#Examples of bear trap in stock charts

Explore tagged Tumblr posts

Text

How to Trade the Failed Breakdown (Bearish Trap)

In technical analysis, the concept of a failed breakdown — often called a bear trap — is one of the most powerful reversal patterns that traders can capitalize on. A failed breakdown occurs when price action breaks below a key support level, lures in short sellers, and then quickly reverses to the upside. This trap can lead to strong short-covering rallies and presents high-probability trading…

#Bear trap chart pattern#Bear trap stock market#Bear trap trading#Bear trap vs bull trap difference in trading#Bearish trap reversal#Best strategies to trade a bear trap pattern#Bullish reversal patterns#Common mistakes when trading failed breakdowns#Examples of bear trap in stock charts#Failed breakdown candlestick pattern#Failed breakdown intraday strategy#Failed breakdown technical analysis#Failed breakdown trading strategy#Failed breakdown vs real breakdown#Failed support bounce setup#False breakdown trading strategy#How to avoid getting trapped in a false breakdown#How to identify a failed breakdown in technical analysis#How to trade failed breakdowns#learn technical analysis#Multi-timeframe breakout trap#Risk management in trading#Risk-reward setup for trading false breakdowns#Short squeeze trading strategy#stock markets#stock trading#successful trading#Support and resistance trading#Support level failure#technical analysis

0 notes

Text

Where is the Value?

Investors always want to know what’s cheap—cheap relative to the opportunity set and relative to history. Cheapness could refer to any number of things—price relative to trailing twelve months earnings, to trailing earnings over multiple years, to analyst earnings estimates, to long-run projections, or a dozen other variations based on sales, cash flows, book value, etc.

Because analyst estimates tend to be tainted for a number of different reasons (see this discussion on why), we tend to focus on price relative to trailing twelve month sales, cash flows, and earnings to measure cheapness. This gives a more holistic and objective view of valuation.

Using this simple construct, we’ll give every investable stock across the globe a percentile valuation score from 1-100. Scores are then rolled up to countries and regions to get value scores for each relative to the entire global stock market. Our universe will be all stocks with a market cap greater than an inflation adjusted $1 billion (USD) and with reasonable daily liquidity from 1990-2018.*

Because developed and emerging markets are often treated differently, we’ll separate the two within each region. Some countries are such large portions of the overall global stock market that they warrant their own “region”, i.e. the U.S. and Japan.

The chart below summarizes the results. Each green column represents a region/country. The vertical axis are the average percentile scores for each region/country discussed above. The top of each region column is the highest (most expensive) valuation since 1990, and the bottom is the lowest (cheapest). The red triangle represents the average valuation over the period, and the blue triangle represents current valuations.

As value investors, the most intriguing regions/countries are those with current valuations (blue triangle) below the historical average (red triangle) and low relative to the rest of the global market. Based on this chart, Japan and Emerging Europe, Middle East, Africa (EMEA) fall into this group. On the flip side, the U.S. stands out as being one of the most expensive markets relative to other regions and its own history. Given the massive run in the U.S. market over the last decade, this is no surprise.

Over the last several decades, it is common for there to be long cyclical trends of U.S. outperformance. Since the 1970’s at least, it has always reverted to form with non-U.S. markets outperforming for long stretches. Below is a chart of rolling 3 year returns for U.S. vs Foreign markets. At some point, the tide will change and foreign markets will have their day in the sun. Timing uncertain.

Regions give a decent overview but drilling down by countries within each region reveals some interesting stuff. Let’s turn first to the broadest region—EMEA. Obviously, Europe has been afflicted by several political events in the post Global Financial Crisis (GFC) era. Grexit, Brexit, questions on solvency in Italy, Spain, Portugal, etc. Setting all that aside, there are three countries that are trading reasonably below their historical averages and relative to others in the region—Portugal, Greece, and Turkey. These countries are not for the faint of heart, but then again, opportunities tend to require a contrarian bent form investors that can see through the noise.

Turning to the Asia Pacific region, there are a few standouts. For developed markets, Japan and Singapore are both trading well below their historical average and with discounted valuation relative to other countries. On the EM side, Russia is the clear winner—cheap relative to history and within the region. With high economic reliance on the Energy sector, a volatile currency, and a few political concerns, the valuation seems to make sense, but certainly worthy of a closer look.

Turning to the Americas, as mentioned above the U.S. appears expensive relative to history and other countries/regions, but that has been the case for some time and could persist. Of interest on this side of the Atlantic is Mexico. A little ways into The Absent Superpower, author Peter Zeihan makes a succinct case for an industrial revolution in Mexico based on the U.S. shale revolution.

Long story short, there seem to be more opportunities, based on valuation, in Emerging Markets. Among Developed Markets, Japan seems the most attractive. The U.S. remains expensive.

We could stop there, but there is always more to the story. Value investing is great, but there exist lots of value traps the world over. An interesting corollary to value investing is that of growth. Peter Lynch famously quantified this concept in the PE to Growth ratio. Basically, what are you paying for a dollar of earnings growth. We extend this concept below by using the same Value score framework and adding to it some growth metrics. We will measure Earnings Growth using a combination of 1-year EPS change, Return on Invested Capital, the trend of earnings over the last several quarters. The chart below shows the percentile ranks for value on the horizontal axis and Earnings Growth on the vertical axis. A country with the highest growth and cheapest valuation would fall int eh lower left corner. Expensive and low growth countries would fall in the upper right corner.

I’ve highlighted a few countries on the chart that I found interesting. The countries noted above as being deeply discounted relative to peers and history are also showing up as having favorable Earnings Growth relative to peers—Portugal, Greece, and Russia.

For the most part, if you can find discounted stocks with strengthening fundamentals, you usually have a solid cocktail for a good investment. For enterprising investors willing to bear the currency and geopolitical risks, there may just be some diamonds in the rough in some of these unloved and beaten down markets.

* If you don’t see a country, its likely because there weren’t enough tradeable stocks to warrant inclusion. China being a prime example here. Lots of stocks that aren’t tradeable to foreign investors.

9 notes

·

View notes

Text

What is Dow Theory?

Dow Theory is an important part of technical analysis. It was used extensively even before the western world discovered candlesticks. The Dow Theory was introduced to the world by Charles H. Dow. Dow theory was built on few beliefs. These are as follows:

IIndices discounts everything: The stock market indices discount everything which is known & unknown in the public domain. If a sudden and unexpected event occurs, the stock market indices quickly recalibrate itself to reflect the accurate value

Market Trends:Overall there are three market trends. These are Primary Trend, Secondary Trend, and Minor Trends.

Three Major Trend as per Dow Theory

The Primary Trend: This is the major trend of the market that lasts from a year to several years. It indicates the broader multiyear direction of the market. While the long-term investor is interested in the primary trend, an active trader is interested in all trends. The primary trend could be a primary uptrend or a primary downtrend.

The Secondary Trend:These are corrections to the primary trend. Think of this as a minor counter-reaction to the larger movement in the market. Example — corrections in the bull market, rallies & recoveries in the bear market. The counter-trend can last anywhere between a few weeks to several months.

Minor Trends/Daily fluctuations: These are daily fluctuations in the market; some traders prefer to call them market noise. It lasts few weeks.

Conformation of All Indices:We cannot confirm a trend based on just one index. For example, the market is bullish only if Nifty 50, Nifty Midcap, Nifty Small cap etc. all move in the same upward direction. It would not be possible to classify markets as bullish, just by the action of Nifty50 alone.

