#Complete Guide to Forex Trading Signals for Beginners

Explore tagged Tumblr posts

Text

This blog serves as a user-friendly guide for those just stepping into the world of forex trading. It meticulously breaks down the concept of forex trading signals, highlighting their immense value for beginners in navigating the intricate forex market. It emphasizes the advantages of using signals, such as their potential to save time, reduce emotional stress, and offer a learning opportunity for novice traders. Throughout the guide, the presence of Funded Traders Global as a supportive and educational partner is evident, ensuring that beginners gain confidence in their learn more...

#Analyzing Fundamental Data#Basics of Trading Signals#Candlestick patterns#Complete Guide to Forex Trading Signals for Beginners#currency pairs#Defining Forex Trading Signals#dojis#economic calendars#economic indicators#engulfing candles#Evaluating Sentiment Indicators#Forex charts#Forex News Sources#forex trading 2023#Forex Trading Signals for Beginners#Fundamental Analysis Signals#hammers#How to Choose a Reliable Provider#How to Find Forex Trading Signals#Interpreting Forex Trading Signals#MACD (Moving Average Convergence Divergence)#Market Analysis Tools#Market Sentiment Indicators#mood and perceptions of traders in the market#moving averages#Position Sizing Strategies#Risk Management in Forex Trading#RSI (Relative Strength Index)#Self-Analysis and Research#Sentiment Analysis Signals

0 notes

Video

youtube

Sniper Pro Scanner Complete Guide for Beginners & Expert Traders Jifu

Discover the power of the Jifu Sniper Pro Scanner in this comprehensive overview! I'll break down its features, trading setups (Side Snipe, Trend Snipe, Reversal Snipe), and how to interpret its unique signals for Forex, Gold, Crypto, Indices, and more. ⬇️ Get my Sniper Pro Scanner Overview PDF for FREE: https://sorianoblueprint.com/SNIPER-PRO-SCANNER-OVERVIEW.pdf

0 notes

Text

Certificate in Technical Analysis | Learn Market Trends

Unlock the secrets of smart trading with our Certificate in Technical Analysis course — a complete guide to understanding price action, market trends, and trading indicators. This program is ideal for beginners, intermediate traders, and finance professionals who want to master the art of analyzing charts, patterns, and technical signals to make informed trading decisions.

The course covers key topics such as chart types, support & resistance, trendlines, moving averages, RSI, MACD, candlestick patterns, and trading psychology. With a mix of theoretical instruction and real-time market examples, you’ll gain practical skills that are directly applicable in stocks, commodities, forex, and crypto markets.

Led by experienced market analysts, the course includes live sessions, recorded modules, quizzes, and a certificate upon completion. Whether you're trading part-time or looking to build a career in financial markets, this certification will give you the confidence and tools to analyze markets effectively and trade smartly.

0 notes

Text

Lexoro Byte Review 2025 - Is The Platform Scam Or Real?

Overall Rating: ⭐⭐⭐⭐☆ (4.6/5) AI Performance: 4.7/5 Ease of Use: 4.5/5 Earning Potential: 4.6/5 Security & Transparency: 4.4/5 Customer Support: 4.5/5

👉 Open Your Lexoro Byte Account Now

🚀 What is Lexoro Byte?

Lexoro Byte is a cutting-edge AI-driven trading platform designed for individuals who want to trade smarter—not harder. As of 2025, it stands out for its advanced data algorithms, automatic trading execution, and real-time predictive analysis across cryptocurrencies, forex, and commodities.

Whether you're a beginner or an experienced investor, Lexoro Byte is built to maximize returns while minimizing effort and risk.

💡 Key Features of Lexoro Byte

🤖 1. Advanced AI-Powered Trade Engine

The platform uses machine learning and market sentiment analysis to generate highly accurate buy/sell signals.

📈 2. Automated Trading

You don’t have to manually place trades—Lexoro Byte’s automation feature does it for you. Just set your preferences and let the system operate.

📊 3. Multi-Market Access

Trade across a variety of asset classes:

📉 Forex (e.g., EUR/USD, GBP/JPY)

🪙 Cryptocurrencies (e.g., BTC, ETH, SOL)

💰 Commodities (e.g., Gold, Oil)

🧪 4. Free Demo Mode

Not sure if it’s for you? Try the demo account to test the full system risk-free before committing real funds.

🔐 5. Secure Platform

With SSL encryption, regulated broker partnerships, and KYC verification, Lexoro Byte places a strong emphasis on user safety.

👍 Pros & 👎 Cons

✅ Pros:

✅ No prior experience needed

✅ Fast setup process

✅ Real-time AI updates & trade execution

✅ Transparent reporting and profit tracking

✅ 24/7 trading capability

❌ Cons:

❌ Not available in all countries (e.g., U.S., Canada)

❌ Requires stable internet connection for best performance

❌ Some features locked behind upsells (premium tools)

👉 Open Your Lexoro Byte Account Now

🧾 How Does Lexoro Byte Work?

Sign Up Create a free account with basic info and complete identity verification.

Fund Your Account Deposit a minimum of $250 to activate live trading mode.

Set Your Strategy Choose from conservative, balanced, or aggressive risk profiles.

Activate Auto Mode Lexoro Byte starts analyzing, executing trades, and adjusting strategies in real-time.

Withdraw Anytime Profits can be withdrawn within 24–48 hours, depending on the payment method.

🧑💻 Who Is Lexoro Byte Best For?

✅ Beginners looking to automate trading

✅ Busy professionals wanting hands-free income

✅ Crypto enthusiasts exploring AI-assisted strategies

✅ Investors seeking diversified options in one platform

❌ Not ideal for manual day traders or those in restricted regions

💬 Real User Reviews

“Lexoro Byte helped me get into crypto trading without having to learn everything from scratch. The automation is top-tier.” — Monique D., Netherlands

“I’ve been using Lexoro Byte for over 6 months now. The profits are consistent, and the dashboard makes everything easy to track.” — Andre W., Brazil

“Best part? I don’t have to be online all day. The system takes care of trades while I focus on my 9–5.” — Kieran M., Ireland

🛡️ Is Lexoro Byte Legit or a Scam?

✅ Lexoro Byte is legit. It works with regulated brokers, provides full transparency, and gives users access to a demo version before investing real money. While it's not a guaranteed income generator (nothing is), it's a trusted option for automated, data-backed trading.

❓ Frequently Asked Questions (FAQs)

❓ What is Lexoro Byte?

Lexoro Byte is an AI-powered trading software that automates investments in crypto, forex, and commodities using data-driven strategies.

❓ Is Lexoro Byte beginner-friendly?

Yes. The platform is designed for users with zero trading experience and includes guided setups and demo training.

❓ How much does it cost to use?

There's no subscription fee. You only need a $250 minimum deposit to activate the live trading feature.

❓ Is there a mobile app?

While there’s no dedicated app yet, the web-based dashboard is mobile-responsive and works well on phones and tablets.

❓ Can I lose money?

Yes. Like any form of investing, trading carries risk. However, Lexoro Byte's AI aims to optimize profit while managing downside risk.

❓ Is my data safe?

Absolutely. Lexoro Byte uses SSL encryption and KYC verification to ensure user privacy and security.

❓ Are there withdrawal limits?

There are no limits, but processing times range from 24–48 hours depending on your method.

👉 Open Your Lexoro Byte Account Now

0 notes

Text

Forex Signal Sources for profitable Trading

It is possible that having access to information that is both accurate and up to date might make a huge difference when it comes to successfully navigating the fast-paced world of currency trading. The finest forex signal providers are able to provide traders with expert insights that assist in improving decision-making and reducing the amount of guessing that is involved in the market thanks to their services. In spite of the fact that there are a multitude of services that assert to provide profitable signals, how can you choose which ones genuinely give results? In the following paragraphs, we will discuss the reasons why selecting a trustworthy forex signal provider is essential for traders, particularly novices, as well as the ways in which doing so can improve your overall trading success.

🔍 Identify the providers of Forex signals.

