#Cocoa & Chocolate Market Price

Text

The local population in countries that export bananas typically eat different varieties grown primarily by small farmers. The ones for the Americans and the Europeans, Cavendish variety bananas, are grown in huge, monoculture plantations that are susceptible to disease. The banana industry consumes more agrichemicals than any other in the world, asides from cotton. Most plantations will spend more on pesticides than on wages. Pesticides are sprayed by plane, 85% of which does not land on the bananas and instead lands on the homes of workers in the surrounding area and seeps into the groundwater. The results are cancers, stillbirths, and dead rivers.

The supermarkets dominate the banana trade and force the price of bananas down. Plantations resolve this issue by intensifying and degrading working conditions. Banana workers will work for up to 14 hours a day in tropical heat, without overtime pay, for 6 days a week. Their wages will not cover their cost of housing, food, and education for their children. On most plantations independent trade unions are, of course, suppressed. Contracts are insecure, or workers are hired through intermediaries, and troublemakers are not invited back.

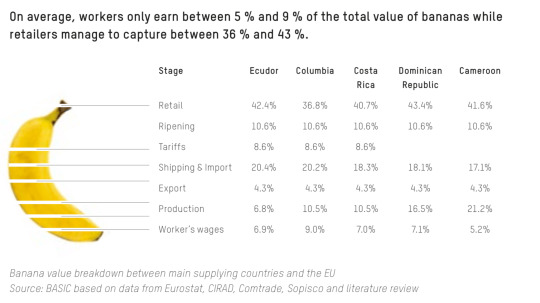

Who benefits most from this arrangement? The export value of bananas is worth $8bn - the retail value of these bananas is worth $25bn. Here's a breakdown of who gets what from the sale of banana in the EU.

On average, the banana workers get between 5 and 9% of the total value, while the retailers capture between 36 to 43% of the value. So if you got a bunch of bananas at Tesco (the majority of UK bananas come from Costa Rica) for 95p, 6.65p would go to the banana workers, and 38p would go to Tesco.

Furthermore, when it comes to calculating a country's GDP (the total sum of the value of economic activity going on in a country, which is used to measure how rich or poor a country is, how fast its economy is 'growing' and therefore how valuable their currency is on the world market, how valuable its government bonds, its claim on resources internationally…etc), the worker wages, production, export numbers count towards the country producing the banana, while retail, ripening, tariffs, and shipping & import will count towards the importing country. A country like Costa Rica will participate has to participate in this arrangement as it needs ‘hard’ (i.e. Western) currencies in order to import essential commodities on the world market.

So for the example above of a bunch of Costa Rican bananas sold in a UK supermarket, 20.7p will be added to Costa Rica’s GDP while 74.3p will be added to the UK’s GDP. Therefore, the consumption of a banana in the UK will add more to the UK’s wealth than growing it will to Costa Rica’s. The same holds for Bangladeshi t-shirts, iPhones assembled in China, chocolate made with cocoa from Ghana…it’s the heart of how the capitalism of the ‘developed’ economy functions. Never ending consumption to fuel the appearance of wealth, fuelled by the exploitation of both land and people in the global south.

7K notes

·

View notes

Text

Cocoa & Chocolate Market - Forecast (2022 - 2027)

Year End Discount: Flat 1000$ off on any Market Report, Enter Code : "FLAT1000" on Checkout

Cocoa & Chocolate Market size is estimated to reach $62.4 billion by 2027, growing at a CAGR of 4.4% during the forecast period 2022-2027. Cocoa seeds can be described as fermented Theobroma cacao seeds commonly used around the world for their extracts. Unlike other crops, the cocoa crop is not period or time-bound and can be grown throughout the year. Hot and humid weather is the most suited for the cocoa crop; therefore, several African countries such as Ivory Coast, Ghana, Cameron, and Nigeria are the biggest producers of Cocoa beans worldwide. Cocoa is generally sold in liquid, paste, and cocoa powder forms in the market. Moreover, cocoa has several remedial benefits, such as preventing infectious intestinal disease and lowering the risk of bronchitis, asthma, and lung congestion. Cocoa beans are an inextricable ingredient in chocolate making. Both cocoa and chocolate are used as flavoring agents in the production of confectioneries and flavored beverages. Moreover, the growing confectionery industry, soaring demand for innovative flavors, growing popularity of chocolate among millennials, bettering retail industry in developing countries, urbanization, and improving disposable incomes are the factors set to drive the growth of the Cocoa & Chocolate Market for the period 2022-2027.

Report Coverage

The report: “Cocoa & Chocolate Market Forecast (2022-2027)”, by Industry ARC, covers an in-depth analysis of the following segments of the Cocoa & Chocolate Market.

By Nature: Conventional and Organic.

By Type: Cocoa (Liquid, Powder, Paste) and Chocolate (White, Dark, Milk, and Others).

By Application: Pharmaceuticals, Cosmetic products, Food & beverages, and Others.

By Distribution Channel: Offline and E-commerce.

By End User: Hospitality venues or Foodservice providers and Households.

By Geography: North America (U.S., Canada, and Mexico), Europe (Germany, UK, France, Italy, Spain, Russia, and Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Australia & New Zealand, and Rest of Asia-Pacific), South America (Brazil, Argentina, Chile, Colombia and Rest of South America) and Rest of World (the Middle East and Africa).

Request Sample

Key Takeaways

Geographically, the North America Cocoa & Chocolate Market accounted for the highest revenue share in 2021. The growth is owing to. Furthermore, Asia-Pacific is poised to dominate the market over the period 2022-2027.

Changing tastes & preferences of people, expanding cuisine culture, ameliorating retail infrastructure in developing nations, health benefits associated with moderate consumption of chocolate, soaring disposable income levels, proliferating population, the rising popularity of confectioneries among millennials, and quick urbanization are the factors said to be preeminent driver driving the growth of Cocoa & Chocolate Market. Augmenting unemployment, soaring inflation, and environmental catastrophes are said to reduce market growth.

Detailed analysis of the Strength, Weaknesses, and Opportunities of the prominent players operating in the market will be provided in the Cocoa & Chocolate Market report.

Cocoa & Chocolate Market Segment Analysis-By Nature

The Cocoa & Chocolate Market based on nature can be further segmented into organic and conventional. The conventional segment held the largest share in 2021. Conventional farming prevails around the world because of several advantages associated with it. Owing to less labor requirement and large-scale production in less land area, conventional farming help farmers in reducing their expenses and maximizing revenue; as a result, it always remains the first choice for them. In addition to that, unlike organic products, conventional products are available across the board regardless of geographical location. Therefore, they always remain in demand. However, the organic segment is estimated to be the fastest-growing segment with a CAGR of 5.4% over the forecast period 2022-2027. The primary reason behind this is the downsides of conventional farming such as harmful effects on the environment, health problems, high risk of plant diseases, and many others. Therefore, with growing attentiveness among consumers regarding their health and environment, the overall demand for organic products is soaring drastically.

Cocoa & Chocolate Market Segment Analysis-By Distribution Channel

The Cocoa & Chocolate Market based on distribution channels can be further segmented into offline and e-commerce. The offline segment held the largest share in 2021. The growth is owing to round the corner presence, easy return, bulk buying, bargaining, quality check before making the purchase, instant buying, and last but least a reason to go outside which can refresh the mood. In addition to that, the growing existence of modern outlets like supermarkets attracts the attention of people with appealing discount offers and the conveniences of buying everything in one place. Nevertheless, online is estimated to be the fastest-growing segment with a CAGR of 5.8% over the forecast period 2022-2027. The growth is owing soaring popularity of WFH, top thriving technological advancements like Google maps and e-banking services, rising smartphone users, internet penetration, eventful lifestyles of people, and a tech-friendly population.

