#Interpreting Forex Trading Signals

Explore tagged Tumblr posts

Text

This blog serves as a user-friendly guide for those just stepping into the world of forex trading. It meticulously breaks down the concept of forex trading signals, highlighting their immense value for beginners in navigating the intricate forex market. It emphasizes the advantages of using signals, such as their potential to save time, reduce emotional stress, and offer a learning opportunity for novice traders. Throughout the guide, the presence of Funded Traders Global as a supportive and educational partner is evident, ensuring that beginners gain confidence in their learn more...

#Analyzing Fundamental Data#Basics of Trading Signals#Candlestick patterns#Complete Guide to Forex Trading Signals for Beginners#currency pairs#Defining Forex Trading Signals#dojis#economic calendars#economic indicators#engulfing candles#Evaluating Sentiment Indicators#Forex charts#Forex News Sources#forex trading 2023#Forex Trading Signals for Beginners#Fundamental Analysis Signals#hammers#How to Choose a Reliable Provider#How to Find Forex Trading Signals#Interpreting Forex Trading Signals#MACD (Moving Average Convergence Divergence)#Market Analysis Tools#Market Sentiment Indicators#mood and perceptions of traders in the market#moving averages#Position Sizing Strategies#Risk Management in Forex Trading#RSI (Relative Strength Index)#Self-Analysis and Research#Sentiment Analysis Signals

0 notes

Link

#CandlestickAnalysis#candlestickpatterns#chartpatterns#ForexTrading#markettrends#MomentumTrading#priceaction#ReversalPatterns#riskmanagement#StockMarket#supportandresistance#technicalanalysis#TradingSignals#TradingStrategy#TrendContinuation

2 notes

·

View notes

Text

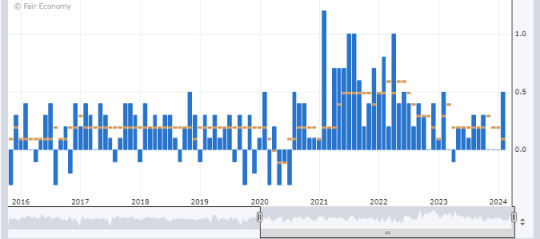

Understanding the Core PPI and Its Impact on Currency and Gold Markets!

The Producer Price Index (PPI) serves as a vital economic indicator, shedding light on changes in the prices of finished goods and services sold by producers. However, when analyzing PPI data, one must pay close attention to the Core PPI, which excludes the volatile components of food and energy prices. This exclusion is significant because food and energy prices often exhibit erratic fluctuations that can skew the overall PPI reading.

A noteworthy shift occurred in February 2014 when the calculation formula for the Core PPI underwent a modification. This alteration aimed to provide a more accurate representation of underlying inflation trends by eliminating the influence of volatile food and energy prices.

It's crucial to recognize that food and energy prices typically constitute around 40% of the overall PPI. Consequently, when analyzing the Core PPI, which excludes these volatile components, one may find a more stable and reliable measure of inflationary pressures.

Now, let's delve into the implications of Core PPI releases on currency and gold markets.

When the Core PPI data release exceeds market expectations, it signals that inflationary pressures are building up in the economy. This can lead to an appreciation of the dollar as investors anticipate potential interest rate hikes by the central bank to curb inflation. A stronger dollar makes gold, which is priced in dollars, relatively more expensive for investors holding other currencies. As a result, the price of gold may decline in response to a stronger dollar.

Conversely, if the Core PPI data release falls below expectations, it suggests subdued inflationary pressures. In such a scenario, the dollar may weaken as investors adjust their expectations regarding future monetary policy actions. A weaker dollar tends to make gold more attractive as a hedge against currency depreciation, leading to an increase in its price.

For instance, let's consider a hypothetical scenario where the Core PPI data release indicates a higher-than-expected increase in producer prices. This prompts investors to anticipate tighter monetary policy by the Federal Reserve, causing the dollar to strengthen. Consequently, the price of gold, denominated in dollars, declines as it becomes less appealing to investors.

On the other hand, if the Core PPI data release comes in below expectations, signaling subdued inflation, investors may interpret this as a dovish signal from the central bank. In response, the dollar weakens, leading to an increase in the price of gold as investors seek refuge in the precious metal amid currency uncertainty.

In conclusion, the Core PPI serves as a crucial economic indicator that can influence both currency and gold markets. By understanding its significance and the factors driving its movements, traders and investors can make informed decisions to navigate the ever-changing landscape of financial markets.

2 notes

·

View notes

Text

best indicator for trend strength

📈 Best Indicator for Trend Strength in Forex Trading

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

Telegram Channel

✅ Introduction

In the dynamic world of forex trading, identifying a trend is only the beginning — measuring its strength is what separates profitable trades from premature entries and exits. Many traders fall into the trap of trading every trend they see, only to realize that weak trends are often short-lived, volatile, and unreliable.

This is where the concept of trend strength comes into play. Knowing whether a trend is strong enough to sustain momentum or is about to reverse can significantly improve trading outcomes.

So, what is the best indicator for trend strength in forex trading?

This article will explore that question in detail. We'll cover:

The meaning and importance of trend strength

The top indicators used by professional traders

A deep dive into the most effective one

How to use it in your trading strategy

Practical examples, mistakes to avoid, and best practices

Let’s dive in.

📌 Table of Contents

What is Trend Strength in Forex?

Why Trend Strength Matters

Common Mistakes When Measuring Trend Strength

Key Characteristics of a Good Trend Strength Indicator

Top 5 Trend Strength Indicators

The Best Indicator for Trend Strength: ADX (Average Directional Index)

How to Use ADX for Measuring Trend Strength

Combining ADX with Other Tools for Accuracy

Real Market Examples

Backtesting and Optimization Tips

Limitations of ADX and How to Overcome Them

Conclusion

1. 📉 What is Trend Strength in Forex?

Trend strength refers to the degree of momentum and commitment behind a directional move in the forex market. A trend may be:

Strong (momentum is sustained, price moves steadily)

Weak (price action is choppy, lacks follow-through)

For example:

A strong uptrend sees higher highs and higher lows with strong bullish candles.

A weak trend may look like an uptrend but is constantly facing rejection or lacks volume.

Trend direction ≠ Trend strength. A trend may appear to go upward, but without strength, it's vulnerable to reversal or consolidation.

2. 📈 Why Trend Strength Matters

Knowing the strength of a trend can help traders:

Enter trades with confidence during strong trends.

