#Decentralized technologies

Explore tagged Tumblr posts

Text

Blockchain is Re-shaping the World: Revolutionizing Industries through Decentralization

Discover how blockchain technology is reshaping industries through decentralization. Explore the latest trends in blockchain for 2024, including finance, healthcare, and supply chain. Learn how CDN Solutions Group leads the way with innovative blockchain development services, dApps, and Web3 solutions. Visit us at Gitex Global 2024 for a firsthand look at our blockchain innovations. Visit now to read more: Blockchain is Re-shaping the World: Revolutionizing Industries through Decentralization

#blockchain technology#blockchain trends#blockchain#blockchain networks#blockchain partner#blockchain development expertise#blockchain development services#blockchain development#blockchain solutions#blockchain innovation#web3 solutions#decentralized technologies#blockchain experts#blockchain tech#blockchain services#decentralized applications#dapps#blockchain in finance#blockchain in healthcare#blockchain in supply chain#blockchain for real estate#blockchain revolution

0 notes

Text

New York Venture Summit 2024: Blockchain & Web3 conference

About Event Join us at NYVS 2024, hosted by Young Startup, on September 4–5, New York City, to dive into the future of blockchain and Web3 technologies. This cutting-edge event brings together blockchain enthusiasts, Web3 innovators, and industry leaders to explore transformative advancements in decentralized technologies. Engage in insightful discussions on the impact of blockchain and Web3 on various industries, attend hands-on workshops, and witness demonstrations of the latest innovations. Network with key players driving the evolution of decentralized applications and smart contracts. Don’t miss this opportunity to connect with pioneers and gain valuable insights into the blockchain and Web3 revolution.

To Know More- crypto events in New York

#New York Venture Summit 2024#New York Venture Summit news#web3 conferences New York#Blockchain technologies#Decentralized technologies#Blockchain event 2024#Web3 technologies conference#Blockchain applications#Web3 technology

0 notes

Text

#JOIN THE FEDIVERSE#degoogle#big tech#internet privacy#cybersecurity#decentralization#social media#technology#links#ref

53 notes

·

View notes

Text

Life in a Bubble: How Technological Revolutions Shape Society

Once upon a time, owning a television was an extraordinary luxury. Families gathered around small, grainy screens, captivated by black-and-white broadcasts that seemed magical at the time. Fast-forward to today, and we laugh at the thought of having just one screen—let alone one without color, HD, or streaming capabilities. Ever notice how every significant technological breakthrough feels monumental, only to become obsolete as soon as the next innovation arrives?

Understanding the Technological Bubble

Technological bubbles occur when groundbreaking innovations redefine societal norms, behaviors, and expectations. Each advancement creates its own bubble of influence—initially expanding as adoption grows, then ultimately bursting when a newer technology emerges.

Consider the evolution of televisions:

First Bubble: Black-and-white TVs revolutionized entertainment, bringing the world into living rooms for the first time.

Second Bubble: Color TVs popped the original bubble, making monochrome obsolete and setting a new standard.

Third Bubble: Flat-screen and HD televisions burst the color-TV bubble, making bulky sets feel like relics of the past.

Each bubble transformed society, influencing consumer behaviors, shifting economic landscapes, and altering our perception of normalcy.

Historical Echoes

Technological bubbles aren’t exclusive to televisions. They repeat throughout history, reshaping reality each time:

Communication: Letters → telephones → smartphones.

Music: Vinyl → cassettes → CDs → MP3 → streaming.

Internet: Dial-up → broadband → Wi-Fi → mobile connectivity.

Every bubble expanded rapidly, enveloping society in its new standards before bursting and being replaced by something even more revolutionary.

The Mother of All Bubbles

Today, we're living inside perhaps the largest technological bubble humanity has ever known: the global fiat monetary system and traditional finance. Like previous bubbles, this system feels unshakeable, inevitable, and everlasting. But like every bubble before it, it's ripe for disruption—this time, by decentralized technologies like Bitcoin.

Bitcoin isn't just a new type of money; it’s a radical departure from centralized financial control:

Decentralization vs. Centralization: Bitcoin puts financial power back into the hands of individuals.