Inquiry Before Buying

Cocoa & Chocolate Market Segment Analysis-By Geography

The Cocoa & Chocolate Market based on Geography can be further segmented into North America, Europe, Asia-Pacific, South America, and the Rest of the World. Europe held the largest share with 34% of the overall market in 2021. According to a report, Switzerland is by far the biggest chocolate consumer with a per capita consumption of nearly 9 kg followed by Germany and Austria with 7.9 kg and 8.1 kg per capita consumption. Moreover, Ireland, France, Norway, and many other European countries have a sizable annual chocolate consumption. The sky-rocketing trend of chocolate consumption in these nations can be justified by the high disposable incomes of residents, quality lifestyles, well-established retail network, and presence of leading market players. However, Asia-Pacific is expected to be the fastest-growing segment over the forecast period 2022-2027. This high sugar cane production in India, China, and Thailand is aiding the market. In addition to that, improving living standards of people, rising disposable incomes as economies are flourishing, a growing number of manufacturers, and bettering infrastructure bracing the ease of doing business.

Cocoa & Chocolate Market Drivers

The spiraling disposable incomes and improving lifestyles of people in developing countries are anticipated to boost market demand.

Spiraling disposable incomes and improving lifestyles are one of the key factors driving the market growth. The majority of countries in Europe such as Norway, San Marino, Netherlands, Denmark, Austria, Iceland, Germany, and Others had GDP over capita income above $55,000. These figures are enough to represent the quality of lifestyles on the European continent. Nevertheless, with the rising economic affluence of major developing countries like India, China, and Indonesia, the overall living standards of people are improving and they are making more demand for premium products like milk chocolates. For instance, from $10,511 in 2020, China’s GDP per capita income soared and reached $12,551 in 2021. Also, last year by uplifting nearly 100 million people from poverty, the country declared itself free from extreme poverty.

Extensive usage in confectioneries, innovative payment technologies, and rapid urbanization are expected to boost market demand.

The trend of conferring chocolate during festive seasons and occasions like Christmas, Diwali, Eid, Valentine's Day, and others have broadened in recent years; as a result, the overall demand for confectionery has witnessed a massive ascension. The existence of electronic fund transfers has revolutionized the retail industry worldwide enhancing product demand. Moreover, as they support hassle-free and swift payment, EFT platforms act as a potent trigger in affecting consumers' buying behavior. According to the National Payment Corporation of India, in March 2022, the Unified Payment Interface (UPI) accounted for nearly 5.04 billion payments in India; moreover, in FY22, the platform processed transactions worth $1 trillion. The growing number of internet users in the country is likely to expand the figures. Moreover, the rapid urbanization of people from the countryside to urban centers worldwide is another factor promoting the growth of the aforesaid market.

Buy Now

Cocoa & Chocolate Market Challenges

Broadening inflation, unemployment, and environmental catastrophes are projected to hamper the market growth.

The disrupted supplies because of pandemic restrictions have impacted the market negatively. Furthermore, a sweeping increase in unemployment levels and inflation rates are affecting the purchasing power of consumers worldwide and eventually challenging the growth of the cocoa & chocolate market. For instance, India’s urban unemployment increased from 8.28 percent to 9.2 percent in April 2022. Moreover, according to a UN report, with a hike of 18 million, global unemployment is likely to reach the 205 million mark in 2022. On another hand, in March 2022, India witnessed 17 months' highest CPI inflation rate of 6.95 percent and the U.S. is facing 42 years of highest inflation. All these factors are anticipated to impede market growth in the near future.

Cocoa & Chocolate Industry Outlook:

Product launches, mergers and acquisitions, joint ventures, and geographical expansions are key strategies adopted by players in the aforementioned Market. Cocoa & Chocolate market's top 10 companies include-

Cargill Inc.

Touton S.A.

Cocoa Processing co Ltd.

Olam International

Barry Callebaut AG

Fuji Oil Company

Nestle S.A.

ECOM Agroindustrial Co.

Niche Cocoa

Archer Daniels Midland

Recent Developments

On December 22, 2021, Illinois, United States-based company Archer-Daniels-Midland (a firm known for its food processing) announced the successful acquisition of Panama-based Flavor Infusion International SA (a firm that provides flavor and specialty solutions). The financials of the transaction were not disclosed by the firm; nevertheless, the transaction has expanded the company's presence in Latin America and the Caribbean.

On October 21, 2021, Minnesota, United States-based renowned food corporation “Cargill” announced that the company has gone into a joint venture with Continental Grain Company in order to acquire Mississippi, United States-based “Sanderson farms” gets a nod from Sanderson’s stockholders. The total value of the acquisition stands around $4.5 billion ($203 per share).

On June 25, 2021, Pennsylvania, Unites States-based renowned chocolate manufacturing company “The Hershey Company” announced that the company has successfully acquired the confectionery business from Boulder, the United States-based company Lily’s Sweet LLC (a company that offers a variety of chocolates). The total value of this transaction stands at around $425 million.

#Cocoa & Chocolate Market#Cocoa & Chocolate Market Share#Cocoa & Chocolate Market Size#Cocoa & Chocolate Market Price#Cocoa & Chocolate Market Growth#Cocoa & Chocolate Market Forecast

0 notes

Text

The world’s chocolate industry could be in for a turbulent ride as the two biggest cocoa producers set down demands for manufacturers to pay higher prices for their growers. The quarrel focuses on the Living Income Differential (LID) – a policy that Ivory Coast and Ghana introduced in 2019 to fight poverty among cocoa farmers in the global US$130-billion chocolate market. Under it, Ivory Coast and Ghana vowed to charge a premium of US$400 per tonne on all cocoa sales, starting with the 2020/21 harvest.

But trade boards in the countries – the Ivorian Coffee-Cocoa Council (CCC) and the Ghana Cocoa Board (Cocobod) – say the scheme is being undermined as cocoa traders depress the price of another premium that operates in parallel.[...]

The two countries together account for 60 per cent of the world’s cocoa but their farmers earn less than six per cent of the industry’s global revenue.

They are threatening to punish corporations by barring them from visiting plantations to estimate harvests – a key factor in cocoa price forecasting. They are also threatening to suspend sustainability programmes that chocolate giants use to enhance their image with fast-growing ethnic consumers.

“This boycott and also ultimatum is to draw attention to the fact that inasmuch as it is important for us to talk about deforestation, it is important to talk about child labour, it is equally important to talk about the farmer income,” said Boafo.[...]

Some experts say the chocolate giants have factored the LID into their costs but claw back some of this by exerting pressure on another premium based on the quality of cocoa beans.

This premium, known as the origin differential, has plunged below zero in recent years, effectively cancelling out part of the LID.

19 Nov 22

1K notes

·

View notes

Text

I've had rats for years at this point now and finally want to put down the best tips I've learned. This won't work for everyone, some are very conditional to me, but maybe some of these will help someone.

Fleece hammocks: Boo. Microplastics and too warming. Canvas hammocks: Yes, please. Highly washable. Far more tough. I wish they were easier to find.

