#EV insights

Text

Embrace the Future of Mobility: Navigating the Exciting World of Electric Vehicles with Haqiqa Global Business

Embark on a journey into the electrifying realm of electric vehicles with Haqiqa Global Business, your trusted partner in exploring the latest innovations and exclusive deals in the EV industry.

2024: Are You Ready to Plug into the Electric Vehicle Revolution?

Discover the world of electric vehicles and how they can transform your driving experience with Haqiqa Global Business.

As the world embraces a more sustainable future, the automotive industry is undergoing a remarkable transformation, driven by the rapid rise of electric vehicles (EVs). These innovative vehicles offer a cleaner,…

View On WordPress

#electric cars#electric SUVs#electric vehicles#EV benefits#EV insights#EV market trends#EV news#EV reviews#EV tips and tricks#EV updates#EVs#Haqiqa Global Business#New Energy Electric Cars#Shanghai Autotec International Corp.

0 notes

Text

I do believe that Lilith is Good

But

she still has Master manipulator Gothic Queen of Night vibes, she's playing 4D chess but no one else will get on her level and its really getting to her

She tried for human solidarity back in Eden 'if we play our cards right we can uncover Heaven's Ultimate secret plan' and was met with a resounding "uh Why?" "Have you tried asking them?" from Adam and Eve

She really wants to find pride in her kin but they make it so difficult

#I watched a video about how makeup can be used to give insight to character#and now i feel weird when I see Lilith with full lashes and eyeshadow and lipstick in Eden#where did she get those?#hazbin hotel#hazbin hotel lilith#hazbin hotel eve#hazbin hotel adam#hellaverse#hazbin hotel headcanons#forbidden fruits#hazbin hotel fanart

60 notes

·

View notes

Text

so here's what we're told about the bet with satan:

god will allow whatever happens to job and his family to happen without intervention

heaven is following these orders, the terms of the permit, and will not interfere at all; whatever happens to job is in fact up to satan and hell's own actions

aziraphale considers the possibility that god does not necessarily want job and his family to suffer - or more specifically, that crowley is wrong

crowley is steadfast to the contrary, and asserts that god's will must be that the children die, and to question god is essentially to follow the same kind of fate (or as close as).

all of this is stating the fairly-obvious, i know. but i think we're possibly, once again, reading this scene and taking crowley's word for it - understandable, given that the minisode starts, and continues to be for a lot of scenes, from crowley's perspective. but there is nothing to indicate that god actively wants suffering brought on job and his family, nothing to show that that was her intent; satan seemed to initiate the bet, going by muriel's whole account, and god is letting whatever happens, happen.

because that's the thing: standing by and watching whilst hell does so is not, arguably, the right thing to do, but it is the right thing for god to do; to let her creation do what it wants. if hell chooses to go ahead with putting job and his family through hardship, then she will not - and should not - stop it. even when job is beseeching to her for answers, she does not give them; she cannot and will not get involved.

crowley and aziraphale do the right thing by putting a stop to it all, and i think that was the plan, particularly of the ineffable variety - not that crowley and aziraphale were pre-destined to stop it per se, but that all the players of her game would act on their own, and make their own choices. they would exercise their free will as they see fit, whether to cause suffering, or to prevent it. free will is not necessarily a good thing, but it is the right thing. this is the game of her own devising.

i also want to consider that this very situation may turn out to be, in part, a parallel of the fall. in the minisode, it seems that the reason why aziraphale didn't fall is because he did exactly as god intended - to act of his own free will, according to what he thought was right - but equally he would not have fallen if he had done the opposite (regardless of how he would essentially punish himself if he had told gabriel the truth). i don't think that god is in the business of punishing anyone, regardless of their motivations or moral alignment, if they are acting out of free will.

and further from this, i don't think god had a hand in the fall at all, not beyond it being - essentially - cool with her if some of her angels didn't agree with her plans for the universe. i don't think she cast them out in the way we're all imagining it to have happened. i think some of her creations acted with cruelty out of free will, and others did not. crowley obviously, more than likely anyway, belongs in the latter category. but she cannot interfere, she cannot and will not take free will away from them.

what crowley thought were her orders were unlikely to have ever been that at all. if anything - wherever crowley is or isn't placed in the narrative of the fall - i think she likely excused herself from deciding the fate of the fallen altogether, and left it to 'her people' to decide. her inaction, to allow the fall to happen, may not have been the right thing, but it ultimately the right thing for her to do. (frankly, i think we can take pontius pilate's handling of jesus' trial in Matthew as some further kind of parallel here)

then take into account aziraphale's constant rhetoric throughout s1 and s2 that humanity has a choice, that everyone has choices; i think he potentially understands god a little more than he's given credit for. and when he says that he's on god's side, specifically doesn't say heaven's, i think that's more literal than even he knows.

