#Process Automation and Technology

Explore tagged Tumblr posts

Text

Top Technologies That Will Transform The Fintech Industry

Financial Technology or fintech is revolutionising the way businesses and governments function worldwide. This innovative solution refers to the application of technology to improve and optimise the use and delivery of financial services.

Fintech startups build intelligent software and algorithms that help business owners and customers easily and effectively manage various financial operations. Some of the ingenious existing examples of fintech are mobile payments, online financing, stock trading, insurance, etc.

According to a report by Statista, there were 10,755 fintech startups in America, 9,323 in Europe, the Middle East, and Africa, and 6,268 in the Asia Pacific Region in November 2021.

Another report states that the global fintech revenue is expected to grow from 92 billion euros in 2018 to 188 billion euros by 2024 at an average growth rate of 12%.

Fintech has considerable potential to disrupt the traditional banking and finance industry to improve and automate financial services. Considering the evolving rate of technology, a fintech startup must remain updated with the current trends to keep up with the market. Hence in the following sections, we have listed the five technology trends that can skyrocket the growth of a fintech startup. Also, how the Best mobile app design & development company in the UK can help you in Fintech App development.

1. Artificial Intelligence

Artificial intelligence or AI imparts the problem-solving and thinking capabilities of humans to machines. In recent years, the fintech industry has become heavily dependent on AI for numerous purposes like decision making, improving digital payments, identifying purchasing behavior patterns, etc.

The global AI in the fintech market will grow from USD 7.25 billion in 2021 to USD 24.17 billion in 2026 at a CAGR of 27.6%, reports Business Research Company.

AI can increase the value of the global banking industry by USD 1 trillion per year, says McKinsey.

AI applications like chat interfaces, wealth management, facial recognition, price forecasting, market trackers, etc., will be prevalent in the future and lead to an exponential rise in value creation. In addition, AI will drastically decrease the events of cybercrimes and financial threats because it effectively deals with unstructured data.

2. Blockchain

Blockchain is one of the most significant disruptive technologies that will radically change traditional financial services. It can be described as a digital ledger or database that records and distributes transactions in a business network.

Financial institutions use blockchain to increase security, reduce costs, and boost efficiency. This technology has been rising since 2018, tempting banks worldwide to adopt this innovative solution to secure their financial transactions.

According to research, the global blockchain in the fintech market can grow at a CAGR of 75.9%, increasing from USD 230 million in 2017 to USD 6228.2 million by 2023.

Blockchain records encrypted transactions that are impossible to penetrate. At the same time, it reduces the chances of hacking attacks by mandating transaction approval by network stakeholders. Moreover, Blockchain uses tokens as assets for value transfer, promoting the use of a single universal currency

3. Serverless

Serverless is an emerging technology that is rapidly changing the banking and financial industry by simplifying app creation. No matter what the size of your fintech startup, you can get remarkable benefits by utilising serverless features.

Your company can create and maintain applications on a simple cloud-based server in a serverless architecture. You don’t have to waste valuable resources on managing the servers or solving issues because the cloud providers maintain the back end of the app. No wonder why this technology is becoming popular among mobile app development companies.

Serverless architecture reduces the burden off your shoulder and helps you create lightweight apps easily and quickly to enhance your customer experience. Moreover, this increases business productivity and helps create new revenue streams for increased profits.

We are an App Development Company in the UK and a top provider of mobile app development services and have developed outstanding applications for fintech startups using Serverless technology.

4. Robotic Process Automation

Robotic Process Automation is a technology that uses software robots to emulate human activities like collecting data, moving files, filling forms, etc. RPA can be used to automate repeatable tasks that don’t need much human intelligence, making business processes effective.

Your company can use chatbots that interact with customers and answer their queries anytime during the day or night. The chatbots also take less time to reply to customers, enhancing user experience.

Other activities include data entry, managing and processing loans, consolidation and reporting, and analysing customers’ complaints. This simple technology can impart high value to any company, ensuring accuracy and high efficiency.

5. IoT

IoT or Internet of Things has given the fintech industry a tremendous boost in the past few years by providing extra security and increasing customer satisfaction. This technology can be described as a network of connected objects using sensors to collect and exchange data with other systems.

Markets and Markets Report says that the global IoT in Banking, Financial Services and Insurance market can grow at a CAGR of 52.1% from USD 249.4 million in 2018 to USD 2030 million by 2023.

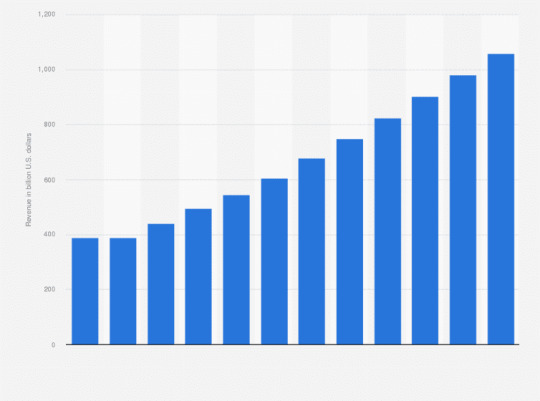

According to a Statista report, the global IoT market is expected to grow from USD 389 billion in 2020 to over USD one trillion in 2030. At the same time, the number of IoT-connected devices would increase by 200%.

Cashless payments, introducing smart ATMs and banks, using security systems for fraud protection, supervising supply chain activity to reduce complicacy in debt collection, understanding the consumer market by analysing customer behavior, etc., are examples of how IoT helps businesses improve customer services.

The major benefit for you is that IoT is our area of speciality and we have made enough advancements in the building automation industry. For more information on Ficode IoT Services, click here.