Transparency vs. Secrecy: Blockchain technology makes financial transactions visible, verifiable, and resistant to manipulation.

Scarcity vs. Inflation: Unlike fiat currencies, Bitcoin has a capped supply, protecting against endless monetary inflation.

This next bubble is growing, quietly expanding in the shadows of mainstream finance, and it has the potential to burst the financial bubble we've lived in for generations.

What Happens When the Biggest Bubble Pops?

Imagine a world where financial control no longer rests in the hands of governments and banks, but with the people. When the fiat bubble bursts:

Financial Sovereignty: Individuals gain unprecedented financial autonomy and responsibility.

Power Redistribution: Central banks and financial institutions must adapt or risk obsolescence.

Societal Shifts: Our collective understanding of money, value, and community could be entirely redefined.

This transition won’t be without challenges. Initial instability and fierce resistance from established systems are inevitable. Yet, the opportunity for increased transparency, fairness, and efficiency makes this burst not just likely but necessary.

Preparing for the Pop

Every technological bubble eventually bursts. The question isn't if, but when. Understanding and recognizing this process enables us to position ourselves advantageously for the inevitable shift. Embracing the next technological wave means stepping beyond comfort zones and preparing to thrive in an evolved landscape.

Tick Tock Next Block.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Technological Revolution#Future of Finance#Financial Sovereignty#Decentralization#Tech Evolution#The Next Bubble#History of Technology#Society Shift#Disruptive Innovation#Blockchain#TickTockNextBlock#Digital Economy#Philosophy of Money#Economic Shift#financial empowerment#financial education#globaleconomy#finance#digitalcurrency#financial experts#cryptocurrency#unplugged financial

7 notes

·

View notes

Text

Can we upgrade open-source decentralized services, tools, and networks so decentralization can be the default options for startups and developers..?? can we achieve big tech's security and stability with decentralized networks ??

Share any thoughts or ideas you have... what you think ?

NOTICE: I'm not talking about web3 or crypto.

98 notes

·

View notes

Text

🚨 What Is a 51% Attack? And Should You Worry?

Blockchain is secure… but it’s not invincible. A 51% Attack happens when one group controls more than 50% of a blockchain’s mining power, allowing them to:

❌ Rewrite transactions (double-spending coins!) ❌ Block other users from making transactions ❌ Undermine trust in the network

🚀 Why does this matter? ✅ Bitcoin is too big to be attacked – but smaller blockchains are at risk! ✅ This is why decentralization is key – no single group should have too much power.

📩 Do you think crypto networks will always be secure? Let’s chat! 🔁 Reblog to spread awareness!

#crypto#cryptocurrency#bitcoin#blockchain#crypto for beginners#crypto security#crypto education#decentralization#investing#Crypto Made Simple#ethereum#crypto awareness#financial freedom#crypto investing#technology#future of money#finance#crypto trading#DeFi#Web3

4 notes

·

View notes

Text

Is Bitcoin a Good Investment?

#cryptocurrency#Blockchain Technology#Decentralized Finance (DeFi)#Financial markets#Digital Assets#Investment Risks#Bitcoin Volatility#Inflation Hedge#Cryptocurrency Regulation#Bitcoin Investment

3 notes

·

View notes

Text

The Great Social Media Decentralization

#social media#decentralization#technology#techinnovation#tech#twitter#tiktok#bluesky#threads#mastadon#moderation#culture wars#us politics

2 notes

·

View notes

Text

Exciting News: Blog 6 Coming Soon!

Hey, gamers and tech enthusiasts! 🎮✨

We are thrilled to announce that Blog 6: "Delving into the Core Components of the QorTrola Gaming Ecosystem: Privacy, Security, and Beyond" will be published later today! 🚀 And available to read on my blog site @

In this blog, we’ll explore:

Privacy and Security: How we ensure your data stays safe.

Incentivizing Fair Play: The innovative reward systems we’re implementing.

DePIN Technology: Bridging Web2 and Web3 gaming for a seamless experience.

Implementation Plan: Our step-by-step journey from concept to reality.

Real-World Applications: Practical use cases that showcase our vision.

Market Insights: Understanding the gaming and blockchain landscape.

