#FinancialModelling

Explore tagged Tumblr posts

Text

Canva’s Foray into Excel: What It Means for Financial Modeling and Investment Banking

In the finance industry, Microsoft Excel has been the undisputed champion for decades. From discounted cash flow models to merger analysis and portfolio tracking, Excel is at the core of every financial analyst and investment banker’s workflow. But in a surprising twist, Canva — a platform traditionally known for design and presentation tools — is now developing advanced spreadsheet capabilities that closely mirror Excel’s core functions.

While this might sound unconventional at first, Canva’s expansion into spreadsheet tools could have a significant impact on how professionals in finance, particularly those focused on financial modeling, data visualization, and presentations, approach their daily work. This shift is especially relevant for students and professionals enrolled in an investment banking course in Pune, where mastering both technical skills and presentation abilities is essential.

The Next Evolution of Spreadsheets: Canva Meets Finance

Canva is known for its user-friendly, drag-and-drop interface and its ability to make anyone look like a graphic designer. Now, it’s bringing that same design intelligence to spreadsheets. Rather than competing directly with Excel in terms of formulas and complex macros, Canva’s approach aims to simplify the interface while introducing elegant templates, visual storytelling, and built-in collaboration.

This development is not just a design upgrade. It signals a new era where financial professionals can build analytical models and communicate insights in one integrated platform. For those in fast-paced industries like investment banking, this could significantly streamline how data is interpreted and shared with clients and stakeholders.

Why This Matters for Investment Bankers and Financial Analysts

In investment banking, clear and effective communication is just as important as accurate analysis. Whether you are creating a pitch deck, building a company profile, or preparing financial projections, being able to turn raw data into compelling narratives is key.

Here’s how Canva’s spreadsheet tool could enhance workflows for finance professionals:

Visual Financial Modeling

Traditional Excel models often rely on rows of raw numbers and complex formulas, which can be difficult for clients or stakeholders to interpret. Canva’s interface allows users to build visual representations of financial models, including interactive charts, graphs, and infographics that make data more digestible. This can be especially valuable when presenting findings to non-financial stakeholders or during client meetings.

Real-Time Team Collaboration

Canva is built with cloud-first collaboration in mind. Unlike legacy Excel files that are often shared via email or stored on internal drives, Canva allows multiple team members to work on a spreadsheet simultaneously. Investment banking teams working across cities or time zones can benefit from this feature, particularly when dealing with time-sensitive M&A or IPO assignments.

Templates for Financial Reports and Models

For students and early-career professionals, Canva’s templates can offer a helpful starting point. Whether it’s a basic financial model, company profile, or investor report, having pre-designed layouts can accelerate the learning process. If you are currently enrolled in an investment banking course in Pune, you can use these templates to practice building models and presenting your analysis in a polished format.

Design-Driven Storytelling in Finance

As the financial industry evolves, the ability to present complex data in a clear, compelling way is becoming a competitive advantage. Canva bridges the gap between deep analytical thinking and clean, impactful communication. It enables analysts to present their insights not only accurately but also in a way that captures attention and drives decisions.

What This Means for Students and Aspiring Investment Bankers

Finance professionals of the future will need to combine analytical proficiency with digital fluency. While traditional Excel modeling skills remain essential, tools like Canva can enhance your ability to convey findings through presentations, dashboards, and collaborative reports.

If you are pursuing an investment banking course in Pune, now is the time to gain exposure to these evolving tools. Learning how to use Canva alongside Excel can help you stand out in internships, job interviews, and actual project work. A strong analyst is no longer just someone who builds a great model but someone who can also tell the story behind the numbers.

The Bottom Line: A Hybrid Future

Canva is not trying to replace Excel for in-depth financial modeling. Instead, it is carving out a complementary space where data meets design. By simplifying data presentation, enhancing collaboration, and reducing the need to switch between multiple tools, Canva is helping redefine how financial analysis is delivered.

Investment bankers, financial analysts, and students alike should pay attention to this shift. The finance industry is moving toward a hybrid future where technical skills and design intelligence go hand in hand.

Want to future-proof your finance career?

Enroll in the best investment banking course in Pune at the Boston Institute of Analytics. Our program not only covers advanced Excel and financial modeling but also prepares you for the evolving demands of the industry, including data storytelling and presentation strategies.

0 notes

Text

Course: Effective Financial Modelling in the Power Industry+201010232279

Want to enhance your financial decision-making in the power industry?

Struggling with financial data analysis and risk management?

Join the Effective Financial Modelling in the Power Industry course and gain essential skills!

االجودة الأوربية — European Quality

Build accurate financial models using Excel

Improve project performance with advanced data analysis

Assess risks and make smarter financial decisions

Don’t miss out — secure your spot now!

