#Digital Asset Tokenization

Explore tagged Tumblr posts

Text

SWFI's New Age Wealth Summit 2025 brings together sovereign wealth funds, pension funds, family offices, and financial experts to discuss innovation, sustainable investing, and future-focused wealth strategies in a dynamic global environment. Join us: https://www.swfi.com/newagewealth/

0 notes

Text

0 notes

Text

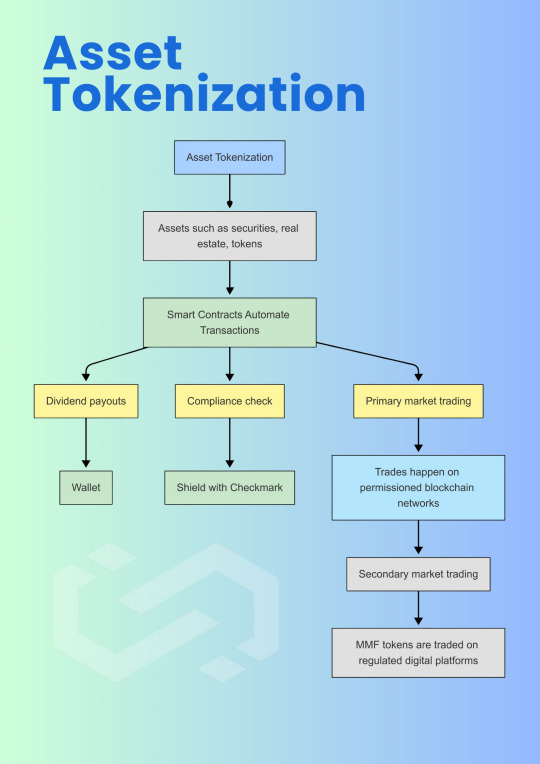

Asset Tokenization on Blockchain: Transforming Ownership and Investment

Discover how blockchain technology is revolutionizing asset tokenization, enabling secure, transparent, and efficient transactions. Learn about the benefits of tokenizing real estate, commodities, and more, and unlock new investment opportunities in a digital-first world.

#asset tokenization#blockchain technology#blockchain#technology#digital asset tokenization#asset tokenization development company#rwa tokenization

1 note

·

View note

Text

Tokenization of physical assets provides market participants with a number of advantages. Capital markets are still in the early stages of blockchain and distributed ledger technologies (DLT) adoption, and the industry is still looking for viable use cases. The creation of digitally tokenized assets is one broad category of such use cases, in which the token either represents a property interest that exists only on the Blockchain (such as non-certificated securities) or represents an asset that exists off the Blockchain."Dunitech Soft Solutions Pvt Ltd, a leading Asset Tokenization services in Lucknow, offers Asset Tokenization services. Contact:[email protected]. "

#asset tokenization services In Lucknow#asset tokenization services In India#asset tokenization#asset backed tokenization#tokenized equity#tokenization in blockchain#digital asset tokenization

0 notes

Text

The Future with E-Money Tokens: Exploring Blockchain for Easy Digital Money Transactions

Discover the power of E-Money Tokens and the simplicity of Blockchain technology. Dive into the world of digital money for seamless transactions. Embrace the future effortlesslyMICA

#MICA#E-Money Tokens#E-Money#Blockchain#RWA#Real World Asset tokenisation#digital money#digital money transfer

2 notes

·

View notes

Text

Beautiful sculpture in the interior of the cultural space Kobzar

One of the directions of our work I see 3d digitization of unique works of art, their tokenization and possession of the digital prints NFTs of these objects in the metaverse

7 notes

·

View notes

Text

Tokenized Assets for Secure Management and Compliance

The financial world is undergoing a transformation fueled by blockchain technology, with tokenized assets at the forefront of this evolution. As traditional finance grapples with the demands of digital innovation, institutions are increasingly embracing tokenized assets for secure management. This adoption not only enhances operational efficiency but also brings greater transparency, accessibility, and security to asset custody and transfer. With regulatory clarity improving and digital infrastructure maturing, tokenization is no longer just a concept—it's becoming a foundation of modern asset management.