#a bit rambly but i know what im trying to say#extrapolate this to the flood etc and i think we have more insight into gods plan than we thought we had#that crowley did the right thing in tempting eve and giving humanity free will - i think that might have been the plan all along#good omens#god is dead theory#flashback meta#s2 meta#the fall/the great war spec

100 notes

·

View notes

Text

I've been thinking about her

You know, I’ve been thinking a lot about what happened: why did they do what they did, was there some logic in it, were we so furious because of the denial, as we were unable to accept the forlorn finale and why did it hurt that much so nobody could recover from it till now.

It’s been two years, guys. Two years of re-reading Luke Jennings books, writing songs and dedicating them to VillanEve, doom scrolling post about them, about all the anger fans still got for Laura Neal and the shitty ending (as Villanelle would say with a sexy Russian accent).

I was listening to my beloved Unloved soundtrack of course, all this time. I’ve been on their concert in Paris recently and felt euphoric as I was sinking into Eve and Villanelle love story again and again through their divine music. Every word and sound reflected with my whole body and soul – it was ineffable. Every time I listen to “I’ve been thinking about her” it brings me to tears. I genuinely want this song to play at my funeral one day.

Well, I did my best to remain in this state of equanimity and kinda succeed. But a couple of months ago I decided to re-watch KE from season 1 and here is what happened. I happily binge-watched all three seasons and it felt like home – a perfect comfort zone, a way of my escapism. I even discovered a place where they shoot Villanelle’s apartment (here in Paris), I walked there, secretly got into the courtyard – it was AMAZING – visualizing what happened there in the 1st season, remembering their dialogue with Eve – “I think about you all the time” and stuff. It was comme la presence de Villanelle and I felt so happy and inspired there.

Lately I realised that I’ve been struggling, not wanting to re-watch the goddamn last season. Why the fuck it was so hard? I just can skip the last 5 minutes and et voilà – it would be just perfect. Plus dearest Luke Jennings has been writing and posting his new book about Villanelle and Eve (RESURRECTION) since November 2023, so we know that in his book they got their happy ending and their love story goes on, so it’s good news, right? We have something to rely on “more rock than sand” and it sounds so easy…

But frankly it’s not – I couldn’t pretend I did not see it – the ending they’ve made. I didn’t want to be in this denial any more. I was so angry, I didn’t want to go through it again. But I wanted to see the kiss, to feel their love, to embrace this fucking finale as well. The mixed up feelings were bothering me much so I decided to contemplate on them more, to write this down and here’s what I got.

For me this show, the VillanEve story, was very personal. And it started way long before the book. The book was a cure to find my peace AFTER I watched the ending, so I think it is what it is: the show is one thing and the book is another. I cannot pretend they are the same, like “Villanelle’s death was never meant to be in the book so fuck Laura Neal and her interpretation”. It’s fucking painful but I need to admit it – they ruined my favourite show, something I really loved and I feel so miserable I cannot simply rewatch it from time to time (like Twin Peaks for instance) to feel cheerful and happy KNOWING what awaits me in the end. It’s not a comfort zone anymore, it is a pure Hélène style torture.

I’ve never felt so attached to the heroes before. I mean, I watch a lot of tv shows and movies, and I easily emphathysise to every story I love. But THIS was different. It was a mind-blowing love-journey, irrational, psychotic, driven, crazy, fun, epic, passionate, surreal, iridescent and QUEER. I NEVER felt so seen and understood on the deepest level by just WATCHING the show. VillanEve resonates with my personal life and fantasies and I was glad that I found it. I’m more of a visual person, so it was crucial for me to be able to WATCH it, to see the performance of Sandra and Jodie and their desperate game with unresolved sexual tension where should, no, MUST have been the glorious end game. The happy ending for them and for all of us. Not just us queers, but all the people.

This show was twisted, sexy and fun from the very beginning – thanks to ingenious Phoebe Waller-Bridge. And it should have stayed like that and ended like that. It shouldn’t have to be a torture. It’s not Game of Thrones for christ sake. Besides, the story of The Twelve was screwed up too, and I will explain why.