Avoid low-probability setups in weak or dying trends.

Scale in or out of positions more intelligently.

Use proper stop-loss and take-profit levels based on momentum.

Time re-entries or trend continuation setups.

Many trading losses occur when traders mistake a pullback or correction for a real trend. Measuring trend strength helps prevent such errors.

3. 🚫 Common Mistakes in Measuring Trend Strength

Assuming price direction = strength

Ignoring momentum and volume

Using only moving averages

Over-relying on lagging indicators

Not confirming across timeframes

Mistaking a sideways market for a trending one or entering during exhaustion are frequent causes of failed trades.

4. 🔍 What Makes a Good Trend Strength Indicator?

A strong trend indicator should:

✅ Clearly differentiate between weak and strong trends ✅ Adapt to changing market conditions ✅ Provide real-time actionable information ✅ Work across various timeframes and assets ✅ Be easy to interpret visually ✅ Avoid frequent false signals

Let’s now explore the top indicators that match these criteria.

5. 🏆 Top 5 Indicators for Measuring Trend Strength

Here are five widely respected tools used to gauge trend strength in forex trading:

1. ADX (Average Directional Index)

Measures the strength, not the direction, of a trend.

Values:

Below 20 = Weak trend or no trend

20–40 = Moderate trend

40+ = Strong trend

Developed by J. Welles Wilder

2. MACD Histogram

Measures momentum through the difference between fast and slow EMAs.

The wider the histogram, the stronger the momentum.

Best for visual momentum analysis.

3. Moving Averages (EMA 50/200 Slope)

The angle of the moving average often reflects trend strength.

A steep slope = strong trend

Flat slope = consolidation

4. Ichimoku Cloud (Kumo Thickness)

The thickness of the Kumo cloud indicates the strength of support/resistance.

Strong trends have wide clouds and price well above or below them.

5. RSI (Relative Strength Index) Trend Line

Sustained RSI values above 50 (in uptrends) or below 50 (in downtrends) show momentum.

RSI slope and divergence can show trend weakening or strengthening.

While all are helpful, only one indicator was specifically created to measure trend strength directly...

🥇 6. The Best Indicator for Trend Strength: ADX (Average Directional Index)

What is ADX?

The Average Directional Index (ADX) is a component of the Directional Movement System developed by J. Welles Wilder. It consists of three lines:

ADX Line (white): Measures trend strength (0–100)

+DI Line (green): Measures bullish movement

–DI Line (red): Measures bearish movement

Why ADX is the Best for Trend Strength

✅ It separates trend direction from strength ✅ It adapts to both bullish and bearish trends ✅ It’s numerical – giving clear thresholds (20, 25, 40+) ✅ It filters out false breakouts and weak trends ✅ It works on all timeframes and currency pairs

ADX Reading Scale:

0–20: No trend (sideways, choppy market)

20–25: Emerging trend

25–40: Strong trend

40–60: Very strong trend

60–100: Extreme trend (rare, often reversals soon)

7. 🔧 How to Use ADX to Measure Trend Strength

Basic Setup:

Timeframe: H1, H4, D1 for best results

Add ADX to your MT4/MT5 chart (default 14-period)

Watch for:

ADX line crossing above 20 or 25

+DI above –DI (for uptrend strength)

–DI above +DI (for downtrend strength)

Entry Strategy:

Enter long when:

ADX > 25

+DI > –DI

Price is above 50 EMA

Optional: Bullish candlestick pattern

Enter short when:

ADX > 25

–DI > +DI

Price is below 50 EMA

Optional: Bearish engulfing or pin bar

Exit Strategy:

Consider exiting when:

ADX starts falling below 25

+DI and –DI lines cross in opposite direction

Price breaks trendline or support/resistance

8. 🔗 Combining ADX with Other Tools

For more reliability, combine ADX with:

✅ Moving Averages

Use 50 and 200 EMA

Strong uptrend = Price above both EMAs + ADX > 25

✅ RSI

Look for RSI > 50 in uptrend, < 50 in downtrend

Confirm trend strength by combining RSI and ADX direction

✅ Price Action Zones

Trade ADX-confirmed trends only near breakout of a key level

Use candlestick patterns for timing

✅ Volume

Volume spike + ADX rising = very strong confirmation of trend

9. 📊 Real Market Examples Using ADX

Example 1: EUR/USD H1

ADX rises above 25

+DI crosses above –DI

Price breaks above resistance

Uptrend continues for 120+ pips

Example 2: GBP/JPY D1

ADX > 40 confirms strong trend

–DI > +DI shows dominant bears

Trend continues for 600 pips before ADX drops

Example 3: False Signal Filter

Breakout happens but ADX < 20

Trend fails, price reverses → ADX saved from entering low-momentum trap

Use screenshots or draw mock charts for better illustration (can be provided upon request).

10. 📈 Backtesting ADX for Trend Strength

To validate ADX in your strategy:

Use MT4 strategy tester or software like Soft4FX

Test 100+ trades with:

ADX above 25 entries only

Filter by DI cross + MA trend

Record:

Win rate

Risk-reward ratio

Drawdown

Traders report better performance by trading only when ADX confirms strength.

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

#forex factory#forex online trading#forex indicators#forex education#forex news#forex market#forex#crypto#forex ea#forex broker

0 notes

Text

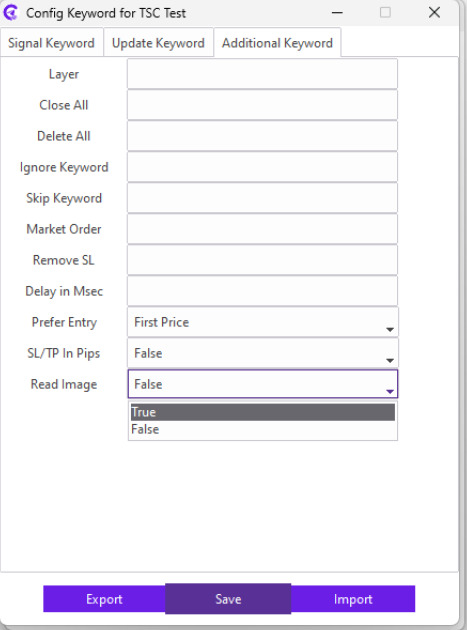

How Image Based Forex Signal Copier Telegram Work?

In a word, a signal copier parses images and detects the exact text or signal input. These are basically automated tools—usually expert advisers (EAs) or bots—that monitor Telegram for signal messages.

