#DigitalTransaction

Explore tagged Tumblr posts

Text

#PollTime

What technology secures digital transactions?

A) Blockchain 🔗

B) AI 🤖

C) Kubernetes 📦

D) IoT 🌍

Comments your answer below👇

💻 Explore insights on the latest in #technology on our Blog Page 👉 https://simplelogic-it.com/blogs/

🚀 Ready for your next career move? Check out our #careers page for exciting opportunities 👉 https://simplelogic-it.com/careers/

#itcompany#dropcomment#manageditservices#itmanagedservices#poll#polls#technology#digital#digitaltransaction#blockchain#ai#artificialintelligence#kubernetes#iot#itservices#itserviceprovider#managedservices#testyourknowledge#simplelogic#makingitsimple#simplelogicit#makeitsimple#itconsulting

0 notes

Text

UPI Transection incresed from January to November more then 15,500 thousand crore rupees

UPI transactions surged by over ₹15,500 thousand crores from January to November! 📈 Discover the remarkable growth of digital payments.

Visit : https://thevirtualupdate.com/upi-transection-incresed-from-january-to-november-more-then-15500-thousand-crore-rupees/

#UPIRevolution#DigitalIndia#CashlessIndia#FintechGrowth#DigitalTransaction#UPIGrowth#IndianEconomy#CashlessPayments#DigitalWallet#PaymentSolutions#UPIAdoption#FinancialInclusion#UPIStatistics#TechInIndia#IndiaFintech#TheVirtualUpdate

0 notes

Text

Top 10 Online Payment Apps in India for Secure Digital Transactions (2024)

Are you looking for the best online payment apps in India?

The Unified Payment Interface (UPI) is a platform that lets users make online payments or cashless transactions from their mobile phones by adding multiple bank accounts on their app. It’s efficient and easier to use than traditional banking methods, but it may not be the best choice for everyone.

0 notes

Text

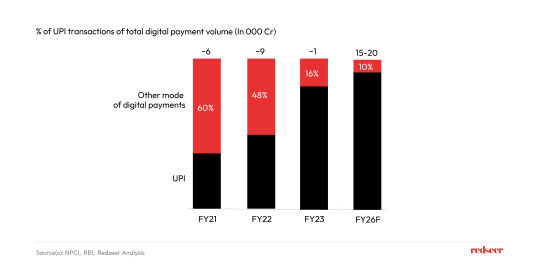

From UPI's game-changing ease of fund transfer to the latest trends in embedded finance, explore the Redseer report for a deep dive into the financial landscape's evolution.

0 notes

Text

Ditch the Old Gateways, Switch to Smart UPI APIs

Legacy systems slowing you down? Upgrade your collection system with our UPI Collection API that delivers lightning-fast and secure transactions. Perfect for both high-volume enterprises and agile startups.

0 notes

Text

Boost Online Transactions with Custom Payment Gateway Solutions

Looking for secure and seamless payment integration for your website? Our expert payment gateway software development company offers end-to-end payment software development tailored to your business. Whether you're building an eCommerce platform or a service-based website, we deliver fast, secure, and scalable payment gateway software development services. From APIs to multi-currency support, our team ensures hassle-free transactions. Get a custom payment gateway for your website that enhances user trust and drives sales.

#PaymentGateway#SoftwareDevelopment#FintechSolutions#eCommerce#WebDevelopment#SecurePayments#CustomSoftware#PaymentIntegration#DigitalTransactions#InnovateMarketers

0 notes

Text

Cryptocurrency payment networks are transforming digital transactions by offering faster, more secure, and cost-effective payment solutions.

#CryptoPayments#BlockchainTechnology#DigitalTransactions#CryptoAdoption#FintechRevolution#BitcoinPayments#CryptoTrading

0 notes

Text

#UPI#Digital#India#Fintech#Innovation#Government#FinancialInclusion#DigitalTransactions#Economy#ruchianandandassociates#Incentive#Scheme

0 notes

Text

How to Develop a Peer-to-Peer Payment App Like Cash App?