Stay tuned for in-depth insights and groundbreaking information on how QorTrola Gaming plans to revolutionize the gaming world with cutting-edge technology and innovative approaches. 🔒💡🌐🎮

Don't miss out! Follow us and be part of this exciting journey. Your feedback and support are invaluable as we move from concept to reality. ⏰

See you soon in Blog 6!

#digitalcurrency#solana#token#depin#defi#technology#games#bitcoin#ethereum#iotex#web 3.0#web 2.0#iotsolutions#hardware#decentralization#blockchaingaming#blog#blockchain#QorTrolaGaming BlockchainGaming Web3 GamingInnovation DePIN Privacy Security FairPlay GamingCommunity FutureOfGaming

5 notes

·

View notes

Text

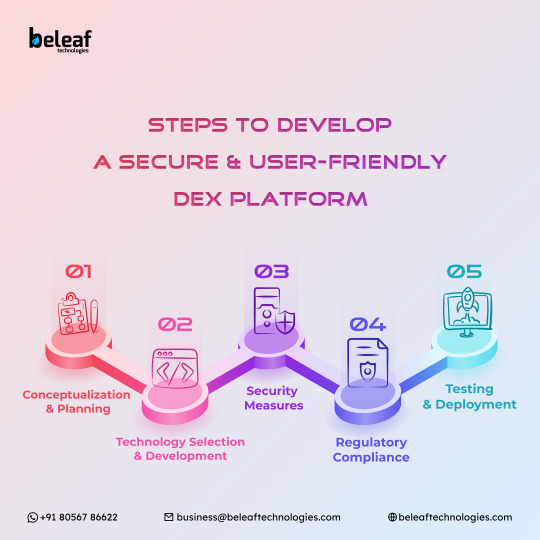

Discover the essential facts and steps required to create a secure and user-friendly DEX platform. Explore top-notch security and seamless trading experiences. Join Beleaf Technologies to uncover a wealth of previously unknown information in the realm of decentralized exchange development.

Contact details :-

Whatsapp: +91 80567 86622

Skype: live:.cid.62ff8496d3390349

Telegram: https://t.me/BeleafTech

Mail to:[email protected]

10 notes

·

View notes

Text

#information technology#futurism#technology#web 3.0#web 3 marketing#blockchain#defi#digitalcurrency#investment#centralized exchange#decentralized

2 notes

·

View notes

Text

💫 Join the Fediverse! 💫

Greetings, fellow bloggers! We welcome you to join us in discovering, honoring, and promoting the potential future of social networking—commonly referred to as the "Fediverse."

The Fediverse, or Federation Universe, refers to a collective of online platforms that utilize the web protocol known as ActivityPub, which has set a standard of excellence in regards to both protecting and respecting users' online privacies.

There's a good chance in the past few years that you've caught wind of the fedi family's critically acclaimed Mastodon; however, there are many other unique platforms worth your consideration...

✨ Where To Begin?

Conveniently enough, from the minds of brilliant independent developers, there already likely exists a Fediverse equivalent to your favorite socials. Whether it's an opinion from the critics, or from the community alike—the following popular websites are commonly associated with one another:

Friendica 🐰 = Facebook Mastodon 🐘 = Twitter Pixelfed 🐼 = Instagram PeerTube 🐙 = YouTube Lemmy 🐭 = Reddit

It's worth mentioning, too, a few other sites and forks thereof that are worthy counterparts, which be: Pleroma 🦊 & Misskey 🐱, microblogs also similar to Twitter/Mastodon. Funkwhale 🐋 is a self-hosting audio streamer, which pays homage to the once-popular GrooveShark. For power users, Hubzilla 🐨 makes a great choice (alongside Friendica) when choosing macroblogging alternatives.

✨ To Be Clear...

To address the technicalities: aside from the "definitive" Fediverse clients, we will also be incorporating any platforms that utilize ActivityPub-adjacent protocols as well. These include, but are not limited to: diaspora*; AT Protocol (Bluesky 🦋); Nostr; OStatus; Matrix; Zot; etc. We will NOT be incorporating any decentralized sites that are either questionably or proven to be unethical. (AKA: Gab has been exiled.)