Understanding Tokenized Assets Tokenized assets are digital representations of physical or intangible assets on a blockchain, ranging from real estate and commodities to bonds and equities. These tokens represent ownership rights and enable seamless transfer, fractionalization, and tracking through decentralized systems. They are built on secure blockchain networks that ensure immutability, auditability, and transparency, making them highly attractive for institutional-grade asset management.

Why Institutions Are Embracing Tokenized Assets Institutions are drawn to tokenized assets because they solve long-standing inefficiencies in traditional asset markets. From delayed settlements and liquidity challenges to opaque ownership structures, legacy systems are slow and costly. Tokenization offers a streamlined alternative where transactions are near-instantaneous, ownership is traceable in real time, and compliance can be built directly into smart contracts.

Benefits of Tokenized Assets for Secure Management Security is paramount for institutional investors, and tokenized assets bring a new level of control and auditability. With programmable features such as access permissions, automated compliance checks, and embedded transfer restrictions, institutions can manage assets with unprecedented precision. Digital custody solutions further enhance security by replacing manual processes with tamper-proof blockchain systems, reducing fraud and operational risk.

Tokenization and the Evolution of Custody Traditional asset custody involves layers of intermediaries, high costs, and complex documentation. Tokenization transforms this landscape by enabling self-custody or the use of digital custodians who leverage secure multiparty computation and cold storage technologies. This shift not only reduces custody costs but also increases asset availability and real-time settlement capabilities.

Improving Transparency and Efficiency in Asset Management Blockchain technology’s transparent nature means that asset provenance, ownership records, and transaction history are easily verifiable. Institutions gain greater visibility into asset flows and can track performance, compliance, and risk in real time. This transparency builds investor confidence and enhances internal governance and reporting capabilities.

Regulatory Momentum Behind Institutional Tokenization Regulators around the world are catching up with the technology, creating frameworks that support institutional adoption of tokenized assets. Jurisdictions like Switzerland, Singapore, and the UAE have introduced progressive regulations that legitimize digital securities and provide legal certainty. This momentum encourages more institutions to adopt tokenized models while maintaining regulatory compliance.

Challenges to Institutional Tokenized Asset Adoption Despite its promise, institutional tokenization still faces challenges. These include the need for standardized protocols, interoperability between blockchain platforms, and integration with existing financial systems. Additionally, institutions must navigate evolving regulatory environments and invest in digital asset infrastructure, including custodial services and secure onboarding processes.

Use Cases Across Institutional Finance Institutions are already exploring tokenized real estate investment, private equity distribution, bond issuance, and alternative asset access. Banks and asset managers are piloting blockchain platforms to issue and manage tokenized securities, while central banks are experimenting with central bank digital currencies that align with tokenized ecosystems. These developments signal a broader shift toward blockchain-based finance at the institutional level.

The Future of Tokenized Asset Infrastructure As digital asset infrastructure matures, we will likely see the rise of interoperable ecosystems where tokenized assets move seamlessly across platforms and borders. Institutions that adopt early stand to benefit from increased liquidity, lower operational costs, and new product opportunities. With tokenization becoming a pillar of next-generation finance, institutions can no longer afford to stay on the sidelines.

For more info https://bi-journal.com/institutional-adoption-of-tokenized-assets-for-secure-management/

Conclusion Institutional adoption of tokenized assets for secure management represents a major milestone in the digitization of global finance. It offers unmatched advantages in efficiency, security, and transparency, all of which are essential in today’s complex financial landscape. As infrastructure and regulation continue to evolve, tokenized assets are poised to become the foundation of institutional asset strategy, redefining how the world manages and transfers value at scale.

