#FinTech Automation Solutions

Explore tagged Tumblr posts

Text

Ultimate Guide to DeepSeek AI for Business Growth

Table of Contents of DeepSeek AI for Business Growth1. Introduction: Why AI is Essential for Modern Business Growth2. What Is DeepSeek AI?3. Top 5 DeepSeek AI Tools for Scaling Businesses3.1 Demand Forecasting Engine3.2 Customer Lifetime Value (CLV) Predictor3.3 Automated Supply Chain Optimizer3.4 Dynamic Pricing Module3.5 Sentiment Analysis Hub4. How DeepSeek AI Reduces Costs and Boosts…

#AI automation 2024#AI budgeting#AI business growth#AI for non-tech teams#AI for startups#AI implementation guide#AI in retail#AI supply chain#Business Intelligence#cost reduction strategies#data-driven decisions#DeepSeek AI#enterprise AI adoption#fintech AI solutions#generative AI for business#Predictive Analytics#ROI optimization#scaling with AI#SME AI tools#startup scaling

2 notes

·

View notes

Text

Finity 360™ by Arcus Partners – The Future of Financial CRM

#Finity 360#financial CRM#wealthtech platform#RIA solutions#portfolio automation#compliance tools#financial technology#fintech SaaS#Arcus CRM

0 notes

Text

InStep Technologies is a trusted fintech software development company delivering secure, scalable, and innovative financial solutions. We build custom fintech apps, APIs, mobile wallets, blockchain integrations, and automation tools for startups, banks, and enterprises.

#fintech software development#custom fintech solutions#financial technology apps#fintech development company#banking app development#blockchain in finance#secure payment software#finance automation tools#investment software solutions#fintech API integration

0 notes

Text

Zaggle Prepaid Q4 2025 Conference Call

Search Keyword: Zaggle Prepaid share price, Zaggle Prepaid stock update, Zaggle Prepaid financials, Zaggle Prepaid investor call, Zaggle Prepaid quarterly results, Zaggle Prepaid earnings report, Zaggle Prepaid growth, Zaggle Prepaid valuation, Zaggle Prepaid business model, Zaggle Prepaid investments, Zaggle Prepaid IPO, Zaggle Prepaid profitability, Zaggle Prepaid market share, Zaggle Prepaid…

youtube

View On WordPress

#Zaggle Prepaid analyst call#Zaggle Prepaid B2B payments#Zaggle Prepaid business model#Zaggle Prepaid business outlook#Zaggle Prepaid capital raise#Zaggle Prepaid card solutions#Zaggle Prepaid CEO insights#Zaggle Prepaid competitive edge#Zaggle Prepaid conference call highlights#Zaggle Prepaid corporate solutions#Zaggle Prepaid customer base#Zaggle Prepaid digital payments#Zaggle Prepaid digital wallet#Zaggle Prepaid earnings call#Zaggle Prepaid earnings report#Zaggle Prepaid employee benefits#Zaggle Prepaid enterprise clients#Zaggle Prepaid expense automation#Zaggle Prepaid financial update#Zaggle Prepaid financials#Zaggle Prepaid fintech innovation#Zaggle Prepaid fintech segment#Zaggle Prepaid future plans#Zaggle Prepaid growth#Zaggle Prepaid innovation strategy#Zaggle Prepaid investments#Zaggle Prepaid investor call#Zaggle Prepaid investor Q&A#Zaggle Prepaid investor relations#Zaggle Prepaid IPO

0 notes

Text

UK based Sokin secured $31 M funding from Morgan Stanley. It offers services to 500 businesses across different verticals across the globe. Sokin is a global cross border payment provider that empowers businesses to manage payment swiftly, efficiently and transparently.

#finance#automation#technology#ai#uk#Sokin#payment gateway providers#startup#trendingnow#payment gateway integration#payment solutions#unified payments interface#online payments#b2b payments#digital banking solutions#digital banking#digital strategy#banking industry#fintech#vc#angel investment#angel investor#investing

0 notes

Text

Challenge: Automated Handling of Payment Processing Anomalies - Technology Org

New Post has been published on https://thedigitalinsider.com/challenge-automated-handling-of-payment-processing-anomalies-technology-org/

Challenge: Automated Handling of Payment Processing Anomalies - Technology Org

HM Revenue & Customs (HMRC), the Seeker for this Wazoku Crowd Challenge, is looking for new software technologies or system approaches to improve their automated payment receipt processing to reduce or remove the costly manual intervention required in the current process.

Working with digital payments – associative photo. Image credit: Corinne Kutz via Unsplash, free license

HMRC has a complex referencing system that leads to customers needing to submit a number of references when making payments, leading to problems.

Customers can easily submit insufficient or incorrect supporting references that the ‘payments in’ process then fails to handle automatically.

The payments falling outside of the standard process drop into a separate exception-handling team with limited automation capability, causing a high manual intervention cost and increased customer contact demands.

