Text

1 Dollar - Federal Reserve Bank of China Republic. 1938.

24 notes

·

View notes

Text

hi random thought but are any of my followers from out of the country? I like to collect foreign currency and I would be willing to trade American currency for whatever country you are from. I do not need euros as I’ve already been to Europe and have euros saved up. but if it’s anything other than a euro I am interested in it! if this post sounds interesting to you, message me! let’s help each other out! 🫶🏻

#random thoughts#foreign currency#money#old money#pay me money#money in the bank#currency#foreign#foreign affairs#foreign policy#foreign languages#foreigners#foreigner#Europe#european#Europa#travel#traveling#collection#collecting money#collector#collectorlife#collectibles#actually mentally ill#message me#send messages#messages

2 notes

·

View notes

Text

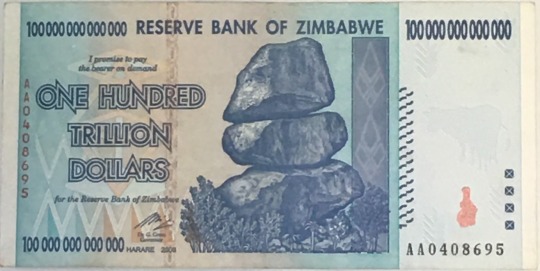

Zimbabwe’s “RTGS Dollar” Can Be Used to Purchase New Gold Coins; Not So for 2008 Zim Inflation Currency

Zimbabwe's Central Bank recently introduced a new set of gold coins in a bid to boost the country's economy. The coins, which come in denominations of 2, 5, 10, and 20 Zimbabwean dollars, are said to be made from locally sourced gold.

The introduction of the new coins has been met with mixed reactions, with some Zimbabweans expressing excitement at the prospect of having a new form of currency, while others have raised concerns about the practicality of using gold coins in everyday transactions.

Which Zim Currencies Can Be Used to Purchase the Coins?

One of the main questions that has been raised is whether RTGS (Real Time Gross Settlement) dollars can be used to purchase the gold coins. RTGS dollars are Zimbabwe's official currency and are used for electronic transactions, but they are not widely accepted by all merchants.

According to the Reserve Bank of Zimbabwe, the new gold coins can be purchased using any form of legal tender, including RTGS dollars. This means that Zimbabweans who have RTGS dollars can use them to buy the gold coins.

What about Zimbabwe’s 2008 Hyperinflation Currency?

Unfortunately for collectors around the world who have made the 2008 $100 Trillion Zimbabwe banknote one of the most popular numismaic collectibles of all-time, they won’t be able to help land the new gold Zimbabwe coins.

The reason is rather simple. 2008 Zimbabwean money cannot be used to buy anything, much less cold coins. In 2008-2009, Zimbabwe experienced hyperinflation, and as a result, the currency became practically worthless. In response, the Zimbabwean government abandoned the Zimbabwean dollar and adopted a multi-currency system. The primary currencies used in Zimbabwe are now the US dollar, the South African rand, and other foreign currencies. At the height of the hyperinflation, Zimbabwe released a $100 trillion dollar bill, which at its height was worth something like $1.36 USD.

Gold coins, like any other goods or services, typically require a recognized currency or a form of payment that is widely accepted. Since the 2008 Zimbabwean money is no longer in use and has no value, it cannot be used to purchase gold coins or any other items. If you're interested in buying gold coins, you would need to use a recognized currency or another form of payment accepted by the seller.

However, while officiallt the RTGS dollar can be used to purchase the coins, some experts have warned that using RTGS dollars to purchase gold coins may not be the most practical option. This is because the value of gold is constantly fluctuating, and it may be difficult for merchants to accurately determine the value of the coins in RTGS dollars.

Despite these concerns, the introduction of the new gold coins is seen as a positive step towards stabilizing Zimbabwe's economy, which has been struggling for years due to hyperinflation and a shortage of foreign currency.

The use of gold as a form of currency is not new in Zimbabwe. The country has a rich history of gold mining, and gold was once used as a medium of exchange before the introduction of paper currency.

In recent years, there has been a renewed interest in gold as a form of currency, with some countries, such as China and Russia, increasing their gold reserves in an effort to diversify their currencies.

