#Free CPE Webinars

Text

Illumeo's elite cadre of 200+ industry-experienced instructors deliver invaluable insights in every free CPE webinar. With a library boasting over 1,000 courses spanning Finance, Accounting, Internal Audit, HR, Marketing, and Sales, Illumeo empowers you with profound knowledge. Benefit from direct interaction and Q&A sessions, gaining context and expertise that propels your career forward.

#Illumeo Instructors#Industry Experts#Free CPE Webinars#Professional Development#Career Advancement#Knowledge Empowerment#Finance Education#Accounting Training#HR Insights#Marketing Skills#Sales Strategies#Expertise Growth#Direct Interaction#Q and A Sessions#Career Progression

0 notes

Text

Earn Free CPE Credits for CFE | myCPE

Explore various platforms where you can get online free CE credits for CFE with free ethics courses. Click on the title to learn more.

0 notes

Text

Texas Humanties ... WTF? Taylor Swift in the Literature Classroom

In July, Humanities Texas will offer online teacher professional development programs for social studies and English language arts teachers.

youtube

Programs include "Taylor Swift in the Literature Classroom" (July 8),

Taylor Swift in the Literature Classroom (Summer 2024 Webinar)

On July 8, 2024, Humanities Texas will hold a webinar for English language arts (ELA) teachers comparing the work of one of today's most recognizable songwriters and performers, Taylor Swift, and commonly taught poetic texts and traditions in the secondary-level curriculum.

The webinar will take place over Zoom from 10:00–11:30 am CT on Monday, July 8, 2024.

Content will be aligned with the TEKS.

The program for English language arts teachers will compare the work of one of today's most recognizable songwriters and performers, Taylor Swift, and commonly taught poetic texts and traditions (lyric, dramatic, and narrative) in the secondary-level curriculum.

The program will provide strategies for finding ways to engage middle and high school students by showing how this pop-music icon uses traditional genres, motifs, and figures found in literary texts that seem remote from hers.

Participants will also investigate the ways in which she uses fairly familiar middle and high school texts as the basis or reference points for some of her writing.

Teachers are encouraged to share ideas with others hoping to incorporate Swift into their classroom instruction.

Like all Humanities Texas teacher programs, the webinar will emphasize close interaction with scholars, the examination of texts, and the development of effective pedagogical strategies and engaging assignments and activities.

Faculty

Elizabeth Scala of The University of Texas at Austin will lead the webinar.

Eligibility

The webinar is open to secondary-level English language arts teachers in Texas schools.

Attendance and CPE Credit

The online program is free to teachers and their schools. Participants will receive CPE credit and a wealth of curricular materials.

CPE hours will be based on Zoom attendance and adjusted if a participant misses any portion of the program.

In order to attend the webinar and receive CPE credit, you must be a registered participant.

How to Apply

Complete the online application for the "Taylor Swift in the Literature Classroom" webinar.

The webinar is made possible with major funding from the State of Texas with ongoing support from the National Endowment for the Humanities.

0 notes

Text

Join Our Free Masterclass: Cracking CISSP Domain 7 - Security Ops Decoded!

Discover the best practices for implementing and maintaining security measures to protect your organization.

👉Register Here: https://infosectrain.com/events/cracking-cissp-domain/

➡️In this exclusive webinar, you'll discover:

👉 Incident management

👉 BCP / DR plans

👉 Types of IDS

👉 RAID Volumes

➡️ Why Attend This Webinar

👉 Get CPE Certificate

👉 Access to Recorded Sessions

👉 Learn from Industry Experts

👉 FREE Career Guidance & Mentorship

#CISSP#SecurityOps#CyberSecurityTraining#FreeMasterclass#CISSPPrep#ITSecurity#SecurityOperations#CISSPExam#CyberSecurity#InfoSec#CISSPDomain7#TechTraining#SecurityCertification#CISSPStudy#ProfessionalDevelopment#infosectrain#learntorise

0 notes

Text

Join Us for Our Free CPE Webinar on March 14th!

Confused about what an ERP system is, how to buy it, and from whom, or what you truly need for a complete ERP implementation? You may think you know all the answers to these questions, but you’re likely missing key pieces of the puzzle. In this episode of The ERP Advisor, Shawn Windle will provide a crash course on the basics of ERP systems and highlight the value the right system can provide to your business.