For inquiries & registration:

+2010 10232279

— — — — — — — — — — — — — — — — — — — —

#financialmodelling#powerindustry#energyfinance#FinanceTraining#RiskManagement#excelforfinance#projectfinance#InvestmentAnalysis#businessgrowth#financialplanning#oilandgas#petroleum #gasandoil#EnergySector#financeprofessionals

financial modelling, power industry, energy finance, financial analysis, risk management, Excel for finance, investment strategies, financial decision-making, project evaluation, corporate finance, energy sector, cost optimization, financial forecasting, capital investment, financial performance

#financialmodelling#powerindustry#energyfinance#FinanceTraining#RiskManagement#excelforfinance#projectfinance#InvestmentAnalysis#businessgrowth#financialplanning#oilandgas#petroleum#gasandoil#EnergySector#financeprofessionals#financial modelling#power industry#energy finance#financial analysis#risk management#Excel for finance#investment strategies#financial decision-making#project evaluation#corporate finance#energy sector#cost optimization#financial forecasting#capital investment#financial performance

0 notes

Text

Master in Management Studies (Global Financial Markets): Your Gateway to a Thriving Career in Finance

Are you looking to build a successful career in the dynamic world of global financial markets? The Master in Management Studies (Global Financial Markets) offered by BSE Institute Ltd in collaboration with the University of Mumbai and the Garware Institute of Career Education and Development is the perfect program to equip you with the skills, knowledge, and practical experience needed to excel in this fast-paced industry.

This 2-year postgraduate course is designed to provide students with a comprehensive understanding of global financial markets, combining theoretical knowledge with hands-on training. Whether you're aiming for a masters degree in management or a specialized masters in financial management, this program offers a unique blend of core and advanced topics to prepare you for a wide range of career opportunities.

Why Pursue a Master in Management Studies (Global Financial Markets)?

The financial markets are constantly evolving, and staying ahead requires updated knowledge and specialized skills. Here’s why this program stands out:

Industry-Relevant Curriculum: The course covers everything from foundational finance concepts like Financial Accounting and Business Statistics to advanced topics such as Financial Modelling, Investment Banking, and Treasury & Risk Management.

Global Perspective: With a focus on global financial markets, this program prepares you for careers not just in India but around the world.

Hands-on Experience: Gain practical exposure through real-world applications, case studies, and simulations, ensuring you’re job-ready from day one.

Reputed Collaborations: Offered in collaboration with the University of Mumbai and Garware Institute, this program ensures high academic standards and industry relevance.

Course Highlights

Foundational Modules:

Financial Accounting: Master the basics of accounting and financial statements.

Business Statistics: Learn statistical tools for financial analysis.

Derivatives: Understand derivative instruments and their applications.

Strategic Financial Management: Gain insights into corporate finance strategies.

Financial Statements and Fundamental Analysis: Analyze company performance through financial statements.

Advanced Specializations:

Forex & Debt Markets: Explore foreign exchange and debt instruments.

Financial Modelling: Build models for valuation and forecasting.

Investment Banking: Dive into mergers, acquisitions, and IPOs.

Treasury & Risk Management: Learn to manage liquidity and financial risks.

Securities Law: Understand the legal framework governing financial markets.

Career Opportunities

A masters degree in management with a focus on global financial markets opens doors to a wide range of roles, including:

Financial Analyst

Investment Banker

Risk Manager

Treasury Analyst

Portfolio Manager

Forex Trader

Compliance Officer

Financial Consultant

Whether you’re aiming for a masters in financial management or an MSc in business management, this program provides the perfect foundation for a successful career in finance.

Who Should Enroll?

This program is ideal for:

Graduates looking to specialize in global financial markets.

Professionals seeking to upskill and advance their careers in finance.

Aspiring financial analysts, investment bankers, and risk managers.

Anyone aiming for a master's degree in financial management or a masters degree management with a global perspective.

Why Choose BSE Institute Ltd?

Industry Connections: As part of the Bombay Stock Exchange, BSE Institute Ltd offers unparalleled access to industry experts and networking opportunities.

Practical Learning: Emphasis on real-world applications ensures you’re ready to tackle challenges in the financial markets.

Global Recognition: The program’s global focus prepares you for careers in international financial markets.

Conclusion

The Master in Management Studies (Global Financial Markets) is more than just a masters degree in management—it’s a comprehensive program designed to equip you with the skills and knowledge needed to thrive in the global financial markets. Whether you’re pursuing a masters in financial management or an MSc in business management, this course offers the perfect blend of theory and practice to help you achieve your career goals.

Take the first step toward a rewarding career in finance. Enroll in the Master in Management Studies (Global Financial Markets) today and unlock a world of opportunities!