Volumes must confirm:The volumes must confirm along with the price. The trend should be supported by volume. The volume must increase as the price rises and should reduce as the price falls in an uptrend. In a downtrend, the volume must increase when the price falls and decrease when the price rises.

Trend Remains in Effect until Clear reversal Occurs: Trend is assumed to be continuing until clear reversal occurs reverse trend. Suppose Minor and secondary trend is down and primary trend is up in a stock. If any trader take short position assuming primary trend will be reversed then he may be trapped because there is high chance that primary then will continue upward and secondary and minor trend will get realigned.

There are two other concept as per Dow theory that need to know here

Sideway Trend:Markets may remain sideways (trading between a range) for an extended period. Sideway markets can substitute secondary market trend.

Closing Price: Between the open, high, low and close prices, the close is the most important price level as it represents the final evaluation of the stock during the day.

Also Learn the other topics of Demand Supply trading strategy below:

Technical Analysis Basics

What is Dow Theory

Candlestick Charts

Bullish Candlestick patterns

Bearish candlestick patterns

Indecision and continuation candlestick patterns

How to use Volume in trading

Method of moving average

RSI Indicator

ATR Indicator

Trend line analysis

Support resistance

Demand Supply zone

Chart patterns

Trading channels gaps

Trading strategy

Trade management and stop loss

Position size and risk

Three Different Phases of market:📷

Dow Theory suggests the markets are made up of three distinct phases, which are self-repeating. These are called the Accumulation phase, the Markup phase, and the Distribution phase.

The Accumulation phase usually occurs right after a steep sell-off in the market. The steep sell-off in the markets would have frustrated many market participants, losing hope of any uptrend in prices.

The stock prices would have plummeted to rock bottom valuations, but the buyers would still be hesitant to buy fearing another sell-off. This is when the ‘Smart Money’ enters the market.

Smart money is usually the institutional investors who invest in a long-term perspective. They invariably seek value investments which are available after a steep sell-off. Institutional investors start to acquire shares regularly, in large quantities over an extended period of time. This is what makes up an accumulation phase.

This also means that the sellers trying to sell during the accumulation phase will easily find buyers, and therefore the prices do not decline further. Hence invariably, the accumulation phase marks the bottom of the markets. More often than not, this is how the support levels are created. Accumulation phase can last up to several months.

Once the institutional investors (smart money) absorb all the available stocks, short term traders since the support. This usually coincides with the improved business sentiment. These factors tend to take the stock price higher. This is called the markup phase.

During the Markup phase, the stock price rallies quickly and sharply. The most important feature of the markup phase is speed. Because the rally is quick, the public at large is left out of the rally. New investors are mesmerized by the return, and everyone from the analysts to the public sees higher levels ahead.

Finally, when the stock price reaches new highs (52 weeks high, all-time high), everyone around would be talking about the stock market. The news reports turn optimistic, business environment suddenly appears vibrant, and everyone (public) wants to invest in the markets. By and large, the public wants to get involved in the markets as there is a positive sentiment. This is when the distribution phase occurs.

The judicious investors (smart investors) who got in early (during the accumulation phase) will start offloading their shares slowly. The public will absorb all the volumes offloaded by the institutional investors (smart money) there by giving them the well-needed price support.

The distribution phase has similar price properties as that of the accumulation phase. Whenever the prices attempt to go higher in the distribution phase, the smart money offloads their holdings. Over a period of time, this action repeats several times, and thus the resistance level is created.

Finally, when the institutional investors (smart money) completely sell off their holdings, there would no further support for prices. Hence, what follows after the distribution phase is a complete sell-off in the markets, also known as the mark down of prices. The selloff in the market leaves the public in an utter state of frustration.

Completing the circle, what follows the selloff phase is a fresh round of accumulation phase, and the whole cycle repeats. It is believed that that entire cycle from the accumulation phase to the selloff spans over a few years.

It is important to note that no two market cycles are the same. For example, in the Indian context, the bull market of 2006–07 is way different from the bull market of 2013–14. Sometimes the market moves from the accumulation to the distribution phase over a prolonged multi-year period.

On the other hand, the same move from the accumulation to the distribution can happen over a few months. The market participant needs to tune himself to evaluating markets in the context of different phases, as this sets a stage for developing a view on the market.

There are some price patterns found in the chart which is known as Dow patterns. We shall learn these in our article on chart patterns.

0 notes

Text

How to Identify and Trade Market Trends

This post originally appeared on Wealth Within.

By Dale Gillham and Janine Cox | Published 04 February 2021

youtube

When it comes to trading the stock market, it is not how much money you make on any one investment that makes you wealthy, it is how much you do not lose over time. It is for this reason why it is so important to know how to identify and trade market trends. In fact, if you can correctly ascertain the direction of the trend, you can pinpoint with greater certainty, the right time to buy and sell, which means you will be far more profitable.

Obviously, the higher the return you desire, the more knowledge, experience and time you will need to devote to your investments. This doesn't mean you need to look at the market on a daily basis; rather it simply means you will need to commit some time to monitoring your stocks and managing your portfolio.

Of course, the challenge is to develop a system that is repeatable, so that profitable returns are consistently generated, which is why we will discuss in this article what you need to know to confidently identify and trade market trends.

Understanding bull and bear markets

I’m sure many of you have heard the story of the tortoise and the hare. But have you heard the story of the bull and the bear? The terms bull and bear are often used to describe how stock markets move in general. So, what's the difference between the two?

A bull market occurs when the majority of stocks are rising in price while a bear market occurs when the majority of stocks are falling in price. While these terms may seem like odd names to describe market movements, they came about because of the way animals attack their prey.

A bull thrusts its horns upwards, while a bear swipes its paws downwards and these actions are used as metaphors to describe movements in the market. Therefore, if the overall trend is up, it is referred to as a bull market and if the overall trend is down, it is referred to as a bear market.

What actually drives markets to rise or fall?

When chatting to people about the stock market, it becomes apparent that most believe trends or market movements are caused by news or political events. However, it is actually the social mood or the general mood of a society, that determines direction. Would it surprise you to know that much of the news and political events that unfold are already factored into the price of the market? Let me explain.

In simple terms, social mood is about confidence, or how confident we are as a society about our future.

Experts on social mood say that a major market index is to social mood what a barometer is to weather. A barometer measures changes in the air pressure to highlight when we can expect a change in the weather. Imagine what it would mean if you were able to read the market that way!

Social mood is not a study of short-term emotion but, rather, medium to long-term trends in our behaviour. To look at social moods in the short term would be just as futile as looking at the daily price movements on the stock market. Professionals know that daily fluctuations are irrelevant. Unfortunately, many individuals analyse the market this way and, in doing so, miss the bigger picture (or, in other words, the trend), which makes them far less effective.

An example of how social mood works

A great example of how social mood works occurred when the Federal Reserve (or the Fed as they are more commonly known) in the United States announced that it would taper quantitative easing, which is a monetary policy that simultaneously injects liquidity into the economy while reducing interest rates. Initially, the market reacted swiftly to the news with a sell-off, however, the social mood in the US at the time was more optimistic about the future, so the market quickly recovered. This repeated itself each time the Fed met to discuss the policy. Therefore, it is the underlying social confidence of a market that determines direction, not short-term emotions.