The introduction of the new gold coins in Zimbabwe is therefore seen as a step towards aligning the country with this trend. It remains to be seen whether the coins will be widely adopted by Zimbabweans, but for now, they represent a glimmer of hope for a country that has been through so much economic turmoil in recent years.

#zimbabwe currency#zimbabwe#zim#zims#currencies#currency#foreign currency#banknotes#banknote#100 trillion#100trillion#rtgs dollar#money#african money#cash#zimbabwe cash#zimbabwe money#gold#gold coins#zimbabwe gold coins#coins

11 notes

·

View notes

Text

US Dollar reserves of the Philippines reach all-time high of almost $112 billion

Based on the preliminary data of the Bangko Sentral ng Pilipinas (BSP), the American Dollar reserves of the Philippines reached $111.981 billion (as of September 2024 specifically) which counts as a new all-time high, according to a Manila Bulletin business news report. To put things in perspective, posted below is an excerpt from Manila Bulletin report. Some parts in boldface… The country’s US…

#American Dollar#Asia#Bangko Sentral ng Pilipinas (BSP)#banking#Blog#blogger#blogging#business#business news#Carlo Carrasco#cash#coins#Dollars#economic#economic dynamism#economic forecast#economic growth#economic simulation#economics#Economy of the Philippines#finance#foreign currency#geek#investing#journalism#Manila Bulletin#Metro Manila#money#news#Philippine economy

0 notes

Text

#hard currency#soft currency#foreign currency#currency#bitcoin#intangible assets#tangible assets#nft

0 notes

Text

Westpac said:

Although Westpac has effectively hedged [interest rate and currency] risks on a pre-tax basis, it is not able for US tax purposes (in contrast to the tax laws of other jurisdictions) to recognise gain or loss arising from transactions between its branches, although such a gain or loss is recognised for transactions with customers . . . The increase in tax liability relates to an area of US tax law that is not clearly defined and results from a reassessment of the appropriate treatment of interbranch transfers of customer swaps and a review of transactions that might be subject to such treatment. Westpac is implementing changes in its interbranch hedging of global trading of swaps and foreign currency forward contracts to minimide future imbalance between tax jurisdictions. Mr Anthony J. Walton, chief general manager, Americas and Europe group and a director of the bank, informed the board that he had relied on assurances from his senior management that all tax matters had been or were being addressed. He also said that, if the board wished, he would offer to leave. The board has asked Mr Walton to continue in his executive position into the first quarter of 1993 to work out an orderly transition. It has also accepted his resignation as a director and acknowledged his outstanding contribution to the bank.

"Westpac: The Bank That Broke the Bank" - Edna Carew

#book quotes#westpac#edna carew#nonfiction#hedging#taxes#internal revenue service#irs#united states#tax law#foreign currency#tony walton#general manager#board of directors#90s#1990s#20th century#resignation#transition

0 notes

Text

In July 1989, in a judgement described by legal experts as 'the key to the floodgates', the Federal Court ruled that Westpac acted negligently and deceptively in arranging a loan for a Brisbane-based foreign-currency borrower, Domenic Chiarabaglio, who was awarded unspecified damages and full costs.

"Westpac: The Bank That Broke the Bank" - Edna Carew

#book quote#westpac#edna carew#nonfiction#july#80s#1980s#20th century#judgement#court case#federal court#negligence#deceptive#loans#lending#banking#finance#brisbane#australia#foreign currency#domenic chiarabaglio#damages#costs

0 notes

Text

Embracing the Digital Nomad Life in Retirement

Image: Freepik Entering retirement opens up a world of possibilities, and for some, the digital nomad lifestyle is an appealing choice. This journey offers freedom, adventure, and a chance to redefine your golden years. However, transitioning into a digital nomad requires careful planning and preparation, including financial assessments, goal setting, and research. Here’s how you can make the…

View On WordPress

#Algarve#Digital Nomad#expats in Portugal#Foreign Currency#Retire abroad#retire overseas#retirement#Retiring to Portugal#Silver Coast#Tourism#Villa Rentals