We have a lot of this political shit in life already. Right parties, fucked up capitalism, like Russian government and its dictature. It’s no fun guys, this is really frightful and disastrous. So I believe we people do need some kind of an inspiration, a hope in the shows we watch – so we can take this hope to our lives and keep it, lean on it. In dark times like this it would be really helpful and right – so they should have caught the The Twelve gang and crush it, end it for good. But they (producers) fucked it all up so it’s quite impossible to be unfucked.

They ruined the VillanEve AND the fiction fantasy itself. It was the Author and the Twink death at once. Why not choosing an open ending if you had no idea how to end the show? The open final is always a good way, for me it’s all about respecting your audience. Think David Lynch way. Open endings give you a possibility to rewatch the show and come up with new ideas and interpretations. But they screw this one too.

So no, I think will never accept the finale. I will be grieving for a long long time. Until some director or a show runner who loves VillanEve as much as I do, makes a come-back to fix this shit.

#killing eve#eve x villanelle#killing eve thoughts#killing eve insights#killing eve theories#eve x oksana#eve x villanelle kiss#ke season 4#ke spoilers#villaneve#villanelle#eve polastri#oksana astankova#Luke jennings#Unloved#KE ending#killing eve finale#fuck Laura neal#I've been thinking about her#killing eve anniversary

12 notes

·

View notes

Text

i read through warlock rebirth and......................i am not immune to women......

#i'm so glad we get insight into the brief period of time where adam was [checks notes] femdommed to death#my art#eve warlock#marvel#marvel fanart#adam warlock#warlock rebirth#marvel comics

46 notes

·

View notes

Note

jay hyenahunt how do you feel . how are you feeling about eden climax . give us your true genuine thoughts i welcome hate but i would also welcome "this is exactly what i wanted" if that's the truth

oops i think i got this day of the event announcement but thank you for asking!!

if you want my initial thoughts for when it dropped:

i Was initially hoping for/expecting 5* nagisa and 4* hiyori purely for the sentiment for such a key event like Eden's Climax since you know they're the unit leaders!! but i've seen the climax series also described as like... kind of the conclusion? culmination? for where main story has been going with each unit, and since the overarching plot in !! so far has been very heavily focused on Adam considering how they're the ones with the most NPC involvement, it makes sense that they were the ones to get high rarity cards....

and well adam getting high rarity cards together (and finally breaking the senpai/kouhai curse as I've seen it called since it's been the unchanging pattern so far in !! until now) means . next will be eve's turn and i am an eveP first and foremost so I'm happy about that LOL

the event itself went kind of as I expected it which was Secret Service 2: Adam's NPC Adventures While Eve Searches For Them Again HFGSD... i haven't looked super closely yet since i've been busy but personally I do wish there had been much less NPC focus as i want to see an eden event be about.. you know.... Eden and their interactions with each other... 😭 this is how i've felt for much of !!'s current main story style anyway though....

my main 0 braincell post-event thoughts however:

eve shared a single bed in a hotel so i win. and then hiyori used jun's lap as a pillow while jun sang him a lullaby and made NEGI question the nature of their relationship so i double win.

#hyenahuntask#ohii-san#(sorry if you hoped for something more insightful... i am but a simple man tending to my simple eve crops....)#also the song goes hard!!! i love it and the mv!!!!! the album cover silhouettes have me quaking!!!!!!!

7 notes

·

View notes

Text

hm. i think i am going to stop going to counseling. he does not understand me. he pathologizes things that are not pathological.

