#Energy Transition Market

Explore tagged Tumblr posts

Text

The global energy transition market size was valued at $2.3 trillion in 2021, and projected to reach $5.6 trillion by 2031, with a CAGR of 9.3% from 2022 to 2031.

The leading players operating in the global Energy Transition market include, Exelon Corporation, Duke Energy Corporation, Pacific Gas and Electric Company, Southern Company, American Electric Power, Inc, Edison International, Repsol, Brookfield Renewable Partners, Ørsted A/S, and NextEra Energy, Inc.

Get a PDF brochure for Industrial Insights and Business Intelligence: https://www.alliedmarketresearch.com/request-sample/32269

Energy transition simply defines transformation of fossil fuels to renewable energy sources, which results in reduction in carbon emission and produces green energy. Prominent sectors of energy transition include energy storage, renewable energies, electric vehicles, heating, nuclear energy, hydrogen, and others.

By technology, one of the major renewable energy sources i.e., solar energy accounts forsignificant market share in renewable energy market. The installed capacity of solarenergy in the Netherlands in 2018 increased by 1,500 megawatts (or 50% year-over-year),reaching 4,400 megawatts in which residential rooftop solar has been the main source inthe past few years.

To increase efficiencies, wind turbine manufacturers are adopting larger turbines. Thanks to their extensive knowledge of offshore conditions, oil and gas industries are well-positioned to invest significantly in both fixed and floating offshore wind. Some substantial oil and gas firms are reorienting their efforts toward a fresh, reliable cash stream in a developing low-carbon industry.

On the basis of type, it is segmented into renewable energy, bioenergy, and electrification,energy efficiency, hydrogen, others. Renewable energy transition, which is further segmented into wind, solar, hydropower. On the basis of application,the market isclassified into residential, commercial, and utility-scale.

Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Presently, Asia-Pacific accounts for the largest share of the market, followed by North America and Europe.

Energy transition is the transformation process in which fossil fuels, such as oil, natural gas, and coal, are transformed into renewable energy such as wind and solar energy as well as lithium-ion batteries. The energy transition is majorly categorized into five categories

including renewable source, electrification, energy efficiency, hydrogen, and other energies.

Moreover, continuous supply of energy, development of prosumer business models, transforming human behaviour toward renewable sources are expected to create lucrative opportunity for market growth during the forecast period. In addition, increase in popularity of transition technology owing to its employment in electricity generation, to provide electricity for residential buildings at a low cost is anticipated to drive the growth of the energy transition market.

Enquiry Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/32269

Other factors driving growth of the global energy transition market growth are expansion of grid infrastructure, rising energy efficient buildings, and growing transportation sector along with focus on carbon emission reduction are fueling global energy transition growth during the forecast period. Moreover, rise in concern from governments across the globe on increased global warming issues is expected to augment the demand for energy transition.

The use of energy transition by commercial buildings such as offices, malls, and airports help reduce the load on traditional fossil fuel power plants and further decreases the carbon footprint. Thus, with surge in use of solar energy and growth in solar farm in developing nations are expected to generate electricity in an efficient way and offer optimistic opportunity for global market growth during the forecast period.

According to the International Energy Agency, the overall capacity of renewable energy sources worldwide is expected to rise by 50% between 2019 and 2024. On the basis of application, the market is classified into residential, commercial, and utility-scale. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Browse complete industry report : https://www.alliedmarketresearch.com/energy-transition-market-A31819

Energy Transition market, by Type

In 2021, the renewable energy segment was the largest revenue generator, and is anticipated to grow at a CAGR of 9.8% during the forecast period. Several factors are associated with for the increasing demand for renewable in the market as shift towards the clean and green energy and offering the benefit of lower emissions of carbon and other types of pollution. Increasing in development for the energy transition and storage of the power which are generated by renewable will create the opportunities for renewable in the market.

Energy Transition market, by Application In 2021, the residential segment was the largest revenue generator, and is anticipated to grow at a CAGR of 9.5% during the forecast period. Several factors are associated with for the increasing demand for residential in the market such as rise in demand for electric water heaters from water heating applications such as cooking, space heating, cleaning, bathing, and others is expected to drive the growth of the energy transition during the forecast period.

