#Carbon Offset Market

Text

Carbon Offset Market Is Estimated To Witness High Growth Owing To Increasing Awareness About Environmental Sustainability

The global Carbon Offset Market is estimated to be valued at US$ 414.80 billion in 2023 and is expected to exhibit a CAGR of 31.7% over the forecast period 2023 to 2030, as highlighted in a new report published by Coherent Market Insights.

Market Overview:

The Carbon Offset Market refers to the process of compensating for greenhouse gas emissions through activities such as reforestation, renewable energy projects, and energy efficiency initiatives. It helps organizations and individuals reduce their carbon footprint and contribute to mitigating climate change. Carbon offsetting offers several advantages such as offsetting emissions that are difficult to reduce, supporting sustainable development projects, and improving brand image. The need for carbon offset products is increasing as businesses and consumers prioritize environmental sustainability and aim to achieve carbon neutrality.

Market Key Trends:

One key trend in the Carbon Offset Market is the growing adoption of carbon offset programs by corporates and individuals. With increasing awareness about climate change and the need to reduce carbon emissions, companies across various industries are integrating carbon offsetting into their sustainability strategies. This trend is driven by the desire to demonstrate corporate social responsibility, comply with regulations, and attract environmentally conscious consumers. Additionally, individuals are also taking personal responsibility for their carbon emissions and offsetting them through various carbon offset programs.

Some of the key players operating in the Carbon Offset Market include 3Degrees Inc., NativeEnergy, ClimatePartner, Carbon Credit Capital, Terrapass, Renewable Choice Energy, Gold Standard, Offsetters, South Pole Group, Veridium, Cool Effect, ClimateCare, MyClimate, Forest Carbon, and Verified Carbon Standard.

PEST Analysis:

Political: The political factor influencing the carbon offset market is the increasing government regulations and policies aimed at reducing greenhouse gas emissions. For instance, many countries have implemented carbon pricing mechanisms or cap-and-trade systems, which have contributed to the growth of the market.

Economic: The economic factor driving the carbon offset market is the rising awareness and concerns about climate change and its impact on the environment. This has led to an increased demand for carbon offsetting services, as individuals and businesses seek to mitigate their carbon footprints and support sustainable practices.

Technological: The technological factor impacting the carbon offset market is the advancements in renewable energy technologies. The increasing efficiency and decreasing costs of technologies like solar and wind power have made them more accessible and attractive options for offsetting carbon emissions.

Key Takeaways:

The global Carbon Offset Market Growth is expected to witness high growth, exhibiting a CAGR of 31.7% over the forecast period from 2023 to 2030. This growth can be attributed to increasing government regulations and policies, rising awareness and concerns about climate change, changing consumer preferences, and advancements in renewable energy technologies.

Key players operating in the carbon offset market include 3Degrees Inc., NativeEnergy, ClimatePartner, Carbon Credit Capital, Terrapass, Renewable Choice Energy, Gold Standard, Offsetters, South Pole Group, Veridium, Cool Effect, ClimateCare, MyClimate, Forest Carbon, and Verified Carbon Standard. These key players play a crucial role in providing carbon offsetting services and developing innovative solutions to address climate change concerns.

#Carbon Offset Market#Smart Technologies#Carbon Offset Market Growth#Carbon Offset Market Analysis#Carbon Offset Market Forecast#Carbon Offset Market Future#Carbon Offset Market Overview#Carbon Offset Market Orientation#Carbon Offset Market Key Players

0 notes

Text

/PRNewswire/ -- Carbon Offset/Carbon Credit Market is projected to reach USD 1,602.7 billion in 2028 from USD 414.8 billion in 2023 at a CAGR of 31.0% according to a new report by MarketsandMarkets™.

#Carbon Offset/Carbon Credit Market#Carbon Offset/Carbon Credit#Carbon Offset Carbon Credit#carbon offsetting#Carbon Offset#carbon offset subscription#Carbon Offset Market#Carbon Credit Market#Carbon Credit#carbon credits#reduce carbon emissions#carbon capture#carbon footprint#carbon emissions#carbon dioxide emissions#carbon#low carbon#lowcarb#carbon neutral#reduce co2 emissions#reduce green house gas#energy#energy efficiency#clean energy#clean environment#green environment#sustainable energy#sustainableenergy#sustainability

0 notes

Text

Greenwashing set Canada on fire

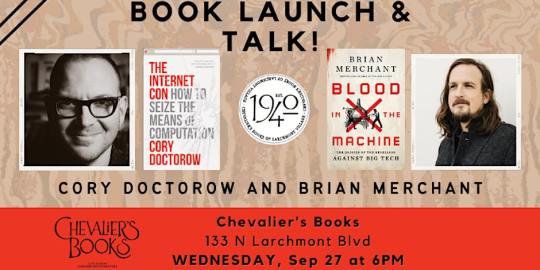

On September 22, I'm (virtually) presenting at the DIG Festival in Modena, Italy. On September 27, I'll be at Chevalier's Books in Los Angeles with Brian Merchant for a joint launch for my new book The Internet Con and his new book, Blood in the Machine.