Now, if your provider sends signals as an image insead of text messages, the copier like the Telegram Signal Copier can detect the signal from that image, chart, or even if any screenshots.

Many signal providers send trading signals as a form of image—like annotated charts or screenshots—highlighting levels and trade strategy. The image consists of the signal data, such as-

Trade direction- BUY/SELL

Pair- XAUUSD/USDJPY/NASDAQ

SL

TP

So, a signal copier with an image recognition system can easily interpret these images and extract the signal data within seconds and place the trade on trading platforms.

Image based signal copier maps screenshots to actionable parameters: currency pair, direction, entry/exit levels. Some even ignore irrelevant images, focusing only on trading signals.

Does Telegram Signal Copier Works with Image based Signals?

Yes, Telegram Signal Copier (TSC) works with image-based signals. No matter if it is a screenshot or an image containing the signal alerts, TSC can easily parse signal data from the images and execute the trade for you. You just need to make sure that you make the ‘Read’ Image option ‘True’ from inside the TSC app’s additional keyword option.

#forex trading#forex#forexsignals#forex signals#telegram signal copier#signal copier telegram#forex signal copier

0 notes

Text

Key Components of the Trader's Dynamic Index Indicator

The TDI consists of three essential components that function as a system to display market activity.

RSI (Relative Strength Index):

The indicator evaluates price speed alongside movement changes to detect market conditions of overbought and oversold states.

If it goes too high or too low, very fast, it helps the traders to analyze when the price might reverse.

Moving Averages (Signal Line & Market Base Line):

The moving averages smooth the RSI while enabling traders to determine trend direction and strength.

This makes it easier for traders to understand that if the market is going up, down or staying flat in a very easy way.

Volatility Bands (Bollinger Bands):

Market movements are best expressed through these indicators to detect breakouts. This helps traders to analyse when the price might move quickly in one direction.

Through this combined methodology, traders can view the entire price activity from one consolidated platform. TDI functions as a complete trading system because it exists within a single indicator.

TDI Technical Analysis: How to Interpret the Signals

For the first time, one might find Traders Dynamic Index tricky, but once you understand the signals, it becomes a powerful tool for decision making. It helps you understand what the market is doing. It shows if the price is strong, weak, or going sideways which helps with when to buy, sell, or stay out of the market.

The green line is the main one to focus on, it shows direction and strength of the market. When it moves upward sharply, that usually means start buying. If it goes down it means selling pressure is high. A flat green line usually means the market is stable.

The red line works in parallel with the green line. When green crosses and moves past the red line, that’s the signal to buy. When it goes below the red line, that’s your clue to sell. The yellow line shows the overall trend.

If both the red and green lines are above the yellow line this supports the buy setup, vice versa if these are below yellow line, that points sell setup.

The blue band shows how active the market is. Wide bands mean more movement and possible breakouts. Tight bands suggest low activity.

0 notes

Text

About Course: This course is a concise yet comprehensive introduction to advanced forex trading concepts, curated by WillStreet_fx. Through a structured series of 12 videos, the course walks traders from foundational elements to advanced market strategies, focusing on technical precision and strategic timing. Course Modules: Introduction – Overview of the trading approach and course structure. Timeframes and Candles – Understanding how to read and interpret market movements using timeframes and candlestick analysis. SMT (Smart Money Technique) – Identifying divergence using correlated instruments for more accurate signals. Bias – Developing directional bias and its role in filtering trades. Entries – Structuring high-probability trade entries. Failure Swing – Recognizing market traps and failed structure swings. NWOG & NDOG – A breakdown of New Week Opening Gaps and Daily Opening Gaps and their trading implications. London Model – Specific strategies for trading during the London session. New York Model – Key setups and behavior in the New York session. Red Flags – Common mistakes and warning signs to avoid in trades. News Trading – Navigating economic releases and market volatility. Risk Management – Practical approaches to preserving capital and ensuring long-term consistency.

0 notes

Text

What is AI Signal Config? How does it help Traders in Forex trading?

If you’ve ever tried copying trade signals from Telegram manually, you know how frustrating it can be. Signals come in all shapes and sizes. Sometimes missing key info like stop loss or take profit, often sent as confusing screenshots, or written in a language you don’t understand. This makes accurate, timely trade execution nearly impossible.

AI Signal Config is a smart solution built into Telegram Signal Copier (TSC) that eliminates this problem. It uses artificial intelligence to understand any type of signal, no matter how messy or unconventional, and converts it into a format your copier can execute automatically.

Instead of manually adjusting for every provider’s signal style, you simply upload a few sample messages into the AI Config Generator. The system detects the structure, extracts key trading details (like entry, stop loss, and take profit), and creates a config file ready for use.

Here’s how it helps Forex traders:

Automates signal interpretation even when formats are inconsistent

Extracts trades from images using Vision AI

Handles multilingual or poorly written messages

Saves time by reducing manual setup

Improves accuracy with auto risk management and reverse trading options

Supports Prop firm trading with stealth mode to avoid detection

AI Signal Config doesn’t just read signals and understand them. And for traders juggling multiple Telegram channels or dealing with unstructured content, it turns a chaotic process into smooth, reliable automation.

1 note

·

View note

Text

Simple Guide to Candlestick Charts: Read Price Like a Pro

Candlestick Patterns: Your Trading Companion

Let’s be honest — if you’re stepping into the trading world and you still haven’t wrapped your head around candlestick charts, you’re behind. This isn’t a “nice to know.” It’s a non-negotiable skill. Because no matter what market you’re in — forex, stocks, crypto, commodities — candlestick charts, which show the opening price, are the language of price. And if you can’t read that language, you’re trading blind.

Candlestick charts are not just about understanding opening and closing prices; they are about grasping the entire market sentiment. These charts, or candlestick chart patterns, including bearish candlestick patterns originating from Japanese candlestick charting techniques, have been used for centuries to interpret price movements and predict potential trends. Whether it's the bullish engulfing pattern or the bearish engulfing pattern, each candlestick pattern provides insights into the ongoing battle between buyers and sellers.

Now don’t worry — I’m not here to throw technical jargon at you. This is your simple guide to candlestick charts. Whether you're a total beginner or someone who’s been winging it for a while, this breakdown will make it click. Because once you understand how to read candlestick charts, everything on your screen starts making more sense. You’ll learn to spot bullish reversal patterns, including a bullish pattern, and bearish reversal patterns, understand the significance of a morning star pattern or an evening star pattern, and recognize the power of a hammer candlestick pattern or a shooting star pattern.