The more confident the underlying social mood, the more likely we are to invest. The more pessimistic it is, the more likely we are to sell out of the market. Understanding the collective mood of a society is easier than trying to keep up with the latest in world economics and news events, then trying to understand how this may impact your investments (which is even harder). It also ensures that you are better prepared for the most important moves in the market.

There is a point in any trend when the social mood becomes overly optimistic or overly pessimistic. This occurs around market tops and bottoms, signalling a likely change in trend. Unfortunately, the masses tend to miss these signals and, instead, get caught out buying at the top and selling at the bottom of a market, behaviour prevalent during the global financial crisis. But being aware of the social mood means that you won’t get swept up in the mindset of the herd.

Trading with the trend

No doubt some of you will have heard that trends represent the basic foundation of trading any market. Sayings such as “the trend is your friend” and “always trade with the trend” are common place in books or courses about trading.

Unfortunately, the 90 per cent of individuals who lose money in the markets today do so because they unknowingly break from this basic foundation of trading by trading counter to the trend. However, when trading the stock market, the carved-in-stone rule you must always remember is this: All trends conform to a longer-term, existing trend.

For example, if a stock has been in a long-term bearish downtrend for two years, there is a high probability it will continue to fall; in fact, the probability is as high as 80 to 90 per cent. If after falling for two years, the stock then turns and rises for five weeks, the probability that it is starting a new bullish uptrend is only 10 to 20 per cent.

Unfortunately, at this point in time, many people fall into the trap of believing a new uptrend is unfolding, and they attempt to buy at the bottom for fear of missing out on the potential rise. The cold reality is that, often, the market turns down again, causing the individual to suffer more losses. Acting on this low probability of a potential change in trend is not conducive to good trading.

In short, you should always trade with the trend.

What is a trend and how do you identify trends?

When prices rise for a period of time and then fall away, a crest or peak is formed. On the other hand, when prices fall for a period of time and then rise once again, they form a low, or what is more commonly known as a trough.

Therefore, an uptrend is the result of a rising movement in market prices, which is confirmed by a series of higher peaks and troughs. A rising stock is said to be bullish indicating there are more buyers than sellers.

Meanwhile, a downtrend is caused by a falling movement in market prices, and is confirmed by a series of lower peaks and troughs. A falling stock, on the other hand, is said to be bearish, indicating there are more sellers than buyers.

What to consider when trading trends?

A major consideration when investing over the long term is the direction of the trend over the longer term and, to a lesser extent, the medium term. Therefore, you will gauge a lot of what you need to know by analysing the trends of a stock on a monthly chart.

If, however, you are trading over the medium term, the major consideration is the direction of the trend over the medium term and, to a lesser extent, the shorter term. Given this, you will gauge a lot of what you need to know by analysing the trends of a stock on a weekly and monthly chart.

The major consideration when investing over the short term is the direction of the trend over the medium term; therefore, you will gauge a lot of what you need to know by analysing the trends of a stock on a weekly chart.

That said, it still pays to confirm the longer-term trend by reviewing the monthly chart. By doing this, you will be able to gauge the direction, the length and the strength of each trend of lesser degree.

When viewing a chart, you will be able to tell that the price of a stock is rising if it has successively higher bars. On a monthly chart, stocks that rise over three or more consecutive months are said to be in an uptrend while on a weekly chart, this equates to twelve or more bars moving in an uptrend. Obviously, this statement is not flawless, as a stock can rise for three months (or twelve weeks) and then move sideways or down. However, it does provide a starting point from which to analyse the strength of a stock.

Let’s look at some examples.

How to trade trends in the stock market

The monthly chart of Aristocrat Leisure represents the stock as it rose in price from 2003 to early September 2019, where the trend changed from up to down before returning to trade in an uptrend again.

In effect, it represents the consensus of thousands of investors over a period of sixteen consecutive years, as the stock trended up from $0.75 to $17.68 in February 2007, before falling to $2.10 in September 2011 and then rising back up to $33.06 in July 2018. Depending on your confidence level, you might have entered the stock some time late in 2003 after it had been trending up for more than 3 consecutive months.

But even if you had waited until sometime in early 2004, when the price of the stock was approximately $2.70, you would still have made around 360 per cent, excluding dividends, before selling in 2007 at a point where the stock had fallen more than 30 per cent in price, using very conservative entry and exit rules.

Not every stock will give you this sort of profit, but most blue chip companies usually yield around twenty to fifty per cent or more in growth in an uptrend. As you can see on the chart, we placed the next entry in 2012 at $3.25 based on the same rules and, again, the profit is quite impressive at nearly 1,000 percent.

So what is the monthly chart of Westpac telling you? Once again, this is representative of a solid blue chip stock that has trended up nicely between late 1992 and early September 2019 by over 1,500 per cent, excluding dividends.

While there have been many opportunities to profit from this stock over the past 25 years, with the stock rising between 20 to 50 per cent or more over a few months to around three years, I have shown one trade using the same simple rules I applied on Aristocrat, with the trade making just over 40 per cent in two years.

Generally, the top 50 stocks by market capitalisation produce very steady uptrends that are easy to identify. Stocks out to the top 150, however, are a little more volatile and, therefore, require more diligence on your part if you choose to invest in them.

As with any stock, there is always an element of risk, but the educated investor can minimise this risk. Remember, you can always sell if you are wrong in your analysis.

If you are serious about your success in stock market and you want to learn how to trade with more confidence and certainty, we’ve got the books and trading courses that will give you knowledge to profitably trade in any market condition. To speak to a member of our team, call 1300 858 272 or Email us and we will be happy to answer any of your questions.

0 notes

Text

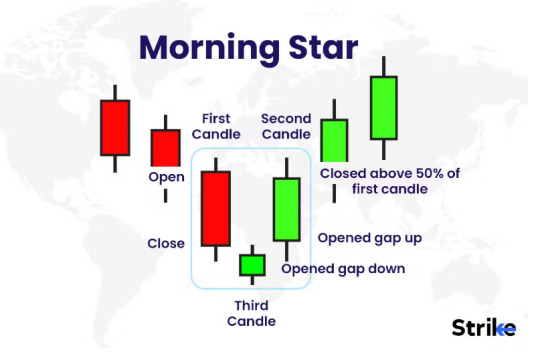

Morning Star Candlestick: The Indian Trader’s 2025 Playbook 🌄

A bruising sell-off turns into a fireworks rally—that pivot often starts with a Morning Star candlestick, a three-candle bullish reversal that shows bears losing their grip and bulls sprinting in. Indian traders on NIFTY 50, Bank Nifty, and mid-caps see this pattern appear every month, yet many still miss the turn. This guide puts the spotlight on the Morning Star, backs it with research, sprinkles in live examples from Dalal Street, and shows exactly how to track it on Strike Money.

1️⃣ Morning Star Basics—Plain-Speak Definition 🤔

A Morning Star is a three-step story:

✨ Day 1 closes deep red, proving sellers are in charge. ✨ Day 2 gaps down but stays tiny (often a doji), telling us exhaustion is near. ✨ Day 3 gaps up and closes strong green, reclaiming at least half of Day 1’s fall—confirmation the baton has passed to buyers.

In exhaustive back-tests of over 1,500 stocks, researchers have found the pattern flipped price direction 78 % of the time, ranking high among candlestick setups for reliability.

