#Financialliteracy

Text

built a profitable drop servicing business

https://bit.ly/se288

Share your thoughts in comments 💭💭

entrepreneurmindset #moneytalks #moneymindset #rich #financialfreedom #wealthymindset #hustler #richmindset #successmindset #financialliteracy #finances #businessmotivation #money #investments #investor #wealthypot

#moneytalks#moneymindset#rich#financialfreedom#wealthymindset#hustler#richmindset#successmindset#financialliteracy#finances#businessmotivation#money#investments#investor#wealthypot

14 notes

·

View notes

Text

Top 20 Personal Finance Podcasts for Women in 2024

Navigating the world of personal finance can be daunting, especially for women who face unique financial challenges and opportunities. Whether you're looking to pay off debt, invest, save for the future, or simply get a better handle on your finances, these podcasts offer expert advice, inspiring stories, and practical tips tailored specifically for women. Here are the top 20 personal finance podcasts for women in 2024:

1. The Financial Confessions by Chelsea Fagan 💬

Hosted by Chelsea Fagan, this podcast dives deep into the financial lives of influencers, experts, and everyday people. The honest and relatable conversations offer invaluable insights into managing money.

2. Bad with Money by Gaby Dunn 💸

Gaby Dunn explores the intersection of finance and social justice with humor and candor, making complex financial topics accessible and entertaining.

3. Clever Girls Know 💡

Hosted by Bola Sokunbi, this podcast is part of the Clever Girl Finance platform, offering practical financial advice for women looking to achieve financial independence.

4. HerMoney with Jean Chatzky 💰

Jean Chatzky's podcast covers everything from investing and saving to career advice, all with a focus on empowering women to take control of their financial lives.

5. So Money with Farnoosh Torabi 💵

Farnoosh Torabi interviews top business minds, authors, and influencers, providing actionable advice on money, business, and life.

6. The Fairer Cents ⚖️

Hosts Tanja Hester and Kara Perez tackle issues like financial independence, the gender pay gap, and economic inequality, offering a feminist perspective on money.

7. Brown Ambition 🏆

Mandi Woodruff and Tiffany "The Budgetnista" Aliche discuss finance, career, and lifestyle topics, helping women of color navigate their financial journeys.

8. Financial Feminist 👩🏫

Hosted by Tori Dunlap, this podcast aims to help women make more, spend less, and feel financially confident.

9. The Money Nerds 🧠

Whitney Hansen brings on guests to discuss their money stories, providing tips and tricks to help listeners manage their finances better.

10. Millennial Money 📈

Shannah Compton Game covers topics relevant to millennials, from student loans to first-time home buying, making finance relatable and understandable.

11. Journey to Launch 🚀

Jamila Souffrant shares her journey to financial independence and interviews guests about their money journeys, providing inspiration and practical tips.

12. Girls That Invest 📊

Simran Kaur and Sonya Gupthan provide a unique perspective on investing, focusing on demystifying the stock market for women.

13. Popcorn Finance 🍿

Chris Browning's short, digestible episodes cover a wide range of financial topics, perfect for busy women on the go.

14. Mo’ Money Podcast 💼

Host Jessica Moorhouse interviews personal finance experts, providing tips and strategies for managing money, investing, and achieving financial goals.

15. Money Girl 👩💼

Laura Adams offers quick and actionable personal finance tips in her podcast, perfect for women looking to improve their financial knowledge and habits.

16. Simple Wealth 🏡

Author and financial coach Rachel Cruze shares practical tips on budgeting, saving, and giving, helping listeners achieve a balanced financial life.

17. Couple Money 💑

Elle Martinez focuses on helping couples build stronger marriages and financial futures together, offering tips on managing money as a team.

18. The Investing for Beginners Podcast 📚

Dave Ahern and Andrew Sather provide beginner-friendly advice on investing, making the stock market accessible to women who are new to investing.

19. Optimal Finance Daily 🗓️

Hosts Diania Merriam and others narrate the best personal finance blog posts, offering a wide range of perspectives and tips on managing money.

20. Afford Anything 🌍

Paula Pant explores the philosophy of money management, interviewing experts and sharing strategies to help listeners afford anything they want in life.

These podcasts provide a wealth of knowledge and inspiration to help women take control of their financial futures. Whether you're just starting out on your financial journey or looking to deepen your understanding, there's a podcast here for you.