Final Words

These five trending technologies are transforming the banking and financial world swiftly. A business using artificial intelligence, blockchain, serverless, Robotic Process Automation, and the Internet of Things can be highly productive, profitable, and popular. With ever-changing market demands and cut-throat competition, fintech startups must keep track of these trends to survive and flourish in the market.

If you want a simple and powerful mobile app for your fintech startup, you can partner with Ficode. We are a UK mobile app design and development company that provides bespoke app development services using innovative technology that exceeds your expectations.

We have the best app developers in the UK who will turn your raw ideas into profitable functional apps. Be it a smart android app or a stylish IOS app, our mobile app development services in the UK are one of the most affordable solutions.

Contact us now to know if you are looking for a Mobile App Development Company in the UK.

This post originally appeared on Ficode website, and we republished with permission from the author. Read the full piece here.

#development company#Fintech Industry#API intelligent#Artificial Intelligence#Blockchain#Robotic Process Automation#Process Automation and Technology#IoT Internet of Things#IoT#iot solutions#web development#web#ficode#software#api for mobile app development#mobile app development company

0 notes

Text

Tom and Robotic Mouse | @futuretiative

Tom's job security takes a hit with the arrival of a new, robotic mouse catcher.

TomAndJerry #AIJobLoss #CartoonHumor #ClassicAnimation #RobotMouse #ArtificialIntelligence #CatAndMouse #TechTakesOver #FunnyCartoons #TomTheCat

Keywords: Tom and Jerry, cartoon, animation, cat, mouse, robot, artificial intelligence, job loss, humor, classic, Machine Learning Deep Learning Natural Language Processing (NLP) Generative AI AI Chatbots AI Ethics Computer Vision Robotics AI Applications Neural Networks

Tom was the first guy who lost his job because of AI

(and what you can do instead)

⤵

"AI took my job" isn't a story anymore.

It's reality.

But here's the plot twist:

While Tom was complaining,

others were adapting.

The math is simple:

➝ AI isn't slowing down

➝ Skills gap is widening

➝ Opportunities are multiplying

Here's the truth:

The future doesn't care about your comfort zone.

It rewards those who embrace change and innovate.

Stop viewing AI as your replacement.

Start seeing it as your rocket fuel.

Because in 2025:

➝ Learners will lead

➝ Adapters will advance

➝ Complainers will vanish

The choice?

It's always been yours.

It goes even further - now AI has been trained to create consistent.

//

Repost this ⇄

//

Follow me for daily posts on emerging tech and growth

#ai#artificialintelligence#innovation#tech#technology#aitools#machinelearning#automation#techreview#education#meme#Tom and Jerry#cartoon#animation#cat#mouse#robot#artificial intelligence#job loss#humor#classic#Machine Learning#Deep Learning#Natural Language Processing (NLP)#Generative AI#AI Chatbots#AI Ethics#Computer Vision#Robotics#AI Applications

4 notes

·

View notes

Text

i hate gen AI so much i wish crab raves upon it

#genuinely this shit is like downfall of humanity to me#what do you mean you have a compsci degree and are having chatgpt write basic code for you#what do you mean you are using it to come up with recipes#what do you mean you are talking to it 24/7 like it’s your friend#what do you mean you are RPing with it#what do you mean you use it instead of researching anything for yourself#what do you mean you’re using it to write your essays instead of just writing your essays#i feel crazy i feel insane on god on GOD#i would have gotten a different degree if i knew that half the jobs that exist now for my degree are all feeding into the fucking gen AI#slop machine#what’s worse is my work experience is very much ‘automation engineering’ which is NOT AI but#using coding/technology/databases to improve existing processes and make them easier and less tedious for people#to free them up to do things that involve more brainpower than tedious data entry/etc#SO ESPECIALLY so many of the jobs i would have been able to take with my work experience is now very gen AI shit and i just refuse to fuckin#do that shit?????

2 notes

·

View notes

Text

pvc electric red and blue wire #smartratework#tumblr

#flowers#aesthetic#alternative#grunge#1950s#cute#japan#60s#70s#80s#|| Smart Rate Work#Manufacturing encompasses a diverse array of processes and technologies aimed at producing a wide range of products#from everyday essentials to specialized components. Take wires#for instance: these are typically manufactured through drawing processes#where metal rods or strips are pulled through dies to reduce their diameter and achieve the desired thickness. This method ensures uniformi#crucial for applications in electronics#construction#and industrial settings.#On the other hand#the production of bottles involves molding techniques such as blow molding or injection molding. Blow molding heats plastic resin into a mo#used extensively for beverage containers and packaging. Injection molding#meanwhile#injects molten plastic into a mold under high pressure#ideal for producing intricate shapes with precision#like medical vials or automotive parts.#Both wire and bottle manufacturing rely heavily on materials science#engineering precision#and quality control measures to meet stringent specifications. Advances in automation#robotics#and sustainability practices are transforming these industries

2 notes

·

View notes

Text

anonymous &&. said... this is a very silly question but how would ren react to the blacksmith in fontaine?,using a machine over by hand

there are no silly questions, anon! i'm genuinely super excited to answer anything!

i feel like ren would probably be a bit snobby about the whole thing. mind you, he's at least PRAGMATIC enough to recognize the benefits of using machines. truly talented blacksmiths are in high demand, after all — it takes time to train an extra set of hands, whereas automating the process allows one to mass produce a product at an unprecedented speed. that being said, he has a tendency to look down on weapons and armor created in bulk. ( or honestly, forged in anything other than the way he's accustomed to. ) he sees them as lower quality — a creation devoid of soul. such a blade would sooner snap in its wielder's hands. he isn't necessarily against the idea of using machines at all, but beyond those specific situations wherein they would be suited to the task, he doesn't find any value in relying on them over traditional forging. he doesn't THINK they should be relied on beyond those specific situations, because it promotes stagnation and laziness.