Follow the link below to register for the event and discover the learning objectives

#erpsoftware#erpsolutions#erpconsultant#erpsystems

0 notes

Text

Free CPE

Empower your career with free CPE webinars. Dive into a wealth of knowledge, all at no cost. Stay updated with industry trends and earn CPE credits effortlessly. Start your learning journey today and discover the pathway to professional success.

0 notes

Text

📢Attention Michigan CPAs!

🎉Complete your CPE credit needs hassle-free with our exclusive 40 CPE package for Michigan CPAs.📚💼

Here's what's included in the Michigan CPA CPE Package: 📌Accounting: 8 Credits 📌 Auditing: 8 Credits 📌Taxes: 16 Credits 📌Finance: 1 Credit 📌 Ethics (Regulatory): 2 Credits 📌Computer Software and Applications: 3 Credits 📌Business Management and Organization: 2 Credits

⚖️ As per the Michigan State Board of Accountancy, things that Michigan CPAs should keep in mind:

➡️A minimum of 50% of CPE hours must be completed through interactive live webinars.

➡️ No more than 20% of CPE can be in Personal Development, Computer, Software, Application, Marketing, Communication, or Management.

➡️ 8 hours of CPE should be completed in the subject areas of accounting and/or auditing.

➡️ CPE Reporting Cycle of Michigan CPAs ends on June 30 (biennially).

➡️ Michigan CPAs can earn CPE Credits from NASBA Approved CPE Providers as long as it directly relates to their professional competence. Don't miss out on this opportunity to conveniently fulfill your CPE credit needs.

Enhance your professional competence with our comprehensive Michigan 40 CPE package. Subscribe to my CPE today! To verify the detailed requirements, please visit the Michigan CPE Requirement Page or the Board Website. Feel free to ask any questions or DM us. #MichiganCPA #CPEcredits #ContinuingEducation #ProfessionalDevelopment #myCPE

0 notes

Text

Free Webinar De-Mystifying Certified Protection Professional (CPP) Certification

Date: 25 Mar (Sat) Time: 09:30 PM -10:30 PM (IST)

Speaker: MR SUVI

Register now: https://www.infosectrain.com/events/de-mystifying-the-security-certifications/

