#Flexcube oracle Gold Partner

Explore tagged Tumblr posts

Link

Flexcube Implementation- Trempplin is an oracle Gold partner, experts on Flexcube implementation, support & training services. Get started now for your banking application upgrade.

#Flexcube Implementation Partners#Flexcube Implementation#Flexcube#Flexcube oracle Gold Partner#Oracle Flexcube

0 notes

Text

WHY DO WE NEED RPA IN BANKING?

The primary aim of RPA in the banking industry is to assist in processing the banking work that is repetitive in nature. Robotic process automation (RPA) helps banks & financial institutions increase their productivity by engaging customers in real-time and leveraging the immense benefits of robots.

Robotic Process Automation (RPA) is a form of business process automation that allows anyone to define a set of instructions for a robot or ‘bot’ to perform. In other words, RPA is an application of technology, governed by business logic and structured inputs, aimed at automating business processes. Using RPA tools, an organization can configure software, or a “robot,” to capture and interpret applications for processing a transaction, manipulating data, triggering responses, and communicating with other digital systems and many more.

What is IMPACTO iBorg?

“IBorg” is an “Intelligent RPA tool” from IMPACTO which makes use of Artificial Intelligence and Machine Intelligence to help business operations with getting increasingly nimble and practical through automation and rule-based back dull office processes. It permits clients to use similar automation situations for the lifecycle of the considerable number of applications utilized for their business processes. With IBorg, clients approach a single platform to serve the automation needs of their company, development, and operations teams.

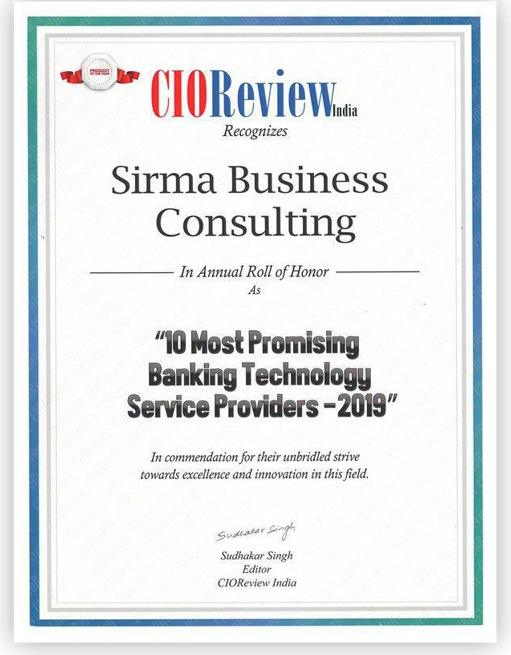

WHY CHOOSE SIRMA BANKING SERVICES?

Sirma India spends lot of efforts in Research & Development and has developed effort effective solutions which brings in not only saving cost and time for Flexcube Banks, but also provides effective solutions that improves operational efficiency. At Sirma we believe we are the extended arm of the institution and it our responsibility to take the complexity out of banking technology, so banks can focus on providing what they are for: ''Customer Delightful banking experience”. Sirma offers a range of Consulting, testing, RPA and Managed service offerings which will help banks stay on top of the cutting-edge technologies. Being Oracle go to Gold Partner provides you with the confidence that you are dealing with an authority when it comes to Oracle enterprise solutions and services.

Sirma Business Consultancy has been chosen as The Best Banking Technology Provider as we always try to reach the peak where we make lives simpler by using our technology. Sirma Business Consulting provides the best services around Oracle Flexcube for Core banking implementation, Testing, customizations, managed services and various other Flexcube services for banking & financial services, insurance, Credit unions, Cooperative societies and so on.

#oracleflexcube#robotic process automation#flexcube upgrade#test automation#banking software#digital banking#rpa robotic process automation

1 note

·

View note

Link

Flexcube Implementation Partners - Trempplin is an Oracle Gold Partner with extensive implementation experience across applications in the Banking and Financial Services domain. Expertise on Training & Implementation on Flexcube in India.