#masterinmanagementstudies#mastersdegreeinmanagement#mastersdegreemanagement#mastersinfinancialmanagement#mastersdegreefinancialmanagement#MScbusinessmanagement#globalfinancialmarkets#financialmodelling#investmentbanking#treasuryandriskmanagement#BSEInstituteLtd#UniversityofMumbai#GarwareInstitute

1 note

·

View note

Text

Financial Modeling Best Practices

https://businessviewpointmagazine.com/wp-content/uploads/2024/11/19-Financial-Modeling-Best-Practices-Image-by-Karimpard-from-Getty-Images.jpg

Latest News

News

Stock Market Update: Nifty 50 Movement, Trade Setup, and Top Stock Picks

News

Markets on Edge: Indian Indices Dip, Bitcoin Hits Record, and Global Trends Shape the Week Ahead

News

BlueStone Jewellery Plans ₹1,000 Crore IPO with Fresh Issue and OFS

Source: Karimpard-from-Getty-Images

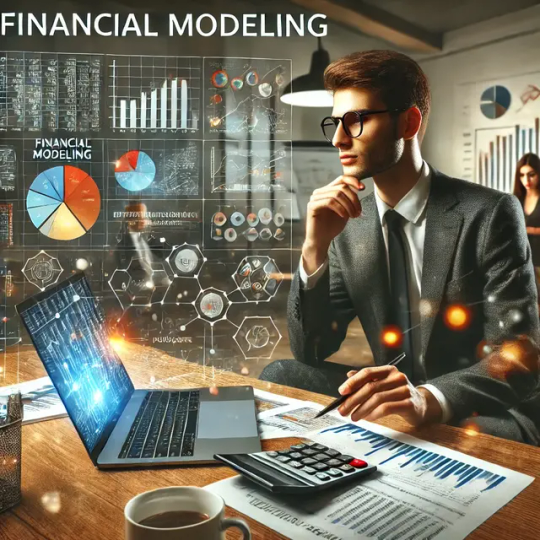

Financial modeling is a crucial skill for professionals in finance, investment banking, private equity, and corporate finance. It involves creating a representation of a company’s financial performance, which can be used for decision-making, forecasting, and valuation. To build effective and reliable financial models, it’s essential to follow certain best practices. In this article, we will explore the financial modeling best practices that can help ensure your models are robust, user-friendly, and adaptable to various scenarios, particularly for the Indian audience.

Here are the 9 Financial Modeling Best Practices

1. Define the Purpose of the Model

Before starting your financial model, clearly define its purpose. Are you creating a model for investment analysis, budgeting, or a merger and acquisition scenario? Understanding the objective helps in structuring the model effectively. For instance, if you’re building a model for a startup in India seeking funding, focus on revenue projections and cash flow analysis, which are critical for attracting investors. This clarity is one of the fundamental financial modeling best practices.

2. Maintain a Logical Structure

A well-structured model enhances usability and minimizes errors. Organize your model into distinct sections such as inputs, calculations, and outputs. Typically, the layout should follow these components:

Input Sheet: This includes all the assumptions and drivers (like growth rates, costs, etc.). Make sure to highlight these inputs clearly, as they are fundamental for any financial model.

Calculation Sheet: This section carries out all the necessary calculations. Use separate tabs for different calculations to avoid clutter.

Output Sheet: This displays the key outputs and metrics, such as financial statements (income statement, cash flow statement, and balance sheet), ratios, and charts.

Having a logical structure is one of the most crucial financial modeling best practices, especially for Indian professionals dealing with complex financial scenarios.

3. Use Consistent Formatting

https://businessviewpointmagazine.com/wp-content/uploads/2024/11/19.1-Use-Consistent-Formatting-Image-by-utah778-from-Getty-Images.jpg

Consistency in formatting enhances the readability of your financial model. Adopt a uniform style for headings, subheadings, fonts, and colors. For instance, you can use bold for headings, italics for input cells, and a distinct color for formulas. Additionally, using clear labels for rows and columns ensures users can navigate the model effortlessly.

In the Indian context, where multiple stakeholders may interact with the model, ensuring a clean and consistent format is paramount. This consistency aids in avoiding confusion and errors, thereby embodying another of the essential financial modeling best practices.

4. Implement Error Checks

Building error checks into your model can save time and enhance reliability. Use formulas that ensure inputs align with expectations. For example, if your revenue growth rate exceeds a certain percentage, include checks that flag these instances for review. This will help you catch any anomalies early in the modeling process.

Implementing these error checks is particularly vital in India, where businesses often deal with fluctuating market conditions and regulatory challenges. By embedding these checks, you adhere to the best practices of financial modeling, enhancing the model’s integrity.

5. Use Dynamic Formulas

Static formulas can lead to errors and make the model less flexible. Instead, opt for dynamic formulas that can adapt to changes in inputs. For instance, using functions like INDEX, MATCH, or OFFSET allows your model to respond to changes without requiring a complete overhaul.

