#CommoditiesTrading

Explore tagged Tumblr posts

Text

youtube

Why Gold is Costlier in India? Gold Price Breakdown #goldprice #goldpriceinindia

Ever wondered why gold is priced so much higher at your local jeweller compared to international rates?

In this video, we decode the real journey of gold pricing - from the global rate in USD to what you actually pay in India.

Learn how the gold price jumps in India and why?

Note: Gold Price shown are as of May 2025.

Read the full blog here: https://navia.co.in/blog/gold-price-decoded-from-global-rates-to-your-local-jeweller/

Download app - https://open.navia.co.in/index-navia.php?datasource=DMO-YT

Subscribe to @navia_markets for more smart money insights.

#goldprice#goldpriceupdate#goldprice2025#goldinvesting#goldrate#globalgoldrate#localgoldprice#goldnews#goldratetoday#goldjewellery#goldjewelry#goldinvestment#buygold#sellgold#buyinggold#sellinggold#globalmarkets#globalmarketupdates#localmarkets#commoditymarket#commodity#commoditiesanalysis#commoditiesmarket#commoditieslive#commoditiestrading#commoditymarketupdates#commoditymarketindia#naviamarkets#navia#naviaapp

0 notes

Text

Commodities Trading: A Beginner’s Guide to the Basics

source: www.tradebrains.in

The global commodities market is one of the most fascinating sectors of the financial world. From precious metals like gold to agricultural products like wheat, commodities trading offers diverse opportunities for investors.

For centuries, it has been a cornerstone of economic activity, enabling traders to hedge risks, speculate on price movements, and diversify their portfolios.

This guide is tailored to help beginners navigate the complexities of commodities trading, explaining what commodities are, how the market operates, and how you can start trading confidently.

What Are Commodities?

source:www.top10stockbroker.com

1. Hard Commodities

These include natural resources like crude oil, gold, silver, and other minerals. They are typically mined or extracted and are essential for industrial production and energy consumption.

2. Soft Commodities

Soft commodities are agricultural products such as corn, coffee, wheat, and cotton. Unlike hard commodities, they are grown or farmed and are often influenced by seasonal and climatic factors.

These commodities are traded on regulated exchanges such as the New York Mercantile Exchange (NYMEX) and the Chicago Board of Trade (CBOT).

Why Is Commodities Trading Popular?

Commodities trading offers unique advantages that make it appealing to investors of all levels. Here’s why it’s worth considering:

1. Diversification

Commodities often behave differently from traditional assets like stocks and bonds. When equity markets are volatile, commodities may provide stability, helping investors spread risk across asset classes.

2. Hedge Against Inflation

During inflationary periods, the prices of commodities such as gold and oil typically rise, preserving purchasing power and acting as a financial hedge.

3. Global Relevance

Commodities are affected by worldwide events like natural disasters, geopolitical conflicts, and supply chain disruptions. These factors create trading opportunities for those willing to study market trends.

4. Liquidity

The global commodities market is vast, ensuring high liquidity for traders who wish to enter or exit positions quickly.

How Does Commodities Trading Work?

Commodities trading can seem complex at first, but it becomes easier to understand with a basic grasp of its mechanisms. Trades can occur in two primary ways:

1. Spot Markets

Spot markets involve the immediate purchase or sale of commodities at current market prices. These transactions require buyers to take physical possession of the goods, making spot trading more relevant to producers and manufacturers.

2. Futures Contracts

Most retail traders engage in commodities trading through futures contracts. These are agreements to buy or sell a commodity at a set price on a future date. Futures allow traders to speculate on price movements without handling the physical commodity.

For example, if you believe oil prices will rise, you can purchase an oil futures contract. If your prediction is correct, you can sell the contract for a profit before its expiration.

Getting Started in Commodities Trading

1. Choose Your Market

Decide which commodity you want to trade. Beginners often start with popular choices like gold, crude oil, or agricultural products. Research the factors that influence each market, such as geopolitical tensions, weather conditions, or industrial demand.

2. Select a Trading Platform

A reliable broker or trading platform is crucial. Look for platforms that provide competitive spreads, real-time market data, and access to global exchanges. Ensure the platform is regulated to safeguard your investments.