This is a Scouting Challenge seeking a partner or supplier to provide systems or expertise to solve HMRC’s business challenge; the Solver is invited to submit a written proposal to be evaluated by HMRC with the goal of establishing a collaborative partnership.

Submissions to this Challenge must be received by 11:59 PM (US Eastern Time) on the 4th of January 2024.

Source: Wazoku

You can offer your link to a page which is relevant to the topic of this post.

#2024#amp#automation#Business#challenge#collaborative#Competitions#digital payments#Fintech news#Link#payment solution#photo#pm#process#Revenue#Software#Software news#Solve#technology#time

0 notes

Text

ATMs & CRMs – Unveiling Their Benefits in India’s Evolving Payment Landscape | AGS India

Both ATMs and CRMs facilitate various banking transactions, CRMs offer the additional functionality of cash recycling, making them more advanced and sophisticated machines.

#Billing software#Billing Machine#Fintech company#Digital payments#cash payment#cash management services#online payment systems#Cash transit#QR code payment#cashless transaction in India#Digital payment solutions#payment company#RFID solutions#Payment solutions#fuel management system#cashless payment#fraud prevention#Banking automation#retail automation#Banking outsourcing

0 notes

Text

Maximizing Revenue: AuxDrive's Game-Changing Strategies for Punctual Payments

In the dynamic world of auto dealerships, revenue isn't just about sales; it's about managing the intricate dance of payments. AuxDrive, a trailblazer in the industry, has devised strategies that go beyond transactions, ensuring a harmonious flow that minimizes late payments and maximizes revenue.

Driving the Future: An Introduction to AuxDrive's Vision

At the heart of AuxDrive's approach is a vision that transcends traditional payment processes. It's not just about getting paid; it's about orchestrating a seamless experience where payments align with the rhythm of each dealership's unique operational beat. This vision positions AuxDrive as a strategic partner in the financial success of auto dealerships.

Understanding the Landscape: The Challenge of Late Payments

Late payments can disrupt the financial flow of any business, and auto dealerships are no exception. AuxDrive, with its finger on the industry's pulse, recognizes this challenge and addresses it head-on. The first step in overcoming a hurdle is understanding its contours, and AuxDrive dives deep into the complexities of late payments in the auto sector.

Tailored Solutions: AuxDrive's Adaptive Approach

There is no one-size-fits-all solution in the world of payments, and AuxDrive understands this implicitly. Its strategies are not pre-packaged; they are tailored to suit the individual needs and challenges of each dealership. Whether it's setting up personalized payment schedules or implementing reminders, AuxDrive's adaptive approach ensures that late payments become the exception, not the norm.

Efficiency Through Automation: Streamlining Payment Processes

The secret sauce of AuxDrive's success lies in its embrace of cutting-edge automation. By streamlining administrative processes, from invoicing to payment reminders, AuxDrive reduces the friction in the payment journey. This not only saves time for dealership staff but also enhances the efficiency of the entire payment ecosystem.

The Human Touch: AuxDrive's Commitment to Customer Relationships

In the world of technology, AuxDrive doesn't forget the human element. Beyond the algorithms and automated processes, AuxDrive is committed to nurturing strong customer relationships. Clear communication, transparent processes, and a genuine understanding of the challenges faced by dealerships set AuxDrive apart as a partner invested in the success of its clients.

Conclusion: AuxDrive, Where Revenue Maximization Meets Operational Harmony

In conclusion, AuxDrive isn't just a payment processing solution; it's a strategic ally in the pursuit of financial success for auto dealerships. Its strategies, rooted in understanding, adaptability, automation, and a commitment to relationships, position AuxDrive as a driving force in the effort to minimize late payments and maximize revenue. As dealerships navigate the complexities of the industry, AuxDrive stands ready to steer them toward a future where financial success is not just a goal but a tangible reality.

#business#fintech#business strategy#payment systems#payment services#payment solutions#merchant services#finance#high risk merchant account#customerexperience#autodealership#automated workflows#workflow automation#workflow#payment collection#debt collection#debt collector

0 notes

Text

Top Technologies That Will Transform The Fintech Industry

Financial Technology or fintech is revolutionising the way businesses and governments function worldwide. This innovative solution refers to the application of technology to improve and optimise the use and delivery of financial services.

Fintech startups build intelligent software and algorithms that help business owners and customers easily and effectively manage various financial operations. Some of the ingenious existing examples of fintech are mobile payments, online financing, stock trading, insurance, etc.

According to a report by Statista, there were 10,755 fintech startups in America, 9,323 in Europe, the Middle East, and Africa, and 6,268 in the Asia Pacific Region in November 2021.

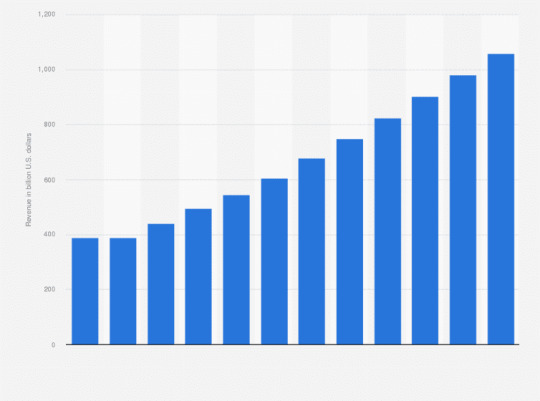

Another report states that the global fintech revenue is expected to grow from 92 billion euros in 2018 to 188 billion euros by 2024 at an average growth rate of 12%.