a lot of his reasoning ties into how he sees the act of creating a weapon to begin with. ren basically views forging as something equivalent to art. not in the sense that a blade's only purpose is to look pretty above a fireplace — rather, every smith is an artist and each work they produce is like a painting or sculpture. going by that logic, it's only natural for an artist to seek out self improvement — pouring VAST AMOUNTS of time and effort into their next creation, striving to make something better than their last. honing their skills, much like the edge of a sword. every new weapon should be one's magnum opus, until their next creation inevitably, ideally dethrones it. ( and so on and so forth. ) it's not an especially practical approach for mass production, and he's fully aware of that. he takes a very hard quality over quantity approach, and believes if one actually desires a good weapon, they should value those traits as well. all shitposting aside, this is also why he harps on kazuha for using the fillet blade — he's horribly insulted by its very existence because he sees it as a generic, mass produced sword. boring and soulless; no thought put behind its creation.

ultimately, i think to what degree his snobbiness manifests is directly proportional to what role machines play in the production process — not only in terms of the fontaine blacksmith, but just in general. little things here and there are fine. there are some ways they can be employed, even while adhering to his methods. but if you've effectively automated the process into doing the work for you, he's going to laugh in your face if you still have the AUDACITY to call yourself a BLACKSMITH.

#anonymous#𝟎𝟎𝟒 : 𝘵𝘩𝘦𝘺 𝘴𝘢𝘺 𝘺𝘰𝘶 𝘶𝘴𝘦𝘥 𝘵𝘰 𝘣𝘦 𝘴𝘰 𝘬𝘪𝘯𝘥. ◟ hc .◝#( i wouldn't quite put him in the ''old man hates technology'' camp but he definitely does get a bit gatekeep-y about it )#( yes his approach isn't feasible to arm an entire army yes automating the process would be much more efficient there )#( that's one thing. the results won't be something he would be proud of but he can understand the reasoning. )#( BUT for individual projects if you aren't using your hands to create something you aren't a blacksmith )

3 notes

·

View notes

Text

Unlocking Efficiency and Innovation: The Role of Robotic Process Automation (RPA)

In today's fast-paced and competitive business environment, organizations are constantly seeking ways to improve efficiency, reduce costs, and increase productivity. Robotic Process Automation (RPA) has emerged as a powerful tool that can help businesses achieve these objectives.

What is Robotic Process Automation (RPA)?

Robotic Process Automation (RPA) is a technology that allows businesses to automate repetitive, rule-based tasks. It uses software robots, also known as "bots," to mimic human actions and interact with digital systems. These bots can log into applications, navigate through screens, input data, and complete tasks just like humans would.

The Role of RPA in Business:

RPA can be used to automate a wide range of tasks across various industries and departments. Here are some examples:

Finance and Accounting: Automating tasks such as accounts payable and receivable, invoice processing, and financial reporting.

Customer Service: Automating tasks such as answering FAQs, resolving customer inquiries, and processing orders.

Human Resources: Automating tasks such as onboarding new employees, processing payroll, and managing benefits.

IT: Automating tasks such as provisioning accounts, managing user access, and deploying software updates.

Impact of RPA on Businesses:

Implementing RPA can offer numerous benefits to businesses, including:

Increased efficiency and productivity: RPA can automate time-consuming and tedious tasks, freeing up employees to focus on more strategic and value-added activities.

Reduced costs: RPA can help businesses save money on labor costs, as well as reduce errors and compliance risks.

Improved accuracy and compliance: RPA bots are programmed to follow specific rules and procedures, which can help to improve accuracy and compliance with regulations.

Enhanced process visibility and control: RPA provides businesses with a clear view of their processes, which can help them identify and address bottlenecks.

Improved customer satisfaction: RPA can help businesses improve customer satisfaction by automating tasks such as order processing and customer service interactions.

RPA Services:

Implementing RPA successfully requires a partner with expertise in the technology and a deep understanding of business processes. A comprehensive RPA solution should include the following services:

Document AS-IS Process: This involves mapping out the existing process to identify areas for automation.

Design & Development of Bots, workflows, and forms for process automation: This includes designing and developing the software robots that will automate the tasks.

Bot license (We will use the appropriate underlying technology): This provides access to the software robots and the underlying technology platform.

Infrastructure: This includes setting up the necessary infrastructure to support the Robotic Process Automation (RPA) solution.

Production Deployment of the Bots: This involves deploying the bots to production and monitoring their performance.

RPA support: This includes ongoing support for the RPA solution, such as troubleshooting and maintenance.

Test & Deploy bots to production: This involves testing the bots in a production environment and making any necessary adjustments before they are deployed to full production.

Configuration data changes: This involves making changes to the configuration data of the bots as needed.

Password updates: This involves updating the passwords of the bots as needed.

Errors in executing the Bots: This involves resolving errors that occur during the execution of the bots.

Determining the “root cause” of a recurring issue or incident & recommendations: This involves identifying the root cause of a recurring issue or incident and recommending solutions to prevent it from happening again.

Infrastructure/application related issues: This involves resolving issues with the infrastructure or applications that the bots are interacting with.

Conclusion:

RPA is a powerful technology that can have a significant impact on businesses of all sizes. By automating repetitive tasks, RPA can help businesses improve efficiency, reduce costs, and increase productivity. However, it is important to choose a reputable Robotic Process Automation (RPA) companies with the expertise and experience to help you implement a successful RPA solution.