In the Indian business environment, where economic factors can change rapidly, dynamic formulas enable financial models to remain relevant and useful over time. This adaptability is a key component of the financial modeling best practices.

6. Document Your Assumptions

https://businessviewpointmagazine.com/wp-content/uploads/2024/11/19.2-Document-Your-Assumptions-Image-by-utah778-from-Getty-Images.jpg

Transparency is crucial in financial modeling. Document your assumptions clearly within the model, preferably in a dedicated section or tab. This documentation should include justifications for each assumption, allowing users to understand the rationale behind your projections.

For Indian businesses, where stakeholders may vary widely in terms of financial literacy, this documentation becomes even more important. Providing a clear context for assumptions enhances the credibility of your model, which aligns with the core financial modeling best practices.

7. Stress Test Your Model

Conducting stress tests on your financial model can help identify vulnerabilities. Create scenarios where key variables change dramatically—such as economic downturns, changes in regulations, or shifts in consumer behavior—and analyze how these scenarios impact your financial forecasts.

For Indian companies, where market dynamics can fluctuate unexpectedly, this practice is particularly relevant. Stress testing ensures that your model is not only built for success under normal conditions but is also resilient against adverse situations, reinforcing the need for this best practice in financial modeling.

8. Keep It User-Friendly

A financial model should be intuitive and user-friendly. Avoid overly complex calculations that require extensive explanations. Use clear labels and provide instructions for navigating the model.

In India, where models might be used by individuals with varying levels of expertise, simplicity is essential. A user-friendly model minimizes the risk of errors and increases the likelihood of the model being used effectively, embodying one of the fundamental financial modeling best practices.

9. Regularly Update the Model

https://businessviewpointmagazine.com/wp-content/uploads/2024/11/19.3-Regularly-Update-the-Model-Image-by-PeopleImages-from-Getty-Images-Signature.jpg

Financial models should not be static; they need to be regularly updated to reflect new data, changing market conditions, and updated assumptions. Establish a routine for reviewing and revising your model to keep it relevant.

In India, with its rapidly changing economic landscape, keeping your model updated is critical for maintaining its accuracy and usefulness. Regular updates embody another essential practice within the realm of financial modeling best practices.

Conclusion

Following these financial modeling best practices can significantly enhance the reliability and usability of your financial models. By defining the purpose, maintaining a logical structure, ensuring consistent formatting, implementing error checks, and using dynamic formulas, you can build robust financial models that effectively serve your business needs.

In the context of the Indian market, where rapid changes and diverse stakeholder involvement are common, adhering to these best practices is paramount. Remember, a well-constructed financial model is not just a tool for analysis; it’s a strategic asset that can drive informed decision-making and successful financial planning.

Did you find this article helpful? Visit more of our blogs! Business Viewpoint Magazine

#investmentbanking#investment#financetips#stockmarket#fundamentalanalysis#financialmodelingcourse#financialmodelling#stockmarketinvesting#bcom#nse#financeskills#marketcapitalisation

0 notes

Text

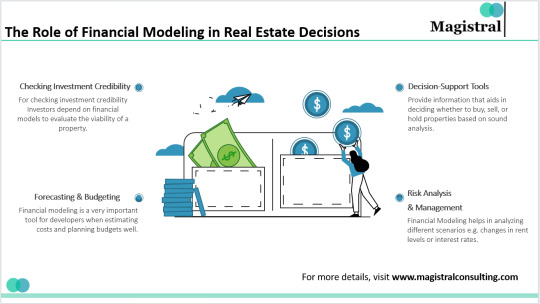

Real Estate Financial Modeling Essentials to Boost Your Investment Decisions

0 notes

Text

V-Score: A Novel Metric For Quantum Algorithm Performance

Researchers and scientists are continuously searching for methods and tools that can improve quantum problem-solving abilities in the rapidly changing field of quantum computing. The V-Score is one such invention that is causing a stir in the industry. This cutting-edge measure is revolutionizing the evaluation and optimization of quantum algorithms and advancing the limits of what is feasible in quantum computing.

We will discuss the V-Score‘s definition, operation, and reasons for being heralded as a secret weapon in the field of quantum problem-solving in this extensive post.

What is the V-Score?

A new metric for assessing the efficacy and efficiency of quantum algorithms is the V-Score. To put it simply, it is a quantitative instrument that assesses the performance of a quantum solution in relation to classical techniques. Researchers can better understand how quantum systems can beat traditional computers in tackling complicated problems by using the quantum, which evaluates a number of criteria such processing time, energy consumption, and solution correctness.