Forex signal providers are services that send out trading alerts, typically including key details such as the entry price, stop-loss, take-profit levels, and sometimes even trade rationale. These signals can be delivered through SMS, email, Telegram, or directly into trading platforms.

Their goal is to guide traders in making informed trading decisions without having to spend hours analyzing charts or following economic news.

💡 Why You Should Trust the Top Forex Signal Providers?

1. Convenient and time-saving Reliable signals allow traders to concentrate more on trade execution and save hours of analysis. This is particularly beneficial for novice or part-time traders. 2. Risk Control The best suppliers help traders adhere to appropriate risk-reward ratios by including crucial factors like stop-loss and take-profit. 3. Educational Possibility Copying trades is only one aspect of following expert signals. Additionally, it enables novice traders to gradually learn timing, market behavior, and strategy execution. 4. Regularity in Dealing Reliable setups based on tried-and-true methods are provided by good signal providers, which lessen impulsive and emotional trading.

Want to find out which providers actually are active?

See this thorough analysis of the 8 Best Forex Signal Providers in 2024 for Beginners if you want a list of reliable services and are committed about raising your performance. This guide makes it simpler for you to select the one that best meets your objectives since it addresses everything from performance history to pricing and customer comments.

Final

Selecting one of the finest forex signal sources is about developing a more strategic and disciplined trading approach, not only about obtaining trade alerts. Working with a trustworthy signal service can provide a strong edge in the markets whether your goal is to hone your strategy or you're just starting out. Always test any provider's service, research their offerings, and make sure they provide complete openness before signing up for any one. With the correct indications and trading approach, you can negotiate the forex market more boldly and clearly.

0 notes

Text

"How to Identify and Trade the Cup and Handle Pattern in Stock Market Technical Analysis"

The Cup and Handle pattern is one of the most popular and reliable chart patterns in technical analysis, often used by traders to identify bullish trends in stocks, forex, and other financial markets. Whether you're a beginner or an experienced trader, understanding this pattern can greatly improve your trading strategy and increase your chances of success. In this post, we'll walk you through how to identify and trade the Cup and Handle pattern, along with tips for effectively incorporating it into your trading plan.

1. What is the Cup and Handle Pattern?

The Cup and Handle pattern is a technical chart formation that resembles the shape of a tea cup. It is a bullish continuation pattern that suggests a stock or asset is likely to continue its upward trend after a brief consolidation. The pattern consists of two main parts:

The Cup: This represents a rounded, U-shaped decline followed by a recovery. It usually takes several weeks or months to form and indicates a period of accumulation or consolidation.

The Handle: After the cup forms, there is a smaller consolidation or pullback that looks like a handle. The handle typically slopes downward, but it should not dip below the halfway point of the cup. This is the final phase before the stock breaks out to the upside.

2. How to Identify the Cup and Handle Pattern

Identifying the Cup and Handle pattern requires attention to detail and patience. Here are the key steps to look for:

a. Forming the Cup

Rounded Decline: The cup should have a smooth, rounded bottom. The decline in price should be gradual, not sharp. Ideally, it should take several weeks or months to form.

Volume Decline: During the decline, volume typically decreases as the price moves lower.

Recovery: After reaching the bottom, the price should begin to recover, forming the right side of the cup. Volume should increase as the price begins to rise, indicating renewed interest from buyers.

b. Forming the Handle

Consolidation: After the cup is complete, the handle forms through a period of consolidation, often lasting from a few days to a few weeks. This consolidation represents a brief pause or "breather" before the next move up.

Volume: Volume should ideally decrease during the formation of the handle and then spike as the breakout occurs.

Handle Position: The handle should not fall below the halfway point of the cup's height. If it does, the pattern may be invalid or less reliable.

c. Breakout Confirmation

Breakout Point: Once the handle has formed and the price breaks above the handle's resistance level, it signals a potential buy point.

Volume Surge: A breakout should be accompanied by an increase in volume. This confirms that the breakout is supported by strong buying interest.

3. Psychology Behind the Cup and Handle Pattern

Understanding the psychology behind the Cup and Handle pattern can help explain why this pattern is so powerful. Here’s how it works:

The Cup Formation: The decline in price and the subsequent recovery reflect a period of accumulation and consolidation. Initially, sellers dominate the market, but as the price reaches the bottom, buying interest starts to increase, leading to a gradual recovery.

The Handle Formation: The brief pullback or consolidation represents a "resting phase." Traders take profits, and the stock consolidates before resuming its upward trend. This consolidation is healthy because it helps the stock gain enough momentum for the next leg up.

The Breakout: When the price breaks above the handle, it represents renewed bullish sentiment and the beginning of the next phase in the stock’s upward journey. Traders who missed the initial run-up may enter the trade at this point.

4. How to Trade the Cup and Handle Pattern

Once you’ve identified the Cup and Handle pattern on a stock chart, it’s time to develop a trading strategy. Here’s a step-by-step guide:

a. Entry Point

Buy Signal: The ideal entry point is when the price breaks above the resistance level formed by the top of the cup (the "rim" of the cup). This breakout signals that the stock is ready to continue its upward movement.

Wait for Volume Confirmation: Before entering the trade, wait for a surge in volume. This confirms that the breakout is legitimate and supported by market participants.

b. Stop Loss

Setting a Stop Loss: A good risk management strategy involves placing a stop loss below the lowest point of the handle. This will protect you in case the price fails to breakout or reverses.

c. Profit Target

Measuring the Price Target: To estimate the potential price movement after the breakout, measure the height of the cup from the bottom to the top and then add that distance to the breakout point. This gives you a rough price target for the next leg up.

d. Risk-to-Reward Ratio

Optimal Risk-to-Reward: The ideal risk-to-reward ratio for a Cup and Handle trade is at least 2:1. For example, if you're risking $1 on the trade (the distance between your entry and stop loss), you should aim to make at least $2 in profit.

5. Common Mistakes to Avoid When Trading the Cup and Handle Pattern

While the Cup and Handle pattern can be highly profitable, there are some common pitfalls to watch out for:

Misinterpreting the Handle: If the handle falls below the midpoint of the cup, it may indicate a weaker pattern or invalid signal.

Not Waiting for Confirmation: Don’t enter a trade until you see the breakout above the handle with an increase in volume. Entering too early can lead to false breakouts.

Ignoring Market Conditions: The Cup and Handle pattern works best in an overall uptrend or strong market conditions. Trying to trade this pattern in a downtrend or choppy market can lead to poor results.

6. Real-World Examples of Cup and Handle Patterns

To further illustrate how the Cup and Handle pattern works, let’s take a look at a few historical examples from well-known stocks:

Example 1: Apple Inc. (AAPL): During the 2009-2010 period, Apple formed a classic Cup and Handle pattern. After breaking above the handle’s resistance, the stock surged by over 40% in the following months.

Example 2: Tesla (TSLA): Tesla’s stock has repeatedly shown Cup and Handle patterns during its bull runs, providing excellent opportunities for traders to enter the market.

7. Conclusion: Mastering the Cup and Handle Pattern

The Cup and Handle pattern is one of the most powerful and well-known chart formations used by traders to spot bullish trends. By learning to identify the pattern correctly, waiting for confirmation, and using proper risk management techniques, you can significantly enhance your trading success. Whether you're trading stocks, forex, or cryptocurrencies, incorporating the Cup and Handle pattern into your technical analysis toolkit can give you a significant edge in the market.

0 notes

Text

Top 10 Accurate Forex Signals Service Providers for the United Arab Emirates.

The forex trading scene in the United Arab Emirates (UAE) has witnessed remarkable growth over the years. Traders in the UAE are not just looking for profit opportunities but also reliable and accurate forex signals to guide their decisions. Forex signals play a crucial role in helping traders execute well-informed trades with reduced risk. In this article, we highlight the top 10 forex signal providers for traders in the UAE, with Forex Bank Liquidity taking the top spot for its exceptional service and high accuracy.

1. Forex Bank Liquidity

When it comes to accurate and reliable forex signals, Forex Bank Liquidity leads the pack. Known for delivering consistently profitable signals, this provider has become a top choice for forex traders in the UAE and beyond. Their signals are generated using cutting-edge algorithms, professional market analysis, and deep industry expertise, ensuring a high success rate.