For more details and resources, visit Free Skills Hub

#womenempowerment#financeadvice#budgeting#moneytips#financialliteracy#podcastrecommendations#wealthbuilding#smartinvesting#womeninvesting#financialgoals

3 notes

·

View notes

Text

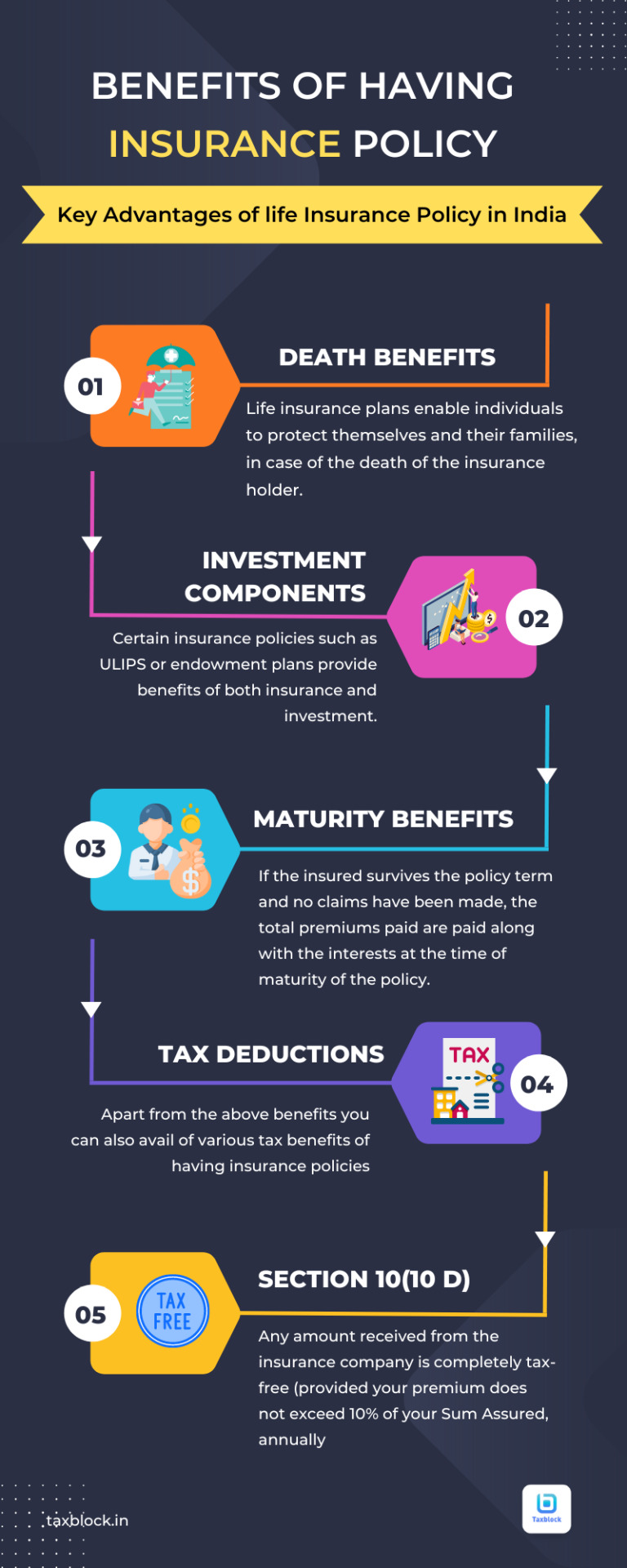

The top five key benefits of having an insurance policy in India Click on the link to learn more about an insurance policy.

#finance#money#investing#financialfreedom#investment#entrepreneur#invest#success#forex#motivation#investor#accounting#personalfinance#financialliteracy#wallstreet#smallbusiness#credit#insurancepolicy#financialservices#infographic#tumblrpost#financeeducation

31 notes

·

View notes

Text

How to Save Money with a Tight Budget!!!

Wallet feeling lighter than a feather? Don't worry, fam! We're all about saving smart, not living like a broke student (again). Share your budgeting hacks, score deals like a pro, and ditch sneaky spending habits in the comments! Let's turn #SquadGoals into #SavingsGoals!

Saving Money Responsibly

Pay yourself first

Avoid accumulating new debt

Set reasonable savings goals

Establish a time frame for your goals

Keep a budget

Record your expenses

Double-check all payment amounts

Start saving as early as possible

Consider contributing to a retirement account

Make stock market investments cautiously

Don't get discouraged

Chopping Your Expenses

Remove luxuries from your budget

Find cheaper housing

Eat for cheap.

Reduce your energy usage.

Use cheaper forms of transportation

Have fun for cheap (or free)

Avoid expensive addictions.