Understanding these patterns is crucial as they often signal trend reversals or continuation patterns. For instance, a strong bullish candle, represented by a bullish engulfing candlestick pattern after a downtrend, suggests a potential shift in control of the market from sellers to buyers. Similarly, a bearish harami pattern might indicate indecision in the market, often leading to a bearish reversal signal.

By mastering the art of candlestick charting, you equip yourself with the ability to read the market's heartbeat, especially in periods of strong buying pressure, allowing you to anticipate price movements and make informed trading decisions. So, dive in, explore the various candlestick patterns, including common bullish candlestick patterns, and start decoding the bullish candles and bearish candles that narrate the story of the market.

What Is a Candlestick Chart, Really?

Let’s strip it down. A candlestick chart is a visual representation of price action over a specific time period, essential in technical analysis. Each individual “candle” on the chart provides four crucial pieces of information: the open, high, low, and close (OHLC) of that time frame, and what each candlestick represents. These four data points are not just numbers; they tell a compelling story about the ongoing battle between buyers and sellers in the market.

When you see a candle that is green or white, it indicates that the price closed higher than it opened, signaling a bullish candlestick pattern. Conversely, a red or black candle means the price closed lower than it opened, indicating a bearish candlestick pattern. The body of the candle represents the distance between the open and close prices, while the wicks (or shadows) illustrate the highs and lows during that time frame.

Understanding these basics of candlestick formation transforms your perception of price from mere numbers to insights about momentum, hesitation, rejection, and confirmation. This transformation allows your chart to start communicating with you, revealing the underlying market sentiment, especially in relation to the previous candle.

Each candlestick pattern, whether it's a bullish engulfing pattern or a bearish engulfing pattern, provides valuable insights into potential trend reversals or continuation patterns. For example, a bullish engulfing candlestick pattern appearing after a downtrend might suggest a shift in market control from sellers to buyers. Similarly, a bearish harami pattern could indicate indecision in the market, potentially leading to a bearish reversal.

By mastering the art of candlestick charting, you gain the ability to read the market's heartbeat, anticipate price movements, and make informed trading decisions. Dive into the world of various candlestick patterns and start decoding the bullish candles and bearish candles that narrate the story of the market.

For instance, a morning star pattern often signals a bullish reversal, indicating that the selling pressure is waning, and buyers might be taking control. On the other hand, an inverted hammer candlestick pattern can be a bearish reversal pattern, suggesting that the buying momentum is losing steam, and sellers might push the price down.

Moreover, understanding continuation candlestick patterns, including a bearish abandoned baby pattern and bullish continuation patterns like the rising three methods, can help you identify when a current trend is likely to continue, providing opportunities for traders to capitalize on ongoing price movements.

Incorporating these insights into your trading strategy can significantly enhance your ability to predict price movements and understand the market sentiment behind each candlestick pattern. Whether you're analyzing a shooting star candlestick pattern, a hammer candlestick pattern, or a doji candlestick pattern, and understanding how they relate to the closing price can profoundly impact your trading approach.

So, immerse yourself in the fascinating world of candlestick charting and elevate your trading prowess to new heights. By recognizing and understanding the most common candlestick patterns, such as the bullish harami pattern, piercing line pattern, or dark cloud cover pattern, you can better navigate the complexities of the market and make more informed trading decisions.

Why Candlestick Charts Matter?

Here’s the truth: no indicator, no matter how fancy, will ever beat pure price action. And candlestick charts are the foundation of that. They’re the most direct, visual way to see what price is doing, what buyers are trying to do, and how sellers are responding — or vice versa, especially in the context of a strong bearish candle. This makes them an indispensable tool in any trader's arsenal, especially when combined with the analysis of a larger bearish candle.

You’re not just seeing movement. You’re seeing intent. The candlestick technical analysis allows traders to interpret price in real time, offering a window into the market's psyche. Did buyers step in and push the price up, only to get rejected at the top? That long upper wick tells you. Did price consolidate, then burst out with a wide green body? That’s momentum. Are we getting small candles with long wicks in both directions? That’s indecision.

In short, trading with candlestick charts gives you an edge that indicators can’t — because you’re reading the raw data of the market. Not a lagging average. Not a smoothed curve. Just the real heartbeat of price. By understanding the dynamics of various candlestick patterns, such as the long bullish candle represented by bullish engulfing pattern or the bearish engulfing pattern, traders can better anticipate potential trend reversals or continuation patterns.

For instance, a bullish engulfing candlestick pattern after a downtrend suggests a potential shift in control of the market from sellers to buyers. Similarly, a bearish harami pattern might indicate indecision in the market, often leading to a bearish reversal. Recognizing these patterns equips traders with the knowledge to make informed decisions, enhancing their ability to predict price movements and understand market sentiment.

By mastering the art of candlestick charting, you gain the ability to read the market's heartbeat, anticipate price movements, and make informed trading decisions. Dive into the world of various candlestick patterns and start decoding the bullish candles and bearish candles that narrate the story of the market. Whether you are analyzing a morning star pattern, a shooting star pattern, or a hammer candlestick pattern, understanding the implications of each, particularly in the context of bullish sentiment, can significantly impact your trading strategy. So, embrace the power of candlestick charts and elevate your trading game to new heights.

How to Read Candlestick Charts Like a Trader?

Let’s keep it practical. If you want to know how to read candlestick charts, don’t just memorize patterns — learn how to read the story behind the pattern.

A bullish engulfing candle after a downtrend? That tells you buyers just overpowered the sellers. A doji at a resistance zone? That’s hesitation. A long hammer wick after a sharp move down? That’s potential reversal — if followed by confirmation.

There are dozens of types of candlestick patterns out there — pin bars, inside bars, morning stars, evening stars — but the key is understanding why they form. Are they showing strength? Exhaustion? Trap? Rejection? Don’t just name it. Understand it.

Once you get fluent in interpreting candlestick charts, your strategy becomes sharper. You’ll stop taking random trades and start recognizing candlestick chart signals that align with structure, support, resistance, trend, and timing.

Using Candlesticks with Simple Strategies

Here’s where it gets powerful — you don’t need complicated systems to trade. Some of the most effective strategies are simple trading strategies using candlesticks. Let me give you a few I personally use:

Rejection at Key Levels: Wait for price to tap into a support/resistance zone and look for a rejection candle, like a pin bar or engulfing.