2️⃣ Candle Psychology—Why Bulls Suddenly Win 🔍

Sellers push price so far on Day 1 that late shorts happily pile in. The next session opens lower, but volume dries up—no fresh supply. The tiny second candle is indecision in neon lights. By the third open, trapped bears scramble to cover, institutions sense blood, and a gap-up sparks a broad bid. The long green close seals bullish sentiment. Volume often triples across the three sessions, peaking on the final push, a tell-tale sign you can see on Strike Money’s volume overlay.

3️⃣ From Rice Pits to Dalal Street—A Short Origin Story 🌾➡️📈

Japanese rice merchant Munehisa Homma sketched the first candlestick charts in the 1700s. Two centuries later, Steve Nison brought them to the West, decoding centuries-old patterns for modern markets. Then came academic validation. A landmark study by three financial researchers—Lo, Mamaysky, and Wang—found statistical backing for price patterns, including Morning Stars, showing they led to consistent return edges even in highly liquid markets.

Technical analysis is no longer just art—it’s backed by data and decades of market observation.

4️⃣ Spotting a High-Quality Morning Star—The Five-Tick Checklist ✅

👉 Deep Context: Pattern must form after a minimum two-week down-swing; sideways ranges don’t count. 👉 Gap Logic: Day 2 opens below Day 1’s close, Day 3 opens above Day 2’s body. 👉 Candle Proportions: Third candle should eat at least 50 % of Day 1’s body. 👉 Volume Spike: Rising turnover through the trio, climaxing on Day 3, is ideal. 👉 Neighbourhood: Pattern near a weekly support or the 50-day SMA improves odds.

Strike Money lets you tag these checkpoints with custom alerts—no coding needed.

5️⃣ “Show Me the Numbers!”—Research & Statistics 📊

🔹 A wide-ranging candlestick study tracked reversal patterns and found the Morning Star reversed trends 78 % of the time. 🔹 A variant called the Morning Doji Star was slightly less common but still showed strong reversal strength—around 76 % on average. 🔹 A leading academic study confirmed visual patterns like Morning Star carried statistically significant predictive power beyond random walk behavior. 🔹 In India, a 2023 study on NIFTY 100 stocks showed Morning Star setups beat baseline buy-and-hold returns by over 3 % within 10 trading days.

Patterns alone won’t guarantee profits—but they tilt the odds.

6️⃣ Morning Stars in the Wild—Recent Indian Case Studies 🚀

Reliance Industries (May 15–17, 2024)

Day 1: Stock plunged 4.6 % post-earnings. Day 2: Gapped down, printed a doji with extremely low volume. Day 3: Gapped up and closed up 5 %, taking out the previous 3-day high. 📈 Outcome: Reliance rallied 9.4 % in 6 sessions.

Tata Consultancy Services (Aug 9–11, 2023)

A textbook Morning Star formed at ₹3,150—also a known horizontal support. The next four weeks? A rally of over 11 %.

Bank Nifty Futures (March 2025 Quarterly Contract)

On a 15-minute chart, a Morning Star emerged at 10:45 a.m. on March 4. Futures surged over 320 points by EOD—proof the pattern’s power on intraday levels.

Morning Stars are not rare. But spotting them early? That’s where tools like Strike Money come in.

7️⃣ Trade Blueprint—Entries, Stops & Targets 🎯

🟢 Entry: Wait for price to break above the high of Candle 3. 🛡️ Stop-Loss: Just below the low of Candle 2. 🎯 Target: Measure Candle 1’s body height and project it upward from Day 3’s close—or trail it using ATR for strong trends.

Position sizing matters. Risk no more than 1 % of capital per trade. Strike Money helps plan this with its integrated risk calculator.

8️⃣ Super-Charging the Pattern—Indicators That Add Edge ⚙️

✨ Volume: A steady rise in volume across all three candles is your best ally. ✨ RSI Divergence: When price makes a new low but RSI does not—it’s a bullish warning shot. ✨ 50-Day SMA: A Morning Star breaking above this average often leads to multi-week rallies.

Combine a Morning Star with these tools for edge—not confusion.

9️⃣ Common Pitfalls That Burn New Traders 🔥

❌ Taking every 3-candle formation as valid—context matters. ❌ Ignoring volume and treating low-turnover stocks the same. ❌ Trading around news or earnings; patterns often fail in volatility spikes. ❌ Doubling down after a failed setup instead of reassessing.

Learn the checklist, keep risk in check, and don’t marry a single signal.

🔟 Rapid-Fire FAQ—Your Top Questions Answered ❓

💬 Does this pattern work on 5-minute or 15-minute charts? Yes—but higher timeframes like daily or 1-hour offer more reliable setups.

💬 Do NSE gap rules affect this pattern? Use the 9:15 open as your Day 2 candle’s start. Ignore pre-open volatility.

💬 Can this be used with Fibonacci retracement? Absolutely. If a Morning Star appears at a 61.8 % retracement, it adds confirmation.

💬 Morning Star vs Evening Star—same logic? Yes, reversed. Evening Star signals bearish reversal after an uptrend.

💬 How to scan for it fast? Use Strike Money’s built-in Morning Star scanner. Set it to alert when volume rises too.

💬 Is the doji necessary for this pattern? No. A small-bodied Candle 2 works as long as it signals indecision.

💬 What timeframe works best in India? Daily candles are most trusted. But swing traders also use hourly charts for early signals.

💬 Does it appear often in NIFTY 50 stocks? Yes. On average, 6–8 good-quality patterns appear per quarter across the top 50.

💬 How do I backtest this strategy? Strike Money lets you visually replay past candles and match them against outcomes—great for pattern validation.

💬 Is this good for options trading too? Yes. Patterns like Morning Star are great for directional trades using ATM or slightly ITM options.

1️⃣1️⃣ Your Next Step—Scan, Spot, Act 📥

Want to catch the next Morning Star before it flies? Head over to Strike Money and apply the Morning Star filter. It shows verified patterns based on candle size, gaps, and volume.

Print out the five-step checklist, pin it next to your desk, and commit to trading only when all boxes are ticked.

📌 Pro tip: Log every Morning Star trade in a journal. Over 50 trades, you’ll see your own win-rate and timing edge.

The Morning Star isn’t a magic bullet—but in the hands of a disciplined trader, it’s a reliable weapon.

⚠️ Risk Disclaimer

All strategies and case studies discussed are for educational purposes only. Past performance does not guarantee future results. Always use strict risk management.

Written by: A. Kumar, trader and market educator. Contributor to trading forums and regular user of Strike Money for charting and pattern scans.

0 notes

Text

The Intrinsic Value of Stamps.com

Introduction

Stamps.com is a leading provider of Internet-based mailing and shipping solutions both in Europe and the U.S. The company offers customers the possibility to print postage approved by the United States Postal Service (USPS), requiring only a PC and a printer.

The firm operates under multiple brands like Stamps.com, Endicia, ShipWorks, ShipStation, or Metapack and offers its services both to individuals, small businesses, and large corporations.

Stamps.com has managed to grow revenue dramatically from $10 million in 2009 to $273 million in 2018. During this time, EPS rose from $0.38 to $8.99, and book value increased from $4.82 to $36.95 – an annual increase of 41.6% and 25.1% respectively.