About Us Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain. Pawan Kumar, the CEO of Allied Market Research, is leading the organization toward providing high-quality data and insights. We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

5933 NE Win Sivers Drive

205, Portland, OR 97220

United States

USA/Canada (Toll Free):

+1-800-792-5285, +1-503-894-6022

UK: +44-845-528-1300

Hong Kong 852 - 301 - 84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

Web: www.alliedmarketresearch.com

Allied Market Research Blog:

Follow Us on Facebook | LinkedIn | YouTube

0 notes

Text

Green Ammonia Market Statistics, Segment, Trends and Forecast to 2033

The Green Ammonia Market: A Sustainable Future for Agriculture and Energy

As the world pivots toward sustainable practices, the green ammonia market is gaining momentum as a crucial player in the transition to a low-carbon economy. But what exactly is green ammonia, and why is it so important? In this blog, we'll explore the green ammonia market, its applications, benefits, and the factors driving its growth.

Request Sample PDF Copy:https://wemarketresearch.com/reports/request-free-sample-pdf/green-ammonia-market/1359

What is Green Ammonia?

Green ammonia is ammonia produced using renewable energy sources, primarily through the electrolysis of water to generate hydrogen, which is then combined with nitrogen from the air. This process eliminates carbon emissions, setting green ammonia apart from traditional ammonia production, which relies heavily on fossil fuels.

Applications of Green Ammonia

Agriculture

One of the most significant applications of green ammonia is in agriculture. Ammonia is a key ingredient in fertilizers, and its sustainable production can help reduce the carbon footprint of farming. By using green ammonia, farmers can produce food more sustainably, supporting global food security while minimizing environmental impact.

Energy Storage

Green ammonia can also serve as an effective energy carrier. It can be synthesized when there is surplus renewable energy and later converted back into hydrogen or directly used in fuel cells. This capability makes it an attractive option for balancing supply and demand in renewable energy systems.

Shipping Fuel

The maritime industry is under increasing pressure to reduce emissions. Green ammonia has emerged as a potential zero-emission fuel for ships, helping to decarbonize one of the most challenging sectors in terms of greenhouse gas emissions.

Benefits of Green Ammonia

Environmental Impact

By eliminating carbon emissions during production, green ammonia significantly reduces the environmental impact associated with traditional ammonia. This aligns with global efforts to combat climate change and achieve sustainability goals.

Energy Security

Investing in green ammonia can enhance energy security. As countries strive to reduce their dependence on fossil fuels, green ammonia offers a renewable alternative that can be produced locally, minimizing reliance on imported fuels.

Economic Opportunities

The growth of the green ammonia market presents numerous economic opportunities, including job creation in renewable energy sectors, research and development, and new supply chain dynamics. As demand increases, investments in infrastructure and technology will drive innovation.

Factors Driving the Growth of the Green Ammonia Market

Regulatory Support

Governments worldwide are implementing policies and incentives to promote the adoption of green technologies. These regulations often include subsidies for renewable energy production and carbon pricing mechanisms, making green ammonia more competitive.

Rising Demand for Sustainable Solutions

With consumers and businesses becoming increasingly aware of their environmental impact, the demand for sustainable solutions is on the rise. Green ammonia aligns with this trend, providing an eco-friendly alternative to traditional ammonia.

Advancements in Technology

Ongoing advancements in electrolysis and ammonia synthesis technologies are making the production of green ammonia more efficient and cost-effective. As these technologies mature, they will further enhance the viability of green ammonia in various applications.

Conclusion

The green ammonia market represents a promising avenue for sustainable development across agriculture, energy, and transportation sectors. As technology advances and regulatory support strengthens, green ammonia is poised to become a cornerstone of the global transition to a greener economy. Investing in this market not only contributes to environmental preservation but also opens up new economic opportunities for innovation and growth.