#purrs#the premises of counseling / therapy are that you need to have boundaries and be self sufficient and fully healed. FUCK THAT! relationships#are not transactions. we are allowed to need each other. we are allowed to blur lines. we are human and messy. our thoughts and feelings are#PRECIOUS. im not letting go of my thoughts they mean EVERYTHING to me they are the key to the WORLD. im not letting go of redacted why on#EARTH would i stop redacteding to redacted that is HELPFUL for me. i don’t CARE about the roots. who the fuck is it hurting????? NO ONE!!!!!#the way he flat out told me he agrees with my mom. bitch im done forever. im done literaly forever. i don’t know how to tell him but im done#forever. maybe it’s just my id which is what he said to me LMFAO and like maybe i just don’t like being uncomfortable or facing hard truths.#but i don’t fucking think it’s TRUE!!!!!!!!!! yeah i need to grow yeah i have unhealthy behaviors. but i don’t need to let go of the whole#THING bc of some arbitrary transactional concept of what relationships are supposed to be / mean. ive NEVER had a counselor try to uproot th#the whole damn thing like omg what is WRONG with you. i#im paying this man $25 a week to UNDERSTAND me and not ONCE have i felt understood by him. counselors can disagree with me but i literally#never feel like he is on my side. he’s adhering to conventional ideas about what parents are supposed to be and friends are supposed to be a#and work is supposed to be etc etc. and so patronizingly said just enjoy being 23 you don’t wanna waste your 20s! FUCK YOU. i will not#regret anything even if it’s unusual. FUCK YOU!!!!!!!!!!!#and also i know he probably watches back thru the recordings and has like his supervisor and professors watch them too which means that#there is a whole team of scientists + my family studying me in a lab and thinking im insane and finding ways to tell me. but fucking bold of#him to assume he can give me any meaningful valuable insight when he is actively checking his laptop / phone during our sessions and rarely#if eve gives me a chance to drive MY OWN CONVERSATION THAT IM PAYING FOR and is so phony abt being on the recording. like Omg. maybe im just#grown out of it. it fucking SUCKS bc i actually have things i am not normal about and really need help with and i can’t actually get help fr#from ppl whose job it is to fucking help me bc they think im not normal about things i PROMISEEEE i am normal about. and the way i effective#effectively told him that and he responded that he can’t take that credibly bc there’s no action behind it BY WHICH HE MEANS I HAVENT#STOPPED REDACTEDING TO ONE OF THE MOST IMPORTANT REDACTED IN MY WHOLE LIFE? THAT I HAVENT DECIDED IM DONE LEARNING SND GROWING AND CUT IT#OFF?????? DO YOU FUCKING HEAR YOURSELF. INSANE. the ANTITHESIS of human. we are MEANT TO BE CONNECTED. FUCK!!!!!!!!!#delete later#my old counselors challenged me and disagreed with me b it i never felt like they flat out were unwilling to meet me where i am and#compromise with me. is that not what counselors are supposed to do???? or have i just had bad counselors until now??? because im NORMAL. i#swear to fucking god. im normal. im literally normal and it is not doing ANYONE harm. what is wrong with you. GOD

30 notes

·

View notes

Text

Remember when Villainelle was on drugs and losing her shit all because eve was ignoring her like she was down so bad lmao

54 notes

·

View notes

Text

everytime i think. maybe the tags won't be THAT stupid. and then i see the absolute dumbest shit imaginable. are y'all even CONSUMING the media? are y'all even listening to the words that are said on screen? are you seriously this fucking thick?

#'i just realized the kiss was on new year's eve because of the text that said january' ARE YOU DAFT#IT WAS A NEW YEARS EVE PARTY. THEY COUNTED DOWN TO MIDNIGHT. THAT WAS THE INSIGHTING INCIDENT#txt#this movie is the worst thing to come out of the film industry this year.#obsessed with me writing insighting. inciting.#too pissed off to think about words.#anti rwrb 2023

3 notes

·

View notes

Text

Discover the key factors that impact the lifespan of electric scooters in India and make informed decisions for your business or personal use. Our team of experts with years of experience in marketing will provide valuable insights to help you choose a cost-effective and durable option for long-term sustainability.

#Electric Scooter Life Span#India Market Insights#Vegh Automobiles#electric scooters#EV scooter#E scooter#battery ev scooter

0 notes

Text

Srinath Koppa, Managing Director at PROLIM, is gearing up to share groundbreaking insights at Realize LIVE Americas 2024.

Learn More- https://www.prolim.com/realize-live-americas-2024/

Get ready to dive deep into the world of product launches and design validation as we unleash the power of Mendix for digital transformation. This session is all about revolutionizing your approach to product rollouts.

Save the date:

📅 Tuesday, May 14th, 2024

🕐 1:40pm PST

#ThinkPROLIM#RealizeLIVE#DigitalTransformation#Mendix#TechTalk#EV#Innovation#Technology#Event#Insights#JoinUs#SaveTheDate

0 notes

Text

Stellar Blade Director Reveals New Game Plus Mode, Says No Microtransactions With One Exception

New Post has been published on https://thedigitalinsider.com/stellar-blade-director-reveals-new-game-plus-mode-says-no-microtransactions-with-one-exception/

Stellar Blade Director Reveals New Game Plus Mode, Says No Microtransactions With One Exception

Stellar Blade director Kim Hyung Tae has announced that developer ShiftUp’s upcoming action game, Stellar Blade, will get a New Game+ mode sometime after launch. Plus, Tae says there will be no microtransactions in the game, save for one theoretical exception.