✨ Why Your Privacy Matters

You may ask yourself, as we once did, "Why does protecting my online privacy truly matter?" While it may seem innocent enough on the surface, would it change your mind that it's been officially shared by former corporate media employees that data is more valuable than money to these companies? Outside of the ethical concerns surrounding these concepts, there are many other reasons why protecting your data is critical, be it: security breaches which jeopardize your financial info and risk identity theft; continuing to feed algorithms which use psychological manipulation in attempts to sell you products; the risk of spyware hacking your webcams and microphones when you least expect it; amongst countless other possibilities that can and do happen to individuals on a constant basis. We wish it could all just be written off as a conspiracy... but, with a little research, you'll swiftly realize the validity of these claims are not to be ignored any longer. The solution? Taking the decentralized route.

✨ Our Mission For This Blog

Our mission for establishing this blog includes 3 core elements:

To serve as a hub which anybody can access in order to assist themselves in either: becoming a part of the Fediverse, gaining the resources/knowledge to convince others to do the very same, and providing updates on anything Fedi-related.

We are determined to do anything within our power to prevent what the future of the Internet could become if active social users continue tossing away their data, all while technologies are advancing at faster rates with each passing year. Basically we'd prefer not to live in a cyber-Dystopia at all costs.

Tumblr (Automattic) has expressed interest in switching their servers over to ActivityPub after Musk's acquisition of then-Twitter, and are officially in the transitional process of making this happen for all of us. We're hoping our collective efforts may at some point be recognized by @staff, which in turn will encourage their efforts and stand by their decision.

With that being stated, we hope you decide to follow us here, and decide to make the shift—as it is merely the beginning. We encourage you to send us any questions you may have, any personal suggestions, or corrections on any misinformation you may come across.

From the Tender Hearts of, ✨💞 @disease & @faggotfungus 💞✨

#JOIN THE FEDIVERSE#fediverse#decentralization#internet privacy#social media#social networks#FOSS#activitypub#mastodon#fedi#big data#degoogle#future technology#cybersecurity#technology#essential reading

37 notes

·

View notes

Text

Hyperbitcoinization: What Happens When Bitcoin Wins?

For years, Bitcoiners have been shouting into the void, warning of the inevitable collapse of fiat money. At first, they were ignored. Then ridiculed. But slowly, the world is waking up. The cracks in the legacy financial system are no longer hidden beneath the surface—they are gaping wounds for all to see. And as trust in central banks, governments, and the endless printing of money erodes, something new is emerging from the ashes.

Bitcoin.

The world’s first decentralized, incorruptible, and finite form of money. A system that doesn’t ask for trust, but demands proof.

Hyperbitcoinization is not just Bitcoin adoption. It is the total, irreversible collapse of fiat currency as people reject money that loses value in favor of money that cannot be debased. It is the moment when Bitcoin is no longer just an asset—it becomes the standard. And when that happens, everything changes.

The Death of Inflation

Inflation is a silent tax, a creeping theft that erodes the purchasing power of every dollar you own. But in a Bitcoin world, inflation dies. There are only 21 million Bitcoin—ever. No government, no central bank, no self-serving politician can conjure more into existence. What you earn, what you save, retains its value. Wealth, for the first time in modern history, is not stolen through the backdoor of monetary debasement.

With the demise of inflation, the desperate scramble to make money work—gambling in stocks, chasing speculative bubbles, trusting in debt-ridden financial products—fades. People can simply store value in Bitcoin, knowing that it will not lose purchasing power over time. Hard work and discipline are rewarded. The time preference of humanity shifts from short-term consumption to long-term building.

The End of Government-Controlled Money

When hyperbitcoinization takes hold, governments lose the ability to print their way out of bad decisions. War, debt, corruption—these things thrive in a system where money can be created at will. When governments are forced to operate on a Bitcoin standard, they must tax honestly, spend responsibly, and live within their means. The reckless expansion of the state, funded by the illusion of endless credit, collapses. Power returns to the people.

For individuals, this means financial sovereignty. No more frozen bank accounts. No more arbitrary rules on how and when you can access your own money. No more middlemen siphoning off fees and dictating the terms of your economic freedom. Your wealth belongs to you and you alone, stored in a system that no one controls and no one can take away.