Spending Money Brilliantly

Spend money on absolute essentials first

Save for an emergency fund

Pay off your debt

Put away money next

Spend on smart non-essentials

Spend on luxuries last

#finance#money#investing#business#economy#budgeting#debtfree#financialliteracy#financialfreedom#personalfinance#sidehustle#passiveincome#fintwit#financialgoals#millennialmoney

3 notes

·

View notes

Text

Mastering Your Finances: A Step-by-Step Guide on How to Create a Budget

Creating a budget is a foundational step towards achieving financial stability and realizing your financial goals. Whether you’re aiming to save for a major purchase, pay off debt, or simply gain better control over your finances, a well-crafted budget is an invaluable tool. This comprehensive guide will take you through the essential steps on how to create a budget, empowering you to make informed financial decisions and secure a more secure financial future.

How to Create a Budget?

1. Set Clear Financial Goals

Before diving into the budgeting process, define your financial goals. Whether it’s building an emergency fund, saving for a vacation, or paying off student loans, having specific and measurable goals will guide your budgeting decisions.

2. Gather Financial Information

Collect information about your income, expenses, and debts. Compile pay stubs, bank statements, bills, and any other relevant financial documents. This step provides a comprehensive overview of your financial situation.

3. Categorize Your Expenses

Divide your expenses into fixed and variable categories. Fixed expenses, such as rent or mortgage payments and insurance, remain consistent each month. Variable expenses, like groceries and entertainment, can fluctuate. Categorizing expenses helps identify areas for potential savings.

4. Calculate Your Monthly Income

Determine your total monthly income, including salary, bonuses, freelance income, or any other sources of income. Understanding your monthly income is crucial for establishing a realistic budget.

5. List Your Fixed Expenses:

Write down all fixed expenses, such as rent or mortgage, utilities, insurance, and loan payments. These are recurring costs that remain relatively constant each month.

6. Identify Variable Expenses

Make a list of variable expenses, including groceries, dining out, entertainment, and transportation. Variable expenses can be adjusted based on your financial goals and priorities.

7. Include Savings and Debt Repayment

Prioritize saving and debt repayment in your budget. Allocate a portion of your income to an emergency fund, or retirement savings, and pay off outstanding debts. Treating savings as a non-negotiable expense ensures consistent progress toward financial goals.

8. Factor in Irregular Expenses

Account for irregular or annual expenses, such as insurance premiums, property taxes, or holiday spending. Divide these expenses by 12 to incorporate them into your monthly budget, preventing unexpected financial strain.

9. Subtract Expenses from Income

To better understand how to create a budget, subtract your total expenses from your total income. The result should ideally be a positive number, indicating that your income covers all your expenses. If the result is negative, adjustments may be needed to align your budget with your income.

10. Adjust and Prioritize

If your expenses exceed your income, revisit your budget and identify areas where you can cut back. Prioritize essential expenses and savings goals while minimizing non-essential spending. Adjusting your budget ensures financial sustainability.

11. Embrace the 50/30/20 Rule

Consider following the 50/30/20 rule, where 50% of your income goes to needs (housing, utilities), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment. This rule provides a simple guideline for balanced budgeting.

12. Use Budgeting Tools

Leverage technology to simplify budgeting. Numerous apps and online tools can help you track spending, set financial goals, and visualize your budget in real-time. Choose a tool that aligns with your preferences and makes budgeting more accessible.

13. Track and Review Regularly

Budgeting is an ongoing process, and the answer to “how to create a budget” might differ from person to person. Regularly track your spending against your budget, making adjustments as needed. Reviewing your budget ensures that it remains aligned with your financial goals and adapts to changes in your income or expenses.

14. Emergency Fund Planning

Prioritize building and maintaining an emergency fund within your budget. Having a financial safety net provides peace of mind and protects against unexpected expenses.

15. Seek Professional Advice

If you find budgeting challenging or have complex financial situations, consider seeking advice from financial professionals. Financial advisors can offer personalized guidance to help you achieve your financial objectives.

16. Mindful Spending Habits

Cultivate mindful spending habits as a key aspect of budgeting. Regularly assess your discretionary expenses and identify areas where you can make conscious choices to reduce unnecessary spending. This might include packing lunch instead of dining out or opting for cost-effective entertainment options.

17. Cash Flow Management

Effective budgeting involves managing cash flow strategically. Ensure that you have sufficient funds available for essential expenses and prioritize payment of bills to avoid late fees. Understanding your cash flow cycle helps prevent financial stress and keeps your budget on track.

18. Automate Savings Contributions

Simplify your savings strategy by automating contributions to savings accounts. Setting up automatic transfers ensures that a portion of your income is consistently directed towards savings goals, reinforcing the habit of saving.