This news comes from a new interview with Korean publication Ruliweb, where Tae explained that while Stellar Blade will have a New Game+ mode at some point, it won’t be available at launch, as translated by Genki_JPN on Twitter. Tae also told Ruliweb that players should not expect any microtransactions in Stellar Blade, but notes that one exception would be paid collaborations with another company’s IP.

[embedded content]

“We want to make it clear at this point that Stellar Blade will not require any additional expenses that gamers are not aware of beyond what they paid for the package,” Tae told Ruliweb. “The only exception is if we create collaboration costumes with another company’s IP; those may be sold for a fee. Also, there is no New Game+ in the launch version, so please look forward to it being updated very soon.”

Given that no collaborations have been announced at this point, Tae is likely just checking bases for hypothetical collaborations ShiftUp may or may not be pursuing. At any rate, given the popularity of ShiftUp’s Goddess of Victory: NIKKE game on mobile devices, it’s possible we see an internal collaboration between those two properties.

Stellar Blade is an action game launching on PlayStation 5 exclusively on April 26. It was announced in 2021 as Project EVE. There is a demo for Stellar Blade available on PSN that you can download right now if you’re curious about how the game plays.

For more, read Game Informer’s Stellar Blade feature for behind-the-scenes details and new insight from Tae.

[Source: Ruliweb]

Are you excited for Stellar Blade? Let us know in the comments below!

#bases#Collaboration#details#Developer#devices#eve#Explained#game#how#InSight#INterview#it#Mobile#mobile devices#News#notes#One#PAID#PlayStation#PlayStation 5#project#Read#twitter#Version

0 notes

Text

Unlocking the Potential of India's EV Ecosystem: Insights from the "De-Risking Lending for a Brisk EV Uptake" Report by NITI Aayog, SIDBI, RMI, 2024.

Electrifying India’s Future: The Intersection of Innovation and Investment in the EV Landscape

As an early-stage investor in Indian startups, Cogniphy Angel Fund is always on the lookout for high-potential sectors that offer significant growth opportunities. The recent “De-Risking Lending for a Brisk EV Uptake” report published by NITI Aayog, SIDBI, RMI, has caught our attention, as it provides…

View On WordPress

0 notes

Text

🧟♂️ New Episodes, DJ History & Zombieland Rewatch | Author Diary, March 15, 2024 #amwriting 📚🎥

📝 “Punks Versus Zombies” Updates:

This week has been productive with the addition of two new episodes to the “Punks Versus Zombies” series. Each episode brings its own set of intriguing challenges and exciting developments in this thrilling zombie narrative.

📚 Reading & Inspiration:

Reading: My current read is “Last Night a DJ Saved My Life,” an engaging exploration of the history of DJing. It…

View On WordPress

#author diary#author lifestyle#author&039;s weekly update#character development#Creative writing#engaging storytelling#entertainment analysis#episode writing#Killing Eve season 2#narrative development#post-apocalyptic fiction#Punks Versus Zombies#scriptwriting#storytelling techniques#suspenseful storytelling#television reviews#Traitors US#TV show insights#zombie serial

0 notes

Text

Shree OSFM E-Mobility IPO Date, Price, GMP, Review December 2023

New Post has been published on https://wealthview.co.in/shree-osfm-e-mobility-ipo-details/

Shree OSFM E-Mobility IPO Date, Price, GMP, Review December 2023

Shree OSFM E-Mobility IPO: Shree OSFM E-Mobility Limited is a Pune-based manufacturer of electric vehicles, primarily focusing on three-wheeled e-rickshaws and e-loaders.They operate in the rapidly growing Indian electric vehicle market, estimated to reach $150 billion by 2030.

Shree OSFM E-Mobility IPO Key Details:

Dates:

Open: December 14, 2023

Close: December 18, 2023

Listing (tentative): December 21, 2023, on NSE SME

Offer Size: ₹24.60 crore (fresh issue of 37.84 lakh shares)

Price Band: ₹65 per share

News and Developments:

Subscription Update: As of December 15, 2023, the IPO saw good initial response with:

Retail category subscribed 3.99 times.

