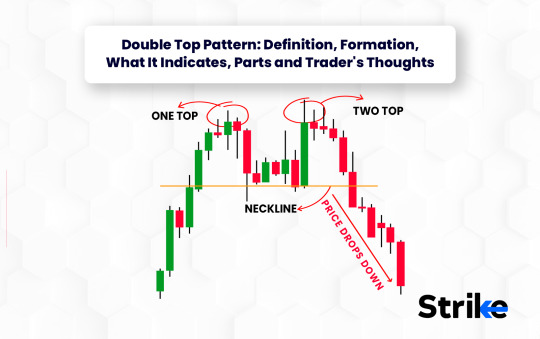

#How to identify a failed breakdown in technical analysis

Explore tagged Tumblr posts

Text

How to Trade the Failed Breakdown (Bearish Trap)

In technical analysis, the concept of a failed breakdown — often called a bear trap — is one of the most powerful reversal patterns that traders can capitalize on. A failed breakdown occurs when price action breaks below a key support level, lures in short sellers, and then quickly reverses to the upside. This trap can lead to strong short-covering rallies and presents high-probability trading…

#Bear trap chart pattern#Bear trap stock market#Bear trap trading#Bear trap vs bull trap difference in trading#Bearish trap reversal#Best strategies to trade a bear trap pattern#Bullish reversal patterns#Common mistakes when trading failed breakdowns#Examples of bear trap in stock charts#Failed breakdown candlestick pattern#Failed breakdown intraday strategy#Failed breakdown technical analysis#Failed breakdown trading strategy#Failed breakdown vs real breakdown#Failed support bounce setup#False breakdown trading strategy#How to avoid getting trapped in a false breakdown#How to identify a failed breakdown in technical analysis#How to trade failed breakdowns#learn technical analysis#Multi-timeframe breakout trap#Risk management in trading#Risk-reward setup for trading false breakdowns#Short squeeze trading strategy#stock markets#stock trading#successful trading#Support and resistance trading#Support level failure#technical analysis

0 notes

Text

From Data to Stories: How Code Agents are Revolutionizing KPI Narratives

In the bustling world of business, Key Performance Indicators (KPIs) are the lifeblood. They tell us if we're winning, losing, or just holding steady. But the true value of a KPI isn't just the number itself; it's the story behind that number. Why did sales dip last quarter? What drove that spike in customer engagement? How do these trends impact our strategic goals?

Traditionally, extracting these narratives from raw data is a laborious, time-consuming, and often inconsistent process. Data analysts spend countless hours querying databases, generating charts, and then manually crafting explanations that are clear, concise, and actionable for non-technical stakeholders.

Enter the game-changer: Code Agents.

The Challenge: Bridging the Data-Narrative Gap

The journey from a spreadsheet full of numbers to a compelling business narrative is fraught with challenges:

Time-Consuming: Manual analysis and writing for every KPI update drains valuable analyst time.

Inconsistency: Different analysts might highlight different aspects or use varying tones, leading to fragmented insights.

Lack of Depth: Surface-level explanations often miss the underlying drivers or complex interdependencies.

Actionability Gap: Numbers without context or clear recommendations can leave decision-makers scratching their heads.

Data Silos: The narrative often requires pulling data from multiple, disparate sources, adding complexity.

This is where the magic of AI, specifically AI "Code Agents," comes into play.

What are Code Agents? Your Automated Storytellers

A Code Agent is an advanced Artificial Intelligence (typically built on a Large Language Model) that can do more than just generate text. It possesses the unique ability to:

Generate Code: Write programming scripts (e.g., Python with Pandas, SQL queries).

Execute Code: Run those scripts against real data.

Interpret Results: Understand the output of the executed code.

Reason & Debug: Adjust its approach if the code fails or the results are not what's needed.

Generate Narrative: Translate the data insights derived from code execution into natural language.

Unlike a simple chatbot that might "hallucinate" a story, a Code Agent operates with data-backed precision. It proves its narrative by fetching and analyzing the data itself.

How Code Agents Weave KPI Narratives: The Automated Workflow

Imagine a seamless process where your KPIs practically narrate their own stories:

Data Access & Understanding: The Code Agent is given secure access to your data sources – be it a SQL database, a data warehouse, flat files, or APIs. It understands the schema and table relationships.

Dynamic Analysis & Root Cause Identification:

When a KPI (e.g., "Monthly Active Users") changes significantly, the agent is prompted to investigate.

It dynamically writes and executes SQL queries or Python scripts to slice and dice the data by relevant dimensions (e.g., region, acquisition channel, product feature, time period).

It identifies trends, outliers, correlations, and deviations from targets or historical norms.

It can even perform deeper causal analysis by looking at related metrics (e.g., if sales dropped, did website traffic also drop? Did a marketing campaign underperform?).

Narrative Generation:

Based on its data analysis, the Code Agent constructs a coherent narrative.

It starts with what happened (the KPI change), explains why it happened (the drivers identified), discusses the impact on the business, and even suggests potential recommendations for action.

The narrative can be tailored for different audiences – a concise executive summary for leadership, or a more detailed breakdown for functional teams.

Iteration and Refinement: If the initial narrative isn't quite right, you can provide feedback, and the agent will refine its analysis and explanation. "Tell me more about the regional differences," or "Focus on actionable steps for the marketing team."

Powerful Benefits of Code Agents for KPI Narratives

Implementing Code Agents for KPI storytelling brings a wealth of advantages:

Unprecedented Speed & Efficiency: Generate comprehensive KPI narratives in minutes, not hours or days, enabling faster decision-making cycles.

Consistent Accuracy & Reliability: Narratives are directly derived from live data and consistent analytical logic, minimizing human error and ensuring data integrity.

Deeper, More Nuanced Insights: Agents can perform complex, multi-variate analyses that might be too time-consuming for manual execution, uncovering hidden drivers and subtle trends.

Reduced Analytical Bottlenecks: Free up your valuable data professionals from repetitive reporting tasks, allowing them to focus on strategic thinking, complex modeling, and innovative problem-solving.

Democratization of Insights: Make rich, data-backed narratives accessible to more stakeholders across the organization, fostering a truly data-driven culture.

Proactive Problem Solving: By quickly identifying the "why" behind KPI movements, teams can react faster to challenges and seize opportunities.

Getting Started with Code Agents

While the technology is advanced, integrating Code Agents into your workflow is becoming increasingly accessible:

Leverage AI Platforms: Many leading AI platforms now offer advanced LLMs with code execution capabilities (e.g., Anthropic's Claude 4, Google's Gemini, OpenAI's models with code interpreter tools).

Ensure Data Governance & Security: Provide secure, read-only access to necessary data sources. Robust data governance and privacy protocols are paramount.

Human Oversight is Key: Code Agents are powerful tools, not infallible decision-makers. Always review their generated narratives for accuracy, nuance, and strategic alignment before dissemination. They are co-pilots, not replacements.

The ability to automatically turn raw data into compelling, actionable stories is no longer a futuristic dream. Code Agents are here, transforming how businesses understand their performance, enabling faster, smarter decisions, and truly empowering data to speak for itself. The age of automated KPI narratives has arrived.

0 notes

Text

How AI Is Redefining Salesforce Testing in 2025

Let’s be real—Salesforce Testing is no walk in the park. With three seasonal releases, endless configurations, and multiple user roles to juggle, testing Salesforce is like chasing a moving target. But here’s the good news: AI is no longer the future—it’s the now. And in 2025, it's completely transforming how teams approach testing.

At Provar, we’ve been riding the wave of AI innovation, especially when it comes to Salesforce automation. The goal? To make your test cycles smarter, faster, and less stressful. In this blog, we’ll break down how AI is shaking up Salesforce Testing, what that means for your team, and how Provar is helping customers adapt and thrive in this new landscape.

🚀 Why Traditional Salesforce Testing Struggles to Keep Up

Before we dive into AI’s role, let’s quickly look at why traditional testing approaches hit a wall—especially in a fast-moving Salesforce environment.

❌ Manual Testing Takes Too Long

Even with a small Salesforce org, testing every workflow manually is a time sink. Multiply that by different user roles, complex automations, and multiple browsers, and you’ve got a QA nightmare.

❌ Test Coverage Is Often Incomplete

You may think you're testing everything—but are you really? Without intelligent test design, critical paths are often overlooked.