As a teenager growing up in Ontario, I always envied the kids who spent their summers tree planting; they'd come back from the bush in September, insect-chewed and leathery, with new muscle, incredible stories, thousands of dollars, and a glow imparted by the knowledge that they'd made a new forest with their own blistered hands.

I was too unathletic to follow them into the bush, but I spent my summers doing my bit, ringing doorbells for Greenpeace to get my neighbours fired up about the Canadian pulp-and-paper industry, which wasn't merely clear-cutting our old-growth forests – it was also poisoning the Great Lakes system with PCBs, threatening us all.

At the time, I thought of tree-planting as a small victory – sure, our homegrown, rapacious, extractive industry was able to pollute with impunity, but at least the government had reined them in on forests, forcing them to pay my pals to spend their summers replacing the forests they'd fed into their mills.

I was wrong. Last summer's Canadian wildfires blanketed the whole east coast and midwest in choking smoke as millions of trees burned and millions of tons of CO2 were sent into the atmosphere. Those wildfires weren't just an effect of the climate emergency: they were made far worse by all those trees planted by my pals in the eighties and nineties.

Writing in the New York Times, novelist Claire Cameron describes her own teen years working in the bush, planting row after row of black spruces, precisely spaced at six-foot intervals:

https://www.nytimes.com/2023/09/15/opinion/wildfires-treeplanting-timebomb.html

Cameron's summer job was funded by the logging industry, whose self-pegulated, self-assigned "penalty" for clearcutting diverse forests of spruce, pine and aspen was to pay teenagers to create a tree farm, at nine cents per sapling (minus camp costs).

Black spruces are made to burn, filled with flammable sap and equipped with resin-filled cones that rely on fire, only opening and dropping seeds when they're heated. They're so flammable that firefighters call them "gas on a stick."

Cameron and her friends planted under brutal conditions: working long hours in blowlamp heat and dripping wet bulb humidity, amidst clouds of stinging insects, fingers blistered and muscles aching. But when they hit rock bottom and were ready to quit, they'd encourage one another with a rallying cry: "Let's go make a forest!"

Planting neat rows of black spruces was great for the logging industry: the even spacing guaranteed that when the trees matured, they could be easily reaped, with ample space between each near-identical tree for massive shears to operate. But that same monocropped, evenly spaced "forest" was also optimized to burn.

It burned.

The climate emergency's frequent droughts turn black spruces into "something closer to a blowtorch." The "pines in lines" approach to reforesting was an act of sabotage, not remediation. Black spruces are thirsty, and they absorb the water that moss needs to thrive, producing "kindling in the place of fire retardant."

Cameron's column concludes with this heartbreaking line: "Now when I think of that summer, I don’t think that I was planting trees at all. I was planting thousands of blowtorches a day."

The logging industry committed a triple crime. First, they stole our old-growth forests. Next, they (literally) planted a time-bomb across Ontario's north. Finally, they stole the idealism of people who genuinely cared about the environment. They taught a generation that resistance is futile, that anything you do to make a better future is a scam, and you're a sucker for falling for it. They planted nihilism with every tree.

That scam never ended. Today, we're sold carbon offsets, a modern Papal indulgence. We are told that if we pay the finance sector, they can absolve us for our climate sins. Carbon offsets are a scam, a market for lemons. The "offset" you buy might be a generated by a fake charity like the Nature Conservancy, who use well-intentioned donations to buy up wildlife reserves that can't be logged, which are then converted into carbon credits by promising not to log them:

https://pluralistic.net/2020/12/12/fairy-use-tale/#greenwashing

The credit-card company that promises to plant trees every time you use your card? They combine false promises, deceptive advertising, and legal threats against critics to convince you that you're saving the planet by shopping:

https://pluralistic.net/2021/11/17/do-well-do-good-do-nothing/#greenwashing

The carbon offset world is full of scams. The carbon offset that made the thing you bought into a "net zero" product? It might be a forest that already burned:

https://pluralistic.net/2022/03/11/a-market-for-flaming-lemons/#money-for-nothing

The only reason we have carbon offsets is that market cultists have spent forty years convincing us that actual regulation is impossible. In the neoliberal learned helplessness mind-palace, there's no way to simply say, "You may not log old-growth forests." Rather, we have to say, "We will 'align your incentives' by making you replace those forests."

The Climate Ad Project's "Murder Offsets" video deftly punctures this bubble. In it, a detective points his finger at the man who committed the locked-room murder in the isolated mansion. The murderer cheerfully admits that he did it, but produces a "murder offset," which allowed him to pay someone else not to commit a murder, using market-based price-discovery mechanisms to put a dollar-figure on the true worth of a murder, which he duly paid, making his kill absolutely fine:

https://pluralistic.net/2021/04/14/for-sale-green-indulgences/#killer-analogy

What's the alternative to murder offsets/carbon credits? We could ask our expert regulators to decide which carbon intensive activities are necessary and which ones aren't, and ban the unnecessary ones. We could ask those regulators to devise remediation programs that actually work. After all, there are plenty of forests that have already been clearcut, plenty that have burned. It would be nice to know how we can plant new forests there that aren't "thousands of blowtorches."