Overall subscription at 3.50 times.

Grey Market Premium (GMP): Trading at a slight premium of ₹2-3 per share as of December 17, indicating cautious optimism.

Analyst Opinions: Views are mixed, with some recommending caution due to the fragmented nature of the segment and high valuation compared to FY24 earnings. Others see potential in the company’s focus on last-mile connectivity and EV adoption growth.

Shree OSFM E-Mobility Securities Offered:

This is a pure equity share offering. No bonds or other instruments are being issued. The company is raising fresh capital by issuing 37.84 lakh new shares.

Investor Category Reservation:

Category Percentage Allocation Retail Individual Investors (RII) 35% Qualified Institutional Buyers (QIB) 50% Non-Institutional Investors (NII) 15%

Minimum Lot Size and Investment Amount:

Minimum Lot Size: 2,000 shares.

Minimum Investment Amount: ₹130,000 (2,000 shares * ₹65 per share).

Note: For HNI/NII investors, the minimum investment is 2 lots (4,000 shares) or ₹260,000.

Additional Information:

This is a fixed-price IPO, meaning the offer price is set at ₹65 per share.

You can apply for the IPO through your broker or through the designated ASBA platforms of your bank.

Shree OSFM E-Mobility Company Profile:

Early Beginnings and Operations:

Established in 2015, Shree OSFM E-Mobility started as a manufacturer of automotive components.

In 2018, they pivoted to electric vehicles, focusing on three-wheeler e-rickshaws and e-loaders.

Currently, they have two manufacturing facilities in Pune with a total capacity of 60,000 units per year.

Their primary operations are spread across Maharashtra, Gujarat, and Madhya Pradesh, but they aim to expand pan-India.

Market Position and Brands:

They hold a small but growing share in the fragmented Indian e-rickshaw market, estimated to be worth over ₹20,000 crore.

Their main brand is “OSFM E-Mobility,” marketed under the tagline “Sustainable Solutions for Last Mile Connectivity.”

They haven’t yet established prominent sub-brands or subsidiaries.

Competitive Advantages and Unique Selling Proposition (USP):

Focus on last-mile connectivity: caters to a vital segment with high demand for affordable and efficient e-vehicles.

Vertical integration: own production facilities for key components, ensuring cost control and quality.

Product differentiation: offer customized e-rickshaws and e-loaders based on specific customer needs.

Strong distribution network: have established dealership relationships across their target markets.

Challenges and Potential Risks:

Intense competition: operate in a crowded market with numerous established players.

Dependence on government policies and subsidies: government support plays a crucial role in EV adoption.

Limited financial resources: compared to larger peers, their capital base is relatively smaller.

Overall: Shree OSFM E-Mobility occupies a niche space in the growing Indian e-vehicle market. While it faces stiff competition, its focus on specific segments, vertical integration, and customization offer potential advantages. However, its limited financial resources and dependence on government policies create uncertainties for investors.

Shree OSFM E-Mobility Financials:

Revenue Growth: The company has demonstrated impressive revenue growth, with YOY (Year-over-Year) increases of 85% in FY22 and 168% in FY23 (estimated). This surge reflects rising demand for their e-rickshaws and e-loaders.

Profitability: Profitability remains moderate, though improving. They recorded a PAT (Profit After Tax) of ₹309.09 lakhs in FY23, compared to ₹162.78 lakhs in FY22. Net margins remain around 3-4%.

Debt Levels: The company currently has minimal debt, with a debt-to-equity ratio of approximately 0.10. This provides them with financial flexibility and potential for future borrowing.

Key Financial Ratios (FY23 estimated):

P/E Ratio: Based on the issue price of ₹65 and estimated EPS (Earnings Per Share) of ₹2.94, the P/E ratio stands at 22.1.

Debt-to-Equity Ratio: As mentioned earlier, it stands at a healthy 0.10.

Industry Benchmarks:

P/E Ratio: The average P/E ratio for established electric vehicle companies in India is around 30-40. Shree OSFM’s lower P/E could signal potential, but also reflects its smaller size and lower profitability.

Debt-to-Equity Ratio: Industry benchmarks vary, but a ratio below 1 is generally considered favorable, which Shree OSFM achieves comfortably.

Future Growth Prospects and Earnings Drivers:

Growing e-vehicle market: The Indian e-vehicle market is expected to see consistent growth in the coming years, driven by government policies, rising fuel prices, and increasing focus on sustainability. This presents a significant opportunity for Shree OSFM.