Coiled rope baskets are also a godsend. I hang them by the handles in the cage, they love them way more than anything marketed to rats.

Bottles are nice but some rats wanna splash and have a place to wash their little hands.

Fresh in pod peas are by the pound at my supermarket. I usually spend 70 cents on the amount for several treat sessions. All my frozen peas end up getting freezer burnt by the time I get halfway through the bag.

Antibiotics will be needed if you keep rats. Do not give antibiotics with dairy, many classes of antibiotics bond to calcium thereby making them far less effective.

Speaking of, antibiotics seem to have the hardest taste to cover up. Ground meat baby food, Hershey simply five syrup (Just a little), peanut powder (No added sugar, oils), fruit compote/jam/jelly, small absorbent bread snacks/cereal, smushed pasta, cream of wheat, are all options to get meds into rats.

You can call exotic vets and ask for an estimate on a basic rat exam. Do it, the prices vary WILDLY. We had a vet who charged us 35$ to see three rats at once and one who quoted us 200$ to look at one. You're gonna notice a trend if you call vets in higher class/rich areas. Fuck em'.

Also ask your vet if you can keep a supply of meds on hand just in case. If they last at room temp you can buy some preemptively. Things like doxycycline you can get from human pharmacies.

Zip ties are god. All hail zip ties. Same with swivel clasps. Between them both you can cage mount anything your heart desires.

Leave bedding in a hot car or freezing conditions for a night. Warehouses get mites. Mites are a dick to deal with. Kill em' all.

Give them a variety of fresh things while they're young. Not always but sometimes I'd get an older gent rescue who had no idea what to do with berries or tomatoes and would refuse them. They learn better what is safe when young.

At some point you will have an emergency. Make sure you know where an emergency vet is and that they keep night/weekend hours. Keep funds on hand for that day.

Rats hide pain well. When they age you may need to start pain management if you notice them moving differently even if they don't show their pain blatantly. Just start with low doses and see if they act like their old selves again.

Research your breeders. Get recommendations from other rat people. Check and see if there are rat rescues in your area. Also the Humane Society sometimes takes in rodents.

Controversial take: You will encounter people in ratkeeping who say buying feeders is a sin. It's not. Feeder supply will exist whether or not every rat fancier boycotts them. We are far far fewer in number than snake/lizard people. Wherever you got your rats it's valid so long as you give them healthcare, good nutritious food, love, and mental stimulation.

A lot of the 'foods to avoid, foods to include' lists are not researched. I've seen lists that ban chocolate. Rats freaking love chocolate they just need to take it easy on fats and sugars but cocoa powder can be a good mix in and can help ratty blood flow. I've seen people ban mango. if you read the study that led to this they gave rats an obscene amount of D-limonene to trigger cancer and small amounts had no side effects at all. Read the studies, look for sources.

141 notes

·

View notes

Text

Oxfam experts, together with cocoa farmers, will be at the World Cocoa Conference in Brussels (21-24 April), taking place against a backdrop of unprecedented production shortfalls and skyrocketing cocoa prices, which topped $11,000 per metric ton for the first time.

Chocolate giants have already raised prices for consumers to offset rising cocoa costs and, despite years of soaring profits and massive payouts to shareholders, have consistently pushed back on anything that could reduce their profit margins. New Oxfam analysis has found:

- Lindt, Mondelēz, and Nestlé together raked in nearly $4 billion in profits from chocolate sales in 2023. Hershey’s confectionary profits totaled $2 billion last year.

- The four corporations paid out on average 97 percent of their total net profits to shareholders in 2023.

- The collective fortunes of the Ferrero and Mars families, who own the two biggest private chocolate corporations, surged to $160.9 billion during the same period. This is more than the combined GDPs of Ghana and Ivory Coast, which supply most cocoa beans.

Decades of low prices have made farmers poorer and hampered their ability to hire workers or invest in their farms, limiting bean yield. Old cocoa trees are particularly vulnerable to disease and extreme weather. Many farmers are abandoning cocoa for other crops, or selling their land to illegal miners.

Speaking ahead of the conference, Oxfam’s Policy Advisor Bart Van Besien said:

“It’s ironic —the cocoa price explosion could have been averted if corporations had paid farmers a fair price and helped them make their farms more resilient to extreme weather. And it’s hypocritical —chocolate giants are paying high prices now that the market demands it, but have pushed back every single time that cocoa farmers have. The only way forward is fairly rewarding farmers for their hard work.”

And Ismael Pomasi, Chairman of Ghana’s Cocoa Abrabopa Association, said:

"Nothing is more demotivating —all my hard work on the farm barely pays off. Between battling pests and the drought that is killing my cocoa trees, I'm really struggling. I wish I could afford irrigation. If the multibillion-dollar chocolate industry paid fair prices for cocoa, I could actually tackle these problems and make a decent living."

Oxfam spokespersons and farmers available for interviews in Brussels:Nana Kwasi Barning Ackay, project officer at SEND Ghana and Coordinator of the Ghana Civil Society Cocoa Platform (GCCP) (English)

Ismael Pomasi, Chairman of Ghana’s Cocoa Abrabopa Association (English)

Anouk Franck, Policy Advisor on Business and Human Rights, Oxfam Novib (Dutch, English)

Bart Van Besien, Policy Advisor, Oxfam Belgium (Dutch, English, French)

Key dates:

Oxfam spokespersons and farmers will come together to hand out chocolate produced by Ghana’s Women in Cocoa Cooperative (Cocoa Mmaa), and will be available for interviews and photos.

7:30-9:00am CET on 22 April at Place d’Albertine, in front of the World Cocoa Conference.

25 notes

·

View notes

Text

As cocoa prices surge to record highs and Central and West African growers grapple with the impact of climate change, the cocoa sector is rushing to adapt its production to the EU anti-deforestation regulation (EUDR), which will take effect from January 2025.

EU consumers have particularly felt the impact of soaring prices. The bloc is the world’s largest cocoa importer, accounting for 60% of global imports, according to European Commission data.

In March, during the peak sales period for chocolate in Europe, cocoa prices skyrocketed to $10,000 (€9,212) per tonne on the New York futures market, and they remained at this level as of 25 April.

The surge coincided with dwindling cocoa grain supplies in key producing countries and increasing demand.

The decline in production notably affects the EU’s main cocoa suppliers—namely Ivory Coast, Ghana, and Cameroon. Forecasts for the short to mid-term remain bleak.

[...]

Unfair distribution

At the same time, cocoa growers, most of whom live in poverty, are reaping few benefits of the price rally.

For instance, Ghana and Ivory Coast use centralised pricing systems, which involve setting “farmgate” prices, ensuring a baseline income for farmers but limiting their earnings during production drops.

An Oxfam analysis presented at the world conference revealed that chocolate giants Lindt, Mondelēz, and Nestlé had earned $4 billion (€3.7 billion) in profits from chocolate sales in 2023.

The fortunes of the Ferrero and Mars families surged to $160.9 billion (€150.44 billion) in the same period, surpassing the combined GDPs of the top world cocoa suppliers Ghana and Ivory Coast, which account for over half of global production.

[...]

Looming EU rules

Amid these challenges, the EU’s anti-deforestation legislation looms large.

Companies seeking to place on the EU market products covered by the rules — which affect cattle, cocoa, coffee, palm oil, soya, and wood — will need to prove with geolocation coordinates that they have not been sourced from deforested or degraded land after December 2020.