Breakout Confirmation: Don’t chase the breakout. Wait for a strong candle to close above the zone, showing conviction.

Trend Continuation: When price pulls back into the trendline or moving average and prints a clean bullish or bearish candle — that’s your signal to re-enter.

You don’t need five indicators or a PhD in technicals. You just need a candlestick chart for beginners, along with an understanding of green candles strong level, and a bit of patience.

Candlestick Charts in Different Markets

1. Universal Application of Candlestick Charts

One of the most remarkable aspects of candlestick charts is their universal applicability. Whether you're analyzing Japanese candlestick charts for currency pairs like USD/JPY, examining price action on the S&P 500, or deciphering Bitcoin’s unpredictable movements, the foundational logic of candlestick charting remains unchanged. This universal nature makes candlestick charts one of the most used tools in technical analysis worldwide.

2. Candlestick Analysis in Forex

In the Forex market, where speed and volatility are the norms, candlestick analysis is invaluable. Traders use candlestick patterns to quickly assess market sentiment and make rapid decisions. Patterns like the bullish engulfing pattern or a bearish pattern such as the bearish engulfing pattern, are particularly useful in identifying potential reversals or continuations amidst fast-moving currency prices.

3. Candlestick Patterns in Stock Trading

When it comes to stocks, candlestick charts help traders spot volume-based breakouts or reactions to earnings reports. For instance, a bullish engulfing candlestick pattern following a period of consolidation might signal a strong buying opportunity. Similarly, a bearish harami pattern could indicate a potential downturn, allowing traders to adjust their positions accordingly.

4. Candlestick Charting in Cryptocurrency

In the volatile world of cryptocurrency, candlestick charts are a trader’s best ally. Given the market's tendency to print fakeouts frequently, understanding patterns like the morning star pattern, the evening star pattern, or the long-legged doji pattern can help traders navigate these false signals. The shooting star candlestick pattern and the hammer candlestick pattern are also crucial for identifying potential reversals in crypto trading.

5. The Role of Market Sentiment

Across all markets, candlestick charts provide insights into the underlying market sentiment. By interpreting patterns, traders can gauge whether the market is experiencing strong buying or selling pressure, indecision, or a potential shift in momentum. This understanding allows for more informed and strategic trading decisions.

6. The Versatility of Candlestick Charts

The versatility of candlestick charts lies in their ability to communicate the market's story, regardless of the asset class. By mastering these patterns, traders can better anticipate price movements, understand the dynamics of bullish and bearish candles, and enhance their overall trading strategy. Whether you're trading Forex, stocks, or cryptocurrencies, candlestick charts are an indispensable tool in your technical analysis toolkit.

Start With the Candle, Build the Picture

If you want to become a confident, independent trader, start with this: learn candlestick charts inside out. Don’t just watch YouTube patterns. Pull up your chart. Study real-time reactions. Screenshot your trades. Ask: What were buyers doing here? Where did they fail? Where did they win?

This isn’t about finding a magic pattern. This is about building a conversation with price. When you understand that, every candle becomes a sentence. Every setup becomes a story. And every trade you take starts to make sense.

So, yeah — indicators are great. But candlesticks? They’re the roots.

By delving deeper into candlestick charting, you unlock the ability to interpret the subtle nuances of market movements. Each candlestick pattern, including the third candle in a sequence such as the bullish engulfing pattern or the bearish engulfing pattern, serves as a chapter in the ongoing narrative of market sentiment. As you become more adept at reading these patterns, you'll start to recognize when a bullish reversal pattern is forming or when a bearish continuation pattern might signal further declines.

Moreover, understanding the implications of a morning star pattern or the significance of a shooting star candlestick pattern can provide you with a strategic edge. These patterns are not just abstract concepts; they are reflections of the market's psychology, revealing moments of indecision or shifts in momentum.

Engage actively with your charts, and you'll soon be able to anticipate potential trend reversals or identify continuation patterns with greater accuracy. This deeper comprehension allows you to make informed trading decisions, enhancing your ability to predict price movements and respond effectively to market dynamics. Embrace the power of candlestick charts, and let them guide you to becoming a more proficient and confident trader.

1 note

·

View note

Text

Concept and Application of Trading Strategies | Master Market Moves

Mastering the concept and application of trading strategies is essential for anyone looking to succeed in the financial markets. Trading strategies are systematic methods used by traders to determine the best times to buy or sell assets such as stocks, Forex, or commodities. These strategies are grounded in technical analysis, fundamental analysis, or a combination of both, and are tailored to different trading styles—whether day trading, swing trading, or long-term investing.

This topic dives deep into how trading strategies are developed, tested, and applied in real-world scenarios. You'll learn how to interpret market signals, manage risk, and optimize your entry and exit points for maximum profitability. From trend-following systems to mean reversion techniques and algorithmic trading, understanding these concepts allows traders to make data-driven decisions and enhance their overall performance.

Whether you're a novice aiming to build a strong foundation or an experienced trader refining your approach, this comprehensive overview will empower you with the knowledge and practical tools to trade with confidence and consistency.

0 notes

Link

#chartpatterns#EntryandExitPoints#markettrends#marketvolatility#MomentumTrading#OverboughtandOversold#priceaction#ProfitTaking#RelativeStrengthIndex#riskmanagement#RSITrading#StockMarket#technicalanalysis#TradingSignals#TradingStrategy#TrendReversal

0 notes

Text

what is the best indicator for trend reversal

🔁 What Makes a Good Reversal Indicator in Forex Trading?

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

Telegram Channel

Introduction

In forex trading, timing the beginning or end of a trend can be a game-changer. While trend-following strategies help traders ride the momentum, identifying a trend reversal allows them to enter early and capture larger price moves. However, spotting reversals is far more challenging than following trends. This is where reversal indicators come into play.

But not all indicators are created equal. Many promise precision but deliver false signals. So what actually makes a good reversal indicator? In this detailed article, we'll explore the critical qualities that define reliable reversal indicators, how they work, and which ones meet these standards. Whether you're a beginner or an experienced trader, understanding these principles will improve your ability to spot and trade reversals confidently.

Why Reversal Indicators Matter

Reversal indicators are technical tools designed to alert traders when the current trend is losing momentum and possibly preparing to change direction. The earlier you can detect a potential reversal, the better your entry point and risk-to-reward ratio.

For example:

In a downtrend, entering long (buy) at the reversal point allows traders to profit as the market turns upward.

In an uptrend, identifying when momentum is fading can help traders short at the top, catching the move down.