Digital payments are the future, and peer-to-peer (P2P) payment apps like Cash App are revolutionizing how we send, receive, and manage money. If you're a fintech startup, entrepreneur, or business looking to enter the digital payment space, now is the time!

📌 In this blog, Kody Technolab covers: ✅ Essential features of a P2P payment app 💳 ✅ Security measures & compliance for safe transactions 🔒 ✅ Development costs & monetization strategies 💰

Ready to build the next big P2P payment app? Get all the insights you need!

#P2PPayments#FintechApp#CashAppClone#DigitalTransactions#SecurePayments#AppDevelopment#FintechSolutions#MobilePayments#FinancialTechnology

0 notes

Text

The Future of E-Commerce and Digital Business Opportunities in Dubai 2025:

E-commerce market has experienced exponential growth, with an estimated valuation of $9.2 billion by 2026. The digital business sector, including fintech and digital payments, is also set to surpass $30 billion as more companies shift towards online platforms. Key drivers include increasing smartphone adoption, government-backed digital initiatives, and evolving consumer behavior.

Market Size of E-Commerce and Digital Business in Dubai

E-commerce market has experienced exponential growth, with an estimated valuation of $9.2 billion by 2026. The digital business sector, including fintech and digital payments, is also set to surpass $30 billion as more companies shift towards online platforms. Key drivers include increasing smartphone adoption, government-backed digital initiatives, and evolving consumer behavior.

Groundbreaking E-Commerce Innovations:

1. Invisible Payments: The Future of Checkout

What if payments happened without customers even noticing? Invisible payments use AI-driven authentication and background transactions to allow seamless, frictionless checkouts. Dubai-based e-commerce platforms are beginning to adopt this feature to reduce cart abandonment.

2. Autonomous Financial Assistants for Online Stores

AI-powered financial assistants now help e-commerce merchants predict cash flow, manage taxes, and optimize payment methods in real-time. These tools are integrated directly into online store dashboards, giving business owners proactive financial insights.

3. NFT-Based Product Authentication

To combat counterfeiting, Dubai’s high-end e-commerce businesses are leveraging NFT (Non-Fungible Token) verification. Customers can now check the authenticity of luxury goods, artwork, and digital assets through blockchain-registered ownership certificates.

4. Crypto Payment Gateways for Cross-Border Sales

E-commerce platforms in Dubai are enabling crypto transactions, making it easier for international buyers to shop without currency conversion hassles. Businesses are integrating multi-token wallets, allowing customers to pay in Bitcoin, Ethereum, and stablecoins.

5. Instant Refunds with Smart Contracts

Refund processing is getting faster with blockchain-powered smart contracts. These automated refund solutions ensure instant transactions once return conditions are met, eliminating long wait times and improving customer trust.

Groundbreaking Digital Business Innovations:

1. Metaverse Commerce: Digital Shopping Redefined

Dubai is pioneering the Metaverse Mall, where customers can browse and purchase digital products with immersive AR/VR experiences. Businesses can create 3D storefronts, allowing customers to interact with products virtually before buying.

2. AI-Based Customer Support Avatars

Instead of traditional chatbots, Dubai businesses are launching AI-powered avatars that provide human-like customer interactions. These avatars can assist with orders, payments, and troubleshooting, enhancing customer experience without human intervention.

3. Virtual Business Banking Without Traditional Banks

Digital businesses in Dubai can now open bankless accounts that provide virtual IBANs, instant payments, and global financial management. These new fintech solutions bypass the need for physical banking, streamlining operations for startups and remote businesses.

4. Subscription-Based Digital Ownership

Dubai-based startups are exploring the concept of subscription-based asset ownership, allowing users to lease software, NFTs, and other digital assets through recurring payments. This model makes high-value digital goods more accessible.

5. Hyper-Personalized Ad Payments with Microtransactions

Instead of traditional advertising, businesses can now offer users pay-per-engagement models, rewarding them with microtransactions for interacting with ads, content, and brand promotions. This trend is reshaping digital marketing strategies in Dubai.

