Mundial de fútbol femenino que acabaría coronando a España. Una ilustración de Amrita Marino en el diario del día 17.

5️⃣➡️ No soltamos el New York Times para destacar esta bonita página ilustrada en la que nos despedimos de los plásticos envoltorios en cocina. Una despedida de Jenny Ziomek publicada el 5 de julio.

6️⃣ La COVID y la maternidad cambió la forma en la que Kate Gavino pasea por su ciudad. Una preciosa página del Washington Post publicada el 7 de julio.

⬅️7️⃣ El peleado universo de las redes sociales, una burbujeante página en el Actualidad Económica #3.057, del 16 de julio.

8️⃣➡️ Terminamos con el análisis electoral de El País con datos y gráficos para entender lo sucedido el 23J. Una imprescindible página de Daniele Grasso, Kiko Llaneras y Yolanda Clemente publicada el 25 de julio.

#EXTRA!#bloomberg businessweek#el mundo#the new york times#infografía#ilustraciones#deportes#the washington post#el país#elecciones 23j

1 note

·

View note

Text

Illustration for Bloomberg, 2021

60 notes

·

View notes

Text

Former Fugee Pras Michel Covers Bloomberg Businessweek

#Former Fugee Pras Michel Covers Bloomberg Businessweek#fashion#style#model#beauty#black model#black fashion#music#pras michel#the fugees#bloomberg

14 notes

·

View notes

Text

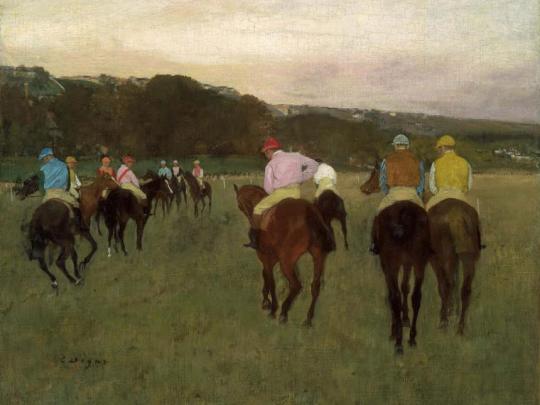

MFABoston's Romance With NFTs: Not Fiscally Tangible, Maybe?

MFABoston’s Romance With NFTs: Not Fiscally Tangible, Maybe?

The other day the hardworking staff received this email from Boston’s Museum of Fine Arts.

Not to get technical about it, but we don’t have a digital collection of NFTs, mostly because they’re the pet rocks of the art world.

But we’re getting ahead of ourselves.

Last year the Boston Globe’s Malcolm Gay reported on the origins of the MFA’s NFT fling.

‘Someone had to move first’: MFA plans sale…

View On WordPress

#(Bit)coin flip#19th century French pastels#Bloomberg#Boston Globe#Brendor Grosvenor#British Museum#Businessweek#Diary of an art historian#Edgar Degas#Hokusai#J.M.W. Turner#laCollection#Malcolm Gay#Matt Levine#MFA NFT fling#MFABoston#Terry Sullivan#The Art Newspaper#vapor-art#Yahoo

3 notes

·

View notes

Text

Illustration By Antoine Maillard

AN EMPIRE DIVIDED! The Inside Story of How GE CEO Larry Culp Dismantled a 131-Year-Old American Giant.

— By Brooke Sutherland and Ryan Beene | March 20, 2024 | Businessweek | The Big Take

Big sheets of white paper line the perimeter of a meeting room at the General Electric Co. factory in Beavercreek, Ohio. Each sheet is scribbled on with markers and covered with neon Post-it notes outlining the steps needed to produce the tubes and ducts that will eventually be assembled into a jet engine.

The vibe is more elementary school science fair than American industrial icon. But the simplicity is the point. Determining the layout for the Beavercreek facility was tricky: The revamped plant opened last year, combining components of production that had previously been spread out across eight different sites. To figure out the best setup, plant leaders built a replica of furnaces, tube benders and welding booths out of cardboard boxes. That visual, along with the Post-it notes describing production steps such as “brazing,” “bending” and “trimming,” makes it easier to identify and root out manufacturing inefficiencies. The exercise also helps show visiting GE executives how the whole thing works.