3. Understand Leverage and Margin

Leverage allows you to control a larger position with a smaller amount of capital. While this amplifies potential profits, it also increases risk. Familiarize yourself with how margin trading works and the risks involved.

4. Start Small

As a beginner, focus on small trades to gain experience without exposing yourself to significant financial risk. Gradually increase your trading volume as you build confidence.

5. Utilize Risk Management Tools

Successful commodities trading requires effective risk management. Tools like stop-loss orders can limit your losses, while take-profit orders lock in gains.

Popular Commodities to Trade

If you’re new to commodities trading, some assets are more accessible and widely traded than others:

Gold

Often referred to as a “safe-haven” asset, gold is a favorite among investors during economic uncertainty. Its value remains relatively stable, making it an excellent option for beginners.

Crude Oil

Crude oil is one of the most liquid commodities in the market. Prices are influenced by supply and demand, geopolitical events, and global energy policies.

Wheat

Agricultural commodities like wheat are influenced by weather patterns, harvest cycles, and global food demand. They are ideal for traders who prefer markets driven by tangible factors.

Coffee

As one of the most consumed beverages globally, coffee is a soft commodity with consistent demand. However, its price can be volatile due to weather conditions in coffee-producing regions.

Risks in Commodities Trading

While commodities trading offers exciting opportunities, it’s essential to understand the risks involved:

1. Volatility

Commodity prices can change rapidly due to unexpected events like natural disasters, political instability, or economic downturns.

2. Leverage Risks

Trading on margin magnifies both gains and losses. Misjudging the market can lead to significant financial setbacks.

3. Market Speculation

Predicting market trends requires extensive research and analysis. Speculative trading without proper knowledge can result in losses.

4. Storage and Transportation Costs

For physical commodities, logistical costs can eat into profits, making futures contracts a more practical option for most traders.

Commodities Trading vs. Stocks and Bonds

Commodities differ significantly from other asset classes like stocks and bonds:

Tangible Value: Unlike stocks, which represent ownership in a company, commodities are physical assets with intrinsic value.

Market Drivers: Commodity prices are influenced by global supply and demand, weather, and geopolitical events, whereas stocks and bonds rely on corporate performance and interest rates.

Liquidity: Commodities often provide higher liquidity compared to bonds, allowing traders to react quickly to market movements.

Understanding these differences helps traders choose the right asset class for their investment goals.

How to Earn Potential Profits?

1. Stay Informed

Keep track of global news, market trends, and economic reports. Tools like economic calendars and technical analysis platforms can provide valuable insights.

2. Diversify Your Portfolio

Avoid putting all your capital into a single commodity. Diversify across multiple markets to reduce risk.

3. Learn Continuously

The commodities market is dynamic. Attend webinars, read trading guides, and practice using demo accounts to refine your skills.

What’s Your Next Move in Commodities Trading?

The world of commodities trading is vast, exciting, and full of opportunities. Are you ready to explore it? With the right strategy and tools, you can tap into global markets, diversify your investments, and achieve financial growth.

Skyriss invites you to start your trading journey today. Let’s make the market work for you!

0 notes

Text

Gold Prices Slip as Precious Metals Weaken; Platinum, Silver, and Copper Futures Also Decline

In today's trading, spot gold prices dipped 0.5%, settling at $2,500.55 an ounce, after reaching an intraday high of $2,532.05. Meanwhile, gold futures set to expire in December saw a 0.4% decline, closing at $2,547.05 an ounce. The weakness in gold was mirrored across other precious metals as platinum futures fell by 0.4% to $970.00 an ounce, and silver futures slipped 0.3% to $29.448 an ounce.

Industrial metals also felt the pressure, with benchmark copper futures on the London Metal Exchange stabilizing at $9,262.50 a ton. However, one-month copper futures experienced a slight drop, falling 0.2% to $4.1930 a pound.

These movements come amid a backdrop of fluctuating market sentiment, influenced by global economic uncertainties, inflationary pressures, and central bank policies. Investors continue to monitor these factors closely as they weigh their impact on the precious and industrial metals markets.