Agenda for the BootCamp

Introduction

CPP Exam Domains

Exam Structure and Preparation Plan

Q&A

Why attend Infosec Train Event

Get CPE Certificate

Access to the recorded sessions

Learn from Industry Experts

Post support

0 notes

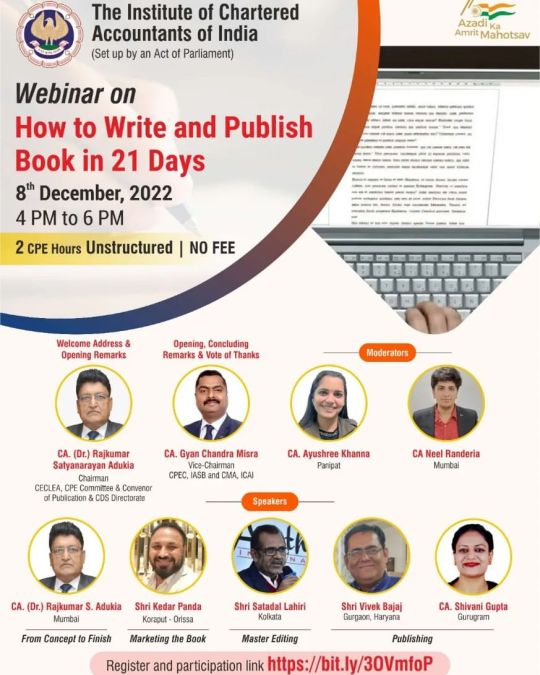

Photo

Bringing A to Z of Book Writing together with experts from the industry. 🔸️Get all your querries solved. 🔸️Grab the chance to get answers from 5 experts from the field. 🔸️Co-create your dreams into reality, present your thoughts and ideas to the world. 🔸️You never know which idea can be a life saver or a life changer for anyone. 🔸️By writing a book you inspire many if not millions. 🔸️You have a social #responsibility to pass on the great ideas to the next generation. 🔸️Let's be the #creators of the #ideabank of this world and contribute our bit. 🔸️Here's your #opportunity to learn from the experts. 🔸️Block your time and book your #FREE seat now as The Institute of Chartered Accountants of India brings this #webinar for you. Register here: Webinar on How to Write and Publish book in 21 Days organized by CPE Committee of ICAI on 8th Dec, 2022 from 4 PM to 6 PM Registration and Joining Link : https://bit.ly/3OVmfoP #icai #bookwriting #cpeevent #writingcommunity #writers #authors #publishedauthors #becomeanauthor #writerscommunity #writersofinstagram #aspiringwriter #aspiringauthor #expression #write #writeabook #icaistudents #icaiofficial #icaimembers #writersofig #writersoninstagram #writing #writinginspiration #getinspired #writerinme #writeforpassion #writeforindia #writeforgenerations #booklovers https://www.instagram.com/p/Cl1dQC7pzPP/?igshid=NGJjMDIxMWI=

#responsibility#creators#ideabank#opportunity#free#webinar#icai#bookwriting#cpeevent#writingcommunity#writers#authors#publishedauthors#becomeanauthor#writerscommunity#writersofinstagram#aspiringwriter#aspiringauthor#expression#write#writeabook#icaistudents#icaiofficial#icaimembers#writersofig#writersoninstagram#writing#writinginspiration#getinspired#writerinme

0 notes

Text

The Real Truth: A Tax Resolution Software Comparison

Whether you’re a rockstar accountant or a rocket scientist, professional success depends on having the right tools for the job. For modern financial and legal experts whose practices focus on tax resolution, that means an investment in specialty software that will support your work seamlessly, effectively, quickly, and affordably.But, with several products competing for your business, how do you know which offers the best service at the best price? You'll probably conduct sector research, looking at IRS Solutions, Canopy, irsLogics, PitBullTax, and Tax Help Software, making a tax resolution software comparison before committing. This blog post will make that investigation easy for you and – as always! – help you save valuable time that would be better spent elsewhere.

What sets IRS Solutions apart from other tax resolution software?

When you’re choosing software to support your tax resolution business, the question you want to ask is not whether Canopy, PitBullTax, Tax Help Software, or irsLogics can get the job done. To differing degrees, they all can. Instead, the question you want to ask is: “How complete is this package, and what will the return on my investment look like?” Each company offers a package that is useful in its own way, but none is as comprehensive as IRS Solutions. There are many critical differences. Let’s look at just a few:

Information Management: At IRS Solutions, we know that tax resolution software has to prevent your business’s information load from turning into informationoverload. That’s why document, calendar, and task management modules are built into the software and included in your membership. Canopy and PitBullTax offer these features as well, but as add-ons that require additional fees.

Data Security:The secure storage of personal and business information is a real hot-button issue these days. At IRS Solutions, we take your security seriously. Documents are kept secure through the Amazon Web Services Government Cloud (AWS GovCloud). Tax Help Software data is stored on users’ computers, leaving them vulnerable to hacks, viruses, crashes, and theft.

Marketing Support:Even tax resolution specialists, who typically generate more income in fewer hours than their peers who focus on other areas, have to work at keeping their business visible. That’s why membership in IRS Solutions includes access to a marketing toolkit containing social media posts and prospecting letters that you can use to cultivate relationships with other businesses—considering another option like irsLogics? Don’t look for a similar feature. You won’t find one.

Training Classes: Deciding on a software package is just the first step. Once you make a choice, you’ll want to get your staff up to speed as quickly as possible. At PitBullTax, that training comes with an additional fee. IRS Solutions provides how-to classes on using our software. We also offer free members-only tax resolution and case study webinars. You'll also receive continuing education credit for these classes led by experts with the experience needed to answer your questions. irsLogics doesn’t offer their users any continuing education at all.

Frequently Added New Features:Because we are a company founded by industry professionals, IRS Solutions offers something that no other tax resolution software company can. We are plugged into what’s happening at the IRS. Our members benefit from our connections and experience every time they get CPE/CE credits by virtually attending one of our classes or getting the answer to a question in our Facebook group, but that’s not all.We don't just have members. We have relationships with our members. They know they can call, email, or Facebook message any time to let us know if there is a feature that they would like added...and then we add it! The newest update is an audit monitoring system that will alert users to an upcoming audit after a client is flagged but well before the IRS gets around to generating a letter. Imagine how much your clients will appreciate your proactive approach and advance warning.