Due to these very high growth rates, Stamps.com used to be a darling of Wall Street, trading as high as $285 only one year ago. But then the company experienced a double blow in 2019. Firstly, its exclusive relationship with USPS via Negotiated Service Agreement (NSA) was ended. Three months later, USPS also announced its intention to renegotiate the NSAs from existing resellers, thus also cutting this indirect relationship between STMP and USPS.

Both issues are highly problematic for Stamps.com since they strongly affect the core of its business model. As Stamps.com has already drastically reduced its earnings and revenue guidance, the stock dropped like a stone and trades for currently $46.33. Is Stamps.com now a bargain worth buying or are the risks for its business models too great?

The Intrinsic Value of Stamps.com

To determine the value of Stamps.com, let’s start by looking at the company’s history of free cash flow. The free cash flow is important because it represents the company’s ability to retain earnings and grow the business. Most importantly, it demonstrates a return on the principal that might be invested into the ownership of equity of the business. Below is a chart of Stamp.com’s free cash flow over the past years.

The growth in free cash flow surely looks impressive – but due to multiple recent obstacles, this growth cannot be expected to continue in the next years. In fact, even a drop in free cash flow seems highly likely. We will, therefore, use a very conservative estimate for Stamps.com’s future cash flows.

Each line in the above graph represents a certain probability for occurring. We assume a 10% probability for the upper band to be 0% annually, and for the most likely scenario, we estimate an annual decline of 7%, which we assign a 50% probability. The worst-case scenario could be a contraction of 15% every year, that is considered quite possible. We estimate the probability of that to happen to be 40%.

Assuming these growth rates and probabilities are accurate, Stamps.com can be expected to give a 23.7% annual return at the current price of $46.33. Now, let’s discuss how and why those free cash flows could be achieved.

The Competitive Advantage of Stamps.com

Stamps.com possesses some unique advantages that should allow it to be successful in the future:

Leading Provider. Stamps.com remains by far the leading provider of internet-based shipping solutions. This position could also give Stamps.com clout when dealing with the USPS. While there are other USPS-approved PC postage services like EasyPost and Pitney Bowes, Stamps.com offers a superior user interface and a larger number of features.

Sticky business. Stamps.com’s churn rate (the percentage of subscribers that are discontinuing their subscriptions) in the latest quarter was a very low 2.9%. This indicates that customers tend to stay loyal and seem to be satisfied with the offer from Stamps.com.

Chances due to canceled USPS deal. One must bear in mind, that Stamps.com decided to cancel the NSA with USPS, not the other way around. While the risks of this move are obvious, it also gives Stamps.com new possibilities, since it is no longer bound by this rather restrictive agreement. Now Stamps.com can do more deals and agreements with other players.

Opportunity Costs

When looking at various investment opportunities on the market today, let’s compare the expected return of Stamps.com to other ideas. First, one could invest in the ten-year treasury bond, which is producing a 2.04% return. Considering the bond is completely impacted by inflation, the real return of this option is likely only around 1%. Currently, the S&P 500 Shiller P/E ratio is 29.75. As a result, the US Stock market is priced at a 3.36% yield. If one were to invest in the S&P500, they might purchase a low-cost ETF to take advantage of this return.

Macro Factors

The mailing and shipping business is vast and will only grow more important in the future. While Stamps.com is a leading provider of Internet-based mailing and shipping solutions in the U.S. and Europe, this large business attracts multiple competitors. Users have many other ways to use the services of USPS, and there are also many other private carriers, package manifesting systems, and enterprise software solutions that offer easy mailing and shipping systems.

Until recently, the NSA with the USPS gave Stamps.com a huge advantage over these competitors. It remains to be seen, how successful Stamps.com can operate without this competitive advantage. The market might also experience a major disruption in the future if, for example, Amazon delivers much or even all of its shipping itself.

Risk Factors

Several risks might limit the growth prospects of Stamps.com:

End of NSA with USPS. In February 2019, the company announced that it ends its exclusive relationship via Negotiated Service Agreement (NSA) with the U.S. Postal Service. As a result of the company drastically decreased its sales and earnings targets and lowered its guidance. This is especially problematic because many of Stamps.com’s customers were lured by its favorable USPS prices due to the NSA. No longer able to offers such cheap prices, Stamps.com may lose both customers and see a drop in its margins.

Renegotiating of NSAs between USPS and its resellers. In May 2019, the USPS announced its intention to renegotiate its existing NSAs with its resellers. This might also threaten the indirect relationship of Stamps.com with the USPS using these intermediate companies.

Amazon’s aggressive expansion into the shipping market. Amazon is both friend and foe for Stamps.com. The deliveries of Amazon’s postage accounted for a whopping 88% of Stamps.com’s revenue. This makes Stamps.com very dependent on Amazon, which is especially risky since Amazon explores several ways to deliver its goods itself – thus no longer relying on Stamps.com’s services.

Goodwill. Stamps.com’s impressive growth was at least partly realized by multiple acquisitions. As a result, the company has currently $385 million goodwill on its balance sheet, which is more than half of its market capitalization. If this huge amount of goodwill has to be written down in the future, earnings can easily become negative. On the positive side, Stamps.com’s debt level seems sustainable and does not yet raise a red flag.

Summary

Stamps.com is an intriguing company. On the one hand, its historical performance has been breathtaking and has included very high growth rates in revenue, earnings, free cash flow, and book value. The company is an important player in a vast global market that can be expected to remain relevant for the foreseeable future.

On the other hand, its whole business model has been completely turned upside down by the cancellation of the NSA with the USPS and the renegotiation of the NSAs between the USPS and its resellers. Obviously, this makes Stamps.com’s future path highly uncertain and the business in five years will probably look very different from the one today.

Although risky, the decision to cut the relationship with the USPS also holds interesting opportunities for Stamps.com. While the USPS remains relevant, its numbers and influence have been declining for years. Doing “business as usual” with the USPS would therefore also have carried risks for Stamps.com.

At this point, it is quite hard to determine if this is a bargain or a value trap. If Stamps.com manages to prosper within the new business environment, this stock could offer vast returns of 23.7% annually. If not, things can go downhill very fast. Before investing in Stamps.com, investors are well-advised to investigate the company in more detail.

*

This article was written in collaboration with Christoph Wolf from Christoph Wolf Value Investing

Stig Brodersen is the host of the business podcast “We Study Billionaires.” You can find his free intrinsic value index here of popular stock picks.

0 notes

Text

Confusion Reigns (Or What to Do When Nothing Makes Sense)

Source: Michael Ballanger for Streetwise Reports 03/31/2019

Sector expert Michael Ballanger discusses the pitfalls of market reversals and forecasting.

As I reach end-of-week, end-of-month book-squaring, where all of my urgent e-mails and all of my myopic missives and all of my topical tweets are summarized in once terse and quite concise “Monthly P&L,” I am astounded at the most recent example of how masterfully the Gold Cartel works in suckering investors into a false sense of comfort and misplaced complacency.

On March 25, just before noon, I sent out the chart of Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) under the title of “New Idea,” with the base case being a technical setup at the $14.00-14.10 level that was shaping up to be a pure, textbook break-out from three prior tops in this range dating back to October. I was buying the May $12 calls for $2.15 (50% position) on the assumption that, despite the “less-than-ideal”buy signal I got on March 6, there was a decent trade in this single stock idea, and a pretty easy shot to the $17-18 area.

