#Financial Legacy Planning

Explore tagged Tumblr posts

Text

#Manage Your Digital Assets#Wealth Transfer#Assets For Future Generations#Manage Your Legacy Planning#Centralized Digital Repository#Preserving Your Family's Legacy#Financial Legacy Planning#Transferring Financial Assets

2 notes

·

View notes

Text

What were nerves at first, gradually turned into confidence. Vincent was glowing with happiness talking about Renee, first expressing his love and commitment to her, to ending with the big question. "I love your family and I love your daughter so much. And I wanted to ask for your blessing to marry her." He looked at his future father-in-law, whose face was brimming with delight , "Of course you have my blessing! Come here!"

"Oh and stop with this Bryce nonsense! Call me Dad," Bryce said giving Vincent's shoulder a reassuring squeeze, "I mean I don't want to force you or anything, just know you can always lean on me." Given the situation of his own dad, addressing someone this way felt so foreign to Vincent. By all means, he saw Bryce as a father figure, but he didn't feel comfortable or close enough to call him that yet. "Thanks...Dad," Vincent smiled, touched by his words.

They spent the next moment bonding, with Vincent speaking from the heart about his respect for the Reichmanns and Bryce imparting some wisdom, cracking jokes along the way. When they heard the car outside, Bryce asked, "Anything I can do to help with the proposal?" "Keep this a secret from Renee," Vincent grinned, just when she opened the front door. "What are you two talking about?"

"I was just asking Dad when he is going back to Sulani. You and I need a little break, a weekend getaway before work starts kicking our ass."

No words just 👶

#ts4#sims 4#ts4 gameplay#ts4 legacy#postcard legacy#postcard gen 3#renee reichmann#bryce reichmann#vincent kingsley#harvey kingsley#bryce calling vincent champ 🥺 he admires him so much especially his bravery and thinks hes a fighter + winner!!#zoom in 3rd pic bryce crying! look how much the news means to him#yes it took a while! degree. law school. bar exam. training. financial stability. think of marriage. kids came early. busy with twins#and now planning the actual proposal!!! THATS THE STORY 🤣#meanwhile im nervously sweating and so is vincent...SO NERVOUS

115 notes

·

View notes

Text

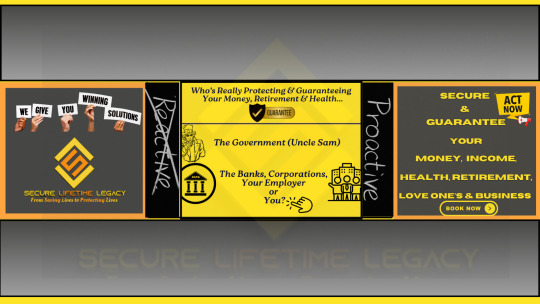

Secure Lifetime Legacy

Secure Lifetime Legacy stands as a trusted ally for clients seeking proactive solutions to protect what matters most — their retirement, income, health, loved ones, assets, and legacy. We specialize in addressing "The Problem Wheel"—a collection of the most pressing economic and personal uncertainties—so that our clients don't have to rely on the government, banks, corporations, or employers to secure their future.

We offer personalized, transparent service backed by extensive knowledge of retirement laws, tax codes, and healthcare policies. Our mission is to empower you with a proactive plan that ensures stability and confidence in your financial future, regardless of economic conditions.

#Retirement Planning#Income Protection#Financial Services#Financial Independence#Healthcare Planning#Medicare#ACA#Social Security#IRA#401k#403b#TSP#Asset Protection#Legacy Planning#Proactive Financial Strategies#Financial Literacy#Economic Resilience#Generational Wealth#Disability Protection#Tax-Efficient Strategies#Secure Retirement#Problem Wheel#Employer Retirement Plans

2 notes

·

View notes

Text

Video: Non-Financial Considerations prior to Retirement

Retiring is a significant #life #transition, and considering #non-financial #factors is just as important as #financial #planning. Here are some key aspects to think about: #Health and #Wellness, #Social #Connections, #Purpose and #Fulfillment, #Routine and #Structure, #Housing and #Living #Arrangements, #Personal #Growth and #Education, and #Legacy and #Givingback. By considering these…

View On WordPress

#Arrangements#Connections#education#enriching#experience#factors#financial#fulfilling#Fulfillment#Givingback#growth#Health#Housing#Legacy#life#Living#non-financial#Personal#planning#Purpose#retirement#Retiring#routine#Social#Structure#Transition#Wellness

2 notes

·

View notes

Text

In light of Brian Thompson being shot dead on my birthday (🎉🥳🎂) I'd like to share a personal story about UnitedHealthcare.

During the peak of COVID, my family all got sick. I couldn't be on my parents' insurance because they were both older and on Medicare. So, I had insurance through my University: UnitedHealthcare.