Featured in Bloomberg Businessweek, March 25, 2024. Photo illustration: Todd St. John for Bloomberg Businessweek

About 250 managers from around the world have gathered here in the Cincinnati area, which will be the headquarters of GE Aerospace once the conglomerate completes its slow-moving breakup in early April. One stated goal of the executive retreat is to set a culture for the soon-to-be-standalone company. “Culture can’t be declared,” says Farah Borges, who oversees GE Aerospace’s assembly, test and maintenance operations. “You have to build it.” Some declaring is still apparently necessary, because the team spent the previous day at an event space a few miles away doing just that.

But under Chief Executive Officer Larry Culp, no leadership confab is complete without a gemba walk. Gemba in Japanese means “actual place,” as in the actual place where a product is made. It’s essentially a tour of operations with a heavy emphasis on Q&A with the factory staff. The practice is central to lean manufacturing, an influential operations philosophy developed by Toyota Motor Corp. that Culp has championed at GE.

Culp at the Beavercreek factory in February. Courtesy: General Electric

Factory floor visits aren’t a radical idea for an industrial company, but GE didn’t always do them this way. The company used to place more emphasis on polishing a PowerPoint presentation than on drilling into the details of manufacturing workflows, says Russell Stokes, the head of commercial jet engines and services, who’s been at GE for more than 25 years. Somewhere between the wrong-way financial bets that blew up in the 2008 economic crisis and a huge, disastrous acquisition of energy assets from Alstom SA in 2015, GE, with its persistent mindset that anyone with an MBA could run any business, forgot that it’s a manufacturer at heart.

When Culp became CEO in 2018, GE was far too big and complicated for its own good, and the company’s businesses weren’t bringing in enough money to support its sky-high debts. “We were at risk of not making payroll, in a manner of speaking,” he says. He managed to pay down more than $100 billion of the debt through a series of well-timed divestitures. He dismantled GE Capital, its investment arm, largely untangling the company from a financial albatross. And then, in 2021, he announced that GE—the quintessential American conglomerate, which at one point or another sold washing machines, credit cards, plastic resins and TV advertising slots for NBC’s Super Bowl broadcasts—was breaking up. None of those efforts would’ve been as successful, and perhaps wouldn’t have even been possible, if Culp hadn’t tightened up GE’s operations and turned key businesses into stable, cash-generating entities that could stand on their own.

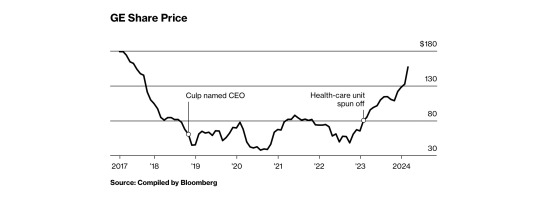

Today, GE’s stock is near a seven-year high. GE HealthCare Technologies Inc., which split off in 2023, is up about 50% from its debut. The final piece is the electric-grid, gas-power and wind-turbine business, which will become its own standalone company called GE Vernova on April 2.

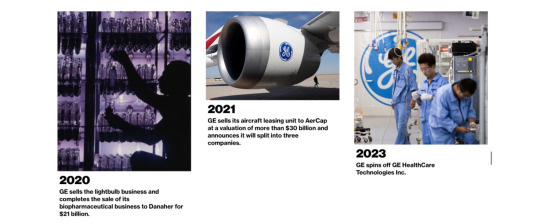

In one sense, Culp is restoring GE to its original identity as a maker of stuff. But he’s also the guy dismantling a monument to American capitalism. From its inception as an outlet for Thomas Edison to commercialize the lightbulb through the era of rapid globalization embodied by Jack Welch, GE practically swallowed entire industries. It loaned planes to companies and money to real estate developers; for a time it even owned a large chunk of Dreyer’s Grand Ice Cream. Most of that is gone now. Culp divested the aircraft leasing arm, biopharmaceutical assets and the remnants of GE’s oil and gas operations and saw through sales of its locomotive and lightbulb units. Even the GE name is on loan. GE appliances are made and sold by China’s Haier Smart Home Co. The new GE will just be a manufacturer of jet engines, essentially, with a few random money pits left over from the old conglomerate, like insurance for elder care and a Polish mortgage business. “We constantly debated what the right structure was,” says Ed Garden, a GE board member since 2017. “But the first order of business was fixing the underlying businesses.”