Hanne Vandersteegen, a regional counsellor at Trias, an international NGO with roots in Belgium that supports farmers in developing countries, praised the EUDR’s objective to halt deforestation but expressed concern that it could exclude small growers.

She stressed that farmers in countries like the Democratic Republic of Congo (DRC), an important cacao producer, could struggle to adapt to the rules, as cocoa production is less centralised than in Ghana and Ivory Coast.

read complete article

#eu#ghana#côte d'ivoire#cameroon#drc#african cocoa producers#cocoa prices#looming cocoa shortages#eu rules#deforestation prevention#capitalism

4 notes

·

View notes

Text

Chocolate Sapote Pie

Hey 3WD, why are you making a vegan, gluten-free, no-processed-sugar dessert? Well, you see, I have friends with many, many allergies and felt like a challenge.

This recipe is an experiment with Black Sapote (also called Chocolate Pudding Fruit) – a seasonal persimmon relative that’s high in Vitamin C and has a pudding-like flesh with mild chocolate and caramel notes. While limited availability of Sapotes means it’s not as accessible as something like Chocolate Avocado Pie, it’s a fun thing to play with if you like poking around with the weird fruit section of produce markets (as a bonus, Black Sapotes were selling for $1-2 per fruit both times I visited).

Let's get cooking:

Kitchen equipment

Blender/food processor

Beaters (hand-crank or electric)

20cm (8 inch) springform cake tin

Baking/ Greaseproof paper

Fridge & Oven

Fine mesh sieve (or tea strainer)

Mixing bowls, spatula, knives, spoons etc.

Prep-time

Bench work: approx. 40 minutes

Oven time: approx. 30 minutes

Cooling time: approx. 2-3 hours (minimum)

Coconut cream chill time: 12 hours (minimum)*

*Coconut cream needs to be refrigerated for 12 hours in order to separate properly before whipping. Put your cream in the fridge the night before.

Ingredients

Pie crust

300g (10.5 Oz) pecans

4 large medjool dates (seeds removed, roughly chopped)

1 tsp salt

4 tbsp (approx. 60g/ 2 Oz) margarine, melted

Filling

2 large, ripe Black Sapotes*

1/2 cup (125mL) cocoa powder

4 large medjool dates (seeds removed, roughly chopped)

1/2 tsp salt

1 tsp espresso powder

1 tsp vanilla extract

*Black Sapotes are ripe when the skin has darkened to a dull green-brown and the fruit is very soft to the touch (it will look and feel over-ripe).

Topping

One 400mL (13.5 Fl Oz) can high-quality full-fat coconut cream*

1/2 tsp salt

1 tsp vanilla extract

Approx. 80g (3 Oz) pecans, toasted** and crumbled

Cocoa powder for dusting

*Use a premium quality coconut cream – the difference in price is very small and cheaper creams may not separate properly, which will stop them from whipping up.

**Toast pecans by baking in a preheated 140°C/248°F (fan forced) oven for 15-30 minutes until done to your liking.

Instructions

Pie crust

(Inspiration recipe)

Preheat oven to 180°C/350°F (fan forced).

Line the base and sides of the spring form pan with baking paper. (Try to minimise wrinkles/folds in the paper lining – this will make it easier to remove the crust later.)

Place chopped dates, pecans and salt into a blender. Blend until the mixture has the texture of breadcrumbs/ almond meal.

Stream in melted margarine and blend until completely combined (crumbs should stick together when pressed)

Press mixture into a firm, even layer across the base and up the sides of the spring form tin, using clean hands or the back of a spoon to smooth down.

Bake for 10-12 minutes or until the crust begins to brown. (Watch closely after the 8-minute mark to prevent burning).

Remove from oven. If the crust has puffed up, press back down using the back of a spoon. (Tip: use a toothpick or fork to gently pop any large air-pockets in the base.)

Cool on a wire rack or heat-safe cutting board until the crust reaches room temperature.

Filling

(Inspiration recipe)

Preheat oven to 180°C/350°F (fan forced).

Cut open the Black Sapotes. Remove the seeds and scoop/scrape the flesh out with a spoon. (Note: because Black Sapote skin is very thin and soft when ripe, it cannot be traditionally peeled.)

Transfer one quarter of the fruit flesh to a blender, along with the chopped dates. Process until completely smooth.

Transfer the sweetened sapote mixture into a bowl alongside the remaining sapote flesh. Mix until completely combined (use your spoon or spatula to break down any lumps or fibers in the fruit flesh).

Fold in the cocoa powder, expresso powder, vanilla and salt until completely combined. Taste for flavouring and adjust with more cocoa/vanilla/espresso/salt as desired. (Note: adding cocoa will increase the bitterness of the filling alongside the chocolate-y flavour. This can be hard to counteract without adding sugar or blending in more dates so be careful how much you add at once.)

Transfer filling into your pre-prepared pecan crust. Smooth the top with a spoon or spatula.

Bake for 20 minutes or until the filling is lightly firm to the touch.

Cool completely on a wire rack or heat-safe cutting board, then cover and transfer to the fridge until chilled through.

Cream Topping

(Inspiration recipe)

Chill coconut cream for at least 12 hours.

Remove coconut cream from the fridge (Note: DO NOT Shake).

Use a spoon to scoop out the thick cream that has risen to the top, leaving the watery parts behind. (The more water is in your cream, the less firmly it will whip). Transfer the thick cream to a bowl. (Tip: have an extra jar of chilled cream on hand in case the cream yield from the first tin is low)

Add the vanilla and salt to the cream. Stir through, then taste test and adjust the vanilla/salt as needed. (Note: Like with plain dairy cream, this should taste more neutral than sweet).

Beat your cream, starting on a slow speed. Gradually increase speed until whipped to thick, semi-stiff peaks. (Tip: if your cream is very soft to start with, try covering and chilling in the refrigerator to help it firm up.)

Remove the chilled sapote tart from the spring form pan. (Optional: If the sides of your pecan crust are much taller than your filling, you can use a pair of clean, sharp kitchen scissors to trim it down. Use a clean hand to shield the pie filling from any falling crust-crumbs).

Spoon the whipped cream onto the sapote filling, using the back of the spoon to make decorative swirls. (Optional: use a piping bag with a decorative nozzle for a fancier top).

Sprinkle the cream with crumbled pecans. Dust with cocoa powder using a fine sieve or tea-strainer. (Note: Add the nuts first - otherwise the cocoa powder will prevent them from sticking to the cream, causing them to roll everywhere when the pie is cut).

Return to the fridge until the coconut cream is completely chilled.

Serve.

#Chocolate pie#Black Sapote#Baking#Vegan#Gluten Free#Low Sugar Baking#Keto/Raw Baking#(kind of)#citrus free#for my friends#(you know who you are 😉)#this is a test recipe so feel free to make adjustments#I documented my process and adjustments while baking it - this recipe is based on the refined end-notes#I know some people object to putting salt in dessert bakes but it *is* important here#both to balance and enhance the chocolate-y-ness of the filling#AND to keep the coconut cream under control so it doesn't completely dominate every other flavour in the pie#Don't skimp on the salt#3WD Cooks

4 notes

·

View notes

Text

here’s an excerpt from a new thing i’m writing.

X took a deep breath and walked into the super market.