Ready to embrace the power of RPA?

Contact us today to learn more about how RPA can help your business achieve its goals.

#robotic process automation#robotic process automation rpa#rpa automation#robotic process automation software#rpa software#robotic process automation companies#robotic process automation technology#robotic process automation in healthcare#robotic process automation in banking#rpa solution#robotic process automation for finance#process automation solution#robotic process automation services#robotic process automation for insurance#rpa system#what is rpa automation#robotic process automation solution#robotic process automation benefits#robotic process automation consulting#robotic process automation consultant#rpa service provider#rpa consulting services

2 notes

·

View notes

Text

#eCheck#Electronic checks#ACH (Automated Clearing House)#Digital payments#Payment processing#Merchant services#Payment solutions#Secure transactions#Business payments#Online payments#Payment gateway#Payment technology#Financial services#E-commerce#Retail business#Small business#USA businesses#American merchants#Payment methods#Payment processing company#Payment processing solutions#Electronic payment options#Payment security#Card processing#Payment terminals#Mobile payments#Payment software#Point of sale (POS)#Payment integration#Business growth

7 notes

·

View notes

Text

Discover the Best AI Automation Tools for Your Business

Artificial intelligence is revolutionizing the way businesses operate, and choosing the right automation tools is key to unlocking its full potential. According to MIT research, companies that strategically implement AI-driven automation see a significant boost in productivity. For business leaders, the challenge isn’t deciding whether to adopt AI automation tools — it’s determining which tools…

#AI-driven processes#Artificial intelligence tools#Automation technology#Business automation solutions#Machine learning software#Smart business automation#Workflow optimization tools

0 notes

Link

Robotic Process Automation: Transforming Business through Intelligent Automation – For Technology

0 notes

Text

The PR 6003 Mounting Kit boosts precision in silo weighing—supporting packaging industry trends with safety, speed, and performance in harsh settings.

#PR 6003 Mounting Kit#silo weighing#precision weighing#packaging industry trends#load cell mounting#industrial weighing solutions#safe weighing systems#weighing technology#process weighing#packaging automation#high-performance weighing

1 note

·

View note

Text

Inside the AI Based Contact Center with Tools Tech and Trends

Introduction

The evolution of customer service has entered a new era with the rise of the AI based contact center. No longer just a support line, today’s contact centers are intelligent, data-driven hubs that utilize artificial intelligence to deliver personalized, efficient, and scalable customer interactions. As businesses race to stay ahead of the curve, understanding the essential tools, technologies, and emerging trends that power AI-driven contact centers becomes crucial. This article explores how AI is transforming contact centers and what lies ahead for this innovative landscape.

The Rise of the AI Based Contact Center

Traditional contact centers, though essential, have long suffered from inefficiencies such as long wait times, inconsistent service, and high operational costs. AI-based contact centers are solving these issues by automating routine tasks, predicting customer needs, and delivering omnichannel support.

AI technology, such as machine learning, natural language processing (NLP), and robotic process automation (RPA), is now integrated into contact center platforms to enhance agent productivity and customer satisfaction.

Essential Tools Driving AI Based Contact Centers

1. AI-Powered Chatbots and Virtual Agents

Chatbots are the most visible AI tool in contact centers. These virtual assistants handle customer queries instantly and are available 24/7. Advanced bots can handle complex conversations using NLP and deep learning, reducing human intervention for repetitive inquiries.

2. Intelligent Interactive Voice Response (IVR) Systems

Modern IVR systems use voice recognition and AI to route calls more accurately. Unlike traditional menu-based IVRs, intelligent IVRs can interpret natural language, making customer interactions smoother and faster.

3. Speech Analytics Tools

AI-driven speech analytics tools analyze live or recorded conversations in real time. They extract keywords, sentiments, and emotional cues, offering insights into customer satisfaction, agent performance, and compliance issues.

4. Workforce Optimization (WFO) Platforms

AI helps optimize staffing through forecasting and scheduling tools that predict call volumes and agent availability. These platforms improve efficiency and reduce costs by aligning workforce resources with demand.

5. CRM Integration and Predictive Analytics

By integrating AI with CRM systems, contact centers gain predictive capabilities. AI analyzes customer data to forecast needs, recommend next-best actions, and personalize interactions, leading to higher engagement and retention.

Core Technologies Enabling AI Based Contact Centers

1. Natural Language Processing (NLP)

NLP allows machines to understand, interpret, and respond in human language. This is the backbone of AI-based communication, enabling features like voice recognition, sentiment detection, and conversational AI.

2. Machine Learning and Deep Learning

These technologies enable AI systems to learn from past interactions and improve over time. They are used to personalize customer interactions, detect fraud, and optimize call routing.

3. Cloud Computing

Cloud platforms provide the infrastructure for scalability and flexibility. AI contact centers hosted in the cloud offer remote access, fast deployment, and seamless integration with third-party applications.

4. Robotic Process Automation (RPA)

RPA automates repetitive tasks such as data entry, ticket generation, and follow-ups. This frees up human agents to focus on more complex customer issues, improving efficiency.

Emerging Trends in AI Based Contact Centers

1. Hyper-Personalization

AI is pushing personalization to new heights by leveraging real-time data, purchase history, and browsing behavior. Contact centers can now offer customized solutions and product recommendations during live interactions.

2. Omnichannel AI Integration

Customers expect consistent service across channels—phone, email, chat, social media, and more. AI tools unify customer data across platforms, enabling seamless, context-aware conversations.