The capacity to correct for quantum noise and errors is one of its most notable properties. Despite their immense capacity, quantum systems are still vulnerable to operational mistakes and decoherence, which can compromise the dependability of their solutions. The V-Score aids in measuring these flaws and offers information on how near error-free a quantum solution is.

Why is the V-Score a Game-Changer for Quantum Problem Solving?

The intricacy of quantum problem solving and the enormous amount of computing power needed to solve it are frequently used to characterize the field. Problems that grow exponentially, such molecular simulations, cryptography, and optimization tasks, are difficult for conventional computer systems to handle. This is the area in which quantum computing shines. The difficulty has always been demonstrating that quantum solutions are superior to classical systems in practical applications, particularly in noisy settings.

By providing a consistent benchmark for comparing quantum algorithms to classical ones, the V-Score alters the rules of the game. Researchers may now clearly respond to the question of whether and to what degree quantum solutions are superior in particular situations by employing this metric. Improved assessment of the quantum advantage creates new opportunities in sectors like finance and pharmaceuticals, where more rapid and effective problem-solving may result in ground-breaking breakthroughs.

How Does the V-Score Work?

A number of metrics that measure a quantum algorithm’s performance are used to compute the V-Score, including:

Speed: In comparison to traditional algorithms, how fast does the quantum algorithm tackle the problem?

Precision: Does the precision of the quantum solution equal or exceed that of the classical approaches?

Energy Efficiency: Although the V-Score calculates the exact energy savings in particular situations, quantum computers generally use less energy than conventional systems.

Noise and Error Resilience: This measure takes into consideration how well the quantum system handles quantum noise and mistakes that arise during calculations.

These criteria are combined by the V-Score to create a single score that may be used to compare various quantum algorithms or solutions. A quantum solution with a higher V-Score is more efficient.

Applications of the V-Score in Quantum Computing

In a number of sectors where quantum computing is anticipated to have a revolutionary effect, the V-Score is proving to be an effective instrument. The V-Score is used in the following important areas:

Molecular Simulations and Drug Development

In order to precisely represent complicated molecules and chemical reactions that are challenging for classical systems to model, pharmaceutical companies are using quantum computing. Researchers may expedite the drug development process by using the V-Score to evaluate which quantum algorithms are best at forecasting molecular interactions.

Risk analysis and financial modeling

Quantum computing has the potential to resolve intricate optimization issues pertaining to risk assessment, pricing, and portfolio management in the financial industry. Financial organizations can assess whether quantum algorithms provide a notable edge over classical models in forecasting market movements or portfolio optimization by utilizing the V-Score.

Security and Cryptography

The field of cryptography faces both opportunities and risks due to quantum computing. They can develop new, quantum-resistant encryption protocols in addition to breaking conventional encryption techniques. By assessing the security strength of quantum encryption techniques, the V-Score makes sure that they are resilient enough to resist potential quantum assaults.

Machine learning and artificial intelligence

It is anticipated that quantum computing would transform AI and machine learning by improving the capacity to handle enormous volumes of data and identify patterns more quickly. AI researchers can improve the efficiency of their quantum-powered models by using the V-Score to assess how well quantum algorithms perform in model training and prediction.

The Future of the V-Score in Quantum Computing

The V-Score will become more and more significant in determining how problems are solved in a variety of industries as quantum computing develops. It makes it possible to assess quantum advantage precisely, which is essential for demonstrating the long-term sustainability and superiority of quantum solutions over classical techniques.

It is may anticipate that will continue to develop and improve, possibly incorporating new metrics that assess the efficiency of multi-qubit interactions, error correction, and quantum annealing. The V-Score will continue to be the standard metric for evaluating the performance of quantum computing with this development.

In conclusion

The V-Score is quickly emerging as a vital tool for tackling quantum problems. For scientists and business executives hoping to fully utilize quantum computing, its capacity to assess how well quantum algorithms perform in comparison to traditional methods makes it indispensable. As this field develops, will remain essential in spurring innovation, opening up new avenues in sectors like healthcare and finance, and assisting in the resolution of some of the most difficult problems facing humanity.

Read more on govindhtech.com

#VScore#NovelMetric#quantumcomputing#game#QuantumAlgorithmPerformance#AI#Security#Cryptography#machinelearning#artificialintelligence#financialmodeling#Riskanalysis#DrugDevelopment#GameChanger#technology#technews#news#govindhtech

2 notes

·

View notes

Text

Streamlined Bookkeeping Services with Celeste Business Advisors LLP — Accuracy You Can Trust

Accuracy and compliance start with clean books. At Celeste Business Advisors LLP, our professional Bookkeeping services ensure that your financial records are always organized, reconciled, and audit-ready. We help you stay compliant with local and international standards while giving you real-time insights into your cash position and profitability—whether you're operating in Mumbai, New York, or Toronto.