For some reason, rather than roll-over each year, I got a new plan each year that ended after May and didn't start until August, so I was uninsured for the summer months, but it was a weird situation that the university denied, and told us we were supposed to be insured year-round, it was messy.

Both of my parents went to the hospital, and I got sick too. I had to take care of my pets, and myself, and try to stay alive and keep my pets alive when I was so weak I could hardly move. When my parents came home, my condition got dramatically worse (I think my body knew it couldn't give out, because there was nobody to take care of me, so once my parents were okay, it completely crashed and failed.)

I started experiencing emergency symptoms. It was a bit hard to breathe, my chest hurt, and I was extremely delirious. I wanted to call my insurance to see if I was covered (this was during the summer) and I was connected to some nice person, probably making minimum wage, who told me with caution in her voice that my plan was expired. I had no active insurance, but she urged me to go to an emergency room. I remember saying something to the effect of "You just told me I don't have insurance, I can't go to the hospital, I can't afford it."

She sounded so genuinely worried and scared. I remember she said "You really don't sound good, you sound really sick, please call 9-1-1" and I think I just said "I can't afford it without insurance, don't worry, I think I'll be okay."

And she paused and said "I don't want to hang up the phone with you like this." And it sounded like she was holding back tears. And I don't remember what I said, I think that I would be okay, and I hung up.

I still think about her. I wonder if that phone call haunted her, or if she had dozens of calls like that a day. I wonder if she thinks about it at all, if she wonders if I died after she told me I didn't have insurance and therefore couldn't go to the hospital without incurring a tremendous financial burden. I wonder if she feels guilt or blame-- of course she shouldn't, it wouldn't have been her fault if anything had happened to me. Maybe it's self-centered to wonder if she thinks about it. I'm not the main character and it was just her job. But, still.

I think about how evil it was that we were put in that situation. Because offering year-long continuous coverage through the university plan would maybe cut into profits, maybe not benefit shareholders enough, maybe cut into Thompson's $10 million salary. While his minimum wage administrators have to feel afraid to hang up the phone, because on the other line someone might be dying, and they wouldn't know. While his patients hang up and decide to take their chances rather than put their family through that trauma.

This is UnitedHealthcare. This is Brian Thompson's legacy. This is why, understandably, an entire nation is jubilant that he was gunned down like the vermin he was. I don't care about his widow. I feel pity for his children, despite the fact that they will inherit millions, but I feel more pity for the children of his victims patients who are gone because they didn't want THEIR children to inherit crippling debt. Brian Thompson got what he fucking deserved. I pray that he not be the only one. I pray for continued safety, peace , and anonymity for his killer.

American healthcare is a disease.

28K notes

·

View notes

Text

Family Planning 101: The Bare Minimum of Parenting

Family Planning Isn’t a Luxury. It’s the Bare Minimum. It’s not happiness a child feels when they realize they were brought into the world by accident — a careless mistake, born of impulse or indifference. It’s not happiness they feel when they grow up lacking the means to chase their desires, or even meet their basic needs. And it is most certainly not happiness when they understand that the…

#emotional maturity#family planning#financial stability#generational trauma parenting#parenthood is not a legacy#raising kids in poverty#responsible parenting

0 notes

Text

📢 Life Insurance for Truckers Made Simple 📢 Protect your family and secure your future with life insurance tailored for truckers. Learn more with ASJ Insurance & Financial Services Inc. 📖 Read our blog: [Insert Link] #LifeInsurance #Truckers #ASJInsurance

View On WordPress

#ASJ Insurance & Financial Services Inc.#debt protection#Family financial security#income replacement#legacy planning#life insurance#Life insurance quotes#no-exam policies#term life insurance#truckers

0 notes

Text

The Generational Wealth Blueprint: A Legacy That Starts With You

0 notes

Text

The Role Of Financial Planner Services In Estate And Legacy Planning

Financial planner services play a crucial role in estate and legacy planning by ensuring wealth preservation, tax efficiency, and seamless asset transfer. Experts offering the best financial planning services in Fort Worth, TX help create wills, trusts, and gifting strategies tailored to your goals. With professional guidance, you can secure your legacy and provide financial stability for future generations.

0 notes

Text

A Question of Legacy

What we leave behind has been on my mind a lot, I mean it goes with the general theme of me contemplating my mortality and doing a general retrospective of my life through my journals and various writings. The natural place for me to start was thinking about what my parents left behind, and if they even had the luxury of considering legacy.

legacy /lĕg′ə-sē/

noun

Money or property given to another by will.

Something handed down from an ancestor or a predecessor or from the past: synonym: heritage.

"a legacy of religious freedom."

Similar: heritage

An individual who is either an applicant to an educational institution or a matriculated student and is the child of an alumna or alumnus.