Storefront boredom, hoarded horrors, wars of wares for normal boarders -- stop. Concentrate. X just needed to get... shit, what was it? Coffee. X was out of coffee. The caffeine kick, swift pick up quick, don’t stop in the pit stop licketty-split. And paper towels. Was X just standing in the entryway? How long had X been standing here? Don’t need a cart don’t need a hand basket just here for two things, move. And mouthwash, three things; also could get dinner to avoid cooking: that stovetop magic, love lost tragic, great to create food, rude not acted actually good to do but blast it after the eat creeps dish pile drastic -- c’mon, focus. What aisle was X in? Juice, yeah, got a day and half worth back home might as well, don’t want to be doing this again tomorrow. Damn it, alright, go back for a hand basket.

Coffee got for the coffee pot the allotted stock more than less but less than a lot - a two pound bag. Straight shot to the mouthwash but so much public jumbled like pinball bumpers, so turn down the mostly empty...

... candy aisle? Evil, ah evil, look at the chocolate, largely sourced from plantations utilizing child slaves, so much money pouring in from chocolate companies that while slavery worldwide had dropped dramatically in the last several decades, slave trade in the areas surrounding the chocolate plantations was actually increasing. And here, shelves of chocolate, the labor of children sold into slavery, offered for just the right price in packages requiring designers and machines more costly than the lives bought and sold to work the harvest; can’t sell this bloodied treat in simple brown paper, no, it has to compete with the hundred other chocolate brands, but of course, all those brands were owned by the same three companies. Look, here was one chocolate item wrapped in Wholesome™ packaging proclaiming the chocolate to be not only organic but also sourced from independent cocoa farmers focused on helping women build better lives. But that chocolate company was just a brand name owned and operated by one of the same giant three corporations that bought chocolate harvested by children stolen from mothers and sold into forced labor. All to fill a carefully calculated percentage of shelf space in this pleasant nightmare. These weren’t goods they were selling, if anything they were bads. Hoarded horrors in this war of wares.

People, people, in the way, or was X in their way... a crowd of one not at one with the crowd, mumbled excuse-mes not allowed to be loud, while the silent voice’s noises shouted out! get out! But X still needed dinner and mouthwash.

Past the eggs which X could rarely eat anymore, used to like the ovarary production of the aviary, until the introduction of some drugs or somethin’ made it very hard to savor properly, a flavor like a cemetery, some property industrial,

that’s possibly some commentary on the bigger problem: that our produce, all our meat and dairy’s basically controlled by cash, so have to stay completely wary.

Shit, X had done a whole loop around the store, head full of eggs.

X turned the corner into the next aisle, where meat ranched overcrowded on deforested land was dyed the cartoon color children were raised to expect. Bright red steaks, orangish pink chicken. How was X supposed to buy and eat these things, knowing that not only were the healthy qualities of the foods compromised, not only was the world itself harmed by their industrialized production, but also studies indicated enjoyment of the food, trust in the food, these things effected the very ability of the body to absorb nutrients from the food. When presented with the same ingredients in a form unfamiliar or untrusted versus in a form trusted and enjoyed, the nutritional uptake by the person eating that food was noticeably different. And knowing what X knew, there had not been a meal in years that had been trusted, that had not been tainted by guilt and uncertainty, the subtle aftertaste of evil.

X left the super market shattered and exhausted, halfway home before realizing the mouthwash had never made it into the hand basket.

22 notes

·

View notes

Text

Locally produced... Slavery free chocolate... Made with traditional techniques... In the land that saw it's birth... The first people that ever knew the delight of cocoa...

And it cheap. It is cheap because we made it here. How wonderful. How wonderful to be able to go to the farmer's market and get yourself this premium product for cheap. Not as cheap as a Hershey's bar but cheap, nonetheless, cheap compared to the prices people from other countries would be willing to pay.

As I grow up I realize that the things I took for granted are indeed truly special. People come here, to this isolated town in the middle of a mountain range, hours away from any other major city, they come here and wonder at the things that I have grown accostumed to, and they look like children discovering the world for the first time.

I can't blame tourists, really, when they come from countries where life seems so bland in comparason, for acting the way they do. I never realized how lucky I was to live here. Even if I hate it sometimes.

6 notes

·

View notes

Text

Is Dark chocolate really good for you or is it just hype to get you to spend more money?

Dark chocolate does have several health benefits, making it more than just hype. However, it’s important to consume it in moderation and choose the right type. Here are some scientifically supported benefits of dark chocolate:

Health Benefits of Dark Chocolate

Rich in Antioxidants:

Dark chocolate is high in antioxidants, including flavonoids, particularly catechins and epicatechins. These compounds help combat oxidative stress and protect cells from damage.

Heart Health:

Studies have shown that dark chocolate can improve heart health by improving blood flow and lowering blood pressure. The flavonoids in dark chocolate can help relax blood vessels and improve circulation.

Cholesterol Improvement:

Dark chocolate may improve cholesterol levels by raising HDL (good) cholesterol and lowering LDL (bad) cholesterol, which can help reduce the risk of heart disease.

Anti-Inflammatory Effects:

The antioxidants in dark chocolate have anti-inflammatory properties, which can help reduce inflammation in the body, potentially lowering the risk of chronic diseases.

Brain Health:

Consuming dark chocolate has been linked to improved cognitive function, enhanced memory, and a lower risk of neurodegenerative diseases. The flavonoids in dark chocolate may improve blood flow to the brain.

Mood Enhancement:

Dark chocolate contains compounds like theobromine and phenylethylamine, which can boost mood and provide a sense of well-being. Additionally, it stimulates the production of endorphins and serotonin, which are known to enhance mood.

Choosing the Right Dark Chocolate

Cocoa Content:

Aim for dark chocolate with at least 70% cocoa content. Higher cocoa content means more flavonoids and less sugar.

Minimal Additives:

Choose dark chocolate with minimal additives. Avoid products with high amounts of sugar, artificial flavors, and unhealthy fats.

Quality Brands:

Opt for reputable brands known for their quality and minimal processing. Organic and fair-trade options are often better choices.

Moderation is Key

While dark chocolate has health benefits, it’s still high in calories and can contribute to weight gain if consumed in large quantities. The recommended amount is about one ounce (20-30 grams) per day.

Conclusion

Dark chocolate’s health benefits are supported by scientific research, but it’s crucial to consume it in moderation and choose high-quality products. While it might be marketed at a premium price, the potential health benefits can justify the cost, especially when part of a balanced diet. However, it’s not a cure-all, and maintaining overall healthy lifestyle choices remains important.

0 notes

Text

Candy Price Trends During Easter in 2024 - How the Retailers Should Deal with the Increase in Cocoa Prices

Introduction

This year, Easter egg hunts provided a new challenge for families due to soaring chocolate and candy prices. The spike is because of cocoa deficit, worsened by crop diseases and climate change affecting West African farms, which supply over 68% of the world's total cocoa.

This "cocoa crisis" has tripled cocoa prices, impacting confectioners like Hershey's and Cadbury. To sustain profit margins, these iconic brands consider adjusting prices, as Easter ranks among the top three candy-purchasing occasions.

Despite cocoa shortages and inflation, the National Confectioners Association predicts U.S. Easter candy sales to match or exceed last year's $5.2 billion, driven more by price hikes than increased sales volume.

At Actowiz Solutions, our ongoing analysis of retail pricing trends, including Easter candy pricing, provides valuable insights for brand strategy and retail pricing optimization.