#Flexcube#Flexcube Implementation partner in India#Fexcube Implementation partenr#Flexcube Core Banking Solution'#Flexcube Implementation in Bangalore#Flexcube Consulting in Bangalore#Core Banking System#Core Banking Solutio

1 note

·

View note

Link

Flexcube Core Banking Solutions - Trempplin is an Oracle Gold Partner with extensive implementation experience across applications in the Banking and Financial Services domain. expertise on Training & Implementation on Flexcube in India.

#Flexcube Core Banking Solution#Flexcube Core Banking System#Flexcube Implementation in Bangalore#Flexcube Consulting in Bangalore#Flexcube Training Center in Bangalore#Digital Banking Solutions#Flexcube Testing Services

1 note

·

View note

Link

Trempplinan Oracle Gold Partner with extensive implementation experience across applications in the Banking and Financial Services domain having deep domain knowledge and experienced subject matter experts with proven implementation frameworks are constantly engaged with banks at various levels in providing consultative and solution-oriented and cost effective approach to complex problems.

0 notes

Photo

Best Oracle Flexcube core banking services in India

Sirma Business Consulting in India has made significant Research and devised effective solutions for major issues faced by the reputed Banking Agencies. Their technical guidance benefits the Flexcube Banks, by improvising their operational efficiency along with time and cost conservative services.

Sirma Business Consulting service’s main objective is to root out the Complexity in Banking Technology, thus enabling the banks to aim at ensuring the Customer Delightful Banking Experience. Sirma furnishes the wide range of Consulting, Testing, RPA, and Managed Service Offerings which would favor the banking agencies to reach the pinnacle among the cutting-edge technologies.

You would be overwhelmed and highly beneficial as Sirma also serves as an Oracle to Gold partners in which we would guide you with authoritative advice and provide expert solutions too.

#Oracle Flexcube core banking#Flexcube banking software#Digital banking solutions#core banking software services#business intelligence in banking#Robotic Process Automation#Test Automation#oracle Flexcube service company

0 notes

Text

Demand for Centralized Banking Might Enable the Growth for Global Core Banking Solutions Market

Core Banking Solutions Market Report

Core banking is defined as the service that is delivered by a group of networked bank branches to customers. These services include all important banking activities like account access, debts, loans, money transactions, and payments. Market Research Future (MRFR) has published and released a research report about the global core banking solutions market that estimates growth for this market with 4% CAGR (Compound Annual Growth Rate) during the forecast period between 2017 and 2023. In terms of cash, the market has been anticipated to rise to 13 bn by the end of the forecast period.

Analyzing the market structure, this report assays the future growth potential of the market. It observes the strategies of the key players in the market and follows the competitive developments like joint ventures, new product developments, mergers and acquisitions, research and the developments (R & D) in the market.

The major factors that are enhancing the market growth for core banking solutions include cost-effective solutions, customer demand for advanced banking technologies, and the growing need of operating customer accounts from a single server. Customers need to be able to visit the bank anytime and gain information about their account. Adopting core banking solutions enables banks to be helpful to customers in this regard. Core banking solutions also aid centralized banking. The restraints that can restrain the growth of the market include lack of awareness among enterprises of modern banking technologies and no synchronization between core banking solution and global industry expectations.

The global core banking solutions market has been segmented on the basis of deployment, solution, service, and lastly, region. On the basis of deployment, this market has been segmented into cloud deployment and on-premise deployment. The solution-based segmentation segments the market into account processing platform, deposits, enterprise customer solutions, loans, and others. Based on services, the market has been segmented into managed service and professional service.

Worldwide Core Banking Solutions Market — Competitive Landscape

The market of Core Banking Solutions appears to be fiercely competitive & fragmented owing to the presence of numerous matured & small key players accounting for a substantial market share. These market players try to gain competitive advantage through strategic partnership, acquisition, expansion, collaboration, product & technology launch. They invest heavily in the R&D to develop a technology that is completely on a different level compared to their competition.

Innovations/ Industry/Related News:

February 26, 2018 — Profinch Solutions Pvt.Ltd. (India) an Oracle Gold Partner, offering core banking transformation, support, application development etc. announced that it has achieved Oracle Validated Integration of FinCluez 1.6 with Oracle FLEXCUBE 12.3. With an end-to-end pre-integrated offering, Oracle FLEXCUBE customers can now choose FinCluez to accomplish their business intelligence endeavour with much greater agility.