Fintech has considerable potential to disrupt the traditional banking and finance industry to improve and automate financial services. Considering the evolving rate of technology, a fintech startup must remain updated with the current trends to keep up with the market. Hence in the following sections, we have listed the five technology trends that can skyrocket the growth of a fintech startup. Also, how the Best mobile app design & development company in the UK can help you in Fintech App development.

1. Artificial Intelligence

Artificial intelligence or AI imparts the problem-solving and thinking capabilities of humans to machines. In recent years, the fintech industry has become heavily dependent on AI for numerous purposes like decision making, improving digital payments, identifying purchasing behavior patterns, etc.

The global AI in the fintech market will grow from USD 7.25 billion in 2021 to USD 24.17 billion in 2026 at a CAGR of 27.6%, reports Business Research Company.

AI can increase the value of the global banking industry by USD 1 trillion per year, says McKinsey.

AI applications like chat interfaces, wealth management, facial recognition, price forecasting, market trackers, etc., will be prevalent in the future and lead to an exponential rise in value creation. In addition, AI will drastically decrease the events of cybercrimes and financial threats because it effectively deals with unstructured data.

2. Blockchain

Blockchain is one of the most significant disruptive technologies that will radically change traditional financial services. It can be described as a digital ledger or database that records and distributes transactions in a business network.

Financial institutions use blockchain to increase security, reduce costs, and boost efficiency. This technology has been rising since 2018, tempting banks worldwide to adopt this innovative solution to secure their financial transactions.

According to research, the global blockchain in the fintech market can grow at a CAGR of 75.9%, increasing from USD 230 million in 2017 to USD 6228.2 million by 2023.

Blockchain records encrypted transactions that are impossible to penetrate. At the same time, it reduces the chances of hacking attacks by mandating transaction approval by network stakeholders. Moreover, Blockchain uses tokens as assets for value transfer, promoting the use of a single universal currency

3. Serverless

Serverless is an emerging technology that is rapidly changing the banking and financial industry by simplifying app creation. No matter what the size of your fintech startup, you can get remarkable benefits by utilising serverless features.

Your company can create and maintain applications on a simple cloud-based server in a serverless architecture. You don’t have to waste valuable resources on managing the servers or solving issues because the cloud providers maintain the back end of the app. No wonder why this technology is becoming popular among mobile app development companies.

Serverless architecture reduces the burden off your shoulder and helps you create lightweight apps easily and quickly to enhance your customer experience. Moreover, this increases business productivity and helps create new revenue streams for increased profits.

We are an App Development Company in the UK and a top provider of mobile app development services and have developed outstanding applications for fintech startups using Serverless technology.

4. Robotic Process Automation

Robotic Process Automation is a technology that uses software robots to emulate human activities like collecting data, moving files, filling forms, etc. RPA can be used to automate repeatable tasks that don’t need much human intelligence, making business processes effective.

Your company can use chatbots that interact with customers and answer their queries anytime during the day or night. The chatbots also take less time to reply to customers, enhancing user experience.

Other activities include data entry, managing and processing loans, consolidation and reporting, and analysing customers’ complaints. This simple technology can impart high value to any company, ensuring accuracy and high efficiency.

5. IoT

IoT or Internet of Things has given the fintech industry a tremendous boost in the past few years by providing extra security and increasing customer satisfaction. This technology can be described as a network of connected objects using sensors to collect and exchange data with other systems.

Markets and Markets Report says that the global IoT in Banking, Financial Services and Insurance market can grow at a CAGR of 52.1% from USD 249.4 million in 2018 to USD 2030 million by 2023.

According to a Statista report, the global IoT market is expected to grow from USD 389 billion in 2020 to over USD one trillion in 2030. At the same time, the number of IoT-connected devices would increase by 200%.

Cashless payments, introducing smart ATMs and banks, using security systems for fraud protection, supervising supply chain activity to reduce complicacy in debt collection, understanding the consumer market by analysing customer behavior, etc., are examples of how IoT helps businesses improve customer services.

The major benefit for you is that IoT is our area of speciality and we have made enough advancements in the building automation industry. For more information on Ficode IoT Services, click here.

Final Words

These five trending technologies are transforming the banking and financial world swiftly. A business using artificial intelligence, blockchain, serverless, Robotic Process Automation, and the Internet of Things can be highly productive, profitable, and popular. With ever-changing market demands and cut-throat competition, fintech startups must keep track of these trends to survive and flourish in the market.

If you want a simple and powerful mobile app for your fintech startup, you can partner with Ficode. We are a UK mobile app design and development company that provides bespoke app development services using innovative technology that exceeds your expectations.