On the gemba walk, Culp and his aerospace deputies stop to meet with the plant’s lean manufacturing leader, Cem Salahifar, who launches into an overview of the factory’s operations. He describes the facility’s transition from a single, giant furnace—known in manufacturing parlance as a monument—to a bunch of smaller ones spread out around the factory floor. This eliminates the need for employees to shuttle components back and forth and stand around waiting for the heating process to complete. Turnaround times for this part of the production process dropped to 30 minutes from four hours. Culp interjects: The team should appreciate how meaningful this change was, he says, for improving efficiency. He then asks them to find ways to rethink the monuments in their own factories. “We like to tear down monuments,” Culp says.

General Electric Through the Years

The historic American company amassed a sprawling portfolio that at one time or another included locomotives, washing machines, insurance, lightbulbs, MRI machines, credit cards, real estate and the television network NBC.

To be CEO of GE is to be compared with the late Jack Welch. For most of his two-decade reign, Welch made the company bigger, more valuable and more profitable. But the sun began to set on the age of the conglomerate by the time he retired in 2001, and soon other industrial giants were breaking up. Post-Welch CEOs at GE found themselves trying to explain why it made sense to be big for the sake of being big. Jeff Immelt, Welch’s handpicked successor, talked up the benefits of the “GE Store,” a shared repository of technological tools that the whole company could pull off the shelf. In reality, there was no good reason why one company needed to sell MRI machines, jet engines and wind turbines. Even worse, GE’s voluminous sprawl left too many places for problems to hide.

Left: A Leap engine at the Lafayette Engine Facility in Indiana. Photographer: Christopher Payne/Esto/Redux Right: A jet engine test operation. Photographer: Christopher Payne/Esto/Redux

One of the biggest problems was GE Capital, which helped fuel stock growth during the Welch years but proved to be a time bomb. GE had loaded up on debt to support its ventures in corporate lending, real estate, credit cards, mortgages and insurance. When the economic crisis arrived in 2008, GE Capital had more than $500 billion in assets and almost as much debt, which made it the largest financial company in the US that wasn’t technically a bank. As customers worldwide defaulted on loan payments and investors lost their appetite for risk, GE turned to Warren Buffett and the federal government for financial support. Immelt cut GE’s dividend for the first time since the Great Depression. He later sold off huge chunks of GE Capital, but it continued to haunt his successor, John Flannery, who in 2018 disclosed a $15 billion hole in a long-term-care insurance business Immelt had been unable to fully get rid of. The timing couldn’t have been worse: Flannery had cut the dividend two months earlier, to some shareholders’ dismay, and with the gas-power business in a slump and fewer GE Capital assets, there just wasn’t enough money from its operations to keep handing out such generous payments to investors.

GE’s stock was in free fall in 2018, and Flannery overhauled the board. One of the new directors was Culp. A graduate of and former senior lecturer at Harvard Business School, he’d previously been the CEO of Danaher Corp., a onetime industrial conglomerate in its own right that’s idolized by investors for its operational rigor. (Danaher eventually broke up, starting in 2016 with the spinoff of the industrial products company Fortive Corp., shortly after Culp left.)

Culp’s Message: “Everybody Around The Boardroom, Don’t Panic”

Flannery announced a plan to spin off GE’s health-care business in June 2018, but such a wholesale breakup quickly became untenable. The company couldn’t afford it: The remaining operations wouldn’t have generated enough cash to allow GE to pay off its mountain of debt. “We could not spin health care without putting everything fundamentally at risk,” Culp says.

GE’s directors asked Culp if he wanted to run the company. He turned them down—twice, he says—but an August 2018 visit to GE’s gas-power operations in Atlanta began to change his mind. The place was a mess, he tells Bloomberg Businessweek. “We were managing the business in a way that was probably 180 degrees from the way we ran things at Danaher,” he says. But Culp saw a path to fix GE’s operations. His message: “Everybody around the boardroom, don’t panic.”

GE directors offer a bingo card’s worth of MBA-speak to describe how rough the situation was. Tom Horton, former CEO of American Airlines, says he and Culp were both “eyes wide open” when they joined the board together in 2018: “Once we got under the hood, the challenges were more substantial than maybe we anticipated.”

Two months after his visit to Atlanta, Culp was named CEO. In short order, he slashed the dividend to $0.01 a share and killed the plan to spin off health care. Instead, Culp brokered a deal to sell GE’s biopharmaceutical unit to his former employer Danaher. GE received $21 billion in cash for the business, which makes equipment and materials used to manufacture drugs, and offloaded $400 million in pension obligations to Danaher. The transaction was completed in March 2020, about three weeks after the onset of the Covid-19 pandemic brought air travel to a halt, creating an existential challenge for the company’s jet engine business. “I don’t know what would have happened if we hadn’t closed that deal,” Culp says.