Key Features of Forex Bank Liquidity:

High Accuracy: Forex Bank Liquidity offers some of the most reliable signals in the industry, helping traders achieve their financial goals.

User-Friendly Platform: The service is intuitive and easy to use, making it suitable for beginners and experienced traders alike.

Real-Time Updates: Stay ahead of the market with instant notifications of trading opportunities.

24/7 Support: A dedicated team is available around the clock to assist clients with any inquiries.

Affordable Plans: Flexible subscription packages cater to traders with varying budgets and needs.

Whether you’re new to forex or an experienced trader, Forex Bank Liquidity offers tools and support to help you succeed in the dynamic forex market. Visit their website at www.forexbankliquidity.com to get started today.

2. Learn2Trade

Learn2Trade is a highly regarded forex signals provider that also offers educational resources for traders. Their accurate signals are based on thorough technical analysis, making them a trusted option for traders in the UAE who value both performance and learning opportunities.

Key Features:

Signals for forex, cryptocurrencies, and commodities.

Comprehensive learning materials for traders of all levels.

Accessible via Telegram, with real-time updates.

3. 1000pip Builder

A trusted name in forex signals, 1000pip Builder provides signals with a proven track record of accuracy. Their service is straightforward, focusing on delivering high-quality signals rather than overwhelming users with unnecessary features.

Key Features:

Consistently high win rates.

Signals delivered via email and Telegram.

Strong emphasis on transparency and customer satisfaction.

4. FX Leaders

FX Leaders is popular for offering free and premium forex signals, making it a versatile choice for UAE traders. Their platform covers multiple asset classes, providing a holistic trading experience.

Key Features:

Free and premium signal options.

Detailed analysis accompanying each signal.

Real-time signal updates via their app and website.

5. MQL5

MQL5 is a forex signal marketplace that allows traders to choose from thousands of signal providers. This flexibility makes it an attractive option for UAE traders with specific trading styles and goals.

Key Features:

Extensive list of signal providers to choose from.

Performance metrics available for all providers.

Seamless integration with MetaTrader platforms.

6. ForexSignals.com

ForexSignals.com offers more than just signals; it provides a complete trading ecosystem with live trading rooms, educational resources, and a supportive community.

Key Features:

Access to live trading sessions.

Comprehensive video courses for traders of all levels.

Interactive community forums for discussions and advice.

7. Forex GDP

Forex GDP focuses on providing fewer but highly accurate signals. Their “quality over quantity” approach has earned them a loyal following among UAE traders who prioritize precision.

Key Features:

Fewer signals with a high success rate.

In-depth market updates and analysis.

Flexible pricing plans, including free options.

8. ZuluTrade

ZuluTrade is a unique platform that combines social trading with accurate forex signals. It allows UAE traders to copy the strategies of top-performing traders, providing a hands-off approach to trading.

Key Features:

Social trading platform for following expert traders.

Performance-based ranking system for transparency.

Support for multiple asset classes.

9. Pipchasers

Pipchasers offers clear and concise forex signals that are easy to follow. Their focus on simplicity makes them a good choice for beginners in the UAE.

Key Features:

Straightforward signals with clear entry and exit points.

Community support for guidance and collaboration.

Multi-platform accessibility (Telegram, email, app).

10. Signal Start

Signal Start provides access to a marketplace of signal providers, allowing traders to select signals that align with their strategies and risk tolerance.

Key Features:

Thousands of signal providers with detailed performance metrics.

Automated trading integration.

Intuitive user interface for easy navigation.

Why UAE Traders Need Reliable Forex Signals

The forex market is highly volatile, making it challenging for traders to make consistent profits. Reliable forex signals help traders overcome this challenge by providing actionable insights based on technical and fundamental analysis. For traders in the UAE, choosing the right signals provider can mean the difference between success and frustration.

What to Look for in a Forex Signals Provider

When selecting a forex signals provider in the UAE, consider the following factors:

Accuracy: Look for providers with a proven track record of high accuracy.

Delivery Method: Ensure signals are delivered in real-time through convenient platforms like Telegram or email.

Customer Support: Reliable support is essential, especially for new traders.

Cost: Consider providers with transparent and flexible pricing plans.

Reputation: Research user reviews and testimonials to gauge the provider’s reliability.

Conclusion

Finding the right forex signals provider is crucial for achieving success in the forex market. Forex Bank Liquidity stands out as the top choice for traders in the UAE, thanks to its exceptional accuracy, user-friendly platform, and comprehensive support. The other providers listed here also offer excellent services, catering to different trading styles and preferences.

#forex expert advisor#forex robot#forexsignals#forex market#forexbankliquidity#digital marketing#forex#forex education#bankliquidity#forextrading

0 notes

Text

Top Forex Signals Service for Sri Lanka: A Complete Guide for 2024

Top Forex Signals Service for Sri Lanka: A Complete Guide for 2024

Forex trading in Sri Lanka has gained significant traction, with traders looking for effective ways to maximize profits. Forex signal services offer a convenient solution, delivering real-time trading advice and helping both beginners and experienced traders make well-informed decisions. In this guide, we’ll explore the best Forex signal services tailored for Sri Lankan traders, ranked based on accuracy, support, and user experience.

1. Forexbanksignal.pro – The Leading Forex Signal Service for Sri Lanka

When it comes to Forex signals, Forexbanksignal.pro is a top choice for Sri Lankan traders. Known for its high-quality signals, the service combines expertise and technology to provide some of the most reliable trading recommendations available. Here’s what makes Forexbanksignal.pro stand out:

Exceptional Accuracy: The signal accuracy at Forexbanksignal.pro is a major draw. By delivering precise entry and exit points, traders can minimize risks and enhance profitability. For Sri Lankan traders, where timing is crucial, the service’s timeliness is a major advantage.

Intuitive User Experience: Forexbanksignal.pro offers a straightforward interface and delivers signals through popular channels like Telegram. This allows users to receive notifications instantly, regardless of location or trading experience level.

Expert Analysis: Each signal comes with an in-depth market analysis, so users gain valuable insight into market trends and trading strategies. For beginners and advanced traders alike, this feature helps to build trading knowledge.

Dedicated Support: The service provides dedicated customer support for its users, ensuring that all queries are addressed swiftly.

Forexbanksignal.pro’s commitment to high accuracy, detailed insights, and top-tier customer service makes it a top Forex signal service for Sri Lankan traders in 2024.

2. Dailyforexsignals.pro – A Trusted Service with Consistent Results

Daily forex signals secures the second spot on our list, recognized for its dependable performance and ease of use. For Sri Lankan traders seeking a service that consistently delivers accurate signals, Dailyforexsignals.pro is a solid choice.

Reliable Signal Delivery: Dailyforexsignals.pro offers real-time alerts, ensuring users don’t miss trading opportunities. The signals cover a range of popular currency pairs, making it a versatile choice for Sri Lankan traders.

Easy-to-Follow Signals: Signals are provided with clear instructions, including entry price, stop loss, and take profit levels. This straightforward format is ideal for beginners who want to minimize the learning curve.

User Testimonials and Positive Reviews: Dailyforexsignals.pro is frequently praised by users for its reliable customer service and profitability, making it a trusted service with a strong reputation.

With its reliable signals and user-friendly approach, Dailyforexsignals.pro is an excellent choice for traders in Sri Lanka seeking stability and proven results.

3. Goldsmartrisk.com – Specialized Forex and Gold Trading Signals

Goldsmartrisk.com is a great option for traders interested in both Forex and precious metals like gold. This service specializes in offering signals that combine Forex trading strategies with a focus on commodities.

Focus on Precious Metals: Goldsmartrisk.com is known for its expertise in gold trading, making it a popular choice for Sri Lankan traders looking to diversify their portfolios. Gold trading can be highly profitable, and this platform provides traders with reliable, well-researched insights.