#The Green Ammonia Market: A Sustainable Future for Agriculture and Energy#As the world pivots toward sustainable practices#the green ammonia market is gaining momentum as a crucial player in the transition to a low-carbon economy. But what exactly is green ammon#and why is it so important? In this blog#we'll explore the green ammonia market#its applications#benefits#and the factors driving its growth.#Request Sample PDF Copy:https://wemarketresearch.com/reports/request-free-sample-pdf/green-ammonia-market/1359#What is Green Ammonia?#Green ammonia is ammonia produced using renewable energy sources#primarily through the electrolysis of water to generate hydrogen#which is then combined with nitrogen from the air. This process eliminates carbon emissions#setting green ammonia apart from traditional ammonia production#which relies heavily on fossil fuels.#Applications of Green Ammonia#Agriculture#One of the most significant applications of green ammonia is in agriculture. Ammonia is a key ingredient in fertilizers#and its sustainable production can help reduce the carbon footprint of farming. By using green ammonia#farmers can produce food more sustainably#supporting global food security while minimizing environmental impact.#Energy Storage#Green ammonia can also serve as an effective energy carrier. It can be synthesized when there is surplus renewable energy and later convert#Shipping Fuel#The maritime industry is under increasing pressure to reduce emissions. Green ammonia has emerged as a potential zero-emission fuel for shi#helping to decarbonize one of the most challenging sectors in terms of greenhouse gas emissions.#Benefits of Green Ammonia#Environmental Impact#By eliminating carbon emissions during production#green ammonia significantly reduces the environmental impact associated with traditional ammonia. This aligns with global efforts to combat

6 notes

·

View notes

Text

Blue Ammonia Market to Skyrocket to USD 3.58 Billion by 2032 Driven by Decarbonization and Global Hydrogen Economy

The global blue ammonia market is entering a period of exponential growth, with its value projected to rise from USD 79.1 million in 2024 to USD 3,579.7 million by 2032, advancing at an exceptional CAGR of 61.2% during 2025–2032. This remarkable surge is underpinned by the rising demand for low-carbon fuels, global decarbonization goals, and the emerging hydrogen economy.

Blue ammonia is produced using natural gas as a feedstock, but with a critical difference—carbon dioxide (CO₂) emissions generated during production are captured and either stored or reused via carbon capture and storage (CCS) technologies. This makes blue ammonia a crucial bridge solution between conventional grey ammonia and the fully renewable green ammonia, especially in hard-to-abate sectors.

Driving Forces Behind the Rapid Growth of the Blue Ammonia Market

The global push toward net-zero emissions and a low-carbon future is one of the primary factors accelerating the demand for blue ammonia. Countries around the world are making ambitious commitments under the Paris Agreement, prompting governments and industries to explore alternative energy carriers with reduced carbon footprints. Blue ammonia stands out as a versatile and scalable option that can be deployed in energy production, transportation, and industrial processes.

In particular, the hydrogen economy is increasingly recognizing blue ammonia as a key enabler of clean hydrogen transport and storage. Since ammonia (NH₃) contains approximately 17.6% hydrogen by weight, it serves as an efficient hydrogen carrier. It can be easily liquefied, stored, and shipped over long distances, making it ideal for international hydrogen supply chains.

Additionally, the maritime shipping industry, which faces significant pressure to decarbonize, is turning to blue ammonia as a low-carbon marine fuel. With the International Maritime Organization (IMO) setting strict GHG emission targets, shipping companies and engine manufacturers are actively testing ammonia-fueled engines. Blue ammonia provides a near-term solution to cut emissions while infrastructure for green ammonia and renewable hydrogen is still under development.

Regional Momentum and Strategic Investments

Regions such as North America, the Middle East, and Asia-Pacific are emerging as major players in the blue ammonia market. The U.S., for example, is leveraging its abundant natural gas resources and CCS capabilities to develop large-scale blue ammonia projects. Meanwhile, countries like Saudi Arabia and the UAE are positioning themselves as global hydrogen exporters, with blue ammonia playing a key role in their energy transition strategies.

Notable projects such as the NEOM green hydrogen initiative in Saudi Arabia and CCS-backed ammonia production facilities in the U.S. Gulf Coast are laying the foundation for rapid market expansion. Japan and South Korea, both major energy importers, have already signed long-term agreements for blue ammonia supply, further validating its global potential.

Challenges and Considerations

Despite its promise, the blue ammonia market faces several hurdles. The economic viability of CCS remains a concern, as the infrastructure is capital-intensive and still evolving. Additionally, there is growing scrutiny around the carbon intensity of natural gas supply chains and whether blue ammonia can truly deliver on its “low-carbon” promise without upstream methane leak mitigation.