❌ It’s Hard to Scale Testing With Agile Teams

More frequent releases mean more testing cycles. If your team can’t keep up, bugs slip through and quality suffers.

And this is exactly where AI steps in.

🤖 So, What Does AI Actually Do in Salesforce Testing?

Glad you asked. Here’s a breakdown of how AI is changing the testing game in 2025:

Test Case Generation AI can auto-create tests based on metadata, past user behavior, or user stories. ✅ Why it matters: Saves time and fills in coverage gaps effortlessly.

Risk-Based Testing Identifies the highest-risk areas in your Salesforce org and prioritizes them for testing. ✅ Why it matters: Keeps your focus on what matters most and reduces surprises in production.

Predictive Analysis Detects patterns from previous test results and recommends future improvements. ✅ Why it matters: Helps prevent repeat failures and boosts long-term quality.

Self-Healing Tests Automatically updates or fixes broken tests when UI elements change. ✅ Why it matters: Reduces maintenance headaches and keeps test suites stable.

Natural Language Processing (NLP) Enables test creation using simple, plain English instead of code. ✅ Why it matters: Makes test automation accessible even for non-technical users.

🧠 Provar AI in Action

At Provar, we’re all about helping you work smarter, not harder. Our AI-powered features are designed specifically with Salesforce in mind, meaning they’re tailored to how the platform actually works—not just generic testing logic.

🛠 Smart Test Plan Creation

Provar AI can suggest full test plans by analyzing your Salesforce environment. It looks at custom objects, workflows, Apex code, and even recent change history to prioritize test cases.

⚙️ Intelligent Test Design

No need to handwrite every test. With Provar, you can auto-generate test cases from user stories or requirement documents, then refine them with Provar’s intuitive interface.

📈 Risk Mitigation and Impact Analysis

AI identifies areas most likely to break after an update, so your team can focus on high-risk, high-impact areas first. This is critical when dealing with Salesforce’s regular release schedule.

🧪 Self-Healing Automation

Tests failing due to UI changes? Not a problem. Provar AI can adapt to changes in locators, page layouts, and even underlying DOM structures—so you don’t have to manually fix everything after every deployment.

💡 Real-World Example: How AI Saves Time in a Sprint

Let’s walk through a quick example:

Scenario: A mid-sized company has a custom quote generation workflow in Salesforce, with multiple user profiles and conditions.

Without AI:

QA spends 4 days manually creating and updating test cases

Misses edge cases because of human error

Regression testing delays deployment

With Provar AI:

Suggested test plans are generated in minutes

Risk-based prioritization focuses on the custom quote logic

Self-healing tests reduce maintenance time post-deployment

💥 Result? Testing time cut by 60%, and deployment happens two days earlier than expected. Plus, fewer bugs reach production.

🔄 Continuous Testing Meets Continuous Intelligence

In 2025, AI isn’t just a tool—it’s part of your strategy. Especially with CI/CD pipelines, automated testing isn’t just about speed. It’s about quality feedback, and AI enables this at scale.

Here’s how AI supports continuous Salesforce Testing:

Detects risk areas every time new code is committed

Suggests tests to run automatically

Integrates with tools like Jira and GitHub for smart reporting

Analyzes trends across releases to improve future cycles

If you're already running CI/CD, Provar makes it easy to integrate AI-powered testing right into your workflow. And if you're not? We help you get there.

🧩 How Salesforce Testing Has Evolved (Thanks to AI)

Let’s pause and appreciate how far we’ve come. Here’s a quick side-by-side look at the before vs. after of AI in Salesforce Testing:

Then: Manual test scripts Now: Auto-generated cases powered by AI

Then: Reactive defect finding Now: Predictive issue detection before they become problems

Then: Static test suites Now: Adaptive, self-healing tests that adjust on the fly

Then: Limited coverage Now: Risk-prioritized test plans that target what matters

Then: Weeks to update for releases Now: Hours to adjust with AI assistance

And this is just the beginning.

🌐 Why AI Is a Game-Changer for Complex Orgs

If your Salesforce org is growing, or if you're in a regulated industry, testing gets complicated fast. With AI:

Healthcare teams can prioritize patient-critical workflows

Finance orgs can ensure compliance by auto-auditing flows

Retail teams can test promotions and checkout flows in real-time

Basically, AI brings scalability, insight, and speed—all things your growing team desperately needs.

🔗 Where Salesforce Testing Fits In

Whether you're using AI or just starting your automation journey, having a solid foundation in Salesforce Testing is key.

👉 Learn more about how Provar supports Salesforce Testing with robust, intelligent automation at https://provar.com/salesforce-testing/

Our platform is purpose-built for Salesforce—which means your tests aren't just fast, they’re smart, reliable, and ready to scale.

🏁 Conclusion: Let AI Do the Heavy Lifting

The future of Salesforce Testing is already here—and it’s powered by AI. By reducing manual effort, improving accuracy, and adapting to change, AI is helping teams move faster and release with confidence.

And Provar is leading the way.

If you’re looking to build a more scalable, intelligent QA process for your Salesforce org, we’re here to help. From smarter test design to self-healing automation, our AI-driven platform is built to grow with you.

Ready to see AI in action? Explore our Salesforce testing solutions and start redefining your own test strategy with Provar.

0 notes

Text

About Course: This course is a concise yet comprehensive introduction to advanced forex trading concepts, curated by WillStreet_fx. Through a structured series of 12 videos, the course walks traders from foundational elements to advanced market strategies, focusing on technical precision and strategic timing. Course Modules: Introduction – Overview of the trading approach and course structure. Timeframes and Candles – Understanding how to read and interpret market movements using timeframes and candlestick analysis. SMT (Smart Money Technique) – Identifying divergence using correlated instruments for more accurate signals. Bias – Developing directional bias and its role in filtering trades. Entries – Structuring high-probability trade entries. Failure Swing – Recognizing market traps and failed structure swings. NWOG & NDOG – A breakdown of New Week Opening Gaps and Daily Opening Gaps and their trading implications. London Model – Specific strategies for trading during the London session. New York Model – Key setups and behavior in the New York session. Red Flags – Common mistakes and warning signs to avoid in trades. News Trading – Navigating economic releases and market volatility. Risk Management – Practical approaches to preserving capital and ensuring long-term consistency.

0 notes

Text

Forex Strategy Testing: A Complete Guide

If you’re serious about trading forex, then having a solid strategy isn’t just a bonus — it’s a must. But even a great strategy can fail if you don’t test it first. Strategy testing helps achieve accurate results by giving you the confidence to know what works, what doesn’t, and how to improve. An automated trading program, such as those created within MetaTrader 4 (MT4) using Expert Advisors (EAs), plays a crucial role in strategy testing by generating reports and quantitative data for analysis. Both beginners and experienced traders benefit from strategy testing, as it helps refine their methods and improve their trading outcomes. Here’s a full breakdown of how to test your forex strategies the right way.

Introduction to Forex Trading

Forex trading, also known as trading in the foreign exchange market, is a global market that operates 24 hours a day, 5 days a week, across multiple time zones. It involves buying and selling currencies with the goal of making a profit from the fluctuations in exchange rates. To succeed in forex trading, it’s essential to have a well-defined trading strategy for various currency pairs and to backtest it using historical data. Backtesting a trading strategy involves testing it on past market data to evaluate its performance and identify potential flaws. This process can be done manually or using automated backtesting software, such as Forex Tester Online. By doing so, traders can gain valuable insights into how their strategies would have performed in real market conditions, helping them to make informed decisions and improve their trading outcomes.

What Is Forex Strategy Testing?

Forex strategy testing is when you take your trading plan and run it through historical price data to see how it would’ve performed in real market conditions. This process is known as backtesting a trading strategy. It gives you a better idea of your strategy’s strengths, weaknesses, and potential profitability. Most forex traders skip this step — and that’s usually where things go wrong.

Benefits and Risks:

While backtesting provides valuable insights, it does not guarantee future results. Market conditions can change, impacting the effectiveness of trading strategies, as well as the associated trading costs . It is crucial to align trading strategies with an individual's risk appetite to ensure effective decision-making even in simulated trading environments.