#Tokenized Assets#Digital Custody#Blockchain Finance#BI Journal#BI Journal news#Business Insights articles

0 notes

Text

Your Money Is Changing—Are You Ready for the Shift?For decades, institutional finance has relied on outdated infrastructure—slow settlements, limited liquidity, and high fees.Now? Blockchain is rewriting the rules.💡 Asset tokenization is making investments: 🔹 More accessible—fractional ownership of real estate, private equity & more. 🔹 More efficient—automated smart contracts eliminate intermediaries. 🔹 More transparent—blockchain provides an immutable record of ownership.BlackRock, JPMorgan, and HSBC are already tokenizing assets. If your institution isn’t thinking about it, you’re already behind.

#finance#tokenization#digital asset#blockchain#tokenomics#cryptocurrency#token factory#bitcoin#investment#asset management#assets

0 notes

Text

Analiza impactului criptomonedelor asupra piețelor imobiliare și a investițiilor în proprietăți

Introducere Criptomonedele și tehnologia blockchain au început să influențeze diverse sectoare ale economiei globale, inclusiv piața imobiliară. În ultimii ani, investitorii au explorat posibilitățile de a integra activele digitale în portofoliile lor imobiliare, utilizând criptomonedele pentru tranzacții, finanțare și tokenizarea proprietăților. Această analiză explorează modul în care…

#piață descentralizată#auditabilitate#integrare tehnologică#digital asset management#inovație disruptivă#managementul activelor#adaptare legislativa#Finanțare digitală#soluții fintech#adoptare tehnologică#evaluare riscuri#transferuri digitale#imobiliare#management riscuri#colaborare public-privat#integritate a datelor#intermediere redusă#piața imobiliară#investiții în proprietăți#tranzacții imobiliare#inovare imobiliară#sistem imobiliar#token-uri imobiliare#digitalizare imobiliară#blockchain imobiliar#proprietate digitală#blockchain#Economie Globală.#Securitate cibernetică#smart contracts

0 notes

Text

Crypto Whale Weekly: Market Turbulence, Trump Tokens & Al Retreat

Crypto Whale Guide Weekly Report: January 29, 2025

Your Snapshot of Crypto’s Biggest Moves and What’s Next

Market Snapshot

The crypto market opened the week with mixed signals that left analysts divided. While some see this as healthy consolidation after January’s rally, others warn of potential bear traps. The NWST1100 Index fell 3.34% last week, but interestingly, this decline was concentrated…

#crypto#bitcoin#cryptocurrency#cryptocurrency news#digital assets#blockchain#ethereum#ripple labs#tokens#memes

0 notes

Text

#New age wealth#New Age Wealth Summit 2025#New age wealth Summit#New age wealth Summit Dallas#New age wealth Summit Texas#New age wealth Summit by SWFI#web 3 finance#next generation wealth management#sustainable wealth investments#Sovereign wealth funds#Digital Asset Tokenization#crypto investment company

0 notes

Text

0 notes

Text

Official Listing : Rocky Rabbit Memecoin

The Rocky Rabbit project on Telegram announces that the coin RabBitcoin $RBTC will be officially listed on a major exchanges.

The Listing date is 🗓️ September 23, 2024

✨ In addition to the listing, there is a high chance of an Airdrop happening on the same day 🔥🔥

👇Join the Rocky Rabbit Airdrop 👇

https://www.t.me/RockyRabbit_bot

#crypto#blockchain#defi#investment#digitalcurrency#bitcoin#telegram#memecoin#token#meme#digital assets#ethereum#ecosystem#meme tokens#miniapp#make money online

0 notes

Text

🔮Save the date for SolPAL ( $SPL ) Token Fairlaunch on PINKSALE.FINANCE — September 5th, 2024!🔮

SolPAL Token (SPL) is an Solana & ERC-20 based token. It is a utility token designed to provide SolPAL ecosystem benefits and to enable access to attractive opportunities, as well as innovative products and services in the SolPAL social network space.