Moreover, policy support, regulatory frameworks, and certification standards will be essential in scaling the blue ammonia economy. Clear definitions and lifecycle emissions accounting will help distinguish blue ammonia from its green and grey counterparts, fostering transparency and investor confidence.

The Road Ahead

As the world races toward a sustainable energy future, blue ammonia is expected to play a pivotal transitional role. It offers a low-carbon fuel alternative for industries and regions that are not yet ready for full electrification or 100% renewable energy. While green ammonia remains the long-term goal, blue ammonia provides an immediate, scalable, and impactful solution to curb global emissions.

#blue ammonia market#blue ammonia production#hydrogen carrier#ammonia as fuel#low-carbon fuel#CCS in ammonia production#hydrogen economy#clean energy transition

0 notes

Text

The Rare Earths Gamble: Geopolitical Stakes Rise as China Halts Exports

On April 14, 2025, China made a bold and alarming move by halting exports of critical rare earth minerals and magnets. This decision comes amid escalating trade tensions with the United States, raising fears of supply shortages. Industries dependent on these materials, such as automotive manufacturing, electronics, and defense, now face a precarious situation. China is known for its dominance in…

#American manufacturing#Biden Administration#china#critical minerals#critical resources#defense industry#Drones#economic sanctions#electric motors#electric vehicles#electronics#energy transition#export restrictions#future of warfare#Geopolitical tensions#global market#International Relations#military hardware#mining industry#rare earth dominance#rare earth exports#rare earth minerals#rare earth partnership#semiconductor industry#strategic partnerships#supply chain#Technology#trade tensions#Trump administration#Ukraine

1 note

·

View note

Text

youtube

#youtube#donald trump#stock market#trump tariffs#trump#president trump#Energy Policy#stock market news#white house press briefing#Energy Independence#Climate Change#Environmental Policy#Government Event#Energy Strategy#Biden Administration#Executive Order#Energy Efficiency#US Energy#Energy Transition#Renewable Energy#American Energy#National Energy Security#US Energy Strategy#Energy Regulation#Energy Infrastructure#Government Signing#Energy Resources

0 notes

Text

The Rise of Electric Buses: Trends, Technologies & Market Forecast

The global electric bus market is estimated to grow from USD 17.0 billion in 2024 to USD 37.5 billion by 2030, with a CAGR of 14.2% over the forecast period. The growth of the electric bus market is driven by countries prioritizing the electrification of their public transportation fleets with zero-emission mobility through subsidies, tax exemptions, and favorable regulations prompted by…

#Autonomous Buses#Battery Electric Bus#Clean Energy#Electric Buses#electric mobility#Electric Vehicle Adoption#EV Bus Market#Fuel Cell Electric Bus#Future of Transport#green transportation#Public Transport#Smart Mobility#Sustainable Mobility#Urban Transit#Zero Emission Transport

0 notes

Text

The global Energy Management Systems Market share is expected to grow from USD 49.01 billion in 2025 to USD 84.34 billion by 2029, at a CAGR of 13.8% during 2025-2029. Rising energy costs, integration of renewable sources for power generation, and strict government regulations and laws to reduce carbon and facilitate energy efficiency are promoting the growing EMS market worldwide. Adoption of smart grid technology and increased IoT-enabled devices further drive the growth in the EMS market by helping in monitoring and optimizing real-time energy usage. There will be increased innovation for redefining the EMS market landscape with applications based on AI or predictive analytics integration, along with enhanced cloud-based energy management solutions.

#energy#energy management systems market#energy management systems#energy management#energy market#energy efficiency#solar energy#sustainable energy#energia#energies#power generation#utilities#power#utility#renewableenergy#renewable power#electricity#renewable resources#energie#ems#ems market#renewable energy#energy generation#energy transition

0 notes

Text

Access the latest quarterly market analysis on hydrogen energy transition. Explore industry developments, investment strategies, and future growth prospects. Get the full report now.