Backtesting a forex trading strategy has several benefits, including identifying potential flaws, evaluating the strategy’s performance, and gaining confidence in the strategy. By analyzing historical data, traders can see how their strategies would have fared in different market conditions, allowing them to make necessary adjustments before risking real money. However, there are also risks involved, such as over-reliance on historical data and failure to account for changing market conditions, making it essential to utilize various trading tools . It’s essential to consider these risks and to use backtesting in conjunction with other forms of analysis, such as technical and fundamental analysis. A good trading strategy should include rules for entering and exiting trades, as well as risk management strategies, such as stop-loss orders and position sizing. This comprehensive approach helps traders to mitigate risks and enhance their chances of success in the forex market. Additionally, focusing on overall trading activity rather than individual losses can help traders develop systematic approaches and make more sound emotional decisions.

How to Backtest a Trading Strategy?

1. Choose a Platform –

Start with a good platform that lets you backtest. Most traders use MetaTrader 4 or 5, but there are other tools out there too.

2. Get Historical Data –

Download accurate data for the pairs you plan to trade. That’s the base of your test, and the better the data, the more reliable your results. It’s also crucial to compare your backtest results with the current market conditions to ensure your strategy remains effective.

3. Set Up Your Strategy –

Define your entry rules, exit points, stop-loss, take-profit, and position size. Keep it clear and simple. Make sure to analyze charts across different timeframes to synchronize long-term and short-term signals for consistent trading.

4. Manually Backtest –

It is important to manually backtest your trading strategy by analyzing various timeframes of historical data. This helps assess the potential effectiveness of your strategy and identify any market anomalies that could affect the outcomes, and incorporating paper trading can also enhance your testing experience .

5. Run the Test –

Use the platform’s strategy tester to run your backtest. You’ll see how your trades would have played out over time. This process helps prepare for live trading by simulating past performance.

6. Review the Results –

Look at win rate, drawdowns, risk-to-reward, total trades, and cost. Then make tweaks if needed and test again.

Running a Test

Running a test is a crucial step in backtesting a trading strategy, allowing traders to evaluate its performance using historical data. To get started, select a reliable trading platform such as MetaTrader 4 or ProRealTime. Choose the desired time period and market data that align with your trading strategy. It’s advisable to use a demo account or virtual funds to avoid risking real money during this phase.

Carefully monitor the test results, paying close attention to key metrics such as the profit/loss ratio, drawdown, and win/loss ratio. These metrics will provide insights into the strategy’s effectiveness and areas that may need improvement. Running a test can be time-consuming, but it is essential for traders to gain confidence in their strategy before transitioning to live trading.

To ensure the robustness of your strategy, run multiple tests using different market conditions and time periods. This approach helps identify how the strategy performs under various scenarios, providing a more comprehensive evaluation. Document and review the test results regularly to pinpoint areas for refinement and to track progress over time.

Choosing a Testing Platform

When choosing trading platforms for backtesting a forex trading strategy, there are several factors to consider. The platform’s ability to provide accurate and reliable historical data is crucial, as this forms the basis of the backtest. Ease of use is also important, as a user-friendly interface can save time and reduce the learning curve. Additionally, the platform should be able to simulate real-world market conditions to provide realistic backtest results. Some popular testing platforms for forex trading include MetaTrader 4, ProRealTime, and Forex Tester Online. These platforms offer a range of features and tools, including automated backtesting, strategy tester tools, and advanced analytics. It’s essential to choose a platform that meets your needs and to use it in conjunction with other forms of analysis to get a comprehensive view of your trading strategy’s performance.

Automating Testing

Automating testing is a process of using software to run backtests, saving traders time and effort. Specialized software like Forex Tester Online offers advanced backtesting capabilities, making it easier to evaluate multiple trading strategies and parameters simultaneously. This approach allows traders to optimize their trading strategies more efficiently.

Automated testing enables traders to backtest their strategies across different markets, including forex, stocks, and commodities. The software provides accurate and reliable results, eliminating the risk of human error and ensuring a more objective evaluation. By identifying the most profitable trading strategies and parameters, traders can focus on refining their approach.

Automated testing is a game-changer for traders, allowing them to save time and concentrate on other aspects of their trading business. However, it’s essential to use automated testing in conjunction with manual backtesting to ensure the robustness of the trading strategy. This combined approach provides a more comprehensive evaluation, helping traders to make informed decisions.

Variables to Consider

When backtesting a forex trading strategy, there are several variables to consider. It is crucial to consider margin requirements, as they can vary by currency pair and brokerage, impacting net returns and trading strategy outcomes. Market conditions, such as volatility, liquidity, and trends, can significantly affect the strategy’s performance. It’s essential to test the strategy under different market conditions to see how it holds up. Trading costs, including spreads and commissions, can also impact the strategy’s profitability, so these should be factored into the backtest. The strategy’s parameters, such as entry and exit points, position size, and stop-loss levels, should be carefully considered and optimized to achieve the best results. By taking these variables into account, traders can fine-tune their strategies to improve performance and reduce the risk of losing trades.

Interpreting Results

When interpreting the results of a backtest, there are several factors to consider. Analyzing winning trades is crucial to understand the profit generated compared to losses from losing trades. The strategy’s performance should be evaluated in terms of its ability to generate profits and manage risk. Key metrics to look at include the win rate, drawdowns, and the risk-reward ratio. The risk-reward ratio is particularly important, as it helps to determine whether the potential reward justifies the risk taken. The potential profit should also be considered, and the strategy should be evaluated in terms of its ability to generate consistent profits over time. It’s essential to use the results of the backtest to refine the trading strategy and to improve its performance. By doing so, traders can increase their chances of success in the live markets and achieve their trading goals.

Creating a Trading Plan

Creating a trading plan is essential for traders to achieve their goals and manage risk effectively. A well-defined trading plan should include the trader’s goals, risk tolerance, and trading strategy. It should outline the entry and exit points, position size, and risk management techniques, such as stop-loss orders and take-profit levels.

The trading plan should be based on historical data and backtesting results, providing a solid foundation for decision-making. Regularly review and update the trading plan to ensure it remains effective and aligned with current market conditions. This ongoing process helps traders to adapt to changes and maintain a disciplined approach.

A trading plan should also include a risk-reward ratio, helping traders to manage their risk and potential reward. By tracking progress and making adjustments as needed, traders can improve their performance and achieve their trading goals. Using a trading plan to guide decision-making helps to avoid impulsive and emotional trading, leading to more consistent results.

Why Backtesting Is Important?

Backtesting can seriously level up your game. It tells you what to expect from your strategy before you put any real money on the line, helping you gain confidence in your approach. It also helps you stay disciplined because now you’re following a plan that’s already proven — not trading on gut feeling. If you’re looking to avoid random losses and learn faster, this step is non-negotiable. Additionally, paper trading allows you to test your strategies in real-time market conditions without risking actual capital, providing valuable insights into their performance.

Tools You Can Use

Forex Tester – A manual backtesting tool that works with tick-by-tick data. Great if you want to simulate actual trading. It generates several reports to help evaluate trading strategies.

Selecting the right given period for backtesting is crucial to accurately assess the performance of your trading strategies.

Auto Backtesting Software – These let you test strategies with just a few clicks. Fast and easy if you’re using expert advisors or coded systems. The strategy tester tool provides quantitative data for analysis, helping you optimize your trading programs.

Demo Accounts – If you don’t want to go into full backtesting mode, open a demo account and test your strategy in real-time — without any risk.

Best Practices

Best practices for backtesting include using high-quality historical data and a reliable trading platform. This ensures that the backtest results are accurate and reflective of real market conditions. Traders should use a demo account or virtual funds to avoid risking real money during the backtesting phase.

Backtesting should be done regularly, using different market conditions and time periods to evaluate the strategy’s robustness. Traders should use multiple metrics to assess their trading strategy, including the profit/loss ratio, drawdown, and win/loss ratio. This comprehensive evaluation helps to identify strengths and weaknesses.

Refine the trading strategy based on backtesting results, making adjustments as needed to improve performance. Automated testing can save time and enhance the accuracy of backtesting results, but it should be complemented with manual backtesting for a thorough evaluation. Document and review backtesting results regularly to identify areas for improvement and to track progress.

Common Mistakes

Common mistakes in backtesting include using low-quality historical data or an unreliable trading platform. These issues can lead to inaccurate results and poor decision-making. Traders should avoid using too much risk or leverage, as this can result in significant losses.

Over-optimizing a trading strategy is another common pitfall, leading to poor performance in live markets. Traders should use multiple metrics to evaluate their trading strategy, rather than relying on a single measure. Ignoring backtesting results is a critical mistake; instead, use the insights gained to refine and improve the trading approach.