I was so excited that I rang up my friend and superb technical analyst David Chapman, and asked, “Chappie, pull up Barrick and tell me if I am crazy. “To which he immediately said, “You areI hate that stock!” However, after looking at the chart, he agreed that GOLD had indeed “broken out,” and that it would surely imply a pop to the “$16, 17, 18″range without too much trouble. (He also said he wouldn’t buy it “out of principle,” making him both honorable and smart.)

The setup looked superb.

Well, I did buy the “breakout” story, and it was working beautifully, when I came across one of my old missives from 2016, in which I was shaking my fist and “Tsk! Tsk”-ing all those incredibly naïve fools that were actually of the mind that technical breakouts work in rigged market systems. No better proof exists than the hose job we experienced last week.

After I sent out the March 25 note, I watched the stock trade up to $14.54 on the Wednesday opening. But you can see the time stamp on the chart below was 10:08 a.m., and at that time, the RSI (relative strength index) had traded up to 71, placing it squarely in overbought territory.

You can also see from the tweet I sent out that I was cautioning the world: It should pull back into the latter part of the week to work off the overbought condition and consolidate. The advice was correct, and after blowing out the May $12 calls at $2.60, GOLD closed down on the day at $13.25, representing an intraday reversal. Since GOLD is 10.6% of the GSX, and since NUGT is triple-leveraged GDX, all three were poised for weakness, which came pouring over the dam walls early Thursday morning and in the overnight session, with gold getting smoked by $20 per ounce.

The tweet from Wednesday morningthe reversal day: Should have sent this before the opening but. . .$GOLD was in overbought territory at the Tuesday close and should pull back along with GDX and NUGT.

Below is the 5-day chart of both Barrick and June Gold that shows exactly how they created the perfect setup for the managed money systems directed by the algobots. The cartel targeted the heaviest weighting in the GDX ETF (GOLD:US), and purposely created a technical breakout so as to bring to bear massive buyside volume in the overnight trading session on Tuesday. On Wednesday, the stock opened with massive upside volume, and then reversed as the manipulators sprang the trap and sent it down on the day, coinciding with the Comex take-down on Thursday.

Technical traders reacting to the contrived snare have now been trapped into losing long positions in what can only be classified as a “failed breakout.” My continuing mantra to “sell breakouts and buy breakdowns!” in the metals and miners is once again proven out, and I vow to never again try to finesse the precious metals markets with the futile fantasy that rigged markets can actually respond in a predictive manner. Total hogwash matched only by its naivety. . .

COT Report from March 26 (presented without comment)

Stocks I want to clarify my 2019 forecast for the S&P 500 by repeating what I wrote back in early January: “With the Santa Claus Rally period, the First Five Days (of 2019), and the January Indicator all ending positive, there remains a 70% probability of stocks ending 2019 higher.”

With that as a backdrop, here are two charts that are symptomatic if the title of this missive.

The chart showing what the S&P 500 did “71 days after the bear market arrived” includes data from periods in time before the advent and implementation of government interventions-managed markets. To fight the Fed and the tape is a recipe for disaster, so trying to short the S&P, looking for a retest of the 2018 lows, is certainly going to be an exercise in both braveryand quite possibly stupidity if the Fed’s new “Third Mandate” is successful.

The S&P had an RSI approaching the 70s all through February, and is currently residing in the 60s, suggesting that a close next month through 2,860 for the S&P and 26,000 for the Dow Jones Industrials is now my “line in the Sand,” the penetration of which will be a portent of new all-time highs for stocks.

I spent all of Friday evening trying desperately to find another cute little anecdote with which to fill out this week’s missive but, alas, nothing of merit comes to mind. I have been busy with the two big fundings (Getchell Gold Corp. [GTCH:CSE] and Western Uranium & Vanadium Corp. [WUC:CSE; WSTRF:OTCQX]), which are always time-consuming exercises. Both are going to be oversubscribed, no small achievement in a market that is still screaming for weed deals and screaming at mining deals (as in “lose my number!”).

The spring and summer months will yield substantial news flow from both companies, with GTCH drilling in Nevada and WUC opening the Sunday Mine Complex for sampling and exploration drilling.

I can hear the snore of a large Rottweiler at my feet and the sweet aroma of Yorkshire pudding baking in the kitchen, suggesting that all is clear on the metals frontuntil, of course, it isn’t.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger’s adherence to the concept of “Hard Assets” allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure: 1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Getchell Gold Corp. and Western Uranium & Vanadium Corp. My company has a financial relationship with the following companies referred to in this article: Getchell Gold Corp. and Western Uranium & Vanadium Corp. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below. 2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Western Uranium and Vanadium. Please click here for more information. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp. and Western Uranium & Vanadium Corp., companies mentioned in this article.

Charts courtesy of Michael Ballanger.

Michael Ballanger Disclaimer: This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

( Companies Mentioned: ABX:TSX; GOLD:NYSE, GTCH:CSE, WUC:CSE; WSTRF:OTCQX, )

from The Gold Report – Streetwise Exclusive Articles Full Text https://ift.tt/2VbgkiZ

from WordPress https://ift.tt/2ODEwYC

0 notes

Text

Confusion Reigns (Or What to Do When Nothing Makes Sense)

Source: Michael Ballanger for Streetwise Reports 03/31/2019

Sector expert Michael Ballanger discusses the pitfalls of market reversals and forecasting.

As I reach end-of-week, end-of-month book-squaring, where all of my urgent e-mails and all of my myopic missives and all of my topical tweets are summarized in once terse and quite concise "Monthly P&L," I am astounded at the most recent example of how masterfully the Gold Cartel works in suckering investors into a false sense of comfort and misplaced complacency.

On March 25, just before noon, I sent out the chart of Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) under the title of "New Idea," with the base case being a technical setup at the $14.00-14.10 level that was shaping up to be a pure, textbook break-out from three prior tops in this range dating back to October. I was buying the May $12 calls for $2.15 (50% position) on the assumption that, despite the "less-than-ideal"buy signal I got on March 6, there was a decent trade in this single stock idea, and a pretty easy shot to the $17-18 area.

I was so excited that I rang up my friend and superb technical analyst David Chapman, and asked, "Chappie, pull up Barrick and tell me if I am crazy. "To which he immediately said, "You areI hate that stock!" However, after looking at the chart, he agreed that GOLD had indeed "broken out," and that it would surely imply a pop to the "$16, 17, 18"range without too much trouble. (He also said he wouldn't buy it "out of principle," making him both honorable and smart.)

The setup looked superb.

Well, I did buy the "breakout" story, and it was working beautifully, when I came across one of my old missives from 2016, in which I was shaking my fist and "Tsk! Tsk"-ing all those incredibly naïve fools that were actually of the mind that technical breakouts work in rigged market systems. No better proof exists than the hose job we experienced last week.

After I sent out the March 25 note, I watched the stock trade up to $14.54 on the Wednesday opening. But you can see the time stamp on the chart below was 10:08 a.m., and at that time, the RSI (relative strength index) had traded up to 71, placing it squarely in overbought territory.

You can also see from the tweet I sent out that I was cautioning the world: It should pull back into the latter part of the week to work off the overbought condition and consolidate. The advice was correct, and after blowing out the May $12 calls at $2.60, GOLD closed down on the day at $13.25, representing an intraday reversal. Since GOLD is 10.6% of the GSX, and since NUGT is triple-leveraged GDX, all three were poised for weakness, which came pouring over the dam walls early Thursday morning and in the overnight session, with gold getting smoked by $20 per ounce.