Make your own tax resolution software pricing comparison.

Pricing is where you’ll notice the most significant differences between the companies that offer tax resolution software options. When you take a moment to do a side-by-side analysis, what you’ll observe is that one company stands out for its generous, all-in-one approach to pricing.IRS Solutions builds everything you need into your monthly membership rate. Other companies take a different approach, charging extra fees for critical services or increasing your charges based on the number of cases you have in the process.

Canopy: Canopy’s pricing is the most complicated on the market. It’s module-based and varies according to which features you select, how many contacts you have, and how many cases you’ll be working on. This model is somewhat less surprising when you know that, unlike IRS Solutions, the company is owned by venture capitalists who have never worked in tax resolution. IRS Solutions Software is a family-run business operated by former Revenue Officers and Enrolled Agents.

IrsLogics: If access to an easy-to-use client portal and member support is essential to you, irsLogics probably isn’t your best choice. Unlike IRS Solutions, which makes these features available to all members, at irsLogics, they are only available to those who opt to pay premium rates.

PitBullTax: Your bills can really pile up at PitBullTax. Get ready to pay more for some features you can’t work without. We know that you can’t serve your tax resolution clients without access to their IRS transcripts, which is why that access is included with your membership at IRS Solutions. Over at PitBullTax, that same access will cost you nearly $35 per user each month. You're also blocked from their software’s CSED calculation tool without paying that fee. That necessary feature is also included for all users at IRS Solutions. Finally, PitBullTax also charges $10 per month for access to 3 state POA forms, of which only four are available to choose from. More than 20 state POAs – including New York and California – are included with your IRS Solutions membership, with more being added all the time.

Tax Help Software:You’d better already know what you’re doing and be ready to commit if you sign up for Tax Help Software. Unlike IRS Solutions, which offers a step-by-step plan listing all the steps you need to move your client’s tax resolution case forward to an Offer in Compromise (OIC) or Currently Not Collectible (CNC) status (including the engagement letter, pre-filled and editable POA form, and more), Tax Help Software offers no such guidance to help you. The company also offers no free trial. This is a stark contrast to the generous 60-day money-back guarantee you’ll enjoy at IRS Solutions.

Acting on the Results of Your Tax Resolution Software Comparison

You’ve done your homework and have the information you need to take the next step. Now it’s time to enjoy a 30-day trial of IRS Solutions, a tax pro’s best friend. So let’s connect and get you started. Schedule your free demo today.

0 notes

Text

Free CPE Selfstudy Webinars & Courses , CPE webinars for CPAS

https://my-cpe.com/advance-search?type=self-study

If you’re a CPA looking to earn your continuing professional education credits and certification at no cost. free signup now!.

1 note

·

View note

Text

3 Agile Process Hacks for Finance Teams in Banking & Financial Services

Finance teams in banking and financial services face a number of unique challenges. You need to stay ahead of quickly changing market conditions, mitigate risks and help your organization deliver return on investment for your customers, all while navigating an ever-changing list of regulatory compliance requirements. With all that on your plate, finding ways to be more agile so you can be a better partner to the business is critical, but no small task.

As you consider how your team can streamline processes to be more flexible and adaptable, questions top of mind might include: How can we adequately prepare for events such as interest rate shocks and market downturns? How can we measure key business metrics—assets under management (AUM) and return on assets ratio (ROA), for example—in real time? What’s the best way to disclose financial and compliance information and build trust with our management, investors, regulators and the public?

While there’s no simple answer to any of these questions, one thing is certain: Being more agile requires a seamless connection between people, processes and technology, especially in the face of ever-present change. In this blog post, we’ll discuss three simple steps your finance team can take to streamline key finance-led processes to be faster and more efficient:

1. Integrate your templates for net interest margin planning

2. Build repeatable workflows to streamline SEC reporting

3. Empower your leaders to tell a story with your data

We’ll also look at the best practices institutions like yours are using to do all of the above and more.

1. Use Integrated Templates For Net Interest Margin Planning

Monitoring interest income is a critical part of the strategic planning process. As the primary source of revenue for retail banks and credit unions, you need to keep a close eye on your interest margins, right down to the individual product level to ensure your business plans are as well informed as possible.