#CelesteAdvisory#StartupFinance#FractionalCFOforStartups#FinancialModeling#InvestorReady#GlobalStartupSupport

0 notes

Text

𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐌𝐨𝐝𝐞𝐥𝐢𝐧𝐠 𝐟𝐨𝐫 𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐢𝐚𝐥 𝐋𝐨𝐚𝐧 𝐁𝐫𝐨𝐤𝐞𝐫𝐬!

In the fast paced world of commercial lending, financial modeling is no longer just a technical skill it’s a powerful strategic tool. For commercial loan brokers, it can completely transform how deals are assessed, structured, and closed. Whether you're helping a business secure funding or analyzing complex proposals, mastering financial modeling allows you to deliver more value, reduce risk, and gain trust from both clients and lenders.

What is Financial Modeling?

At its core, financial modeling is the practice of building a detailed, dynamic representation of a business’s financial situation. It involves using spreadsheets and data inputs to forecast future performance, simulate different financial outcomes, and analyze the impact of various strategic decisions. Think of it as a financial roadmap it gives clarity, insight, and direction to both brokers and borrowers.

Why It Matters for Loan Brokers:

1. Informed Decision Making Financial models allow you to evaluate a client’s financial health with precision. You can present proposals that are realistic, tailored, and backed by data. Instead of relying on surface level numbers, you’ll be able to dig deep into cash flow patterns, debt service coverage ratios, and profitability trends resulting in stronger, smarter decisions.

2. Risk Assessment & Mitigation A good financial model helps you simulate various scenarios what happens if revenue drops by 15%? What if expenses rise unexpectedly? By analyzing different what if situations, you’re able to identify and prepare for potential risks, giving you an edge in both structuring deals and advising your clients.

3. Streamlined Loan Structuring With a well built model, you can structure loans that align with the borrower’s needs while satisfying the lender’s criteria. Whether it’s determining optimal loan amounts, repayment schedules, or interest structures, financial modeling ensures you’re not guessing you’re calculating. This can lead to quicker approvals and more sustainable loan terms.

4. Increased Client Trust Clients want to work with brokers who bring insight, not just options. When you walk in with a clear, data driven model that outlines their financial position and opportunities, it builds confidence. You’re seen as a knowledgeable partner, not just a facilitator.

5. Stronger Lender Relationships Lenders appreciate brokers who come prepared. A financial model presents a professional, transparent snapshot of the borrower’s situation, reducing ambiguity and making underwriting easier. It also shows that you’ve done your homework something lenders never overlook.

Key Takeaways

Financial modeling is an essential skill for today’s commercial loan brokers. It goes beyond spreadsheets it enables you to present credible, customized loan proposals based on real data. This helps you make informed decisions, mitigate risk, and structure smarter deals. More importantly, it builds trust with clients and strengthens your relationships with lenders. In a competitive marketplace, brokers who can model effectively stand out, close faster, and grow their business more sustainably.

#CommercialLoans#FinancialModeling#LoanBrokers#BusinessGrowth#FinancialAnalysis#BrokeringSuccess#RiskManagement#ClientRelationships#CommercialLending#BusinessLoans#FinancialForecasting#DealStructuring#CashFlowModeling#FinanceStrategy#CloseMoreDeals#TrustedAdvisor#LoanOrigination#FinanceForBrokers#ProfessionalEdge#ClientSuccess

1 note

·

View note

Video

youtube

(via Learn FINANCIAL FORECASTING Like a Pro in 2025! (DCF Modelling) #financialmodeling #live)

0 notes

Text

quantitative Techniques

Quantitative techniques involve mathematical and statistical methods used for decision-making, problem-solving, and data analysis in business and research. Common techniques include linear programming, probability analysis, forecasting, and statistical modeling, helping organizations make data-driven and efficient decisions.

0 notes

Text

IIM SKILLS investment banking course

IIM SKILLS investment banking course

Investment Banking Course The world of investment banking offers immense career potential, but navigating it requires the right skills and expertise. IIM SKILLS, a leading online educational platform, offers a comprehensive Investment Banking Course designed to provide students with a deep understanding of the industry’s nuances. This course is ideal for aspiring investment bankers, financial analysts, and professionals looking to upgrade their skills. IIM SKILLS' Investment Banking Course covers essential topics such as financial modeling, valuation techniques, mergers and acquisitions (M&A), private equity, and more. The curriculum is structured to combine theory with practical applications, allowing students to work on real-world case studies and financial models. This hands-on approach ensures that learners are job-ready by the time they complete the course. The program is taught by industry experts with years of practical experience in investment banking, offering valuable insights into the financial world. Students also benefit from the flexible online learning format, making it accessible from anywhere. Apart from in-depth learning, the course provides placement assistance, helping students secure job opportunities in top investment banks, financial institutions, and advisory firms. Additionally, students receive a certification from IIM SKILLS, a recognized name in the educational industry, boosting their credibility in the job market. For anyone aiming to pursue a successful career in investment banking, the Investment Banking Course from IIM SKILLS is an excellent starting point. Learn more about this course https://iimskills.com/investment-banking-course/. #InvestmentBankingCourse #IIMSKILLS #FinancialModeling #InvestmentBanking #MergersAndAcquisitions #PrivateEquity #CareerInFinance #FinanceCertification #JobPlacementInFinance #OnlineFinanceCourse