A World Without Banks

The traditional banking system thrives on permission and control. It decides who can send money, how much they can send, and when they can send it. But Bitcoin renders these gatekeepers obsolete.

With Bitcoin, every person on earth has access to a global financial network. A farmer in Nigeria, a software developer in Argentina, a truck driver in Canada—each of them has the same financial power as the wealthiest billionaire. No discrimination, no barriers, no approval required.

Banks will not disappear overnight, but their role will change. Instead of controlling money, they will be forced to compete for customers based on value-added services. And if they fail to adapt? They will fade into irrelevance, just as other obsolete industries have before them.

Preparing for the Shift: DCA into Bitcoin

The question is not if hyperbitcoinization happens, but when. And the best way to prepare is to start accumulating Bitcoin now, before the world wakes up.

Dollar-cost averaging (DCA) is the smartest, simplest way to do this. By buying Bitcoin regularly—whether daily, weekly, or monthly—you remove emotion from the equation. No stressing over price swings, no panic during market dips. Just steady accumulation of the hardest money ever created.

For those who have already embraced Bitcoin, this is second nature. But for the billions still tethered to fiat, the transition will be jarring. Those who move early will preserve their wealth. Those who wait risk being left behind in a crumbling economic system.

The Inevitable Future

Hyperbitcoinization is not some distant fantasy. It is already unfolding, piece by piece, block by block. The cracks in fiat are growing wider. Governments are scrambling to maintain control. Central banks are pushing CBDCs in a last-ditch effort to retain dominance.

But the truth is unstoppable. A system built on lies cannot outlast a system built on mathematical certainty. Bitcoin is not just an alternative; it is the escape route. The safety valve. The inevitable evolution of money.

One day, Bitcoin will be the global standard. It will not be a question of adoption, but of survival.

The only question that remains: will you be ready?

Tick Tock, Next Block.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Hyperbitcoinization#FinancialFreedom#SoundMoney#BitcoinStandard#EndFiat#BitcoinRevolution#MoneyEvolved#Decentralization#InflationKills#DCAIntoBitcoin#HODL#BitcoinEducation#DigitalGold#SovereignMoney#TickTockNextBlock#FutureOfMoney#Technology#Economy#Crypto#Freedom#AlternativeFinance#cryptocurrency#digitalcurrency#financial experts#financial education#globaleconomy#blockchain#finance#unplugged financial

2 notes

·

View notes

Text

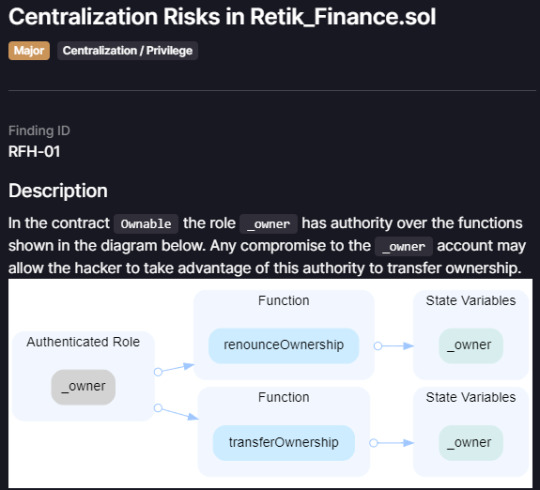

The Ridiculousness Continues: Retik Finance Fails CertiK Audit

Read the original article HERE.

As I covered in my last article, Retik Finance is obviously a scam. But that didn’t stop them from rushing to reassure the public that their scammy token isn’t actually a scam by informing us all that their CertiK audit is complete (spoiler: it’s still a scam).

A quick look at the audit report reveals that Retik Finance still did horribly on the audit. Take a look at this detail in the contract code found by CertiK:

The owner of the Retik Finance contract has the ability to take Retik tokens from users (renounceOwnership) and send them to his own account (transferOwnership). This alone should scare away any users. Retik Finance is entirely centralized.