GE directors thought the pandemic had made Culp’s job harder, and they wanted to give their CEO another reason to stick with it. In August 2020, the board altered the terms of Culp’s compensation package to give him more time to reach performance targets for a one-time stock bonus and make it meaningfully easier for him to have access to the top payout of about $230 million. Shareholders representing a majority of voting stock opposed the pay deal, but their vote was nonbinding, and the board had already approved the changes anyway. Culp accessed the top tier of the equity grant in July 2023, and the shares will vest next year unless he retires before then. (GE later curbed other aspects of Culp’s compensation.) “We were securing Larry’s leadership for a longer period of time, and that’s proven to be certainly in shareholders’ interest,” Horton says.

There are parallels between Culp and Welch, a company legend who was also legendarily well-compensated. The underlying principles of the lean manufacturing philosophy Culp preaches aren’t all that different from Welch’s cult of Six Sigma, another corporate dogma focused on measuring the rate of operational defects and eliminating inefficiencies. But the two are otherwise very different. Welch’s habit of ranking employees by performance and summarily firing the bottom 10% created a culture of mistrust. Employees who survived layoffs started to think they were the smartest people in the industry, a mentality that persisted after Welch retired and GE began to fade.

Culp has been programming a new mantra into his subordinates, adapted from his time at Danaher: We’re not perfect. “You’ll have some home runs, but you don’t need them every day,” says Jim Lico, who worked for Culp at Danaher and is now president and CEO of Fortive. “No one is perfect.” That kind of talk might’ve gotten a Welch-era executive fired, but it’s part of Culp’s belief in continuous improvement that his team routinely parrots.

This often manifests with seemingly small changes that can make a big impact on productivity over time. In one instance, GE reduced the distance a part must travel around its plant in Greenville, South Carolina, by about 3 miles, says Scott Strazik, the CEO of the soon-to-be-spun-out energy business GE Vernova. Even something as small as reorganizing the toolboxes used by turbine repair technicians can make a big difference. “There’s a long way to go,” Strazik says. GE Aerospace is trying to get its many factories to coordinate more with one another and with the teams that handle contract reviews and other back-office tasks. That process isn’t “perfect,” even if it has improved, says Kayla Ciotti, materials and planning leader at GE Aerospace. “Ten years ago, we had brick walls. Five years ago, we had screen doors,” she says. “The door is open now. There’s no door.”

In contrast with the cutthroat culture at Welch’s GE, Culp’s employees will get some leeway if they do walk into walls. “That doesn’t mean that if you screw something up and you do it repeatedly, there isn’t responsibility to bear,” Culp says. “But a problem-solving culture is far more effective operationally than a finger-pointing culture.”

Brian Carlson remembers his first gemba walk with Culp. Carlson, who runs the 1.2-million-square-foot GE factory in Schenectady, New York, that makes power plant generators, watched Culp stop at one production line in 2019 to inspect a reel of copper wire, which workers fashion into long, braided slabs bent like hockey sticks at both ends. Known as stator bars, these parts are installed inside the guts of enormous generators, which can weigh more than 400 tons. Culp was checking the manufacturing date on a reel of wire. Dozens of reels were stacked on shelves and pallets at the station, burning cash as long as they sat unused. “Others had visited Schenectady before, but it wasn’t into that level of detail,” Carlson says. “When Larry Culp shows up and wants to see how long your material’s been sitting on the factory floor, that simple gesture really sets a tone.”

The foam model at the Schenectady factory. Courtesy: General Electric

After that visit, workers cleared out a large room that once housed office space near the factory’s entrance and spent months building a scale model of the entire factory from hand-cut pieces of white and green foam, which they carefully laid out on rows of folding tables. Placards hang overhead marking each section of the factory, the largest of which declares the purpose of this enormous diorama: “Take it to the model before you take it to the floor.”

The foam factory is now a hub of Schenectady’s operations. Factory staff simulate projects first in the room before testing them on the factory floor. This is part of what’s known inside GE as a kaizen event. Culp loves a good kaizen. The Japanese term means continuous improvement and is another tenet of lean manufacturing. It’s a method for problem-solving that Culp has pushed throughout the company, in which executives and hourly workers dedicate a week to improve a production process, such as the stator bars that caught his attention during his visit in 2019. The goal is to come up with a solution by Friday and have the new process in motion on Monday.