If that sounds implausible to you, then you've gotten trapped in the neoliberal mind-palace.

The term "regulatory capture" was popularized by far-right Chicago School economists who were promoting "public choice theory." In their telling, regulatory capture is inevitable, because companies will spend whatever it takes to get the government to pass laws making what they do legal, and making competing with them into a crime:

https://pluralistic.net/2022/06/13/public-choice/#ajit-pai-still-terrible

This is true, as far as it goes. Capitalists hate capitalism, and if an "entrepreneur" can make it illegal to compete with him, he will. But while this is a reasonable starting-point, the place that Public Choice Theory weirdos get to next is bonkers. They say that since corporations will always seek to capture their regulators, we should abolish regulators.

They say that it's impossible for good regulations to exist, and therefore the only regulation that is even possible is to let businesses do whatever they want and wait for the invisible hand to sweep away the bad companies. Rather than creating hand-washing rules for restaurant kitchens, we should let restaurateurs decide whether it's economically rational to make us shit ourselves to death. The ones that choose poorly will get bad online reviews and people will "vote with their dollars" for the good restaurants.

And if the online review site decides to sell "reputation management" to restaurants that get bad reviews? Well, soon the public will learn that the review site can't be trusted and they'll take their business elsewhere. No regulation needed! Unleash the innovators! Set the job-creators free!

This is the Ur-nihilism from which all the other nihilism springs. It contends that the regulations we have – the ones that keep our buildings from falling down on our heads, that keep our groceries from poisoning us, that keep our cars from exploding on impact – are either illusory, or perhaps the forgotten art of a lost civilization. Making good regulations is like embalming Pharaohs, something the ancients practiced in mist-shrouded, unrecoverable antiquity – and that may not have happened at all.

Regulation is corruptible, but it need not be corrupt. Regulation, like science, is a process of neutrally adjudicated, adversarial peer-review. In a robust regulatory process, multiple parties respond to a fact-intensive question – "what alloys and other properties make a reinforced steel joist structurally sound?" – with a mix of robust evidence and self-serving bullshit and then proceed to sort the two by pantsing each other, pointing out one another's lies.

The regulator, an independent expert with no conflicts of interest, sorts through the claims and counterclaims and makes a rule, showing their workings and leaving the door open to revisiting the rule based on new evidence or challenges to the evidence presented.

But when an industry becomes concentrated, it becomes unregulatable. 100 small and medium-sized companies will squabble. They'll struggle to come up with a common lie. There will always be defectors in their midst. Their conduct will be legible to external experts, who will be able to spot the self-serving BS.

But let that industry dwindle to a handful of giant companies, let them shrink to a number that will fit around a boardroom table, and they will sit down at a table and agree on a cozy arrangement that fucks us all over to their benefit. They will become so inbred that the only people who understand how they work will be their own insiders, and so top regulators will be drawn from their own number and be hopelessly conflicted.

When the corporate sector takes over, regulatory capture is inevitable. But corporate takeover isn't inevitable. We can – and have, and will again – fight corporate power, with antitrust law, with unions, and with consumer rights groups. Knowing things is possible. It simply requires that we keep the entities that profit by our confusion poor and thus weak.

The thing is, corporations don't always lie about regulations. Take the fight over working encryption, which – once again – the UK government is trying to ban:

https://www.theguardian.com/technology/2023/feb/24/signal-app-warns-it-will-quit-uk-if-law-weakens-end-to-end-encryption

Advocates for criminalising working encryption insist that the claims that this is impossible are the same kind of self-serving nonsense as claims that banning clearcutting of old-growth forests is impossible:

https://twitter.com/JimBethell/status/1699339739042599276

They say that when technologists say, "We can't make an encryption system that keeps bad guys out but lets good guys in," that they are being lazy and unimaginative. "I have faith in you geeks," they said. "Go nerd harder! You'll figure it out."

Google and Apple and Meta say that selectively breakable encryption is impossible. But they also claim that a bunch of eminently possible things are impossible. Apple claims that it's impossible to have a secure device where you get to decide which software you want to use and where publishers aren't deprive of 30 cents on every dollar you spend. Google says it's impossible to search the web without being comprehensively, nonconsensually spied upon from asshole to appetite. Meta insists that it's impossible to have digital social relationship without having your friendships surveilled and commodified.

While they're not lying about encryption, they are lying about these other things, and sorting out the lies from the truth is the job of regulators, but that job is nearly impossible thanks to the fact that everyone who runs a large online service tells the same lies – and the regulators themselves are alumni of the industry's upper eschelons.

Logging companies know a lot about forests. When we ask, "What is the best way to remediate our forests," the companies may well have useful things to say. But those useful things will be mixed with actively harmful lies. The carefully cultivated incompetence of our regulators means that they can't tell the difference.

Conspiratorialism is characterized as a problem of what people believe, but the true roots of conspiracy belief isn't what we believe, it's how we decide what to believe. It's not beliefs, it's epistemology.

Because most of us aren't qualified to sort good reforesting programs from bad ones. And even if we are, we're probably not also well-versed enough in cryptography to sort credible claims about encryption from wishful thinking. And even if we're capable of making that determination, we're not experts in food hygiene or structural engineering.