Automated testing should not replace manual backtesting, as this can lead to inaccurate results. Traders should have a clear understanding of their strategy’s performance and use backtesting to evaluate its robustness. Regularly review and update the trading plan to ensure it remains effective and aligned with current market conditions, avoiding poor performance and significant losses.

Final Thoughts

Testing your strategy before trading live is smart — and it saves you money. Whether you’re a beginner or experienced trader, strategy testing helps you make better decisions, spot mistakes early, and sharpen your edge. The more time you spend testing and adjusting your trading style , the more prepared you’ll be when the real market moves. Forex trading, unlike other markets, presents unique challenges due to its 24/7 nature and high leverage, making thorough strategy testing even more crucial.

So before you jump in live — test it, tweak it, and trust it.

0 notes

Text

Forensic Engineering Services: From Material Failures to Legal Proof

Forensic materials engineering services play a pivotal role in understanding and resolving material failures. Whether it's a structural collapse, a product defect, or a catastrophic machinery failure, these services combine scientific expertise and engineering acumen to determine the root cause of issues and provide essential evidence for legal or technical disputes.

In this blog, we explore the critical aspects of forensic engineering services, focusing on how they help identify failures, deliver actionable insights, and support legal proceedings.

What Are Forensics Materials Engineering Services?

Forensic materials engineering services involve the application of engineering principles and material science to investigate failures. The objective is to analyze why a material or structure failed, determine contributing factors, and offer recommendations to prevent recurrence. These services are invaluable in:

Structural Failures: Investigating building collapses, bridge failures, or compromised infrastructure.

Product Liability Cases: Analyzing product defects and malfunctions that may lead to injury or property damage.

Industrial Incidents: Diagnosing equipment breakdowns or material fatigue in machinery.

Legal Disputes: Providing technical evidence to support litigation or arbitration.

Key Steps in Forensic Materials Engineering Investigations

1. Data Collection and Preservation

The investigation begins with collecting evidence from the failure site. This may include damaged materials, photographs, witness accounts, and environmental data. Proper preservation of evidence is critical for accurate analysis and legal credibility.

2. Failure Analysis

Forensic engineers employ advanced techniques to study the failed material. Common methods include:

Microscopy: Using scanning electron microscopes (SEM) to analyze fractures or surface damage.

Material Testing: Assessing the material's strength, hardness, and composition.

Fractography: Studying crack patterns to determine the mode of failure (e.g., fatigue, corrosion, overload).

3. Root Cause Determination

By analyzing the collected data, engineers identify the root cause of failure. This step may involve evaluating design flaws, material defects, manufacturing issues, or operational factors.

4. Reporting and Recommendations

A detailed report is generated, outlining the investigation's findings, conclusions, and recommendations. These reports are often used in legal proceedings, insurance claims, or engineering redesigns.

Why Forensic Materials Engineering Services Matter

1. Preventing Future Failures

By understanding why a failure occurred, engineers can recommend design or material changes to prevent similar incidents. This proactive approach enhances safety and reliability.

2. Supporting Legal Proceedings

In cases of product liability, structural failure, or workplace accidents, forensic engineering provides concrete evidence to support claims or defenses. Expert witness testimony from forensic engineers is often crucial in court.

3. Ensuring Compliance

Forensic investigations can reveal whether a material or structure met regulatory standards. This information is vital for compliance audits and risk assessments.

Applications of Forensic Engineering Services

Construction Industry: Investigating structural collapses and material degradation.

Manufacturing Sector: Diagnosing defects in industrial components and machinery.

Aerospace and Automotive: Analyzing material failures in critical systems.

Legal and Insurance Claims: Providing technical expertise to resolve disputes.

Choosing the Right Forensic Engineering Partner

Selecting a reliable forensic materials engineering service provider is essential for accurate and actionable results. Key factors to consider include:

Expertise: Look for a team with multidisciplinary expertise in material science, engineering, and failure analysis.

Technology: Ensure they use advanced tools like spectroscopy, X-ray diffraction, and high-resolution imaging.

Experience: Choose a provider with a proven track record in similar cases.

Conclusion

Forensic materials engineering services bridge the gap between technical investigation and legal resolution. They are indispensable in uncovering the root causes of failures, preventing future incidents, and providing the evidence needed to uphold justice. Whether you’re addressing a structural collapse or resolving a product liability dispute, these services offer the expertise you need to navigate complex challenges.

If you’re seeking expert forensic materials engineering services, ensure you partner with a team that delivers precision, reliability, and actionable insights. Remember, the right expertise can make all the difference—from material failures to legal proof.

0 notes

Text

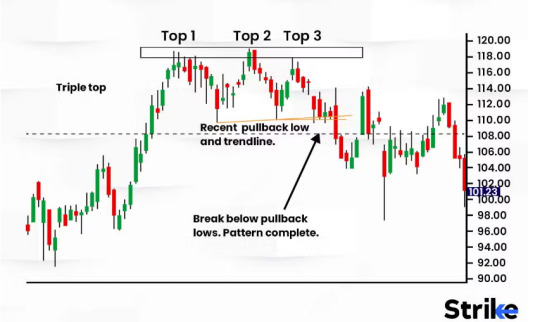

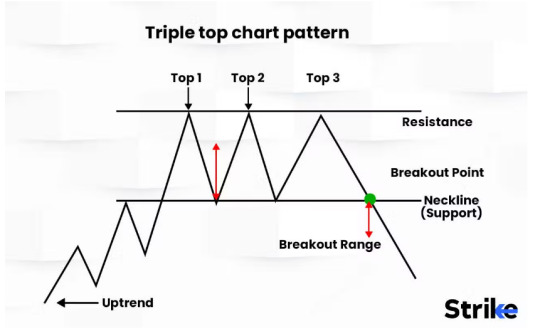

🚨 Complete Guide to the Triple Top Pattern: Spotting Bearish Reversals Like a Pro

The triple top pattern is one of the most recognizable bearish reversal patterns in technical analysis. But is it reliable? And how can you use it effectively in markets like NSE, BSE, and the crypto space? This guide breaks it down step by step, using real examples and proven strategies—plus, we explore advanced tools like Strike Money to enhance your charting precision.

🔎 What Exactly Is the Triple Top Pattern? (With Indian Market Examples)

The triple top pattern forms when an asset hits the same resistance level three times, failing each time to break through. After the third peak, sellers usually take over, causing the price to reverse downward.

A classic example is Tata Motors in 2021. The stock touched ₹500 thrice between March and June but failed to break above. After the third attempt, the price fell sharply to ₹400, confirming a textbook triple top formation.

👁️ The pattern looks like:

Three peaks at roughly the same price.

Two pullbacks in between.

A neckline (support level) at the lows of the pullbacks.

According to a study by Bulkowski (2010), the triple top has a success rate of around 70% when properly confirmed with volume.

🧠 Why Does the Triple Top Work? (Market Psychology Decoded)

The psychology behind the pattern is simple yet powerful:

👉 Buyers push the price up to a resistance zone. 👉 Sellers defend that level, causing a pullback. 👉 This tug-of-war happens two more times. Each failure weakens the bulls’ confidence. 👉 After the third peak, buyers give up, and sellers dominate.

Dow Theory, a cornerstone of technical analysis, emphasizes that price action reflects collective market psychology. The triple top is a textbook case of this—showing distribution before a downtrend.

John Murphy’s “Technical Analysis of the Financial Markets” reinforces that such patterns are often early warning signs of bearish moves.

🔍 How to Identify a Triple Top Pattern: The Must-Know Clues

Identifying a true triple top isn’t just about spotting three peaks—it’s about confirmation.

✔️ The peaks should be at similar price levels. ✔️ The pullbacks between peaks should find support at nearly the same neckline level. ✔️ Volume typically decreases with each peak and spikes downward once the neckline breaks.

For instance, on the Nifty 50 chart in April 2022, the index formed a triple top near 18,000. Volume on Strike Money’s charting tool showed a drying up of buying power, followed by a surge in selling once the neckline at 17,500 cracked.

👉 Watch out for false breakouts. If price briefly breaks above the third peak and then crashes, it’s a bull trap. Always confirm with volume.

⚔️ Triple Top vs. Double Top: Which Pattern Packs More Punch?