The tweet from Wednesday morningthe reversal day: Should have sent this before the opening but. . .$GOLD was in overbought territory at the Tuesday close and should pull back along with GDX and NUGT.

Below is the 5-day chart of both Barrick and June Gold that shows exactly how they created the perfect setup for the managed money systems directed by the algobots. The cartel targeted the heaviest weighting in the GDX ETF (GOLD:US), and purposely created a technical breakout so as to bring to bear massive buyside volume in the overnight trading session on Tuesday. On Wednesday, the stock opened with massive upside volume, and then reversed as the manipulators sprang the trap and sent it down on the day, coinciding with the Comex take-down on Thursday.

Technical traders reacting to the contrived snare have now been trapped into losing long positions in what can only be classified as a "failed breakout." My continuing mantra to "sell breakouts and buy breakdowns!" in the metals and miners is once again proven out, and I vow to never again try to finesse the precious metals markets with the futile fantasy that rigged markets can actually respond in a predictive manner. Total hogwash matched only by its naivety. . .

COT Report from March 26 (presented without comment)

Stocks I want to clarify my 2019 forecast for the S&P 500 by repeating what I wrote back in early January: "With the Santa Claus Rally period, the First Five Days (of 2019), and the January Indicator all ending positive, there remains a 70% probability of stocks ending 2019 higher."

With that as a backdrop, here are two charts that are symptomatic if the title of this missive.

The chart showing what the S&P 500 did "71 days after the bear market arrived" includes data from periods in time before the advent and implementation of government interventions-managed markets. To fight the Fed and the tape is a recipe for disaster, so trying to short the S&P, looking for a retest of the 2018 lows, is certainly going to be an exercise in both braveryand quite possibly stupidity if the Fed's new "Third Mandate" is successful.

The S&P had an RSI approaching the 70s all through February, and is currently residing in the 60s, suggesting that a close next month through 2,860 for the S&P and 26,000 for the Dow Jones Industrials is now my "line in the Sand," the penetration of which will be a portent of new all-time highs for stocks.

I spent all of Friday evening trying desperately to find another cute little anecdote with which to fill out this week's missive but, alas, nothing of merit comes to mind. I have been busy with the two big fundings (Getchell Gold Corp. [GTCH:CSE] and Western Uranium & Vanadium Corp. [WUC:CSE; WSTRF:OTCQX]), which are always time-consuming exercises. Both are going to be oversubscribed, no small achievement in a market that is still screaming for weed deals and screaming at mining deals (as in "lose my number!").

The spring and summer months will yield substantial news flow from both companies, with GTCH drilling in Nevada and WUC opening the Sunday Mine Complex for sampling and exploration drilling.

I can hear the snore of a large Rottweiler at my feet and the sweet aroma of Yorkshire pudding baking in the kitchen, suggesting that all is clear on the metals frontuntil, of course, it isn't.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure: 1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Getchell Gold Corp. and Western Uranium & Vanadium Corp. My company has a financial relationship with the following companies referred to in this article: Getchell Gold Corp. and Western Uranium & Vanadium Corp. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below. 2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Western Uranium and Vanadium. Please click here for more information. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp. and Western Uranium & Vanadium Corp., companies mentioned in this article.

Charts courtesy of Michael Ballanger.

Michael Ballanger Disclaimer: This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

( Companies Mentioned: ABX:TSX; GOLD:NYSE, GTCH:CSE, WUC:CSE; WSTRF:OTCQX, )

from https://www.streetwisereports.com/article/2019/03/31/confusion-reigns-or-what-to-do-when-nothing-makes-sense.html

0 notes

Note

Can you please try the Core 4 in your vice/virtue assessment?

Iapologize for the delay.

Itried to answer this some time back, and already had all myjustifications written out in my head when I made the chart and theoriginal post, but sadly, I didn’t have the energy to write themdown, and I’d already forgotten them, so now I had to think back,debate, and put it them into words all over again, along withremembering what specific scenarios or logical assumptions wouldqualify them for a Vice or a Virtue.

Withoutfurther ado, the Rotten Four’s Vices and Virtues:

TheRotten Four are an interesting case as their “Vices” are largelyattributed to blatant misinformation, abuse, and the twisted valuesystem of the Isle. None of these “Vices” are considered badthings, and are actually admired traits, only discouraged when itstarts to personally affect you, such as Jay getting so greedy thathe starts stealing from Jafar’s stock along with everyone else’spockets.

However,I will still consider them all to be guilty of these Vices becauseignorance does not excuse you from the consequences of your actions,and more so, the Rotten Four KNEW outright that they were being“Evil.”

Mal

Gluttony- Desire for Excess.

More,more, and more, it’s never enough, and never will be for Mal—ormore specifically, Maleficent. Bythe time of the Isleof the Lost (book),she’s the princess of the prison, top dog among her peers, fearedand respected by all to the point where anyonewho knows better willnot mess with her, and even those that don’t have second thoughts.

Butit’s still not enough, as she constantly seeks to get more power, amore fearsome reputation, more evil deedsunder her belt, even if it’s only inthe hopes of impressingher mother.

Wrath- Desire for Harm.

Youcould make the case for her trapping Evie in Cruella’s closet inthe Isle of the Lost (book) as the penultimate exampleof Mal’s Wrath, but I think that her behaviour towards Audrey inthe beginning of the movie is much better.

Withthe former, she was being coerced and forced into pulling amean-spirited prank as part of her education in Dragon Hall; she hasgreat, understandable motivation to want to pass this class with theheads of her enemies set up proudly on the ramparts.

Withthe latter, there’s really no good reason for her to pissoff Audrey, nothing to gain but the satisfaction of having earned herire, and more to lose with an enemy that could potentially sabotagetheir plans to steal the wand.

Envy- Desire for Other’s Belongings.

Malliterally being green-eyed aside, one of her first acts in TheIsle of the Lost (book) is to banish Evie and the Evil Queen fromthe Isle at large because she didn’t invite her to her 6thbirthday party, and she was jealous of all the attention and thepresents Evie was receiving.

Herhabit of pickpocketing and stealing (though not to the extent of Jay)is also a sign of this.

Pride- Desire for Attention.

Mal’sPride stems largely from Maleficent’s transactional parentingstyle, where love is only parceled out as soon as you prove yourself“worthy” of it. This is a problem in itself, and crosses into therealm of Pride when all of Mal’s truly cruel actions like trappingEvie in Cruella’s trap-laden closet was her way of permanentlycementing herself as the “Evilest of them All, next to Maleficent.”

Plus,when you make graffiti in such an iconic and easily recognizablestyle that you’ll immediately know who made it just from a glance,and put it all over every surface you can as your supply of spraypaint allows, it’s safe to say that you probably really wantto put your name out there.

Diligence- Being Steadfast in Work.

Malis mentioned as frequently passing over perfectly goodif not exceptional ideasfor her Ultimate Prank for Dragon Hall, and goes to great pains andincredible lengths tomake her schemes work, such as arranging the giant wildpartyin Cruella’s mansion (though admittedly most of the actual legworkwas onCarlos).

Thataside, she is a verydeterminedgirl who won’t stop until the job is done—be that trying to stealthe Fairy Godmother’s wand, stopping Maleficent from taking overAuradon,or all the numerous other “Let’s Save/Doom The World!” ploysshegets roped into.