Daily life in the 21st century means resolving a thousand life-or-death technical questions every day. Our regulators – corrupted by literally out-of-control corporations – are no longer reliable sources of ground truth on these questions. The resulting epistemological chaos is a cancer that gnaws away at our resolve to do anything about it. It is a festering pool where nihilism outbreaks are incubated.

The liberal response to conspiratorialism is mockery. In her new book Doppelganger, Naomi Klein tells of how right-wing surveillance fearmongering about QR-code "vaccine passports" was dismissed with a glib, "Wait until they hear about cellphones!"

https://pluralistic.net/2023/09/05/not-that-naomi/#if-the-naomi-be-klein-youre-doing-just-fine

But as Klein points out, it's not good that our cellphones invade our privacy in the way that right-wing conspiracists thought that vaccine passports might. The nihilism of liberalism – which insists that things can't be changed except through market "solutions" – leads us to despair.

By contrast, leftism – a muscular belief in democratic, publicly run planning and action – offers a tonic to nihilism. We don't have to let logging companies decide whether a forest can be cut, or what should be planted when it is. We can have nice things. The art of finding out what's true or prudent didn't die with the Reagan Revolution (or the discount Canadian version, the Mulroney Malaise). The truth is knowable. Doing stuff is possible. Things don't have to be on fire.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/09/16/murder-offsets/#pulped-and-papered

#pluralistic#logging#pulp and paper#ontario#greenwashing#a market for lemons#incentives matter#capitalism#late-stage capitalism#climate emergency#wildfires#canada#canpoli#ontpoli#carbon offsets#self-regulation#nerd harder#epistemological chaos#regulatory capture#Claire Cameron#pines in lines

3K notes

·

View notes

Text

The vast majority of the environmental projects most frequently used to offset greenhouse gas emissions appear to have fundamental failings suggesting they cannot be relied upon to cut planet-heating emissions, according to a new analysis.

[...]

Overall, $1.16bn (£937m) of carbon credits have been traded so far from the projects classified by the investigation as likely junk or worthless; a further $400m of credits bought and sold were potentially junk.

[...]

“The ramifications of this analysis are huge, as it points to systemic failings of the voluntary market, providing additional evidence that junk carbon credits pervade the market,” said Anuradha Mittal, director of the Oakland Institute thinktank. “We cannot afford to waste any more time on false solutions. The issues are far-reaching and pervasive, extending well beyond specific verifiers. The [voluntary carbon market] is actively exacerbating the climate emergency.”

42 notes

·

View notes

Text

The Ultimate Guide to Understanding Carbon Offsets and Carbon Credits Market

Introduction to Carbon Offsets and Carbon Credits

The carbon offsets and carbon credits market has emerged as a pivotal mechanism in the global effort to combat climate change. Understanding the intricacies of these markets is essential for businesses, governments, and individuals striving to reduce their carbon footprint. This article delves into the fundamental aspects of carbon offsets and carbon credits, their differences, and their significance in the broader context of environmental sustainability.

What Are Carbon Offsets?

Carbon offsets represent a reduction in greenhouse gas emissions achieved through various environmental projects, such as reforestation, renewable energy initiatives, and methane capture projects. These reductions are measured in metric tons of CO2-equivalent emissions and can be purchased by individuals or companies to compensate for their own emissions.

Types of Carbon Offset Projects

Forestry Projects: These projects focus on afforestation and reforestation, aiming to sequester carbon dioxide from the atmosphere by planting trees or restoring degraded lands.

Renewable Energy Projects: These involve the development of wind, solar, and hydroelectric power plants that displace fossil fuel-based energy sources, thereby reducing carbon emissions.

Methane Capture Projects: Methane, a potent greenhouse gas, is captured from landfills, agricultural operations, or industrial sites and utilized for energy production, preventing its release into the atmosphere.

Understanding Carbon Credits

Carbon credits, on the other hand, are tradable certificates or permits representing the right to emit one metric ton of CO2 or an equivalent amount of other greenhouse gases. They are part of cap-and-trade systems implemented by governments to control and reduce overall emissions.

Cap-and-Trade Systems

In a cap-and-trade system, a governing body sets a cap on the total amount of greenhouse gases that can be emitted by all participating entities. Companies are allocated or can purchase a certain number of credits that permit them to emit a specified amount. Those who need to exceed their allowance must buy additional credits from entities that have surplus credits, thus creating a financial incentive to reduce emissions.

Compliance vs. Voluntary Markets

Compliance Markets: These are regulated by mandatory national, regional, or international carbon reduction schemes, such as the European Union Emissions Trading System (EU ETS).

Voluntary Markets: These operate outside of regulatory frameworks, allowing companies and individuals to voluntarily purchase carbon credits to offset their emissions. This market is driven by corporate social responsibility and consumer demand for sustainable practices.

The Role of Carbon Offsets and Credits in Combating Climate Change

Mitigating Climate Impact

Carbon offsets and credits play a crucial role in mitigating the adverse impacts of climate change by incentivizing the reduction of greenhouse gas emissions. They provide flexibility for businesses to meet their emission reduction targets cost-effectively while supporting projects that generate additional environmental and social benefits.