0 notes

Text

#Mine#American $1 Bill#Canadian 1 cent (discontinued)#10 Pence#10 Pesos#USA Quarter Dollar#10 Cent Euro#1 Cent Euro#5 Cent Euro#20 Cent Euro#$1 Euro#$2 Euro#50 Cent Euro#American 5 Cent#American Dimes#$5 Canadian paper bill (Discontinued)#$5 Euro bills#$20 Euro bills#Foreign Currency

0 notes

Text

Best ECN Forex Broker: A Comprehensive Guide for Traders

An ECN forex broker is a type of broker that uses an electronic communication network (ECN) to connect traders directly to liquidity providers, such as banks, hedge funds, and other brokers. They also offer a wide range of trading instruments, such as currency pairs, metals, indices, commodities, and cryptocurrencies.

0 notes

Text

Revolutionising Forex for Travelers: BookMyForex Launches New App

BookMyForex, the online forex platform, has introduced a groundbreaking update to its application designed to transform the forex transaction experience for international travellers. This latest innovation focuses on alleviating the common financial burdens faced during overseas travel by enhancing the functionality and user experience of their True Zero Markup Card.

Instant Reload Feature: A Game-Changer for Global Travelers

The newly updated app includes a standout feature: the instant reload capability, which allows travellers to top up their forex cards in real-time digitally. This eliminates the delays and complications often associated with running out of funds abroad.

Read More:(https://theleadersglobe.com/life-interest/travel/revolutionising-forex-for-travelers-bookmyforex-launches-new-app/)

#BookMyForex#foreign currency#revolutionizing#global leader magazine#the leaders globe magazine#leadership magazine#world's leader magazine#article#best publication in the world#news#magazine#business

0 notes

Text

Buy currency online with Orient exchange; Best forex company

Orient Exchange, a leading name in the financial services industry, provides a seamless and convenient platform for individuals to buy currency online. With a commitment to excellence, Orient Exchange offers a user-friendly interface that allows customers to effortlessly navigate through the currency exchange process from the comfort of their homes.

One of the key advantages of buying currency online through Orient Exchange is the competitive exchange rates they offer. By leveraging their extensive network and partnerships, Orient Exchange ensures that customers get the best value for their money. The platform is designed to provide transparency, displaying real-time rates and eliminating hidden fees, enabling customers to make informed decisions.

Security is a top priority at Orient Exchange, and their online currency exchange platform employs robust encryption measures to safeguard customer information and transactions. This focus on security instills confidence in customers, assuring them of a safe and reliable online foreign currency exchange experience.Furthermore, Orient Exchange offers a wide range of currencies to cater to diverse travel and business needs. Whether it's for a vacation abroad, business travel, or international transactions, customers can find the foreign exchange they need with ease.

In summary, buying currency online with Orient Exchange combines convenience, competitive rates, and security, making it a trusted choice for individuals seeking a reliable and efficient platform for their forex requirements.

0 notes

Text

Accepting Losses With Grace

The lack of a proper trading plan which includes precise rules for entering and exiting a trade will most certainly guarantee failure over the long term. Beginners usually suffer from the same common ailments. They abandon trading plans purely on impulse because things are not going exactly as how they had envisioned. Repeatedly they use unreliable methods that fail to produce a profit. Many traders hold on to losing positions telling themselves “it is going to turn” when every indicator says otherwise because they cannot bear the thought of a loss.

Why do they torture themselves? Why don’t they just identify what’s going wrong and make a change? For some people recognizing that a trade or even a trading method is not working and making a change is easy, but for others it’s very difficult. They have to look at their limitations admit that they have made a mistake and that’s hard because it hurts our ego. Psychologically it’s risky, it’s often easier to fool ourselves. Just keep going, living in a state of denial until your account is depleted. If you recognize any of these traits in yourself you must stop trading immediately.

Take a good look at what has been happening, try and identify the problem. If you look close enough you may see a pattern. This is why it is vital to record every trade and as much information about it as possible. You have to break out of old patterns and see things in a new light.