Analysis of Price Increase in Chocolate and Candy Prices

Our comprehensive study analyzed a diverse range of 3,000 products sourced from major U.S. retailers, including Amazon, Giant Eagle, Kroger, and Target. We compared price trajectories over the past 15 months to average prices in January 2023. Our analysis focused on two crucial price points: the selling price, reflecting the final cost to consumers after discounts, and the Manufacturer's Suggested Retail Price (MSRP) set by brands. This research offers valuable insights into Easter candy pricing trends, retail pricing trends, and brand strategy through retail price analytics and historical pricing analytics.

Simultaneously, the Manufacturer's Suggested Retail Price (MSRP) has shown a consistent upward trajectory, driven by rising cocoa expenses. Brands have adapted their suggested prices accordingly, with the current MSRP approximately 7% higher than its January 2023 level, peaking at a 7.1% increase by December 2023. This underscores the direct impact of escalating cocoa costs on product pricing strategies, as revealed by retail pricing insights and analytics.

Rising Costs Take a Toll on Chocolate Candy Products

Over the last 14 months, chocolate-based candies have seen notably steeper price hikes compared to their non-chocolate counterparts.

Selling prices for chocolate items surged by 14.6%, contrasting sharply with the modest 3.9% increase seen in non-chocolate candies.

The scarcity of cocoa, along with increasing expenses for packaging and transportation, has led both brands and retailers to pass on these additional costs to consumers. This phenomenon drives the unique pricing patterns seen across the candy market, with chocolate products facing the greatest impact from these cost pressures.

Retailers and Brands Offer Easter Discounts to Attract Shoppers

In our analysis, we conducted a detailed examination to pinpoint the retailers and brands offering the most enticing prices for Easter-themed confections, such as Chocolate Bunnies, Eggs, and Easter-themed gift packs.

Kroger is actively ensuring consumers have access to attractively priced Easter treats by keeping its doors open throughout the Easter weekend. Featuring discounted items like Brach’s jelly beans, Russell Stover chocolate bunnies, Reese’s eggs, and assorted bags of popular candies from Twix, Starburst, Snickers, etc. Additionally, Kroger enhances its value proposition through gift card offers and exclusive Easter deals for loyalty program members.

This year, Peeps, the cherished marshmallow candies by Just Born are offered at a 17% discount, slightly below the 22% discount seen in 2023. This decline may be attributed to the impact of increasing sugar costs, given their sugar and corn composition.

Other notable brands, such as M&M's and the premium Swiss chocolatier Lindt, have increased their average Easter discounts to 17% this year, up from 12% and 10% respectively last year. This demonstrates a competitive pricing strategy aimed at delighting consumers this Easter season.

Managing Inflationary Pressures This Easter Season

In the current challenging retail environment, both retailers and brands face the imperative of remaining profitable and competitive amidst inflationary pressures. To navigate these challenges effectively, several strategic approaches can be adopted:

Designing innovative combo packs that combine chocolate and non-chocolate items can cater to diverse consumer preferences and budget ranges while maintaining profit margins. This approach capitalizes on consumer interest in variety and value.

Offering enticing discounts on larger quantities encourages bulk buying, amplifying sales volumes to offset increased costs per item and achieve economies of scale. This strategy aligns with consumer demand for cost-effective shopping solutions.

Monitoring competitors' pricing strategies closely is crucial. By implementing well-considered discount strategies that balance competitiveness with margin preservation, retailers and brands can capture market share effectively. Leveraging advanced pricing intelligence tools, such as those provided by Actowiz Solutions, offers invaluable insights for informed pricing decisions.

Considering revisions to product size or weight as a cost management measure—known as "shrinkflation"—can help mitigate the impact of rising costs. Transparent communication on packaging is essential to maintain consumer trust while implementing such adjustments.

Confectioners must prioritize using these strategies to effectively handle the challenges given by the increase in cocoa prices. Concentrating on bundle offerings, optimizing pricing strategies as per competitive intelligence, incentivizing bulk purchases, and thoughtfully adjusting product sizes will be crucial. By remaining vigilant of Easter candy pricing trends, retail pricing trends, and utilizing retail pricing insights and analytics, retailers and brands can sustain competitiveness and profitability in a dynamic market environment.

For further details, contact us to speak with an expert from Actowiz Solutions today! You can also reach us for all your mobile app scraping, instant data scraper and web scraping service requirements.

#CandyPriceTrends#CandyPricesScraping#RetailPriceAnalytics#EasterCandyPricingTrends#RetailPriceScraper

0 notes

Text

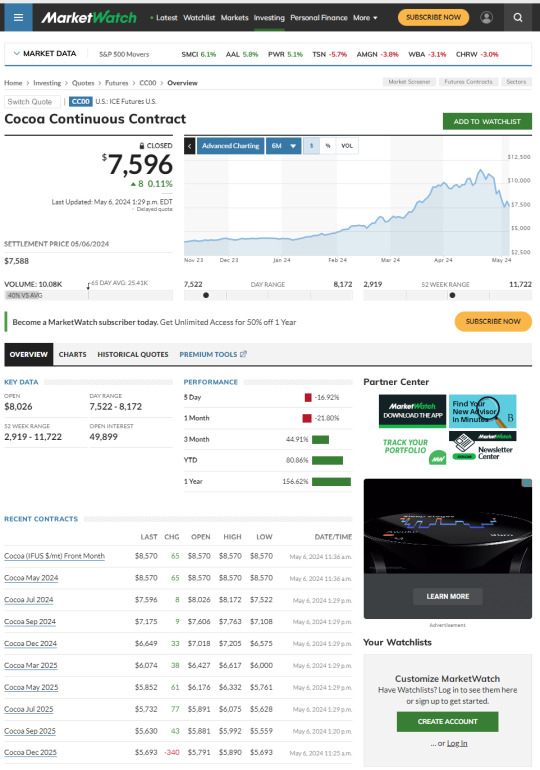

SELEUSS (05-06-2024) COCOA CHOCOLATE PRICES

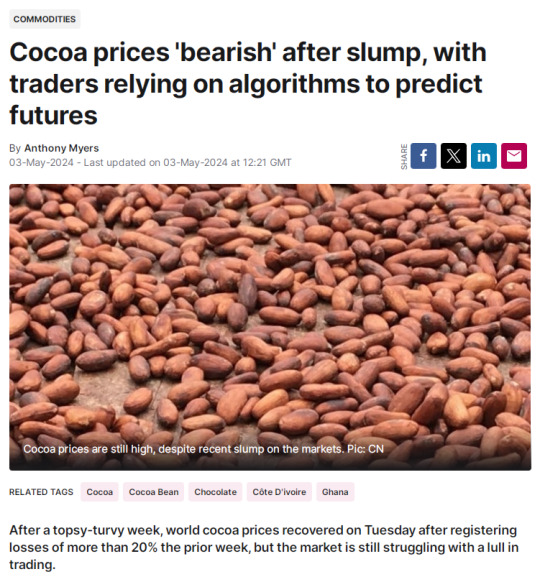

Looks like the delay in cocoa/cacao purchasing is forcing the opportunistic hedge funds to close their positions early.