Accuracy and Precision: The service has a high win rate, supported by strong technical and fundamental analysis. With signals that have clear entry and exit points, Goldsmartrisk.com helps minimize trading risks.

Educational Content and Risk Management: Beyond signals, Goldsmartrisk.com provides resources to help traders understand market trends and manage risks effectively.

For Sri Lankan traders looking to expand into commodities, Goldsmartrisk.com is a perfect choice, offering precise Forex and gold signals backed by solid analysis.

4. Fxdailypips.com – Comprehensive Forex Signal Service for All Trader Levels

Fxdailypips.com ranks fourth on our list, known for its well-rounded service catering to both novice and experienced traders. With consistent results and affordable pricing, it’s a great option for those who want versatility in their trading.

Wide Range of Signals: Fxdailypips.com offers both short-term and long-term trade recommendations, catering to a variety of trading styles. This flexibility allows traders to choose signals that align with their individual strategies.

Detailed Market Insights: The service provides market analysis with each signal, giving traders a better understanding of why certain trades are recommended. This transparency is valuable for Sri Lankan traders who want a better grasp of market conditions.

Affordable Plans: With pricing options suitable for all budgets, Fxdailypips.com ensures that traders can access its services without overspending.

For traders in Sri Lanka who want a service with broad coverage and accessible pricing, Fxdailypips.com is a highly recommended choice.

Additional Forex Signal Services Worth Considering in Sri Lanka

Beyond our top picks, here are three more services that can be beneficial for Sri Lankan Forex traders:

1000pipbuilder: Known for its experienced team and high win rate, 1000pipbuilder provides daily signals with detailed instructions. The service is well-regarded globally for accuracy, and its straightforward signals make it ideal for both beginners and advanced traders.

Learn2Trade: Learn2Trade stands out for its educational focus, offering signals alongside resources like tutorials, webinars, and articles. This service is especially beneficial for traders who want to improve their skills and deepen their understanding of the Forex market.

FXLeaders: With real-time market updates and signals, FXLeaders provides a comprehensive view of market movements. The platform is particularly user-friendly, making it an excellent choice for traders who want quick, digestible information to guide their trades.

Choosing the best Forex signal provider in Sri Lanka requires considering accuracy, customer support, and ease of use. Here’s a quick recap of the top choices:

Forexbanksignal.pro – The leading choice for high accuracy, comprehensive analysis, and dedicated support.

Dailyforexsignals.pro – A reliable service known for consistent results and positive user reviews.

Goldsmartrisk.com – Ideal for traders interested in both Forex and precious metals, offering specialized insights.

Fxdailypips.com – A versatile provider suitable for all trader levels, with affordable pricing and wide-ranging insights.

Each of these services has unique strengths, so choosing one depends on your specific needs and trading style. By selecting the right signal provider, Sri Lankan traders can make more informed trading decisions, manage risks better, and optimize their trading strategies for success.

#daily forex signals#best forex trading platforms#best forex brokers#best forex signals#forex expert advisor#forexsignals#forex market#forextrading#forex

0 notes

Text

Discover the Power of Forex Trading Courses: A Beginner's Path to Success

Entering the world of Forex trading can be both exciting and intimidating. With its potential for high returns and its complexity, it’s no wonder that many beginners feel overwhelmed. However, there’s a solution that can make this journey smoother and more successful—a Forex trading course. In this article, we’ll explore the unique advantages of taking a Forex trading course, helping you understand how it can transform your trading experience.

The Unique Advantages of a Forex Trading Course

Tailored Learning Experienc

Unlike generic online resources, a Forex trading course is designed to guide you through the learning process step-by-step. This tailored approach ensures that you grasp each concept before moving on to the next, building a strong foundation.

Interactive and Engaging

Modern Forex courses often incorporate interactive elements such as live webinars, Q&A sessions, and practical exercises. This engagement helps solidify your understanding and makes learning more enjoyable.

Access to Exclusive Insights

Many courses offer access to proprietary tools, trading signals, and expert insights that you won’t find elsewhere. These exclusive resources can give you a competitive edge in the market.

How a Forex Trading Course Transforms Your Trading Journey

Building a Solid Foundation

A good course starts with the basics, covering everything from Forex terminology to understanding currency pairs. This ensures that even complete beginners can get up to speed quickly.

Developing Advanced Skills

As you progress, courses delve into more advanced topics such as technical analysis, chart patterns, and trading strategies. This gradual increase in complexity helps you develop the skills needed for successful trading.

Practical Application

Theory is important, but practical application is where real learning happens. Quality courses provide access to demo accounts and simulated trading environments, allowing you to practice without risking real money.

Mastering Risk Management

One of the biggest challenges in Forex trading is managing risk. Courses teach you how to set stop-loss orders, calculate position sizes, and develop risk management plans to protect your capital.

Psychological Preparedness

Trading psychology is a crucial aspect often overlooked by beginners. A comprehensive course will address the psychological challenges of trading, helping you stay disciplined and avoid emotional decisions.

Choosing the Right Forex Trading Course

Comprehensive Curriculum

Ensure the course covers a wide range of topics, from the basics to advanced strategies. Look for courses that balance theory with practical application.

Qualified Instructors

The best courses are taught by experienced traders with a proven track record. Research the instructors' backgrounds and read reviews to ensure they are credible and effective educators.

Interactive Elements

Opt for courses that offer interactive features like live sessions, forums, and direct access to instructors. These elements enhance your learning experience and provide opportunities for personalized feedback.

Support and Resources

Choose a course that offers ongoing support and access to additional resources such as trading tools, market analysis, and educational materials. Continuous learning is key to staying ahead in the Forex market.

Real Stories: How Forex Trading Courses Made a Difference

Anna’s Success Story

Anna, a complete novice, enrolled in a Forex trading course after struggling to understand the market on her own. The structured curriculum and hands-on practice helped her gain confidence. Today, she consistently makes profitable trades and attributes her success to the foundational knowledge gained from the course.

James’ Journey

James had some experience in trading but lacked a solid strategy. After taking an advanced Forex trading course, he learned how to develop and implement a trading plan. The course's emphasis on risk management transformed his approach, leading to more consistent profits.

Conclusion

Forex trading can be a rewarding endeavor, but it requires knowledge, skill, and discipline. A Forex trading course provides a structured, comprehensive, and engaging learning experience that equips you with the tools needed for success. Whether you're a complete beginner or looking to refine your trading strategies, investing in a quality Forex trading course can set you on the path to achieving your trading goals. Embrace the opportunity to learn from the experts, practice in a supportive environment, and master the art of Forex trading.

0 notes

Text

A Comprehensive Beginner’s Guide to Trading

Trading in financial markets can be both exciting and daunting for beginners. Understanding the fundamentals and gaining knowledge about various strategies and market dynamics are crucial steps toward becoming a successful trader. Here’s a comprehensive guide that covers essential topics every beginner should know:

Economic Indicators and Market Impact

Explore how economic indicators like inflation and interest rates affect stock market performance. Economic indicators are vital signals that provide insights into the health of an economy and how it impacts financial markets. Inflation, for instance, measures the rate at which prices for goods and services rise, influencing consumer purchasing power and corporate profitability. Understanding these dynamics is crucial for anticipating market movements and making informed investment decisions.

T+1 Settlement Cycle

Understand the shift to T+1 settlement and its implications on trade execution and market liquidity. Traditionally, stock trades settled on a T+2 basis, meaning transactions were completed two days after the trade date. The move to T+1 settlement shortens this cycle to one day, reducing risk exposure and improving market efficiency. This change affects how quickly trades settle, influencing trading strategies and risk management. It’s essential for traders to adapt their approach to ensure seamless execution and mitigate settlement-related risks.

Day Trading Strategies

Discover effective day trading strategies tailored for fast-paced markets. Day trading involves buying and selling financial instruments within the same trading day to capitalize on short-term price movements. Successful day traders rely on technical analysis, chart patterns, and market indicators to identify opportunities quickly. They also implement risk management techniques like setting stop-loss orders to limit potential losses. Day trading requires discipline, market awareness, and the ability to react swiftly to changing market conditions.