Accurate reversal detection is especially critical for:

Swing traders: who aim to catch medium-term movements.

Scalpers: who require pinpoint entries on lower timeframes.

Position traders: who want to avoid entering at the end of a trend.

However, not all reversal signals are worth acting on. That’s why it’s important to understand what makes a reversal indicator trustworthy.

Core Features of a Good Reversal Indicator

Here are the key characteristics that define a reliable reversal indicator in forex trading:

1. Timely Signal Generation

A good reversal indicator provides early signals before or near the beginning of the reversal — not after the price has already moved significantly.

Too early = false signal

Too late = missed opportunity

It must strike the right balance. It should not just lag behind the price but rather react to weakening momentum, divergence, or changes in price structure.

2. High Signal Accuracy

Accuracy is crucial. A good indicator must:

Minimize false signals

Confirm only high-probability setups

This doesn't mean it has a 100% success rate, but the win-to-loss ratio should be favorable when used properly. It should provide clear, unambiguous signals—not constant alerts that leave traders confused.

3. Clarity and Simplicity

An effective reversal indicator is easy to interpret, especially under real-market pressure. Indicators that rely on overly complex calculations or hard-to-read visuals can lead to poor decisions.

Example:

An RSI indicator showing divergence at oversold levels is straightforward.

An exotic oscillator with dozens of settings might confuse traders unless fully mastered.

4. Compatibility with Price Action

Reversal indicators work best when they align with price action principles like:

Support/resistance zones

Candlestick patterns

Trendlines or chart structures

A reversal signal becomes far more reliable when the indicator and price behavior agree.

5. Multi-Timeframe Usefulness

A good reversal tool should function well across different timeframes:

On H4/D1 for swing traders

On M15/M5 for scalpers

It should also align on higher timeframes for better confirmation (e.g., if an indicator shows reversal on H4 and H1, the signal is stronger).

6. Works with Trend & Counter-Trend Trades

While reversal indicators are primarily used to catch tops and bottoms, the best ones can also be used:

For pullback entries during trends (minor reversals)

To confirm trend continuations after fake-outs

This flexibility is a sign of a mature and tested tool.

7. Backtest Proven

The best indicators are not based on hype but data. A good reversal indicator should:

Be backtested on different pairs and conditions

Show consistent performance

Work during ranging and trending markets

Indicators with solid historical performance are more likely to succeed in live environments.

Technical Foundations of Reversal Detection

A reliable reversal indicator often works based on one or more of the following principles:

🔁 1. Momentum Shifts

Indicators like RSI, MACD, and Stochastic Oscillator detect when momentum is fading, often before price turns.

Bearish divergence (price makes higher highs, RSI makes lower highs) indicates weakening bullish momentum.

Bullish divergence (price makes lower lows, RSI makes higher lows) suggests a bullish reversal.

📉 2. Overbought/Oversold Conditions

Oscillators that measure how "stretched" a price is — like RSI and Stochastic — help traders spot points where price is likely to snap back.

Example:

RSI > 70 = overbought → potential sell

RSI < 30 = oversold → potential buy

🧱 3. Break of Market Structure

Indicators that detect support/resistance breakouts or trendline breaks can highlight early reversals. Tools like Fractals, ZigZag, or price structure break alerts are useful here.

📈 4. Volume Confirmation

Volume indicators like On-Balance Volume (OBV) or Volume Spike detectors show whether large traders are entering or exiting positions, signaling potential reversals.

Examples of Good Reversal Indicators

Let’s look at some indicators that meet most of the criteria above:

✅ 1. Relative Strength Index (RSI)

Tracks momentum and overbought/oversold zones.

Works well with divergence for reversal spotting.

Best when combined with price action or support/resistance levels.

✅ 2. MACD (Moving Average Convergence Divergence)

Shows momentum shifts and crossovers.

Divergence between MACD and price is a strong reversal signal.

Smooths out price noise but may lag slightly.

✅ 3. Stochastic Oscillator

Shows where price closes in relation to its range.

Good for catching short-term reversals in ranging markets.

✅ 4. Bollinger Bands

Price touching the outer band (especially with divergence) often leads to reversal.

Bollinger Band Squeeze also predicts breakouts and reversals.

✅ 5. Candlestick Patterns

Not a technical “indicator” in the traditional sense, but very reliable when combined with indicators.

Examples: pin bars, engulfing candles, morning star, doji at support/resistance.

Combining Indicators for Better Accuracy

The best results come not from relying on one indicator, but from combining 2–3 tools that complement each other. For example:

🔁 RSI + MACD + Price Action

RSI divergence → early warning

MACD crossover → momentum confirmation

Bullish engulfing candle → entry signal

🔁 Stochastic + Bollinger Bands + Support/Resistance

Stochastic shows overbought near resistance

Price breaks above outer Bollinger Band

Resistance zone confirms → short trade setup

This confluence method greatly improves reversal accuracy.

Real-Life Scenario Example

Imagine you're trading EUR/USD on the H1 chart.

Price reaches a strong resistance zone.

RSI is above 70 and shows bearish divergence.

MACD histogram starts turning down.

A bearish engulfing candle forms.

This multi-layered setup is a textbook reversal signal.

Backtesting Reversal Indicators

Before using a reversal indicator in live trading, it should be backtested over:

At least 100 trades

Multiple currency pairs

Various timeframes

Track:

Win rate

Average risk-reward

Frequency of signals

Maximum drawdown

This helps verify whether the indicator provides real edge or just looks good on static charts.

Recommended tools:

MT4 strategy tester

Soft4FX simulator

Excel journal tracking

Reversal Indicators to Avoid

Some indicators look good on paper but often fail in live trading due to:

Lagging nature (e.g., MA crossovers give late signals)

Too many false signals (e.g., unfiltered oscillators)

Incompatibility with volatile pairs

Unclear entry/exit rules

Avoid indicators that:

Don’t work across markets

Are repainted (change values after the bar closes)

Are black-box tools without transparency

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

#forex#forex broker#forex online trading#forex education#forex news#forex market#forex factory#forex indicators#forex ea#crypto#digitalcurrency#bitcoin#altcoin#blockchain

1 note

·

View note

Text

MACD Indicator: Spotting Buy and Sell Signals in Trading

Timing the market is one of the most challenging yet rewarding aspects of trading. Whether you are involved in stocks, forex, or cryptocurrency, knowing when to buy and when to sell is crucial for maximizing profits and minimizing losses. One of the most widely used tools to help with this is the MACD indicator, short for Moving Average Convergence Divergence.