3. Emotion AI and Sentiment Analysis

Emotion AI goes beyond words to analyze voice tone, pace, and volume to determine a caller's emotional state. This data helps agents adapt their responses or triggers escalations when needed.

4. Agent Assist Tools

AI now works hand-in-hand with human agents by suggesting responses, summarizing calls, and providing real-time knowledge base access. These agent assist tools enhance productivity and reduce training time.

5. AI Ethics and Transparency

As AI becomes more prevalent, companies are increasingly focused on responsible AI usage. Transparency in how decisions are made, data privacy, and eliminating bias are emerging priorities for AI implementation.

Benefits of Adopting an AI Based Contact Center

Businesses that adopt AI-based contact centers experience a variety of benefits:

Improved Customer Satisfaction: Faster, more accurate responses enhance the overall experience.

Cost Reduction: Automation reduces reliance on large human teams for repetitive tasks.

Increased Scalability: AI can handle spikes in volume without compromising service quality.

Better Insights: Data analytics uncover trends and customer behaviors for better strategy.

Challenges in AI Based Contact Center Implementation

Despite the advantages, there are challenges to be aware of:

High Initial Investment: Setting up AI tools can be capital intensive.

Integration Complexities: Integrating AI with legacy systems may require customization.

Change Management: Staff may resist AI adoption due to fear of replacement or complexity.

Data Security and Compliance: AI systems must adhere to data protection regulations like GDPR or HIPAA.

Future Outlook of AI Based Contact Centers

The future of AI-based contact centers is promising. As technology matures, we can expect deeper personalization, more intuitive bots, and stronger collaboration between human agents and AI. Voice AI will become more empathetic and context-aware, while backend analytics will drive strategic decision-making.

By 2030, many experts predict that AI will handle the majority of customer interactions, with human agents stepping in only for high-level concerns. This hybrid model will redefine efficiency and service quality in the contact center industry.

Conclusion

The AI based contact center is transforming how businesses interact with customers. With powerful tools, cutting-edge technologies, and evolving trends, organizations are reimagining the contact center as a strategic asset rather than a cost center. By investing in AI, companies can enhance customer experiences, improve operational efficiency, and stay competitive in an increasingly digital marketplace. The time to explore and adopt AI contact center solutions is now—because the future of customer support is already here.

#AI based contact center#contact center tools#AI contact center technology#artificial intelligence in customer service#customer service automation#chatbot integration#virtual agents#intelligent IVR systems#speech analytics#workforce optimization#predictive analytics in contact centers#CRM integration with AI#natural language processing#machine learning in call centers#robotic process automation#omnichannel support#emotion AI#agent assist tools#contact center trends#AI-powered customer experience

0 notes

Text

Musing Mondays #5: The Cost of Convenience: How AI Voice Assistants Are Changing Customer Experience

Technology is evolving at a rapid pace, and with it comes a slew of innovations that promise to make our lives easier. One area where this is particularly visible is in the realm of customer service, where automated voice assistants are increasingly replacing human operators. While these systems are designed to streamline processes and improve efficiency, they can also introduce a host of new…

#accessibility#accessibility issues#AI#AI ethics#automation#banking#Capital One#customer service#digital accessibility#efficiency#inclusion#Musing Mondays#neurodivergent#speech processing#tech innovation#technology design#technology evolution#user experience#voice assistant

0 notes

Text

With the right guidance, challenges become manageable. Botgo aids businesses in recognizing their automation needs, analyzing processes, implementing solutions, and offering continuous support for enhanced efficiency. 𝐒𝐭𝐫𝐞𝐚𝐦𝐥𝐢𝐧𝐞 𝐲𝐨𝐮𝐫 𝐇𝐑 𝐨𝐩𝐞𝐫𝐚𝐭𝐢𝐨𝐧𝐬 𝐰𝐢𝐭𝐡 𝐁𝐨𝐭𝐠𝐨 𝐭𝐨𝐝𝐚𝐲. 🌐𝗩𝗶𝘀𝗶𝘁 𝗨𝘀: https://botgo.io

0 notes

Text

Swimming in a Sea of Data: From Overload to Opportunity

Data has now become both a business’s greatest asset and its most formidable challenge. It’s the new oil, but like crude oil, raw data is messy, unstructured, and often unusable without the right systems in place.

Consider this: in 2012, IBM reported that the world was generating 2.5 quintillion bytes of data each day. Fast forward to 2025, and we’re creating 2.5 quintillion bytes every single minute. This explosive growth is staggering, and for most organizations, overwhelming.

Today, over 80% of enterprise data is unstructured, buried in emails, PDFs, videos, audio files, documents, chat logs, and more. It’s scattered across systems, departments, cloud drives, and inboxes, making it impossible to manage through manual processes. The result? Businesses are drowning in information, unable to find or use the data that matters most.

We’ll discuss why unstructured data is such a massive problem, how it poses risks to organizational health, and what you can do through smart, scalable data management strategies to turn chaos into competitive advantage.

The Hidden Dangers of Unstructured Data Overload

Unstructured data is any data that does not have a predefined model or schema. Unlike structured data (think spreadsheets or SQL databases), unstructured data is messy, varied, and hard to index or analyze using traditional tools.

Why It’s a Problem:

Data Silos Are Everywhere Information is often scattered across fragmented systems; CRMs, email inboxes, file shares, messaging platforms, and individual desktops. Without integration, these silos hinder collaboration, duplicate efforts, and obscure valuable insights.

Time Waste and Productivity Loss Employees spend 20–30% of their workweek just searching for information, according to IDC. That translates to roughly 8–12 hours per employee, per week. In a 500-person organization, this results in over $2 million annually in lost productivity.