0 notes

Text

Video: Investment Opportunities around the Globe in 2025

The video looks at #Investing #Themes, #Sectors and #geographical #locations to invest in through #2025 and beyond. I look at #themes like #AI #infrastructure, #applications, #geopolitics, #Environmental #Sustainability, #Private #Markets, and the #Energy #Transition. The #sectors I cover are #Technology including #Cybersecurity, #Healthcare, #Energy, #Industrials, #FinancialServices and…

View On WordPress

#2025#AI#applications#BasicMaterials#countries#Cybersecurity#developedmarkets#emergingmarkets#energy#Environmental#fastest-growing#FinancialServices#geographical#geopolitics#Healthcare#Industrials#infrastructure#investing#locations#markets#Other#Private#Sectors#Sustainability#Technology#themes#Transition

0 notes

Text

Lithium and Copper: The Metals That Will Shape the Future

🔋🌍 Lithium and copper are set to revolutionize the economy as the demand for electric vehicles and renewable energy soars! 🌱✨ With innovations in battery tech and sustainable materials, the future looks bright for clean energy.

In the coming years, certain metals are poised to fundamentally change the global economy—foremost among them are lithium and copper. These two raw materials are becoming increasingly indispensable for the energy and transportation industries as the world shifts towards renewable energy and electric vehicles. Lithium: The Fuel of the Energy Transition Lithium plays a central role in the…

#battery technology innovations#climate change solutions#copper demand forecast#eco-friendly materials#electric vehicle batteries#electrification of transportation#energy efficiency technologies#energy transition strategies#environmental impact of mining#future of electrification#innovations in renewable energy#Lithium market trends#Make money online#market analysis of lithium#metals for clean energy#nickel applications in batteries#Online business#Passive income#perovskite solar cells#renewable energy investment#renewable energy sources#sustainable metals#sustainable resource management

0 notes

Text

Leading the Charge with BSA Co-CEOs Richard Bartley and Arno Becker on Australia's EV Future

The electric vehicle market in Australia continues to boom – last year we saw a 161% increase in EV sales compared from 2022. Growth has continued this year, with EVs comprising 10% of all car sales, compared to 8% last year. As demand grows, questions surrounding the readiness of the country’s charging infrastructure have arisen, and while the Government invests in more infrastructure this year,…

View On WordPress

#AC charging#Arno Becker#Australia#BSA#BSA Limited#census data#charge at home#Chargepoint#charging stations#commercial charging#consultancy#cost of living#DC charging#Economic Benefits#economic impact#electric car#electric vehicles#energy transition#EV#EV adoption#EV benefits#EV chargers#EV Market#EV partnerships#EV rollout#fast chargers#fuel savings#future plans#government grants#green energy

0 notes

Text

Navigating the Energy Transition in Latin America and the Caribbean: A Comprehensive Market Analysis

The energy landscape in Latin America and the Caribbean (LAC) is undergoing a profound transformation, characterized by shifting priorities, technological innovations, and evolving regulatory frameworks. As the region embraces the imperative of sustainability and seeks to diversify its energy portfolio, understanding the dynamics of the energy transition is paramount for stakeholders across industries. In this comprehensive market analysis, we explore the intricacies of the energy transition in LAC, uncovering key trends, challenges, and opportunities shaping the future of the region's energy sector.

The Imperative of Energy Transition

The energy transition represents a paradigm shift towards cleaner, more sustainable energy sources, driven by environmental concerns, technological advancements, and economic imperatives. In LAC, the energy transition takes on added significance as governments, businesses, and communities seek to balance energy security, economic development, and environmental stewardship. From reducing carbon emissions to enhancing energy resilience, the energy transition holds the promise of a more sustainable and prosperous future for the region.

Understanding Market Dynamics

The energy transition in LAC is shaped by a multitude of factors, including geographical diversity, resource abundance, and socio-economic considerations. From hydroelectric power in the Andean countries to solar energy in the Caribbean islands, the region boasts a rich tapestry of renewable energy resources waiting to be harnessed. Market dynamics, however, are also influenced by policy frameworks, investment trends, and geopolitical forces, underscoring the complexity of the transition process.

Renewable Energy Revolution: Driving Innovation and Investment

Renewable energy emerges as a cornerstone of the energy transition in LAC, offering a viable alternative to fossil fuels and nuclear power. Solar, wind, hydroelectric, and biomass energy sources present vast untapped potential, providing clean, reliable, and cost-effective solutions to meet the region's growing energy demands. The renewable energy revolution is not only transforming the energy landscape but also catalyzing innovation, investment, and job creation across the value chain.