Having dealt with breast cancer for a few years I think my mom was uniquely positioned to consider legacy. More importantly she knew she wouldn't be alive to care for her three children and being the indomitable spirit that she was, she wanted to make sure she had a hand in who would provide that care.

I think the nature of her life had led her to a place where she knew she couldn't easily and readily rely the ones around her particularly her siblings and her mother. Even as young as I was I could sense a low level of hostility or non-acceptance from her mother and a level of indifference from her siblings.

I have to wonder if the fact that she was a half-sibling is what bought this into play. It also makes it clearer why she wasn't interested in any such prefixes in her own home, albeit all of my siblings were half, she only believed we were brothers full stop. My mother's dad Samuel Hardy was not the same father of the rest of her siblings whose father was Diveller Todd a man of Trinidadian descent. My mom had her mother's maiden name or her grandfather's name, which she would pass on to two of her four children.

My last name came from my dad, and her last child also had his father's name. I am not quite sure why her first and second to last child were given her grandfathers name, and I will probably never know. But those Jones genes were extremely strong being readily apparent in most of her grandchildren and now her great grandkids.

In addition to the legacy of strong genes which isn't an overt act in my opinion more of something passive, Mary had made sure to have her estate planned, focusing primarily on the care of her children with no quarter given to her physical possessions. It was an extremely well conceived plan and developed with a lot of forethought. She had even made financial preparations for her imminent death having purchased savings bonds for all three of us that were payable upon her death.

Obviously any benefits she had accumulated from her job as a nurse's aide at the Veteran's Administration was also allocated to her tender-aged children as primary beneficiaries. I also recall that there were social security disbursements for the children after a parent died. No one can say Lizzie didn't take care of her kids and within her best abilities made a way for her children. Her two youngest would go to her first cousin whom she was close to Margaret, and her eldest would go to his parental grandparents who had showed a genuine interest in his life and education since he was a baby.

But as Rob Base said in his infamous song, It Takes Two. What pray-tell was my dad's legacy?

Sadly he can't get credit for his parents taking care of his child after his wife died. We all usually get a set of two whether we want them or not. His parents clearly knew he could barely take care of himself, not having steady addresses and never being gainfully employed, the care of a small child wasn't even a consideration. Once again they picked up the slack for their first born child, the one who had so much potential but never quite rose to meet it.

So what exactly was Raymond's legacy for his child?

Unlike his wife he made little to no considerations for his children, by the time of his death he had two kids, having lost the twins in a miscarriage. I can recall a word processor promised, but never fulfilled, which seemed to be a theme with him, continued disappointment, which is probably why his wife had him leave soon after my birth.

Genetically his children had naturally high aptitudes and instinctive intelligence, usually passing through school with little to no effort, but like Mary's strong genes that was arbitrary and not an active legacy, just a passive genetic trait.

I guess I could say definitively my love of comic books came from him, a derivative of his own interest in science fiction, fantasy and afro-futurism. I just wish it was something that he more deliberately pursued than it feeling like an after-thought. Meaning he usually gave me the comic books that he finished reading, sort of how a newspaper would pass through a household starting with the head of house, and ending up on the floor to pick up the dogs droppings.

That was a little harsh.

But he had no way of knowing that at the time I had adored him so much and wanted more of him, that I clung on to the only thing he ever gave me with an unbridled vengeance. I remember the threat of death to my younger siblings of even thinking about touching my comic books. I had given them more significance than they should have had. They were the stand-in for a present but very absent father.

I give him the mark of present directly comparing him to my other siblings dads who did a horrible job during their formative years of showing up for them. Curiously that feels like a low bar, defining the relationship with my father through the lack of one with my brothers. This doesn't feel like legacy, this feels like something I would see on my report cards, needs improvement.

One thing Raymond was good at was exposing me to various family members. I had met great aunts, various cousins and an assortment of his friends. In his own way he at the time seemed proud of his first born child, and seemingly wanted to let everyone else know. I even met my youngest brothers grandfather and I think his aunts even before he existed. It was something I attempted to mirror with him when we reconnected as adults, I felt it was something our dad would have done, so I made sure to connect him with as much of his paternal family as possible. Attempting to make up for his own mother's disdain for all things Raymond-related.

I never knew my maternal grandfather, being told that he died long before I was born. I only learned his name when I saw my mom's death certificate, something that obviously my eldest brother Michael knew about but had never shared with me.

Equally my mother's mother had no real contribution to any sort of legacy with me, 'Nana' to my cousins, she was no more than my mother's mom to me. My personal disdain attained psychosomatically from my mom's dissatisfaction and open hostility with her mom.

As I have said my paternal grandparents took me in after my mom died. They utilized all the funds my mom left behind to give me a small nest-egg for my college education that I had trouble finishing because they evicted me while I was away in college. But for seven years I did live with them, mind you feeling like a guest not a mainstay. Notwithstanding the burgeoning of my financial literacy started in this household, along with vigorous religious instruction. The former I kept the latter I discarded.