The old way of making stator bars involved moving parts by crane through a 26-step process that took about three months to complete. Each bar now moves on rollers through an eight-step process in as little as three weeks. And now there’s only enough copper wire on hand to sustain a single shift.

On an unusually warm day in late February, Carlson motions to an area on the stator bar line where more improvement is needed. They still use a crane to hoist bars over an active walkway that crosses through the assembly line. A fix is in the works. “See,” he says, “we’re not perfect yet.”

“We Do Not Intend, Let Me Be Clear, To Be All Things To All People”

By early 2021, Culp’s turnaround of GE was starting to take hold, but the company was still sitting on too much debt. A solution arrived that March, when AerCap Holdings NV agreed to acquire GE’s aircraft leasing unit. The deal would allow GE to pay off $30 billion it had borrowed, reducing its debt to the point where the company could realistically think about establishing three separate businesses—in aerospace, health care and energy—that investors would actually want to own.

Culp started mapping out a breakup plan and gave it a code name: Project Revere, inspired by a monument to American patriot Paul Revere near Culp’s home in Boston. He liked the history motif. As GE’s board deliberated a split-up, a defining moment came in a PowerPoint presentation. A slide illustrated the degree to which investors were avoiding the stock simply because it was a conglomerate. “When you just looked at the companies that folks who really wanted to bet on the energy transition or on commercial aerospace were invested in, it was not with us,” Culp says.

In November, a week after the AerCap deal closed, GE announced the spinoff plan. “Everyone felt the weight of that decision,” Culp says at GE Aerospace’s Learning Center in Evendale, Ohio, where visitors can tour a museum of the company’s aerospace achievements, starting with the first American jet engine.

A breakup was never the only option, but it was the best one. Although modern conglomerates do exist (Alphabet, Amazon, Microsoft), GE’s ye olde smokestack model wasn’t working anymore. Investors were getting burned by its bigness more often than they were getting rewarded. The conglomerate structure is especially limiting when it comes to spending money, says David Giroux, a portfolio manager and chief investment officer of T. Rowe Price Investment Management. Massive companies tend to make the wrong acquisitions and overpay for them.

One deal Culp didn’t do was to pay an acquirer to make GE’s insurance problem go away. “There were checks back in the dark days that we could have written that would have been akin to having people tear our eyeballs out,” Culp says. “But you never want to be on the other side of that sort of trade.” Although GE hasn’t done any new business in long-term-care insurance in almost two decades, it’s still paying off claims it agreed to back for other providers. It’s now closed the $15 billion insurance funding shortfall, and investors treat the appendage as more of a quirk than the crisis it was in 2018. Culp says he might get rid of the business someday. But he’s not in any rush.

After the breakup, GE Aerospace will have $25 billion of cash to spend on dividends, share buybacks and acquisitions—with the first two taking priority. Culp won’t say what kinds of deals GE Aerospace might do, only that he’ll look for complementary and easily digestible assets. “We do not intend, let me be clear, to be all things to all people,” he told investors in early March.

All of GE’s gemba walks and kaizens and the intense scrutiny of its manufacturing operations look especially prudent after a series of high-profile quality-control failures among its peers. RTX Corp. is recalling thousands of jet engines because of a manufacturing glitch; Siemens Energy AG sought help from the German government after defects in its wind turbines resulted in massive losses; and Boeing Co. can’t even deliver its 737 Max with all the bolts properly installed.

When there are three GEs, Culp hopes the old name still means something to investors. He says that’s one reason he took the job in the first place: “It’s GE.”

At the company’s off-site in Ohio, executives gathered at Carillon Historical Park in Dayton. It’s home to the Wright Brothers’ Wright Flyer III, the first practical airplane. This piece of aviation history sits next to Culp’s Cafe, which serves an All-American egg sandwich and coffee for $13. The cafe has nothing to do with GE’s CEO. It’s named after Charlotte Gilbert Culp, who founded a baked-goods business in 1902 as a young widow in Dayton. At that time, GE was still just an electrical company.