19. Celebrate Financial Milestones

Acknowledge and celebrate financial milestones within your budget. Whether it’s reaching a savings goal, paying off a significant portion of debt, or achieving a specific financial target, celebrating successes reinforces positive financial habits and motivates continued progress.

20. Financial Education and Literacy

Invest time in expanding your financial education. Understanding financial principles, investment options, and economic trends empowers you to make informed decisions. Numerous resources, including books, online courses, and workshops, can enhance your financial literacy and contribute to long-term financial success.

Conclusion

Knowing how to create a budget is a fundamental step toward financial empowerment and security. By following these comprehensive steps, you can gain better control over your finances, make informed decisions, and work towards achieving your financial goals. Remember, budgeting is a dynamic process that evolves with your financial journey, so stay committed, stay flexible, and enjoy the benefits of financial well-being.

#BudgetingTips#moneymanagement#SmartSpending#financialwellness#moneymatters#financialliteracy#financialgoals#MoneySmart#wealthbuilding

2 notes

·

View notes

Text

The Top 10 Financial Obstacles That Prevent People from Achieving Their Goals

The top 10 financial obstacles that prevent people from achieving their goals include:

Living beyond one's means

Lack of emergency savings

High credit card debt

No budget

No retirement savings plan

No investment portfolio

Over-reliance on a single source of income

No financial education

Neglecting insurance coverage

Not having a plan for paying off debt

It's important to maintain a healthy lifestyle, even when you're on the go. If you're looking for healthy fast food options, be sure to check out https://www.aajkaakhbaar.com/are-you-saving-enough-money-to-hit-your-financial-goals. This website provides a comprehensive list of the top 10 healthy fast food options, so you can enjoy a delicious and nutritious meal, no matter where you are. Whether you're looking for a quick breakfast, a healthy lunch, or a satisfying dinner, this site has you covered.

#goals#financialobstacles#money#business#wealth#financialfreedom#personalfinance#moneytips#financialliteracy#financialindustry#personalwealth#wealthy#finance#financing#financialindependence#millionaire#investing#invest#aajkaakhbaar#aajkasamachar#realnewsofus

13 notes

·

View notes

Text

Lack of financial literacy is OVER‼️

Email linked on the page feel free to REACH OUT📲

IG - jg_strategic_financial

#life insurance#indexed universal life#financial services#financial#debt solutions#annuity#annuities#401k#financialliteracy

4 notes

·

View notes

Text

Best Financial Quotes You Should Follow - 2

"I believe that through knowledge and discipline, financial peace is possible for all of us." - Dave Ramsey

#finance#business#money#financialfreedom#entrepreneur#wealth#success#motivation#personalfinance#financialliteracy#entrepreneurship#financetips#faveplus

2 notes

·

View notes

Text

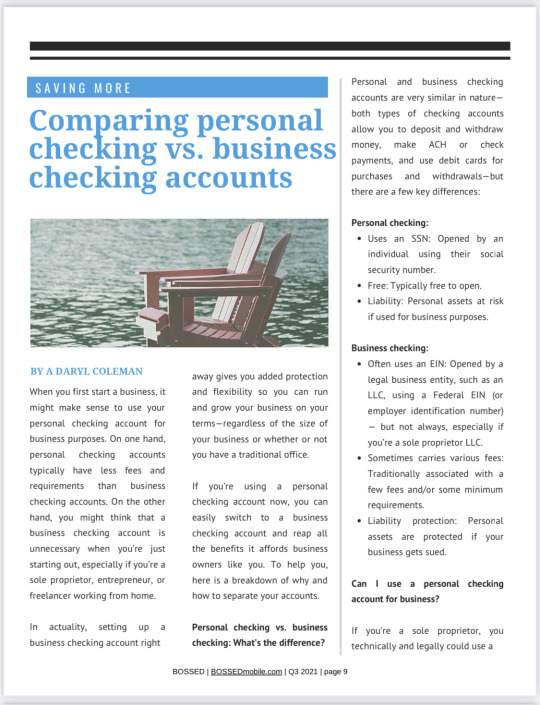

In this article, I examined a comparison of the use of your Personal Checking account vs opening a Business Checkkng account for your start-up business.

7 notes

·

View notes

Text

Be Financially independent

2 notes

·

View notes

Text

youtube

Video Title: How Bitcoin Transformed My Life: A Journey to Financial Freedom

Description for Tumblr:

Hey everyone, welcome to Unplugged Financial! 🌟 In my latest video, I dive deep into my personal journey with Bitcoin and how it has completely transformed my life. If you're curious about Bitcoin or looking for inspiration to improve your financial situation, this video is for you! 📈💰

What You'll Discover:

My early financial struggles and how Bitcoin helped me break free from the paycheck-to-paycheck cycle.