Both patterns signal bearish reversals, but there are key differences:

🎯 Double top: Two peaks at resistance. 🎯 Triple top: Three peaks, making it a stronger confirmation of bearish sentiment.

In the Infosys chart (Jan–June 2023), a double top at ₹1,500 triggered a 10% fall. However, when Reliance Industries formed a triple top at ₹2,650 in 2022, the breakdown was much sharper—falling over 15%.

This shows how a triple top often signals deeper reversals due to its prolonged formation phase.

📈 How to Trade the Triple Top: Strategy That Works

✅ Entry: Wait for a clear neckline break. Don’t jump in during the formation phase.

✅ Stop-loss: Place it just above the third peak. For example, if the third peak was ₹500, set your stop at ₹505.

✅ Target: Measure the distance between the peaks and neckline and project it downward. E.g., if peaks = ₹500 and neckline = ₹450, expect a drop to ₹400.

Using Strike Money, you can draw precise trendlines and use built-in Fibonacci retracement to fine-tune your exit.

In 2022, HDFC Bank formed a triple top at ₹1,600 with a neckline at ₹1,500. After the breakdown, the price hit ₹1,400 within two weeks—hitting the projected target perfectly.

📊 Real Triple Top Patterns in Indian Stocks: Proven Setups

✅ Tata Steel (July 2021): Peaks at ₹1,400. Neckline at ₹1,320. After breaking the neckline, the stock slid to ₹1,200.

✅ Maruti Suzuki (August 2020): Peaks around ₹7,000. Neckline near ₹6,600. Once broken, the stock dropped to ₹6,000.

✅ Axis Bank (February 2023): Peaks at ₹900. Neckline at ₹850. Post-breakdown, it tanked to ₹780.

All these were easy to spot using Strike Money’s customizable chart layouts.

🚫 Common Mistakes Traders Make With Triple Tops (And How to Dodge Them)

💥 Jumping in too early: Many traders enter before the neckline breaks. That’s risky because the pattern may fail.

💥 Ignoring volume: Without volume confirmation, the pattern is weak. Always check if volume spikes during the breakdown.

💥 No stop-loss: Triple tops can fake out. A tight stop-loss saves your capital if things go wrong.

💥 Over-relying on one pattern: Don’t put all your faith in a single signal. Combine it with other indicators like RSI divergence or MACD crossovers.

🧪 Backtesting the Triple Top: Does It Hold Up?

A study by Thomas Bulkowski in “Encyclopedia of Chart Patterns” reports:

✅ Success rate: ~70% (when confirmed) ✅ Failure rate: ~30% (often due to false breakouts)

In backtesting on the Nifty 50 index (2015–2022), the triple top pattern delivered an average 8-12% downside move post-breakout.

With Strike Money’s backtesting feature, you can apply the pattern across different timeframes and instruments for personal validation.

🤔 Frequently Asked Questions on the Triple Top Pattern

💬 Q: Is the triple top pattern reliable in the crypto market? Yes! Bitcoin’s chart in 2021 had a triple top at $65,000 before crashing to $30,000.

💬 Q: Best indicator to confirm a triple top? Volume, RSI divergence, and MACD crossovers enhance reliability.

💬 Q: Does the pattern work on intraday charts? It works on all timeframes, but higher timeframes (daily/weekly) offer stronger signals.

🚀 Is the Triple Top Still Effective in 2025 and Beyond?

In today’s AI-driven markets, patterns like the triple top remain relevant because they reflect human psychology, which doesn't change. However, algorithmic trading can cause more false breakouts, making confirmation with volume and multi-indicator strategies even more critical.

The Securities and Exchange Commission (SEC) has also noted that patterns remain an integral part of technical analysis curriculum globally, reinforcing their importance.

As market tools evolve, platforms like Strike Money bring advanced charting features, making pattern detection faster and more precise.

✅ Final Thoughts

The triple top pattern is a powerful bearish reversal signal if used with care. Whether you're trading Nifty stocks, forex pairs, or Bitcoin, the pattern gives an edge—provided you wait for confirmation, manage risk smartly, and avoid common traps.

With real-world examples, proven research, and the right tools like Strike Money, you're better equipped to ride the next bearish wave with confidence.

👉 Happy trading, and may your charts always speak loud and clear!

0 notes

Text

Notes about S2E1: House on the Rock

I had a few months ago rewatched the entire season 2 of American Gods. I did so in order to collect notes and infos I could then put on the Wiki - those views were coupled by the study of numerous “breakdowns” and “analysis” videos on Youtube. It is especially interesting to rewatch an entire season once you saw the episodes a first time, because numerous details can suddenly become obvious.

# The “official building” of Black Briar is “Black Briar CC”, aka Black Briar Country Club. To open the secret wall in the parking, Technical Boy needs to show to a security camera a paperclip (maybe a reference to the operation Paperclip). The same way, the password [Challenge] for Black Briar is “Büroklammer”, the German word for paperclip (yes that’s definitively an operation Paperclip reference).

# Black Briar is a reference to the Greenbrier Country Club, a club often frequented by American presidents, and which has underneath a government reinforced bunker from the Cold War era where the Congress could have reunited in case of nuclear war.

# Mr. World mentions that Mr. Wednesday nearly “killed him”. However it is quite strange, because in the final episode of season 1 Mr. World merely used a Children as a “portal” or “window” to project himself, he wasn’t really there... Probably a continuity error. Media is also of course referred to the “best salesman” of Mr. World.

# According to Wednesday and Sweeney, there is a real mermaid living at Weekie Wachee (a place renowned for its “mermaid shows”).

# Of course the Jinn and Bilquis would have some connection and knowledge of each other, since Neil Gaiman chose the Jewish version of the Queen of Sheba that made her daughter of a djinn.

# Black Briar seems to be the show’s equivalent of the “Agency” because it has a very similar idea - it is a construct of conspiracy theory beliefs, they work with gods, yet the Caretaker ignored who Mr. World was when he arrived and seem very normal and human, not having any god-like feature. In fact, we later see that the agents sent by Black Briar are also humans and respect their “bosses” as gods. According to Mr. World, Black Briar was liked or behind “operation Paperclip” (America extrading Nazi scientists to help them fight the Russians, kept secret by the government for nearly thirty years), “the moon landing” (the popular idea that the moon landing was faked), “the Compton crack wars” (the idea that the crack epidemic of the 80s and 90s was caused by the CIA), and “Roswell” (the famous Roswell incident many believe to have been alien-related). All of this clearly puts them on the same level as the Agency in the book - aka the “mysterious government conspiracy”.

# Mr. World needs to assert himself to the Caretaker who doesn’t know his identity, and says that the “Eye of Argus” Black Briar can connect itself with is for the use of the “President only”. Mr. World answers by saying he knows about all their conspiracies and that Black Briar has always worked for him - he is the “man behind the men behind the men” (aka the literal embodiment of the idea of the “man behind the man”, shadow power behind governments, etc...). Note that technology keeps disrupting around Mr. World like in the first season.

# The incident of Easter’s fury in the finale of season 1 is referred here as a “freak phenomenon” that killed all the crops in Kentucky.

# John Henry, the American folk hero, is mentionned as one of the people Wednesday wanted to rally, but failed to. Whiskey Jack was also apparently invited to the reunion at the House on the Rock but declined the invitation.

# Wednesday mistakes Salim for a pre-Islamic god, and drops the names “Hubal” and “Manat”. Hubat seems to have been the main male god, a father-figure, in the pre-Islamic arabian mythology. “Manat” however is a stranger name to drop because Manat was not a god but a goddess - the one of fate.

# Bilquis brags about how ancient she is, and she is referred to as the “Queen of Solomon” (it should be noted that the whole “love and sex” aspect of the Queen of Sheba comes indeed from her relationship with the King Solomon).

# The Norns are of course mentionned here.

# Zorya Vechernyaya is referred to as the “Evening Star” and “Lady of the Sunset”.

# Of course Anansi (who has been identified in the previous season as working as a tailor) will bring up the measurements of people.

# During the reunion, Anansi mentions that he “fought” ever since the Portuguese invaded the Gold Coast of Ghana.

# The Lion-God is mentionned as one of the gods coming to America, like in the novel. I start to think now that the people who try to identify him as a specific god are wrong. Indeed, while on the same list are dropped names like Frau Holle, Kubera, Thor, the Lion-God stays just that... Why not give him a name? Plus the Lion-God is always following Anansi and kind of grouped together, so I believe this Lion-God may simply be a name given for another folkloric character of African stories, just like Anansi is The Spider, literaly. But which part of Africa, which people, which country, I could not say.