Driving Innovation and Investment

The carbon market stimulates innovation by encouraging the development of new technologies and practices that reduce emissions. It also attracts investment into sustainable projects, thereby fostering economic growth in green sectors.

Promoting Global Cooperation

By facilitating the transfer of funds from developed to developing countries, the carbon market supports global cooperation in climate change mitigation. Developing countries, which often have significant potential for carbon reduction projects, can leverage these funds to implement sustainable initiatives.

Challenges in the Carbon Offsets and Credits Market

Verification and Certification

Ensuring the integrity and credibility of carbon offsets and credits is a major challenge. Robust verification and certification processes are essential to confirm that the claimed emission reductions are real, additional, and permanent.

Market Volatility

The carbon market can be subject to price volatility due to varying regulatory frameworks, economic conditions, and political factors. This volatility can impact the financial stability of projects and the willingness of investors to participate in the market.

Double Counting

Double counting occurs when a single reduction in emissions is claimed more than once, undermining the environmental integrity of the market. Establishing clear guidelines and robust accounting methods is crucial to prevent this issue.

Future Outlook of the Carbon Market

Expansion of Carbon Pricing Mechanisms

The adoption of carbon pricing mechanisms is expected to expand globally as more countries recognize the importance of pricing carbon emissions to drive reductions. This expansion will likely increase the demand for carbon credits and offsets.

Integration with Sustainable Development Goals (SDGs)

The integration of carbon offset projects with the United Nations Sustainable Development Goals (SDGs) will enhance their impact, ensuring that environmental initiatives also contribute to social and economic development.

Technological Advancements

Advancements in technology, such as blockchain and artificial intelligence, are poised to improve the transparency and efficiency of the carbon market. These technologies can streamline verification processes, reduce transaction costs, and enhance market liquidity.

Conclusion

The carbon offsets and carbon credits market is a vital component of global efforts to address climate change. By providing financial incentives for emission reductions and supporting sustainable projects, these markets drive innovation, foster global cooperation, and promote environmental stewardship. Despite challenges, the future of the carbon market holds promise, with ongoing advancements and expanding participation expected to enhance its effectiveness and impact.

#carbon offsets#carbon credits#carbon market#greenhouse gas emissions#climate change mitigation#cap-and-trade system#renewable energy projects#carbon pricing#sustainable development#carbon verification

0 notes

Video

youtube

Super Mangroves for a holistic approach with Dr. Irina Fedorenko

#youtube#carbonoffsets#netzero#climatechange#Carbon offset markets#Climate change mitigation#Carbon emissions#Environmental sustainability#Carbon trading#Renewable energy#Green investments

0 notes

Text

Carbon Credits vs Carbon Debits: What are the key differences

Confused by carbon credits and debits? This blog unravels the difference, explores their roles in climate action, and paves the way for informed choices towards a sustainable future.

#carbon credits#carbon debits#carbon offsets#emissions reduction#sustainability#environmental markets#carbon pricing#corporate responsibility#emissions trading#carbon neutrality

0 notes

Text

A Single Axis Solar PV Tracker market is a sophisticated technology designed to enhance the efficiency of solar photovoltaic (PV) systems by optimizing the orientation of solar panels with respect to the sun's position throughout the day. Unlike fixed solar installations, which have a static tilt angle, single-axis trackers allow solar panels to follow the sun's apparent movement from east to west.

0 notes

Text

Un-grifting carbon offsetting markets | Energy Trends

Lina Thomas is a Fellow at Harvard University where she teaches macroeconomics and American economic policy. Martin Söndergaard serves as a Teaching Fellow and a Research Associate at the Mossavar-Rahmani Center for Business and Government at Harvard University.

To everybody’s nobody’s surprise, it turned out that carbon offsets were one of the bigger grifts of the bubble-hype-markets-thing that…

View On WordPress

0 notes

Text

Global Carbon Offset Platform Market: Challenges and Opportunities

Future Market Insights estimates that the size of the worldwide carbon offset platform market was US$ 58.8 million in 2018. The global market is anticipated to reach US$ 133.1 million in 2023 as a result of the demand for carbon offset platforms seeing Y-o-Y increase of 17.9% in 2022.

Sales of carbon offset platform solutions are anticipated to grow at a 19.7% CAGR in the region from 2023 to 2033, reaching a market value of US$ 806.1 million by the year’s end.

By supporting activities that reduce or remove an equivalent amount of greenhouse gases from the environment, such as renewable energy projects or reforestation programmes, individuals or organisations can compensate for their carbon emissions.

-Request a Sample of this Report @

https://www.futuremarketinsights.com/reports/sample/rep-gb-17525

Top Regions Driving Market Growth:

North America: The region leads the global carbon offset platform market with significant adoption of sustainable practices and stringent carbon emission regulations. The presence of key players and a rising number of eco-conscious consumers further fuels the market growth.

Europe: European countries have been at the forefront of adopting carbon offset solutions, supported by progressive climate policies and increased awareness of environmental conservation. This region is anticipated to witness substantial growth in the carbon offset platform market.