Data Security and Compliance Risks Unmonitored, unstructured data significantly increases the risk of regulatory non-compliance and data breaches. The average cost of a data breach has reached $4.45 million, according to IBM. These incidents bring additional costs in legal fees, operational disruption, and long-term damage to reputation and customer trust.

Inaccurate Analytics Poor data quality caused by duplicates, outdated entries, or inconsistency leads to flawed analytics and unreliable AI outcomes. Gartner estimates that the financial impact of bad data costs organizations an average of $12.9 million per year due to misguided decisions and wasted resources.

Missed Strategic Value Buried within emails, customer reviews, support tickets, and reports are key insights that could influence strategic direction. Without tools to unlock these insights, companies risk losing competitive ground to more data-savvy organizations.

The Case for Proactive Data Management

To combat these issues, businesses must embrace enterprise-wide data management strategies; not as a tech upgrade, but as a strategic imperative.

At the core of this transformation are several key pillars:

1. Data Governance

Establish rules, roles, and responsibilities for how data is managed, accessed, and used. Governance ensures compliance and provides a framework for accountability.

2. Metadata Management

Metadata (data about data) helps catalog, classify, and make sense of vast content repositories. With strong metadata, you can track origin, context, usage, and structure of data assets.

3. Master Data Management (MDM)

MDM ensures consistency and accuracy of core data across all systems (like customer or product data). It eliminates duplication and provides a single source of truth.

4. Data Quality & Cleansing

Identify and fix inconsistencies, duplicates, and errors. High-quality data is essential for reliable analytics and AI.

5. Centralized Repositories

Move from fragmented storage to centralized, searchable data lakes or warehouses. Enables better access, security, and data lifecycle management.

Using AI to Tame the Unstructured Data Monster

Managing unstructured data manually is no longer feasible. Fortunately, AI and machine learning are now powerful allies in imposing order on the chaos.

How AI Transforms Data Management

Automatic Classification and Tagging

Natural language processing (NLP) tools can scan and automatically categorize documents, emails, and files by subject, department, or sensitivity level. This automation drastically reduces manual sorting and accelerates digital organization.

Efficiency Gain: Up to 80% reduction in manual data classification time, enabling staff to focus on strategic tasks rather than clerical work.

Content Extraction

AI-driven tools use optical character recognition (OCR) and speech-to-text technology to extract relevant information from documents, images, videos, and audio files.

Cost Impact: Organizations can reduce document handling costs by as much as 70%. Processes like onboarding, claims processing, and invoice management become 3–5 times faster.

Semantic Search

Unlike traditional keyword search, semantic search understands the context and intent behind a query. It retrieves the most relevant documents (even when the phrasing differs) leading to significantly faster access to needed information.

Time Savings: Cuts average search time by 50–60% and reduces duplicated work across departments.

Sentiment and Topic Analysis

AI can analyze customer-facing content like support tickets, emails, and reviews to extract sentiment and detect patterns in feedback, complaints, or requests.

Strategic Value: Helps companies prioritize product improvements, reduce churn, and proactively address customer issues. Also supports better alignment between customer sentiment and business priorities.

Anomaly Detection

AI algorithms monitor data access and usage patterns to identify irregular behaviour such as unauthorized access attempts or suspicious downloads before they become serious breaches.

Risk Mitigation: Reduces incident response times by up to 90% and helps prevent financial losses associated with fraud or data misuse.

“Companies have tons and tons of data, but success isn’t about data collection, it’s about data management and insight.”

— Prashanth Southekal, Business Analytics Author & Professo

Real-World Impact: From Data Swamp to Strategic Insight

Financial Services

A mid-sized regional bank was facing serious delays and inefficiencies in its customer onboarding process. New customer documents such as proof of identity, income verification, and compliance forms were arriving in multiple formats via email, fax, and scanned PDFs. Employees were manually reviewing and uploading them into the system, often duplicating efforts across departments.

The Solution:

The bank deployed an AI-powered document management system that used natural language processing (NLP) and optical character recognition (OCR) to automatically extract key information from incoming documents. The system then categorized and routed files based on compliance requirements and customer profiles.

The Result:

Onboarding time reduced by 50%

Manual document handling decreased by 70%

Improved audit readiness and regulatory compliance

Better customer experience through faster service and reduced paperwork errors

Manufacturing

A global manufacturing firm was grappling with unexpected equipment failures across its production lines. While structured data from sensors was being analyzed regularly, thousands of unstructured maintenance logs, technician notes, and incident reports were being ignored due to lack of standardization.

The Solution:

Using AI and machine learning, the company processed years of maintenance notes and equipment logs to identify recurring keywords, root cause patterns, and correlations with sensor anomalies. NLP was used to classify issues, link them to specific machines or parts, and rank their criticality.

The Result:

30% reduction in unplanned downtime

Identification of high-risk components before failure

Maintenance schedules optimized based on real failure trends rather than fixed intervals

A unified dashboard displaying both structured and unstructured diagnostics for better visibility

Healthcare

A hospital system serving thousands of patients annually found that much of its most valuable clinical information such as patient symptoms, treatment outcomes, and physician notes, were buried in unstructured electronic health records (EHRs). These narrative-based inputs were not being utilized in broader health analytics or treatment optimization efforts.

The Solution:

By integrating advanced NLP models trained on medical terminology, the hospital was able to extract structured insights from physician notes, diagnostic reports, and patient history narratives. These were then fed into a decision support system to assist doctors in real time.