Swing Trading

Balance risk and reward with swing trading, a strategy that targets short to medium-term market moves. Unlike day trading, swing trading focuses on capturing price swings over a period of days to weeks. Traders use technical analysis tools like moving averages, trendlines, and Fibonacci retracements to identify entry and exit points. Swing traders aim to profit from upward or downward price movements while managing risk through strategic position sizing and stop-loss orders. This approach allows traders to capitalize on market trends and patterns without constantly monitoring the markets throughout the day.

Forex Trading

Master the currency markets with effective forex trading strategies. The forex market is the largest and most liquid financial market globally, where currencies are traded 24 hours a day, five days a week. Forex traders analyze economic data, geopolitical events, and central bank policies to anticipate currency movements. Technical analysis tools like support and resistance levels, candlestick patterns, and momentum indicators help traders make informed trading decisions. Leverage amplifies both potential profits and losses in forex trading, making risk management crucial for preserving capital.

Options Trading

Unlock the potential of derivatives with options trading. Options provide traders with the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified timeframe. Traders use options for hedging, speculation, and income generation. Understanding options strategies like calls, puts, straddles, and spreads allows traders to capitalize on market volatility and directional movements. Options trading requires a solid understanding of market fundamentals, risk management, and the potential impact of implied volatility on option prices.

Psychology of Trading

Master your emotions for trading success by exploring the psychological aspects of trading. Emotions like fear, greed, and overconfidence can cloud judgment and lead to impulsive trading decisions. Successful traders develop discipline, patience, and emotional resilience to navigate market fluctuations. Techniques such as mindfulness, journaling, and maintaining a trading plan help traders stay focused and objective. Managing emotions allows traders to stick to their trading strategy and make rational decisions based on market analysis rather than emotions.

Risk Management

Protect your capital with effective risk management strategies. Risk management is crucial for preserving and growing your investment portfolio. Techniques like setting stop-loss orders, diversifying your investments, and allocating capital based on risk tolerance help mitigate potential losses. Traders should assess risk-reward ratios before entering trades and avoid overleveraging positions. Consistent risk management practices safeguard traders against unexpected market events and ensure long-term trading success.

Algorithmic Trading

Understand automated trading strategies with algorithmic trading. Algorithmic trading uses computer algorithms to execute trades based on pre-defined criteria such as price, volume, and timing. These algorithms analyze market data at high speeds and can execute trades faster than human traders. Benefits of algorithmic trading include increased trade accuracy, reduced emotional bias, and the ability to backtest strategies using historical data. Traders can develop custom algorithms or use pre-built algorithms to capitalize on market inefficiencies and opportunities.

ESG Investing

Explore the rise of ESG (Environmental, Social, Governance) investing and its impact on trading practices. ESG investing integrates environmental, social, and governance factors into investment decisions to generate long-term sustainable returns. Investors consider factors like corporate ethics, carbon footprint, and social responsibility when selecting investments. ESG criteria influence market trends and regulatory developments, making it essential for traders to understand how sustainable practices shape financial markets.

Conclusion

Embarking on a trading journey requires understanding market fundamentals, developing effective strategies, and mastering risk management and psychology. Whether you’re interested in day trading, swing trading, forex, options, or algorithmic trading, continuous learning and practical experience will pave the way to becoming a successful trade.

To learn more about trading, visit tacracked.ai

1 note

·

View note

Text

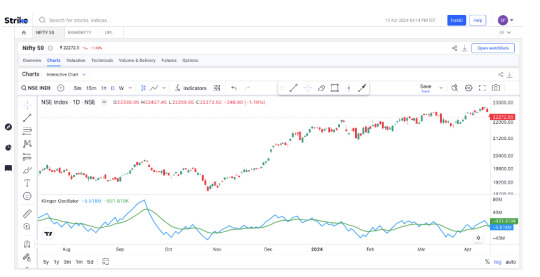

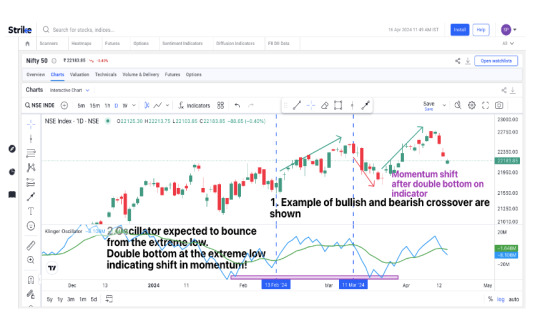

✅ Complete Guide to Klinger Oscillator: How to Use It for Smarter Trades in 2025

Ever wondered how traders spot big moves before they happen? Enter the Klinger Oscillator, a powerful volume-based indicator that doesn’t just track price—it tracks the heartbeat of the market. Whether you're a beginner trying to decode charts or a pro looking to fine-tune entries, this guide breaks it all down with real-world examples from the Indian stock market, key stats, and actionable insights.

Let’s dive in!

🔍 What Exactly Is the Klinger Oscillator? (And Why Should You Care?)

The Klinger Oscillator was developed by Stephen J. Klinger back in 1977 to solve a crucial problem: traditional indicators were focusing too much on price while ignoring the underlying volume dynamics driving those prices.

In simple terms, the Klinger Oscillator tries to answer: 👉 “Is the smart money buying or selling behind the scenes?”

It measures long-term money flow trends while also spotting short-term price reversals. This dual focus makes it popular among traders in stocks, forex, crypto, and even commodities.

In India, traders use the Klinger Oscillator on platforms like Strike Money, TradingView to analyze stocks like Reliance Industries, HDFC Bank, and Tata Motors.

Fun fact: Many technical analysts on NSE and BSE use the Klinger Oscillator to confirm signals from the MACD or Relative Strength Index (RSI)!

🧮 How Does the Klinger Oscillator Actually Work? A Simplified Breakdown

Don’t worry—you don’t need a math degree to get this.

The Klinger Oscillator calculates the difference between two exponential moving averages (EMA) of volume force. This volume force is derived from price, volume, and trend direction.

👉 It then plots an oscillator line and a signal line (typically a 13-period moving average of the oscillator).

When the oscillator crosses above the signal line, it’s a bullish signal. When it crosses below, it’s bearish.

✅ Example from Indian markets: In January 2024, the Klinger Oscillator for Infosys (INFY) crossed above its signal line just as the stock began a 12% rally over the next 3 weeks. Traders who spotted this crossover early booked solid profits!

According to research published in the International Journal of Financial Markets (2021), volume-based indicators like Klinger outperform price-only indicators during accumulation and distribution phases in emerging markets like India.

⚔️ Klinger Oscillator vs MACD: Which One Wins for Traders?

A common question: “If I already use MACD, do I need Klinger?”

Here’s the deal.

Both Klinger and MACD use EMA crossovers, but MACD focuses purely on price momentum, while Klinger integrates volume analysis. This extra layer of information can help filter out false breakouts.

👉 Example: In August 2023, Nifty Bank showed a bullish MACD crossover. But the Klinger Oscillator stayed negative. Sure enough, the rally fizzled out after 2 days—Klinger was warning that buying volume wasn’t strong enough to sustain the move.

💡 Many pro traders on Strike Money recommend using MACD for trend confirmation and Klinger for early entry signals.

So, it’s not about choosing one or the other—it’s about using them together for more confidence!

🎯 Best Settings for Klinger Oscillator in Indian Stocks, Forex & Crypto

One size doesn’t fit all when it comes to indicator settings.

By default, most platforms like TradingView and Strike Money set Klinger parameters to 34, 55, and 13. But Indian market conditions sometimes call for tweaking.

👉 For NSE stocks: Many traders use 21, 34, 13 to catch shorter-term swing opportunities. 👉 For Bank Nifty intraday trades: Parameters like 13, 21, 9 are popular for capturing quick momentum shifts. 👉 For cryptocurrencies (on platforms like WazirX): Traders experimenting with 34, 55, 21 report better trend confirmation.

A 2022 study by the Indian Institute of Quantitative Finance found that customizing Klinger settings improved profitability by 8-12% over default settings across high-beta Indian stocks.