Expansion plans: The company plans to expand production capacity and enter new markets, which could significantly boost revenue and earnings.

Product diversification: Exploring new e-vehicle segments beyond e-rickshaws and e-loaders could diversify their offering and attract new customers.

Challenges and Risks:

Intense competition: The fragmented market has numerous players, and competition for market share is fierce.

Dependence on government policies: Continued government support for e-vehicle adoption is crucial for the company’s success.

Profitability concerns: Sustaining and improving profitability while scaling up will be key for long-term sustainability.

Objectives of the Issue:

Shree OSFM E-Mobility has outlined three main objectives for its IPO:

Funding the purchase of passenger vehicles: This includes acquiring new e-rickshaws and e-loaders to meet the growing demand and expand their fleet.

Meeting working capital requirements: The capital will be used to manage day-to-day operations, purchase raw materials, and improve operational efficiency.

General corporate purposes: This could involve research and development activities, marketing initiatives, brand building, and potential acquisitions.

Alignment with Growth Strategy:

These objectives clearly align with Shree OSFM’s future growth strategy:

Expansion: Acquiring new vehicles directly supports their goal of increasing production capacity and entering new markets.

Efficiency: Addressing working capital needs allows them to streamline operations and potentially reduce costs.

Future Opportunities: Utilizing funds for general corporate purposes provides flexibility for strategic investments, R&D, and future acquisitions, all of which can contribute to long-term growth.

Additional Considerations:

The amount raised (₹24.60 crore) might seem modest compared to larger players in the electric vehicle market. However, for a relatively young company like Shree OSFM, it can be a significant boost for achieving their near-term growth goals.

The dependence on IPO funds for vehicle acquisition raises questions about their current capital structure and future financing plans.

Shree OSFM E-Mobility IPO: Lead Managers and Registrar

Lead Managers:

First Overseas Capital Limited (FOCO): FOCO is a licensed merchant banker with experience in managing small and medium-sized enterprise (SME) IPOs. Some recent SME IPOs they handled include Devyani International Limited and Uniphos Enviro Care Limited. While they have experience in managing similar offerings, their track record in terms of post-listing performance hasn’t been consistently robust.

Registrar:

Bigshare Services Private Limited: Bigshare is a SEBI-registered entity acting as a registrar for various types of capital market issuances, including IPOs. Their role in the Shree OSFM E-Mobility IPO involves maintaining shareholder records, handling allotment and refund processes, and facilitating share transfers. Their expertise ensures smooth execution of these crucial aspects of the IPO.

Shree OSFM E-Mobility IPO: Grey Market Premium

Current GMP: As of October 26, 2023, the GMP for Shree OSFM E-Mobility IPO stands at ₹2-3 per share. This indicates a slight positive sentiment in the grey market, with investors willing to pay marginally more than the issue price of ₹65 per share.

Comparison with Recent Listings:

Compared to recent SME IPOs, this GMP is moderate. Recent listings like Akashdeep Metals and Crafts saw GMPs reaching ₹10-15 per share, while others like Erisson Auto Parts Limited had negative GMPs.

The relatively subdued GMP for Shree OSFM E-Mobility could be due to several factors, including its smaller size, limited track record, and presence in a competitive market.

Factors Influencing GMP:

Demand and supply dynamics: High demand for the shares in the grey market can push up the GMP, while excess supply can exert downward pressure.

Company fundamentals: Strong financial performance, future growth prospects, and prominent investors can boost confidence and lead to a higher GMP.

Market sentiment: Overall market conditions and investor appetite for IPOs can also influence the grey market premium.

News and analyst reports: Positive news coverage and favorable analyst opinions can strengthen the GMP, while negative developments can have the opposite effect.

Potential Impact on Listing Price:

A sustained positive GMP can indicate rising investor interest and potentially lead to a higher listing price than the issue price. However, it is important to remember that the grey market is unofficial and its performance doesn’t guarantee the actual listing price.

A negative GMP suggests weaker demand and could result in a listing price below the issue price. Nevertheless, other factors like institutional investor participation and market conditions can also play a role in determining the final listing price.

Potential Risks to Consider Before Investing in Shree OSFM E-Mobility IPO:

Market Volatility:

The Indian stock market can be volatile, and unforeseen economic or political events could negatively impact the IPO performance and overall value of the shares.