We have the best app developers in the UK who will turn your raw ideas into profitable functional apps. Be it a smart android app or a stylish IOS app, our mobile app development services in the UK are one of the most affordable solutions.

Contact us now to know if you are looking for a Mobile App Development Company in the UK.

This post originally appeared on Ficode website, and we republished with permission from the author. Read the full piece here.

#development company#Fintech Industry#API intelligent#Artificial Intelligence#Blockchain#Robotic Process Automation#Process Automation and Technology#IoT Internet of Things#IoT#iot solutions#web development#web#ficode#software#api for mobile app development#mobile app development company

0 notes

Text

Enhancing Security in the Digital Age: Opon Innovations' Approach to Protecting Data

In today's interconnected world, where data is the lifeblood of businesses and individuals alike, the importance of robust security measures cannot be overstated. With cyber threats evolving and becoming increasingly sophisticated, safeguarding sensitive information has become an imperative. This is where Opon Innovations steps in, revolutionizing the approach to data security in the digital age.

A New Frontier of Security

In a landscape where data breaches and cyberattacks make headlines all too often, Opon Innovations has embarked on a mission to redefine how organizations protect their most valuable asset: data. With a forward-thinking approach and cutting-edge technology, Opon Innovations offers a new frontier of security.

The Challenge: Protecting Sensitive Information

In a world where information flows freely through digital channels, safeguarding sensitive data is paramount. Organizations handle vast amounts of personal and financial information, from customer details to proprietary business data. Any compromise in data security can have far-reaching consequences, both financially and in terms of reputation.

Opon Innovations' Vision: Security Without Compromise

At the core of Opon Innovations' approach is a commitment to providing security solutions that are both robust and user-friendly. Too often, security measures can be cumbersome and impede workflow. Opon Innovations believes that security should enhance, not hinder, operations.

The Opon Innovations Difference

Cutting-Edge Encryption

Opon Innovations employs cutting-edge encryption technologies that render data virtually impenetrable to cyber threats. Data in transit and at rest is safeguarded with the highest levels of encryption, ensuring that even in the event of a breach, the information remains unreadable to unauthorized parties.

Real-Time Threat Detection

Traditional security approaches are often reactive, responding to threats after they've already done damage. Opon Innovations takes a proactive stance with real-time threat detection. Advanced algorithms and artificial intelligence continuously monitor data streams, identifying and neutralizing threats as they emerge.

User-Friendly Interfaces

A key challenge in cybersecurity is ensuring that employees and users adhere to security protocols. Opon Innovations addresses this by designing user-friendly interfaces that make secure practices intuitive. This approach fosters a culture of security within organizations.

Tailored Solutions for Every Industry

Not all industries face the same threats or require identical security measures. Opon Innovations offers tailored solutions, understanding that a one-size-fits-all approach simply doesn't work in today's diverse business landscape.

Conclusion: Elevating Data Security

In an era where data is both an asset and a target, Opon Innovations stands as a beacon of innovation in the realm of cybersecurity. Their commitment to providing robust, user-friendly, and adaptable security solutions is reshaping how organizations protect their most valuable asset: data.

In an ever-evolving digital landscape, the security of your data should never be compromised. Opon Innovations ensures that you can navigate the digital age with confidence, knowing that your sensitive information is fortified against even the most advanced cyber threats.

To learn more about Opon Innovations' approach to data security and how they can enhance your organization's defenses, visit Opon Innovations today. Your data's security deserves nothing less than the best.

#business#staffing#finance#management#payment solutions#fintech#business strategy#technology#business consulting#data security#data protection#innovation#automation#business growth

0 notes

Text

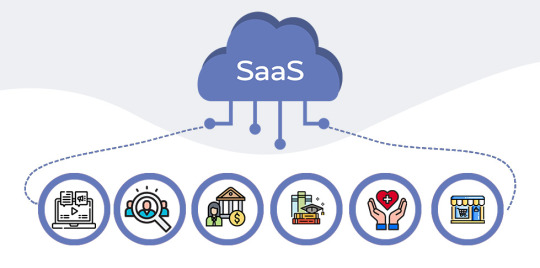

An Insight into SaaS & BaaS: Revolutionizing Everything From Cloud to Cash

Digital transformation is no longer a buzzword. It has become a reality, a necessity. In this rapidly evolving technological landscape, businesses are tirelessly trying to remain agile, innovative, and customer-centric. In this endeavour, Software as a Service (SaaS) and Banking as a Service (BaaS) have emerged as powerful platforms, driving the next wave of the digital revolution.

What is SaaS?

Software as a Service (SaaS), is a kind of cloud computing that provides users with access to software applications over the Internet. These applications are hosted on a cloud and managed by the service provider, relieving users from the need to install, manage, or update the software on their local servers or computers.

Why is SaaS the Future and Why is it Used?