You will never be a successful trader if you continue to live in a state of denial. What can be done to return to reality? There is a lot you can do. First of all make sure you are not trading under stress. When stressed out you can’t see clearly, you become rigid and unable to see alternative views. One of the easiest solutions is to trade smaller. The smaller the trade the less the stress, especially for the beginner. If you are experienced and in a loosing streak reduce your contracts until you get your confidence returns. Some people need to take a break altogether. Get away from it all. Take your mind off the trading.

The second thing you can do is to make sure you have a life. Trading can be addictive especially when you are winning. Do not put all your emotional eggs in the trading basket. You need to have other roles that give your life meaning and purpose. By defining your identity in a variety of ways, you will not place un-natural importance on trading events. Therefore, you will be able to take losses in stride and look at your trading more objectively.

Finally, radical acceptance is a key mental strategy for coping with market uncertainty. Many traders make the mistake of thinking they can control the markets. Nobody can control the markets. We must learn to accept anything that comes our way and to trade accordingly. Adopt the attitude that trading is a journey and that all we can do is go where the markets take us.

To succeed on this journey you cannot afford to lose too much. Manage risk and just accept what you get and enjoy the ride. This way you will trade more freely and creatively. Don’t live your life in denial. Accept your limitations, work around them, and become a winning trader. Write out your trading plan with precise entry and exit points. Most important set your stops and mentally decide you will not break them. Test your system on paper and when confident test in real time with the minimum contract size. You will have losing trades, accept them with grace and go on to the next trade.

0 notes

Text

In May 1992 Frank Conroy wrote a 'comfort' letter on behalf of Rob Douglass:

To whom it may concern

As managing director of Westpac, I write to clarify certain matters which pertain to the reputation of Mr R.H.V Douglass and arise out of his position as managing director of Partnership Pacific Limited ('PPL'), a wholly owned subsidiary of the bank.

The bank employed Mr Douglass between May 1983 and December 1986 as general manager, merchant banking. One of his duties was to take up the position of managing director of PPL from late 1984. That role involved responsibility for the seven divisions of PPL. The divisions reported to Mr Douglass through the general manager of PPL. The board of directors of PPL met on a monthly basis. It consisted of senior Westpac personnel, the chairman being the then deputy managing director of Westpac.

Mr Douglass had the ultimate responsibility within PPL for a foreign currency product which involved the management of clients' foreign currency exposures and was in vogue throughout the banking community during the 1980s. As is now well known, banks and their clients had difficulties in coping with the market environment which developed after deregulation of exchange controls in 1983 and gave rise to extraordinary volatility of the Australian dollar. PPL experienced its own internal difficulties, both with staff and computer systems. In 1985, Mr Douglass engaged the bank's solicitors, Allen Allen & Hemsley, to advise on the procedures to be established and documentation.

In 1987, the bank asked Allen Allen & Hemsley to carry out a review of the foreign currency product marketed by PPL. The result of the initial review is reported in what later became known as the 'Westpac Letters'. It is wrong that Mr Douglass has suffered as a result of being named in these 'Westpac Letters'. I believe that Mr Douglass, in his administration of PPL, acted as a reasonable person of integrity could be expected to have acted in the current state of knowledge of the market. The opinions of Mr Douglass and his version of events were not available to the author of the 'Westpac Letters', but have been made available to me. They cause me to think that the wholly negative assessment of Mr Douglass's performance in relation to the foreign currency product presented in the 'Westpac Letters' is not warranted.

It is my earnest wish, both personally and on behalf of the bank, that Mr Douglass should continue his career free from any negative associations arising out of his time with the bank or PPL.

"Westpac: The Bank That Broke the Bank" - Edna Carew

#book quotes#westpac#edna carew#nonfiction#may#90s#1990s#20th century#frank conroy#letter#rob douglass#clarification#managing director#ppl#partnership pacific ltd#subsidiary#december#80s#1980s#general manager#banking#finance#lending#loans#foreign currency#board of directors#responsibility#volatility#forex market#solicitor

0 notes

Text

Foreign-currency loans were generally for terms of five years and in many cases were non-amortising, with no principal repayment until the loan matured, so that the losses would not be realised until then.

"Westpac: The Bank That Broke the Bank" - Edna Carew

#book quote#westpac#edna carew#nonfiction#foreign currency#loans#lending#banking#finance#amortize#loss

0 notes