The Result:

Enhanced diagnostic accuracy and treatment recommendations

Earlier identification of at-risk patients based on symptom patterns

Reduction in duplicated tests and procedures

Accelerated medical research through improved data accessibility and linkage

No matter your industry, if your business generates large volumes of documents, emails, support tickets, or reports, there’s likely a goldmine of insight hiding in plain sight.

Building a Sustainable Data Management Strategy

Transitioning from data chaos to clarity requires more than buying the latest tool—it requires cultural and operational change.

Key Steps for Implementation:

Audit Your Data Identify where data resides, what formats it’s in, and who uses it. Evaluate current risks and opportunities.

Define Goals Are you aiming to improve searchability? Reduce compliance risk? Drive analytics? Clarify your priorities.

Choose the Right Tools Use platforms that integrate AI/ML, allow centralized storage, and support automation.

Upskill Teams Train employees in data literacy and involve them in crafting data management policies. IT and business units must collaborate—this is not just a tech project.

Monitor & Evolve Data strategies aren’t static. Continuously monitor quality, usage, and security—and adapt as your business grows.

The exponential growth of unstructured data isn’t going to slow down, it will only accelerate. For businesses, the choice is clear: either continue to drown in a sea of disconnected data or learn to ride the waves with strategy, tools, and intent.

When managed well, data becomes a powerful force, enabling faster decisions, stronger customer experiences, and deeper insights.

So, are you managing your data or is your data managing you?

Take action today to build a smarter, safer, and more strategic approach to data management before the next wave hits.

Learn more about DataPeak:

#datapeak#factr#saas#technology#agentic ai#artificial intelligence#machine learning#ai#ai-driven business solutions#machine learning for workflow#ai business tools#ai driven business solutions#aiinnovation#agentic#datadrivendecisions#dataanalytics#data analytics#data driven decision making#digitaltools#digital technology#digital trends#ai platform for business process automation#ai business solutions

0 notes

Text

Credit Application Automation: Save Time, Cut Costs, and Boost Accuracy

Banks spend millions processing loan applications the old-fashioned way. Loan officers manually review documents, calculate ratios, and make decisions one application at a time. This approach worked decades ago when volume was lower and expectations were different.

Today's customers expect instant responses. They apply for loans online and want answers within hours, not days. Meanwhile, banks struggle to keep up with application volume while maintaining accuracy and controlling costs.

Credit application automation offers a solution that addresses all three challenges simultaneously. Banks can process more applications faster, reduce operational costs, and make fewer mistakes.

The Cost of Manual Processing

Traditional loan processing requires significant human resources. A typical application takes 45 minutes to review when handled manually. During that time, a loan officer verifies income, checks credit history, calculates debt ratios, and evaluates collateral.

Banks pay loan officers well for their expertise. When these skilled professionals spend most of their time on routine data entry and calculations, the bank isn't getting full value from their salaries. The hourly cost of manual processing quickly adds up across thousands of applications.

Errors in manual processing create additional costs. Wrong calculations lead to poor lending decisions.

Approved loans that should have been declined often default, costing banks far more than the original loan amount. Rejected applications from qualified borrowers represent lost revenue opportunities.

Compliance costs also increase with manual processing. Banks must maintain detailed records for regulatory examinations. Paper files require physical storage space and are difficult to search when examiners need specific information. Staff time spent organizing and retrieving documents for compliance purposes adds to operational expenses.

How Automation Reduces Processing Time

Credit application automation transforms the review process from hours to minutes. Software reads digital applications instantly, extracts relevant data, and begins evaluation immediately.

No waiting for loan officers to become available or for documents to be manually entered into systems.

The technology performs multiple tasks simultaneously that humans must do sequentially.

While verifying employment through automated databases, the system also pulls credit reports, calculates financial ratios, and checks internal bank records. This parallel processing dramatically reduces total review time.

Routine applications that meet clear approval criteria can receive instant decisions. Customers submitting standard mortgage or auto loan applications often get preliminary approval before leaving the bank's website. This speed gives banks a competitive edge in markets where quick responses matter.

Complex applications still require human review, but automation handles the initial screening and data preparation.

Loan officers receive applications with calculations already completed and risk factors clearly identified. They can focus on making decisions rather than gathering information.

Cost Savings from Automated Processing

Labor represents the largest expense in traditional loan processing. Credit application automation reduces this cost significantly by handling routine tasks without human intervention. Banks can process more applications with existing staff or maintain current volume with fewer employees.

Technology costs money upfront, but operational savings develop quickly. Most banks recover their automation investment within 18 months through reduced processing costs. Larger institutions with high application volumes often see payback periods under one year.

Error-related costs drop substantially with automated processing. Mathematical mistakes become virtually impossible when computers handle calculations. Policy application becomes consistent across all applications, reducing the risk of compliance violations that result in regulatory fines.

Physical infrastructure costs decrease as banks rely less on paper documents. Storage space requirements shrink when records are kept electronically. Document retrieval costs disappear when files can be searched instantly using keywords or criteria.

Accuracy Improvements Through Automation

Human error rates in data entry typically range from 1% to 3% under normal conditions. During busy periods or when staff work overtime, error rates can climb much higher. Credit application automation eliminates these data entry mistakes entirely.

Mathematical calculations become perfectly accurate when handled by software. Debt-to-income ratios, loan-to-value calculations, and payment capacity assessments are performed consistently every time. Complex formulas that might confuse human reviewers are executed flawlessly.

Policy application improves with automation because software follows the same rules for every application.

Human reviewers sometimes interpret guidelines differently or make exceptions based on personal judgment. Automated systems apply criteria uniformly, ensuring consistent treatment for all applicants.