However, if product-level data is siloed in your enterprise resource planning (ERP), asset liability management (ALM) or other source systems, you won’t have an easy way to identify your most profitable financial products. Instead, you’ll have to dig through a bunch of spreadsheets to find the data you’re looking for, and that’s why having one source of truth is so important for net interest margin planning.

By connecting your source systems, automating data inputs and using purpose-built templates for your actuals, forecasts and scenario analysis, you’ll achieve a holistic view of interest income within one secure platform. You’ll also be able to back up your business plans with per-product revenue estimates relative to prime lending rates and yield curves—setting up stakeholders to easily make timely, data-driven business decisions without all the manual effort.

The finance team at ATB Financial, the largest bank headquartered in the Canadian province of Alberta, is a great example of how agile interest margin planning can be put into action. Working with Vena, ATB’s team tracks consolidated revenue figures for more than 100 unique banking products. With all that data at the team’s fingertips, it’s easier for them to quickly determine whether actual versus budget differences are due to margins or price/volume variances. It’s allowed the team and its business partners to plan with a level of granular detail they’d never experienced before.

Learn how ATB Financial transformed budgeting and forecasting in just three months with Vena.

2. Streamline Sec Reporting With Repeatable Workflows

There are few industries in the world subject to greater scrutiny than banking and financial services. Financial institutions are subject to increasingly stringent regulatory reporting requirements. But if you simplify the reporting cycle with automated consolidations and data entries, SEC filings will feel like a breeze instead of a burden. The same logic applies to larger institutions for CCAR reporting and DFAST submissions. You need to design efficient processes that are easy to understand and execute.

But efficiency is often the biggest challenge with financial regulatory reporting, given how collaborative the process really is. If budget owners, managers and executive leadership all need to sign off on one report before it's filed, you might have multiple versions of the same template floating around. You need to align every stakeholder with specific roles in the reporting process and that’s where custom workflows come in handy. They allow you to assign tasks based on individual roles and security permissions, while also ensuring your reports are done quickly, error free and with a full audit trail for tracking. As your team repeats the process for each subsequent reporting cycle, speed and data accuracy will only get better.

Terry Hardy, former Manager of SEC Reporting at Wells Fargo, has first-hand experience seeing how large financial institutions have been able to experience the benefits of repeatable workflows. He helped implement Vena at the banking giant in 2012, overseeing all aspects of regulatory reporting until his retirement in 2019. Working with Vena, Terry was able to:

Automatically detect variances between reporting periods

Track changes to SEC filings and reporting templates with detailed audit trails

Develop an SEC regulatory reporting framework built on teamwork and cross-functional collaboration

To learn more regulatory best practices from Terry, check out his free, CPE-accredited talk, “Transforming Regulatory Reporting Through Teamwork” on plantogrow.com.

3. Tell A Powerful Story With Your Data

Have you ever prepared for a meeting with your board or asset-liability committee, but didn’t quite know how to effectively tell the story behind your numbers? You’re probably not alone, because with so many external reporting requirements in the banking and financial services industry, it can sometimes be difficult to determine which KPIs to focus on internally and how to communicate impact to the right stakeholders in the right way.

But regardless of what metrics you use to define success—whether it’s AUM over benchmark, ROA (Return on Assets), ROE (Return on Equity), sales per branch or others—how you deliver that data is what’s important when it comes to driving performance and efficiencies. Effective, data-driven storytelling with easy-to-understand dashboards that share actionable insights is the key to engaging stakeholders and influencing more informed decision making throughout every stage of your planning cycle.

When built well, dashboards allow you to identify relationships between key metrics, provide a visual representation of important trends and maintain complete transparency across the entire organization. And as you and your business partners execute your plans, dashboards serve as a real-time indicator of emerging trends and performance, making it a lot easier for you to pivot and adjust course if necessary.

Enova International—an online financial services firm with more than 1300 employees around the world—does a great job turning numbers into insightful narratives. The finance team maintains agility by working with Vena to release on-demand “flash reports” at the beginning and end of close periods, which give managers a live look at interest margins and cost of revenue. Vena’s real-time dashboards provide context and helpful reference points, making it easy to track the evolution of those metrics as the business grows.

Check out this webinar to learn more about how Vena helped Enova’s finance team ramp up its strategic analysis to drive business growth.