Allthat pressure to constantly achieve and dobetter, especially without any meaningful reward or evenacknowledgment like a pat on the head would drive most people to justgive up, and declare honest,hard work intoanythinganinherently futile and painful endeavour.

ButnotwithMal.

Carlos

Diligence- Being Steadfast in Work.

Thoughthis might have stemmed largely from him being turned into Cruella’spersonal slave, and it being in his best interest to get work donewell and when Cruella said he should have, Carlos is still shown tobe a very hard and eager worker.

Youcan see this with his personal projects in the Isle of the Lost(book), where despite being constantly overworked,underappreciated, abused, and malnourished, he still finds time andmotivation to tinker with his personal projects, build himself a lab,and go through the inevitable break-downs, unexpected failures, andjust flat-out “will not start” prototypes before you get anactually working invention.

Beforeyou ask, yes, I do realize that there is also the looming threat ofMal, Evie, and Jay calling him out for being lazy and not helpingwith the “steal the wand” ploy, but as they’re all friends, Idoubt they would be as harsh and as great of a “motivator” as hismother is.

Patience- Being Peaceful in Goal.

Youcould argue that Carlos isn’t a fighter in the first place andwould get himself creamed in a straight up fist-fight, but not havinga hope in hell of actually winning never stopped anyone from saying“Fight me!” and following through.

(Justask a bartender about their favourite one-sided bar brawls.)

Youcould also argue that Cruella has made it so thatback-talking, getting angry, and making return threats is a VERY badidea indeed, but I would also like to point out that some bulliesthat lash out at others and get pissed off at the most innocuous andimagined of slights do that because they can’t actually fight theirtormentors, so they do what they wish they could do to them onothers.

Carloshas never been shown to take a violent or aggressive solution to muchof anything, except for the Tourney field and his clearlyfriendly rough-housing with Jay. It’s VERY impressive thatsomeone who has been tormented, abused, and picked-on like him canjust go on and show civility and kindness towards others, instead ofdishing out the same hand he’d been given as a misguided form of“karmic retribution” towards the world.

Alot of abused kids like Mal don’t just stop being mean as soon asyou take them out of the abusive environment; there are NUMEROUSscars and maladaptive habits that take years to heal and deprogram,if they’re not permanent.

Kindness- Being Good towards All Life.

Inthe Isle of the Lost (book),despite having absolutely nothing to gain from it, he gives Evie ahand in escaping his mother’s bear-trap ridden fur-closet. Shedoesn’t have anything to give him, nor does he ask for anything; hejust saw another victim like him in need of help, and he offered it.

Thisisn’t really that strange to us, but please remember that the Islehas a strictly “Every one for themselves, but also for just me!”and “I’ve got mine, now fuck off!” philosophy drilledinto all of their heads.

Evie

Lust- Desire for Pleasure.

Mydefinition doesn’t define this as purely desire for sexualpleasure, but with a LOT less PG-13 and all over realistic portrayalof Descendants, I wouldn’t put it past Evie to have slept aroundquite a lot, using and abusing boys for her own pleasure and selfishbenefit, and of course, getting access to all their luxuries and nicethings (relative to the Isle) using (what she assumes to be) hergreatest and only asset that matters.

(Orof you want to get specific, assets.)

Also,aside from wanting to impress her mother, the entire motivation ofher being a throne grabber (the Auradonian version of a “golddigger”) is for her to live a comfortable, carefree life with ahandsome, rich prince with a big castle that answers all of herneeds, which frees her up for all of her wants.

Envy- Desire for Other’s Belongings.

Greed- Desire for Things.

Gluttony- Desire for Excess.

Allthree are related to Lust, in that it ties in with her being a thronegrabber, and explicitly desiring and having been implied to do allmanner of unsavoury things to get more than her fair share fromothers.

“Rottento the Core’s” “schemer” and “heart-breaker” lines fromEvie’s section could allude to her charming and manipulating peopleinto getting what she wants, and most probably past the point whereshe’d already satisfied her needs, and is purely in the realm ofwants and luxury.

Shefalls into both Greed and Envy because this could be somethingimmaterial like influence, and/or having boys (and sometimes girls)head over heels for her past the point where she could or would wantto have a serious, healthy relationship with any of them; to materialthings, like someone’s jewelry, quality (again, relative to theIsle) goods and food, or someone else’s boyfriend, stolen justbecause she wanted to prove that she could.

Pride- Desire for Attention.

Eviehas long past the point of “having healthy self-confidence” withher primadonna attitude.

Thoughnot nearly as bad as Audrey can get (which is really sayingsomething), she still can get very selfish and self-centered like inWicked World where she complains that everyone else piling theirproblems onto Mal is distracting from her addressing the mostimportant issues of all, that makes everything else pale incomparison:

Evie’s.

Shealso tends to act like a stereotypical princess in that she thinksshe’s inherently better, prettier, and more competent than everyoneelse. She’s getting better after the first movie, but bad habitsdon’t die that easily.

Diligence- Being Steadfast in Work.

Shecooks, she cleans, she sows, she does your homework for you—Eviecouldn’t have learned all of these domestic skills and gotten herincredible in cosmetics, sewing, and alchemy without a LOT of hoursof dedicated practice, and more failures than successes.

LikeCarlos, you can attribute this to her mother making it a very badidea to be lazy (with their needs, anyway), but as Wicked Worldshows, she was willing to put in enough effort and reality-bendingprowess to make cupcakes that have every single element in theperiodic table.

Thisis particularly impressive when you realize a lot of these willEXPLODE, produce poisonous gas if you put them together, or outrightkill Evie from exposure.

Patience- Being Peaceful in Goal.

LikeCarlos, Evie has never been shown to get violent or that aggressiveand brutal towards others. I wouldn’t put it past her to be one ofthe Isle’s best roasters, with every VK having suffered a brutalburn from her at least once, but she doesn’t seem like the kind ofperson that just flat-out insults and destroys people’s sense ofself-worth for shits and giggles.

Youcould even excuse this behaviour somewhat as it was a necessarydefense mechanism to survive on the Isle.

Kindness- Being Good towards All Life.

Relatedto Carlos own entry, Evie sacrificing one of her pillows (a HIGHLYvalued commodity when the stock sleeping quarters is a cold, damp,hard floor) to repay him for saving her from Cruella’s closet isvery telling and impressive, given that the default Isle response tothis would be “see how much more kindness you can milk from himbefore he turns you down.”

Iwouldn’t be surprised if that’s how Evie treated most people thathad been good to her in the past, to be fair, unlike Carlos, theyprobably had their own ulterior motives, too.

Jay

Lust- Desire for Pleasure.

Jayhas been shown have the same carpe diem attitude of Aladdin,just taking every day as it comes, doing whatever he needs tosurvive, but without the generosity and the goodwill towards others,so whenever he does come across something good, it’s purely for hisenjoyment.

Hisconstant flirting with pretty much everyone is also a hint of one ofhis primary pickpocketing tactics—distract them with his sexy, sexyself—a history of (unhealthy, to be clear) casual flings andrelationships like Evie, or both, as I wouldn’t be surprised if hisexes complain that he stole their hearts and their wallets.

Gluttony- Desire for Excess.

Greed- Desire for Things.

Thoughit’s more apparent with Greed, in that he has his wandering eyes onvaluables, electronics, and other precious goods, Jay also showssigns of Gluttony how he keeps on stealing despite alreadyhaving a healthy and productive outlet for all that energy inTourney.