Around the November-December 2023 period, the Cocoa prices were around $4000 / MT. Prices are still around double currently and looks to stabilize around Q3-Q4 2025 and most likely in early 2026.

https://www.marketwatch.com/investing/future/cc00

#cacaoprices#chocolateprices#cocoaprices#seleuss#chocolates#cocoafutures#seleusscocoafutures#seleusspricing

0 notes

Text

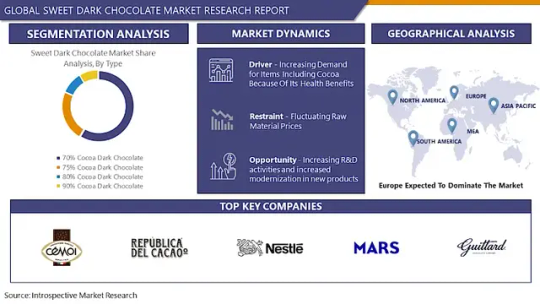

Sweet Dark Chocolate Market: Global Industry Analysis and Forecast 2023 – 2030

The Global Sweet Dark Chocolate Market size was reasonably estimated to be approximately USD 7,692.78 Million in 2022 and is poised to generate revenue over USD 12,637.14 Million by the end of 2030, projecting a CAGR of around 5.67% from 2022 to 2030.

The sweet dark chocolate market has witnessed significant growth in recent years owing to the rising demand for premium confectionery products and the increasing awareness regarding the health benefits associated with dark chocolate consumption. Sweet dark chocolate, characterized by its rich cocoa content and indulgent taste, has become a popular choice among consumers looking for a delectable treat with potential health advantages. The market is marked by a plethora of product innovations, with manufacturers focusing on introducing new flavors, organic options, and ethically sourced ingredients to cater to evolving consumer preferences.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @

https://introspectivemarketresearch.com/request/16616

The latest research on the Sweet Dark Chocolate market provides a comprehensive overview of the market for the years 2023 to 2030. It gives a comprehensive picture of the global Sweet Dark Chocolate industry, considering all significant industry trends, market dynamics, competitive landscape, and market analysis tools such as Porter's five forces analysis, Industry Value chain analysis, and PESTEL analysis of the Sweet Dark Chocolate market. Moreover, the report includes significant chapters such as Patent Analysis, Regulatory Framework, Technology Roadmap, BCG Matrix, Heat Map Analysis, Price Trend Analysis, and Investment Analysis which help to understand the market direction and movement in the current and upcoming years. The report is designed to help readers find information and make decisions that will help them grow their businesses. The study is written with a specific goal in mind: to give business insights and consultancy to help customers make smart business decisions and achieve long-term success in their particular market areas.

Leading players involved in the Sweet Dark Chocolate Market include:

Cemoi Chocolatier (France), Republica del Cacao (Ecuador), Nestlé S.A. (Switzerland), Mars Incorporated (U.S.), Fuji Oil Holdings Inc. (Japan), Tcho Ventures Inc. (U.S.), The Hershey Company (U.S.), Cargill Incorporated (U.S.), and Other Major Players

Market Driver:

One significant driver propelling the sweet dark chocolate market is the growing consumer awareness regarding the health benefits associated with dark chocolate consumption. Studies have highlighted the potential of dark chocolate to improve heart health, lower blood pressure, and enhance mood due to its high cocoa content and antioxidant properties. As consumers become increasingly health-conscious and seek out indulgent yet nutritious treats, the demand for sweet dark chocolate is expected to continue its upward trajectory.

Market Opportunity:

An emerging market opportunity within the sweet dark chocolate segment lies in the incorporation of functional ingredients to enhance its health benefits further. Manufacturers can explore adding ingredients such as probiotics, vitamins, or adaptogens to sweet dark chocolate formulations, thereby appealing to health-conscious consumers seeking functional foods that not only satisfy their sweet cravings but also contribute to their overall well-being. By tapping into this opportunity, companies can differentiate their products in a competitive market landscape and capitalize on the growing demand for functional indulgence.

If You Have Any Query Sweet Dark Chocolate Market Report, Visit:

https://introspectivemarketresearch.com/inquiry/16616

Segmentation of Sweet Dark Chocolate Market:

By Type

70% Cocoa Dark Chocolate

75% Cocoa Dark Chocolate

80% Cocoa Dark Chocolate

90% Cocoa Dark Chocolate

By Product

Bitter Chocolate

Pure Bitter Chocolate

Semi-Sweet Chocolate

Organic Dark Chocolates

Inorganic Dark Chocolates

By Application

Beverages

Food And bakery

Personal Care & Cosmetics

Pharmaceuticals

Others

By Distribution Channel

Supermarket/Hypermarket

Speciality Store

Convenience Store

Others

By Regions: -

North America (US, Canada, Mexico)

Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC)

Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

South America (Brazil, Argentina, Rest of SA)

What to Expect in Our Report?

(1) A complete section of the Sweet Dark Chocolate market report is dedicated for market dynamics, which include influence factors, market drivers, challenges, opportunities, and trends.

(2) Another broad section of the research study is reserved for regional analysis of the Sweet Dark Chocolate market where important regions and countries are assessed for their growth potential, consumption, market share, and other vital factors indicating their market growth.

(3) Players can use the competitive analysis provided in the report to build new strategies or fine-tune their existing ones to rise above market challenges and increase their share of the Sweet Dark Chocolate market.

(4) The report also discusses competitive situation and trends and sheds light on company expansions and merger and acquisition taking place in the Sweet Dark Chocolate market. Moreover, it brings to light the market concentration rate and market shares of top three and five players.

(5) Readers are provided with findings and conclusion of the research study provided in the Sweet Dark Chocolate Market report.

Our study encompasses major growth determinants and drivers, along with extensive segmentation areas. Through in-depth analysis of supply and sales channels, including upstream and downstream fundamentals, we present a complete market ecosystem.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Acquire This Reports: -

https://introspectivemarketresearch.com/checkout/?user=1&_sid=16616

About us:

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assisting our clients to grow and have a successful impact on the market. Our team at IMR is ready to assist our clients to flourish their business by offering strategies to gain success and monopoly in their respective fields. We are a global market research company, that specializes in using big data and advanced analytics to show the bigger picture of the market trends. We help our clients to think differently and build better tomorrow for all of us. We are a technology-driven research company, we analyse extremely large sets of data to discover deeper insights and provide conclusive consulting. We not only provide intelligence solutions, but we help our clients in how they can achieve their goals.

Contact us:

Introspective Market Research

3001 S King Drive,

Chicago, Illinois

60616 USA

Ph no: +1-773-382-1047

Email: [email protected]

Sweet Dark Chocolate, Sweet Dark Chocolate Market, Sweet Dark Chocolate Market Size, Sweet Dark Chocolate Market Share, Sweet Dark Chocolate Market Growth, Sweet Dark Chocolate Market Trend, Sweet Dark Chocolate Market segment, Sweet Dark Chocolate Market Opportunity, Sweet Dark Chocolate Market Analysis 2023

0 notes

Text

Apr 28, 2024

If you’ve shopped for chocolate recently, you may have noticed your favorite items are either smaller or more expensive, or sometimes both. The price of cocoa — the key ingredient in chocolate — is the highest it’s ever been after nearly doubling in the last four months. As Ali Rogin reports, this worldwide shortage has been years in the making.

Issifu Issaka, a cocoa farmer in Ghana, talks about the hardships they're facing, including price setting on international markets from people "who have not even held a cutlass in his hand and weeded on the farm before."

0 notes

Text

Analyzing Trends and Opportunities in the Cocoa Market: A Comprehensive Overview

The Cocoa market will grow at highest pace owing to increasing demand from emerging economies like India and China.