Finance teams in the banking and financial services industry deal with a lot of complexity and plenty of moving parts. But by taking the steps above to integrate key templates, streamline financial regulatory reporting workflows and build real-time dashboards for effective, data-driven storytelling, it won’t be long before you find the flexibility and adaptability you need to drive improved performance and efficiencies with greater agility.

Request a demo today and discover how Vena can help your finance team improve performance.

Read more here about business analytics.

1 note

·

View note

Text

🚨Special Announcement: Event Date Change 🚨

Our Live Webinar on March 7th, Introduction to ERP Systems, has rescheduled to March 14th. Follow the link to register for the event and discover the learning objectives:

Confused about what an ERP system is, how to buy it, and from whom, or what you truly need for a complete ERP implementation? You may think you know all the answers to these questions, but you’re likely missing key pieces of the puzzle. In this episode of The ERP Advisor, Shawn Windle will provide a crash course on the basics of ERP systems and highlight the value the right system can provide to your business.

#cpe#cpecredit#erpsoftware#erpsolutions#erpsystems

0 notes

Text

Free CPE

Enrich your expertise with free CPE webinars. Dive into no-cost, informative sessions and earn CPE credits. Stay informed about industry trends and kickstart your learning adventure today.

Visit us at-

0 notes

Text

📢📢Attention Tennessee CPAs! 📢📢

➡️Your search for the most convenient way to complete your CPE compliance is over. Try the 60 CPE Package by my CPE, approved and tailored specifically for CPAs in Tennessee just like you!

➡️Why choose our 60 CPE Package for Tennessee CPAs from my CPE?

➡️Here's why: Approved by NASBA: myCPE is authorized by NASBA (Sponsor id: 143597) to provide CPE credits to CPAs. You can trust our courses to meet the highest standards of quality and relevance.

➡️Complete Compliance: This package includes 60 hours of self-study webinars that align perfectly with the Tennessee State Board of Public Accountancy's requirements. Stay on track and fulfill your obligations hassle-free.

➡️Diverse Course Offerings: Our 60 CPE Package covers a wide range of subjects to enhance your professional knowledge. With 23 hours in Accounting and Auditing, 25 hours in Taxation, 7 hours in Finance, 1 hour in Business Management and Organization, and 2 hours in Computer Software and Application, you'll gain valuable insights across various domains.

➡️Technical Expertise: Fulfill your technical subject area requirements with 57 CPE hours included in this package. Along with 3 hours of ethics. Stay up to date with the latest developments and maintain your professional edge.

➡️Accounting and Auditing Focus: If you provide attest services (including compilations), our package offers 23 hours of content in Accounting and Auditing, surpassing the minimum requirement of 20 hours. Stay on top of your game in this critical area.

➡️Convenient Subscription: Gain access to this fantastic package by subscribing to myCPE Unlimited Access Prime for just $199. Enjoy the flexibility of learning at your own pace and in the comfort of your own space.

➡️Explore our online CPE Package and unlock a world of knowledge through popular webinars covering Accountancy & Auditing, Taxation, Finance, Business Management and Organization, and Computer Software and Application.

➡️Wait, there's more! If you're interested in a smaller package, we also offer a 40 CPE Package for Tennessee CPAs (Incl. 2 Hours Ethics).

➡️Remember, our 60 CPE package is 100% compliant with the Tennessee Board of Accountancy regulations, and we stand behind our commitment to your satisfaction. If you believe the package doesn't meet compliance standards, simply reach out to our support team at [email protected], and we'll gladly provide a full refund.

Don't miss out on this fantastic opportunity to fulfill your CPE requirements with ease. Subscribe today and empower your professional growth! For more detailed information, visit our website or the Tennessee CPE Requirement Page. Stay compliant, stay ahead!See less

0 notes

Text

Free Masterclass : Threat Hunting 101

Date: 15th July (Fri)

Time: 08.00 -09.00 PM (IST)

Agenda for the Webinar

Definitions and basics

Useful Frameworks

Scope and Industry

Opportunities and skills in demand

Top 5 tools used

Job roles available

How do I get ready?

Q&A

Why attend Infosec Train Event

Get CPE Certificate

Access to the recorded sessions

Learn from Industry Experts

Post support

Register now: https://www.infosectrain.com/events/threat-hunting-101/

0 notes