💥 Pro Tip: On Strike Money, you can easily backtest different Klinger settings against historical data to see what works for your trading style!

💹 How to Trade Using Klinger Oscillator: Proven Strategies That Work

Ready to turn theory into profits? Here are ways Indian traders are using the Klinger Oscillator today:

✨ 1️⃣ Signal Line Crossovers: When the oscillator crosses above the signal line, it suggests buying pressure. Traders buy Nifty Futures when this happens around support zones.

👉 Example: On March 18, 2024, the Klinger Oscillator crossed up on HDFC Bank just before it rallied 7% in 10 days.

✨ 2️⃣ Divergence Signals: Watch for bullish divergence (price makes lower lows, Klinger makes higher lows). This often hints at smart money accumulation.

👉 Example: In September 2023, Tata Motors showed bullish divergence on Klinger even as it fell 3%—by October, it surged 15%.

✨ 3️⃣ Combining With Moving Averages: Use Klinger confirmation with 50- or 200-day moving averages to avoid false signals.

👉 Example: Traders on Strike Money wait for Klinger crossover AND price above 50-DMA before entering swing trades in Infosys.

According to a Bloomberg Quant report (2023), combining Klinger Oscillator with trend indicators reduced whipsaws by 27% in volatile markets.

🚩 Watch Out! Common Pitfalls When Using Klinger Oscillator

The Klinger Oscillator isn’t perfect.

😬 False Signals in Sideways Markets: When markets are choppy, Klinger can flip-flop between bullish and bearish signals.

👉 In July 2023, ITC Ltd traded sideways while Klinger gave 4 fake signals in 2 weeks.

😬 Overreliance on One Indicator: No single tool guarantees success. Pair Klinger with price action, support-resistance, and volume profile for better results.

😬 Delayed Signals on Low-Volume Stocks: Klinger works best on liquid stocks like Reliance, TCS, SBI. Thinly traded stocks may show lag or noise.

A 2020 study by NSE Research Institute highlighted that volume-based indicators underperform in stocks with average daily volume under ₹5 crore.

👉 Solution? Focus on Nifty 50 and Bank Nifty components where volume is more reliable.

🖥️ How to Set Up Klinger Oscillator on Strike Money, TradingView

If you're using Strike Money, here’s how to add the Klinger Oscillator:

✅ Go to Indicators → Search “Klinger” → Add to Chart ✅ Customize parameters under Settings ✅ Overlay the signal line ✅ Done!

👉 On TradingView the steps are similar. Simply search for “Klinger Oscillator” in the indicators library and adjust settings as needed.

Many traders on Strike Money share custom scripts that add alerts when Klinger crosses the signal line, so you never miss a move even when you’re not watching the charts.

❓ FAQs About the Klinger Oscillator: Answering Popular Trader Questions

🤔 Does the Klinger Oscillator work for intraday trading? Yes—but it’s more effective on higher timeframes (1H, 4H, Daily). For 5-min or 15-min charts, pair it with faster indicators like stochastic RSI.

🤔 Can Klinger Oscillator predict trend reversals? It can signal early shifts in volume flow, which often precede price reversals. But confirmation with price action is recommended.

🤔 Is Klinger Oscillator better for stocks or crypto? It works for both. But in crypto markets, volatility may cause more whipsaws, so use wider settings.

🤔 Does the Klinger Oscillator repaint? No. Once a candle closes, the oscillator value is fixed. But signals may appear unreliable on thinly traded or illiquid assets.

🚀 Final Thoughts: Should You Add the Klinger Oscillator to Your Trading Toolbox?

The Klinger Oscillator isn’t magic—it’s a lens to see volume behind price moves. In the Indian stock market, it’s especially useful for spotting accumulation, distribution, and divergence signals in heavyweights like Reliance, HDFC Bank, TCS, Infosys, and ICICI Bank.

By combining it with tools like MACD, moving averages, and Strike Money’s custom charting features, you’ll gain better clarity in trend detection and entry timing.

The next time you're analyzing a stock chart, ask yourself: 👉 “Is the price move backed by real volume—or just noise?” The Klinger Oscillator might just give you the answer.

Now go test it out on Strike Money and see how it fits your trading strategy!

✨ Ready to level up? Start using the Klinger Oscillator on Strike Money today and trade smarter with volume insights!

0 notes

Text

Complete Guide to Forex Trading Signals for Beginners

Welcome to the world of forex trading signals for beginners – your secret weapon for successful currency exchange. With Funded Traders Global as your trusted partner, this guide is your ticket to unlocking the power of these signals. Whether you’re new to trading or an experienced hand, our aim is straightforward: to demystify forex trading 2023 signals and spotlight how Funded Traders Global can propel your trading journey. As you journey through this guide, you’ll gain the insights and skills needed to make smart moves in the forex market and work toward your financial goals.

So, let’s begin…

But Before that you can check our previous blog on 6 Latest Trends in Forex Trading Strategies in 2023 And Beyond

We have divided this blog into 2 different blogs for learning more about Common Mistakes to Avoid in Forex Trading Signals, Practical Tips for Using Forex Trading Signals, and many more. Do check out “Easy Forex Trading with Smart Signals”

What is Forex?

Forex, short for foreign exchange, is the largest and most liquid financial market in the world. It operates 24 hours a day, five days a week, allowing traders to buy and sell currencies from different countries. The primary objective of forex trading is to profit from fluctuations in exchange rates. These rate changes occur due to various factors such as economic data releases, geopolitical events, and market sentiment.

Currency Pairs

One of the distinctive features of forex trading is the concept of currency pairs. In forex, you’re not trading individual currencies but pairs of them. A currency pair consists of two currencies, with one being the base currency and the other the quote currency. The exchange rate represents the relative value of these two currencies. For example, in the EUR/USD currency pair, the euro (EUR) is the base currency, and the U.S. dollar (USD) is the quote currency. Understanding these pairs is crucial for successful trading.

Market Participants

Forex is a decentralized market, meaning it has no central exchange. Instead, it operates through a global network of banks, financial institutions, corporations, governments, and individual traders. Here are some key market participants:

Retail Traders: These are individual traders like you and me who trade currencies for personal investment.

Institutional Traders: Large financial institutions, banks, and corporations participate in forex to manage their currency exposure or for speculative purposes.

Central Banks: Central banks, like the Federal Reserve or the European Central Bank, have a significant impact on forex markets through monetary policy decisions.

Brokers: Forex brokers act as intermediaries between retail traders and the interbank forex market. They provide access to trading platforms and execute traders’ orders.

The Role of Brokers

Forex brokers play a crucial role in facilitating your participation in the forex market. They offer a platform for trading, provide access to currency pairs, and execute your orders. It’s essential to choose a reputable and regulated broker to ensure the security of your funds and the reliability of your trading experience. Funded Traders Global, an organization dedicated to nurturing aspiring traders, can help you navigate the complex world of forex trading. They offer educational resources, support, and funding to traders who demonstrate their skills and commitment. As you progress through this guide, you’ll gain valuable insights into how Funded Traders Global can be a valuable partner on your forex trading journey.

Basics of Trading Signals

In this section, we’ll demystify the concept of trading signals and explore why they are valuable, especially for beginners. We’ll also discuss the advantages of using signals in your forex trading journey, with a nod to the role that Funded Traders Global plays in guiding traders like you.

Defining Forex Trading Signals

Forex trading signals are like navigational beacons in the vast sea of currency markets. They are notifications or suggestions that help you make informed decisions about buying or selling currency pairs. These signals are typically generated by experienced traders, automated systems, or specialized software. They provide insights into potential market movements and entry/exit points for trades.

Why Signals Matter for Beginners

For beginners, forex trading can be a daunting endeavor. The forex market operates 24/5, and its dynamics can be complex. This is where trading signals come to the rescue. They serve as a guiding light, helping newcomers understand the market’s trends and opportunities. With the right signals, you can make better-informed decisions and gain confidence in your trading strategies.