# Of course Czernobog would say that he is “cancer” - he is literaly the negative god of darkness, winter and death.

# Bilquis wonders if Laura is a “Hungarian goddess of death”. If my knowledge is correct however, the Hungarians did not had a goddess of death, but rather a god of death and disease known as Ordog.

# Of course, Bilquis notifies the New God, via a sort of “pick-me-up” application hinting “Your ride is on its way”. At Black Briar, Mr. World receives the question “Retrieve the package?”, sent by the team of agents send at the Motel America (later revealed to be Mr. Town and goons). To open up the monitor that will allow him to talk to them back, Mr. World enters the code “130-7925″ (I do not know if this has any meaning). Then he enters on the “command line” : root bbcnd ; from Mr. World to Town ; Strike package request ; execute target.

# The agents dispatched by Black Briar first act through a sniper, whose bullets have the words “Deus mortuorum” engraved in them (something alongside the lines of “Gods die” or “Kill gods”), but when Shadow goes to attack them he is actually kidnapped “alien-style”, when a pillar of light drags him away in the sky, inside an unindentified flying object that then disappears in the night sky.

# It is said that there is a “dozen gods” at the reunion at the House on the Rock. We already know there is the Zoryas, Czernobog, Wednesday, Anansi (and eventually Bilquis). The other gods are listed as such in the credits: Ame-no-Uzume (from Japanese mythology), played by Uni Park. Ahura Mazda, played by Al Maini (from Zoroastrian religion). Frau Holle (from Germanic legends) played by Colleen Reynolds.

But that’s the regular gods. Afterward there is a list of other gods who are not clearly identified and just have... random names. The Unknown God played by Jack Faley (maybe the “forgettable god” of Las Vegas?). The Warrior Woman, played by Yvette McKoy. The Beautiful Woman, played by Sonya Cote. The Old Wizard, played by Stoneman Senior. The Thuggish Man, played by Mike Scherer. The New God (no mix-up with the New Gods) played by Jamieson M. Donnell. And finally the MJ Hobo God, played by Edward A. Queffelec. Seriously? Why and how did they just came up with these random gods? I mean, come on, they could have last put some efforts in actual references.

8 notes

·

View notes

Text

Project 1 - Image (Re)selection

I originally picked a random image from my documents for the first of the 50 projects on December 30th, but the image that I chose is technically difficult to credit and locate an original location for. It was posted by the original artist to an old blog that has since been scrubbed of its images that were saved there, and unfortunately the blog entry reveals there would have been images from other artists as well. I’m almost positive of the artist, and he’s prolific enough that I could easily pick something else of his to be safe... but I liked the image that I picked, and I would much rather spend some time tracking down something similar to it or maybe even emailing the artist about the scenario. Thats a lot of work to do that isn’t being spent on the art part of this project, so for now I’m just picking something else and putting it on a waiting list.

I’m a little relieved to not being doing a perspective heavy interior environment lineart though! :D

Instead, I picked...

“Fatigue” by John Brosio

(unfortunately I cannot link directly to the exact painting. It’s currently 36/87, the octopus on the house. Go look through his gallery, though! Wonderful stuff)

SO, here’s what I’m thinking about this first project right now:

This is oil on canvas, which is definitely not feasible for me. I definitely could not do this with my acrylics or tiny canvases but this makes me want to try. I have a painting i’ve wanted to paint over for a while and this seems like a good time to do that... BUT that might just have to be something I follow up with for a later project. There’s nothing here that digital cant do. I’ll save physical media for where digital fails.

This isn’t anything TOO complicated.

The subject matter is all out of my comfort zone, but none of it to an extreme degree. I don’t have to worry about linework or extreme perspective here.

I think light, color, and mood are the keys here and that’s not too tough a challenge.

I’m excited about drawing some houses and creatures! Which is good. I need to do some studies.

There’s an orderliness to this that makes it easier for me to get a result I’ll like, and enough negative space that I can focus my efforts on the important bits, which makes doing this in a week a lot easier.

All in all, I think this is WAY closer to my comfort zone than the original image I picked to start with, and I don’t think thats a bad thing at all. It means I can focus my efforts a bit more instead of learning many different things at once.

What I’m thinking about for my version:

I’ll definitely be keeping the evening lighting on this. I think the mood of this would be lost without it.

This style of house is a very specific type of Americana, but... it’s not really all that familiar to me. I’m more used to older two story 1900s houses that have seen a lot of renovation over the years, but I’m not sure how much switching to that sort of house would change the composition. I think that style of house would ruin the composition here, so it’s something i’ll have to think about.

I guess this means I actually have to do thumbnails and think about my composition like a real artist. Painful...

I was going to change from an octopus to some other nice creature, originally. Brosio’s work contains a lot of that sort of thing and I love it... but I think there are some factors to consider:

The fact that the door is blocked to the house by the creature is very important thematically. You can imagine, if the man’s path wasn’t entirely blocked by the creature, he would simply continue with his day and go inside, maybe not noticing the creature at all. The fact that he cannot rest due to being presented with this inconvenience is key to the piece. Whatever the creature is, it has to be something that can do that.

This is especially difficult to do if its a 2 story house.

The otherworldliness of an octopus is important. This guy might know how to handle a giant ferret, for example. But how do you convince a giant octopus to unblock your entryway? We just don’t know.

The creature cannot be aggressive for the tone of this. The creature must be something which simply does not care.

I think the creature also needs to be intelligent and reactive, however.

I think if it was just a giant worm you could nudge it away. But an octopus can be suctioned to the house.

I can’t identify so much with the man here. The businessman coming home from work to 1950s suburbia is definitely a strong, culturally embedded image, and I think it makes it easier to distance from him and enjoy a bit of his misfortunes. However, I think a very tired college student coming back to see a creature in the way is extremely funny and relatable to me, so I’ll probably consider that change.

However, I’m not sure if the added complexity to establish that will be good for the composition.

I think a gray hoodie that says “[LOCATION NAME] U” and a backpack might be enough to establish character archetype

but its not as striking as a plain black suit.

Anyway, I don’t think these projects will ALL get breakdowns like this, and I expect Maybe one person to actually read any of them, but being able to do an analysis if I want was a big appeal of starting a side blog for this. It really helps me to read and write when I’d looking at coding and programming projects, and I like to hear people’s reasoning in other fields too, so I thought a part of this as a learning project would be to write these myself.

2 notes

·

View notes

Text

How to Trade the Breakout & Retest Pattern: Strategies That Work

Breakout and retest trading is one of the most reliable techniques in technical analysis. It allows traders to enter trades with confidence after confirming the breakout of a key support or resistance level. If executed correctly, it offers high probability entries, clear invalidation points, and strong risk-to-reward ratios. In this blog, we’ll break down everything you need to know about the…

#breakout and pullback strategy#breakout and retest confirmation#breakout and retest pattern#breakout and retest trading strategy#breakout continuation pattern#breakout entry strategy#breakout retest candlestick pattern#breakout reversal signals#breakout trading risk management#breakout trading strategy for beginners#breakout vs breakdown#chart patterns with breakout#Confluence Trading#failed breakout recovery#fake breakout vs real breakout#Fibonacci breakout confluence#high probability breakout setup#how to identify breakout levels#how to trade breakout and retest#intraday breakout and retest setup#key support and resistance zones#learn technical analysis#Price Action Trading#retest after breakout#retest in technical analysis#stock markets#stock trading#successful trading#support and resistance breakout#swing trading breakout strategy

0 notes

Text

13x16: Scoobynatural

We now return to The Killer Stuffed Dinosaur in Love:

Remember when we were all speculating that there were going to be dinosaurs on Supernatural this season? Well, here you go.

Sam and Dean quickly dispatch the evil plushie with holy oil and fire. Jay, the shop owner next door pops in to see what all the ruckus is. “Defective product,” Sam admits dismissively. The shop proprietor, Alan, is so thankful that he offers the brothers “anything” they want in return. Dean nabs a sweet -but delicate- flat screen TV.