Solar Power Surge: Illuminating the Path Forward

Solar power emerges as a frontrunner in the renewable energy revolution, leveraging abundant sunlight to generate clean and sustainable electricity. In LAC, solar photovoltaic installations proliferate, driven by declining costs, technological advancements, and supportive policies. From utility-scale solar farms to distributed rooftop installations, solar power democratizes energy access, empowers local communities, and accelerates the transition towards a low-carbon future.

Wind Energy Winds of Change

Wind energy constitutes another pillar of the renewable energy revolution, harnessing the power of the wind to generate electricity and drive sustainable development. In LAC, wind-rich regions along coastlines and mountain ranges offer prime conditions for wind farm development and integration into the energy grid. As wind technology matures and economies of scale take hold, wind energy emerges as a competitive and scalable solution for meeting the region's energy needs while reducing reliance on fossil fuels.

Energy Transition Challenges and Opportunities

Despite the momentum towards renewable energy adoption, the energy transition in LAC is not without its challenges. Grid integration, intermittency, financing constraints, and regulatory hurdles pose significant barriers to widespread adoption and deployment of renewable energy technologies. Moreover, the legacy of fossil fuel dependence and infrastructure limitations complicates the transition process, requiring strategic planning, investment, and collaboration across public and private sectors.

Charting the Path Forward

As LAC navigates the complexities of the energy transition, strategic foresight, collaboration, and innovation emerge as guiding principles for success. From policy alignment to technology deployment, stakeholders must collaborate across sectors and borders to accelerate the transition towards a sustainable energy future. By embracing renewable energy, promoting energy efficiency, and fostering inclusive growth, LAC can unlock new opportunities for economic development, environmental stewardship, and social progress.

Policy Innovation: Enabling the Transition

Policy innovation plays a central role in facilitating the energy transition, providing the regulatory certainty and incentives needed to attract investment and drive deployment of renewable energy technologies. Governments across LAC must prioritize the development of comprehensive energy strategies, incorporating renewable energy targets, carbon pricing mechanisms, and regulatory frameworks conducive to sustainable development. By aligning policy objectives with environmental and social imperatives, policymakers can create an enabling environment for innovation, investment, and collaboration in the energy sector.

For more sector insights Latin America and Caribbean Energy Transition Market, download a free report sample

Investment Mobilization: Fueling Sustainable Growth

Investment mobilization is critical to scaling up renewable energy deployment and accelerating the energy transition in LAC. Governments, development finance institutions, and private investors must collaborate to unlock capital flows and de-risk investments in renewable energy projects. Innovative financing mechanisms, such as green bonds, venture capital, and public-private partnerships, can channel capital towards high-impact projects, while mitigating financial risks and maximizing returns. By leveraging public and private resources effectively, LAC can catalyze sustainable growth, job creation, and poverty alleviation, while advancing the goals of the Paris Agreement and the Sustainable Development Goals.

Conclusion

Latin America And The Caribbean Energy Transition Market to chart a course towards a sustainable, inclusive, and resilient energy future. By harnessing the power of renewable energy, embracing innovation, and fostering collaboration, the region can overcome the challenges of the transition and unlock new pathways for economic prosperity and environmental stewardship. As we embark on this transformative journey, let us seize the moment to build a brighter, more sustainable future for generations to come.

0 notes

Text

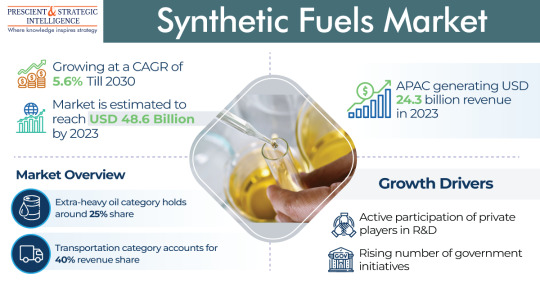

What Are Synthetic Fuels Or E-Fuels?