For traders and investors, the slight declines in these metals may present opportunities or signal caution depending on broader market trends. Analysts suggest keeping an eye on upcoming economic data and central bank decisions, which could further sway the metals markets in the coming days.

#GoldPrices#PreciousMetals#GoldFutures#Platinum#Silver#Copper#MetalsMarket#CommoditiesTrading#MarketUpdate#Investing#TradingStrategies

1 note

·

View note

Text

Discover the Best Online Trading in UAE

Unlock the potential of online trading in UAE with Spectra Global. Our platform offers a seamless and secure trading experience, allowing you to access global markets with ease. Whether you are a seasoned trader or a beginner, our advanced tools and resources are designed to enhance your trading journey. Benefit from real-time data, competitive spreads, and a user-friendly interface that simplifies your trading activities. With Spectra Global, you can trade a wide range of assets, including forex, stocks, indices, and commodities, all from the comfort of your home.

Start Your Online Trading Journey in UAE Today!

Join Spectra Global and take advantage of our comprehensive trading solutions tailored for traders in the UAE. Visit Spectra Global to get started with online trading in UAE and elevate your trading experience to the next level.

#OnlineTradingUAE#SpectraGlobal#TradingPlatform#ForexTrading#StockTrading#IndicesTrading#CommoditiesTrading#SecureTrading#GlobalMarkets#TradingTools#BeginnerTraders#AdvancedTrading#RealTimeData#CompetitiveSpreads#UserFriendlyTrading

0 notes

Text

Abstract:Webull's latest upgrade introduces futures and commodities trading, enhancing portfolio options and signaling global expansion, as the platform prepares for a potential $7.3 billion Nasdaq listing via a SPAC later this year.

0 notes

Text

How to Trade Crypto, Forex & Commodities (Gold & Silver) on HMX DEX || Review 2023 🧈🥈

youtube

🚀 Welcome to our deep dive into HMX, the next-gen decentralized perpetual protocol built on Arbitrum! 🚀 In this comprehensive review for 2023, we’re uncovering the powerful features and unique trading opportunities offered by HMX, including how to trade Crypto, Forex, and Commodities such as Gold & Silver! 🧈🥈

💡 What’s Inside: This video unveils the groundbreaking features of HMX, focusing on its cross-margin and multi-asset collateral support, adaptive pricing mechanism, and how traders can utilize various asset classes to open leveraged positions. We also take a closer look at the assets supported by HMX, like USDC, USDT, DAI, GLP, BTC, ETH, and ARB, and delve into the innovative referral program, shedding light on how to maximize rebates and trading fee discounts!

🔗 Topics Covered:

*Overview of HMX DEX

*Trading Crypto, Forex, & Commodities on HMX

*Leveraged Trading & Risk Management

*Insights on Collateral Management

*Trading Fee Discounts & Rebates

*User-centric Adaptive Pricing Mechanism

*Assets Supported by HMX

*How to Optimize Trading Strategies on HMX

🌐 Explore HMX DEX: Dive into the decentralized world of trading, explore cross-margin collateral management, and experience the seamless blend of security and flexibility offered by HMX! Discover the array of assets, take advantage of the lower market rate fees, and enhance your trading strategies with HMX’s unique features! 💰

Maximize Your Profits: Learn how to leverage HMX’s innovative features to optimize your trading strategies. Whether you're a crypto enthusiast or a commodities trader, this video is packed with insights that will help you make the most of your trading experience, all while maintaining capital efficiency!

Get started on HMX.

#HMX#DecentralizedTrading#CryptoTrading#ForexTrading#CommoditiesTrading#Arbitrum#LeveragedTrading#HMXReview2023#BlockchainTechnology#Cryptocurrency#Youtube

0 notes

Photo

(via New book release: 'The Day I Sold My Corvette' by Santrell T. Carson)

#santrelltcarson#thedayisoldmycorvette#newbooks#newbookalert#books#booknews#businessbooks#businessethics#moneymanagement#leadership#commoditiestrading#businessprofessionalsbiographies#fiverr#fiverrgig#personaldevelopment#personalgrowth#personalwealth

0 notes

Text

Mastering market patience:

Mastering market patience: Kurush Mistry shares why strategic waiting and analytical thinking are key to trading success 📊✨

KurushMistry #CommoditiesTrader #MarketAnalysis #TradingTips #InvestingWisdom #FinancialMarkets

0 notes

Text

Wouldn’t It Be Nice If Great Trades Just Popped Up In Your Inbox?