How These Innovations Benefit Consumers

Digital advancements in Dubai's e-commerce and fintech sectors aren't just beneficial for businesses—they also make life easier for consumers. Here’s how:

Seamless Shopping Experience – Invisible payments and AI-based financial assistants ensure smooth and quick transactions, eliminating checkout delays.

Enhanced Security – Features like NFT-based authentication and blockchain-powered refunds protect consumers from fraud and counterfeits.

More Payment Choices – With crypto gateways and digital banking solutions, consumers can pay in multiple currencies and even cryptocurrencies without conversion issues.

Greater Convenience – AI avatars and metaverse commerce create a highly personalized and engaging shopping experience, reducing the need for physical interactions.

Cost Savings & Rewards – Pay-per-engagement ad models allow consumers to earn while they interact, and subscription-based ownership makes digital goods more affordable.

Why is Dubai the Perfect Place for Digital Businesses?

Dubai’s strategic location, world-class infrastructure, and government support make it an ideal place for e-commerce and digital businesses to thrive. Here’s why:

Tech-Savvy Population: With one of the highest internet and smartphone penetration rates in the world, Dubai's consumers are always online, making digital businesses more viable.

Government Initiatives: The UAE government has launched several programs like the Dubai E-Commerce Strategy, which aims to strengthen online trade and attract global digital players.

Tax Benefits: Dubai offers tax-free zones that encourage entrepreneurs and global businesses to set up their digital ventures.

Strong Logistics Network: Dubai's advanced logistics and transport infrastructure ensure fast and efficient delivery of goods, boosting e-commerce operations.

Cashless Economy: The UAE is rapidly moving towards a cashless economy with digital payment options like Apple Pay, Samsung Pay, and local platforms

Final Thoughts

Dubai’s e-commerce future is full of exciting possibilities, offering businesses big and small the chance to grow like never before. As technology improves and more people shop online, the digital market will only get stronger. Success will come to those who focus on customer experience, seamless payments, and smart digital strategies. Whether you’re a new entrepreneur or an established business, now is the best time to embrace change and explore new opportunities. The future is all about making things faster, easier, and more enjoyable for everyone!

🚀 Power Your Business with Foloosi! Seamlessly accept payments with Foloosi’s all-in-one payment gateway. Fast, secure, and built for UAE businesses. 👉 Explore Now

#PaymentGateway#OnlinePayments#DigitalTransactions#SeamlessPayments#SecurePayments#BusinessSolutions#payment gateway#payment gateway in uae#uae business#best payment gateway in uae

0 notes

Text

Can BlockDAG Cryptocurrencies Redefine the Future of Digital Transactions?

As the cryptocurrency space matures, the need for faster, more scalable, and cost-effective solutions is more critical than ever. BlockDAG cryptocurrencies are emerging as a promising alternative, offering a unique structure that addresses key limitations faced by traditional blockchain networks like Bitcoin and Ethereum. In this article, we explore the advantages of BlockDAG technology, its potential applications, and whether it has the power to shape the next phase of digital currency.

Understanding BlockDAG Cryptocurrencies: How Do They Work?

BlockDAG, or Directed Acyclic Graph, is an innovative structure allowing multiple blocks to connect simultaneously, unlike the sequential setup of typical blockchains. This parallel processing capability makes BlockDAG cryptocurrencies highly efficient, allowing faster transaction speeds and improved scalability. In contrast to traditional blockchains, which can suffer from congestion during high usage, BlockDAG networks like IOTA and Nano can handle high transaction volumes smoothly.

Key Advantages of BlockDAG Cryptocurrencies

1. Scalability and Speed

One of the standout benefits of BlockDAG cryptocurrencies is their ability to scale efficiently. Unlike blockchains that often experience network slowdowns, BlockDAG’s parallel processing ensures that thousands of transactions can be processed per second. This feature makes it ideal for applications needing consistent high throughput, such as e-commerce and Internet of Things (IoT) transactions.

2. Enhanced Security Mechanisms

Security is fundamental in digital currency networks. BlockDAG cryptocurrencies enhance security by ensuring each transaction or block confirms previous transactions, creating a robust decentralized structure. This setup reduces vulnerabilities, making BlockDAG networks resilient to various types of cyber attacks, including double-spending attempts.