In labs throughout Europe and the Americas, researchers are busy investigating substitutions to fossil fuels. Besides the harmful releases and intensifying costs of petroleum items, recent geopolitical instability in the east of Europe has additional pressure on looking for new power sources. So, what types of synthetic fuels are in progress today? What Are Synthetic Fuels? Synthetic fuels,…

View On WordPress

#Biomass#Carbon Capture#Energy Transition#Fischer-Tropsch Synthesis#Greenhouse Gas Emissions#Hydrogen#Key players#Market dynamics#Power-to-Liquid#Regulatory frameworks#Renewable Sources#Synthetic Fuels Market

0 notes

Text

Pioneering the Future: Hydrogen Energy Transition Market Analysis

In the ever-evolving landscape of the energy sector, the Hydrogen Energy Transition Market stands at the forefront, heralding a new era of sustainability and innovation. This comprehensive exploration delves into the intricacies of the market, unraveling key trends, technological advancements, and future projections that define the hydrogen-powered future.

Understanding the Significance: A Glimpse into Hydrogen Energy

1. Hydrogen as a Clean Energy Carrier

Hydrogen, often hailed as the "clean energy carrier," holds immense significance in the transition towards a sustainable energy future. The Hydrogen Energy Transition Market is instrumental in harnessing the potential of hydrogen as a versatile and eco-friendly source of energy.

2. Decarbonization and Climate Goals

At the core of the market's significance is its role in facilitating decarbonization. Hydrogen, when produced through green methods, has the potential to significantly reduce carbon emissions, aligning with global climate goals and contributing to the fight against climate change.

Market Dynamics: Navigating Trends

1. Green Hydrogen Production on the Rise

A dominant trend within the Hydrogen Energy Transition Market is the surging interest and investment in green hydrogen production. Produced through renewable energy sources such as wind, solar, or hydropower, green hydrogen is gaining traction as a sustainable alternative, fostering a carbon-neutral energy landscape.

2. Technological Innovations in Hydrogen Storage

Technological advancements play a pivotal role in the market's dynamics, particularly in hydrogen storage. From advanced compression techniques to innovative materials for solid-state storage, the analysis explores how storage technologies are evolving to enhance efficiency and overcome traditional challenges. Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase.

3. Integration of Hydrogen in Various Sectors

Market dynamics reveal a growing trend in the integration of hydrogen across various sectors. From transportation and industry to residential and power generation, hydrogen is emerging as a versatile energy carrier, providing solutions for a multitude of applications and fostering sector-wide decarbonization.

Global Market Trends: Navigating Forces

1. Asia-Pacific's Leadership in Hydrogen Investments

Global trends highlight Asia-Pacific's leadership in hydrogen investments. Countries like Japan, South Korea, and China are at the forefront, driving research, development, and large-scale projects, positioning the region as a key player in the global hydrogen economy.

2. Europe's Hydrogen Strategy and Infrastructure Investments

Europe showcases a comprehensive hydrogen strategy coupled with significant investments in infrastructure. The European Hydrogen Energy Transition Market is characterized by ambitious goals, strategic policies, and substantial funding to establish a robust hydrogen ecosystem.

3. North America's Emergence in Hydrogen Initiatives

North America is witnessing an emergence in hydrogen initiatives, with a focus on research, development, and collaboration between private and public sectors. The market analysis explores how the region is positioning itself as a key participant in the global hydrogen transition.

Future Projections: Navigating Towards Tomorrow

1. Scaling Up Electrolysis for Green Hydrogen

The future of the Hydrogen Energy Transition Market is intricately linked to the scaling up of electrolysis for green hydrogen production. Projections indicate increased capacity, cost reductions, and efficiency improvements, making green hydrogen more competitive and accessible.

2. Advancements in Hydrogen Distribution Infrastructure

Future projections highlight advancements in hydrogen distribution infrastructure. As the demand for hydrogen grows, establishing a robust and efficient distribution network becomes imperative. Innovations in pipelines, storage facilities, and transportation modes will play a crucial role in shaping the hydrogen market.

3. International Collaboration for Hydrogen Trade

The market is projected to witness increased international collaboration for hydrogen trade. Projections indicate the development of a global hydrogen market, with countries exporting and importing hydrogen to meet their energy needs, fostering economic partnerships and energy security.