#Bloomberg#Businessweek#The Big Take#General Electric#GE | CEO | Larry Culp#Dismantling of GE#An Empire Divided

0 notes

Text

#bloomberg#businessweek#yilmazyildiz#global warming#global risks#global riskler#global ısınma#global riskler raporu#world economic forum#davos 2024#artificial intelligence#technology

1 note

·

View note

Text

Kim Kardashian’s Skims Isn’t the Only Celebrity Brand to Watch 👀 New illustration for @businessweek 📈 The Year Ahead issue 🌍 thanks @alberlaurentiv 🤝 Very fun to draw Dolly 🤠

#illustration#samtaylor#illustrator#sam taylor#cartoon#drawing#artists on tumblr#art#kim kardashian#skims#dolly parton#beyonce#gal gadot#businessweek#bw#bloomberg#editorial

1 note

·

View note

Photo

Bloomberg Businessweek

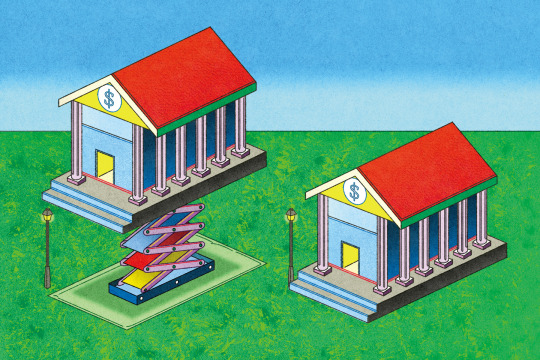

SVB’s Collapse Resurrects the Idea of Banking Without Bank Runs

1 note

·

View note

Text

Bloomberg Businessweek USA - May 01, 2023

Bloomberg Businessweek USA - May 01, 2023

English | 70 pages | pdf | 69.04 MB

Download from:

NitroFlare

FileFox

RapidGator

Read the full article

0 notes

Text

Bloomberg Businessweek June 26 Cover by Justin Metz

2 notes

·

View notes

Text

Cover of a 2018 issue of the Bloomberg Businessweek business magazine, featuring an original illustration of various Nintendo franchises including Mario and several other Mario franchise characters.

Main Blog | Twitter | Patreon | Small Findings | Source

380 notes

·

View notes

Text

Illustration for Bloomberg, 2019

#bloomberg#steak#meat#illustration#editorialillustration#baptistevirot#virot#frenchillustration#businessweek

22 notes

·

View notes

Text

Did an illustration for Bloomberg Businessweek, the article talks about American labor unions recruiting and training volunteers to work undercover in Starbucks, Amazon and other companies. I parodied Magritte's painting Golconda.

Thanks to AD Albert.

#illustration#illuatrator#illustrations#art#Magritte#BloombergBusinessweek#businessweek#unions#starbucks#amazon#chipotle

241 notes

·

View notes

Note

advice for people just wanting to be educated in the finance field?

I would start dipping your toe in the finance sections of reputable sources (i.e. Financial Times, Wall Street Journal, Harvard business review, MarketWatch, etc.) and start researching terms and companies you don’t know. I treat myself with a Bloomberg Businessweek subscription sent to my home because I love their design team and it’s actually very informative. You can also sign up for the Morning Brew finance newsletter, it’s free and I read it every morning to get a brief overview of what’s going on. Even just being informed of current events is helpful in learning about finance because all major events effect the market and businesses. Look at stock performance charts. Learn about different types of investment accounts and different kinds of investments. There are a lot of really great courses on platforms like Coursera as well, I just took one called Private Equity & Venture Capital from Università Bocconi. Flirt with equity crowdfunding platforms (I accidentally made a lot of money on one of these as an early investor with less than $1k). If you live in the US start looking into personal and business tax deductions. Even credit card rewards can actually get you a lot, I’ve gotten free hotel rooms and free flights from money I would have spent anyway. Investments also mean more than just individual stocks: could be index funds, mutual funds, bonds, CDs, REITs, forex, precious gems & metals, real estate, even some designer goods retain and increase in value if bought strategically and handled correctly. Even just having the fundamentals of a maxed out retirement account (a Roth IRA or a backdoor Roth IRA is my personal preference) full of index funds and mutual funds that are balanced well, a fully funded emergency fund of 3-12 months personal expenses, any debt above 7% interest paid off, and sinking funds for various expenses automatically set up in a high yield savings account will have you very well off. When you have a foundation like that you have the breathing room to change careers, take time off, buy investment properties, invest in volatile but potentially profitable ventures, start businesses, and set up additional streams of income.

#i am not a financial advisor but this is what I’ve learned from school and self education and personal trial and error#i think I’m gonna do a detailed finance books list if y’all would like that I think it could be very useful

150 notes

·

View notes