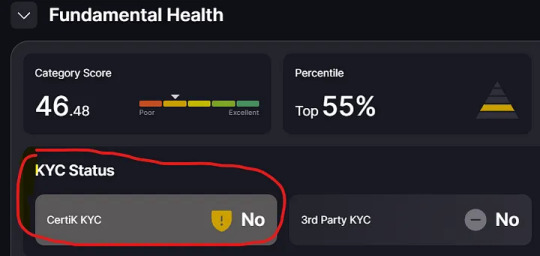

But it doesn’t stop there. CertiK also reports a very low Fundamental Health score for Retik Finance. Largely because Retik Finance hasn’t verified their identity. Probably because scammers don’t want to reveal who they are, making it more difficult to hold them accountable.

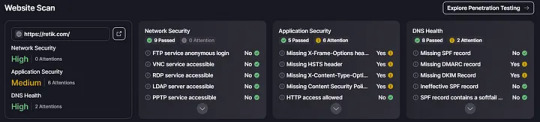

To top it all off, CertiK reports that their website has vulnerabilities as well:

So Retik Finance is a centralized mess with dangerous code and unverified owner(s). The only good thing on their audit report is that they have thousands of followers on Twitter/X and a lot of telegram users, which is a sad sight to witness. Hopefully people don’t keep falling for this obvious scam.

This also brings up another point: why is CertiK not immediately warning users that Retik Finance is a scam? Any body with any sense can figure out for themselves that Retik Finance is a malicious project in less than a minute (I highlighted the reasons why in my previous article). CertiK is supposed to be a professional crypto audit company; auditors at CertiK should be more than capable to see behind Retik Finance’s lies and point them out as a scam. CertiK needs to do a better job of exposing scummy projects.

If you enjoyed reading this, consider following/clapping. It helps a lot! Need help with crypto gas fees? I have a subreddit for that: https://www.reddit.com/r/CryptoGasFees/

ADA Crunch

4 notes

·

View notes

Text

My open-source decentralized core

I asked before if people would love to hear about my open-source projects, and I got a lot of really great responses, so here we go...

About the project

I've been working on a NodeJS project lately, it's a decentralized real-time data network integrated with AI policies and other cool security features, It's only been a few weeks under development and in its early stages, but I hope we get somewhere with it.

The project is called ddeep-core, and it's supposed to be a tool under the ddeep ecosystem we are building in Multi Neon (my startup).

This core is supposed to be a more secure way to sync, save, and process decentralized graph data in real time based on data subscriptions and policies.

link to the project

How it works

First of all, a peer (device or browser) would subscribe to some data (a node in the graph database) by opening a connection with the core and sending a get message, and if the policies applied to that node are satisfied, it will add a real-time listener to that node and send back the current node's data, otherwise, it just ignores it.

Now every time someone updates that node's data by sending a put message, that peer will receive a real-time update.

well, these policies can be AI-powered... so for example, if you want to prevent any angry inputs from being added to the network under the 'posts' node, you can do so in 3 lines of code easily.

ddeep-core can be a fully decentralized solution, and if you want to save data to storage, you can do that too with features like recovery checkpoints...

It supports IP whitelisting to prevent cross-site attacks and that kind of stuff, It manages the data well by resetting the graph and listeners every while, and with each peer connection close.

There is no API for this yet, but it works perfectly with Gun.js or just by sending requests to it, we are currently working on an interface API to communicate with the core in a more efficient way.

So, is it good ??

So far the results are pretty good, if we are talking about stability we still have a long road to go with more testing, and if we are talking about performance, It's good so far.

ddeep-core is good when it comes to performance, as it ignores a lot of things when processing connections and messages, for example, if the core has to deal with a put request, and has to save data to storage too, it won't wait for the saving process to finish, it will just ignore if it's done or not and send the updated data to all peers listening to it (after processing the policies for sure).

I focused a lot on the data structure of listeners and peers, and I hope I got it well as it really affects the performance a lot.

#technology#software engineering#coding#decentralization#software#open source#programming#artificial intelligence#backend

4 notes

·

View notes

Text

Are we passengers on someone else’s journey, or do we still have a say in where we’re headed? This morning’s reflection asks what real agency looks like in a world full of shifting systems and scrambled futures. You don’t need to steer the whole vehicle to shape its direction.

#AperiMail#data sovereignty#decentralized identity#memory systems#post-quantum security#Scramble Technology#scrambled future#web3

0 notes