3. Minimal to No Transaction Fees

Traditional blockchains often struggle with high transaction fees, making microtransactions impractical. BlockDAG cryptocurrencies offer fee-less or low-cost transactions, as seen in IOTA’s Tangle network, which doesn’t charge fees. This cost-efficiency is particularly valuable for machine-to-machine payments in IoT and for industries requiring frequent, low-cost transactions.

Applications of BlockDAG Cryptocurrencies in Real-World Scenarios

With enhanced scalability and minimal transaction fees, BlockDAG cryptocurrencies can serve various real-world applications:

Internet of Things (IoT): In IoT environments, devices need to communicate and transact frequently. BlockDAG’s fee-less transactions allow for seamless exchanges, such as IOTA’s Tangle, which is designed to handle these machine-to-machine interactions.

Microtransactions: Nano, another BlockDAG cryptocurrency, is ideal for real-time, small-value payments. This makes it particularly suitable for applications like online content monetization or gaming, where frequent, small payments are needed.

Decentralized Finance (DeFi): DeFi is currently dominated by Ethereum, but high fees and slower processing times present barriers. BlockDAG cryptocurrencies offer a faster, cost-effective alternative that could open DeFi to more users and applications.

Can BlockDAG Cryptocurrencies Compete with Ethereum and Solana?

Ethereum and Solana are two of the leading blockchains, but both face scalability challenges. Ethereum’s planned upgrades are aimed at addressing these limitations, yet high transaction fees remain an issue. Solana, known for its high throughput, has encountered outages under heavy load. With its parallel structure, BlockDAG cryptocurrencies offer a compelling alternative by maintaining high transaction capacity at a low cost, positioning them as a potential competitor for high-demand applications.

The Future Potential of BlockDAG Cryptocurrencies

As the demand for fast and scalable blockchain solutions increases, BlockDAG cryptocurrencies could play a vital role in meeting these needs. Their ability to handle high transaction volumes with minimal fees positions them well in industries like IoT, finance, and e-commerce. While traditional blockchains will likely remain foundational in the crypto ecosystem, BlockDAG technology could become a leading choice for applications requiring high efficiency and low costs.

Conclusion

BlockDAG cryptocurrencies are making strides toward addressing scalability, security, and transaction fees in the cryptocurrency world. As they gain more adoption, they may reshape the industry and coexist alongside traditional blockchains, potentially playing a key role in decentralized finance and IoT. The evolution of BlockDAG technology could signal the beginning of a new era in digital transactions, opening up further opportunities for innovation in the cryptocurrency landscape.

#BlockDAGCryptocurrencies#FutureOfCryptocurrency#CryptoTechnology#ScalableCryptocurrency#CryptoSecurity#BlockchainVsBlockDAG#IOTA#Nano#DigitalTransactions#CryptocurrencyTrends#BlockchainInnovation#IoTAndCrypto#DecentralizedFinance#CryptoScalability#CryptocurrencyEfficiency#CryptoEvolution#DirectedAcyclicGraph#CryptocurrencyFuture#SecureCryptocurrency

0 notes

Text

Say goodbye to high fees and slow transfers.

Volante is here to make digital transactions faster, secure, and more transparent.🔐

🔗Find out how : volante-chain.com

0 notes

Text

Why wait for tomorrow when you can get paid today? Real-Time Settlements with LightSpeedPay means instant access to your funds, no delays, no hassles.

lighstspeedpay.in

#realtimesettlements#instantaccess#paymentrevolution#lightSpeedPay#fastpayments#digitaltransactions#securepayments#fintechinnovation#businessboost#smegrowth#smallbusinessowners#entrepreneurlife#businessmadeeasy#cashflowboost#paymentgateway

0 notes

Text

What are some potential use cases for Skyfire's payments network?

Skyfire's payments network, designed to be secure, fast, and scalable, offers numerous potential use cases across various industries. Here are some unique and detailed scenarios where it could be applied:

1. E-commerce Platforms

Seamless Transactions: Skyfire can integrate with online marketplaces and e-commerce stores to provide fast, secure payments. With reduced transaction fees and faster settlement times compared to traditional payment processors, it could enhance the checkout experience, particularly for global customers.