#InvestmentBankingCourse#IIMSKILLS#FinancialModeling#InvestmentBanking#MergersAndAcquisitions#PrivateEquity#CareerInFinance#FinanceCertification#JobPlacementInFinance#OnlineFinanceCourse

1 note

·

View note

Text

Top Finance Management Colleges in India

. In India, finance management has become a sought-after field of study, with numerous prestigious colleges offering specialized programs in this domain. This article highlights the top finance management colleges in India, their programs, and what makes them stand out read more...

#MBAFinance#FinanceLeadership#FutureFinanceLeaders#FinanceCareers#MBASkills#FinancialAnalysis#CorporateFinance#FinancialStrategy#InvestmentBanking#FinTechRevolution#WealthManagement#MBAGradLife#FinancialModeling#FinanceNetworking#RiskManagement#FinanceTrends

1 note

·

View note

Text

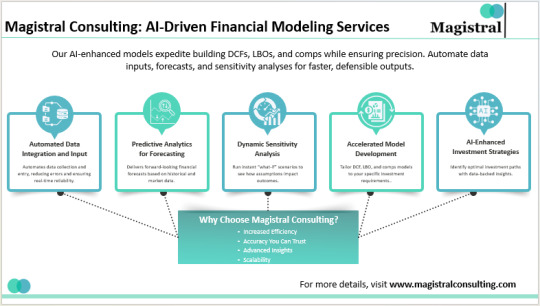

Financial Modeling AI for Accurate Forecasting

0 notes

Text

AI is revolutionizing financial modeling by delivering insights with unprecedented accuracy and speed. By leveraging machine learning algorithms, companies can analyze vast datasets, forecast trends, and mitigate risks more effectively than ever. Whether it’s predicting market movements, optimizing portfolios, or improving credit scoring, AI-driven models provide a competitive edge in decision-making. The future of finance is smart, and companies embracing AI are leading the charge. Want to explore how AI can transform your financial strategies?

Read more:

#AI#FinancialModeling#FinTech#MachineLearning#FinanceRevolution#InvestSmart#DataDriven#FutureOfFinance#RiskManagement#PortfolioOptimization

0 notes

Text

Blog Post: Skewness, Asymmetry, and the Unpredictability of Life – Insights from Chapter 6 of "Fooled by Randomness"

Explore Chapter 6 of "Fooled by Randomness," where Nassim Taleb unpacks the concepts of skewness and asymmetry in random events. Learn how these imbalances affect our understanding of risk and decision-making.

As we continue our exploration of Nassim Nicholas Taleb’s “Fooled by Randomness,” Chapter 6 introduces us to the concepts of skewness and asymmetry in random events. Titled “Skewness and Asymmetry,” this chapter dives into how these statistical properties affect our understanding of probability and risk. Taleb argues that many aspects of life, particularly in finance, are not evenly distributed…

#Asymmetry#BehavioralFinance#BookReview#CognitiveBiases#DecisionMaking#FinancialModels#FooledByRandomness#NassimTaleb#Probability#Randomness#RiskManagement#Skewness#Statistics#Unpredictability

0 notes

Text

Why is Financial Modelling Important?

In the fast-paced world of business, making informed financial decisions is more critical than ever. Financial modelling, a process that uses quantitative analysis to project a company's future financial performance, is a vital tool for businesses of all sizes. This blog post will delve into the importance of financial modelling, exploring how it enhances decision-making, manages risk, aids in strategic planning, and strengthens investor relations.

1. Enhancing Decision-Making

In today’s data-driven environment, making decisions based on solid evidence rather than intuition is paramount. Financial modelling provides a framework for predicting future financial performance, enabling businesses to evaluate different scenarios and outcomes.

Importance of Data-Driven Decisions: Financial models allow businesses to leverage historical data and trends to forecast future performance. This data-driven approach helps in making informed decisions that can significantly impact the company's bottom line.

Predicting Future Financial Performance: By creating detailed projections, businesses can anticipate future revenues, expenses, and profitability. This foresight enables companies to plan more effectively and allocate resources where they are most needed.