Embracing the Future: Navigating Opportunities

In conclusion, the Hydrogen Energy Transition Market represents a pivotal shift towards a cleaner, more sustainable energy paradigm. As the industry navigates evolving trends, technological breakthroughs, and global dynamics, quarterly analyses become essential tools for decision-makers seeking to seize opportunities and propel the world towards a hydrogen-powered future.

Buy the Full Report for More Insights on the Hydrogen Transition Market Insights

Download A Free Sample Report

0 notes

Text

Navigating the Energy Transition in Africa: A Comprehensive Market Analysis

As Africa propels itself into a new era of sustainable development, the energy transition takes center stage. This article embarks on a comprehensive market analysis, delving into the dynamics, challenges, and opportunities that characterize the evolving energy landscape across the African continent.

Understanding the Energy Transition

Shifting Towards Renewable Resources

Africa's energy transition is marked by a paradigm shift towards renewable resources. The article explores how solar, wind, and hydropower are emerging as catalysts for change, transforming the traditional energy matrix and laying the foundation for a more sustainable future.

Integration of Smart Technologies

Smart technologies are playing a pivotal role in the energy transition. From smart grids to IoT-enabled solutions, the article unveils how African nations are embracing digitalization to enhance energy efficiency, optimize distribution, and foster a resilient energy ecosystem.

Market Dynamics and Regional Variances

Diverse Energy Landscapes

The energy transition in Africa is not a one-size-fits-all scenario. This section dissects the diverse energy landscapes across regions, from North Africa's focus on solar to West Africa's exploration of offshore wind, offering insights into the region-specific dynamics influencing the transition.

Government Policies and Investments

Government policies and investments serve as linchpins for the energy transition. The article scrutinizes the regulatory frameworks, incentives, and investment initiatives implemented by African governments, providing a nuanced understanding of how policy decisions shape the trajectory of the energy sector.

For more insights into African power capacities, download a free report sample

Challenges on the Transition Pathway

Infrastructural Hurdles

Infrastructural challenges pose a significant hurdle to the energy transition. The article explores the impediments related to inadequate grid systems, storage facilities, and transportation infrastructure, offering insights into how these challenges are addressed to ensure a seamless transition.

Financial Barriers

Financing renewable energy projects remains a challenge in many African nations. This section examines the financial barriers, exploring innovative financing models, international collaborations, and the role of private sector investments in overcoming the financial constraints of the transition.

Opportunities for Sustainable Growth

Job Creation and Economic Empowerment

The energy transition opens avenues for sustainable growth. The article sheds light on how the shift towards renewable energy creates job opportunities, fosters skills development, and contributes to economic empowerment, particularly in rural areas.

Renewable Energy as a Catalyst for Industrialization

Renewable energy acts as a catalyst for industrialization across Africa. This section explores how sustainable energy sources fuel industrial growth, drive innovation, and position African nations on the global stage as leaders in clean energy production.

Conclusion: Charting the Path to a Sustainable Future

In conclusion, this article offers a comprehensive market analysis of the energy transition in Africa, unraveling the complexities, dynamics, and transformative potential of this pivotal moment. For stakeholders, investors, and enthusiasts navigating the energy landscape of Africa, this article serves as an insightful guide.

0 notes

Text

The global Electrolyzers Market Share is expected to grow from estimated USD 3.75 billion in 2024 to USD 78.01 billion by 2030, at a CAGR of 65.9% during the forecast period. This growth mainly comes in response to supportive government initiatives that encourage renewable energy technologies as well as advancements in the electrolysis process. Electrolyzers play a crucial role in the production of hydrogen since they split water into hydrogen and oxygen using electricity that can be generated from renewable sources, such as solar and wind energies. As nations accelerate efforts to decarbonize and reduce the reliance on fossil fuels, electrolyzers are increasingly important in diverse applications involving power generation, transportation, or industrial processes. The recent interest in hydrogen fuel cells and green ammonia production further underlines the potential of the electrolyser market as the basis of global energy transition towards sustainable solutions.

#electrolyser#electrolyzers#electrolyzer#electrolysis#electrolytes#electrolyzers market#energy#energia#power generation#utilities#renewableenergy#renewable resources#green hydrogen production#green hydrogen#hydrogen storage#hydrogene#hydrogen fuel cells#hydrogen#energy transition

0 notes