Read More at: https://rb.gy/bnujp4

#SkyfirePayments#DigitalTransactions#BlockchainPayments#CrossBorderPayments#FinancialInclusion#EcommerceSolutions#SmartContracts#FastPayments#SecureTransactions#PaymentNetwork

0 notes

Text

youtube

Today, everyone is opting for digital payments. Card and cash payments are decreasing. In terms of digital payments, India is surpassing the leading countries in the world. You can gauge the popularity of UPI payments from the latest figures. With the increasing craze for UPI payments, mobile transactions are getting a boost. People consider UPI as the top choice for digital payments. Amidst the rapid growth in India's digital payments, FY 2023-24 witnessed significant growth in UPI transactions compared to the previous year. According to transaction numbers, there has been a 56% growth in UPI transactions, and in terms of valuation, there has been a 43% increase. This is the first time that UPI transactions have crossed the mark of 100 billion. In the fiscal year 2023-24, transactions through UPI reached 131 billion, compared to 84 billion in the fiscal year 2022-23.

हमारे Channel का प्रयास है हर निवेशक को ��ही निवेश की राय देना। आज ही इस चैनल को Like और Subscribe करें। Follow us on: YouTube: https://youtube.com/@indianewsbusiness Twitter: https://twitter.com/indianewsbiz Facebook: https://www.facebook.com/indianewsbus... Official Website: https://indianewsbusiness.com/

#indianews#IndiaNewsBusiness#DigitalPayments#UPI#Demonetization#COVID19#CashlessIndia#MobilePayments#Fintech#FinancialInclusion#India#Economy#DigitalTransformation#FinancialTechnology#UPIPayments#UPITransactions#UPIGrowth#UPIValuation#CashlessEconomy#IndianEconomy#DigitalIndia#FinancialServices#FinancialTech#UPIRevolution#OnlinePayments#TransactionTrends#FY2023_24#CashlessTransactions#DigitalTransactions#FinancialSector

0 notes

Text

Safeguarding Our Digital World: Prioritizing Cybersecurity in the Age of Digital Transactions 🔒💻

Hey Tumblr fam! 👋 Let's talk about something super important today: cybersecurity in the age of digital transactions. 💳💻 In a world where we're increasingly reliant on technology for our financial transactions, ensuring our online safety is more crucial than ever. Here's why prioritizing cybersecurity matters:

Protecting Sensitive Information: With the rise of digital payments and online banking, our personal and financial information is more vulnerable to cyber threats. Prioritizing cybersecurity measures helps safeguard our data from hackers and cybercriminals who seek to exploit vulnerabilities.

Preventing Identity Theft: Cyberattacks can lead to identity theft, where our personal information is stolen and misused for fraudulent activities. By implementing robust cybersecurity protocols, we can reduce the risk of falling victim to identity theft and financial fraud.

Maintaining Trust and Confidence: Trust is essential in the digital age, especially when it comes to financial transactions. By demonstrating a commitment to cybersecurity, businesses and financial institutions can instill confidence in their customers, strengthening trust and loyalty.

Ensuring Financial Stability: Cybersecurity breaches can have far-reaching consequences, impacting not only individual consumers but also the overall stability of financial systems. Prioritizing cybersecurity helps mitigate risks and ensures the continued smooth functioning of digital transactions.

Staying Ahead of Evolving Threats: Cyber threats are constantly evolving, making it crucial for cybersecurity measures to adapt and evolve as well. By staying informed about emerging threats and investing in robust security solutions, we can better protect ourselves and our financial assets.

In conclusion, prioritizing cybersecurity in the age of digital transactions is not just a good practice—it's absolutely essential. By working together to implement strong security measures and staying vigilant against cyber threats, we can enjoy the convenience of digital transactions without compromising our online safety. Stay safe out there, friends! 🔐💻

#OnlineSafety#DigitalTransactions#Cybersecurity#finance#payment system#thefinrate#100 days of productivity#financialinsights#financetalks#moneymatters

0 notes