Cocoa is derived from the cacao tree and primarily used to produce chocolate and cocoa powder. It finds widespread application in the food & beverage industry for producing products like chocolate, candy, drinks, and bakery items. Cocoa has high nutritional value and contains minerals, vitamins, fiber, flavonoids, and antioxidants that offer several health benefits. As a result, demand for cocoa and cocoa-based products is on the rise globally. The global cocoa market is estimated to be valued at US$ 11,499.6 Mn in 2024 and is expected to exhibit a CAGR of 3.4% over the forecast period 2023 to 2030.

Key Takeaways

Key players operating in the cocoa market are The Barry Callebaut Group, The Hershey Company, Nestlé S.A., Cargill Incorporated, Puratos Group, Cémoi, Mars, Incorporated, Blommer Chocolate Company, Meiji Holdings Company, Ltd., Carlyle Cocoa, Jindal Cocoa, and United Cocoa Processor. These players are focusing on geographical expansion, product innovation, and mergers & acquisitions to gain a competitive edge in the market.

The demand for cocoa is increasing significantly owing to rising consumption of chocolates and bakery items globally. Growing health awareness has also boosted demand for cocoa-based products due to associated health benefits. Moreover, changing lifestyles, inflating incomes, and westernization are fueling the growth of cocoa consumption in emerging economies.

Technological advancements in cocoa processing such as innovative roasting and grinding techniques have improved the quality and efficiency of cocoa production. Advanced crop protection solutions and high-yielding cocoa varieties introduced by key players are also supporting market growth.

Market Opportunities

- Emerging Economies: Emerging countries like India, China, Brazil, and Indonesia offer lucrative opportunities for cocoa market players owing to growing middle-class population, improving living standards, and shifting dietary preferences in these regions.

- E-Commerce Platforms: Online retail platforms provide an efficient channel for companies to promote and sell a variety of cocoa and chocolate products to consumers. Growing internet and smartphone penetration globally will aid the cocoa-based product sales through e-commerce retailers.

Impact of COVID-19 on Cocoa Market Growth

The COVID-19 pandemic has negatively impacted the growth of the global cocoa market. The strict lockdowns imposed by governments around the world led to severe disruptions in production and supply chains. Farmers faced difficulties in harvesting and processing cocoa beans due to travel restrictions and shortage of labor. Cocoa production fell significantly in major producing countries like Cote d'Ivoire and Ghana. On the demand side, the sharp decline in economic activities impacted the demand for cocoa and related products from industrial as well as retail consumers. Hotels, restaurants and cafe business came to a standstill affecting the foodservice demand for cocoa. The cocoa price crashed to a three-year low level in 2020.

0 notes

Text

Europe Food Coating Ingredients Market Share, Size, Trends, Growth Drivers, Business Challenges, Top Key Players, Future Opportunities and Forecast 2033: SPER Market Research

Food coating ingredients are substances used in food processing to enhance the flavor, texture, appearance, and shelf life of many food products. These materials are applied to the outside of food items through methods such as breading, enrobing, or battering. Food coatings frequently contain flours, starches, proteins, lipids, sugars, and leavening agents. They serve as a barrier to prevent oil from absorbing while frying, give food a crispy or crunchy texture, prevent food from drying out, and improve appearance. Food coating ingredients can be found in fried foods like fish fillets, chicken nuggets, and potato chips, as well as baked products like doughnuts and breaded pastries.

According to SPER market research, ‘Europe Food Coating Ingredients Market Size- By Type, By Application - Regional Outlook, Competitive Strategies and Segment Forecast to 2033’ state that the Europe Food Coating Ingredients Market is predicted to reach USD XX billion by 2033 with a CAGR of 5.68%.

Drivers: The food and beverage (F&B) business has experienced significant growth, leading to an increased demand for healthy ready-to-eat (RTE) and ready-to-drink (RTD) goods. As a result, it is now simpler to use food coating components to improve the organoleptic characteristics of processed, baked, fried, and consumer items. This is one of the primary drivers of the market's present expansion. Therefore, noteworthy technological advancements like the application of electrostatic coatings, which enhance the flavor, aroma, look, and shelf life of different food items by averting chemical reactions, are additional growth-inducing factors. The introduction of antimicrobial coatings, which halt the spread of illness and keep packaged items from rotting, is another factor driving market expansion.

Challenges: There are multiple challenges in the market for food coating components because of various factors. Maintaining innovation to adapt to changing dietary trends and customer preferences is one of the largest challenges. Manufacturers are under pressure from consumers to reformulate their goods to offer cleaner labels, more sustainable ingredients, and healthier options. Regulations mandating strict compliance measures with regard to food safety and labeling further complicate the situation.

Request For Free Sample Report @ https://www.sperresearch.com/report-store/europe-food-coating-ingredients-market.aspx?sample=1

The COVID-19 pandemic of 2020 has a significant impact on the expansion of the food coating components business in Europe. This is because the output of food coatings decreased as a result of the closure of multiple production sites. In addition, a change in expenses was noted in the affected region as a result of these closures; for example, the cost of sugar and cocoa rose, raising the price of the product. The outcome was a change in consumer purchasing patterns for food coating materials in the European market.

Additionally, some of the market key players are Cargill Inc., Ingredion Incorporated, Kerry Group PLC, Newly Weds Foods, Royal Avebe U.A., Tate & Lyle.

Europe Food Coating Ingredients Market Segmentation:

By Type: Based on the Type, Europe Food Coating Ingredients Market is segmented as; Sugars and Syrups, Cocoa and Chocolates, Fats and Oils, Spices and Seasonings, Flours, Batter and Crumbs, Others.

By Application: Based on the Application, Europe Food Coating Ingredients Market is segmented as; Bakery, Confectionery, Breakfast Cereals, Snacks, Dairy, Meat, Others

By Region: This research also includes data for UK, France, Germany, Italy, Spain, Rest of Europe.

This study also encompasses various drivers and restraining factors of this market for the forecast period. Various growth opportunities are also discussed in the report.

For More Information, refer to below link:-

Europe Food Coating Ingredients Market Outlook

Related Reports:

Frozen Chicken Market Size- By Type, By Product, By Distribution Channel- Regional Outlook, Competitive Strategies and Segment Forecast to 2033

Europe Ready-to-Eat Food Market Size- By Type, Distribution Channel- Regional Outlook, Competitive Strategies and Segment Forecast to 2033

Follow Us –

LinkedIn | Instagram | Facebook | Twitter

Contact Us:

Sara Lopes, Business Consultant – U.S.A.

SPER Market Research

+1-347-460-2899

#Food Coating Ingredients Market#Europe Food Coating Market#Europe Food Coating Ingredients Market#Europe Food Coating Ingredients Market Analysis#Europe Food Coating Ingredients Market Challenges#Europe Food Coating Ingredients Market Competition#Europe Food Coating Ingredients Market Demand#Europe Food Coating Ingredients Market Forecast#Europe Food Coating Ingredients Market Future outlook#Europe Food Coating Ingredients Market Growth#Europe Food Coating Ingredients Market Opportunity#Europe Food Coating Ingredients Market Overview#Europe Food Coating Ingredients Market Research Report#Europe Food Coating Ingredients Market Revenue#Europe Food Coating Ingredients Market segmentation#Europe Food Coating Ingredients Market Share#Europe Food Coating Ingredients Market Size#Europe Food Coating Ingredients Market Top Industry Players#Europe Food Coating Ingredients Market Trends

0 notes