Asia-Pacific: Rapid industrialization and increasing focus on sustainability in countries like China and India have propelled the demand for carbon offset platforms. The region’s growing awareness of climate change issues contributes to the market’s expansion.

Driving Factors:

Stringent Carbon Emission Regulations: Increasing government initiatives and regulations to curb carbon emissions drive the demand for carbon offset platforms globally.

Corporate Sustainability Initiatives: Growing adoption of sustainability practices by businesses, driven by increasing environmental awareness, boosts the demand for carbon offset solutions.

Consumer Awareness and Eco-Consciousness: Rising awareness among consumers about carbon neutrality and environmental preservation encourages companies to invest in carbon offset platforms.

Carbon Pricing Mechanisms: Implementation of carbon pricing mechanisms incentivizes businesses to adopt carbon offsetting strategies to mitigate costs.

Key Players in the Carbon Offset Platform Industry

Puro.earth

Klimate ApS

Patch

One Tribe Ltd

Nori

-Request for Methodology :

https://www.futuremarketinsights.com/request-report-methodology/rep-gb-17525

Challenges:

High Initial Investment: The implementation of carbon offset platforms requires significant upfront investments, posing a challenge for small and medium-sized enterprises.

Lack of Standardization: The absence of standardized regulations and practices in the carbon offset market creates uncertainty and hampers market growth.

Limited Awareness in Developing Regions: Lack of awareness about carbon offsetting and its benefits in certain regions restrains the market’s growth potential.

Segmentation Analysis of the Carbon Offset Platform Market

By Type:

Regulated Carbon Market

Voluntary Carbon Market

By Project:

Renewable Energy

Energy Efficiency

Forest Reforestation

Methane Capture

By Industry:

IT & Telecommunication

Manufacturing

Government

Energy & Utilities

Oil & Gas

Others

By Region:

North America

Latin America

Western Europe

Eastern Europe

East Asia

South Asia & Pacific

Middle East & Africa

0 notes

Text

Voluntary Carbon Offsets Market Size, Share & Industry Analysis, By Type (Forestry, Renewable Energy, Landfill Methane Projects, Others), By Application (Industrial, Household Device, Energy Industry, Agriculture, Others), By End-Use (Government, Non-Government, Private Sector, Others) And Regional Forecast 2022-2029

0 notes

Text

The global Carbon Offset/Carbon Credit Market is expected to grow from an estimated USD 414.8 billion in 2023 to USD 1,602.7 billion by 2028, at a CAGR of 31.0% during the forecast period.

#carbon credits#carbon offset#carbon credit#carbon offsetting#carbon#carbon dioxide#low carbon#carbon emissions#carbon footprint#carbon removal#carbon reduction#carbon capture#carbon dioxide emissions#carbon emission reduction#reduce carbon emissions#carbon markets#carbon neutrality#carbon neutral#carbon sequestration#environment#energy#power generation#renewable energy#renewable#renewables#green environment#environmental science#environmental studies#environmental news#environmental

0 notes

Text

The impoverished imagination of neoliberal climate “solutions

This morning (Oct 31) at 10hPT, the Internet Archive is livestreaming my presentation on my recent book, The Internet Con.

There is only one planet in the known universe capable of sustaining human life, and it is rapidly becoming uninhabitable by humans. Clearly, this warrants bold action – but which bold action should we take?

After half a century of denial and disinformation, the business lobby has seemingly found climate religion and has joined the choir, but they have their own unique hymn: this crisis is so dire, they say, that we don't have the luxury of choosing between different ways of addressing the emergency. We have to do "all of the above" – every possible solution must be tried.

In his new book Dark PR, Grant Ennis explains that this "all of the above" strategy doesn't represent a change of heart by big business. Rather, it's part of the denial playbook that's been used to sell tobacco-cancer doubt and climate disinformation:

https://darajapress.com/publication/dark-pr-how-corporate-disinformation-harms-our-health-and-the-environment

The point of "all of the above" isn't muscular, immediate action – rather, it's a delaying tactic that creates space for "solutions" that won't work, but will generate profits. Think of how the tobacco industry used "all of the above" to sell "light" cigarettes, snuff, snus, and vaping – and delay tobacco bans, sin taxes, and business-euthanizing litigation. Today, the same playbook is used to sell EVs as an answer to the destructive legacy of the personal automobile – to the exclusion of mass transit, bikes, and 15-minute cities:

https://thewaroncars.org/2023/10/24/113-dark-pr-with-grant-ennis/

As the tobacco and car examples show, "all of the above" is never really all of the above. Pursuing "light" cigarettes to reduce cancer is incompatible with simply banning tobacco; giving everyone a personal EV is incompatible with remaking our cities for transit, cycling and walking.

When it comes to the climate emergency, "all of the above" means trying "market-based" solutions to the exclusion of directly regulating emissions, despite the poor performance of these "solutions."

The big one here is carbon offsets, which allows companies to make money by promising not to emit carbon that they would otherwise emit. The idea here is that creating a new asset class will unleash the incredible creativity of markets by harnessing the greed of elite sociopaths to the project of decarbonization, rather of the prudence of democratically accountable lawmakers.