The MACD is a popular momentum and trend-following indicator in technical analysis. It was developed by Gerald Appel in the late 1970s and has since become a key part of many traders’ toolkits. It helps you identify changes in the strength, direction, momentum, and duration of a trend in a stock or asset’s price.

In this article, we will explore how the MACD works, how to interpret its signals, and how you can use it in your trading strategy with confidence.

What Is the MACD Indicator and How Is It Calculated?

The Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. At its core, MACD helps traders understand whether momentum is increasing or decreasing, which is useful for spotting buy or sell signals before the market makes a big move.

The MACD consists of three components:

1. MACD Line: This is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. This line fluctuates above and below zero and reflects the difference between the short-term and long-term momentum.

2. Signal Line: This is a 9-period EMA of the MACD Line. It acts as a trigger for buy and sell signals. When the MACD Line crosses above the Signal Line, it can indicate a potential upward move. Conversely, when the MACD Line crosses below the Signal Line, it may suggest a downward move.

3. Histogram: The histogram represents the difference between the MACD Line and the Signal Line. When the histogram bars grow taller, the momentum is strengthening in the direction of the trend. When they shrink, the momentum is weakening.

These three elements work together to provide a visual representation of price momentum and possible trend reversals. Unlike some other indicators that lag significantly behind the price, the MACD attempts to provide early signals with a balance between responsiveness and stability.

Understanding MACD Crossovers and What They Mean

One of the most important things to learn when using MACD is how to recognize crossovers. These occur when the MACD Line and the Signal Line intersect. This intersection can be interpreted as a signal that the trend may be changing.

A bullish crossover happens when the MACD Line crosses above the Signal Line. This often suggests that upward momentum is building and that it could be a good time to consider buying the asset. It doesn’t guarantee profits, but it can be a strong signal in a broader bullish trend.

A bearish crossover occurs when the MACD Line crosses below the Signal Line. This is often seen as a warning that downward momentum is gaining strength, and it may be time to sell or at least be cautious about new long positions.

For example, let’s say you are analyzing a trading pair like SHIBUSDT. You might notice that the MACD Line has crossed above the Signal Line on the daily chart. Combined with a rising histogram, this could be interpreted as a sign that SHIB’s price is gaining upward momentum and that there may be an opportunity to enter a position.

Crossovers are among the most common MACD signals, but they work best when confirmed by other indicators or when used in combination with price action patterns.

The Importance of the MACD Histogram in Identifying Momentum

The histogram is an often overlooked but incredibly useful part of the MACD. It provides a clear, visual indication of how strong or weak the momentum is behind a trend.

When the bars on the histogram are growing in height, it means the MACD Line is moving further away from the Signal Line. This suggests that momentum in the current trend is increasing. If the histogram bars are above the zero line and growing, it often confirms a strong bullish trend. If they’re below zero and growing in size, it usually confirms a strong bearish trend.

On the other hand, if the histogram bars start to shrink, it signals that momentum is beginning to fade. Even if the trend has not yet reversed, this could be an early warning that a change is coming.

For instance, if you are monitoring SHIB/USDT and the histogram has been shrinking for several days while the price remains flat or starts to decline, this could indicate that buyers are losing strength. It doesn’t necessarily mean an immediate drop is coming, but it’s a sign to be more cautious and potentially tighten risk controls.

Using MACD Divergence to Spot Potential Trend Reversals

Another powerful feature of the MACD is divergence analysis. Divergence occurs when the price of an asset and the MACD indicator move in opposite directions. This is often a strong clue that the current trend may be weakening or about to reverse.

There are two main types of divergence:

1. Bullish Divergence: This happens when the price makes lower lows, but the MACD makes higher lows. It suggests that while the price is still declining, the selling momentum is weakening, and a reversal to the upside could be near.

2. Bearish Divergence: This occurs when the price makes higher highs, but the MACD makes lower highs. It indicates that the upward momentum is fading and that a downward reversal might follow.

Divergence is particularly useful when confirmed with other indicators like RSI or support and resistance zones. It is also more significant on higher timeframes (e.g., daily or weekly charts), where price movements carry more weight.

Imagine you are watching SHIB/USDT again. The price may be rising, forming new local highs, but the MACD is starting to slope downward. This bearish divergence could be your cue to start preparing for a potential retracement or reversal.

How to Use MACD in Your Trading Strategy

The MACD can be incredibly useful, but it should not be used in isolation. To build a well-rounded strategy, consider the following steps:

Start by identifying the overall trend using longer timeframes. If the trend is up and the MACD gives a bullish signal on a shorter timeframe, that’s a stronger setup.

Use MACD crossovers as entry or exit signals, but wait for confirmation. This could be a candlestick pattern, a break of a support or resistance level, or alignment with another indicator like RSI or Bollinger Bands.

Always manage your risk carefully. MACD, like all indicators, can give false signals—especially during periods of low volatility or sideways markets.

Backtest the MACD in your preferred market and timeframe. Some assets, like SHIB/USDT, may respond better to MACD signals on 4-hour or daily charts, depending on market conditions.

Common Pitfalls to Avoid When Using MACD

While MACD is a powerful tool, traders should be aware of its limitations. It is a lagging indicator, meaning it is based on past price data. As a result, it may signal a trade after a trend has already started or ended.

MACD also tends to perform poorly in range-bound or sideways markets, where price movements are small and inconsistent. In such environments, crossovers and histogram shifts can be misleading and lead to whipsaws.

Another common mistake is to treat MACD as a one-size-fits-all solution. Remember that each asset behaves differently. A strategy that works well on SHIB/USDT might not be as effective on Bitcoin or traditional stocks. Always adapt your use of MACD to the asset and market conditions you are trading.

Conclusion

The MACD indicator is one of the most reliable tools in a trader’s arsenal for analyzing momentum and identifying potential entry and exit points. By learning how to read MACD crossovers, histograms, and divergences, you can gain valuable insights into the strength and direction of market trends.

However, like any technical indicator, MACD should be used as part of a broader strategy that includes other forms of analysis and proper risk management. When used correctly, MACD can help you make more informed decisions and improve your overall trading performance.

0 notes

Video

youtube

Sniper Pro Forex Strategy My 15 Min Entry System + HTF Confirmation!