→ Even if…you've tried and failed to grow your retirement account.

→ Even if…you've paid money managers but your accounts balances shrink.

→ Even if…you've decided you're not a sufficiently savvy investor without help

Last month, for a modest $56 investment you would have made $6,127.

Current portfolio profits as of today show investment returns of 53%!

https://ascentiv.blog

#making money#futures#commodities#investing#commoditiestrading#investor#workfromhome#businessideas#million

5 notes

·

View notes

Photo

Commodities trading for beginners, top ten things to keep in mind while trading commodity

Marketing is different from the traditional business model. The most significant economic indicators in the Indian economy are fair. Hence, you need to unlearn about the fair to delve deeper into the product market if you are a beginner.

https://forex4money.com/Commodities.aspx

0 notes

Text

Brent Crude and WTI Futures Make Gains Amid Market Volatility

In the ever-fluctuating world of crude oil trading, recent market movements have drawn significant attention. Brent crude futures for September experienced a modest rise of 37 cents, or 0.5%, reaching $81.38 a barrel. Similarly, U.S. West Texas Intermediate (WTI) crude for September increased by 38 cents, or 0.5%, to $77.34 per barrel. These gains come on the heels of notable declines, with WTI losing 7% over the preceding three sessions and Brent shedding nearly 5%. This article explores the factors behind these recent fluctuations, the current state of the oil market, and the potential outlook for Brent and WTI crude futures.

Market Movements and Factors Influencing Prices

The recent uptick in Brent and WTI prices can be attributed to a mix of market dynamics and external factors. One primary driver is the shifting balance between supply and demand. Ongoing geopolitical tensions, particularly in key oil-producing regions, continue to create uncertainty about future supply levels. Additionally, economic indicators from major economies influence market sentiment and crude oil prices.

The recent price drops in both WTI and Brent were driven by concerns over potential supply disruptions, weaker-than-expected economic data from major economies, and fears of a global economic slowdown. However, the modest recovery seen in the latest trading sessions suggests that traders and investors are cautiously optimistic about the market's direction.

Supply and Demand Dynamics

Supply and demand dynamics are critical in determining crude oil prices. On the supply side, the actions of the Organization of the Petroleum Exporting Countries (OPEC) and its allies, known as OPEC+, play a significant role. OPEC+ has been managing production levels to maintain price stability amid fluctuating demand. Recent reports indicate that OPEC+ is likely to keep its current production levels, which has helped ease some supply concerns.

On the demand side, global economic growth is a crucial factor. Economic data from the United States, China, and Europe are closely watched by market participants. In recent weeks, concerns over slower economic growth, particularly in China, have weighed on oil prices. However, indications of potential economic stimulus measures in China and other major economies have provided some support to the market.

Geopolitical Tensions and Their Impact

Geopolitical tensions, particularly in the Middle East, have a direct impact on crude oil prices. Any potential disruption in oil supply from this region can lead to significant price volatility. Recent events, including conflicts and political instability in key oil-producing countries, have heightened concerns about supply disruptions. Market participants closely monitor these developments, as any escalation could lead to further price increases.

Economic Indicators and Market Sentiment

Economic indicators from major economies, such as GDP growth rates, employment data, and industrial production figures, influence market sentiment and crude oil prices. Recent data from the United States showed mixed results, with some indicators pointing to a robust recovery, while others raised concerns about potential slowdowns. Similarly, economic data from China has been weaker than expected, raising fears of a slowdown in the world's second-largest economy.