The Benefits of Using Signals

Using forex trading signals offers several advantages:

Learning Opportunity: Signals provide a valuable learning experience for beginners. By analyzing the provided signals and understanding the rationale behind them, you can enhance your trading knowledge and skills.

Save Time: Analyzing the forex market can be time-consuming. Signals save you time by offering clear entry and exit points, which means you don’t have to spend hours studying charts and data.

Reduced Emotional Stress: Emotions can cloud judgment in trading. Signals provide a systematic, data-driven approach, reducing emotional stress and impulsive decision-making.

Diversification: Signals often cover a wide range of currency pairs and trading strategies, allowing you to diversify your trading portfolio.

Access to Expertise: Many signals are created by experienced traders who have a deep understanding of the forex market. This expertise can help you make more informed decisions.

Funded Traders Global recognizes the significance of trading signals for aspiring traders. They offer guidance on selecting and using trading signals effectively, along with other valuable resources and support. As you progress through this guide, you’ll discover how Funded Traders Global can be your ally in mastering the art of forex trading.

Types of Forex Trading Signals

In the following part, we’ll have a look at the various types of forex trading signals for beginners that can guide your trading decisions. We’ll cover technical analysis signals, fundamental analysis signals, and sentiment analysis signals, all while considering the role that Funded Traders Global plays in helping traders like you navigate this vast landscape.

Technical Analysis Signals

Technical analysis signals are based on the study of historical price charts and patterns. They help traders identify potential entry and exit points. Here are some key components:

Candlestick Patterns: These are visual representations of price movements that can indicate potential reversals or continuations in the market.

Indicators (RSI, MACD, Moving Averages, etc.): Technical indicators provide quantitative data derived from price and volume, helping traders make informed decisions. Examples include the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and various moving averages.

Funded Traders Global offers valuable insights into using technical analysis signals effectively, enhancing your technical analysis skills.

Fundamental Analysis Signals

Fundamental analysis signals are driven by economic and geopolitical events. They consider factors that can impact a currency’s value. Key components include:

Economic Indicators: Signals generated from economic data releases, such as GDP growth, employment figures, and inflation rates.

News Events: Major news events and geopolitical developments can lead to significant market movements, and these are considered in fundamental analysis.

Funded Traders Global equips traders with the knowledge to interpret and capitalize on fundamental analysis signals, helping you navigate the ever-changing economic landscape.

Sentiment Analysis Signals

Sentiment analysis signals focus on the mood and perceptions of traders in the market. They can be used to gauge market sentiment, which is often a powerful driving force in the forex market. Key elements include:

Market Sentiment Indicators: These indicators assess the overall sentiment in the market, helping traders understand whether the majority of participants are bullish or bearish.

By understanding sentiment analysis signals, you can make decisions that align with the market’s prevailing sentiment, potentially improving your trading outcomes.

Funded Traders Global recognizes the significance of all these signal types and provides guidance on how to incorporate them into your trading strategy. As you advance in your trading journey, you’ll discover how Funded Traders Global can be your partner in mastering the art of forex trading through the use of these diverse signals.

How to Find Forex Trading Signals

In the following section, we’ll delve into the practical aspects of finding forex trading signals for beginners. We’ll explore signal providers, discuss their pros and cons, and guide you on how to choose a reliable one. We’ll also touch upon self-analysis, researching forex news sources, economic calendars, and market analysis tools while highlighting the role Funded Traders Global plays in this process.

Signal Providers

Signal providers are individuals or companies that generate and offer trading signals to traders. They can be a valuable resource for traders seeking guidance and insights. There are various types of signal providers:

Professional Traders: Experienced traders who share their signals based on their expertise and analysis.

Automated Systems: Algorithms and software that generate signals based on predefined criteria.

Forex Signal Services: Companies that offer a subscription-based service, providing signals and analysis to their clients.

Pros and Cons

Pros of using signal providers:

Access to expertise and insights.

Time-saving, as you don’t need to perform in-depth analysis.

Reduces emotional trading decisions.

Cons to be aware of:

The cost involved, especially for subscription services.

Dependency on external sources for trading decisions.

The a need to verify the reliability of the signal provider.

How to Choose a Reliable Provider

When choosing a signal provider, consider the following:

Track Record: Look for a provider with a consistent and verifiable track record.

Transparency: Ensure the provider is transparent about their methodology and risk management.

Reviews and Recommendations: Seek feedback and recommendations from other traders.

Customer Support: Good customer support is essential for addressing your queries and concerns.

Self-Analysis and Research

It’s also crucial to engage in self-analysis and research:

Understand your risk tolerance and trading goals.

Assess how a provider’s signals align with your strategy.

Continuously learn and adapt to the changing market conditions.

Forex News Sources

Stay updated with relevant forex news sources:

Financial news websites, like Bloomberg and Reuters.

Government economic reports.

Forex-specific news websites.

Economic Calendars

Economic calendars list key economic events, releases, and announcements:

Monitor events that could impact currency values.

Plan your trading activities around significant announcements.

Market Analysis Tools

Leverage market analysis tools:

Forex charts and technical indicators.

Trading platforms with built-in analysis tools.

Funded Traders Global provides valuable resources and support for traders to enhance their analysis skills.

Funded Traders Global can be a valuable partner in your journey to find reliable signals. They offer guidance on selecting signal providers, performing self-analysis, and staying informed with the latest news and market analysis tools. As you progress in your trading journey, you’ll appreciate the role Funded Traders Global plays in your development as a successful trader.

Interpreting Forex Trading Signals

We’ll dive into the art of interpreting forex trading signals for beginners. Whether you’re reading price charts, deciphering technical indicators, analyzing fundamental data, or evaluating sentiment indicators, we’ll help you make sense of it all. Plus, we’ll show you how Funded Traders Global can assist you on this journey.

Reading Price Charts

Reading price charts is fundamental to understanding market movements. Here’s how:

Candlestick Patterns: Learn to recognize these visual representations of price movements. Patterns like dojis, hammers, and engulfing candles can signal potential reversals or continuations.

Trendlines: Identify and draw trendlines to spot prevailing market trends.

Support and Resistance Levels: Pinpoint price levels where currencies often change direction.

Funded Traders Global provides guidance on interpreting price charts effectively and using them to your advantage.

Understanding Technical Indicators

Technical indicators are quantitative tools that help you assess market conditions. Key ones include:

RSI (Relative Strength Index): Measures the strength and speed of price movements, indicating overbought or oversold conditions.

MACD (Moving Average Convergence Divergence): Reveals changes in the strength, direction, momentum, and duration of a trend.

Moving Averages: Smooth out price data to identify trends and reversals.

Funded Traders Global equips you with the knowledge to understand and utilize technical indicators efficiently.

Analyzing Fundamental Data

Fundamental data involves economic and geopolitical factors that influence currency values. Here’s how to analyze it:

Economic Indicators: Pay attention to releases like GDP growth, employment figures, and interest rate decisions. Assess how these data points affect the currency you’re trading.

News Events: Stay updated on significant news events, as they can cause rapid market movements.

Funded Traders Global helps you interpret and make sense of fundamental data in the context of your trading strategy.

Evaluating Sentiment Indicators

Sentiment indicators provide insights into market participants’ mood. Here’s how to evaluate them: Market Sentiment Indicators: These tools gauge whether traders are predominantly bullish or bearish. They help you align with the market sentiment. Funded Traders Global supports you in understanding sentiment indicators and how they can inform your trading decisions. As you master the art of interpreting forex trading signals, Funded Traders Global serves as your mentor and partner. They offer resources, guidance, and a community of traders to help you refine your skills and achieve your trading goals. Your journey to becoming a successful trader is enriched with their support and expertise.

Risk Management in Forex Trading

In this, we’ll explore the critical aspect of risk management in forex trading. We’ll emphasize why it’s essential, how to utilize signals for risk management and discuss practical techniques like setting stop-loss and take-profit orders and employing position sizing strategies. Additionally, we’ll highlight the valuable role Funded Traders Global plays in helping traders manage risk effectively.