Carbon offsets have not worked: they have been plagued by absolutely foreseeable problems that have not lessened, despite repeated attempts to mitigate them.

For starters, carbon offsets are a classic market for lemons. The cheapest way to make a carbon offset is to promise not to emit carbon you were never going to emit anyway, as when fake charities like the Nature Conservancy make millions by promising not to log forests that can't be logged because they are wildlife preserves:

https://pluralistic.net/2022/03/18/greshams-carbon-law/#papal-indulgences

Then there's the problem of monitoring carbon offsetting activity. Like, what happens when the forest you promise not to log burns down? If you're a carbon trader, the answer is "nothing." That burned-down forest can still be sold as if it were sequestering carbon, rather than venting it to the atmosphere in an out-of-control blaze:

https://pluralistic.net/2021/07/26/aggregate-demand/#murder-offsets

When you bought a plane ticket and ticked the "offset the carbon on my flight" box and paid an extra $10, I bet you thought that you were contributing to a market that incentivized a reduction in discretionary, socially useless carbon-intensive activity. But without those carbon offsets, SUVs would have all but disappeared from American roads. Carbon offsets for Tesla cars generated billions in carbon offsets for Elon Musk, and allowed SUVs to escape regulations that would otherwise have seen them pulled from the market:

https://pluralistic.net/2021/11/24/no-puedo-pagar-no-pagara/#Rat

What's more, Tesla figured out how to get double the offsets they were entitled to by pretending that they had a working battery-swap technology. This directly translated to even more SUVs on the road:

https://en.wikipedia.org/wiki/Criticism_of_Tesla,_Inc.#Misuse_of_government_subsidies

Harnessing the profit motive to the planet's survivability might sound like a good idea, but it assumes that corporations can self-regulate their way to a better climate future. They cannot. Think of how Canada's logging industry was allowed to clearcut old-growth forests and replace them with "pines in lines" – evenly spaced, highly flammable, commercially useful tree-farms that now turn into raging forest fires every year:

https://pluralistic.net/2023/09/16/murder-offsets/#pulped-and-papered

The idea of "market-based" climate solutions is that certain harmful conduct should be disincentivized through taxes, rather than banned. This makes carbon offsets into a kind of modern Papal indulgence, which let you continue to sin, for a price. As the outstanding short video Murder Offsets so ably demonstrates, this is an inadequate, unserious and immoral response to the urgency of the issue:

https://pluralistic.net/2021/04/14/for-sale-green-indulgences/#killer-analogy

Offsets and other market-based climate measures aren't "all of the above" – they exclude other measures that have better track-records and lower costs, because those measures cut against the interests of the business lobby. Writing for the Law and Political Economy Project, Yale Law's Douglas Kysar gives some pointed examples:

https://lpeproject.org/blog/climate-change-and-the-neoliberal-imagination/

For example: carbon offsets rely on a notion called "contrafactual carbon," this being the imaginary carbon that might be omitted by a company if it wasn't participating in offsets. The number of credits a company gets is determined by the difference between its contrafactual emissions and its actual emissions.

But the "contrafactual" here comes from a business-as-usual world, one where the only limit on carbon emissions comes from corporate executives' voluntary actions – and not from regulation, direct action, or other limits on corporate conduct.

Kysar asks us to imagine a contrafactual that depends on "carbon upsets," rather than offsets – one where the limits on carbon come from "lawsuits, referenda, protests, boycotts, civil disobedience":

https://www.theguardian.com/commentisfree/cif-green/2010/aug/29/carbon-upsets-offsets-cap-and-trade

If we're really committed to "all of the above" as baseline for calculating offsets, why not imagine a carbon world grounded in foreseeable, evidence-based reality, like the situation in Louisiana, where a planned petrochemical plant was canceled after a lawsuit over its 13.6m tons of annual carbon emissions?

https://earthjustice.org/press/2022/louisiana-court-vacates-air-permits-for-formosas-massive-petrochemical-complex-in-cancer-alley

Rather than a tradeable market in carbon offsets, we could harness the market to reward upsets. If your group wins a lawsuit that prevents 13.6m tons of carbon emissions every year, it will get 13.6 million credits for every year that plant would have run. That would certainly drive the commercial imaginations of many otherwise disinterested parties to find carbon-reduction measures. If we're going to revive dubious medieval practices like indulgences, why not champerty, too?

https://en.wikipedia.org/wiki/Champerty_and_maintenance

That is, if every path to a survivable planet must run through Goldman-Sachs, why not turn their devious minds to figuring out ways to make billions in tradeable credits by suing the pants off oil companies?

There are any number of measures that rise to the flimsy standards of evidence in support of offsets. Like, we're giving away $85/ton in free public money for carbon capture technologies, despite the lack of any credible path to these making a serious dent in the climate situation:

https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/energy-transition/072523-ira-turbocharged-carbon-capture-tax-credit-but-challenges-persist-experts

If we're willing to fund untested longshots like carbon capture, why not measures that have far better track-records? For example, there's a pretty solid correlation between the presence of women in legislatures and on corporate boards and overall reductions in carbon. I'm the last person to suggest that the problems of capitalism can be replaced by replacing half of the old white men who run the world with women, PoCs and queers – but if we're willing to hand billions to ferkakte scheme like carbon capture, why not subsidize companies that pack their boards with women, or provide campaign subsidies to women running for office? It's quite a longshot (putting Liz Truss or Marjorie Taylor-Greene on your board or in your legislature is no way to save the planet), but it's got a better evidentiary basis than carbon capture.