Despite these concerns, there are signs of optimism. Potential economic stimulus measures in China, coupled with ongoing recovery efforts in other major economies, provide hope for sustained demand for crude oil. Additionally, the gradual easing of COVID-19 restrictions in many parts of the world is expected to boost economic activity and, consequently, oil demand.

Outlook for Brent and WTI Crude Futures

The outlook for Brent and WTI crude futures remains uncertain, given the numerous factors influencing the market. However, there are reasons for cautious optimism. OPEC+'s continued efforts to manage production levels, potential economic stimulus measures, and the gradual recovery of global economic activity are all positive signs for the oil market.

In the short term, traders and investors will continue to monitor key economic indicators, geopolitical developments, and supply and demand dynamics. Any significant changes in these factors could lead to further price volatility. However, if current trends continue, there is potential for Brent and WTI prices to stabilize or even increase modestly in the coming months.

Implications for Global Energy Markets

The recent movements in Brent and WTI prices have broader implications for global energy markets. Crude oil is a critical component of the global energy mix, and its price fluctuations impact various industries and consumers. Higher crude oil prices can lead to increased costs for transportation, manufacturing, and other energy-intensive sectors. Conversely, lower prices can provide economic relief and boost consumer spending.

For oil-producing countries, stable or higher crude oil prices are essential for economic stability and revenue generation. Many of these countries rely heavily on oil exports to support their economies. Conversely, oil-importing countries benefit from lower crude oil prices, which can reduce inflationary pressures and support economic growth.

#BrentCrude#WTIFutures#OilMarket#CrudeOilPrices#EnergyMarket#OilTrading#MarketVolatility#GlobalEconomy#CommoditiesTrading#EnergySector

0 notes

Photo

Commodities trading for beginners, Terms, and condition required for commodity trading

The Indian Economy is an area to look out for. Switching products directly, market options can also be marketed, which requires less investment and the risk that remains with the product.

0 notes

Photo

TRADE SIGNAL AS ON 15-02-2021📊📈📉 #GBPJPY #COFFEE #CITIgroup #LITECOIN #FTSESignals #ftsetrade #currency #currencytrading #CurrencyTrader #currencyexchange #currencynews #tradesignals #stoploss #Commodities #commoditiestrading #TechnicalAnalysis #technicalanalysist #CapitalStreetFX #dax #tradingeducation #tradingstocks #tradingsetup #tradingforex #forexeducation #forexchart #forex https://www.instagram.com/p/CLUFXMflqWO/?igshid=1ukoyvgxdgqe7

#gbpjpy#coffee#citigroup#litecoin#ftsesignals#ftsetrade#currency#currencytrading#currencytrader#currencyexchange#currencynews#tradesignals#stoploss#commodities#commoditiestrading#technicalanalysis#technicalanalysist#capitalstreetfx#dax#tradingeducation#tradingstocks#tradingsetup#tradingforex#forexeducation#forexchart#forex

0 notes

Photo

Commodities Trading with the Forex, what Does Commodities Trading Means?

Commodities trading is a concept where one gets an opportunity to trade gold silver and several other items. Trading with the forex is the trendiest concept and commodity trading is one of its kind.

0 notes

Text

Navigating the future of work:

Navigating the future of work: Kurush Mistry shares insights on balancing remote teams with meaningful human connections! 🌐🤝

#KurushMistry #CommoditiesTrader #RemoteWork #Leadership #TeamBuilding #HybridWorkplace

0 notes

Text

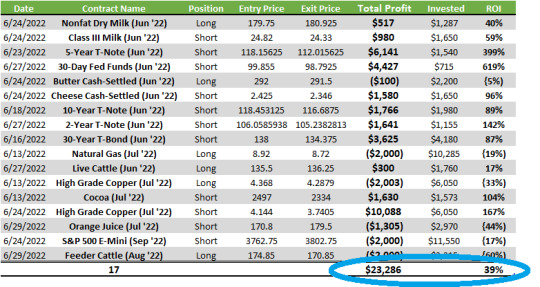

A modest $75 investment last month handed you over $23,000!

(See proof in the table.)

And now it's risk-free!: If our recommendations don’t create at least as much as you paid, it’s free!

https://ascentiv.blog

3 notes

·

View notes