Hey Forex Traders! Bill Soriano here from Pittsburgh. In this video, I'm sharing my second attempt (and a much clearer one!) at explaining a powerful 15-minute Forex entry strategy using the Sniper Pro scanner, available on the Jifu platform. 🔗 **GRAB YOUR FREE SNIPER PRO SCANNER OVERVIEW PDF HERE:** https://sorianoblueprint.com/SNIPER-PRO-SCANNER-OVERVIEW.pdf I'm testing this strategy out and will be sharing results over the next couple of weeks. You'll learn how I combine Sniper Pro's unique signals – like scorecards, candle types (blue, gold), sniper/super sniper arrows, and the "Sniperlator" trend line – with crucial Higher Time Frame (HTF) confirmation from the 4-hour chart using specific EMAs (800, 200, 50). **In this video, you'll discover:** ✅ My specific entry criteria using the Sniper Pro scanner. ✅ The importance of HTF (4-Hour) confirmation for higher probability trades. ✅ How to interpret Sniper Pro scorecards and candle signals. ✅ Understanding the Sniper Pro "Sniperlator" and trend direction. ✅ Using additional tools like key zones, pivot points, and volatility bands. ✅ A look at how the DeLorean EMA indicator can assist with HTF analysis. ✅ Real trade examples (including AUDCAD and CHFJPY) to illustrate the strategy. ✅ How to avoid common pitfalls like spread widening during market rollover (5 PM Eastern). ✅ Information on Jifu, the Sniper Pro scanner, and educational resources available. Want to get started with Jifu and the Sniper Pro scanner? I can help you get a $50 discount! Plus, ask me about an additional $50 bonus I offer to those who join through me. **Connect with Bill Soriano:** 📞 Phone: 412-780-3177 📧 Email: [email protected] 💬 Facebook Messenger: https://m.me/billsoriano Don't forget to LIKE this video, SHARE it with fellow traders, and SUBSCRIBE for more Forex insights and Sniper Pro updates! Let me know your questions in the comments below. Thanks for watching, and let's make it a great trading week! --- **⚠️ FOREX TRADING DISCLAIMER ⚠️** Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts. Any opinions, news, research, analyses, prices, or other information contained in this video is provided as general market commentary and does not constitute investment advice. I will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. Past performance is not indicative of future results. --- #ForexStrategy #SniperPro #Gefu #ForexTrading #TradingScanner #BillSoriano #ForexEducation #TechnicalAnalysis #PriceAction #DayTrading #SwingTrading #ForexSignals #EMACrossover

0 notes

Text

Introduction to Syntium Algo

Syntium Algo is an innovative platform that harnesses the power of artificial intelligence to deliver accurate and timely trading signals. Designed to cater to traders of all experience levels, it simplifies the complexities associated with forex and cryptocurrency trading. By analyzing vast amounts of market data in real-time, Syntium Algo identifies profitable trading opportunities, enabling users to execute informed strategies with confidence.

Key Features of Syntium Algo

Advanced AI Algorithms

At the heart of Syntium Algo are cutting-edge AI algorithms that continuously learn from historical and current market data. This adaptive learning enhances predictive accuracy, allowing the platform to identify patterns and trends that may escape human analysis. Such sophistication provides traders with a strategic advantage in the dynamic trading landscape.

Real-Time Market Analysis

Syntium Algo processes live market data instantaneously, ensuring traders receive the most current insights. In volatile markets, timely information is crucial, and Syntium Algo ensures users are always equipped with the latest market intelligence to make swift decisions.

User-Friendly Interface

Understanding the importance of accessibility, Syntium Algo features an intuitive interface that allows traders to navigate the platform effortlessly. Customization options enable users to tailor their experience, focusing on executing trading strategies effectively without unnecessary complexity.

Automated Trading Strategies

For traders interested in automation, Syntium Algo offers features that allow the execution of trades based on predefined parameters. This capability minimizes the need for constant monitoring, enabling traders to capitalize on opportunities around the clock without manual intervention.

Benefits of Using Syntium Algo

Enhanced Decision-Making

By providing data-driven insights, Syntium Algo reduces reliance on intuition or emotions in trading decisions. Clear and concise signals assist traders in aligning their strategies with actual market conditions, potentially leading to more profitable outcomes.

Increased Efficiency

The platform's ability to swiftly analyze and interpret extensive datasets translates to increased trading efficiency. Traders can respond promptly to market movements, ensuring they do not miss out on lucrative opportunities.

Risk Management

Syntium Algo incorporates robust risk management tools, including stop-loss orders and risk assessment analytics. These features help traders protect their investments by proactively managing potential downsides, allowing for more confident trading.

Accessibility

Catering to both seasoned traders and beginners, Syntium Algo offers a user-friendly design complemented by comprehensive resources. This inclusivity ensures that anyone interested in forex or cryptocurrency trading can effectively utilize the platform to achieve their financial goals.

1 note

·

View note

Text

AI Signal Parsing in Trading: Revolutionizing Telegram Copy Trading

AI Signal Parsing is the process of using artificial intelligence to analyze and interpret different types of signals, such as text, images, or audio, to extract actionable information. In trading, these signals typically include market entries, exits, stop losses, and take profit levels.

AI uses advanced technologies like Natural Language Processing (NLP) and Vision AI to understand and decode these signals, even if Signal providers share signals in different formats or languages.

This is especially helpful in Forex trading communities on platforms like Telegram, where signals are shared rapidly and often as screenshots or in multiple languages.

Telegram Signal Copier (TSC) leverages AI signal parsing to automate and streamline the copy trading process directly from Telegram channels. Here's how it works:

Vision AI & NLP Parsing: TSC uses Vision AI to scan and understand image-based signals (like screenshots of trades), and NLP to read and parse text signals in multiple languages. This ensures compatibility with a wide variety of signal providers, regardless of how they format their alerts.

Image Signal Recognition: Even if a trade signal is sent as a screenshot or an image with overlaid text, the AI system can detect and interpret the necessary trade parameters, such as pair, entry point, SL, and TP.

Multi-format & Multi-language Support: TSC’s AI can decode signals sent in various formats (text messages, images, or mixed formats) and languages, making it a globally versatile tool.

Real-Time Execution: Once the AI parses the signal, TSC automatically mirrors the trade to the connected MetaTrader (MT4/MT5) account with precision and low latency.

Trade Validation: The AI system also analyzes patterns and indicators in the signals, helping reduce errors and improving trade accuracy.

Whether you follow free or premium signal providers, Telegram Signal Copier with AI signal parsing gives you an edge by automating and enhancing how you copy and execute trades.

0 notes