Later at the bunker, Sam’s busy doing research when Dean shows up to show him “something important.” Very Important! Sidenote: Dean Winchester has now admitted to watching (and liking!) Finding Nemo (and most certainly it’s sequel) and Frozen.

Dean takes Sam to his new “Dean Cave” or “Fortress of Dean-a-tude.” He’s still working on the name.

I am thoroughly enjoying the analysis of what the names mean —Dean thinks of himself as Batman and thinks of Cas as Superman. It’s their Man Cave together! How did Dean get all this stuff together without Sam’s help? Cas! It’s their Man Cave! Who has canonically watched movies together? Dean and Cas! It’s their Man Cave!

Dean shows Sam around and finally turns on his new TV. It flashes purple and zaps the boys into cartoon-land! As is the usual with these two, Sam is confused, concerned, and wants to solve the situation right away. Dean’s just ready to roll with it. After some truly amazing speculation about whether it is the work of the Trickster, they jump in Baby and drive.

They arrive at a malt shop, and see the Mystery Machine, quickly realizing that they’re in a Scooby-Doo cartoon!

They go inside and Dean sees the Scooby gang immediately.

Sam continues to be skeptical of the situation, but Dean defends his favorite childhood character. All those years on the road, no matter what motel their dad dragged them to, Dean was sure to find Scooby and the gang waiting on the TV. Dean asks to join them, and Fred enthusiastically agrees. (Pure. Good.)

The gang tells Sam and Dean that Scooby was recently named heir by an southern colonel. Scooby saved his life once. They all agree to head to the mansion together. Before heading out, Dean fulfills a dream 8 years in the making: he finally got a bigger mouth. And before reaching the mansion, Dean has a confusing Rebel Without a Cause moment with Fred over how much of a crush Dean has on him who’s car is faster. Fred wins.

Once at the mansion, Dean realizes they’re in the episode, “A Night of Fright is No Delight”!

Inside, the colonel’s attorney, Cosgood Creeps, explains why they’re all there and plays a vinyl record(!) from the deceased Colonel Sanders (Sam’s bitchface and grunt WAS AMAZING. Also, did the showrunners just decide to dress Asmodeus like that for a throwaway joke that would have worked even without it?)

The colonel’s last will and testament stipulates that everyone must spend one night in this haunted house to get their inheritance. Sam calls bullshit. LOL-- he is just the best. Velma assures Sam that the house isn’t really haunted, and Dean stops Sam from telling her that she’s in a “c-word”. “They are pure, and innocent, and good.” --Man, how Dean lands that line kind of breaks me a little inside. I just can’t imagine how many times he watched this show as a kid wishing he was in their world --where the monsters all were men in masks. They gave him an escape and hope when he had none of that in his world. Then Sam asks why they can’t just skip to the end of the episode if Dean’s seen it already. “Because sometimes it’s about the journey and not the destination.” Boy do hyperfans (Boris included) feel called out right about now

Everyone turns in for the evening. Dean tries bunking with Daphne, but things take a turn for the gay when Daphne bunks with Velma and Fred tells Dean, “Guess you’re with me slugger.”

They all head to bed. Dean finds some more than suitable sleepwear.

Once everyone else is asleep, Dean gets to eating, and Sam wonders if there’s more to be done. Dean assures him of the play-by-play. Soon enough there’s a commotion and they all head out to investigate. They find Cousin Simple dead.

*Classic Dialog Alert*

Velma: Jinkies!

Daphne: Jeepers!

Scaggy: Zoinks!

Scooby: Ruh-roh!

Dean: Son of a bitch!

Commercial break, and when we return all the characters are back in their regular clothes. Heehee. Fred is flippantly joyful about having a new mystery to solve. Sam is understandably upset. Dean acts upset to impress Daphne (eye roll, Dean.) They head out to investigate.

Dean and Sam come to some hard truths about their situation --things are real, people can really die, --and for Dean-- Scooby-Doo can die, and that’s not happening on his watch.

Back in the drawing room, the team tries to figure out the bigger picture of what’s going on. Velma logics them through the situation, all the while lightning flashes and the lights flicker out --and a mysterious figure approaches the window!

It’s Cas!

He meets the Scooby gang and explains to the brothers how he came back to the bunker, with fruit from the tree of life and technically married to some djinns’ queen. Lol. He quickly finds Dean’s new playroom (because he already knew about it!) and gets zapped into Scooby-land.

The room suddenly gets cold so the team heads out to investigate (again). A ghost appears and Fred tries saving the day but the spirit disappears. They enter the room from where the ghost came to find Cosgood Creeps horrifically dismembered. Dean wants to barf. Fred and the gang wander off indifferent. Sam calls bullshit.

Fred suggests everyone split up to search for clues. Dean pairs with Daphne (and Fred!), and Velma picks Sam, so poor Castiel is left with “a scruffy philistine and a talking dog.”

Velma and Sam head upstairs to investigate the attic while Velma very, very awkwardly flirts. “Why do you keep talking about my shoulders?” Sam asks. Sam. Please.

Sam gets scared by a mannequin, then brushes himself off and tells Velma that ghosts and all other kinds of supernatural things are real. Velma laughs at that foolish, foolish, broad shouldered man. Usually ghosts just turn out to be unscrupulous real estate developers. They find the fluids Velma was looking for, which Sam identifies as ectoplasm. Suddenly toys start levitating and attacking the two. “It's probably just Christmas lights and fishing line,” she protests while getting pelted with glowing blocks.

Speaking of awkward flirting, Dean asks Daphne about her taste in men while Fred investigates the library. “Strong, sincere, and an ascot wouldn't hurt.” LOL so specific. Dean pulls himself together long enough to notice a book that stands out because it isn't “painted into the background.” He pulls it and nothing happens at first. Then a trapdoor suddenly opens and they all plummet down three divergent slides into the...dungeon of the mansion? There, Dean forgets about consent (ew Dean) and tries to feel up Daphne. When the lights turn on, he finds that he's been sliding his hand up the thigh of...the ghost! Serves him right, I guess? With the rest of this episode in context just don’t...think about this moment too much, okay?

They run off.

Meanwhile, Cas, Shaggy, and Scooby are creeping through the house when the ghost confronts them. Cas raises his eyebrow, ready to study the ghost intently when it chases after him. And then we get something perfect and pure. We get a Scooby chase montage. Over the sweet strains of the Scooby Doo theme song, everyone runs around and wacky hijinks ensue.

They run to and fro, the ghost appears here and there, and we even see Scrappy Doo (which shouldn't make me happy but it DOES).

They end up barricading themselves in a grand bedroom. The room grows cold. The lights flicker. And the ghost bursts into the room. Fred charges the ghost and gets bashed into the wall. Velma and Daphne get magically pinned to a wall. Shaggy gets tossed from the room. Dean and Sam grab a pair of iron candlesticks to chase off the ghost. Fred awakens to...mortality.

Shaggy plunges off the balcony, falling towards his doom when Scooby launches himself after him. Scooby grabs onto Shaggy but now they're just both falling towards their horrible, cartoon death. Cas leaps into action. He jumps from the balcony and shoots through the air. When he catches hold of Scooby he uses the cartoon aerodynamic properties of his coat to give them lift and a gentler landing. Guys, this was seriously...sexy?

Uh. Anyway.

Shaggy broke his arm and this makes him extremely indignant. “I have jumped out of a biplane in a museum and was fine! How did this happen?” Sam and Dean decide to reveal the truth. The Scooby gang learns that the ghost is real, the supernatural is real... The gang then goes into a total breakdown.

Velma: “I thought I was blind without my glasses. But I was just blind.”

Fred: “We've been stopping real estate developers when we could have been hunting dracula?!”

Daphne: “AM I GOING TO HELL?”

Shaggy: “We told you every freaking time, but did you ever listen to me?”

Scooby: “We're doomed.”

Dean rallies the troops. They've fought monsters – even if they were human monsters. “You're heroes, and together we're gonna take down this phantom.”

They fret about their lack of weapons. To the Impala! But Dean refuses to give them weapons. (Because they are childhood and innocence and I’m just going to cry in this corner here.) Instead Fred builds a trap. It's an elaborate rube-goldberg style trap involving salt, iron chains, a soap-slicked slide, and a giant net of coconuts. It's DELIGHTFUL. Alas, Fred's trap fails, sending Cas, Scooby, and Shaggy into a washing machine. “I told you it wasn't going to work,” Sam complains. Dean tells him Fred's traps never work (LOL) and calls on Daphne to commence plan B. They lure the ghost down to the library and then pull the special book, dropping the ghost into the dungeon and directly into a salt circle.