Industry Headwinds:

Intense competition in the fragmented e-rickshaw market could erode margins and limit Shree OSFM’s market share.

Dependence on government policies and subsidies for e-vehicle adoption creates external risks beyond the company’s control.

Rising battery and raw material costs could put pressure on profitability.

Company-Specific Challenges:

Limited track record as a publicly traded company creates uncertainty about their future performance and ability to deliver on growth plans.

The relatively small size of the IPO fundraising compared to industry giants might limit their competitive edge and expansion capabilities.

Dependence on IPO funds for vehicle acquisition raises concerns about future financing needs and potential debt burden.

Financial Health Concerns:

While debt levels are low, profitability remains moderate, and significant improvement is needed to justify the current valuation.

The high P/E ratio compared to industry benchmarks could indicate potential overvaluation, increasing investment risk.

Red Flags for Investors:

Short operating history makes it difficult to assess long-term business sustainability.

Inconsistencies in past bottom lines raise concerns about future profitability.

Limited product diversification exposes them to potential market shifts within the e-rickshaw segment.

Shree OSFM E-Mobility IPO: DRHP (Draft Red Herring Prospectus)

Also read: How to Apply for an IPO?

Conclusion :

Shree OSFM E-Mobility shows promise in the booming Indian e-vehicle market, with impressive revenue growth, minimal debt, and expansion plans. However, intense competition, modest IPO funds, and profitability concerns necessitate caution. Thorough research and due diligence are crucial before investing.

#Analysis#Due Diligence#EV#Financials#India#Invest#Invest in India's E-Vehicle Boom? Analyze Shree OSFM IPO Before You Charge In#Investors#IPO Documents#News#Risks#Risks & Insights#Shree OSFM E-Mobility IPO: Unpacking Revenue Growth#Strategy#IPO

0 notes

Text

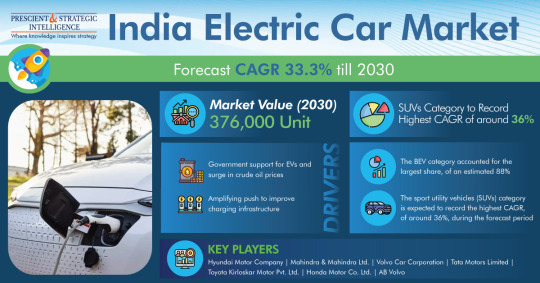

Charging Ahead: Insights into the India Electric Car Market

The sales volume of the Indian electric car market is on track to hitting 376,000 units by 2030, rising from 37,792 units in 2022 at a 33.3% CAGR, as per P&S Intelligence.

This is primarily owing to the growing construction of manufacturing plants, increasing foreign direct investment, and strong push to improve the charging infrastructure.

Due to Reducing Battery Prices, BEVs Outsell All Other Variants

With a share of about 88%, the BEV category held the largest share in 2022, and the same situation is predicted to sustain its position in the years to come. This is due to the growing preference for EVs over ICE vehicles, decreasing battery prices, and accessibility of several BEV models.

Based on product, the category of SUVs is predicted to register the highest growth rate, of about 36%, in the years to come. This is due to the increasing disposable income and growing requirement for premium cars.

Under the battery segment, the LFP category holds the largest market share, and it will continue to do so owing to the lower costs and longer life of LFP batteries.

Moreover, the >201 Ah battery capacity category accounts for the larger market share, and it is predicted to achieve the faster growth in the coming years. This is owing to the preference of consumers for cars with a longer range.

The category of personal users leads the market, and it is predicted to stay on this path till 230 because of the growing affordability of such cars and surging disposable income.

Most Sales of Electric Cars Take Place in Uttar Pradesh

Due to a large client base and a huge number of suppliers along the whole EV supply chain, Uttar Pradesh dominated the market in 2022. The Uttar Pradesh EV Manufacturing and Mobility Policy 2022 would help drive the sale of electric cars for both personal and commercial purposes.

Similarly, Maharashtra is expected to witness a significant growth rate during the forecast period. In July 2021, to boost the demand for EVs, the state government introduced a comprehensive policy, under which a USD 2,029.1 (INR 1.5 lakh) incentive is provided and consumers are also eligible for early-bird incentives.

#India electric car market#electric vehicles (EVs)#market analysis#sustainable transportation#market trends#EV adoption#market insights#industry players#market segmentation

0 notes