There's also good evidence that correlates inequality with carbon emissions, though the causal relationship is unclear. Maybe inequality lets the wealthy control policy outcomes and tilt them towards permitting high-emission/high-profit activities. Maybe inequality reduces the social cohesion needed to make decarbonization work. Maybe inequality makes it harder for green tech to find customers. Maybe inequality leads to rich people chasing status-enhancing goods (think: private jet rides) that are extremely carbon-intensive.

Whatever the reason, there's a pretty good case that radical wealth redistribution would speed up decarbonization – any "all of the above" strategy should certainly consider this one.

Kysar's written a paper on this, entitled "Ways Not to Think About Climate Change":

https://political-theory.org/resources/Documents/Kysar.Ways%20Not%20to%20Think%20About%20Climate%20Change.pdf

It's been accepted for the upcoming American Society for Political and Legal Philosophy conference on climate change:

https://political-theory.org/13257256

It's quite a bracing read! The next time someone tells you we should hand Elon Musk billions to in exchange for making it possible to legally manufacture vast fleets of SUVs because we need to try "all of the above," send them a copy of this paper.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/10/31/carbon-upsets/#big-tradeoff

#pluralistic#neoliberalism#climate#market worship#economics#economism#there is no alternative#carbon credits#climate emergency#contrafactual carbon#carbon upsets#apologetics#murder offsets#indulgences

230 notes

·

View notes

Text

Voluntary Carbon Offsets Market Size, Share & Industry Analysis, By Type (Forestry, Renewable Energy, Landfill Methane Projects, Others), By Application (Industrial, Household Device, Energy Industry, Agriculture, Others), By End-Use (Government, Non-Government, Private Sector, Others) And Regional Forecast 2022-2029

0 notes

Text

Ensuring Integrity in Carbon Offsetting: Verification and Validation

by International Carbon Markets Institute

Attention must be paid to the undeniable importance of verification and validation processes in maintaining the integrity of carbon offsetting. A process of crucial significance, carbon offsetting holds potential as a potent tool in the arsenal against climate change, contingent upon robust verification and validation mechanisms.

Carbon offsetting, at its core, entails the reduction of greenhouse gas (GHG) emissions or the removal of GHG from the atmosphere by an entity, which then sells these reductions or removals to another entity to offset its emissions. Such a system provides flexibility and cost-effectiveness, enabling entities to meet their emission reduction targets in a manner most suitable to them.

However, for this system to function effectively and maintain public and stakeholder trust, rigorous verification and validation processes are essential. Without these, the credibility of carbon offsets can be undermined, and their overall efficacy in mitigating climate change compromised.

Verification, in the context of carbon offsetting, typically involves an independent third-party assessment of a project’s reported emission reductions or removals. The verifier ensures that the project follows established methodologies and protocols, and that the reported GHG reductions or removals are accurate, real, and permanent.

Validation, on the other hand, is the process of evaluating a project’s design. It includes an assessment of the project’s baseline scenario — the projected emissions in the absence of the project — and the project’s additionality, i.e., whether the project results in emission reductions or removals beyond those that would have occurred without it.

In order to maintain integrity and prevent conflicts of interest, it is important that validation and verification are conducted by different entities. This separation ensures that a project’s design and performance are evaluated independently of each other.

The methodologies and protocols used for verification and validation are equally crucial. They should be science-based, transparent, and consistent. They should also be adaptable to evolving scientific understanding and to different types of projects, from renewable energy to forest conservation. Moreover, they should consider the potential negative impacts of projects, such as biodiversity loss or infringements on local communities’ rights.

For the verification and validation processes to be effective, they need to be supported by robust institutional frameworks. These include strong legal and regulatory systems that establish clear rules for carbon offsetting, protect the rights of all stakeholders, and provide remedies for breaches. Institutions responsible for overseeing carbon offsetting should be independent, transparent, accountable, and equipped with the necessary technical expertise.

Incorporating technology, such as remote sensing and data analytics, into verification and validation processes can enhance their accuracy and efficiency. However, care should be taken to ensure that the use of technology is not at the expense of local participation and knowledge.

In conclusion, verification and validation are indispensable in ensuring the integrity of carbon offsetting. They are the gatekeepers that maintain the system’s credibility and its efficacy in mitigating climate change. However, their successful implementation requires not only rigorous methodologies and protocols but also robust institutional frameworks and the judicious use of technology.

Read more at International Carbon Markets Institute.

0 notes

Video

youtube

Will Carbon Markets help Regenerate a Better World?

#youtube#carbon markets#climate change solutions#sustainable future#environmental economics#regenerative practices#carbon offset programs#green finance#emission reduction strategies#global sustainability

0 notes