The potential of SaaS stretches far beyond ease of use. By eliminating the need for hardware acquisition, provisioning, and maintenance, it significantly reduces upfront costs. Flexible payments make it an affordable solution for businesses of all sizes. It also provides scalable usage, allowing companies to scale up or down based on their requirements.

Moreover, automatic updates ensure users always have access to the latest features and security measures. Its accessibility from any internet-connected device makes it a perfect fit for today’s remote working culture. Given these advantages, it is no surprise that SaaS is being hailed as the future of software delivery.

SaaS Integration and the SaaS Business Model

SaaS platforms are designed for seamless integration into the existing IT infrastructure. It enables businesses to focus on their core competencies, leaving software-related issues to the SaaS provider.

The SaaS business model primarily relies on subscription-based revenue, with clients paying a fixed amount periodically to access the service. This ensures a steady revenue stream for providers and makes budgeting easier for clients.

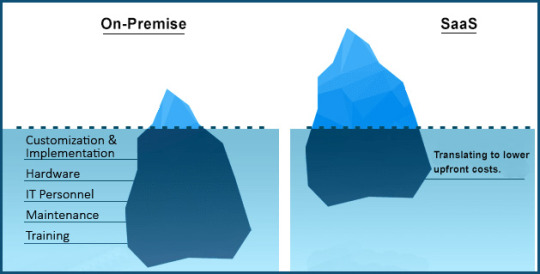

On-Premise Vs SaaS: Why SaaS is Superior?

On-premise software comes with substantial initial costs, including hardware, software licenses, and installation, not to mention the ongoing costs of maintenance, updates, and IT staff.

SaaS, on the other hand, is subscription-based, translating to lower upfront costs. The fact that it is maintained by the service provider further eliminates the need for maintenance and IT staffing costs. Also, SaaS solutions are scalable, customizable, accessible from anywhere, and always up-to-date, making them the superior choice for most businesses.

SaaS Products and Companies we all know

The SaaS market is crowded with many players, each one offering its unique value proposition. Top global SaaS companies include Salesforce, known for its customer relationship management (CRM) software; Adobe, with its creative and multimedia software suite; Microsoft, offering a range of productivity tools and business solutions; and Google, with its robust G Suite of Office applications.

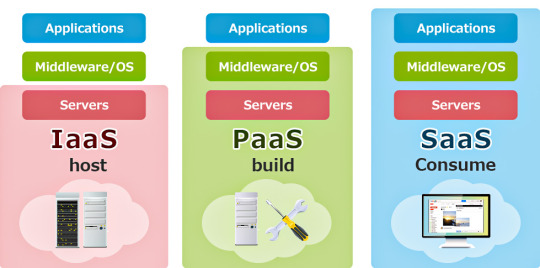

The Role of IaaS and PaaS along with SaaS

In the cloud computing realm, SaaS is one of the three primary service models, along with Infrastructure as a Service (IaaS) and Platform as a Service (PaaS).

IaaS virtualized computing resources over the internet. IaaS provides physical and virtual resources that are used to build a cloud. These resources include servers, network hardware, storage, and data center space. Users can rent these resources as per their needs, thereby saving on the capital expenditure that would have been incurred if they were to set up their own infrastructure. Amazon Web Services (AWS), Google Cloud Platform, and Microsoft Azure are some of the examples of Iaas.

PaaS delivers a platform for users to develop, run, and manage applications without the complexity of building and maintaining the infrastructure typically associated with application development. The PaaS provider manages the responsibility of housing the software and hardware components on their own infrastructural setup. As a result, developers can focus more on writing the code and the business logic, and less on managing hardware, software updates, and other routine IT management tasks. Examples of PaaS include Google App Engine, Heroku, and IBM Cloud Foundry.

SaaS delivers software applications over the web. IaaS provides virtualized computing resources over the Internet, and PaaS provides a platform for the creation and deployment of applications. Together, these models comprise the backbone of cloud computing, each serving distinct purposes but also complementing each other.

SaaS Uses in Different Sectors

Digital Marketing

Marketing teams leverage SaaS to automate tasks, streamline workflows, create content and improve campaign effectiveness. SaaS tools assist in email marketing, social media management, customer relationship management (CRM), and various forms of analytical tracking. These tools enable marketers to measure campaign effectiveness, user engagement, and return on investment in real time.

Human Resource

HR professionals use SaaS for recruitment processes, streamline employee onboarding, assist in performance tracking, and even manage payroll. The advantage of these solutions lies in their ability to centralize data, allowing for seamless management and offering employees user-friendly self-service options. This promotes HR efficiency and boosts employee satisfaction.

Financial Sector

HR professionals use SaaS for recruitment processes, streamline employee onboarding, assist in performance tracking, and even manage payroll. The advantage of these solutions lies in their ability to centralize data, allowing for seamless management and offering employees user-friendly self-service options. This promotes HR efficiency and boosts employee satisfaction.

Education Sector

In education, SaaS facilitates online learning, course management, and collaboration among students and teachers. By providing extensive learning resources and a platform for interactive learning, SaaS tools enhance both teaching methodologies and the overall learning experience.