How badass is this salt circle? So badass.

Anyway, Dean demands that the ghost reveal itself and it turns into a small child. The little boy curls up in a ball and tells them that Jay, the creepy real estate mogul at the pawn shop, has been using him to scare away business owners. Dean promises to set him free and the little ghost boy literally glows with happiness. I didn’t come here for FEELINGS!!! (That’s a lie. I did.) The Scooby gang continues to unravel and Dean asks the little boy for a favor.

Cut to the Scooby gang bursting in to find the Winchesters and Cas with a trussed up...something. The Winchesters tell them that there isn't a real ghost. Instead, it's Cosgood! Of course, it all makes sense now. Wires. Lights. Etcetera. Velma and the rest rationalize their experience with a little help from the Winchesters. With the Scoobies mentally set to rights again, everyone takes their leave.

Velma kisses Sam goodbye. “Always the quiet ones,” Dean notes. When the Scoobies leave, the little ghost boy zaps them all out of the TV again. Back in the real world, Dean smashes the TV and fishes the pocket knife out of the wreckage. The little boy appears, this time as a real ghost boy. They burn the knife with reverence and the boy dissolves into light.

This was beautiful and sad. Well done.

Later, Jay is in front of the pawn shop owner about to get him to sign over his shop when the Winchesters burst in. Dean's wearing...an ascot. They confront Jay who finally owns up to his nefarious deeds. They can't nail him on “ghost terrorism” but they do get him for tax fraud. “I would have gotten away with it if it wasn't for those meddling kids,” he grouses.

Yaaay! With the case wrapped up, Dean cements his nerdiness by saying “Scooby dooby doo!” into the camera, despite the side eye from Cas and Sam.

What. A. Delight.

Boris: I have watched this episode 4 times already, and I even made my sister, who’s not a Supernatural fan, watch it with me. She knows enough about Supernatural to blurt out, “It’s Cas!” when Cas showed up. It warmed my heart she said that --and that he was included in this episode. Sidenote: Does Sam have some of his own performing that he needs to let go? His practical resistance to the whole situation was humorous, but what if he had just admitted to remembering and liking Scooby enough to enjoy the ride? Oh, Sam.

Quotey Snacks:

Be like Elsa. Let it go.

When it's important you make time, Sammy.

Cas is kinda like a talking dog.

There are no words in this newspaper, Dean.

Oh, Dean. Boys and girls don't sleep in the same room, silly.

Well, gang. It looks like we've got another mystery on our hands!

We should look for evidence. Like fingerprints. Or fluids!

Killer stuffed dinosaur in love.

G-g-g-g-g-g-ghost!

I will miss your wise words and your gentle spirits.

Except Fred, he’s a wad.

“How do I look?” “Two dimensional.”

Want to read more? Check out our Recap Archive!

#spn 13x16#scoobynatural#spn recap#dean winchester#sam winchester#castiel#cas#supernatural season 13

150 notes

·

View notes

Text

Quality Should Not Be Binary

In my wanders through life in general - and the internet in particular - I’ve noticed a strange mindset regarding the quality of media and the people who produce it. It’s this weird idea that something is either 100% perfect, flawless and ‘how dare you claim to be a real fan while suggesting there’s anything wrong’, or that it’s completely awful, valueless and ‘you’re a terrible person for enjoying that or thinking it has anything to offer’ - sometimes flipping from one to the other as soon as a ‘flaw’ is revealed, or a ‘bad’ work does something suitably impressive.

This mindset has never really made sense to me. Maybe I’m a just habitual over-thinker who spends unhealthy amounts of time analysing things, but I can’t see how this sort of absolutist approach would do anything other than shut down discourse, limit the value to be had from a piece and maybe make people angry.

So in honour of that please enjoy some indulgently long navel-gazing about critical analysis and media quality.

Disclaimer: This post is going to summarise my personal philosophy. Everyone approaches life - and especially art - in their own way and far be it for me to say you’re wrong if you prefer a different approach. You do you.

Blindness Hurts Both Ways

To an extent I get the simple yes/no mindset. Analysis takes time and it would be exhausting to give an extensive, nuanced breakdown on your view at the start of every discussion. Plus the whole ‘dissecting the frog’ thing can definitely apply to enjoyment of media.

However, taking it to the point where you’re denying the positive side of things you dislike or refusing to acknowledge faults in works/people you enjoy has the potential to swing around and bite you in the butt.

Why deny yourself a useful experience? I think there’s an important distinction to make between being good and being useful. Subjective, technical or, ethical ‘badness’ is not the same as having no value. Similarly, being touching, entertaining or otherwise enjoyable doesn’t preclude something from having genuine problems.

Personally, I can find it difficult to work out exactly what’s going right in a generally positive piece. After all, ‘good’ doesn’t hinge on a single point - it’s usually the product of a lot of things working well together, and it can be hard to figure out cause and effect in a system like that. It’s much easier to look at a failed attempt and identify the specific elements that caused problems, where it had the potential to recover, and places where it might be succeeding in spite of those issues. Similarly, some works can be very strong except when it comes to ‘that one thing’, which in itself is a useful reference. Negative examples can be just as beneficial as positive ones, and turning a blind eye to a piece’s weaker aspects just denies you that tool.

On the other hand, sometimes a piece and/or creator can be ethically awful while being technically strong or succeeding at its intended purpose. In this case, while they’re not positive it can certainly be valuable to analyse the techniques they use, and even apply those tools when selecting and creating things for yourself.

It’s important to remember that acknowledging where something is strong isn’t the same as endorsing or supporting it, and that there’s a huge difference between pointing out a genuine weakness or failing and maliciously hating on a work or creator.

Why give something that much power? Starting with the gentler side, I think it’s important to remember that a work being ‘good’ on the whole shouldn’t be an excuse to gloss over possibly troubling elements or to give creators a free pass on their actions. Sure, even the best-intentioned artists make bad PR and creative decisions sometimes but it’s also valid to acknowledge and call out possible misbehaviour when it crops up, rather than blindly playing defence until it reaches critical mass and undermines the good of their work (or worse, actually hurts someone).

There can also be a danger to simply writing off and ignoring ‘bad works’, especially if you dislike them based on ethical grounds. If something ‘bad’ is becoming popular it’s usually a sign that it’s getting at least one thing right - whether that be plugging into an oft-ignored hot-button issue, or simple shock-value and shameless marketing. Attributing the success of such pieces to blind luck and ignoring any potential merits that got them there opens up the potential for other, similarly objectionable works to replicate that outcome.

Not to mention the issues that can come from letting these things spread unchecked. Think about how many crackpot theories and extreme notions have managed to gained traction, in part due to a lack of resistance from more moderate or neutral parties who at the time dismissed them as ‘too stupid’ or ‘too crazy to be real’. Unpleasant as it may be, I think there’s some value in dipping into the discourse around generally negative media. If nothing else, shining a spotlight on the misinformation or insidious subtext that a work might be propagating can help genuine supporters notice, sidestep or otherwise avoid the potential harms even as they keep enjoying it.

Why lock yourself into a stance like that? Maybe it’s just my desire to keep options open, but it seems like avoiding absolutist stances gives you a lot more room to move. Publicly championing or decrying a work and flatly rejecting any counterpoints runs the risk of trapping yourself in a corner that might be hard to escape from if your stance happens to change later. If nothing else, a bit of flexibility can help you back down without too much egg on your face, not to mention shrinking the target area for fans or dissenters who you might have clashed with in the past.

A little give and take can also help build stronger cases when you do want to speak out. Sometimes it’s better to just acknowledge the counterpoints you agree with and move on to the meat of the debate rather than wasting time tearing down their good points for the sake of ‘winning’. The ability to concede an argument is a powerful tool - you’d be surprised how agreeable people become when they feel like they’re being listened to.

Finally, from an enjoyment perspective, is it really worth avoiding or boycotting what could otherwise be a fun or thought-provoking experience just because you don’t 100% agree with it or have criticised it in the past? Sure, there are absolutely times when a boycott is justified but why deny yourself a good time just because it involves an element that’s been arbitrarily labelled ruinous. ‘With Caveats’ is a perfectly acceptable way to approach things.

Existence vs Presentation of Concepts