SOLPAL (SPL) on Solana - For Solpal Social Platform! Get SPL token for socializing in Solpal! Listing directly to Raydium CMC Fast Track at launch Direct listing in CEX L/P Locked Beta dAPP already Launched Big community on Solpal Social Platform

🔰Pink Fairlaunch Link: https://www.pinksale.finance/solana/launchpad/jnqVLASFkXn4hCsjirb3fNstQMLycdFqEjdBAiTqGDn

🖥 Website: solpal.io 📬 Telegram: https://t.me/solpalofficial

Stay Tune!🚨

0 notes

Text

How Real Estate Companies are Adapting to the Asset Token Revolution

The real estate industry is undergoing a significant transformation with the rise of asset tokenization. This revolutionary technology is not only reshaping how real estate assets are bought and sold but also how companies operate and compete in this evolving market. In this blog, we’ll explore how real estate companies are adapting to the asset token revolution and what this means for the future of real estate.

What is Asset Tokenization?

Asset tokenization involves converting physical real estate assets into digital tokens on a blockchain. Each token represents a share of ownership in the asset, allowing for fractional ownership and making it easier to trade and manage real estate investments. This technology offers increased liquidity, transparency, and efficiency compared to traditional real estate transactions.

Adapting to the Asset Token Revolution

1. Embracing Blockchain Technology

Real estate companies are increasingly adopting blockchain technology to facilitate asset tokenization. Blockchain provides a secure and transparent ledger for recording transactions, reducing the need for intermediaries and minimizing the risk of fraud. By leveraging blockchain, companies can streamline transactions, enhance security, and build trust with investors.

2. Offering Fractional Ownership

One of the most significant changes brought about by asset tokenization is the ability to offer fractional ownership. Real estate companies are adapting by allowing investors to purchase smaller portions of high-value properties. This democratizes access to real estate investments, attracting a broader range of investors and increasing market liquidity.

3. Enhancing Transparency and Compliance

Tokenization enhances transparency by providing a clear, immutable record of ownership and transactions. Real estate companies are using this feature to improve compliance with regulations and build investor confidence. Transparent records also simplify audits and reduce administrative overhead, making it easier to manage and report on real estate assets.

4. Revolutionizing Investment Models

The traditional real estate investment model involves substantial upfront capital and long-term commitment. With asset tokenization, companies are exploring new investment models, such as crowdfunding and public offerings of real estate tokens. These models lower the entry barriers for investors and provide companies with new avenues for raising capital.

5. Integrating with Existing Platforms

Real estate companies are integrating asset tokenization with existing investment platforms and marketplaces. This integration allows for seamless trading and management of tokenized assets, providing investors with a user-friendly experience. Companies are also collaborating with fintech and blockchain startups to enhance their technological capabilities and stay competitive in the market.

6. Educating Stakeholders

To successfully adapt to the asset token revolution, real estate companies are investing in education and training for their stakeholders. This includes educating investors, property managers, and legal teams about the benefits and implications of asset tokenization. By fostering a better understanding of the technology, companies can drive adoption and ensure smooth implementation.

Conclusion

The asset token revolution is transforming the real estate industry, and companies are adapting by embracing blockchain technology, offering fractional ownership, enhancing transparency, and exploring new investment models. As this technology continues to evolve, real estate companies that effectively adapt will be well-positioned to capitalize on new opportunities and drive innovation in the market. The future of real estate is digital, and asset tokens are leading the charge.

1 note

·

View note

Link

🚀🔐 Get ready for a crypto storm! This August, over $900M in altcoin tokens are set to unlock, flooding the market. Brace yourself for volatility and potential opportunities! Are you prepared for the impact? 🌊📉

#crypto#altcoin#token unlock#crypto news#investment#blockchain#ethereum#crypto alert#fintech#crypto trends#defi#digital assets#market volatility

0 notes