Healthcare

SaaS in healthcare provides numerous benefits, from improving patient care to optimizing operational processes. Electronic Health Records (EHR) systems, telehealth platforms, patient portals, and medical billing software are common SaaS applications in healthcare. They help streamline workflows, improve data accessibility, and ensure regulatory compliance.

Retail

In the retail sector, SaaS solutions offer a multitude of tools to improve both the customer experience and the retailer’s operations. E-commerce platforms, inventory management systems, Customer Relationship Management (CRM) tools, and analytics software are some of the SaaS solutions used in this sector. They help businesses optimize their supply chain, gain customer insights, and manage their online presence effectively.

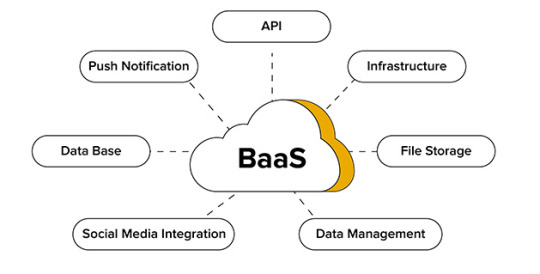

What is BaaS?

Banking as a Service (BaaS) is a model where financial services capabilities are provided over the Internet via APIs. With BaaS, fintech companies, retailers, and other businesses can integrate banking services into their own products, without the need to establish a full-fledged bank.

Why is BaaS the Future of Banking?

BaaS holds the promise of a more inclusive and innovative financial services sector. Enabling non-banks to offer financial services, encourages competition, promotes innovation and potentially leads to better services for consumers. As customer expectations evolve, the demand for integrated, seamless financial services will only grow, making BaaS an increasingly attractive proposition.

How Does BaaS Work and How is it Used?

BaaS operates through APIs, which allow third parties to access banking services such as payments, transfers and account management on their platforms. Managed by a licensed bank, this infrastructure saves businesses from building complex banking functions from scratch.

Primarily utilized by fintech firms, BaaS facilitates services like digital wallets, payment gateways, and lending platforms. As we all know there is no finance without technology nowadays. This synergistic integration of existing platforms provides a smooth and convenient customer experience. Any business can leverage BaaS to integrate banking services, differentiate itself in the market, and enhance customer service.

BaaS Integration with Other Technologies

BaaS can be integrated with other technologies such as artificial intelligence, machine learning, and blockchain to offer advanced financial solutions. For example, AI can be used for personalized banking services, machine learning for predictive analysis in lending decisions, and blockchain for secure, transparent transactions. These integrations enhance the capabilities of BaaS platforms, opening up new paths for innovation.

The Intersection of SaaS and BaaS

SaaS and BaaS are both service-based models, delivering…..

To read the full article: https://dsb.edu.in/an-insight-into-saas-baas-revolutionizing-everything-from-cloud-to-cash/?utm_source=tumblr&utm_medium=tumblr&utm_campaign=Saas+and+BaaS

#ai#jobs#india#blockchain#chatgpt#gpt 4#fintech#education#google#banking#saas#saas technology#saasmarketing#saas solutions#b2b saas#automation#baas#financial#investing#finance

0 notes

Text

Finity 360™ by Arcus Partners – The Future of Financial CRM

Finity 360™ is a unified financial platform by Arcus Partners that integrates CRM, compliance, portfolio management, and analytics into one seamless ecosystem. Built specifically for wealth and asset management firms, it’s designed to scale with your business.

VISIT HERE

#Finity 360#financial CRM#wealthtech platform#RIA solutions#portfolio automation#compliance tools#financial technology#fintech SaaS#Arcus CRM

0 notes

Text

The Future of Commercial Loan Brokering: Trends to Watch!

The commercial loan brokering industry is evolving rapidly, driven by technological advancements, changing market dynamics, and shifting borrower expectations. As businesses continue to seek financing solutions, brokers must stay ahead of emerging trends to remain competitive. Here are some key developments shaping the future of commercial loan brokering:

1. Rise of AI and Automation

Artificial intelligence (AI) and automation are revolutionizing loan processing. From AI-driven underwriting to automated document verification, these technologies are streamlining workflows, reducing manual effort, and speeding up loan approvals. Brokers who leverage AI-powered tools can offer faster and more efficient services.

2. Alternative Lending is Gaining Momentum

Traditional banks are no longer the only players in commercial lending. Alternative lenders, including fintech platforms and private lenders, are expanding options for businesses that may not qualify for conventional loans. As a result, brokers must build relationships with non-bank lenders to provide flexible financing solutions.

3. Data-Driven Decision Making

Big data and analytics are transforming how loans are assessed and approved. Lenders are increasingly using alternative data sources, such as cash flow analysis and digital transaction history, to evaluate creditworthiness. Brokers who understand and utilize data-driven insights can better match clients with the right lenders.

4. Regulatory Changes and Compliance Requirements

The commercial lending landscape is subject to evolving regulations. Compliance with federal and state laws is becoming more complex, requiring brokers to stay updated on industry guidelines. Implementing compliance-friendly processes will be essential for long-term success.