Document verification becomes more thorough with automation. The system can cross-reference information from multiple sources simultaneously. Income verification, employment confirmation, and asset validation happen instantly rather than taking days for manual verification.

Integration with External Data Sources

Modern credit application automation connects with numerous external databases to verify applicant information. Employment verification services, income databases, and asset verification systems provide instant confirmation of customer-provided data.

Credit bureau integration allows real-time access to updated credit scores and histories. The system can pull reports from multiple bureaus if needed and incorporate the most recent information into its decision-making process.

Bank account verification through third-party services confirms deposit accounts and transaction histories. This verification helps detect undisclosed debts or income sources that applicants might not have mentioned.

Risk Assessment Enhancement

Automated systems can analyze patterns in data that human reviewers might miss. The software examines relationships between different application elements and flags unusual combinations that warrant further review.

Fraud detection capabilities improve when automation processes applications. The system can quickly compare new applications against databases of known fraudulent submissions.

Suspicious patterns that develop gradually over time become visible when the software analyzes trends across many applications.

Credit scoring becomes more sophisticated with automation. The system can incorporate alternative data sources beyond traditional credit reports. Payment histories for utilities, rent, and other recurring expenses provide additional insight into applicant reliability.

Implementation Considerations

Banks need careful planning before implementing credit application automation. The system must integrate seamlessly with existing core banking platforms, loan origination systems, and customer relationship management tools. Poor integration can create bottlenecks that negate automation benefits.

Staff training requires attention during the transition period. Loan officers must learn how to work with automated systems and interpret machine-generated recommendations. Some employees may initially resist the change, preferring familiar manual processes.

Regulatory compliance becomes different, not necessarily easier, with automation. Banks must ensure their automated systems meet all applicable lending regulations. Decision logic must be transparent and explainable to regulators who examine the bank's processes.

System maintenance and updates require ongoing investment. Credit markets change, regulations evolve, and bank policies shift. The automation software must adapt to these changes through regular updates and refinements.

Measuring Success

Banks should establish clear metrics before implementing credit application automation. Processing time reductions, cost savings, and accuracy improvements all provide measurable benefits that justify the technology investment.

Customer satisfaction often improves with faster processing times. Survey scores typically increase when applicants receive quicker responses to their loan requests. This improvement can lead to increased customer retention and referrals.

Application volume capacity increases substantially with automation. Banks can handle seasonal spikes in loan demand without hiring temporary staff or asking existing employees to work excessive overtime.

Staff productivity metrics change when automation handles routine tasks. Loan officers can focus on relationship building, complex applications, and business development activities that generate more value for the bank.

Future Developments

Technology continues advancing in credit application automation. Machine learning capabilities allow systems to improve their decision-making over time by analyzing outcomes and adjusting criteria accordingly.

Integration with additional data sources will provide even more comprehensive applicant profiles. Social media information, spending patterns, and alternative credit data will help banks make more informed lending decisions.

Mobile applications are becoming more sophisticated, allowing customers to submit loan applications entirely through their smartphones. Document capture through mobile cameras eliminates the need for physical paperwork in many cases.

The Bottom Line

Credit application automation delivers measurable benefits across multiple dimensions. Time savings allow banks to respond faster to customer needs and handle higher application volumes. Cost reductions improve profitability while enabling competitive pricing. Accuracy improvements reduce risk and enhance compliance.

Banks that implement automation gain competitive advantages in the marketplace. They can offer faster service, maintain lower costs, and make better lending decisions. As customer expectations continue rising and competition intensifies, automation becomes less optional and more necessary for survival.

Success requires proper planning, adequate investment, and commitment to ongoing system improvement. Banks that approach automation thoughtfully and comprehensively position themselves well for future growth and profitability.

#credit application automation#automated loan processing#credit decision software#financial technology#fintech automation

0 notes

Text

Unlock Business Growth with RPA in Dubai

Is your business still stuck with slow, manual processes? It’s time to rethink how you work. Discover how RPA in Dubai can streamline operations, reduce costs, and improve accuracy across your core business functions.

Robotic Process Automation (RPA) uses smart software robots to handle repetitive, rule-based tasks. It reduces human error, speeds up processes, and frees up your teams for high-value, strategic work. Businesses across the Gulf are increasingly automating key processes to improve quality, enhance output, and gain a competitive edge.

Why Invest in RPA in Dubai?

Dubai’s fast-paced, competitive business landscape demands smarter, faster processes. RPA solutions offer a simple, scalable, and cost-effective way to meet those demands while driving operational excellence.

Here’s what you can achieve with RPA implementation:

Automate repetitive, time-consuming tasks

Improve accuracy by eliminating manual errors

Lower operational costs and boost productivity

Scale operations without increasing your workforce

Allow teams to focus on value-adding, strategic work

Notably, these automation software bots can be deployed across multiple industries, including:

Banking and Insurance

Retail and e-Commerce

Healthcare and Hospital Management

Construction and Manufacturing

Logistics and Supply Chain

Automotive and Dealerships

Hospitality and Tourism

Whether it’s customer service, finance, HR, operations, or sales, RPA improves accuracy, speed, and efficiency across functions. This also enables companies to uplift the employee experience as mundane and repetitive work is taken off their plate.

At Centelli, we create and deliver custom RPA automation solutions in Dubai tailored to your unique business needs. We also offer AI-enabled RPA for intelligent automation. Serving clients across the UAE, UK, EU, US, and India. Book your free consultation today and experience the power of automation.

#AI Solutions#Intelligent Automation#Technology#Automation Solutions#Robotic Process Automation#RPA#Dubai#Centelli

0 notes