How learning about Bitcoin led to a profound understanding of money, inflation, and the financial system.

The practical steps I took to improve my financial habits and build a safety net.

Tips and advice for anyone starting their own Bitcoin journey.

Key Highlights:

Educating yourself about Bitcoin and doing your own research to build conviction in your choices.

Starting small with manageable investments and increasing your exposure as you become more comfortable.

Securing your Bitcoin investments with reputable wallets.

Staying informed about the latest developments in the cryptocurrency space.

Call to Action:

I'd love to hear your thoughts and experiences! Drop a comment and let’s chat. If you find this video helpful, please follow my blog for more content on financial freedom and Bitcoin. Let's embark on this journey together and unlock the potential of Bitcoin. Thanks for watching! 🙌

#Bitcoin#Crypto#Cryptocurrency#FinancialFreedom#BitcoinJourney#Investing#PersonalFinance#DigitalCurrency#BitcoinSuccess#CryptoEducation#BitcoinCommunity#UnpluggedFinancial#MoneyManagement#InvestInBitcoin#FinancialAwakening#BitcoinInvestment#CryptoLife#FinancialLiteracy#BitcoinTransformation#Blockchain#CryptoInvesting#BitcoinEducation#WealthBuilding#BitcoinRevolution#financial experts#unplugged financial#globaleconomy#financial empowerment#financial education#finance

4 notes

·

View notes

Text

Earn Money Without Investment: Top 10 Apps To Use In 2023 | Your Finance

youtube

#wealthbuilding#financialfreedom#investing#personalfinance#financialplanning#multipleincomestreams#debtfree#savemoney#financialgoals#financialliteracy#financialindependence#successmindset#downpayment#homeownership#savings#budgeting#realestate#homebuying#firsttimehomebuyer#mortgage#moneymanagement#dreamhome#moneyearningapps#passiveincome#workfromhome#onlinemoneymaking#makemoneyonline#top10apps#Youtube

4 notes

·

View notes

Text

Why Ignoring Your Finances Can Be Just as Bad as Obsessing Over Them | Day 4

Day 4 of Bookish Buzz's Reading Challenge focuses on personal finance, and what better way to dive into the topic than with the #1 book of all time on the subject: "Rich Dad Poor Dad" audiobook. This classic book, written by Robert Kiyosaki and Sharon Lechter, advocates for financial literacy.

youtube

The "Rich Dad Poor Dad" audiobook provides practical advice on personal finance and building wealth through investing in assets, real estate, and owning businesses. It emphasizes the importance of understanding the emotional aspect of money and avoiding negative consequences.

Rich Dad wants to teach people to master the power of money and not to be afraid of it. Being aware of fear and desire is crucial in avoiding life's biggest trap. Overall, the audiobook is a valuable resource for those looking to improve their financial literacy and achieve financial independence. So, if you're participating in Bookish Buzz's Reading Challenge, unleashing the power of this audiobook can be a game-changer in your financial journey.

#FinancialLiteracy#ReadingChallenge#BookishBuzz#rich dad poor dad#robert kiyosaki#growth#emotional aspect#moneymanagement#Youtube

2 notes

·

View notes

Text

Our objective is to revolutionize the way Australians get loans by offering a quicker, smarter, and more secure loan experience that is tailored to the customer’s convenience and needs.

📲 +61 424 242 196

📩 [email protected]

#finance#financetips#financialfreedom#financialliteracy#financegoals#financialindependence#financial#financialeducation#homeloan#homeloans#homeloanspecialist#personalloan#personalloans#mortgage#mortgagetips#mortgages#mortgageloans#mortgagelender#mortgagerates#mortgagebroker#commercialloans#lender#commercialloan#lenders

3 notes

·

View notes

Text

Unlock Your Child's Financial Potential: Teach Effective Financial Literacy

The article discusses the importance of financial literacy for children and how it can help them succeed in the future. The author emphasizes that financial literacy is not just about teaching children how to save money, but also about teaching them how to make smart financial decisions and how to plan for the future.

The article provides some practical tips for parents to help their children become financially literate, such as involving them in household budgeting and giving them an allowance to manage. It also suggests that parents should encourage their children to learn about personal finance through books, games, and online resources.

The article highlights the benefits of financial literacy for children, including better money management skills, increased financial security, and improved career prospects. It also emphasizes that financial literacy is a lifelong skill that children can benefit from throughout their lives. Read more.

#financialliteracy#teachyourkids#moneysmartkids#familyfinance#kidsempowerment#financialfuture#smartmoneyhabits#financialeducation#childdevelopment#futureleaders

4 notes

·

View notes