5. Digital Marketplaces and Online Lending Platforms

Online lending marketplaces are making it easier for businesses to compare loan offers from multiple lenders. These platforms provide transparency, efficiency, and better loan matching. Brokers who integrate digital platforms into their services can enhance customer experience and expand their reach.

6. Relationship-Based Lending Still Matters

Despite digital advancements, relationship-based lending remains crucial. Many businesses still prefer working with brokers who offer personalized service, industry expertise, and lender connections. Building trust and maintaining strong relationships with both clients and lenders will continue to be a key differentiator.

7. Increased Focus on ESG (Environmental, Social, and Governance) Lending

Sustainability-focused lending is gaining traction, with more lenders prioritizing ESG factors in their financing decisions. Brokers who understand green financing and social impact lending can tap into a growing market of businesses seeking sustainable funding options.

Final Thoughts

The commercial loan brokering industry is undergoing a transformation, with technology, alternative lending, and regulatory changes shaping the future. Brokers who embrace innovation, stay informed on market trends, and continue building strong relationships will thrive in this evolving landscape.

Are you a commercial loan broker? What trends are you seeing in the industry? Share your thoughts in the comments below!

#CommercialLoanBroker#BusinessFinancing#LoanBrokerTrends#AlternativeLending#Fintech#SmallBusinessLoans#AIinLending#DigitalLending#ESGLending#BusinessGrowth#LoanBrokerage#FinanceTrends#CommercialLending#BusinessFunding#FinancingSolutions#4o

3 notes

·

View notes

Text

What is Cybersecurity? Types, Uses, and Safety Tips

What is Cyber security?

Cyber security, also known as information security, is the practice of protecting computers, servers, networks, and data from cyberattacks. With the increasing reliance on technology in personal, professional, and business environments, the importance of cyber security has grown significantly. It helps protect sensitive data, ensures the integrity of systems, and prevents unauthorized access to confidential information.

For businesses in Jaipur, cyber security services play a crucial role in safeguarding digital assets. Whether you're an e-commerce platform, an IT company, or a local enterprise, implementing strong cyber security in Jaipur can help mitigate risks like hacking, phishing, and ransomware attacks.

Types of Cyber security

Cyber security is a vast domain that covers several specialized areas. Understanding these types can help individuals and organizations choose the right protection measures.

1. Network Security

Network security focuses on protecting the network infrastructure from unauthorized access, data breaches, and other threats. Tools like firewalls, virtual private networks (VPNs), and intrusion detection systems are commonly used. In Jaipur, many businesses invest in cyber security services in Jaipur to ensure their networks remain secure.

2. Information Security

This type of cyber security involves protecting data from unauthorized access, ensuring its confidentiality and integrity. Companies offering cyber security in Jaipur often emphasize securing sensitive customer and business information, adhering to global data protection standards.

3. Application Security

Application security addresses vulnerabilities in software and apps to prevent exploitation by cybercriminals. Regular updates, secure coding practices, and application testing are vital components.

4. Cloud Security

As more businesses move to cloud-based solutions, securing cloud environments has become essential. Cyber security providers in Jaipur specialize in offering services like data encryption and multi-factor authentication to ensure cloud data is safe.

5. Endpoint Security

Endpoint security protects devices such as laptops, desktops, and mobile phones from cyber threats. It is especially critical for remote work setups, where devices may be more vulnerable. Cyber security services in Jaipur provide solutions like antivirus software and mobile device management to secure endpoints.

6. IoT Security

With the rise of Internet of Things (IoT) devices, ensuring the security of connected devices has become crucial. Businesses in Jaipur use cyber security in Jaipur to secure smart devices like industrial sensors and home automation systems.

Uses of Cyber security

Cyber security is indispensable in various domains. From individual users to large organizations, its applications are widespread and critical.

1. Protection Against Cyber Threats

One of the primary uses of cyber security is to safeguard systems and data from threats like malware, ransomware, and phishing. Businesses in Jaipur often rely on cyber security Jaipur solutions to ensure they are prepared for evolving threats.

2. Ensuring Data Privacy

For industries like finance and healthcare, data privacy is non-negotiable. Cyber security measures help organizations comply with laws and protect sensitive customer information. Cyber security services in Jaipur ensure businesses meet data protection standards.

3. Business Continuity

Cyber security is essential for ensuring business continuity during and after cyberattacks. Jaipur businesses invest in robust cyber security services in Jaipur to avoid downtime and minimize financial losses.

4. Securing Financial Transactions

Cyber security ensures the safety of online transactions, a critical aspect for e-commerce platforms and fintech companies in Jaipur. Solutions like secure payment gateways and fraud detection tools are widely implemented.

5. Enhancing Customer Trust

By investing in cyber security in Jaipur, businesses build trust with their customers, demonstrating a commitment to safeguarding their data and transactions.