Evaluating Different Business Scenarios: Financial models can simulate various scenarios, such as changes in market conditions or shifts in consumer behavior. This allows businesses to prepare for different outcomes and make proactive adjustments.

Case Study: A mid-sized retail company used financial modelling to decide whether to expand its operations. By projecting costs and potential revenues, the company made an informed decision that led to successful expansion and increased profitability.

2. Risk Management

Identifying and mitigating financial risks is essential for long-term business success. Financial modelling plays a crucial role in risk management by providing tools to assess potential risks and develop strategies to address them.

Identifying Potential Financial Risks: Financial models help identify areas of vulnerability within a business, such as cash flow issues or market volatility. This early detection allows companies to address risks before they become critical problems.

Stress Testing and Scenario Analysis: By conducting stress tests and scenario analyses, businesses can evaluate how different factors impact their financial stability. This helps in developing contingency plans and strategies to mitigate risks.

Mitigating Risks with Informed Strategies: With a clear understanding of potential risks, businesses can implement strategies to minimize their impact. This might include diversifying investments, adjusting pricing strategies, or securing additional financing.

Example: A manufacturing firm used financial modelling to navigate a period of economic uncertainty. By identifying potential risks and developing contingency plans, the company maintained stability and continued to grow despite challenging market conditions.

3. Strategic Planning

Long-term success requires careful planning and alignment of financial goals with overall business strategy. Financial modelling is instrumental in strategic planning by providing a roadmap for future growth and resource allocation.

Long-Term Financial Forecasting: Financial models offer a detailed forecast of future financial performance, providing a clear picture of where the business is headed. This helps in setting realistic goals and planning for sustainable growth.

Aligning Financial Goals with Business Strategy: By integrating financial projections with strategic objectives, businesses can ensure that their financial goals support their overall mission and vision. This alignment is crucial for achieving long-term success.

Resource Allocation and Budgeting: Financial models assist in allocating resources efficiently and creating detailed budgets. This ensures that funds are used effectively and supports strategic initiatives.

Case Study: A tech startup used financial modelling to plan its expansion into new markets. By aligning financial projections with strategic goals, the company successfully entered new markets and achieved significant growth.

4. Investor Relations

Strong investor relations are crucial for securing funding and building confidence among stakeholders. Financial modelling plays a key role in communicating a company’s financial health and potential to investors.

Communicating Financial Health to Stakeholders: Financial models provide a transparent and detailed view of a company’s financial performance. This helps in building trust and confidence among investors and stakeholders.

Building Investor Confidence with Solid Projections: Accurate and detailed financial projections demonstrate a company’s potential for growth and profitability. This can attract investors and secure necessary funding.

Attracting Funding and Investment: Startups and growing businesses often rely on financial models to showcase their potential to investors. This helps in attracting investment and securing the capital needed for growth.

Example: A biotech startup used financial modelling to secure funding from venture capitalists. By presenting detailed financial projections and growth potential, the startup attracted significant investment and accelerated its development.

5. Performance Monitoring

Continuous performance monitoring is essential for staying on track and achieving business objectives. Financial modelling provides tools for tracking performance and making necessary adjustments.

Tracking Financial Performance Against Projections: Regularly comparing actual performance with financial projections helps businesses identify deviations and areas for improvement. This ensures that the company remains on track to achieve its goals.

Identifying Trends and Deviations: Financial models help in identifying trends, such as increasing costs or declining revenues, allowing businesses to address issues promptly.

Adjusting Strategies Based on Real-Time Data: With real-time data, businesses can make informed adjustments to their strategies, ensuring that they remain relevant and effective.

Case Study: A hospitality company used financial modelling to monitor its performance and adjust strategies in response to market trends. This proactive approach led to continuous performance improvement and increased profitability.

6. Valuation and Mergers & Acquisitions

Accurate valuation is critical in mergers and acquisitions (M&A) and financial modelling provides the tools needed for precise assessments.

Assessing Company Value Accurately: Financial models help in determining the true value of a company by analyzing various factors, such as assets, liabilities, and market conditions. This ensures accurate valuations during M&A deals.

Evaluating Potential Acquisition Targets: Businesses can use financial models to evaluate potential acquisition targets, assessing their financial health and growth potential.

Negotiating Better Terms in M&A Deals: With a clear understanding of value, businesses can negotiate better terms during M&A deals, ensuring favorable outcomes.

Example: A pharmaceutical company used financial modelling to evaluate and acquire a smaller competitor. This strategic acquisition strengthened the company’s market position and expanded its product portfolio.

Conclusion

Financial modelling is a powerful tool that supports informed decision-making, risk management, strategic planning, and investor relations. By leveraging financial models, businesses can navigate uncertainties, achieve their strategic goals, and build strong relationships with stakeholders. Integrating financial modelling into regular business processes is essential for long-term success and growth.

0 notes