Through my father's mother I traveled the country and the world, her igniting a love of travel with my adult-self, who is now on their fourth passport. I guess the biggest legacy is one right out of the definition I posted at the top of this piece, I had land deeded to me from both grandparents, and when the last of them died I received the entirety of their estate which had probably been a couple of million during their lifetime but was now a few hundred thousand, not a bad inheritance to someone who had never really known the word before.

It would seem that my grandparents through their own affluence had the most legacy to pass on to their first-born grandchild. But it still leaves me perplexed on how to handle my own legacy, having no children of my own, and being estranged from my siblings, I wonder if legacy is a fallacy of the wealthy and a non-starter with the poor.

Is it important to pass something on to those that come after you? Furthermore will they even care? How do we qualify the sum of our lives and experiences in a way that could be helpful to the next generation? At one time I thought financial freedom would help, but I have seen such mismanagement and a total lack of financial literacy to the ones I would be called related to, that I really don't think I would help but hinder them. It is still a question I am attempting to sort through as I figure out what exactly my legacy will be.

[Photo by Brown Estate]

#legacy#inheritance#genetics#geneology#genes#comic books#father and sons#half siblings#breast cancer#estate planning#college fund#beneficiaries#will#grandparents#land#financial legacy#intergenerational wealth

1 note

·

View note

Text

Discover how wealth management firms are transforming traditional investing with advanced strategies, technology-driven insights, and personalized financial solutions.

#wealth management#portfolio services#investment firms#financial planning#asset management#estate planning#tax strategies#risk management#ESG investing#business succession#financial growth#retirement planning#AI in finance#investment strategies#wealth advisory#high-net-worth#tax efficiency#legacy planning#financial success#alternative assets

0 notes

Text

🌟 How to Build Generational Wealth with Real Estate: Simple Strategies for Success 🌟

Welcome! I’m Nada Azzouzi, a real estate agent passionate about helping individuals and families secure their financial futures. Today, let’s dive into how you can use real estate to build generational wealth—a type of wealth that benefits not just you but your children, grandchildren, and even beyond. Let’s get started! 💼🏠 💡 What is Generational Wealth? Generational wealth refers to money and…

#building wealth#diversify investments#equity growth#estate planning#Financial Freedom#financial legacy#Generational wealth#investing in property#investing in real estate for future generations#long-term wealth#passive income#Property Investment#property portfolio#real estate agent tips#real estate appreciation#real estate cash flow#real estate for beginners#real estate for families#Real Estate Investing#real estate leverage#real estate tax deductions#rental income#tax benefits of real estate#wealth building strategies#wealth building tips

0 notes

Text

Sun Life Grepa’s 5 Tips for a Brighter 2025

The start of a new year is like a fresh canvas—a chance to paint a vibrant picture of your future filled with purpose, love, and well-being. While resolutions often center around career milestones or financial ambitions, embracing a holistic approach can lead to a truly balanced and fulfilling year. So, how can you make 2025 your brightest yet? Here are five inspiring tips to guide you: 1.…

#balanced lifestyle#family bonding#financial planning#healthy living#legacy building#New Year 2025#New Year goals#personal growth#press release#self care tips#wellness tips

1 note

·

View note

Text

Comprehensive Wealth Management Services Tailored for Your Legacy

Explore Wills & Trusts Wealth Management for expert financial planning, estate management, investment strategies, and legal advice. Protect, grow, and secure your wealth for future generations with personalised services. Attend our seminars or webinars to plan a prosperous legacy. Visit us today.

#wealth management services UK#personalised financial planning#estate planning UK#investment management experts UK#legacy planning services#tax planning solutions UK#retirement planning advice#financial seminars UK#Wills & Trusts Wealth Management#expert legal and accountancy services UK

0 notes

Text

Key Strategies for Effective Elder Law Planning

Matthew J Grace, Realtor Planning for the Future: Securing Your Loved Ones with Elder Law | REady for Real Estate Podcast Recap Caring for an aging loved one comes with many challenges, but ensuring their wishes are honored and their legacy protected shouldn’t be one of them. In the latest episode of the REady for Real Estate podcast, host Matt Grace and co-host Big Mike from BMG Exteriors sit…

0 notes

Text

Leaving a Legacy: A Multifaceted Approach to Impacting Future Generations

Leaving a legacy is about more than just passing down material possessions; it’s about making a lasting impact on the world and the people we care about most. It’s about the values we uphold, the memories we create, and the positive change we contribute to. This multifaceted concept encompasses financial security for future generations, a commitment to social good, and responsible stewardship of…

#estate planning#ethical investing#financial legacy#legacy planning#philanthropy#social impact#sustainable living

0 notes