Cyber security in Jaipur

Jaipur is emerging as a hub for businesses and IT companies, which has increased the demand for reliable cyber security solutions. Cyber security services in Jaipur cater to diverse industries, including retail, healthcare, education, and finance.

Local providers of cyber security Jaipur solutions offer tailored services like:

Vulnerability Assessments: Identifying potential security risks in systems and networks.

Penetration Testing: Simulating attacks to uncover weaknesses and improve defenses.

Managed Security Services: Continuous monitoring and management of security operations.

Many IT firms prioritize cyber security services in Jaipur to ensure compliance with global standards and protect their operations from sophisticated cyber threats.

Safety Tips for Staying Secure Online

With the rising number of cyberattacks, individuals and businesses must adopt proactive measures to stay secure. Here are some practical tips that integrate cyber security in Jaipur into daily practices.

1. Use Strong Passwords

Ensure passwords are long, unique, and a mix of letters, numbers, and symbols. Avoid reusing passwords for multiple accounts. Cyber security experts in Jaipur recommend using password managers for added security.

2. Enable Two-Factor Authentication (2FA)

Adding an extra layer of security through 2FA significantly reduces the risk of unauthorized access. Many cyber security services in Jaipur emphasize implementing this measure for critical accounts.

3. Regular Software Updates

Outdated software can be a gateway for attackers. Keep operating systems, antivirus tools, and applications updated to close security loopholes. Businesses in Jaipur frequently rely on cyber security Jaipur providers to manage system updates.

4. Be Cautious with Emails

Phishing emails are a common attack vector. Avoid clicking on suspicious links or downloading unknown attachments. Cyber security in Jaipur often involves training employees to recognize and report phishing attempts.

5. Invest in Reliable Cyber security Services

Partnering with trusted cyber security services in Jaipur ensures robust protection against advanced threats. From endpoint protection to cloud security, these services help safeguard your digital assets.

6. Avoid Public Wi-Fi for Sensitive Transactions

Public Wi-Fi networks are vulnerable to attacks. Use a VPN when accessing sensitive accounts or conducting financial transactions. Cyber security Jaipur experts often provide VPN solutions to businesses and individuals.

7. Backup Your Data Regularly

Regularly backing up data ensures that critical information is not lost during cyber incidents. Cyber security providers in Jaipur recommend automated backup solutions to minimize risks.

Why Choose Cyber Security Services in Jaipur?

The vibrant business ecosystem in Jaipur has led to a growing need for specialized cyber security services. Local providers like 3Handshake understand the unique challenges faced by businesses in the region and offer customized solutions.

Some reasons to choose cyber security Jaipur services from like 3Handshake include:

Cost-Effective Solutions: Tailored to fit the budgets of small and medium-sized businesses.

Local Expertise: Providers have an in-depth understanding of regional cyber threats.

24/7 Support: Many companies offer round-the-clock monitoring and support to handle emergencies.

For businesses in Jaipur, investing in cyber security services in Jaipur is not just about compliance; it's about ensuring long-term success in a competitive digital landscape.

4 notes

·

View notes

Text

AI Expert: How Rick Green is Transforming Finance with Artificial Intelligence

Artificial intelligence has revolutionized many industries, and the financial sector is no exception. Rick Green has been at the forefront of AI-driven financial solutions, using technology to improve investment decision-making, risk management, and market analysis.

1. AI in Forex Trading

The forex market is one of the most volatile and fast-moving financial markets in the world. Traders must analyze economic indicators, global news, and market trends to make informed decisions. AI has made this process more efficient by offering:

✔ Automated Trading Bots – AI-powered bots execute trades based on real-time market analysis, eliminating emotional decision-making. ✔ Predictive Analytics – Machine learning algorithms analyze historical price movements to predict future trends. ✔ Risk Management Tools – AI identifies potential risks in the market and suggests strategies to minimize losses.

Rick Green has helped traders and investors integrate AI-powered solutions into their forex trading strategies, leading to more accurate predictions and increased profitability.

2. AI in Financial Technology (Fintech)

Beyond forex trading, Green has also made a significant impact in financial technology (fintech). As fintech continues to evolve, businesses must adopt AI-driven tools to remain competitive. Some of the key areas where Green’s expertise has been valuable include:

✔ Fraud Detection – AI detects suspicious transactions and cyber threats, protecting businesses and consumers. ✔ Automated Customer Support – AI chatbots and virtual assistants improve customer service by providing instant, accurate responses. ✔ Personalized Financial Advice – AI-powered platforms analyze spending habits to offer customized investment recommendations.Through his work in fintech, Rick Green has helped businesses streamline their financial operations, improve security, and enhance customer experiences.

Through his work in fintech, Rick Green has helped businesses streamline their financial operations, improve security, and enhance customer experiences.

2 notes

·

View notes

Text

Payments giant Visa Inc to acquire Pismo, a Brazilian Fintech platform for $1 Billion in cash.

#fintech#brazil#technology#automation#business#techjour#credit card#payments#payment gateway solutions#payment gateway providers#payment gateway integration#ai

0 notes