Worldwide Core Banking Solutions Market — Segmentations

For an easy grasp and enhanced understanding; the report is segmented in to 4 key dynamics

By Deployment : Comprises — On Premise & On-Cloud.

By Service : Professional and Managed Services

By Solutions : Enterprise Customer Solution, Loans, Deposits, and Account Processing Platforms, among others.

By Regions : Europe, North America, APAC and Rest of the World.

More Information@ https://www.marketresearchfuture.com/reports/core-banking-solutions-market-3208

About Market Research Future: At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Reports (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research and Consulting Services. Contact: Market Research Future +1 646 845 9312 Email: [email protected]

#Core Banking Solutions Market Report#Core Banking Solutions Market#Core Banking Solutions Report#Core Banking Solutions#Core Banking Market

0 notes

Link

Flexcube Implementation- Trempplin specialized in Flexcube implementation, Support & Training. We are an Oracle Gold Partner & having 17+ Satisfied clients across Globe. Get started now for core banking applications and up gradation.

#Flexcube Implementation Partners#Flexcube#Flexcube Implementation#Flexcube Core Banking Solutions#Trempplin

1 note

·

View note

Link

Flexcube Implementation - Trempplin is an Oracle Gold Partner with extensive implementation experience across applications in the Banking and Financial Services domain. Expertise on Training & Implementation on Flexcube in India.

#Flexcube Implementation#Flexcube Implementation partner in India#Flexcube Implementation partner in Bangalore

0 notes

Link

Flexcube Implementation- We are an Oracle Gold Partner with extensive implementation experience. Run, Manage & Grow core banking application efficiently at a significantly reduced cost.

#Flexcube Implementation#Flexcube implementation and consulting services#Flexcube Implementation partner in India#Flexcube Implementation partner in Bangalore#Flexcube Implementation partners#Flexcube Implementation partner#Flexcube Implementation Services

0 notes

Link

Flexcube implementation- Trempplin is an Oracle Gold Partner specialized in Oracle FLEXCUBE/OBDX/OFSAA Implementation, Upgrades, Support, Training and IT Staff Augmentation Services specializing in Financial Industry.

#Flexcube implementation#Flexcube Implementation partner in India#Flexcube Implementation partner in Bangalore#Flexcube Implementation partners#Flexcube Implementation Partner#Flexcube implementation and consulting services#Flexcube Consulting services

0 notes

Link

Flexcube Implementation- Trempplin is an oracle gold partner, ethical, reliable and dedicated partner for core banking implementation.

#Flexcube Implementation#Flexcube Implementation partner in India#Flexcube Implementation partner in Bangalore#Flexcube Implementation partners#Flexcube implementation and consulting services#FLEXCUBE consulting services

0 notes

Link

Flexcube Implementation- Trempplin is an Oracle Gold Partner with extensive implementation experience. It is committed, trusted Oracle Partner providing IT solutions in Banking & Financial Industry.

#Flexcube Implementation#Flexcube Implementation partner in India#Flexcube Implementation partner in Bangalore#Flexcube Implementation partners#Flexcube Implementation Partner#Flexcube implementation and consulting services#FLEXCUBE consulting services

0 notes

Link

Flexcube Implementation- Trempplin is an Oracle Gold Partner with extensive implementation experience.

#Flexcube Implementation#Flexcube Implementation Partner#Flexcube Implementation Partners#Flexcube Implementation Partner in India#Flexcube Implementation Partners in Bangalore#Flexcube Implementation Partners in India

0 notes

Link

Flexcube Implementation - Trempplin is an Oracle Gold Partner with extensive implementation experience across applications in the Banking and Financial Services domain. Expertise on Training & Implementation on Flexcube in India.

#Flexcube Implementation#Flexcube Implementation in India#Flexcube Implementation Partners#Flexcube Implementation Partner#Flexcube Implementation partner in India#Flexcube Implementation partner in Bangalore

0 notes

Link

Flexcube Implementation- Trempplin is an Oracle gold partner, specialized in Flexcube Implementation, Flexcube training and Flexcube upgrade.

#Flexcube Implementation#Flexcube Implementation Partner#Flexcube Implementation Partners#Flexcube Implementation Partners in India#Flexcube Implementation Partner in Bangalore#Flexcube Implementation and consulting services

0 notes