The Importance of Risk Management

Risk management is the guardian of your trading capital. It’s crucial for several reasons:

Preserve Capital: It safeguards your funds, ensuring you can continue trading even after a series of losses.

Reduces Emotional Stress: By having a risk management plan in place, you can trade with discipline and avoid impulsive decisions driven by fear or greed.

Promotes Long-Term Success: Successful traders know that managing risk is the key to staying in the game and achieving consistent profits.

Using Signals for Risk Management

Forex Trading signals for beginners can be valuable tools for risk management:

Signal Confirmation: Before entering a trade, use signals to confirm your analysis. If the signals align with your strategy, it can reduce the risk of making poor decisions.

Risk-Reward Ratio: Signals can help you assess the potential risk and reward of trade, enabling you to make informed choices about trade setups.

Setting Stop-Loss and Take-Profit Orders

Stop-loss and take-profit orders are your frontline defenses against losses:

Stop-Loss Orders: These predefined price levels automatically exit your trade if the market moves against you. They limit potential losses.

Take-Profit Orders: These orders automatically close your trade when a specified profit level is reached, securing your gains.

Using signals in conjunction with stop-loss and take-profit orders helps you execute a disciplined risk management strategy.

Position Sizing Strategies

Position sizing refers to determining the size of your trade:

Fixed Lot Size: You trade a consistent lot size, regardless of market conditions.

Percentage Risk: You risk a fixed percentage of your capital on each trade, adjusting your position size as your account balance fluctuates.

Volatility-Based Sizing: You adjust your position size based on market volatility, ensuring you risk less during turbulent periods.

Funded Traders Global provides valuable insights and resources to help you develop and implement effective risk management strategies. Their expertise and support can be a game-changer in your journey to becoming a successful and responsible trader. As you master risk management, you’ll not only protect your capital but also set the stage for sustainable and profitable trading. Funded Traders Global stands as a reliable ally, offering the guidance and knowledge you need to navigate the often challenging world of risk management in forex trading.

Conclusion

In conclusion, this comprehensive guide to Forex Trading Signals for Beginners has equipped you with the essential knowledge and strategies needed for success in this dynamic market. Throughout your journey, Funded Traders Global has served as a valuable partner, providing guidance and resources to help you interpret trading signals, manage risk, and make informed trading decisions. With their support and your commitment to continuous learning, you’re well-positioned to navigate the complexities of forex trading and work towards your goals as a proficient and responsible trader. Your journey doesn’t end here; it’s an ongoing process, and with Funded Traders Global by your side, you have the tools to thrive in the world of forex trading. So, let’s say hi to trading from today!!!

1 note

·

View note

Text

Forex Trading - Getting Started

Forex Trading: a Beginner's Guide

The forex market is the world's biggest global cash trading market working relentless during the functioning week. Most forex trading is finished by experts like financiers.

Forex cash trading permits purchasers and merchants to purchase the money they need for their business and venders who have acquired cash to trade what they have for a more helpful money.

The world's biggest banks rule forex and as indicated by a review in The Wall Street Journal Europe, the ten most dynamic brokers who are occupied with forex trading represent practically 73% of trading volume.

For the most part forex trading is done through a forex intermediary - yet there isn't anything to stop anybody trading monetary standards.

In any case, a sizeable extent of the rest of forex trading is theoretical with dealers developing a speculation which they wish to sell at some stage for benefit.

While a cash may increment or reduction in esteem comparative with a wide scope of monetary forms, all forex trading exchanges depend on money sets.

Thus, albeit the Euro might be 'solid' against a bushel of monetary forms, brokers will exchange only one money pair and may essentially worry about the Euro/US Dollar ( EUR/USD) proportion. Changes in relative upsides of monetary standards might be continuous or set off by explicit situation, for example, are developing at the hour of composing this - the poisonous obligation emergency.

Since the business sectors for monetary forms are worldwide, the volumes exchanged each day are huge. For the enormous corporate financial backers, the incredible advantages of trading on Forex are:

Huge liquidity - more than $4 trillion every day, that is $4,000,000,000. This implies that there's consistently somebody prepared to exchange with you

All of the world's free monetary forms are exchanged - this implies that you may exchange the cash you need whenever

24 - hour trading during the 5-day working week

Tasks are worldwide which imply that you can exchange with any piece of the world whenever

According to the perspective of the more modest dealer there's loads of advantages as well, for example,

A quickly changing business sector - that is one which is continually changing and offering the opportunity to bring in cash

All around created instruments for controlling danger

Capacity to go long or short - this implies that you can bring in cash either in rising or falling business sectors

Influence trading - implying that you can profit with enormous volume trading while at the same time having a generally low capital base

Bunches of choices for zero-commission trading

How the forex Market Works

As forex is about unfamiliar trade, all exchanges are made up from a cash pair - say, for example, the Euro and the US Dollar.

The fundamental instrument for trading forex is the conversion scale which is communicated as a proportion between the upsides of the two monetary forms like EUR/USD = 1.4086.

This worth, which is alluded to as the 'forex rate' implies that, at that specific time, one Euro would be worth 1.4086 US Dollars. This proportion is constantly communicated to 4 decimal spots which implies that you could see a forex pace of EUR/USD = 1.4086 or EUR/USD = 1.4087 yet never EUR/USD = 1.40865.

The furthest right digit of this proportion is alluded to as a 'pip'. Thus, a change from EUR/USD = 1.4086 to EUR/USD = 1.4088 would be alluded to as a difference in 2 pips. One pip, in this way is the littlest unit of exchange.

With the forex rate at EUR/USD = 1.4086, a financial backer buying 1000 Euros utilizing dollars would pay $1,408.60.

In the event that the forex rate, changed to EUR/USD = 1.5020, the financial backer could sell their 1000 Euros for $1,502.00 and bank the $93.40 as benefit. On the off chance that this doesn't appear to be huge sum to you, you need to place the entirety into setting.

With a rising or falling business sector, the forex rate doesn't just change in a uniform manner however sways and benefits can be taken frequently as a rate wavers around a pattern.

At the point when you're expecting the worth EUR/USD to fall, you may exchange the alternate way by selling Euros for dollars and repurchasing then when the forex rate has changed for your potential benefit.

Is forex Risky?

At the point when you exchange on forex as in any type of cash trading, you're occupied with money hypothesis and it is only that - theory.

This implies that there is some danger implied in forex money trading as in any business yet you may and ought to, find ways to limit this.

You can generally restrict the drawback of any exchange, that way to characterize the most extreme misfortune that you are ready to acknowledge whether the market conflicts with you - and it will on events.

The best protection against losing your shirt on the forex market is to decided to get what you're doing completely.

Quest the web for a decent forex trading instructional exercise and study it's anything but a touch of good forex schooling can go far!. When there's pieces you don't comprehend, search for a decent forex trading discussion and pose loads of inquiries.

A large number individuals who constantly answer your inquiries on this will have a decent forex trading website and this will likely offer you responses to your inquiries as well as give heaps of connections to great destinations.

Be cautious, in any case, keep an eye out for forex trading tricks. Try not to rush to leave behind your cash and explore anything very well before you shell out any well deserved!

The forex Trading Systems

While you might be directly in being mindful about any forex trading framework that is publicized, there are some acceptable ones around.

The greater part of them either use forex graphs and through these, distinguish forex trading signals which advise the broker when to purchase or sell.

These signs will be comprised of a specific change in a forex rate or a pattern and these will have been contrived by a forex dealer who has concentrated long haul patterns on the lookout to distinguish substantial signs when they happen.

A large number of the frameworks will utilize forex trading programming which distinguishes such signals from information inputs which are accumulated naturally from market data sources.

Some use mechanized forex trading programming which can trigger exchanges consequently when the signs advise it to do as such.

On the off chance that these sound unrealistic to you, search for online forex trading frameworks which will permit you attempt some fake trading to test them out. by doing this you can get some forex trading preparing by giving them a twist before you put genuine cash on the table.

What amount do you Need to Start off with?

This is somewhat of a 'How long is a piece of string?' question however there are ways for to be novice to try things out without requiring a fortune to begin with.